The Company was incorporated September 26, 2003 to engage in the acquisition, exploration, and, if warranted, the development of properties containing precious and base metals and uranium. In particular, the Company’s activities since incorporation have focused on the financing of exploration of the following projects

On July 27, 2004 the Company completed a 2 for 1 stock split, pursuant to which each issued Share of the Company was subdivided into two Shares. On September 6, 2005 the Company completed a second 2 for 1 stock split, pursuant to which each issued Share of the Company was subdivided into two Shares. Per Share amounts in this Annual Report have been retroactively adjusted to reflect the stock splits.

The Company commenced operations during September 2003. From September 26, 2003 through March 31, 2007, Management has devoted most of its time and resources towards (i) organizing the Company, (ii) acquiring various property interests, (iii) evaluating properties for acquisition, and (v) conducting initial exploration of some of its properties. During this time, no revenues were realized.

For the year ended December 31, 2006 the Company’s loss from operations was $2,581,592 ($0.03 per Share), compared to $1,223,081 ($0.02 per Share) for the year ended December 31, 2005, an increase of $1,358,511. The primary reasons for this increase were (i) non-cash stock based compensation expenses increased by $652,676 to $1,146,144, resulting from the grant of stock options to newly appointed officers and directors, following a change in the Company’s management, (ii) management fees and administrative services increased by $431,106 to $560,289 because of the hiring of additional staff, and the implementation of directors fees in 2006, and (iii) increased professional fees and travel expenses as a result of increased activities during the year.

The table below shows the exploration costs incurred by the Company on its various property interests.

During 2006, the Company dropped its interest in the Firefly Project, writing off a total of $163,246.

During 2005, the Company dropped its interest in the Bear Project, writing off a total of $602,193.

Table of ContentsThe Company has funded operations since its incorporation (September 26, 2003) through the net proceeds of various financings.

In November 2003 the Company issued 2,000,000 Special Warrants (pre-stock split) at a price of $0.10 per Special Warrant, resulting in gross proceeds of $200,000. Each Special Warrant entitled the holder thereof to acquire, without additional payment and subject to adjustment pursuant to the Special Warrant Certificates, one Share. A Prospectus dated January 9, 2004 qualified the distribution of 2,000,000 Shares (pre-stock split) issued by the Company, without additional payment, upon the exercise of the 2,000,000 Special Warrants (pre-stock split).

For the year ended December 31, 2004, the Company raised total gross proceeds of approximately $2.6 million through various equity financings. On February 26, 2004, the Company raised financing from an initial public offering of $1,500,000 through the issuance of 15 million common shares (30 million shares post 2 for 1 stock split).

On July 23, 2004 the Company completed a stock split whereby each common share of the Company was subdivided into two common shares of the Company.

During 2004, the Company issued 206,000 flow-through common shares for gross proceeds of $125,660 (net proceeds of $114,979).

On October 15, 2004, the Company completed a private placement financing of 450,000 units at a price of $0.70 per unit for gross proceeds of $315,000 (net proceeds of $292,950). Each unit consisted of one Share and one Share purchase warrant exercisable at a price of $0.95 until April 15, 2006.

On December 3, 2004, the Company completed a private placement financing of 1,004,500 units at a price of $0.65 per unit for gross proceeds of $652,925 (net proceeds of $587,633). Each unit consisted of one Share and one-half of one common share purchase warrant. Each whole warrant was exercisable at a price of $0.95 until June 4, 2006.

On January 27, 2005, the Company completed a non-brokered private placement of 1,333,334 units at a price of $0.375 per unit for gross proceeds of $500,000. Each unit consisted of one common share and once common share purchase warrant exercisable at a price of $0.465 until July 27, 2006. In September 2005 the Company had a two-for-one stock split.

In October 2005, 455,000 share purchase warrants, at an exercise price of $0.475, were exercised, resulting in proceeds of $216,125. On December 21, 2005, the Company completed a private placement of 1,707,665 flow-through common shares at a price of $0.60 per Share receiving gross proceeds of $1,024,399, and 909,091 units at a price of $0.55 per unit, receiving gross proceeds of $500,000. Each unit consists of one common share and one-half of one common share purchase warrant exercisable at a price of $0.70 per Share until December 21, 2006. The Company paid a broker a commission of $106,700 and issued broker warrants entitling it to acquire 63,636 units at an exercise price of $0.55 per unit until December 21, 2006.

On May 5, 2006 the Company completed a private placement financing of 21,144,027 units of for gross proceeds of $17,972,423 (net proceeds of $16,538,358). Each unit (priced at $0.85 per unit) consists of one common share and one half of one common share purchase warrant. Each whole warrant entitles the holder to purchase one additional common share of the Company at a price of $1.15 until either (i) the May 5, 2008; or (ii) if the common shares of Northwestern commence trading on either Tier 1 of the TSX Venture Exchange or the Toronto Stock Exchange prior to the May 5, 2008, by May 5, 2011.

B. Liquidity and Capital Resources

At March 31, 2007, the Company had working capital (including cash of $13,542,269) of $13,420,037. At December 31, 2006, the Company had working capital of $14,643,599, up from $1,603,476 at December 31, 2005. The current working capital is the balance left from the proceeds of its equity fundings, after deducting the costs of raising that funding, payment of outstanding accounts payable, payment of the Company’s general and administrative costs, and the monies which have been spent acquiring and exploring its properties to that date. At December 31, 2006, the Company had

32

Table of Contentscash and short-term investments of $14,908,791, compared to $1,681,524 at December 31, 2005. This increase resulted from the net proceeds raised through equity financings in 2006 less operating and mineral property costs incurred during the same period.

The Company does not have any material commitments for capital expenditures or any debt instruments outstanding. Other than its exploration commitments and purchase/option payment commitments described in F. Tabular Disclosure of Contractual Obligations, the Company does not anticipate having to commit to undertake any significant capital expenditures in the foreseeable future.

The Company’s expenditures to date have satisfied the various conditions necessary to maintain the Company’s option agreements on the Company’s Pichachos copper-gold and the Irhazer and In Gall, Waterbury and North Rae Uranium Projects. For the next twelve months, the Company anticipates that it will require approximately $3,335,000 in funds to satisfy its exploration and purchase payment obligations for its various property interests. In addition, the Company believes it will need a minimum of $1,000,000 for expenses relating to administration, salaries, and shareholder and public relations activities. The Company has sufficient capital on hand to undertake is exploration plans and fund its general and administrative expenses. However, there can be no assurance the Company will be able to raise the necessary funds to fulfill its obligations.

Since all of its property interests are only at the exploration stage, the Company has no sources of revenue other than interest earned on its cash. The primary source of funding for the Company is the issue of equity capital. The Company’s capital requirements in the future will be largely dependant upon the success of its various exploration programs. Until such time as a feasibility study is completed and a production decision is made with regard to one of the Company’s properties, it is expected that the only available source of future capital will be through the issuance of additional equity shares. The availability of equity capital, and the price at which additional equity could be issued, is dependent upon the success of the Company’s exploration activities, and upon the state of the capital markets generally. See ‘‘Item 3. Key Info rmation. D. Risk Factors.’’]

C. Research and development, patents and licenses, etc.

Since its incorporation on September 26, 2003 the Company has not engaged in any research and development activities.

D. Trend Information.

Not Applicable.

E. Off-Balance Sheet Arrangements.

The Company is not engaged in any off-balance sheet arrangements.

F. Tabular Disclosure of Contractual Obligations.

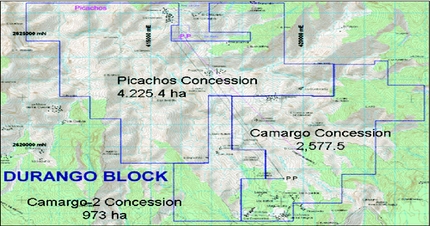

The Company’s contractual obligations are in connection with its following mining interests: (i) an option to acquire a 70% interest in properties in Mexico’s Durango provinces (the ‘‘Picachos Project’’), (ii) the acquisition in March 2006 of the right to explore two uranium properties in the Republic of Niger, Africa, (iii) an option to acquire up to a 65% interest in the North Rae Uranium Project, Northern Quebec, Canada, (iv), an option to acquire a 75% interest in the Waterbury Project, which consists of nine uranium claims in the Athabasca Basin, Saskatchewan, Canada, and (v) an option to acquire a 65 % interest in the Daniel Lake Property, Northern Quebec, Canada. The payments and required exploration expenditures described in the following table are optional by the Company, are not contractual obligations of the Company, and, if the Company does not make any payment, or incur the required exploration expenditures, the Company will only lose its interest in that particular property. Reference is made to ‘‘Item 4. Information on the Company. D. Property, Plants and Equipment’’ for a description of the Company’s obligations regarding its various property interests. Unless otherwise indicated, all references below are in Canadian dollars. Reference is made to Item 3.

33

Table of ContentsKey Information. for the exchange rate over the past five years between U.S. dollars and Canadian dollars.

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | |  |  | Payments due by Period |

| |  |  | TOTAL |  |  | LESS THAN

ONE YEAR |  |  | 1-3 YEARS |  |  | 3-5 YEARS |  |  | MORE THAN

FIVE YEARS |

Option Payments or

Exploration Expenditures

Necessary to Retain Property

Interests at December, 2006 |  |  | |  |  | |  |  | |  |  | |  |  | |

| Payments relating to Picachos Project |  |  |  |  | $3,300,000 |  |  |  |  |  | $500,000 | * |  |  |  |  | $2,500,000 | | * |  |  |  |  | 0 |  |  |  |  |  | 0 |  |

| |  |  |  |  | |  |  |  |  |  | $100,000 | ** |  |  |  |  | $200,000 | | ** |  |  |  |  | |  |  |  |  |  | |  |

| Payments relating to Niger Concessions |  |  |  |  | $4,000,000 |  |  |  |  |  | $1,200,000U.S. | * |  |  |  |  | $2,800,000 | U.S. | * |  |  |  |  | 0 |  |  |  |  |  | 0 |  |

| Payments relating to Waterbury Project |  |  |  |  | $3,850,000 |  |  |  |  |  | $750,000 | * |  |  |  |  | $2,500,000 | | * |  |  |  |  | $500,000 | * |  |  |  |  | 0 |  |

| |  |  |  |  | |  |  |  |  |  | $25,000 | ** |  |  |  |  | $75,000 | | ** |  |  |  |  | |  |  |  |  |  | |  |

| Payments relating to North Rae Uranium Project |  |  |  |  | $3,730,000 |  |  |  |  |  | $400,000 | * |  |  |  |  | $2,100,000 | | * |  |  |  |  | $400,000 | * |  |  |  |  | $600,000 | * |

| |  |  |  |  | |  |  |  |  |  | $30,000 | ** |  |  |  |  | $100,000 | | ** |  |  |  |  | $40,000 | ** |  |  |  |  | $60,000 | ** |

| Payments relating to Daniel Lake Uranium Project |  |  |  |  | $3,930,000 |  |  |  |  |  | $300,000 | * |  |  |  |  | $1,500,000 | | * |  |  |  |  | $1,000,000 | * |  |  |  |  | $800,000 | * |

| |  |  |  |  | |  |  |  |  |  | $30,000 | ** |  |  |  |  | $150,000 | | ** |  |  |  |  | $30,000 | ** |  |  |  |  | $120,000 | ** |

| TOTAL FOR ALL PROPERTY INTERESTS |  |  |  |  | $18,810,000 |  |  |  |  |  | $3,335,000 |  |  |  |  |  | $11,925,000 | |  |  |  |  |  | $1,970,000 |  |  |  |  |  | $1,580,000 |  |

| * | Required exploration expenditures. |

| ** | Required option payments. |

Item 6. Directors, Senior Management and Employees.

A. Directors and Senior Management.

Directors and Officers. At June 25, 2007 the names, municipalities of residence and principal occupations of the directors and officers of the Company were as follows:

|  |  |  |  |  |  |  |  |  |  |  |  |

Name &

Municipality of Residence |  |  | Position with Company |  |  | Principal Occupation |  |  | Age |

Marek Kreczmer

West Vancouver, British Columbia, Canada |  |  | Chief Executive Officer, President, Director |  |  | Chief Executive Officer, President – Northwestern Mineral Ventures Inc. |  |  |  |  | 56 |  |

| Anton Esterhuizen Johannesburg, South Africa |  |  | Director |  |  | Geologist, Managing Director – Pangea Exploration (Pty) |  |  |  |  | 56 |  |

Simon Lawrence

Toronto, Ontario

Canada |  |  | Director |  |  | Mining Engineer |  |  |  |  | 44 |  |

John P. Lynch

Toronto, Ontario |  |  | Director |  |  | Businessman; President, Universal Packaging Systems Inc. since 2003 |  |  |  |  | 47 |  |

Erik H. Martin

Burlington, Ontario |  |  | Chief Financial Officer* |  |  | Certified Management Accountant – President Bractea Enterprises Ltd. |  |  |  |  | 37 |  |

| * | Mr. Martin will be leaving his position as Chief Financial Officer effective July 31, 2007. |

34

Table of ContentsMarek Kreczmer has been a geologist and mining executive for more than 30 years. He has worked for major and emerging mining industry companies focused on uranium, base and precious metals. Mr. Kreczmer also has extensive experience in corporate governance and administration as a current and former director of several publicly listed mining companies in Canada. In 1991, Mr. Kreczmer founded Tan Range Exploration Corporation (now Tanzanian Royalty Exploration Corporation), a company active in the Tanzania region of Africa, which he served as the President through to 2003. His background includes work with the uranium giant Cameco Corporation, AGIP Canada Ltd., Granges Exploration Ltd., Golden Patriot Mining Inc. (now Hana Mining Inc.), Soho Resources Corp. and Northern Canadian Minerals Inc. Mr. Kreczmer obtained a B.Sc. Honours (Miner al Deposits Major) from the University of Ottawa and a Master of Science specializing in mineral deposits from the University of Toronto. He is a member of the Association of Professional Engineers of Saskatchewan and the Prospectors and Developers Association of Canada (PDAC). Mr. Kreczmer dedicates approximately 90% of his time to the Company and has not entered into any non-competition or non-disclosure agreement with the Company.

Anton Esterhuizen, M.Sc., B.Sc. (Hons), is an experienced geologist with extensive experience in Africa. Among his career highlights, he is credited with the discovery and evaluation of the Xstrata Group’s world-class, high-grade Rhovan vanadium deposit in South Africa, the re-evaluation of the sizeable Burnstone gold deposit, also in South Africa, and a number of Tanzanian gold deposits. At present, Mr. Esterhuizen is Managing Director of Pangea Exploration (Pty) Limited in Johannesburg and a director of Tanzanian Royalty Exploration Corporation. His background also includes work with African precious metals producer Gold Fields Ltd. Mr. Esterhuizen is a fellow of the Geological Society of South Africa and the first recipient of the Des Pretorius Memorial Award for outstanding work in economic geology in Africa. He also received the Dreyer Award from the Society for Mining Metallurgy and Exploration Inc. (USA) for outstanding achievements in applied economic geology, one the world’s most prestigious awards for exploration.

Simon Lawrence Mr. Lawrence, B.Eng (Mining Engineering) ACSM, MBA (International Finance), is a seasoned professional in the resources sector. Earlier in his career, Mr. Lawrence worked in mining production on the underground platinum and gold mines of South Africa. Following this Mr. Lawrence worked for HSBC James Capel and ABN AMRO Bank in London, England, where he was involved in financing and developing mining exploration companies in numerous countries throughout the world. More recently, Mr Lawrence was VP Corporate Development of Gabriel Resources Ltd, where he was a key team member in the discovery, development and financing of the multi-million ounce Rosia Montana gold project in Romania, Eastern Europe. Mr. Lawrence was also a founder and director of Canadian-listed African Gold Group and European Goldfields Limite d.

John P. Lynch Mr. Lynch has a bachelor degree in Administrative and Commercial Studies from Western University. He is currently President of a packaging company operating throughout North America.

Erik H. Martin will be leaving his position as Chief Financial Officer effective July 31, 2007.

On May 25, 2006 Mr. Wayne Beach, Jon North, and J. Scott Waldie resigned from the Company’s Board of Directors and were replaced by Messrs. Esterhuizen, Lawrence, and Horne. Mr. Horne resigned on August 29th 2006. On July 6, 2006 Mr. Kabir Ahmed resigned from all positions with the Company.

C. Compensation.

The following table sets forth all annual and long-term compensation for services rendered in all capacities to the Corporation for the fiscal year ending December 31, 2006 in respect of the individuals who were, during the year ended December 31, 2006, the Chief Executive Officer, President and Chief Financial Officer of the Corporation (collectively, the ‘‘Named Executive Officers’’). The Corporation had no other executive officers whose total salaries and bonuses during the fiscal year ending December 31, 2006 exceeded $150,000.

35

Summary Compensation Table

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | |  |  | |  |  | |  |  | |  |  | Long Term Compensation |  |  | |

| |  |  | |  |  | Annual Compensation |  |  | Awards |  |  | Payouts |  |  | |

| Name and Principal Position |  |  | Year(1) |  |  | Salary

($) |  |  | Bonus

($) |  |  | Other

Annual

Compen-

sation

(4) |  |  | Securities

under

Options/

SARs(2)

Granted |  |  | Restricted

Shares of

Restricted

Share Units

($) |  |  | LTIP(3)

Payouts

($) |  |  | All

Other

Compen-

sation(4)

($) |

Kabir Ahmed

Former President and

Chief Executive

Officer(5) |  |  |  |  | 2006 |  |  |  | Nil |  |  |  | $ | 25,000 |  |  |  |  | $ | 46,875 |  |  |  | Nil |  |  | Nil |  |  | Nil |  |  |  | $ | 46,675 |  |

|  |  | 2005 |  |  |  | Nil |  |  | Nil |  |  |  | $ | 90,000 |  |  |  | Nil |  |  | Nil |  |  | Nil |  |  | Nil |

|  |  | 2004 |  |  |  | Nil |  |  | $15,000 |  |  |  | $ | 90,000 |  |  |  |  |  | 400,000 | (9) |  |  | Nil |  |  | Nil |  |  | Nil |

Marek Kreczmer

President and Chief

Executive Officer(6) |  |  |  |  | 2006 |  |  |  | |  |  | $12,500 |  |  |  | $ | 120,833 |  |  |  |  |  | 250,000 |  |  |  | Nil |  |  | Nil |  |  | $12,750 |

|  |  | 2005 |  |  |  | Nil |  |  | Nil |  |  |  | $ | 120,000 |  |  |  |  |  | 100,000 |  |  |  | Nil |  |  | Nil |  |  | Nil |

|  |  | 2004 |  |  |  | Nil |  |  | Nil |  |  |  | $ | 39,000 |  |  |  |  |  | 240,000 |  |  |  | Nil |  |  | Nil |  |  | Nil |

| Erik H. Martin CFO(7) |  |  |  |  | 2006 |  |  |  | Nil |  |  | Nil |  |  |  | $ | 57,500 |  |  |  |  |  | 250,000 |  |  |  | Nil |  |  | Nil |  |  | Nil |

|  |  | 2005 |  |  |  | N/A |  |  | N/A |  |  | N/A |  |  | N/A |  |  | N/A |  |  | N/A |  |  | N/A |

|  |  | 2004 |  |  |  | N/A |  |  | N/A |  |  | N/A |  |  | N/A |  |  | N/A |  |  | N/A |  |  | N/A |

Errol Farr

Former CFO(8) |  |  |  |  | 2006 |  |  |  | Nil |  |  | Nil |  |  |  | $ | 16,000 |  |  |  | Nil |  |  | Nil |  |  | Nil |  |  | Nil |

|  |  | 2005 |  |  |  | N/A |  |  | N/A |  |  |  | $ | 21,000 |  |  |  | Nil |  |  | Nil |  |  | Nil |  |  | Nil |

|  |  | 2004 |  |  |  | N/A |  |  | N/A |  |  | N/A |  |  | N/A |  |  | N/A |  |  | N/A |  |  | N/A |

| (1) | Financial year ended December 31. |

| (2) | Stock appreciation rights. The Corporation has not granted any SARs. |

| (3) | Long-term incentive plan. The Corporation does not have any LTIPs. |

| (4) | Amounts shown represent retroactive director fees paid for past services. Mr. Kabir Ahmed was also given computer equipment valued at $4,175 upon his resignation. |

| (5) | Mr. Kabir Ahmed was appointed President and CEO of the Corporation on November 1, 2003. On October 14, 2005, Mr. Ahmed resigned as President. On July 7, 2006, Mr. Ahmed resigned as CEO of the Corporation. He received an annual fee of $90,000. The 2006 amount reflects payment of his fee up to July 7, 2006. |

| (6) | Mr. Kreczmer joined as President of the Corporation on October 14, 2005. On October 15, 2006, Mr. Kreczmer became CEO of the Corporation and his annual fee was increased from $100,000/year to $200,000/year. |

| (7) | Mr. Martin was appointed CFO on September 1, 2006. The Corporation pays $12,500.00 per month to Bractea Enterprises Ltd., a company controlled by Mr. Martin. |

| (8) | Mr. Farr was CFO of the Corporation between February 10, 2005 and August 31, 2006. He was entitled to a monthly fee of $2,000. |

| (9) | This amount has been adjusted to reflect the 2 for 1 stock split that occurred on September 6, 2005. Mr. Ahmed’s options expired, unexercised on October 7, 2006. |

On May 25, 2006 the Company, through its Compensation Committee consisting at the time of Wayne Beach, Jon North, and J. Scott Waldie, established the following compensation plan for its directors, which was retroactive to the Company’s incorporation on September 26, 2003:

|  |

| 1. | $10,000 per annum retainer for all directors; |

|  |

| 2. | An additional $1,000 for each board of directors meeting attended during the year; |

|  |

| 3. | An additional $2,500 to be paid to the Chair of the Audit Committee and the Chair of the Compensation Committee; |

|  |

| 4. | An additional $2,000 per annum to be paid to the Chair of the Corporate Governance and Nomination Committee and Chair of the Environmental, Health & Safety Committee. |

All persons who had served as a director of the Company since its incorporation on September 26, 2003 received the following retroactive compensation:

|  |  |

| 1. | Kabir Ahmed, Jon North and J. Scott Waldie – 2.5 years of service – payments of $42,500 to each person. |

|  |  |

| 2. | Wayne Beach – 14 months of service – $19,833.33. |

|  |  |

| 3. | Marek Kreczmer – 9 months of service – $12,750. |

36

In addition, the Compensation Committee awarded the following bonus payments on May 25, 2006:

|  |  |

| 2. | Kabir Ahmed − $25,000. |

Kabir Ahmed served as Chair of the Audit Committee.

Directors are also entitled to participate in the stock option plan of the Company (the ‘‘Plan’’). As at June 25, 2007, the Company had outstanding options to purchase 3,550,000 Shares, of which 2,530,000 may be exercised by directors. See ‘‘Summary of Stock Option Plan.’’

Termination Agreements for Executive Officers and Directors.

On October 14, 2006 the Company entered into a consulting agreement with Mr. Marek Kreczmer, its president and chief executive officer, pursuant to which Mr. Kreczmer is paid a monthly management fee of $16,666.66. The agreement provides that Mr. Kreczmer would be entitled to a severance payment equal to two years salary in the event his consulting agreement was terminated in connection with any acquisition of the Company’s Shares resulting in a change of control of the Company, provided the Company has a project which has achieved commercial feasibility at that time. In the event none of the Company’s projects had achieved commercial feasibility by such time, Mr. Kreczmer would each receive one year’s salary.

On September 1, 2006, the Company entered into a consulting agreement with Bractea Enterprises Ltd. (‘‘Bractea’’), a company controlled by Erik H. Martin, the Chief Financial Officer of the Corporation, pursuant to which Bractea receive a monthly management fee of $12,500.00 for services performed by Mr. Martin. This agreement may be terminated upon provision of 60 days written notice by the Corporation or 60 days written notice by Bractea.

Stock Option Plan.

The shareholders of the Corporation approved the Company’s original stock option plan (the ‘‘Original Plan’’) on June 23, 2004. The Original Plan permited the grant of up to 7,200,000 options net of expired or cancelled options issued pursuant to previous option grants.

At the Company’s Annual and Special Meeting of Shareholders held on June 26, 2007, Company’s shareholders approved a resolution terminating the Original Plan, approving a new plan (the ‘‘2007 Plan’’), and authorizing the issue of up to 10% of the total number of Shares issued and outstanding from time to time, under the 2007 Plan. The 3,635,000 options that are outstanding under the Original Plan remain outstanding under the 2007 Plan, without amendment to their terms. The Company is able to issue up to an additional 6,941,884 options under the 2007 Plan (calculated based upon 10% of the issued and outstanding Common Shares as of June 25, 2007, less the number of options currently outstanding under the Original Plan which remain outstanding under the 2007 Plan.) A copy of the proposed 2007 Plan is set forth in Item 19. Exhibits. As of June 25, 2007, the Company had 105,768,842 Common Shares outsta nding.

The purpose of the 2007 Plan is to attract, retain and motivate directors, officers, employees and other service providers by providing them with the opportunity, through share options, to acquire a proprietary interest in the Corporation and benefit from its growth. The options are non-assignable and may be granted for a term not exceeding five years.

Options may be granted under the 2007 Plan only to directors, officers, employees and other service providers subject to the rules and regulations of applicable regulatory authorities and any Canadian stock exchange upon which the Common Shares may be listed or may trade from time to time. The number of Common Shares reserved for issue to any one person pursuant to the 2007 Plan may not exceed 5% of the issued and outstanding Common Shares at the date of such grant. The exercise price of options issued may not be less than the fair market value of the Common Shares at the time the option is granted, subject to any discounts permitted by applicable legislative and regulatory requirements.

37

Set forth below is a summary of the 3,635,000 outstanding options under the 2007 Plan to purchase Common Shares at June 25, 2007:

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| Holder |  |  | Number of

Common Shares

Under Option |  |  | Date of Grant |  |  | Expiry Date |  |  | Exercise

Price |

All 2 executive officers and past executive officers of the Company, as

a group |  |  |  |  | 1,900,000 |  |  |  | October 14, 2005 |  |  | October 14, 2010 |  |  |  | $ | 0.75 |  |

|  |  | 250,000 |  |  |  | May 25, 2006 |  |  | May 25, 2011 |  |  |  | $ | 0.68 |  |

|  |  | 250,000 |  |  |  | September 8, 2006 |  |  | September 8, 2011 |  |  |  | $ | 0.44 |  |

|  |  | 100,000 |  |  |  | April 30, 2007 |  |  | April 27, 2012 |  |  |  | $ | 0.77 |  |

| All 3 directors and past directors (who are not also executive officers) of the Company, as a group |  |  |  |  | 400,000 |  |  |  | May 25, 2006 |  |  | May 25, 2011 |  |  |  | $ | 0.68 |  |

|  |  | 100,000 |  |  |  | June 4, 2007 |  |  | June 1, 2012 |  |  |  | $ | 0.72 |  |

| All other employees and past employees of the Company as a group |  |  |  |  | 100,000 |  |  |  | September 20, 2006 |  |  | September 20, 2011 |  |  |  | $ | 0.40 |  |

|  |  | 25,000 |  |  |  | May 8, 2007 |  |  | May 8, 2012 |  |  |  | $ | 0.85 |  |

| All consultants of the Company as a group |  |  |  |  | 80,000 |  |  |  | August 2, 2005 |  |  | August 2, 2008 |  |  |  | $ | 0.47 |  |

|  |  | 250,000 |  |  |  | January 1, 2007 |  |  | January 1, 2012 |  |  |  | $ | 0.84 |  |

|  |  | 200,000 |  |  |  | April 16, 2007 |  |  | April 16, 2012 |  |  |  | $ | 0.81 |  |

|  |  | 100,000 |  |  |  | June 4, 2007 |  |  | June 4, 2007 |  |  |  | $ | 0.72 |  |

Options/SARs Granted during Fiscal Year Ended December 31, 2006

During the year ended December 31, 2006, 500,000 stock options were granted to the Named Executive Officers. The following table sets out the options granted to the Named executive Officers during the year ended December 31, 2006.

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| Name |  |  | Securities

Under Options

Granted (#) |  |  | % of Total

Options granted to

Employees in the

Financial Year |  |  | Exercise

or Base

Price

($/Security) |  |  | Market Value of

Securities Underlying

Options on the Date of

Grant ($/Security) |  |  | Expiration Date |

| Marek J. Kreczmer |  |  |  |  | 250,000 |  |  |  | 19.2% |  |  |  | $ | 0.68 |  |  |  |  | $ | 0.68 |  |  |  | May 25, 2011 |

| Erik H. Martin |  |  |  |  | 250,000 |  |  |  | 19.2% |  |  |  | $ | 0.44 |  |  |  |  | $ | 0.44 |  |  |  | September 6, 2011 |

Upon exercise in accordance with the terms thereof, each of these options entitles the holder thereof to acquire one Share.

38

Option Exercises in 2006

The following table sets forth details with respect to the number of stock options exercised by each of the Named Executive Officers during the fiscal year ended December 31, 2006, and details with respect to the number of options held at the end of such period by such individuals.

|  |  |  |  |  |  |  |  |  |  |  |  |

| Name |  |  | Securities

Acquired on

Exercise (#) |  |  | Aggregate

Value

realized ($) |  |  | Unexercised Options

at Year End

Exercisable/Unexercisable |  |  | Value of Unexercised

in-the-Money

Options at Year End

Exercisable/Unexercisable(1) |

| Kabir Ahmed |  |  | NIL |  |  | NIL |  |  | NIL/NIL |  |  | NIL/NIL |

| Marek Kreczmer |  |  | NIL |  |  | NIL |  |  | 2,150,000/NIL |  |  | $211,000/NIL |

| Erik H. Martin |  |  | Nil |  |  | NIL |  |  | NIL/250,000 |  |  | NIL/$100,000 |

| Errol Farr |  |  | NIL |  |  | NIL |  |  | NIL/NIL |  |  | NIL/NIL |

| (1) | The value is calculated as the difference between the market value ($0.84) of the securities underlying the options at financial year end and the exercise price of the stock options. |

No amount has been set aside or accrued by the Company and its subsidiaries during the last fiscal year of the Company to provide pension, retirement or similar benefits for directors and officers of the Company pursuant to any existing plan provided or contributed to by the Company and its subsidiaries, or otherwise.

C. Board Practices.

The directors of the Company at June 27, 2007 were as follows:

|  |  |  |  |  |  |  |  |  |

| Name |  |  | Position |  |  | date appointed director |

| Marek Kreczmer |  |  |  |  | Director |  |  |  | October 14, 2005 |

| Simon J. Lawrence |  |  |  |  | Director |  |  |  | May 25, 2006 |

| Anton Esterhuizen |  |  |  |  | Director |  |  |  | May 25, 2006 |

| John P. Lynch |  |  |  |  | Director |  |  |  | May 26, 2007 |

Composition of the Audit Committee

The Company’s audit committee is comprised of the entire board of directors. Each of the directors are considered to be ‘‘independent’’ other than Mr. Marek Kreczmer, the Company’s president and chief executive officer.

Pre-Approval Policies and Procedures

In the event that the Company wishes to retain the services of its external auditors for tax compliance, tax advice or tax planning, the Chief Financial Officer of the Company shall consult with the members of the audit committee, who shall have the authority to approve or disapprove on behalf of the audit committee, such non-audit services. All other non-audit services shall be approved or disapproved by the audit Committee as a whole.

Compensation Committee

The members of the Company’s compensation committee are the independent, non-management directors of the Board of Directors. The Compensation Committee may from time to time determine the compensation of the Company’s officers and directors by taking into consideration, among other factors, corporate performance, industry standards for compensation, and the state of the Company’s treasury. The Compensation Committee is composed of Marek Kreczmer, Simon Lawrence and Anton Esterhuizen.

D. Employees.

The Company has two consultants acting in a management capacity: Marek Kreczmer, its Chief Executive Officer and President, and Erik H. Martin, its Chief Financial Officer. Mr. Martin will be leaving his position as Chief Financial Officer effective July 31, 2007.

39

E. Share Ownership.

The following table sets forth the shareholdings of the Company’s directors and senior management at June 25, 2007.

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| Name |  |  | Position |  |  | Number of

Shares

Owned |  |  | Percentage of

Outstanding

Shares* |

| Marek Kreczmer |  |  | CEO, President, Director |  |  |  |  | 120,000 |  |  |  |  |  | 0.11 | % |

| Anton Esterhuizen |  |  | Director |  |  |  |  | 0 |  |  |  |  |  | 0 |  |

| Simon Lawrence |  |  | Director |  |  |  |  | 0 |  |  |  |  |  | 0 | % |

| Joseph D. Horne |  |  | Director |  |  |  |  | 0 |  |  |  |  |  | 0 | % |

| John P. Lynch |  |  | Director |  |  |  |  | 370,000 |  |  |  |  |  | 0.35 | % |

| Erik H. Martin |  |  | Chief Financial Officer |  |  |  |  | 20,000 |  |  |  |  |  | >0.02 | % |

| Officers & Directors, as a group |  |  | |  |  |  |  | 320,000 | ** |  |  |  |  | 0.48 | % |

| * | At June 25, 2007 the Company had 105,768,842 Shares outstanding. |

| ** | These amounts do not reflect the Shares the Company’s officers and directors can each acquire pursuant to the exercise of options, as set forth in the following table. |

Stock Options Held by Officers and Directors

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| Name |  |  | Number of

Shares |  |  | Exercise Price |  |  | Grant Date |  |  | Expiration Date |

| Kabir Ahmed |  |  |  |  | 400,000 |  |  |  |  |  | 0.2875 |  |  |  | March 26, 2004 |  |  | Expired October 5,

2006 – 90 days

from resignation |

| Marek Kreczmer |  |  |  |  | 1,720,000 |  |  |  |  |  | 0.75 |  |  |  | Oct. 14, 2005 |  |  | Oct. 14, 2010 |

| |  |  |  |  | 250,000 |  |  |  |  |  | 0.68 |  |  |  | May 25, 2006 |  |  | May 25, 2011 |

| Anton Esterhuizen |  |  |  |  | 200,000 |  |  |  |  |  | 0.68 |  |  |  | May 25, 2006 |  |  | May 25, 2011 |

| Simon Lawrence |  |  |  |  | 200,000 |  |  |  |  |  | 0.68 |  |  |  | May 25, 2006 |  |  | May 25, 2011 |

| Joseph D. Horne (former) |  |  |  |  | 200,000 |  |  |  |  |  | 0.68 |  |  |  | May 25, 2006 |  |  | November 27,

2006 – 90 days

from resignation |

| John P. Lynch |  |  |  |  | 100,000 |  |  |  |  |  | 0.72 |  |  |  | June 4, 2007 |  |  | June 4, 2012 |

| Erik Martin |  |  |  |  | 250,000 |  |  |  |  |  | 0.44 |  |  |  | September 6, 2006 |  |  | October 27, 2007 – 90 days

from resignation |

| |  |  |  |  | 100,000 |  |  |  |  |  | .77 |  |  |  | April 30, 2007 |  |  | October 27, 2007 – 90 days

from resignation |

40

Pursuant to an Escrow Agreement dated January 9, 2004 among Northwestern Mineral Ventures Inc., Equity Transfer Services Inc. (the ‘‘Escrow Agent’’), and Kabir Ahmed (‘‘Ahmed’’), in connection with the Company’s initial public offering of up to 15,000,000 Shares (pre-splits) in February 2004, Ahmed agreed to place 4,000,000 Shares (post two 2-1 stock-splits) in escrow with the Escrow Agent, to be released from escrow as follows:

|  |  |  |

| DATE |  |  | NUMBER OF SHARES

RELEASED FROM ESCROW |

| Date Company’s Shares are listed on TSX Venture Exchange (‘‘Listing Date’’) |  |  | 1/10 of Shares in Escrow |

| 6 Months After Listing Date |  |  | 1/6 of Shares Remaining in Escrow |

| 12 Months After Listing Date |  |  | 1/5 of Shares Remaining in Escrow |

| 18 Months After Listing Date |  |  | 1/4 of Shares Remaining in Escrow |

| 24 Months After Listing Date |  |  | 1/3 of Shares Remaining in Escrow |

| 30 Months After Listing Date |  |  | 1/2 of Shares Remaining in Escrow |

| 36 Months After Listing Date |  |  | any Shares Remaining in Escrow |

At June 22, 2007 all of Mr. Ahmed’s Shares have been released from escrow.

Item 7. Major Shareholders and Related Party Transactions.

A. Major Shareholders.

At June 22, 2007 Management is unaware of any person beneficially owning 5% or more of the Company’s outstanding Shares.

At June 22, 2007, the Company had 24 U.S. shareholders of record, holding 18,790,848 Shares, which represented 17.8% of the Company’s outstanding Shares. At such date, there were no arrangements, the operation of which could result in a change of control. All shareholders have the same voting rights with respect to the Shares.

B. Related Party Transactions.

No executive officer, director, or person owning at least 5% of the Company’s outstanding Shares, or affiliate thereof, has or has had any material interest, directly or indirectly, in any transaction involving the Company since its incorporation, or in any proposed transaction involving the Company.

Item 8. Financial Information.

A. Consolidated Statements and Other Financial Information.

Reference is made to ‘‘Item 18. Financial Statements’’ for the financial statements included in this Annual Report.

There are no legal proceedings of a material nature pending against the Company, or its sole U.S. subsidiary. The Company is unaware of any legal proceedings known to be contemplated by any governmental authorities.

The Company has never paid a dividend and it is unlikely that the Company will declare or pay a dividend until warranted based upon the factors outlined below. The declaration, amount and date of distribution of any dividends in the future will be decided by the Board of Directors from time-to-time, based upon, and subject to, the Company’s earnings, financial requirements and other conditions prevailing at the time.

B. Significant Changes.

There have been no significant changes since the Company’s unaudited financial statements at March 31, 2007.

41

Table of ContentsItem 9. The Offer and Listing.

A. Offer and Listing Details.

The Company’s Shares commenced trading (i) on the TSX Venture Exchange in Canada on March 19, 2004 under the symbol ‘‘NWT,’’ (ii) on the Berlin Stock Exchange on March 30, 2004 (‘‘NMV’’), (iii) the Frankfurt Stock Exchange on April 5, 2004 (‘‘NMV’’), and (iv) on the NASD OTC Bulletin Board on August 25, 2004 (‘‘NWTMF’’).

Following is information on the trading history of the Company’s Shares:

The low and high market prices for the Shares, on a quarterly basis, on the TSX Venture Exchange are as follows:

TSX Venture Exchange

|  |  |  |  |  |  |  |  |  |  |  |  |

| Month and Year |  |  | Low |  |  | High |

| January – March 2005 |  |  |  |  | 0.70 | * |  |  |  |  | 1.01 | * |

| April – June 2005 |  |  |  |  | 0.65 | * |  |  |  |  | 1.12 | * |

| July – September 2005 |  |  |  |  | 0.445 |  |  |  |  |  | 0.97 |  |

| October – December 2005 |  |  |  |  | 0.46 |  |  |  |  |  | 0.87 |  |

| January – March 2006 |  |  |  |  | 0.63 |  |  |  |  |  | 1.35 |  |

| April – June 2006 |  |  |  |  | 0.40 |  |  |  |  |  | 1.20 |  |

| July – September 2006 |  |  |  |  | 0.27 |  |  |  |  |  | 0.66 |  |

| October – December 2006 |  |  |  |  | 0.30 |  |  |  |  |  | 0.85 |  |

The low and high market prices for the Shares on the TSX Venture Exchange for the period January 1, 2006 to June 30, 2006 are as follows:

TSX Venture Exchange

|  |  |  |  |  |  |  |  |  |  |  |  |

| DATE |  |  | Low |  |  | High |

| January 2007 |  |  |  |  | 0.66 |  |  |  |  |  | 0.89 |  |

| February 2007 |  |  |  |  | 0.56 |  |  |  |  |  | 0.77 |  |

| March 2007 |  |  |  |  | 0.58 |  |  |  |  |  | 0.73 |  |

| April 2007 |  |  |  |  | 0.70 |  |  |  |  |  | 0.91 |  |

| May 2007 |  |  |  |  | 0.67 |  |  |  |  |  | 0.91 |  |

| June 2007 |  |  |  |  | 0.72 | ** |  |  |  |  | 1.33 | ** |

The closing price of the Shares on the TSX Venture Exchange on June 22, 2007 was $1.15.

42

Table of ContentsThe low and high market prices for the Shares, on a quarterly basis, on the Berlin Stock Exchanges and Frankfurt Stock Exchanges are as follows:

BERLIN STOCK EXCHANGE (Euros)

|  |  |  |  |  |  |  |  |  |  |  |  |

| Month and Year |  |  | Low |  |  | High |

| January – March 2005 |  |  |  |  | 0.40 |  |  |  |  |  | 0.63 |  |

| April – June 2005 |  |  |  |  | 0.39 |  |  |  |  |  | 0.74 |  |

| July – September 2005 |  |  |  |  | 0.26 |  |  |  |  |  | 0.71 |  |

| October – December 2005 |  |  |  |  | 0.33 |  |  |  |  |  | 0.63 |  |

| January – March 2006 |  |  |  |  | 0.41 |  |  |  |  |  | 0.90 |  |

| April – June 2006 |  |  |  |  | 0.27 |  |  |  |  |  | 0.88 |  |

| July – September 2006 |  |  |  |  | 0.17 |  |  |  |  |  | 0.43 |  |

| October – December 2006 |  |  |  |  | 0.20 |  |  |  |  |  | 0.53 |  |

Berlin Stock Exchange (Euros)

|  |  |  |  |  |  |  |  |  |  |  |  |

| Month and Year |  |  | Low |  |  | High |

| January 2007 |  |  |  |  | 0.41 |  |  |  |  |  | 0.52 |  |

| February 2007 |  |  |  |  | 0.35 |  |  |  |  |  | 0.48 |  |

| March 2007 |  |  |  |  | 0.37 |  |  |  |  |  | 0.47 |  |

| April 2007 |  |  |  |  | 0.43 |  |  |  |  |  | 0.54 |  |

| May 2007 |  |  |  |  | 0.444 |  |  |  |  |  | 0.55 |  |

| June 2007 |  |  |  |  | 0.471 | * |  |  |  |  | 0.90 | * |

FRANKFURT STOCK EXCHANGE (Euros)

|  |  |  |  |  |  |  |  |  |  |  |  |

| Month and Year |  |  | Low |  |  | High |

| January – March 2005 |  |  |  |  | 0.43 |  |  |  |  |  | 0.66 |  |

| April – June 2005 |  |  |  |  | 0.37 |  |  |  |  |  | 0.74 |  |

| July 2005 – September 2005 |  |  |  |  | 0.27 |  |  |  |  |  | 0.71 |  |

| October – December 2005 |  |  |  |  | 0.35 |  |  |  |  |  | 0.63 |  |

| January – March 2006 |  |  |  |  | 0.43 |  |  |  |  |  | 0.94 |  |

| April – June 2006 |  |  |  |  | 0.29 |  |  |  |  |  | 0.88 |  |

| July – September 2006 |  |  |  |  | 0.193 |  |  |  |  |  | 0.46 |  |

| October – December 2006 |  |  |  |  | .207 |  |  |  |  |  | .53 |  |

FRANKFURT STOCK EXCHANGE (Euros)

|  |  |  |  |  |  |  |  |  |  |  |  |

| Month and Year |  |  | Low |  |  | High |

| January 2007 |  |  |  |  | 0.42 |  |  |  |  |  | 0.56 |  |

| February 2007 |  |  |  |  | 0.36 |  |  |  |  |  | 0.49 |  |

| March 2007 |  |  |  |  | 0.38 |  |  |  |  |  | 0.45 |  |

| April 2007 |  |  |  |  | 0.43 |  |  |  |  |  | 0.558 |  |

| May 2007 |  |  |  |  | 0.45 |  |  |  |  |  | 0.595 |  |

| June 2007 |  |  |  |  | 0.49 | * |  |  |  |  | 0.917 | * |

At June 28, 2007, one Euro, as quoted by Reuters and other sources at 4 P.M. Eastern Time for New York foreign exchange selling rates (for bank transactions of at least $1,000,000), equaled $1.3449 in U.S. dollars. (Source: The Wall Street Journal)

43

Table of ContentsThe low and high market prices for the Shares, on a quarterly basis, on the OTC Bulletin Board are as follows:

otc bulletin Board (US $)

|  |  |  |  |  |  |  |  |  |  |  |  |

| Month and Year |  |  | Low |  |  | High |

| January – March 2005 |  |  |  |  | 0.59 |  |  |  |  |  | 0.82 |  |

| April – June 2005 |  |  |  |  | 0.51 |  |  |  |  |  | 0.90 |  |

| July – September 2005 |  |  |  |  | 0.32 |  |  |  |  |  | 0.90 |  |

| October – December 2005 |  |  |  |  | 0.40 |  |  |  |  |  | 0.73 |  |

| January – March 2006 |  |  |  |  | 0.55 |  |  |  |  |  | 1.20 |  |

| April – June 2006 |  |  |  |  | 0.35 |  |  |  |  |  | 1.03 |  |

| July – September 2006 |  |  |  |  | 0.23 |  |  |  |  |  | 0.62 |  |

| October – December 2006 |  |  |  |  | 0.25 |  |  |  |  |  | 0.73 |  |

otc bulletin Board (US $)

|  |  |  |  |  |  |  |  |  |  |  |  |

| Month and Year |  |  | Low |  |  | High |

| January 2007 |  |  |  |  | 0.55 |  |  |  |  |  | 0.725 |  |

| February 2007 |  |  |  |  | 0.465 |  |  |  |  |  | 0.64 |  |

| March 2007 |  |  |  |  | 0.48 |  |  |  |  |  | 0.62 |  |

| April 2007 |  |  |  |  | 0.60 |  |  |  |  |  | 0.77 |  |

| May 2007 |  |  |  |  | 0.61 |  |  |  |  |  | 0.82 |  |

| June 2007 |  |  | 0.65* |  |  | 1.23* |

The closing prices of the Shares on the Berlin Stock Exchange and Frankfurt Stock Exchange on June 22, 2007 were 0.789 Euros and $0.781 Euros, respectively. The closing price of the Shares on the OTC Bulletin Board on June 22, 2007 was US$1.07.

B. Plan of Distribution.

Not applicable.

C. Markets

(see A. above)

D. Selling Shareholders.

Not applicable.

E. Dilution.

Not applicable.

F. Expenses of the Issue.

Not applicable.

Item 10. Additional Information.

A. Share Capital.

Not Applicable.

44

Table of ContentsB. Certificate and Articles of Incorporation

Common Shares

The Company is authorized to issue an unlimited number of Common Shares (‘‘Shares’’), with no par value.

The holders of Shares are entitled to such dividends as and when declared by our board of directors, to one vote per share at meetings of shareholders and upon liquidation, to receive such of our assets as are distributable to holders of Shares, subject to the rights of holders, if any, of the Preferred Shares. All Shares presently outstanding are duly authorized, validly issued, fully paid and non-assessable. Shares have no preference, conversion, exchange, preemptive or cumulative voting rights.

All Shares are entitled to one vote per share at all meetings of shareholders, rank equally as to dividends and as to the distribution of the Company’s assets available for distribution in the event of a liquidation, dissolution or winding up of the Company. There are no preemptive or conversion rights and no provision for redemption, purchase for cancellation, surrender or sinking or purchase funds.

Provisions as to the modification, amendment or variation of such rights and provisions are contained in the Business Companies Act (Ontario) (the ‘‘Act’’) and the regulations promulgated thereunder. Certain fundamental changes to the articles of the Company will require the approval of two-thirds of the votes cast on a resolution submitted to a special meeting of the Company’s shareholders called for the purpose of considering the resolution. These items include (i) an amendment to the provisions relating to the outstanding capital of the Company, (ii) a sale of all or substantially all of the assets of the Company, (iii) an amalgamation of the Company with another company, other than a subsidiary, (iv) a winding-up of the Company, (v) a continuance of the Company into another jurisdiction, (vi) a statutory court approved arrangement under the Act (essentially a corporate reorganization such as an amalgamation, sale of assets, wind ing-up, etc.), and (vii) a change of name.

Although the Act does not specifically impose any restrictions on the repurchase or redemption of shares, under the Act a corporation cannot repurchase its shares or declare dividends if there are reasonable grounds for believing that (a) the corporation is, or after payment would be, unable to pay its liabilities as they become due, or (b) after the payment, the realizable value of the corporation’s assets would be less than the aggregate of (i) its liabilities and (ii) its stated capital of all classes of its securities. Generally, stated capital is the amount paid on the issuance of a share.

45

Table of ContentsARTICLES AND BY-LAWS

The following presents a description of certain terms and provisions of the Company’s articles and by-laws.

General

The Company was incorporated in the Province of Ontario on September 26, 2003. Its Ontario Corporation Number is 1589236.

The Company’s corporate objectives and purpose are unrestricted.

Directors

Pursuant to Section 132 of the Business Corporation Act (Ontario) (‘‘OBCA’’), a director who is a party to, or who is a director or officer of or has a material interest in any person who is a party to, a material contract or transaction or proposed material contract or transaction with us shall disclose to us the nature and extent of that interest and shall not vote on any resolution to approve such contract or transaction.

If a quorum of independent directors is present, the directors are entitled to vote compensation to themselves.

Section 137 of the OBCA provides that the directors shall be paid such remuneration for their services as the board of directors may from time to time determine.

Section 184 of the OBCA provides that the board may from time to time on our behalf, without authorization of shareholders:

|  |  |

| • | borrow money upon Company credit; |

|  |  |

| • | issue, reissue, sell or pledge debt obligations of the Company; |

|  |  |

| • | guarantee on our behalf to secure performance of any obligation of any person; and |

|  |  |

| • | mortgage, hypothecate, pledge or otherwise create a security interest in all or any of our currently owned or subsequently acquired property of the Company, to secure any obligations of the Company. |

There are no provisions in the Company’s by-laws relating to retirement or non-retirement of directors under an age limit requirement. A director need not be a shareholder. A majority of directors must be resident Canadians and at least one-third of the directors must not be officers or employees of the Company or of any of the Company’s affiliates.

Annual and special meetings

The annual meeting and special meetings of shareholders are held at such time and place as the board of directors, the chairman of the board, the managing director or the president shall determine. Notice of meetings are sent out to shareholders not less than 21 nor more than 50 days before the date of such meeting. All shareholders at the record date are entitled to notice of the meeting and have the right to attend the meeting. The directors do not stand for reelection at staggered intervals.

There are no provisions in either the Company’s Articles of Incorporation or By-laws that would have the effect of delaying, deferring or preventing a change in control of the Company and that would operate only with respect to a merger, acquisition or corporate restructuring involving the Company or its subsidiary.

There are no by-law provisions governing the ownership threshold above which shareholder ownership must be disclosed.

46

Table of ContentsC. Material Contracts

|  |  |

| 1. | Consulting Agreement with Primoris Group Inc. (‘‘Primoris Group’’), dated March 29, 2007. Under the terms of this agreement, Primoris Group is to provide investor relations services to the Company for one year. Primoris Group is receiving $8,500 per month and has been granted stock options to acquire 200,000 Shares at an exercise price of $0.81 per Share, with an expiration date of April 17, 2012. |

|  |  |

| 2. | Option Agreement dated December 22, 2006 with Yamana Gold Inc.with Yamana, concerning the Picachos Project. Reference is made to ‘‘Item 4. Information on the Company. D. Property, Plants and Equipment.’’ for a description of the agreement. |

|  |  |

| 3. | Option Agreement dated January 24, 2007 with Azimut Exploration Inc. regarding the Daniel Lake Property, Quebec, Canada. Reference is made to ‘‘Item 4. Information on the Company. D. Property, Plants and Equipment.’’ for a description of the agreement. |

|  |  |

| 4. | Mining Agreement between the Republic of Niger and Northwestern Mineral Ventures Inc. for the Irhazer Concession. Reference is made to ‘‘Item 4. Information on the Company. D. Property, Plants and Equipment.’’ for a description of the agreement. |

|  |  |

| 5. | Mining Agreement between the Republic of Niger and Northwestern Mineral Ventures Inc. for the In Gall Concession. Reference is made to ‘‘Item 4. Information on the Company. D. Property, Plants and Equipment.’’ for a description of the agreement. |

|  |  |

| 6. | Option Agreement between Canalaska Ventures Ltd. and Northwestern Mineral Ventures Inc. concerning the Waterbury Project, dated as of November 9, 2005. Reference is made to ‘‘Item 4. Information on the Company. D. Property, Plants and Equipment.’’ for a description of the agreement. |

|  |  |

| 7. | Letter of Intent dated March 2, 2006 between Northwestern Mineral Ventures Inc. and Azimut Exploration Inc. Reference is made to ‘‘Item 4. Information on the Company. D. Property, Plants and Equipment.’’ for a description of the Letter of Intent. |

|  |  |

| 8. | Consulting Agreement dated September 1, 2006 between Northwestern Mineral Ventures Inc. and Erik Martin. Reference is made to ‘‘Item 6. Directors, Senior Management and Employees’’ for a description of the material terms of this agreement. |

|  |  |

| 9. | Consulting Agreement dated October 14, 2006 between Northwestern Mineral Ventures Inc. and Marek Kreczmer. Reference is made to ‘‘Item 6. Directors, Senior Management and Employees’’ for a description of the material terms of this agreement. |

The above descriptions of the Company’s agreements are summaries only. The full agreements are set forth at ‘‘Item 19. Exhibits.’’

D. Exchange Controls.

There are no laws, governmental decrees or regulations in Canada that restrict the export or import of capital or which affect the remittance of dividends, interest or other payments to non-resident holders of our shares, other than withholding tax requirements. Reference is made to ‘‘Item E. Taxation.’’

There are no limitations under the laws of Canada or the Province of Ontario, or in our constituting documents, with respect to the right of non-resident or foreign owners to hold or vote Shares other than those imposed by the Investment Canada Act.

The Investment Canada Act is a federal Canadian statute which regulates the acquisition of control of existing Canadian businesses and the establishment of new Canadian businesses by an individual, a government or entity that is a ‘‘non-Canadian’’ as that term is defined in the Investment Canada Act.

Management of the Company believes that it is not currently a ‘‘non-Canadian’’ for purposes of the Investment Canada Act. If the Company were to become a ‘‘non-Canadian’’ in the future,

47

Table of Contentsacquisitions of control of Canadian businesses by the Company would become subject to the Investment Canada Act. Generally, the direct acquisition by a ‘‘non-Canadian’’ of an existing Canadian business with gross assets of $5,000,000 or more is reviewable under the Investment Canada Act, with a thresholds of $223 million and $237 million for transactions closing in 2003 and 2004, respectively, for ‘‘WTO investors’’ as defined under the Investment Canada Act. If the Company were to become a ‘‘non-Canadian ’’ in the future, Management believes the Company would likely become a ‘‘non-Canadian’’ which is a ‘‘WTO investor.’’ Generally, indirect acquisitions of existing Canadian businesses (with gross assets over certain threshold levels) are reviewable under the Investment Canada Act, except in situations involving ‘‘WTO investors’’ where indirect acquisitions are generally not reviewable. In transactions involving Canadian businesses engaged in the production of uranium, providing financial services, providing transportation services or which are cultural businesses, the benefit of the higher ‘‘WTO investor’’ thresholds do not apply.

Acquisitions of businesses related to Canada’s cultural heritage or national identity (regardless of the value of assets involved) may also be reviewable under the Investment Canada Act. In addition, investments to establish new, unrelated businesses are not generally reviewable. An investment to establish a new business that is related to the non-Canadian’s existing business in Canada is not notifiable under the Investment Canada Act unless such investment relates to Canada’s cultural heritage or national identity.

Investments which are reviewable under the Investment Canada Act are reviewed by the Minister, designated as being responsible for the administration of the Investment Canada Act. Reviewable investments, generally, may not be implemented prior to the Minister’s determining that the investment is likely to be of ‘‘net benefit to Canada’’ based on the criteria set out in the Investment Canada Act. Generally investments by non-Canadians consisting of the acquisition of control of Canadian businesses which acquisitions are otherwise non-reviewable or the establishment of new Canadian businesses require that a notice be given under the Investment Canada Act in the prescribed form and manner.

Any proposed take-over of the Company by a ‘‘non-Canadian’’ would likely be subject only to the simple ‘‘notification’’ requirements of the Investment Canada Act as in all likelihood that non-Canadian would be a ‘‘WTO investor’’ for purposes of the Investment Canada Act. Generally, a ‘‘WTO investor’’ is an individual, other than a Canadian, who is a national of a country which is a member of the World Trade Organization. In the case of a person which is not an individual, a WTO investor is a person which, generally, is ultimately controlled by individuals, other than Canadians, who are nationals of a WTO member. Currently there are 134 countries which are members of the WTO, including virtually all countries of the Western world. The Company would have to have an asset base of at least before the ‘‘reviewable’’ transaction provisions of the Investment Canada Act became relevant for consideration by a third party non-Canadian acquirer, which is not a WTO investor.

E. Taxation.

Certain Canadian Federal Income Tax Consequences

The following is a general summary of the principal Canadian federal income tax considerations generally applicable to a person who holds Shares and who, at all relevant times, for the purposes of the Income Tax Act (Canada) (the ‘‘Act’’) and any applicable bi-lateral tax convention, is not and has never been resident or deemed to be resident in Canada, deals at arm’s length and is not affiliated with the Company, holds his/her Shares as capital property, does not use or hold (and will not use or hold) and is not deemed to use or hold his/her Shares in, or in the course of, carrying on a business in Canada and does not carry on an insurance business in Canada and elsewhere (a ‘‘Non-Resident Holder’’).

The summary is based on the current provisions of the Act and the regulations thereunder and the Company’s understanding of the current published administrative practices, and assessing policies of the Canada Revenue Agency (the ‘‘CRA’’). This summary takes into account all specific proposals

48

Table of Contentsto amend the Act and the regulations publicly announced by the Minister of Finance (Canada) prior to the date hereof (the ‘‘Proposed Amendments’’) although no assurances can be given that such Proposed Amendments will be enacted in the form proposed or at all. This summary does not otherwise take into account or anticipate any other changes in law, whether by judicial, governmental or legislative action or decision or other changes in administrative practices or assessing policies of the CRA nor does it take into account any provincial, territorial, local or foreign tax considerations. The provisions of provincial income tax legislation may vary from province to province in Canada and, in some cases, differ from federal tax legislation.

This summary is of a general nature only and is not intended to be, nor should it be construed to be, legal or tax advice to any particular holder. Accordingly, holders and prospective holders of Shares should consult their own tax advisors with respect to their particular circumstances, including the application and effect of the income and other tax laws of any country, province, state or local tax authority. Any Non-Resident Holder who acquires Shares other than from the Company may be required to obtain from the vendor a certificate pursuant to section 116 of the Act (described below) unless the Shares are listed on a prescribed stock exchange or, after reasonable inquiry, the purchaser had no reason to believe the vendor was a non-resident of Canada within the meaning of the Act.

Dividends on Shares

Dividends paid or credited or deemed under the Act to be paid or credited on the Shares held by a Non-Resident Holder will be subject to Canadian non-resident withholding tax at a general rate of 25%. This rate may be reduced pursuant to the terms of an applicable tax treaty between Canada and the country of residence of the Non-Resident Holder. Dividends paid or credited or deemed under the Act to be paid or credited on the Shares held by a Non-Resident Holder who is resident in the United States for purposes of the Canada− United States Income Tax Convention will generally be subject to Canadian non-resident withholding tax at a rate of 15% and may, in the case of a corporation, be further reduced in certain circumstances.

Disposition of Shares

A Non-Resident Holder will not be subject to tax under the Act in respect of any capital gain realized on a disposition of Shares unless at the time of such a disposition such shares constitute taxable Canadian property of the Non-Resident Holder for purposes of the Act and such Non-Resident Holder is not entitled to relief under an applicable tax treaty between Canada and the country of residence of the Non-Resident Holder.

Shares will generally not constitute taxable Canadian property of a Non-Resident Holder at a particular time provided that such Shares are listed on a prescribed stock exchange (which includes Tiers 1 and 2 of the TSX Venture Exchange) at that time unless at any time during the sixty month period immediately preceding the disposition of such Shares, the Non-Resident Holder, persons with whom the Non-Resident Holder did not deal at arm’s length, or the Non-Resident Holder together will all such persons, owned or had an interest in or right to acquire 25% or more of the Shares of any class or series of the capital stock of the Company. Under certain circumstances, Shares of the Company may be deemed to be taxable Canadian property. In the event that Shares constitute taxable Canadian property to a particular Non-Resident Holder, capital gains realized on the disposition of the Shares held by a Non-Resident Holder who is resident in the United States for purp oses of the Canada-United States Income Tax Convention will generally not be subject to Canadian tax unless the value of the Shares at that time is derived principally from real property situated in Canada.

A purchase of Shares by the Company (other than a purchase of Shares in the open market in the manner in which Shares would normally be purchased by any member of the public in the open market) will give rise to a deemed dividend under the Act equal to the amount, if any, by which the amount paid by the Company on the purchase exceeds the paid-up capital of such Shares determined in accordance with the Act. The paid-up capital may be less than the Non-Resident Holder’s adjusted cost base of such Shares. Any such dividend deemed to have been received by a Non-Resident Holder will be subject to non-resident withholding tax as described above. The amount of such deemed

49

Table of Contentsdividend will reduce the proceeds of disposition of the Shares to the Non-Resident Holder for purposes of computing the Non-Resident Holder’s capital gain or loss under the Act.

Holders of Shares are entitled to receive dividends in cash, property or Shares when and if dividends are declared by the Board of Directors out of funds legally available therefore. There are no limitations on the payment of dividends. To date, the Company has never paid any dividends to its shareholders.

G. Statements by Experts.

Not applicable.

H. Documents on Display.

Copies of the documents referred to in this annual report may be inspected during normal business hours, at 36 Toronto Street, Suite 1000, Toronto, Ontario M5C 2C5 Canada.

I. Subsidiary Information.

Not applicable.

Item 11. Quantitative and Qualitative Disclosures About Market Risk.

Not applicable.

Item 12. Description of Securities Other than Equity Securities.

Not applicable.

Item 13. Defaults, Dividend Arrearages, and Delinquencies.

None.

Item 14. Material Modifications to the Rights of Security Holders and Use of Proceeds.

None.

Item. 15. Controls and Procedures.

Evaluation of Disclosure Controls and Procedures

The Company maintains disclosure controls and procedures designed to ensure that information required to be disclosed in the Company’s reports filed under the Securities Exchange Act of 1934, as amended, is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission rules and forms, and that such information is accumulated and communicated to our management, including our Chief Executive Officer and Chief Financial Officer, as appropriate, to allow for timely decisions regarding required disclosure.

Pursuant to the requirements of the Sarbanes-Oxley Act of 2002, as amended, and Canada Multilateral Instrument 52-109, an evaluation of the effectiveness of the design and operation of the Company’s disclosure controls and procedures and internal control over financial reporting was conducted as of December 31, 2006 under the supervision of management, including the CEO and the CFO. Based on that evaluation, the CEO and CFO have concluded that the Company’s disclosure controls and procedures were operating effectively.

Changes in Internal Controls over Financial Reporting

The Company is unaware of any changes in our internal controls over financial reporting during our fiscal year ended December 31, 2006 that has materially affected, or is reasonably likely to materially affect, our internal controls over financial reporting.

50

Table of ContentsItem 16A. Audit Committee Financial Expert.

The Company’s audit committee is comprised of the entire board of directors. Each of the directors are considered to be ‘‘independent’’ other than Mr. Marek Kreczmer, the Company’s president and chief executive officer. Each member of the board of directors is considered, under Canadian guidelines, to be ‘‘financially literate,’’which includes the ability to read and understand a set of financial statements that present a breadth and complexity of the Company’s accounting issues.

Although a financial expert does not serve on the Company’s Audit Committee. The Company believes that its Audit Committee is well equipped to address all financial matters of the Company since the Company’s Chief Financial Officer, a Certified Management Accountant, serves as Secretary and active financial advisor to the Audit Committee.

Item 16B. Code of Ethics.

The Company’s Board of Directors has currently requested the formulation of a Draft Proposal for a Code of Business Conduct and Ethics, the specifics of which will be reviewed and considered for possible adoption by the Company’s Board of Directors in due course.

Item 16C. Principal Accountant Fees and Services.

The following chart summarizes the aggregate fees billed by the Company’s external auditors for professional services rendered to the Company during the fiscal years ended December 31, 2006 and 2005 for audit and non-audit related services:

|  |  |  |  |  |  |  |  |  |  |  |  |

| Type of Work |  |  | Year Ended

Dec. 31,

2006 |  |  | Year Ended

Dec. 31,

2005 |

| Audit fees* |  |  |  | $ | 30,432 |  |  |  |  | $ | 18,000 |  |

| Audit-related fees** |  |  |  | $ | 0 |  |  |  |  | $ | 0 |  |

| Tax advisory fees |  |  |  | $ | 3,000 |  |  |  |  | $ | 1,000 |  |

| All other fees |  |  |  | $ | 0 |  |  |  |  | $ | 0 |  |

| Total |  |  |  | $ | 33,432 |  |  |  |  | $ | 19,000 |  |

| * | Aggregate fees billed for the Company’s annual financial statements and services normally provided by the auditor in connection with the Company’s statutory and regulatory filings. |

| ** | Aggregate fees billed for assurance and related services that are reasonably related to the performance of the audit or review of the Company’s financial statements and are not reported as ‘‘Audit fees’’, including: assistance with aspects of tax accounting, attest services not required by state or regulation and consultation regarding financial accounting and reporting standards. |

| *** | Aggregate fees billed for tax compliance, advice, planning and assistance with tax for specific transactions. |

Item. 16D. Exemptions from the Listing Standards for Audit Committees.

Not Applicable.

Item 16 E. Purchases of Equity Services by the Issuer and Affiliated Purchasers.

Not Applicable.

Item 17. Financial Statements.

See ‘‘Item 18. Financial Statements.’’

Item 18. Financial Statements.

(1) Consolidated Balance Sheets of the Company as at December 31, 2006 and 2005, and Consolidated Statements of Operations and Deficit, Shareholders Equity, and Cash Flows, for each of

51

Table of Contentsthe years in the three-year period ended December 31, 2006, the period from inception (September 26, 2003) to December 31, 2003, and the cumulative period from inception to December 31, 2006. These statements were prepared in accordance with Canadian generally accepted accounting principles, which differ in certain respects from United States generally accepted accounting principles. See Note 13 to the consolidated financial statements for a description of the differences between Canadian Generally Accepted Accounting Principles and United States Generally Accepted Accounting Principles.

(2) Unaudited Consolidated Balance Sheet of the Company as at March 31, 2007, Consolidated Statements of Operations and Deficit for the three months ended March 31, 2007, Statements of Cash Flows for the three months ended March 31, 2007, and Statements of Shareholders’ Equity from Commencement of Operations, September 26, 2003 to March 31, 2007.

Item 19. Exhibits.

Exhibits. (Reference is made to Registration Statement on Form 20-F, dated March 9, 2004, submitted to the Securities and Exchange Commission on March 15, 2004, for exhibits 1, 2, 3.A-3.B. Reference is made to Annual Report on Form 20-F, for the year ended December 31, 2004, dated July 19, 2005, submitted to the Securities and Exchange Commission on July 20, 2005, for exhibits 3.C and 3.D Reference is made to Annual Report on Form 20-F, for the year ended December 31, 2005, submitted to the Securities and Exchange on June 30, 2006, for exhibits 3.E-3.K and exhibits 4.A-4.E. Reference is made to Annual Report on Form 20-F, for the year ended December 31, 2006, submitted to the Securities and Exchange on July 13, 2007, for exhibits Ex-3.J, Ex-3.K, Ex-3.L, Ex-3.M, Ex-3.N, Ex-3.O, E x-4.A, Ex-4.B, Ex-4.C, Ex-12.1, Ex-12.2, Ex-13.1, Ex-13.2).

|  |  |

| 1. | Certificate and Articles of Incorporation. |

|  |  |

| A. | Consulting Agreement dated April 22, 2004 with Primoris Group Inc. |

|  |  |

| B. | Option Agreement dated July 14, 2004 between RNC Gold Inc. and Northwestern Mineral Ventures Inc. concerning the Picachos Project. |

|  |  |

| C. | Letter of Intent dated May 19, 2005 between Northwestern Mineral Ventures Inc. and RNC Gold Inc. regarding Picachos Project. |

|  |  |

| D. | Amending Agreement dated October 14, 2005 between Northwestern Mineral Ventures Inc. and RNC Gold Inc. |

|  |  |

| E. | Mining Agreement between the Republic of Niger and Northwestern Mineral Ventures Inc. for the Irhazer Concession. |

|  |  |

| F. | Mining Agreement between the Republic of Niger and Northwestern Mineral Ventures Inc. for the In Gall Concession. |

|  |  |

| G. | Option Agreement between Canalaska Ventures Ltd. And Northwestern Mineral Ventures Inc. concerning the Waterbury Project, dated as of November 9, 2005. |

|  |  |

| H. | Letter of Intent dated March 2, 2006 between Northwestern Mineral Ventures inc. and Azimut Exploration Inc. |

|  |  |

| I. | Consulting Agreement dated November 1, 2003 between Northwestern Mineral Ventures Inc. and Kabir Ahmed. |

|  |  |

| J. | Consulting Agreement dated October 14, 2006 between Northwestern Mineral Ventures Inc. and Marek Kreczmer. |

|  |  |

| K. | Option Agreement dated January 24, 2007 between Northwestern Mineral Ventures Inc. and Azimut Exploration Inc. |

|  |  |

| L. | Consulting Agreement dated September 1, 2006 between Northwestern Mineral Ventures Inc. and Erik Martin. |

52

Table of Contents |  |  |

| M. | Option Agreement dated December 22, 2006 among Minera Tango, S.A. de C.V., Northwestern Mineral Ventures Inc., and Yamana Gold Inc. |

|  |  |

| N. | Consulting Agreement dated March 29, 2007 with Primoris Group Inc. |

|  |  |

| O. | 2007 Stock Option Plan. |

|  |  |

| A. | Consent of McGovern, Hurley, Cunningham, LLP, Chartered Accountants. |

|  |  |

| B. | Consent of Watts, Griffis and McOuat Limited, Consulting Geologists and Engineers. |

|  |  |

| C. | Consent of Claude Jobin, P.Eng., M.Sc |

|  |  |

| 12.1 | Certification of Chief Executive Officer. |

|  |  |

| 12.2 | Certification of Chief Financial Officer |

|  |  |

| 13.1 | Certification of Chief Executive Officer |

|  |  |

| 13.2 | Certification of Chief Financial Officer |

53

Table of ContentsThe Registrant hereby certifies that it meets all of the requirements for filing on Form 20-F and that is has duly caused and authorized the undersigned to sign this annual report on its behalf.

| NORTHWESTERN MINERAL VENTURES INC. |

| By: /s/ Marek Kreczmer |

| By: Marek Kreczmer |

| Title: President and Chief Executive Officer |

Date: July 20, 2007

54