QuickLinks -- Click here to rapidly navigate through this document

SHIP FINANCE INTERNATIONAL LIMITED

OFFER TO EXCHANGE ITS OUTSTANDING 81/2% SENIOR NOTES DUE DECEMBER 15, 2013 FOR 81/2% SENIOR NOTES DUE DECEMBER 15, 2013, WHICH HAVE BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933

TERMS OF THE EXCHANGE OFFER

- •

- We will exchange all of our outstanding 81/2% senior notes due December 15, 2013 that were issued on December 18, 2003, which we refer to as the "outstanding notes" and which have not been registered under the Securities Act of 1933, that are validly tendered and not properly withdrawn for an equal principal amount of 81/2% senior notes due December 15, 2013, which we refer to as the "exchange notes" and which are registered under the Securities Act of 1933 and are freely tradable. References we make in this prospectus to "notes" shall mean both outstanding notes and exchange notes.

- •

- Any holder of outstanding notes electing to exchange its outstanding notes for exchange notes must surrender its exchange notes, together with the appropriate letter of transmittal, to Wilmington Trust Company.

- •

- You are entitled to withdraw your election to tender the outstanding notes at any time prior to the expiration of the exchange offer.

- •

- This exchange offer expires at 5:00 p.m., New York City time, on July 26, 2004, unless we extend the expiration date.

- •

- The exchange of the outstanding notes for the exchange notes in the exchange offer will not be a taxable event for U.S. federal income tax purposes.

- •

- We will not receive any proceeds from the exchange offer.

TERMS OF THE EXCHANGE NOTES:

- •

- The exchange notes are being offered in order to satisfy some of our obligations under the registration rights agreement entered into in connection with the private placement of the outstanding notes.

- •

- The terms of the exchange notes are identical to the terms of the outstanding notes except that the exchange notes are registered under the Securities Act of 1933 and will not be subject to restrictions on transfer or to any increase in annual interest rate.

- •

- Outstanding notes not tendered in the exchange offer will remain outstanding and continue to accrue interest but will not retain any rights under the registration rights agreement.

RESALES OF EXCHANGE NOTES

- •

- The exchange notes may be sold in the over-the-counter market, in negotiated transactions or through a combination of these methods.

SEE "RISK FACTORS" BEGINNING ON PAGE 23 FOR A DISCUSSION OF SOME OF THE RISKS THAT YOU SHOULD CONSIDER IN CONNECTION WITH PARTICIPATION IN THE EXCHANGE OFFER.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this Prospectus is May 25, 2004.

| GLOSSARY OF SHIPPING TERMS | 6 | |

| SUMMARY | 9 | |

| SUMMARY OF THE TERMS OF THE EXCHANGE OFFER | 13 | |

| SUMMARY OF THE TERMS OF THE EXCHANGE NOTES | 17 | |

| RISK FACTORS | 23 | |

| UNAUDITED PRO FORMA FINANCIAL INFORMATION | 31 | |

| USE OF PROCEEDS OF OUR OUTSTANDING NOTES | 38 | |

| CAPITALIZATION | 39 | |

| RATIO OF EARNINGS TO FIXED CHARGES | 40 | |

| SELECTED COMBINED FINANCIAL INFORMATION AND OTHER DATA | 41 | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 43 | |

| INDUSTRY | 57 | |

| BUSINESS | 62 | |

| MANAGEMENT | 77 | |

| SECURITY OWNERSHIP OF CERTAIN SHAREHOLDERS AND MANAGEMENT | 78 | |

| RELATED PARTY TRANSACTIONS | 79 | |

| DESCRIPTION OF OTHER INDEBTEDNESS | 81 | |

| THE EXCHANGE OFFER | 82 | |

| DESCRIPTION OF THE EXCHANGE NOTES | 92 | |

| CERTAIN U.S. FEDERAL INCOME TAX CONSIDERATIONS | 142 | |

| CERTAIN ERISA CONSIDERATIONS | 146 | |

| PLAN OF DISTRIBUTION | 148 | |

| LEGAL MATTERS | 149 | |

| EXPERTS | 149 | |

| WHERE YOU CAN FIND MORE INFORMATION | 149 | |

| INDEX TO PREDECESSOR COMBINED CARVE-OUT FINANCIAL STATEMENTS | F-1 | |

| INDEX TO STAND ALONE FINANCIAL STATEMENTS | F-27 |

2

Ship Finance International Limited is a Bermuda company that is a wholly owned subsidiary of Frontline Ltd. Our principal executive offices are located at Par-la-Ville Place, 14 Par-la-Ville Road Hamilton, HM 08, Bermuda, and our telephone number at that address is (441) 295-9500. We do not currently maintain a website, however, information about our fleet may be found on the website of our parent at www.frontline.bm. No information on www.frontline.bm should be considered part of this prospectus.

In this prospectus, "Ship Finance International Limited", the "Company", "we", "us" and "our" refers only to Ship Finance International Limited and its subsidiaries.

This prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities in any jurisdiction or in any circumstances where the offer or sale is not permitted. Please refer to the letter of transmittal and the other documents relating to this prospectus for instructions as to your eligibility to tender outstanding notes in this exchange offer. You must not:

- •

- use this prospectus for any other purpose;

- •

- make copies of any part of this prospectus or give a copy of it to any other person; or

- •

- disclose any information in this prospectus to any other person.

We have prepared this prospectus and we are solely responsible for its contents. You are responsible for making your own examination of us and your own assessment of the merits and risks of investing in the notes. You may contact us if you need any additional information.

We are not providing you with any legal, business, tax or other advice in this prospectus. You should consult with your own advisors as needed to assist you in making your investment decision and to advise you whether you are legally permitted to tender your outstanding notes for exchange notes.

You must comply with all laws that apply to you in any place in which you buy, offer or sell any notes or possess this prospectus. You must also obtain any consents or approvals that you need in order to tender outstanding notes. We are not responsible for your compliance with these legal requirements.

NOTICE TO NEW HAMPSHIRE RESIDENTS

NEITHER THE FACT THAT A REGISTRATION STATEMENT OR AN APPLICATION FOR A LICENSE HAS BEEN FILED UNDER RSA 421-B WITH THE STATE OF NEW HAMPSHIRE NOR THE FACT THAT A SECURITY IS EFFECTIVELY REGISTERED OR A PERSON IS LICENSED IN THE STATE OF NEW HAMPSHIRE CONSTITUTES A FINDING BY THE SECRETARY OF STATE THAT ANY DOCUMENT FILED UNDER RSA 421-B IS TRUE, COMPLETE AND NOT MISLEADING. NEITHER ANY SUCH FACT NOR THE FACT THAT AN EXEMPTION OR EXCEPTION IS AVAILABLE FOR A SECURITY OR A TRANSACTION MEANS THAT THE SECRETARY OF STATE HAS PASSED IN ANY WAY UPON THE MERITS OR QUALIFICATIONS OF, OR RECOMMENDED OR GIVEN APPROVAL TO, ANY PERSON, SECURITY, OR TRANSACTION. IT IS UNLAWFUL TO MAKE, OR CAUSE TO BE MADE, TO ANY PROSPECTIVE PURCHASER, CUSTOMER OR CLIENT ANY REPRESENTATION INCONSISTENT WITH THE PROVISIONS OF THIS PARAGRAPH.

3

CAUTIONARY STATEMENT REGARDING FORWARD LOOKING STATEMENTS

This prospectus contains assumptions, expectations, projections, intentions and beliefs about future events, in particular under the headings "Business" and "Management's Discussion and Analysis of Financial Condition and Results of Operations". These statements are intended as "forward-looking statements." We may also from time to time make forward-looking statements in our periodic reports that we will file with the United States Securities and Exchange Commission, other information sent to our security holders, and other written materials. We caution that assumptions, expectations, projections, intentions and beliefs about future events may and often do vary from actual results and the differences can be material.

All statements in this document that are not statements of historical fact are forward-looking statements. Forward-looking statements include, but are not limited to, such matters as:

- •

- future operating or financial results;

- •

- statements about future, pending or recent acquisitions, business strategy, areas of possible expansion, and expected capital spending or operating expenses;

- •

- statements about tanker market trends, including charter rates and factors affecting supply and demand;

- •

- expectations about the availability of vessels to purchase, the time which it may take to construct new vessels, or vessels' useful lives; and

- •

- our ability to obtain additional financing.

When used in this document, words such as "believe," "intend," "anticipate," "estimate," "project," "forecast," "plan," "potential," "will," "may," "should," and "expect" and similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements.

We undertake no obligation to publicly update or revise any forward-looking statements contained in this prospectus, whether as a result of new information, future events or otherwise, except as required by law. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this prospectus might not occur, and our actual results could differ materially from those anticipated in these forward-looking statements.

INFORMATION ABOUT THE ENFORCEABILITY OF JUDGMENTS

AND THE EFFECT OF FOREIGN LAW

We are a Bermuda exempted company and we operate through our vessel owning subsidiaries located in the Bahamas, the Isle of Man, Liberia, Panama and Singapore. Our executive offices are located outside of the United States. The majority of our directors, officers and the experts named in this prospectus reside outside of the United States. In addition, substantially all of our assets and the assets of our directors, officers and experts are located outside of the United States. As a result, you may have difficulty serving legal process within the United States upon us or on some of these persons.

We have been advised by our Bermuda counsel, Mello, Jones & Martin, that the United States and Bermuda do not currently have a treaty providing for the reciprocal recognition and enforcement of judgments obtained in civil and commercial matters and that there is uncertainty as to whether the courts of Bermuda would (1) enforce judgments of United States courts obtained against us or such persons predicated upon the civil liability provisions of the United States federal or state securities laws or (2) entertain original actions brought in Bermuda against us or such persons, predicated upon the United States federal and state securities laws. As a result, it may be difficult for you to enforce judgments obtained in United States courts against our assets located outside the United States, and it

4

may be difficult for you to enforce judgments obtained in United States courts against our directors, officers and experts that are not in the United States.

We have appointed Seward & Kissel LLP as our authorized agent upon which process may be served in any action or proceeding arising out of or based upon the indenture or the notes and instituted in any United States federal or state court having subject matter jurisdiction in the Borough of Manhattan, the City of New York, New York. In connection therewith, we have irrevocably submitted to the jurisdiction of such courts in any such action or proceeding in the United States with respect to the indenture or the notes.

Some of the industry and market data used throughout this prospectus were obtained through company research, surveys and studies conducted by third parties and industry and general publications. We believe that this information is accurate and accordingly rely on it in this prospectus, however, neither we nor any of our respective affiliates have undertaken any independent investigation to confirm the accuracy or completeness of such information. In addition, some of the shipping industry information, statistics and charts contained in the section entitled "Industry" have been compiled by P.F. Bassøe AS & Co. ("P.F. Bassøe"), a leading shipping industry consultant.

5

The following are definitions of certain terms that are commonly used in the tanker shipping industry and in this Prospectus.

Aframax tanker. Tanker ranging in size from 80,000 dwt to 120,000 dwt.

Annual survey. The inspection of a vessel pursuant to international conventions, by a classification society surveyor, on behalf of the flag state, that takes place every year.

Ballast. A substance, usually water, used to improve the stability and control the draft of a ship.

Bareboat charter. Charter of a vessel under which the shipowner is usually paid a fixed amount of charterhire for a certain period of time during which the charterer is responsible for the operating and voyage costs of the vessel and for the management of the vessel, including crewing. A bareboat charter is also known as a "demise charter" or a "time charter by demise."

Bunkers. Heavy fuel oil used to power the engines of a vessel.

Charter. The hire of a vessel for a specified period of time or to carry a cargo from a loading port to a discharging port. The contract for a charter is called a charterparty.

Charterer. The company that hires a vessel.

Charterhire. A sum of money paid to the shipowner by a charterer under a charter for the use of a vessel.

Classification society. An independent society that certifies that a vessel has been built and maintained according to the society's rules for that type of vessel and complies with the applicable rules and regulations of the country of the vessel and the international conventions of which that country is a member. A vessel that receives its certification from time to time is referred to as being "in-class."

Contract of Affreightment. A contract for the carriage of a specific type and quantity of cargo which will be carried in two or more shipments over an agreed period of time, usually for more than one year.

Demurrage. The delaying of a ship caused by a voyage charterer's failure to take on or discharge its cargo before the time of scheduled departure. The term is also used to describe the payment owed by the voyage charterer for such delay.

Double-bottom. Hull construction design in which a vessel has watertight protective spaces that do not carry any oil and which separate the bottom of tanks that hold any oil within the cargo tank length from the outer skin of the vessel.

Double hull. Hull construction design in which a vessel has an inner and outer side and bottom separated by void space, usually several feet in width.

Double side. Hull construction design in which a vessel has watertight protective spaces that do not carry any oil and which separate the sides of tanks that hold any oil within the cargo tank length from the outer skin of the vessel.

Drydocking. The removal of a vessel from the water for inspection and/or repair of those parts of a vessel which are below the water line.

Dwt. Deadweight ton. A unit of a vessel's capacity, for cargo, fuel oil, stores and crew, measured in metric tons of 1,000 kilograms.

6

Gross ton. Unit of 100 cubic feet or 2.831 cubic meters.

Hull. Shell or body of a ship.

IMO. International Maritime Organization, a United Nations agency that issues international standards for shipping.

Lightering. To put cargo in a lighter to partially discharge a vessel or to reduce her draft. A lighter is a small vessel used to transport cargo from a vessel anchored offshore.

Newbuilding. A new vessel under construction or just completed.

OBO carrier. Oil/bulk/ore carrier. A vessel that is designed to carry either oil or dry bulk cargoes, such as ores and minerals, coal, grain forest products and iron/steel products.

Off hire. The period a vessel is unable to perform the services for which it is immediately required under a time charter. Off hire periods include days spent on repairs, drydocking and surveys, whether or not scheduled.

OPA. The United States Oil Pollution Act of 1990.

Operating Costs. The costs of operating a vessel that is incurred during a charter, primarily consisting of crew wages and associated costs, insurance premiums, lubricants and spare parts, and repair and maintenance costs. For a time charter or a voyage charter, the shipowner pays operating costs. For a bareboat charter, the charterer pays operating costs.

Panamax tanker. A tanker of approximately 50,000 to 80,000 dwt. The term is derived from the maximum length, breadth and draft capable of passing fully loaded through the Panama Canal.

Petroleum products. Refined crude oil products, such as fuel oils, gasoline and jet fuel.

Protection and indemnity insurance. Insurance obtained through a mutual association formed by shipowners to provide liability insurance protection against large financial loss to one member by contribution towards that loss by all members.

Scrapping. The disposal of old vessel tonnage by way of sale as scrap metal.

Single hull. Hull construction design in which a vessel has only one hull.

Special survey. The inspection of a vessel by a classification society surveyor that takes place every four to five years.

Spot market. The market for immediate chartering a vessel, usually for single voyages.

Suezmax tanker. Tanker ranging in size from 120,000 dwt to 200,000 dwt. The term is derived from the maximum length, breadth and draft capable of passing fully loaded through the Suez Canal.

Tanker. Ship designed for the carriage of liquid cargoes in bulk with cargo space consisting of many tanks. Tankers carry a variety of products including crude oil, refined products, liquid chemicals and liquid gas.

Time charter. Charter under which the shipowner is paid charterhire on a per day basis for a certain period of time. The shipowner is responsible for providing the crew and paying operating costs while the charterer is responsible for paying the voyage costs. Any delays at port or during the voyages are the responsibility of the charterer, save for certain specific exceptions such as off-hire.

7

Time charter equivalent. A measure of the average daily revenue performance of a vessel on a per voyage basis determined by dividing net voyage revenues by voyage days for the applicable time period. For bareboat charters, operating costs are added to revenues attributable to such charters.

ULCC. Ultra large crude carrier. Tanker that is 320,000 dwt or greater in size.

VLCC. Very large crude carrier. Tanker ranging in size from 200,000 to 320,000 dwt.

Voyage charter. Charter under which a shipowner is paid freight on the basis of moving cargo from a loading port to a discharge port. The shipowner is responsible for paying both operating costs and voyage costs. The charterer is typically responsible for any delay at the loading or discharging ports.

Voyage costs. Bunker costs, port charges and canal dues (or tolls) incurred during the course of a voyage.

Voyage revenues. Revenues generated from voyage charters and time charters.

8

This summary highlights information contained elsewhere in this prospectus, including documents that are incorporated by reference. Before investing in the notes you should read this entire prospectus carefully, including the section entitled "Risk Factors" and our financial statements and related notes for a more complete understanding of our business and this offering. Unless we specify otherwise, all references and data in this prospectus to our business, our vessels and our fleet refers to our fleet of 46 vessels that we acquired in the first quarter of 2004. Unless we specify otherwise, all references in this prospectus to "we," "our," "us" and the "Company" refer to Ship Finance International Limited and our subsidiaries, and not to Frontline or its other affiliates.

Overview

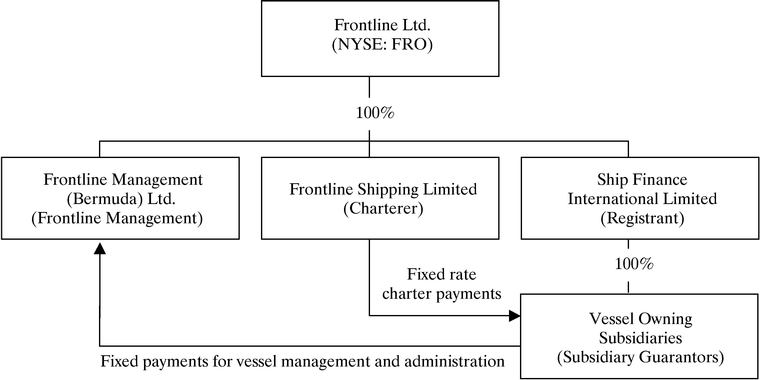

We were formed in October 2003 as a wholly owned subsidiary of Frontline Ltd. (NYSE: FRO), which is one of the largest owners and operators of large crude oil tankers in the world. We purchased a fleet of 46 crude oil tankers from Frontline, which we have chartered under long term, fixed rate charters to Frontline Shipping Limited, also a wholly owned subsidiary of Frontline that we refer to as the Charterer. We also acquired from Frontline an option to purchase one additional VLCC tanker, which we expect to exercise before the end of 2004. The Charterer was initially capitalized with $250 million in cash provided by Frontline to support its obligation to make payments to us under the charters. We have also entered into fixed rate management and administrative services agreements with Frontline Management (Bermuda) Ltd., which we refer as Frontline Management, also a wholly owned subsidiary of Frontline, to provide for the operation and maintenance of our vessels and administrative support services. These arrangements are intended to provide us with stable cash flow and reduce our exposure to volatility in the markets for seaborne oil transportation services.

Our Fleet

The vessels we acquired from Frontline, including the vessel under option, consist of 23 very large crude carriers, or VLCCs, each having a capacity of 275,000 to 308,000 dwt, and 24 Suezmax tankers, each having a capacity of 142,000 to 169,000 dwt. Our fleet is one of the largest tanker fleets in the world, with a combined deadweight tonnage of 10.5 million dwt, and has an average age of 8.6 years as of December 31, 2003. Thirteen of our VLCCs and 16 of our Suezmax tankers are of double hull construction, with the remainder being modern single hull or double sided vessels built since 1990.

Our tankers primarily transport crude oil. VLCCs, due to their size, principally operate on routes from the Middle East to the Far East, Northern Europe, the Caribbean and the Louisiana Offshore Oil Port, or LOOP. Suezmax tankers are similarly designed for worldwide trade, although the trade for those vessels is mainly in the Atlantic basin on routes between Northern Europe, the Caribbean and the United States. Eight of our Suezmax tankers are oil/bulk/ore carriers, or OBO carriers, which can be configured to carry either oil or dry cargo as market conditions warrant.

Strategy

Our long term charters with the Charterer are our sole source of operating income. We currently plan to grow our fleet and to replace vessels as they are retired with modern double hull vessels to maintain stable cash flow and the quality of our fleet. We expect that our replacement and growth vessels will be either existing or newly built VLCC or Suezmax tankers. Depending on market conditions, we may charter any additional vessels that we acquire on long or short term time charters or in the spot markets. We may also seek to diversify our customer base by securing charters with companies other than the Charterer. Frontline currently intends to distribute up to 40% of our shares to Frontline's shareholders, at which time we will seek to list our shares on the New York Stock Exchange. We cannot assure you that this distribution will occur.

9

Competitive Strengths

We believe that our fleet, together with our contractual arrangements with Frontline, give us a number of competitive strengths, including:

- •

- one of the largest and most modern VLCC and Suezmax fleets in the world;

- •

- fixed rate, long term charters intended to reduce our exposure to volatility in tanker rates;

- •

- profit sharing potential when the Charterer's earnings from deploying our vessels exceed certain levels;

- •

- substantially fixed operating costs under our management agreements;

- •

- a charter counterparty initially capitalized with $250 million to support its obligation to make charter payments to us; and

- •

- vessels managed by Frontline Management, which we believe is one of the industry's most experienced operators of tankers.

Fleet Purchase Agreement

Pursuant to a fleet purchase agreement executed in December 2003, we have acquired from Frontline 46 vessel owning subsidiaries and one subsidiary that holds an option to purchase an additional vessel for an aggregate purchase price of $950 million, excluding working capital and other intercompany balances retained by Frontline. We also assumed senior secured indebtedness with respect to our fleet of 46 vessels in the amount of approximately $1.158 billion. The purchase price for the fleet and the refinancing of the existing senior secured indebtedness were financed through a combination of the net proceeds from the sale of the notes to the initial purchasers, funds from a $1.058 billion senior secured credit facility and a deemed equity contribution from Frontline. The charters and the management agreements were each given economic effect as of January 1, 2004.

Time Charters

We have chartered the vessels that we acquired from Frontline to the Charter under long term time charters, which will extend for various periods depending on the age of the vessels, ranging from approximately seven to 23 years.

With certain exceptions, the daily base charter rates, which are payable to us monthly in advance, for a maximum of 360 days per year (361 days per leap year), are as follows:

| Year | VLCC | Suezmax | ||||

|---|---|---|---|---|---|---|

| 2003 to 2006 | $ | 25,575 | $ | 21,100 | ||

| 2007 to 2010 | $ | 25,175 | $ | 20,700 | ||

| 2011 and beyond | $ | 24,175 | $ | 19,700 | ||

These daily base charter rates are subject to reductions after some periods and to deferral rights that we describe more fully in this prospectus under "Business—Charter Arrangements."

In addition to the base charter rates, the Charterer has agreed to pay us a profit sharing payment equal to 20% of its excess revenues, calculated annually on a time charter equivalent, or TCE, basis, realized by the Charterer for our fleet above a weighted average rate of $25,575 per day for each VLCC and $21,100 per day for each Suezmax tanker.

The Charterer

The Charterer was initially capitalized by Frontline with $250 million in cash, which will serve to support the Charterer's obligations to make charter payments to us. The Charterer is entitled to use these funds only (1) to make charter payments to us and (2) for reasonable working capital to meet

10

short term voyage expenses. The Charterer's obligations to us under the charters are secured by a lien over all the assets of the Charterer and a pledge of the equity interests of the Charterer.

The Charterer is a Bermuda corporation and a wholly owned subsidiary of Frontline, formed to charter the vessels in our fleet and to engage in matters necessary or incidental to that business. Under its constituent documents, the Charterer is not permitted to engage in other businesses or activities and is required to have at least one independent director on its board of directors whose consent is required to approve bankruptcy actions and other extraordinary transactions.

Management and Administrative Services Agreements

To give us added certainty with respect to the costs of operating our vessels, our vessel owning subsidiaries have entered into fixed rate management agreements with Frontline Management. Under the management agreements, Frontline Management is responsible for all technical management of the vessels, including crewing, maintenance, repair, capital expenditures, drydocking, vessel taxes, maintaining insurance and other vessel operating expenses. Frontline Management will also reimburse us for all lost charter revenue caused by our vessels being off hire for more than five days per year on a fleet-wide basis. Under the management agreements, we pay Frontline Management a fixed fee of $6,500 per day per vessel for all of these services, for as long as the relevant charter is in place. Frontline has guaranteed to us Frontline Management's performance under these management agreements.

We have also entered into an administrative services agreement with Frontline Management under which Frontline Management provides us with administrative support services. We and each of our vessel owning subsidiaries pay Frontline Management a fixed fee of $20,000 per year for its services under the agreement, and agree to reimburse Frontline Management for reasonable third party costs.

Because Frontline Management has assumed full managerial responsibility for our fleet and our administrative services, we currently do not have management or employees who are not also officers or employees of Frontline. We have one independent director, while each of our other directors is also a director or executive officer of Frontline.

Structure

The following diagram depicts our ownership and contractual structure. This diagram does not depict Frontline's other activities.

11

Our Contractual Cash Flow

The following table sets forth the aggregate contracted charter revenue that is payable to us under our charters with the Charterer, together with the management fees that are payable by us under the management agreements and the administrative services agreement, but does not include any debt service or other expenses. These figures do not include any profit sharing payments or reflect charter payment deferrals. These amounts are based on our current fleet of 46 vessels and include the additional VLCC under option from January 1, 2005. This table assumes that all parties fully perform their obligations under the relevant agreements and that none of the charters are terminated due to loss of the vessel or otherwise, except for the charters for our non-double hull vessels, which are assumed to be terminated after 2010. Factors beyond our control may affect other parties' ability to satisfy their contractual obligations to us, and we cannot assure you that these results will actually be achieved. These factors may include, among others, a decline in tanker charter rates that could prevent the Charterer from earning sufficient revenue to satisfy its obligation to us if the $250 million cash reserve provided by Frontline is not sufficient to cover any deficiency. Please see "Risks Relating to Our Business—We depend on the Charterer for all of our operating cash flow" and "The Charterer's ability to pay charterhire to us could be materially and adversely affected by volatility in the tanker markets". For more complete information about the rates and terms of our charters, please see "Business—Charter Arrangements".

| Year | Charter Payments | Management and Administrative Fees | Net Contracted Cash Payments | ||||||

|---|---|---|---|---|---|---|---|---|---|

| | (dollars in millions) | ||||||||

| 2004 | $ | 385.9 | $ | 110.9 | $ | 275.0 | |||

| 2005 | 394.1 | 112.9 | 281.2 | ||||||

| 2006 | 394.1 | 112.9 | 281.2 | ||||||

| 2007 | 387.3 | 112.9 | 274.4 | ||||||

| 2008 | 388.4 | 113.3 | 275.1 | ||||||

| 2009 | 383.0 | 112.9 | 270.1 | ||||||

| 2010 | 370.4 | 112.9 | 257.5 | ||||||

| 2011 | 226.6 | 69.9 | 156.7 | ||||||

| 2012 | 219.4 | 70.1 | 149.3 | ||||||

| 2013 | 214.1 | 69.9 | 144.2 | ||||||

| 2014 and beyond | 1,517.1 | 496.8 | 1,020.3 | ||||||

| Total | $ | 4,880 | $ | 1,495.4 | $ | 3,385.0 | |||

12

SUMMARY OF THE TERMS OF THE EXCHANGE OFFER

The following summary contains basic information about the exchange notes and is not intended to be complete. For a more complete understanding of the exchange notes, please refer to the section of this prospectus entitled "Description of Exchange Notes".

| Exchange Offer | We are offering to exchange up to $580,000,000 in aggregate principal amount of our 81/2% Senior notes due 2013 that have been registered under the Securities Act of 1933, in exchange for any or all of our outstanding 81/2% Senior notes due 2013. In this prospectus, we refer to the unregistered notes as the outstanding notes and the registered notes as the exchange notes. We refer to both the outstanding and the exchange notes collectively as the notes. The issuance of the exchange notes is intended to satisfy some of our obligations under the registration rights agreement entered into in connection with our private placement of the outstanding notes. For procedures for tendering your outstanding notes, please see the section of this prospectus entitled "The Exchange Offer". The exchange notes will be issued in denominations of $1,000, and integral multiples of $1,000. | |||

Expiration Date | This exchange offer expires at 5:00 p.m., New York City time, on July 26, 2004, unless we extend the expiration date. Please read the section of this prospectus entitled "The Exchange Offer—Extensions, Delay in Acceptance, Termination or Amendment" for more information about the expiration date of the exchange offer. | |||

Withdrawal of Tenders | You are entitled to withdraw your election to tender outstanding notes at any time prior to the expiration of the exchange offer. We will return to you, without charge, promptly after the expiration or termination of the exchange offer any outstanding notes that you tendered but that were not accepted for exchange. | |||

Conditions to the Exchange Offer | We will not be required to accept outstanding notes for exchange: | |||

• | if the exchange offer would be unlawful or would violate any interpretation of the staff of the Securities and Exchange Commission, or SEC, or | |||

• | if any legal action has been instituted or threatened that would impair our ability to proceed with the exchange offer. | |||

The exchange offer is not conditioned upon any minimum aggregate principal amount of outstanding notes being tendered. For more information about the conditions to the exchange offer please read the section of this prospectus entitled "The Exchange Offer—Conditions to the Exchange Offer". | ||||

13

Procedures for Tendering Outstanding Notes | If your outstanding notes are held through The Depository Trust Company, which we refer to in this prospectus as DTC, and you wish to participate in the exchange offer, you may do so through DTC's automated tender offer program. If you tender under this program, you will agree to be bound by the letter of transmittal that we are providing with this prospectus as though you had signed the letter of transmittal. By signing or agreeing to be bound by the letter of transmittal, you will represent to us that, among other things: | |||

• | any exchange notes that you receive will be acquired in the ordinary course of your business; | |||

• | you have no arrangement or understanding with any person to participate in the distribution (within the meaning of the Securities Act of 1933) of the exchange notes in violation of the Securities Act of 1933; | |||

• | you are not an "affiliate" of ours or of any of our subsidiaries within the meaning of Rule 405 under the Securities Act of 1933; and | |||

• | if you are a broker-dealer that will receive exchange notes for your own account in exchange for outstanding notes that you acquired as a result of market-making activities or other trading activities, you will deliver a prospectus in connection with any resale of such exchange notes. | |||

Special Procedures for Beneficial Owners | If you own a beneficial interest in outstanding notes that are registered in the name of a broker, dealer, commercial bank, trust company or other nominee and you wish to tender the outstanding notes in the exchange offer, please contact the registered holder as soon as possible and instruct the registered holder to tender on your behalf and to comply with our instructions described in this prospectus. | |||

Guaranteed Delivery Procedures | You must tender your outstanding notes according to the guaranteed delivery procedures described on page 88 of this prospectus under the heading "The Exchange Offer—Guaranteed Delivery Procedures" if any of the following apply: | |||

• | you wish to tender your outstanding notes but they are not immediately available; | |||

• | you cannot deliver your outstanding notes, the letter of transmittal or any other required documents to the exchange agent, who is identified below, before the expiration date; or | |||

• | you cannot comply with the applicable procedures under DTC's automated tender offer program before to the expiration date. | |||

14

Resales | Except as indicated in this prospectus, we believe that the exchange notes may be offered for resale, resold and otherwise transferred without compliance with the registration and prospectus delivery provisions of the Securities Act of 1933, provided that: | |||

• | you are acquiring the exchange notes in the ordinary course of your business; | |||

• | you are not participating, do not intend to participate, and have no arrangement or understanding with any person to participate, in the distribution of the exchange notes; and | |||

• | you are not an affiliate of the Company. | |||

Our belief is based on existing interpretations of the Securities Act of 1933 by the SEC staff set forth in several no-action letters to third parties. We do not intend to seek our own no-action letter, and there is no assurance that the SEC staff would make a similar determination with respect to the exchange notes. If this interpretation is inapplicable, and you transfer any exchange note without delivering a prospectus meeting the requirements of the Securities Act of 1933 or without an exemption from such requirements, you may incur liability under the Securities Act of 1933. We do not assume or indemnify holders of notes against such liability. | ||||

Each broker-dealer that is issued exchange notes for its own account in exchange for outstanding notes that were acquired by that broker-dealer as a result of market-making or other trading activities must acknowledge that it will deliver a prospectus meeting the requirements of the Securities Act of 1933 in connection with any resale of the exchange notes. Broker-dealers who acquired outstanding notes directly from us will not be eligible to receive exchange notes in return for those outstanding notes. A broker-dealer may use this prospectus for an offer to resell, resale or other transfer of the exchange notes. Please read the section of this prospectus entitled "Plan of Distribution" for more information regarding the resale of the exchange notes. | ||||

U.S. Federal Income Tax Considerations | The exchange of outstanding notes for exchange notes under the exchange offer will not be subject to U.S. federal income tax. You will not recognize any taxable gain or loss or any interest income as a result of such exchange. For more information about tax considerations of the exchange offer please read the section of the prospectus entitled "Certain U.S. Federal Income Tax Consequences". | |||

15

Use of proceeds | We will not receive any proceeds from the issuance of the exchange notes pursuant to the exchange offer. We are making this exchange offer solely to satisfy our obligations under the registration rights agreement. We will pay all our expenses incident to the exchange offer. | |||

Registration Rights | If we fail to complete the exchange offer as required by the registration rights agreement, we may be obligated to pay additional interest to holders of outstanding notes. | |||

Exchange Agent | Wilmington Trust Company is the exchange agent for this exchange offer. Please direct questions and requests for assistance, requests for additional copies of this prospectus or of the letter of transmittal and requests for the notice of guaranteed delivery to the exchange agent. If you are not tendering under DTC's automated tender offer program, you should send the letter of transmittal and any other required documents to the exchange agent as follows: | |||

Wilmington Trust Company Rodney Square North 1100 North Market Street Wilmington, Delaware 19890 Attention: Mary St. Amand Assistant Vice President Telephone: (302) 636-6436 Facsimile: (302) 636-4145 | ||||

16

SUMMARY OF THE TERMS OF THE EXCHANGE NOTES

The summary below describes the principal terms of the exchange notes. Some of the terms and conditions described below are subject to important limitations and exceptions. A more detailed description of the terms and conditions of the exchange notes is contained in this prospectus in the section entitled "Description of the Exchange Notes".

| Issuer | Ship Finance International Limited. | |||

| Securities | $580 million aggregate principal amount of 81/2% Senior Notes due 2013, which have been registered under the Securities Act of 1933. The terms of the exchange notes and the outstanding notes are identical in all material respects, except that the exchange notes will not be subject to restrictions on transfer or to any increase in annual interest rate for failure to comply with the registration rights agreement. The same indenture will govern the exchange notes as governs the outstanding notes. | |||

Maturity | December 15, 2013. | |||

Interest payment dates | June 15 and December 15, commencing June 15, 2004. | |||

Optional redemption | The notes will be redeemable at our option, in whole or in part, at any time on or after December 15, 2008, at the redemption prices set forth in this prospectus, together with accrued and unpaid interest, if any, to the date of redemption. | |||

At any time prior to December 15, 2006, we may redeem up to 35% of the original principal amount of the notes with the proceeds of one or more equity offerings of our common stock at a redemption price of 1081/2% of the principal amount of the notes, together with accrued and unpaid interest, if any, to the date of redemption. | ||||

Optional tax redemption | The notes are redeemable, in whole, but not in part, at our option, at a price equal to 100% of the principal amount thereof, together with any accrued and unpaid interest to the date of redemption, in the event of a change in tax law requiring the imposition of withholding taxes by any relevant tax jurisdiction. | |||

Guarantees | The notes will be guaranteed on a senior unsecured basis by all of our current subsidiaries and any future restricted subsidiaries. The guarantees will be unsecured senior indebtedness of our subsidiary guarantors and will have the same ranking with respect to indebtedness of our subsidiary guarantors as the exchange notes will have with respect to our indebtedness. Neither Frontline nor any of its other subsidiaries has guaranteed the notes. | |||

Ranking | The notes will: | |||

• | be our unsecured obligations; | |||

• | rank equally in right of payment with all of our existing and future unsecured senior indebtedness; | |||

17

• | be effectively junior to our $1.058 billion senior secured credit facility that we have entered into as of the date of this prospectus and to any future senior secured indebtedness; and | |||

• | be senior in right of payment to any future subordinated indebtedness. | |||

For more information about our $1.058 billion senior credit facility, please read the section of this prospectus entitled "Description of Existing Credit Facility". | ||||

Covenants | The outstanding notes were issued under an indenture with Wilmington Trust Company, as trustee. The indenture, among other things, limits our ability and the ability of our restricted subsidiaries to: | |||

• | incur additional debt; | |||

• | issue redeemable stock and preferred stock; | |||

• | pay dividends on our common stock; | |||

• | repurchase capital stock; | |||

• | make other restricted payments including, without limitation, investments; | |||

• | redeem debt that is junior in right of payment to the notes; | |||

• | create liens; | |||

• | sell or otherwise dispose of assets, including capital stock of subsidiaries; | |||

• | enter into agreements that restrict dividends from subsidiaries; | |||

• | amend certain of our material agreements prior to a successful public listing; | |||

• | enter into mergers or consolidations; | |||

• | enter into transactions with affiliates; and | |||

• | enter into sale/leaseback transactions. | |||

These covenants are subject to a number of important exceptions and qualifications, which are discussed in more detail in the section of this prospectus entitled "Description of the Exchange Notes". | ||||

18

Additional amounts | All payments with respect to the notes will be made without withholding or deduction for taxes imposed by Bermuda or any jurisdiction from or through which payment on the notes is made unless required by law or the interpretation or administration thereof, in which case, subject to some exceptions, we will pay additional amounts as may be necessary so that the net amount received by the holders after such withholding or deduction will not be less than the amount that would have been received in the absence of such withholding or deduction. | |||

Mandatory offers to purchase | Upon the occurrence of a change of control, you will have the right to require us to purchase all or a portion of your exchange notes at a price equal to 101% of their principal amount, together with accrued and unpaid interest, if any, to the date of purchase. | |||

In connection with some asset dispositions, we may be required to use the proceeds from those asset dispositions to make an offer to purchase the notes at 100% of their principal amount, together with accrued and unpaid interest, if any, to the date of purchase if such proceeds are not otherwise used within 360 days to repay some types of indebtedness, or to invest in assets related to our business. | ||||

Registration rights agreement | You will be entitled to the payment of additional interest if we do not comply with the obligations of the registration rights agreement within the specified time periods. | |||

Absence of public market for the notes | The exchange notes are a new issue of securities and there is currently no established trading market for the notes. Accordingly, there can be no assurance as to the development or liquidity of any market for the exchange notes. The initial purchasers of the outstanding notes have advised us that they currently intend to make a market in the exchange notes. However, they are not obligated to do so, and any market making with respect to the exchange notes may be discontinued without notice. We do not intend to apply for a listing of the exchange notes on any securities exchange or an automated dealer quotation system. | |||

In evaluating participation in the exchange offer, you should carefully consider, along with the other information set forth in or incorporated by reference into this prospectus, the specific factors set forth under "Risk Factors" for risks involved with an investment in the notes.

19

SUMMARY COMBINED FINANCIAL AND OTHER DATA

The following summary combined financial and other data summarize our historical combined financial information. The summary combined income statement data for the fiscal years ended December 31, 2003, 2002, 2001 and the summary combined balance sheet data with respect to the fiscal years ended December 31, 2003 and 2002 have been derived from our audited predecessor combined carve-out financial statements included herein. The combined balance sheet data with respect to the fiscal year ended December 31, 2001 has been derived from our audited predecessor combined carve-out financial statements not included herein. The summary combined financial data are not necessarily indicative of our future results. The following standalone financial information as at December 31, 2003 has been derived from our audited standalone financial statements included herein. This information should be read in conjunction with "Selected Combined Financial and Other Data", "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our historical predecessor combined carve-out financial statements and the notes thereto included elsewhere in this prospectus.

Predecessor Combined Carve-Out Financial Information

| | Year Ended December 31, | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2003 | 2002 | 2001 | ||||||||

| | (dollars in thousands) | ||||||||||

| Income Statement Data: | |||||||||||

| Total operating revenues | $ | 695,068 | $ | 365,174 | $ | 486,655 | |||||

| Net operating income | 348,816 | 86,091 | 230,718 | ||||||||

| Net income | 334,812 | 18,024 | 212,010 | ||||||||

| Balance Sheet Data (at end of period): | |||||||||||

| Cash and cash equivalents | $ | 26,519 | $ | 20,634 | $ | 26,041 | |||||

| Total assets | 2,156,348 | 2,123,607 | 1,951,353 | ||||||||

| Stockholders' equity | 822,026 | 485,605 | 466,742 | ||||||||

| Cash Flow Data | |||||||||||

| Cash provided by operating activities | $ | 415,523 | $ | 115,658 | $ | 307,167 | |||||

| Cash provided by (used in) investing activities | (51,632 | ) | (261,779 | ) | (271,850 | ) | |||||

| Cash provided by (used in) financing activities | (358,006 | ) | 140,714 | (24,549 | ) | ||||||

| Other Financial Data | |||||||||||

| EBITDA(1) | $ | 470,078 | $ | 162,554 | $ | 330,687 | |||||

| Fleet Data | |||||||||||

| Number of wholly owned vessels (end of period) | 43 | 42 | 38 | ||||||||

| Number of vessels owned in joint ventures (end of period) | 6 | 9 | 7 | ||||||||

| Average Daily Time Charter Equivalent(2) | |||||||||||

| VLCCs | $ | 40,400 | $ | 22,200 | $ | 34,600 | |||||

| Suezmaxes | $ | 33,500 | $ | 18,400 | $ | 30,600 | |||||

| Suezmax OBOs | $ | 32,000 | $ | 17,700 | $ | 28,900 | |||||

- (1)

- EBITDA is defined as net income before taxes, interest expense, interest income, depreciation and amortization and cumulative effect of change in accounting principle. We believe that EBITDA is a relevant measurement for assessing performance since it attempts to eliminate variances caused by the effects of differences in taxation, the amount and types of capital employed and depreciation and amortization policies. EBITDA is not a measure determined in accordance with generally accepted accounting principles and should not be considered by investors as an alternative to income from operations or net income as an indicator of our performance. The EBITDA disclosed here is not necessarily comparable to EBITDA disclosed by other companies

20

because EBITDA is not uniformly defined. The following table reconciles EBITDA to Net Income for the 12-month periods ending December 31, 2001, 2002 and 2003:

| | Year Ended December 31, | ||||||

|---|---|---|---|---|---|---|---|

| | 2003 | 2002 | 2001 | ||||

| | (dollars in thousands) | ||||||

| Net income (loss) | 334,812 | 18,024 | 212,010 | ||||

| Interest income | (5,866 | ) | (8,511 | ) | (4,346 | ) | |

| Interest expense | 35,117 | 42,126 | 58,892 | ||||

| Depreciation and amortization | 106,015 | 96,773 | 88,603 | ||||

| Change in Accounting Principle | — | 14,142 | (24,472 | ) | |||

| EBITDA | 470,078 | 162,554 | 330,687 | ||||

- (2)

- Time charter equivalent, or TCE, is a standard industry measure of the average daily revenue performance of a vessel. This is calculated by dividing net operating revenues by the number of days on charter. Net operating revenues are revenues minus voyage expenses. Days spent off hire are excluded from this calculation.

21

SHIP FINANCE INTERNATIONAL LIMITED

Audited Balance Sheet as of December 31, 2003 on a Stand Alone Basis

(in thousands of $)

| ASSETS | ||||

| Current Assets | ||||

| Restricted cash | 565,500 | |||

| Other receivables | 211 | |||

| Total current assets | 565,711 | |||

| Deferred charges | 16,481 | |||

| Total assets | 582,192 | |||

LIABILITIES AND STOCKHOLDERS' EQUITY | ||||

| Current liabilities | ||||

| Trade accounts payable | — | |||

| Accrued expenses | 4,015 | |||

| Amount due to parent company | 102 | |||

| Total current liabilities | 4,117 | |||

| Long-term liabilities | ||||

| Long term debt | 580,000 | |||

| Total liabilities | 584,117 | |||

| Commitments and contingencies | — | |||

| Stockholders' equity | ||||

| Share capital (12,000 shares of $1 authorized and issued) | 12 | |||

| Retained deficit | (1,937 | ) | ||

| Total stockholders' equity | (1,925 | ) | ||

| Total liabilities and stockholders' equity | 582,192 | |||

22

An investment in the notes involves a high degree of risk. You should carefully consider the following risk factors and other information included in this prospectus before investing in the notes.

Risks Related to the Notes

We may not be able to satisfy our obligations to holders of the notes upon a change of control.

In the event of a change of control, we may be required to offer to purchase all of the outstanding notes at a price equal to 101% of their principal amount, plus accrued and unpaid interest thereon to the date of purchase. It is possible that we will not have sufficient funds at the time of the change of control to make the required repurchase of the notes or that restrictions in our other indebtedness may not allow these repurchases. Our failure to purchase notes that we are required to purchase would be a default under the indenture.

The notes are effectively subordinated to our and the subsidiary guarantors' secured indebtedness.

The notes and the guarantees will be our and the subsidiary guarantors' unsecured obligations and will be effectively subordinated to our and their secured indebtedness to the extent of the value of the collateral securing that debt. We currently have outstanding senior secured indebtedness of $1.058 billion that is secured by the vessels owned by each of our vessel owning subsidiaries. The effect of this subordination is that upon a default in payment on, or the acceleration of, any indebtedness under our credit facilities or other secured indebtedness, or in the event of our or a subsidiary guarantor's bankruptcy, insolvency, liquidation, dissolution, reorganization or similar proceeding, our assets and those of the subsidiary guarantors that secure indebtedness will be available to pay obligations on the notes only after all indebtedness under our expected credit facilities or other secured indebtedness has been paid in full from those assets. We may not have sufficient assets remaining to pay amounts due on any or all of the notes then outstanding. The notes also will be structurally subordinated to all existing and future obligations, including indebtedness, of any of our future subsidiaries that do not guarantee the notes, and the claims of creditors of our subsidiaries that do not guarantee the notes will have priority as to those subsidiaries' assets.

A court may void the guarantees of the notes or subordinate the guarantees to other obligations of the guarantors.

Although standards may vary depending upon applicable law, a court could void all or a portion of the guarantees of the notes or subordinate the guarantees to other obligations of the guarantors. If the claims of the holders of the notes against any guarantor were voided or held to be subordinated in favor of other creditors of that guarantor, the other creditors would be entitled to be paid in full before any payment could be made on the notes. If one or more of the guarantees is voided or subordinated, we cannot assure you that after providing for all prior claims, there would be sufficient assets remaining to satisfy the claims of the holders of the notes.

In the future, we intend to pay significant cash dividends on our equity.

If our equity becomes publicly traded, we contemplate making significant cash dividends to our shareholders to the extent permitted by the indenture and the terms of our credit facilities. In that case we will not likely hold any significant cash reserves other than amounts that our board of directors may from time to time deem necessary for the conduct of our business. Our expected credit facilities and the indenture governing the notes will permit us to make significant distributions on our equity.

23

You may be unable to sell the notes because there is no public trading market for the notes.

The exchange notes will constitute a new issue of securities with no established trading market. We cannot assure you as to the liquidity of any trading market that may develop for the exchange notes. We do not intend to apply to list the notes on any national securities exchange, although we do expect that they will be eligible for trading in the PORTAL market. In addition, although the initial purchasers have advised us that they currently intend to make a market in the notes, they are not obligated to do so and may discontinue market-making activities at any time without notice. If an active market does not develop or is not maintained, the market price and liquidity of the exchange notes may be adversely affected. We cannot assure you as to the liquidity of the market for the exchange notes or the prices at which you may be able to sell the exchange notes.

Risks Relating to Our Business

We depend on the Charterer for all of our operating cash flow.

All of our vessels are chartered to the Charterer under long term time charters, and the Charterer's payments to us are currently our sole source of operating cash flow. The Charterer is a newly formed entity created to charter our fleet and has no business or sources of funds other than those related to the chartering of our fleet to third parties and no assets other than, initially, $250 million in cash provided by Frontline, which serves to support the Charterer's obligations to make charter payments to us under the charters. Neither Frontline nor any of its affiliates guarantees the payment of the charter payments or is obligated to contribute additional capital to the Charterer at any time.

Although there are restrictions on the Charterer's rights to use its cash to pay dividends or make other distributions if its cash reserves are below the specified minimum reserve requirement, the Charterer is permitted to use its cash reserves to pay charter payments to us and for reasonable working capital purposes. Accordingly, at any given time in the future, its cash reserves may be diminished or exhausted, and we cannot assure you that the Charterer will be able to make charter payments to us. If the Charterer is unable to make charter payments to us, our results of operations and financial condition will be materially adversely affected.

The Charterer's ability to pay charterhire to us could be materially and adversely affected by volatility in the tanker markets.

The Charterer subcharters our vessels to end users under long term time charters, on the spot charter market, or under contracts of affreightment under which our vessels carry an agreed upon quantity of cargo over a specified route and time period. As a result, it is directly exposed to the risk of volatility in tanker charter rates. Tanker charter rates have historically fluctuated significantly based upon many factors, including:

- •

- global and regional economic and political conditions;

- •

- changes in production of crude oil, particularly by OPEC and other key producers;

- •

- developments in international trade;

- •

- changes in seaborne and other transportation patterns, including changes in the distances that cargoes are transported;

- •

- environmental concerns and regulations;

- •

- weather; and

- •

- competition from alternative sources of energy.

24

Tanker charter rates also tend to be subject to seasonal variations, with demand (and rates) normally higher in winter months.

The Charterer's successful operation of our vessels in the tanker charter market will depend on, among other things, its ability to obtain profitable tanker charters. We cannot assure you that future tanker charters will be available to the Charterer at rates sufficient to enable the Charterer to meet its obligations to pay charterhire to us.

We are a wholly owned subsidiary of Frontline and depend on officers and directors of Frontline for our management, which may create conflicts of interest.

We are a wholly owned subsidiary of Frontline. For so long as Frontline owns at least a majority of our outstanding common shares, it will generally be able to control the outcome of any shareholder vote, including the election of directors. We do not have any employees or officers who are not employees or officers of Frontline. Although we do have one independent director, all of our other directors are directors or executive officers of Frontline. These directors owe fiduciary duties to the shareholders of each company and may have conflicts of interest in matters involving or affecting us and Frontline, including matters arising under our agreements with Frontline and its affiliates. In addition, due to their ownership of Frontline common shares, some of these individuals may have conflicts of interest when faced with decisions that could have different implications for Frontline than they do for us. We cannot assure you that any of these conflicts of interest will be resolved in our favor.

The agreements between us and Frontline and its other affiliates may be less favorable than agreements that we could obtain from unaffiliated third parties.

The charters, the management agreements, the charter ancillary agreement and the other contractual agreements we have with Frontline and its other affiliates were made in the context of an affiliated relationship and were negotiated in the overall context of the private offering of the notes to the initial purchasers and other related transactions. Because we are a wholly owned subsidiary of Frontline, the negotiation of these agreements may have resulted in prices and other terms that are less favorable to us than terms we might have obtained in arm's length negotiations with unaffiliated third parties for similar services.

Frontline's other business activities may create conflicts of interest with Frontline.

While Frontline has agreed to cause the Charterer to use its commercial best efforts to employ our vessels on market terms and not to give preferential treatment in the marketing of any other vessels owned or managed by Frontline or its other affiliates, it is possible that conflicts of interests in this regard will adversely affect us. Under our charter ancillary agreement with the Charterer and Frontline, we are entitled to receive annual profit sharing payments to the extent that the average TCE rates realized by the Charterer exceed specified levels. Because Frontline also owns or manages other vessels in addition to our fleet, which are not included in the profit sharing calculation, conflicts of interest may arise between us and Frontline in the allocation of chartering opportunities that could limit our fleet's earnings and reduce our profit sharing payments or charter payments under our charters.

Holders of notes must rely on us to enforce our rights against our contract counterparties.

Holders of exchange notes will have no direct right to enforce the obligations of the Charterer, Frontline Management or Frontline under the charters and related agreements, the Frontline performance guarantee or the management agreements with Frontline Management. Accordingly, if any of those counterparties were to breach their obligations to us under any of these agreements, holders of notes would have to rely on us to pursue our remedies against those counterparties. Under the

25

indenture, some breaches of these agreements by the counterparties will constitute an event of default under the notes only prior to our completing a successful public listing, after which they will not be an event of default. A distribution by Frontline to its shareholders of up to 40% of our shares and a listing of our shares with the New York Stock Exchange would constitute a successful public listing for this purpose.

If our charters or management agreements terminate, we could be exposed to increased volatility in our business and financial results.

If any of our charters terminate, it is unlikely that we would be able to re-charter these vessels on a long term basis with terms similar to the terms of our charters with the Charterer. While the terms of our current charters end between 2014 and 2025, the Charterer has the option to terminate the charters of our non double hull vessels in 2010. One or more of the charters with respect to our vessels may also terminate in the event of a requisition for title or a loss of a vessel. We may acquire additional vessels in the future and we cannot assure you that we will be able to enter into similar charters with the Charterer or with a third party charterer. In addition, under our vessel management agreements with Frontline Management, for a fixed management fee Frontline Management is responsible for all of the technical and operational management of our vessels, and will indemnify us against certain losses of hire and various other liabilities relating to the operation of the vessels. Our current management agreements with Frontline Management may be terminated if the relevant charter is terminated. If our management agreements with Frontline Management were to terminate or we were to acquire additional vessels in the future, we do not believe we could obtain similar fixed rate terms from an independent third party.

With respect to any vessels we acquire that are not subject to the charter and management agreements with the Charterer and Frontline Management, we will be directly exposed to all of the operational and other risks associated with operating our vessels as described in these risk factors. As a result, our future cash flow could be more volatile and we could be exposed to increases in our vessel operating expenses, each of which could materially and adversely affect our results of operations and business and our ability to meet the debt service obligations on our senior secured indebtedness and the notes.

An increase in interest rates could materially and adversely affect our financial performance.

We have outstanding approximately $1.058 billion in floating rate debt under a senior secured credit facility as of the date of this prospectus. Although we use interest rate swaps to manage our interest rate exposure from a portion of our floating rate debt, if interest rates rise, interest payments on our floating rate debt that we have not swapped into effectively fixed rates would increase. As of March 22, 2004 we have entered into interest rate swaps to fix the interest on $500.0 million of our outstanding indebtedness. Any such increase could materially and adversely affect our results of operations and our ability to make payments on the notes.

Because we are a newly formed company with no separate operating history, our historical financial and operating data will not be representative of our future results.

We are a newly formed company with no separate operating history. The predecessor combined carve-out financial statements included in this prospectus have been prepared on a carve-out basis and reflect the historical business activities of Frontline relating to our vessel owning subsidiaries. These predecessor financial statements do not reflect the results we would have obtained under our current fixed rate long term charters and management agreements and therefore are not a meaningful representation of our future results of operations.

26

We are highly leveraged and subject to restrictions in our financing agreements that impose constraints on our operating and financing flexibility.

We have significant indebtedness outstanding and have significant principal amortization requirements during the term of the notes. We may need to refinance some or all of our indebtedness on maturity but we cannot assure you we will be able to do so. We may incur additional debt following this offering subject to limitations under our credit facilities and the indenture. These limitations include:

- •

- limitations on our incurrence of additional indebtedness, including our issuance of additional guarantees;

- •

- limitations on our incurrence of liens; and

- •

- limitations on our ability to pay dividends.

For more detailed descriptions of these limitations, please see "Description of the Exchange Notes—Certain Covenants" and "Description of Other Indebtedness".

Our debt service obligations require us to dedicate a substantial portion of our cash flow from operations to required payments on indebtedness and could limit our ability to obtain additional financing in the future for capital expenditures, acquisitions, and other general corporate activities. It also may limit our flexibility in planning for, or reacting to, changes in our business and the shipping industry or detract from our ability to successfully withstand a downturn in our business or the economy generally and place us at a competitive disadvantage against other less leveraged competitors.

An acceleration of the current prohibition to trade deadlines for our non-double hull tankers could adversely affect our operations.

Our tanker fleet includes 18 non-double hull tankers. The United States, the European Union and the International Maritime Organization, or the IMO, have all imposed limits or prohibitions on the use of these types of tankers in specified markets after certain target dates, which range from 2010 to 2015. The sinking of the single hull m.t.Prestige offshore Spain in November 2002 has led to proposals by the European Union and the IMO to accelerate the prohibition to trade of all non-double hull tankers, with certain limited exceptions. In December 2003, the Marine Environmental Protection Committee of the IMO adopted a proposed amendment to the International Convention for the Prevention of Pollution from Ships to accelerate the phase out of single hull tankers from 2015 to 2010 unless the relevant flag states extend the date to 2015. This proposed amendment will take effect in April 2005 unless objected to by a sufficient number of states. We do not know whether any of our vessels will be subject to this accelerated phase-out, but this change could result in a number of our vessels being unable to trade in many markets after 2010. Moreover, the IMO may still adopt regulations in the future that could adversely affect the useful lives of our non-double hull tankers as well as our ability to generate income from them.

Compliance with safety, environmental and other governmental and other requirements may adversely affect our business.

The shipping industry is affected by numerous regulations in the form of international conventions, national, state and local laws and national and international regulations in force in the jurisdictions in which such tankers operate, as well as in the country or countries in which such tankers are registered. These regulations include the U.S. Oil Pollution Act of 1990, or OPA, the International Convention on Civil Liability for Oil Pollution Damage of 1969, International Convention for the Prevention of Pollution from Ships, the IMO International Convention for the Safety of Life at Sea of 1974, or SOLAS, the International Convention on Load Lines of 1966 and the U.S. Marine Transportation Security Act of 2002. In addition, vessel classification societies also impose significant safety and other

27

requirements on our vessels. We believe our tankers are maintained in good condition in compliance with present regulatory and class requirements relevant to areas in which they operate, and are operated in compliance with applicable safety/environmental laws and regulations.

However, regulation of tankers, particularly in the areas of safety and environmental impact may change in the future and require significant capital expenditures be incurred on our vessels to keep them in compliance.

We may incur losses when we sell vessels, which may adversely affect our earnings.

The market value of our vessels will change depending on a number of factors, including general economic and market conditions affecting the shipping industry, competition, cost of vessel construction, governmental or other regulations, prevailing levels of charter rates, and technological changes. During the period a vessel is subject to a charter with the Charterer, we will not be permitted to sell it to take advantage of increases in vessel values without the Charterer's agreement. On the other hand, if the Charterer were to default under the charters due to adverse conditions in the tanker market, causing a termination of the charters, it is likely that the fair market value of vessels would be depressed in such market conditions. If we were to sell a vessel at a time when vessel prices have fallen, we could incur a loss and a reduction in earnings.

Our business has inherent operational risks, which may not be adequately covered by insurance.

Our tankers and their cargoes are at risk of being damaged or lost because of events such as marine disasters, bad weather, mechanical failures, human error, war, terrorism, piracy and other circumstances or events. In addition, transporting crude oil across a wide variety of international jurisdictions creates a risk of business interruptions due to political circumstances in foreign countries, hostilities, labor strikes and boycotts, the potential for changes in tax rates or policies, and the potential for government expropriation of our vessels. Any of these events may result in loss of revenues, increased costs and decreased cash flows to the Charterer, which could impair its ability to make payments to us under our charters.

In the event of a casualty to a vessel or other catastrophic event, we will rely on our insurance to pay the insured value of the vessel or the damages incurred. Under the management agreements, Frontline Management is responsible for procuring insurance for our fleet against those risks that we believe the shipping industry commonly insures against. These insurances include marine hull and machinery insurance, protection and indemnity insurance, which includes pollution risks and crew insurances and war risk insurance. Currently, the amount of coverage for liability for pollution, spillage and leakage available to us on commercially reasonable terms through protection and indemnity associations and providers of excess coverage is $1 billion per vessel per occurrence. We cannot assure you that we will be adequately insured against all risks. Frontline Management may not be able to obtain adequate insurance coverage at reasonable rates for our fleet in the future. Additionally, our insurers may refuse to pay particular claims. Any significant loss or liability for which we are not insured could have a material adverse effect on our financial condition.

Maritime claimants could arrest our tankers, which could interrupt the Charterer's or our cash flow.

Crew members, suppliers of goods and services to a vessel, shippers of cargo and other parties may be entitled to a maritime lien against that vessel for unsatisfied debts, claims or damages. In many jurisdictions, a maritime lien holder may enforce its lien by arresting a vessel through foreclosure proceedings. The arrest or attachment of one or more of our vessels could interrupt the Charterer's or our cash flow and require us to pay a significant amount of money to have the arrest lifted. In addition, in some jurisdictions, such as South Africa, under the "sister ship" theory of liability, a claimant may arrest both the vessel which is subject to the claimant's maritime lien and any "associated" vessel,

28

which is any vessel owned or controlled by the same owner. Claimants could try to assert "sister ship" liability against one vessel in our fleet for claims relating to another vessel in our fleet.

As our fleet ages, the risks associated with older tankers could adversely affect our operations.

In general, the costs to maintain a tanker in good operating condition increase as the tanker ages. Due to improvements in engine technology, older tankers typically are less fuel-efficient than more recently constructed tankers. Cargo insurance rates increase with the age of a tanker, making older tankers less desirable to charterers.

Governmental regulations, safety or other equipment standards related to the age of tankers may require expenditures for alterations or the addition of new equipment to our tankers to comply with safety or environmental laws or regulations that may be enacted in the future. These laws or regulations may also restrict the type of activities in which our tanker may engage or the geographic regions in which they may operate. We cannot predict what alterations or modifications our vessels may be required to undergo in the future or that as our tankers age, market conditions will justify any required expenditures or enable us to operate our tankers profitably during the remainder of their useful lives.

There may be risks associated with the purchase and operation of secondhand tankers.

Our current business strategy includes additional growth through the acquisition of secondhand tankers. Although we will inspect secondhand tankers prior to purchase, this does not normally provide us with the same knowledge about their condition that we would have had if such tankers had been built for and operated exclusively by us. Therefore, our future operating results could be negatively affected if some of the tankers do not perform as we expect. Also, we do not receive the benefit of warranties from the builders if the tankers we buy are older than one year.