Unaudited Interim Consolidated Financial Statements

GOL Linhas Aéreas Inteligentes S.A.

March 31, 2019

Gol Linhas Aéreas Inteligentes S.A.

Unaudited Interim Condensed Consolidated Financial Statements

March 31, 2019

Contents

Unaudited interim consolidated statements of financial position | 02 |

Unaudited interim consolidated statements of operations | 04 |

Unaudited interim consolidated statements of comprehensive income | 05 |

Unaudited interim consolidated statements of changes in equity | 06 |

Unaudited interim consolidated statements of cash flows | 07 |

Notes to the unaudited interim condensed consolidated financial statements | 09 |

| |

| |

Gol Linhas Aéreas Inteligentes S.A.

Unaudited interim consolidated statements of financial position

As of March 31, 2019 and December 31, 2018

(In thousands of Brazilian Reais - R$)

Statement of financial position

Assets | Note | 03/31/2019 | 12/31/2018 |

| | | | |

Current assets | | | |

Cash and cash equivalents | 6 | 1,880,638 | 826,187 |

Short-term investments | 7 | 354,994 | 478,364 |

Restricted cash | 8 | 352,662 | 133,391 |

Trade receivables | 9 | 824,728 | 853,328 |

Inventories | 10 | 187,007 | 180,141 |

Recoverable taxes | 11.1 | 278,338 | 360,796 |

Other assets | | 169,135 | 478,628 |

Total current assets | | 4,047,502 | 3,310,835 |

| | | |

Noncurrent assets | | | |

Deposits | 12 | 1,706,075 | 1,612,295 |

Restricted cash | 8 | 116,661 | 688,741 |

Recoverable taxes | 11.1 | 97,630 | 95,873 |

Deferred taxes | 11.2 | 91,358 | 73,822 |

Derivatives | 30 | 82,767 | - |

Investments | 14 | 1,255 | 1,177 |

Property, plant and equipment | 15 | 5,809,588 | 2,818,057 |

Intangible assets | 16 | 1,782,369 | 1,777,466 |

Total noncurrent assets | | 9,687,703 | 7,067,431 |

| | | |

Total assets | | 13,735,205 | 10,378,266 |

The accompanying notes are an integral part of the unaudited interim condensed consolidated financial statements.

Gol Linhas Aéreas Inteligentes S.A.

Unaudited interim consolidated statements of financial position

As of March 31, 2019 and December 31, 2018

(In thousands of Brazilian Reais - R$)

Liabilities and equity | Note | 03/31/2019 | 12/31/2018 |

| | | | |

Current liabilities | | | |

Loans and financing | 17 | 1,098,101 | 1,103,206 |

Leases | 18 | 1,195,907 | 255,917 |

Suppliers | | 1,241,680 | 1,403,815 |

Suppliers – Forfaiting | 19 | 326,435 | 365,696 |

Salaries | | 402,910 | 368,764 |

Taxes payable | 20 | 100,118 | 111,702 |

Landing fees | | 594,546 | 556,300 |

Advances from ticket sales | 21 | 1,337,812 | 1,673,987 |

Mileage program | | 872,886 | 826,284 |

Advances from customers | | 60,764 | 169,967 |

Provisions | 22 | 86,011 | 70,396 |

Derivatives | 30 | 88,186 | 195,444 |

Other liabilities | | 105,394 | 99,078 |

Total current liabilities | | 7,510,750 | 7,200,556 |

| | | |

Noncurrent liabilities | | | |

Loans and financing | 17 | 6,269,667 | 5,340,601 |

Leases | 18 | 5,120,201 | 656,228 |

Suppliers | | 88,365 | 120,137 |

Provisions | 22 | 834,702 | 829,198 |

Mileage program | | 217,319 | 192,569 |

Deferred taxes | 11.2 | 277,673 | 227,290 |

Taxes payable | 20 | 6,199 | 54,659 |

Derivatives | 30 | 21,523 | 214,218 |

Other liabilities | | 40,385 | 48,161 |

Total noncurrent liabilities | | 12,876,034 | 7,683,061 |

| | | |

Equity | | | |

Capital stock | 23.1 | 2,947,201 | 2,942,612 |

Advance for future capital increase | 23.1 | 512 | 2,818 |

Treasury shares | | (126) | (126) |

Capital reserves | | 88,476 | 88,476 |

Equity valuation adjustments | | (243,203) | (500,022) |

Share-based payments reserve | | 120,970 | 117,413 |

Gains on change in interest in investment | | 759,335 | 759,984 |

Accumulated losses | | (10,864,951) | (8,396,567) |

Deficit attributable to equity holders of the parent | | (7,191,786) | (4,985,412) |

| | | |

Non-controlling interests from Smiles | | 540,207 | 480,061 |

| | | |

Total deficit | | (6,651,579) | (4,505,351) |

| | | |

Total liabilities and deficit | | 13,735,205 | 10,378,266 |

The accompanying notes are an integral part of the unaudited interim condensed consolidated financial statements.

Gol Linhas Aéreas Inteligentes S.A.

Unaudited interim consolidated statements of operations

Three-month periods ended March 31, 2019 and 2018

(In thousands of Brazilian Reais - R$, except basic and diluted earnings (loss) per share)

DRE

| Note | 03/31/2019 | 03/31/2018 |

Net revenue | | | |

Passenger | | 3,033,553 | 2,798,857 |

Cargo and other | | 177,255 | 165,410 |

Total net revenue | 26 | 3,210,808 | 2,964,267 |

| | | |

Operating costs and expenses | | | |

Salaries | | (573,818) | (483,672) |

Aircraft fuel | | (995,186) | (884,213) |

Aircraft rent | | - | (235,421) |

Sales and marketing | | (133,055) | (127,280) |

Landing fees | | (196,577) | (187,439) |

Services rendered | | (149,506) | (130,241) |

Maintenance, materials and repairs | | (44,294) | (110,324) |

Depreciation and amortization | | (405,577) | (150,568) |

Passenger service expenses | | (152,145) | (119,746) |

Sale-leaseback transactions | | 7,924 | 80,978 |

Other operating expenses, net | | (62,442) | (112,030) |

Total operating costs and expenses | | (2,704,676) | (2,459,956) |

| | | |

Equity results | 14 | 78 | (19) |

Income before financial results, net and income taxes | | 506,210 | 504,292 |

| | | |

Financial results | 27 | | |

Financial income | | 102,440 | 64,639 |

Financial expenses | | (388,203) | (260,987) |

Exchange rate variation, net | | (115,332) | (21,515) |

Total financial results | | (401,095) | (217,863) |

| | | |

Income before income taxes | | 105,115 | 286,429 |

| | | |

Income taxes | | | |

Current | | (40,048) | (49,293) |

Deferred | | (29,861) | (16,299) |

Total income taxes | 11.2 | (69,909) | (65,592) |

| | | |

Net income for the period | | 35,206 | 220,837 |

| | | |

Net income (loss) attributable to: | | | |

Equity holders of the parent | | (32,307) | 147,471 |

Non-controlling interests from Smiles | | 67,513 | 73,366 |

| | | |

Basic earnings (loss) per share | | | |

Per common share | 24 | (0.003) | 0.012 |

Per preferred share | 24 | (0.092) | 0.424 |

| | | |

Diluted earnings (loss) per share | | | |

Per common share | 24 | (0.003) | 0.012 |

Per preferred share | 24 | (0.092) | 0.418 |

The accompanying notes are an integral part of the unaudited interim condensed consolidated financial statements.

Gol Linhas Aéreas Inteligentes S.A.

Unaudited interim consolidated statements of comprehensive income

Three-month periods ended March 31, 2019 and 2018

(In thousands of Brazilian Reais - R$)

OCI

| Note | 03/31/2019 | 03/31/2018 |

| | | |

Net income for the period | | 35,206 | 220,837 |

| | | |

Other comprehensive income to be reclassified to profit and loss in subsequent periods | 30 | | |

Cash flow hedge | | 256,819 | 660 |

Total | | 256,819 | 660 |

| | | |

Total comprehensive income for the period | | 292,025 | 221,497 |

| | | |

Comprehensive income for the year attributable to: | | | |

Equity holders of the parent | | 224,512 | 148,131 |

Non-controlling interests from Smiles | | 67,513 | 73,366 |

The accompanying notes are an integral part of theunaudited interim condensedconsolidated financial statements.

Gol Linhas Aéreas Inteligentes S.A.

Unaudited interim consolidated statements of changes in equity

Three-month periods ended March 31, 2019 and 2018

(In thousands of Brazilian Reais - R$)

| | | | | Capital reserves | | | | | | | |

| Note | Capital stock | Advance for future capital increase | Treasury shares | Goodwill on transfer of shares | Special goodwill reserve of subsidiary | Unrealized hedge gains (losses) | Share- based payments | Gains on change in investment reserve | Accumulated losses | Total attributable to equity holders of the parent | Smiles’ non- controlling interests | Total |

Balances as of December 31, 2017 | | 2,927,184 | - | (4,168) | 17,783 | 70,979 | (79,316) | 119,308 | 760,545 | (7,312,849) | (3,500,534) | 412,013 | (3,088,521) |

Initial adoption of IFRS 9 | | - | - | - | - | - | - | - | - | 1,675 | 1,675 | 39 | 1,714 |

Net income for theperiod | | - | - | - | - | - | - | - | - | 147,471 | 147,471 | 73,366 | 220,837 |

Other comprehensive income, net | | - | - | - | - | - | 660 | - | - | - | 660 | - | 660 |

Stock options exercised | | 1,500 | 5,799 | - | - | - | - | - | - | - | 7,299 | - | 7,299 |

Capital increase from exercise of stock options in subsidiary | | - | - | - | - | - | - | - | - | - | - | 875 | 875 |

Share-based payments | | - | - | - | - | - | - | 4,694 | - | - | 4,694 | 41 | 4,735 |

Effects on change in interest in investment | | - | - | - | - | - | - | - | (561) | - | (561) | 561 | - |

Additional dividends distributed by Smiles | | - | - | - | - | - | - | - | - | - | - | (6,972) | (6,972) |

Balances as of March 31, 2018 | | 2,928,684 | 5,799 | (4,168) | 17,783 | 70,979 | (78,656) | 124,002 | 759,984 | (7,163,703) | (3,339,296) | 479,923 | (2,859,373) |

| | | | | | | | | | | | | |

Balances as of December 31, 2018 | | 2,942,612 | 2,818 | (126) | 17,497 | 70,979 | (500,022) | 117,413 | 759,984 | (8,396,567) | (4,985,412) | 480,061 | (4,505,351) |

Initial adoption of IFRS 16 (*) | 4.1.1 | - | - | - | - | - | - | - | - | (2,436,077) | (2,436,077) | (257) | (2,436,334) |

Net income (loss) for the period | | - | - | - | - | - | - | - | - | (32,307) | (32,307) | 67,513 | 35,206 |

Other comprehensive income, net | | - | - | - | - | - | 256,819 | - | - | - | 256,819 | - | 256,819 |

Stock options exercised | 23.1 | 4,589 | (2,306) | - | - | - | - | - | - | - | 2,283 | - | 2,283 |

Capital increase from exercise of stock options in subsidiary | | - | - | - | - | - | - | - | - | - | - | 106 | 106 |

Share-based payments | | - | - | - | - | - | - | 3,557 | - | - | 3,557 | 384 | 3,941 |

Effects on change in interest in investment | | - | - | - | - | - | - | - | (649) | - | (649) | 649 | - |

Interest on shareholders’ equity distributed by Smiles | | - | - | - | - | - | - | - | - | - | - | (8,249) | (8,249) |

Balances as of March 31, 2019 | | 2,947,201 | 512 | (126) | 17,497 | 70,979 | (243,203) | 120,970 | 759,335 | (10,864,951) | (7,191,786) | 540,207 | (6,651,579) |

(*) On January 1, 2019, the Company adopted IFRS 16 – “Leases” which resulted in an initial adjustment in accumulated losses. See note 4.1.1.

The accompanying notes are an integral part of theunauditedinterim condensedconsolidated financial statements.

Gol Linhas Aéreas Inteligentes S.A.

Unaudited interim consolidated statements of cash flows

Three-month periods ended March 31, 2019 and 2018

(In thousands of Brazilian Reais - R$)

| 03/31/2019 | 03/31/2018 |

Operating activities | | |

Net income for the period | 35,206 | 220,837 |

Adjustments to reconcile net income to net cash provided by operating activities | | |

Depreciation and amortization | 405,577 | 150,568 |

Reversal of doubtful accounts | (6,986) | (988) |

Provisions for legal proceedings | 47,103 | 72,531 |

Provisions for inventory obsolescence | 22 | 1,512 |

Deferred taxes | 29,861 | 16,299 |

Equity results | (78) | 19 |

Share-based payments | 3,941 | 4,735 |

Exchange and monetary variations, net | 132,817 | 18,311 |

Interest on loans and financing and leases | 260,297 | 168,551 |

Unrealized hedge results | (9,030) | (16,086) |

Provision for profit sharing | 2,392 | 15,157 |

Disposals of property, plant and equipment and intangible assets | 2,196 | 2,500 |

Other provisions | (50,458) | - |

| 852,860 | 653,946 |

| | |

Changes in assets and liabilities: | | |

Trade receivables | 36,102 | (73,669) |

Short-term investments | 93,502 | 10,904 |

Inventories | (6,888) | (3,935) |

Deposits | (41,212) | 2,426 |

Suppliers | (227,717) | (143,270) |

Suppliers – Forfaiting | (35,549) | 342,060 |

Advances from ticket sales | (336,175) | (422,652) |

Mileage program | 71,352 | (20,420) |

Advances from customers | (109,203) | 59,940 |

Salaries | 31,754 | 1,003 |

Landing fees | 38,246 | (107,990) |

Taxes obligation | (38,485) | 44,821 |

Derivatives | (64,197) | 12,086 |

Provisions | (38,287) | (48,089) |

Operating leases | - | 19,876 |

Other assets (liabilities) | 391,121 | (70,974) |

Interest paid | (189,624) | (150,591) |

Income taxes paid | (21,559) | (53,805) |

Net cash flows from operating activities | 406,041 | 51,667 |

| | |

Investing activities | | |

Short-term investments of Smiles | 29,868 | (320,408) |

Restricted cash | 345,801 | (25,117) |

Advances for aircraft acquisition | (2,131) | (11,373) |

Property, plant and equipment acquisitions | (99,901) | (162,448) |

Intangible assets acquisitions | (20,782) | (8,022) |

Net cash flows from (used in) investing activities | 252,855 | (527,368) |

Gol Linhas Aéreas Inteligentes S.A.

Unaudited interim consolidated statements of cash flows

Three-month periods ended March 31, 2019 and 2018

(In thousands of Brazilian Reais - R$)

| 03/31/2019 | 03/31/2018 |

Financing activities | | |

Loans and financing issued | 1,208,246 | 604,571 |

Debt issuance and exchange offer costs | (48,829) | (10,742) |

Loans and financing payments | (228,289) | (37,751) |

Early payment of Senior Notes | (50,320) | (531,907) |

Leases payments | (354,926) | (52,970) |

Capped call | (102,055) | - |

Dividends and interest attributable to shareholders’ equity paid to non-controlling interests of Smiles | (7,371) | - |

Capital increase | 1,771 | 1,500 |

Capital increase in subsidiary from non-controlling interests | 106 | 875 |

Advance for future capital increase | 512 | 5,799 |

Net cash flows from (used in) financing activities | 418,845 | (20,625) |

| | |

Foreign exchange rate variation on cash held in foreign currencies | (23,290) | 1,910 |

| | |

Net increase (decrease) in cash and cash equivalents | 1,054,451 | (494,416) |

| | |

Cash and cash equivalents at beginning of the period | 826,187 | 1,026,862 |

Cash and cash equivalents at end of the period | 1,880,638 | 532,446 |

| | |

| | |

Non-cash transactions | | |

Interest on equity, net of taxes | (7,512) | - |

Deposits in guarantee for lease agreements | (476) | - |

Maintenance reserve | (1,692) | - |

Write-off of finance lease agreements | 3,501 | - |

Property, plant and equipment acquisition through Finimp | 114,623 | - |

| | | |

The accompanying notes are an integral part of theunauditedinterim condensedconsolidated financial statements.

GOL Linhas Aéreas Inteligentes S.A.

Notes to the unaudited interim consolidated financial statements

For the three-month periods ended March 31, 2019 and 2018

(In thousands of Brazilian Reais - R$, except when otherwise indicated)

1. General information

Gol Linhas Aéreas Inteligentes S.A. (the “Company” or “GLAI”) is a publicly-listed company incorporated on March 12, 2004, under the Brazilian Corporate Law. According to the Bylaws,the Company's corporate purpose is primarily the exercise of GOL Linhas Aéreas SA ("GLA") shareholder control, of which operates regular and non-scheduled passenger flight transportation services, loyalty programs development, among others.

The Company’s shares are traded on B3 S.A. - Brasil, Bolsa, Balcão (“B3”) and on the New York Stock Exchange (“NYSE”). The Company adopted Level 2 Differentiated Corporate Governance Practices from B3 and is included in the Special Corporate Governance Stock Index (“IGC”) and the Special Tag Along Stock Index (“ITAG”), which were created for companies committed to apply differentiated corporate governance practices.

As of March 11, 2019, as a result of the second accident involving an aircraft Max 8, and, the security being the Company's number 1 value, by free will and before any communication from the regulatory agencies, the Company’s management decided to suspend the operations of its 7 aircraft of this model.

As a result of this strategy, the Company quickly reconfigured its flight network, causing the least inconvenience to its passengers. The Company did not need and does not intend to interrupt any of its routes due to the suspension of the use of these aircraft.

The use of these aircraft is subject to authorization regulatory authorities from Brazil and from routes destination countries, being mainly the United States of America.

Until the date of issuance of these unaudited interim condensed consolidated financial statements, the Company’s management assessed that there are no indications of losses related to the right of use assets registered under these aircraft and, therefore, no impairment was recorded.

The Company’s corporate address is located at Praça Comandante Linneu Gomes, s/n, concierge 3, building 24, Jardim Aeroporto, São Paulo, Brazil.

1.1. Capital structure and net working capital

As of March 31, 2019, the Company held a negative shareholders' equity of R$7,191,786 (R$4,985,412 as of December 31, 2018), the increase resulted from the IFRS 16 – “Leases” adoption, and held a negative consolidated working capital of R$3,463,248 (R$3,889,721 as of December 31, 2018).

GLA is highly sensitive to the economy and also to the U.S. dollar, as approximately 38.4% of its costs are denominated in U.S. dollar and GLA’s capacity to adjust ticket prices charged to its customers in order to offset the U.S. dollar appreciation is dependent on capacity (offer) and ticket prices practiced by the competitors.

The Company implemented several initiatives to adjust its fleet size to the economy growth and match seat supply to demand, in order to maintain a high load factor, reduce costs and adjust its capital structure.

At the end of 2017, the Company executed initiatives to restructure its balance sheet, equating of the extension of terms and the reduction of the financial cost of its debtstructure as a result of an offer made on December 11, 2017, with the funding of funds in the amount of US$500 million with interest rates of 7.1% p.a., partially intended for the amortization of debts with an average rate of 9.8% p.a.

GOL Linhas Aéreas Inteligentes S.A.

Notes to the unaudited interim consolidated financial statements

For the three-month periods ended March 31, 2019 and 2018

(In thousands of Brazilian Reais - R$, except when otherwise indicated)

In October 2018, the Company completed the refinancing of the debentures of its wholly-owned subsidiary GLA, fully amortizing the total amount of R$1,025,000 and issuing a new series of non-convertible and unsecured debentures in the amount of R$887,500, resulting in a reduction of indebtedness of R$137,500. The new debentures were issued with interest of 120.0% of the Interbank Deposit Certificate ("CDI"), representing a substantial reduction compared to the amortized debt, which was 132.0% of CDI. This operation represented additional deleveraging of the Company's balance sheet and better adjusted the generation of GLA's operating cash flows with the amortization of its liabilities.

In March 2019, the Company raised US$300 million through the international offer of exchangeable notes with nominal interest rate of 3.5% p.a.

The Company will continue strengthening its balance sheet management and results in order to guarantee sustainability, including the corporate reorganization described in Note 1.3 of these unaudited interim condensed consolidated financial statements. Management understands that the business plan prepared, presented and approved by the Board of Directors on January 17, 2019, shows strong elements to continue as going concern.

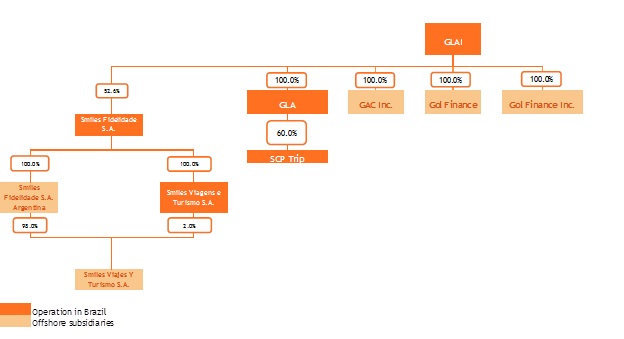

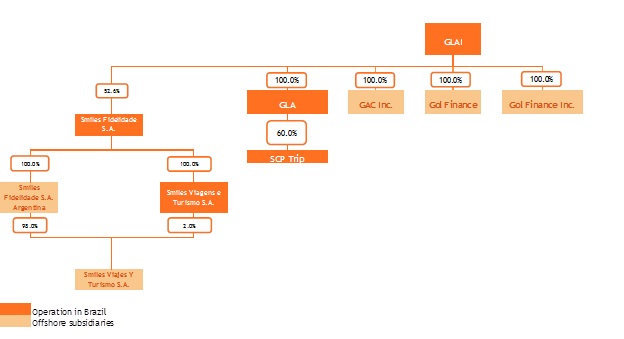

1.2. Ownership structure

On February 1, 2019, Smiles Fidelidade S.A. ("Smiles Fidelidade") sold its equity interest in the affiliate Netpoints S.A. for R$914.

In the three-month period ended March 31, 2019, there were no other changes in the Company's corporate structure, which is presented below:

GOL Linhas Aéreas Inteligentes S.A.

Notes to the unaudited interim consolidated financial statements

For the three-month periods ended March 31, 2019 and 2018

(In thousands of Brazilian Reais - R$, except when otherwise indicated)

1.3. Corporate reorganization plan

On October 15, 2018, the Company and its subsidiary Smiles Fidelidade announced to the market a corporate reorganization comprising the intention of ensuring the long-term competitiveness of the Gol Group ("GOL"), through the alignment of interests of all stakeholders, reinforcing a consolidated capital structure, simplifying the corporate governance of the Group companies, reducing operational and administrative costs and expenses, and increasing market liquidity for all GOL shareholders through the merger of Smiles Fidelidade by the subsidiary GLA.

Due to the decision of inadmissibility of the Company's migration to B3's New Market, as well as the new opportunities for structuring the Brazilian air sector, authorized by Provisional Measure No. 863, published on December 13, 2018, which eliminated all restrictions on participation of foreigners in the voting capital of Brazilian airlines, the Company also informed on December 17, 2018 that it is evaluating additional options available for the implementation of the potential merger of the subsidiary Smiles Fidelidade, in light of the new scenario of the Brazilian airline sector which, in Management's opinion, enhances the creation of value for the Company's shareholders by authorizing non-Brazilian control of GLA and other structures present on the Brazilian stock exchange. During the three-month period ended March 31, 2019, there were no additional facts to the above.

1.4. Compliance program

Since 2016, the Company has taken a series of measures to strengthen and expand its internal control and compliance programs, which were detailed presented in the annual financial statements for the year ended December 31, 2018.

The senior management is constantly reinforcing to its employees, customers and suppliers its commitment to continue improving its internal control and compliance programs.

As previously disclosed in the financial statements for the year ended December 31, 2018, the Company entered into an agreement with the Brazilian Federal Public Ministry (the “Agreement”), under which the Company agreed to pay R$12 million in fines and make improvements to its compliance program along with the Federal Public Ministry on not to raise any charges related to activities that are the subject to the Agreement, in addition, the Company paid R$4.2 million in fines to the Brazilian tax authorities.

The Company voluntarily informed the U.S. Department of Justice (“DOJ”), the Securities and Exchange Commission (“SEC”) and the Brazilian Securities Commission (“CVM”) of the external independent investigation hired by the Company and the Agreement, these authorities may impose fines and possibly other sanctions to the Company.

During the three-month period ended March 31, 2019 there was no new developments on this matter.

GOL Linhas Aéreas Inteligentes S.A.

Notes to the unaudited interim consolidated financial statements

For the three-month periods ended March 31, 2019 and 2018

(In thousands of Brazilian Reais - R$, except when otherwise indicated)

2. Management’s statement, basis of preparation and presentation of the interim condensed consolidated financial statements

The unaudited interim consolidated financial statements were prepared in accordance with International Financial Reporting Standard IAS No. 34 - "Interim Financial Information" (“IAS 34”), issued by the International Accounting Standards Board ("IASB").

The unaudited interim condensed consolidated financial statements were prepared using the Brazilian real (“R$”) as the functional and presentation currency and the figures are expressed in thousands of Brazilian reais. The amounts disclosed in other currencies, when necessary, are also reported in thousands. The items disclosed in foreign currencies are identified, when applicable.

The preparation of the Company’s unaudited interim condensed consolidated financial statements requires Management to make judgments, use estimates and adopt assumptions affecting the stated amounts of revenues, expenses, assets and liabilities. However, the uncertainty inherent in these judgments, assumptions and estimates could give rise to results that require a material adjustment of the book value of certain assets and liabilities in future reporting years.

The Company continually reviews its judgments, estimates and assumptions.

In preparing the unaudited interim condensed consolidated financial statements the disclosure criteria were used considering regulatory aspects and the relevance of transactions to understand the changes observed in the Company's equity, economic and financial position and its performance since the term related to the last fiscal year ended on December 31, 2018, as well as the updating of relevant information included in the annual financial statements for the year ended December 31, 2018 issued on March 13, 2019.

Management confirms that all the material information in these unaudited interim condensed consolidated financial statements is being demonstrated and corresponds to the information used by Management in the development of its business management activities.

The interim condensed consolidated financial statements were prepared based on the historical cost, except for certain financial assets and liabilities measured at fair value when applicable, and investments measured by the equity method of accounting at the Parent Company.

· short-term investments classified as cash and cash equivalents measured at fair value;

· short-term investments comprising exclusive investment funds measured at fair value;

· derivative financial instruments measured at fair value; and

· investments recorded by the equity method.

The Company’s unaudited interim condensed consolidated financial statements as of March 31, 2019 and for the three-month periods ended March 31, 2019 and 2018 have been prepared assuming that it will continue as going concern, realizing assets and settling liabilities in the normal course of business, as per Note 1.1.

GOL Linhas Aéreas Inteligentes S.A.

Notes to the unaudited interim consolidated financial statements

For the three-month periods ended March 31, 2019 and 2018

(In thousands of Brazilian Reais - R$, except when otherwise indicated)

3. Approval for issuance of the unaudited interim condensed consolidated financial statements

The unaudited interim condensed consolidated financial statements were authorized for issue by Management on April30, 2019.

4. Summary of significant accounting practices

The unaudited interim condensed consolidated financial statements presented were prepared based on accounting policies, accounting practices and calculation methods adopted in the preparation of the annual financial statements for the year ended December 31, 2018, in which they are presented in detail, except for the adoption of IFRS 16 - "Leases", presented in Note 4.1 of these unaudited interim condensed consolidated financial statements.

4.1. New standards and accounting pronouncements adopted in the three-month period ended March 31, 2019

4.1.1. IFRS 16 - “Leases”

IFRS 16 – Leases (“IFRS 16”) sets out the principles for the recognition, measurement, presentation and disclosure of leases and requires lessees to account for all leases under a single on-balance sheet model similar to the accounting for finance leases under IAS 17. The standard includes two recognition exemptions for lessees – leases of ‘low-value’ assets (e.g., personal computers) and short-term leases (i.e., leases with a lease term of 12 months or less). At the commencement date of a lease, a lessee will recognize a liability to make lease payments (i.e., the lease liability) and an asset representing the right to use the underlying asset during the lease term (i.e., the right-of-use asset). Lessees will be required to separately recognize the interest expense on the lease liability and the depreciation expense on the right-of-use asset.

Lessees are also required to remeasure the lease liability upon the occurrence of certain events (e.g., a change in the lease term, a change in future lease payments resulting from a change in an index or rate used to determine those payments). The lessee generally recognize the amount of the remeasurement of the lease liability as an adjustment to the right-of-use asset.

Among the adoption methods provided for in the standard, the Company chose to adopt the modified retrospective method, therefore, in accordance with IFRS 16, did not restate comparative information and balances. Within the modified retrospective method, the Company chose to adopt the following transition practical expedients and exemptions:

· the Company used hindsight, such as in determining the lease term and considering extensions and renegotiations throughout the agreement; and

· the Company applied a single discount rate to its portfolio of leases with similar characteristics, considering the remaining term of the agreements and the guarantee provided for by the assets.

The Company assessed the impacts arising from the adoption of this standard, considering the above-mentioned assumptions, and will record 120 aircraft and flight equipment lease agreements and 14 other lease agreements as right-of-use, and the effects of the initial adoptions are shown in the table below:

GOL Linhas Aéreas Inteligentes S.A.

Notes to the unaudited interim consolidated financial statements

For the three-month periods ended March 31, 2019 and 2018

(In thousands of Brazilian Reais - R$, except when otherwise indicated)

| | Assets (a) | Liabilities (b) | Equity (a-b) |

Operating leases | - | (219,728) | 219,728 |

Right of use - Aircraft and flight equipment | 2,892,836 | 5,540,621 | (2,647,785) |

Right of use - Other | 41,420 | 49,975 | (8,555) |

Deferred tax - Smiles (*) | - | - | 278 |

Net effect | 2,934,256 | 5,370,868 | (2,436,334) |

(*) The amount refers to the tax credit constituted from the initial adoption of IFRS 16 recorded in the deferred tax asset of the subsidiary Smiles Fidelidade.

The Company assessed the estimated impacts arising from deferred taxes over IFRS 16 adjustments which will be recorded in the accumulated losses as of January 1, 2019 and should not record the corresponding tax effects in accordance to IAS 12 – “Income Taxes”, since GLA hashistory of losses in recent years.

As a consequence of the adoption of IFRS 16, the Company’s recorded some reclassifications in the balance sheet as of December 31, 2018, presented for comparison purposes, as shown below:

| 12/31/2018 |

| As previously reported | Reclassification | Reclassified |

| | | |

Current liabilities | | | |

Loans and financing | 1,223,324 | (120,118) | 1,103,206 |

Leases | - | 255,917 | 255,917 |

Operating leases | 135,799 | (135,799) | - |

| | | |

Noncurrent liabilities | | | |

Loans and financing | 5,861,143 | (520,542) | 5,340,601 |

Leases | - | 656,228 | 656,228 |

Operating leases | 135,686 | (135,686) | - |

GOL Linhas Aéreas Inteligentes S.A.

Notes to the unaudited interim consolidated financial statements

For the three-month periods ended March 31, 2019 and 2018

(In thousands of Brazilian Reais - R$, except when otherwise indicated)

4.1.2. IFRIC 23 - “Uncertainty Over Income Tax Treatments”

In June 2017, the IASB issued IFRIC 23, which clarifies the application of requirements in IAS 12 - “Income Taxes” when there is uncertainty over the acceptance of income tax treatments by the tax authority. The interpretation clarifies that, if it is not probable that the tax authority will accept the income tax treatments, the amounts of tax assets and liabilities shall be adjusted to reflect the best resolution of the uncertainty. IFRIC 23 is effective since January 1, 2019, based on the evaluation made by the Company’s Management concluded that there are no impacts or needs of additional disclosure in these unaudited interim condensed consolidated financial statements arising from the application of this interpretation.

4.2. New accounting standards and pronouncements not yet adopted

There are no other standards and interpretations issued and not yet adopted that may have a significant impact on the results or equity disclosed by the Company.

5. Seasonality

The Company expects its revenues and operating results for its flights to reach their highest levels during the summer and winter holidays in January and July, respectively, and in the last two weeks of December during the holiday season of year end. Given the large proportion of fixed costs, this seasonality tends to cause variations in the operating results between the quarters of the year.

6. Cash and cash equivalents

| 03/31/2019 | 12/31/2018 |

| | |

Cash and bank deposits | 60,069 | 157,970 |

Cash equivalents | 1,820,569 | 668,217 |

Total | 1,880,638 | 826,187 |

The breakdown of cash equivalents is as follows:

| Weighted average rate (p.a.) | 03/31/2019 | 12/31/2018 |

| | | |

Private bonds | 86.8% of CDI rate | 3,972 | 74,819 |

Government bonds | 88.1% of CDI rate | 92 | 39 |

Investment funds | 99.3% of CDI rate | 682,545 | 307,499 |

Local currency | | 686,609 | 382,357 |

| | | |

Private bonds | 2.5% | 1,121,427 | 285,860 |

Investment funds | 35.4% | 12,533 | - |

Foreign currency | | 1,133,960 | 285,860 |

| | | |

Total | | 1,820,569 | 668,217 |

GOL Linhas Aéreas Inteligentes S.A.

Notes to the unaudited interim consolidated financial statements

For the three-month periods ended March 31, 2019 and 2018

(In thousands of Brazilian Reais - R$, except when otherwise indicated)

7. Short-term investments

| Weighted average rate (p.a.) | 03/31/2019 | 12/31/2018 |

| | | |

Government bonds | 100.7% of CDI rate | 11,848 | 21,100 |

Investment funds | 103.8% of CDI rate | 343,146 | 365,249 |

Local currency | | 354,994 | 386,349 |

| | | |

Private bonds | - | - | 92,015 |

Foreign currency | | - | 92,015 |

| | | |

Total | | 354,994 | 478,364 |

8. Restricted cash

| Weighted average rate (p.a.) | 03/31/2019 | 12/31/2018 |

| | | |

Deposits in guarantee of letter of credit | 98.8% of CDI rate | 144,397 | 100,394 |

Escrow deposits (a) | 95.0% of CDI rate | 32,476 | 72,089 |

Escrow deposits for hedge margin | 100.0% of CDI rate | 3,239 | 18 |

Escrow deposits - leases (b) | 100.0% of CDI rate | 128,505 | 102,880 |

Other deposits (c) | 83.4% of CDI rate | 41,375 | 113,447 |

Local currency | | 349,992 | 388,828 |

| | | |

Escrow deposits for hedge margin | 2.6% | 119,331 | 433,304 |

Foreign currency | | 119,331 | 433,304 |

| | | |

Total | | 469,323 | 822,132 |

| | | |

Current | | 352,662 | 133,391 |

Noncurrent | | 116,661 | 688,741 |

(a) The amount of R$34,437 refers to a guarantee for GLAI’s legal proceedings. The other amounts relate to guarantees of GLA letters of credit.

(b) Related to deposits made to obtain letters of credit for aircraft leases from GLA.

(c) Refers mainly to bank guarantees.

GOL Linhas Aéreas Inteligentes S.A.

Notes to the unaudited interim consolidated financial statements

For the three-month periods ended March 31, 2019 and 2018

(In thousands of Brazilian Reais - R$, except when otherwise indicated)

9. Trade receivables

| 03/31/2019 | 12/31/2018 |

Local currency | | |

Credit card administrators | 316,111 | 393,557 |

Travel agencies | 290,897 | 226,627 |

Cargo agencies | 40,370 | 40,431 |

Airline partner companies | - | 3,243 |

Other | 34,949 | 52,216 |

Total local currency | 682,327 | 716,074 |

| | |

Foreign currency | | |

Credit card administrators | 98,558 | 97,488 |

Travel agencies | 22,247 | 21,005 |

Cargo agencies | 1,415 | 1,378 |

Airline partner companies | 22,997 | 23,294 |

Other | 1,482 | 5,373 |

Total foreign currency | 146,699 | 148,538 |

| | |

Total | 829,026 | 864,612 |

| | |

Estimated losses for doubtful accounts | (4,298) | (11,284) |

| | |

Total trade receivables | 824,728 | 853,328 |

The aging list of trade receivables, net of allowance for doubtful accounts, is as follows:

| | 03/31/2019 | 12/31/2018 |

Current | | |

Until 30 days | 515,878 | 527,878 |

31 to 60 days | 107,781 | 101,226 |

61 to 90 days | 42,731 | 49,696 |

91 to 180 days | 73,343 | 83,128 |

181 to 360 days | 33,558 | 36,801 |

Above 360 days | 845 | 268 |

Total | 774,136 | 798,997 |

| | |

Overdue | | |

Until 30 days | 14,761 | 13,167 |

31 to 60 days | 6,206 | 4,726 |

61 to 90 days | 2,235 | 2,672 |

91 to 180 days | 5,882 | 11,173 |

181 to 360 days | 6,893 | 9,863 |

Above 360 days | 14,615 | 12,730 |

Total overdue | 50,592 | 54,331 |

| | |

Total | 824,728 | 853,328 |

The changes in allowance for doubtful accounts are as follows:

| 03/31/2019 | 12/31/2018 |

Adjusted balance at the beginning of the period | (11,284) | (36,088) |

Exclusions (*) | 6,986 | 9,789 |

Write-off of unrecoverable amounts | - | 15,015 |

Balance at the end of the period | (4,298) | (11,284) |

(*) Recoveries occurred during the period are reflected in the changes to the receivables portfolio balance and presented under “Exclusions”.

GOL Linhas Aéreas Inteligentes S.A.

Notes to the unaudited interim consolidated financial statements

For the three-month periods ended March 31, 2019 and 2018

(In thousands of Brazilian Reais - R$, except when otherwise indicated)

10.Inventories

| 03/31/2019 | 12/31/2018 |

Consumables | 23,423 | 22,098 |

Parts and maintenance materials | 176,319 | 170,851 |

(-) Provision for obsolescence | (12,735) | (12,808) |

Total | 187,007 | 180,141 |

The changes in provision for obsolescence are as follows:

| 03/31/2019 | 12/31/2018 |

Balance at the beginning of the period | (12.808) | (12,509) |

Addition | (22) | (5,023) |

Write-off | 95 | 4,724 |

Balance at the end of the period | (12.735) | (12,808) |

11.Deferred and recoverable taxes

11.1. Recoverable taxes

| 03/31/2019 | 12/31/2018 |

Prepaid and recoverable income taxes | 219,117 | 268,428 |

Withholding income tax (IRRF) | 832 | 4,744 |

PIS and COFINS | 132,590 | 163,921 |

Withholding tax of public institutions | 2,417 | 6,812 |

Value added tax (IVA) | 6,011 | 5,649 |

Other | 15,001 | 7,115 |

Total | 375,968 | 456,669 |

| | |

Current | 278,338 | 360,796 |

Noncurrent | 97,630 | 95,873 |

11.2. Deferred tax assets (liabilities)

| 03/31/2019 | 12/31/2018 |

Net operating losses carryforward: | | |

Income tax losses | 82,198 | 75,367 |

Negative basis of social contribution | 29,591 | 27,132 |

| | |

Temporary differences: | | |

Allowance for doubtful accounts and other credits | 68,802 | 72,845 |

Breakage provision | (175,529) | (172,869) |

Provision for losses on GLA’s acquisition | 143,350 | 143,350 |

Provision for legal proceedings and tax liabilities | 81,097 | 94,137 |

Provision for aircraft return | 63,665 | 62,642 |

Derivative transactions | 5,666 | 5,335 |

Slots | (353,226) | (353,226) |

Depreciation of engines and spare parts | (176,548) | (174,129) |

Reversal of goodwill amortization on GLA’s acquisition | (127,659) | (127,659) |

Aircraft leases and other | 27,154 | 30,956 |

Other | 145,124 | 162,651 |

Total deferred taxes, net | (186,315) | (153,468) |

| | |

Deferred tax assets | 91,358 | 73,822 |

Deferred tax liabilities | (277,673) | (227,290) |

| | |

GOL Linhas Aéreas Inteligentes S.A.

Notes to the unaudited interim consolidated financial statements

For the three-month periods ended March 31, 2019 and 2018

(In thousands of Brazilian Reais - R$, except when otherwise indicated)

The Company and its subsidiaries GLA and Smiles have net operating loss carryforwards, comprised of accumulated income tax losses and negative basis of social contribution. The net operating loss carryforwards do not expire; however, their use is limited to 30% of the annual taxable income. Net operating loss carryforwards balances are as follows:

| GLAI | GLA | Smiles |

| 03/31/2019 | 12/31/2018 | 03/31/2019 | 12/31/2018 | 03/31/2019 | 12/31/2018 |

Income tax losses | 167,999 | 170,418 | 4,939,286 | 5,631,209 | 474,940 | 522,743 |

Negative basis of social contribution | 167,999 | 170,418 | 4,939,286 | 5,631,209 | 474,940 | 522,743 |

The Company’s Management considers that the deferred assets recognized as of March 31, 2019 arising from temporary differences will be realized in connections with the realization of the deferred tax liabilities and the expectation of future results.

The reconciliation of effective income tax and social contribution rate for the three-month periods ended Mach 31, 2019 and 2018 are as follows:

| 03/31/2019 | 03/31/2018 |

| | |

Income before income taxes | 105,115 | 286,429 |

Income tax and social contribution tax rate | 34% | 34% |

Income at the statutory combined tax rate | (35,739) | (97,386) |

| | |

Adjustments to calculate the effective tax rate: | | |

Equity pick up method | 27 | (6) |

Tax losses from wholly-owned subsidiaries | (40,037) | (20,471) |

Income tax on permanent differences and other | 46,941 | 82,876 |

Exchange variation on foreign investments | (42,630) | (5,995) |

Interest attributable to shareholders’ equity | 2,805 | 2,371 |

Unrecognized benefit on tax losses and unrecognized portion on temporary differences | (1,276) | (26,981) |

Total income taxes | (69,909) | (65,592) |

| | |

Income taxes | | |

Current | (40,048) | (49,293) |

Deferred | (29,861) | (16,299) |

Total income taxes | (69,909) | (65,592) |

12.Deposits

| 03/31/2019 | 12/31/2018 |

Judicial deposits | 767,584 | 726,491 |

Maintenance deposits | 688,503 | 647,057 |

Deposits in guarantee for lease agreements | 249,988 | 238,747 |

Total | 1,706,075 | 1,612,295 |

GOL Linhas Aéreas Inteligentes S.A.

Notes to the unaudited interim consolidated financial statements

For the three-month periods ended March 31, 2019 and 2018

(In thousands of Brazilian Reais - R$, except when otherwise indicated)

13.Transactions with related parties

13.1. Transportation and consulting services with entities controlled by the controlling shareholder

In the course of its operations, the Company, through its subsidiaries, contracts and is contracted by related parties, namely: Viação Piracicabana Ltda., Mobitrans Administração e Participações S.A. and Expresso Caxiense SA. The nature of contracted services are detailed in the annual financial statements for the year ended December 31, 2018. For the three-month period ended March 31, 2019, GLA recognized total expenses related to these services of R$2,758 (R$2,550 for the three-month period ended March 31, 2018). As of March 31, 2019, the balance payable to related parties was R$1,431 (R$1,107 as of December 31, 2018), and was mainly related to services provided by Viação Piracicabana Ltda.

13.2. Contracts account opening UATP (“Universal Air Transportation Plan”) to grant credit limit

In September 2011, GLA entered into agreements with the related parties Empresa de Ônibus Pássaro Marrom S.A., Viação Piracicabana Ltda., Thurgau Participações S.A., Comporte Participações S.A., Quality Bus Comércio De Veículos S.A., Empresa Princesa Do Norte S.A., Expresso União Ltda., Oeste Sul Empreendimentos Imobiliários S.A. SPE., Empresa Cruz De Transportes Ltda., Expresso Maringá do Vale S.A., Glarus Serviços Tecnologia e Participações LTDA., Expresso Itamarati S.A., Transporte Coletivo Cidade Canção Ltda., Turb Transporte Urbano S.A., Vaud Participações S.A., Aller Participações S.A. and BR Mobilidade Baixada Santista S.A. SPE, all with no expiration date, whose purpose is to issue credits to purchase airline tickets issued by the Company.The UATP account (virtual card) is accepted as a payment method on the purchase of airline tickets and related services, seeking to simplify billing and facilitate payment between the participating companies.

13.3. Agreement to use VIP lounge

On April 9, 2012, the Company entered into an agreement with Delta Air Lines Inc. (“Delta Air Lines”) for the mutual use of VIP lounge, with expected payments between the companies of US$20 per passenger. On August 30, 2016, the companies signed a contractual amendment establishing a prepayment for the use of VIP lounge in the amount of US$3,000. As of March 31, 2019, the outstanding balance was R$4,452, recorded in “Advances from customers” (R$4,741 as of December 31, 2018).

13.4. Contract for maintenance of parts and financing engine maintenance

In 2010, GLA entered into an engine maintenance service agreement with Delta Air Lines. The maintenance agreement was renewed on December 22, 2016 and will expire on December 31, 2020.

On January 31, 2017, GLA entered into a loan agreement with Delta Air Lines in the amount of US$50 million: maturing on December 31, 2020, with a refund obligation to be performed by the Company, GLA and Gol Finance, pursuant to the refund agreement entered into on August 19, 2015, with personal guarantee granted by the Company to GAC. Under the terms of this agreement, the Company holds flexible payment maturities regarding engine maintenance services, through a credit limit available. During the three-month period ended March 31, 2019, expenses incurred for components maintenance services provided by Delta Air Lines amounted to R$112,315 (R$87,599 as of March 31, 2018). As of March 31, 2019, theoutstanding balance with Delta Air Lines recorded in “Suppliers” totaled R$195,546 (R$211,087 as of December 31, 2018).

GOL Linhas Aéreas Inteligentes S.A.

Notes to the unaudited interim consolidated financial statements

For the three-month periods ended March 31, 2019 and 2018

(In thousands of Brazilian Reais - R$, except when otherwise indicated)

13.5. Handling agreement

On November 4, 2018, the subsidiary GLA entered into an agreement with Delta Air Lines for handling services in Miami and Orlando airports, the agreements expire on November 3, 2021.

During the three-month period ended March 31, 2019, expenses related to this agreement were R$1,438 recorded in "Services rendered". As of March 31, 2019, the outstanding balance recorded in "Suppliers" with Delta Air Lines was R$298.

13.6. Term loan guarantee

On August 31, 2015, through its subsidiary Gol Finance, the Company issued a term loan in the amount of US$300 million, with a term of 5 years and effective interest rate of 6.7% p.a. The Term Loan has an additional backstop guarantee provided by Delta Air Lines. For additional information, see Note 17.

13.7. Commercial partnership and maintenance agreement

On February 19, 2014, the Company signed a long-term strategic partnership agreement for long-term business cooperation and components maintenance along with Air France-KLM. On January 1, 2017, an extension of the scope for inclusion of maintenance services was celebrated. During the three-month period ended March 31, 2019, component maintenance expenses provided by AirFrance-KLM totaled R$42,363 (R$26,473 for the three-month period ended March 31, 2018). On March 31, 2019, the Company did not hold deferred income in the amount related to these contracts classified in "Other liabilities" (R$8,565 as of December 31, 2018) and had R$129,306 in “Suppliers”, in current liabilities (R$170,673 as of December 31, 2018).

13.8. Remuneration of key management personnel

| 03/31/2019 | 03/31/2018 |

Salaries, bonus and benefits (*) | 20,205 | 16,945 |

Related taxes and charges | 2,127 | 1,405 |

Share-based payments | 2,668 | 2,810 |

Total | 25,000 | 21,160 |

(*) Includes the Board of Directors’ and Audit Committee’s compensation.

GOL Linhas Aéreas Inteligentes S.A.

Notes to the unaudited interim consolidated financial statements

For the three-month periods ended March 31, 2019 and 2018

(In thousands of Brazilian Reais - R$, except when otherwise indicated)

14.Investments

14.1. Composition of Investments

The financial information of the Company’s investees and the changes in the investments for the three-month periods ended March 31, 2019 is as follows:

| Trip |

| 03/31/2019 | 12/31/2018 |

Relevant information of the Company’s investees: | | |

Capital stock | 1,318 | 1,318 |

Interest | 60.0% | 60.0% |

Total equity | 2,092 | 1,962 |

| | |

Adjusted equity (*) | 1,255 | 1,177 |

Net income for the period | 129 | 644 |

Adjusted net income for the period attributable to the Company’s interest | 78 | 387 |

(*) Adjusted shareholders' equity corresponds to the percentage of total shareholders' equity net of unrealized profits.

14.2. Changes in investments

| Trip |

Changes in investments | |

Balance as of December 31, 2018 | 1,177 |

Equity pick up | 78 |

Balance as of March 31, 2019 | 1,255 |

GOL Linhas Aéreas Inteligentes S.A.

Notes to the unaudited interim consolidated financial statements

For the three-month periods ended March 31, 2019 and 2018

(In thousands of Brazilian Reais - R$, except when otherwise indicated)

15.Property, plant and equipment

| | Weighted average rate (p.a.) | 12/31/2018 |

IFRS 16 adoption (**)

| Additions | Disposals | Transfers | 03/31/2019 |

Flight equipment | | | | | | | |

Cost | | | | | | | |

Aicraft – right of use with purchase option | - | 673,675 | - | - | (4,481) | - | 669,194 |

Aicraft – right of use without purchase option | - | - | 2,821,509 | 210,549 | - | - | 3,032,058 |

Sets of replacement parts and spare engines - owned | - | 1,583,865 | - | 78,840 | (2,877) | - | 1,659,828 |

Sets of replacement parts and spare engines – right of use | - | - | 71,327 | 12,473 | - | - | 83,800 |

Aircraft reconfigurations/overhauling | - | 2,443,747 | - | 140,032 | (10,339) | - | 2,573,440 |

Tools | - | 44,121 | - | 986 | (21) | - | 45,086 |

| | 4,745,408 | 2,892,836 | 442,880 | (17,718) | - | 8,063,406 |

Depreciation | | | | | | | |

Aicraft – right of use with purchase option | 5.76% | (222,240) | - | (4,403) | 4,481 | - | (222,162) |

Aicraft – right of use without purchase option | 22.86% | - | - | (172,671) | - | - | (172,671) |

Sets of replacement parts and spare engines - owned | 7.21% | (590,239) | - | (29,693) | 1,423 | - | (618,509) |

Sets of replacement parts and spare engines – right of use | 25.28% | - | - | (5,312) | - | - | (5,312) |

Aircraft reconfigurations/overhauling | 27.00% | (1,275,298) | - | (165,267) | 10,414 | - | (1,430,151) |

Tools | 10.00% | (21,153) | - | (831) | 16 | - | (21,968) |

| | | (2,108,930) | - | (378,177) | 16,334 | - | (2,470,773) |

Total, net – flight equipment | | 2,636,478 | 2,892,836 | 64,703 | (1,384) | - | 5,592,633 |

| | | | | | | | |

Property, plant and equipment in use | | | | | | | |

Cost | | | | | | | |

Vehicles | - | 11,513 | - | 127 | (122) | - | 11,518 |

Machinery and equipment | - | 59,404 | - | 859 | (24) | - | 60,239 |

Furniture and fixtures | - | 30,698 | - | 425 | (34) | - | 31,089 |

Computers and peripherals - owned | - | 40,813 | - | 1,178 | - | - | 41,991 |

Computers and peripherals – right of use | - | - | 20,619 | - | - | (493) | 20,126 |

Communication equipment | - | 2,692 | - | 8 | - | - | 2,700 |

Security equipment | - | 856 | - | - | - | - | 856 |

Leasehold improvements - Maintenance center (Confins) | - | 107,637 | - | - | - | - | 107,637 |

Leasehold improvements - Others | - | 60,115 | - | 224 | - | - | 60,339 |

Third-party leasehold – right of use | - | - | 20,801 | 501 | - | 493 | 21,795 |

Construction in progress | - | 15,443 | - | 866 | - | - | 16,309 |

| | | 329,171 | 41,420 | 4,188 | (180) | - | 374,599 |

Depreciation | | | | | | | |

Vehicles | 20.00% | (9,609) | - | (173) | 122 | - | (9,660) |

Machinery and equipment | 10.00% | (41,619) | - | (1,007) | 22 | - | (42,604) |

Furniture and fixtures | 10.00% | (18,188) | - | (492) | 27 | - | (18,653) |

Computers and peripherals - owned | 20.00% | (31,314) | - | (959) | - | - | (32,273) |

Computers and peripherals – right of use | 36.59% | - | - | (1,841) | - | - | (1,841) |

Communication equipment | 10.00% | (2,089) | - | (43) | - | - | (2,132) |

Security equipment | 10.00% | (533) | - | (21) | - | - | (554) |

Leasehold improvements - Maintenance center (Confins) | 10.43% | (91,395) | - | (2,820) | - | - | (94,215) |

Leasehold improvements - Others | 19.06% | (29,354) | - | (2,383) | - | - | (31,737) |

Third-party leasehold – right of use | 32.71% | - | - | (1,782) | - | - | (1,782) |

| | (224,101) | - | (11,521) | 171 | - | (235,451) |

Total, net – property, plant and equipment in use | | 105,070 | 41,420 | (7,333) | (9) | - | 139,148 |

| | | | | | | | |

Impairment losses | - | (48,839) | - | (30) | - | - | (48,869) |

Total | | 2,692,709 | 2,934,256 | 57,340 | (1,393) | - | 5,682,912 |

| | | | | | | | |

Advances for property, plant and equipment acquisition | - | 125,348 | - | 2,131 | - | (803) | 126,676 |

Total property, plant and equipment | | 2,818,057 | 2,934,256 | 59,471 | (1,393) | (803) | 5,809,588 |

(*) Refers to provisions for impairment losses for rotable items, classified under "Sets of replacement parts and spare engines", and recorded by the Company in order to present its assets according to the actual capacity for the generation of economic benefits.

(**) Effect related to IFRS 16 adoption, as disclosed in Note 4.1.1.

GOL Linhas Aéreas Inteligentes S.A.

Notes to the unaudited interim consolidated financial statements

For the three-month periods ended March 31, 2019 and 2018

(In thousands of Brazilian Reais - R$, except when otherwise indicated)

16.Intangible assets

The breakdown of and changes in intangible assets were as follows:

| Weighted average rate (p.a.) | 12/31/2018 | Additions | Disposals | 03/31/2019 |

|

Cost | | | | | |

Goodwill | - | 542,302 | - | - | 542,302 |

Slots | - | 1,038,900 | - | - | 1,038,900 |

Software | - | 528,426 | 20,782 | (1,292) | 547,916 |

Other | | 10,000 | - | - | 10,000 |

Total cost | | 2,119,628 | 20,782 | (1,292) | 2,139,118 |

| | | | | |

Amortization | | | | | |

Slots | 22.4% | (339,995) | (15,379) | 1,292 | (354,082) |

Software | 20.0% | (2,167) | (500) | - | (2,667) |

Total amortization | | (342,162) | (15,879) | 1,292 | (356,749) |

| | | | | |

Total | | 1,777,466 | 4,903 | - | 1,782,369 |

GOL Linhas Aéreas Inteligentes S.A.

Notes to the unaudited interim consolidated financial statements

For the three-month periods ended March 31, 2019 and 2018

(In thousands of Brazilian Reais - R$, except when otherwise indicated)

17.Loans and financing

The composition and movement of loans and financing are presented below:

| | | Consolidated |

| | | 12/31/2018 | | | | | | | | 03/31/2019 |

| | Maturity of the contract | Interest rate | Current | Non-current | Total | Additions | MTM | Payments | Interest | Interest paid | Exchange variation | Amorti-zations | Current | Non-current | Total |

In R$: | | | | | | | | | | | | | | | |

Debentures VII | 09/2021 | 120% of CDI | 288,991 | 577,981 | 866,972 | - | - | (147,917) | 16,355 | (16,137) | - | 1,866 | 289,831 | 431,308 | 721,139 |

| | | | | | | | | | | | | | | | |

In US$: | | | | | | | | | | | | | | | |

Import financing | 11/2019 | 5.46% a.a. | 503,869 | - | 503,869 | 72,762 | - | (27,398) | 7,319 | (5,031) | 4,395 | - | 555,916 | - | 555,916 |

Engine maintenance | 12/2020 | Libor 3m+0.75% p.a. | 14,743 | - | 14,743 | 36,784 | - | (9,670) | 244 | (219) | 1,555 | 303 | 29,271 | 14,469 | 43,740 |

Term Loan | 08/2020 | 6.70% p.a. | 25,255 | 1,147,196 | 1,172,451 | - | - | - | 18,094 | (36,151) | 5,826 | 2,287 | 6,454 | 1,156,053 | 1,162,507 |

Credit line - engines | 09/2020 | Libor 3m+0.75% p.a. | 138,539 | 43,431 | 181,970 | - | - | (39,297) | 1,504 | (1,604) | 367 | 1,796 | 125,351 | 19,385 | 144,736 |

Credit line - engines | 06/2021 | Libor 3m+2.25% p.a. | 20,140 | 146,457 | 166,597 | - | - | - | 2,026 | - | 1,015 | 47 | 27,456 | 142,229 | 169,685 |

Senior Notes IV | 01/2022 | 9.24% p.a. | 13,640 | 352,205 | 365,845 | - | - | (50,320) | 6,949 | (14,970) | (793) | 552 | 4,950 | 302,313 | 307,263 |

Exchangeable Senior Notes | 07/2024 | 3.73% p.a. | - | - | - | 1,121,945 | (49,381) | - | 1,300 | - | - | 96 | 609 | 1,073,351 | 1,073,960 |

Senior Notes VIII | 01/2025 | 7.09% p.a. | 72,658 | 2,439,492 | 2,512,150 | - | - | - | 42,346 | (82,165) | 10,475 | 2,158 | 29,232 | 2,455,732 | 2,484,964 |

Loan with guarantee of engines | 08/2026 | 6.65% p.a. | 13,051 | 120,557 | 133,608 | 42,548 | - | (4,006) | 2,807 | (2,807) | 3,097 | 38 | 16,642 | 158,643 | 175,285 |

Perpetual Notes | - | 8.75% p.a. | 12,320 | 513,282 | 525,602 | - | - | - | 10,950 | (10,595) | 2,616 | - | 12,389 | 516,184 | 528,573 |

Total | | | 1,103,206 | 5,340,601 | 6,443,807 | 1,274,039 | (49,381) | (278,608) | 109,894 | (169,679) | 28,553 | 9,143 | 1,098,101 | 6,269,667 | 7,367,768 |

GOL Linhas Aéreas Inteligentes S.A.

Notes to the unaudited interim consolidated financial statements

For the three-month periods ended March 31, 2019 and 2018

(In thousands of Brazilian Reais - R$, except when otherwise indicated)

The terms of the loans and financing contracted up to December 31, 2018 by the Company and its subsidiaries were disclosed in the financial statements for the year ended December 31, 2018 and did not have changes during the three-month period ended March 31, 2019.

Loans and financing include issuance costs of R$124,041 as of March 31, 2019 (R$83,684 as of December 31, 2018), which are amortized over the term of the related debt.

During the three-month period ended March 31, 2019 the Company issued new obligations as detailed below.

17.1. New loans obtained during the three-month period ended March 31, 2019

17.1.1. Exchangeable Senior Notes

On March 26, 2019, the Company, through GOL Equity Finance (“issuer”), a special purpose company incorporated under the laws of Luxembourg, issued Exchangeable Senior Notes ("Notes") in the total principal amount of US$300,000 maturing in 2024, which will bear interest of 3.75% p.a., to be paid in semi-annual installments. This transaction was guaranteed by the Company and GLA.

The holders of the Notes will have the right, in their sole discretion, to exchange their Notes in American Depositary Shares (each representing two preferred shares of GLAI) if certain conditions and at certain periods are verified. The initial exchange rate of the Notes is 49.3827 ADSs per US$1,000 of the Notes principal amount (equivalent to an initial exchange price of approximately US$20.25 per ADS and represents an exchange premium of approximately 35% above of the initial public offering price of the ADSs sold in the simultaneous offering of ADSs described below, which was US$15.00 per ADS). The Notes exchange rate is subject to adjustment at the time of certain events.

Settlement of Notes may be effected in cash, ADSs or through a combination of both.

In addition, in the context of the pricing of the Notes, the issuer entered into private capped call transactions with certain of the Notes subscribers and/or other financial instructions ("counterparties"), with which it is generally expected to reduce the potential dilution of GLAI's preferred shares and ADSs upon the exchange of any Notes and/or offset any cash payments required of the issuer that exceed the principal amount of the Notes exchanged, as the case may be, such reduction or compensation being subject to a based on the maximum price. The maximum capped call private transaction price will be approximately US$27.75 per ADS (representing a premium of approximately 85% above the price of the initial public offering of the ADSs sold in the simultaneous offer of ADSs).

The capped call is recorded in Derivative assets, for further details, see Note 30.1.4.

The Company will use the proceeds from the issuance of the Notes to pay the transaction costs associated with the issue, including costs related to derivative operations and to financing its operations.

The debt issuance costs corresponding to US$18,711 were proportionally allocated to the loan components and to the segregated derivative of the issue. The amount of US$6,533 attributed to the segregated derivative was recognized in the statement of operation on the date of issue, and the amount attributed to the loan component of US$12,178 is recorded in the loan at the principal amount and is being amortized over the debt term and comprises the measurement of the effective interest rate.

GOL Linhas Aéreas Inteligentes S.A.

Notes to the unaudited interim consolidated financial statements

For the three-month periods ended March 31, 2019 and 2018

(In thousands of Brazilian Reais - R$, except when otherwise indicated)

17.1.2. Loan with guarantee of engines

On January 22, 2019, the Company, through its subsidiary GLA, obtained funding with a guarantee of one own engine in the amount of R$43,129 (US$11.7 million on the transaction date), with issuance costs amounting to R$580 (US$154 on the transaction date). This type of financing has monthly interest amortization and payment.

17.1.3. Import financing

The Company, through its subsidiary GLA, obtained import financing in the three-month period ended March 31, 2019 and renegotiated the maturities of the agreements, with the issue of promissory notes as collateral for these transactions, which are part of a credit line maintained by GLA for import financing in order to carry out engine maintenance, purchase spare parts and aircraft equipment. The import financing operations are as follows:

Transaction | Principal amount | Interest | Maturity |

date | (US$) | (R$) | rate (p.a.) | date |

New issuances | | | | |

01/24/2019 | 6,454 | 24,409 | 6.57% | 07/23/2019 |

02/04/2019 | 5,924 | 21,777 | 6.52% | 08/05/2019 |

02/21/2019 | 7,069 | 26,577 | 6.46% | 08/20/2019 |

| | | | | |

Renegotiations | | | | |

01/31/2019 | 4,815 | 17,583 | 5.09% | 01/07/2019 |

17.1.4. Engine maintenance

During the three-month period ended March 31, 2019, the subsidiary GLA obtained new credit lines by issuing Guaranteed Notes for engine maintenance services with Delta AirLines.

Transaction | Principal amount | Issuance costs | Interest | Maturity |

Date | (US$) | (R$) | (US$) | (R$) | Rate | date |

02/15/2019 | 10,219 | 37,969 | 319 | 1,185 | Libor 3m+0.75% p.a. | 12/15/2020 |

As of March 31, 2019, the maturities of non-current loans and financing, were as follows:

| 2020 | 2021 | 2022 | 2023 | 2024 onwards | Without maturity date | Total |

In R$: | | | | | | | |

Debentures VII | 141,695 | 289,613 | - | - | - | - | 431,308 |

| | | | | | | |

In US$: | | | | | | | |

Engine maintenance | 14,469 | - | - | - | - | - | 14,469 |

Term Loan | 1,156,053 | - | - | - | - | - | 1,156,053 |

Credit line - engines | 19,385 | - | - | - | - | - | 19,385 |

Credit line - engines | 15,289 | 126,940 | - | - | - | - | 142,229 |

Senior Notes IV | - | - | 302,313 | - | - | - | 302,313 |

Exchangeable Senior Notes | - | - | - | - | 1,073,351 | - | 1,073,351 |

Senior Notes VIII | - | - | - | - | 2,455,732 | - | 2,455,732 |

Loan with guarantee of engines | 12,902 | 17,763 | 18,416 | 19,109 | 90,453 | - | 158,643 |

Perpetual Notes | - | - | - | - | - | 516,184 | 516,184 |

Total | 1,359,793 | 434,316 | 320,729 | 19,109 | 3,619,536 | 516,184 | 6,269,667 |

GOL Linhas Aéreas Inteligentes S.A.

Notes to the unaudited interim consolidated financial statements

For the three-month periods ended March 31, 2019 and 2018

(In thousands of Brazilian Reais - R$, except when otherwise indicated)

The fair value of loans and financing as of March 31, 2019 is as follows:

| Book value (c) | Market value |

Senior Notes and Perpetual Notes (a) | 3,320,800 | 3,152,339 |

Term Loan (b) | 1,162,507 | 1,232,014 |

Exchangeable Senior Notes (a) | 1,073,960 | 1,085,765 |

Debentures (b) | 721,139 | 750,324 |

Other | 1,089,362 | 1,089,362 |

Total | 7,367,768 | 7,309,804 |

(a) Fair value obtained through current market quotations.

(b) Fair value obtained through internal method valuation.

(c) The book value presented is net of interest and issue costs.

17.2. Covenants

As of March 31, 2019, non-current loans and financing (excluding Perpetual Notes and Exchangeable Senior Notes)) that amounted to R$5,753,483 (R$4,827,319 as of December 31, 2018) is subject to restrictive covenants, including but not limited to those that require the Company to maintain certain levels of liquidity and indebtedness and interest expenses coverage.

The Company has restrictive covenants on the Term Loan and Debentures VII. In the Term Loan, the Company must make deposits for reaching contractual limits of the debt pegged to the U.S. dollar. As of March 31, 2019, the Company did not have collateral deposits linked to the contractual limits of the Term Loan. As of March 31, 2019, Debentures VII were not subject to any covenants scheduled for measurement, due to the renegotiation of the transaction. Pursuant to the agreement, the Company will resume measuring the following ratios, which are measured half-yearly, as of June 30, 2019: (i) net debt / earnings before interest, taxes, depreciation, amortization, and restructuring or rent costs (“EBITDAR”); and (ii) debt coverage ratio (“ICSD”). Under the indenture, these indicators must be measured every six months and the next measurement will occur at the end of the first half of 2019. As a result, as of March 31, 2019, the Company was in compliance with the Debentures VII’s covenants.

GOL Linhas Aéreas Inteligentes S.A.

Notes to the unaudited interim consolidated financial statements

For the three-month periods ended March 31, 2019 and 2018

(In thousands of Brazilian Reais - R$, except when otherwise indicated)

18.Leases

| | 12/31/2018 | | | | | | | | | | 03/31/2019 |

| | Weighted average rate (p.a.) | Short-term leases | Long-term leases | Total | Initial adoption IFRS 16 | Additions | Provision | Payments | Payment (Guarantee Deposit) | Payment (Maintenance Reserve) | Interest | Interest payment | Exchange variation | Short-term leases | Long-term leases | Total |

In R$: | | | | | | | | | | | | | | | | |

Right of use leases without purchase option | 8.57% | - | - | - | 49,975 | 501 | - | (2,406) | - | - | 1,667 | - | - | 17,363 | 32,374 | 49,737 |

Total | | - | - | - | 49,975 | 501 | - | (2,406) | - | - | 1,667 | - | - | 17,363 | 32,374 | 49,737 |

| | | | | | | | | | | | | | | | | |

In US$: | | | | | | | | | | | | | | | | |

Right of use leases with purchase option | 3.72% | 120,118 | 520,542 | 640,660 | - | - | - | (26,822) | - | - | 5,982 | (5,965) | 2,339 | 121,672 | 494,522 | 616,194 |

Right of use leases | - | 135,799 | 135,686 | 271,485 | (219,728) | - | (3,484) | (48,273) | - | - | - | - | - | - | - | - |

Right of use leases without purchase option | 8.57% | - | - | - | 5,540,621 | 232,012 | - | (277,425) | (476) | (1,692) | 118,613 | - | 38,524 | 1,056,872 | 4,593,305 | 5,650,177 |

Total | | 255,917 | 656,228 | 912,145 | 5,320,893 | 232,012 | (3,484) | (352,520) | (476) | (1,692) | 124,595 | (5,965) | 40,863 | 1,178,544 | 5,087,827 | 6,266,371 |

| | | | | | | | | | | | | | | | | |

Total leases | | 255,917 | 656,228 | 912,145 | 5,370,868 | 232,513 | (3,484) | (354,926) | (476) | (1,692) | 126,262 | (5,965) | 40,863 | 1,195,907 | 5,120,201 | 6,316,108 |

The future payments of right of use leases without purchase option agreements indexed to U.S. dollars are detailed as follows:

| 03/31/2019 |

2019 | 1,173,562 |

2020 | 1,419,001 |

2021 | 1,209,248 |

2022 | 1,018,974 |

2023 | 808,385 |

2024 and thereafter | 1,766,498 |

Total minimum lease payments | 7,395,668 |

Less total interest | (1,695,754) |

Present value of minimum lease payments | 5,699,914 |

Less current portion | (1,074,235) |

Noncurrent portion | 4,625,679 |

GOL Linhas Aéreas Inteligentes S.A.

Notes to the unaudited interim consolidated financial statements

For the three-month periods ended March 31, 2019 and 2018

(In thousands of Brazilian Reais - R$, except when otherwise indicated)

The future payments of right of use leases with purchase option agreements indexed to U.S. dollars are detailed as follows:

| 03/31/2019 | 12/31/2018 |

2019 | 105,804 | 140,307 |

2020 | 140,871 | 140,080 |

2021 | 140,642 | 139,852 |

2022 | 140,414 | 139,624 |

2023 | 70,380 | 69,985 |

2024 and thereafter | 67,825 | 65,776 |

Total minimum lease payments | 665,936 | 695,624 |

Less total interest | (49,742) | (54,964) |

Present value of minimum lease payments | 616,194 | 640,660 |

Less current portion | (121,672) | (120,118) |

Noncurrent portion | 494,522 | 520,542 |

18.1. Sale-leaseback transactions

During the three-month period ended March 31, 2019, the Company recorded a net gain of R$7,924 arising from one aircraft sale-leaseback transactions, classified under “Sale-leaseback transactions”.

19.Suppliers - Forfaiting

The Company has operations that allow suppliers to receive their rights in advance. This type of operation does not change the existing commercial conditions between the Company and its suppliers. As of March 31, 2019, the amount recorded under current liabilities from forfaiting operations totaled R$326,435 (R$365,696 as of December 31, 2018).

20.Taxes payable

| 03/31/2019 | 12/31/2018 |

PIS and COFINS | 35,771 | 43,237 |

Installment payments - PRT and PERT | 16,500 | 23,858 |

Withholding income tax on salaries | 27,512 | 34,883 |

ICMS | 366 | 46,952 |

IRPJ and CSLL payable | 16,553 | 8,991 |

Other | 9,615 | 8,440 |

Total | 106,317 | 166,361 |

| | |

Current | 100,118 | 111,702 |

Noncurrent | 6,199 | 54,659 |

21.Advances from ticket sales

As of March 31, 2019, the balance of Advances from ticket sales classified in current liabilities was R$1,337,812 (R$1,673,987 as of December 31, 2018) and is represented by 5,251,305 tickets sold and not yet used (5,804,941 as of December 31, 2018) with an average use of 77 days (57 days as of December 31, 2018).

GOL Linhas Aéreas Inteligentes S.A.

Notes to the unaudited interim consolidated financial statements

For the three-month periods ended March 31, 2019 and 2018

(In thousands of Brazilian Reais - R$, except when otherwise indicated)

22.Provisions

| Provision for aircraft and engine return (a) | Provision for legal proceedings (b) | Total |

Balance as of December 31, 2018 | 652,134 | 247,460 | 899,594 |

Additional provisions recognized | 8,213 | 47,103 | 55,316 |

Utilized provisions | (50) | (38,237) | (38,287) |

Foreign exchange rate variation, net | 4,241 | (151) | 4,090 |

Balance as of March 31, 2019 | 664,538 | 256,175 | 920,713 |

| | | |

As of December 31, 2018 | | | |

Current | 70,396 | - | 70,396 |

Noncurrent | 581,738 | 247,460 | 829,198 |

Total | 652,134 | 247,460 | 899,594 |

| | | |

As of March 31, 2019 | | | |

Current | 86,011 | - | 86,011 |

Noncurrent | 578,527 | 256,175 | 834,702 |

Total | 664,538 | 256,175 | 920,713 |

(a) The additional provisions recognized for aircraft and engine return also include present value adjustment effects.

(b) The provisions recorded include write-offs due to the revision of estimates and processes settled.

22.1. Provision for legal proceedings

As of March 31, 2019, the Company and its subsidiaries are parties to lawsuits and administrative proceedings. Details of the relevant lawsuits were disclosed in the financial statements as of December 31, 2018.

The Company's Management believes that the provision for tax, civil and labor proceedings, recorded in accordance with IAS 37 – “Provisions, Contingent Liabilities and Contingent Assets”, is sufficient to cover possible losses on administrative and judicial proceedings, as presented below:

22.2. Estimated probable loss proceedings

| 03/31/2019 | 12/31/2018 |

Civil | 64,922 | 64,005 |

Labor | 189,348 | 181,556 |

Taxes | 1,905 | 1,899 |

Total | 256,175 | 247,460 |

22.3. Estimated possible loss proceedings

| 03/31/2019 | 12/31/2018 |

Civil | 39,142 | 36,320 |

Labor | 197,234 | 183,506 |

Taxes | 605,510 | 548,136 |

Total | 841,886 | 767,962 |

GOL Linhas Aéreas Inteligentes S.A.

Notes to the unaudited interim consolidated financial statements

For the three-month periods ended March 31, 2019 and 2018

(In thousands of Brazilian Reais - R$, except when otherwise indicated)

23.Equity

23.1. Capital stock

As of March 31, 2019, the Company’s capital stock was R$3,102,819, represented by 3,131,747,978 shares, comprised by 2,863,682,710 common shares and 268,065,268 preferred shares. The Company’s shares are held as follows:

| 03/31/2019 | 12/31/2018 |

| Common | Preferred | Total | Common | Preferred | Total |

Fundo Volluto | 100.00% | - | 23.38% | 100.00% | - | 23.42% |

MOBI | - | 38.39% | 29.41% | - | 48.85% | 37.41% |

Delta Air Lines, Inc. | - | 12.28% | 9.41% | - | 12.29% | 9.41% |

AirFrance – KLM | - | 1.58% | 1.21% | - | 1.58% | 1.21% |

Other | - | 0.99% | 0.76% | - | 1.03% | 0.79% |

Free float | - | 46.76% | 35.83% | - | 36.25% | 27.76% |

Total | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

The Company’s authorized capital stock as of March 31, 2019 and December 31, 2018 was R$4.0 billion.

On February 27, 2019, the Company's Board of Directors approved capital increase in the amount of R$4,589, due to the subscription of 521,528 preferred shares related to stock option exercises.

As of March 31, 2019 and December 31, 2018, the share issuance costs totaled R$155,618.

As of March 31, 2019, the Company held an amount of Advance for future capital increase of R$512 related to stock options exercises of 142,290 shares during the three-month period ended March 31, 2019.

24.Earnings (loss) per share

The Company's earnings per share were determined as follows:

| | 03/31/2019 | 03/31/2018 |

| Common | Preferred | Total | Common | Preferred | Total |

| | | | |

Numerator | | | | | | |

Net income (loss) for the period attributable to equity holders of the parent | (7,553) | (24,754) | (32,307) | 34,700 | 112,771 | 147,471 |

| | | | | | |

Denominator | | | | | | |

Weighted average number of outstanding shares (in thousands) | 2,863,683 | 268,138 | | 2,863,683 | 265,902 | |

Effects of dilution from stock options | - | - | | - | 4,007 | |

Adjusted weighted average number of outstanding shares and diluted presumed conversions (in thousands) | 2,863,683 | 268,138 | | 2,863,683 | 269,909 | |

| | | | | | |

Basic earnings (loss) per share | (0.003) | (0.092) | | 0.012 | 0.424 | |

Diluted earnings (loss) per share | (0.003) | (0.092) | | 0.012 | 0.418 | |

Diluted earnings (loss) per share are calculated by adjusting the weighted average number of shares outstanding by instruments potentially convertible into shares. However, due to losses recorded in the three-month period ended March 31, 2019, these instruments issued have no dilutive effect and therefore were not included in the total quantity of outstanding shares in order to determine the diluted loss per share.

GOL Linhas Aéreas Inteligentes S.A.

Notes to the unaudited interim consolidated financial statements

For the three-month periods ended March 31, 2019 and 2018

(In thousands of Brazilian Reais - R$, except when otherwise indicated)

25.Share-based payments