SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month ofFebruary2020

(Commission File No. 001-32221)

GOL LINHAS AÉREAS INTELIGENTES S.A.

(Exact name of registrant as specified in its charter)

GOL INTELLIGENT AIRLINES INC.

(Translation of registrant’s name into English)

Praça Comandante Linneu Gomes, Portaria 3, Prédio 24

Jd. Aeroporto

04630-000 São Paulo, São Paulo

Federative Republic of Brazil

(Address of registrant’s principal executive offices)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes ______ No ___X___

Individual and Consolidated

Financial Statements

GOL Linhas Aéreas Inteligentes S.A.

December 31, 2019

with Independent Auditor’s Report

Gol Linhas Aéreas Inteligentes S.A.

Individual and Consolidated Financial Statements

December 31, 2019

Contents

Management’s report | 01 |

Comments on business forecast trends | 07 |

Report of the statutory audit committee (CAE) | 08 |

Report of the Fiscal Council | 10 |

Executive Officers’ Statement on Income Statements | 11 |

Executive Officers’ Statement on the Independent Auditor’s Report | 12 |

Independent Auditor’s Report on the Individual and Consolidated Financial Statements | 13 |

| | |

Statements of financial position | 14 |

Statements of operations | 16 |

Statements of comprehensive income | 17 |

Statement of changes in equity | 18 |

Statement of cash flows | 19 |

Statements of value added | 21 |

Notes on the financial statements | 22 |

Management’s Report

In 2019, GOL accomplished a number of significant milestones in its business strategy to be The First Airline for Everyone and to grow its network both internationally and domestically.

“Be The First Airline For Everyone”

Strong customer demand, especially in the corporate segment, combined with our capacity discipline enabled us to deliver excellent operating results in 4Q19. We’d like to particularly thank the dedication and engagement of the Team of Eagles who, amid challenging market conditions, met the demands of our customers in Brazil and abroad in a fast and safe manner.

We transported almost 10 million passengers in 4Q19, a growth of 8.0% over the same period last year.

This year, we also achieved a Black Friday sales record with more than 450,000 tickets sold, which corresponds to more than R$120 million in just one day, and a total sale in the promotional period of more than R$250 million. That represents an increase of more than 50% in sales compared to Black Friday of 2018.

The excellent sales numbers in the fourth quarter underline our purpose of being The First Airline For Everyone, by providing the best customer experience in terms of products and services, with the lowest cost in the market.

Our Net Promoter Score (NPS) was 35 in the quarter and is indicative of the winning combination of our best-in-market product and our highly engaged customer service team. For the third consecutive year, we won the Top of Mind award from Datafolha São Paulo Institute as the most remembered and preferred airline by Brazilians. We also won, for the sixth time, the Companies of the Decade award byConsumidor Moderno, being the only airline among the winning companies.

These acknowledgments are the result of the continuous innovation across our products and services, and they reflect the close relationship we maintain with our customers in their daily lives.

Growth of the GOL Network

In the quarter, we expanded our reach in regional markets in Brazil, adding three more regional destinations. In addition, we enhanced our partnerships with two regional carriers that added 22 new destinations for GOL customers.

GOL is the largest regional carrier in Brazil, as measured by ASKs. The new regional destinations have strengthened our overall network, increased connectivity, and reduced our exposure to highly competitive markets. These destinations also generate even more feeder traffic from customers connecting to our international hubs in Guarulhos, Rio de Janeiro, Brasília and Fortaleza. Continuing our international expansion, we began regular flights between São Paulo and Lima, Peru. In the period, we also launched weekly flights between Manaus and Orlando and seasonal flights between Porto Alegre and Punta del Este.

At the end of December, GOL celebrated 15 years operating in Argentina, where we have transported over 12 million passengers on 77 weekly flights.

We seek to continue our growth in domestic and international markets.

In February 2020, we announced a new codeshare with American Airlines. The flights will operate from GOL’s hubs in São Paulo (GRU), Rio de Janeiro (GIG), Brasília (BSB) and Fortaleza (FOR), and will add to GOL’s existing regular flights to Miami and Orlando. Also, we signed a new codeshare with Avianca Holdings that includes 60 domestic Brazil GOL destinations and 16 GOL international destinations, in 11 countries, and 26 domestic Colombia Avianca destinations and another 50 in America and Europe.

By strengthening these partnerships, we reiterate our expansion plan in both domestic and international markets and consolidate our purpose of being The First Airline For Everyone. Our codeshare with Air France-KLM covers more than 18 countries, including 66 cities in Europe and more than 30 cities in Brazil. In addition, our recently announced codeshare with American Airlines will offer more daily flights between South America and the U.S. than any other airline partnership, doubling the amount of seats we offer in this market,enabling GOL’s customers to travel seamlessly to more than 30 destinations in the U.S.

Agile Fleet Management

Despite the temporary grounding of the 737 MAX aircraft, the flexibility of our fleet plan enabled us to serve all of our markets with a high utilization rate of our aircraft, which reached 12.2 hours in the quarter. GOL’s route network is based on a high connectivity with the main markets. This sophisticated model has enabled us to create greater capillarity for corporate routes and a reduction in average stage length. When combined with the intensive use of data analytics and a focus on the personalization of our services, this has best positioned GOL to capture economic growth. Based on Boeing’s latest forecast, we believe that the regulatory agencies will approve the return of MAX aircraft at the beginning of the second half of 2020.

At the beginning of the fourth quarter, 14 aircraft went under unplanned maintenance on pickle forks, in compliance with FAA Airworthiness Directive. Maintenance was 100% completed at the end of December when the aircraft returned to th fleet, thanks to the prompt response of GOL Aerotech.

In November 2019, GOL Aerotech was formally launched; a new business unit that leverages GOL’s aircraft maintenance expertise to provide aircraft and components maintenance, repairs, and overhauls to third-party airlines. This generates a new source of revenue and reduces our costs for the Company. With 760 employees and over 600,000 hours of availability per year, GOL Aerotech is qualified by ANAC, FAA and EASA to perform maintenance services for four Boeing models: the 737 Classic, the 737 Next Generation, the 737 MAX, and the 767 family. Aviation Capital Group (ACG) and Dubai Aerospace are among our first customers. In 2020, we expect revenues of R$140 million from GOL Aerotech.

Effective Balance Sheet Management

Despite several operational challenges, such as the MAX temporary grounding and the unplanned maintenance on the pickle fork in certain NGs, GOL posted outstanding results. We registered record revenues and high margins, with operating cash flow generation around R$1.0 billion in the quarter. Through this, we implemented a R$102.4 million share repurchase program and improved our credit profile.

Quarterly net revenue increased 18.8% year-over-year, with a record of R$3.8 billion in the 4Q19. Currently, trends in revenue and passenger bookings remain strong, and the Company expects the first quarter RASK to increase by4% to 6%, compared to 1Q19.

GOL remains the lowest unit cost leader in South America for the 19th consecutive year. Recurring CASK in 2019 increased 1.9% over the previous year, to R$21.97. Based on current trends, the Company estimates that the recurring CASK in the first quarter of 2020 will increase approximately 0% to 2%, year-over-year. The Company has a high level of fuel hedging protection in place, with around 90% hedged in the first quarter of 2020 and 68% hedged in 2020.

We are working hard to further increase GOL's competitiveness through fuel hedging.

In 4Q19, recurring earnings per diluted share were R$0.88 and recurring earnings per diluted ADS were US$0.43. Operating activities generated R$1.0 billion in cash in the quarter. From the net cash flow generation of R$637.3 million in 4Q19, we repaid R$617.1 million in debt, paid R$50.2 million of interest on own capital, and repurchased R$102.4 million of shares. Before share repurchases and interest on own capital, free cash flow to equity was R$219.2 million. On December 31, 2019, total liquidity was R$4.3 billion, R$1.3 billion higher than on December 31, 2018.

We continue to strengthen the Company's equilibrium through disciplined working capital management and capital structure optimization.

In February 2020, GOL signed sale and leaseback agreements for 11 Boeing 737 Next Generation (NG) aircraft. The transaction will reduce GOL’s net debt by approximately R$500 million, comprised of a R$130 million reduction in finance leases debt and a R$370 million increase in cash liquidity. The Company plans to use a portion of these proceeds to call the outstanding amount of its 8.875% Senior Notes due in 2022. The asset management income and reduction in interest expense will contribute over R$420 million to the Company’s 2020 earnings and improve GOL’s credit ratios by reducing the net debt/EBITDA ratio by 0.2x and increase the EBITDA/net interest expense ratio by 0.5x.

The results obtained in GOL’s aircraft disposals demonstrate the consistent market value of the Boeing 737 aircraft and the continuous creation of value for all GOL shareholders.Making GOL The First Airline For Everyone is what drives our best-in-Brazil aviation team.We are, and will continue to be, an even stronger Company.

Operating and Financial Indicators

Traffic Data – GOL (in Millions) | 4Q19 | 4Q18 | % Var. | 2019 | 2018 | % Var. |

RPK GOL – Total | 10,806 | 10,244 | 5.5% | 41,863 | 38,424 | 9.0% |

RPK GOL – Domestic | 9,630 | 9,037 | 6.6% | 36,391 | 34,266 | 6.2% |

RPK GOL – International | 1,176 | 1,207 | -2.6% | 5,472 | 4,158 | 31.6% |

ASK GOL – Total | 13,257 | 12,506 | 6.0% | 51,065 | 48,058 | 6.3% |

ASK GOL – Domestic | 11,667 | 10,901 | 7.0% | 43,897 | 42,428 | 3.5% |

ASK GOL – International | 1,590 | 1,605 | -0.9% | 7,168 | 5,630 | 27.3% |

GOL Load Factor – Total | 81.5% | 81.9% | -0.4 p.p. | 82.0% | 80.0% | 2.0 p.p. |

GOL Load Factor – Domestic | 82.5% | 82.9% | -0.4 p.p. | 82.9% | 80.8% | 2.1 p.p. |

GOL Load Factor – International | 74.0% | 75.2% | -1.2 p.p. | 76.3% | 73.9% | 2.4 p.p. |

Operating Data | 4Q19 | 4Q18 | % Var. | 2019 | 2018 | % Var. |

Revenue Passengers - Pax on Board ('000) | 9,660 | 8,944 | 8.0% | 36,445 | 33,446 | 9.0% |

Aircraft Utilization (Block Hours/Day) | 12.2 | 11.5 | 6.1% | 12.3 | 11.8 | 4.2% |

Departures | 68,228 | 63,431 | 7.6% | 259,377 | 250,040 | 3.7% |

Total Seats (‘000) | 12,142 | 11,079 | 9.6% | 45,574 | 42,968 | 6.1% |

Average Stage Length (km) | 1,089 | 1,108 | -1.7% | 1,114 | 1,098 | 1.5% |

Fuel Consumption (mm liters) | 382 | 365 | 4.7% | 1,475 | 1,403 | 5.1% |

Full-time Employees (at Period End) | 16,113 | 15,294 | 5.4% | 16,113 | 15,294 | 5.4% |

Average Operating Fleet(6) | 117 | 116 | 0.9% | 113 | 112 | 0.9% |

On-time Departures | 86.2% | 87.5% | -1.3 p.p. | 89.0% | 91.8% | -2.8 p.p. |

Flight Completion | 99.2% | 98.6% | 0.6 p.p. | 98.1% | 98.5% | 0.4 p.p. |

Passenger Complaints (per 1,000 pax) | 0.88 | 1.31 | -32.8% | 1.12 | 1.75 | -36.0% |

Lost Baggage (per 1,000 pax) | 2.08 | 2.19 | -5.0% | 2.09 | 2.03 | 3.0% |

Financial Data | 4Q19 | 4Q18(1) | % Var. | 2019 | 2018(1) | % Var. |

Net YIELD (R$ cents) | 33.17 | 29.14 | 13.8% | 31.24 | 27.67 | 12.9% |

Net PRASK (R$ cents) | 27.04 | 23.87 | 13.3% | 25.61 | 22.13 | 15.7% |

Net RASK (R$ cents) | 28.69 | 25.59 | 12.1% | 27.15 | 23.75 | 14.3% |

CASK (R$ cents)(5) | 21.10 | 24.19 | -12.8% | 21.97 | 21.57 | 1.9% |

CASK Ex-Fuel (R$ cents)(5) | 13.49 | 15.17 | -11.1% | 14.05 | 12.95 | 8.5% |

Breakeven Load Factor(5) | 60.0% | 77.4% | -17.4 p.p. | 66.3% | 72.6% | -6.3 p.p. |

Average Exchange Rate(2) | 4.1158 | 3.8084 | 8.1% | 3.9461 | 3.6558 | 7.9% |

End of Period Exchange Rate(2) | 4.0307 | 3.8748 | 4.0% | 4.0307 | 3.8748 | 4.0% |

WTI (Average per Barrel. US$)(3) | 56.87 | 59.34 | -4.2% | 57.04 | 64.90 | -12.1% |

Price per Liter Fuel (R$)(4) | 2.71 | 3.28 | -17.4% | 2.79 | 2.91 | -4.1% |

Gulf Coast Jet Fuel (Average per Liter, US$)(3) | 0.49 | 0.52 | -5.8% | 0.50 | 0.47 | 6.4% |

(1)Amounts restated in accordance with IFRS 16. (2) Source: Brazilian Central Bank; (3) Source: Bloomberg; (4) Fuel expenses excluding hedge results and PIS/COFINS credits/liters consumed; (5) Excluding non-recurring expenses. (6) Average operating fleet excluding aircraft in sub-leasing and MRO. Certain calculations may not match with the financial statements due to rounding.

Domestic market

GOL’s domestic supply increased by 7.0%, and demand increased by 6.6% in comparison to 4Q18. As a result, the Company’s load factor reached 82.5%. GOL transported 9.2 million passengers in the quarter, an increase of 9.5% compared with the same period in 2018. In 2019, GOL’s domestic supply increased by 3.5%, and demand increased by 6.2% year-over-year. The Company is the leader in transporting passengers in the Brazilian market.

International market

GOL’s international supply decreased by 0.9%, and international demand decreased by 2.6% in 4Q19 compared to 4Q18. The Company’s load factor in 4Q19 was 74.0%, a decrease of 1.2 p.p. During the quarter, the Company transported 0.5 million passengers in the international market, the same as in 4Q18. In 2019, GOL’s international supply increased by 27.3%, and demand increased by 31.6% year-over-year.

Volume of Departures and Total Seats

The total volume of GOL departures was 68,228, an increase of 7.6% over 4Q18. The total number of seats available to the market was 12.1 million in the fourth quarter of 2019, increase of 9.6% quarter-over-quarter.

PRASK, Yield and RASK

Net PRASK increased by 13.3% in the quarter when compared to 4Q18, reaching 27.04 cents (R$), driven by a growth in net passenger revenue of 20.1% in the quarter. GOL’s net RASK was 28.69 cents (R$) in 4Q19, an increase of 12.1% over 4Q18. Net yieldincreased by 13.8% over 4Q18, reaching 33.17 cents (R$).

Operating Results

Recurring operating income (EBIT) for the quarter was R$1,006.3 million, an increase of R$830.0 million when compared to the same period of 2018. In 2019, recurring operating income reached R$2,645.0 million, an increase of 153% compared to 2018. Recurring operating margin was 26.5%, an increase of 21.0 p.p. over 4Q18. On a per available seat-kilometer basis, recurring EBIT was 7.59 cents (R$) in 4Q19, an increase of 6.19 cents (R$) compared to 4Q18.

EBITDA totaled R$1.5 billion in the period, an increase of 180.5% over 4Q18. EBITDA per available seat-kilometer was 11.05 cents (R$), an increase of 6.88 cents (R$) when compared to the same period last year.

EBIT and EBITDA reconciliation (R$ MM)* | 4Q19 | 4Q18(1) | % Var. | 2019 | 2018(1) | % Var. |

Net Income (Loss)(2) | 747.6 | 121.0 | NM | 691.6 | (2,223.7) | -131.1% |

(-) Income Taxes | 124.5 | 74.5 | 67.1% | 209.6 | 297.1 | -29.5% |

(-) Net Financial Result | 134.0 | (19.3) | NM | 1,743.8 | 2,970.5 | -41.3% |

EBIT(2) | 1,006.3 | 176.3 | NM | 2,645.0 | 1,043.9 | 153.4% |

EBIT Margin(2) | 26.5% | 5.5% | 21.0 p.p. | 19.1% | 9.1% | 10.0 p.p. |

(-) Depreciation and Amortization | 458.6 | 345.8 | 32.6% | 1,728.0 | 1,234.6 | 40.0% |

EBITDA(2) | 1,464.9 | 522.1 | 180.5% | 4,373.0 | 2,278.5 | 91.9% |

EBITDA Margin(2) | 38.5% | 16.3% | 22.2 p.p. | 31.5% | 20.0% | 11.5 p.p. |

EBITDA Calculation (R$ cents/ASK) | 4Q19 | 4Q18(1) | % Var. | 2019 | 2018(1) | % Var. |

Net Revenues | 28.69 | 25.59 | 12.1% | 27.15 | 23.75 | 14.3% |

Operating Expenses(2) | (21.10) | (24.19) | -12.8% | (21.97) | (21.57) | 1.9% |

EBIT(2) | 7.59 | 1.40 | NM | 5.18 | 2.18 | 137.6% |

Depreciation and Amortization | (3.46) | (2.77) | 24.9% | (3.38) | (2.57) | 31.5% |

EBITDA(2) | 11.05 | 4.17 | 165.0% | 8.56 | 4.75 | 80.2% |

(1) Amounts restated in accordance with IFRS 16. (2) Excluding non-recurring expenses. * In accordance with CVM Instruction 527, the Company presents the reconciliation of EBIT and EBITDA, whereby: EBIT = net income (loss) (+) income tax and social contribution (+) net financial result; and EBITDA = net income (loss) (+) income tax and social contributions (+) net financial result (+) depreciation and amortization. Some report valuesmay differ from the financial statements due to rounding.

Fleet

At the end of 4Q19, GOL's total fleet was 137 Boeing 737 aircraft, comprised of 130 NGs and 7 MAXs (the latter non-operational). At the end of 4Q18, GOL's total operating fleet was 121 aircraft, of which 6 were MAX aircraft. During the quarter, GOL entered a leasing contracts for 13 additional aircraft, of which 12 were 737-800 NG aircraft and 1 was a 737-700 NG aircraft. The average age of the Company's fleet was 9.9 years at the end of 4Q19.

Total Fleet at the End of Period | 4Q19 | 4Q18 | Var. | 3Q19 | Var. |

B737s | 137 | 121 | +16 | 125 | +12 |

B737-7 NG | 24 | 24 | 0 | 24 | 0 |

B737-8 NG | 106 | 91 | +15 | 94 | +12 |

B737-8 MAX | 7 | 6 | +1 | 7 | 0 |

As of December 31, 2019, the Company had 129 firm orders for the acquisition of Boeing 737 MAX aircraft, of which 99 were orders for 737 MAX-8 and 30 orders were for 737 MAX-10.

Fleet Plan | 2019 | 2020E | 2021E | >2022E | Total |

Operating Fleet at the End of the Year | 137 | 140 | | | |

Aircraft Commitments (R$ MM)* | - | - | 7,113.8 | 58,666.1 | 65,779.9 |

(*) Considers aircraft list price.

In February 2020, GOL signed sale and leaseback agreements on 11 Boeing 737 Next Generation (NG) aircraft. GOL’s aircraft transactions demonstrate the consistent market value of Boeing 737 aircraft and the continuous value creation for all of GOL's shareholders.

Relationship with Independent Auditors

When hiring services that are not related to external auditing from its independent auditors, Smiles bases its conduct on principles that preserve the auditor’s independence. Pursuant to internationally accepted standards, these principles consist of: (a) the auditors must not audit their own work, (b) the auditors must not execute managing functions for their clients and (c) the auditors must not represent their clients’ legal interests.

Based on the subparagraph III, article 2 of the CVM Instruction 381/2003, the Company adopts a formal procedure to hire services other than external auditing from our auditors. The procedure consists of consulting its Audit Committee to ensure that those services shall not affect the independence and the objectivity, required for the independent audit performance. Additionally, formal statements are required from the auditors regarding their independence while providing such services.

The Company informs that its independent auditor for the period, KPMG Auditores Independentes (“KPMG”) did not provide additional services not related to auditing in the 2018 fiscal year.

Glossary of industry terms

· AIRCRAFT LEASING:an agreement through which a company (the lessor), acquires a resource chosen by its client (the lessee) for subsequent rental to the latter for a determined period.

· AIRCRAFT UTILIZATION:the average number of hours operated per day by the aircraft.

· AVAILABLE SEAT KILOMETERS (ASK):the aircraft seating capacity multiplied by the number of kilometers flown.

· AVAILABLE FREIGHT TONNE KILOMETER (AFTK): cargo capacity in tonnes multiplied by number of kilometers flown.

· AVERAGE STAGE LENGTH:the average number of kilometers flown per flight.

· EXCHANGEABLE SENIOR NOTES (ESN): convertible securities.

· BLOCK HOURS:the time an aircraft is in flight plus taxiing time.

· BREAKEVEN LOAD FACTOR:the passenger load factor that will result in passenger revenues being equal to operating expenses.

· BRENT:oil produced in the North Sea, traded on the London Stock Exchange and used as a reference in the European and Asian derivatives markets.

· CHARTER:a flight operated by an airline outside its normal or regular operations.

· FREIGHT LOAD FACTOR (FLF):percentage of cargo capacity that is actually utilized (calculated dividing FTK by AFTK)

· FREIGHT TONNE KILOMETERS (FTK): weight of revenue cargo in tonnes multiplied by number of kilometers flown by such tonnes.

· LESSOR:the party renting a property or other asset to another party, the lessee.

· LOAD FACTOR:the percentage of aircraft seating capacity that is actually utilized (calculated by dividing RPK by ASK).

· LONG-HAUL FLIGHTS:long-distance flights (in GOL's case, flights of more than four hours' duration).

· OPERATING COST PER AVAILABLE SEAT KILOMETER (CASK):operating expenses divided by the total number of available seat kilometers.

· OPERATING COST PER AVAILABLE SEAT KILOMETER EX-FUEL (CASK EX-FUEL):operating cost divided by the total number of available seat kilometers excluding fuel expenses.

· OPERATING REVENUE PER AVAILABLE SEAT KILOMETER (RASK):total operating revenue divided by the total number of available seat kilometers.

· PASSENGER REVENUE PER AVAILABLE SEAT KILOMETER (PRASK): total passenger revenue divided by the total number of available seat kilometers.

· PDP:credit for advance payments for aircraft purchases financing.

· REVENUE PASSENGERS:the total number of passengers on board who have paid more than 25% of the full flight fare.

· REVENUE PASSENGER KILOMETERS (RPK):the sum of the products of the number of paying passengers on a given flight and the length of the flight.

· SALE-LEASEBACK: a financial transaction whereby a resource is sold and then leased back, enabling use of the resource without owning it.

· SLOT:the right of an aircraft to take off or land at a given airport for a determined period of time.

· SUB-LEASES:an arrangement whereby a lessor in a rent agreement leases the item rented to a fourth party.

· TOTAL CASH:the sum of cash, financial investments and short and long-term restricted cash.

· WTI BARREL:West Texas Intermediate - the West Texas region, where US oil exploration is concentrated. Serves as a reference for the US petroleum byproduct markets.

· YIELD PER PASSENGER KILOMETER:the average value paid by a passenger to fly one kilometer.

About GOL Linhas Aéreas Inteligentes S.A.

GOLserves more than 36 million passengers annually. With Brazil's largest network,GOL offers customers more than 750 daily flights to over 100 destinations in Brazil and in South America, the Caribbean and the United States.GOLLOG’s cargo transportation and logistics business serves more than 3,400 Brazilian municipalities and more than 200 international destinations in 95 countries.SMILES allows over 16 million registered clients to accumulate miles and redeem tickets to more than 700 destinations worldwide on the GOL partner network. Headquartered in São Paulo, GOL has a team of approximately 16,000 highly skilled aviation professionals and operates a fleet of 137 Boeing 737 aircraft, delivering Brazil's top on-time performance and an industry leading 19-year safety record. GOL has invested billions of Reais in facilities, products and services and technology to enhance the customer experience in the air and on the ground. GOL's shares are traded on the NYSE (GOL) and the B3 (GOLL4). For further information, visitwww.voegol.com.br/ir.

Disclaimer

This release contains forward-looking statements relating to the prospects of the business, estimates for operating and financial results, and those related to growth prospects of GOL, as well as the expected impact of the recently issued accounting standard IFRS 16. These are merely estimates and projections and, as such, are based exclusively on the expectations of GOL’s management. Such forward-looking statements depend, substantially, on external factors, in addition to the risksdisclosed in GOL’s filed disclosure documents and are, therefore, subject to change without prior notice.

Non-GAAP Measures

To be consistent with industry practice. GOL discloses so-called non-GAAP financial measures, which are not recognized under IFRS or U.S. GAAP, including “Net Debt”, “total liquidity” and "EBITDA". The Company’s management believes that disclosure of non-GAAP measures provides useful information to investors, financial analysts and the public in their review of its operating performance and their comparison of its operating performance to the operating performance of other companies in the same industry and other industries. However, these non-GAAP items do not have standardized meanings and may not be directly comparable to similarly-titled items adopted by other companies. Potential investors should not rely on information not recognized under IFRS as a substitute for the GAAP measures of earnings or liquidity in making an investment decision.

Contacts

E-mail:ri@voegol.com.br

Phone: +55 (11) 2128-4700

Website:www.voegol.com.br/ir

Comments on Business Forecast Trends

The Company’s guidance highlights key metrics which impact financial results and drive long-term shareholdervalue. GOL provides forward-looking information that is focused on the main metrics the Company uses to measure business performance. These indicators are useful for investors and analysts who project GOL’s results.

Financial Outlook (Consolidated, IFRS) | 2020E | 2021E |

Previous | Revised | | Preliminary |

Total fleet (average) | 134 to 139 | 135 to 139 | | 137 to 141 |

Total operational fleet (average) | 127 | 125 | 130 |

ASKs, System (% change) | 7 to 9 | 7 to 9 | 7 to 9 |

- Domestic | 6 to 9 | 6 to 9 | 6 to 9 |

- International | 15 to 20 | 7 to 10 | 15 to 20 |

Seats, System (% change) | 6 to 8 | 8 to 10 | 6 to 8 |

Departures, System (% change) | 6 to 8 | 7 to 9 | 8 to 10 |

Net revenues (R$ billion) | ~15.5 | ~15.4 | ~17.0 |

EBITDA margin (%) | ~30 | ~30 | ~31 |

EBIT margin (%) | ~19 | ~19 | ~20 |

Pre-tax margin(1) (%) | ~13 | ~13 | ~13 |

Effective income tax rate (%) | ~15 | ~15 | ~15 |

Minority interest(R$ MM) | ~311 | ~250 | ~270 |

Net Debt / EBITDA(3)(x) | ~2.0x | ~2.0x | ~1.9x |

Fully-diluted shares out. (2) (MM) | 391 | 391 | 391 |

EPS, fully diluted(1)(R$) | 2.80 to 3.30 | 2.65 to 3.15 | 4.00 to 4.70 |

Fully-diluted ADS out.(2) (MM) | 195.5 | 195.5 | 195.5 |

EPADS, fully diluted(1) (US$) | 1.40 to 1.65 | 1.25 to 1.50 | 1.90 to 2.30 |

| | | | | |

(1) Excluding currency gains and losses and Unrealized gains/losses on Exchangeable Notes. (2) Assumes stock option exercises and conversion of the Exchangeable Notes. (3) Excluding Perpetual and Exchangeable Notes.

Report of the Statutory Audit Committee (CAE)

The Statutory Audit Committee (“CAE”) is a statutory body linked to the Board of Directors of Gol Linhas Aéreas Inteligentes S.A. (“Company”), with three independent members who are members of the Board of Directors and are elected by the board members annually. One of these members is qualified as a Financial Specialist. Under the terms of its charter, CAE’s main duties include supervising the quality and integrity of financial reports and statements, the compliance with legal, regulatory and statutory standards, the compliance with the processes related to risk management, policies and procedures for internal controls and the activities of the internal auditors. In addition, CAE supervises the work of the independent auditors, including their independence, the quality, and adequacy of the services provided, in addition to any differences of opinion with the management and approves the fees charged by them. Provides for the registration and exercise of independent audit activity within the scope of the Brazilian securities market (CVM), in addition to performing the function of Audit Committee, in compliance with the provisions of the Sarbanes Oxley Act, to which the Company is subject as a company registered with the Securities and Exchange Commission (“SEC”). Transactions with related parties, activities related to monitoring risks and compliance and the functioning of the complaints channel installed are also supervised by the CAE.

The activities carried out by CAE, through 6 meetings, for the year ended December 31, 2019, include:

· | The CAE coordinator established the agendas and chaired the CAE meetings; |

· | Evaluated the annual work plan and discussed the results of the activities performed by the independent auditors for the 2019 fiscal year; |

· | Supervised the activities and performance of the Company’s internal audit, analyzing the annual work plan, discussing the results of the activities performed and the reviews carried out. The issues raised by the internal audit about improvements in the internal control environment are discussed with the responsible members of the management/board to implement continuous improvements. Supervised and analyzed the effectiveness, quality, and integrity of the internal control mechanisms, in order, among others, to monitor the compliance with the provisions related to the integrity of the financial statements, including the quarterly earnings release and other interim statements; |

· | Jointly supervised with the Management and the internal audit the agreements of different nature between the Company or its subsidiaries, on the one hand, and the controlling shareholder, on the other hand, to verify the compliance with the Company’s policies and controls in relation to the operations with related parties; |

· | Gathered together with the independent auditors, Ernst & Young, until the issue of the quarterly earnings release for the three-month period ended March 31, 2019, and KPMG Auditores Independentes, having dealt with, among others, the following subjects: relationship and communication between CAE and the external auditors, scope of the auditors’ work, as well as the conclusions presented through the work plan of the Independent Auditors; and |

· | Prepared CAE’s activity and operations report in 2019, following good corporate governance practices, as well as the applicable regulations. |

Internal Control Systems

Based on the agenda defined for the 2019 fiscal year, CAE addressed the main issues related to the Company’s internal controls, evaluating the actions to mitigate risks and the commitment of the top management to its continuous improvement.

As a result of the meetings with the Company’s internal areas, the Statutory Audit Committee had the opportunity to offer suggestions to the Board of Directors to improve the processes, supervising the results already obtained in 2019.

Based on the work carried out throughout 2019, CAE believes that the internal control system of the Company and its subsidiaries is appropriate to the size and complexity of its business and structured to guarantee the efficiency of its operations, of the systems that generate financial reports, as well as the compliance with applicable internal and external standards.

Management of Corporate Risks

CAE members, within their legal duties and responsibilities, received information from the Management on the relevant corporate risks, including continuity risks, making their assessments and recommendations to increase the effectiveness of risk management processes, directly at meetings of the Board of Directors, contributing and ratifying the actions implemented in 2019.

Conclusion

CAE deemed the facts submitted to the body at the time of the work carried out and described in this Report to be appropriate, recommending, in its opinion, the approval of the Company’s audited financial statements for the year ended on December 31, 2019.

São Paulo, February28, 2020.

André Béla Jánszky

Member of the Statutory Audit Committee

Antônio Kandir

Member of the Statutory Audit Committee

Francis James Leahy Meaney

Member of the Statutory Audit Committee

Legal Opinion of the Fiscal Council

The Fiscal Council of Gol Linhas Aéreas Inteligentes S.A., within its legal and statutory duties, having examined the Management’s Report, the Statements of financial position, the statements of operations, the comprehensive income statement, the cash flow statement, the statement of changes in the shareholders’ equity, the statement of added value and the respective notes, individual and consolidated, related to the fiscal year ended on December 31, 2019, and accompanied by the independent auditors’ report, issues an opinion that the aforementioned pieces duly reflect the Company’s equity situation and economic-financial position on December 31, 2019, recognizing that they are able to be deliberate by the annual Shareholders’ Meeting.

São Paulo, February28, 2020.

Renato Chiodaro

Chairman of the Fiscal Council

Marcelo Moraes

Member of the Fiscal Council

Marcela de Paiva

Member of the Fiscal Council

Executive Officers’ Statement on the Financial Statements

In compliance with the provisions of CVM Instruction 480/09, the officers state that they have discussed, reviewed and agreed with the financial statements for the year ended on December 31, 2019.

São Paulo, February28, 2020.

Paulo Sérgio Kakinoff

President and Chief Executive Officer

Richard Freeman Lark Jr.

Executive Vice President and Chief Financial Officer

Executive Officers’ Statement on the Independent Auditor’s Report

In compliance with the provisions in CVM Instruction 480/09, the Board states that it has discussed, reviewed and agreed with the opinion issued in the report of the independent auditor, KPMG Auditores Independentes, on the individual and consolidated financial statements for the year ended on December 31, 2019.

São Paulo, February28, 2020.

Paulo Sérgio Kakinoff

President and Chief Executive Officer

Richard Freeman Lark Jr.

Executive Vice President and Chief Financial Officer

Report on the Audit of the Individual and Consolidated Financial Statements |

|

To the shareholders and Board members and Officers of GOL Linhas Aéreas Inteligentes S.A. São Paulo – SP |

Opinion |

We have audited the individual and consolidated financial statements of Gol Linhas Aéreas Inteligentes S.A. (“the Company”), respectively referred to as Individual and Consolidated, which comprise the statement of financial position as at December 31, 2019, the statements of income and other comprehensive income, changes in equity and cash flows for the year then ended, and notes, comprising significant accounting policies and other explanatory information. Opinion on the individual financial statements Inouropinion,theaccompanyingfinancialstatementspresentfairly,inallmaterialrespects, the individual financial position of the Gol Linhas Aéreas Inteligentes S.A. as at December31,2019,andofitsindividualfinancialperformanceanditscash flowsfortheyearthenendedinaccordancewithAccountingPracticesAdoptedinBrazil. Opinion on the consolidated financial statements Inouropinion,theaccompanyingfinancialstatementspresentfairly,inallmaterialrespects, the consolidated financial position of the Gol Linhas Aéreas Inteligentes S.A. as at December31,2019,andofitsconsolidatedfinancialperformanceanditscash flowsfortheyearthenendedinaccordancewithAccountingPracticesAdoptedinBraziland with International Financial Reporting Standards (IFRS), issued by the International Accounting Standards Board(IASB). |

Basis for Opinion |

We conducted our audit in accordance with Brazilian and International Standards on Auditing. Our responsibilities under those standards are further described in the Auditors’ Responsibilities for the Audit of the Individual and Consolidated Financial Statements section of our report. We are independent of the Company and its subsidiaries in accordance with the relevant ethical requirements included in the Accountant Professional Code of Ethics (“Código de Ética Profissional do Contador”) and in the professional standards issued by the Brazilian Federal Accounting Council (“Conselho Federal de Contabilidade”) and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion. |

Emphasis |

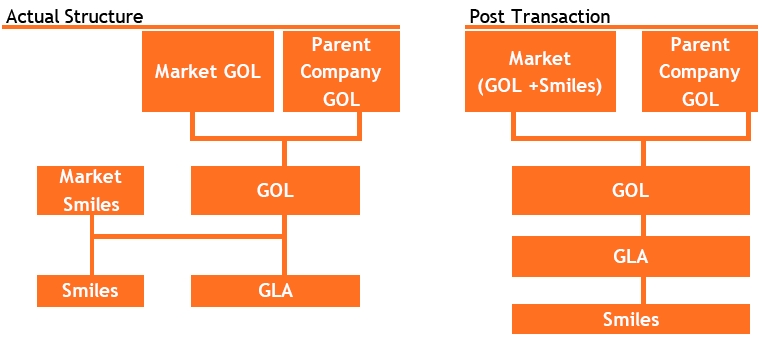

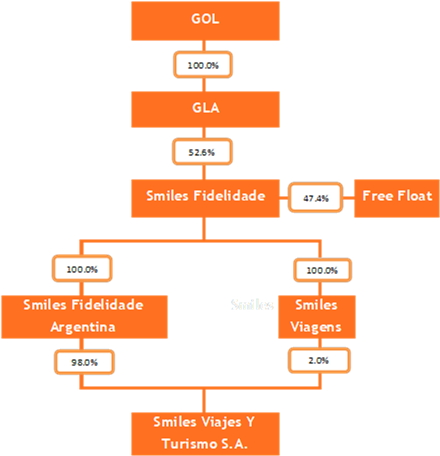

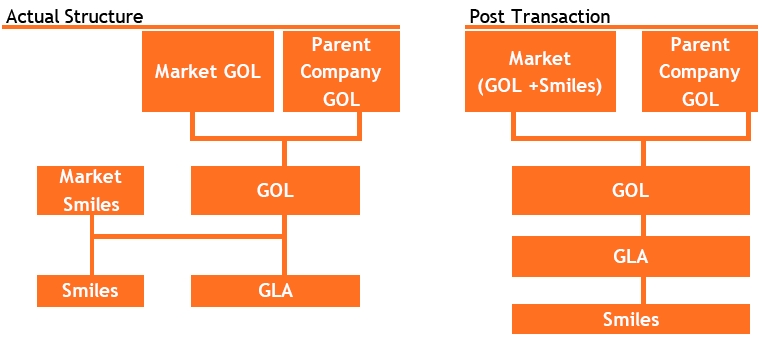

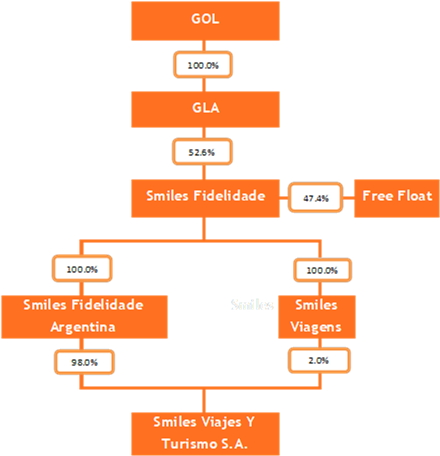

We call attention to note 38.3 to the individual and consolidated financial statements, which describes that on a meeting held on February 4, 2020, the Board of Directors decided to hold the Company’s Extraordinary General Meeting on March 5, 2020, calling on shareholders to examine and deliberate on the Protocol and Justification (“Protocolo e Justificação”) that establishes the terms and conditions of the corporate reorganization. In this reorganization process, the shares issued by the subsidiary Smiles Fidelidade S.A. (“Smiles”) will be merged into by the other subsidiary Gol Linhas Aéreas S.A. (“GLA”), and the shares issued by GLA will be merged by the Company, becoming the Company, as a result of indirectly holding all shares issued by the Smiles, with the consequent merging of operations and shareholder bases of the Company and Smiles. Our opinion is not qualified in this respect. |

Key audit matters |

Key audit matters are those matters that, in our professional judgment, were of most significance in our audit of the current period. These matters were addressed in the context of our audit of the individual and consolidated financial statements as a whole, and in forming our opinion thereon, and we do not provide a separate opinion on these matters. |

Recognition and measurement of miles and expired miles revenue (“breakage”) |

See footnotes 4.18.1, 4.18.3, 4.23.2, 23, 29, 32.2 of the accompanying consolidated and individual financial statements |

Key audit matter | How our audit conducted this matter |

The Company initially recognizes revenue related to the redemption of miles issued and accumulated as deferred revenue and recognizes the related revenue through the redemption of miles by the Program participants. The recognition and measurement of the revenue also considers the estimated amount of miles that will be expired unused, which are recorded as breakage revenue, based on the calculation that estimates the miles that will expire unused. The recognition and measurement of breakage revenue request significant judgment of the Company to determine the expected miles that will expire unused. The Company considers the historical behavior of expired miles, and the potential of expiration, which is based on the loyalty program policies that varies according to the category of benefits that each client is entitled to. Additionally, the recognition of breakage and miles revenue is highly dependent on the functionality of the information systems and the controls related to the process of accumulating and redeeming miles for the revenue being recognized effectively at the redemption made by the Program participant. Due to the reasons above mentioned, this topic was considered one of the key audit matters. | Our audit procedures comprised the following, but were not limited to: |

| · | Evaluation, with the involvement of information technology experts, of the information technology environment and the design of automatic controls used to process miles revenue recognition. |

| · | Performing substantive tests, based on samples, with the purpose of validating the accumulated and redeemed miles rollforward. |

| · | Obtaining and evaluating the reconciliations, prepared by the Company, of the trade accounts receivable, comparing the balance to the accounting positions at the reporting date, respectively. |

| · | Confirming trade accounting receivables with credit cards operators which Company transacted throughout the fiscal year and non- airlines partners, the latest ones based on sample, comparing the confirmed balances with accounting records at the reporting date. |

| · | Evaluating, through sample, agreements established with partners, and if miles unitary amount used for recognition and measurement of revenue was in compliance with the respective agreements. |

| · | Evaluating the assumptions related to the estimate of miles that will expire unused in order to determine the estimated amount of breakage revenue to be recognized, comparing the assumptions to historical data of expired miles by client. |

| · | Performing substantive tests, based on sample, to evaluate, if the data related to accumulated miles used to determine the estimated miles that will expire unused is according to the benefits offered in each category of the Program to each client. |

The deficiencies related to the design of internal controls that came to our attention linked to the recognition and measurement of breakage and miles revenue have influenced the extension and nature of our substantive audit procedures in order to obtain enough and appropriate audit evidence of the miles and breakage revenue. Based on the above-summarized results of audit procedures, we consider the balance of breakage and miles revenue, as well as the respective disclosures, in the context of individual and consolidated financial statements taken as a whole for the year ended December 31, 2019. |

| |

Going concern |

See note 1.1 to the individual and consolidated financial statements |

Key audit matter | How the audit addressed this issue |

On December 31, 2019, the Company presents in its individual and consolidated financial statements negative shareholders' equity and negative working capital. In order to assess the use of the going concern assumption when preparing the individual and consolidated financial statements for the year ended as of December 31,2019, the Company, based on its assessment, concluded that there is no material uncertainty regarding its ability to continue operating for the foreseeable future. This assessment involves judgments and contains uncertainties related to the assumptions used to determine future cash flows and relevant macroeconomic and sectorial assumptions, such as forecasts of the dollar exchange rate and the price of fuel. This matter was considered as one of the main audit matters due to the judgment inherent in the process of determining the estimates and basic assumptions of this assessment, specifically those associated with the determination of cash flow projections, and the impact that any significant change in these assumptions could have. in the assessment of the assumption of business continuity and, consequently, in the individual and consolidated financial statements for the year ended December as of 31, 2019. | Our audit procedures included, but were not limited to: |

| · | Obtaining and analyzing the evaluation prepared by the Company regarding the uncertainties related to the ability to continue operating and the evaluation of the cash flow projections prepared by the Company and approved by the Board of Directors. |

| · | With the assistance of our Corporate Finance specialists, we evaluated the assumptions used in determining the cash flow projections, considering realized results, external data and market conditions, as well as the consistency of the projections used by the Company used in the assessment of the assumption of operational continuity with projections duly approved by the Board of Directors. |

| · | We also evaluated the Company's plans approved by the Board of Directors for future actions in relation to operational continuity, we read the contractual terms of debentures and loans, considering a potential material breach, as well as the minutes of the shareholders' meetings, those responsible for the governance and relevant committees. |

| · | We also assessed the adequacy of the information disclosed in the Company's individual and consolidated financial statements. Based on the evidence obtained through the procedures summarized above, we consider acceptable the Company's judgment that there is no material uncertainty related to operating continuity, in the context of the financial statements taken as a whole, for the year ended December 31, 2019. |

| |

Other matters |

Statements of value added The individual and consolidated statements of value added (DVA) for the year ended December 31, 2019 prepared under the responsibility of the Company’s management, and presented herein as supplementary information for IFRS purposes, have been subject to audit procedures jointly performed with the audit of the Company's financial statements. In order to form our opinion, we assessed whether those statements are reconciled with the financial statements and accounting records, as applicable, and whether their format and contents are in accordance with criteria determined in the Technical Pronouncement 09 (CPC 09) - Statement of Value Added. In our opinion, the statements of value added have been fairly prepared, in all material respects, in accordance with the criteria determined by the aforementioned Technical Pronouncement and are consistent with the overall individual and consolidated financial statements. Corresponding audited values The individual and consolidated balance sheets as of December 31, 2018 and the individual and consolidated statements of income, comprehensive income, changes in equity and cash flows and respective notes for the year ended on that date, presented as corresponding amounts in the individual and consolidated financial statements for the current year, were previously audited by other independent auditors, who issued a report dated February 27, 2019, without modification. The corresponding amounts related to the individual and consolidated statements of added value (DVA), for the year ended December 31, 2018, were submitted to the same audit procedures by those independent auditors and, based on their examination, those auditors issued a report without modification. |

Other information accompanying the individual and consolidated financial statements and the auditor's report |

Management is responsible for the other information comprising the management report. Our opinion on the individual and consolidated financial statements does not cover the other information and we do not express any form of assurance conclusion thereon. In connection with our audit of the individual and consolidated financial statements, our responsibility is to read the other information and, in doing so, consider whether the other information is materially inconsistent with the individual and consolidated financial statements or our knowledge obtained in the audit, or otherwise appears to be materially misstated. If, based on the work we have performed, we conclude that there is a material misstatement of this other information, we are required to report that fact. |

Responsibilities of Management and Those Charged with Governance for the Individual and Consolidated Financial Statements |

Management is responsible for the preparation and fair presentation of the individual and consolidated financial statements in accordance with Accounting Practices Adopted in Brazil and with International Financial Reporting Standards (IFRS), issued by the International Accounting Standards Board (IASB) and for such internal control as management determines is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error. In preparing the individual and consolidated financial statements, management is responsible for assessing the Company’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate the Company and subsidiaries or to cease operations, or has no realistic alternative but to do so. Those charged with governance are responsible for overseeing the Company’s and subsidiaries financial reporting process. |

Auditors’ Responsibilities for the Audit of the Individual and Consolidated Financial Statements |

Our objectives are to obtain reasonable assurance about whether the individual and consolidated financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditors’ report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with Brazilian and international standards on auditing will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements. As part of an audit in accordance with Brazilian and international standards on auditing, we exercise professional judgment and maintain professional skepticism throughout the audit. We also: |

- | Identify and assess the risks of material misstatement of the individual and consolidated financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. |

- | Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s and its subsidiaries internal control. |

- | Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management. |

- | Conclude on the appropriateness of management’s use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Company’s and its subsidiaries ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditors’ report to the related disclosures in the individual and consolidated financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditors’ report. However, future events or conditions may cause the Company and subsidiaries to cease to continue as a going concern. |

- | Evaluate the overall presentation, structure and content of the financial statements, including the disclosures, and whether the individual and consolidated financial statements represent the underlying transactions and events in a manner that achieves fair presentation. |

- | Obtain sufficient appropriate audit evidence regarding the financial information of the entities or business activities within the Group to express an opinion on the consolidated financial statements. We are responsible for the direction, supervision and performance of the group audit. We remain solely responsible for our audit opinion. |

We communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit. We also provide those charged with governance with a statement that we have complied with relevant ethical requirements regarding independence, and communicate with them all relationships and other matters that may reasonably be thought to bear on our independence, and where applicable, related safeguards. From the matters communicated with those charged with governance, we determine those matters that were of most significance in the audit of the individual and consolidated financial statements of the current period and are therefore the key audit matters. We describe these matters in our auditors’ report unless law or regulation precludes public disclosure about the matter or when, in extremely rare circumstances, we determine that a matter should not be communicated in our report because the adverse consequences of doing so would reasonably be expected to outweigh the public interest benefits of such communication. São Paulo, February 28, 2020 |

KPMG Auditores Independentes CRC 2SP014428/O-6 (Original in Portuguese signed by) Márcio Serpejante Peppe Accountant CRC 1SP233011/O-8 |

| Statements of Financial Position December 31, 2019 and 2018 (In thousands of Reais - R$) |

| | | Parent Company | Consolidated |

Assets | Note | 2019 | 2018 | 2019 | 2018 |

| | | | | | |

Current Assets | | | | | |

Cash and cash equivalents | 6 | 1,016,746 | 282,465 | 1,645,425 | 826,187 |

Short-term investments | 7 | 673 | 92,015 | 953,762 | 478,364 |

Restricted cash | 8 | 6,399 | - | 304,920 | 133,391 |

Trade receivables | 9 | - | - | 1,229,530 | 853,328 |

Inventories | 10 | - | - | 199,213 | 180,141 |

Recoverable taxes | 11 | 5,163 | 5,279 | 309,674 | 360,796 |

Derivative assets | 34.2 | - | - | 3,500 | - |

Advance to suppliers and third parties | 13 | 37 | - | 142,338 | 55,132 |

Other Assets | | 79,587 | 425,913 | 139,015 | 423,496 |

Total current assets | | 1,108,605 | 805,672 | 4,927,377 | 3,310,835 |

| | | | | |

Non-current | | | | | |

Deposits | 14 | 112,502 | 108,386 | 1,968,355 | 1,612,295 |

Restricted cash | 8 | - | 39,784 | 139,386 | 688,741 |

Advance to suppliers and third parties | 13 | - | - | 48,387 | - |

Recoverable taxes | 11 | 22,449 | 24,789 | 174,142 | 95,873 |

Deferred taxes | 12 | 56,903 | 24,209 | 59,809 | 73,822 |

Other credits and amounts | | - | - | 991 | - |

Related parties | 28 | 3,440,701 | 2,294,143 | - | - |

Derivative assets | 34.2 | 143,969 | - | 143,969 | - |

Investments | 15 | 501,986 | 437,875 | 1,254 | 1,177 |

Property, plant and equipment | 16 | 240,379 | 202,698 | 6,058,101 | 2,818,057 |

Intangible assets | 17 | - | - | 1,776,675 | 1,777,466 |

Total Non-current assets | | 4,518,889 | 3,131,884 | 10,371,069 | 7,067,431 |

| | | | | |

Total | | 5,627,494 | 3,937,556 | 15,298,446 | 10,378,266 |

The accompanying notes are an integral part of these consolidated financial statements.

10

| Statements of Financial Position December 31, 2019 and 2018 (In thousands of Reais - R$) |

| | | Parent Company | Consolidated |

Liabilities and equity | Note | 2019 | 2018 | 2019 | 2018 |

| | | | | | |

Current liabilities | | | | | |

Loans and financing | 18 | 1,359,547 | 123,873 | 2,543,039 | 1,103,206 |

Leases | 19 | - | - | 1,404,712 | 255,917 |

Suppliers | 20 | 19,116 | 10,765 | 1,286,275 | 1,403,815 |

Suppliers - forfaiting | 21 | - | - | 554,467 | 365,696 |

Salaries | | 137 | 478 | 396,010 | 368,764 |

Taxes payable | 22 | 4,261 | 8,944 | 116,523 | 111,702 |

Landing fees | | - | - | 728,339 | 556,300 |

Air traffic liability | 23 | - | - | 1,966,148 | 1,673,987 |

Mileage program | | - | - | 1,009,023 | 826,284 |

Advances from customers | | - | - | 16,424 | 169,967 |

Provisions | 24 | - | - | 203,816 | 70,396 |

Derivatives | 34.2 | - | - | 9,080 | 195,444 |

Other liabilities | | - | 5,263 | 128,744 | 99,078 |

Total current liabilities | | 1,383,061 | 149,323 | 10,362,600 | 7,200,556 |

| | | | | |

Non-current liabilities | | | | | |

Loans and financing | 18 | 5,235,593 | 4,535,229 | 5,866,802 | 5,340,601 |

Leases | 19 | - | - | 4,648,068 | 656,228 |

Suppliers | 20 | - | - | 10,142 | 120,137 |

Provisions | 24 | - | - | 1,053,240 | 829,198 |

Mileage program | | - | - | 171,651 | 192,569 |

Deferred taxes | 12 | - | - | 244,041 | 227,290 |

Taxes payable | 22 | - | 7,794 | 84 | 54,659 |

Related parties | 28 | 163,350 | - | - | - |

Derivatives | 34.2 | - | - | 11,270 | 214,218 |

Provision for loss on investment | 15 | 6,498,660 | 4,200,243 | - | - |

Other liabilities | | 23,501 | 30,379 | 35,965 | 48,161 |

Total non-current liabilities | | 11,921,104 | 8,773,645 | 12,041,263 | 7,683,061 |

| | | | | |

Equity (deficit) | | | | | |

Capital stock | 25.1 | 3,008,178 | 2,942,612 | 3,008,178 | 2,942,612 |

Advances for future capital increase | | 584 | 2,818 | 584 | 2,818 |

Treasury shares | 25.2 | (102,543) | (126) | (102,543) | (126) |

Capital reserves | | 225,276 | 205,889 | 225,276 | 205,889 |

Equity valuation adjustments | | 188,247 | 259,962 | 188,247 | 259,962 |

Accumulated losses | | (10,996,413) | (8,396,567) | (10,996,413) | (8,396,567) |

Deficit attributable to equity holders of the parent company | | (7,676,671) | (4,985,412) | (7,676,671) | (4,985,412) |

| | | | | |

Non-controlling interest (NCI) | | - | - | 571,254 | 480,061 |

Total deficit | | (7,676,671) | (4,985,412) | (7,105,417) | (4,505,351) |

| | | | | |

Total liabilities and deficit | | 5,627,494 | 3,937,556 | 15,298,446 | 10,378,266 |

The accompanying notes are an integral part of these consolidated financial statements.

11

| Consolidated statements of operations Fiscal year ended on December 31, 2019 and 2018(In thousands of Reais - R$, except Basic and Diluted Earnings (Loss) per Share) |

| | Parent Company | Consolidated |

| Note | 2019 | 2018 | 2019 | 2018 |

Net revenue | | | | | |

Passenger | | - | - | 13,077,743 | 10,633,488 |

Cargo and other | | - | - | 786,961 | 777,866 |

Total net revenue | 29 | - | - | 13,864,704 | 11,411,354 |

| | | | | |

Cost of services provided | 30 | - | - | (9,807,028) | (9,135,311) |

Gross profit | | - | - | 4,057,676 | 2,276,043 |

| | | | | |

Operating income (expenses) | | | | | |

Selling expenses | | - | - | (902,669) | (761,926) |

Administrative expenses | | (212,783) | (25,551) | (1,341,698) | (1,028,709) |

Other income and expenses, net | | 43,054 | 562,571 | 319,353 | 914,167 |

Total operating expenses | 30 | (169,729) | 537,020 | (1,925,014) | (876,468) |

| | | | | |

Equity results | 15 | 509,926 | (852,866) | 77 | 387 |

| | | | | |

Income (loss) before financial results, exchange rate variation, net and income taxes | | 340,197 | (315,846) | 2,132,739 | 1,399,962 |

| | | | | |

Financial results | | | | | |

Financial income | | 155,838 | 108,969 | 389,563 | 259,728 |

Financial expenses | | (550,278) | (440,119) | (1,748,265) | (1,061,089) |

Total financial results | 31 | (394,440) | (331,150) | (1,358,702) | (801,361) |

| | | | | |

Income (loss) before exchange rate variation, net and income taxes | | (54,243) | (646,996) | 774,037 | 598,601 |

| | | | | |

Exchange rate variation, net | 31 | (87,133) | (433,239) | (385,092) | (1,081,197) |

| | | | | |

Income (loss) before income taxes | | (141,376) | (1,080,235) | 388,945 | (482,596) |

| | | | | |

Income taxes | | | | | |

Current | | (8,591) | (1,664) | (178,621) | (52,139) |

Deferred | | 32,694 | (3,494) | (30,986) | (244,989) |

Total income (loss) taxes | 12 | 24,103 | (5,158) | (209,607) | (297,128) |

| | | | | |

Net income (loss) for the year | | (117,273) | (1,085,393) | 179,338 | (779,724) |

| | | | | |

Net income (loss) attributable to: | | | | | |

Equity holders of the parent company | | (117,273) | (1,085,393) | (117,273) | (1,085,393) |

Non-controlling interest shareholders | | - | - | 296,611 | 305,669 |

| | | | | |

Basic loss per share | 26 | | | | |

Per common share | | (0.010) | (0.089) | (0.010) | (0.089) |

Per preferred share | | (0.333) | (3.115) | (0.333) | (3.115) |

| | | | | |

Diluted loss per share | 26 | | | | |

Per common share | | (0.010) | (0.089) | (0.010) | (0.089) |

Per preferred share | | (0.333) | (3.115) | (0.333) | (3.115) |

The accompanying notes are an integral part of these consolidated financial statements.

12

| Statements of comprehensive income Fiscal year ended on December 31, 2019 and 2018(In thousands of Reais - R$) |

| Parent Company | Consolidated |

| 2019 | 2018 | 2019 | 2018 |

| | | |

Net income (loss) for the year | (117,273) | (1,085,393) | 179,338 | (779,724) |

| | | | |

Other comprehensive income (loss) to be reclassified to profit and loss in subsequent years | | | | |

| | | | | |

Actuarial losses from post-employment benefits | (41,045) | - | (41,045) | - |

Cash flow hedge, net of Income tax and social contribution | (30,021) | (420,706) | (30,021) | (420,706) |

| (71,066) | (420,706) | (71,066) | (420,706) |

| | | | |

Total comprehensive Income (loss) for the year | (188,339) | (1,506,099) | 108,272 | (1,200,430) |

| | | | |

Comprehensive income (loss) attributable to: | | | |

Equity holders of the parent company | (188,339) | (1,506,099) | (188,339) | (1,506,099) |

Non-controlling interest shareholders | - | - | 296,611 | 305,669 |

The accompanying notes are an integral part of these consolidated financial statements.

13

| Statement of Changes of changes in equity Fiscal year ended on December 31, 2019 and 2018 (In thousands of Reais - R$) |

| Parent Company and Consolidated (a) |

| | | | Capital reserves | Equity valuation adjustment | | | | |

| Capital stock | Advance for future capital increase | Treasury shares | Premium on transfer of shares | Special premium reserve of subsidiary | Share- based payments | Cash flow hedge reserve | Post-employment benefit | Net gains from purchase/sale of non-controlling interest | Accumulated losses | Deficit attributable to equity holders of the parent company | Non-controlling interests | Total |

Balances on December 31, 2017 | 2,927,184 | - | (4,168) | 17,783 | 70,979 | 119,308 | (79,316) | - | 760,545 | (7,312,849) | (3,500,534) | 412,013 | (3,088,521) |

Initial adoption of accounting standard – (IFRS 9) | - | - | - | - | - | - | - | - | - | 1,675 | 1,675 | 38 | 1,713 |

Other comprehensive income, net | - | - | - | - | - | - | (420,706) | - | - | - | (420,706) | - | (420,706) |

Stock options exercised | 15,428 | 2,818 | - | - | - | - | - | - | - | - | 18,246 | - | 18,246 |

Stock Options of stock option in subsidiary | - | - | - | - | - | - | - | - | - | - | - | 875 | 875 |

Share-based payments | - | - | - | - | - | 17,790 | - | - | - | - | 17,790 | 782 | 18,572 |

Effects of the change in interest in investment | - | - | - | - | - | - | - | - | (561) | - | (561) | 561 | - |

Treasury shares buyback | - | - | (15,929) | - | - | - | - | - | - | - | (15,929) | - | (15,929) |

Treasury shares transferred | - | - | 19,971 | (286) | - | (19,685) | - | - | - | - | - | - | - |

Net loss for the year | - | - | - | - | - | - | - | - | - | (1,085,393) | (1,085,393) | 305,669 | (779,724) |

Dividends and interest on shareholders’ equity paid by Smiles | - | - | - | - | - | - | - | - | - | - | - | (172,865) | (172,865) |

Dividends and interest on shareholders’ equity distributed by Smiles | - | - | - | - | - | - | - | - | - | - | - | (67,012) | (67,012) |

Balances as of December 31, 2018 | 2,942,612 | 2,818 | (126) | 17,497 | 70,979 | 117,413 | (500,022) | - | 759,984 | (8,396,567) | (4,985,412) | 480,061 | (4,505,351) |

| | | | | | | | - | | | | | |

Initial adoption of accounting standards | - | - | - | - | - | - | - | - | - | (2,482,573) | (2,482,573) | (256) | (2,482,829) |

Adjusted balance as of1st, 2019 | 2,942,612 | 2,818 | (126) | 17,497 | 70,979 | 117,413 | (500,022) | | 759,984 | (10,879,140) | (7,467,985) | 479,805 | (6,988,180) |

Other comprehensive income (loss), net | - | - | - | - | - | - | (30,021) | (41,045) | - | - | (71,066) | - | (30,021) |

Net income (loss) for the year | - | - | - | - | - | - | - | - | - | (117,273) | (117,273) | 296,611 | 179,338 |

Total comprehensive income (loss) for the year | - | - | - | - | - | - | (30,021) | (41,045) | - | (117,273) | (188,339) | 296,611 | 108,272 |

Advances for future capital increase | - | 584 | - | - | - | - | - | - | - | - | 584 | - | 584 |

Stock options exercised | 65,566 | (2,818) | - | - | - | 7,137 | - | - | - | - | 69,885 | 2,366 | 72,251 |

Effects of the change in interest in investment | - | - | - | - | - | - | - | - | (649) | - | (649) | 649 | - |

Treasury shares buyback | - | - | (102,417) | - | - | - | - | - | - | - | (102,417) | - | (102,417) |

Subscription warrants | - | - | - | - | 12,250 | - | - | - | - | - | 12,250 | - | 12,250 |

Interest on shareholders’ equity distributed by Smiles | - | - | - | - | - | - | - | - | - | - | - | (208,177) | (208,177) |

Balances as of December 31, 2019 | 3,008,178 | 584 | (102,543) | 17,497 | 83,229 | 124,550 | (530,043) | (41,045) | 759,335 | (10,996,413) | (7,676,671) | 571,254 | (7,105,417) |

(a) On December 31, 2019, the equalization between the DMPL of the subsidiary and the consolidated was carried out, impacting the parent company's capital and retained earnings by R$113,328 retroactive to December 31, 2017(unaudited).

The accompanying notes are an integral part of these consolidated financial statements.

14

| Statement of Cash Flows Fiscal year ended on December 31, 2019 and 2018 (In thousands of Reais - R$) |

| Parent Company | Consolidated |

| 2019 | 2018 | 2019 | 2018 |

| | | | |

Net income (loss) for the year | (117,273) | (1,085,393) | 179,338 | (779,724) |

Adjustments to reconcile net income (loss) to net cash flows from operating activities | | | | |

Depreciation and amortization | - | - | 1,727,982 | 668,516 |

Provision for expected credit losses | - | - | 5,668 | (9,789) |

Provision for legal proceedings | - | - | 195,465 | 243,860 |

Provision for inventory obsolescence | - | - | 2,168 | 5,023 |

Provision for loss on advances from suppliers | 161,228 | - | 161,228 | - |

Adjustment to present value of advance from suppliers | - | - | 10,604 | - |

Deferred taxes | (32,694) | 3,494 | 30,986 | 244,989 |

Equitypick upmethod | (509,926) | 852,866 | (77) | (387) |

Share-based payments | - | 17,790 | 40,725 | 18,572 |

Actuarial losses from post-employment benefits | - | - | 4,907 | - |

Foreign exchange, net | 82,657 | 300,778 | 399,174 | 946,732 |

Interest on loans and financing andleases | 344,192 | 289,343 | 1,126,527 | 679,985 |

Provision for aircraft and engine return | - | - | 231,821 | - |

Provision for maintenance reserve | - | - | 75,451 | 65,334 |

Result of derivatives recognized in profit or loss | 23,230 | - | 22,022 | (13,239) |

Unrealized hedge results | (40,717) | - | (40,717) | - |

Termination of obligation due to contractual term reduction | - | - | (275,921) | - |

Provision for labor obligations | - | - | (280,320) | 127,618 |

Disposals of property, plant and Equipment and intangible assets | 3,301 | 214,475 | 152,017 | 90,639 |

Other provisions | - | - | (14,602) | - |

Adjusted net income (loss) | (86,002) | 593,353 | 3,754,446 | 2,288,129 |

| | | | |

Changes in operating assets and liabilities: | | | | |

Trade receivables | - | - | (384,147) | 95,844 |

Short-term investments | 169,052 | 694,273 | 162,167 | 695,831 |

Inventories | - | - | (21,240) | (6,673) |

Deposits | (2,141) | (41,166) | (399,345) | (402,495) |

Recoverable taxes | 2,456 | - | (27,147) | - |

Suppliers | 8,335 | (2,787) | (232,021) | 16,382 |

Suppliers - forfaiting | - | - | 188,771 | 267,502 |

Advance from ticket sales | - | - | 292,161 | 197,473 |

Mileage program | - | - | 161,821 | 65,535 |

Advances from customers | - | - | (153,543) | 148,249 |

Salaries | (341) | 167 | 307,566 | (64,308) |

Landing fees | - | - | 172,039 | 190,649 |

Taxes obligation | (20,375) | (5,774) | 179,706 | 127,663 |

Derivatives | - | - | (124,548) | (20,998) |

Receipt (payment) of fuel derivative bonus | - | - | (43,008) | 29,383 |

Advance to suppliers and third parties | (161,265) | - | (305,906) | - |

Payments for lawsuits and aircraft return | - | - | (317,591) | (236,882) |

Provisions | - | - | - | - |

Operating leases | - | - | - | 103,838 |

Prepaid expenses | (1,728) | - | (49,352) | - |

Other assets and liabilities, net | (23,052) | (328,933) | 501 | (736,638) |

Interest paid | (330,824) | (291,216) | (470,794) | (508,973) |

Income tax paid | (984) | (2,532) | (229,460) | (167,642) |

Net cash flows from operating activities | (446,869) | 615,385 | 2,461,076 | 2,081,869 |

| | | | |

Transactions with related parties | (758,935) | (379,223) | - | - |

Short-term investments | - | - | (501,607) | (163,218) |

Restricted cash | 33,385 | (1,352) | 377,826 | (548,928) |

Interests received | 5,950 | - | - | - |

Receipt of dividends and interest on shareholders’ equity through subsidiary | 234,831 | 245,178 | - | 543 |

Advances for property, plant and equipment acquisition, net | (40,982) | (94,160) | (30,804) | (106,628) |

Receipt of aircraft sales | 348,389 | - | 348,389 | - |

Acquisition of fixed assets | - | - | (872,570) | (686,946) |

Acquisition of intangible assets | - | - | (75,845) | (82,079) |

Net cash flows used in investing activities | (177,362) | (229,557) | (754,611) | (1,587,256) |

15

| Statement of Cash Flows Fiscal year ended on December 31, 2019 and 2018 (In thousands of Reais - R$) |

| Parent Company | Consolidated |

| 2019 | 2018 | 2019 | 2018 |

| | | | |

Loans and financing issued, net of costs | 1,707,935 | 486,735 | 2,275,615 | 1,703,933 |

Costs of borrowing and repurchasing securities | (69,924) | (8,578) | (80,953) | (39,926) |

Loan and financing payments | (50,320) | - | (793,537) | (1,318,349) |

Early payment of senior notes | - | (630,988) | - | (630,989) |

Leases payments | - | - | (1,617,677) | (251,557) |

Treasury share buyback | (102,417) | (15,929) | (102,417) | (15,929) |

Derivative premium payment | (153,252) | - | (407,322) | - |

Dividends and interest on shareholders’ equity paid to non-controlling interests | - | - | (210,242) | (219,493) |

Warrants | 12,250 | - | 12,250 | - |

Capital increase | 31,526 | 15,428 | 31,526 | 15,428 |

Capital increase from non-controlling interests | - | - | - | 875 |

Shares to be issued | 584 | 2,818 | 584 | 2,818 |

Transactions with related parties | - | (136,420) | - | - |

Net cash flows (used in) from financing activities | 1,376,382 | (286,934) | (892,173) | (753,189) |

| | | | |

Foreign exchange variation on cash held in foreign currencies | (17,870) | 79,844 | 4,946 | 57,901 |

| | | | |

Net (decrease) increase in cash and cash equivalents | 734,281 | 178,738 | 819,238 | (200,675) |

| | | | |

Cash and cash equivalents at the beginning of the year | 282,465 | 103,727 | 826,187 | 1,026,862 |

Cash and cash equivalents at the end of the year | 1,016,746 | 282,465 | 1,645,425 | 826,187 |

| | | | |

| | | | | |

The transactions that don’t affect the cash are presented in Note 35 of these financial statements.

The accompanying notes are an integral part of these consolidated financial statements.

16

| Statements of Added Value Fiscal year ended on December 31, 2019 and 2018 (In thousands of Reais - R$) |

DVA

| Parent Company | Consolidated |

| 2019 | 2018 | 2019 | 2018 |

Revenues | | | | |

Passengers, cargo and other | - | - | 14,432,648 | 12,091,380 |

Other operating income | 43,054 | 956,261 | 319,354 | 1,203,364 |

Allowance for doubtful accounts | - | - | (5,668) | 24,804 |

| 43,054 | 956,261 | 14,746,334 | 13,319,548 |

Inputs acquired from third parties (including ICMS and IPI) | | | | |

Suppliers of aircraft fuel | - | - | (4,047,344) | (3,958,158) |

Material, electricity, third-party services and others | (207,078) | (415,129) | (3,182,978) | (2,952,394) |

Aircraft insurance | - | - | (25,676) | (20,543) |

Sales and marketing | (338) | (307) | (670,392) | (607,772) |

Gross added value (used) | (164,362) | 540,825 | 6,819,944 | 5,780,681 |

| | | | |

Depreciation and amortization | - | - | (1,727,982) | (668,516) |

Net added value produced (used) by the company | (164,362) | 540,825 | 5,091,962 | 5,112,165 |

| | | | |

Value added received in transfer | | | | |

Equity results | 509,926 | (852,866) | 77 | 387 |

Financial income | 155,838 | 35,983 | 389,563 | 2,143,254 |

Total added value to be distributed (distributed) | 501,402 | (276,058) | 5,481,602 | 7,255,806 |

| | | | |

Distribution of value added: | | | | |

Salaries | 3,969 | 3,439 | 1,613,227 | 1,516,591 |

Benefits | - | - | 194,429 | 165,316 |

FGTS | - | (309) | 132,135 | 103,354 |

Personnel | 3,969 | 3,130 | 1,939,791 | 1,785,261 |

| | | | |

Federal taxes | (22,632) | 11,991 | 1,170,909 | 1,035,625 |

State taxes | - | - | 21,750 | 20,762 |

Municipal taxes | - | - | 4,119 | 3,752 |

Tax, charges and contributions | (22,632) | 11,991 | 1,196,778 | 1,060,139 |

| | | | |

Interest | 637,308 | 794,173 | 2,101,853 | 4,007,639 |

Rent | - | - | 63,613 | 1,182,325 |

Other | 30 | 41 | 229 | 166 |

Third-party capital remuneration | 637,338 | 794,214 | 2,165,695 | 5,190,130 |

| | | | |

Net earnings (loss) for the Fiscal Year | (117,273) | (1,085,393) | (117,273) | (1,085,393) |

Net income for the year attributable to non- controlling interests | - | - | 296,611 | 305,669 |

Remuneration of own capital | (117,273) | (1,085,393) | 179,338 | (779,724) |

| | | | |

Total added value distributed | 501,402 | (276,058) | 5,481,602 | 7,255,806 |

17

| Notes to the Financial Statements Fiscal year ended December 31, 2019. (In thousands of Reais - R$, except when otherwise indicated) |

1. Operating Context

Gol Linhas Aéreas Inteligentes S.A. (the “Company” or “GOL”) is a publicly-listed company incorporated on March 12, 2004, under the Brazilian Corporate Law. The Company’s bylaws provide that it has as its corporate purpose the exercise of share control of GOL Linhas Aéreas S.A. (“GLA”), through subsidiaries or affiliated companies, as well as exploring:

· | regular and non-scheduled air transportation services for passengers, cargo and postal bags, at national and international levels, as per the concessions of the due authorities; |

· | complementary air transportation service activities by chartering passengers, cargo and postal bags; |

· | provision of maintenance services, repair of aircraft, own or third parties, engines, parts, and pieces; |

· | provision of aircraft hangar services; |

· | provision of courtyard and runway service, the supply of flight attendants and aircraft cleaning; |

· | development of other activities related or complementary to air transportation and the other activities described above; |

· | development of loyalty programs; and |

· | interest in the capital of other companies as a partner or shareholder. |

The Company’s shares are traded on B3 S.A. - Brasil, Bolsa, Balcão (“B3”) and on the New York Stock Exchange (“NYSE”) under the ticker GOLL4 and GOL, respectively. The Company adopted Level 2 Differentiated Corporate Governance Practices from B3 and is included in the Special Corporate Governance Stock Index (“IGC”) and the Special Tag Along Stock Index (“ITAG”), which were created for companies committed to applying differentiated corporate governance practices.

The Company’s corporate address is located at Praça Comandante Linneu Gomes, s/n, portaria 3, prédio 24, Jardim Aeroporto, São Paulo, Brazil.