SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of May 2020

(Commission File No. 001-32221)

GOL LINHAS AÉREAS INTELIGENTES S.A.

(Exact name of registrant as specified in its charter)

GOL INTELLIGENT AIRLINES INC.

(Translation of registrant’s name into English)

Praça Comandante Linneu Gomes, Portaria 3, Prédio 24

Jd. Aeroporto

04630-000 São Paulo, São Paulo

Federative Republic of Brazil

(Address of registrant’s principal executive offices)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes ______ No ___X___

Individual and Consolidated

Preliminary Quarterly Information, Without Independent Auditors’ Limited Review Report

The preliminary quarterly information as of and for the three-month period ended March 31, 2020, without independent auditors’ limited review report is part of the (appendix) Earnings Release First Quarter 2020.

GOL Linhas Aéreas Inteligentes S.A.

March 31, 2020

Gol Linhas Aéreas Inteligentes S.A.

Individual and Consolidated Preliminary Quarterly Information, without Independent Auditors’ Limited Review Report

March 31, 2020

Contents

Balance sheets | 03 |

Income statements | 05 |

Statements of Comprehensive Income | 06 |

Statements of Changes in Shareholders’ Equity | 07 |

Statements of Cash Flows | 08 |

Statements of Value Added | 10 |

Notes to the individual and consolidated preliminary quarterly information | 11 |

Gol Linhas Aéreas Inteligentes S.A.

NOTICE TO THE USERS OF THE PRELIMINARY QUARTERLY INFORMATION – PARENT COMPANY AND CONSOLIDATEDWITHOUT INDEPENDENT AUDITORS’ LIMITED REVIEW REPORT

The preliminary quarterly information as of and for the three-month period ended March 31, 2020 contained herein has not been subject to a limited review by GOL's independent auditors. The complete quarterly Information for the first quarter of 2020 is still under review by the Company's independent auditors and will be released after the completion of the relevant work by the independent auditors.

As the complete quarterly information are still subject to review by GOL's independent auditors, the preliminary quarterly information for the first quarter of 2020 is subject to adjustments and changes, which may cause the results, performances or events hereby disclosed to be substantially different from those to be reported in the company's complete quarterly information to be released after the issuance of the limited review report by the Company’s independent auditors. Notwithstanding, GOL does not anticipate that adjustments or changes to the information disclosed herein will be necessary.

| |

| Balance sheets (without independent auditors’ limited review report) March 31, 2020 and December 31, 2019 (In thousands of Reais - R$) |

| | | Parent company | Consolidated |

Assets | Note | 03/31/2020 | 12/31/2019 | 03/31/2020 | 12/31/2019 |

| | | (Unaudited) | | (Unaudited) | |

Current assets | | | | | |

Cash and cash equivalents | 6 | 438,663 | 1,016,746 | 659,027 | 1,645,425 |

Short-term investments | 7 | 514 | 673 | 1,133,502 | 953,762 |

Amounts receivable | 1,3 | 446,942 | - | 446,942 | - |

Restricted cash | 8 | 6,545 | 6,399 | 1,059,579 | 304,920 |

Trade receivables | 9 | - | - | 791,841 | 1,229,530 |

Inventories | 10 | - | - | 215,780 | 199,213 |

Recoverable taxes | 11 | 6,686 | 5,163 | 205,227 | 309,674 |

Derivative assets | 34,2 | - | - | - | 3,500 |

Advance to suppliers and third Parties | 13 | 48 | 37 | 187,328 | 142,338 |

Other assets | | 66,297 | 79,587 | 172,386 | 139,015 |

Total current assets | | 965,695 | 1,108,605 | 4,871,612 | 4,927,377 |

| | | | | |

Noncurrent | | | | | |

Restricted cash | 9 | - | - | 140,195 | 139,386 |

Deposits | 14 | 129,070 | 112,502 | 2,411,796 | 1,968,355 |

Advance to suppliers and third parties | 13 | - | - | 48,665 | 48,387 |

Recoverable taxes | 11 | 17,538 | 22,449 | 417,403 | 174,142 |

Deferred taxes | 12 | 54,618 | 56,903 | 58,102 | 59,809 |

Other credits and amounts | | - | - | 4,033 | 991 |

Related parties | 28 | 4,921,516 | 3,440,701 | - | - |

Derivative assets | 34,2 | 14,127 | 143,969 | 14,127 | 143,969 |

Investments | 15 | 545,817 | 501,986 | 1,254 | 1,254 |

Property, plant and equipment | 16 | 541 | 240,379 | 5,884,464 | 6,058,101 |

Intangible assets | 17 | - | - | 1,773,176 | 1,776,675 |

Total noncurrent assets | | 5,683,227 | 4,518,889 | 10,753,215 | 10,371,069 |

| | | | | |

Total | | 6,648,922 | 5,627,494 | 15,624,827 | 15,298,446 |

The accompanying notes are an integral part of the individual and consolidated preliminary quarterly information.

3

| |

| Balance sheets (without independent auditors’ limited review report) March 31, 2020 and December 31, 2019 (In thousands of Reais - R$) |

| | | Parent company | Consolidated |

Liabilities | Note | 03/31/2020 | 12/31/2019 | 03/31/2020 | 12/31/2019 |

| | | (Unaudited) | | (Unaudited) | |

Current liabilities | | | | | |

Loans and financing | 18 | 1,636,180 | 1,359,547 | 3,208,438 | 2,543,039 |

Leases | 19 | - | - | 1,781,432 | 1,404,712 |

Suppliers | 20 | 16,834 | 19,116 | 1,272,819 | 1,286,275 |

Suppliers - forfaiting | 21 | - | - | 781,600 | 554,467 |

Salaries | | 34 | 137 | 406,595 | 396,010 |

Taxes payable | 22 | 1,691 | 4,261 | 113,940 | 116,523 |

Landing fees | | - | - | 779,939 | 728,339 |

Advance ticket sales | 23 | - | - | 1,604,106 | 1,966,148 |

Mileage program | | - | - | 1,124,633 | 1,009,023 |

Advances from customers | | - | - | 19,691 | 16,424 |

Provisions | 24 | - | - | 270,327 | 203,816 |

Derivatives | 34,2 | - | - | 702,604 | 9,080 |

Other liabilities | | - | - | 68,316 | 128,744 |

Total current liabilities | | 1,654,739 | 1,383,061 | 12,134,440 | 10,362,600 |

| | | | | |

Noncurrent liabilities | | | | | |

Loans and financing | 18 | 5,720,569 | 5,235,593 | 6,315,251 | 5,866,802 |

Leases | 19 | - | - | 5,637,222 | 4,648,068 |

Suppliers | 20 | - | - | 56,203 | 10,142 |

Provisions | 24 | - | - | 1,342,356 | 1,053,240 |

Mileage program | | - | - | 217,342 | 171,651 |

Deferred taxes | 12 | - | - | 260,900 | 244,041 |

Taxes payable | 22 | - | - | 21 | 84 |

Related parties | 28 | 454,889 | 163,350 | - | - |

Derivatives | 34,2 | - | - | 65,597 | 11,270 |

Provision for loss on investment | 15 | 9,832,633 | 6,498,660 | - | - |

Other liabilities | | 23,393 | 23,501 | 34,940 | 35,965 |

Total noncurrent liabilities | | 16,031,484 | 11,921,104 | 13,929,832 | 12,041,263 |

| | | | | |

Equity (deficit) | | | | | |

Capital stock | 25,1 | 3,008,178 | 3,008,178 | 3,008,178 | 3,008,178 |

Capital increase | | 727 | 584 | 727 | 584 |

Treasury shares | 25,2 | (102,543) | (102,543) | (102,543) | (102,543) |

Capital reserves | | 230,751 | 225,276 | 230,751 | 225,276 |

Equity valuation adjustments | | (889,042) | 188,247 | (889,042) | 188,247 |

Accumulated losses | | (13,285,372) | (10,996,413) | (13,285,372) | (10,996,413) |

Deficit attributable to equity holders of the parent company | | (11,037,301) | (7,676,671) | (11,037,301) | (7,676,671) |

| | | | | |

Non-controlling interest (NCI) | | - | - | 597,856 | 571,254 |

Total deficit | | (11,037,301) | (7,676,671) | (10,439,445) | (7,105,417) |

| | | | | |

Total liabilities and deficit | | 6,648,922 | 5,627,494 | 15,624,827 | 15,298,446 |

The accompanying notes are an integral part of the individual and consolidated preliminary quarterly information.

4

| |

| Income Statements(without independent auditors’ limited review report)Quarters ended on March 31, 2020 and 2019(In thousands of Reais - R$, except Basic and Diluted Earnings (Loss) per Share) |

Income Statement

| | Parent company | Consolidated |

| Note | 03/31/2020 | 03/31/2019 | 03/31/2020 | 03/31/2019 |

| | (Unaudited) | | (Unaudited) | |

| | | | | |

Net revenue | | | | | |

Passenger | | - | - | 2,941,333 | 3,033,553 |

Cargo and other | | - | - | 206,394 | 177,255 |

Total net revenue | 29 | - | - | 3,147,727 | 3,210,808 |

| | | | | |

Cost of services provided | 30 | - | - | (2,579,910) | (2,302,137) |

Gross profit | | - | - | 567,817 | 908,671 |

| | | | | |

Operating income (expenses) | | | | | |

Selling expenses | | - | - | (168,957) | (186,005) |

Administrative expenses | | (4,999) | (4,635) | (328,277) | (224,458) |

Other income and expenses, net | | 376,308 | 18,145 | 954,838 | 7,924 |

Total operating expenses | 30 | 371,309 | 13,510 | 457,604 | (402,539) |

| | | | | |

Equity method investees | 15 | (2,217,639) | 17,865 | - | 78 |

| | | | | |

Income before financial income (Expense), exchange (variation) and income taxes | | (1,846,330) | 31,375 | 1,025,421 | 506,210 |

| | | | | |

Financial results | | | | | |

Financial income | | 616,916 | 74,137 | 698,246 | 102,440 |

Financial expenses | | (334,259) | (146,168) | (998,456) | (388,203) |

Total financial results, net | 31 | 282,657 | (72,031) | (300,210) | (285,763) |

| | | | | |

Income before exchange rate variation, net | | (1,563,673) | (40,656) | 725,211 | 220,447 |

| | | | | |

Exchange rate change, net | 31 | (721,263) | (15,029) | (2,943,404) | (115,332) |

| | | | | |

(Loss) income Before Income Taxes | | (2,284,936) | (55,685) | (2,218,193) | 105,115 |

| | | | | |

Income taxes | | | | | |

Current | | (1,048) | (1,913) | (24,273) | (40,048) |

Deferred | | (2,285) | 25,291 | (19,143) | (29,861) |

Total income taxes | 12 | (3,333) | 23,378 | (43,416) | (69,909) |

| | | | | |

Net income (loss) for the period before minority interests | | (2,288,269) | (32,307) | (2,261,609) | 35,206 |

| | | | | |

Net income (loss) attributable to: | | | | | |

Equity holders of the parent company | | (2,288,269) | (32,307) | (2,288,269) | (32,307) |

Non-controlling interest shareholders | | - | - | 26,660 | 67,513 |

| | | | | |

Basic loss per share | 26 | | | | |

Per common share | | (0.184) | (0.003) | (0.184) | (0.003) |

Per preferred share | | (6.433) | (0.092) | (6.433) | (0.092) |

| | | | | |

Diluted loss per share | 26 | | | | |

Per common share | | (0.184) | (0.003) | (0.184) | (0.003) |

Per preferred share | | (6.433) | (0.092) | (6.433) | (0.092) |

The accompanying notes are an integral part of the individual and consolidated preliminary quarterly information.

5

| |

| Statements of Comprehensive Income(without independent auditors’ limited review)Quarters ended on March 31, 2020 and 2019(In thousands of Reais - R$) |

Statement of comprehensive income

| Parent company | Consolidated |

| 03/31/2020 | 03/31/2019 | 03/31/2020 | 03/31/2019 |

| (Unaudited) | | (Unaudited) | |

| | | | |

Net income (loss) for the period | (2,288,269) | (32,307) | (2,261,609) | 35,206 |

| | | | |

Other comprehensive income to be reclassified | | | | |

| | | | | |

Cash flow hedge, net of income tax and social contribution | (1,077,289) | 256,819 | (1,077,289) | 256,819 |

| (1,077,289) | 256,819 | (1,077,289) | 256,819 |

| | | | |

Total comprehensive income loss for the period | (3,365,558) | 224,512 | (3,338,898) | 292,025 |

| | | | |

Comprehensive income loss attributable to: | | | |

Equity holders of the parent company | (3,365,558) | 224,512 | (3,365,558) | 224,512 |

Non-controlling interest shareholders | - | - | 26,660 | 67,513 |

The accompanying notes are an integral part of the individual and consolidated preliminary quarterly information.

6

| |

| Statements of Changes in Shareholders’ Equity(without independent auditors’ limited review) Quarters ended on March 31, 2020 and 2019(In thousands of Reais - R$) |

DMPL

| Parent company and consolidated |

| | | | Capital reserves | adjustments of equity valuation | | | | |

| Capital stock | Advance for future capital increase | Treasury shares | Premium on transfer of shares | Special premium reserve of subsidiary | Share- based payments | Cash flow hedge reserve | Post-employment benefit | Net gains from purchase/sale of non-controlling interest | Accumulated losses | Deficit attributable to equity holders of the parent company | Non-controlling interests | Total |

Balances as of december 31, 2018 | 2,942,612 | 2,818 | (126) | 17,497 | 70,979 | 117,413 | (500,022) | - | 759,984 | (8,396,567) | (4,985,412) | 480,061 | (4,505,351) |

| | | | | | | | | | | | | |

Adoption of accounting standards | - | - | - | - | - | - | - | - | - | (2,482,573) | (2,482,573) | (256) | (2,482,829) |

Adjusted balance as of january 1, 2019 | 2,942,612 | 2,818 | (126) | 17,497 | 70,979 | 117,413 | (500,022) | | 759,984 | (10,879,140) | (7,467,985) | 479,805 | (6,988,180) |

Other comprehensive income (loss), net | - | - | - | - | - | - | 256,819 | - | - | - | 256,819 | - | 256,819 |

Capital Increase by stock options period | 4,589 | (2,306) | - | - | - | - | - | - | - | - | 2,283 | 106 | 2,389 |

Stock options exercised | - | - | - | - | - | 3,557 | - | - | - | - | 3,557 | 384 | 3,941 |

Effects of the change in interest in investment | - | - | - | - | - | - | - | - | (649) | - | (649) | 649 | - |

Net loss for the period | - | - | - | - | - | - | - | - | - | (32,307) | (32,307) | 67,513 | 35,206 |

Dividends and interest on shareholders’ equity paid by Smiles subsidiary | - | - | - | - | - | - | - | - | - | - | - | (8,249) | (8,249) |

Balances as of march 31, 2019 | 2,947,201 | 512 | (126) | 17,497 | 70,979 | 120,970 | (243,203) | - | 759,335 | (10,911,447) | (7,238,282) | 540,208 | (6,698,074) |

| | | | | | | | | | | | | |

Balances as of december 31, 2019 | 3,008,178 | 584 | (102,543) | 17,497 | 83,229 | 124,550 | (530,043) | (41,045) | 759,335 | (10,996,413) | (7,676,671) | 571,254 | (7,105,417) |

Other comprehensive income (loss), net | - | - | - | - | - | - | (1,077,289) | - | - | - | (1,077,289) | - | (1,077,289) |

Net income (loss) for the period | - | - | - | - | - | - | - | - | - | (2,288,269) | (2,288,269) | 26,660 | (2,261,609) |

Total comprehensive income (loss) for the period | - | - | - | - | - | - | (1,077,289) | - | - | (2,288,269) | (3,365,558) | 26,660 | (3,338,898) |

Capital increase by stock options period | - | 143 | - | - | - | - | - | - | - | - | 143 | - | 143 |

Stock options | - | - | - | - | - | 5,005 | - | - | - | - | 5,005 | (58) | 4,947 |

Effects of the change in Interest in investment | - | - | - | - | 470 | - | - | - | - | (690) | (220) | - | (220) |

Balances as of march 31, 2020(Unaudited) | 3,008,178 | 727 | (102,543) | 17,497 | 83,699 | 129,555 | (1,607,332) | (41,045) | 759,335 | (13,285,372) | (11,037,301) | 597,856 | (10,439,445) |

The accompanying notes are an integral part of the individual and consolidated preliminary quarterly information.

7

| |

| Statements of Cash Flows(without independent auditors’ limited review)Quarters ended on March 31, 2020 and 2019(In thousands of Reais - R$) |

DFC

| Parent company | Consolidated |

| 03/31/2020 | 03/31/2019 | 03/31/2020 | 03/31/2019 |

| (Unaudited) | | (Unaudited) | |

| | | | |

Net income (loss) for the period | (2,288,269) | (32,307) | (2,261,609) | 35,206 |

Adjustments to reconcile net income (loss) to net cash flows from Operating activities | | | | |

Depreciation and amortization | - | - | 528,036 | 405,577 |

Provision (reversal) for expected credit losses | - | - | 2,518 | (6,986) |

Provision for legal proceedings | - | - | 74,502 | 47,103 |

Provision for inventory obsolescence | - | - | 45 | 22 |

Recovery of one-off credits | - | - | (126,675) | - |

Deferred taxes | 2,285 | (25,291) | 19,143 | 29,861 |

Equity method investees | 2,217,639 | (17,865) | - | (78) |

Share-based payments | - | 3,557 | 4,947 | 3,941 |

Recovery of expenses | - | | (309,980) | - |

Sale-leaseback | - | - | (112,590) | - |

Actuarial losses from post-employment benefits | - | - | 4,750 | - |

Foreign exchange, net | 1,229,175 | 14,276 | 3,588,432 | 132,817 |

Interest income | (3,045) | | (11,657) | |

Interest on loans and financing and leases | 81,041 | 63,811 | 304,163 | 260,297 |

Losses from investment funds | - | - | 233,812 | - |

Provision for aircraft and engine return | - | - | 31,906 | - |

Provision for maintenance reserve | - | - | 53,871 | - |

Result of derivatives recognized | 148,500 | (30,093) | 130,200 | (9,030) |

Unrealized hedge results - ESN | (575,357) | - | (575,357) | - |

Change in contractual term of leases | - | - | (20,968) | - |

Provision for labor obligations | - | - | 70,461 | 2,392 |

Disposals of property, plant and equipment and intangible assets | 108,538 | 3,301 | 15,478 | 2,196 |

Others | - | - | (2,209) | (50,458) |

Adjusted net income | 920,507 | (20,611) | 1,641,219 | 852,860 |

| | | | |

Changes in operating assets and liabilities: | | | | |

Trade receivables | - | - | 449,475 | 36,102 |

Short-term investments | 3,204 | 92,015 | (11,775) | 93,502 |

Inventories | - | - | (16,612) | (6,888) |

Deposits | (2,248) | (4,533) | (159,717) | (41,212) |

Recoverable taxes | 3,388 | - | (12,139) | - |

Suppliers | (2,104) | (142,775) | (54,202) | (227,717) |

Suppliers – forfaiting | - | - | 227,552 | (35,549) |

Advance from ticket sales | - | - | (362,042) | (336,175) |

Mileage program | - | - | 161,301 | 71,352 |

Advances from customers | - | - | 3,267 | (109,203) |

Salaries | (103) | (327) | (59,876) | 31,754 |

Landing fees | - | - | 51,600 | 38,246 |

Taxes obligation | (12,836) | (1,002) | 25,822 | (38,485) |

Obligations with derivative transactions | - | - | (329,438) | (64,197) |

Advance to suppliers and third parties | (11) | - | (45,268) | - |

Payments for lawsuits and aircraft return | - | - | (72,686) | (38,287) |

Prepaid expenses | - | - | (38,308) | - |

Other credits (obligations) | (1,345) | 495,025 | (44,748) | 391,121 |

Interest paid | (207,971) | (144,156) | (234,352) | (189,624) |

Income tax paid | (2,040) | - | (28,468) | (21,559) |

Net cash flows from operating activities | 698,441 | 273,636 | 1,090,605 | 406,041 |

| | | | |

Loan receivable from related parties | (985,402) | (414,611) | - | - |

Short-term investments | - | - | (241,810) | 29,868 |

Restricted cash | (146) | (1,238) | (839,593) | 345,801 |

Receipt of dividends and interest on shareholders’ equity through subsidiary | 15,002 | 8,203 | - | - |

Advances for property, plant and equipment acquisition, net | - | (13,202) | (56,851) | (2,131) |

Acquisition of fixed assets | (5,662) | - | (232,457) | (99,901) |

Acquisition of intangible assets | - | - | (18,610) | (20,782) |

Net cash flows used in investing activities | (976,208) | (420,848) | (1,389,321) | 252,855 |

| | | | |

8

| |

| Statements of Cash Flows(without independent auditors’ limited review)Quarters ended on March 31, 2020 and 2019(In thousands of Reais - R$) |

| Parent company | Consolidated |

| 03/31/2020 | 03/31/2019 | 03/31/2020 | 03/31/2019 |

| (Unaudited) | | (Unaudited) | |

| | | | |

Loans and financing issued, net of costs | - | 1,169,010 | 60,975 | 1,208,246 |

Costs of borrowing and repurchasing securities | - | (47,065) | (819) | (48,829) |

Loan and financing payments | (405,878) | - | (501,570) | (228,289) |

Early payment of senior notes | - | (50,320) | | (50,320) |

Lease payments | - | - | (421,713) | (354,926) |

(Payment) receipt of premium | - | (102,055) | 21,800 | (102,055) |

Dividends and interest on shareholders’ equity paid to non-Controlling interests | - | - | (14,811) | (7,371) |

Capital increase | - | 1,771 | - | 1,771 |

Capital increase from non-controlling interests | - | - | - | 106 |

Shares to be issued | 143 | 512 | 143 | 512 |

Net cash flows (used in) from financing activities | (405,735) | 971,853 | (855,995) | 418,845 |

| | | | |

Foreign exchange variation on cash held in foreign currencies | 105,419 | (15,352) | 168,313 | (23,290) |

| | | | |

(Decrease) increase in cash and cash equivalents | (578,083) | 809,289 | (986,398) | 1,054,451 |

| | | | |

Cash and cash equivalents at the beginning of the period | 1,016,746 | 282,465 | 1,645,425 | 826,187 |

Cash and cash equivalents at the end of the period | 438,663 | 1,091,754 | 659,027 | 1,880,638 |

| | | | |

The accompanying notes are an integral part of the individual and consolidated preliminary quarterly information.

9

| |

| Statements of Added Value(without independent auditors’ limited review)Quarter ended on March 31, 2020 and 2019(In thousands of Reais - R$) |

DVA

| Parent company | Consolidated |

| 03/31/2020 | 03/31/2019 | 03/31/2020 | 03/31/2019 |

| (Unaudited) | | (Unaudited) | |

Revenues | | | | |

Passengers, cargo and other | - | - | 3,267,055 | 3,351,958 |

Other operating income | 376,308 | 14,419 | 305,915 | 44,179 |

Allowance for doubtful accounts | - | - | (2,518) | 6,986 |

| 376,308 | 14,419 | 3,570,452 | 3,403,123 |

Inputs acquired from third parties (including ICMS and IPI) | | | | |

Suppliers of aircraft fuel | - | - | (1,001,138) | (1,024,374) |

Material, electricity, third-party services and others | (3,424) | 626 | (176,154) | (651,129) |

Aircraft insurance | - | - | (8,546) | (6,188) |

Sales and marketing | (367) | - | (118,012) | (140,103) |

Gross added value | 372,517 | 15,045 | 2,266,602 | 1,581,329 |

| | | | |

Depreciation and amortization | - | - | (528,036) | (405,577) |

Net added value produced (used) by the Company | 372,517 | 15,045 | 1,738,566 | 1,175,752 |

| | | | |

Value added received in transfer | | | | |

Equity results | (2,217,639) | 17,865 | - | 78 |

Financial income | 616,916 | 60,472 | 698,246 | 923,210 |

Total added value to be distributed (distributed) | (1,228,206) | 93,382 | 2,436,812 | 2,099,040 |

| | | | |

Distribution of value added: | | | | |

Salaries | 770 | 958 | 432,448 | 378,505 |

Benefits | - | - | 50,774 | 42,862 |

FGTS | - | - | 29,993 | 33,512 |

Personnel | 770 | 958 | 513,215 | 454,879 |

| | | | |

Federal taxes | 3,771 | (21,832) | 228,524 | 275,028 |

State taxes | - | - | 4,964 | 4,740 |

Municipal taxes | - | - | 1,331 | 1,001 |

Tax, charges and contributions | 3,771 | (21,832) | 234,819 | 280,769 |

| | | | |

Interest and foreign exchange variation | 1,055,522 | 146,533 | 3,929,575 | 1,313,946 |

Rent | - | - | 19,669 | 14,176 |

Other | - | 30 | 1,143 | 64 |

Third-party capital remuneration | 1,055,522 | 146,563 | 3,950,387 | 1,328,186 |

| | | | |

Net loss for the period | (2,288,269) | (32,307) | (2,288,269) | (32,307) |

Net income for the period attributable to non- controlling interests | - | - | 26,660 | 67,513 |

Remuneration of own capital | (2,288,269) | (32,307) | (2,261,609) | 35,206 |

| | | | |

Total added value distributed | (1,228,206) | 93,382 | 2,436,812 | 2,099,040 |

The accompanying notes are an integral part of the individual and consolidated preliminary quarterly information.

10

| |

| Notes to the Preliminary Quarterly Information (without independent auditors’ limited review report) For the three-month period ended March 31, 2020. (In thousands of Reais - R$, except when otherwise indicated) |

1. Operating Context

Gol Linhas Aéreas Inteligentes S.A. (the “Company” or “GOL”) is a publicly-listed company incorporated on March 12, 2004, under the Brazilian Corporate Law. The Company’s bylaws provide that it has as its corporate purpose the exercise of share control of GOL Linhas Aéreas S.A. (“GLA”), which provides regular and non-scheduled air transportation services for passengers, and development of loyalty programs, among others.

The Company’s shares are traded on B3 S.A. - Brasil, Bolsa, Balcão (“B3”) and on the New York Stock Exchange (“NYSE”) under the ticker GOLL4 and GOL, respectively. The Company adopted Level 2 Differentiated Corporate Governance Practices from B3 and is included in the Special Corporate Governance Stock Index (“IGC”) and the Special Tag Along Stock Index (“ITAG”), which were created for companies committed to applying differentiated corporate governance practices.

The Company’s corporate address is located at Praça Comandante Linneu Gomes, s/n, portaria 3, prédio 24, Jardim Aeroporto, São Paulo, Brazil.

1.1 Actions and impacts resulting from the COVID-19 pandemic

The COVID-19 pandemic, which is seen by the World Health Organization as a “public health emergency of international interest,” has rapidly disseminated throughout the world, causing important disruptions in the global economic activity and starting an unprecedented crisis.

This crisis has significantly increased the uncertainty in the macroeconomic environment, and it will inevitably lead to global recession, according to the World Bank’s report named “The Economy in the Time of COVID-19,” published on April 12.In Brazil, a 5% GDP retraction is being expected in 2020, caused, above all, by weak external demand, lower oil prices, and sharp fall in the economic activity in order to contain the virus.

The measures taken in Brazil to reduce the speed of spread and dissemination of the disease include social distancing, travel restrictions and the closing of borders. As a result, the aircraft industry was one of the first and more affected sectors with regard to its operations and results. These impacts were immediate and severe.

To face this absolutely disruptive scenario, our Company, through its Executive Committee, which is made up of all management bodies, is attentively monitoring this situation and its developments; establishing financial and operational strategies; and defining how it can support the society. In a moment like this, our Company is willing to make all contributions possible by using the tools under its control. This said, our Management took the following actions:

1.1.1. Adjustment of operations – Essential Network

On March 16, GOL started to reduce its capacity by 50% to 60% in the domestic market, and by 90% to 95% in the international market, in order to reflect the changes in the demand from Customers.

On March 24, as Brazilians were adopting responsible social distancing measures and avoiding travelling due to the pandemic, we adjusted our network again from 750 to 50 essential daily flights between the São Paulo International Airport, located in the city of Guarulhos, and all 26 state capitals and Brasília (“Essential Network”).

11

| |

| Notes to the Preliminary Quarterly Information (without independent auditors’ limited review report) For the three-month period ended March 31, 2020. (In thousands of Reais - R$, except when otherwise indicated) |

1.1.2. Reduction in fixed and variable costs

· Variable costs:as mentioned above, we reviewed our flight network as the end of March in order to ensure essential services in all Brazilian capitals and the federal district, which corresponded to a reduction of 93% in domestic flights, and a temporary interruption in all international flights, thus reducing the related variable costs;

· Personnel Expenses:with effects expected as of April, the Company adopted measures aiming at a planned reduction of approximately 50% in payroll expenses and relevant charges, particularly with reduction of working hours and, consequently, a reduction of 35% in salaries of air service and ground service workers; negotiation to reduce the working hours of our crew by 50%; 40% reduction in the compensation of our officers; adoption of unpaid leave (LNR) by approximately 5.4 thousand employees (approximately 34% of our total staff), with these adoptions signed until March 31, 2020; and

In April, with effects expected as of May, we adopted the measures provided for in MP [Provisional Measure] 936/20, reducing the salaries of employees by 50%, the compensation of officers by 60%, and adopting the suspension of labor agreements of around 800 employees, in addition to the 5,400 employees previously mentioned.

· Other expenses:suspension of expenses for advertising and publicity, and immediate interruption of projects of any nature that are not absolutely essential for the continuity of operations.

1.1.3. Preservation and strengthening of our cash position and liquidity

· Aircraft and engines lease:negotiation with key lessors on the postponement of payments for a period of 3 to 6 months, which should enable us to retain funds of approximately R$452.4 million;

· Fuel costs:agreements with suppliers on the postponement of payments, which should be resumed in installments as of September 2020;

· Personnel Expenses:interruption in the payment of profit sharing and bonuses for the year 2019, and in the payment of the advance of the 13th salary and vacation pay;

· Investments:suspension of non-essential CAPEX, including the interruption of “pre-delivery payments (PDPs);“

· Engine maintenance services:postponement by 60 to 90 days of payments to suppliers;

· Taxes, contributions and social charges – suspension of payment of federal taxes through the issue of a court injunction, and also as a result of the measures enacted by the Federal Government;

· Other expenses and revenues:agreement on the refund of expenses incurred since grounding of 737MAX aircraft, with an immediate effect of R$447 million on cash (see note 1.3); and

· Loans and financing:postponement of the R$148-million installment maturing in March 2020 to March 2022; obtainment of a waiver for all covenants maturing in2020; and postponement of the maturity of working capital transactions scheduled for the first quarter of 2020.

12

| |

| Notes to the Preliminary Quarterly Information (without independent auditors’ limited review report) For the three-month period ended March 31, 2020. (In thousands of Reais - R$, except when otherwise indicated) |

1.1.4. Support from the Government and regulatory bodies

· Maintenance of receivables from air tickets:reduction in reimbursements and cancellations based on the Provisional Measure enacted by the Government, which provides for the rescheduling of flights within a period of up to 12 months;

· Airport fees:change in the terms of payment of navigation and airport fees, which may be paid until December without penalties; and

· Maintenance of slots – ANAC:(i) allowance for cancellation of slots as per the regularity index, valid until the end of October 2020, in line with a similar decision issued by other civil aviation organizations and authorities, such as the European Commission and FAA; and (ii) extension of 120 days for renewal of licenses.

1.1.5. Impacts on the individual and consolidated preliminary quarterly information

As mentioned above, the impacts of the COVID-19 pandemic on the Company were immediate and severe, its main consequence being the adoption of the essential network. Below is presented a table summarizing the adjustments and reclassifications made in this preliminary quarterly information, as well as the details on each of these items and additional disclosures in the text below:

Description | | Parent Company | Consolidated |

Adjustments | | | (Unaudited) |

Provision for cancellation of mileage exchange | | - | (22,271) |

De-recognition of the cash flow hedge – fuel | | - | (291,925) |

De-recognition of the cash flow hedge – revenues in US$ | | - | (290,346) |

| | | |

Reclassifications | | | |

Taxes to recover in the short- and long-term | | - | 61,020 |

| | | |

As a link between the travel and tourism industries, our Smiles subsidiary is also being affected by the crisis, with impacts on its operations and results. The main effect was the reduction, in the first quarter of 2020, in the volume of redemption of miles accumulated by the participants of the Smiles Program, particularly regarding air tickets, hotel accommodation and car rental. In April, the Company also recorded cancellations, above the usual levels, of miles redeemed in previous months. Accordingly, a provision for cancellations, in the amount of R$22,271 was recorded as of March 31, 2020.

Additionally, as a result of the reduction in operations due to the adoption of the essential network, the Company derecognized cash flow hedging transactions, since it expects a drop in the fuel consumption previously estimated. Accordingly, the amount of R$291,925 was transferred from the “equity valuation adjustment” group, in shareholders’ equity, to the item “derivative losses” in financial income.

Also, as a result of the temporary interruption in all international flights, the Company also derecognized the hedge accounting transactions used for protecting future revenues in foreign currency (subject matter of the hedge), using lease agreements as hedge instruments. Accordingly, the amount of R$290,346 was transferred from the “equity valuation adjustment” group, in shareholders’ equity, to the item “exchange variation expenses” in financial income.

13

| |

| Notes to the Preliminary Quarterly Information (without independent auditors’ limited review report) For the three-month period ended March 31, 2020. (In thousands of Reais - R$, except when otherwise indicated) |

The expectations of realization of assets and liabilities were reviewed. As a result, the Company reclassified Recoverable taxes and contributions in the amount of R$61,020, since the realization of these assets will be postponed.

Another impact on the balance sheet was the lower performance of investment funds in the period. All activities and growth estimates were adjusted to negative figures.

It is important to note that, during this period, management maintained the Company’s investment policy, by investing in sovereign equity funds linked to the SELIC basic rate, and private credit fixed income funds with high liquidity and high quality.

With regard to lease balances payable as of March 31, 2020, short-term obligations in the amount of R$233,081 were renegotiated with creditors.

The Company has also conducted impairment tests in the balances of property, plant and equipment, goodwill and slots rights. No provision for impairment was recorded, as mentioned in notes 17 and 18.

The Company we have also carried out a detailed review of budget estimates for the current and coming years (“Business Plan”). Accordingly, we are able to evidence and conclude, based on the information available, that we have the conditions to continue operating and to fulfill our obligations according to the maturities that were renegotiated with our suppliers and creditors, as detailed in Note 1.2.

1.1.6. Support to the Society, the Employees and the Customers

Passenger transportation services are essential for the society. We recognize our duty of care towards our audiences, and we are working closely to the authorities to help reduce the impact of COVID-19 on the population and the health services.

Regarding the flights in our essential network, we are taking extraordinary measures in addition to the strict sanitation standards of the civil aviation sector. Our aircraft are sanitized and disinfected on a daily basis.

The measures used include keeping the integrity and health of our employees as a priority. As from the second week of March, all administrative employees have been working remotely. The employees are being continuously monitored by the Company’s leadership and the People and Culture area, which manages our human resources.

In order to improve our Customer Assistance services in a period of high demand and uncertainty, we created specific communication channels on the coronavirus that are constantly updated. We reinforced our dedicated Customer Assistance team, giving priority to more urgent cases. This team helps customers with the reorganization of air ticket bookings with flexible conditions for changes in future flights.

Regarding the Smiles loyalty program, we have also improved the digital channels by deploying the free online cancellation self-service, which is available in our website and in the “Smiles Fidelidade” app, and our chat, for customers with optional GOL tickets. This system was developed internally in a record time.

Since the crisis may last for an undefined period and, thus, impact customers’ travel plans, our Smiles subsidiary announced that the effectiveness of the program’s categories is being postponed. Moreover, the current year is not being considered as base for requalification forthe next year, since the analysis of downgrade of categories would take into account the accumulation of miles originated from stretches flown in the period from January to December 2020.This enables customers to gain more time within their categories, and take advantage of the benefits provided.

14

| |

| Notes to the Preliminary Quarterly Information (without independent auditors’ limited review report) For the three-month period ended March 31, 2020. (In thousands of Reais - R$, except when otherwise indicated) |

At the social level, as a contribution to and in recognition of those who fight COVID-19 on the frontline of the battle, the Company, in partnership with GLA, is now providing free transportation to health professionals, and in partnership with the subsidiary Smiles is now crediting miles for them to travel throughout Brazil to provide care to patients affected. At each GOL stretch flown, they receive 1,000 miles.

With the purpose of reducing the negative impacts of the COVID-19 crisis, Smiles Fidelidade has launched several initiatives to stimulate participants to use their miles in products offered by other partners, particularly retailers, through the Shopping Smiles program.

The Company’s most important commitment will continue to be the integrity and health of persons. Accordingly, we are strictly following the guidelines issued by WHO, and undertaking to do everything we can to face this turbulent period in the best way possible.

1.2 Capital structure and net current capital

As of March 31, 2020, the Company’s negative shareholders’ equity attributed to the controlling shareholders amounted to R$11,037,301 (R$7,676,671 on December 31, 2019), while the negative net current capital was R$7,262,828 (negative R$5,435,223 as of December 31, 2019).

The variation recorded in the three-month period ended March 31, 2020 is the result of a devaluation of approximately 30% of the Real against the US Dollar.

As shown in note 1.1, due to the outbreak of the COVID-19 pandemic, the Company took a series of measures in March and April 2020. In this period, we have also carried out a detailed review of budget estimates of its Business Plan. Accordingly, we are able to evidence and conclude, based on the information available, that we have the conditions to continue operating and to fulfill our obligations according to the maturities that were renegotiated with our suppliers and creditors.

The Management’s assessment considers the Company’s business plan that includes future actions planned by Management, as well as other relevant macroeconomic and aviation sector’s assumptions, such as the estimate of the US dollar exchange rate and aviation fuel prices. The Management’s assessment also assumes that the Company will adjust its fleet size to demand and match seat supply to demand, in order to maintain a high load factor, reduce costs and adjust its capital structure.

In accordance with the Management’s assessment, the consolidated current assets and the budget forecast of cash flows to be generated by the operation will be sufficient to meet the Company’s working capital and investment needs in the next 12 months.

Additionally, the Company has access to credit lines, should it be necessary.

The Company will continue to strengthen its balance sheet management and results in order to guarantee sustainability. Management believes that the business plan reviewed, presented and approved by the Board of Directors on April 30, 2020, demonstrates all elements required to continue as going concern.

15

| |

| Notes to the Preliminary Quarterly Information (without independent auditors’ limited review report) For the three-month period ended March 31, 2020. (In thousands of Reais - R$, except when otherwise indicated) |

Based on this assessment, the Management concluded that there are no material uncertainties related to the Company’s ability to continue operating; therefore, the financial statements have been prepared based on this assumption.

1.3. Grounding status of Boeing 737 MAX

On March 11, 2019, as a result of a second accident involving a Boeing 737 MAX 8 aircraft, and as SAFETY is GOL’s number one value, the Company’s Management decided to suspend the operation of its seven aircraft before being required to do so by the regulatory authorities.

As a result of this strategy, the Company quickly reconfigured its flight network in order to supply the capacity required to meet the new demand levels, through revised lease agreements. The aircraft downtime and additional efforts caused the Company to incur unplanned costs, including interline fares due to the relocation of passengers, accommodation, meals and other expenses for passengers, additional fuel consumption, airport tariffs and fees, salaries and charges related to overtime, payment for the lease of additional aircraft and negative publicity, causing disruption in the Company’s business.

The return of these aircraft is subject to authorization by the Brazilian regulatory authorities and destination countries, mainly Brazil and the United States of America.

As a consequence and in recognition of a long-lasting partnership, the Company reached an agreement with Boeing. The terms of the agreement are strictly confidential, but they aim at providing (a) compensation that addresses damages resulting from the aircraft grounding to date, and as a result of the non-delivery of aircraft, as set forth in the purchase agreements; (b) reduction in the number of firm commitments by 34 aircraft to 95 in total; (c) the flexibility to additionally adjust the number of aircraft; and (d) the flexibility to convert the existing orders for other Max-models.

In accordance with the accounting principles and standards in force, the amounts mentioned in the agreement were recognized in this quarterly financial information as follows: R$446,942 as “Receivables” in the current assets group, with counter-entries of R$136,962 in “advances for acquisition of property, plant and equipment” in fixed assets, since it is a repayment of “pre delivery payment” and R$309,980 recorded in the income statement, with R$63,041 as a result of exchange variation, R$193,503 as other income and expenses, net since it refers to a reimbursement of expenses incurred in prior years, and the remaining amount distributed in the other lines of the income statement. These amounts do not affect the statements of cash flow presented in this quarterly financial information.

The amount of R$446,942 was received in full by GOL on April 1, 2020.

Additionally, subject to future events, the Company will be entitled to credits with a present value of approximately R$1,9 billion to be invested in future acquisition of new aircraft, which, in turn, will reduce the amount of future depreciation and financial costs, since the credits will affect the present values of assets and liabilities related to use rights.

16

| |

| Notes to the Preliminary Quarterly Information (without independent auditors’ limited review report) For the three-month period ended March 31, 2020. (In thousands of Reais - R$, except when otherwise indicated) |

1.4. Ownership Structure

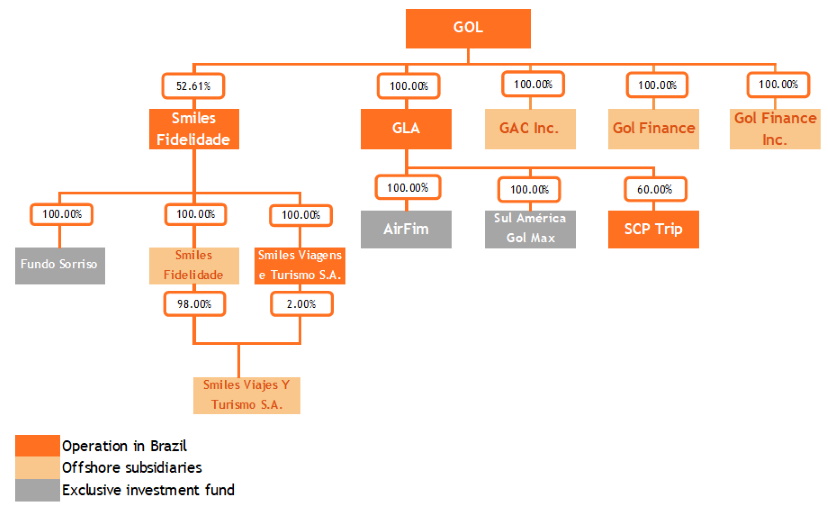

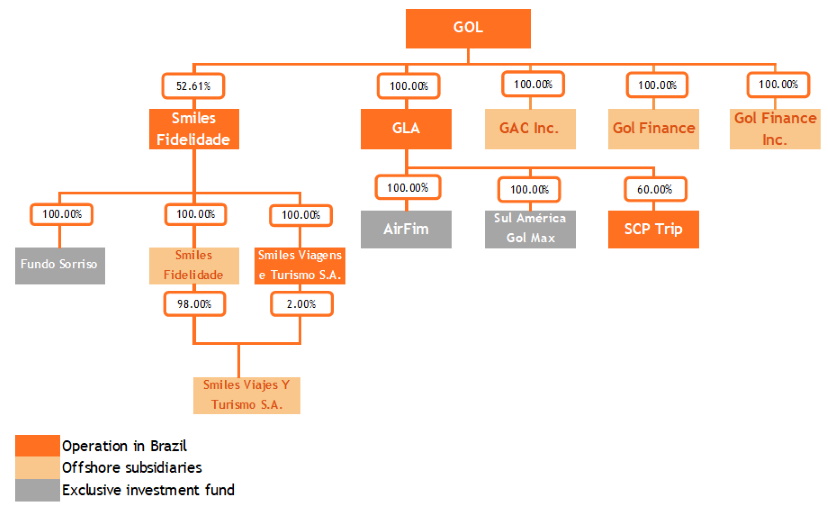

The corporate structure of the Company and its subsidiaries, on March 31, 2020, is shown below:

The Company’s ownership interest in the capital of its subsidiaries, as of March 31, 2020, is shown below:

Entity | Date of Incorporation | Location | Principal Activity | Type of Control | % of Interest

in the Capital Stock |

03/31/2020 | 12/31/2019 |

Offshore Subsidiaries: | | | | | | |

GAC | 03/23/2006 | Cayman Islands | Aircraft Acquisition | Direct | 100,00 | 100,00 |

Gol Finance Inc. | 03/16/2006 | Cayman Islands | Fund-Raising | Direct | 100,00 | 100,00 |

Gol Finance | 06/21/2013 | Luxembourg | Fund-Raising | Direct | 100,00 | 100,00 |

Subsidiaries: | | | | | | |

GLA | 04/09/2007 | Brazil | Flight Transportation | Direct | 100,00 | 100,00 |

AirFim | 11/7/2003 | Brazil | Investment Fund | Indirect | 100,00 | 100,00 |

Sul América Gol Max | 01/14/2014 | Brazil | Investment Fund | Indirect | 100,00 | 100,00 |

Smiles Fidelidade | 08/01/2011 | Brazil | Loyalty Program | Direct | 52,61 | 52,61 |

Smiles Viagens | 08/10/2017 | Brazil | Tourism Agency | Indirect | 52,61 | 52,61 |

Smiles Fidelidade Argentina (a) | 11/07/2018 | Argentina | Loyalty Program | Indirect | 52,61 | 52,61 |

Smiles Viagens Argentina (a) | 11/20/2018 | Argentina | Tourism Agency | Indirect | 52,61 | 52,61 |

Fundo Sorriso | 07/14/2014 | Brazil | Investment Fund | Indirect | 52,61 | 52,61 |

Company booked as an investment: |

SCP Trip | 04/27/2012 | Brazil | Flight Magazine | Indirect | 60,00 | 60,00 |

| | | | | | | |

(a) Companies with functional currency in Argentine pesos.

1.5. Corporate Reorganization Plan

On December 9, 2019, and February 4, 2020, through a Material Fact, the Company, together with its subsidiaries, announced the corporate reorganization plans with the main purpose ofensuring the long-term competitiveness of GOL Group, by aligning the interests of all stakeholders, reinforcing a consolidated capital structure, simplifying the corporate governance of companies, reducing the operating, administrative and financial costs and expenses, and increasing the market liquidity for all GOL’s shareholders, through the incorporation of Smiles shares by GLA.

17

| |

| Notes to the Preliminary Quarterly Information (without independent auditors’ limited review report) For the three-month period ended March 31, 2020. (In thousands of Reais - R$, except when otherwise indicated) |

On March 13, 2020, the Company and its subsidiary Smiles issued a Material Fact informing that, due to the extraordinary events in the national and international markets caused by the spread of COVID-19, and particularly by virtue of its structuring impacts on the aviation sector, they had canceled the corporate reorganization proposal submitted on December 9, 2019 and on February 4, 2020.

1.6. Compliance Program

Since 2016, the Company has adopted several measures to strengthen and expand its internal control and compliance programs, presented in detail in the annual financial statements issued on February 28, 2020.

The Management is constantly reinforcing to its employees, customers and suppliers its commitment to continue improving its internal control and compliance programs.

As previously disclosed in the financial statements for the year ended December 31, 2017, 2018 and 2019, the Company entered into an agreement with the Brazilian Federal Public Ministry in December 2016 (“Agreement”), under which the Company agreed to pay R$12 million in fines and make improvements to its compliance program. In turn, the Federal Public Ministry agreed not to raise any charges related to activities that are the subject of the Agreement. In addition, the Company paid R$4.2 million in fines to the Brazilian tax authorities.

The Company voluntarily informed the U.S. Department of Justice (“DOJ”), the Securities and Exchange Commission (“SEC”) and the Brazilian Securities and Exchange Commission (“CVM”) of the Agreement and the external independent investigation hired by the Company, and about the Agreement. The investigation was completed in April 2017 and revealed that immaterial payments were made to politically exposed people. None of the current employees, representatives or members of the Company’s Board or Management knew of any illegal purpose behind any of the transactions identified, or of any unlawful benefit to the Company arising from the investigated operations.

The Company informed the due authorities of the result of the investigation and will continue to communicate on the development of the issue, following the analyses already initiated by these bodies. These authorities may impose fines and possibly other sanctions on the Company.

There were no further developments on the subject during the quarter ended March 31, 2020.

2. Statementof the Management, basis for preparing and presenting the individual and consolidated preliminary quarterly information

The Company’s preliminary quarterly information was prepared in accordance with accounting practices adopted in Brazil. The accounting practices adopted in Brazil include those in the Brazilian Corporation Law and in the technical pronouncements, guidelines and interpretations issued by the Accounting Pronouncements Committee (“CPC”), approved by the Federal Accounting Council (“CFC”) and the Brazilian Securities and Exchange Commission(“CVM”).

18

| |

| Notes to the Preliminary Quarterly Information (without independent auditors’ limited review report) For the three-month period ended March 31, 2020. (In thousands of Reais - R$, except when otherwise indicated) |

The Company’s consolidated preliminary quarterly information was prepared in accordance with accounting practices adopted in Brazil and the International Financial Reporting Standards (“IFRS”) issued by the International Accounting Standards Board (“IASB”). The accounting practices adopted in Brazil include those in the Brazilian Corporation Law and in the technical pronouncements, guidelines and interpretations issued by the Accounting Pronouncements Committee (“CPC”), and approved by the Federal Accounting Council (“CFC”) and the Brazilian Securities and Exchange Commission (“CVM”).

The Company’s individual and consolidated preliminary quarterly information was prepared based on the Real (“R$”) as the functional and presentation currency, expressed in thousands of Reais, except when otherwise indicated. The items disclosed in foreign currencies are duly identified, when applicable.

The preparation of the Company’s individual and consolidated preliminary quarterly information requires Management to make judgments, use estimates and adopt assumptions affecting the stated amounts of revenues, expenses, assets, and liabilities. However, the uncertainty inherent in these judgments, assumptions, and estimates could give rise to results that require a material adjustment of the book value of certain assets and liabilities in future reporting years.

The Company is continually reviewing its judgments, estimates, and assumptions.

The Management, when preparing this individual and consolidated preliminary quarterly information, used disclosure criteria based on regulatory aspects and the relevance of the transactions for understanding the changes in the Company’s economic and financial position and its performance since the end of the fiscal year ended on December 31, 2019, as well as the update of significant information included in the annual financial statements issued on February 28, 2020.

The Management confirms that all the material information in this individual and consolidated preliminary preliminary quarterly information is being demonstrated and corresponds to the information used by Management in the development of its business management activities.

The individual and consolidated preliminary quarterly information has been prepared based on historical cost, with the exception of the following material items recognized in the balance sheets:

· short-term investments classified as cash and cash equivalents measured at fair value;

· short-term investments comprising mainly exclusive investment funds, measured at fair value;

· restricted cash measured at fair value;

· derivative financial instruments measured at fair value; and

· investments accounted for using the equity method.

The Company’s individual and consolidated preliminary quarterly information for the period ended March 31, 2020 was prepared based on the assumption of its operational continuity, which includes the realization of assets and the settlement of liabilities in the regular course of business, as detailed in Note 1.2.

19

| |

| Notes to the Preliminary Quarterly Information (without independent auditors’ limited review report) For the three-month period ended March 31, 2020. (In thousands of Reais - R$, except when otherwise indicated) |

3. Approval of Individual and Consolidated Financial Statements

The approval and authorization for the issuance of these individual and consolidated preliminary quarterly information took place at the Board of Directors’ meeting held on April 30, 2020.

4. Summary of Significant Accounting Practices

The individual and consolidated preliminary quarterly information presented herein was prepared based on the policies, accounting practices and methods for calculation of estimates adopted and presented in detail in the annual financial statements for the year ended December 31, 2019 and issued on February 28, 2020.

4.1. New accounting standards and interpretations adopted in the period

There are no new standards and interpretations adopted in the three-month period ended March 31, 2020.

4.2. New Accounting Standards and Pronouncements Not Yet Adopted

According to Management, there are no other standards and interpretations issued andnot yet adopted that may have a significant impact on the result or equity disclosed by the Company.

4.3. Transactions in Foreign Currency

Foreign currency transactions are recorded at the exchange rate change prevailing on the date on which the transactions take place. Monetary assets and liabilities designated in foreign currency are calculated based on the exchange rate change on the balance sheet date. Any difference resulting from the translation of currencies is recorded under the item “Exchange Rate Change, Net” in the income statement for the period.

The exchange rate changes inReaisin effect on the base date of this individual and consolidated preliminary quarterly information are as follows:

| Final Rate | Average rate |

| 03/31/2020 | 12/31/2019 | 03/31/2020 | 12/31/2019 |

| (Unaudited) | | (Unaudited) | |

| | | | |

US Dollar | 5,1987 | 4,0307 | 4,8643 | 4,1102 |

Argentinean Peso | 0,0807 | 0,0673 | 0,0769 | 0,0686 |

5. Seasonality

In normal economic and social conditions, the Company expects revenues and operating results from its flights to be at their highest levels in the summer and winter months of January and July, respectively, and during the last weeks of December and in the year-end holiday period. Given the high proportion of fixed costs, this seasonality tends to drive variations in operating results across the fiscal-year quarters.

20

| |

| Notes to the Preliminary Quarterly Information (without independent auditors’ limited review report) For the three-month period ended March 31, 2020. (In thousands of Reais - R$, except when otherwise indicated) |

6. Cash and Cash Equivalents

| Parent Company | Consolidated |

| 03/31/2020 | 12/31/2019 | 03/31/2020 | 12/31/2019 |

| (Unaudited) | | (Unaudited) | |

| | | | |

Cash and Bank Deposits | 438,535 | 488 | 568,662 | 418,447 |

Cash Equivalents | 128 | 1,016,258 | 90,365 | 1,226,978 |

Total | 438,663 | 1,016,746 | 659,027 | 1,645,425 |

The breakdown of cash equivalents is as follows:

| | Parent Company | Consolidated |

| Weighted Average Rate (p.a.) | 03/31/2020 | 12/31/2019 | 03/31/2020 | 12/31/2019 |

| | (Unaudited) | | (Unaudited) | |

| | | | | |

Local Currency | | | | | |

Financial deposits | 94.8% of CDI | 128 | 366,338 | 88,676 | 514,356 |

Automatic Deposits | 23.5% of CDI | - | - | 626 | 5,505 |

Total Local Currency | | 128 | 366,338 | 89,302 | 519,861 |

| | | | | |

Foreign Currency | | | | | |

Financial deposits | 0.1% | - | 649,920 | 98 | 707,117 |

Investment funds | | - | - | 965 | - |

Total Foreign Currency | | - | 649,920 | 1,063 | 707,117 |

| | | | | |

Total | | 128 | 1,016,258 | 90,365 | 1,226,978 |

7. Short-Term Investments

| | Parent Company | Consolidated |

| Weighted Average Rate (p.a.) | 03/31/2020 | 12/31/2019 | 03/31/2020 | 12/31/2019 |

| | (Unaudited) | | (Unaudited) | |

| | | | | |

Local Currency | | | | | |

Government Bonds | 97.1% of CDI | - | - | 39.763 | 56.532 |

Investment Funds | 55.7% of CDI | 514 | 673 | 1,091,302 | 862.868 |

Total Local Currency | | 514 | 673 | 1,131,065 | 919.400 |

| | | | | |

Foreign Currency | | | | | |

Deposits with Banks | 3.00% | - | - | 2,437 | 1,713 |

Government Bonds | -% | - | - | - | 29,684 |

Investment Funds | - | - | - | - | 2,965 |

Total Foreign Currency | | - | - | 2,437 | 34,362 |

| | | | | |

Total | | 514 | 673 | 1,131,502 | 953,762 |

The decrease in the performance of the investment funds’ profitability in the period also reflects the outbreak of the COVID-19 pandemic, with all activity and growth estimates being revised to fundamentally negative numbers.

21

| |

| Notes to the Preliminary Quarterly Information (without independent auditors’ limited review report) For the three-month period ended March 31, 2020. (In thousands of Reais - R$, except when otherwise indicated) |

8. Restricted Cash

| | Parent Company | Consolidated |

| Weighted Average Profitability (p.a.) | 03/31/2020 | 12/31/2019 | 03/31/2020 | 12/31/2019 |

| | (Unaudited) | | (Unaudited) | |

| | | | | |

Local Currency | | | | | |

Deposits in Guarantee of Letter of Credit | 97.1% of CDI | 4,092 | 3,948 | 104,287 | 138,164 |

Deposits in Guarantee of Letter of Credit -lawsuits | 95.7% of CDI | 2,430 | - | 85,164 | 85,351 |

Deposit for Hedge Margin | 100.0% of CDI | - | - | 101,160 | - |

Lease Agreement Letter of Credit | 98.4% of CDI | - | - | 125,104 | 136,438 |

Other deposits | 69.7% of CDI | 23 | 2,451 | 5,159 | 9,922 |

Total Local Currency | | 6,545 | 6,399 | 420,874 | 369,875 |

| | | | | |

Foreign Currency | | | | | |

Deposits for Hedge Margin | 0.1% | - | - | 778,900 | 74,431 |

Total Foreign Currency | | - | - | 778,900 | 74,431 |

| | | | | |

Total | | 6,545 | 6,399 | 1,199,774 | 444,306 |

| | | | | |

Current | | 6,545 | 6,399 | 1,059,579 | 304,920 |

Noncurrent | | - | - | 140,195 | 139,386 |

9. Trade Receivables

| Consolidated |

| 03/31/2020 | 12/31/2019 |

| (Unaudited) | |

| | |

Local Currency | | |

Credit Card Administrators | 363,478 | 740,967 |

Travel Agencies | 185,214 | 253,494 |

Cargo Agencies | 30,409 | 33,677 |

Airline Partner Companies | 5,453 | 291 |

Other | 15,929 | 15,690 |

Total Local Currency | 600,483 | 1,044,119 |

| | |

Foreign Currency | | |

Credit Card Administrators | 109,730 | 121,844 |

Travel Agencies | 24,047 | 36,845 |

Cargo Agencies | 1,985 | 1,384 |

Airline Partner Companies | 21,675 | 30,740 |

Other | 53,391 | 11,550 |

Total Foreign Currency | 210,828 | 202,363 |

| | |

Total | 811,311 | 1,246,482 |

| | |

Allowance for expected loss on trade receivables accounts | (19,470) | (16,952) |

| | |

Total Trade Receivables | 791,841 | 1,229,530 |

22

| |

| Notes to the Preliminary Quarterly Information (without independent auditors’ limited review report) For the three-month period ended March 31, 2020. (In thousands of Reais - R$, except when otherwise indicated) |

The aging list of trade receivables, net of allowance for expected loss on trade receivables accounts, is as follows:

| Consolidated |

| 03/31/2020 | 12/31/2019 |

| (Unaudited) | |

Not Yet Due | | |

Until 30 days | 446,330 | 567,567 |

31 to 60 days | 117,219 | 213,334 |

61 to 90 days | 54,064 | 100,478 |

91 to 180 days | 76,248 | 187,883 |

181 to 360 days | 50,352 | 76,902 |

Above 360 days | 1,143 | 1,499 |

Total not Yet Due | 745,356 | 1,147,663 |

| | |

Overdue | | |

Until 30 days | 30,845 | 47,959 |

31 to 60 days | 4,789 | 23,290 |

61 to 90 days | 4,731 | 3,986 |

91 to 180 days | 2,039 | 3,009 |

181 to 360 days | 845 | 421 |

Above 360 days | 3,236 | 3,202 |

Total Overdue | 46,485 | 81,867 |

| | |

Total | 791,841 | 1,229,530 |

The changes in an expected loss on trade receivables are as follows:

| Consolidated |

| 03/31/2020 | 12/31/2019 |

| (Unaudited) | |

Balance at the Beginning of the Period | (16,952) | (11,284) |

Addition and Exclusions | (2,726) | (13,499) |

Write-off of Bad Debts | 208 | 7,831 |

Balance at the End of the Period | (19,470) | (16,952) |

10. Inventories

| Consolidated |

| 03/31/2020 | 12/31/2019 |

| (Unaudited) | |

| | |

Consumables | 18,603 | 14,274 |

Parts and maintenance materials | 197,177 | 184,939 |

Total | 215,780 | 199,213 |

The changes in the provision for obsolescence are as follows:

| Consolidated |

| 03/31/2020 | 12/31/2019 |

| (Unaudited) | |

Balances at the Beginning of the Period | (14,302) | (12,808) |

Additions | (45) | (2,168) |

Write-offs | 293 | 674 |

Balances at the End of the Period | (14,054) | (14,302) |

23

| |

| Notes to the Preliminary Quarterly Information (without independent auditors’ limited review report) For the three-month period ended March 31, 2020. (In thousands of Reais - R$, except when otherwise indicated) |

11. RecoverableTaxes to Recover

| Parent Company | Consolidated |

| 03/31/2020 | 12/31/2019 | 03/31/2020 | 12/31/2019 |

| (Unaudited) | | (Unaudited) | |

| | | | |

IRPJ and CSLL Prepayments | 22,641 | 27,552 | 186,613 | 195,864 |

Withholding Income Tax | 1,523 | - | 7,635 | 3,969 |

PIS and COFINS to recover(*) | - | - | 407,360 | 273,152 |

Value Added Tax (VAT) Abroad | - | - | 8,708 | 4,650 |

Other | 60 | 60 | 12,314 | 6,181 |

Total | 24,224 | 27,612 | 622,630 | 483,816 |

| | | | |

Current | 6,686 | 5,163 | 205,227 | 309,674 |

Noncurrent | 17,538 | 22,449 | 417,403 | 174,142 |

(*) During the quarter ended March 31, 2020, the subsidiary GLA ascertained out-of-date tax credits from PIS and COFINS, in the total amount of R$126,675.

24

| |

| Notes to the Preliminary Quarterly Information (without independent auditors’ limited review report) For the three-month period ended March 31, 2020. (In thousands of Reais - R$, except when otherwise indicated) |

12. Deferred Taxes

12.1.Deferred Tax Assets (Liabilities)

The positions of deferred assets and liabilities are presented below and comply with the enforceable offset legal rights that consider taxes levied by the same tax authority under the same tax entity.

| | Parent Company | Consolidated |

| 12/31/2019 | Result | 03/31/2020 | 12/31/2019 | Result | Exchange Rate Change | 03/31/2020 |

| | | (Unaudited) | | | | (Unaudited) |

Income Tax Losses Carry Forward | 39,890 | (332) | 39,558 | 42,795 | (331) | 578 | 43,042 |

Negative Basis of Social Contribution | 14,360 | (120) | 14,240 | 14,360 | (120) | - | 14,240 |

Temporary Differences | | | | | | | |

Allowance for loss on other credits | 1,957 | (1,822) | 135 | 1,958 | (1,823) | - | 135 |

Provision for Legal Proceedings and Tax Liabilities | 696 | (11) | 685 | 696 | (11) | - | 685 |

Total Deferred Taxes - Assets | 56,903 | (2,285) | 54,618 | 59,809 | (2,285) | 578 | 58,102 |

Controlled Subsidiary GLA and Smiles | | | | | | | |

Temporary Differences | | | | | | | |

Allowance for expenses loss on trade receivables and other credits | - | - | - | 56,738 | (16,086) | - | 40,652 |

Breakage Provision | - | - | - | (196,206) | (12,048) | - | (208,254) |

Provision for Losses on Other Credits | - | - | - | 143,350 | - | - | 143,350 |

Provision for Legal Proceedings and Tax Liabilities | - | - | - | 91,051 | 7,602 | - | 98,653 |

Aircraft Return | - | - | - | 146,239 | 1,615 | 2 | 147,856 |

Derivative Transactions | - | - | - | (42,154) | 83,776 | - | 41,622 |

Flight Rights | - | - | - | (353,226) | - | - | (353,226) |

Depreciation of Engines and Parts for Aircraft Maintenance | - | - | - | (183,977) | (3,445) | - | (187,422) |

Reversal of Goodwill Amortization for Tax Purpose | - | - | - | (127,659) | - | - | (127,659) |

Aircraft Leases and Other | - | - | - | 64,379 | (42,753) | - | 21,626 |

Other | - | - | - | 89,313 | (28,233) | (3) | 61,077 |

Unrealized Profits | - | - | - | 68,111 | (7,286) | - | 60,825 |

Total Deferred Taxes – Liabilities | - | - | - | (244,041) | (16,858) | (1) | (260,900) |

Total deferred taxes on income | - | (2,285) | - | - | (19,143) | - | - |

| | | | | | | | |

25

| |

| Notes to the Preliminary Quarterly Information (without independent auditors’ limited review report) For the three-month period ended March 31, 2020. (In thousands of Reais - R$, except when otherwise indicated) |

The Management considers that the deferred assets and liabilities recorded on March 31, 2020, resulting from temporary differences will be realized in proportion to the realization of their bases and the expectation of future results.

The analysis of the realization of deferred tax credits was performed by the company, as follows:

GOL: has the total tax credits of R$54,618, of which R$53,798 refers to tax loss and negative basis of social contribution and R$820 refers to temporary differences, with realization supported by the long-term plan.

The Management estimates that deferred tax credits, recorded on tax losses and negative social contribution basis, may be realized as follows:

Year | Amount |

| (Unaudited) |

| |

2020 | 4,316 |

2021 | 8,375 |

2022 | 7,473 |

2023 | 8,332 |

2024 | 9,471 |

2025 to 2029 | 15,831 |

Total | 53,798 |

Smiles Fidelidade Argentina:The Management estimates that the deferred tax assets relating to tax losses totaling R$3,484 will be realized in 36 months.

The direct subsidiary GLA has tax losses and negative social contribution bases in the determination of taxable profit, to be offset against 30% of future annual tax profits, with no time limit for prescription, off-balance sheet, in the following amounts:

| GLA |

| 03/31/2020 | 12/31/2019 |

| (Unaudited) | |

| | |

IRPJ tax loss | 6,158,776 | 5,017,227 |

CSLL negative base | 6,158,776 | 5,017,227 |

| | |

Potential tax credit | 2,093,984 | 1,705,857 |

26

| |

| Notes to the Preliminary Quarterly Information (without independent auditors’ limited review report) For the three-month period ended March 31, 2020. (In thousands of Reais - R$, except when otherwise indicated) |

The reconciliation of effective income taxes and social contribution rates for the periods ended on March 31, 2020, and 2019 is as follows:

| Parent Company | Consolidated |

| 03/31/2020 | 03/31/2019 | 03/31/2020 | 03/31/2019 |

| (Unaudited) | | (Unaudited) | |

| | | | |

Income (Loss) Before Income Taxes | (2,284,936) | (55,685) | (2,218,193) | 105,115 |

Combined Tax Rate | 34% | 34% | 34% | 34% |

Income at the statutory combined tax rate | 776,878 | 18,933 | 754,186 | (35,739) |

| | | | |

Adjustments to calculate the effective tax rate: | | | | |

Equity Method Investees | (753,997) | 6,074 | - | 27 |

Tax difference on results of subsidiaries | 160,843 | (19,722) | 160,843 | (40,037) |

Income tax on permanent differences and others | (204) | (249) | 50,194 | 46,941 |

Exchange Rate Change on Foreign Investments | (186,853) | (4,910) | (131,967) | (42,630) |

Interest on Shareholders’ Equity | - | (3,114) | - | 2,805 |

Non-deferred Asset Benefit, negative base | - | 26,366 | (876,672) | (1,276) |

Total Income Tax | (3,333) | 23,378 | (43,416) | (69,909) |

| | | | |

Income Taxes | | | | |

Current | (1,048) | (1,913) | (24,273) | (40,048) |

Deferred | (2,285) | 25,291 | (19,143) | (29,861) |

Total Income Taxes | (3,333) | 23,378 | (43,416) | (69,909) |

| | | | | |

13. Advance to Suppliers and Third Parties

| Parent Company | Consolidated |

| 03/31/2020 | 12/31/2019 | 03/31/2020 | 12/31/2019 |

| (Unaudited) | | (Unaudited) | |

| | | | |

Oceanair Advance | 207,949 | 161,228 | 239,435 | 192,715 |

Advance to National Suppliers | - | - | 129,911 | 95,596 |

Advance to International Suppliers | 48 | 37 | 36,268 | 25,316 |

Advance for Materials and Repairs | - | - | 48,932 | 48,930 |

Total | 207,997 | 161,265 | 454,546 | 362,557 |

Adjustment to Present Value of Advance to Suppliers | - | - | (10,604) | (10,604) |

Provision for Loss of Advance to Oceanair | (207,949) | (161,228) | (207,949) | (161,228) |

Total Advance to Suppliers | 48 | 37 | 235,993 | 190,725 |

| | | | |

Current | 48 | 37 | 187,328 | 142,338 |

Noncurrent | - | - | 48,665 | 48,387 |

(*) increase due to US dollar exchange rate difference.

14. Deposits

| Parent Company | Consolidated |

| 03/31/2020 | 12/31/2019 | 03/31/2020 | 12/31/2019 |

| (Unaudited) | | (Unaudited) | |

| | | | |

Judicial Deposits | 60,973 | 61,447 | 861,349 | 841,746 |

Maintenance Deposits | - | - | 1,140,179 | 830,282 |

Deposits in Guarantee for Lease Agreements | 68,097 | 51,055 | 410,268 | 296,327 |

Total | 129,070 | 112,502 | 2,411,796 | 1,968,355 |

27

| |

| Notes to the Preliminary Quarterly Information (without independent auditors’ limited review report) For the three-month period ended March 31, 2020. (In thousands of Reais - R$, except when otherwise indicated) |

15. Investments

15.1.Breakdown of Investments

The investment information is shown below:

| Parent Company | | Consolidated |

| GLA | Smiles Fidelidade | | Trip |

Relevant Information of the Subsidiaries on March 31, 2020 (Unaudited) | | | | |

Total Number of Shares | 5,262,335,049 | 124,158,953 | | - |

Capital Stock | 4,554,280 | 254,609 | | 1,318 |

Interest | 100,0% | 52,61% | | 60,0% |

Total Equity (negative) | (9,832,633) | 1,261,975 | | 2,103 |

Unrealized Profits (a) | - | (118,072) | | - |

| | | | |

Adjusted Equity (b) | (9,832,633) | 545,817 | | 1,254 |

Net Income (Loss) for the Period | (2,261,376) | 56,252 | | - |

Unrealized Profits in the Period (a) | - | 14,144 | | - |

Net Income for the Period Attributable to the Company’s Interest (b) | (2,261,376) | 43,737 | | - |

| Parent Company | | Consolidated |

| GLA | Smiles Fidelidade | | Trip |

Relevant Information of the Subsidiaries on March 31, 2019 | | | | |

Total Number of Shares | 5,262,335,049 | 124,158,953 | | - |

Capital Stock | 4,554,280 | 254,610 | | 1,318 |

Interest | 100.00% | 52.61% | | 60.00% |

Total Equity (negative) | (6,498,660) | 1,205,335 | | 2,103 |

Unrealized Profits (a) | - | (132,215) | | - |

| | | | |

Adjusted Equity (b) | (6,498,660) | 501,986 | | 1,254 |

Net Income (Loss) for the Period | 215,027 | 626,725 | | 129 |

Unrealized Profits in the Period (a) | - | (35,909) | | - |

Net Income for the Period Attributable to the Company’s Interest (b) | 215,027 | 294,899 | | 77 |

(a) Corresponds to transactions involving revenue from mileage redemption for airline tickets by members in the Smiles Program which, for the purposes of preliminary quarterly information, are only accrued when program members are actually transported by GLA.

(b) Adjusted shareholders’ equity and net income corresponds to the percentage of total shareholders’ equity and income for the period net of unrealized profits.

15.2.Changes in Investments

| Parent Company | Consolidated |

| GLA | Smiles Fidelidade | Total | Trip |

Balances on December 31, 2019 | (6,498,660) | 501,986 | (5,996,674) | 1,254 |

Equity Method Results | (2,261,376) | 43,737 | (2,217,639) | - |

Unrealized Gains on Hedges | (1,077,289) | - | (1,077,289) | - |

Share-based Payments | - | 315 | 315 | - |

Other Equity Changes in Investments | 4,692 | (221) | 4,471 | - |

Balances on March 31, 2020 (Unaudited) | (9,832,633) | 545,817 | (9,286,816) | 1,254 |

28

| |

| Notes to the Preliminary Quarterly Information (without independent auditors’ limited review report) For the three-month period ended March 31, 2020. (In thousands of Reais - R$, except when otherwise indicated) |

16. Property, Plant and Equipment

16.1.Parent Company

On March 31, 2020, the balance of other property, plant and equipment assets reached R$541. On December 31, 2019, the balance was of R$131,841, mainly referring to advances for the acquisition of aircraft, which were returned by the manufacturer, as mentioned in note 1.3. In addition, there is no residual value of the ownership rights on March 31, 2020 (R$108,538 as of December 31, 2019), both recorded in the subsidiary GAC.

29

| |

| Notes to the Preliminary Quarterly Information (without independent auditors’ limited review report) For the three-month period ended March 31, 2020. (In thousands of Reais - R$, except when otherwise indicated) |

16.2.Consolidated

| Weighted average rate (p.a.) | December 31, 2019 | Additions | Write-off | Transfers | March 31, 2020 |

| | | | | | (Unaudited) |

Flight Equipment | | | | | | |

Cost | | | | | | |

Aircraft - ROU(1) with Purchase Option(5) | | 660,256 | - | (660,256) | - | - |

Aircraft - ROU with no Purchase Option | | 3,561,980 | 520,594 | (53,301) | - | 4,029,273 |

Spare Parts and Engines - Own | | 1,764,295 | 13,025 | (2,816) | (250) | 1,774,254 |

Spare Parts and Engines - Rou | | 109,977 | - | - | - | 109,977 |

Aircraft and Engine Overhauling | | 3,084,023 | 316,482 | (20,321) | - | 3,380,184 |

Tools | | 53,454 | 1,691 | (32) | 250 | 55,363 |

| | 9,233,985 | 851,792 | (736,726) | - | 9,349,051 |

Depreciation | | | | | | |

Aircraft - ROU with Purchase Option(5) | 5.76% | (226,433) | (2,935) | 229,368 | - | - |

Aircraft - ROU with no Purchase Option | 21.09% | (719,377) | (216,287) | 39,427 | - | (896,237) |

Spare Parts and Engines – Own | 7.29% | (706,381) | (32,238) | 1,415 | - | (737,204) |

Spare Parts and Engines – Rou | 33.29% | (26,745) | (9,007) | - | - | (35,752) |

Aircraft and Engine Overhauling | 60.87% | (1,717,552) | (232,290) | 20,439 | - | (1,929,403) |

Tools | 10.00% | (24,712) | (1,040) | 12 | - | (25,740) |

| | (3,421,200) | (493,797) | 290,661 | - | (3,624,336) |

| | | | | | |

Total, Net - Flight Equipment | | 5,812,785 | 357,995 | (446,065) | - | 5,724,715 |

Property, Plant and Equipment in Use | | | | | | |

Cost | | | | | | |

Vehicles | | 11,681 | 172 | (43) | - | 11,810 |

Machinery and Equipment | | 63,091 | 218 | (544) | - | 62,765 |

Furniture and Fixtures | | 32,983 | 1,242 | (155) | - | 34,070 |

Computers and Peripherals – Own | | 45,732 | 2,083 | (402) | - | 47,413 |

Computers and Peripherals – ROU | | 21,992 | - | - | - | 21,992 |

Communication Equipment | | 2,548 | 11 | (180) | - | 2,379 |

Safety Equipment | | 856 | - | (789) | - | 67 |

Improvement on third party property - CMA(3) | | 107,637 | - | - | - | 107,637 |

Leasehold Improvements | | 71,174 | 347 | - | 3,099 | 74,620 |

Third-Party Real Estate – ROU | | 22,354 | - | - | - | 22,354 |

Construction in Progress | | 17,906 | 1,042 | - | (3,099) | 15,849 |

| | | 397,954 | 5,115 | (2,113) | - | 400,956 |

Depreciation | | | | | | |

Vehicles | 20.00% | (9,291) | (190) | 43 | - | (9,438) |

Machinery and Equipment | 10.00% | (45,437) | (1,055) | 485 | - | (46,007) |

Furniture and Fixtures | 10.00% | (19,908) | (547) | 150 | - | (20,305) |

Computers and Peripherals – Own | 20.00% | (33,190) | (954) | 397 | - | (33,747) |

Computers and Peripherals – ROU | 36.13% | (7,682) | (1,997) | - | - | (9,679) |

Communication Equipment | 10.00% | (2,081) | (40) | 164 | - | (1,957) |

Safety Equipment | 10.00% | (615) | (1) | 573 | - | (43) |

Leasehold Improvements – CMA | 10.43% | (102,675) | (2,820) | - | - | (105,495) |