SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of October 2020

(Commission File No. 001-32221)

GOL LINHAS AÉREAS INTELIGENTES S.A.

(Exact name of registrant as specified in its charter)

GOL INTELLIGENT AIRLINES INC.

(Translation of registrant’s name into English)

Praça Comandante Linneu Gomes, Portaria 3, Prédio 24

Jd. Aeroporto

04630-000 São Paulo, São Paulo

Federative Republic of Brazil

(Address of registrant’s principal executive offices)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes ______ No ___X___

Parent Company and Consolidated

Quarterly Information (ITR)

GOL Linhas Aéreas Inteligentes S.A.

September 30, 2020

with Review Report on the Quarterly Information

Gol Linhas Aéreas Inteligentes S.A.

Parent Company and Consolidated Quarterly Information (ITR)

September 30, 2020

Contents

| Comments on the Performance | 03 |

| Report of the Statutory Audit Committee | 08 |

| Statement of the Executive officers on the Parent Company and Consolidated Quarterly Information (ITR) | 09 |

| Statement of the Executive officers on the Independent Auditors’ Review Report | 10 |

| Independent Auditors’ Review Report on the Quarterly Information (ITR) | 11 |

| Statements of Comprehensive Income (SCI) | 16 |

| Statements of Changes in Shareholders’ Equity (SCSE) | 17 |

| Statements of Cash Flows (SCF) | 18 |

| Statements of Value Added (SVA) | 20 |

| Notes on the Parent Company and Consolidated Quarterly Information (ITR) | 21 |

Comments on Performance

The third quarter of 2020 reflects a period of strong recovery in the volume of operations, with a record number of passengers since GOL initiated its essential network in April. GOL is the only airline in Brazil that managed consistently to maintain a load factor at a level close to 80% across its network during the pandemic to date.

Added to the cost containment and cash preservation measures implemented by the Company, GOL is now in an advantageous position to capture market share as the demand for travel continues to increase. The operating environment remains challenging, but the Company is optimistic that conditions will continue to improve during the remainder of the year. We are seeing consistent growth in the search for GOL air tickets for leisure and holiday planning at the end of the year. This demand growth is specifically concentrated in the domestic market, which accounts for 100% of the Company’s network operations.

Team of Eagles: We are immensely proud to be the first and only airline in South America to announce agreements to guarantee the jobs of over 14,000 Employees, in addition to offering Voluntary Leave, Dismissal and Retirement Programs. The dedication, commitment and professionalism in this extremely challenging moment has been crucial for our success to date and it will be a great competitive differential for the recovery in 2021. Once again, we would like to thank our Employees for the demonstration of unity and proactiveness that are unique characteristics of GOL.

Customer Experience and Personal Safety: Net Promoter Score (NPS) remained stable at 38 in the quarter and is indicative of the combination of the Company’s best-in-market product and the high engagement of the Customer service team. For the third consecutive year, GOL was the most remembered brand in its category as measured in the 30th edition of “Folha Top of Mind 2020”, with 33% mentions among the more than 7,500 Brazilians interviewed. GOL’s strategy has proved to be effective as the Company increased its market share to 40% in the Brazilian domestic market, according to data from ANAC. GOL also owns a 42% share of the 3Q20 corporate passenger segment, according to data from ABRACORP.

Sales: The month of September was marked by a 43% increase in the search for airline tickets. As a result of this greater interest, the Company registered a 60% increase in ticket sales, across all of its channels, compared to August 2020. In the third quarter, consolidated gross sales reached approximately R$1.7 billion, an increase of 132% in relation to 2Q20. GOL’s daily sales in 3Q20 exceeded R$20 million, which represent 50% of pre-pandemic sales level. With additional flights during the month of September, passenger revenue increased 110% over July.

Also in September, GOL launched a new fast package delivery service, the “CHEGOL”. The service consists of express freight with priority throughout Brazil, without the need to weigh the product according to the dimensions of the freight box.

On September 15th, the Company celebrated the 14th anniversary of its Aeronautical Maintenance Center. This story started with the old Campaign Hangar, and today, thanks to the commitment to innovation and efficiency, together with the exceptional work of the Team of Eagles, this facility has become a business opportunity for GOL Aerotech.

Capacity: The Company maintains solid position in the main Brazilian commercial airports due to its irreplaceable network, with main hubs at GRU, GIG, BSB and FOR. In addition, it establishes a new hub in Salvador, through which GOL can explore new regional markets together with its strategic partners. The addition of capacity has clear profitability criteria to ensure the sustainable resumption of operations. During the quarter, the Company did not operate regular flights in the international market, however, we plan the reopening of these bases in a phased manner, according to the position of governments in relation to the reopening of borders for tourism and the demand behavior.

Our single-type fleet operating model and dominant position in the main Brazilian hubs with high density traffic allows us to quickly add routes where required by demand. We are adapting our network almost simultaneously to market variations, while maintaining our discipline to ensure equilibrium between supply and demand. We do not face the same concerns as our competitors with fleet complexity or the exposure of large aircraft exclusively destined for the international market. We have not deviated from what GOL has always focused on doing: delivering an efficient service with the best Customer experience and maintaining a resilient balance sheet to finance our operations and accelerate our profitable growth.

Operating and Financial Indicators

| Traffic Data – GOL (in Millions) | 3Q20 | 3Q19 | % Var. | 9M20 | 9M19 | % Var. |

| RPK GOL – Total | 3,164 | 11,114 | -71.5% | 13,884 | 31,056 | -55.3% |

| RPK GOL –Domestic | 3,164 | 9,595 | -67.0% | 12,594 | 26,760 | -52.9% |

| RPK GOL – International | - | 1,519 | NM | 1,290 | 4,295 | -70.0% |

| ASK GOL – Total | 3,992 | 13,406 | -70.2% | 17,444 | 37,808 | -53.9% |

| ASK GOL – Domestic | 3,992 | 11,463 | -65.2% | 15,660 | 32,230 | -51.4% |

| ASK GOL – International | - | 1,943 | NM | 1,784 | 5,578 | -68.0% |

| GOL Load Factor – Total | 79.3% | 82.9% | -3.6 p.p. | 79.6% | 82.1% | -2.5 p.p. |

| GOL Load Factor – Domestic | 79.3% | 83.7% | -4.4 p.p. | 80.4% | 83.0% | -2.6 p.p. |

| GOL Load Factor – International | - | 78.2% | NM | 72.3% | 77.0% | -4.7 p.p. |

| Operating Data | 3Q20 | 3Q19 | % Var. | 9M20 | 9M19 | % Var. |

| Revenue Passengers - Pax on Board ('000) | 2,604 | 9,803 | -73.4% | 11,577 | 26,939 | -57.0% |

| Aircraft Utilization (Block Hours/Day) | 6.7 | 12.6 | -46.8% | 9.8 | 12.4 | -21.0% |

| Departures | 19,338 | 68,579 | -71.8% | 87,440 | 191,149 | -54.3% |

| Total Seats (‘000) | 3,360 | 12,054 | -72.1% | 15,015 | 33,434 | -55.1% |

| Average Stage Length (km) | 1,172 | 1,110 | 5.6% | 1,146 | 1,123 | 2.0% |

| Fuel Consumption (mm liters) | 113 | 387 | -70.8% | 506 | 1,092 | -53.7% |

| Full-time Employees (at Period End) | 15,083 | 15,838 | -4.8% | 15,083 | 15,838 | -4.8% |

| Average Operating Fleet(6) | 63 | 115 | -45.2% | 65 | 111 | -41.4% |

| On-time Departures | 96.7% | 91.2% | 5.5 p.p. | 93.5% | 90.4% | 3.1 p.p. |

| Flight Completion | 98.1% | 98.8% | -0.7 p.p. | 97.5% | 98.5% | -1.0 p.p. |

| Passenger Complaints (per 1,000 pax) | 1.02 | 1.02 | 0.0% | 1.08 | 1.21 | -10.7% |

| Lost Baggage (per 1,000 pax) | 1.77 | 2.12 | -16.5% | 2.11 | 2.10 | 0.5% |

| Financial Data | 3Q20 | 3Q19 | % Var. | 9M20 | 9M19 | % Var. |

| Net YIELD (R$ cents) | 27.78 | 31.50 | -11.8% | 29.27 | 30.57 | -4.3% |

| Net PRASK (R$ cents) | 22.02 | 26.12 | -15.7% | 23.30 | 25.11 | -7.2% |

| Net RASK (R$ cents) | 24.42 | 27.67 | -11.7% | 25.68 | 26.61 | -3.5% |

| CASK (R$ cents)(4) | 34.12 | 22.51 | 51.6% | 24.97 | 22.17 | 12.6% |

| CASK Ex-Fuel (R$ cents)(4) | 26.19 | 14.56 | 79.9% | 16.64 | 14.14 | 17.7% |

| Adjusted CASK(6) | 21.56 | 22.51 | -4.2% | 19.53 | 22.17 | -11.9% |

| Adjusted CASK(6) Ex-Fuel (R$ cents)(4) | 15.11 | 14.56 | 3.8% | 11.98 | 14.14 | -15.3% |

| Breakeven Load Factor(4) | 110.7% | 67.4% | 43.3 p.p. | 77.4% | 68.4% | 9.0 p.p. |

| Average Exchange Rate(1) | 5.3772 | 3.9684 | 35.5% | 5.0793 | 3.8872 | 30.7% |

| End of Period Exchange Rate(1) | 5.6407 | 4.1644 | 35.5% | 5.6407 | 4.1644 | 35.5% |

| WTI (Average per Barrel. US$)(2) | 40.91 | 56.44 | -27.5% | 38.36 | 57.10 | -32.8% |

| Price per Liter Fuel (R$)(3) | 2.34 | 2.81 | -16.7% | 2.65 | 2.84 | -6.7% |

| Gulf Coast Jet Fuel (Average per Liter, US$)(2) | 0.28 | 0.51 | -45.1% | 0.28 | 0.50 | -44.0% |

(1) Source: Brazilian Central Bank; (2) Source: Bloomberg; (3) Fuel expenses excluding hedge results and PIS/COFINS credits/liters consumed; (4) Excluding non-recurring expenses and Idle expenses. (5) Average operating fleet excluding aircraft in sub-leasing and MRO. Certain calculations may not match with the financial statements due to rounding. (6) Considers only expenses related to current operating levels (3Q20).

Domestic market

GOL’s domestic demand was 3,164 million RPK, a decrease by 67.0%, while ASK supply reduced 65.2% in comparison to 3Q19, and the load factor reached 79.3% in the quarter. GOL transported 2.6 million Clients during the quarter, a decrease of 73.4% compared with the same quarter in 2019. The Company remains the leader in transporting passengers in Brazil.

International market

In 3Q20, GOL carried out non-regular charter flights for soccer teams in championships, related to our sponsorship of national teams. As most country borders were closed, the Company did not offer regular international flights.

Volume of Departures and Total Seats

The total volume of GOL’s departures was 19,338, a decrease of 71.8% over 3Q19. The total number of seats available to the market was 3.4 million in the third quarter of 2020, a decrease of 72.1% quarter-over-quarter.

PRASK, Yield and RASK

Net PRASK decreased by 15.7% in the quarter when compared to 3Q19, reaching 22.02 cents (R$), due to the decline of the levels of net passenger revenue and the ASK reduction of 70.2% in the quarter. GOL’s net RASK was 24.42 cents (R$) in 3Q20, a decrease of 11.7% over 3Q19. Net yield decreased 11.8% over 3Q19, reaching 27.78 cents (R$).

Fleet

At the end of 3Q20, GOL's total fleet was 129 Boeing 737 aircraft, comprised of 122 NGs and seven (7) MAXs (non-operational). At the end of 3Q19, GOL's total fleet was 125 aircraft, of which seven (7) were MAXs (non-operational). The average age of the Company's fleet was 10.8 years at the end of 3Q20.

GOL does not operate widebody aircraft, and has no aircraft financed via the capital markets, EETCs or finance leases. Its operating fleet is 100% composed of narrowbody aircraft financed via operating leases.

| Total Fleet at the End of Period | 3Q20 | 3Q19 | Var. | 2Q20 | Var. |

| B737s | 129 | 125 | +4 | 130 | -1 |

| B737-7 NG | 22 | 24 | -2 | 23 | -1 |

| B737-8 NG | 100 | 94 | +6 | 100 | 0 |

| B737-8 MAX | 7 | 7 | 0 | 7 | 0 |

As of September 30, 2020, GOL had 95 firm orders for the acquisition of Boeing 737 MAX aircraft, of which 73 were orders for 737 MAX-8 and 22 orders were for 737 MAX-10. The Company’s fleet plan is for a reduction of 4 operating aircraft through 2020, with the flexibility to return even more aircraft if necessary.

| Fleet Plan | 2020E | 2021E | 2022E | >2023E | Total |

| Operating Fleet at the End of the Year | 126 | 122 | | | |

| Aircraft Commitments (R$ MM) | - | - | - | 25,091.1 | 25,091.1 |

At the end of 3Q20, the Company concluded renegotiations of part of its aircraft and operating engine leasing contracts with no purchase option, which resulted in contractual modifications related to term extensions and new monthly amounts compared to the original terms of the contracts. Leasing remeasurement took into account the new payment flows, the discount rate and the exchange rate on the date of the contractual changes. The calculated effects were recorded as a reduction in the lease liability in the amount of R$180 million, with a corresponding reduction in fixed assets of R$171 million and a gain of R$9 million in the operating result.

Glossary of industry terms

| · | AIRCRAFT LEASING: an agreement through which a company (the lessor), acquires a resource chosen by its client (the lessee) for subsequent rental to the latter for a determined period. |

| · | AIRCRAFT UTILIZATION: the average number of hours operated per day by the aircraft. |

| · | AVAILABLE SEAT KILOMETERS (ASK): the aircraft seating capacity multiplied by the number of kilometers flown. |

| · | AVAILABLE FREIGHT TONNE KILOMETER (AFTK): cargo capacity in tonnes multiplied by number of kilometers flown. |

| · | AVERAGE STAGE LENGTH: the average number of kilometers flown per flight. |

| · | EXCHANGEABLE SENIOR NOTES (ESN): convertible securities. |

| · | BLOCK HOURS: the time an aircraft is in flight plus taxiing time. |

| · | BREAKEVEN LOAD FACTOR: the passenger load factor that will result in passenger revenues being equal to operating expenses. |

| · | BRENT: oil produced in the North Sea, traded on the London Stock Exchange and used as a reference in the European and Asian derivatives markets. |

| · | CHARTER: a flight operated by an airline outside its normal or regular operations. |

| · | FREIGHT LOAD FACTOR (FLF): percentage of cargo capacity that is actually utilized (calculated dividing FTK by AFTK) |

| · | FREIGHT TONNE KILOMETERS (FTK): weight of revenue cargo in tonnes multiplied by number of kilometers flown by such tonnes. |

| · | LESSOR: the party renting a property or other asset to another party, the lessee. |

| · | LOAD FACTOR: the percentage of aircraft seating capacity that is actually utilized (calculated by dividing RPK by ASK). |

| · | LONG-HAUL FLIGHTS: long-distance flights (in GOL's case, flights of more than four hours' duration). |

| · | OPERATING COST PER AVAILABLE SEAT KILOMETER (CASK): operating expenses divided by the total number of available seat kilometers. |

| · | OPERATING COST PER AVAILABLE SEAT KILOMETER EX-FUEL (CASK EX-FUEL): operating cost divided by the total number of available seat kilometers excluding fuel expenses. |

| · | OPERATING REVENUE PER AVAILABLE SEAT KILOMETER (RASK): total operating revenue divided by the total number of available seat kilometers. |

| · | PASSENGER REVENUE PER AVAILABLE SEAT KILOMETER (PRASK): total passenger revenue divided by the total number of available seat kilometers. |

| · | PDP: credit for advance payments for aircraft purchases financing. |

| · | REVENUE PASSENGERS: the total number of passengers on board who have paid more than 25% of the full flight fare. |

| · | REVENUE PASSENGER KILOMETERS (RPK): the sum of the products of the number of paying passengers on a given flight and the length of the flight. |

| · | SALE-LEASEBACK: a financial transaction whereby a resource is sold and then leased back, enabling use of the resource without owning it. |

| · | SLOT: the right of an aircraft to take off or land at a given airport for a determined period of time. |

| · | SUB-LEASE: an arrangement whereby a lessor in a rent agreement leases the item rented to a fourth party. |

| · | TOTAL CASH: the sum of cash, financial investments and short and long-term restricted cash. |

| · | WTI BARREL: West Texas Intermediate - the West Texas region, where US oil exploration is concentrated. Serves as a reference for the US petroleum byproduct markets. |

| · | YIELD PER PASSENGER KILOMETER: the average value paid by a passenger to fly one kilometer. |

About GOL Linhas Aéreas Inteligentes S.A.

GOL serves more than 36 million passengers annually. With Brazil's largest network, GOL offers customers more than 750 daily flights to over 100 destinations in Brazil and in South America, the Caribbean and the United States. GOLLOG’s cargo transportation and logistics business serves more than 3,400 Brazilian municipalities and more than 200 international destinations in 95 countries. SMILES allows over 16 million registered clients to accumulate miles and redeem tickets to more than 700 destinations worldwide on the GOL partner network. Headquartered in São Paulo, GOL has a team of approximately 15,000 highly skilled aviation professionals and operates a fleet of 129 Boeing 737 aircraft, delivering Brazil's top on-time performance and an industry leading 19-year safety record. GOL has invested billions of Reais in facilities, products and services and technology to enhance the customer experience in the air and on the ground. GOL's shares are traded on the NYSE (GOL) and the B3 (GOLL4). For further information, visit www.voegol.com.br/ir.

Disclaimer

This release contains forward-looking statements relating to the prospects of the business, estimates for operating and financial results and growth prospects of GOL. These forward-looking statements, which are subject to change without prior notice, reflect mere estimates and projections and are based exclusively on the expectations of GOL’s management at the time the forward-looking statements are made. Further, these forward-looking statements depend substantially on external factors, many of which are highly uncertain, including (i) macroeconomic developments in Brazil and volatility in exchange rates, interest rates and other economic indicators, (ii) developments relating to the spread of COVID-19, such as the duration and extent of quarantine measures and travel restrictions and the impact on overall demand for air travel, (iii) the competitive environment in the Brazilian airline market and government measures that may affect it, (iv) fuel price volatility and (v) the risks disclosed in GOL’s filings with the U.S. Securities and Exchange Commission.

Non-GAAP Measures

To be consistent with industry practice, GOL discloses so-called non-GAAP financial measures, which are not recognized under IFRS or U.S. GAAP, including “net debt,” “total liquidity” and “EBITDA.” GOL’s management believes that disclosure of non-GAAP measures provides useful information to investors, financial analysts and the public in their review of its operating performance and their comparison of its operating performance to the operating performance of other companies in the same industry and other industries. However, these non-GAAP measures do not have standardized meanings and may not be directly comparable to similarly-titled measures adopted by other companies. Potential investors should not rely on information not recognized under IFRS as a substitute for the IFRS measures of earnings or cash flow in making an investment decision.

Contacts

E-mail: ri@voegol.com.br

Phone: +55 (11) 2128-4700

Website: www.voegol.com.br/ir

Report of the Statutory Audit Committee (“SAC”)

The Statutory Audit Committee of GOL LINHAS AÉREAS INTELIGENTES S.A., in compliance with its legal and statutory obligations, has reviewed the Parent Company and Consolidated Quarterly Information (ITR) for the period ended on September 30, 2020. Based on the procedures we have undertaken and considering the independent auditors’ review report issued by Grant Thornton Auditores Independentes, as well as the information and explanations we have received during the quarter, our opinion is that these documents can be submitted to the assessment of the Board of Directors.

São Paulo, October 29, 2020.

André Béla Jánszky

Member of the Statutory Audit Committee

Antônio Kandir

Member of the Statutory Audit Committee

Francis James Leahy Meaney

Member of the Statutory Audit Committee

Statement of the Executive Officers on the Parent Company and Consolidated Quarterly Information (ITR)

Under the provisions of CVM Instruction 480/09, the executive officers state that they have discussed, reviewed, and approved the Parent Company and Consolidated Quarterly Information (ITR) for the three-month period and nine-month period ended on September 30, 2020.

São Paulo, October 29, 2020.

Paulo Sérgio Kakinoff

Chief Executive Officer

Richard F. Lark Jr.

Executive Vice President, Chief Financial Officer and Investor Relations Officer

Statement of the Executive officers on the Independent Auditors’ Review Report

Under the provisions of CVM Instruction 480/09, the Executive Board states that it has discussed, reviewed and agreed with the conclusion of the review report from the independent auditor, Grant Thornton Auditores Independentes, on the Parent Company and Consolidated Quarterly Information (ITR) for the period ended on September 30, 2020.

São Paulo, October 29, 2020.

Paulo Sérgio Kakinoff

Chief Executive Officer

Richard F. Lark Jr.

Executive Vice President, Chief Financial Officer and Investor Relations Officer

Review Report on the Quarterly Information

| | Grant Thornton Auditores Independentes Av. Eng. Luís Carlos Berrini, 105 - 12o andar

Itaim Bibi, São Paulo (SP) Brasil Phone: +55 11 3886-5100 |

To the Board of directors and shareholders of

Gol Linhas Aéreas Inteligentes S.A.

São Paulo – SP

Introduction

We have reviewed the accompanying individual and consolidated interim financial information of Gol Linhas Aéreas Inteligentes S.A. (“the Company”), comprised in the Quarterly Information Form for the quarter ended September 30, 2020, comprising the balance sheets as of September 30, 2020 and the respective statements of income and comprehensive income for the three and nine-month periods then ended, and of changes in shareholders’ equity and of cash flows for the period of nine months then ended, including the footnotes.

Management is responsible for the preparation of the individual and consolidated interim financial information in accordance with NBC TG 21 – Interim Financial Reporting and with international standard IAS 34 – Interim Financial Reporting, as issued by the International Accounting Standards Board (Iasb), such as for the presentation of these information in accordance with the standards issued by the Brazilian Exchange Securities Commission, applicable to the preparation of interim financial information. Our responsibility is to express a conclusion on this interim financial information based on our review.

Review scope

We conducted our review in accordance with the Brazilian and International standards on reviews of interim information (NBC TR 2410 – Review of Interim Financial Information Performed by the Independent Auditor of the Entity and ISRE 2410 – Review of Interim Financial Information Performed by the Independent Auditor of the Entity, respectively). The review of interim information consists of making inquiries, primarily of persons responsible for the financial and accounting matters and applying analytical and other review procedures. A review is substantially less in scope than an audit conducted in accordance with the audit standards and, consequently, does not enable us to obtain assurance that we would become aware of all significant matters that might be identified in an audit. Accordingly, we do not express an audit opinion.

Conclusion on the individual and consolidated interim financial information

Based on our review, nothing has come to our attention that causes us to believe that the accompanying individual and consolidated interim financial information included in the quarterly information form referred to above has not been prepared, in all material respects, in accordance with NBC TG 21 and IAS 34 applicable to the preparation of interim financial information, and presented in accordance with the standards issued by the Brazilian Securities and Exchange Commission.

Relevant uncertainty about going concern

We draw attention to Note 1, which mentions that the individual and consolidated interim financial information were prepared on the assumption of going concern. As described in the aforementioned note, the Company suffered recurring reductions in its operations and has a deficiency in net working capital which, together with other events and conditions, indicates the existence of relevant uncertainty that may raise significant doubt as to its ability to continue as a going concern. Management's plans and actions under development in order to reestablish the Company’s economic-financial balance and its equity position are described in Note 1. The individual and consolidated interim financial information do not include any adjustments that may arise from the result of this uncertainty. Our conclusion is not qualified in relation to this matter.

Other matters

Statements of value added

The quarterly information referred to above includes the individual and consolidated statements of value added for the period of nine months ended September 30, 2020, prepared under the responsibility of the Company's management and presented as supplementary information for the purposes of IAS 34. These statements were submitted to the same review procedures in conjunction with the review of the Company's interim financial information in the order to conclude they are reconciliated to the interim financial information and to the accounting records, as applicable, and whether the structure and content are in accordance with the criteria established in the NBC TG 09 - Statement of Value Added. Based on our review, nothing has come to our attention that causes us to believe that the accompanying statements of value added were not prepared, in all material respects, in accordance with the individual and consolidated interim financial information taken as a whole.

Audit and review of figures corresponding to the comparative year and period

The audit of the individual and consolidated financial statements for the year ended December 31, 2019 and the review of the individual and consolidated interim financial information for the three and nine-month periods ended September 30, 2019 were conducted under the responsibility of other independent auditor, which issued an audit report and a review report thereon, without qualifications, on February 28, 2020 and October 30, 2019, respectively.

São Paulo, October 29, 2020

Daniel Gomes Maranhão Junior

Assurance Partner

Grant Thornton Auditores Independentes

CRC 2SP-025.583/O-1

| Balance Sheets September 30, 2020 and December 31, 2019 (In thousands of Brazilian Reais - R$) |

| | | Parent Company | Consolidated |

| Assets | Note | September 30, 2020 | December 31, 2019 | September 30, 2020 | December 31, 2019 |

| | | | | | |

| Current | | | | | |

| Cash and Cash Equivalents | 6 | 6,628 | 1,016,746 | 498,754 | 1,645,425 |

| Financial Investments | 7 | 205 | 673 | 399,624 | 953,762 |

| Restricted Cash | 8 | 4,145 | 6,399 | 372,668 | 304,920 |

| Trade Receivables | 9 | - | - | 790,911 | 1,229,530 |

| Inventories | 10 | - | - | 199,717 | 199,213 |

| Taxes to Recover | 11 | 8,852 | 5,163 | 240,372 | 309,674 |

| Rights from Derivative Transactions | 35.2 | - | - | - | 3,500 |

| Advances to Suppliers and Third-Parties | 13 | 52 | 37 | 277,222 | 142,338 |

| Dividends and Interest on Shareholders’ Equity to Receive | 29.1 | 54,544 | 69,548 | - | - |

| Other Credits | | 12,272 | 10,039 | 115,493 | 139,015 |

| Total Current | | 86,698 | 1,108,605 | 2,894,761 | 4,927,377 |

| | | | | | |

| Noncurrent | | | | | |

| Restricted Cash | 8 | - | - | 180,388 | 139,386 |

| Deposits | 14 | 134,424 | 112,502 | 2,294,792 | 1,968,355 |

| Advances to Suppliers | 13 | - | - | 31,770 | 48,387 |

| Taxes to Recover | 11 | 11,879 | 22,449 | 322,172 | 174,142 |

| Deferred Taxes | 12 | 57,818 | 56,903 | 57,762 | 59,809 |

| Other Credits | | - | - | 35,653 | 991 |

| Credits with Related Companies | 29 | 5,150,125 | 3,440,701 | - | - |

| Rights from Derivative Transactions | 35.2 | 44,079 | 143,969 | 50,055 | 143,969 |

| Investments | 15.2 | 559,747 | 501,986 | 1,254 | 1,254 |

| Property, Plant & Equipment | 16 | 5,298 | 240,379 | 5,197,231 | 6,058,101 |

| Intangible Assets | 17 | - | - | 1,754,991 | 1,776,675 |

| Total Noncurrent | | 5,963,370 | 4,518,889 | 9,926,068 | 10,371,069 |

| | | | | | |

| Total | | 6,050,068 | 5,627,494 | 12,820,829 | 15,298,446 |

The accompanying notes are an integral part of the Parent Company and Consolidated Quarterly Information (ITR).

| Balance Sheets September 30, 2020 and December 31, 2019 (In thousands of Brazilian Reais - R$) |

| | | Parent Company | Consolidated |

| Liabilities | Note | September 30, 2020 | December 31, 2019 | September 30, 2020 | December 31, 2019 |

| | | | | | |

| Current | | | | | |

| Loans and Financing | 18 | 1,138,687 | 1,359,547 | 3,090,339 | 2,543,039 |

| Leases to Pay | 19 | - | - | 2,247,758 | 1,404,712 |

| Suppliers | 20 | 34,597 | 19,116 | 1,634,527 | 1,286,275 |

| Suppliers - Forfaiting | 21 | - | - | 52,120 | 554,467 |

| Labor Obligations | | 170 | 137 | 338,989 | 396,010 |

| Taxes to Collect | 22 | 1,272 | 4,261 | 71,151 | 116,523 |

| Landing Fees | | - | - | 780,426 | 728,339 |

| Advance Ticket Sales | 23 | - | - | 1,805,930 | 1,966,148 |

| Frequent-Flyer Program | 24 | - | - | 1,253,020 | 1,009,023 |

| Advances from Customers | | - | - | 19,989 | 16,424 |

| Provisions | 25 | - | - | 355,346 | 203,816 |

| Obligations with Derivative Transactions | 35.2 | - | - | 100,962 | 9,080 |

| Other Liabilities | | - | - | 256,729 | 128,744 |

| Total Current | | 1,174,726 | 1,383,061 | 12,007,286 | 10,362,600 |

| | | | | | |

| Noncurrent | | | | | |

| Loans and Financing | 18 | 6,612,379 | 5,235,593 | 7,193,379 | 5,866,802 |

| Leases to Pay | 19 | - | - | 5,735,626 | 4,648,068 |

| Suppliers | 20 | - | - | 44,749 | 10,142 |

| Provisions | 25 | - | - | 1,386,432 | 1,053,240 |

| Frequent-Flyer Program | 24 | - | - | 307,592 | 171,651 |

| Deferred Taxes | 12 | - | - | 218,621 | 244,041 |

| Taxes to Collect | 22 | - | - | 34,536 | 84 |

| Obligations to Related Parties | 29 | 9,509 | 163,350 | - | - |

| Obligations with Derivative Transactions | 35.2 | - | - | - | 11,270 |

| Provision for Investment Losses | 15.2 | 12,989,261 | 6,498,660 | - | - |

| Other Liabilities | | 23,394 | 23,501 | 29,554 | 35,965 |

| Total Noncurrent | | 19,634,543 | 11,921,104 | 14,950,489 | 12,041,263 |

| | | | | | |

| Shareholders’ Equity | | | | | |

| Share Capital | 26.1 | 3,009,132 | 3,008,178 | 3,009,132 | 3,008,178 | |

| Shares to Issue | | 304 | 584 | 304 | 584 | |

| Treasury Shares | 26.2 | (62,215) | (102,543) | (62,215) | (102,543) | |

| Capital Reserves | | 202,574 | 225,276 | 202,574 | 225,276 | |

| Equity Valuation Adjustments | | (906,941) | 188,247 | (906,941) | 188,247 | |

| Accumulated Losses | | (17,002,055) | (10,996,413) | (17,002,055) | (10,996,413) | |

| Negative Shareholders’ Equity (Deficit) Attributable to Controlling Shareholders | | (14,759,201) | (7,676,671) | (14,759,201) | (7,676,671) | |

| | | | | | |

| Non-Controlling Interests | | - | - | 622,255 | 571,254 |

| Total Shareholders’ Equity (Deficit) | | (14,759,201) | (7,676,671) | (14,136,946) | (7,105,417) |

| | | | | | |

| Total | | 6,050,068 | 5,627,494 | 12,820,829 | 15,298,446 |

The accompanying notes are an integral part of the Parent Company and Consolidated Quarterly Information (ITR).

| Income Statement Periods ended on September 30, 2020 and 2019 (In thousands of Brazilian Reais - R$, except basic and diluted loss per share) |

| | | Parent Company |

| | | Three-month period ended on | | Nine-month period ended on |

| | Note | September 30, 2020 | September 30, 2019 | | September 30, 2020 | September 30, 2019 |

| | | | | | | |

| Operating Revenues (Expenses) | | | | | | |

| Administrative Expenses | | (6,095) | (27,284) | | (13,265) | (34,016) |

| Other Revenues and Expenses, Net | | (18,289) | 25,780 | | 357,970 | 35,591 |

| Total Operating (Expenses) Revenues | 31 | (24,384) | (1,504) | | 344,705 | 1,575 |

| | | | | | | |

| Equity Income (Expenses) | 15 | (1,564,142) | (241,542) | | (5,354,694) | (112,556) |

| | | | | | | |

| Operating Loss before Financial Income (Expenses) and Taxes | | (1,588,526) | (243,046) | | (5,009,989) | (110,981) |

| | | | | | | |

| Financial Income (Expenses) | | | | | | |

| Financial Revenues | | 244,748 | 157,594 | | 1,010,892 | 99,630 |

| Financial Expenses | | (272,462) | 54,791 | | (1,013,662) | (303,172) |

| Financial Revenues (Expenses), Net | 32 | (27,714) | 212,385 | | (2,770) | (203,542) |

| | | | | | | |

| Financial Income (Expenses) before Exchange Rate Change, Net | | (1,616,240) | (30,661) | | (5,012,759) | (314,523) |

| | | | | | | |

| Exchange Rate Change, Net | 32 | (108,328) | (210,906) | | (990,752) | (178,244) |

| | | | | | | |

| Loss before Income Tax and Social Contribution | | (1,724,568) | (241,567) | | (6,003,511) | (492,767) |

| | | | | | | |

| Income Tax and Social Contribution | | | | | | |

| Current | | 722 | (238) | | (2,356) | (1,633) |

| Deferred | | 4,076 | (247) | | 915 | 25,418 |

| Total Income Tax and Social Contribution | 12 | 4,798 | (485) | | (1,441) | 23,785 |

| | | | | | | |

| Net Loss of the Period before Non-Controlling Interests | | (1,719,770) | (242,052) | | (6,004,952) | (468,982) |

| | | | | | | |

| | | | | | | |

| Basic Loss | 27 | | | | | |

| Per Common Share | | (0.163) | (0.020) | | (0.570) | (0.038) |

| Per Preferred Share | | (22.340) | (1.228) | | (19.964) | (1.338) |

| | | | | | | |

| Diluted Loss | 27 | | | | | |

| Per Common Share | | (0.163) | (0.020) | | (0.570) | (0.038) |

| Per Preferred Share | | (22.340) | (1.228) | | (19.964) | (1.338) |

The accompanying notes are an integral part of the Parent Company and Consolidated Quarterly Information (ITR).

| Income Statement Periods ended on September 30, 2020 and 2019 (In thousands of Brazilian Reais - R$, except basic and diluted loss per share) |

| | | Consolidated |

| | | Three-month period ended on | | Nine-month period ended on |

| | Note | September 30, 2020 | September 30, 2019 | | September 30, 2020 | September 30, 2019 |

| Net Revenue | | | | | | |

| Passenger Transportation | | 879,026 | 3,500,987 | | 4,063,662 | 9,493,188 |

| Cargo and Others | | 95,894 | 208,950 | | 416,833 | 568,173 |

| Total Net Revenue | 30 | 974,920 | 3,709,937 | | 4,480,495 | 10,061,361 |

| | | | | | | |

| Cost of Services | 31 | (958,970) | (2,546,834) | | (4,040,886) | (7,311,700) |

| gross profit | | 15,950 | 1,163,103 | | 439,609 | 2,749,661 |

| | | | | | | |

| Operating Revenues (Expenses) | | | | | | |

| Selling Expenses | | (82,257) | (247,492) | | (317,431) | (669,412) |

| Administrative Expenses | | (381,304) | (330,815) | | (949,021) | (812,531) |

| Other Revenues and Expenses, Net | | (312,836) | 28,178 | | 194,217 | 170,265 |

| Total Operating Expenses | 31 | (776,397) | (550,129) | | (1,072,235) | (1,311,678) |

| | | | | | | |

| Equity Income (Expenses) | 15 | - | - | | - | 79 |

| | | | | | | |

| Operating Income (Loss) before Financial Income (Expenses) and Taxes | | (760,447) | 612,974 | | (632,626) | 1,438,062 |

| | | | | | | |

| Financial Income (Expenses) | | | | | | |

| Financial Revenues | | 242,584 | 200,658 | | 1,137,231 | 282,965 |

| Financial Expenses | | (618,460) | (262,486) | | (2,339,673) | (1,211,288) |

| Financial Expenses, Net | 32 | (375,876) | (61,828) | | (1,202,442) | (928,323) |

| | | | | | | |

| Financial Income (Expenses) before Exchange Rate Change, Net | | (1,136,323) | 551,146 | | (1,835,068) | 509,739 |

| | | | | | | |

| Exchange Rate Change, Net | 32 | (551,232) | (728,623) | | (4,064,660) | (681,327) |

| | | | | | | |

| Loss before Income Tax and Social Contribution | | (1,687,555) | (177,477) | | (5,899,728) | (171,588) |

| | | | | | | |

| Income Tax and Social Contribution | | | | | | |

| Current | | (42,093) | (49,560) | | (77,946) | (125,203) |

| Deferred | | 33,723 | 55,917 | | 23,059 | 40,053 |

| Total Income Tax and Social Contribution | 12 | (8,370) | 6,357 | | (54,887) | (85,150) |

| | | | | | | |

| Net Loss of the Period before Non-Controlling Interests | | (1,695,925) | (171,120) | | (5,954,615) | (256,738) |

| | | | | | | |

| Income (Expenses) Attributed to: | | | | | | |

| Controlling Shareholders | | (1,719,770) | (242,052) | | (6,004,952) | (468,982) |

| Non-Controlling Shareholders | | 23,845 | 70,932 | | 50,337 | 212,244 |

| | | | | | | |

| Basic Loss | 27 | | | | | |

| Per Common Share | | (0.163) | (0.020) | | (0.570) | (0.038) |

| Per Preferred Share | | (22.340) | (1.228) | | (19.964) | (1.338) |

| | | | | | | |

| Diluted Loss | 27 | | | | | |

| Per Common Share | | (0.163) | (0.020) | | (0.570) | (0.038) |

| Per Preferred Share | | (22.340) | (1.228) | | (19.964) | (1.338) |

The accompanying notes are an integral part of the Parent Company and Consolidated Quarterly Information (ITR).

| Statements of Comprehensive Income Periods ended on September 30, 2020 and 2019 (In thousands of Brazilian Reais - R$) |

| | Parent Company |

| | Three-month period ended on | | Nine-month period ended on |

| | September 30, 2020 | September 30, 2019 | | September 30, 2020 | September 30, 2019 |

| | | | | |

| Net Loss for the Period | (1,719,770) | (242,052) | | (6,004,952) | (468,982) |

| | | | | | |

| Other Comprehensive Income that will be Reversed to Income (Expenses) | | | | | |

| | | | | | |

| Cash Flow Hedge, Net of Income Tax and Social Contribution | (43,822) | (473,226) | | (1,122,171) | (316,977) |

| Actuarial Losses from Pension Plans and Post-Employment Benefits | - | - | | 27,287 | - |

| Other Comprehensive Income | (29) | - | | (304) | - |

| | (43,851) | (473,226) | | (1,095,188) | (316,977) |

| | | | | | |

| Total Comprehensive Income (Expenses) for the Period | (1,763,621) | (715,278) | | (7,100,140) | (785,959) |

| | | | | |

| | Consolidated |

| | Three-month period ended on | | Nine-month period ended on |

| | September 30, 2020 | September 30, 2019 | | September 30, 2020 | September 30, 2019 |

| | | | | |

| Net Loss for the Period | (1,695,925) | (171,120) | | (5,954,615) | (256,738) |

| | | | | | |

| Other Comprehensive Income that will be Reversed to Income (Expenses) | | | | | |

| | | | | | |

| Cash Flow Hedge, Net of Income Tax and Social Contribution | (43,822) | (473,226) | | (1,122,171) | (316,977) |

| Actuarial Losses from Pension Plans and Post-Employment Benefits | - | - | | 27,287 | - |

| Other Comprehensive Income | (29) | - | | (304) | - |

| | (43,851) | (473,226) | | (1,095,188) | (316,977) |

| | | | | | |

| Total Comprehensive Income (Expenses) for the Period | (1,739,776) | (644,346) | | (7,049,803) | (573,715) |

| | | | | |

| Comprehensive Income (Expenses) Attributed to: | | | | |

| Controlling Shareholders | (1,763,621) | (715,278) | | (7,100,140) | (785,959) |

| Non-Controlling Shareholders | 23,845 | 70,932 | | 50,337 | 212,244 |

The accompanying notes are an integral part of the Parent Company and Consolidated Quarterly Information (ITR).

| Statements of Changes in Shareholders’ Equity Periods ended on September 30, 2020 and 2019 (In thousands of Brazilian Reais - R$) |

| Parent Company and Consolidated |

| | | | Capital Reserves | Equity Valuation Adjustments | | | |

| Share Capital | Shares to Issue | Treasury Shares | Premium when Granting Shares | Special Premium Reserve of the Subsidiary | Share-Based Compensation | Unrealized Income (Expenses) on Hedge | Post-Employment Benefits | Other Comprehensive Income | Effects from Changes in the Equity Interest | Accumulated Losses | Negative Shareholders’ Equity (Deficit) Attributable to Controlling Shareholders | Non-Controlling Interests - Smiles | Total |

| Balances on December 31, 2018 | 3,055,940 | 2,818 | (126) | 17,497 | 70,979 | 117,413 | (500,022) | - | - | 759,984 | (8,509,895) | (4,985,412) | 480,061 | (4,505,351) |

| Initial Adoption of Accounting Standard - CPC 06 (IFRS 16) | - | - | - | - | - | - | - | - | - | - | (2,436,077) | (2,436,077) | (256) | (2,436,333) |

| Net Income (Loss) for the Period | - | - | - | - | - | - | - | - | - | - | (468,982) | (468,982) | 212,244 | (256,738) |

| Income (Expenses) from Cash Flow Hedge | - | - | - | - | - | - | (316,977) | - | - | - | - | (316,977) | - | (316,977) |

Capital Increase due to Stock Options Exercised | 5,401 | (2,818) | - | - | - | - | - | - | - | - | - | 2,583 | (6) | 2,577 |

| Advances for Future Capital Increase | - | 28,343 | - | - | - | - | - | - | - | - | - | 28,343 | - | 28,343 |

| Stock Option | - | - | - | - | - | 31,018 | - | - | - | - | - | 31,018 | 1,117 | 32,135 |

| Effects from Dilution in the Equity Interest | - | - | - | - | - | - | - | - | - | (649) | - | (649) | 649 | - |

| Subscription Bonus | - | - | - | - | 9,134 | - | - | - | - | - | - | 9,134 | - | 9,134 |

| Interest on Shareholders’ Equity Distributed by the Subsidiary Smiles | - | - | - | - | - | - | - | - | - | - | - | - | (143,137) | (143,137) |

| Balances on September 30, 2019 | 3,061,341 | 28,343 | (126) | 17,497 | 80,113 | 148,431 | (816,999) | - | - | 759,335 | (11,414,954) | (8,137,019) | 550,672 | (7,586,347) |

| | | | | | | | | | | | | | | |

| Balances on December 31, 2019 | 3,008,178 | 584 | (102,543) | 17,497 | 83,229 | 124,550 | (530,043) | (41,045) | - | 759,335 | (10,996,413) | (7,676,671) | 571,254 | (7,105,417) |

| Other Comprehensive Income, Net | - | - | - | - | - | - | (1,122,171) | 27,287 | (304) | - | - | (1,095,188) | (73) | (1,095,261) |

| Net Income (Loss) for the Period | - | - | - | - | - | - | - | - | - | - | (6,004,952) | (6,004,952) | 50,337 | (5,954,615) |

| Total Comprehensive Income (Expenses) for the Period | - | - | - | - | - | - | (1,122,171) | 27,287 | (304) | - | (6,004,952) | (7,100,140) | 50,264 | (7,049,876) |

Capital Increase by Stock Option Period | 954 | (954) | - | - | - | - | - | - | - | - | - | - | - | - |

| Advances for Future Capital Increase | - | 674 | - | - | - | - | - | - | - | - | - | 674 | - | 674 |

| Transfer of Treasury Shares | - | - | 40,328 | - | - | (40,328) | - | - | - | - | - | - | - | - |

| Effects from Dilution in the Equity Interest | - | - | - | - | 642 | - | - | - | - | - | (690) | (48) | 48 | - |

| Stock Option | - | - | - | - | - | 16,984 | - | - | - | - | - | 16,984 | 689 | 17,673 |

| Balances on September 30, 2020 | 3,009,132 | 304 | (62,215) | 17,497 | 83,871 | 101,206 | (1,652,214) | (13,758) | (304) | 759,335 | (17,002,055) | (14,759,201) | 622,255 | (14,136,946) |

The accompanying notes are an integral part of the Parent Company and Consolidated Quarterly Information (ITR).

| Statements of Cash Flows Periods ended on September 30, 2020 and 2019 (In thousands of Brazilian Reais - R$) |

| | Parent Company | Consolidated |

| | September 30, 2020 | September 30, 2019 | September 30, 2020 | September 30, 2019 |

| | | | | |

| Net Loss for the Period | (6,004,952) | (468,982) | (5,954,615) | (256,738) |

| Adjustments to Reconcile the Net Loss to Cash Generated from Operating Activities | - | | | |

| Depreciation and Amortization | - | - | 1,469,790 | 1,269,438 |

| Provision for Doubtful Accounts | - | - | 598 | 1,005 |

| Provision for Legal Proceedings | - | - | 219,160 | 145,288 |

| Provisions for Inventory Obsolescence | - | - | 608 | 32 |

| Recovery of Overdue Credits | - | - | (126,675) | - |

| Adjustment to Present Value of Assets and Liabilities | - | - | 48,603 | - |

| Deferred Taxes | (915) | (25,418) | (23,059) | (40,053) |

| Equity Income (Loss) | 5,354,694 | 112,556 | - | (79) |

| Share-Based Compensation | - | 31,018 | 16,984 | 32,135 |

| Sale-Leaseback | - | - | (112,591) | - |

| Actuarial Losses from Post-Employment Benefits | - | - | 8,024 | - |

| Exchange Rate and Cash Changes, Net | 1,137,929 | 196,692 | 3,922,820 | 667,930 |

| Interest Assets | - | 322 | - | 6,790 |

| Interest on Loans and Leases | 342,241 | 248,854 | 1,075,638 | 797,014 |

| Change from Financial Investments | (5,422) | - | (110,796) | - |

| Provision for Aircraft and Engine Return | - | - | 90,883 | 269,434 |

| Provision for Maintenance Reserve | - | - | - | (55,346) |

| Write-off of Collateral Deposits for Lease and Maintenance | - | - | 117,310 | - |

| Income (Expenses) from Derivatives Recognized in Income (Expenses) | 121,745 | 41,582 | 668,447 | 138,901 |

| Unrealized Income (Expenses) on Derivatives – ESN (*) | (512,876) | (151,169) | (512,876) | (151,169) |

| Extinction of Obligation due to the Reduced Contractual Term | - | - | - | (262,569) |

| Provision for Labor Obligations | - | - | 131,494 | 205,834 |

| Write-off of Property, Plant & Equipment and Intangible Assets | 108,538 | 3,301 | 91,617 | 135,723 |

| Other Provisions | 1,313 | - | 54,500 | (12,038) |

| Adjusted Net Income (Expenses) | 542,295 | (11,244) | 1,075,864 | 2,891,532 |

| | | | | |

| Changes in Operating Assets and Liabilities: | | | | |

| Trade Receivables | - | - | 451,337 | (325,005) |

| Financial Investments | 5,975 | 87,478 | 231,223 | 27,962 |

| Restricted Cash | - | (2,354) | - | 200,841 |

| Inventories | - | - | (1,112) | (14,526) |

| Deposits | (2,270) | (4,694) | (30,995) | (158,851) |

| Deposit in Guarantee for Lease Agreements | - | - | (33,629) | (34,408) |

| Taxes to Recover | 6,881 | 731 | 47,947 | 100,883 |

| Suppliers | 15,950 | 15,742 | 336,321 | (233,971) |

| Suppliers - Forfaiting | - | - | (143,010) | 193,807 |

| Advance Ticket Sales | - | - | (160,218) | 311,563 |

| Frequent-Flyer Program | - | - | 379,938 | 79,940 |

| Advances from Customers | - | - | 3,565 | (155,427) |

| Labor Obligations | 33 | (445) | (188,515) | (155,254) |

| Landing Fees | - | - | 52,087 | 132,099 |

| Taxes to Collect | (4,667) | (22,529) | 40,142 | 111,297 |

| Obligations with Derivative Transactions | - | - | - | (25,855) |

| Liquidations with Derivative Transactions | - | - | (749,915) | (17,627) |

| Advances to Suppliers and Third-Parties | (15) | (157,991) | (139,149) | (284,460) |

| Payments for Lawsuits and Aircraft Return | - | - | (198,914) | (208,902) |

| Other Credits (Obligations) | (2,445) | (48,631) | 125,246 | (92,326) |

| Interest Paid | (465,844) | (313,273) | (546,360) | (428,255) |

| Income Tax Paid | (2,789) | (1,259) | (51,060) | (176,290) |

| Net Cash Flows from (Used in) Operating Activities | 93,104 | (458,469) | 500,793 | 1,738,767 |

| Statements of Cash Flows Periods ended on September 30, 2020 and 2019 (In thousands of Brazilian Reais - R$) |

| | Parent Company | Consolidated |

| | September 30, 2020 | September 30, 2019 | September 30, 2020 | September 30, 2019 |

| | | | | |

| Loans Receivable from Related Parties | (629,303) | (926,118) | - | - |

| Restricted Cash | 2,254 | | (108,750) | |

| Financial Investments in Subsidiary | - | - | 497,777 | (542,261) |

| Dividends and Interest on Shareholders’ Equity Received through Subsidiary | 15,002 | 232,183 | - | - |

| Advances for Property, Plant & Equipment Acquisition, Net | - | (35,189) | (91,439) | (39,418) |

| Aircraft Sales Received | - | 348,389 | - | 348,389 |

| Return of Advance to Suppliers | 136,962 | - | 136,962 | - |

| Acquisition of Property, Plant & Equipment | (10,419) | - | (507,095) | (561,307) |

| Acquisition of Intangible Assets | - | - | (47,910) | (53,513) |

Net Cash Used in Investment Activities Funding from Loans and Leases | (485,504) | (380,735) | (120,455) | (848,110) |

| 1,367,870 | 1,707,935 | 1,852,154 | 1,950,040 |

| Funding Costs from Loans and Securities Buyback | (45) | (70,356) | (6,041) | (77,082) |

| Loan Payments | (2,131,879) | (50,320) | (2,761,194) | (570,413) |

| Lease Payments | - | - | (784,433) | (1,223,685) |

| Derivatives Paid (Received) | - | (153,038) | 21,800 | (403,022) |

| Dividends and Interest on Shareholders’ Equity Paid to Non-Controlling Shareholders | - | - | (14,811) | (209,150) |

| Capital Increase | - | 2,583 | - | 2,576 |

| Subscription Bonus | - | 9,134 | - | 9,134 |

| Shares to Issue | 674 | 28,343 | 674 | 28,343 |

| Net Cash (Used in) from Financing Activities | (763,380) | 1,474,281 | (1,691,851) | (493,259) |

| | | | | |

| Exchange Rate Change of the Cash of Subsidiaries Abroad | 145,662 | 44,805 | 164,842 | 35,880 |

| | | | | |

Net (Decrease) Increase in Cash and Cash Equivalents | (1,010,118) | 679,882 | (1,146,671) | 433,278 |

| | | | | |

| Cash and Cash Equivalents at the Start of the Period | 1,016,746 | 282,465 | 1,645,425 | 826,187 |

| Cash and Cash Equivalents at the End of the Period | 6,628 | 962,347 | 498,754 | 1,259,465 |

| | | | | |

(*) Exchangeable Senior Notes NE 35.2.

Transactions that do not affect cash are presented in Note 36 of this Parent Company and Consolidated Quarterly Information (ITR).

The accompanying notes are an integral part of the Parent Company and Consolidated Quarterly Information (ITR).

| Statement of Value Added Periods ended on September 30, 2020 and 2019 (In thousands of Brazilian Reais - R$) |

| | Parent Company | Consolidated |

| | September 30, 2020 | September 30, 2019 | September 30, 2020 | September 30, 2019 |

| Revenues | | | | |

| Passenger, Cargo, and Other Transportation | - | - | 4,681,010 | 10,508,186 |

| Other Operational Revenues | 357,970 | 35,591 | 194,217 | 170,265 |

| Provision for Doubtful Accounts | - | - | (598) | (1,005) |

| | 357,970 | 35,591 | 4,874,629 | 10,677,446 |

| Inputs Acquired from Third Parties (includes ICMS and IPI) | | | | |

| Fuel and Lubricant Suppliers | - | - | (1,506,552) | (3,099,808) |

| Materials, Energy, Third-Party Services, and Others | (8,567) | (29,870) | (961,465) | (2,248,352) |

| Aircraft Insurance | - | - | (27,332) | (18,927) |

| Sales and Marketing | (366) | (338) | (221,496) | (475,315) |

| Gross Added Value | 349,037 | 5,383 | 2,157,784 | 4,835,044 |

| | | | | |

| Depreciation and Amortization | - | - | (1,469,790) | (1,269,438) |

| Net Added Value Produced by the Company | 349,037 | 5,383 | 687,994 | 3,565,606 |

| | | | | |

| Added Value Received on Transfers | | | | |

| Equity Income (Expenses) | (5,354,694) | (112,556) | - | 79 |

| Financial Revenue | 1,010,892 | 134,625 | 1,137,231 | 282,965 |

| Total Value Added (Distributed) to Distribute | (3,994,765) | 27,452 | 1,825,225 | 3,848,650 |

| | | | | |

| Distribution of Value Added: | | | | |

| Direct Compensation | 3,137 | 2,966 | 794,321 | 1,182,779 |

| Benefits | 1 | - | 128,945 | 135,379 |

| FGTS | - | - | 31,613 | 94,061 |

| Employees | 3,138 | 2,966 | 954,879 | 1,412,219 |

| | | | | |

| Federal | 2,695 | (21,004) | 362,875 | 775,388 |

| State | - | - | 10,362 | 14,367 |

| Municipal | - | - | 2,373 | 3,062 |

| Taxes, Fees, and Contributions | 2,695 | (21,004) | 375,610 | 792,817 |

| | | | | |

| Interest and Exchange Rate Change | 2,004,354 | 514,442 | 6,384,596 | 1,854,825 |

| Rents | - | - | 63,396 | 45,412 |

| Others | - | 30 | 1,359 | 115 |

| Third-Party Capital Compensation | 2,004,354 | 514,472 | 6,449,351 | 1,900,352 |

| | | | | |

| Net Loss for the Period | (6,004,952) | (468,982) | (6,004,952) | (468,982) |

| Income (Expenses) of the Period Attributed to Non-Controlling Shareholders | - | - | 50,337 | 212,244 |

| Shareholders’ Equity Compensation | (6,004,952) | (468,982) | (5,954,615) | (256,738) |

| | | | | |

| Total Value Added (Distributed) to Distribute | (3,994,765) | 27,452 | 1,825,225 | 3,848,650 |

The accompanying notes are an integral part of the Parent Company and Consolidated Quarterly Information (ITR).

| Notes on the Parent Company and Consolidated Quarterly Information (ITR) September 30, 2020 (In thousands of Brazilian Reais - R$, except when otherwise indicated) |

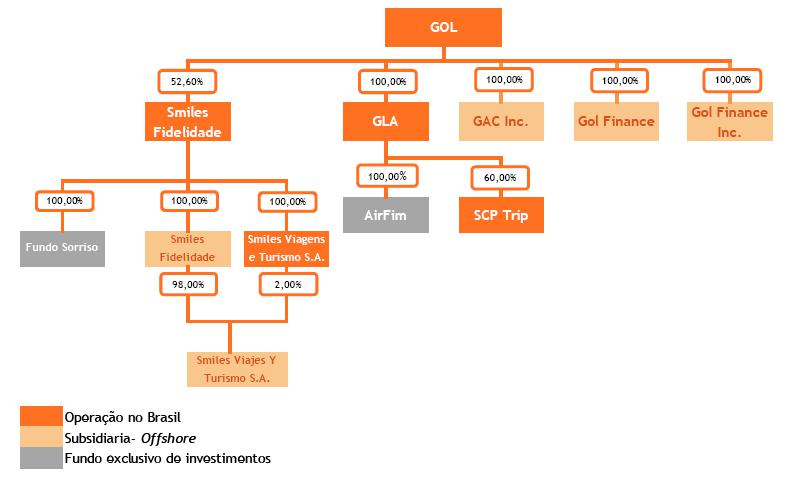

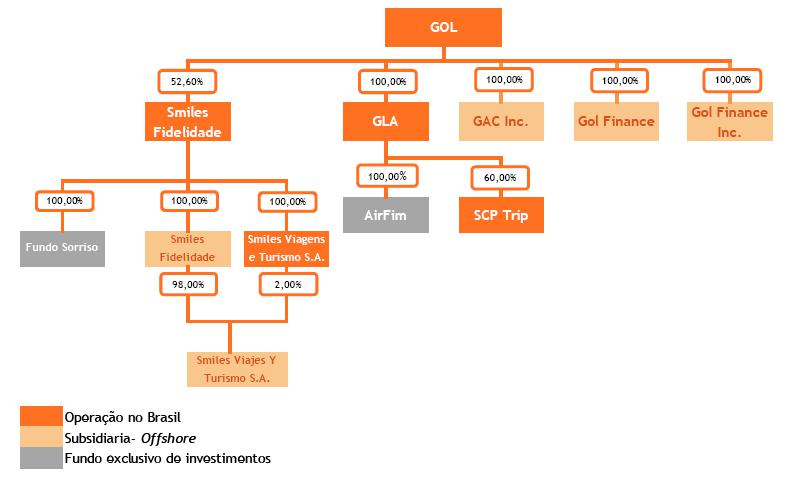

Gol Linhas Aéreas Inteligentes S.A. (the “Company” or “GOL”) is a publicly-listed company incorporated on March 12, 2004, under the Brazilian Corporate Law. According to its Bylaws, the Company's purpose is to exercise control of GOL Linhas Aéreas S.A. (“GLA”), which operates regular and non-scheduled passenger flight transportation services and the development of loyalty programs, among others.

The Company’s shares are traded on B3 S.A. - Brasil, Bolsa, Balcão (“B3”) and on the New York Stock Exchange (“NYSE”) under the ticker GOLL4 and GOL, respectively. The Company adopted Level 2 Differentiated Corporate Governance Practices from B3 and is included in the Special Corporate Governance Stock Index (“IGC”) and the Special Tag Along Stock Index (“ITAG”), which were created for companies committed to apply the differentiated corporate governance practices.

The Company’s corporate address is located at Praça Comandante Linneu Gomes, s/n, concierge 3, building 24, Jardim Aeroporto, São Paulo, Brazil.

1.1. Measures taken by the Management regarding COVID-19 and the Gradual Resumption of Demand

The pandemic sparked by COVID-19, considered by the World Health Organization as a “public health emergency of international interest”, spread rapidly across the world, leading to unprecedented disruptions in the global economic activity.

Such crisis affected the macroeconomic environment. According to Getúlio Vargas Foundation’s economic activity indicator, the Brazilian economy retracted by 5.8% from January through the end of July 2020. The Focus Report, issued by the Central Bank on July 3, 2020, included forecasts for 2020 of a 6.50% and 8.10% retraction in gross domestic product and industrial production, respectively. With the improved visibility of the pandemic’s impacts and a phased return of economic activities, an updated Focus Report issued on October 16, 2020 forecasts a 5.00% decrease in gross domestic product and a 5.98% decrease in industrial production for 2020.

Among the measures taken in Brazil, which reduced the spread of the disease, are the recommendation of social distancing, restrictions and recommendations to reduce travel and closing of borders. As a consequence, the airline industry was one of the first and most affected sectors.

The highlight of the third quarter of 2020 was the return of growth in the volume of passengers in the Brazilian domestic market. Since the beginning of the pandemic, GOL has had consistent load factors around 80%, which, in addition to cost control and cash preservation measures implemented, have proven the sound management of the Company, which favorably positioned GOL to capture the expectedgrowth in demand. The scenario remains challenging, but Management is experiencing a consistent and increasing search for GOL’s tickets for leisure travel for the year-end vacations, specifically in the domestic market, which is GOL's main area of activity.

Due to the increased demand, in September 2020, the Company registered a 60% increase in ticket sales, in all of its channels, compared to August 2020. In the same month, GOL’s daily sales exceeded R$20 million, which represents more than 50% of pre-pandemic sales levels.

The Company operates with a significant cash balance, and a positive demand trend. GOL

| Notes on the Parent Company and Consolidated Quarterly Information (ITR) September 30, 2020 (In thousands of Brazilian Reais - R$, except when otherwise indicated) |

believes that it has enough funds to meet its financial obligations in the next twelve months, after successfully adjusting its debt amortization schedule in the third quarter of 2020. GOL was the Brazilian airline that achieved the highest rate of job maintenance, and was able to strengthen its direct and transparent business relationships with its main business partners. A flexible business model based on a single fleet type of fleet has historically allowed the Company to reach the lowest operating costs and to manage the fleet's capacity to keep pace with Brazilian GDP and passenger demand. This flexibility was key in the first half of 2020 to meet the more than 90% drop in passenger demand due to government measures to control the spread of the COVID-19 pandemic. These qualifications led the Company to a strong position to capture passenger demand arising from the expected Brazilian economic recovery in the coming years.

In addition, GOL honored all its financial commitments, including the amortization of its 2022 Senior Notes in March, the full payment of interest on all its notes, and the fullrepayment of the Term Loan B totaling US$300 million in August.

GOL received a credit rating upgrade by Standard & Poor's on September 25, 2020, and by Fitch on October 9, 2020, which raised the Company's issuer and issue credit ratings to from “CCC-” to “CCC+”.

The Company, through its Executive Committee, with the participation of its entire management body, monitors the demand recovery and determines GOL’s financial and operational strategies, in addition to improving GOL’s support to the society. Among the measures already taken by the management, the following stand out:

| 1.1.1 | Operational Readjustment - Flight Network |

On March 16, 2020, GOL reduced its capacity by 50 to 60% in the domestic market, and by 90 to 95% in the international markets, to reflect the change in customer demand. The Company adjusted its network from 750 to 50 essential daily flights (“Essential Air Network”).

Since April 2020, GOL has already reopened flight to 36 destinations in Brazil, operating, on average, 210 daily flights in the third quarter of 2020, with daily peaks of up to 360 flights. GOL had no regular international flights between April and September.

GOL has been readjusting its flight network, expanding flights to the Northeast and launching Salvador as a hub to capture the resumption of leisure demand, which has had a load factor above 90% in this region. With the increased demand indicators and sales levels, GOL is well positioned with the most comprehensive Brazilian domestic network to expand its market share and reinforce its dominance in large domestic markets.

1.1.2 Decrease in Fixed and Variable Costs

| · | Variable Costs: At the end of March, the Company reformulated its flight network to ensure essential services to Brazilian state capitals and the federal district. With the demand resuming and airports reopening in a phased manner, according to the position of governments regarding the reopening for tourism, the Company reopened flights to 36 airports (15 in third quarter) to serve 134 markets (118 markets operated by the Company and 16 through its strategic partners). Currently, the Company’s network represents nearly 95% of the network operated at the beginning of year. The number of aircraft operated increased from 11 in the beginning of crisis to 71 by the end of third quarter, while consistent initiatives and efforts for cost reduction were implemented; |

| Notes on the Parent Company and Consolidated Quarterly Information (ITR) September 30, 2020 (In thousands of Brazilian Reais - R$, except when otherwise indicated) |

| · | Personnel Expenses: Through the adoption of the government’s Provisional Measure MP 936, converted into Law 14020/20, the Company adopted measures to reduce about 50% of payroll expenses and respective charges, reducing the number of hours worked per day, suspending employment agreements, adopting unpaid leave (LNR) programs and reducing salaries by 50% for employees and by 60% for senior management (the latter which was not included in MP 936’s scope). |

In addition, in June, the Company signed collective bargaining agreements with the Brazilian Union of Aeronauts and the Aviators’ Unions, which, jointly, will ensure the maintenance of the jobs of pilots and crew. Among the main initiatives of the package of measures with the Unions, we highlight the salary reduction of up to 50% for the next 12 months and voluntary plans (voluntary dismissal program, retirement, part-time, and unpaid leave). This package of measures came into effect on July 1, and will remain in force for a period between 12 and 18 months, a period of post-crisis recovery, thus making it possible to manage a gradual growth of costs with the resumption of operations.

| · | Other Expenses: Suspension of advertising expenses, as well as the immediate interruption of projects that are not absolutely essential for the continuity of our operations. |

1.1.3 Preserving and Strengthening the Cash and Liquidity Position

| · | Aircraft and Engine Leases: The Company finalized the agreements with its lessors, renegotiated payment flows, obtained reductions in the current leases and converted a portion of the fixed monthly payments into variable payments (power-by-the-hour). The agreements ensure monthly lease payments and are adjusted to the demand recovery in 2020 and 2021, and will represent an actual saving in the Company’s structure of unit costs after the pandemic. For further information, see Note 19; |

| · | Fuel Costs: The Company entered into agreements with suppliers to postpone payments, and installment payments were resumed in September 2020; |

| · | Personnel Expenses: The Company postponed the payment of salary bonuses related to 2019 as well as vacation bonuses, and is not pre-paying employees’ t13th salary; |

| · | Investments: The Company suspended all non-essential investments, and interrupted “pre delivery payments (PDPs)”, and postponed deliveries of new aircraft with Boeing for the next two years; |

| · | Engine Maintenance: The Company postponed engine maintenance payments, which are being made according to specific negotiations with suppliers and the Company's operational needs; |

| · | Taxes, Contributions, and Social Charges: The Company postponed federal tax payments based on measures enacted by the Federal Government; |

| · | Other Expenses and Revenues: The Company entered into an agreement, under which Boing reimburses certain expenses incurred since the grounding of Boeing 737MAX aircraft, with immediate cash effect of R$447 million, received on April 1, 2020 with additional receivables to be received in 4Q20; and |

| · | Loans and Financing: The Company obtained the support of its main creditors and renegotiated the extension of terms and rollovers of its debt obligations, as further explained in Note 18. Highlights were the postponement of the amortization schedule for GOL’s debentures and the waiver obtained for the 2020 covenants under those debentures. |

| Notes on the Parent Company and Consolidated Quarterly Information (ITR) September 30, 2020 (In thousands of Brazilian Reais - R$, except when otherwise indicated) |

| 1.1.4 | Government and Regulators Support |

| · | Preservation of Advance Ticket Sales: The Company reduced the level of refunds and cancellation based on measures enacted by the Federal Government that allowed rescheduling trips for up to 18 months; |

| · | Landing Fees: The Company changed the payment term for navigation fees and landing fees, which may be paid up to December 2020 without fines; and |

| · | Maintenance of ANAC’s Slots and Qualifications: The Company obtained, (i) a bonus for the cancellation of slots by the regularity index, valid until the end of October 2020, in line with a similar decision adopted by other organizations and civil aviation authorities, such as the European Commission and the FAA; and (ii) an extension for 120 days of the renewal of qualifications due between June and December 2020. |

1.1.5 Support to Society, Employees, and Customers

Air passenger transportation is an essential service for society. The Company recognizes the duty to care for its customers and is working with the authorities to help minimize the impact of COVID-19 on the country's population and health services.

For its flights, the Company adopted additional cleaning measures according to the new standards issued by ANVISA and international healthcare agencies. Among the main measures, we highlight the adoption of mandatory protection masks, closing VIP rooms, disconnection of self-service totems, implementation of segmented boarding and adoption of self-boarding without handling the boarding passes. The Company also expanded the incentive to use its digital channels and remodeled the in-flight service with sealed and sanitized products, along with the timely use of hand sanitizers. In addition, all aircraft are equipped with HEPA filters, which captures about 99.9% of viruses, bacteria and impurities, renewing the air every 3 minutes.

The Company created specific communication channels regarding the coronavirus, which are constantly updated, to improve customer service at a time of increasing demand and great uncertainty. The Company reinforced the dedicated team in its Call Center and continues to give priority to the most urgent cases. This team is committed to assisting customers in reorganizing their airline ticket reservations, with flexible conditions to change their future travel.

Currently, 90% of the processes for traveling with GOL happen without human contact. GOL's flight application allows Customers to purchase tickets, check in, check baggage and board, including through face recognition, in addition to the service via WhatsApp, in which many of its Customers perform check-ins without need for human interaction, consult their flight status and have the possibility of managing the reservation. Intensifying the use of technology and innovation is a strategic pillar of GOL’s business.

Regarding GOL’s Frequent-Flyer Program, Smiles, digital channels were also improved by implementing online cancellation self-service, free of charge, available on Smiles Fidelidade website and apps, and the Company improved Smiles’ online service (chat), for customers who have eligible GOL tickets. The system was developed internally, in record time.

Understanding that there is no set deadline for the end of this crisis and that this will inevitably have an impact on the travel planning of its customers, Smiles announced the extension of the maturity of the frequent-flyer program’s categories. Just as it chose not to consider the current year as the basis for the requalification of next year's customers, since

| Notes on the Parent Company and Consolidated Quarterly Information (ITR) September 30, 2020 (In thousands of Brazilian Reais - R$, except when otherwise indicated) |

the analysis of categories would include miles accumulated from segments flown from January to December 2020. The measure allows customers to gain more time within their category and to take advantage of the benefits offered.

To mitigate negative impacts from the COVID-19 crisis, Smiles has launched a number of incentive initiatives for participants to use their miles on products offered by other partners, mainly retailers, through Shopping Smiles.

Socially, supporting and recognizing those who fight COVID-19 on the front lines, the Company, started transporting health professionals free of charge. By September 30, 2020, 1,390 airline tickets were granted. In turn, Smiles started to credit miles for these health professionals who travel around Brazil to provide care to affected patients. For each GOL segment, flown at no cost, the traveler receives 1,000 miles. Until September 30, 2020, a total of 309,800 miles were distributed, and did not generate material financial impacts on the Parent Company and Consolidated Quarterly Information (ITR).

Among all the measures adopted by GOL during the pandemic, keeping the integrity and health of the Company's employees is a priority. Since the second half of March 2020, all Company employees with administrative assignments started working from home. Employees are constantly being monitored by the Company's leadership and by the People & Culture area that manages human resources.

The Company’s greatest commitment will continue to be people’s integrity and health, strictly following the WHO’s guidelines as a commitment to do everything possible to get through this period of turbulence in the best possible way.

1.1.6 Effects on the Parent Company and Consolidated Quarterly Information (ITR)

As already mentioned, the COVID-19 pandemic’s impacts were immediate and severe for the Company. The main consequence was the reduction in the operational flight network.

Below is a table summarizing the accounting adjustments and reclassifications made in the nine month period ended September 30, 2020, as well as the details on each of these items and additional disclosures:

| | | September 30, 2020 |

| | | Nine-month period |

| Provisions for Cancellations of Miles Redeemed | (a) | (22,271) |

| Losses with Financial Investments | (b) | (63,104) |

| Derecognition of Cash Flow Hedge - Fuel | (c) | (315,286) |

| Derecognition of Cash Flow Hedge - Revenues in US$ | (d) | (290,345) |

| Lease contracts renegotiation – IFRS 16 | (e) | 8,482 |

| Appropriation of Interest due to Renegotiation with Suppliers | | (23,435) |

| Total | | (714,441) |

| (a) | The subsidiary Smiles, which connects the travel and tourism segments, is also among the most affected by the crisis, with impacts to its operations and income (expenses). The main effect was the drop in the volume of miles redeemed by participants of the Smiles Program, mainly for airline tickets, hotel stays and car rentals. In April, the Company had cancellations of miles redeemed in previous months, in volumes higher than usual. Thus, a provision for cancellations was recorded on March 31, 2020, totaling R$22,271. This provision has been monitored and was considered sufficient to cover such losses, maintained on September 30, 2020. |

| Notes on the Parent Company and Consolidated Quarterly Information (ITR) September 30, 2020 (In thousands of Brazilian Reais - R$, except when otherwise indicated) |

| (b) | Even though the Management of the Company and its subsidiaries have remained faithful to the Company’s investment policy, the abrupt changes in macroeconomic indicators, including cuts to the SELIC rate made by the Federal Government, led the Company to record unusual losses in its investments in sovereign fixed income funds linked to SELIC, as well as in private credit fixed income funds with a high degree of liquidity and high quality of credit. |

| (c) | Furthermore, due to the operations downsizing, the Company derecognized operations designated as cash flow hedges, as a drop is expected in the fuel consumption previously estimated. Accordingly, the Company transferred a total loss of R$315,286 (R$291,925 in the first quarter and R$23,361 in the second quarter) from the “equity valuation adjustment” group in shareholders’ equity to the financial income (expenses) as “losses from derivatives”. |

| (d) | Due to the temporary interruption of all international flights, the Company also derecognized hedge accounting transactions used to hedge future revenues in foreign currency (hedged object), using lease agreements as hedge instruments. That said, the Company transferred R$290,345 from the “equity valuation adjustment” group in shareholders' equity to the financial income (expenses) as “exchange rate change expenses”. |

| (e) | The Company entered into renegotiations for part of its aircraft and operating engine leasing contracts, with no purchase option, including postponement and deferral of payments, extension of terms and modification of monthly payment amounts, which resulted in a reduction of lease obligations by R$179,579 with an offset to aircraft rights of use in fixed assets of R$ 171,097 and in the result of R$8,482. |

| | | Consolidated |

| | | September 30, 2020 |

| | | Nine-Month Period |

| Balance Sheet - Reclassifications | | Cost of Services | Other Revenues and Expenses, Net |

| Personnel Costs - Idleness | (f) | 160,802 | (160,802) |

| Flight Equipment Depreciation - Idleness | (f) | 615,667 | (615,667) |

| (f) | Due to the drop in the number of flights operated and suspension of employment agreement, where the Company paid 30% of personnel expenses, by analogy to the provisions of CPC 16 (R1) - Inventories, equivalent to IAS 2, personnel expenses and depreciation of flight equipment not directly related to the revenues generated in the period, called idleness, were reclassified from the group of costs of services to the group of other revenues and expenses, net. |

| | | Consolidated |

| | | September 30, 2020 |

| Balance Sheet - Reclassifications | | Current | Noncurrent |

| Taxes and Contributions to Recover | (g) | (18,564) | 18,564 |

| (g) | Expectations of realization of assets and liabilities were reassessed and, as a result, R$18,564 were reclassified between short- and long-term of taxes and contributions to be recovered, since such asset will take longer to be realized. |

| Notes on the Parent Company and Consolidated Quarterly Information (ITR) September 30, 2020 (In thousands of Brazilian Reais - R$, except when otherwise indicated) |

| | | Consolidated |

| | | September 30, 2020 |

| Balance Sheet - Adjustments | | Noncurrent Liabilities | Other Comprehensive Income |

| Provision for Post-Employment Benefits | (h) | (27,287) | 27,287 |

| (h) | Given the abrupt changes in the macroeconomic scenario, the Company updated the actuarial studies that establish obligations from post-employment benefits, and -- mainly due to the drop in the long-term interest rate -- the balance related to such obligations was reduced by R$27,287. For further details, see Note 25.1. |

On June 30, 2020, March 31, 2020 and December 31, 2019, the Company carried out impairment tests on the balances of fixed assets, goodwill and slot rights, no provision for impairment was recorded. On September 30, 2020, the Company assessed the indications of impairment of these assets and concluded that there is no evidence of loss due to impairment.

The Company reassessed the estimated realization of deferred tax assets recognized at the parent company and did not identify any need to adjust the balance.

The Company also carried out a thorough review of its budget estimates for the current and subsequent fiscal years (“Business Plan”), as detailed in Note 1.2.

| 1.2. | Capital Structure and Net Current Capital |

On September 30, 2020, the Company had a negative shareholders’ equity position attributed to the controlling shareholders of R$14,759,201 (R$7,676,671 on December 31, 2019).

The change observed in the nine-month period ended on September 30, 2020 is mainly due to the devaluation of the Real against US Dollar (approximately 29%), which negatively affected the result for the period due to exchange rate changes of around R$3.5 billion, as well as non-comprehensive income (expenses) of around R$1.0 billion, mainly due to derivative transactions, in addition to interest expenses of R$1.0 billion.

The negative net current capital position on September 30, 2020 was R$1,088,028 in the parent company and R$9,112,525 in the consolidated financial statements (R$274,456 and R$5,435,223 negative on December 31, 2019 in the parent company and in the consolidated financial statements, respectively). This change is mainly due to the increase in loan and lease obligations of around R$1.4 billion, due to the devaluation of Real against US Dollar and the reduction in the balance of accounts receivable of around R$451 million due to the downsizing in operations resulting from the economic crisis due to the COVID-19 pandemic.

| Notes on the Parent Company and Consolidated Quarterly Information (ITR) September 30, 2020 (In thousands of Brazilian Reais - R$, except when otherwise indicated) |