SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of March 2021

(Commission File No. 001-32221)

GOL LINHAS AÉREAS INTELIGENTES S.A.

(Exact name of registrant as specified in its charter)

GOL INTELLIGENT AIRLINES INC.

(Translation of registrant’s name into English)

Praça Comandante Linneu Gomes, Portaria 3, Prédio 24

Jd. Aeroporto

04630-000 São Paulo, São Paulo

Federative Republic of Brazil

(Address of registrant’s principal executive offices)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes ______ No ___X___

Parent Company and Consolidated

Financial Statements

GOL Linhas Aéreas Inteligentes S.A.

December 31, 2020

with Independent Auditor’s Report

Gol Linhas Aéreas Inteligentes S.A.

Parent Company and Consolidated Financial Statements

December 31, 2019

Contents

Management’s report | 01 |

Comments on business forecast trends | 06 |

Report of the statutory audit committee (CAE) | 09 |

Report of the Fiscal Council | 11 |

Executive Officers’ Statement on Income Statements | 12 |

Executive Officers’ Statement on the Independent Auditor’s Report | 13 |

Independent Auditor’s Report on the Individual and Consolidated Financial Statements | 14 |

| | |

Statements of financial position | 19 |

Statements of operations | 20 |

Statements of comprehensive income | 21 |

Statement of changes in equity | 23 |

Statement of cash flows | 24 |

Statements of value added | 26 |

Notes on the financial statements | 27 |

Management’s report

On January 15, 2021, GOL celebrated its 20th anniversary, with over 500 million Customers transported over the course of its history. During these two decades of continuous innovation, GOL has transformed the history of commercial aviation in Brazil and popularized high-quality air travel, a journey that has made it the leader in Brazilian domestic market for the fifth consecutive year, with a market share of 38%. GOL has operated over 4.2 million flights to destinations in Brazil, Latin America, the Caribbean and the United States, while its fleet expanded from 13 aircraft in January/2001 to 128 today.

“This story is written every day by our Team of Eagles, comprised of thousands of people who dedicate themselves to GOL. Once again, we would like to thank our Employees for their continued loyalty, dedication and proactiveness, which are fundamental to GOL’s success. Even more so throughout this pandemic, when the hard work of our Team of Eagles provided an essential service to Brazilians, transported health professionals and is now helping to distribute the vaccine. We are proud that this is the result of developing an intelligent airline committed to efficiency. The democratization of air transportation will always be our trademark and it drives us to continue to broaden our horizons,” added Kakinoff.

Customer experience and personal Safety: GOL’s Net Promoter Score (NPS) was 34 in the quarter and 38 in FY20, a solid metric of the winning combination of the Company’s best-in-market product and highly engaged Customer service team. GOL won the Top of Mind award for the fifth consecutive year as the most remembered airline in the country.

“The reputation of GOL among our Customers attests to our ability to adapt in the face of a global crisis that has fully reshaped the commercial airline sector. Without a doubt, this award has made the entire Team of Eagles proud,” commented Kakinoff. “We believe that maintaining consumer trust will be important both during and after the pandemic as Customers will choose to fly with airlines that have a strong track record of Service and Safety.”

Sustainability as a strategic driver: Through its Sustainability Policy, the Company has established a strategy for strengthening its environmental, social and governance practices. In 2020, GOL was the only Brazilian company to be included in a select list of 13 global airlines that received Stage 1 certification of the IATA Environmental Assessment, IEnvA, which is validation that the Company has developed a consistent environmental policy and is fulfilling its responsibilities.

During the pandemic, GOL is also supporting important health and social initiatives, including the free transportation of Health Professionals flying for work, free transportation of medicine and making its network available to government entities for the roll-out of vaccines. In 2020, the Company partnered with Albert Einstein Hospital, a leading authority on private and public healthcare in Brazil and Latin America, to develop an advisory project for assessing, restructuring and certifying its already strict hygiene measures against the spread of coronavirus in aircraft and airports. GOL is the first and only company in Brazil to obtain the Einstein Covid-19 Quality and Safety Standards seal of approval.

Sales: In the fourth quarter, consolidated gross sales reached approximately R$2.5 billion, 44% more than in 3Q20. GOL’s average daily sales exceeded R$27 million, which represents around 80% of pre-pandemic sales levels. With additional flights in December, passenger revenue increased 91% over 3Q20. In November, the Company’s Black Friday campaign resulted in the sale of over half a million tickets.

Kakinoff commented: “We saw a substantial spike in sales during the fourth quarter as passengers returned to the skies. We know the recovery won’t be linear, but this indicates how rapidly demand could return as the vaccine roll-out progresses in Brazil. We are prepared to meet that demand with our flexible, low-cost operating model.”

The Ministry of Health of Brazil expects to have 576 million doses of vaccines against Covid-19 by the end of this year, according to a document presented at a federal hearing in the Senate on March 4, 2021. Of these, 415 million have already been contracted, while 161 million are under negotiation. The forecast includes the Oxford-AstraZeneca, CoronaVac, Covaxin, Sputnik V, Johnson&Johnson Janssen, Pfizer-BioNTech and Moderna vaccines. The estimate also includes nine million doses received by the Covax consortium. Some of these vaccines have not yet obtained registration or approval for emergency use by Anvisa (Brazil's Health Regulatory Agency). The Ministry of Health foresees that all Brazilians can be vaccinated by the end of 2021.

Capacity: The Company maintains solid position in the main Brazilian commercial airports due to its established network and with main hubs at GRU, GIG, BSB and FOR. In addition, in July/20, GOL established a new hub in Salvador, through which the Company can explore new regional markets together with its strategic partners.

Celso complemented: “Capacity adjustment based on demand has always been a competitive advantage of the Company’s fleet management, enabling us to maintain significant flexibility to response to major traffic trends. We do not face the same concerns as our competitors with fleet complexity or exposure to large aircraft exclusively for the international market. During the pandemic, we continued to lead the industry in capacity management, maintaining high load factors consistent with the pre-pandemic period.”

Adjustments of network and fleet: Compared to 3Q20, daily flights doubled to 403 in 4Q20, serving 177 markets and representing 54% of the daily flights in 4Q19. 166 of those markets are operated by the Company and 11 are operated by GOL partners. GOL reopened six bases in Brazil this quarter: Carajás (CKS), Fernando de Noronha (FEN), Cruzeiro do Sul (CZS), Jericoacoara (JJD), Caldas Novas (CLV) and Cabo Frio (CFB). As a result, during the fourth quarter GOL once again operated all of the domestic network bases that were operating before the pandemic. The Company remains attentive to rulings issued by governments of other countries and demand behavior in order to guide when to operate its international network. The Company concluded its 2020 fleet plan adjustments and ended December with a total fleet of 127 B737s, including seven MAX and 95 aircraft in operation, an increase of 24 aircraft compared to the end of September/20.

Liquidity and financial obligations: In 2020, GOL’s Management fully honored its commitments to the global capital markets, including the amortization of its 2022 Senior Notes (US$78 million in 1Q20), and its Term Loan B in the amount US$300 million in 3Q20. During 4Q20, the Company amortized approximately R$1 billion in financial debt, significantly reducing its short-term debt, which is primarily concentrated with local banks with which GOL maintains good relationships. Including the financeable amounts of deposits and unencumbered assets, the Company’s potential liquidity sources total over R$5 billion. The average maturity of the GOL’s long-term debt, excluding aircraft leases and perpetual notes, is approximately three years.

“Even during this very challenging year, we kept our liability management discipline and addressed all the relevant financial obligations provided for in our cash flow. We ended 2020 by significantly reducing our short-term debt and have strengthened our solid partnership with the main providers of working capital. Our new secured debt program also shows that the Company’s decision to wait for the best moment and cost in accessing capital was correct and aligned with value creation, increasing financial flexibility and reinforcing capital structure,” said Richard Lark, CFO. “Our financial management since the beginning of this pandemic reflects GOL’s commitment to having a sound capital structure and our focus on minimizing costs and strengthening the balance sheet as we manage through to a greater recovery.”

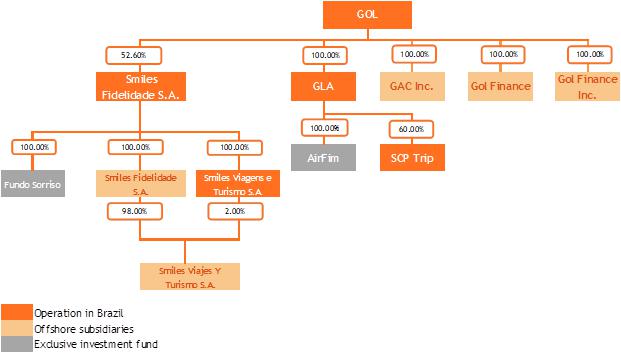

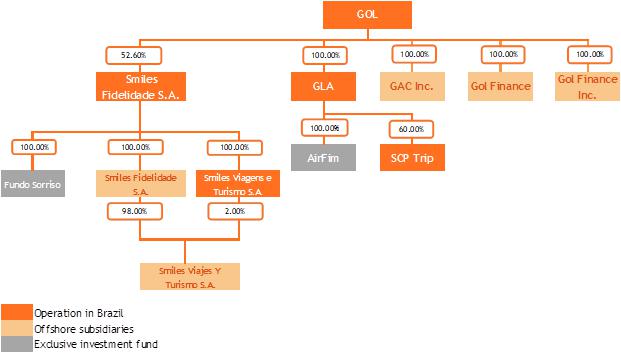

Proposal to Combine GLA and Smiles: In December, GOL and GLA (GOL Linhas Aéreas) submitted to Smiles’ Board of Directors a new proposal to combine the Company’s two operating subsidiaries, GLA, the largest domestic airline in Brazil, and Smiles, the loyalty and mileage program. With greater visibility on what is required to more efficiently manage its businesses, GOL believes the proposed transaction is an important milestone to maximize future value for both the Company and Smiles’ shareholders by increasing the GOL Group’s market competitiveness. As the Company manages through a challenging operating environment in Brazil, GOL believes the current situation makes the successful conclusion of this transaction even more critical for both companies and will reduce the risks both companies are facing during the pandemic. The proposed corporate merger has been submitted to the Company and Smiles’ shareholders for approval at a shareholders meeting to be held on March 24th.

Kakinoff commented: “We believe that this reorganization will ensure the continued necessary competitiveness of the airline and the loyalty program, simplify governance, strengthen the combined capital structure, and decrease operating, administrative and financial costs, which also reduces tax inefficiencies – thereby maximizing value for all shareholders of the GOL Group.”

Operating and Financial Indicators

| Traffic Data – GOL (in Millions) | 4Q20 | 4Q19 | % Var. | 2020 | 2019 | % Var. |

| RPK GOL – Total | 6,242 | 10,807 | -42.2% | 20,127 | 41,862 | -51.9% |

| RPK GOL –Domestic | 6,242 | 9,630 | -35.2% | 18,837 | 36,391 | -48.2% |

| RPK GOL – International | - | 1,176 | NM | 1,290 | 5,472 | -76.4% |

| ASK GOL – Total | 7,698 | 13,257 | -41.9% | 25,142 | 51,065 | -50.8% |

| ASK GOL – Domestic | 7,698 | 11,667 | -34.0% | 23,358 | 43,897 | -46.8% |

| ASK GOL – International | - | 1,590 | NM | 1,784 | 7,168 | -75.1% |

| GOL Load Factor – Total | 81.1% | 81.5% | -0.4 p.p. | 80.1% | 82.0% | -1.9 p.p. |

| GOL Load Factor – Domestic | 81.1% | 82.5% | -1.4 p.p. | 80.6% | 82.9% | -2.3 p.p. |

| GOL Load Factor – International | 0.0% | 74.0% | NM | 72.3% | 76.3% | -4.0 p.p. |

| Operating Data | 4Q20 | 4Q19 | % Var. | 2020 | 2019 | % Var. |

| Revenue Passengers - Pax on Board ('000) | 5,199 | 9,660 | -46.2% | 16,776 | 36,445 | -54.0% |

| Aircraft Utilization (Block Hours/Day) | 8.9 | 12.2 | -27.0% | 9.6 | 12.3 | -22.0% |

| Departures | 37,088 | 68,228 | -45.6% | 124,528 | 259,377 | -52.0% |

| Total Seats (‘000) | 6,525 | 12,142 | -46.3% | 21,540 | 45,574 | -52.7% |

| Average Stage Length (km) | 1,167 | 1,089 | 7.2% | 1,152 | 1,114 | 3.4% |

| Fuel Consumption (mm liters) | 216 | 382 | -43.5% | 722 | 1,475 | -51.1% |

| Full-time Employees (at Period End) | 13,899 | 16,113 | -13.7% | 13,899 | 16,113 | -13.7% |

| Average Operating Fleet(6) | 91 | 117 | -22.2% | 71 | 113 | -37.2% |

| On-time Departures | 92.5% | 86.2% | 6.3 p.p. | 93.7% | 89.0% | 4.7 p.p. |

| Flight Completion | 99.2% | 99.2% | 0.0 p.p. | 97.8% | 98.1% | -0.3 p.p. |

| Passenger Complaints (per 1,000 pax) | 0.56 | 0.88 | -36.4% | 0.92 | 1.12 | -17.9% |

| Lost Baggage (per 1,000 pax) | 2.07 | 2.08 | -0.5% | 2.10 | 2.09 | 0.5% |

| Financial Data | 4Q20 | 4Q19 | % Var. | 2020 | 2019 | % Var. |

| Net YIELD (R$ cents) | 27.55 | 33.17 | -16.9% | 28.74 | 31.24 | -8.0% |

| Net PRASK (R$ cents) | 22.34 | 27.04 | -17.4% | 23.00 | 25.61 | -10.2% |

| Net RASK (R$ cents) | 24.57 | 28.69 | -14.4% | 25.34 | 27.15 | -6.7% |

| CASK (R$ cents)(4) | 26.44 | 21.10 | 25.3% | 25.42 | 21.97 | 15.7% |

| CASK Ex-Fuel (R$ cents)(4) | 19.00 | 13.49 | 40.8% | 17.36 | 14.05 | 23.6% |

| Adjusted CASK(6) | 20.06 | 21.10 | -4.9% | 19.51 | 21.97 | -11.2% |

| Adjusted CASK(6) Ex-Fuel (R$ cents)(4) | 13.72 | 13.49 | 1.7% | 12.33 | 14.05 | -12.2% |

| Breakeven Load Factor(4) | 87.2% | 60.0% | 27.2 p.p. | 80.3% | 66.3% | 14.0 p.p. |

| Average Exchange Rate(1) | 5.3921 | 4.1158 | 31.0% | 5.1578 | 3.9461 | 30.7% |

| End of Period Exchange Rate(1) | 5.1967 | 4.0307 | 28.9% | 5.1967 | 4.0307 | 28.9% |

| WTI (Average per Barrel. US$)(2) | 41.44 | 56.87 | -27.1% | 39.13 | 57.04 | -31.4% |

| Price per Liter Fuel (R$)(3) | 2.32 | 2.71 | -14.4% | 2.55 | 2.79 | -8.6% |

| Gulf Coast Jet Fuel (Average per Liter, US$)(2) | 0.28 | 0.49 | -42.9% | 0.28 | 0.50 | -44.0% |

(1) Source: Brazilian Central Bank; (2) Source: Bloomberg; (3) Fuel expenses excluding hedge results and PIS/COFINS credits/liters consumed; (4) Excluding non-recurring expenses and Idle expenses. (5) Average operating fleet excluding aircraft in sub-leasing and MRO. Certain calculations may not match with the financial statements due to rounding. (6) Considers only expenses related to current operating levels (4Q20).

Domestic market

GOL’s domestic demand was 6,242 million RPK, a decrease by 35.2%, while ASK supply reduced 34.0% in comparison to 4Q19, and the load factor reached 81.1% in the quarter. The Company transported 5.2 million Clients during the quarter, a decrease of 43.3% compared with the same quarter in 2019. For the 5th consecutive year, GOL remains the leader in transporting passengers in Brazil.

International market

In 4Q20, the Company carried out non-regular charter flights for soccer teams and the Brazilian National Team in championships, related to its sponsorship of national teams. As most country borders were closed, GOL did not offer regular international flights.

Volume of Departures and Total Seats

The total volume of the Company’s departures was 37,088, a decrease of 45.6% over 4Q19. The total number of seats available to the market was 6.5 million in the fourth quarter of 2020, a decrease of 46.3% quarter-over-quarter.

PRASK, Yield and RASK

Net PRASK decreased by 17.4% in the quarter when compared to 4Q19, reaching 22.34 cents (R$), due to the decline of the levels of net passenger revenue and the ASK reduction of 41.9% in the quarter. GOL’s net RASK was 24.57 cents (R$) in 4Q20, a decrease of 14.4% over 4Q19. Net yield decreased 16.9% over 4Q19, reaching 27.55 cents (R$).

Net revenue

Net revenue within the quarter increased by 37% from October to December. Quarterly net revenue totaled R$1.9 billion, representing a decrease of 50.3% when compared to 4Q19, mainly due to the reduction in demand following the adoption of the social distancing by Customers and the closing of borders as a way of containing the worldwide contamination by Covid-19. Despite the significant decrease in the number of flights operated, cargo transportation revenues had a lower level of decrease, at 12.1%, mainly due to the launch in the quarter of CHEGOL, a new fast and efficient delivery service. Loyalty program revenues decreased 16.6% compared to 4Q19. In 2020, GOL achieved net revenue of R$6.4 billion, a 54.0% reduction compared to 2019.

Operating results

Adjusted EBIT for the quarter was R$346.8 million. Operating margin was 18.3%. On an available seat-kilometer basis, adjusted EBIT was 4.51 cents (R$). In 2020, adjusted EBIT reached R$1,554.2 million, with a margin of 24.4%, an increase of 5.3 p.p.

Adjusted EBITDA totaled R$558.5 million in the period. Adjusted EBITDA per available seat-kilometer was 7.25 cents (R$). In 2020, adjusted EBITDA reached R$2,469.0 million, with a margin of 38.7%, an increase of 7.2 p.p.

| EBIT and EBITDA reconciliation (R$ MM)* | 4Q20 | 4Q19 | % Var. | 2020 | 2019 | % Var. |

| Net Income (Loss) before NCI(1) | 234.5 | 747.6 | -68.6% | (4,962.2) | 691.6 | NM |

| (-) Income Taxes | 23.1 | 124.5 | -81.4% | 78.0 | 209.6 | -62.8% |

| (-) Financial Result | (401.7) | 134.1 | NM | 4,865.4 | 1,743.8 | 179.0% |

| EBIT(1) | (144.1) | 1,006.2 | NM | (18.8) | 2,645.0 | NM |

| EBIT Margin(1) | -7.6% | 26.5% | NM | -0.3% | 19.1% | NM |

| (-) Depreciation and Amortization | 276.9 | 458.5 | -39.6% | 1,105.1 | 1,728.0 | -36.0% |

| EBITDA(1) | 132.8 | 1,464.7 | -90.9% | 1,086.3 | 4,373.0 | -75.2% |

| EBITDA Margin(1) | 7.0% | 38.5% | -31.5 p.p. | 17.0% | 31.5% | -14.5 p.p. |

| Adjusted EBIT(2) | 346.8 | 1,006.2 | -65.5% | 1,554.2 | 2,645.0 | -41.2% |

| Adjusted EBIT Margin(2) | 18.3% | 26.5% | -8.2 p.p. | 24.4% | 19.1% | 5.3 p.p. |

| Adjusted EBITDA(2) | 558.5 | 1,464.7 | -61.9% | 2,469.0 | 4,373.0 | -43.5% |

| Adjusted EBITDA Margin(2) | 29.5% | 38.5% | -9.0 p.p. | 38.7% | 31.5% | 7.2 p.p. |

| EBITDA Calculation (R$ cents/ASK) | 4Q20 | 4Q19 | % Var. | 2020 | 2019 | % Var. |

| Net Revenues | 24.57 | 28.69 | -14.3% | 25.34 | 27.15 | -7.0% |

| Operating Expenses(1) | (26.44) | (21.10) | 25.1% | (25.42) | (21.97) | 15.5% |

| EBIT(1) | (1.87) | 7.59 | NM | (0.07) | 5.18 | NM |

| Depreciation and Amortization | (3.60) | (3.46) | 2.9% | (4.40) | (3.38) | 29.4% |

| EBITDA(1) | 1.73 | 11.05 | -84.5% | 4.32 | 8.56 | -50.0% |

| Adjusted EBIT(2) | 4.51 | 7.59 | -40.8% | 6.18 | 5.18 | 19.2% |

| Adjusted EBITDA(2) | 7.25 | 11.05 | -33.6% | 9.82 | 8.56 | 14.0% |

(1) Excluding non-recurring expenses and related to fleet idleness. * In accordance with CVM Instruction n.527, the Company presents the reconciliation of EBIT and EBITDA, whereby: EBIT = net income (loss) (+) income tax and social contribution (+) net financial result; and EBITDA = net income (loss) (+) income tax and social contributions (+) net financial result (+) depreciation and amortization. Some report values may differ from the financial statements due to rounding. (2) Considers expenses strictly related to current operating levels (3Q20).

Fleet

At the end of 4Q20, GOL's total fleet was 127 Boeing 737 aircraft, comprised of 120 NGs and seven (7) MAXs (operational). At the end of 4Q19, GOL's total fleet was 137 aircraft, of which seven (7) were MAXs (non-operational). The average age of the Company's fleet was 11.0 years at the end of 4Q20.

GOL does not operate widebody aircraft, and has no aircraft financed via the capital markets, EETCs or finance leases. Its operating fleet is 100% composed of narrowbody aircraft financed via operating leases.

| Total Fleet at the End of Period | 4Q20 | 4Q19 | % Var. | 3Q20 | % Var. |

| B737s | 127 | 137 | -10 | 129 | -2 |

| B737-7 NG | 23 | 24 | -1 | 22 | 1 |

| B737-8 NG | 97 | 106 | -9 | 100 | -3 |

| B737-8 MAX | 7 | 7 | 0 | 7 | 0 |

As of Dec. 31, 2020, GOL had 95 firm orders for the acquisition of Boeing 737 MAX aircraft, of which 73 were orders for 737 MAX-8 and 22 orders were for 737 MAX-10. The Company's fleet plan returns up to eleven (11) operational aircraft by the end of 2021, with the flexibility to return even more aircraft if necessary.

| Fleet Plan | 2021E | 2022E | 2023E | >2024E | Total |

| Operating Fleet at the End of the Year | 129 | 132 | | | |

| Aircraft Commitments (R$ MM) | - | - | 3,353.7 | 19,915.4 | 23,269.2 |

At the end of 4Q20, the Company concluded renegotiations for part of its aircraft and operating engine leasing contracts with no purchase option, which resulted in contractual modifications related to term extensions and new monthly amounts compared to the original terms of the contracts. Leasing remeasurement took into account the new payment flows, the discount rate and the exchange rate on the date of the contractual changes. The calculated effects were recorded as a reduction in the lease liability in the amount of R$15.0 million, with a corresponding reduction in fixed assets of R$7.4 million and a gain of R$22.4 million in the operating result.

Relationship with Independent Auditors

When hiring services that are not related to external auditing from its independent auditors, Smiles bases its conduct on principles that preserve the auditor’s independence. Pursuant to internationally accepted standards, these principles consist of: (a) the auditors must not audit their own work, (b) the auditors must not execute managing functions for their clients and (c) the auditors must not represent their clients’ legal interests.

Based on the subparagraph III, article 2 of the CVM Instruction 381/2003, the Company adopts a formal procedure to hire services other than external auditing from our auditors, to consult its Audit Committee to ensure that those services shall not affect the independence and the objectivity, required for the independent audit performance. Additionally, formal statements are required from the auditors regarding their independence while providing such services.

The Company informs that its independent auditor for the period, Grant Thornton Auditores Independentes (“GT”) as the Company’s independent auditor for purposes of meeting the requirements of the CVM and Ernst & Young Auditores Independentes S.S. (“EY”) as the Company’s independent auditor for purposes of meeting the requirements of the U.S. Securities and Exchange Commission, did not provide additional services not related to auditing in the 2020 fiscal year.

Comments on business forecast trends

In 1Q21, the Company estimates an average operating fleet of 74 aircraft, which will represent 67% of the average fleet operated in the same quarter of 2019. Revenue for the quarter ended March 2021 is expected to decrease approximately 10% compared to the quarter ended December 2020.

GOL expects to end 1Q21 with R$1.9 billion in liquidity and R$14.3 billion in adjusted net debt. Several important initiatives are relevant to ensure that the Company maintains liquidity at expected levels in 1Q21.

With the objective of assisting investors and analysts in understanding how GOL is approaching its short-term planning, the Company is sharing these metrics:

| Metrics | 4Q20A | 1Q21E

(Previous) | 1Q21E

(Revised) |

Brazil Quarterly GDP Growth1 (%) Domestic Routes Served (average) % of 2019 Average Operating Fleet % of 2019 ASK (in million) % of 2019 Load Factor (%) | +2.4% ~161 94% ~91 77% ~7,698 58% ~81% | +3.0% ~167 85% ~102 92% ~9,400 76% ~78% | +1.0% ~159 81% ~74 67% ~7,100 55% ~82% |

Net Operating Revenues (R$ BN) % of 2019 Capex (R$ MM) Net Cash Generation (Burn) (R$/day) | ~1.9 50% ~62 ~3 | ~2.4 66% ~290 ~(2) | ~1.7 52% ~100 ~(3) |

Total Liquidity2 (R$ BN) Net Debt3 (R$ BN) Net Debt / LTM EBITDA Ratio3,4 (x) | ~2.6 ~13.0 ~5.3x | ~2.5 ~13.1 ~8x | ~1.9 ~14.3 ~17x |

(1) Sequential; Source: Brazilian Central Bank.

(2) Cash and cash equivalents, restricted cash, accounts receivable, securities and receivables.

(3) Excluding perpetual bonds and exchangeable notes.

(4) Pro-forma, excluding non-operating expenses and depreciation.

Glossary of industry terms

| · | AIRCRAFT LEASING: an agreement through which a company (the lessor), acquires a resource chosen by its client (the lessee) for subsequent rental to the latter for a determined period. |

| · | AIRCRAFT UTILIZATION: the average number of hours operated per day by the aircraft. |

| · | AVAILABLE SEAT KILOMETERS (ASK): the aircraft seating capacity multiplied by the number of kilometers flown. |

| · | AVAILABLE FREIGHT TONNE KILOMETER (AFTK): cargo capacity in tonnes multiplied by number of kilometers flown. |

| · | AVERAGE STAGE LENGTH: the average number of kilometers flown per flight. |

| · | EXCHANGEABLE SENIOR NOTES (ESN): convertible securities. |

| · | BLOCK HOURS: the time an aircraft is in flight plus taxiing time. |

| · | BREAKEVEN LOAD FACTOR: the passenger load factor that will result in passenger revenues being equal to operating expenses. |

| · | BRENT: oil produced in the North Sea, traded on the London Stock Exchange and used as a reference in the European and Asian derivatives markets. |

| · | CHARTER: a flight operated by an airline outside its normal or regular operations. |

| · | FREIGHT LOAD FACTOR (FLF): percentage of cargo capacity that is actually utilized (calculated dividing FTK by AFTK) |

| · | FREIGHT TONNE KILOMETERS (FTK): weight of revenue cargo in tonnes multiplied by number of kilometers flown by such tonnes. |

| · | LESSOR: the party renting a property or other asset to another party, the lessee. |

| · | LOAD FACTOR: the percentage of aircraft seating capacity that is actually utilized (calculated by dividing RPK by ASK). |

| · | LONG-HAUL FLIGHTS: long-distance flights (in GOL's case, flights of more than four hours' duration). |

| · | OPERATING COST PER AVAILABLE SEAT KILOMETER (CASK): operating expenses divided by the total number of available seat kilometers. |

| · | OPERATING COST PER AVAILABLE SEAT KILOMETER EX-FUEL (CASK EX-FUEL): operating cost divided by the total number of available seat kilometers excluding fuel expenses. |

| · | OPERATING REVENUE PER AVAILABLE SEAT KILOMETER (RASK): total operating revenue divided by the total number of available seat kilometers. |

| · | PASSENGER REVENUE PER AVAILABLE SEAT KILOMETER (PRASK): total passenger revenue divided by the total number of available seat kilometers. |

| · | PDP: credit for advance payments for aircraft purchases financing. |

| · | REVENUE PASSENGERS: the total number of passengers on board who have paid more than 25% of the full flight fare. |

| · | REVENUE PASSENGER KILOMETERS (RPK): the sum of the products of the number of paying passengers on a given flight and the length of the flight. |

| · | SALE-LEASEBACK: a financial transaction whereby a resource is sold and then leased back, enabling use of the resource without owning it. |

| · | SLOT: the right of an aircraft to take off or land at a given airport for a determined period of time. |

| · | SUB-LEASE: an arrangement whereby a lessor in a rent agreement leases the item rented to a fourth party. |

| · | TOTAL CASH: the sum of cash, financial investments and short and long-term restricted cash. |

| · | WTI BARREL: West Texas Intermediate - the West Texas region, where US oil exploration is concentrated. Serves as a reference for the US petroleum byproduct markets. |

| · | YIELD PER PASSENGER KILOMETER: the average value paid by a passenger to fly one kilometer. |

About GOL Linhas Aéreas Inteligentes S.A.

GOL serves more than 36 million passengers annually. With Brazil's largest network, GOL offers customers more than 750 daily flights to over 100 destinations in Brazil and in South America, the Caribbean and the United States. GOLLOG’s cargo transportation and logistics business serves more than 3,400 Brazilian municipalities and more than 200 international destinations in 95 countries. SMILES allows over 16 million registered clients to accumulate miles and redeem tickets to more than 700 destinations worldwide on the GOL partner network. Headquartered in São Paulo, GOL has a team of approximately 15,000 highly skilled aviation professionals and operates a fleet of 128 Boeing 737 aircraft, delivering Brazil's top on-time performance and an industry leading 20-year safety record. GOL has invested billions of Reais in facilities, products and services and technology to enhance the customer experience in the air and on the ground. GOL's shares are traded on the NYSE (GOL) and the B3 (GOLL4). For further information, visit www.voegol.com.br/ir.

Disclaimer

This release contains forward-looking statements relating to the prospects of the business, estimates for operating and financial results and growth prospects of GOL. These forward-looking statements, which are subject to change without prior notice, reflect mere estimates and projections and are based exclusively on the expectations of GOL’s management at the time the forward-looking statements are made. Further, these forward-looking statements depend substantially on external factors, many of which are highly uncertain, including (i) macroeconomic developments in Brazil and volatility in exchange rates, interest rates and other economic indicators, (ii) developments relating to the spread of Covid-19, such as the duration and extent of quarantine measures and travel restrictions and the impact on overall demand for air travel, (iii) the competitive environment in the Brazilian airline market and government measures that may affect it, (iv) fuel price volatility and (v) the risks disclosed in GOL’s filings with the U.S. Securities and Exchange Commission.

Non-GAAP Measures

To be consistent with industry practice, GOL discloses so-called non-GAAP financial measures, which are not recognized under IFRS or U.S. GAAP, including “net debt,” “total liquidity” and “EBITDA.” GOL’s management believes that disclosure of non-GAAP measures provides useful information to investors, financial analysts and the public in their review of its operating performance and their comparison of its operating performance to the operating performance of other companies in the same industry and other industries. However, these non-GAAP measures do not have standardized meanings and may not be directly comparable to similarly-titled measures adopted by other companies. Potential investors should not rely on information not recognized under IFRS as a substitute for the IFRS measures of earnings or cash flow in making an investment decision.

Report of the Statutory Audit Committee (CAE)

The Statutory Audit Committee (“CAE”) is a statutory body linked to the Board of Directors of Gol Linhas Aéreas Inteligentes S.A. (“Company”), with three independent members who are members of the Board of Directors and are elected by the board members annually. One of these members is qualified as a Financial Specialist. Under the terms of its charter, CAE’s main duties include supervising the quality and integrity of financial reports and statements, the compliance with legal, regulatory and statutory standards, the compliance with the processes related to risk management, policies and procedures for internal controls and the activities of the internal auditors. In addition, CAE supervises the work of the independent auditors, including their independence, the quality, and adequacy of the services provided, in addition to any differences of opinion with the management and approves the fees charged by them. Provides for the registration and exercise of independent audit activity within the scope of the Brazilian securities market (CVM), in addition to performing the function of Audit Committee, in compliance with the provisions of the Sarbanes Oxley Act, to which the Company is subject as a company registered with the Securities and Exchange Commission (“SEC”). Transactions with related parties, activities related to monitoring risks and compliance and the functioning of the complaints channel installed are also supervised by the CAE.

The activities carried out by CAE, through 6 meetings, for the year ended December 31, 2020, include:

| · | The CAE coordinator established the agendas and chaired the CAE meetings; |

| · | Evaluated the annual work plan and discussed the results of the activities performed by the independent auditors for the 2020 fiscal year; |

| · | Supervised the activities and performance of the Company’s internal audit, analyzing the annual work plan, discussing the results of the activities performed and the reviews carried out. The issues raised by the internal audit about improvements in the internal control environment are discussed with the responsible members of the management/board to implement continuous improvements. |

| · | Supervised and analyzed the effectiveness, quality, and integrity of the internal control mechanisms, in order, among others, to monitor the compliance with the provisions related to the integrity of the financial statements, including the quarterly earnings release and other interim statements; |

| · | Jointly supervised with the Management and the internal audit the agreements of different nature between the Company or its subsidiaries, on the one hand, and the controlling shareholder, on the other hand, to verify the compliance with the Company’s policies and controls in relation to the operations with related parties; |

| · | Gathered together with the independent auditors, KPMG Auditores Independentes, until the issue of the quarterly earnings release for the three-month period ended March 31, 2020, succeeded by Grant Thornton Auditores Independentes, for purposes of complying with CVM requirements, and by Ernst & Young Auditores Independentes, for purposes of complying with U.S. Securities and Exchange Commission requirements, having dealt with, among others, the following subjects: relationship and communication between CAE and the external auditors, scope of the auditors’ work, as well as the conclusions presented through the work plan of the Independent Auditors; and |

· Prepared CAE’s activity and operations report in 2020, following good corporate governance practices, as well as the applicable regulations.

Internal Control Systems

Based on the agenda defined for the 2020 fiscal year, CAE addressed the main issues related to the Company’s internal controls, evaluating the actions to mitigate risks and the commitment of the top management to its continuous improvement.

As a result of the meetings with the Company’s internal areas, the Statutory Audit Committee had the opportunity to offer suggestions to the Board of Directors to improve the processes, supervising the results already obtained in 2020.

Based on the work carried out throughout 2020, CAE believes that the internal control system of the Company and its subsidiaries is appropriate to the size and complexity of its business and structured to guarantee the efficiency of its operations, of the systems that generate financial reports, as well as the compliance with applicable internal and external standards.

Management of Corporate Risks

CAE members, within their legal duties and responsibilities, received information from the Management on the relevant corporate risks, including continuity risks, making their assessments and recommendations to increase the effectiveness of risk management processes, directly at meetings of the Board of Directors, contributing and ratifying the actions implemented in 2020.

Conclusion

CAE deemed the facts submitted to the body at the time of the work carried out and described in this Report to be appropriate, recommending, in its opinion, the approval of the Company’s audited financial statements for the year ended on December 31, 2020.

São Paulo, March 17, 2021.

André Béla Jánszky

Member of the Statutory Audit Committee

Antônio Kandir

Member of the Statutory Audit Committee

Francis James Leahy Meaney

Member of the Statutory Audit Committee

Report of the Fiscal Council

The Fiscal Council of Gol Linhas Aéreas Inteligentes S.A., within its legal and statutory duties, having examined the Management’s Report, the Statements of financial position, the statements of operations, the comprehensive income statement, the cash flow statement, the statement of changes in the shareholders’ equity, the statement of added value and the respective notes, individual and consolidated, related to the fiscal year ended on December 31, 2020, and accompanied by the independent auditors’ report, issues an opinion that the aforementioned pieces duly reflect the Company’s equity situation and economic-financial position on December 31, 2020, recognizing that they are able to be deliberate by the annual Shareholders’ Meeting.

São Paulo, March 17, 2021.

Renato Chiodaro

Chairman of the Fiscal Council

Marcelo Moraes

Member of the Fiscal Council

Marcela de Paiva

Member of the Fiscal Council

Executive Officers’ Statement on the Financial Statements

In compliance with the provisions of CVM Instruction 480/09, the officers state that they have discussed, reviewed and agreed with the financial statements for the year ended on December 31, 2020.

São Paulo, March 17, 2021.

Paulo Sérgio Kakinoff

President and Chief Executive Officer

Richard Freeman Lark Jr.

Executive Vice President and Chief Financial Officer

Executive Officers’ Statement on the Independent Auditor’s Report

In compliance with the provisions in CVM Instruction 480/09, the Board states that it has discussed, reviewed and agreed with the opinion issued by Grant Thornton Auditores Independentes in the independent auditor report on the parent company and consolidated financial statements for the year ended on December 31, 2020.

São Paulo, March 17, 2021.

Paulo Sérgio Kakinoff

President and Chief Executive Officer

Richard Freeman Lark Jr.

Executive Vice President and Chief Financial Officer

(Free translation from the original issued in Portuguese. In the event of any discrepancies, the Portuguese language version shall prevail.)

Independent auditor’s report on the individual and consolidated financial statements

To the Shareholders, Directors and Management of

GOL Linhas Aéreas Inteligentes S.A.

São Paulo – SP

Opinion

We have audited the accompanying individual and consolidated financial statements of GOL Linhas Aéreas Inteligentes S.A. (the “Company”), identified as parent and consolidated, respectively, which comprise the statement of financial position as of December 31, 2020, and the respective statements of income, of comprehensive income, of changes in equity and of cash flows for the year then ended, and notes to the consolidated financial statements, including a summary of significant accounting policies.

Opinion on the individual financial statements

In our opinion, the individual financial statements referred to above present fairly, in all material respects, the financial position of GOL Linhas Aéreas Inteligentes S.A. as of December 31, 2020, and its financial performance and its cash flows for the year then ended, in accordance with accounting practices adopted in Brazil.

Opinion on the consolidated financial statements

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the consolidated financial position of GOL Linhas Aéreas Inteligentes S.A. as of December 31, 2020, and its consolidated financial performance and consolidated cash flows for the year then ended, in accordance with accounting practices adopted in Brazil and International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board (Iasb).

Basis for opinion

We conducted our audit in accordance with Brazilian and International Standards on Auditing (ISAs).

Our responsibilities under those standards are further described in the “Auditor’s responsibilities for the audit of the individual and consolidated financial statements” section of our report. We are independent of the Company and its subsidiaries in accordance with the relevant ethical requirements set forth in the Code of Ethics for Professional Accountants and the professional standards issued by the Federal Accounting Council and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Significant uncertainty as to the ability to continue as a going concern

We draw attention to Note 2, which states that the individual and consolidated financial statements were prepared under the going concern. Additionally, as described in Note 1, the Company faced recurring reductions in operations during 2020 mainly due to the effects of the COVID-19 pandemic, with a significant decrease in demand (a 56% reduction in passengers revenues in 2020 compared to 2019), and recorded net working capital deficit and equity deficiency as of December 31, 2020, which, together with other events and conditions, indicate the existence of material uncertainty that may cast significant doubt about the Company’s ability to continue as a going concern. The plans and actions being developed by Management to restore the Company’s financial-economic balance and financial position are described in Note 1. The individual and consolidated financial statements do not include any adjustments that may arise from the result of such uncertainties. Our opinion is not qualified regarding this matter.

Key audit matters

Key audit matters are those matters that, in our judgment, were of most significance in our audit in the current period. These matters were addressed in the context of our audit of the individual and consolidated financial statements taken as a whole and in forming our opinion on such individual and consolidated financial statements, and, therefore, we do not provide a separate opinion on these matters. In addition to the matter described in the “Significant uncertainty as to the ability to continue as a going concern” section, we determined that the matters below are the key audit matters that should be communicated in our report.

1. Passengers transport revenues (Notes 4.18.1, 8 and 29)

Why the matter was determined to be a key audit matter

As of December 31, 2020, the Company's passengers transportation revenues amounted to R$ 5,958 million, being recognized when the transportation service is provided. The process of recognizing this revenue is highly dependent on information technology systems, in addition to considering other complex aspects that may affect its recognition, such as the registration of tickets sold and not flown (and respective liabilities), among others. As a consequence, this matter was considered as a key audit matter and an area of focus in our audit due to its relevance in the context of the individual and consolidated financial statements, since the audit of passengers transport revenues, including the respective information generated by the environment of information technology mentioned above, required the performance of audit procedures with the involvement of our information technology specialists that, among other procedures, examined the design and carried out evaluation and tests of the integrity of the information technology environment, aiming to verify its sufficiency in the recognition of passengers transport revenues.

How the matter was addressed in our audit

Our audit procedures included, among others:

| · | with the involvement of our specialists in audit of systems, we identified the relevant systems that support the Company's passengers revenue recognition process, evaluated the design of the general controls of the processing environment and tested the operational effectiveness of these controls, including, when necessary, the tests of compensatory controls related to the operation, information security, development and maintenance of relevant systems focused on the aforementioned process; |

| · | we reviewed the design of the controls and performed audit procedures to test the records obtained from the information technology systems related to the transaction records of tickets sold, tickets flown and respective revenue recognition; |

| · | we carried out tests of details in the respective transactions and tests in the reconciliations provided by the Company; |

| · | evaluated if the disclosures in the individual and consolidated financial statements consider relevant information.

|

Based on results of the auditing procedures previously described, we considered that the balances related to passengers transport revenues, as well as the respective disclosures, are acceptable in the context of the individual and consolidated financial statements taken as a whole. However, as a result of the aforementioned procedures, we identified a significant deficiency in the Information Technology systems that did not result in adjustments or reclassifications in the individual and consolidated financial statements.

2. Impairment of intangible assets – goodwill and airport slot rights (Note 16)

Why the matter was determined to be a key audit matter

As of December 31, 2020, the Company’s intangible assets having indefinite useful life (goodwill and airport slot rights) amounted to R$1,581 million. As discussed in Note 16 to the individual and consolidated financial statements, such assets are tested for impairment at least annually for each cash-generating unit. The auditing procedures to determine that the goodwill and the Company’s airport slot rights are adequate and recorded at their recoverable values are activities that require complex calculations and evaluations to be made due to the significant uncertainty inherent in the process of estimating and determining the recoverable use in use of said assets. The analyses performed include complex, significant and highly subjective assumptions that are used by Management, such as discount rates, exchange rates, aviation kerosene barrel price, among others. These assumptions are prospective and may be affected by future economic and market conditions, impacting the individual and consolidated financial statements. Due to these aspects, this issue was considered a key audit matter in our audit for the current year.

How the matter was addressed in our audit

Our audit procedures included, among others:

| · | examine the analysis prepared by Management, supported by our internal specialists, to evaluate the reasonableness of the model used in Management´s evaluation, the logical and arithmetic adequacy of the cash flow projections as well as test the consistency of the key information and assumptions used in cash flows projections by comparing them to budgets approved by management and the assumptions, market inputs and current industry trends (in addition to the Company´s historical results); |

| · | discussion with Management about the business plan; |

| · | challenging the assumptions used by Management in order to corroborate if there were assumptions not consistent and/or that might be revised; |

| · | sensitivity analysis for significant assumptions to evaluate the change in the assets’ value in use resulting from changes and assumptions; |

| · | analyzes and evaluation of the disclosures required in the individual and consolidated financial statements for consistency with the information and representations obtained from Management.

|

Based on the procedures performed, we considered that the assumptions and methodologies used by the Company to evaluate the recoverable value of such assets are reasonable, and the information presented in the individual and consolidated financial statements is consistent with the information analyzed in our auditing procedures in the context of those individual and consolidated financial statements taken as a whole.

Other matters

Statements of value added

The individual and consolidated statements of value added (DVA) for the year ended December 31, 2020, prepared under the responsibility of the Company’s management and presented as supplemental information for IFRS purposes, have been subject to auditing procedures which were performed together with the audit of the Company’s financial statements. In forming our opinion, we evaluated if these statements are reconciled to the financial statements and accounting records, as applicable, and if their form and content are in accordance with the criteria defined in NBC TG 09 – Statement of Value Added. In our opinion, these statements of value added were appropriately prepared, in all material respects, according to the criteria defined in said technical pronouncement and are consistent in relation to the individual and consolidated financial statements taken as a whole.

Audit of the figures corresponding to the comparative year

The examination of the individual and consolidated financial statements as of December 31, 2019, which corresponding figures are presented for comparison purposes, was conducted under the responsibility of another independent auditor, which issued a report thereon dated February 28, 2020 without modifications (containing an emphasis-of-matter paragraph regarding the corporate reorganization plan then under discussion).

Other information accompanying the individual and consolidated financial statements and auditor’s report thereon

The Company’s Management is responsible for this other information that is included in the Management Report.

Our opinion on the individual and consolidated financial statements does not cover the Management Report and we do not express any form of assurance conclusion thereon.

In connection with our audit of the individual and consolidated financial statements, our responsibility is to read the Management Report and, in doing so, consider whether this report is materially inconsistent with the financial statements or our knowledge obtained in the audit, or otherwise, appears to be materially misstated. If, based on the work we have performed, we conclude that there is a material misstatement in the Management Report, we are required to report this fact. We have nothing to report in this regard.

Responsibilities of Management and those charged with governance for the individual and consolidated financial statements

Management is responsible for the preparation and fair presentation of the individual and consolidated financial statements in accordance with accounting practices adopted in Brazil and International Financial Reporting Standards (IFRS), issued by the International Accounting Standards Board (IASB), and for such internal control as management determines is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the individual and consolidated financial statements, management is responsible for assessing the Company’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting in preparing the financial statements, unless management either intends to liquidate the Company or to cease operations, or has no realistic alternative but to do so.

Those charged with the Company’s and its subsidiaries’ governance are responsible for overseeing the financial reporting process.

Auditor’s responsibility for the audit of the individual and consolidated financial statements

Our objectives are to obtain reasonable assurance about whether the individual and consolidated financial statements, taken as a whole, are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with Brazilian and International Standards on Auditing will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements.

As part of an audit in accordance with Brazilian and International Standards on Auditing, we exercise professional judgment and maintain professional skepticism throughout the audit. We also:

| · | identify and assess the risks of material misstatement of the individual and consolidated financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve override of internal control, collusion, forgery, intentional omissions or misrepresentations; |

| · | obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s and its subsidiaries’ internal control; |

| · | evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management; |

| · | conclude on the appropriateness of management’s use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Company’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditor’s report to the related disclosures in the individual and consolidated financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditor’s report. However, future events or conditions may cause the Company to cease to continue as a going concern; |

| · | evaluate the overall presentation, structure and content of the financial statements, including the disclosures, and whether the individual and consolidated financial statements represent the underlying transactions and events in a manner that achieves fair presentation; |

| · | obtain sufficient and appropriate audit evidence regarding the financial statements of the entities or business activities within the Group to express an opinion on the individual and consolidated financial statements. We are responsible for the direction, supervision and performance of the group audit and, consequently, for the audit opinion. |

We communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we may have identified during our audit.

We also provide those charged with governance with a statement that we have complied with relevant ethical requirements, including those regarding independence, and communicate to them all relationships and other matters that may reasonably be thought to bear on our independence and, where applicable, related safeguards.

From the matters communicated with those charged with governance, we determined those matters that were of most significance in the audit of the financial statements for the current year and are, therefore, the key audit matters. We describe these matters in our audit report, unless law or regulation preclude public disclosure about the matter or when, in extremely rare circumstances, we determine that a matter should not be communicated in our report because the adverse consequences of doing so would reasonably be expected to outweigh the public interest benefits of such communication.

São Paulo, March 17, 2021

Daniel Gomes Maranhão Junior

Grant Thornton Auditores Independentes

| Balance Sheets December 31, 2020 and 2019 (In thousand of Reais) |

| | | Parent Company | Consolidated |

| Assets | Note | 2020 | 2019 | 2020 | 2019 |

| | | | | | |

| Current | | | | | |

| Cash and Cash Equivalents | 5 | 423,937 | 1,016,746 | 662,830 | 1,645,425 |

| Financial Investments | 6 | 236 | 673 | 628,343 | 953,762 |

| Restricted Cash | 7 | 4,194 | 6,399 | 355,769 | 304,920 |

| Trade Receivables | 8 | - | - | 739,699 | 1,229,530 |

| Inventories | 9 | - | - | 195,638 | 199,213 |

| Advances to Suppliers and Third-Parties | 10 | 10,441 | 37 | 318,769 | 142,338 |

| Taxes to Recover | 11 | 6,295 | 5,163 | 186,955 | 309,674 |

| Rights from Derivative Transactions | 34.2 | - | - | 12,526 | 3,500 |

| Dividends and Interest on Shareholders’ Equity to Receive | 28.1 | 24,120 | 69,548 | - | - |

| Other Credits | | 9,640 | 10,039 | 144,822 | 139,015 |

| Total Current | | 478,863 | 1,108,605 | 3,245,351 | 4,927,377 |

| | | | | | |

| Noncurrent | | | | | |

| Financial Investments | 6 | - | - | 992 | - |

| Restricted Cash | 7 | 7 | - | 188,838 | 139,386 |

| Deposits | 13 | 118,261 | 112,502 | 2,058,455 | 1,968,355 |

| Advances to Suppliers | 10 | - | - | 89,701 | 48,387 |

| Taxes to Recover | 11 | 12,102 | 22,449 | 318,404 | 174,142 |

| Deferred Taxes | 12 | 53,492 | 56,903 | 53,563 | 59,809 |

| Other Credits | | - | - | 34,338 | 991 |

| Credits with Related Parties | 28.1 | 4,897,331 | 3,440,701 | - | - |

| Rights from Derivative Transactions | 34.2 | 87,663 | 143,969 | 116,283 | 143,969 |

| Investments | 14 | 574,717 | 501,986 | 815 | 1,254 |

| Property, Plant & Equipment | 15 | 68,660 | 240,379 | 4,960,288 | 6,058,101 |

| Intangible Assets | 16 | - | - | 1,747,108 | 1,776,675 |

| Total Noncurrent | | 5,812,233 | 4,518,889 | 9,568,785 | 10,371,069 |

| | | | | | |

| Total | | 6,291,096 | 5,627,494 | 12,814,136 | 15,298,446 |

The accompanying notes are an integral part of these financial statements - parent company and consolidated.

| Balance Sheets December 31, 2020 and 2019 (In thousand of Reais) |

| | | Parent Company | Consolidated |

| Liabilities | Note | 2020 | 2019 | 2020 | 2019 |

| | | | | | |

| Current | | | | | |

| Loans and Financing | 17 | 638,964 | 1,359,547 | 2,353,279 | 2,543,039 |

| Leases to Pay | 18 | - | - | 1,317,008 | 1,404,712 |

| Suppliers | 19 | 72,702 | 19,116 | 1,612,536 | 1,286,275 |

| Suppliers - Forfaiting | 20 | - | - | - | 554,467 |

| Labor Obligations | | 181 | 137 | 334,670 | 396,010 |

| Taxes to Collect | 21 | 292 | 4,261 | 73,614 | 116,523 |

| Landing Fees | | - | - | 907,958 | 728,339 |

| Advance Ticket Sales | 22 | - | - | 2,050,799 | 1,966,148 |

| Frequent-Flyer Program | 23 | - | - | 1,258,502 | 1,009,023 |

| Advances from Customers | | - | - | 27,897 | 16,424 |

| Provisions | 24 | - | - | 169,381 | 203,816 |

| Obligations with Derivative Transactions | 34.2 | - | - | 5,297 | 9,080 |

| Other Liabilities | | - | - | 287,275 | 128,744 |

| Total Current | | 712,139 | 1,383,061 | 10,398,216 | 10,362,600 |

| | | | | | |

| Noncurrent | | | | | |

| Loans and Financing | 17 | 6,990,749 | 5,235,593 | 7,623,687 | 5,866,802 |

| Leases to Pay | 18 | - | - | 6,267,184 | 4,648,068 |

| Suppliers | 19 | - | - | 32,658 | 10,142 |

| Taxes to Collect | 21 | - | - | 32,362 | 84 |

| Frequent-Flyer Program | 23 | - | - | 322,460 | 171,651 |

| Provisions | 24 | - | - | 1,353,515 | 1,053,240 |

| Deferred Taxes | 12 | - | - | 219,634 | 244,041 |

| Obligations to Related Parties | 28.1 | 8,791 | 163,350 | - | - |

| Obligations with Derivative Transactions | 34.2 | - | - | - | 11,270 |

| Provision for Investment Losses | 14 | 12,670,479 | 6,498,660 | - | - |

| Other Liabilities | | 316,030 | 23,501 | 331,479 | 35,965 |

| Total Noncurrent | | 19,986,049 | 11,921,104 | 16,182,979 | 12,041,263 |

| | | | | | |

| Shareholders’ Equity | | | | | |

| Share Capital | 25.1 | 3,009,436 | 3,008,178 | 3,009,436 | 3,008,178 |

| Shares to Issue | | 1,180 | 584 | 1,180 | 584 |

| Treasury Shares | 25.2 | (62,215) | (102,543) | (62,215) | (102,543) |

| Capital Reserves | | 207,246 | 225,276 | 207,246 | 225,276 |

| Equity Valuation Adjustments | | (577,369) | 188,247 | (577,369) | 188,247 |

| Accumulated Losses | | (16,985,370) | (10,996,413) | (16,985,370) | (10,996,413) |

| Negative Shareholders’ Equity (Deficit) Attributable to the Parent Company | | (14,407,092) | (7,676,671) | (14,407,092) | (7,676,671) |

| | | | | | |

| Non-Controlling Interests | | - | - | 640,033 | 571,254 |

| Total Shareholders’ Equity (Deficit) | | (14,407,092) | (7,676,671) | (13,767,059) | (7,105,417) |

| | | | | | |

| Total | | 6,291,096 | 5,627,494 | 12,814,136 | 15,298,446 |

The accompanying notes are an integral part of these financial statements - parent company and consolidated.

| Statements of Comprehensive Income Fiscal year ended on December 31, 2020 and 2019 (In thousands of Brazilian Reais - R$) |

| | | Parent Company | | Consolidated |

| | Note | 2020 | 2019 | | 2020 | 2019 |

| Net Revenue | | | | | | |

| Passenger | | - | - | | 5,783,323 | 13,077,743 |

| Cargo and Others | | - | - | | 588,494 | 786,961 |

| Total Net Revenue | 29 | - | - | | 6,371,817 | 13,864,704 |

| | | | | | | |

| Cost from Services | 30 | - | - | | (5,653,305) | (9,807,028) |

| Gross Profit | | - | - | | 718,512 | 4,057,676 |

| | | | | | | |

| Operating Revenues (Expenses) | | | | | | |

| Selling Expenses | | - | - | | (465,898) | (902,669) |

| Administrative Expenses | | (44,506) | (212,783) | | (1,319,981) | (1,341,698) |

| Other Revenues and Expenses, Net | | 379,133 | 43,054 | | 115,962 | 319,353 |

| Total Operating Expenses | 30 | 334,627 | (169,729) | | (1,669,917) | (1,925,014) |

| | | | | | | |

| Equity Income (Expenses) | 14 | (5,326,571) | 509,926 | | (439) | 77 |

| | | | | | | |

| Operating Profit (Loss) before Financial Results and Income Taxes | | (4,991,944) | 340,197 | | (951,844) | 2,132,739 |

| | | | | | | |

| Financial results | | | | | | |

| Financial income | | 528,365 | 155,838 | | 736,969 | 389,563 |

| Financial expenses | | (781,610) | (550,278) | | (2,546,192) | (1,748,265) |

| Total financial results | 31 | (253,245) | (394,440) | | (1,809,223) | (1,358,702) |

| | | | | | | |

| Income (Expenses) before Exchange Rate Variation, Net | | (5,245,189) | (54,243) | | (2,761,067) | 774,037 |

| | | | | | | |

| Exchange rate variation, net | 31 | (733,302) | (87,133) | | (3,056,226) | (385,092) |

| | | | | | | |

| (Loss) Income before Income Taxes | | (5,978,491) | (141,376) | | (5,817,293) | 388,945 |

| | | | | | | |

| Income taxes | | | | | | |

| Current | | (6,226) | (8,591) | | (95,537) | (178,621) |

| Deferred | | (3,411) | 32,694 | | 17,579 | (30,986) |

| Total income taxes | 12 | (9,637) | 24,103 | | (77,958) | (209,607) |

| | | | | | | |

| Net Income (Loss) for the Fiscal Year | | (5,988,128) | (117,273) | | (5,895,251) | 179,338 |

| | | | | | | |

| Attributable to: | | | | | | |

| Shareholders of the Parent Company | | (5,988,128) | (117,273) | | (5,988,128) | (117,273) |

| Non-Controlling Shareholders | | - | - | | 92,877 | 296,611 |

| | | | | | | |

| Basic Loss | 26 | | | | | |

| Per Common Share | | (0.481) | (0.010) | | (0.481) | (0.010) |

| Per Preferred Share | | (16.831) | (0.333) | | (16,831) | (0.333) |

| | | | | | | |

| Diluted Loss | 26 | | | | | |

| Per Common Share | | (0.481) | (0.010) | | (0.481) | (0.010) |

| Per Preferred Share | | (16.831) | (0.333) | | (16.831) | (0.333) |

The accompanying notes are an integral part of these financial statements - parent company and consolidated.

| Statements of Comprehensive Income Fiscal year ended on December 31, 2020 and 2019 (In thousands of Brazilian Reais - R$) |

| | Parent Company | | Consolidated |

| | 2020 | 2019 | | 2020 | 2019 |

| | | | | |

| Net Income (Loss) for the Fiscal Year | (5,988,128) | (117,273) | | (5,895,251) | 179,338 |

| | | | | | |

| Other Comprehensive Income that will be Reversed to Income (Expenses) | | | | | |

| | | | | | |

| Cash Flow Hedge, Net of Income Tax and Social Contribution | (781,033) | (30,021) | | (781,033) | (30,021) |

| Actuarial (Gains) Losses from Pension Plans and Post-Employment Benefits, Net of Income Tax and Social Contribution | 14,376 | (41,045) | | 13,921 | (41,045) |

| Cumulative Adjustment of Conversion into Subsidiaries | 564 | - | | 1,010 | - |

| | (766,093) | (71,066) | | (766,102) | (71,066) |

| | | | | | |

| Total Comprehensive Income (Expenses) for the Fiscal Year | (6,754,221) | (188,339) | | (6,661,353) | 108,272 |

| | | | | | |

| Comprehensive Income (Expenses) Attributed to: | | | | | |

| Shareholders of the Parent Company | (6,754,221) | (188,339) | | (6,754,221) | (188,339) |

| Non-Controlling Shareholders | - | - | | 92,868 | 296,611 |

The accompanying notes are an integral part of these financial statements - parent company and consolidated.

| Statements of Changes in Shareholders’ Equity Fiscal year ended on December 31, 2020 and 2019 (In thousands of Brazilian Reais - R$) |

| Parent Company and Consolidated |

| | | | | Capital Reserves | Equity Valuation Adjustments | | | | |

| | Share Capital | Shares to Issue | Treasury Shares | Premium when Granting Shares | Special Premium Reserve of the Subsidiary | Share-Based Compensation | Unrealized Income (Expenses) on Hedge | Post-Employment Benefits | Other Comprehensive Income (Expenses) | Effects from Changes in the Equity Interest | Accumulated Losses | Negative Shareholders’ Equity (Deficit) Attributable to the Parent Company | Non-Controlling Interests | Total |

| Balances on December 31, 2018 | 2,942,612 | 2,818 | (126) | 17,497 | 70,979 | 117,413 | (500,022) | - | - | 759,984 | (8,396,567) | (4,985,412) | 480,061 | (4,505,351) |

| | | | | | | | | | | | | | | |

| Initial Adoption of Accounting Standard - CPC 06 (IFRS 16) | - | - | - | - | - | - | - | - | - | - | (2,482,573) | (2,482,573) | (256) | (2,482,829) |

| Adjusted Balance on January 1, 2019 | 2,942,612 | 2,818 | (126) | 17,497 | 70,979 | 117,413 | (500,022) | - | - | 759,984 | (10,879,140) | (7,467,985) | 479,805 | (6,988,180) |

| Other Comprehensive Income (Expenses), Net | - | - | - | - | - | - | (30,021) | (41,045) | - | - | - | (71,066) | - | (71,066) |

| Net Income (Loss) for the Fiscal Year | - | - | - | - | - | - | - | - | - | - | (117,273) | (117,273) | 296,611 | 179,338 |

| Total Comprehensive Income (Expenses) for the Fiscal Year | - | - | - | - | - | - | (30,021) | (41,045) | - | - | (117,273) | (188,339) | 296,611 | 108,272 |

| Capital Increase due to Stock Options Exercised | 65,566 | (2,818) | - | - | - | 7,137 | - | - | - | - | - | 69,885 | 2,366 | 72,251 |

| Advances for Future Capital Increase | - | 584 | - | - | - | - | - | - | - | - | - | 584 | - | 584 |

| Effects from Dilution in the Equity Interest | - | - | - | - | - | - | - | - | - | (649) | - | (649) | 649 | - |

| Share Buyback | - | - | (102,417) | - | - | - | - | - | - | - | - | (102,417) | - | (102,417) |

| Subscription Bonus | - | - | - | - | 12,250 | - | - | - | - | - | - | 12,250 | - | 12,250 |

| Interest on Shareholders’ Equity Distributed by the Subsidiary Smiles | - | - | - | - | - | - | - | - | - | - | - | - | (208,177) | (208,177) |

| Balances on December 31, 2019 | 3,008,178 | 584 | (102,543) | 17,497 | 83,229 | 124,550 | (530,043) | (41,045) | - | 759,335 | (10,996,413) | (7,676,671) | 571,254 | (7,105,417) |

| | | | | | | | | | | | | | | |

| Other Comprehensive Income (Expenses), Net | - | - | - | - | - | - | (781,033) | 14,376 | 564 | - | - | (766,093) | (9) | (766,102) |

| Loss for the Fiscal Year | - | - | - | - | - | - | - | - | - | - | (5,988,128) | (5,988,128) | 92,877 | (5,895,251) |

| Total Comprehensive Income (Expenses) for the Fiscal Year | - | - | - | - | - | - | (781,033) | 14,376 | 564 | - | (5,988,128) | (6,754,221) | 92,868 | (6,661,353) |

| Capital Increase due to Stock Options Exercised | 1,258 | (584) | - | - | - | - | - | - | - | - | - | 674 | - | 674 |

| Advances for Future Capital Increase | - | 1,180 | - | - | - | - | - | - | - | - | - | 1,180 | - | 1,180 |

| Transfer of Treasury Shares | - | - | 40,328 | - | - | (40,328) | - | - | - | - | - | - | - | - |

| Stock Option | - | - | - | - | - | 22,298 | - | - | - | - | - | 22,298 | 1,132 | 23,430 |

| Effects from Dilution in the Equity Interest | - | - | - | - | - | - | - | - | - | 477 | (829) | (352) | 352 | - |

| Interest on Shareholders’ Equity Distributed by the Subsidiary Smiles | - | - | - | - | - | - | - | - | - | - | - | - | (25,573) | (25,573) |

| Balances on December 31, 2020 | 3,009,436 | 1,180 | (62,215) | 17,497 | 83,229 | 106,520 | (1,311,076) | (26,669) | 564 | 759,812 | (16,985,370) | (14,407,092) | 640,033 | (13,767,059) |

The accompanying notes are an integral part of these financial statements - parent company and consolidated.

| Statements of Cash Flows Fiscal year ended on December 31, 2020 and 2019 (In thousands of Brazilian Reais - R$) |

| | Parent Company | Consolidated |

| | 2020 | 2019 | 2020 | 2019 |

| | | | | |

| Net Income (Loss) for the Fiscal Year | (5,988,128) | (117,273) | (5,895,251) | 179,338 |

| Adjustments to Reconcile the Net Profit (Loss) to Cash Generated from Operating Activities | | | | |

| Depreciation and Amortization | - | - | 1,870,552 | 1,727,982 |

| Provision for Doubtful Accounts | - | - | 1,095 | 5,668 |

| Provision for Legal Proceedings | - | - | 288,803 | 195,465 |

| Provisions for Inventory Obsolescence | - | - | 702 | 2,168 |

| Provision for Losses on Advance of Suppliers | - | 161,228 | 31,486 | 161,228 |

| Adjustment to Present Value of Assets and Liabilities | - | - | 63,493 | 10,604 |

| Deferred Taxes | 3,411 | (32,694) | (17,579) | 30,986 |

| Equity Income (Loss) | 5,326,571 | (509,926) | 439 | (77) |

| Share-Based Compensation | - | - | 23,430 | 40,725 |

| Sale-Leaseback | (372,712) | - | (551,942) | - |

| Actuarial Losses from Post-Employment Benefits | - | - | 10,677 | 4,907 |

| Foreign Exchange and Monetary Variation, Net | 872,622 | 82,657 | 3,114,032 | 399,174 |

| Interest on Loans and Leases | 472,956 | 344,192 | 1,545,847 | 1,126,527 |

| Provision for Aircraft and Engine Return | - | - | (58,702) | 231,821 |

| Provision for Maintenance Reserve and Deposits | - | - | 186,856 | 75,451 |

| Income (Expenses) from Derivatives Recognized in Income (Expenses) | 74,728 | 23,230 | 732,398 | 22,022 |

| Unrealized Income (Expenses) on Derivatives – ESN (*) | (374,994) | (40,717) | (374,994) | (40,717) |

| Extinction of Obligation due to the Reduced Contractual Term | - | - | (104,109) | (275,921) |

| Provision for Labor Obligations | - | - | 227,710 | 280,320 |

| Write-off of Property, Plant & Equipment and Intangible Assets | - | 3,301 | 96,594 | 152,017 |

| Other Provisions | - | - | (7,416) | (14,602) |

| Adjusted Net Income (Expenses) | 14,454 | (86,002) | 1,184,121 | 4,315,086 |

| | | | | |

| Changes in Operating Assets and Liabilities: | | | | |

| Trade Receivables | - | - | 498,901 | (384,147) |

| Financial Investments | 6,480 | 169,052 | (6,320) | 162,167 |

| Inventories | - | - | 2,873 | (21,240) |

| Advances to Suppliers and Third-Parties | (10,404) | (161,265) | (238,627) | (305,906) |

| Deposits | 9,361 | (2,141) | (52,016) | (399,345) |

| Taxes to Recover | 13,465 | 2,456 | (21,543) | (27,147) |

| Variable Leases | - | - | 18,731 | - |

| Suppliers | 53,682 | 8,335 | 392,236 | (232,021) |

| Suppliers - Forfaiting | - | - | (143,010) | 188,771 |

| Advance Ticket Sales | - | - | 84,651 | 292,161 |

| Frequent-Flyer Program | - | - | 400,288 | 161,821 |

| Advances from Customers | - | - | 11,473 | (153,543) |

| Labor Obligations | 44 | (341) | (289,050) | (253,074) |

| Landing Fees | - | - | 179,619 | 172,039 |

| Taxes to Collect | 372 | (20,375) | 82,716 | 179,706 |

| Obligations with Derivative Transactions | - | - | (779,462) | (167,556) |

| Payments for Lawsuits and Aircraft Return | - | - | (301,297) | (317,591) |

| Other Credits (Obligations) | 292,927 | (24,780) | 444,990 | (48,851) |

| Interest Paid | (515,278) | (330,824) | (619,557) | (470,794) |

| Income Tax Paid | (4,341) | (984) | (95,781) | (229,460) |

| Net Cash Flows from (Used in) Operating Activities | (139,238) | (446,869) | 753,936 | 2,461,076 |

| | | | | |

| Loans Receivable from Related Parties | (680,441) | (758,935) | - | - |

| Financial Investments in Subsidiary | - | - | 271,935 | (501,607) |

| Restricted Cash | 2,198 | 33,385 | (100,301) | 377,826 |

| Interests Received | - | 5,950 | - | - |

| Dividends and Interest on Shareholders’ Equity Received through Subsidiary | 69,548 | 234,831 | - | - |

| Advances for Property, Plant & Equipment Acquisition, Net | - | (40,982) | (96,537) | (30,804) |

| Aircraft Sales Received | 448,482 | 348,389 | 448,482 | 348,389 |

| Return of Advance for Property, Plant and Equipment Acquisition | 73,600 | - | 73,600 | - |

| Acquisition of Property, Plant & Equipment | (10,419) | - | (501,416) | (872,570) |

| Acquisition of Intangible Assets | - | - | (63,993) | (75,845) |

| Net Cash Used in Investment Activities | (97,032) | (177,362) | 31,770 | (754,611) |

| Statements of Cash Flows Fiscal year ended on December 31, 2020 and 2019 (In thousands of Brazilian Reais - R$) |

| | Parent Company | Consolidated |

| | 2020 | 2019 | 2020 | 2019 |

| | | | | |

| | | | | |

| Funding from Loans and Leases | 2,357,656 | 1,638,011 | 2,933,529 | 2,194,662 |

| Loan Payments | (2,880,439) | (50,320) | (3,748,239) | (793,537) |

| Lease Payments | - | - | (1,058,692) | (1,617,677) |

| Treasury Share Buyback | - | (102,417) | - | (102,417) |

| Derivatives Paid (Received) | - | (153,252) | - | (407,322) |

| Dividends and Interest on Shareholders’ Equity Paid to Non-Controlling Shareholders | - | - | (63,949) | (210,242) |

| Subscription Bonus | - | 12,250 | - | 12,250 |

| Capital Increase | 1,180 | 31,526 | 1,180 | 31,526 |

| Shares to Issue | 674 | 584 | 674 | 584 |

| Net Cash Flows from (Used in) Financing Activities | (520,929) | 1,376,382 | (1,935,497) | (892,173) |

| | | | | |

| Exchange Rate Change of the Cash of Subsidiaries Abroad | 164,390 | (17,870) | 167,196 | 4,946 |

| | | | | |

Net (Decrease) Increase in Cash and Cash Equivalents | (592,809) | 734,281 | (982,595) | 819,238 |

| | | | | |

| Cash and Cash Equivalents at the Start of the Fiscal Year | 1,016,746 | 282,465 | 1,645,425 | 826,187 |

| Cash and Cash Equivalents at the End of the Fiscal Year | 423,937 | 1,016,746 | 662,830 | 1,645,425 |

| | | | | |

(*) Exchangeable Senior Notes

Transactions that do not affect cash are presented in Note 35 of these financial statements.

The accompanying notes are an integral part of these financial statements - parent company and consolidated.

| Statement of Value Added Fiscal year ended on December 31, 2020 and 2019 (In thousands of Brazilian Reais - R$) |

| | Parent Company | Consolidated |

| | 2020 | 2019 | 2020 | 2019 |

| Revenues | | | | |

| Passenger, Cargo, and Other Transportation | - | - | 6,663,416 | 14,432,648 |

| Other Operational Revenues | 379,133 | 43,054 | 1,150,835 | 319,354 |

| Provision for Doubtful Accounts | - | - | (1,095) | (5,668) |

| | 379,133 | 43,054 | 7,813,156 | 14,746,334 |

| Inputs Acquired from Third Parties (includes ICMS and IPI) | | | | |

| Fuel and Lubricant Suppliers | - | - | (2,094,946) | (4,047,344) |

| Materials, Energy, Third-Party Services, and Others | (31,911) | (207,078) | (2,375,632) | (3,182,978) |

| Aircraft Insurance | - | - | (34,592) | (25,676) |

| Sales and Marketing | (446) | (338) | (336,064) | (670,392) |

| Gross Added Value | 346,776 | (164,362) | 2,971,922 | 6,819,944 |

| | | | | |

| Depreciation and Amortization | - | - | (1,870,552) | (1,727,982) |

| Net Added Value Produced by the Company | 346,776 | (164,362) | 1,101,370 | 5,091,962 |

| | | | | |

| Added Value Received on Transfers | | | | |

| Equity Income (Expenses) | (5,326,571) | 509,926 | (439) | 77 |

| Financial Revenue | 532,923 | 155,838 | 775,521 | 389,563 |

| Total Value Added (Distributed) to Distribute | (4,446,872) | 501,402 | 1,876,452 | 5,481,602 |

| | | | | |

| Distribution of Value Added: | | | | |