As filed with the Securities and Exchange Commission on May 7, 2021.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________

FORM F-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

__________________________

GOL Linhas AÉreas Inteligentes S.A.

(exact name of registrant as specified in its charter)

GOL Intelligent Airlines Inc.

(translation of registrant’s name into English)

| The Federative Republic of Brazil | Not Applicable |

| (state or other jurisdiction of incorporation or organization) | (I.R.S. employer identification number) |

__________________________

Praça Comandante Linneu Gomes, S/N, Portaria 3

Jardim Aeroporto

04626-020 São Paulo, SP

Federative Republic of Brazil

+55 (11) 2128-4700

(address and telephone number of registrant’s principal executive offices)

__________________________

Puglisi & Associates

850 Library Avenue, Suite 204

Newark, Delaware 19711

+1 (302) 738-6680

(name, address and telephone number of agent for service)

__________________________

With copies to:

Tobias Stirnberg, Esq.

Milbank LLP

Av. Brigadeiro Faria Lima, 4100

04538-132 São Paulo, SP

+55 (11) 3927-7702

Approximate date of commencement of proposed sale to the public: May 14, 2021.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. 1

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. 1

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. 1

If this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☒

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. 1

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company 1

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. 1

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

__________________________

| CALCULATION OF REGISTRATION FEE |

Title of each class of securities to be registered | Amount to be registered | Proposed maximum offering price | Proposed maximum aggregate offering price | Amount of registration fee |

| Preferred shares, no par value(1)(2) | 16,268,441 | - | $80,363,670.32 | $8,767.68 |

| | | | | | |

| (1) | The registrant’s preferred shares may be represented by American Depositary Shares, each of which represents two preferred shares. |

| (2) | No separate consideration will be received for the preferred share rights or the American Depositary Share rights. |

PROSPECTUS

GOL Linhas Aéreas Inteligentes S.A.

(GOL Intelligent Airlines Inc.)

Rights Offering of up to 16,268,441 Preferred Shares,

Including Preferred Shares represented by American Depositary Shares

__________________________

Overview

In this rights offering we are offering:

· holders of American depositary shares, or ADSs, each representing two of our preferred shares, preemptive rights to subscribe new ADSs; and

· holders of our preferred shares preemptive rights to subscribe new preferred shares.

Offering to holders of ADSs

We will grant 0.059760 non-transferable ADS right for every ADSs you own of record on May 13, 2021. One ADS right will entitle you to purchase one new ADS upon making a deposit with The Bank of New York Mellon, or the ADS rights agent, of US$9.88 per ADS subscribed for, which is equal to two times the preferred share subscription price of R$24.19, converted into U.S. dollars at the Brazilian Central Bank (Banco Central do Brasil), or Central Bank, buying rate of R$5.3866 per US$1.00 on May 5, 2021, plus 10% of such amount to cover (1) currency rate fluctuations to the date on which the ADS rights agent converts currency in connection with the exercise by the Brazilian custodian of the preferred share rights underlying the ADS rights, (2) the ADS depositary’s issuance fee of US$0.05 per new ADS, and (3) any other applicable fees, expenses or taxes.

You will bear the risk of exchange rate fluctuations between the U.S. dollar and the Brazilian real relating to the exercise of your ADS rights and, addition to the subscription price, you will have to pay an ADS issuance fee of US$0.05 per new ADS and any financial transaction taxes in Brazil. Rights to subscribe for ADSs will expire at 5:00 p.m. (New York City time) on June 1, 2021.

Offering to holders of preferred shares

We will grant 0.059760 transferable preferred share right for every preferred shares you own of record at the close of B3’s trading session on May 4, 2021. One preferred share right will entitle you to purchase one new preferred share at R$24.19 per preferred share. You will have to pay financial transaction taxes in Brazil if applicable. See “Taxation––Material Brazilian Tax Considerations.” Rights to subscribe for preferred shares will expire on June 9, 2021.

________________________

The ADSs trade on the New York Stock Exchange, or NYSE, under the symbol “GOL.” The preferred shares trade on the B3 S.A. – Brasil, Bolsa, Balcão (the “B3”), under the symbol “GOLL4.” On May 5, 2021, the trading price of the ADSs on the NYSE was US$8.95 per ADS and the trading sale price of the preferred shares on the B3 was R$24.19 per preferred share.

Investing in our securities involves a high degree of risk. You should carefully consider the risks described under “Risk Factors” beginning on page 21 of our annual report on Form 20-F for the year ended December 31, 2020, which is incorporated by reference herein.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

We expect to deliver the new preferred shares and ADSs purchased through the exercise of rights on or as soon as practicable after June 16, 2021 and June 17, 2021, respectively.

The date of this prospectus is May 7, 2021.

TABLE OF CONTENTS

Page

We are responsible for the information contained in this prospectus and the documents incorporated by reference herein. You should rely only on the information contained or incorporated by reference in this prospectus. We have not authorized anyone to provide you with different information. This prospectus may only be used where it is legal to sell these securities. You should not assume that the information in this prospectus is accurate as of any date other than the date on the front of those documents. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted.

________________________

Unless otherwise indicated, references in this prospectus to the “registrant,” “company,” “we,” “us” and “our” and similar terms refer to GOL Linhas Aéreas Inteligentes S.A. and its consolidated subsidiaries.

PRESENTATION OF FINANCIAL AND OTHER DATA

Financial Statements and Information

We maintain our books and records in reais, which is our functional currency as well as our reporting currency. Our audited consolidated financial statements as of December 31, 2020, 2019 and 2018 and for the years ended December 31, 2020, 2019 and 2018 (our “audited consolidated financial statements”) and our unaudited interim condensed consolidated financial statements as of March 31, 2021 and for the three months ended March 31, 2021 and 2020 (our “unaudited interim condensed consolidated financial statements”) have been prepared in accordance with International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board (the “IASB”), and are incorporated by reference in this prospectus. See “Incorporation by Reference.”

Translation of Reais into U.S. Dollars

Solely for the convenience of the reader, we have translated some of the real amounts in this prospectus into U.S. dollars at the rate of R$5.697 to US$1.00, which was the U.S. dollar selling rate as of March 31, 2021, as reported by the Central Bank. The U.S. dollar equivalent information presented in this prospectus is provided solely for the convenience of investors and should not be construed as implying that the real amounts represent, or could have been or could be converted into, U.S. dollars at the above rate.

Market Information

We make statements in this prospectus about our competitive position and market share in, and the market size of, the Brazilian and international airline industry. We have made these statements on the basis of statistics and other information from third party sources, governmental agencies or industry or general publications that we believe are reliable. Although we have no reason to believe any of this information or these reports are inaccurate in any material respect, we have not independently verified such information and cannot guarantee the accuracy or completeness of such information. All industry and market data contained or incorporated by reference in this prospectus are from the latest publicly available information.

Going Concern Basis of Accounting

Our audited consolidated financial statements have been prepared on a going concern basis of accounting, which contemplates continuity of operations, realization of assets and satisfaction of liabilities and commitments in the normal course of business. As such, our audited consolidated financial statements do not include any adjustments that might result from an inability to continue as a going concern. If we cannot continue as a going concern, adjustments to the carrying values and classification of our assets and liabilities and the reported amounts of income and expenses could be required and could be material.

Rounding

Certain figures included or incorporated by reference in this prospectus have been rounded. Accordingly, figures shown as totals in certain tables may not be an arithmetic sum of the figures that precede them.

Special Note Regarding Non-IFRS Financial Measures

We disclose certain non-IFRS financial measures, which are not defined under IFRS, specifically “EBITDA,” “Adjusted EBITDA,” “EBITDA Margin,” “Adjusted EBITDA Margin,” “Adjusted Operating Margin,” “Total Liquidity” and “Adjusted Net Indebtedness.” Non-IFRS financial measures do not have standardized meanings and may not be directly comparable to similarly-titled measures adopted by other companies. We believe the non-IFRS financial measures that we use help to understand our profitability and indebtedness. Potential investors should not rely on information not defined under IFRS as a substitute for the IFRS measures of earnings, cash flows or net income (loss) in making an investment decision. For more information on this non-IFRS financial measures, “Selected Financial Information.”

Certain Definitions

This prospectus contains terms relating to operating performance in the airline industry that are defined as follows:

“Aircraft utilization” represents the average number of block-hours operated per day per aircraft for the total aircraft fleet.

“ATK” refers to available ton kilometers and is a measure of total capacity, considering passenger and cargo.

“Available seat kilometers” or “ASK” represents the aircraft seating capacity multiplied by the number of kilometers flown.

“Average stage length” represents the average number of kilometers flown per flight.

“Block-hours” refers to the elapsed time between an aircraft’s leaving an airport gate and arriving at an airport gate.

“Load factor” represents the percentage of aircraft seating capacity that is actually utilized (calculated by dividing revenue passenger kilometers by available seat kilometers).

“Low-cost carrier” refers to airlines with a business model focused on a single fleet type, low-cost distribution channels and a highly efficient flight network.

“MRO” refers to maintenance, repair and operations.

“Net revenue per available seat kilometer” or “RASK” represents net revenue divided by available seat kilometers.

“Operating costs and expenses per available seat kilometer” or “CASK” represents operating costs and expenses divided by available seat kilometers, which is the generally accepted industry metric to measure operational cost efficiency.

“Operating costs and expenses excluding fuel expense per available seat kilometer” or “CASK ex-fuel” represents operating costs and expenses less fuel expense, divided by available seat kilometers.

“Passenger revenue per available seat kilometer” or “PRASK” represents passenger revenue divided by available seat kilometers.

“Revenue passenger kilometers” or “RPK” represents the number of kilometers flown by revenue passengers.

“Revenue passengers” represents the total number of paying passengers flown on all flight segments.

“Yield per passenger kilometer” or “yield” represents the average amount one passenger pays to fly one kilometer.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the Securities and Exchange Commission, or SEC, a registration statement (including amendments and exhibits to the registration statement) on Form F-3 under the Securities Act of 1933, as amended, or the Securities Act. This prospectus, which is part of the registration statement, does not contain all of the information set forth in the registration statement and the exhibits and schedules to the registration statement. For further information, we refer you to the registration statement and the exhibits and schedules filed as part of the registration statement. If a document has been filed as an exhibit to the registration statement, we refer you to the copy of the document that has been filed. Each statement in this prospectus relating to a document filed as an exhibit is qualified in all respects by the filed exhibit.

You may inspect and copy reports and other information to be filed with the SEC at the public reference facilities maintained by the SEC at 100 F. Street, N.E., Washington, D.C. 20549 and at the SEC’s regional offices at 500 West Madison Street, Suite 1400, Chicago, Illinois 60661 and 233 Broadway, New York, New York 10279. Copies of the materials may be obtained from the Public Reference Room of the SEC at 100 F. Street, N.E., Washington, D.C. 20549 at prescribed rates. The public may obtain information on the operation of the SEC’s Public Reference Room by calling the SEC in the United States at +1 (800) SEC-0330. In addition, the SEC maintains an internet website at http://www.sec.gov, from which you can electronically access the registration statement and its materials.

As a foreign private issuer, we are not subject to the same disclosure requirements as a domestic U.S. registrant under the Exchange Act. For example, we are not required to prepare and issue quarterly reports, and we are exempt from the Exchange Act rules regarding the provision and control of proxy statements and regarding short-swing profit reporting and liability. However, we furnish our shareholders with annual reports containing consolidated financial statements audited by our independent auditors and make available to our shareholders free translations of our quarterly reports (Form ITR as filed with the Brazilian Securities Commission (Comissão de Valores Mobiliários), or the CVM, containing unaudited interim consolidated financial information for the first three quarters of each fiscal year, which are furnished to the SEC under Form 6-K. We furnish quarterly consolidated financial statements with the SEC within two months of the end of each of the first three quarters of our fiscal year, and we file annual reports on Form 20-F within the time period required by the SEC, which is generally four months from December 31, the end of our fiscal year.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The SEC allows us to “incorporate by reference” the information we submit to it, which means that we can disclose important information to you by referring you to those documents that are considered part of this prospectus. Information that we file with or furnish to the SEC in the future and incorporate by reference will automatically update and supersede the previously filed or furnished information. We incorporate in this prospectus by reference the following documents that we have filed with or furnished to the SEC:

| · | Annual Report on Form 20-F for the year ended December 31, 2020, as filed with the SEC on March 29, 2021, or our 2020 Annual Report; |

| · | Our Report on Form 6-K relating to our preliminary traffic figures for March 2021, as furnished to the SEC on April 6, 2021; |

| · | Our Report on Form 6-K relating to our capital increase, as furnished to the SEC on April 29, 2021, and amended on May 3, 2021 and May 4, 2021; |

| · | Our Report on Form 6-K relating to certain terms of our capital increase, as furnished to the SEC on April 29, 2021, and amended on May 3, 2021 and May 4, 2021; |

| · | Our Report on Form 6-K relating to our unaudited interim condensed consolidated financial statements as of March 31, 2021 and for the three months ended March 31, 2021, as furnished to the SEC on May 3, 2021; and |

| · | Our Report on Form 6-K relating to the terms of this ADS rights offering, as furnished to the SEC on May 3, 2021. |

You may obtain a copy of these filings at no cost by writing us at the following address or calling us at the number below:

GOL Linhas Aéreas Inteligentes S.A.

Praça Comandante Linneu Gomes, S/N, Portaria 3

04626-020, São Paulo, SP, Brazil

Telephone +55 (11) 2128-4000

Any statement contained in a document incorporated or deemed to be incorporated by reference in this prospectus shall be deemed to be modified or superseded for purposes hereof to the extent that a statement contained in this prospectus or in any other subsequently filed document that also is, or is deemed to be, incorporated by reference in this prospectus modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus. Information contained on our website is not incorporated by reference in, and shall not be considered a part of, this prospectus.

WHERE YOU CAN FIND INFORMATION ABOUT THE RIGHTS OFFERING

The terms and procedures of the rights offering are described in this prospectus under “Summary of the Rights Offering” and “The Rights Offering.” You may refer any questions regarding the rights offering to D.F. King & Co., Inc., our information agent:

D.F. King & Co., Inc.

48 Wall Street, 22nd Floor

New York, New York 10005

Email: gol@dfking.com

Banks and Brokers, call collect: +1 (212) 269-5550

All others, call toll-free: +1 (866) 828-6931

You may obtain copies of this prospectus and the documents incorporated by reference without charge from the information agent.

FORWARD-LOOKING STATEMENTS

This prospectus includes forward-looking statements, principally under the captions “Item 3. Key Information—D. Risk Factors,” “Item 4.B. Business Overview” and “Item 5. Operating and Financial Review and Prospects” in our 2020 Annual Report. We have based these forward-looking statements largely on our current beliefs, expectations and projections about future events and financial trends affecting us. Although we believe these estimates and forward-looking statements are based on reasonable assumptions, these estimates and statements are subject to several risks and uncertainties and are made in light of the information currently available to us. Many important factors, in addition to those discussed elsewhere in this prospectus, could cause our actual results to differ substantially from those anticipated in our forward-looking statements, including, among others:

| · | general economic, political and business conditions in Brazil, South America and the Caribbean; |

| · | the effects of global financial markets and economic crises; |

| · | developments relating to, and the economic, financial, political and health effects of, the COVID-19 global pandemic and government measures to address it; |

| · | our ability to timely and efficiently implement any measure necessary in response to, or to mitigate the impacts of, the COVID-19 pandemic on our business, operations, cash flow, prospects, liquidity and financial condition; |

| · | management’s expectations and estimates concerning our financial performance and financing plans and programs; |

| · | our level of fixed obligations; |

| · | our capital expenditure plans; |

| · | our ability to obtain financing on acceptable terms; |

| · | our ability to service our indebtedness; |

| · | inflation and fluctuations in the exchange rate of the real; |

| · | changes to existing and future governmental regulations, including air traffic capacity controls; |

| · | fluctuations in crude oil prices and its effect on fuel costs; |

| · | increases in fuel costs, maintenance costs and insurance premiums; |

| · | changes in market prices, customer demand and preferences, and competitive conditions; |

| · | cyclical and seasonal fluctuations in our operating results; |

| · | defects or mechanical problems with our aircraft; |

| · | our ability to successfully implement our strategy; |

| · | developments in the Brazilian civil aviation infrastructure, including air traffic control, airspace and airport infrastructure; |

| · | future terrorism incidents, cyber-security threats, disease outbreaks or related occurrences affecting the airline industry; and |

| · | the risk factors discussed under the caption “Item 3. Key Information—D. Risk Factors” in our 2020 Annual Report. |

We caution you that the foregoing list may not contain all of the material factors that are important to you. The words “believe,” “may,” “will,” “aim,” “estimate,” “continue,” “anticipate,” “intend,” “expect” and similar words are intended to identify forward-looking statements. Forward-looking statements include information concerning our possible or assumed results of operations, business strategies, financing plans, competitive position, industry environment, potential growth opportunities and the effects of regulation and competition.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date they were made. We undertake no obligation to update publicly or to revise any forward-looking statements

after we distribute this prospectus because of new information, events or other factors. In light of the risks and uncertainties described above, the forward-looking events and circumstances discussed in this prospectus might not occur and are not guarantees of future performance.

SUMMARY

This summary highlights information presented in greater detail elsewhere in this prospectus. This summary is not complete and does not contain all the information you should consider before investing in the preferred shares and ADS. You should carefully read this entire prospectus, our 2020 Annual Report and our audited consolidated financial statements before investing. See “Presentation of Financial and Other Data” and “Item 3.A. Selected Financial Data” in our 2020 Annual Report for information regarding our consolidated financial statements, definitions of technical terms and other introductory matters.

Overview

GOL is Brazil’s largest domestic airline by market share, one of the largest low-cost carriers globally and the leading low-cost carrier in South America. We pioneered the low-cost carrier model in South America and believe we offer the best product and customer experience to business and leisure passengers. As a result of our experienced management, we believe we have built a resilient airline capable of maintaining sustainable competitive advantages throughout the business cycle.

Our strategy and business model allow us to adapt our supply to fluctuations in demand. Since our inception in 2001, we have had a strategic focus on sustainability and have been preparing ourselves to successfully operate in highly competitive business environments. Since the beginning of the COVID-19 pandemic, we have been working proactively with our stakeholders to further strengthen our position as the #1 airline in Brazil.

Foundation

GOL was founded in 2000 and initiated operations in 2001, when entrepreneur Constantino de Oliveira Junior pioneered the low-cost carrier concept in Brazil. Constantino de Oliveira Junior has been key to GOL’s success, first as chief executive officer and, since 2012, as chairman of our board of directors. He continues to be the leading figure at GOL, both in helping set strategic direction and in his close supervision of and daily interaction with senior management. As of March 31, 2021, the Constantino family, which indirectly controls us, held 64.8% of the economic interest in us. Our corporate governance practices include a board of nine directors, with a majority of independent directors, a highly experienced executive management team and an independent audit committee.

The GOL Effect

From our launch in 2001 until today, we have been a major driver behind passenger growth in Brazil. Between 2001 and 2019, Brazil’s domestic passenger market grew 3.2x, from 30.8 million passengers in 2001 to 95.3 million in 2019. Brazil’s international passenger market increased 4.1x, from 3.8 million passengers in 2001 to 9.1 million passengers in 2019, excluding international carriers.

Much of this growth can be directly attributed to GOL and our low-cost carrier model. Our passenger market share in the domestic air transportation market, as measured by RPK, increased from 5% in 2001 to 38% in 2019. We have transported more than 480 million passengers since we began our operations.

The Importance of Air Transportation in Brazil

Brazil is geographically similar in size to the continental United States and, according to IATA’s 2018 data, Brazil is the sixth largest domestic airline market in the world, after the United States, China, India, Indonesia and Japan. Brazilian domestic air passenger demand grew 0.8% in 2019, and IATA estimates, based on 2018 data, that it will be the fifth largest domestic airline market by 2026. Based on 2015 data, the Brazilian aviation market has significant untapped potential as flights per capita totaled approximately 0.5 per year, significantly below that of more established markets such as Australia (2.9) or the United States (2.5). Passenger demand declined globally in 2020 as a result of developments relating to the COVID-19 pandemic, but is expected to fully recover.

Competitive Strengths

We believe we are one of the most sustainable Latin American carriers, based on our unique business model and competitive strengths:

| · | Lowest Cost and Strongest Operating Margins: |

| o | Since inception, we have had the lowest operating costs of any Brazilian airline, with a CASK ex-fuel of R$15.05 cents in 2019 and R$21.07 cents in 2020, and we have one of the lowest cost models among airlines globally. |

| o | We have had for many years one of the highest EBITDA margins among our Latin American peers. |

| o | Our fleet of Boeing 737 aircraft provides operational advantages that make it optimally suited for our low-cost carrier model. |

| o | During the COVID-19 pandemic, we were one of the first airlines to enter into an agreement with our employees that offered job security for 18 months, providing flexibility and stability for our team (926 captains, 964 co-pilots and 3,262 flight attendants). We reduced airmen working hours by up to 50%. We also implemented salary cuts of 50% for middle and top managers, and 60% for vice-presidents, our chief financial officer and our chief executive officer, as well as an unpaid leave program for an average of 90 days, which 8,391 employees joined. As a result of these measures, we have reduced labor costs by approximately 44%, including compensation reductions and deferrals, which has permitted us to avoid lay-offs. During this period, we were able to manage yields more effectively than our competitors, becoming the airline with the highest yields in the domestic market in 2020. |

| o | Currently, 100% of our fleet is under operating leases, providing us with operational flexibility. In 2020, we agreed to the early return of 11 aircraft. We also concluded negotiations with aircraft lessor partners to create significant additional operational and financial flexibility, converting a portion of the monthly payments from fixed to variable power-by-the-hour and adjusting the contracts to the expected recovery of demand through 2021. We expect that total estimated cash flow savings in 2021 resulting from these contractual adjustments will exceed R$1.2 billion. |

| · | Flexible, Single Fleet Type: |

| o | Our single fleet strategy provides significant operational flexibility. In 2019, we had best in class aircraft utilization, with 12.3 block hours per day, one of the highest in the world. Our aircraft financings are structured for maximum operational flexibility, and, currently, we lease 100% of our aircraft from global operating lessors. In 2020, during the COVID-19 pandemic, we were able to maintain our high block hours at 9.6, due to the reduction in our operating fleet. We retain full optionality to extend leases or return aircraft at maturity, providing significant flexibility in managing our fleet size. |

| o | In early 2020, we had 18 aircraft under short-term operating leases, allowing us to reduce our fleet size by 14% in the short term via redeliveries. At the end of 2020, our total fleet comprised 127 Boeing 737 aircraft, of which 120 were Next Generation aircraft and seven were MAX aircraft. To match supply with expected demand, we are working toward gradually transitioning our fleet to the MAX. In 2020, we had a net reduction of our Next Generation fleet of 10 leased aircraft. We plan to further reduce our Next Generation fleet by 22 aircraft in 2021 and 2022, in tandem with the transition to MAX aircraft. By end of 2021, we expect to have 127 aircraft and 15% of our fleet transitioned to the MAX. We had an average operating fleet of 63 and 91 aircraft in the third and fourth quarters of 2020, representing, respectively, 56% and 81% of our average operating fleet in 2019, as a result of aircraft groundings in response to decreased demand deriving from developments relating to the COVID-19 pandemic. We have reduced our 2020-2022 Boeing 737 MAX deliveries by 34 aircraft and have flexibility to make further reductions, allowing us to defer delivery of the aircraft until passenger demand requires the additional capacity. |

| o | The benefits and flexibility granted by our single fleet type was also evidenced in our ability to rapidly and efficiently adjust to increasing demand between August and December of 2020, when the first wave of COVID-19 cases started decreasing. We expect a similarly strong demand recovery as the vaccination program in Brazil advances, as was the case in the United States, where vaccination is most advanced, and where demand has since January 2021 increased to 48% of 2019 levels and certain domestic traffic has recovered to pre-pandemic levels. Globally, Brazil currently ranks fifth in the pace of daily vaccination. |

| o | Since 2001, we have forged a deep relationship with Boeing, allowing us to obtain favorable terms for the pricing and delivery of aircraft. Attractive pricing, together with our financing strategy, allow us to create significant value in our aircraft acquisitions. In March 2020, we announced an agreement in which Boeing compensated us for the grounding of the 737 MAX aircraft. The agreement bolstered our liquidity by nearly R$607.5 million in 2020. Additionally, the agreement allowed us to adjust our order book, reducing firm commitments from 129 to 95 aircraft with the flexibility of further reductions. |

| o | In November 2020, each of the Federal Aviation Administration, or FAA, and ANAC lifted its 2019 decision to ground Boeing 737 MAX aircraft in the United States and Brazil, respectively, and we were the first airline globally to reinitiate operations of the MAX. We remain strongly committed to the MAX aircraft and expect our MAX operations will generate significant operating cost savings. |

| · | Highest Load Factors and Passenger Capacity: Our load factor has been best-in-class in Brazil for many years. Even during the peak of the pandemic, in April and May 2020 as well as in February and March 2021, with a largely reduced fleet and flight network, we reported load factors above 75%. In 2020, although our total demand decreased 51.9%, as compared to 2019, we were the only airline in Brazil that kept our average load factor at 80.0%, due to our fleet size flexibility. Our single fleet model and proactive fleet management increased our fleet flexibility, which allowed us to follow varying demand levels for flights without meaningfully impacting our load factors. |

| · | Dominant Market Position in Key Airports: In 2020, we were the largest player in four of the ten busiest airports in Brazil, with an average market share in excess of 47.0%, and we were the leading airline in 40.0% of the 30 largest airports in Brazil, which together represented 93.0% of domestic air traffic by passengers in Brazil. |

| · | Highest Ranking in Customer Service: We have made a significant investment in our product offering, including features such as loyalty program integration, onboard service, onboard entertainment and comfortable seats, among others. We believe we offer more complete products and services than any other leading global low-cost carrier, allowing us to capture the largest portion of premium business and economy leisure customers. Both groups of customers value the experience we offer, allowing us to extract higher yields and a leading share of customer wallet. We are a leader in technology development and digital solutions, enabling us to offer the best passenger experience, with a Net Promoter Score of 38 points in 2020. |

| · | Meaningful ESG Track Record and Initiatives: Since 2010, we have prepared annual sustainability reports based on Global Reporting Initiative guidelines, an international standard for reporting environmental, social and economic performance. By adopting these parameters and providing related data to the public, we are reinforcing our accountability with various stakeholders through added transparency and credibility. Among our initiatives are our voluntary adherence, since 2016, to the carbon pricing leadership coalition, which is a global initiative to price carbon emissions, as well as multiple campaigns and associations dedicated to promoting best ESG practices both in the airline industry and generally. We also maintain social initiatives relating to our workforce, customer satisfaction and safety, as well as governance initiatives through leadership, committees, policies and shareholder meetings. |

| · | Best Route Network, Loyalty Program and Global Partnerships: We have a highly integrated network, operating the most flights at Brazil’s busiest airports. Before the COVID-19 pandemic commenced in Brazil, we were, in 2019, the largest Brazilian airline with over 36 million annual passengers transported and a domestic market share of 38%, as measured by RPK, and we have since then been able to further improve our competitive market position. We operate the leading Brazilian airline loyalty program, with 18.2 million members as of December 31, 2020. We have entered into 14 codeshare agreements, 16 frequent flyer agreements and 76 interline agreements, allowing our customers to connect seamlessly to 177 airports around the world. Since 2020, we have established a new partnership and codeshare agreement with American Airlines, the leading provider of air service between the United States and Brazil. In addition, since 2020, we established codeshare agreements with Avianca Holdings, Alitalia and Ethiopian Airlines to strengthen our international presence. |

| · | Domestic Market Focus: Our network of flights has always been focused on national and regional routes within South America and Brazil, which are returning to normal levels of traffic faster than inter-continental routes prioritized by some of our competitors. We have benefitted from the competitive dynamic that has led to certain competitors pursuing credit restructuring and Chapter 11 bankruptcy procedures, which have further decreased the supply of flights in the market. |

| · | Leading Cargo Business: We are Brazil’s second largest cargo airline with a 26.9% market share as measured by ATKs, and our cargo revenues increased from 2.8% of our gross revenue in 2019 to 4.8% in 2020. Through GOLLOG, we generate cargo revenue through the use of cargo space on regularly scheduled passenger aircraft. Our cargo business has grown at higher rates than our passenger travel business, in large part because we count with an excellent and diversified base of clients in the B2B segment and e-commerce markets, and are well-positioned to support this market’s expected growth as we forge and strengthen our client relationships. We are committed to delivering quality air freight solutions and believe our cargo business will be an increasingly important contributor to our financial performance. |

| · | Leading MRO Service Provider: In 2019, we launched GOL Aerotech, our business unit dedicated to providing MRO services, including to third parties. We have more than 14 years of experience providing maintenance, preventive maintenance and modifications on our own aircraft. Expanding this service to third parties through our MRO business equips us with important competitive advantages, including additional revenues and cash flow and leverage on our operating costs, and is an important contributor to our EBITDA. We operate the largest MRO facility in Brazil, with over 1.0 million square feet of hangar and ramp areas, six shops, more than 60,000 square feet of parts storage area and over 700 employees. Our MRO facility has been temporarily closed as a part of our cost reduction measures. |

| · | GOLLabs: In 2018, we created GOLLabs, our innovation business dedicated to researching and developing new technologies and services to generate new revenues and reduce costs, including by optimizing our pricing and route strategies and enhancing our customer experience through initiatives such as face recognition technology to facilitate check-in and boarding procedures, media streaming partnerships to provide enhanced entertainment options and a customer service platform through mobile chat applications, among others. GOLLabs is responsible for the entire lifecycle of the development of an innovative concept, including market testing and analytics and implementation and training, and plays a key role in creating value in our other business lines. |

Throughout 2020, we maintained liquidity without impairing our balance sheet. We entered into discussions with key suppliers to reduce our costs and adjust them to the new network and fleet profiles. We were able to defer jet fuel payment installments to after September 30, 2020. All non-essential investments in operations and maintenance have been eliminated, as have any pre-delivery payment obligations. We were able to make significant adjustments to our working capital by extending our payment terms and managing other current assets and liabilities. We have also been able to raise new financing to continue to pay down short term maturities at par, while terming out the average maturity of our debt profile. In March 2020, we extended the amortization schedule of our debentures to March 2022. In August 2020, we fully paid down our US$300.0 million term loan, with the support of a loan in the principal amount of US$250.0 million, while also extending out the average maturity of our debt and keeping liquidity close to unchanged. In December 2020, we issued US$200.0 million in aggregate principal amount of 8.00% senior secured notes due 2026. Also in December 2020, we prepaid R$800.0 million in short term debt. For further details on these financings, see note 17 to our unaudited interim condensed consolidated financial statements.

We have been managing our business and liquidity since the beginning of the pandemic, by matching cash inflows with outflows in an efficient manner. As of March 31, 2021, we had R$1.8 billion in Total Liquidity, which includes R$1.0 billion in liquidity held in our loyalty program subsidiary Smiles Fidelidade S.A., or Smiles, and, as of that date, including financeable amounts of deposits and unencumbered assets, our potential liquidity sources reached over R$3.4 billion. We will continue to seek to manage our negative working capital of R$8.4 billion, as of March 31, 2021, by reducing costs, rolling over and deferring short-term obligations with our suppliers and counterparties, most of which have been supportive of GOL during the course of the pandemic. For further information, see “Risk Factors—Risks Relating to Us and the Brazilian Airline Industry—We may not be able to maintain adequate liquidity and our cash flows from operations and financings may not be sufficient to meet our current obligations.”

Recent Developments regarding SMILES

On March 24, 2021, shareholders of GOL and the majority of SMILES’ minority shareholders approved the corporate reorganization to combine the Company’s airline subsidiary with SMILES. Payment will be made to

SMILES minority shareholders in June 2021 and, once the merger is completed, both companies will be better positioned to increase their respective market competitiveness and cash flow generation. The successful completion of this transaction will substantially reduce the risks that each company faces in the pandemic and will provide operating, liquidity, financial and fiscal synergies. As a combined entity, we will be better able to improve revenue and liquidity management, more dynamically manage the inventory of seats, improve its ability to coordinate marketing to customers and be better positioned to optimize yields.

On March 25, 2021, SMILES announced the distribution of R$500 million in dividends that were paid on April 16, 2021. Of the R$4.03 per share dividend paid by SMILES, GOL received R$265 million from the dividend with the balance paid to the SMILES minority shareholders.

As a result of the above-mentioned dividend, the value of the exchange ratio in the corporate reorganization will be automatically adjusted, and the portion due in cash will be reduced accordingly. Under the base exchange ratio, the cash component of the consideration is reduced from R$9.14 per share to R$5.11 per share and the optional exchange ratio cash component of the consideration is reduced from R$22.54 per share to R$18.51 per share. There is no change to the stock consideration in the corporate reorganization due to the payment of the dividend under either the base or optional exchange ratios. Assuming that 70% of the minority shareholders of SMILES elect to receive the more stock option, the expected cash required to close the corporate reorganization will be approximately R$500 million.

A portion of the proceeds of the dividend was used to partially prepay the secured loan with Delta, which, as of the date of this prospectus, has an outstanding principal amount of US$25.8 million. For further information on the secured loan with Delta, see “Recent Developments—Liquidity and Capital Resources—Indebtedness.

The SMILES merger consideration allows the SMILES minority shareholders to elect their desired consideration mix consisting of two choices: (i) the “base exchange ratio”, which provides for more stock and is the option automatically selected unless shareholders elect otherwise, and (ii) the “optional exchange ratio’, which provides for more cash which requires shareholders to affirmatively to elect this option. Given that this transaction is, in our view, highly credit accretive, due to the significant monthly cash flow generation of SMILES and the significant value of the SMILES brand and intellectual property, we expect that financing for the cash portion of the merger consideration can be largely sourced from internally generated cash flow or can be obtained at acceptable terms under most market conditions.

Financial and Operating Data Highlights

The following tables set forth our main financial indicators and operating performance indicators as of the dates and for the periods presented:

Financial Data

| | As of and for the year ended December 31, | As of and for the three months ended March 31, |

| | 2018 | 2019 | 2020 | 2020(1) | 2020 | 2021 | 2021(1) |

| | (in thousands of R$, except percentages) | (in thousands of US$, except percentages) | (in thousands of R$, except percentages) | (in thousands of US$, except percentages) |

| | | | | |

| Net income (loss) | (779,724) | 179,338 | (5,895,251) | (1,034,799) | (2,261,609) | (2,505,791) | (439,844) |

| EBITDA(2) | 2,068,478 | 3,860,721 | 918,708 | 161,262 | 1,553,457 | (186,205) | (32,685) |

| EBITDA Margin(3) | 18.1% | 27.8% | 14.4% | 14.4% | 49.4% | (11.9)% | (11.9)% |

| Operating margin(4) | 12.3% | 15.4% | (14.9)% | (14.9)% | 32.6% | (33.3)% | (33.3)% |

| | As of and for the year ended December 31, | As of and for the three months ended March 31, |

| | 2018 | 2019 | 2020 | 2020(1) | 2020 | 2021 | 2021(1) |

| | (in thousands of R$, except percentages) | (in thousands of US$, except percentages) | (in thousands of R$, except percentages) | (in thousands of US$, except percentages) |

| | | | | |

| Adjusted EBITDA(5) | 2,100,919 | 4,208,582 | 1,086,296 | 190,679 | 1,465,999 | (72,094) | (12,655) |

| Adjusted EBITDA Margin(6) | 18.4% | 30.4% | 17.0% | 17.0% | 46.6% | (4.6)% | (4.6)% |

| Adjusted Operating Margin(7) | 12.6% | 17.9% | (0.3)% | (0.3)% | 29.8% | (22.1)% | (22.1)% |

Net cash flows from operating

activities | 2,081,869 | 2,461,076 | 753,936 | 132,339 | 1,090,605 | 4,639 | 814 |

Net cash flows from (used in) investing

activities | (1,587,256) | (754,611) | 31,770 | 5,577 | (1,389,321) | (20,639) | (3,623) |

Net cash flows used in financing

activities | (753,189) | (892,173) | (1,935,497) | (339,740) | (855,995) | (264,256) | (46,385) |

| Total Liquidity(8) | 2,980,011 | 4,273,023 | 2,576,471 | 452,250 | n.a. | 1,797,682 | 315,549 |

Operating Data

| | Year ended December 31 | Three months ended March 31, |

| | 2018 | 2019 | 2020 | 2020 | 2021 |

| | | | | | |

| Operating aircraft at period end | 121 | 130 | 127 | 131 | 127 |

| Total aircraft at period end | 121 | 137 | 127 | 131 | 127 |

| Revenue passengers carried (in thousands)(9) | 33,446 | 36,445 | 16,776 | 8,346 | 4,495 |

| Revenue passenger kilometers (RPK) (in millions)(9) | 38,423 | 41,863 | 20,126 | 9,947 | 5,592 |

| Available seat kilometers (ASKs) (in millions)(9) | 48,058 | 51,065 | 25,142 | 12,462 | 6,999 |

| Load factor | 80.0% | 82.0% | 80.0% | 79.8% | 79.9% |

| Break-even load factor | 70.1% | 66.3% | 80.0% | 56.0% | 96.9% |

| Aircraft utilization (block hours per day) | 11.8 | 12.3 | 9.6 | 12.1 | 9.7 |

| Average fare (R$) | 318 | 359 | 345 | 352 | 315 |

| Passenger revenue yield per RPK (R$ cents) | 27.6 | 31.2 | 28.7 | 29.6 | 25.3 |

| PRASK (R$ cents) | 22.1 | 25.6 | 23.0 | 23.6 | 20.2 |

| RASK (R$ cents) | 23.7 | 27.2 | 25.3 | 25.3 | 22.4 |

| | Year ended December 31 | Three months ended March 31, |

| | 2018 | 2019 | 2020 | 2020 | 2021 |

| | | | | | |

| CASK (R$ cents) | 20.8 | 23.0 | 29.1 | 17.0 | 29.9 |

| CASK ex-fuel (R$ cents) | 12.8 | 15.1 | 21.1 | 9.0 | 21.8 |

| Adjusted CASK (R$ cents)(10) | 20.8 | 22.3 | 25.4 | 17.7 | 27.3 |

| Adjusted CASK ex-fuel (R$ cents)(10) | 12.8 | 14.4 | 17.4 | 9.7 | 19.2 |

| Departures | 250,040 | 259,377 | 124,528 | 62,956 | 32,797 |

| Departures per day | 685 | 711 | 340 | 692 | 364 |

| Destinations served | 69 | 77 | 63 | 75 | 62 |

| Average stage length (kilometers) | 1,098 | 1,114 | 1,152 | 1,136 | 1,205 |

Active full-time equivalent employees at

year end | 15,259 | 16,113 | 13,899 | 16,345 | 13,999 |

| Fuel liters consumed (in millions) | 1,403 | 1,475 | 722 | 363 | 192 |

| Average fuel expense per liter (R$) | 2.91 | 2.79 | 2.55 | 2.78 | 2.61 |

_________________

| (1) | Translated for convenience using the U.S. dollar selling rate as reported by the Central Bank of R$5.697 to US$1.00 as of March 31, 2021. |

| (2) | We calculate EBITDA as net income (loss) plus financial results, net, exchange rate variation, net, income taxes and depreciation and amortization. EBITDA is not a measure of financial performance recognized under IFRS, nor should it be considered an alternative to net income (loss) as a measure of operating performance, or as an alternative to operating cash flows, or as a measure of liquidity. EBITDA is not calculated using a standard methodology and may not be comparable to the definition of EBITDA or similarly titled measures used by other companies. Because our calculation of EBITDA eliminates financial results, net, exchange rate variation, net, income taxes and depreciation and amortization, we believe that our EBITDA provides an indication of our general economic performance, without giving effect to interest rate or exchange rate fluctuations, changes in income and social contribution tax rates or depreciation and amortization. |

| (3) | We calculate EBITDA Margin as EBITDA divided by total net revenue for the relevant period. |

| (4) | We calculate operating margin as income before financial results, exchange rate variation, net and income taxes divided by total net revenue. |

| (5) | We calculate Adjusted EBITDA as EBITDA plus non-recurring results, net and, in 2019, certain other expenses, principally related to MAX disruption net contingencies and additional costs incurred in restructuring aircraft redeliveries and, in 2020, expenses principally related to MAX disruption net contingencies, restructuring aircraft redeliveries and labor idleness, and for the three months ended March 31, 2021, expenses principally related to restructuring aircraft redeliveries and labor idleness. Adjusted EBITDA does not exclude the effects of the pandemic (aircraft grounding and expenses not strictly related to our current level of operations), which management believes were approximately R$1.3 billion in 2020. Adjusted EBITDA is not a measure of financial performance recognized under IFRS, nor should it be considered an alternative to net income (loss) as a measure of operating performance, or as an alternative to operating cash flows, or as a measure of liquidity. Adjusted EBITDA is not calculated using a standard methodology and may not be comparable to the definition of “adjusted EBITDA” or similarly titled measures used by other companies. Because our Adjusted EBITDA eliminates non-recurring effects on our results of operations, we believe that our Adjusted EBITDA provides an important tool to compare our performance across periods. |

| (6) | We calculate Adjusted EBITDA Margin as Adjusted EBITDA divided by total net revenue for the relevant period. |

| (7) | We calculate Adjusted Operating Margin as income before financial results, exchange rate variation, net and income taxes, plus non-recurring results, net and expenses related to fleet and labor idleness divided by total net revenue. Because our Adjusted Operating Margin eliminates non-recurring effects on our results of operations, we believe that our Adjusted Operating Margin provides an important tool to compare our performance across periods. |

| (8) | We calculate Total Liquidity as the sum of our cash and cash equivalents, current and noncurrent restricted cash, short-term investments and trade receivables; Total Liquidity does not reflect our negative working capital as of the dates presented. For information regarding our negative working capital, see note 1.2 to our unaudited interim condensed consolidated financial statements. |

| (9) | Source: National Civil Aviation Agency (Agência Nacional de Aviação Civil), or ANAC. |

| (10) | We calculate adjusted CASK as CASK excluding non-recurring results, net and, in 2020, expenses related to fleet and labor idleness. |

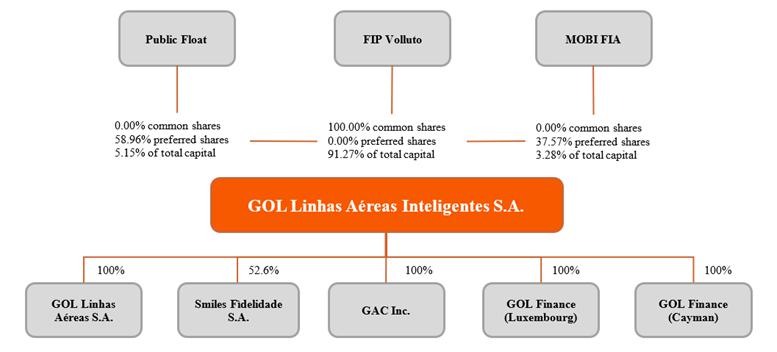

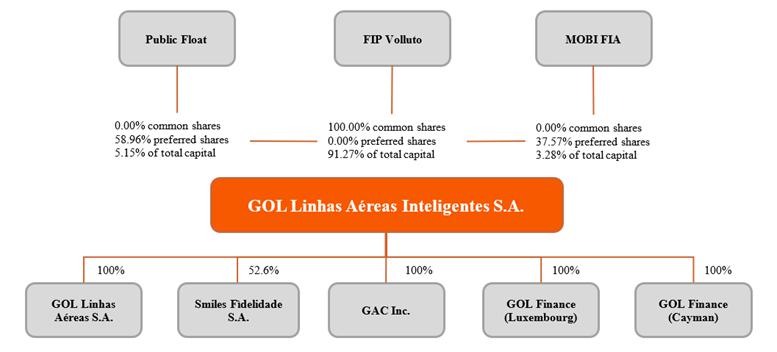

Corporate Structure

The following chart summarizes our corporate structure as of the date of this prospectus:

Our principal executive offices are located at Brazil’s largest domestic airport, the Congonhas airport, at Praça Comandante Linneu Gomes, S/N, Portaria 3, Jardim Aeroporto, 04626-020, São Paulo, SP, Brazil, and the telephone number of our investor relations department is +55 (11) 2128-4700. Our website is www.voegol.com.br and investor information may be found on our website under www.voegol.com.br/ir. Information contained on our website is not incorporated by reference, and is not to be considered a part of, this prospectus.

GOL Finance is a public limited liability company (société anonyme) under the laws of Luxembourg, having its registered office at 17, Boulevard Raiffeisen, L-2411 Luxembourg, and registered with the Luxembourg Register of Commerce and Companies (R.C.S. Luxembourg) under number B 178497, and is a financing subsidiary of GLAI.

SUMMARY OF THE RIGHTS OFFERING

On April 28, 2021, our board of directors approved a capital increase through the issuance of up to 171,136,140 common shares and 16,268,441 preferred shares at a subscription price of R$0.6911 per common share and R$24.19 per preferred share, with a minimum aggregate subscription amount of R$100.0 million and a maximum aggregate subscription amount R$511.8 million.

The Constantino Family, our controlling shareholder, has informed our board of directors of its intention to subscribe approximately R$270.0 million in shares in this offering, which is sufficient to reach the minimum aggregate subscription amount.

According to Brazilian law, the issuance of common and preferred shares triggers preemptive rights of our existing shareholders. Although we are not obligated under the existing arrangements to extend the preemptive rights to U.S. holders of preferred shares and ADSs, we have voluntarily elected to register this rights offering with the Securities and Exchange Commission (SEC), in order to enable U.S. holders to participate in the rights offering.

We are offering up to 16,268,441 preferred shares, including preferred shares represented by ADSs, in this preemptive rights offering to holders of our preferred shares and ADSs.

Offering to Holders of ADSs

| ADS rights offering | You will receive 0.059760 ADS right for every ADS you hold on the ADS record date (as defined below). Fractional ADS rights will not be issued, and fractional entitlements will be reduced to the next smaller whole number of ADS rights. |

| Unsubscribed ADS | Following the preferred share rights exercise period and the ADS rights exercise period, if the maximum aggregate subscription amount is not reached, our board of directors will reduce the size of this offering. There will be no reoffering round. |

| Subscription Card | Our ADS rights agent will send to each registered record-date holder of ADSs a subscription card indicating the number of ADS rights the holder owns. |

| ADS record date | May 13, 2021. |

| ADS subscription price and deposit amount | To validly subscribe for new ADSs, ADS rights holders will need to deposit with the ADS rights agent US$9.88 per ADS subscribed for, or the deposit amount, which is equal to two times the preferred share subscription price of R$24.19 for each new ADS subscribed for, converted into U.S. dollars at the Central Bank buying rate of R$5.3866 per US$1.00 on May 5, 2021, plus 10% of such amount to cover (1) currency rate fluctuations to the date on which the ADS rights agent converts currency in connection with the exercise by the Brazilian custodian of the preferred share rights underlying the ADS rights, (2) the ADS depositary’s issuance fee of US$0.05 per new ADS, and (3) any other applicable fees, expenses or taxes. You will bear the risk of all exchange rate fluctuations relating to the exercise of ADS rights and financial transaction taxes in Brazil. The ADS rights agent may convert currency itself or through any of its affiliates, or the ADS rights agent’s Brazilian custodian, or the custodian, may convert currency and pay U.S. dollars to the ADS rights agent. Where the ADS rights agent converts currency itself or through any of its affiliates, the ADS rights agent acts as principal for its own account and not as agent, advisor, broker or fiduciary on behalf of any other person and earns revenue, including, without limitation, transaction spreads, that it will retain for its own account. The revenue is based on, among other things, the difference between the exchange rate assigned to the currency conversion made under the ADS rights agent agreement and the rate that the ADS rights agent or its affiliate receives when buying or selling foreign currency for its own account. The ADS rights agent makes no representation that the exchange rate used or obtained by it or its affiliate in any currency conversion under the ADS rights agent agreement will be the most favorable rate that could be obtained at the time or that the method by which that rate will be determined will be the most favorable to ADS holders, subject to the ADS rights agent’s obligations under the ADS rights agent agreement to act without gross negligence or willful misconduct. The methodology used to determine exchange rates used in currency conversions made by the ADS rights agent is available upon request. Where the custodian converts currency, the custodian has no obligation to obtain the most favorable rate that could be obtained at the time or to ensure that the method by which that rate will be determined will be the most favorable to ADS holders, and the ADS rights agent makes no representation that the rate is the most favorable rate and will not be liable for any direct or indirect losses associated with the rate. If the deposit amount is insufficient to cover the actual ADS subscription price in reais plus conversion expenses, ADS issuance fees and financial transaction taxes for ADSs you are subscribing for, you will have to pay the deficiency to the ADS rights agent. If you do not pay the deficiency, the ADS rights agent may reduce the amount of new ADSs subscribed or sell a portion of your new ADSs to cover the deficiency. If the deposit amount is greater than the actual ADS subscription price plus conversion expenses, ADS issuance fees and financial transaction taxes for ADSs you are subscribing for or are allocated, the ADS rights agent will refund you the excess without interest. See “Item E. Taxation—Material Brazilian Tax Considerations—Tax on Foreign Exchange Transactions” and “Item E. Taxation—Material Brazilian Tax Considerations—Tax on Transactions Involving Bonds and Securities” in our 2020 Annual Report for more information regarding financial transaction taxes for ADSs. |

| ADS rights exercise period | From May 14, 2021 through 5:00 p.m. (New York City time) on June 1, 2021. |

| Procedure for exercising ADS rights | If you hold ADSs directly as a registered holder, you may exercise your ADS rights during the exercise period by delivering a properly completed subscription card and full payment of the deposit amount for the new ADSs to the ADS rights agent, to be received prior to 5:00 p.m. (New York City time) on June 1, 2021. If you hold ADSs through The Depository Trust Company, you may exercise your ADS rights by timely delivering to the ADS rights agent completed subscription instructions through DTC’s automated system accompanied by payment in full of the deposit amount. If you hold ADSs in account with a broker or other securities intermediary and wish to exercise your ADS rights, you should timely contact the securities intermediary through which you hold ADS rights to arrange for their exercise and for the payment of the deposit amount. Brokers and other securities intermediaries will set their own cutoff dates and times to receive instructions that will be earlier than the expiration time stated in this prospectus. You should contact your broker or other securities intermediary to determine the cutoff date and time that is applicable to you, We provide more details on how to exercise ADS rights under “The Rights Offering—Offering to ADS Holders.” |

Exercise of ADS rights

irrevocable | The exercise of ADS rights is irrevocable and may not be canceled or modified. |

| Withdrawal of Registration Statement | We may, at any time prior to the Initial Settlement Date, withdraw the registration statement of which this prospectus is a part of, in which event this offer of ADS rights will become null and void and any ADS subscription payment already tendered will be returned to you in U.S. dollars without interest. |

| Unexercised rights | If you do not exercise your ADS rights within the ADS rights exercise period, they will expire and you will have no further rights. If practical, the depositary will try to sell unexercised rights in Brazil and will distribute any proceeds, net of applicable fees, expenses and taxes, to the holders of ADSs that did not exercise their ADS rights. |

| Listing | The ADSs are listed on the NYSE under the symbol “GOL.” The ADS rights are not transferable. |

| ADS rights agent | The Bank of New York Mellon. |

| Depositary | The Bank of New York Mellon. |

| Delivery of new ADSs | The Bank of New York Mellon will deliver the new ADSs subscribed in the rights offering as soon as practicable after receipt of the underlying new preferred shares by the custodian. |

| ADS issuance fee | Subscribing holders will be charged an ADS issuance fee of US$0.05 per new ADS purchased in this offering. The ADS rights agent will deduct the ADS issuance fee from the deposit amount in respect of each holder’s subscription. |

| New ADSs | Your specific rights in the new ADSs and in the preferred shares underlying the new ADSs are set out in a deposit agreement among us, The Bank of New York Mellon, as depositary, and the owners and beneficial owners of ADSs. To understand the terms of the ADSs, you should read the deposit agreement, which is incorporated by reference as an exhibit to the registration statement of which this prospectus is a part. |

For additional information regarding the rights offering to holders of the ADSs, see “The Rights Offering—Offering to ADS Holders” which also includes a summary timetable containing some important dates relating to the ADS rights offering.

| Preferred share rights offering | You will receive 0.059760 preferred share right for every preferred share you hold on the preferred share record date (as defined below). One preferred share right will entitle you to purchase one new preferred share. We will only issue whole numbers of preferred share rights. We will not issue any fractional preferred shares. |

| Unsubscribed preferred shares | Following the preferred share rights exercise period and the ADS rights exercise period, if the maximum aggregate subscription amount is not reached, our board of directors will reduce the size of this offering. There will be no reoffering round. Holders of our preferred shares in Brazil will have the opportunity to (i) condition in the subscription bulletin (boletim de subscrição) their participation in the rights offering and the number of preferred shares to be subscribed to the maximum aggregate subscription being reached and (ii) indicate in the subscription bulletin (boletim de subscrição) whether, in the event the amount of the capital increase is lower than the maximum aggregate subscription amount, the shareholder will receive (a) the amount of shares indicated in the subscription bulletin (boletim de subscrição) or (ii) an amount of shares equivalent to the pro rata between the total number of shares subscribed in the offering and the maximum aggregate subscription amount. In the absence of such indication, the shareholder will receive all the subscribed shares. This opportunity will not be granted to U.S. persons (as defined in Regulation S under the Securities Act), ADS holders or holders of our preferred shares in the United States. |

| Preferred share record date | May 4, 2021. |

Preferred share

subscription price | R$24.19 per share. |

Preferred share rights

exercise period | From May 5, 2021 through June 9, 2021. |

| Procedure for exercising preferred share rights | You may exercise your preferred share rights by delivering, or causing your broker to deliver, to custodian (which may be Itaú Unibanco S.A. or the B3 Central Depository (Central Depositária da B3)), a properly completed subscription form and full payment of the preferred share subscription price for the new preferred shares being purchased. |

| Exercise of share rights irrevocable | The exercise of preferred share rights is irrevocable and may not be canceled or modified. |

| Withdrawal of Registration Statement | We may, at any time prior to the Initial Settlement Date, withdraw the registration statement of which this prospectus is a part of, in which event this offer of preferred shares rights will become null and void. |

| Unexercised rights | If you do not exercise your preferred share rights within the preferred share rights exercise period, they will expire and you will have no further rights. |

| Transferability | You may transfer all or any portion of your preferred share rights. If you transfer or sell your preferred share rights, you will have no further right to purchase new preferred shares in the preferred share rights offering with respect to the preferred share rights transferred or sold. |

| Listing | The preferred shares are listed on the B3 under the symbol “GOLL4.” The preferred share rights are transferable and may be listed on the B3. |

Ratification of the

capital increase | On April 28, 2021, our board of directors authorized a capital increase in an aggregate amount of up to R$100.0 million with a minimum aggregate amount of R$511.8 million. We will issue the new preferred shares subscribed in this rights offering following ratification of the capital increase by our board of directors at a meeting that is expected to be held on or about June 15, 2021. |

| Delivery of new shares | We expect to deliver the new preferred shares subscribed in this rights offering on or about June 16, 2021. |

For additional information regarding the rights offering to holders of our preferred shares, see “The Rights Offering—Offering to Holders of Preferred Shares” which includes a summary timetable containing some important dates relating to the preferred shares rights offering.

SUMMARY FINANCIAL AND OTHER INFORMATION

The following table presents a summary of our historical consolidated financial and operating data for each of the periods indicated. You should read this information together with “Item 5. Operating and Financial Review and Prospects” in our 2020 Annual Report and our audited consolidated financial statements.

Solely for the convenience of the reader, we have translated some of the real amounts in this prospectus into U.S. dollars at the rate of R$5.697 to US$1.00, which was the U.S. dollar selling rate in effect as of March 31, 2021, as reported by the Central Bank, and should not be construed as implying that the criteria used followed the criteria established in IAS No. 21 – The Effects of Changes in Foreign Exchange Rates.

Summary Financial and Operating Data

Summary Financial Data

Statements of Operations Data

| | Year ended December 31, | Three months ended March 31, |

| | 2018 | 2019 | 2020 | 2020(1) | 2020 | 2021 | 2021(1) |

| | (in thousands of R$) | (in thousands of US$) | (in thousands of R$) | (in thousands of US$) |

| Net revenue: | | | | | | | |

| Passenger | 10,633,488 | 13,077,743 | 5,783,323 | 1,015,152 | 2,941,333 | 1,416,278 | 248,601 |

| Mileage program, cargo and other | 777,866 | 786,961 | 588,494 | 103,299 | 206,394 | 151,349 | 26,566 |

| Total net revenue | 11,411,354 | 13,864,704 | 6,371,817 | 1,118,451 | 3,147,727 | 1,567,627 | 275,167 |

| Operating costs and expenses: | | | | | | | |

| Salaries, wages and benefits | (1,903,852) | (2,361,268) | (1,765,628) | (309,922) | (595,223) | (464,432) | (81,522) |

| Aircraft fuel | (3,867,673) | (4,047,344) | (2,025,701) | (355,573) | (1,001,138) | (566,128) | (99,373) |

| Aircraft rent(2) | (1,112,837) | - | - | - | - | - | - |

| Landing fees | (743,362) | (759,774) | (411,065) | (72,155) | (201,742) | (114,065) | (20,022) |

| Aircraft, traffic and mileage servicing | (613,768) | (707,392) | (723,244) | (126,952) | (173,968) | (187,102) | (32,842) |

| Passenger service expenses | (474,117) | (578,744) | (389,998) | (68,457) | (176,041) | (108,016) | (18,960) |

| Sales and marketing | (581,977) | (670,392) | (324,185) | (56,905) | (118,012) | (66,361) | (11,648) |

| Maintenance, materials and repairs | (570,333) | (569,229) | (335,868) | (58,955) | (144,321) | (153,366) | (26,920) |

| Depreciation and amortization(2) | (668,516) | (1,727,982) | (1,870,552) | (328,340) | (528,036) | (336,299) | (59,031) |

| Other income (expenses), net | 524,656 | (309,917) | 523,019 | 91,806 | 816,175 | (94,362) | (16,563) |

| Total operating costs and expenses | (10,011,779) | (11,732,042) | (7,323,222) | (1,285,452) | (2,122,306) | (2,090,131) | (366,883) |

| | Year ended December 31, | Three months ended March 31, |

| | 2018 | 2019 | 2020 | 2020(1) | 2020 | 2021 | 2021(1) |

| | (in thousands of R$) | (in thousands of US$) | (in thousands of R$) | (in thousands of US$) |

| Equity pick up method | 387 | 77 | (439) | (77) | - | - | - |

| Operating income (loss) before exchange rate variation, net | 1,399,962 | 2,132,739 | (951,844) | (167,078) | 1,025,421 | (522,504) | (91,716) |

| Financial income | 259,728 | 389,563 | 736,969 | 129,361 | 698,246 | 143,420 | 25,175 |

| Financial expense(2) | (1,061,089) | (1,748,265) | (2,546,192) | (446,936) | (998,456) | (568,498) | (99,789) |

Income before exchange rate variation, net and income taxes | 598,601 | 774,037 | (2,761,067) | (484,653) | 725,211 | (947,582) | (166,330) |

| Exchange rate variation, net | (1,081,197) | (385,092) | (3,056,226) | (536,462) | 2,943,404 | (1,537,240) | 269,833 |

| Income (loss) before income taxes | (482,596) | 388,945 | (5,817,293) | (1,021,115) | (2,218,193) | (2,484,822) | (436,163) |

| Income taxes and social contributions | (297,128) | (209,607) | (77,958) | (13,684) | (43,416) | (20,969) | (3,681) |

| Net income (loss) | (779,724) | 179,338 | (5,895,251) | (1,034,799) | (2,261,609) | (2,505,791) | (439,844) |

| Equity holders of the parent company | 305,669 | 296,611 | 92,877 | 16,303 | 26,660 | 22,612 | 3,969 |

| Non-controlling interest shareholders | (1,085,393) | (117,273) | (5,988,128) | (1,051,102) | (2,288,269) | (2,528,403) | (443,813) |

Other Financial Data

| | As of and for the year ended December 31, | As of and for the three months ended March 31, |

| | 2018 | 2019 | 2020 | 2020(1) | 2020 | 2021 | 2021(1) |

| | (in thousands of R$ except percentages) | (in thousands of US$) | (in thousands of R$ except percentages) | (in thousands of US$) |

| | | | | |

| Net income (loss) | (779,724) | 179,338 | (5,895,251) | (1,034,799) | (2,261,609) | (2,505,791) | (439,844) |

| EBITDA(3) | 2,068,478 | 3,860,721 | 918,708 | 161,253 | 1,553,457 | (186,205) | (32,685) |

| EBITDA Margin(4) | 18.1% | 27.8% | 14.4% | 14.4% | 49.4% | (11.9)% | (11.9)% |

| Operating margin(5) | 12.3% | 15.4% | (14.9)% | (14.9)% | 32.6% | (33.3)% | (33.3)% |

| Adjusted EBITDA(6) | 2,100,919 | 4,208,582 | 1,086,296 | 190,669 | 1,465,999 | (72,094) | (12,655) |

| Adjusted EBITDA Margin(7) | 18.4% | 30.4% | 17.0% | 17.0% | 46.6% | (4.6)% | (4.6)% |

| | As of and for the year ended December 31, | As of and for the three months ended March 31, |

| | 2018 | 2019 | 2020 | 2020(1) | 2020 | 2021 | 2021(1) |

| | (in thousands of R$ except percentages) | (in thousands of US$) | (in thousands of R$ except percentages) | (in thousands of US$) |

| | | | | |

| Adjusted Operating Margin(8) | 12.6% | 17.9% | (0.3)% | (0.3)% | 29.8% | (22.1)% | (22.1)% |

Net cash flows from operating

activities | 2,081,869 | 2,461,076 | 753,936 | 132,339 | 1,090,605 | 4,639 | 814 |

Net cash flows from (used in) investing

activities | (1,587,256) | (754,611) | 31,770 | 5,576 | (1,389,321) | (20,639) | (3,623) |

Net cash flows (used in) financing

activities | (753,189) | (892,173) | (1,935,497) | (339,722) | (855,995) | (264,256) | (46,385) |

| Total Liquidity(9) | 2,980,011 | 4,273,023 | 2,576,471 | 452,250 | n.a. | 1,797,682 | 315,549 |

Summary Operating Data

| | Year ended December 31 | Three months ended March 31, |

| | 2018 | 2019 | 2020 | 2020 | 2021 |

| | | | | | |

| Operating aircraft at period end | 121 | 130 | 127 | 131 | 127 |

| Total aircraft at period end | 121 | 137 | 127 | 131 | 127 |

| Revenue passengers carried (in thousands)(10) | 33,446 | 36,445 | 16,776 | 8,346 | 4,495 |

| Revenue passenger kilometers (RPK) (in millions)(10) | 38,423 | 41,863 | 20,126 | 9,947 | 5,592 |

Available seat kilometers (ASKs)

(in millions)(10) | 48,058 | 51,065 | 25,142 | 12,462 | 6,999 |

| Load factor | 80.0% | 82.0% | 80.0% | 79.8% | 79.9% |

| Break-even load factor | 70.1% | 66.3% | 80.0% | 56.0% | 96.9% |

| Aircraft utilization (block hours per day) | 11.8 | 12.3 | 9.6 | 12.1 | 9.7 |

| Average fare (R$) | 318 | 359 | 345 | 352 | 315 |

| Passenger revenue yield per RPK (R$ cents) | 27.6 | 31.2 | 28.7 | 29.6 | 25.3 |

| PRASK (R$ cents) | 22.1 | 25.6 | 23.0 | 23.6 | 20.2 |

| RASK (R$ cents) | 23.7 | 27.2 | 25.3 | 25.3 | 22.4 |

| CASK (R$ cents) | 20.8 | 23.0 | 29.1 | 17.0 | 29.9 |

| CASK ex-fuel (R$ cents) | 12.8 | 15.1 | 21.1 | 9.0 | 21.8 |

| Adjusted CASK (R$ cents)(11) | 20.8 | 22.3 | 25.4 | 17.7 | 27.3 |

| | Year ended December 31 | Three months ended March 31, |

| | 2018 | 2019 | 2020 | 2020 | 2021 |

| | | | | | |

| Adjusted CASK ex-fuel (R$ cents)(11) | 12.8 | 14.4 | 17.4 | 9.7 | 19.2 |

| Departures | 250,040 | 259,377 | 124,528 | 62,956 | 32,797 |

| Departures per day | 685 | 711 | 340 | 692 | 364 |

| Destinations served | 69 | 77 | 63 | 75 | 62 |

| Average stage length (kilometers) | 1,098 | 1,114 | 1,152 | 1,136 | 1,205 |

Active full-time equivalent employees at

year end | 15,259 | 16,113 | 13,899 | 16,345 | 13,999 |

| Fuel liters consumed (in millions) | 1,403 | 1,475 | 722 | 363 | 192 |

| Average fuel expense per liter (R$) | 2.91 | 2.79 | 2.55 | 2.78 | 2.61 |

_________________

| (1) | Translated for convenience using the U.S. dollar selling rate as reported by the Central Bank of R$5.697 to US$1.00 as of March 31, 2021. |

| (2) | We adopted IFRS 16 on January 1, 2019 using the modified retrospective method and we did not restate our financial information for the year ended December 31, 2018 for comparative purposes. As a result, certain information presented for the year ended December 31, 2018 may not be comparable to other periods presented. For more information, see “Item 5. Operating and Financial Review and Prospects—B. Liquidity and Capital Resources—Recent Accounting Pronouncements” and note 18 to our audited consolidated financial statements included in our 2020 Annual Report. |