SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of July 2021

(Commission File No. 001-32221)

GOL LINHAS AÉREAS INTELIGENTES S.A.

(Exact name of registrant as specified in its charter)

GOL INTELLIGENT AIRLINES INC.

(Translation of registrant’s name into English)

Praça Comandante Linneu Gomes, Portaria 3, Prédio 24

Jd. Aeroporto

04630-000 São Paulo, São Paulo

Federative Republic of Brazil

(Address of registrant’s principal executive offices)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes ______ No ___X___

Parent Company and Consolidated

Quarterly Information (ITR)

GOL Linhas Aéreas Inteligentes S.A.

June 30, 2021

with Review Report on the Quarterly Information

Gol Linhas Aéreas Inteligentes S.A.

Parent Company and Consolidated Quarterly Information (ITR)

June 30, 2021

Contents

Comments on the Performance | 2 |

Report of the Statutory Audit Committee (SAC) | 6 |

Statement of the Executive officers on the Parent Company and Consolidated Quarterly Information (ITR) | 7 |

Statement of the Executive officers on the Independent Auditors’ Review Report | 8 |

| Review Report of the Independent Auditors on the Quarterly Information (ITR) | 9 |

| |

| Balance Sheets | 11 |

Income Statements | 13 |

Statements of Comprehensive Income (SCI) | 15 |

Statements of Changes in Shareholders’ Equity (SCSE) | 16 |

Statements of Cash Flows (SCF) | 17 |

Statements of Value Added (SVA) | 19 |

Notes to the Parent Company and Consolidated Quarterly Information (ITR) | 20 |

Comments on the Performance

GOL is intensely focused on improving its operations as the Company restores its network to meet the ramp-up in demand. “I am beyond thankful for our employees, the Team of Eagles, who are leading with care, clarity and confidence, resulting in successful management throughout the crisis, and placing the Company in a solid position in resuming its operations,” said Kakinoff.

Sales: Consolidated gross sales reached approximately R$1.7 billion in the 2Q21. GOL’s average daily sales reached R$18 million, which represents around 54% of pre-pandemic sales levels, R$300 million above 1Q21 and at the same levels of 4Q20. A traditionally weak quarter proved to be a period of recovery for the industry, which resumed growth in line with the downtrend in cases of Covid-19. During the pandemic, the Company maintained its guideline to invest in technology, having sustained aircraft occupancy close to 80%, even at the peak of the crisis, through robust software and data analytics. Furthermore, these investments are an important item in better pricing the tickets and managing the network.

Network and Fleet: GOL’s fleet currently has 94 737-800 aircraft, 23 737-700 aircraft and 10 Boeing 737 MAX aircraft. In June, the Company started operating the Boeing 737 MAX 8 in Congonhas, São Paulo, one of the most important and busiest airports in the country. As a result of its flexibility, GOL's network was redesigned with a focus on leisure demand, mainly in the Northeast, through the Salvador hub.

“We continue to prove that our standardized and flexible fleet is still the best strategy to meet demand fluctuations. We are getting greater value from our network than other carriers, and resuming operations with increased quality when compared to the pre-pandemic period. We also have fewer route overlaps with competitors, and can adjust our frequencies in booming markets almost instantaneously,” commented Celso Ferrer, Vice President of Operations.

GOL recently announced the acquisition of MAP Linhas Aéreas, a Brazilian domestic airline with routes to regional destinations, and from Congonhas Airport, to expand its network and capacity as it seeks to revitalize demand for leisure and business travel. With the acquisition, the Company further invests in the regional air transport market, especially in the Amazonia region. GOL maintains its traditional flexibility since there are no commitments regarding its fleet and staff.

“We believe that the acquisition of MAP is currently the best opportunity for rational consolidation in the Brazilian aviation market. From now on, we will remain focused on our organic growth strategy, stimulating demand in the business and leisure segments as Brazil emerges from the pandemic in order to expand our network,” added Kakinoff.

Customer experience: The Company stands out for human and intelligent relationships, which are important drivers that provide the best experience for Customers. “With technology as a major ally, the experience of flying with GOL is increasingly faster, simpler, and more independent. We remain the best choice for leisure and business travel,” said Eduardo Bernardes, Vice President of Sales, Marketing and Clients.

GOL’s Net Promoter Score (NPS) reached 43 in the 2Q21, a solid metric resulting from the best-in-market product and its highly engaged Customer service team.

Liquidity: The Company repaid approximately R$420 million of its principal amortizable debt in the second quarter of 2021 and, simultaneously, released assets with a fair value of US$250 million, demonstrating its commitment to strengthening its balance sheet. The acquisition of Smiles’ equity interest held by minority shareholders will boost cash generation and improve GOL’s creditworthiness.

Considering the amounts fundable from deposits and unencumbered assets, the Company’s potential sources of liquidity resulted in approximately R$5 billion of accessible liquidity. The average maturity of GOL’s long-term debt, excluding aircraft leases and perpetual notes, is approximately 3.4 years, with the main obligations already allocated to GOL’s cash flow. The net debt ratio (excluding Exchangeable Notes and perpetual bonds) to adjusted LTM EBITDA was 10.1x on June 30, 2021, representing the lowest leverage among its peers.

Furthermore, the Company has been working to strengthen margins, and has kept its fixed-costs low compared to the pre-pandemic period, in addition to converting its fixed payroll and leasing costs to variable. The strong and agile response to the pandemic in terms of liquidity was possible due to the work of strengthening the balance sheet over the last 5 years, which the Company has carried out diligently and continuously.

“Even in an atypical year, GOL stands out among the few global airlines for repaying approximately R$6.0 billion in debt since the beginning of 2020, its disciplined liquidity management and its ability to get value from the current assets. This strategy enables GOL to focus on growing with profitability, leaving the crisis with a lighter and stronger balance sheet, compared to its competitors,” said Richard Lark, Chief Financial Officer. “The absorption of Smiles’ loyalty program, together with the capital increase led by the controlling shareholders totaled approximately R$1.0 billion in new equity capital.”

Leasing: During the second quarter, GOL maintained flexibility for the duration of its fixed monthly payments contracts remaining variable (power-by-the-hour). The agreements signed with its lessors allow the extension of the deferrals in order to be adjusted proportionally to the recovery of capacity during the year 2021, which enables a lower volume of payments. The efficient management of the lease contracts allowed the Company to record the lowest fleet indebtedness among local peers, and with the lowest commitment of dollars per aircraft.

Sustainability: GOL invests in several initiatives to mitigate its impacts, and it is the first airline in Latin America to affirm its commitment to zero carbon emissions by 2050, by using SAFs (Sustainable Aviation Fuels), and through operational and technical improvements that reduce GHG (Greenhouse Gases) emissions, in line with the guidelines of IATA and the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA). Furthermore, it is the first airline to offer its passengers the option to offset carbon from their travels through a partnership with Moss, an environmental carbon credit platform. The emissions are offset with MCO2, a global token backed by blockchain, which offsets carbon emissions by supporting certified environmental projects in the Amazon.

Operating and Financial Indicators

| Traffic Data – GOL (in Millions) | 2Q21 | 2Q20 | % Var. | 6M21 | 6M20 | % Var. |

| RPK GOL – Total | 3,432 | 773 | 344.0% | 9,024 | 10,721 | -15.8% |

| RPK GOL – Domestic | 3,432 | 771 | 345.1% | 9,024 | 9,431 | -4.3% |

| RPK GOL – International | - | 2 | NM | - | 1,290 | NM |

| ASK GOL – Total | 4,033 | 990 | 307.4% | 11,032 | 13,452 | -18.0% |

| ASK GOL – Domestic | 4,033 | 986 | 309.0% | 11,032 | 11,668 | -5.5% |

| ASK GOL – International | - | 4 | NM | - | 1,784 | NM |

| GOL Load Factor – Total | 85.1% | 78.1% | 7.0 p.p. | 81.8% | 79.7% | 2.1 p.p. |

| GOL Load Factor – Domestic | 85.1% | 78.2% | 6.9 p.p. | 81.8% | 80.8% | 1.0 p.p. |

| GOL Load Factor – International | - | 56.2% | NM | 0.0% | 72.3% | NM |

| Operating Data | 2Q21 | 2Q20 | % Var. | 6M21 | 6M20 | % Var. |

| Revenue Passengers - Pax on Board ('000) | 2,922 | 627 | NM | 7,417 | 8,973 | -17.3% |

| Aircraft Utilization (Block Hours/Day) | 8.0 | 6.5 | 23.1% | 9.0 | 11.4 | -21.1% |

| Departures | 19,662 | 5,146 | 282.1% | 52,459 | 68,102 | -23.0% |

| Total Seats (‘000) | 3,504 | 821 | 326.8% | 9,248 | 11,655 | -20.7% |

| Average Stage Length (km) | 1,142 | 1,177 | -3.0% | 1,182 | 1,139 | 3.8% |

| Fuel Consumption (mm liters) | 113 | 30 | 276.7% | 305 | 393 | -22.4% |

| Full-time Employees (at Period End) | 13,754 | 15,981 | -13.9% | 13,754 | 15,981 | -13.9% |

| Average Operating Fleet(6) | 53 | 17 | 211.8% | 65 | 65 | 0.0% |

| On-time Departures | 96.3% | 96.1% | 0.2 p.p. | 96.3% | 96.9% | -0.6 p.p. |

| Flight Completion | 99.0% | 94.2% | 4.8 p.p. | 98.6% | 97.3% | 1.3 p.p. |

| Passenger Complaints (per 1,000 pax) | 1.35 | 5.99 | -77.5% | 0.97 | 4.53 | -78.6% |

| Lost Baggage (per 1,000 pax) | 1.89 | 2.07 | -8.7% | 1.86 | 2.21 | -15.8% |

| Financial Information | 2Q21 | 2Q20 | % Var. | 6M21 | 6M20 | % Var. |

| Net YIELD (R$ cents) | 25.86 | 31.48 | -17.9% | 25.53 | 29.71 | -14.1% |

| Net PRASK (R$ cents) | 22.01 | 24.58 | -10.5% | 20.88 | 23.67 | -11.8% |

| Net RASK (R$ cents) | 25.50 | 36.15 | -29.5% | 23.53 | 26.06 | -9.7% |

| CASK (R$ cents)(4) | 42.47 | 79.16 | -46.3% | 32.87 | 22.25 | 47.7% |

| CASK Ex-Fuel (R$ cents)(4) | 33.14 | 65.44 | -49.4% | 24.33 | 13.80 | 76.3% |

| Adjusted CASK(6) | 21.94 | 34.09 | -35.6% | 20.34 | 18.93 | 7.4% |

| Adjusted CASK(6) Ex-Fuel (R$ cents)(4) | 12.95 | 28.11 | -53.9% | 12.32 | 11.05 | 11.5% |

| Breakeven Load Factor(4) | NM | NM | NM | NM | NM | NM |

| Average Exchange Rate(1) | 5.2907 | 5.3854 | -1.8% | 5.3862 | 4.9218 | 9.4% |

| End of Period Exchange Rate(1) | 5.0022 | 5.4760 | -8.7% | 5.0022 | 5.4760 | -8.7% |

| WTI (Average per Barrel. US$)(2) | 66.10 | 28.00 | 136.1% | 62.21 | 36.82 | 69.0% |

| Price per Liter Fuel (R$)(3) | 3.35 | 2.19 | 53.0% | 3.00 | 2.74 | 9.5% |

| Gulf Coast Jet Fuel (Average per Liter, US$)(2) | 0.46 | 0.21 | 119.0% | 0.44 | 0.29 | 51.7% |

(1) Source: Brazilian Central Bank; (2) Source: Bloomberg; (3) Fuel expenses excluding hedge results and PIS/COFINS credits/liters consumed; (4) Excluding non-recurring expenses and Idle expenses. (5) Average operating fleet excluding aircraft in sub-leasing and MRO. Certain calculations may not match with the financial statements due to rounding. (6) Considers only expenses related to current operating levels.

Domestic market

GOL’s domestic demand was 3,432 million RPK, an increase of 344.0%, while the ASK supply increased 307.4% compared to 2Q20, and the load factor reached 85.1% in the quarter. The Company transported 2.9 million Customers in 2Q21, an increase of 366.0% compared to the same period in 2020.

International market

In 2Q21, the Company carried out non-regular charter flights for soccer teams in championships. As most country borders were closed, GOL did not offer regular international flights.

Volume of Departures and Total Seats

The total volume of the Company’s departures was 19,662, an increase of 282.1% over 2Q20. The total number of seats available to the market was 3.5 million in the second quarter of 2021, an increase of 326.8% quarter-over-quarter.

PRASK, Yield and RASK

Net PRASK decreased by 10.5% in the quarter when compared to 2Q20, reaching 22.01 cents (R$), mainly due to the higher volume of ASKs compared to the same period last year. GOL’s net RASK was 25.50 cents (R$) in 2Q21, a decrease of 29.5% compared to 2Q20 and a 13.8% increase over 1Q21. Net yield decreased 17.9% compared to 2Q20, reaching 25.86 cents (R$), but increase 2.1% when compared to 1Q21.

Fleet

At the end of 2Q21, GOL's total fleet was 127 Boeing 737 aircraft, comprised of 117 NGs and ten (10) MAXs (operational). At the end of 2Q20, GOL's total fleet was 130 aircraft, of which seven (7) were MAXs (non-operational). The average age of the Company's fleet was 11.3 years at the end of 2Q21.

GOL does not operate widebody aircraft, and has no aircraft financed via the capital markets, EETCs or finance leases. Its operating fleet is 100% composed of narrow body aircraft financed via operating leases.

| Final | 2Q21 | 2Q20 | Var. | 1Q21 | Var. |

| B737s | 127 | 130 | -3 | 127 | 0 |

| B737-7 NG | 23 | 23 | 0 | 23 | 0 |

| B737-8 NG | 94 | 100 | -6 | 96 | -2 |

| B737-8 MAX 8 | 10 | 7 | 3 | 8 | 2 |

As of June 31, 2021, GOL had 95 firm orders for the acquisition of Boeing 737 MAX aircraft, of which 73 were orders for 737 MAX-8 and 22 orders were for 737 MAX-10. The Company's fleet plan returns up to six (6) operational aircraft by the end of 2021, with the flexibility to return even more aircraft if necessary

| Fleet Plain | 2021E | 2022E | 2023E | >2024E | Total |

| Operating Fleet at the End of the Year | 128 | 131 | | | |

| Aircraft Commitments (R$ MM) | | 899.3 | 3,543.1 | 19,125.2 | 23,567.6 |

During the second quarter, GOL maintained flexibility on its fixed monthly payments via variable (power-by-the-hour) contracts. The agreements signed with its lessors allow for the extension of deferrals in order to be adjusted proportionally to the recovery of capacity during 2021. Leasing remeasurement took into account the new payment flows, the discount rate and the exchange rate on the date of the contractual changes. The calculated effects were recorded as an increase in the lease liability in the amount of R$47.4 million, with a corresponding decrease in fixed assets.

Glossary of Industry Terms

| · | AIRCRAFT LEASING: an agreement through which a company (the lessor) acquires a resource chosen by its client (the lessee) for subsequent rental to the latter for a determined period. |

| · | AVAILABLE SEAT KILOMETERS (ASK): The aircraft seating capacity is multiplied by the number of kilometers flown. |

| · | BARREL OF WEST TEXAS INTERMEDIATE (WTI): Intermediate oil from Texas, a region that serves as a reference to the name for concentrating oil exploration in the USA. WTI is used as a reference point in oil for the US derivatives markets. |

| · | BRENT: Oil produced in the North Sea, traded on the London Stock Exchange and used as a reference in the European and Asian derivatives markets. |

| · | TOTAL CASH: Total cash, financial investments, and restricted cash in the short- and long-term. |

| · | OPERATING COST PER AVAILABLE SEAT KILOMETER (CASK): operating expenses divided by the total number of available seat kilometers. |

| · | OPERATING COST PER AVAILABLE SEAT KILOMETER EX-FUEL (CASK EX-FUEL): operating cost divided by the total number of available seat kilometers excluding fuel expenses. |

| · | AVERAGE STAGE LENGTH: It is the average number of kilometers flown per stage performed. |

| · | EXCHANGEABLE SENIOR NOTES (ESN): Securities convertible into shares. |

| · | AIRCRAFT CHARTER: Flight operated by a Company that is out of its normal or regular operation. |

| · | BLOCK HOURS: Time in which the aircraft is in flight, plus taxi time. |

| · | LESSOR: The party renting a property or other asset to another party, the lessee. |

| · | LONG-HAUL FLIGHTS: Long-distance flights (in GOL’s case, flights of more than four hours’ duration). |

| · | REVENUE PASSENGERS: total number of passengers on board who have paid more than 25% of the full flight fare. |

| · | REVENUE PASSENGER KILOMETERS PAID (RPK): sum of the products of the number of paying passengers on a given flight and the length of the flight. |

| · | PDP: Credit for financing prepayments for the acquisition of aircraft. |

| · | Load Factor: Percentage of the aircraft’s capacity used in terms of seats (calculated by dividing the RPK/ASK). |

| · | Break-Even Load Factor: Load factor required for operating revenues to correspond to operating expenses. |

| · | Aircraft Utilization Rate: Average number of hours per day that the aircraft was in operation. |

| · | Passenger Revenue per Available Seat Kilometer (PRASK): total passenger revenue divided by the total number of available seat kilometers. |

| · | Operating Revenue per Available Seat Kilometers (RASK): The operating revenue is divided by the total number of available seat kilometers. |

| · | Sale-leaseback: A financial transaction whereby a resource is sold and then leased back, enabling the use of the resource without owning it. |

| · | SLOT: The right of an aircraft to take off or land at a given airport for a determined period. |

| · | Sub-Lease: An arrangement whereby a lessor in a rent agreement leases the item rented to a fourth party. |

| · | Freight Load Factor (FLF): Measure of capacity utilization (% of AFTKs used). Calculated by dividing FTK by AFTK. |

| · | Freight Tonne Kilometers (FTK): The demand for cargo transportation, calculated as the weight of the cargo in tons multiplied by the total distance traveled. |

| · | Available Freight Tonne Kilometer (AFTK): Weight of the cargo in tons multiplied by the kilometers flown. |

| · | Yield per Passenger Kilometer: The average value paid by a passenger to fly one kilometer. |

Disclaimer

This release contains forward-looking statements relating to the prospects of the business, estimates for operating and financial income (expenses), and those related to growth prospects of GOL, which are, by nature, subject to significant risks and uncertainties. The estimates and forecasts in this document involve known and unknown risks, uncertainties, contingencies, and other factors, many of which are beyond GOL’s control and which may lead the results, performances, or events to be substantially different from those expressed or implied in these statements. The forward-looking statements in this document are based on several assumptions related to GOL’s current and future business strategies and GOL’s future operating environment and are not a guarantee of future performance. GOL does not issue any statement or provide any guarantee that the results anticipated by the estimates in this document will be equivalent to those effectively achieved by GOL. Although GOL believes that the estimates here are reasonable, they may prove incorrect, and the final results may differ. These are merely estimates and projections and, as such, are based exclusively on management’s expectations for GOL. Such forward-looking statements depend, substantially, on external factors and risks presented in the disclosure documents filed by GOL, apply exclusively to the date they were issued and are, therefore, subject to change without prior notice.

Non-Accounting Measures

To be consistent with industry practice, the Company discloses so-called non-GAAP financial measures, which are not recognized under IFRS or other accounting standards, including “Net Debt”, “Total Liquidity” and “EBITDA”. GOL��s Management believes that disclosure of non-GAAP measures provides useful information to investors, financial analysts, and the public in their review of its operating performance and their comparison of its operating performance to the operating performance of other airlines and other industries. However, these non-GAAP items do not have standardized meanings and may not be directly comparable to similarly-titled items adopted by other companies. Potential investors should not rely on information not recognized under IFRS as a substitute for the GAAP measures of earnings or liquidity in making an investment decision.

Report of the Statutory Audit Committee (“SAC”)

The Statutory Audit Committee of Gol Linhas Aéreas Inteligentes S.A., in compliance with its legal and statutory obligations, has reviewed the Parent Company and Consolidated Quarterly Information (ITR) for the three-month and sixth-month periods ended June 30, 2021. Based on the procedures we have undertaken and considering the independent auditors’ review report issued by Grant Thornton Auditores Independentes and the information and explanations we have received during the quarter, we conclude that these documents can be submitted to the assessment of the Board of Directors.

São Paulo, July 28, 2021

André Béla Jánszky

Member of the Statutory Audit Committee

Antônio Kandir

Member of the Statutory Audit Committee

Germán Pasquale Quiroga Vilardo

Member of the Statutory Audit Committee

Statement of the Executive Officers on the Parent Company and Consolidated Quarterly Information (ITR)

Under the provisions of CVM Instruction 480/09, the executive officers state that they have discussed, reviewed, and approved the Parent Company and Consolidated Quarterly Information (ITR) for the three-month and sixth-month periods ended June 30, 2021.

São Paulo, July 28, 2021

Paulo Sérgio Kakinoff

Chief Executive Officer

Richard Freeman Lark Jr.

Executive Vice President, Chief Financial Officer, and Investor Relations Officer

Statement of the Executive officers on the Independent Auditors’ Review Report

Under the provisions of CVM Instruction 480/09, the Executive Board states that it has discussed, reviewed, and agreed with the conclusion of the review report from the independent auditor, Grant Thornton Auditores Independentes, on the Parent Company and Consolidated Quarterly Information (ITR) for the three-month and sixth-month periods ended June 30, 2021.

São Paulo, July 28, 2021

Paulo Sérgio Kakinoff

Chief Executive Officer

Richard Freeman Lark Jr.

Executive Vice President, Chief Financial Officer, and Investor Relations Officer

(Free translation from the original issued in Portuguese. In the event of any discrepancies, the Portuguese language version shall prevail.)

Independent auditor’s report on review of interim financial information

Grant Thornton Auditores Independentes Av. Eng. Luís Carlos Berrini, 105 - 12o andar Itaim Bibi, São Paulo (SP) Brasil T +55 11 3886-5100 |

To the Board of directors and shareholders of

Gol Linhas Aéreas Inteligentes S.A.

São Paulo – SP

Introduction

We have reviewed the accompanying individual and consolidated interim financial information of Gol Linhas Aéreas Inteligentes S.A. (the Company), comprised in the Quarterly Information Form for the quarter ended June 30, 2021, comprising the balance sheet as of June 30, 2021 and the respective statements of income and of comprehensive income for the periods of three and six months then ended and of changes in shareholders’ equity and of cash flows for the period of six months then ended, including the footnotes.

Management is responsible for the preparation of the individual interim financial information in accordance with the NBC TG 21 – Interim Financial Reporting and of the consolidated interim financial information in accordance with the NBC TG 21 and with the international standard IAS 34 – Interim Financial Reporting, as issued by the International Accounting Standards Board (Iasb), such as for the presentation of these information in accordance with the standards issued by the Brazilian Exchange Securities Commission, applicable to the preparation of interim financial information. Our responsibility is to express a conclusion on this interim financial information based on our review.

Review scope

We conducted our review in accordance with the Brazilian and International standards on reviews of interim information (NBC TR 2410 – Review of Interim Financial Information Performed by the Independent Auditor of the Entity and ISRE 2410 – Review of Interim Financial Information Performed by the Independent Auditor of the Entity, respectively). The review of interim information consists of making inquiries, primarily of persons responsible for the financial and accounting matters and applying analytical and other review procedures. A review is substantially less in scope than an audit conducted in accordance with the audit standards and, consequently, does not enable us to obtain assurance that we would become aware of all significant matters that might be identified in an audit. Accordingly, we do not express an audit opinion.

Conclusion on the individual interim financial information

Based on our review, nothing has come to our attention that causes us to believe that the individual interim financial information included in the quarterly information form referred to above has not been prepared, in all material respects, in accordance with NBC TG 21 applicable to the preparation of interim financial information, and presented in accordance with the standards issued by the Brazilian Securities and Exchange Commission.

Conclusion on the consolidated interim financial information

Based on our review, nothing has come to our attention that causes us to believe that the consolidated interim financial information included in the quarterly information form referred to above has not been prepared, in all material respects, in accordance with NBC TG 21 and IAS 34 applicable to the preparation of interim financial information, and presented in accordance with the standards issued by the Brazilian Securities and Exchange Commission.

Emphasis of matter

Significant uncertainty as to the ability to continue as a going concern

We draw attention to Note 1, which states that the individual and consolidated interim financial information were prepared under the assumption of going concern. As described in the aforementioned note, the Company has faced recurring reductions in operations, mainly due to the effects of the COVID-19 pandemic, with a significant decrease in demand (a 28% reduction in passengers revenues in the first semester of 2021 compared to the first semester quarter of 2020), and recorded net working capital deficit and equity deficiency as of June 30, 2021 which, together with other events and conditions, indicate the existence of material uncertainty that may cast significant doubt about the Company’s ability to continue as a going concern. The plans and actions being developed by Management to restore the Company’s financial economic balance and financial position are described in Note 1. The individual and consolidated interim financial information do not include any adjustment that may arise from the result of such uncertainty. Our review conclusion is not qualified regarding this matter.

Other matters

Statements of value added

The quarterly information referred to above includes the individual and consolidated statements of value added for the period of six months ended June 30, 2021, prepared under the responsibility of the Company's management and presented as supplementary information for the purposes of IAS 34.

These statements were submitted to the same review procedures in conjunction with the review of the Company's interim financial information in order to conclude they are reconciliated to the interim financial information and to the accounting records, as applicable, and whether the structure and content are in accordance with the criteria established in the NBC TG 09 - Statement of Value Added. Based on our review, nothing has come to our attention that causes us to believe that the accompanying statements of value added were not prepared, in all material respects, in accordance with the individual and consolidated interim financial information taken as a whole.

São Paulo, July 28, 2021

Octavio Zampirollo Neto

Assurance Partner

Grant Thornton Auditores Independentes

| Balance Sheets June 30, 2021 and December 31, 2020 (In thousand of Reais) |

| | | Parent Company | Consolidated |

| Assets | Note | June 30, 2021 | December 31, 2020 | June 30, 2021 | December 31, 2020 |

| | | | | | |

| Current | | | | | |

| Cash and Cash Equivalents | 6 | 448,648 | 423,937 | 760,269 | 662,830 |

| Financial Investments | 7 | 103 | 236 | 22,838 | 628,343 |

| Restricted Cash | 8 | 4,442 | 4,194 | 269,131 | 355,769 |

| Trade Receivables | 9 | - | - | 717,408 | 739,699 |

| Inventories | 10 | - | - | 212,814 | 195,638 |

| Advances to Suppliers and Third-Parties | 11 | 53 | 10,441 | 198,813 | 318,769 |

| Taxes to Recover | 12 | 1,627 | 6,295 | 265,357 | 186,955 |

| Rights from Derivative Transactions | 34.2 | - | - | - | 12,526 |

| Dividends and Interest on Shareholders’ Equity to Receive | | - | 24,120 | - | - |

| Other Credits | | 9,109 | 9,640 | 123,531 | 144,822 |

| Total Current | | 463,982 | 478,863 | 2,570,161 | 3,245,351 |

| | | | | | |

| Noncurrent | | | | | |

| Financial Investments | 7 | - | - | 168 | 992 |

| Restricted Cash | 8 | 3 | 7 | 44,684 | 188,838 |

| Deposits | 14 | 46,902 | 118,261 | 1,856,128 | 2,058,455 |

| Advances to Suppliers | 11 | - | - | 97,417 | 89,701 |

| Taxes to Recover | 12 | 15,260 | 12,102 | 114,120 | 318,404 |

| Deferred Taxes | 13 | 53,542 | 53,492 | 53,772 | 53,563 |

| Other Credits | | - | - | 31,889 | 34,338 |

| Credits with Related Parties | 28.1 | 5,985,898 | 4,897,331 | - | - |

| Rights from Derivative Transactions | 34.2 | 63,574 | 87,663 | 63,574 | 116,283 |

| Investments | 15 | - | 574,717 | - | 815 |

| Property, Plant & Equipment | 16 | 168,499 | 68,660 | 4,979,649 | 4,960,288 |

| Intangible Assets | 17 | - | - | 1,757,598 | 1,747,108 |

| Total Noncurrent | | 6,333,678 | 5,812,233 | 8,998,999 | 9,568,785 |

| | | | | | |

| Total | | 6,797,660 | 6,291,096 | 11,569,160 | 12,814,136 |

The accompanying notes are an integral part of the Parent Company and Consolidated Quarterly Information (ITR).

| Balance Sheets June 30, 2021 and December 31, 2020 (In thousand of Reais) |

| | | Parent Company | Consolidated |

| Liabilities | Note | June 30, 2021 | December 31, 2020 | June 30, 2021 | December 31, 2020 |

| | | | | | |

| Current | | | | | |

| Loans and Financing | 18 | 147,278 | 638,964 | 1,773,004 | 2,353,279 |

| Leases to Pay | 19 | - | - | 1,864,831 | 1,317,008 |

| Suppliers | 20 | 64,573 | 72,702 | 1,562,946 | 1,612,536 |

| Labor Obligations | | 169 | 181 | 351,203 | 334,670 |

| Taxes to Collect | 21 | 358 | 292 | 61,279 | 73,614 |

| Landing Fees | | - | - | 937,371 | 907,958 |

| Advance Ticket Sales | 22 | - | - | 1,999,013 | 2,050,799 |

| Frequent-Flyer Program | 23 | - | - | 1,280,022 | 1,258,502 |

| Advances from Customers | | - | - | 54,878 | 27,897 |

| Provisions | 24 | - | - | 252,046 | 169,381 |

| Obligations with Derivative Transactions | 34.2 | - | - | - | 5,297 |

| Other Liabilities | | 53 | - | 381,582 | 287,275 |

| Total Current | | 212,431 | 712,139 | 10,518,175 | 10,398,216 |

| | | | | | |

| Noncurrent | | | | | |

| Loans and Financing | 18 | 8,095,433 | 6,990,749 | 8,521,006 | 7,623,687 |

| Leases to Pay | 19 | - | - | 5,831,098 | 6,267,184 |

| Suppliers | 20 | - | - | 10,234 | 32,658 |

| Labor Obligations | | - | - | 30,239 | - |

| Taxes to Collect | 21 | - | - | 28,039 | 32,362 |

| Frequent-Flyer Program | 23 | - | - | 344,760 | 322,460 |

| Provisions | 24 | - | - | 1,363,988 | 1,353,515 |

| Deferred Taxes | 13 | - | - | 206,695 | 219,634 |

| Obligations to Related Parties | 28.1 | 12,693 | 8,791 | - | - |

| Provision for Investment Losses | 15 | 13,795,822 | 12,670,479 | - | - |

| Other Liabilities | | 427,581 | 316,030 | 461,226 | 331,479 |

| Total Noncurrent | | 22,331,529 | 19,986,049 | 16,797,285 | 16,182,979 |

| | | | | | |

| Shareholders’ Equity | | | | | |

| Share Capital | 25.1 | 4,039,336 | 3,009,436 | 4,039,336 | 3,009,436 |

| Shares to Issue | | 2,088 | 1,180 | 2,088 | 1,180 |

| Treasury Shares | 25.2 | (41,514) | (62,215) | (41,514) | (62,215) |

| Capital Reserves | | 195,680 | 207,246 | 195,680 | 207,246 |

| Equity Valuation Adjustments | | (1,071,030) | (577,369) | (1,071,030) | (577,369) |

| Accumulated Losses | | (18,870,860) | (16,985,370) | (18,870,860) | (16,985,370) |

| Negative Shareholders’ Equity (Deficit) Attributable to the Parent Company | | (15,746,300) | (14,407,092) | (15,746,300) | (14,407,092) |

| | | | | | |

| Non-Controlling Shareholders | | - | - | - | 640,033 |

| Total Shareholders’ Equity (Deficit) | | (15,746,300) | (14,407,092) | (15,746,300) | (13,767,059) |

| | | | | | |

| Total | | 6,797,660 | 6,291,096 | 11,569,160 | 12,814,136 |

The accompanying notes are an integral part of the Parent Company and Consolidated Quarterly Information (ITR).

| Statements of Comprehensive Income (Expenses) Quarters ended June 30, 2021 and 2020 (In thousands of Brazilian Reais - R$) |

RE

| | | Parent Company |

| | | Three-month period ended | | Six-month period ended |

| | Note | June 30, 2021 | June 30, 2020 | | June 30, 2021 | June 30, 2020 |

| | | | | | | |

| Operating Revenue (Expenses) | | | | | | |

| Selling Expenses | | (393) | - | | (393) | - |

| Administrative Expenses | | (76,835) | (2,171) | | (104,415) | (7,170) |

| Other Revenues and Expenses, Net | | (9) | (49) | | 480 | 376,259 |

| Total Operating Expenses | 30 | (77,237) | (2,220) | | (104,328) | 369,089 |

| | | | | | | |

| | | | | | | |

| Equity Income (Expenses) | 15 | 387,393 | (1,572,913) | | (1,709,777) | (3,790,552) |

| | | | | | | |

| Operating Profit (Loss) before Financial Income (Expenses) and Income Taxes | | 310,156 | (1,575,133) | | (1,814,105) | (3,421,463) |

| | | | | | | |

| Financial Income (Expenses) | | | | | | |

| Financial Revenue | | 43,039 | 149,228 | | 194,859 | 766,144 |

| Financial Expenses | | (167,066) | (406,941) | | (402,417) | (741,200) |

| Financial Revenues (Expenses), Net | 31 | (124,027) | (257,713) | | (207,558) | 24,944 |

| | | | | | | |

| Financial Income (Expenses) before Exchange Rate Change, Net and before Income Tax and Social Contribution | | 186,129 | (1,832,846) | | (2,021,663) | (3,396,519) |

| | | | | | | |

| Exchange Rate Change, Net | 31 | 460,872 | (161,161) | | 136,123 | (882,424) |

| | | | | | | |

| Loss before Income Tax and Social Contribution | | 647,001 | (1,994,007) | | (1,885,540) | (4,278,943) |

| | | | | | | |

| Income Tax and Social Contribution | | | | | | |

| Current | | - | (2,030) | | - | (3,078) |

| Deferred | | (4,088) | (876) | | 50 | (3,161) |

| Total Income Tax and Social Contribution | 13 | (4,088) | (2,906) | | 50 | (6,239) |

| | | | | | | |

| Net Profit (Loss) for the Period | | 642,913 | (1,996,913) | | (1,885,490) | (4,285,182) |

| | | | | | | |

| | | | | | | |

| Basic Net Profit (Loss) | 26 | | | | | |

| Per Common Share | | 0.050 | (0.169) | | (0.149) | (0.362) |

| Per Preferred Share | | 1.768 | (7.222) | | (5.253) | (12.668) |

| | | | | | | |

| Diluted Net Profit (Loss) | 26 | | | | | |

| Per Common Share | | 0.050 | (0.169) | | (0.149) | (0.362) |

| Per Preferred Share | | 1.765 | (7.222) | | (5.253) | (12.668) |

| | | | | | | |

| | | | | | | |

The accompanying notes are an integral part of the parent company and consolidated interim financial information.

| Statements of Comprehensive Income (Expenses) Quarters ended June 30, 2021 and 2020 (In thousands of Brazilian Reais - R$) |

| | | Consolidated |

| | | Three-month period ended | | Six-month period ended |

| | Note | June 30, 2021 | June 30, 2020 | | June 30, 2021 | June 30, 2020 |

| Net Revenue | | | | | | |

| Passenger Transportation | | 887,574 | 243,303 | | 2,303,852 | 3,184,636 |

| Cargo and Others | | 140,798 | 114,545 | | 292,147 | 320,939 |

| Total Net Revenue | 29 | 1,028,372 | 357,848 | | 2,595,999 | 3,505,575 |

| | | | | | | |

| Cost from Services | 30 | (1,243,943) | (502,006) | | (2,879,188) | (3,081,916) |

| Gross Profit (Loss) | | (215,571) | (144,158) | | (283,189) | 423,659 |

| | | | | | | |

| Operating Revenue (Expenses) | | | | | | |

| Selling Expenses | | (101,046) | (66,217) | | (204,825) | (235,174) |

| Administrative Expenses | | (432,030) | (239,440) | | (795,223) | (567,717) |

| Other Revenues and Expenses, Net | | (61,602) | (447,785) | | (49,516) | 507,053 |

| Total Operating Expenses | 30 | (594,678) | (753,442) | | (1,049,564) | (295,838) |

| | | | | | | |

| Operating Profit (Loss) before Financial Income (Expenses) and Income Taxes | | (810,249) | (897,600) | | (1,332,753) | 127,821 |

| | | | | | | |

| Financial Income (Expenses) | | | | | | |

| Financial Revenue | | 20,231 | 196,401 | | 163,651 | 894,647 |

| Financial Expenses | | (478,857) | (722,757) | | (1,047,355) | (1,721,213) |

| Financial Revenues (Expenses), Net | 31 | (458,626) | (526,356) | | (883,704) | (826,566) |

| | | | | | | |

| Financial Income (Expenses) before Exchange Rate Change, Net and before Income Tax and Social Contribution | | (1,268,875) | (1,423,956) | | (2,216,457) | (698,745) |

| | | | | | | |

| Exchange Rate Change, Net | 31 | 1,938,545 | (570,024) | | 401,305 | (3,513,428) |

| | | | | | | |

| Loss before Income Tax and Social Contribution | | 669,670 | (1,993,980) | | (1,815,152) | (4,212,173) |

| | | | | | | |

| Income Tax and Social Contribution | | | | | | |

| Current | | (16,757) | (11,580) | | (45,588) | (35,853) |

| Deferred | | 5,122 | 8,479 | | 12,984 | (10,664) |

| Total Income Tax and Social Contribution | 13 | (11,635) | (3,101) | | (32,604) | (46,517) |

| | | | | | | |

| Net Profit (Loss) for the Period | | 658,035 | (1,997,081) | | (1,847,756) | (4,258,690) |

| | | | | | | |

| Net Profit (Loss) attributable to: | | | | | | |

| Shareholders of the Parent Company | | 642,913 | (1,996,913) | | (1,885,490) | (4,285,182) |

| Non-Controlling Shareholders | | 15,122 | (168) | | 37,734 | 26,492 |

| | | | | | | |

| Basic Net Profit (Loss) | 26 | | | | | |

| Per Common Share | | 0.050 | (0.169) | | (0.149) | (0.362) |

| Per Preferred Share | | 1.768 | (7.222) | | (5.253) | (12.668) |

| | | | | | | |

| Diluted Net Profit (Loss) | 26 | | | | | |

| Per Common Share | | 0.050 | (0.169) | | (0.149) | (0.362) |

| Per Preferred Share | | 1.765 | (7.222) | | (5.253) | (12.668) |

The accompanying notes are an integral part of the parent company and consolidated interim financial information.

| Statements of Comprehensive Income (Expenses) Quarters ended June 30, 2021 and 2020 (In thousands of Brazilian Reais - R$) |

| | Parent Company |

| | Three-month period ended | | Six-month period ended |

| | June 30, 2021 | June 30, 2020 | | June 30, 2021 | June 30, 2020 |

| | | | | |

| Net Profit (Loss) for the period | 642,913 | (1,996,913) | | (1,885,490) | (4,285,182) |

| | | | | | |

| Other Comprehensive Income that will be Reversed to Income (Expenses) | | | | | |

| Cash Flow Hedge, Net of Income Tax and Social Contribution | 319,060 | (1,060) | | 415,782 | (1,078,349) |

| Actuarial losses from pension plans and post-employment benefits | - | 27,287 | | - | 27,287 |

| Cumulative Adjustment of Conversion into Subsidiaries | 521 | (275) | | 537 | (275) |

| | 319,581 | 25,952 | | 416,319 | (1,051,337) |

| | | | | | |

| Total Comprehensive Income (Expenses) for the Period | 962,494 | (1,970,961) | | (1,469,171) | (5,336,519) |

| | | | | |

| | Consolidated |

| | Three-month period ended | | Six-month period ended |

| | June 30, 2021 | June 30, 2020 | | June 30, 2021 | June 30, 2020 |

| | | | | |

| Net Profit (Loss) for the period | 658,035 | (1,997,081) | | (1,847,756) | (4,258,690) |

| | | | | | |

| Other Comprehensive Income that will be Reversed to Income (Expenses) | | | | | |

| Cash Flow Hedge, Net of Income Tax and Social Contribution | 319,060 | (1,060) | | 415,782 | (1,078,349) |

| Actuarial losses from pension plans and post-employment benefits | - | 27,287 | | - | 27,287 |

| Cumulative Adjustment of Conversion into Subsidiaries | 780 | (275) | | 808 | (275) |

| | 319,840 | 25,952 | | 416,590 | (1,051,337) |

| | | | | | |

| Total Comprehensive Income (Expenses) for the Period | 977,875 | (1,971,129) | | (1,431,166) | (5,310,027) |

| | | | | | |

| | | | | |

| Comprehensive Income (Expenses) attributable to: | | | | |

| Shareholders of the Parent Company | 962,494 | (1,970,961) | | (1,469,171) | (5,336,519) |

| Non-Controlling Shareholders | 15,381 | (168) | | 38,005 | 26,492 |

The accompanying notes are an integral part of the parent company and consolidated interim financial information.

| Statements of Changes in Shareholders’ Equity Periods ended June 30, 2021 and 2020 (In thousands of Brazilian Reais - R$) |

| Parent Company and Consolidated |

| | | | | Capital reserves | Equity valuation adjustments | | | | |

| | Share Capital | Shares to be issued | Treasury shares | Bonus on transfer of stock options | Special premium reserve of subsidiary | Share-based payments | Unrealized hedge gains | Post-Employment Benefit | Other comprehensive income | Gains on change in investment | Accumulated losses | Deficit attributable to shareholders’ equity of the parent company | Smiles’ non-controlling interests | Total |

| Balances as of December 31, 2019 | 3,008,178 | 584 | (102,543) | 17,497 | 83,229 | 124,550 | (530,043) | (41,045) | - | 759,335 | (10,996,413) | (7,676,671) | 571,254 | (7,105,417) |

| Other comprehensive income (loss), net | - | - | - | - | - | - | (1,078,349) | 27,287 | (275) | - | - | (1,051,337) | (278) | (1,051,615) |

| Net Profit (Loss) for the period | - | - | - | - | - | - | - | - | | - | (4,285,182) | (4,285,182) | 26,492 | (4,258,690) |

| Total Comprehensive Income Loss for the period | - | - | - | - | - | - | (1,078,349) | 27,287 | (275) | - | (4,285,182) | (5,336,519) | 26,214 | (5,310,305) |

Capital increase per option period options | 727 | (727) | - | - | - | - | - | - | - | - | - | - | - | - |

| Advances for future capital increase | - | 278 | | - | - | - | - | - | - | - | - | 278 | - | 278 |

| Treasury shares transferred | - | - | 40,007 | - | - | (40,007) | - | - | - | - | - | - | - | - |

| Equity interest dilution effects | - | - | - | - | 548 | - | - | - | - | - | (690) | (142) | - | (142) |

| Stock option exercised | - | - | - | - | - | 10,405 | - | - | - | - | - | 10,405 | 328 | 10,733 |

| Balances as of June 30, 2020 | 3,008,905 | 135 | (62,536) | 17,497 | 83,777 | 94,948 | (1,608,392) | (13,758) | (275) | 759,335 | (15,282,285) | (13,002,649) | 597,796 | (12,404,853) |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Balances as of December 31, 2020 | 3,009,436 | 1,180 | (62,215) | 17,497 | 83,229 | 106,520 | (1,311,076) | (26,669) | 564 | 759,812 | (16,985,370) | (14,407,092) | 640,033 | (13,767,059) |

| Other comprehensive income (loss), net | - | - | - | - | - | - | 415,782 | - | 537 | - | - | 416,319 | 271 | 416,590 |

| Net Profit (Loss) for the period | - | - | - | - | - | - | - | - | - | - | (1,885,490) | (1,885,490) | 37,734 | (1,847,756) |

| Total Comprehensive Income Loss for the period | - | - | - | - | - | - | 415,782 | - | 537 | - | (1,885,490) | (1,469,171) | 38,005 | (1,431,166) |

| Stock option exercised | - | - | - | - | - | 8,547 | - | - | - | - | - | 8,547 | 263 | 8,810 |

Capital increase per stock options period | - | 908 | - | - | - | - | - | - | - | - | - | 908 | - | 908 |

| Dividends and interest shareholders on equity paid by Smiles | - | - | - | - | - | - | - | - | - | - | - | - | (236,992) | (236,992) |

| Treasury shares sold | - | - | 867 | (279) | - | - | - | - | - | - | - | 588 | - | 588 |

| Treasury shares transferred | - | - | 19,834 | (6,198) | - | (13,636) | - | - | - | - | - | - | - | - |

| Acquisition of shares from non-controlling shareholders | 606,839 | - | - | 744,450 | - | - | - | - | - | (909,980) | - | 441,309 | (441,309) | - |

| Preferred shares withdrawn | - | - | - | (744,450) | - | - | - | - | - | - | - | (744,450) | - | (744,450) |

| Capital increase | 423,061 | - | - | - | - | - | - | - | - | - | - | 423,061 | - | 423,061 |

| Balances as of June 30, 2021 | 4,039,336 | 2,088 | (41,514) | 11,020 | 83,229 | 101,431 | (895,294) | (26,669) | 1,101 | (150,168) | (18,870,860) | (15,746,300) | - | (15,746,300) |

The accompanying notes are an integral part of the parent company and consolidated interim financial information.

| Cash Flow Statements Periods ended June 30, 2021 and 2020 (In thousands of Brazilian Reais - R$) |

| | Parent Company | Consolidated |

| | June 30, 2021 | June 30, 2020 | June 30, 2021 | June 30, 2020 |

| | | | | |

| Net loss for the period | (1,885,490) | (4,285,182) | (1,847,756) | (4,258,690) |

| Adjustment to reconcile net (loss) income to net cash provided by operating activities | | | | |

| Depreciation – Aeronautical ROUs | - | - | 280,221 | 452,342 |

| Depreciation and amortization - Other | - | - | 354,417 | 566,239 |

| Allowance (reversal) for doubtful accounts | - | - | (1,081) | 1,440 |

| Provision for legal proceedings | - | - | 154,604 | 113,569 |

| Provision for inventory obsolescence | - | - | 54 | 73 |

| Provision for losses with supplier advances | - | | (4,640) | |

| Recovery of extemporaneous credits | - | - | (57,422) | (126,675) |

| Adjustment to present value of assets and liabilities | - | - | 36,529 | 27,443 |

| Deferred taxes | (50) | 3,161 | (12,984) | 10,664 |

| Equity | 1,709,777 | 3,790,552 | - | - |

| Share-based payments | - | - | 8,810 | 10,405 |

| Leaseback | - | - | - | (112,591) |

| Actuarial Losses from post-employment benefits | - | - | 8,707 | 6,005 |

| Exchange and monetary variations, net | (135,204) | 1,455,387 | (398,198) | 3,439,014 |

| Interest on debt and financial lease | 335,048 | 186,192 | 898,511 | 660,101 |

| Provision for aircraft and engine return | - | - | 157,892 | 81,227 |

| Provision for maintenance reserve | 63,361 | - | 176,363 | 75,276 |

| Results of derivatives recognized in the statement of income | 21,587 | 119,528 | 80,357 | 690,643 |

| Unrealized hedge results – ESN(*) | (124,954) | (409,136) | (124,954) | (409,136) |

| Provision for labor obligations | - | - | 94,490 | 53,091 |

| Disposals of property, plant and equipment and intangible assets | - | 108,538 | 1,583 | 33,489 |

| Other provisions | (537) | 213 | (2,240) | 45,579 |

| Adjusted Net Income | (16,462) | 969,253 | (196,737) | 1,359,508 |

| | | | | |

| Changes in operating assets and liabilities: | | | | |

| Trade receivables | - | - | 20,192 | 705,431 |

| Short-term investments | 1,376 | 511 | 15,987 | 121,002 |

| Inventories | - | - | (17,230) | (19,029) |

| Advance to suppliers and third parties | 10,388 | (14) | 116,881 | (69,469) |

| Deposits | 5,438 | (1,522) | (35,040) | (189,850) |

| Recoverable taxes | 1,510 | 6,968 | 183,304 | (3,651) |

| Variable Leases | - | - | 17,794 | - |

| Suppliers | (8,632) | (4,042) | (48,721) | 215,317 |

| Suppliers - forfaiting | - | - | - | (152,162) |

| Advance from ticket sales | - | - | (51,786) | (383,879) |

| Mileage program | - | - | 43,820 | 353,313 |

| Advances from customers | - | - | 26,981 | (2,401) |

| Labor Charges | (12) | (100) | (47,718) | (96,675) |

| Landing fees | - | - | 29,413 | (39,134) |

| Taxes obligation | 66 | (17,597) | 23,814 | 2,236 |

| Derivatives liabilities | - | - | 133,331 | (545,300) |

| Payments for lawsuits and aircraft return | - | - | (237,982) | (103,964) |

| Other assets (liabilities) | 119,365 | 2,537 | 270,934 | (51,676) |

| Interest paid | (326,520) | (223,770) | (378,944) | (281,153) |

| Income tax paid | - | (2,665) | (40,472) | (29,176) |

| Net Cash Provided (Consumed) by Operating Activities | (213,483) | 729,559 | (172,179) | 789,288 |

| | | | | |

| Cash Flow Statements Periods ended June 30, 2021 and 2020 (In thousands of Brazilian Reais - R$) |

| | Parent Company | Consolidated |

| | June 30, 2021 | June 30, 2020 | June 30, 2021 | June 30, 2020 |

| | | | | |

| Receivable loans from related parties | (1,196,212) | (1,604,676) | - | - |

| Investments in subsidiary | - | - | 606,115 | (483,112) |

| Restricted cash | (244) | 41 | 32,522 | (529,874) |

| Receipt of Dividends and Interest on Shareholders’ Equity through Subsidiary | 287,128 | 15,002 | - | - |

| Advances for future capital increases in controlled entities | (151,000) | - | - | - |

| Advances for property, plant and equipment acquisition, net | - | - | (29,377) | (56,782) |

| Property, plant and equipment acquisitions | (111,429) | (8,904) | (104,276) | (450,142) |

| Return – PDP – Boeing Agreement | 11,590 | 136,962 | 11,590 | 136,962 |

| Acquisition of intangible assets | - | - | (51,877) | (32,366) |

| Net cash flows used in investing activities | (1,160,167) | (1,461,575) | 464,697 | (1,415,314) |

| | | | | |

| Loan funding | 1,501,569 | - | 1,512,521 | 449,062 |

| Loan and financing payments | (499,663) | (405,878) | (572,792) | (699,748) |

| Lease payments – aeronautical | - | - | (515,891) | (517,795) |

| Lease payments - other | | | (9,007) | (10,107) |

| (Payment) derivative receipt | - | - | - | 21,800 |

| Disposal of treasury shares | 588 | - | 588 | - |

| Acquisition of shares from non-controlling shareholders | - | - | (744,450) | - |

| Dividends and interest paid to non-controlling shareholders | - | - | (260,131) | (14,811) |

| Capital increase from shareholders | 423,061 | - | 423,061 | - |

| Shares to be issued | 908 | 278 | 908 | 278 |

| Net cash flows (used in) from financing activities | 1,426,463 | (405,600) | (165,193) | (771,321) |

| | | | | |

| Exchange variation on cash held in foreign currencies | (28,102) | 146,028 | (29,886) | 167,814 |

| | | | | |

Net cash (decrease) increase and cash equivalents | 24,711 | (991,588) | 97,439 | (1,229,533) |

| | | | | |

| Cash and cash equivalents at the beginning of the period | 423,937 | 1,016,746 | 662,830 | 1,645,425 |

| Cash and cash equivalents at the end of the period | 448,648 | 25,158 | 760,269 | 415,892 |

(*) Exchangeable Senior Notes. Transactions that do not affect cash are presented in Note 35 of these financial statements. |

The accompanying notes are an integral part of the parent company and consolidated interim financial information.

| Statement of Value Added Periods ended June 30, 2021 and 2020 (In thousands of Brazilian Reais - R$) |

| | Parent Company | Consolidated |

| | June 30, 2021 | June 30, 2020 | June 30, 2021 | June 30, 2020 |

| Revenues | | | | |

| Passengers, cargo and other | - | - | 2,735,660 | 3,650,199 |

| Other operating revenues | 480 | 376,259 | 93,373 | 542,014 |

| Allowance for doubtful accounts | - | - | 1,081 | (1,439) |

| | 480 | 376,259 | 2,830,114 | 4,190,774 |

| Inputs acquired from third parties (including ICMS and IPI) | | | | |

| Suppliers of aircraft fuel | - | - | (972,651) | (1,181,699) |

| Materials, energy, outsourced services and others | (94,825) | (5,291) | (1,301,860) | (814,132) |

| Aircraft insurance | - | - | (24,381) | (18,697) |

| Sales and marketing | (345) | (366) | (129,577) | (161,042) |

| Gross value added (distributed) | (94,690) | 370,602 | 401,645 | 2,015,204 |

| | | | | |

| Depreciation – aeronautical ROUs | - | - | (280,221) | (452,342) |

| Depreciation and amortization - other | - | - | (354,417) | (566,239) |

| Value added (distributed) produced | (94,690) | 370,602 | (232,993) | 996,623 |

| | | | | |

| Value-added received in transfer | | | | |

| Result of equity income | (1,709,777) | (3,790,552) | - | - |

| Financial income | 239,992 | 766,144 | 217,649 | 894,647 |

| Value added (distributed) for distribution | (1,564,475) | (2,653,806) | (15,344) | 1,891,270 |

| | | | | |

| Distribution of value-added: | | | | |

| Salaries | 9,417 | 1,048 | 674,093 | 540,024 |

| Benefits | - | 1 | 100,975 | 83,237 |

| FGTS | - | - | 37,742 | 16,748 |

| Personnel | 9,417 | 1,049 | 812,810 | 640,009 |

| | | | | |

| Federal taxes | 1,875 | 6,755 | 269,796 | 251,867 |

| State taxes | - | - | 7,461 | 7,130 |

| Municipal taxes | - | - | 1,218 | 1,857 |

| Tax, charges and contributions | 1,875 | 6,755 | 278,475 | 260,854 |

| | | | | |

| Interest and Exchange rate variation – aeronautical leases | 309,723 | 1,623,572 | 145,646 | 2,390,077 |

| Interest and Exchange rate variation – other | | | 539,459 | 2,828,305 |

| Rent | - | - | 55,860 | 29,418 |

| Other | - | - | 162 | 1,297 |

| Third-party capital remuneration | 309,723 | 1,623,572 | 741,127 | 5,249,097 |

| | | | | |

| Net loss for the period | (1,885,490) | (4,285,182) | (1,885,490) | (4,285,182) |

| Net income (loss) for the period attributable to non-controlling interests | - | - | 37,734 | 26,492 |

| Remuneration of own capital | (1,885,490) | (4,285,182) | (1,847,756) | (4,258,690) |

| | | | | |

| Value added (distributed) for distribution | (1,564,475) | (2,653,806) | (15,344) | 1,891,270 |

The accompanying notes are an integral part of the parent company and consolidated interim financial information.

| Notes on the Parent Company and Consolidated Quarterly Information (ITR) June 30, 2021 (In thousands of Brazilian Reais - R$, except when otherwise indicated) |

Gol Linhas Aéreas Inteligentes S.A. (“Company” or “GOL”) is a limited liability company incorporated on March 12, 2004 under Brazilian laws. The Company’s bylaws states that the corporate purpose is exercising the equity control of GOL Linhas Aéreas S.A. (“GLA”), which explores regular and non-regular flight transportation services of passengers, cargo and mailbags, domestically or internationally; development of loyalty programs; among others.

The Company’s shares are traded on B3 S.A. - Brasil, Bolsa, Balcão (“B3”) and on the New York Stock Exchange (“NYSE”) under the ticker GOLL4 and GOL, respectively. The Company adopts B3’s Special Corporate Governance Practices Level 2 and is part of the Special Corporate Governance (“IGC”) and Special Tag Along (“ITAG”) indexes, created to distinguish companies that commit to special corporate governance practices.

The Company’s official headquarters are located at Praça Comandante Linneu Gomes, s/n, portaria 3, prédio 24, Jardim Aeroporto, São Paulo, Brazil.

| 1.1. | Impacts and Management’s Measures regarding Covid-19 |

The pandemic triggered by Covid-19 continues to significantly impact the Global economic activity in fiscal year 2021. In Brazil, the recent increase in the number of cases and deaths, linked to the discovery continues to be impacted by the pandemic triggered by Covid-19, mainly due to the uncertainties related to the emergence of new variants, caused state and municipal authorities to expand restrictive measures on circulation and restrict the operation of non-essential activities. Evolution in the cases’ number and occupation in the hospital network, which directly affects the demand for air tickets in the leisure and corporate markets.

The second quarter of 2021, historically a period of low season for the airline industry, proved to be a turning point for demand recovery after a strong impact caused by the second wave of Covid-19, considering the increase in sales and search for flights on search platforms, mainly resulting from the intensification in the pace of vaccination observed in the country, which currently has an average of more than 1.5 million vaccines administered per day and more than 45% of the population having already received the first dose. According to press media consortium from data of Public Health Secretariat.

GOL's operations reflected an increase in the volume of flights of 78% from 165 daily flights operated in in the first half of April to 295 at the second half of June 2021. The daily sales volume also reflected an increase from R$7 million per day to R$17 million per day in the same period. Since the beginning of the pandemic, GOL, through the readjustment of its air network, has maintained a consistent occupancy rate at a level close to 80%. The flexible business model based on a single type of fleet is essential to keep up with reductions of more than 90% in passenger demand observed during lockdown periods and the installation of sanitary barriers.

The Company, through its Executive Committee, which is entirely formed by the management board members, works promptly to support society, monitor demand, and define financial and operational strategies.

In this second quarter of 2021, GOL also completed important initiatives to strengthen its capital structure, such as: (i) acquisition of non-controlling shareholders in Smiles; (ii) issue (retap) of an additional Senior Secured Notes of US$300 million; (iii) capital increase of R$423 million, led by the Company's controlling shareholders and with participation in the subscription by minority shareholders and; (iv) full payment of the remaining balance of its principal amortizable debt, guaranteed financing, in the amount of R$410 million in principal and interest, with the release of assets in guarantee. The completion of these operations will provide better financial flexibility for the Company and sustain its liquidity through the resumption of the volume of its operations for the second half of 2021.

| Notes on the Parent Company and Consolidated Quarterly Information (ITR) June 30, 2021 (In thousands of Brazilian Reais - R$, except when otherwise indicated) |

In 2021, Gol maintains the initiative to transport Covid-19 vaccines for free – with GOLLOG – and health professionals who work directly in the fight against the pandemic, besides crediting 1,000 Smiles miles to each GOL segment flown at no cost. There are also active and strict protocols for aircraft hygiene and safety and health, together with actions to reduce human contact throughout the entire chain.

The Management works continuously towards people’s health and integrity, managing the cash and has enough funds to meet financial obligations in the next twelve months. However, the scenario remains challenging due to uncertainties on the pandemic, recovery of the Brazilian economy, and demand in the airline industry.

Following WHO guidelines to the letter, the Company is currently working with its ecosystem to help advance the vaccination calendar, which should lead to the resumption of economic activity, as seen in initial forecasts in countries with advanced immunization.

| 1.1.1 | Impacts on the Parent Company and Consolidated Quarterly Information |

As already mentioned, the impacts caused by the pandemic were immediate and severe to the Company, with the main consequence being the reduction in the operational network, in response to the drop in demand, which can be verified by the decrease in net revenue and reduction in the Company's margins. The table below details the reclassifications made in the period, which are directly related to the Covid-19 pandemic and additional disclosures:

| | | Consolidated – June 30, 2021 |

| | | Three months | | Six months |

| Statements of income - recassifications | | Cost of rendered services | Other income and expenses, net | | Cost of rendered services | Other income and expenses, net |

| Flight equipment depreciation – idleness | (a) | 80,535 | (80,535) | | 143,210 | (143,210) |

| Personnel expenses - idleness | (a) | 320 | (320) | | 320 | (320) |

| (a) | Due to the drop in the number of flights operated, where the Company incurred with the burden of time, by analogy to the provisions of CPC 16 (R1) - Inventories, equivalent to IAS 2, expenses and depreciation of flight equipment not directly related to the revenues generated in the period, called idleness, were reclassified from the group of costs of services to the group of other revenues and expenses, net. |

Like all other business organizations, the Company cannot foresee the duration of the pandemic and the extent of the continuous impacts caused by it on future business, results, and cash generation. For this reason, when preparing this quarterly information, the Management considered the most recent forecasts available, duly reflected in the Company’s business plans. In the period ended June 30, 2021, no adjustment was needed regarding impairments on the Company’s Recoverable taxes, Deferred tax assets, Property, plant & equipment, and Intangible assets.

| 1.2. | Capital Structure and Net Current Capital |

The net working capital consolidated on June 30, 2021, is negative by R$7,948,014 (negative by R$7,152,865 on December 31, 2020). The variation is mainly due to financial investments in the amount of R$605,505, and a higher balance of leases payable totaling R$547,823, due to the liquidity management and the drop in operations from the economic crisis caused by the pandemic, partially offset by the rebalancing of debts, which resulted in a reduction of R$580,275 in the balance of short-term loans and financing. Of the negative net working capital as of June 30, 2021, R$3,279,035 refers to advances from ticket sales and the mileage program, (R$3,309,301 on December 31, 2020), which are expected to be substantially recognized with the Company’s services.

| Notes on the Parent Company and Consolidated Quarterly Information (ITR) June 30, 2021 (In thousands of Brazilian Reais - R$, except when otherwise indicated) |

On June 30, 2021, the Company also had a deficit attributable to equity holders of the parent company of R$15,746,300 (R$14,407,092 on December 31, 2020). The variation observed is mainly due to the pandemic’s impacts on the Company’s operations, with a loss of R$1,885,490 attributable to the controlling shareholders in the six-month period ended June 30, 2021. This impact was partially offset by the capital increase promoted by the Company's shareholders in the amount of R$423,061.

The operations of the Company are sensitive to changes in the economic scenario and to the volatility of the Real, given that around 95.4% of its indebtedness (loans and financing and leases) are exposed to the U.S. dollar (“US$”) and 35.2% of its costs are also pegged to the U.S. currency, and its ability to adjust the price of fees charged from its customers to recapture the change of the US$ depends on the rational (offer) capacity and behavior of competitors.

Over the past four years, Management has taken a series of measures to adapt the size of its fleet to demand, matching the supply of seats with the level of demand, thus promoting the maintenance of high occupancy rates, reducing costs and adapting the capital structure, as well as, executing structuring initiatives of its balance sheet, largely completed in the second quarter of 2021 and that will provide better financial flexibility as of the second half of 2021.

With the outbreak of the pandemic, which led to an unprecedented economic crisis, Management reorganized the Company’s businesses. By continuously monitoring Covid-19’s impacts on economic activity, the Company works promptly to ensure business sustainability, considering the market’s management and the Company’s financial position.

In addition to the continuous monitoring of operations and sales, with a focus on economic balance, given the uncertain scenario, Management monitors possible measures to rebalance net working capital for the second half of 2021. Such measures, in case adopted, will have the purpose of optimizing the capital structure, and the definition will be based on a detailed assessment of the economic situation and perspectives of that particular moment.

Our unaudited interim condensed consolidated financial statements have been prepared on the assumption of the Company as a going concern, which includes the continuity of operations, realization of assets and compliance with liabilities and commitments in the usual course of business, in conformity with the business plan prepared by Management, reviewed and approved by the Board of Directors.

Although there is still a substantial uncertainty about how long it will take the airline industry to recover, and that leads to material uncertainty on our ability to continue as a going concern, the unaudited interim condensed consolidated financial statements as of June 30, 2021, don’t include any adjustment that may result from inability to continue operating.

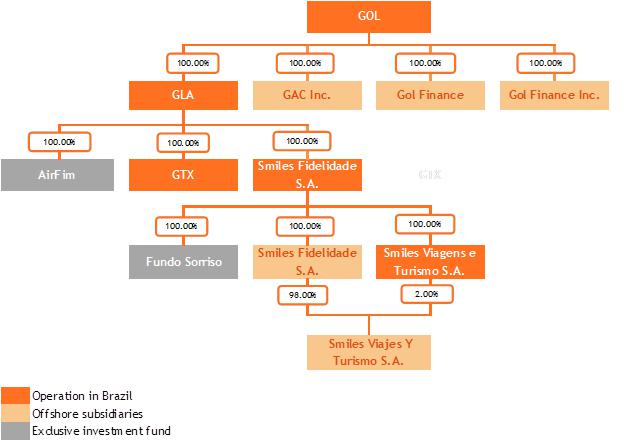

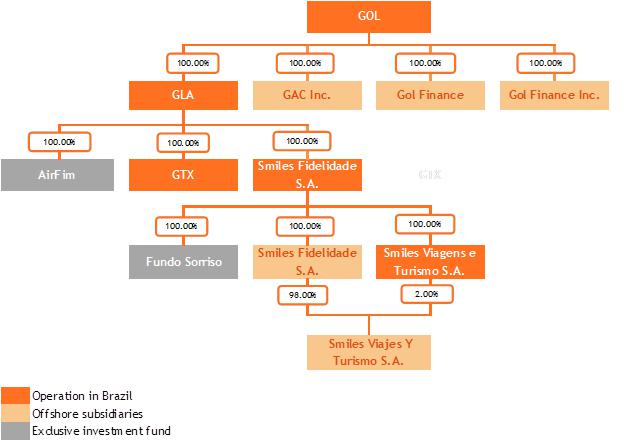

The corporate structure of the Company and its subsidiaries, on June 30, 2021, is shown below:

| Notes on the Parent Company and Consolidated Quarterly Information (ITR) June 30, 2021 (In thousands of Brazilian Reais - R$, except when otherwise indicated) |

The Company’s equity interest in the capital of its subsidiaries, on June 30, 2021, is shown below:

| Entity | Date of incorporation | Location | Principal activity | Type of control | % of interest in the capital stock

in the capital stock |

| June 30, 2021 | December 31, 2020 |

| GAC | March 23, 2006 | Cayman Islands | Aircraft acquisition | Direct | 100.00 | 100.00 |

| Gol Finance Inc. | March 16, 2006 | Cayman Islands | Fundraising | Direct | 100.00 | 100.00 |

| Gol Finance | June 21, 2013 | Luxembourg | Fundraising | Direct | 100.00 | 100.00 |

| GLA | April 9, 2007 | Brazil | Flight transportation | Direct | 100.00 | 100.00 |

| AirFim | November 7, 2003 | Brazil | Investment fund | Indirect | 100.00 | 100.00 |

| GTX | February 8, 2021 | Brazil | Equity investments | Indirect | 100.00 | - |

| Smiles Fidelidade | August 1, 2011 | Brazil | Loyalty program | Direct | 52.60 | 52.60 |

| Smiles Viagens | August 10, 2017 | Brazil | Tourism agency | Indirect | 52.60 | 52.60 |

| Smiles Fidelidade Argentina (a) | November 7, 2018 | Argentina | Loyalty program | Indirect | 52.60 | 52.60 |

| Smiles Viagens Argentina (a) | November 20, 2018 | Argentina | Tourism agency | Indirect | 52.60 | 52.60 |

| Fundo Sorriso | July 14, 2014 | Brazil | Investment fund | Indirect | 52.60 | 52.60 |

| Companies in Shareholding: |

| SCP Trip (b) | April 27, 2012 | Brazil | On-board magazine | - | - | 60.00 |

| (a) | Companies with functional currency in Argentine pesos (ARS). |

| (b) | GLA has cancelled its investment in SCP Trip in February, 2021. |

| (c) | In May, 2021, GOL transfered direct control (52.60% of the capital) of Smiles Fidelidade to its subsidiary GLA. In June, 2021, the Company completes the corporate transaction for the acquisition of minority interest, see note 1.4 |

The subsidiaries GAC Inc., GOL Finance and GOL Finance Inc. are entities incorporated with the specific purpose of continuing the financial operations and related to the Company's fleet. They do not have an independent management structure and are unable to make independent decisions. Thus, the assets and liabilities of these entities are consolidated in the parent company.

| Notes on the Parent Company and Consolidated Quarterly Information (ITR) June 30, 2021 (In thousands of Brazilian Reais - R$, except when otherwise indicated) |

The subsidiaries Smiles Fidelidade S.A. and Smiles Viajes Y Turismo S.A., both headquartered in Buenos Aires, Argentina, incorporated and controlled by Smiles Fidelidade S.A, have the purpose to promote operations of the Smiles Program and the sale of airline tickets in that country.

The subsidiary Smiles Fidelidade also controls Smiles Viagens e Turismo S.A. (“Smiles Viagens”), whose main purpose is intermediating travel organization services, by booking or selling airline tickets, accommodation, tourism packages, among others.

The investment funds Airfim and Fundo Sorriso, controlled by GLA and Smiles Fidelidade, respectively, have the characteristic of an exclusive fund and act as an extension of the subsidiaries to carry out operations with derivatives and investments, so that the Company consolidates the assets and liabilities of this fund in its financial statements.

GTX S.A., directly controlled by GLA, is in a pre-operational stage and its corporate purpose is to manage its own assets and participate in the capital of other companies.

| 1.4. | Corporate reorganization plan |

On June 04, 2021, Smiles Fidelidade became a wholly owned subsidiary of GLA as a result of the proposed merger of shares approved by Smiles and GOL shareholders.

The merger proposal included the following steps, which were implemented concurrently and interdependently:

| · | incorporation of Smiles Fidelidade shares by GLA, issuing preferred shares and redeemable preferred shares of GLA to the shareholders of Smiles Fidelidade; |

| · | incorporation of GLA’s shares by the Company, issuing preferred shares and redeemable preferred shares of the Company to GLA’s shareholders; and |

| · | redemption of GLA’s and the Company's redeemable preferred shares, with cash payment based on the redemption of the Company's redeemable preferred shares to the shareholders of Smiles Fidelidade. |

On April 28, 2021, the period for exercising the right of withdrawal expired, which was exercised on 176 preferred shares of GOL and 28,220 common shares of Smiles, whose total amount of R$299 was settled on May 12, 2021.

On May 25, 2021, the Company transferred to GLA the control of Smiles Fidelidade S.A. through a capital increase in the amount of R$350,075.

Considering the choice of Smiles' minority shareholders among the available exchange ratios, on June 04, 2021, GOL issued 22,433,975 new preferred shares, 25,707,301 class B preferred shares and 33,113,683 class C preferred shares. Classes B and C were redeemed and settled in cash on June 23, 2021 for the total amount of R$744,450.

| 1.5. | Acquisition of MAP Transportes Aéreos |

On June 08, 2021, GOL entered into an agreement to acquire MAP Transportes Aéreos Ltda. (“MAP”), a Brazilian domestic airline with flight routes to regional destinations and São Paulo´s Congonhas Airport, considering the Company's commitment to expand Brazilian demand for passenger air transport and an unparalleled market opportunity for rational consolidation in the Brazilian aviation market, as the country's economy recovers from Covid-19.

| Notes on the Parent Company and Consolidated Quarterly Information (ITR) June 30, 2021 (In thousands of Brazilian Reais - R$, except when otherwise indicated) |

MAP will be acquired for R$28 million, to be paid upon satisfaction of all closing conditions, through 100,000 preferred shares (GOLL4) at R$28.00 per share and R$25 million in cash to be paid in twenty-four monthly installments. At closing, the Company will assume up to R$100 million in MAP's financial obligations.

The main benefits of this transaction are: (i) expansion to new routes; (ii) offering higher seat density to historically underserved markets; and (iii) enhancing cost-efficient operations.

The transaction closing is subject to approval by the National Civil Aviation Agency (ANAC) and by the Administrative Council for Economic Defense (CADE). Therefore, on June 30, 2021 there are no impacts from this transaction on the interim condensed consolidated financial information statements.

In December 2016 as a result of investigations involving the Company, GOL signed an agreement ("Agreement") with the Brazilian Federal Public Ministry, through which the Company agreed to pay fines and make improvements to its compliance program, in return for the commitment of the Brazilian Federal Public Ministry agreed not to file any lawsuits related to activities under the Agreement, as disclosed in the financial statements for the years ended December 31, 2017, 2018, 2019 and 2020.

The Company voluntarily informed the U.S. Department of Justice ("DOJ"), the Securities and Exchange Commission ("SEC") and the Brazilian Securities and Exchange Commission ("CVM") about the Agreement and the external and independent investigation conducted by an independent committee of the Company.

The investigation, completed in April 2017, revealed that immaterial payments were made to politically exposed people and the competent authorities were duly reported. None of the current employees, representatives or members of the Management and Board of Directors knew of any illegal purpose behind any of the transactions identified, or of any illegal benefit to the Company arising from the transactions under investigation.

The Company will keep reporting any future developments regarding this issue, as well as monitor the analyses already started by these agencies, which may impose new fines and possibly other sanctions to the Company.

Since 2016, the Company has adopted several measures to strengthen and expand its internal control and compliance, detailed in the financial statements for the years ended December 31, 2017, 2018, 2019 and 2020. In addition, Management constantly reinforces with its employees, customers and suppliers its commitment to continuous improvement in its internal control programs and compliance.

There were no further developments on the subject during the period ended June 30, 2021.

| 2. | Message from Management, basis of preparation and presentation of the parent company and consolidated quarterly information |

The Company’s parent company and consolidated quarterly information were prepared in accordance with the International Financial Reporting Standards (“IFRS”) issued by the International Accounting Standards Board (“IASB”).

| Notes on the Parent Company and Consolidated Quarterly Information (ITR) June 30, 2021 (In thousands of Brazilian Reais - R$, except when otherwise indicated) |

The Company’s parent company and consolidated quarterly information were prepared using the Brazilian Real (“R$”) as the functional and presentation currency. Figures are expressed in thousands of Brazilian reais, except when stated otherwise. The items disclosed in foreign currencies are duly identified, when applicable.

The preparation of the Company’s parent company and consolidated quarterly information requires Management to make judgments, use estimates, and adopt assumptions affecting the stated amounts of revenues, expenses, assets, and liabilities. However, the uncertainty inherent in these judgments, assumptions, and estimates could give rise to results that require a material adjustment of the book value of certain assets and liabilities in future reporting fiscal years.

The Company is continually reviewing its judgments, estimates, and assumptions.

Management, when preparing these parent company and consolidated quarterly information, used the following disclosure criteria, considering regulatory aspects and the relevance of the transactions to understand the changes in the Company’s economic and financial position and its performance since the end of the fiscal year ended December 31, 2020, as well as the restatement of relevant information included in the annual financial statements related to the year ended December 31, 2020 disclosed on March 17, 2021.

Management confirms that all the material information in these parent company and consolidated quarterly information are being demonstrated and corresponds to the information used by Management in the development of its business management activities.

The parent company and consolidated quarterly information have been prepared based on historical cost, with the exception of the following material items recognized in the statements of financial positions:

· short-term investments classified as cash and cash equivalents measured at fair value;

· short-term investments mainly comprising exclusive investment funds, measured at fair value;

· restricted cash measured at fair value;

· derivative financial instruments measured at fair value; and

· investments accounted for using the equity method.