SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of March 2023

(Commission File No. 001-32221)

GOL LINHAS AÉREAS INTELIGENTES S.A.

(Exact name of registrant as specified in its charter)

GOL INTELLIGENT AIRLINES INC.

(Translation of registrant’s name into English)

Praça Comandante Linneu Gomes, Portaria 3, Prédio 24

Jd. Aeroporto

04630-000 São Paulo, São Paulo

Federative Republic of Brazil

(Address of registrant’s principal executive offices)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes ______ No ___X___

Parent Company and Consolidated

Financial Statements

GOL Linhas Aéreas Inteligentes S.A.

December 31, 2022

with Independent Auditor’s Report

Gol Linhas Aéreas Inteligentes S.A.

Parent Company and Consolidated Financial Statements

December 31, 2022

Contents

| Management Report | | 02 |

| Report of the Statutory Audit Committee (“SAC”) | | 08 |

Fiscal Board’s Report | | 10 |

| Executive Officers’ Statement on the Financial Statements | | 11 |

| Statement of the Executive Officers on the Independent Auditor’s Report | | 12 |

| Independent auditor’s report on the individual and consolidated financial statements | | 13 |

| Balance Sheets | | 19 |

| Income Statement | | 21 |

| Comprehensive Income Statements | | 22 |

| Statements of Changes in Shareholders’ Equity | | 23 |

| Cash Flow Statements | | 24 |

| Value Added Statements | | 26 |

| Notes to the Financial Statements | | 27 |

Management Report

Over the past year, GOL started a new phase characterized by high efficiency and lower costs. 4Q22 was marked by the highest yield in the Company’s history and the highest operating margin since the beginning of the pandemic. GOL saw a strong recovery in demand for air travel in all segments, transporting more than 7.7 million passengers in the quarter, bringing the total passengers in 2022 to approximately 27.3 million. The Company subsequently expanded Available Seat Kilometers by 29% in 4Q22, compared to 4Q21.

At the same time, GOL remained committed to its low-cost and high-productivity business model by taking a rational approach to operating routes. The Company’s levels of aircraft utilization are some of the highest in the industry – a competitive advantage that reduces unit costs and drives cash generation. This business model is further supported by the optimization of GOL’s fleet, with the conversion of non-operating aircraft into cargo carriers and the replacement of the 737 NG by new 737 MAX aircraft. In the fourth quarter, GOL added one new MAX-8 aircraft, resulting in 38 MAX aircraft representing 26% of the total fleet at the end of 2022.

In December, GOL issued Secured Amortizing Notes in the amount of approximately US$200 million, which extended certain lease deferral obligations by an additional year to 2026 and reduced the disbursement of lease repayments throughout 2023, due to the 12-month grace period. These Notes have guarantee on unencumbered receivables, an average cost of capital to GOL of 4.3% p.a. and represent a new innovative initiative to the Company’s liability management program. This financing was successfully secured in the midst of a capital market environment not conducive to new issuances, thereby reflecting confidence in the strength of GOL’s business and its Management.

These results were achieved thanks to the excellence of the Team of Eagles, together with the continuous investments in technology and in the improvement of the Customer experience, and the trust of our Customers, partners, suppliers and shareholders.

Record Revenues and Sales

In 4Q22, GOL achieved a net operating revenue of R$4.7 billion – the highest net revenue in the history of the Company. GOL focused on a number of key strategic initiatives during the quarter, including: ensuring a broader network for leisure destinations in the Northeast, the introduction of new regional markets, the resumption of corporate markets in the RJ-SP routes, and the improvement in Company’s digital channels. Combined, these initiatives helped to significantly increase RASK by 25.3% and yield by 24.8%, compared to 4Q21.

The Company also reached the highest level of sales in any quarter, generating approximately R$5.4 billion. This was accomplished by efficient management of ticket inventory and growth of the SMILES and GOLLOG business units, which increased sales by 25% and 18% respectively compared to the 4Q21, and recorded a joint revenue of approximately R$1.3 billion. In November, characterized as a strong month for sales due to Black Friday, GOL surpassed its daily sales levels versus 4Q19, even with overall retail sales trending lower in Brazil.

“The growth in yields over the last few quarters demonstrates the strength of our highly attractive network with bleisure travelers. We expect the recovery of the corporate market in the fourth quarter to continue to intensify during 2023 and contribute to the expansion of the aviation market in general. Despite the higher cost of living, Brazilians are keen to travel. GOL remains committed to controlling costs and delivering an excellent experience in order to best serve its customers,” commented Eduardo Bernardes, Chief Revenue Officer (CRO).

Capacity, Productivity and Cost Dilution

In the fourth quarter, GOL advanced capacity resumption (ASKs), reaching around 86% compared to the 4Q19, with a peak of 88.5% in December. The Company’s offer management seeks to maximize the profitability of each flight. Even though GOL remained the only airline in the market with a lower capacity than 2019 levels, it has already reached the pre-pandemic period unit cost excluding fuel (19.09 cents (R$)). The Company expects to continually reduce its unit cost excluding fuel as it resumes its full capacity over the coming quarters.

Operating fleet utilization reached 11.6 hours per day in the 4Q22, an increase of approximately 1% compared to the previous quarter. Importantly, other productivity indicators also improved, reaching higher levels when compared to 2019, such as the ASK by number of Employees, at 0.81 (+28.3% vs. 4Q21 and stable compared to 4Q19), and fuel consumption per block hour operated, at 2.7 (-3.7% vs. 4Q21 and -7.3% vs. 4Q19).

SMILES and GOLLOG Business Units as Ancillary Revenue Levers

Ancillary Revenues, mainly from SMILES and GOLLOG, tripled to R$340.7 million during the 4Q22, approximately 7.2% of the GOL’s total net revenue.

SMILES ended 4Q22 with 20.9 million Customers (6% more than in 4Q21) and around 1 billion miles redeemed (26% more than 4Q21), attesting to its market-leading position as the best mileage program in the region. The revenue was R$1.1 billion in the quarter, and the gains from the synergy after the incorporation by GOL continued to be captured, demonstrating the strength of the investments made by the Company and the consolidation of a strong working capital instrument.

GOLLOG, in part through its dedicated cargo agreement with MELI currently with two aircraft, boosted its revenue to R$189 million, its highest ever revenues for a quarter. The contract with MELI provides for the operation of up to six aircraft in 2023, with an option for an additional six, and will be an important factor in increasing GOL’s presence in the cargo transportation market, which has seen growing demand in recent years.

Network Expansion and the Corporate Market Recovery

The fourth quarter was characterized by strong demand for leisure flights at the start to Brazil’s high season. GOL expanded the connectivity of its international network, offering additional flights between Brasília and Orlando, in addition to inaugurating flights between Galeão airport in Rio de Janeiro, connecting to the capital of Uruguay, Montevideo. The Company also reactivated routes during this quarter to the cities of Córdoba and Rosario in Argentina, thus serving 100% of its pre-pandemic destinations in that country. Finally, in December, GOL made its inaugural flights between Manaus and Miami, with its Boeing 737-MAX 8, connecting the north of Brazil to the United States.

In the domestic market, in response of the recovery in corporate demand, the Company increased its offer to Rio de Janeiro by 40% and reached a record number of seats in Congonhas. GOL is also preparing to offer new destinations beginning the first quarter of 2023, in addition to the six airports that began to be served last October: Santa Maria (RIA), São José do Rio Preto (SJP), Uberaba (UBA), Uruguaiana (URG), Ipatinga – Vale do Aço (IPN), Araçatuba (ARU) and Juiz de Outside – Zona da Mata Mineira (IZA), which are operated through the agreement with Voepass.

In November, GOL announced the expansion of operations in the Midwest, connecting capitals in the region on direct flights to the South and Northeast during the high season. Also in November, GOL inaugurated a flight between Salvador and Lençóis. In the South, the Company also consolidated its presence through inaugural flights between Santa Maria and São Paulo, in addition to new routes connecting Curitiba to Florianópolis and Porto Alegre.

“We’ve taking a careful and planned approach to increasing capacity and resuming routes in both the domestic and international markets. We want to make sure the demand is really there, and seek to optimize aircraft utilization and reduce unit cost excluding fuel. We have the required flexibility to return to more corporate markets in 2023, as and when the demand is sufficient, through the combination of our efficient fleet and high productivity,” concluded Celso Ferrer.

Fleet Transformation Plan

In 4Q22, the Company received one new Boeing 737-MAX 8, totaling 38 737-MAX 8 at the end of 2022, and representing 26% of its fleet. The Company returned two Boeing 737-NG aircraft in the quarter.

In 2023, despite the global supply-chain challenges, the Company expects the delivery of 15 new aircraft, raising the total to 53 Boeing 737-MAX 8 in its fleet.

Investments to Improve Customer Experience

In the three months ended December 31, 2022, the Company inaugurated key initiatives aimed at improving its Customer experience, ranging from the new service provided by GOLLOG (CHEGOL) that helps Customers find items left behind on flights, to the debut of an “air shuttle” between Buenos Aires and São Paulo in joint partnership with Aerolíneas Argentinas, promoting greater flexibility for Customers to visit the capital of Argentina.

In October, the Company was recognized for the fifth consecutive time by Folha de São Paulo newspaper as the “Top of Mind” brand in the airline category. In November, GOL was again awarded by APEX (Airline Passenger Experience Association) a Four Star Low-Cost Carrier award in recognition of the Company’s efforts to offer the best product to Customers through ‘GOL’s Way of Serving’. Finally, in December, GOL was recognized as the most admired airline brand by Cariocas, in a survey conducted by the newspaper O Globo in partnership with Troiano Branding.

“We seek to offer a differentiated product to our Customers, especially in the corporate segment. Our product is the sum of its onboard service, flight options, flexibility, technology for the Client journey, and a consistent mileage program with tangible benefits, and we aim to excel in all of these areas. At the heart of that is GOL’s history as a pioneer in aviation and its continued investment in engaging and leveraging its entire Team of Eagles to go above and beyond,” said Carla Fonseca, Chief Experience Officer and President of SMILES.

Developments in ESG

In 4Q22, GOL received the YenVA Stage 2 certification and recorded an improvement in its CDP index, now rated B-. Through MOSS, GOL already offers its Customers the option to offset their carbon when purchasing airline tickets. However, in November, GOL and GLOBO signed a partnership to also neutralize emissions in essential corporate travel, an unprecedented measure in the industry. In December, Brazil’s second 100% Carbon Neutral route, which connects Congonhas to Bonito, also completed one year of existence, neutralizing a total of 2,700 tons of CO2 on more than 210 round-trip flights.

The Company created and consolidated Diversity and Inclusion groups to reflect and promote the diversity of its Eagles Team, addressing topics such as: Racial Equity, Gender Equity, LGBT+, Accessibility, Ageism and the Environment. This group will be responsible for the creation of performance indicators and support the evolution of the Company on these issues. At the GOL Institute, the Company registered 19 institutions that were directly supported, strengthening its Educational pillar.

Abra Group

On March 1, 2023, GOL’s controlling shareholder, Mobi Fundo de Investimento em Ações Investimento no Exterior (“Mobi”) announced that Mobi and some of Avianca’s main investors signed on this date an amendment to the Master Contribution Agreement (“Master Contribution Agreement”) which was the subject of the material disclosure by the Company on May 11, 2022. As part of the implementation of the transaction provided for in the Master Contribution Agreement, as amended, Mobi transferred to Abra Group Limited, a company incorporated under the laws of England and Wales (“Abra”), all shares issued by the Company held by Mobi.

Following the transfer of shares described above, the shares issued by the Company held by Abra will be transferred to two companies incorporated under the laws of England and Wales, called Abra Mobi LLP and Abra Kingsland LLP. Abra Mobi LLP, together with the Constantino brothers, will hold voting control of 50% of the common shares issued by GOL (“Common Shares”); and Abra Kingsland LLP will hold voting control of 50% of the Common Shares. Abra Mobi LLP will be directly controlled by Mobi (Constantino brothers) and Abra Kingsland LLP will be directly controlled by Kingsland. After the implementation of said steps, the Constantino brothers and Kingsland, through their direct and indirect stakes, as applicable, will hold 50% of the Common Shares each and Abra will hold 100% of the economic rights over the shares of issuance of the Company contributed by Mobi to the capital of the Sub-Holdings.

The parties to the Master Contribution Agreement will enter into a Shareholders' Agreement to govern their rights and obligations as shareholders of Abra, with Mobi (and, indirectly, the Constantino brothers) and the major investors of Avianca becoming co-controllers of Abra. The Transaction does not entail the need to carry out a tender offer.

Transformational Refinancing

On March 3, 2023, GOL issued Senior Secured Notes due in 2028 in the amount of up to US$1.4 billion in a private placement to Abra Group Limited, GOL’s controlling shareholder. The Notes bear an interest rate of 18%, of which 4.5% will be paid in cash and 13.5% will be payment-in-kind, and are guaranteed by the intellectual property and brand of Smiles, the Company’s market leading loyalty program, and also a pari passu lien on the intellectual property, brand and spare parts of GOL.

The issuance was comprised of up to US$451 million in cash for specific uses subject to certain conditions and approvals, and the contribution and retirement of US$1,077 million in face value of GOL’s outstanding bonds representing 83% of the bonds maturing in 2024, 47% of the bonds maturing in 2025, 61% of the bonds maturing in 2026 and 10% of the Perpetuals. These bonds have been canceled representing a discount to par of US$312.6 million. Pro forma for the transaction, the net debt of GOL will be reduced by over US$100 million and will result in more than US$30 million in annual interest expense savings.

The transaction represents one of the largest completed liability management and comprehensive refinancing transactions in both the airline industry and the emerging markets. This transaction also represents the tenth liability management or capital raising transaction that GOL has completed since the onset of the Covid-19 pandemic.

As a result of this liability management operation, GOL obtained a series of important benefits in its capital structure and a significant improvement in its credit profile by increasing the average maturity of its bonds from 2.5 to 4.4 years, access to up to US$451 million of cash resources, and a significant reduction in annual interest payments.

Operational and Financial Indicators

| Traffic Data - GOL (in millions) | 4Q22 | 4Q21 | % Var. |

| RPK GOL – Total | 9,107 | 7,281 | 25.1% |

| RPK GOL – Domestic | 8,208 | 7,164 | 14.6% |

| RPK GOL – Foreign Market | 899 | 117 | NM |

| ASK GOL – Total | 11,375 | 8,817 | 29.0% |

| ASK GOL – Domestic | 10,185 | 8,662 | 17.6% |

| ASK GOL – Foreign Market | 1,189 | 154 | NM |

| GOL Load Factor – Total | 80.1% | 82.6% | (2.5 p.p.) |

| GOL Load Factor – Domestic | 80.6% | 82.7% | (2.1 p.p.) |

| GOL Load Factor – Foreign Market | 75.6% | 76.0% | -0.4 p.p. |

| Operating Data | 4T22 | 4T21 | % Var. |

| Revenue Passengers - Pax on Board ('000) | 7,776 | 6,558 | 18.6% |

| Aircraft Utilization (Block Hours/Day) | 11.6 | 11.5 | 0.9% |

| Departures | 57,166 | 45,227 | 26.4% |

| Total Seats (‘000) | 9,958 | 7,892 | 26.2% |

| Average Stage Length (km) | 1,130 | 1,101 | 2.6% |

| Fuel Consumption in the Period (mm liters) | 315 | 249 | 26.5% |

| Full-Time Employees (at period end) | 14,048 | 13,969 | 0.6% |

| Average Operating Fleet(4) | 110 | 84 | 31.0% |

| On-Time Departures | 79.0% | 86.5% | (7.5 p.p.) |

| Flight Completion | 98.3% | 99.4% | (1.1 p.p.) |

| Passenger Complaints (per 1,000 pax) | 0.79 | 1.11 | (28.8%) |

| Lost Baggage (per 1,000 pax) | 2.66 | 2.38 | 11.8% |

| Financial Data | 4T22 | 4T21 | % Var. |

| Net YIELD (R$ cents) | 48.16 | 38.58 | 24.8% |

| Net PRASK (R$ cents) | 38.56 | 31.86 | 21.0% |

| Net RASK (R$ cents) | 41.55 | 33.15 | 25.3% |

| CASK (R$ cents) | 36.00 | 52.99 | (32.1%) |

| Non-fuel CASK2 (R$ cents) | 19.75 | 41.45 | (52.3%) |

| Recurring CASK (R$ cents) (5) | 35.35 | 34.66 | 2.0% |

| Recurring ex-fuel CASK (R$ cents) (5) | 19.09 | 23.12 | (17.4%) |

| Breakeven Load Factor Ex-Non Recurring Expenses | 68.1% | 86.4% | (18.3 p.p.) |

| Average Exchange Rate(1) | 5.26 | 5.58 | (5.9%) |

| End of Period Exchange Rate(1) | 5.22 | 5.58 | (6.5%) |

| WTI (Average per Barrel, US$)(2) | 82.64 | 77.19 | 7.1% |

| Fuel Price per Liter (R$) (3) | 5.99 | 4.17 | 43.6% |

| Gulf Coast Jet Fuel Cost (average per liter, US$)(2) | 0.86 | 0.58 | 48.3% |

(1) Source: Central Bank of Brazil; (2) Source: Bloomberg; (3) Fuel expenses excluding hedge results and PIS and COFINS/liters credits consumed; (4) Medium fleet excluding sub-leased aircraft and MRO aircraft. Some figures may differ from quarterly information - ITR due to rounding. (5) Excludes non-recurring expenses

Domestic Market

Demand in the domestic market reached 8,208 million RPK, an increase of 14.6% compared to 4Q21, and 85% of RPK recorded in 4Q19.

Supply in the domestic market in turn reached 10,185 million ASK, representing an increase of 17.6% compared to 4Q21, and 87% of the levels reached in 4Q19.

The occupancy rate was 80.6% and the Company transported approximately 7.4 million Customers in 4Q22, an increase of 22.4% compared to the same quarter of the previous year.

International Market

The supply in the international market, measured in ASK, was 1.189 million, and the demand (in RPK) was 899 million. The percentage comparison to 4Q21 is distorted by the fact that the previous base is almost nil.

During this period GOL transported approximately 348,000 passengers in this market.

Volume of Departures and Total Seats

In 4Q22, the Company’s total volume of takeoffs was 57,166, representing an increase of 26.4% compared to 4Q21. The total number of seats available on the market was 9.9 million, representing an increase of 26.2% compared to the same period in 2021.

PRASK, RASK and Yield

Net PRASK in 4Q22 was 21% higher compared to 4Q21, reaching 38.56 cents (R$). The Company's net RASK was 41.55 cents (R$), representing an increase of 25.3% also compared to the same period of the previous year. Net yield recorded in 4Q22 was 48.16 cents (R$), resulting in an increase of 24.8% compared to 4Q21.

All profitability indicators for the quarter, described above, also showed significant evolution compared to the same period in 2019, demonstrating the Company's continued and efficient capacity management and pricing.

Fleet

At the end of 4Q22, GOL’s total fleet was 146 Boeing 737 aircraft, of which 106 were NGs, 38 were MAXs and 2 Cargo NGs. The Company’s fleet is 100% composed of medium-sized aircraft (narrowbody), with 97% financed via operating leases and 3% financed via finance leases.

| Total Fleet at the End of Period | 4Q22 | 4Q21 | Var. | 3Q22 | Var. |

| Boeing 737 | 146 | 135 | 11 | 147 | -1 |

| 737-700 NG | 20 | 23 | -3 | 21 | -1 |

| 737-800 NG | 86 | 89 | -3 | 87 | -1 |

| 737-800 NG Freighters | 2 | - | 2 | 2 | 0 |

| 737-MAX 8 | 38 | 23 | 15 | 37 | 1 |

As of December 31, 2022, GOL had 91 firm orders for the acquisition of Boeing 737-MAX aircraft, of which 66 were for the 737-MAX 8 model and 25 for the 737-MAX 10 model. The Company's fleet plan provides for the return of about 17 operational aircraft by the end of 2023, with the flexibility to accelerate or reduce the volume of returns if necessary.

Glossary of Industry Terms

| · | AIRCRAFT LEASING: An agreement through which a company (the lessor), acquires a resource chosen by its client (the lessee) for subsequent rental to the latter for a determined period. |

| · | AVAILABLE SEAT KILOMETERS (ASK): The aircraft seating capacity is multiplied by the number of kilometers flown. |

| · | BARREL OF WEST TEXAS INTERMEDIATE (WTI): Intermediate oil from Texas, a region that refers to the name for concentrating oil exploration in the USA. WTI is used as a reference point in oil for the US derivatives markets. |

| · | BRENT: Refers to oil produced in the North Sea, traded on the London Stock Exchange, serving as a reference for the derivatives markets in Europe and Asia. |

| · | TOTAL CASH: Total cash, financial investments and restricted cash in the short- and long-term. |

| · | OPERATING COST PER AVAILABLE SEAT KILOMETER (CASK): Operating expenses divided by the total number of available seat kilometers. |

| · | OPERATING COST PER AVAILABLE SEAT KILOMETER EX-FUEL (CASK EX-FUEL): Operating cost divided by total available seat kilometers excluding fuel expenses. |

| · | AVERAGE STAGE LENGTH: It is the average number of kilometers flown per stage performed. |

| · | EXCHANGEABLE SENIOR NOTES (ESN): Securities convertible into shares. |

| · | AIRCRAFT CHARTER: Flight operated by a Company that is out of its normal or regular operation. |

| · | BLOCK HOURS: Time in which the aircraft is in flight, plus taxi time. |

| · | LESSOR: The party renting a property or other asset to another party, the lessee. |

| · | LONG-HAUL FLIGHTS: Long-distance flights (in GOL’s case, flights of more than four hours). |

| · | REVENUE PASSENGERS: Total number of passengers on board who have paid more than 25% of the full flight fare. |

| · | REVENUE PASSENGER KILOMETERS PAID (RPK): Sum of the products of the number of paying passengers on a given flight and the length of the flight. |

| · | PDP: Credit for financing advances for the acquisition of aircraft. |

| · | Load Factor: Percentage of the aircraft’s capacity used in terms of seats (calculated by dividing the RPK/ASK). |

| · | Break-Even Load Factor: Load factor required for operating revenues to correspond to operating expenses. |

| · | Aircraft Utilization Rate: Average number of hours per day that the aircraft was in operation. |

| · | Passenger Revenue per Available Seat Kilometer (PRASK): Total passenger revenue divided by the total available seat kilometers. |

| · | Operating Revenue per Available Seat Kilometers (RASK): The operating revenue is divided by the total available seat kilometers. |

| · | Sale-Leaseback: A financial transaction whereby a resource is sold and then leased back, enabling use of the resource without owning it. |

| · | SLOT: The right of an aircraft to take off or land at a given airport for a determined period. |

| · | Sub-Lease: An arrangement whereby a lessor in a rent agreement leases the item rented to a fourth party. |

| · | Freight Load Factor (FLF): Measure of capacity utilization (% of AFTKs used). Calculated by dividing FTK by AFTK. |

| · | Freight Tonne Kilometers (FTK): The demand for cargo transportation is calculated as the cargo's weight in tons multiplied by the total distance traveled. |

| · | Available Freight Tonne Kilometer (AFTK): Weight of the cargo in tons multiplied by the kilometers flown. |

| · | Yield per Passenger Kilometer: The average value paid by a passenger to fly one kilometer. |

Report of the Statutory Audit Committee (“SAC”)

The Statutory Audit Committee (“CAE”) is a statutory body linked to the Board of Directors of Gol Linhas Aéreas Inteligentes S.A. (“Company”), with three independent members in the Board of Directors, elected annually by the Board Members, with one of them qualified as a Financial Expert. CAE's main duties, under its charter, are supervising the quality and integrity of the reports and financial statements, adopt legal, regulatory and statutory standards, adjust procedures linked to risk management, policies and procedures for internal controls and the internal auditors’ activities. Additionally, CAE oversees the independent auditors’ work, including their independence, quality and efficiency of the services, besides any disagreement with the Management, and approves their audit fees. CAE also resolves on the audit registration and activity regarding the Brazilian securities market (CVM), besides working as an Audit Committee, complying with the Sarbanes Oxley Act, to which the Company is subject as a company registered with the Securities and Exchange Commission (“SEC”). Transactions with related parties, activities related to risk and compliance monitoring and the operation of the installed complaints and denouncements channel are also supervised by the CAE.

Below are CAE’s activities carried out at the six meetings in the fiscal year ended December 31, 2022:

· CAE’s coordinator established the agenda and chaired CAE’s meetings;

· Evaluated the annual work plan and discussed the results of the independent auditors’ activities for 2022;

· Oversaw the activities and work of the Company's internal audit, assessing the annual work plan and discussing the results of the activities and reviews. The points made by the internal audit on improving the internal control area were discussed with the managers/executive officers to implement continuous improvements.

· Supervised and assessed the effectiveness, quality and integrity of internal control tools to, among others, monitor compliance with provisions linked to the integrity of financial statements, including quarterly financial information and other interim statements;

· Supervised, with the Management and the internal audit, different contracts between the Company or its subsidiaries, on the one hand, and the controlling shareholder, on the other hand, to verify the compliance with the Company's policies and controls on transactions with parties related;

· Held meetings with the independent auditors, Ernst & Young Auditores Independentes S.S Ltda., to comply with CVM and the U.S. Securities and Exchange Commission, addressing, among others, the following matters: hiring, relationship and communication between CAE and the external auditors, the scope of the auditors' work and findings of the independent auditors’ work plan; and

· Prepared the report on CAE’s activities and operation in 2022, following good corporate governance practices and applicable regulations.

Internal Control Systems

Based on the 2022 agenda, CAE addressed the main subjects linked to the Company's internal controls, evaluating risk mitigation measures and the Senior Management’s commitment to their continuous improvement.

Through the meetings with the Company's internal areas, the Statutory Audit Committee managed to offer to the Board of Directors suggestions to improve procedures, overseeing results already obtained in 2022.

Based on the year’s work, CAE believes that the Company’s and its subsidiaries’ internal control system is adequate for the size and complexity of their businesses and is structured to ensure effective operations and systems for financial reporting and compliance with applicable internal and external standards.

Corporate Risk Management

CAE’s members, in their legal duties and assignments, received information from the Management on relevant corporate risks, including continuity risks, making their assessments and recommendations to increase the effectiveness of risk management procedures, directly in the Board of Directors’ meetings, contributing to and ratifying the measures implemented in 2022.

Conclusion

CAE considered the facts submitted during the work and described in this Report to be adequate, recommending, in its opinion, the approval of the Company's audited financial statements for the fiscal year ended December 31, 2022.

São Paulo, March 21, 2023.

Germán Pasquale Quiroga Vilardo

Member of the Statutory Audit Committee

Marcela de Paiva Bomfim Teixeira

Member of the Statutory Audit Committee

Philipp Schiemer

Member of the Statutory Audit Committee

Fiscal Board’s Report

The Fiscal Board of Gol Linhas Aéreas Inteligentes S.A., within its legal and statutory assignments, after assessing the Management’s Report, Balance Sheet, Financial Statement, Comprehensive Income Statement, Statement of Changes in Shareholders' Equity, Statement of Cash Flows, Statement of Added Value and their Parent Company and Consolidated Notes for the fiscal year ended December 31, 2022, and with the Independent Auditors’ report, issues the opinion that the above document adequately reflect the Company’s equity and economic-financial position as of December 31, 2022, recognizing that they can be resolved by the Annual Shareholders’ Meeting.

São Paulo, March 21, 2023.

Renato Chiodaro

Chairman of the Fiscal Board

Marcelo Moraes

Members of the Fiscal Board

Carla Andrea Furtado Coelho

Members of the Fiscal Board

Executive Officers’ Statement on the Financial Statements

Complying with CVM Instruction 80/2022, the executive officers state that they discussed, reviewed and agreed with the financial statements for the fiscal year ended December 31, 2022.

São Paulo, March 21, 2023.

Celso Ferrer

Chief Executive Officer

Richard Freeman Lark Jr.

Executive Vice President, Chief Financial Officer and Investor Relations Officer

Statement of the Executive Officers on the Independent Auditor’s Report

Complying with CVM Instruction 80/2022, the Executive Board states that it discussed, reviewed and agreed with the opinion issued by Ernst & Young Auditores Independentes S/S Ltda. in the audit report on the financial statements for the fiscal year ended December 31, 2022.

São Paulo, March 21, 2023.

Celso Ferrer

Chief Executive Officer

Richard Freeman Lark Jr.

Executive Vice President, Chief Financial Officer and Investor Relations Officer

A free translation from Portuguese into English of independent auditor’s report on parent company and consolidated financial statements prepared in Brazilian currency in accordance with accounting practices adopted in Brazil and the International Financial Reporting Standards (IFRS)

Independent auditor’s report on parent company and consolidated financial statements

To the

Management and Shareholders of

Gol Linhas Aéreas Inteligentes S.A.

Opinion

We have audited the parent company and consolidated financial statements of Gol Linhas Aéreas Inteligentes S.A. (the “Company”), identified as parent company and consolidated, respectively, which comprise the balance sheet as of December 31, 2022, and the statement of income (loss), comprehensive income (loss), of changes in shareholders’ equity and cash flows for the year then ended, and notes to the financial statements, including a summary of significant accounting policies.

In our opinion, the accompanying financial statements present fairly, in all material respects, the parent company and consolidated financial position of Gol Linhas Aéreas Inteligentes S.A. as of December 31, 2022, and its parent company and consolidated financial performance and cash flows for the year then ended in accordance with the accounting practices adopted in Brazil and with the International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board (IASB).

Basis for opinion

We conducted our audit in accordance with Brazilian and International Standards on Auditing. Our responsibilities under those standards are further described in the Auditor’s responsibilities for the audit of the parent company and consolidated financial statements section of our report. We are independent of the Company and its subsidiaries in accordance with the relevant ethical principles set forth in the Code of Professional Ethics for Accountants, the professional standards issued by the Brazil’s National Association of State Boards of Accountancy (CFC) and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Significant uncertainty related to the Company`s ability to continue as a going concern

We draw attention to note 1.3 to the parent company and consolidated financial statements, which states that, according to the parent company and consolidated balance sheet as of December 31, 2022, the Company presented negative parent company and consolidated shareholders’ equity of R$21,359 million, as well as that current liabilities exceeded total current assets, parent company and consolidated, by R$545 million and R$10,868 million, respectively. As disclosed in note 1.3, these events or conditions, together with other matters described in note 1.3, indicate the existence of substantial doubt about the Company’s ability to continue as a going concern. Our opinion is not modified in respect of this matter.

Key audit matters

Key audit matters are those matters that, in our professional judgment, were of most significance in our audit of the financial statements of the current period. These matters were addressed in the context of our audit of the parent company and consolidated financial statements as a whole, and in forming our opinion thereon, and we do not provide a separate opinion on these matters. In addition to the matter described in the “Significant uncertainty related to the Company`s ability to continue as a going concern” section, we determined that the matters below are the key audit matters that should be communicated in our report. For each matter below, our description of how our audit addressed the matter, including any commentary on the findings or outcome of our procedures, is provided in that context.

We have fulfilled the responsibilities described in the “Auditor’s responsibilities for the audit of the parent company and consolidated financial statements” section of our report, including in relation to these matters. Accordingly, our audit included the performance of procedures designed to respond to our assessment of the risks of material misstatement of the financial statements. The results of our audit procedures, including the procedures performed to address the matters below, provide the basis for our audit opinion on the accompanying financial statements.

| · | Passenger transportation revenue |

As disclosed in note 28 to the parent company and consolidated financial statements, as of December 31, 2022, the Company’s passenger transportation revenue was R$14,621 million. As disclosed in note 4.17.1 to the parent company and consolidated financial statements, passenger revenue is recognized when air transportation is provided.

The passenger transportation revenue recognition process is highly dependent on information technology systems and occur at a relevant volume. This process also takes into consideration other complex aspects that may affect revenue recognition, such as recording of tickets sold but not used, credits to passengers related to unused tickets, accounting for the performance obligation of the Company’s loyalty program, among others. Therefore, this was considered a key audit matter.

How we addressed the matter in our audit:

Our audit procedures included, among others, designing and performing audit procedures to test the underlying records of transaction data obtained from the IT systems; executing data analytics, including correlation analysis and tracing transactions to cash receipts; performing tests of details; testing the reconciliation of accounting records to transactional data from the transport of passengers flown and liabilities related to tickets sold and not used. We also assessed the Company’s disclosures in the respective notes to the parent company and consolidated financial statements as of December 31, 2022.

Based on the results of the audit procedures performed for passenger transportation revenue and liabilities related to tickets sold and not used, we considered that the criteria adopted by the Company, as well as the related disclosures in notes 4.17.1 and 28, are acceptable in the context of the parent company and consolidated financial statements taken as a whole.

| · | Provision for aircraft and engine return |

As disclosed in note 22 to the parent company and consolidated financial statements, as of December 31, 2022, the Company’s provision for aircraft and engine return related to lease return costs for aircraft and engines under lease arrangements amounted to R$2,601 million. As described in notes 4.15.1 and 22.2 to the parent company and consolidated financial statements, certain lease arrangements contain provisions for the Company‘s obligations to fulfill certain return conditions at the end of the lease terms. The Company estimates lease return costs for aircraft and engines taking into account the anticipated aircraft and engines’ utilization patterns, historical maintenance events during the arrangement period, among other variables.

Auditing the Company’s provision for aircraft and engine return involved significant auditor judgment due to the uncertainty and complexity to estimate the amounts related to the anticipated aircraft and engines’ utilization patterns and anticipated return costs used by management to quantify the provision. Therefore, this was considered a key audit matter.

How we addressed the matter in our audit:

Our audit procedures included, among others, evaluating the estimation used by the Company to determine the provision for aircraft and engine return by testing a sample of lease arrangements with return condition clauses; comparing management’s plans for future utilization of aircraft and engines against the respective historical utilization patterns; evaluating the reasonableness of the Company’s anticipated return costs estimation process by reviewing the market price information; assessing the Company’s disclosures in the respective notes to the parent company and consolidated financial statements as of December 31, 2022.

Based on the results of the audit procedures performed for provision for aircraft and engine return, which are consistent with Company’s assessment, we considered that the criteria and assumptions applied to determine the aforementioned provision adopted by the Company, as well as the related disclosures in notes 4.15.1, 22 and 22.2, are acceptable in the context of the parent company and consolidated financial statements taken as a whole.

Other matters

Corresponding figures

The Company`s parent company and consolidated financial statements for the year ended December 31, 2021 were audited under the responsibility of other independent auditor, which issued an audit report on March 14, 2022, with an unmodified opinion over the parent company and consolidated financial statements.

Statements of value added

The parent company and consolidated statements of value added (SVA) for year ended December 31, 2022, prepared under the responsibility of Company management, and presented as supplementary information for purposes of IFRS, were submitted to audit procedures conducted together with the audit of the Company’s financial statements. To form our opinion, we evaluated if these statements are reconciled to the financial statements and accounting records, as applicable, and if their form and content comply with the criteria defined by NBC TG 09 – Statement of Value Added. In our opinion, these statements of value added were prepared fairly, in all material respects, in accordance with the criteria defined in abovementioned accounting pronouncement, and are consistent in relation to the overall parent company and consolidated financial statements.

Other information accompanying the parent company and consolidated financial statements and the auditor’s report

Management is responsible for such other information, which comprise the Management Report.

Our opinion on the parent company and consolidated financial statements does not cover the Management Report and we do not express any form of assurance conclusion thereon.

In connection with our audit of the parent company and consolidated financial statements, our responsibility is to read the Management Report and, in doing so, consider whether this report is materially inconsistent with the financial statements or our knowledge obtained in the audit or otherwise appears to be materially misstated. If, based on the work we have performed, we conclude that there is a material misstatement of the Management Report, we are required to report that fact. We have nothing to report in this regard.

Responsibilities of management and those charged with governance for the parent company and consolidated financial statements

Management is responsible for the preparation and fair presentation of the parent company and consolidated financial statements in accordance with the accounting practices adopted in Brazil and with the International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board (IASB), and for such internal control as management determines is necessary to enable the preparation of financial statements that are free of material misstatement, whether due to fraud or error.

In preparing the parent company and consolidated financial statements, management is responsible for assessing the Company’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate the Company or to cease operations, or has no realistic alternative but to do so.

Those charged with governance are responsible for overseeing the Company’s and its subsidiaries’ financial reporting process.

Auditor’s responsibilities for the audit of the parent company and consolidated financial statements

Our objectives are to obtain reasonable assurance about whether the parent company and consolidated financial statements as a whole are free of material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with Brazilian and International standards on Auditing will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements.

As part of an audit in accordance with Brazilian and International Standards on Auditing, we exercise professional judgment and maintain professional skepticism throughout the audit. We also:

| · | Identified and assessed the risks of material misstatement of the parent company and consolidated financial statements, whether due to fraud or error, designed and performed audit procedures responsive to those risks, and obtained audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. |

| · | Obtained an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s and its subsidiaries’ internal control. |

| · | Evaluated the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management. |

| · | Concluded on the appropriateness of management’s use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Company’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditor’s report to the related disclosures in the parent company and consolidated financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditor’s report. However, future events or conditions may cause the Company to cease to continue as a going concern. |

| · | Evaluated the overall presentation, structure and content of the financial statements, including the disclosures, and whether the parent company and consolidated financial statements represent the underlying transactions and events in a manner that achieves fair presentation. |

We communicate with those charged with governance regarding, among other matters, the scope and timing of the planned audit procedures and significant audit findings, including deficiencies in internal control that we may have identified during our audit.

We also provided those charged with governance with a statement that we have complied with relevant ethical requirements, including applicable independence requirements, and to communicate with them all relationships and other matters that may reasonably be thought to bear on our independence, and where applicable, related safeguards.

From the matters communicated with those charged with governance, we determined those matters that were of most significance in the audit of the financial statements of the current period and are therefore the key audit matters. We describe these matters in our auditor’s report unless law or regulation precludes public disclosure about the matter or when, in extremely rare circumstances, we determine that a matter should not be communicated in our report because the adverse consequences of doing so would reasonably be expected to outweigh the public interest benefits of such communication.

São Paulo, March 21, 2023.

ERNST & YOUNG

Auditores Independentes S/S Ltda.

CRC SP-034519/O

Original report in Portuguese signed by

Uilian Dias Castro de Oliveira

Accountant CRC SP223185/O

| Balance Sheets December 31, 2022 and 2021 (In thousand of Brazilian Reais) | |

Balance Sheet

| | | Parent Company | Consolidated |

| Assets | Note | 2022 | 2021 | 2022 | 2021 |

| | | | | | |

| Current | | | | | |

| Cash and Cash Equivalents | 5 | 179 | 210,941 | 169,035 | 486,258 |

| Financial Investments | 6 | 4,814 | 4,377 | 404,113 | 291,363 |

| Trade Receivables | 7 | - | - | 887,734 | 850,683 |

| Inventories | 8 | - | - | 438,865 | 269,585 |

| Deposits | 9 | - | - | 380,267 | 191,184 |

| Advance to Suppliers and Third Parties | 10 | 36,996 | 83 | 302,658 | 270,342 |

| Taxes to Recover | 11 | 3,975 | 10,159 | 195,175 | 176,391 |

| Rights from Derivative Transactions | 32.2 | - | - | 16,250 | 4,936 |

| Other Credits | | 63,858 | 14,458 | 199,446 | 147,299 |

| Total Current | | 109,822 | 240,018 | 2,993,543 | 2,688,041 |

| | | | | | |

| Non-Current | | | | | |

| Financial Investments | 6 | 1 | 1 | 19,305 | 82,326 |

| Deposits | 9 | 45,042 | 47,534 | 2,279,503 | 1,757,842 |

| Advances to Suppliers and Third Parties | 10 | - | - | 49,698 | 76,138 |

| Taxes to Recover | 11 | 12,925 | 4,464 | 53,107 | 72,976 |

| Deferred Taxes | 12 | 76,907 | 75,560 | 77,251 | 75,799 |

| Rights from Derivative Transactions | 32.2 | 7,002 | 107,170 | 13,006 | 109,124 |

| Other Credits | | 17 | - | 33,187 | 41,718 |

| Credits with Related Companies | 27.1 | 7,084,848 | 7,008,275 | - | - |

| Property, Plant & Equipment | 13 | 416,348 | 451,320 | 9,588,696 | 7,675,170 |

| Intangible Assets | 14 | - | - | 1,862,989 | 1,823,209 |

| Total Non-Current | | 7,643,090 | 7,694,324 | 13,976,742 | 11,714,302 |

| | | | | | |

| Total | | 7,752,912 | 7,934,342 | 16,970,285 | 14,402,343 |

The Notes form an integral part of these parent company and consolidated financial statements.

| Balance Sheets December 31, 2022 and 2021 (In thousand of Brazilian Reais) | |

| | | Parent Company | Consolidated |

| Liabilities | Note | 2022 | 2021 | 2022 | 2021 |

| | | | | | |

| Current | | | | | |

| Loans and Financing | 15 | 274,733 | 164,304 | 1,126,629 | 634,614 |

| Leases to Pay | 16 | - | - | 1,948,258 | 2,057,687 |

| Suppliers | 17 | 41,520 | 84,335 | 2,274,503 | 1,820,056 |

| Suppliers - Forfaiting | 18 | - | - | 29,941 | 22,733 |

| Salaries, Wages and Benefits | | 132 | 180 | 600,451 | 374,576 |

| Taxes Payable | 19 | 478 | 585 | 258,811 | 122,036 |

| Landing Fees | | - | - | 1,173,158 | 911,174 |

| Advance Ticket Sales | 20 | - | - | 3,502,556 | 2,670,469 |

| Mileage Program | 21 | - | - | 1,576,849 | 1,298,782 |

| Advances from Customers | | - | - | 354,904 | 237,092 |

| Provisions | 22 | - | - | 634,820 | 477,324 |

| Derivatives Liabilities | 32.2 | - | - | 519 | - |

| Other Liabilities | | 337,612 | 85,843 | 379,848 | 455,251 |

| Total Current | | 654,475 | 335,247 | 13,861,247 | 11,081,794 |

| | | | | | |

| Non-Current | | | | | |

| Loans and Financing | 15 | 10,149,073 | 9,857,264 | 10,858,262 | 11,265,416 |

| Leases to Pay | 16 | - | - | 9,258,701 | 8,705,297 |

| Suppliers | 17 | - | 16 | 45,451 | 78,914 |

| Salaries, Wages and Benefits | | - | - | 285,736 | 25,919 |

| Taxes Payable | 19 | - | - | 265,112 | 24,414 |

| Landing Fees | | - | - | 218,459 | 277,060 |

| Mileage Program | 21 | - | - | 292,455 | 318,349 |

| Provisions | 22 | - | - | 2,894,983 | 3,109,998 |

| Deferred Taxes | 12 | - | - | 36.354 | 411 |

| Obligations to Related Parties | 27.1 | 145,434 | 6,692 | - | - |

| Derivatives liabilities | 32.2 | - | - | 17 | - |

| Provision for Investment Losses | 23 | 17,910,984 | 18,292,878 | - | - |

| Other Liabilities | | 251,761 | 495,923 | 312,323 | 568,449 |

| Total Non-Current | | 28,457,252 | 28,652,773 | 24,467,853 | 24,374,227 |

| | | | | | |

| Shareholders’ Equity | | | | | |

| Share Capital | 24.1 | 4,040,397 | 4,039,112 | 4,040,397 | 4,039,112 |

| Shares to Issue | | - | 3 | - | 3 |

| Treasury Shares | 24.2 | (38,910) | (41,514) | (38,910) | (41,514) |

| Capital Reserve | | 1,178,568 | 208,711 | 1,178,568 | 208,711 |

| Equity Valuation Adjustments | | (770,489) | (1,053,082) | (770,489) | (1,053,082) |

| Accumulated Losses | | (25,768,381) | (24,206,908) | (25,768,381) | (24,206,908) |

| Negative Shareholders’ Equity (Deficit) Attributable to the Parent Company | | (21,358,815) | (21,053,678) | (21,358,815) | (21,053,678) |

| | | | | | |

| | | | | | |

| Total | | 7,752,912 | 7,934,342 | 16,970,285 | 14,402,343 |

The Notes form an integral part of these parent company and consolidated financial statements.

| Income Statement Fiscal Years ended December 31, 2022 and 2021 (In thousands of Brazilian reais - R$, except basic and diluted earnings (loss) per share) | |

| | | Parent Company | | Consolidated |

| | Note | 2022 | 2021 | | 2022 | 2021 |

| Net Revenue | | | | | | |

| Passenger Transportation | | - | - | | 14,153,076 | 6,880,135 |

| Cargo and Others | | - | - | | 1,045,649 | 553,249 |

| Total Net Revenue | 28 | | | | 15,198,725 | 7,433,384 |

| | | | | | | |

| Cost of Services | 29 | - | - | | (12,048,951) | (8,593,696) |

| Gross Profit (Loss) | | - | - | | 3,149,774 | (1,160,312) |

| | | | | | | |

| Operating Revenues (Expenses) | | | | | | |

| Selling Expenses | 29 | (324) | (442) | | (1,105,732) | (583,684) |

| Administrative Expenses | 29 | (53,553) | (172,397) | | (1,646,182) | (2,051,376) |

| Other Revenues and Expenses, Net | 29 | (102,928) | 6,299 | | 159,254 | (39,223) |

| Total Operating Expenses | | (156,805) | (166,540) | | (2,592,660) | (2,674,283) |

| | | | | | | |

| Equity Pick Up Method | 23 | (1,055,450) | (6,394,162) | | - | - |

| | | | | | | |

| Income (Loss) before financial income (expenses), monetary and exchange rate variation and income taxes | | (1,212,255) | (6,560,702) | | 557,114 | (3,834,595) |

| | | | | | | |

| Financial Income (Expenses) | | | | | | |

| Financial Income | 30 | 190,617 | 156,377 | | 116,517 | 48,794 |

| Financial Expenses | 30 | (847,108) | (787,217) | | (3,516,884) | (2,201,045) |

| Derivative Financial Instruments | 30 | 42,025 | 200,267 | | (2,626) | 198,752 |

| Financial Expenses, Net | | (614,466) | (430,573) | | (3,402,993) | (1,953,499) |

| | | | | | | |

| Loss before monetary and exchange rate variation | | (1,826,721) | (6,991,275) | | (2,845,879) | (5,788,094) |

| | | | | | | |

| Monetary and Foreign Exchange Rate Variations, Net | 30 | 263,901 | (252,331) | | 1,328,204 | (1,588,133) |

| | | | | | | |

| Loss before income tax and social contribution | | (1,562,820) | (7,243,606) | | (1,517,675) | (7,376,227) |

| | | | | | | |

| Income Tax and Social Contribution | | | | | | |

| Current | | - | - | | (9,302) | (48,862) |

| Deferred | | 1,347 | 22,068 | | (34,496) | 241,285 |

| Total Income Tax and Social Contribution | 12 | 1,347 | 22,068 | | (43,798) | 192,423 |

| | | | | | | |

| Loss for the Fiscal Year | | (1,561,473) | (7,221,538) | | (1,561,473) | (7,183,804) |

| | | | | | | |

| Net Income (Loss) Attributable to: | | | | | | |

| Shareholders of the Parent Company | | (1,561,473) | (7,221,538) | | (1,561,473) | (7,221,538) |

| Non-Controlling Shareholders | | - | - | | - | 37,734 |

| | | | | | | |

| Basic and Diluted Loss per share | 25 | | | | | |

| Per Common Share | | (0.109) | (0.545) | | (0.109) | (0.545) |

| Per Preferred Share | | (3.822) | (19.157) | | (3.822) | (19.157) |

| | | | | | | |

| | | | | | | |

The Notes form an integral part of these parent company and consolidated financial statements.

| Comprehensive Income Statements Fiscal Years ended December 31, 2022 and 2021 (In thousands of Brazilian Reais - R$) | |

| | Parent Company | | Consolidated |

| | 2022 | 2021 | | 2022 | 2021 |

| | | | | | |

| Loss for the Fiscal Year | (1,561,473) | (7,221,538) | | (1,561,473) | (7,183,804) |

| | | | | | |

| Other Comprehensive Income that will be Reversed to Income (Expenses) | | | | | |

| | | | | | |

| Cash Flow Hedge, Net of Income Tax and Social Contribution | 305,448 | 392,275 | | 305,448 | 392,275 |

| Actuarial Income (Loss) from Post-Employment Benefits, Net of Income Tax and Social Contribution | (17,514) | 41,524 | | (17,514) | 41,524 |

| Cumulative Adjustment of Conversion into Subsidiaries | (5,341) | 468 | | (5,341) | 739 |

| | 282,593 | 434,267 | | 282,593 | 434,538 |

| | | | | | |

| Total Comprehensive Income (Expenses) for the Fiscal Year | (1,278,880) | (6,787,271) | | (1,278,880) | (6,749,266) |

| | | | | | |

| Comprehensive Income (Expenses) Attributed to: | | | | |

| Shareholders of the Parent Company | (1,278,880) | (6,787,271) | | (1,278,880) | (6,787,271) |

| Non-Controlling Shareholders | - | - | | - | 38,005 |

The Notes form an integral part of these parent company and consolidated financial statements.

| Statements of Changes in Shareholders’ Equity Fiscal Years ended December 31, 2022 and 2021 (In thousands of Brazilian Reais - R$) | |

| Parent Company and Consolidated |

| | | | | Capital Reserve | Equity Valuation Adjustments | | | | | |

| | Share Capital | Shares to Issue | Treasury Shares | Premium when Granting Shares | Special Premium Reserve of the Subsidiary | Share-Based Compensation | Unrealized Income (Expenses) on Hedge | Post-Employment Benefit | Other Comprehensive Income | Effects of Change in Equity Interest | Accumulated Losses | Negative Shareholders’ Equity (Deficit) Attributable to the Parent Company | Non-Controlling Shareholders | Total | |

| Balances on December 31, 2020 | 3,009,436 | 1,180 | (62,215) | 17,497 | 83,229 | 106,520 | (1,311,076) | (26,669) | 564 | 759,812 | (16,985,370) | (14,407,092) | 640,033 | (13,767,059) | |

| | | | | | | | | | | | | | | | |

| Other Comprehensive Income (Expenses), Net | - | - | - | - | - | - | 392,275 | 41,524 | 468 | - | - | 434,267 | 271 | 434,538 | |

| Net Income (Loss) for the Fiscal Year | - | - | - | - | - | - | - | - | - | - | (7,221,538) | (7,221,538) | 37,734 | (7,183,804) | |

| Total Comprehensive Income (Expenses) for the Fiscal Year | - | - | - | - | - | - | 392,275 | 41,524 | 468 | - | (7,221,538) | (6,787,271) | 38,005 | (6,749,266) | |

| Stock Option | - | - | - | - | - | 21,578 | - | - | - | - | - | 21,578 | 263 | 21,841 | |

| Capital Increase due to Stock Options Exercised | 2,103 | (1,177) | - | - | - | - | - | - | - | - | - | 926 | - | 926 | |

| Capital Increase | 420,734 | - | - | - | - | - | - | - | - | - | - | 420,734 | - | 420,734 | |

| Sale of Treasury Shares | - | - | 867 | (279) | - | - | - | - | - | - | - | 588 | - | 588 | |

| Transfer of Treasury Shares | - | - | 19,834 | (6,198) | - | (13,636) | - | - | - | - | - | - | - | - | |

| Interim Dividends Distributed by the Subsidiary Smiles | - | - | - | - | - | - | - | - | - | - | - | - | (236,992) | (236,992) | |

| Acquisition of Interest from Non-Controlling Shareholders | 606,839 | - | - | - | 744,450 | - | - | - | - | (909,980) | - | 441,309 | (441,309) | - | |

| Redemption of Preferred Shares | - | - | - | - | (744,450) | - | - | - | - | - | - | (744,450) | - | (744,450) | |

| Balances on December 31, 2021 | 4,039,112 | 3 | (41,514) | 11,020 | 83,229 | 114,462 | (918,801) | 14,855 | 1,032 | (150,168) | (24,206,908) | (21,053,678) | - | (21,053,678) | |

| | | | | | | | | | | | | | | | |

| Other Comprehensive Income (Expenses), Net | - | - | - | - | - | - | 305,448 | (17,514) | (5,341) | - | - | 282,593 | - | 282,593 | |

| Loss for the Fiscal Year | - | - | - | - | - | - | - | - | - | - | (1,561,473) | (1,561,473) | - | (1,561,473) | |

| Total Comprehensive Income (Expenses) for the Fiscal Year | - | - | - | - | - | - | 305,448 | (17,514) | (5,341) | - | (1,561,473) | (1,278,880) | - | (1,278,880) | |

| Stock Option | - | - | - | - | - | 26,184 | - | - | - | - | - | 26,184 | - | 26,184 | |

| Capital Increase due to Stock Options Exercised (Note 24.1) | 1,285 | (3) | - | - | - | - | - | - | - | - | - | 1,282 | - | 1,282 | |

| Capital Increase (Note 24.1) | - | - | - | 946,261 | - | - | - | - | - | - | - | 946,261 | - | 946,261 | |

| Transfer of Treasury Shares | - | - | 2,567 | (1,516) | - | (1,051) | - | - | - | - | - | - | - | - | |

| Sale of Treasury Shares | - | - | 37 | (21) | - | - | - | - | - | - | - | 16 | - | 16 | |

| Balances on December 31, 2022 | 4,040,397 | - | (38,910) | 955,744 | 83,229 | 139,595 | (613,353) | (2,659) | (4,309) | (150,168) | (25,768,381) | (21,358,815) | - | (21,358,815) | |

The Notes form an integral part of these parent company and consolidated financial statements.

| Cash Flow Statements Fiscal Years ended December 31, 2022 and 2021 (In thousands of Brazilian Reais - R$) | |

| | Parent Company | Consolidated |

| | 2022 | 2021 | 2022 | 2021 |

| | | | | |

| Loss for the Fiscal Year | (1,561,473) | (7,221,538) | (1,561,473) | (7,183,804) |

| Adjustments to Reconcile the Net Loss to Cash Generated from Operating Activities | | | | |

| Depreciation - Aircraft Right of Use | - | - | 1,085,629 | 673,205 |

| Depreciation and Amortization – Others | - | - | 634,505 | 662,608 |

| Provision for Doubtful Accounts | - | - | 3,268 | 1,233 |

| Provisions for Inventory Obsolescence | - | - | 4,876 | 687 |

| Provision for Reduction of Deposits | - | - | (37,005) | 13,574 |

| Reversal of Provision for Losses on Advance to Suppliers | - | - | (1,091) | (4,364) |

| Adjustment to Present Value of provision for Aircraft Return | - | - | 239,777 | 65,818 |

| Deferred Taxes | (1,347) | (22,068) | 34,496 | (241,285) |

| Equity Pickup | 1,055,450 | 6,394,162 | - | - |

| Result of Transactions with Property, Plant and Equipment and Intangible Assets | - | - | 68,276 | 3,881 |

| Sale-Leaseback Gains | (104,711) | (2,113) | (140,368) | (5,913) |

| Amendment to Lease Agreements | - | - | (176,667) | (27,701) |

| Recognition of Provisions | - | - | 278,382 | 2,408,648 |

| Exchange Rate and Cash Changes, Net | (249,286) | 227,417 | (1,327,272) | 1,462,918 |

| Interest on Loans and Leases and Amortization of Costs | 674,959 | 608,315 | 2,409,208 | 1,776,717 |

| Derivative Financial Instruments | (42,025) | (200,267) | 172,506 | (131,144) |

| Share-Based Compensation | - | - | 26,184 | 21,841 |

| Other Provisions | - | - | (7,731) | (6,096) |

| Adjusted Net Income (Expenses) | (228,433) | (216,092) | 1,705,500 | (509,177) |

| | | | | |

| Changes in Operating Assets and Liabilities: | | | | |

| Financial Investments | (437) | 9,265 | (98,500) | 50,832 |

| Trade Receivables | - | - | (44,458) | (111,571) |

| Inventories | - | - | (174,156) | (74,634) |

| Deposits | 2,311 | 82,812 | (307,819) | 159,896 |

| Advance to Suppliers and Third Parties | (36,913) | 10,358 | (4,785) | 66,354 |

| Taxes to Recover | (2,277) | 3,774 | 1,085 | 255,992 |

| Variable Leases | - | - | 2,399 | 16,652 |

| Suppliers | (43,073) | 11,387 | 445,787 | 241,800 |

| Suppliers – Forfaiting | - | - | 7,208 | 22,733 |

| Advance Ticket Sales | - | - | 832,087 | 619,670 |

| Mileage Program | - | - | 252,173 | 36,169 |

| Advances from Customers | - | - | 117,812 | 209,195 |

| Salaries, Wages and Benefits | (48) | (1) | 485,692 | 65,825 |

| Landing Fees | - | - | 203,383 | 280,276 |

| Taxes Payable | 5 | 293 | 378,030 | 83,430 |

| Liabilities with Derivative Transactions | - | - | (53,200) | 128,415 |

| Provisions | - | - | (444,358) | (507,158) |

| Other Credits (Liabilities) | 44,090 | 260,934 | (163,543) | 418,228 |

| Interest Paid | (665,580) | (601,060) | (971,008) | (704,409) |

| Income Tax Paid | (112) | - | (557) | (42,956) |

| Net Cash (Used in) from Operating Activities | (930,467) | (438,330) | 2,168,772 | 705,562 |

| | | | | |

| Cash Flow Statements Fiscal Years ended December 31, 2022 and 2021 (In thousands of Brazilian Reais - R$) | |

| | Parent Company | Consolidated |

| | 2022 | 2021 | 2022 | 2021 |

| | | | | |

| Loans Receivable from Related Parties | 766,753 | (1,537,889) | - | - |

| Financial Investments in Subsidiary, net | - | - | - | 594,300 |

| Prepayment for Future Capital Increase in Subsidiary | - | (307,350) | - | - |

| Capital Contribution in Subsidiary | (1,128,567) | - | - | - |

Dividends and Interest on Shareholders’ Equity Received through Subsidiary | 69,819 | 287,128 | - | - |

Advances for Property, Plant & Equipment Acquisition, Net | (83,797) | (382,660) | (92,811) | (319,927) |

| Acquisition of Property, Plant & Equipment | - | - | (645,056) | (315,995) |

| Sale-leaseback Transactions Received | - | 2,113 | 69,819 | 14,584 |

| Acquisition of Intangible Assets | - | - | (119,462) | (152,584) |

| Net Cash Flows (Used in) from Investment Activities | (375,792) | (1,938,658) | (787,510) | (179,622) |

| | | | | |

| Funding of Borrowings | - | 2,267,646 | 110,000 | 2,893,170 |

| Loan Payments | - | (499,663) | (373,764) | (1,533,575) |

| Lease Payments - Aircraft | - | - | (2,317,125) | (1,431,689) |

| Lease Payments – Others | - | - | (40,216) | (17,596) |

| Sale of Treasury Shares | 16 | 588 | 16 | 588 |

| Capital Increase by Shareholders | 947,543 | 420,734 | 947,543 | 420,734 |

| Shares to Issue | - | 926 | - | 926 |

| Dividends and Interest on Shareholders’ Equity Paid to Non-Controlling Shareholders | - | - | - | (260,131) |

| Loans to Related Parties | 135,252 | - | - | - |

| Acquisition of Non-Controlling Shareholders | - | - | - | (744,450) |

| Net Cash Flows (Used in) from Financing Activities | 1,082,811 | 2,190,231 | (1,673,546) | (672,023) |

| | | | | |

| Exchange Rate Change of the Cash of Subsidiaries Abroad | 12,686 | (26,239) | (24,939) | (30,489) |

| | | | | |

| Increase (Decrease) in Cash and Cash Equivalents | (210,762) | (212,996) | (317,223) | (176,572) |

| | | | | |

| Cash and Cash Equivalents at the Beginning of the Fiscal Year | 210,941 | 423,937 | 486,258 | 662,830 |

| Cash and Cash Equivalents at the End of the Fiscal Year | 179 | 210,941 | 169,035 | 486,258 |

Transactions that do not affect cash are presented in Note 33 of these Parent Company and Consolidated Financial Statements.

The Notes form an integral part of these parent company and consolidated financial statements.

| Value Added Statements Fiscal Years ended December 31, 2022 and 2021 (In thousands of Brazilian Reais - R$) | |

| | Parent Company | Consolidated |

| | 2022 | 2021 | 2022 | 2021 |

| Revenues | | | | |

| Passenger, Cargo, and Other Transportation | - | - | 15,782,523 | 7,784,944 |

| Other Operating Revenues | 109,331 | 6,669 | 524,306 | 203,704 |

| Provision for Doubtful Accounts | - | - | (3,268) | (1,233) |

| | 109,331 | 6,669 | 16,303,561 | 7,987,415 |

| Inputs Acquired from Third Parties (includes ICMS and IPI) | | | | |

| Fuel and Lubricant Suppliers | - | - | (7,022,730) | (2,697,791) |

| Materials, Energy, Third-Party Services, and Others | (259,664) | (159,818) | (3,897,234) | (4,897,043) |

| Aircraft Insurance | - | - | (45,405) | (48,849) |

| Sales and Marketing | (285) | (369) | (822,619) | (412,852) |

| Gross Added Value | (150,618) | (153,518) | 4,515,573 | (69,120) |

| | | | | |

| Depreciation - Aircraft Right of Use | - | - | (1,085,629) | (673,205) |

| Depreciation and Amortization - Others | - | - | (634,505) | (662,608) |

| Net Added Value Produced by the Company | (150,618) | (153,518) | 2,795,439 | (1,404,933) |

| | | | | |

| Added Value Received on Transfers | | | | |

| Equity Pick Up Method | (1,055,450) | (6,394,162) | - | - |

| Derivative Financial Instruments | 42,025 | 200,267 | (2,626) | 198,752 |

| Financial Revenue | 207,138 | 290,925 | 147,876 | 246,007 |

| Total Value Added (Distributed) to Distribute | (956,905) | (6,056,488) | 2,940,689 | (960,174) |

| | | | | |

| Distribution of Value Added: | | | | |

| Direct Compensation | 5,205 | 11,373 | 1,592,698 | 1,485,392 |

| Benefits | - | - | 221,790 | 207,339 |

| FGTS | - | - | 120,681 | 81,355 |

| Personnel | 5,205 | 11,373 | 1,935,169 | 1,774,086 |

| | | | | |

| Federal | 4,474 | (16,687) | 249,469 | 369,886 |

| State | - | - | 22,964 | 16,617 |

| Municipal | - | - | 1,964 | 1,777 |

| Taxes, Fees, and Contributions | 4,474 | (16,687) | 274,397 | 388,280 |

| | | | | |

| Interest and Exchange Rate Change - Aircraft Leases | - | - | 596,122 | 1,392,449 |

| Interest and Exchange Rate Change - Others | 594,849 | 1,170,364 | 1,386,962 | 2,564,012 |

| Rents | - | - | 110,355 | 104,479 |

| Others | 40 | - | 199,157 | 324 |

| Third-Party Capital Compensation | 594,889 | 1,170,364 | 2,292,596 | 4,061,264 |

| | | | | |

| Loss for the Fiscal Year | (1,561,473) | (7,221,538) | (1,561,473) | (7,221,538) |

| Net Profit of the Fiscal Year Attributed to Non-Controlling Shareholders | - | - | - | 37,734 |

| Shareholders’ Equity Compensation | (1,561,473) | (7,221,538) | (1,561,473) | (7,183,804) |

| | | | | |

| Total Value Added Distributed (to Distribute) | (956,905) | (6,056,488) | 2,940,689 | (960,174) |

The Notes form an integral part of these parent company and consolidated financial statements.

| Notes to the Financial Statements Fiscal Year ended December 31, 2022 (In thousands of Brazilian Reais - R$, except when otherwise indicated) | |

Gol Linhas Aéreas Inteligentes S.A. (“Company” or “GOL”) is a limited liability company incorporated on March 12, 2004 under Brazilian laws. The Company’s bylaws states that the corporate purpose is exercising the equity control of GOL Linhas Aéreas S.A. (“GLA”), which provides scheduled and non-scheduled air transportation services for passengers and cargo, maintenance services for aircraft and components, develops frequent-flyer programs, among others.

The Company’s shares are traded on B3 S.A. - Brasil, Bolsa, Balcão (“B3”) and on the New York Stock Exchange (“NYSE”) under the ticker GOLL4 and GOL, respectively. The Company adopts B3’s Special Corporate Governance Practices Level 2 and is part of the Special Corporate Governance (“IGC”) and Special Tag Along (“ITAG”) indexes, created to distinguish companies that commit to special corporate governance practices.

The Company’s official headquarters are located at Praça Comandante Linneu Gomes, s/n, portaria 3, prédio 24, Jardim Aeroporto, São Paulo, Brazil.

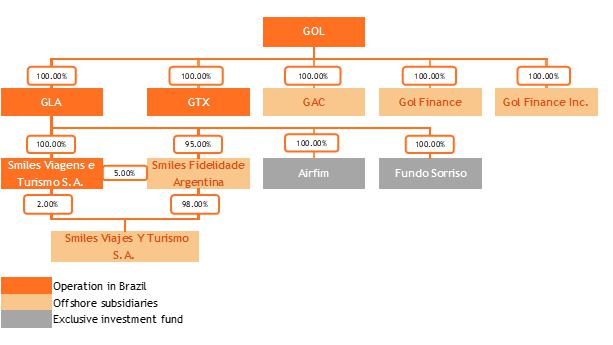

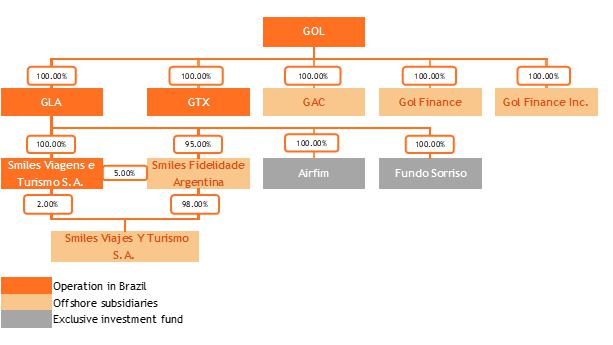

The corporate structure of the Company and its subsidiaries, on December 31, 2022, is shown below:

| Notes to the Financial Statements Fiscal Year ended December 31, 2022 (In thousands of Brazilian Reais - R$, except when otherwise indicated) | |

The Company's equity interest in the capital stock of its subsidiaries, on December 31, 2022, is presented below:

| Entity | Incorporation Date | Location | Main Activity | Type of Control | % of Interest

in the Share Capital |

| December 31, 2022 | December 31, 2021 |

| GAC | March 23, 2006 | Cayman Islands | Aircraft Acquisition | Direct | 100.00 | 100.00 |

| Gol Finance Inc. | March 16, 2006 | Cayman Islands | Fundraising | Direct | 100.00 | 100.00 |

| Gol Finance | June 21, 2013 | Luxembourg | Fundraising | Direct | 100.00 | 100.00 |

| GLA | April 9, 2007 | Brazil | Flight Transportation | Direct | 100.00 | 100.00 |

| GTX | February 8, 2021 | Brazil | Equity in Companies | Direct | 100.00 | 100.00 |

| Smiles Viagens | August 10, 2017 | Brazil | Tourism Agency | Indirect | 100.00 | 100.00 |

| Smiles Fidelidade Argentina (a) | November 7, 2018 | Argentina | Frequent-Flyer Program | Indirect | 100.00 | 100.00 |

| Smiles Viajes Argentina (a) | November 20, 2018 | Argentina | Tourism Agency | Indirect | 100.00 | 100.00 |

| AirFim | November 7, 2003 | Brazil | Investment Fund | Indirect | 100.00 | 100.00 |

| Fundo Sorriso | July 14, 2014 | Brazil | Investment Fund | Indirect | 100.00 | 100.00 |

| | | | | | | |

| (a) | Companies with functional currency in Argentine pesos (ARS). |

The subsidiaries GAC Inc., GOL Finance, and GOL Finance Inc. are entities created for the specific purpose of continuing financial operations and related to the Company's fleet. They do not have their own governing body and decision-making autonomy. Therefore, their assets and liabilities are consolidated in the Parent Company.

GTX S.A., direct subsidiary by the Company, is pre-operational and its corporate purpose is to manage its own assets and have an interest in the capital of other companies.

Smiles Viagens e Turismo S.A. (“Smiles Viagens”) has as main purpose intermediating travel organization services by booking or selling airline tickets, accommodation, tours, among others. The subsidiaries Smiles Fidelidade Argentina and Smiles Viajes Y Turismo S.A., both headquartered in Buenos Aires, Argentina, have the purpose to promote Smiles Program’s operations and the sale of airline tickets in this country.

The investment funds AirFim and Fundo Sorriso, controlled by GLA have the characteristic of an exclusive fund and act as an extension to carry out operations with derivatives and financial investments, so that the Company consolidates the assets and liabilities of this fund.

| 1.2. | Impacts and Measures taken by the Management regarding Covid-19 and the Russian invasion of Ukraine |

The first days of 2022 featured a significant growth in Covid-19 cases, with the “Omicron” variant, which led to flights cancelled by several companies in Brazil and worldwide. Through its flexible business model based on a single type of fleet, GOL did not see any operational impact in the period, with regularity above 99% and market leadership in domestic routes.

In February 2022, Russia launched a military invasion of Ukraine, severely escalating the existing conflict between these countries and generating impacts of reduction in global investments and in the supply of oil production due to the sanctions imposed by the international community on Russia. As a consequence, Brent and WTI oil, as well as the differentials for Heating Oil and Jet Fuel distillates rose sharply during the year 2022, higher than the previous period and resulted in the historical record level of aviation kerosene prices for the third quarter of 2022, as seen in the increase in costs of this nature in note 29. In view of this increase, the Company uses its capacity management to optimize the pricing of its fares, increase productivity and mitigating cost increase, in addition to evaluating protection strategies of future exposure and participate in sectoral negotiations in order to mitigate the impact on the operating margin.

| Notes to the Financial Statements Fiscal Year ended December 31, 2022 (In thousands of Brazilian Reais - R$, except when otherwise indicated) | |

The results of the period demonstrate a consistent recovery in demand, with plans to return to pre-pandemic levels in the coming quarters, with the Company having increased the domestic offer, measured by the ASK, at 40.2% on this period compared to the same period in 2021 and observed an increase of 36.7% in domestic demand, measured by RPK following the same comparison.

In order to keep up with the resumption of demand and increase its positioning in the regional market, the Company, in addition to inaugurating new routes in this market, also signed agreements with new partners and expanded frequencies on previously operated routes.

| 1.2.1. | Impacts on the Consolidated Financial Statements |

Throughout 2022, the operational network resumed and the offer normalized at levels close to 2019, having reached in the fourth quarter of 2022 86% of the supply equivalent to the same period of 2019. However, the result for the period bears the impacts of the pandemic period that led to a reduction in the network. In response to the drop in demand and crew availability, the costs of depreciation of flight equipment not directly related to the revenues generated in the period were reclassified from costs to other operating expenses.

The table below details the reclassifications made to period ended December 31, 2022, linked directly to the Covid-19 pandemic and additional disclosures:

| | | Consolidated |

| Income Statement - Reclassifications | | Cost of Services | Other Revenues and Expenses, Net |

| Flight equipment depreciation – idleness | (a) | 108,706 | (108,706) |

| (a) | Due to the drop in the number of flights operated, where the Company incurred with the burden of time, by analogy to the provisions of CPC 16 (R1) - Inventories, equivalent to IAS 2, expenses and depreciation of flight equipment not directly related to the revenues generated in the period, called idleness, were reclassified from the group of costs of services to the group of other revenues and expenses, net. |

In the preparation of this financial statement, the Management considered the most recent forecasts available, duly reflected in the Company's business plans.