UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

o | Registration Statement pursuant to Section 12(b) or 12(g) of the Securities Exchange Act of 1934 |

| or |

x | Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended February 28, 2005 |

| or |

o | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the transition period from to |

Commission file number: 333-115996

CONCORDIA BUS NORDIC AB (publ)

(Exact Name of Registrant as Specified in its Charter)

SWEDEN

(Jurisdiction of Incorporation or Organization)

Solna Strandväg 78, 171-54 Solna, Sweden

(Address of Principal Executive Offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Securities registered or to be registered pursuant to Section 12(g) of the Act:

NONE

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

€130,000,000 9.125% Senior Secured Notes due August 1, 2009

(Title of Class)

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes | o No |

Indicate by check mark which financial statement item the registrant has elected to follow:

x Item 17 | o Item 18 |

PART I | |||||

Item 1. |

| Identity Of Directors, Senior Management And Advisors |

| 1 | |

Item 2. |

| Offer Statistics And Expected Timetable |

| 1 | |

Item 3. |

| Key Information |

| 1 | |

| A. |

| Selected Financial Data |

| 1 |

| B. |

| Capitalization And Indebtedness |

| 4 |

| C. |

| Reasons For The Offer And Use Of Proceeds |

| 4 |

| D. |

| Risk Factors |

| 4 |

Item 4. |

| Information On The Company |

| 16 | |

| A. |

| History And Development Of The Company |

| 16 |

| B. |

| Business Overview |

| 17 |

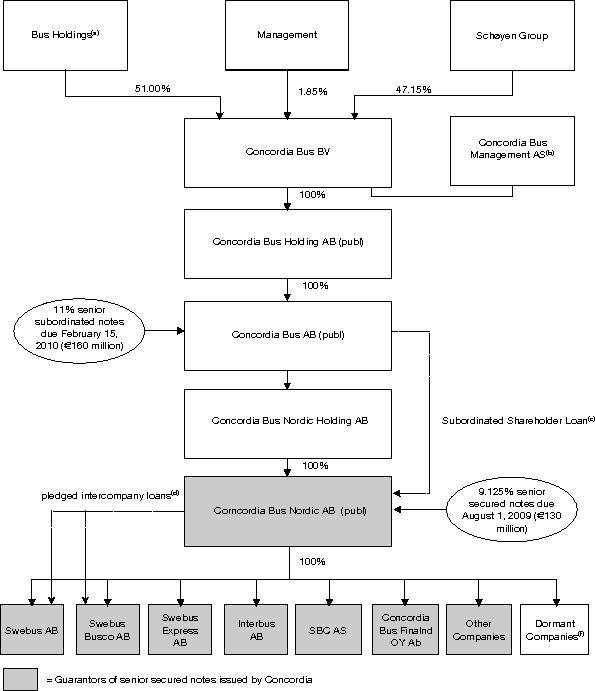

| C. |

| Organizational Structure |

| 30 |

| D. |

| Property, Plant And Equipment |

| 31 |

Item 5. |

| Operating And Financial Review And Prospects |

| 32 | |

| A. |

| Operating Results |

| 32 |

| B. |

| Liquidity And Capital Resources |

| 44 |

| C. |

| Research And Development, Patents, Licences, Etc. |

| 47 |

| D. |

| Trend Information |

| 47 |

| E. |

| Off-Balance Sheet Arrangements |

| 48 |

| F. |

| Tabular Disclosure of Contractual Obligations |

| 48 |

Item 6. |

| Directors, Senior Management And Employees |

| 49 | |

| A. |

| Directors And Senior Management |

| 49 |

| B. |

| Compensation |

| 51 |

| C. |

| Board Practices |

| 51 |

| D. |

| Employees |

| 52 |

| E. |

| Share Ownership |

| 52 |

Item 7. |

| Major Shareholders And Related Party Transactions |

| 52 | |

| A. |

| Major Shareholders |

| 52 |

| B. |

| Related Party Transactions |

| 53 |

| C. |

| Interests Of Experts And Counsel |

| 54 |

Item 8. |

| Financial Information |

| 54 | |

| A. |

| Consolidated Statements And Other Financial Information |

| 54 |

| B. |

| Significant Changes |

| 54 |

Item 9. |

| The Offer And Listing |

| 54 | |

| A. |

| Market Price Information |

| 55 |

| B. |

| Markets |

| 55 |

Item 10. |

| Additional Information |

| 55 | |

| A. |

| Share Capital |

| 55 |

| B. |

| Memorandum And Articles Of Association |

| 55 |

| C. |

| Material Contracts |

| 55 |

| D. |

| Exchange Controls |

| 59 |

| E. |

| Taxation |

| 59 |

| F. |

| Dividends And Paying Agents |

| 63 |

| G. |

| Statement By Experts |

| 63 |

| H. |

| Documents On Display |

| 63 |

| I. |

| Subsidiary Information |

| 63 |

Item 11. |

| Quantitative And Qualitative Disclosures About Market Risk |

| 63 | |

Item 12. |

| Description Of Securities Other Than Equity Securities |

| 65 | |

PART II | |||||

Item 13. |

| Defaults, Dividend Arrearages And Delinquencies |

| 66 | |

Item 14. |

| Material Modifications To The Rights Of Security Holders And Use Of Proceeds |

| 66 | |

Item 15. |

| Controls And Procedures |

| 66 | |

Item 16A. |

| Audit Committee Financial Expert |

| 66 | |

Item 16B. |

| Code Of Ethics |

| 66 | |

Item 16C. |

| Principal Accountant Fees And Services |

| 67 | |

Item 16D. |

| Exemptions From The Listing Standards For Audit Committees |

| 67 | |

Item 16E. |

| Purchases Of Equity Securities By The Issuer And Affiliated Purchasers |

| 67 | |

PART III | |||||

Item 17. |

| Financial Statements |

| 68 | |

Item 18. |

| Financial Statements |

| 68 | |

Item 19. |

| Exhibits |

| 68 | |

|

| Signatures |

| 72 | |

CAUTIONARY NOTICE REGARDING FORWARD LOOKING STATEMENTS

This annual report includes forward looking statements. We have based these forward looking statements on our current expectations and projections about future events. These forward looking statements can be identified by the use of forward looking terminology, including the terms “believe,” “estimate,” “anticipate,” “expect,” “intend,” “continue,” “may,” “will” or “should” or, in each case, their negative, or other variations or comparable terminology. These forward looking statements include all matters that are not historical facts. They appear under subheading “D. Risk Factors” of “Item 3. Key Information” and “Item 5. Operating and Financial Review and Prospects” and elsewhere in this annual report and include statements regarding our intentions, beliefs or current expectations concerning, among other things, our results of operations, financial condition, liquidity, prospects, growth, strategies and the industry in which we operate.

By their nature, forward looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. We caution you that forward looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and the development of the industry in which we operate may differ materially from those made in or suggested by the forward looking statements contained in this annual report. In addition, even if our results of operations, financial condition and liquidity, and the development of the industry in which we operate are consistent with the forward looking statements contained in this annual report, those results or developments may not be indicative of results or developments in subsequent periods. Important factors that could cause those differences include, but are not limited to:

· our substantial leverage and our ability to meet our debt service obligations;

· our ability to win and/or renew public contracts;

· downward pressure on prices resulting from competition in our industry;

· our exposure to cost increases that may not be sufficiently accounted for by the indexation terms in our contracts;

· potential changes in the funding provided to transportation authorities by governments;

· our ability to win contracts with a margin and return on capital commensurate with our cost structure;

· our ability to forecast the costs associated with contracts successfully;

· our ability to take advantage of terms in our lease agreements;

· our exposure to fluctuations in interest notes (leasing);

· our relations with our employees;

· our exposure to fluctuations in fuel prices;

· possible financial losses pursuant to our hedging strategies; and

· our exposure to currency exchange rate fluctuations.

We undertake no obligation to update publicly or to revise any forward looking statements, whether as a result of new information, future events or otherwise. Furthermore, these forward looking statements may be materially impacted by the factors listed under subheading “D. Risk Factors” of “Item 3. Key Information”. In light of these risks, uncertainties and assumptions, the forward looking events discussed in this annual report might not occur. You should not interpret statements regarding past trends or activities as representations that those trends or activities will continue in the future.

i

ENFORCEMENT OF CERTAIN CIVIL LIABILITIES

Concordia Bus Nordic AB (publ) (“Concordia”) is organized under the laws of Sweden. All of our directors, executive officers and our subsidiaries and the independent auditors named in this annual report are non-residents of the United States. As a result, it may not be possible for investors to effect service of process within the United States upon us or such persons or to enforce against any of them judgments of US courts predicated upon civil liabilities under US federal securities laws. Although we agree under the terms of the indenture relating to the senior secured notes to accept service of process in the United States by an agent designated for such purpose, it may not be possible for investors to (i) effect service of process within the United States upon our officers and directors and the independent auditors named herein and to (ii) realize in the United States upon judgments against such persons obtained in such courts predicated upon civil liabilities of such persons, including any judgments predicated upon US federal securities laws to the extent such judgments exceed such person’s US assets. There is also doubt as to the enforceability in Sweden, in original actions or in actions for enforcement, of judgments of US courts predicted upon the civil liability provisions of the federal securities laws of the United States.

CURRENCY AND FINANCIAL STATEMENT PRESENTATION

Unless otherwise indicated, references in this annual report to “SEK,” “Swedish Krona” or “Swedish Kronor” are to the lawful currency of Sweden; references to “euro” or “€” are to the single currency of the participating Member States in the Third Stage of European Economic and Monetary Union of the Treaty Establishing the European Community, as amended from time to time; references to “Norwegian Kroner” or “NOK” are to the lawful currency of Norway; and references to “US dollars” or “$” are to the lawful currency of the United States of America.

The consolidated financial statements of Concordia are prepared in accordance with accounting principles generally accepted in Sweden (“Swedish GAAP”), which differ in certain respects from generally accepted accounting principles in certain other countries. The significant differences between Swedish GAAP and accounting principles generally accepted in the United States of America (“US GAAP”) are discussed in Note 32 to the consolidated financial statements of Concordia included elsewhere in this annual report.

The 9.125% Senior Secured Notes due 2009 were issued by Concordia Bus Nordic AB (publ) and were guaranteed by the issuer’s immediate parent, Concordia Bus Nordic Holding AB and by certain of the issuer’s subsidiaries. The issuer and the issuer’s subsidiaries guaranteeing the notes are all 100% owned by the issuer’s immediate parent. In addition, all guarantees are full and unconditional and joint and several. Pursuant to Rule 3-10(d) of Regulation S-X under the Securities Act of 1933, as amended, only the issuer’s parent would be required to file the financial statements required by Regulation S-X in this annual report on Form 20-F (provided that certain footnote disclosure regarding the issuer was provided). However, because of the limited amount of meaningful historical financial information regarding the issuer’s parent because the issuer’s parent was dormant prior to the issuance of the notes, we are providing financial statements with respect to both the issuer and the issuer’s parent. In addition, the discussion in “Item 5. Operating and Financial Review and Prospects” is based on the issuer’s results, rather than the issuer’s parent’s results.

ii

Unless otherwise stated in this prospectus or unless the context otherwise requires, references to “Concordia”, “we,” or “our” are to Concordia Bus Nordic AB and, as the context may require, its subsidiaries ; references to “our indirect Parent” are to Concordia Bus AB (publ) and, as the context may require, its subsidiaries; references to “our direct Parent” or “the Parent Guarantor” are to Concordia Bus Nordic Holding AB and, as the context may require, its subsidiaries; references to “Swebus” are to Swebus AB; references to “Concordia Finland” are to Concordia Bus Finland Oy Ab; references to “SBC” are to Ingeni&qout;r M.O. Sch&qout;yens Bilcentraler AS; references to “SG” or the “Sch&qout;yen Group” are to Sch&qout;yen Group; and references to “Bus Holdings” are to Bus Holdings S.a.r.l.

iii

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

A. Selected Financial Data

Previously, Concordia Bus Nordic Holding AB (“Holding”) was named Interbus Finans AB and was a wholly owned subsidiary of Concordia, which was wholly owned by Concordia Bus AB (“Bus”). In January 2004, a reorganization was performed whereby Concordia transferred to Bus its 100% share ownership of Interbus Finans AB. Bus then transferred its shares in Concordia to Interbus Finans AB. Interbus Finans AB was then renamed Concordia Bus Nordic Holding AB.

This reorganization had the effect of creating a new holding company for Concordia from one of its dormant subsidiaries. Holding is a non operating holding company that has no assets other than its shares in Concordia. For periods after the reorganization, the consolidated financial position, results of operations and cash flows of Concordia are the same as that of Holding. Since this was a reorganization of entities under common control, the consolidated financial statements contained in this annual report are presented as if Holding was in existence as the shareholder of Concordia for all periods presented.

The following tables set forth selected consolidated financial data derived from audited financial statements as of and for the years ended February 28, 2001, February 28, 2002, February 28, 2003, February 29, 2004 and February 28, 2005.

This information should be read in conjunction with the sections “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and the notes thereto included elsewhere in this annual report.

The consolidated financial statements of Concordia have been prepared in accordance with Swedish GAAP, which differ in certain significant respects from US GAAP. The significant differences between Swedish GAAP and US GAAP are discussed in Note 32 to the consolidated financial statements of Holding included elsewhere in this annual report.

1

CONCORDIA BUS NORDIC HOLDING AB

SELECTED CONSOLIDATED FINANCIAL DATA

(SEK in millions, except per share amount and ratios)

|

| As of and for |

| As of and for |

| As of and for the year |

| ||||||||

|

| 2005 |

| 2004 |

| 2003 |

| 2002 |

| 2001(a) |

| ||||

Statement of Operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net revenue |

|

| 4,812 |

|

|

| 4,761 |

|

| 4,758 |

| 4,226 |

| 3,576 |

|

Operating expenses(g) |

|

| (4,722 | ) |

|

| (4,544 | ) |

| (4,505 | ) | (3,999 | ) | (3,146 | )(b) |

Gain (loss) on sale of fixed assets |

|

| 4 |

|

|

| 6 |

|

| (4 | ) | 20 |

| 65 |

|

Depreciation; amortization and Write-downs |

|

| (350 | ) |

|

| (331 | ) |

| (372 | ) | (362 | ) | (332 | ) |

Operating profit (loss) |

|

| (256 | ) |

|

| (108 | ) |

| (123 | ) | (115 | ) | 163 |

|

Financial income and expense, net(c) |

|

| (141 | ) |

|

| (146 | ) |

| (105 | ) | (104 | ) | (117 | ) |

Income (loss) before taxes |

|

| (397 | ) |

|

| (259 | ) |

| (228 | ) | (219 | ) | 46 |

|

Income taxes |

|

| 1 |

|

|

| 83 |

|

| 49 |

| 46 |

| (42 | ) |

Net profit (loss) |

|

| (396 | ) |

|

| (171 | ) |

| (179 | ) | (173 | ) | 4 |

|

Net profit (loss) per share (in thousands of SEK) |

|

| (1,320 | ) |

|

| (572 | ) |

| (596 | ) | (577 | ) | 13 |

|

Balance Sheet Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total fixed assets |

|

| 1,514 |

|

|

| 1,827 |

|

| 2,127 |

| 2,321 |

| 2,925 |

|

Of which: buses |

|

| 1,228 |

|

|

| 1,491 |

|

| 1,793 |

| 1,971 |

| 2,327 |

|

Total current assets |

|

| 772 |

|

|

| 1,024 |

|

| 757 |

| 1,035 |

| 897 |

|

Total assets |

|

| 2,286 |

|

|

| 2,851 |

|

| 2,884 |

| 3,356 |

| 3,822 |

|

Share capital |

|

| 0 |

|

|

| 0 |

|

| 0 |

| 0 |

| 0 |

|

Total shareholder’s equity (deficit) |

|

| (144 | ) |

|

| 235 |

|

| 412 |

| 692 |

| 940 |

|

Total provisions |

|

| 111 |

|

|

| 146 |

|

| 198 |

| 269 |

| 371 |

|

Total non-current liabilities |

|

| 1,188 |

|

|

| 1,216 |

|

| 858 |

| 1,652 |

| 1,563 |

|

Total current liabilities |

|

| 1,131 |

|

|

| 1,254 |

|

| 1,416 |

| 743 |

| 948 |

|

Total debt |

|

| 1,488 |

|

|

| 1,589 |

|

| 1,497 |

| 1,691 |

| 1,698 |

|

Of which: Subordinated Shareholder Loan, net(d) |

|

| 292 |

|

|

| 368 |

|

| 494 |

| 631 |

| — |

|

Of which: senior debt(e) |

|

| 1,196 |

|

|

| 1,221 |

|

| 1,003 |

| 1,060 |

| 1,698 |

|

US GAAP: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

| (385 | ) |

|

| (127 | ) |

| (168 | ) | (188 | ) | N/A |

|

Basic and diluted loss per share (in thousands of SEK) |

|

| (1,283 | ) |

|

| (425 | ) |

| (560 | ) | (626 | ) | N/A |

|

Total assets |

|

| 3,006 |

|

|

| 3,561 |

|

| 3,579 |

| 4,041 |

| N/A |

|

Shareholder’s equity, end of year |

|

| 453 |

|

|

| 826 |

|

| 952 |

| 1,231 |

| N/A |

|

Cash Flow Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flow from operations |

|

| (99 | ) |

|

| 24 |

|

| (66 | ) | 39 |

| (19 | ) |

Cash flow from investing activities |

|

| (63 | ) |

|

| (11 | ) |

| (136 | ) | 274 |

| 55 |

|

Cash flow from financing activities |

|

| (8 | ) |

|

| 152 |

|

| (95 | ) | (78 | ) | 63 |

|

|

|

| 2005 |

|

|

| 2004 |

|

| 2003 |

| 2002 |

| 2001 |

|

Total capital expenditures |

|

| 112 |

|

|

| 32 |

|

| 216 |

| 43 |

| 336 |

|

Of which: capital expenditures on buses |

|

| 100 |

|

|

| 15 |

|

| 182 |

| 21 |

| 321 |

|

Other Financial Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net present value of operating leases(f) |

|

| 875 |

|

|

| 957 |

|

| 1,003 |

| 748 |

| 348 |

|

(a) In March/April 2000, Concordia Finland experienced a three day strike among its employees. This strike resulted in losses of SEK 1.2 million.

2

(b) Operating expenses for the year ended February 28, 2001, include a refund from the administrator of one of the pension plans of SEK 175 million.

(c) Includes financing costs and other financial charges and unrealized exchange rate gains and losses on loans denominated in foreign currency. The net foreign currency exchange gains and losses represented SEK (20) million, SEK 3 million and SEK 4 million for the years ended February 28, 2001, 2002 and 2003, respectively, SEK (7) million for the year ended February 29, 2004 and SEK 19 for the year ended February 28, 2005.

(d) The Subordinated Shareholder Loan (defined below), net, reflects the combination of the net balance of the initial subordinated loan of SEK 501 million and aggregate group contributions received by Bus from Holding and its subsidiaries in exchange for tax losses from Bus and cash payments from Holding to Bus relating to servicing the €160,000,000 11.0% Senior Subordinated Notes due 2010 issued by Bus. For a description of the Subordinated Shareholder Loan, see “Description of Other Material Indebtedness—Subordinated Shareholder Loan from Holding.”

(e) Total senior debt includes long term senior debt and the short-term portion of long term senior debt to third parties including obligations under financial lease arrangements but excluding the Subordinated Shareholder Loan. Holding believes that total senior debt is a useful supplement to total debt and other balance sheet data as it indicates the amount of debt Holding owes which ranked pari passu with the €130,000,000 9.125% Senior Secured Notes due August 1, 2009 issued by Concordia on January 22, 2004.

(f) Net present value of operating leases represents the net present value of future minimum lease payments for vehicles, real estate and certain other leased assets under operating lease arrangements.

(g) Operating expenses

|

| As of and for the |

| As of and for the |

| As of and for the year |

| ||||||||

|

| 2005 |

| 2004 |

| 2003 |

| 2002 |

| 2001(a) |

| ||||

|

|

|

| SEK |

| SEK |

| SEK |

| SEK |

| ||||

Fuel, tires and other consumables |

|

| (989 | ) |

|

| (929 | ) |

| (919 | ) | (805 | ) | (692 | ) |

Other external costs |

|

| (1,127 | ) |

|

| (1,004 | )] |

| (989 | ) | (854 | ) | (478 | ) |

Total Personnel costs |

|

| (2,606 | ) |

|

| (2,611 | ) |

| (2,597 | ) | (2,340 | ) | (1,976 | ) |

Total Operating expenses . |

|

| (4,722 | ) |

|

| (4,544 | ) |

| (4,505 | ) | (3,999 | ) | (3,146 | ) |

3

The table below sets forth, for the periods and dates indicated, certain information concerning the exchange rate for the Swedish Krona against the US dollar based upon the noon buying rate in the City of New York for cable transfers in Swedish Krona as announced by the Federal Reserve Bank of New York for customs purposes (the “SEK Noon Buying Rate”). We provide these rates for your convenience only, and they are not the rates of exchange we used to prepare our consolidated financial statements used elsewhere in this annual report. We are not representing that Swedish Krona amounts have been or would be converted into U.S. dollars at any of the exchange rates indicated. The SEK Noon Buying Rate expressed in US dollars as of August 26, 2005 was $7.5757.

|

| Period End |

| Average |

| High |

| Low |

| ||

Fiscal Year |

|

|

|

|

|

|

|

|

|

|

|

Ended February 28, 2001 |

|

| 9.8150 |

|

| 9.3723 | (a) | 10.3600 |

| 8.5330 |

|

Ended February 28, 2002 |

|

| 10.4700 |

|

| 10.5832 | (a) | 11.0270 |

| 9.6730 |

|

Ended February 28, 2003 |

|

| 8.5050 |

|

| 9.3218 | (a) | 10.500 |

| 8.4100 |

|

Ended February 29, 2004 |

|

| 7.4330 |

|

| 7.8456 | (a) | 8.7030 |

| 7.0850 |

|

Ended February 28, 2005 |

|

| 6.8275 |

|

| 7.3002 | (a) | 7.7725 |

| 6.5939 |

|

Month |

|

|

|

|

|

|

|

|

|

|

|

February 2005 |

|

|

|

|

|

|

| 7.1114 |

| 6.8275 |

|

March 2005 |

|

|

|

|

|

|

| 7.0716 |

| 6.7312 |

|

April 2005 |

|

|

|

|

|

|

| 7.1627 |

| 7.0018 |

|

May 2005 |

|

|

|

|

|

|

| 7.4108 |

| 7.0850 |

|

June 2005 |

|

|

|

|

|

|

| 7.8114 |

| 7.4373 |

|

July 2005 |

|

|

|

|

|

|

| 7.9218 |

| 7.7225 |

|

August (through August 26, 2005) |

|

|

|

|

|

|

| 7.7121 |

| 7.4762 |

|

(a) The average of the SEK Noon Buying Rate on the last day of each month during the applicable period.

B. Capitalization and Indebtedness

Not applicable.

C. Reasons For the Offer and Use of Proceeds

Not applicable.

Our indirect parent, Bus, has entered into Swedish reorganization proceedings and Bus is insolvent. If the reorganization is not successful, we may not be able to continue as a going concern.

On July 22, 2005 our indirect parent, Bus signed a restructuring agreement (“the Restructuring Agreement”) with among other parties, holders of approximately 75% of Bus’ € 160,000,000 11.0% Senior Subordinated Notes due 2010 (the “Parent Notes”). In connection with that restructuring agreement Bus intends to enter into reorganization proceedings in Sweden on or about September 1, 2005. These proceedings are intended to result in the conversion of Parent Notes into common shares of Bus. Such Holders who sign the restructuring agreement will be issued common shares that will represent approximately 97.5% of Bus’ outstanding common equity at the time of issuance. Risks involving the reorganization include the following:

· There can be no assurance that the Swedish court will approve the reorganization plan.

4

· Publicity and perception issues relating to the reorganization proceedings may adversely affect our business. We believe that any such adverse effects may worsen if the Swedish court does not approve the reorganization plan promptly.

· There can be no assurance regarding any adverse actions that creditors or shareholders of Bus or other parties in interest in the reorganization proceedings may take that could prevent or unduly delay confirmation of Bus reorganization plan.

· There can be no assurance that Bus reorganization will enable it to continue to operate as a going concern over time.

· We may be unable to retain top management and other key personnel through the process of reorganization.

The uncertainty regarding the eventual outcome of Bus restructuring could threaten our ability to continue as a going concern. Continuing on a going concern basis is dependent upon, among other things, the success and court approval of Bus reorganization plan, maintaining the support of key vendors and retaining key personnel, along with financial, business, and other factors, many of which are beyond are control.

Concordia is a holding company with no revenue generating operations of its own as a result our financial condition could be adversely affected if our subsidiaries do not make distributions to us.

Concordia is a holding company. Our principal asset is our investment in our subsidiaries. We conduct no business or operations except through direct and indirect subsidiaries. Our ability to service our indebtedness, including the €130,000,000 9.125% Senior Secured Notes due August 1, 2009 (the “Senior Notes”), and our indebtedness to Bus of approximately SEK 292 million is entirely dependent upon the receipt of funds from our subsidiaries by means of dividends, interest, intercompany loans or otherwise. The ability of our subsidiaries to make those funds available to us is subject to, among other things, applicable corporate and other laws and restrictions contained in agreements to which such subsidiaries may be subject. We cannot assure you that our subsidiaries will be in a position to make funds available to us. Although the indenture related to the Senior Notes limits the ability of such subsidiaries to enter into consensual restrictions on their ability to pay dividends and make other payments to us, such limitations are subject to a number of significant qualifications. Also, according to Swedish law, our subsidiaries may only pay dividends to us to the extent that they have distributable earnings. Their failure to have such distributable earnings in the future could have a material adverse effect on our financial condition.

We expect that Holding and Bus will seek to cause us to make funds available for interest payments in connection with their indebtedness. The making of such distribution to our parent companies could have a material adverse effect on all results of operations or financial condition.

We are a wholly owned indirect subsidiary of Bus. The terms of the Parent Notes require Bus to make semi-annual interest payments which, in fiscal 2005, on an annualized basis equaled €17.6 million. Bus did not make its last payment and in connection with the restructuring expects that the Parent Notes will be converted into common shares representing 97.5% of the common equity in Bus and that the remainder will be reduced to 25% of their face value. In connection with that restructuring Holding has borrowed €25,000,000 to pay for the expenses of the restructuring and Bus intends to borrow an additional €45,000,000 (together, the “Mezzanine Facility”) of which approximately €13,000,000 Bus intends to contribute to us, via Holding, as an equity contribution. A portion of the net proceeds received from the issuance of the Parent Notes was loaned to us by Bus pursuant to a subordinated intercompany loan (the “Subordinated Shareholder Loan”) and which bears interest at a rate of 11% and matures on February 14, 2010 and which, in connection with the restructuring, was transferred to Holding. As of February 28, 2005 the outstanding balance of the Subordinated Shareholder Loan is approximately SEK 167,000,000.

5

Holding will have to make interest payments of approximately €857 thousand in connection with its borrowing until it is repaid with the proceeds of the Mezzanine Facility and Bus will have to make substantial and greater interest payments once it had drawn down the Mezzanine Facility. The terms of the Senior Notes permit us to make distributions to our parent companies, whether in the form of dividends, distributions, advances or otherwise for the purpose of making these semi-annual interest payments. To the extent allowed by Swedish law, we intend to make such distributions to our parent companies via dividends, by making interest payments on the Subordinated Shareholder Loan and the Mezzanine Facility, or by repaying the principal on the Subordinated Shareholder Loan accordingly to Swedish law, however, we can only pay dividends to our parent companies to the extent we have distributable earnings.

To service our debt, we will require a significant amount of cash. If our subsidiaries do not generate sufficient cash, our parent companies may default on our respective debt which could have a material adverse effect on our business.

Our ability to make payments on and to refinance our debt, including the Senior Notes, will depend on our subsidiaries’ ability to generate cash in the future and our subsidiaries’ ability to generate distributable earnings or other funds available for that purpose. For the year ended February 28, 2005 we spent €11.9 million to service our debt. Our subsidiaries ability to generate cash is, to a certain extent, is subject to general economic, financial, competitive and other factors that are beyond our control.

We sustained operating losses of SEK 256 million for the year ended February 28, 2005, SEK 108 million for the year ended February 29, 2004 and SEK 123 million for the year ended February 28, 2003. We sustained net losses of SEK 396 million for the year ended February 28, 2005, SEK 171 million for the year ended February 29, 2004 and SEK 179 million for the year ended February 28, 2003.

We may need to refinance all or a portion of our and our subsidiaries’ debt, including the Senior Notes, on or before maturity. We may not be able to refinance any of such debt, including debt under the Senior Notes, on commercially reasonable terms or at all, which could have a material adverse effect on our business.

Further, our parent companies’ ability to make payments on the Mezzanine Facility is currently wholly dependent upon our and our subsidiaries’ ability to make payments in connection with the Subordinated Shareholder Loan and the Capital Contribution, as well as our and our subsidiaries’ ability to generate distributable earnings for that purpose. Although we believe that, after making payments permitted in respect of the Subordinated Shareholder Loan and the Capital Contribution, we will have available distributable earnings to make payments in respect of the Senior Notes, we cannot assure you we will have sufficient distributable earnings to do so. Any failure to provide funds to our parent companies’ sufficient to make interest payments on the Mezzanine Facility could result in a default under the Mezzanine Facility. A default on the Mezzanine Facility could result in an insolvency of Bus, which would accelerate payment on the Senior Notes in accordance with the terms of the indenture. Even if Bus did not suffer an insolvency, such default could limit our ability to obtain funding on commercially acceptable terms or at all, which could have a material adverse effect on our business.

Our substantial leverage could adversely affect our ability to run our business.

We have now and will continue to have a significant amount of debt. As of February 28, 2005, our total consolidated debt was approximately SEK 1,488 million, of which total consolidated senior debt was approximately SEK 1,196 million and our shareholders deficit was SEK (144) million. We also have substantial payment obligations under our operating leases. The present value of future lease payments for our operating leases February 28, 2005 was SEK 875 million, SEK 957 million as of February 29, 2004 and SEK 1,003 million as of February 28, 2003.

6

In addition, we expect that Holding and Bus will seek to cause us to make funds available to them, in excess of our obligations in respect of the Subordinated Shareholder Loan and the Capital Contribution, in respect of our parent companies’ interest payment obligations under the Mezzanine Facility.

Our and our subsidiaries’ substantial debt, and such need to provide funds to our parent companies, could have important consequences for you. For example, it could among other things:

· make it more difficult for us to satisfy our obligations under the Senior Notes;

· limit our ability to fund our working capital, capital expenditures and general corporate requirements;

· limit our ability to borrow additional funds;

· limit our ability to enter into leases for buses;

· require us to dedicate a substantial portion of our cash flow from operations to payments on our debt, thereby reducing the funds available to us for other purposes;

· make us more vulnerable to economic downturns; and

· reduce our flexibility to respond to changing business and economic conditions.

In addition, we and our subsidiaries may be able to incur substantial additional debt in the future. The terms of the indenture governing the Senior Notes restrict but do not fully prohibit us and our subsidiaries from borrowing, and some of those borrowings may be secured. Further, if new debt is added to our and our subsidiaries’ current debt levels, the related risks that we and they now face could intensify.

Any of the foregoing could have a material adverse effect on our business, our ability to make payments under the Senior Notes and our ability to continue presenting our financial statements under the assumption that we are a going concern.

The terms of our indebtedness restrict our corporate activities, if we fail to comply with these terms could result in a default under our indebtedness.

The indenture under which the Senior Notes were issued, restricts, and in some cases prohibits, among other things, our and our subsidiaries’ ability to:

· incur additional debt;

· make prepayments of certain debt;

· pay dividends;

· make investments;

· engage in transactions with affiliates;

· issue capital stock;

· create liens;

· sell assets; and

· engage in mergers and consolidations.

A failure to comply with these covenants would result in a default under the Senior Notes, which in turn could result in an event of default under our other indebtedness.

7

We may not have the ability to raise the funds necessary to finance the change of control offer or asset sale offers required by the indenture under which the Senior Notes were issued.

Upon the occurrence of specific kinds of change of control events, we will be required to offer to repurchase all outstanding Senior Notes. Furthermore, a change of control may result in a default under and possibly acceleration of other senior debt we may incur. Also, if we or our subsidiaries sell assets we may, subject to conditions, be required to offer to repurchase Senior Notes. It is possible, however, that we will not have sufficient funds at the time we are required to make such an offer to make the required repurchase of Senior Notes.

If we lose many local public transportation authorities’ contracts as they are renewed or we are unable to win new contracts, our business will be adversely affected. Further, if we experience difficulties in operating under our existing contracts, our business may be adversely affected.

In the year ended February 28, 2005, our contracts with local public transportation authorities comprise approximately 89.5% of our revenue. In Sweden, Norway and Finland, we operate under 113, 10 and 37 contracts, respectively, with the largest contract accounting for 4.6% of our net revenue and the top 25 contracts accounting for approximately 43.8% of total revenue in the year ended February 28, 2005. These contracts usually have a five to eight year term. Local public transportation authorities conduct a competitive bidding process for each contract shortly before it terminates and the most important criteria for determining the success of the bid is usually price. See “Business—Sweden—Tendering Procedures” for a discussion of the competitive bidding process in Sweden. If we fail to continue to renew our local public transportation authorities contracts, our revenues will be adversely affected as our older local public transportation authorities contracts expire. This may affect our ability to satisfy our obligations under the Senior Notes.

During the year ended February 28, 2003, Swebus faced significant operating difficulty in the Stockholm and Uppsala region, due largely to poor operational planning of summer and winter traffic schedules, together with an exceptionally severe winter. Restrictions on our ability to manage inherited bus drivers under the new contracts due to a grace period of one year from March 4, 2002, and a shortage of drivers caused significant problems. This situation resulted in additional overtime, training costs, substantial payments due to the inconvenience of working hours, increased subcontracting costs, loss of revenues and contractual penalties. If similar difficulties were to be experienced under current contracts, our business would be adversely affected.

If we do not retain or gain local public transportation authority contracts, we may not benefit from the option to renew existing operating lease agreements at a lower cost.

As of February 28, 2005, we have entered into operating leasing arrangements for 1,470 of our 3,730 buses. The contracts under which these buses are leased are classified as operating leases which means that no carrying values are recorded on our balance sheet. The term of any given lease is established to match as far as possible with the duration of the underlying contract with the local public transportation authority, generally five to eight years.

Currently, the structure of the lease contract is such that at the inception of a new lease contract, the leasing fee is established based on the purchase price paid by the lessor and residual value agreed with the manufacturer for the period of the lease. At the end of each leasing contract period each leasing contract can be renewed or terminated (and we have an obligation to renew the lease contracts for a certain aggregate number of buses). The lease payments for the second leasing period, which are based on the agreed residual value at the date of the extension, are lower than the payments during the initial term. If we are not successful in renewing or extending the local public transportation authority contracts, or in efficiently redeploying our buses elsewhere, we may not gain the benefit of such lower costs.

8

Further, in the event of an acceleration under the Senior Notes following a default, all or part of the leasing contracts covering a significant portion of our leases may be terminated at the option of the lessor. This could have a material adverse effect on our business.

Competition on price or other factors could adversely affect our business.

It is our policy to focus on increasing our return on capital and cash generation. We believe that our change in focus toward higher, more appropriate tendering price levels has been adopted by other major operators. Consolidation in the industry and this change in focus among the larger competitors from a tendering strategy based on increasing market share to a strategy of seeking to maintain adequate margins have recently resulted in more favorable pricing dynamics. For example, during the period fiscal 2002 to fiscal 2005, CPTAs awarded contracts to us on renewal with prices between 10% and 54% above the prices in the previous contracts. However, no assurance can be given that the more favorable pricing trends will continue in the future for new tenders. For more information, see “Business—Sweden—Competition in the Swedish Bus Transportation Market.”

If indices in our contracts do not reflect our cost increases, our business could be adversely affected.

Local public transportation authorities contracts provide for a fee to be paid to us in return for providing bus operations for the routes and schedules described in the contracts. The amount of the fee to be paid each year is adjusted annually based on an index, or on several indices, that are intended to compensate for changes in our costs. Historically, contracts with local public transportation authorities, which produce a substantial portion of Swebus’ revenues in Sweden, have contained cost indices primarily based on consumer price indices.

While, as tendered contracts expire and new contracts are tendered, it is now becoming increasingly common to include either (i) a price adjustment index which reflects bus industry costs, or (ii) a combination of a consumer price index, a labor cost index and a diesel fuel price index, there can be no assurance this trend will continue. Should price adjustment indices contained in our existing or future local public transportation authorities contracts fail to reflect our actual cost structure, changes in our costs that are not reflected in the indices included in these contracts could adversely affect our operating margins.

The local public transportation authorities rely on government subsidies. Removal of these subsidies could drive down local public transportation authorities’ contract fees.

In Sweden and Norway, management believes that approximately 50% and 40%, respectively, of fees to bus operating companies paid by local public transportation authorities under local public transportation authorities contracts in fiscal 2005 were funded by government subsidies (as opposed to bus ticket revenues). See “Business—Sweden—Contractual Public Bus Transportation Service” for a discussion of these subsidies. Many European countries have sought to reduce subsidies in recent years. Should Sweden more aggressively seek to reduce subsidies, fees from local public transportation authorities contracts may decrease, and local public transportation authorities could seek to renegotiate the scope of existing contracts. A decision to reduce subsidies could have an adverse effect on potential fees under local public transportation authorities contracts.

Enforcement of the guarantees of the Senior Notes on the collateral securing the Senior Notes may be subject to certain limitations and could be deemed to be invalid if found to be in violation of Swedish, Finnish or Norwegian corporate benefit requirements.

Under the indenture related to the Senior Notes, some of our subsidiaries (the “Guarantors”) provided guarantees for the Senior Notes (the “Senior Note Guarantees”). In addition, under that indenture, pledges of collateral were made to secure the Senior Notes (the “Collateral”). Generally, claims

9

of creditors of a subsidiary will have priority with respect to the assets of such subsidiary over the claims of creditors of its parent company. However, subject to the limitations and qualifications described below, holders of the Senior Notes will have direct claims against the Guarantors under the Senior Note Guarantees. Guarantors guaranteeing the Senior Notes at include:

Name |

|

|

| Jurisdiction of Incorporation |

| ||

Alpus AB |

|

| Sweden |

|

| ||

Concordia Bus Nordic Holding AB |

|

| Sweden |

|

| ||

Enköping-Bålsta Fastighetsbolag AB |

|

| Sweden |

|

| ||

Interbus AB |

|

| Sweden |

|

| ||

Malmfältens Omnibus AB |

|

| Sweden |

|

| ||

Swebus AB |

|

| Sweden |

|

| ||

Swebus Busco AB |

|

| Sweden |

|

| ||

Swebus Express AB |

|

| Sweden |

|

| ||

Swebus Fastigheter AB |

|

| Sweden |

|

| ||

IngeniØr M.O. SchØyens Bilcentraler AS |

|

| Norway |

|

| ||

Concordia Bus Finland Oy Ab |

|

| Finland |

|

| ||

Enforcement of the Senior Note Guarantees and Collateral may be limited in certain circumstances. Any such limitation would, if applicable, effectively subordinate the Senior Notes in right of payment to all indebtedness of the relevant Guarantor then existing irrespective of the granting of the Senior Note Guarantee.

Swedish Subsidiary Guarantees and Collateral.

Enforcement of the Senior Note Guarantees and Collateral may, in whole or in part, be limited to the extent that the undertaking by each respective subsidiary is deemed to be in conflict with the corporate interest of the respective subsidiary. The corporate interest shall be determined on the basis of whether the undertaking was made for business reasons so as to involve corporate benefit for the subsidiary and whether the guaranteed party is solvent for repayment of the secured amount at the time of providing the security. The absence of business reasons and corporate benefit would have the effect that the performance of the undertaking, or part thereof, would violate the Swedish Companies Act to the extent that it would result in a payment exceeding the distributable profit of the respective subsidiary at the time of providing the security. Upon such violation, the Senior Note Guarantees and Collateral would be invalid and any payments made thereunder would be subject to recovery at least to the extent they violate the above mentioned rules on corporate interest.

Finnish Subsidiary Guarantee and Collateral.

The granting of guarantees and security is restricted under the Finnish Companies Act. Enforcement of the Senior Note Guarantees and Collateral issued or granted by Concordia Finland may, in whole or in part, be limited to the extent that the undertaking by such subsidiary is deemed to be in conflict with the limitations set out in the Finnish Companies Act, including the corporate interest of Concordia Finland. The determination shall be made, inter alia, on the basis of whether the undertaking was made for reasons so as to involve corporate benefit for (and be justified with grounds relating to the operations of) Concordia Finland and whether the guaranteed party is solvent for repayment of the guaranteed amount during the term of the undertaking. The absence of business reasons and corporate benefit would have the effect that the performance of the undertaking, or a part thereof, would violate the Finnish Companies Act. Any such violation would render the Senior Note Guarantees and Collateral invalid and any payments made thereunder would be subject to recovery at least to the extent that they violate the Finnish Companies Act.

10

Norwegian Subsidiary Guarantee and Collateral.

The issuance of the Subsidiary Guarantee and the granting of the relevant security by the Norwegian subsidiary may be invalid under Norwegian law if such issuance and granting are not motivated by a legitimate business reason or corporate benefit for that subsidiary. In determining the sufficiency of the business reason or corporate benefit, a Norwegian court will consider whether or not the granting of the guarantee or security supported the object and the operations of that subsidiary. We believe sufficient corporate benefit exists with respect to the Senior Note Guarantee and Collateral granted by the Norwegian subsidiary. However, there can be no certainty as to the sufficiency of the corporate benefit.]

If we or our Swedish, Norwegian or Finnish operating subsidiaries incur substantial operating losses, we or they may be subject to liquidation under our respective national regimes.

The respective companies acts and insolvency and reorganization laws of Sweden, Norway and Finland apply to Concordia and its operating subsidiaries. Under these regimes, if losses reduce the equity of these entities or any of their subsidiaries (including Concordia itself on a stand alone rather than a consolidated basis) to an amount less than 50% of its registered share capital, or (in Norway only) if the equity becomes inadequate compared to the risks and the size of its business, the directors of such entity would be obligated by law to convene a general shareholders meeting to resolve to liquidate such entity unless the directors were able to balance the amount of such equity and the registered share capital (in Sweden, within eight months of such meeting, and in Finland, within twelve months of such meeting) by (1) increasing the equity in an amount sufficient to achieve such balance and, in the Norwegian scheme, to ensure that its equity becomes adequate compared to the risks and the size of its business, or (2) reducing the share capital to pay off losses in an amount sufficient to achieve such balance. Due to these requirements, Concordia Finland converted portions of its shareholder loan from Concordia into a subordinated loan in July 2001, in February 2003, 2004 and 2005 and also in July 2005. In May 2005, Swebus financial statement showed that the equity is negative and they will require a capital contribution from Concordia Bus Nordic. In addition, if we are not successful in our cost-cutting initiatives and our losses continue, this may cause our equity to decrease sufficiently to require an equity increase or share capital reduction as described above. If we are unable to procure such an equity increase or share capital reduction, it would have an adverse effect on our ability to continue presenting our financial statements under the assumption that we are a going concern. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Operating Results—Critical Accounting Policies—Going concern matters.” In addition, if we are not successful in our cost-cutting initiatives and our losses continue, this may cause our equity to decrease sufficiently to require an equity increase or share capital reduction as described above. If we are unable to procure such an equity increase or share capital reduction, it would have an adverse effect on our ability to continue presenting our financial statements under the assumption that we are a going concern. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Operating Results—Critical Accounting Policies—Going concern matters.”

Your rights as a creditor may not be as strong under Swedish, Norwegian or Finnish insolvency laws as under other insolvency laws.

Under Swedish, Norwegian or Finnish law, there is no consolidation of bankruptcies of the assets and liabilities of a group of companies. Each individual company would thus be treated separately by a bankruptcy administrator appointed by the local district court. The assets of our subsidiaries would first be used to satisfy the debts of each respective subsidiary and only the remaining surplus (if any) of a subsidiary would benefit our creditors. As a result, your ability to protect your interests as a creditor of a parent of such subsidiary may not be as strong under Swedish, Norwegian or Finnish law as it would be under the laws of other countries.

11

Sweden

Under Swedish law, secured creditors enjoy a privileged position in bankruptcy and similar proceedings. Such provisions afford debtors and unsecured creditors only limited protection relative to the claims of secured creditors.

The security in the floating charges pledged by Swebus attach to all of the relevant pledgor’s assets (including real estate property, cash and bank deposits) due to recent amendments in Swedish insolvency law. According to the new rules, the floating charge will carry a general right of priority, which means that it may be enforced only in the event of bankruptcy or insolvent liquidation. Furthermore, the right of priority that will attach to the floating charge will be enforceable only against 55% of the value of the property remaining after distribution has been made to creditors with specific rights of priority.

The business reorganization laws of Sweden apply to Concordia. Under official business reorganization, creditors may under certain circumstances be forced to approve the terms of the business reorganization. During a business reorganization, Concordia will not be allowed to fulfill any obligations incurred before the reorganization without the permission of the administrator appointed by the local district court.

Council Regulation (EC) No 1346/2000 of 29 May 2000 on insolvency proceedings is applicable in Sweden. In certain circumstances, that regulation will govern determinations as to the appropriate jurisdiction and competent authority within the European Union with respect to insolvency proceedings.

Norway

Noteholders’ rights with respect to the Senior Note Guarantees and pledges of security from SBC may be compromised in an insolvency proceeding with respect to SBC.

The Norwegian Bankruptcy Act 1984 sets out two main procedures that can be followed in respect of a company being illiquid or insolvent: debt settlement proceedings (voluntary or compulsory) and bankruptcy. Only the subject company can apply for debt settlement proceedings.

The purpose of debt settlement proceedings is to give a debtor who is illiquid the opportunity to negotiate with its creditors for a voluntary composition or a compulsory composition under the protection of the courts. In such a proceeding, the court will appoint a debt settlement committee composed preferentially of creditors’ representatives with a lawyer as chairman. If a voluntary debt settlement is opposed by any of the creditors, the alternatives are either compulsory debt settlement proceedings or bankruptcy. While in debt settlement proceedings a debtor is restricted with respect to carrying on its business but remains in charge of its business under the supervision of the committee. As a general rule, during the first three months of debt settlement proceedings, a bankruptcy petition cannot be filed.

During the first six months of the debt settlement or bankruptcy proceedings, security may only be enforced with the consent of the debt settlement committee or the bankruptcy trustee (as the case may be).

In certain circumstances, liens by operation of law have priority ranking ahead of any contractually agreed pledges.

Finland

Under Finnish insolvency law, secured creditors enjoy a privileged position in bankruptcy and similar proceedings. Such provisions afford debtors and unsecured creditors only limited protection relative to the claims of secured creditors. In addition to the priority given to secured debts under Finnish insolvency law, in certain circumstances, liens by operation of law have priority ranking ahead of contractually agreed first priority pledges.

12

Pledges over specific assets and certain liens by operation of law have priority ranking ahead of pledged floating charges. Furthermore, in the event of bankruptcy proceedings, the proceeds remaining from the sale of assets subject to the floating charge, after payment to creditors with higher priority ranking, would be divided, with those remaining proceeds being paid (1) 50% to creditors whose claims are secured by the floating charge and (2) 50% to remaining creditors (including creditors secured by floating charge to the extent their claims are not satisfied pursuant to clause (1) above) pro rata in relation to the respective amounts of their claims.

The business reorganization laws of Finland restrict the actions that are allowed to be taken by either debtors or creditors during business reorganization proceedings.

Council Regulation (EC) No 1346/2000 of 29 May 2000 on insolvency proceedings is applicable in Finland. In certain circumstances, that regulation will govern determinations as to the appropriate jurisdiction and competent authority within the European Union with respect to insolvency proceedings.

Fraudulent conveyance laws of Sweden, Norway and Finland may protect our creditors to your disadvantage.

Sweden and Finland

Under Swedish and Finnish law relating to fraudulent conveyance, it is possible that other creditors may claim that payments to you under the Senior Notes or the Senior Note Guarantees or any recoveries with respect to the pledged Collateral should be voided as fraudulent conveyances.

Under Swedish and Finnish law, in the case of bankruptcy or company reorganization proceedings affecting us, the payments to you under the Senior Notes or the Senior Note Guarantees (of principal or interest or otherwise), which are made less than three months (or two years if effected to a related party) before the application for bankruptcy or company reorganization proceedings is filed with the competent court may, in certain situations, be recovered if the payment is carried out:

· using unusual means of payment;

· prematurely; or

· in an amount which, in light of a debtor’s financial position, is material.

Payments which are deemed to be customary are, however, permissible.

Furthermore, the security granted in respect of the Senior Notes or the Senior Note Guarantees, if granted less than three months (or two years, if effected to a related party) before the application for bankruptcy or company reorganization proceedings were filed with a competent court, may be recovered if the security was not a condition under such indebtedness or was not pledged without delay after our accrual of such indebtedness. Nonetheless, security provided that is deemed to be customary is permissible.

A Swedish or Finnish court could also determine that a fraudulent conveyance has taken place under the general provision on recovery whereby a payment to you under the Senior Notes or the Senior Note Guarantees or the pledging of the Collateral could be revoked if an agreement, transaction or other act, such as the issuance of the Senior Notes or the Senior Note Guarantees or the pledging of the Collateral is held to favor a creditor in an undue manner to the detriment of another creditor or to transfer property out of the reach of the creditors or to increase the debt to the detriment of the creditors, provided that:

· the debtor was insolvent at the time the agreement, transaction or other act was concluded or the debtor became insolvent as a result of the transaction, by itself or combined with other circumstances; and

· the other party knew or should have known of the insolvency or over-indebtedness or of the impact of such payment on the debtor’s financing state as well as of the circumstances due to which the

13

payment under the Senior Notes or the Senior Note Guarantees or the pledging of the Collateral was undue.

However, under Swedish and Finnish law, if such an agreement, transaction or other act is concluded earlier than five years before the application for bankruptcy or company reorganization was filed, the payment to you under the Senior Notes or the Senior Note Guarantees or the pledging of the Collateral could be revoked only if a party to the agreement, transaction or other act was someone related to the bankrupt or reorganized party, such as a group company.

Furthermore, under Finnish law, a gift may be recovered by the estate if it has been made within one year prior to the due date. A gift that has been given before this, but within three years prior to the due date may be recovered if it has been given to a person within the debtor’s sphere of interest and it is not proven that the debtor was not excessively indebted nor became excessively indebted as a result of the gift. A transfer resulting from a sale, trade or any other agreement can likewise be recovered if it can be shown that the agreement was unbalanced to the extent that the transfer should be regarded as a gift.

Under Swedish law, a gift may be recovered by the estate if it has been made within six months prior to the date of application for bankruptcy or reorganization. A gift that has been given before this, but within one year prior to the date of application (or three years if effected to a related party) may be recovered if it is not proven that the debtor was not excessively indebted nor became excessively indebted as a result of the gift. A transfer resulting from a sale, trade or any other agreement can likewise be recovered if it can be shown that the agreement was unbalanced to the extent that the transfer should be regarded as a gift.

In addition, if any of our major subsidiaries in Sweden or Finland were to enter bankruptcy proceedings, a court in that jurisdiction could prevent our subsidiaries from making payments to us, thereby possibly impairing our ability to pay the amounts due under the Senior Notes.

Norway

Under Norwegian insolvency laws, the granting of security interests and unusual payments can be voided if undertaken during the three month period prior to the commencement of insolvency proceedings. There are also other preference provisions such as fraudulent conveyance rules that can void any transaction that (a) in an improper way favors one creditor (even if such creditor was not party to the transaction) at the expense of the other creditors, (b) otherwise restricts the availability of debtor’s assets for the benefit of creditors, or (c) increases the debtor’s debt in a detrimental way for the creditors, in each case provided that the debtor’s financial position was weak at the time of, or became materially weaker as a result of, the transaction and the other party knew or should have known of the debtor’s financial difficulties (or other circumstances which made the transaction improper).

You may not be able to recover in civil proceedings for US securities laws violations.

We are a public company with limited liability registered under the laws of Sweden with our registered office in Stockholm, Sweden. The Guarantors are organized under the laws of Sweden, Norway and Finland. None of our directors or officers, nor those of the Guarantors, are residents of the United States. Substantially all of our assets and, all the assets of the Guarantors and all of the assets of such persons are located outside of the United States. There is doubt as to the enforceability in Sweden, Norway and Finland, in original actions or in actions for the enforcement of judgments of US courts, of civil liabilities predicated solely upon the federal securities laws of the United States.

Because there is no treaty between the United States and Sweden providing for the reciprocal recognition and enforcement of judgments, US judgments are not enforceable in Sweden. A US judgment will be of some persuasive authority as a matter of evidence before the courts of law, administrative

14

tribunals or executive or other public authorities of Sweden. However, there is Swedish case law to indicate that a US judgment (i) that is based on contract among the parties excluding the jurisdiction of the courts of Sweden, (ii) that was rendered under observance of due process, (iii) against which there lies no more appeal and (iv) the recognition of which would not manifestly contravene fundamental principles of the legal order, or the public policy, of Sweden, should be acknowledged without retrial on the merits.

A final and conclusive judgment obtained in the state or federal courts in the State of New York in respect of the indenture relating to the Senior Notes would be enforced by the courts of Norway without examination of the merits of the case, if (a) such judgment obtained is final and enforceable in and pursuant to the laws of the country or state where it has been passed, (b) the judgment does not relate to an interest in land in Norway, and (c) enforcement of the judgment is in accordance with the mandatory provisions of the Norwegian Enforcement Act (1992).

A judgment obtained from a competent court in the United States would not be enforceable by the Finnish courts as such since there is no international convention to which both Finland and the United States are parties. However, Finnish title for execution can be sought for such enforcement and in requesting a Finnish court to make a decision to such effect, a judgment of a relevant court of the United States will constitute evidence of the questions of the contents of the governing law as applied to the matter in dispute and such judgment would generally, through such proceedings, be recognized by a Finnish court to the extent it is final and conclusive and not contrary to Finnish public policy or mandatory provisions of Finnish law.

Our employees are heavily unionized. Bargaining power and strikes can hurt our business.

Personnel costs constituted approximately 55% of our total operating expenses (excluding depreciation and amortization) in the year ended February 28, 2005. Our bus drivers and most of our other employees are unionized. Concordia’s operations could be adversely affected in the event that it were not able to reach agreement with any labor union representing Concordia’s employees or by an agreement with a labor union representing Concordia’s employees that contains terms that would prevent Concordia from competing effectively with other bus transportation companies. As in most labor intensive industries, strikes, work stoppages and other organized labor activities could also have significant adverse effects on operating and financial results. In the last fiscal year, an industry wide strike in Finland interfered with the operations of our Finnish operating company for several days.

Fluctuation in price and availability of diesel fuel could hurt our business.

Significant changes in fuel availability or costs would materially impact our business. Diesel fuel availability and prices are affected by a number of factors, including environmental legislation and global economic and political developments, over which we have little to no control. In addition, our costs are affected by annual increases in fuel taxes, which are largely offset by compensation from indexation. In the event of a shortage in diesel fuel supply resulting from a disruption of oil imports, reduction in production or otherwise, we could face higher diesel fuel prices or the curtailment of scheduled diesel fuel deliveries. Notwithstanding our hedging arrangements, in the year ended February 28, 2005, our total cost of diesel fuel averaged SEK 6.27 per liter. For a further discussion of our response to fluctuations in prices or a decrease in fuel availability, including our hedging policies, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Market Risk.”

Variations in exchange rates may affect our performance.

SBC, which comprised approximately 10% of our revenue in the year ended February 28, 2005, prepares its financial statements in, and its functional currency is, Norwegian Kroner. In preparing our consolidated financial statements, we translate SBC’s financial statements into Swedish Kronor at each

15

fiscal year end. Consequently, our results from operations are affected by fluctuations in the rate of exchange between Swedish Kronor and Norwegian Kroner.

Concordia Finland, which comprised approximately 9% of our revenue in the year ended February 28, 2005, prepares its financial statements in, and its functional currency is, the euro. In preparing our consolidated financial statements, we translate Concordia Finland’s financial statements into Swedish Kronor at each reporting period. Consequently, our results from operations are affected by fluctuations in the rate of exchange between the Swedish Krona and the euro.

Further, we are also exposed to currency fluctuations on loans, as a result of having to make interest and principal payments in euro on the Senior Notes and the recalculation of outstanding debt, issued in other currencies than Swedish Krona, foremost the secured notes of €130 million. Furthermore, our parent company, Holdings has incurred €25,000,000 of indebtedness in connection with the restructuring, and the interest rate on such indebtedness is variable. If the restructuring is consummated, our ultimate parent, Bus, intends to borrow €45,000,000 under the Mezzanine Facility, which an increase in interest rates would increase the costs of servicing those debts, which we ultimately service with dividends up to our parents. We have entered into collar arrangements through the sale of puts and the purchase of calls with the same settlement dates. While this arrangement caps the amount of benefit we can obtain from an appreciation of the Swedish Kronor against the euro, it also caps our potential increased interest costs through a depreciation of the Swedish Kronor against the Euro. Our parent companies also face currency fluctuation risks on the Mezzanine Facility and the Parent Notes.

Item 4. Information on the Company

A. History and Development of the Company

Our legal name is Concordia Bus Nordic AB (publ) and our commercial name is Concordia. We were incorporated on December 22, 1932. Concordia is domiciled in Sweden and is a public limited liability company. We are incorporated in Sweden and our registered address is Solna Strandväg 78, SE 171 54, Solna, Sweden. Our financial year ends on the last day of February. Our authorized and issued share capital is SEK 16,000,000 divided into 160,000 shares of one class with a nominal value of SEK 100 each. The share capital is fully paid. Our telephone number is +46 8 546 300 00. Our agent for service of process is CT Corporation System, 111 Eighth Avenue, New York, New York 10011.

Previously, Concordia Bus Nordic Holding AB was named Interbus Finans AB and was a wholly owned subsidiary of Concordia Bus Nordic AB (publ), which was wholly owned by Bus. In January 2004, a reorganization was performed whereby Concordia Bus Nordic AB (publ) transferred to Bus its 100% share ownership of Interbus Finans AB. Bus then transferred its shares in Concordia Bus Nordic AB (publ) to Interbus Finans AB. Interbus Finans AB was then renamed Concordia Bus Nordic Holding AB.

This reorganization had the effect of creating a new holding company for Concordia Bus Nordic AB (publ) from one of its dormant subsidiaries. Holding is a non operating holding company that has no assets other than its shares in Concordia Bus Nordic AB (publ).

In January 2000, Bus, backed by SG (the then parent company of SBC) and certain private equity funds affiliated with Goldman Sachs International, acquired Concordia Bus Nordic. On February 28, 2001, we acquired SBC with effect from February 1, 2001.

Concordia and Bus announced on July 22, 2005 that, with their principal ultimate shareholders, an Ad Hoc Committee of holders of Parent Notes and an informal group of holders of Senior Notes, they signed the Restructuring Agreement to restructure the Parent Notes and strengthen the balance sheet of the Concordia group of companies. The Restructuring Agreement provides that, among other things, Bus will make an application for reorganization proceedings in the District Court in Stockholm, Sweden. Those proceedings are expected to result in the face amount of all the Parent Notes being reduced from 100% to

16

25% and holders of Parent Notes who consent to the restructuring will then be required, pursuant to the Restructuring Agreement, to exchange their reduced debt securities (including all principal, all accrued and unpaid interest and any other amounts due thereon) for ordinary shares of Bus, which will constitute 97.5% of the issued ordinary share capital of Bus immediately following the consummation of the proposed restructuring. Holders who do not consent to the restructuring will also have the face amount of their Parent Notes reduced to 25% of their value. Concordia Bus AB would be required to settle this obligation within 12 months of the restructuring being consummated. However, Bus will not be forced to make an application for reorganization if holders of 99% of the Parent Notes weren’t to exchange Parent Notes for ordinary shares of Bus.

We provide public bus transportation services in Sweden, Norway and Finland, operating through our three main operating subsidiaries: Swebus, SBC and Concordia Finland, respectively. We also provide express bus and coach hire services. In Sweden, we currently operate 2,989 buses, and are the largest operator through Swebus, with an estimated market share of approximately 29% of the public bus transportation market (measured by the number of buses in operation). Management believes that we are the largest operator in Sweden as measured by number of buses because it has reviewed and analysed publicly available material describing how many buses our competitors operate. This market share data has been calculated based on the share of total number of buses, as provided by the relevant CPTA. In Norway, SBC currently operates approximately 379 buses and has an estimated 20% market share of the public bus transportation market in southeastern Norway, which includes Oslo and neighboring cities. This market share data has been calculated based on the share of total number of buses, as provided by the relevant CPTA. In Finland, Concordia Finland currently operates 362 buses and is the second largest operator in the greater Helsinki area with a market share of 24%. This market share data has been calculated based on the relative numbers of contract kilometers. This information is made available at each tendering which, as of February, 2005, showed that we were the second largest operator in the greater Helsinki area.

For the year ended February 28, 2005, we had net revenue of SEK 4,812 million. We sustained operating losses of SEK 256 million for the year ended February 28, 2005; SEK 108 million for the year ended February 29, 2004 and SEK 123 million for the year ended February 28, 2003. We sustained net losses of SEK 396 million for the year ended February 28, 2005; SEK 171 million for the year ended February 29, 2004 and SEK 179 million for the year ended February 28, 2003.