UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

| o | | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2006 |

OR

| | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report |

Commission file number 000-50790

VUANCE LTD.

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s Name into English)

Israel

(Jurisdiction of incorporation or organization)

Sagid House “Hasharon Industrial Park”

P.O.B 5039, Qadima 60920

Israel

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

None

Securities registered or to be registered pursuant to Section 12(g) of the Act. Ordinary Shares NIS0.0588235 nominal value

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None.

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 23,535,994 ordinary shares (pre-reverse share split) as of December 31, 2006.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15 (d) of the Securities Exchange Act of 1934. o Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter periods that the registrant was required to file such reports), and (2) has been subject to such reporting requirements for the past 90 days.

Yes x No o Not applicable

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o | Accelerated filer o | Non-accelerated filer x |

Indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 o Item 18 x

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes o No o

TABLE OF CONTENTS

PART I | | |

| | | |

| NOTES REGARDING FORWARD-LOOKING STATEMENTS | | 5 |

| | | |

| ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT & ADVISORS | | 6 |

| | | |

| ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE | | 6 |

| | | |

| ITEM 3. KEY INFORMATION | | 6 |

| | | |

| Selected Financial Data | | 6 |

| Capitalization and Indebtedness | | 8 |

| Reasons for the Offer and Use of Proceeds | | 8 |

| Risk Factors | | 8 |

| | | |

| ITEM 4. INFORMATION ON THE CORPORATION | | 25 |

| History and Development of the Corporation | | 25 |

| Business Overview | | 27 |

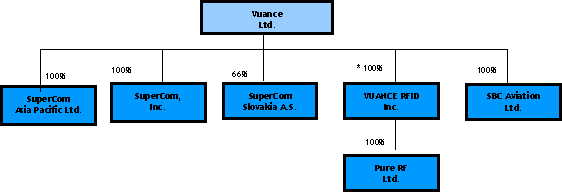

| Organizational Structure | | 40 |

| Property, Plants and Equipment | | 41 |

| | | |

| ITEM 4A. UNSOLVED STAFF COMMENTS | | 42 |

| | | |

| ITEM 5. OPERATING AND FINANCIAL REVIEW AND PROSPECTS | | 42 |

| Operating Results | | 42 |

| Liquidity and Capital Resources | | 51 |

| Research and Development | | 53 |

| Trend Information | | 53 |

| Off-Balance Sheet Arrangements | | 55 |

| Tabular Disclosure of Contractual Obligation | | 55 |

| | | |

| ITEM 6. DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | | 56 |

| Directors and Senior Management | | 56 |

| Compensation | | 58 |

| Board Practices | | 58 |

| Employees | | 61 |

| Share Ownership | | 62 |

| | | |

| ITEM 7. MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS | | 65 |

| Major shareholders | | 65 |

| Related Party Transactions | | 66 |

| Interests of Experts and Counsel | | 67 |

| | | |

| ITEM 8. FINANCIAL INFORMATION | | 68 |

| Consolidated Statements and Other Financial Information (Audited) | | 68 |

| Significant Changes | | 70 |

| | | |

| ITEM 9 THE OFFER AND LISTING | | 70 |

| Offer and Listing Details | | 70 |

| Plan of Distribution | | 72 |

| Markets | | 72 |

| Selling Shareholders | | 72 |

| Dilution | | 72 |

| Expenses of the Issue | | 72 |

| ITEM 10. ADDITIONAL INFORMATION | | 72 |

| Share Capital | | 72 |

| Memorandum and Articles of Association | | 72 |

| Material Contracts | | 73 |

| Exchange Controls | | 73 |

| Taxation | | 73 |

| Dividends and Paying Agent | | 82 |

| Statement by Experts | | 82 |

| Documents on Display | | 82 |

| Subsidiary Information | | 83 |

| | | |

| ITEM 11. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | | 83 |

| Quantitative and Qualitative Information about Market Risk | | 83 |

| | | |

| ITEM 12. DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | | 83 |

| | | |

PART II | | |

| | | |

| ITEM 13. DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES | | 84 |

| | | |

| ITEM 14. MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | | 84 |

| | | |

| ITEM 15. CONTROLS AND PROCEDURES | | 84 |

| | | |

| ITEM 16. RESERVED | | 84 |

| | | |

| ITEM 16A. AUDIT COMMITTEE FINANCIAL EXPERT | | 84 |

| | | |

| ITEM 16B. CODE OF ETHICS | | 84 |

| | | |

| ITEM 16C. PRINCIPAL ACCOUNTANT FEES AND SERVICES | | 85 |

| | | |

| ITEM 16 D. EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES | | 85 |

| | | |

| ITEM 16E. PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS | | 85 |

| | | |

PART III | | |

| | | |

| ITEM 17. FINANCIAL STATEMENTS | | 85 |

| | | |

| ITEM 18. FINANCIAL STATEMENTS | | 85 |

| | | |

| ITEM 19. EXHIBITS | | 131 |

| | | |

| SIGNATURE | | 132 |

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 20-F (“Annual Report”) contains “forward-looking statements” with the meaning of the United States Private Securities Litigation Reform Act of 1995 that are not historical facts but rather reflect our present expectation concerning future results and events. Words such as “anticipate,” “estimate,” “expects,” “may,” “projects,” “intends,” “plans,” “believes,” “would,” “could” and words and terms of similar substance used in connection with any discussion of future operating or financial performance may identify forward-looking statements. These forward looking statements include, but are not limited to, statements regarding: (i) our belief about our competitive position in the security access, tracking, asset management and monitoring, active RFID, disaster recovery and incidental response management markets, and our ability to become a key technological player in such markets; (ii) our belief about the commercial possibilities for our products in such markets; (iii) our expectation to leverage our current products and technologies for the development of new applications and penetration to additional markets; (iv) our expectation to continue to participate in the government market; (v) our belief about our ability to leverage our public sector experience into the commercial sector; (vi) our belief regarding the effects of competitive pricing on our margins, sales and market share; (vii) our expectations regarding the effects of the legal proceedings we are involved in on our sales and operating performance, including our belief regarding the merit of the claim of the Department for Resources Supply of the Ministry of Ukraine against us; (viii) our belief regarding the fluctuations of our operating results, including our belief about the effects of inflation and the fluctuation of the NIS/dollar exchange rate on our operating results; ( ix) our expectations about our future revenues (or absence of revenues); ; (x) our expectations about the effects of seasonality on our revenues and operating results; (xi) our expectations regarding development and introduction of future products; (xii) our expectations regarding revenues from our existing customer contracts and purchase orders, including, without limitation, the value of our agreement for our end-to-end system for a national multi ID issuing and control system with the government of a European country, and our expectations for increased revenues from sales of additional technology and raw materials to such government; (xiii) our expectations regarding the success of our new active RFID technology and our IRMS product; (xiv) our expectations regarding the effectiveness of our marketing programs and generation of business from those programs, including our ability to continue to sell products through strategic alliances and our belief about the role customer service plays in our sales and marketing programs; (xv) our anticipation that sales to a relatively small number of customers will continue to account for significant portion of our net sales; (xvi) our expectations regarding the mix of our sources of revenues; (xvii) our belief about the sufficiency of our capital resources and other sources of liquidity to fund our planned operations; (xiii) our expectations regarding our recurring revenues and backlog ; (xix) our belief about our compliance with the conditions and criteria of the Law for the Encouragement of Capital Investment, 1959 ; (xx) our belief that we have not been a passive foreign investment company (PFIC) for U.S. tax purposes; and (xxi) our belief regarding the impact of recently issued accounting pronouncements (see note 2(z.a) to the financial statements included in this report) and adoption of new accounting pronouncements in the future on our earnings and operating results. All forward-looking statements are based on our management’s present assumptions and beliefs in light of the information currently available to us. Actual results, levels of activity, performance or achievements may differ materially from those expressed or implied in the forward-looking statements for a variety of reasons, including: changes in demand for our products; market conditions in our industry and the economy as a whole; variation, expansions or reductions in the mix of our product offerings; the timing of our product introductions; increased competition; introduction of new competing technologies; the increase of unexpected expenses; and such other factors discussed below under the captions “Risk Factors” in Item 1.D and “Operating and Financial Review and Prospects” in Item 5 and elsewhere in this Annual Report. We are not under any obligation, and expressly disclaim any obligation, to update or alter any forward-looking statements, whether as a result of new information, future events or otherwise. All subsequent forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section, and you are cautioned not to place undue reliance on these forward-looking statements which speak only as of the date of this Annual Report.

In this Annual Report, all references to "Vuance" "we," "us" or "our" are to Vuance Ltd., a company organized under the laws of the State of Israel, and its subsidiaries.

In this Annual Report, unless otherwise specified or unless the context otherwise requires, all references to "$" or "dollars" are to U.S. dollars and all references to "NIS" are to New Israeli Shekels. Except as otherwise indicated, the financial statements of and information regarding Vuance are presented in U.S. dollars.

Note: Unless otherwise indicated herein, the prices and quantities of our ordinary shares provided in this annual report reflect the 1 to 5.88235 share consolidation (reverse share split) that we completed on April 29, 2007 and became effective for trading purpose as of May 14, 2007.

PART I

ITEM 1. Identity of Directors, Senior Management and Advisors.

Not applicable.

ITEM 2. Offer Statistics and Expected Timetables.

Not applicable.

ITEM 3. Key Information.

A. Selected Financial Data

The following selected consolidated financial data as of December 31, 2004, 2005 and 2006 and for the years ended December 31, 2003, 2004 2005 and 2006 have been derived from our audited consolidated financial statements. These financial statements have been prepared in accordance with generally accepted accounting principles in the United States, or U.S. GAAP, and audited by Fahn Kanne & Co., a member of Grant Thornton International. The consolidated selected financial data as of December 31 2002 have been derived from other consolidated financial statements prepared in accordance with U.S. GAAP and audited by Kost, Forer, Gabbay & Kasierer, a member of Ernst & Young Global. The selected consolidated financial data set forth below should be read in conjunction with and are qualified by reference to "Item 5, Operating and Financial Review and Prospects" and the consolidated financial statements and notes thereto and other financial information included elsewhere in this Annual Report. Historical results are not necessarily indicative of future results.

SUMMARY OF CONSOLIDATED FINANCIAL DATA

YEAR ENDED DECEMBER 31,

| | | Audited (IN THOUSANDS OF U.S. DOLLARS, EXCEPT PER SHARE DATA) | |

| | | 2002 | | 2003 | | 2004 | | 2005 | | 2006 | |

| SUMMARY OF STATEMENT OF OPERATIONS: | | | | | | | | | | | |

| Revenues | | | 8,027 | | | 7,244 | | | 7,344 | | | 8,462 | | | 8,795 | |

| Cost of Revenues | | | 1,830 | | | 3,102 | | | 3,730 | | | 4,293 | | | 3,494 | |

| Inventory write-off | | | — | | | | | | | | | 287 | | | | |

| | | | | | | | | | | | | | | | | |

| Gross Profit | | | 6,197 | | | 4,142 | | | 3,614 | | | 3,882 | | | 5,301 | |

| | | | | | | | | | | | | | | | | |

| Operating Expenses: | | | | | | | | | | | | | | | | |

| Research and Development | | | 1,334 | | | 918 | | | 845 | | | 1,182 | | | 1,362 | |

| Selling and Marketing | | | 2,828 | | | 3,026 | | | 2,445 | | | 3,003 | | | 5,619 | |

| General and Administrative | | | 1,988 | | | 1,829 | | | 1,955 | | | 2,968 | | | 2,737 | |

| Restructuring expenses | | | | | | | | | | | | 496 | | | — | |

| Litigation settlement expenses | | | | | | | | | | | | 129 | | | 108 | |

| | | | | | | | | | | | | | | | | |

| Total Operating Expenses | | | 6,150 | | | 5,773 | | | 5,245 | | | 7,778 | | | 9,826 | |

| | | | | | | | | | | | | | | | | |

| Capital gain from the sale of the e-ID Division | | | | | | | | | | | | | | | 10,536 | |

| Operating Income (Loss) | | | 47 | | | (1,631 | ) | | (1,631 | ) | | (3,896 | ) | | 6,011 | |

| Financial Income (Expenses), Net | | | (35 | ) | | (233 | ) | | (214 | ) | | (25 | ) | | (204 | ) |

| OTHER INCOME (EXPENSES), NET | | | 6,203 | | | (83 | ) | | (27 | ) | | (30 | ) | | (367 | ) |

| | | | | | | | | | | | | | | | | |

| Income Loss before Taxes on Income | | | 6,215 | | | (1,947 | ) | | (1,872 | ) | | (3,951 | ) | | 5,440 | |

| | | | | | | | | | | | | | | | | |

| Share in Earnings (Loss) of an Affiliated | | | | | | | | | | | | | | | | |

| Company and impairment, Net of taxes | | | (38 | ) | | (48 | ) | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Net Income (Loss) from continuing | | | | | | | | | | | | | | | | |

| operations | | | 6,177 | | | (1,995 | ) | | (1,872 | ) | | (3,951 | ) | | 5,440 | |

| | | | | | | | | | | | | | | | | |

| Loss from discontinued operations | | | (427 | ) | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Net income (loss) | | $ | 5,750 | | $ | (1,995 | ) | $ | (1,872 | ) | $ | (3,951 | ) | $ | 5,440 | |

| | | | | | | | | | | | | | | | | |

| PER SHARE DATA: | | | | | | | | | | | | | | | | |

| Basic earning (loss) from continuing | | | | | | | | | | | | | | | | |

| operations | | $ | 2.86 | | $ | (0.92 | ) | $ | (0.75 | ) | $ | (1.25 | ) | $ | 1.37 | |

| Diluted earning (loss) from continuing | | | | | | | | | | | | | | | | |

| operations | | $ | 2.86 | | $ | (0.92 | ) | $ | (0.75 | ) | $ | (1.25 | ) | $ | 1.31 | |

| Basic and Diluted loss from | | | | | | | | | | | | | | | | |

| Discontinued operations | | $ | (0.2 | ) | $ | | | $ | | | $ | | | $ | | |

| Basic earning (loss) per share | | $ | 2.66 | | $ | (0.92 | ) | $ | (0.75 | ) | $ | (1.25 | ) | $ | 1.37 | |

| Diluted earning (loss) per share | | $ | 2.66 | | $ | (0.92 | ) | $ | (0.75 | ) | $ | (1.25 | ) | $ | 1.31 | |

| SUMMARY OF BALANCE SHEET DATA: | | | | | | | | | | | | | | | | |

| Cash and Cash Equivalents | | | 4,567 | | | 1,729 | | | 2,894 | | | 2,294 | | | 2,444 | |

| Short term deposit | | | | | | 697 | | | 353 | | | | | | | |

| Marketable debt securities | | | 609 | | | 117 | | | | | | 650 | | | 11,077 | |

| Trade receivables (net of allowance for doubtful | | | | | | | | | | | | | | | | |

| accounts of $ 3,397 and $ 3,487 as of | | | | | | | | | | | | | | | | |

| December 31, 2005 and 2006, respectively) | | | 2,202 | | | 1,808 | | | 1,463 | | | 1,053 | | | 2,625 | |

| Inventories | | | 3,144 | | | 3,236 | | | 2,165 | | | 2,205 | | | 270 | |

| Total Current Assets | | | 11,092 | | | 9,881 | | | 9,254 | | | 8,023 | | | 17,992 | |

| TOTAL ASSETS | | | 13,756 | | | 12,685 | | | 13,938 | | | 12,276 | | | 23,098 | |

| | | 3,468 | | | 4,450 | | | 4,259 | | | 3,218 | | | 5,452 | |

| Accrued Severance Pay | | | 362 | | | 436 | | | 564 | | | 616 | | | 323 | |

| SHAREHOLDERS’ EQUITY: | | | | | | | | | | | | | | | | |

| TOTAL SHAREHOLDERS' EQUITY | | | 9,497 | | | 7,612 | | | 9,115 | | | 8,247 | | | 15,001 | |

| B. | Capitalization and Indebtedness |

Not applicable.

| | C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

You should carefully consider the following risks together with the other information in this Annual Report in evaluating our business, financial condition and our prospects. The risks and uncertainties described below are not the only ones that we face. Additional risks and uncertainties not presently known to us or that we consider immaterial may also impair our business operations, financial results and prospects. If any of the following risks actually occur, our business, financial results and prospects could be harmed. In that case, the trading price of our ordinary shares could decline. You should also refer to the other information set forth in this Annual Report, including our financial statements and related notes and the Section captioned “Note Regarding Forward-Looking Statements”.

We have a history of operating losses and negative cash flows and may not be profitable in the future.

We have incurred substantial losses and negative cash flows since our inception. We had an operating cash flow deficit in each of 2004, 2005, and 2006. As of December 31, 2006, we had an accumulated deficit of approximately $18,625,000. We incurred net losses of approximately $ 1,872,000 and $3,951,000 in the years ended December 31, 2004 and December 31, 2005, respectively. For the year ended December 31, 2006 we would have incurred a net loss of $5,096,000, but for the $10,536,000 capital gain from the sale of the e-ID Division. We expect to have net operating losses and negative cash flows for the foreseeable future, and expect to spend significant amounts of capital to enhance our products and services, develop further sales and operations and fund expansion. As a result, we will need to generate significant revenue to achieve profitability. Even if we do achieve profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis.

Parts of our operating expenses levels are based on internal forecasts for future demand and not on firm customer orders for products or services. Our results may be negatively affected by fluctuating demand for our products and services from one quarter to the next and by increases in the costs of components and raw materials acquired from suppliers.

We will face a need for additional capital and may need to curtail our operations if it is not available.

We have partially funded our operations through the issuance of equity securities and convertible bond to investors and may not be able to generate a positive cash flow from operation in the future. If we are unable to generate sufficient cash flow from operations, we will need to seek additional funds through the issuance of additional equity or debt securities or other sources of financing. We may not be able to secure such additional financing on favorable terms, or at all. Any additional financings will likely cause substantial dilution to existing stockholders. If we are unable to obtain necessary additional financing, we may be required to reduce the scope of, or cease, our operations. We believe that, as of the filing date of this annual report, our current cash and cash equivalents and marketable securities, in addition to our revenues generated from our business operations, will satisfy our operating capital needs for at least the next twelve months based upon our anticipated business activities. However, we may need additional capital even within the next twelve months if we undertake large projects or have a delay in one of our anticipated projects. Our need for additional capital to finance our operations and growth will be greater should, among other things, our revenue or expense estimates prove to be incorrect.

We derive a substantial portion of our revenue from a small number of customers, and the reduction of sales to any one of those customers could adversely impact our operating results by causing a drop in revenues.

We depend on a limited number of customers for a substantial portion of our revenue. In each of 2004 and 2005, we derived 66% of our consolidated net revenue from four individual customers. In the year ended December 31, 2006, four of our customers accounted for 80% of our consolidated net revenues as follows: the government of a European country, China Travel Services (CHK) Ltd., China Travel Service (Holdings) H.K. Ltd. and an African governmental agency accounted for 59%, 10%, 6% and 5%, respectively, of our consolidated net revenues. A substantial reduction in sales to, or loss of, any of our significant customers would adversely affect our business unless we were able to replace the revenue we received from those customers, which replacement we may not be able to do. As a result of this concentration of revenue from a limited number of customers, our revenue has experienced wide fluctuations, and we may continue to experience wide fluctuations in the future. Part of our sales are not recurring sales, quarterly and annual sales levels could therefore fluctuate. Sales in any period may not be indicative of sales in future periods.

We are relying on On Track Innovations Ltd. as a subcontractor in projects not transferred as part of the sale of our E-ID Division.

On December 31, 2006 we sold our E-ID Division to On Track Innovations Ltd. (“OTI”), an Israeli public company (NASDAQ: OTIV). Simultaneously, we entered into a service and supply agreement with OTI under which OTI agreed to act as our subcontractor and provide services, products and materials necessary to carry out and complete our obligations with regard to certain projects that were not transferred to OTI (see description of the OTI Transaction under the caption “The OTI Transaction” in Item 4.A). We will be dependant on OTI to adequately provide such services, products, and materials in order for us to be in good standing in, and successfully complete, these projects. If OTI fails to fulfill it obligations and provide such services and products as necessary for the Existing Projects, it could delay our receipt of revenues for these projects, subject us to certain remedies available to our customers in the Existing Projects, and damage our business reputation, and therefore could have a material adverse effect on our business, operating results and financial condition.

Our reliance on third party technologies, raw materials and components for the development of some of our products and our reliance on third parties for manufacturing may delay product launch, impair our ability to develop and deliver products or hurt our ability to compete in the market.

Most of our products integrate third-party technology that we license and/or raw materials and components that we purchase or otherwise obtain the right to use, including: operating systems, microchips, security and cryptography technology for card operating systems, which prevents unauthorized parties from tampering with our cards, and dual interface technology, which enables cards to operate in both contact and contactless mode. Our ability to purchase and license new technologies and components from third parties is and will continue to be critical to our ability to offer a complete line of products that meets customer needs and technological requirements. We may not be able to renew our existing licenses or be able to purchase components and raw materials on favorable terms, or at all. If we lose the rights to a patented technology, we may need to stop selling or may need to redesign our products that incorporate that technology, and we may lose the potential competitive advantage such technology gave us. In addition, competitors could obtain licenses for technologies for which we are unable to obtain licenses, and third parties may develop or enable others to develop a similar solution to security issues, either of which events could adversely affect our results of operations. Also, dependence on the patent protection of third parties may not afford us any control over the protection of the technologies upon which we rely. If the patent protection of any of these third parties were compromised, our ability to compete in the market also would be impaired.

We do not have minimum supply commitments from our vendors for our raw materials or components and generally purchase raw materials and components on a purchase order basis. Although we generally use standard raw materials and components for our systems, some of the key raw materials or components are available only from a single source or from limited sources. For example, Teslin®, which is a primary raw material used in our smart card products is only available from a single source. Similarly, many of our various chips and toners are only available from limited sources. Even where multiple sources are available, we typically obtain components and raw materials from only one vendor to ensure high quality, prompt delivery and low cost. If one of our suppliers were unable to meet our supply demands and we could not quickly replace the source of supply, it could have a material adverse effect on our business, operating results and financial condition, for reasons including a delay of receipt of revenues and damage to our business reputation.

Delays in deliveries from our suppliers or defects in goods or components supplied by our vendors could cause our revenues and gross margins to decline.

We rely on a limited number of vendors for certain components for the products we are supplying and rely on a single vendor for Teslin®. We do not have any long-term contracts with our suppliers. Any undetected flaws in components or other materials to be supplied by our vendors could lead to unanticipated costs to repair or replace these parts or materials. Even though there are multiple suppliers, we purchase some of our components from a single supplier to take advantage of volume discounts, which presents a risk that the components may not be available in the future on commercially reasonable terms or at all. Although we believe that there are additional suppliers for the equipment and supplies that we require, we may not be able to make such alternative arrangement promptly. If one of our suppliers were unable to meet our supply demands and we could not quickly replace the source of supply, it could cause a delay of receipt of revenues and damage our business reputation.

Our inability to maintain existing relationships with primary integrators for governmental secured ID and passport projects could impact our ability to obtain or sell our products, and prevent us from generating revenues.

We obtain and sell many of our products through strategic alliance and supplier agreements in which we act as subcontractors or suppliers to the primary integrator or contractor, including China Travel Service (Holdings) H.K. Ltd. in Hong Kong for the Hong Kong passport project and China Travel Services (CHK) Ltd. for the China re-entry card project. The loss of any of our existing strategic relationships, could adversely affect our ability to sell our products.

We sometimes depend upon our strategic partners to market our products and to fund and perform their obligations as contemplated by our agreements with them. We do not control the time and resources devoted by our partners to these activities. These relationships may not continue or may require us to spend significant financial, personnel and administrative resources from time to time. We may not have the resources available to satisfy our commitments, which may adversely affect our strategic relationships.

If alliance or supplier agreements are cancelled, modified or delayed, if alliance or supplier partners decide not to purchase our products or to purchase only limited quantities of our products, our ability to produce and sell our products and to generate revenues could be adversely affected.

We have sought U.S. government contracts in the past and may seek additional U.S. government contracts in the future, which subjects us to certain risks associated with such types of contracts.

Most U.S. government contracts are awarded through a competitive bidding process, and some of the business that we expect to seek in the future likely will be subject to a competitive bidding process. Competitive bidding presents a number of risks, including:

| | · | the frequent need to compete against companies or teams of companies with more financial and marketing resources and more experience than we have in bidding on and performing major contracts; |

| | · | the need to compete against companies or teams of companies that may be long-term, entrenched incumbents for a particular contract we are competing for and which have, as a result, greater domain expertise and established customer relations; |

| | · | the need to compete on occasion to retain existing contracts that have in the past been awarded to us on a sole-source basis; |

| | · | the substantial cost and managerial time and effort necessary to prepare bids and proposals for contracts that may not be awarded to us; |

| | · | the need to accurately estimate the resources and cost structure that will be required to service any fixed-price contract that we are awarded; and |

| | · | the expense and delay that may arise if our competitors protest or challenge new contract awards made to us pursuant to competitive bidding or subsequent contract modifications, and the risk that any of these protests or challenges could result in the resubmission of bids on modified specifications, or in termination, reduction or modification of the awarded contract. |

We may not be afforded the opportunity in the future to bid on contracts that are held by other companies and are scheduled to expire if the U.S. government determines to extend the existing contract. If we are unable to win particular contracts that are awarded through the competitive bidding process, we may not be able to operate in the market for products and services that are provided under those contracts for a number of years. If we are unable to win new contract awards or retain those contracts, if any, that we are awarded over any extended period, our business, prospects, financial condition and results of operations will be adversely affected.

In addition, U.S. government contracts subjects us to risks associated with public budgetary restrictions and uncertainties, actual contracts that are less than awarded contract amounts, and cancellation at any time at the option of the government. Any failure to comply with the terms of any government contracts could result in substantial civil and criminal fines and penalties, as well as suspension from future contracts for a significant period of time, any of which could adversely affect our business by requiring us to pay significant fines and penalties or prevent us from earning revenues from government contracts during the suspension period. Cancellation of any one of our major government contracts, however, could have a material adverse effect on our financial condition.

The U.S. government may be in a position to obtain greater rights with respect to our intellectual property than we would grant to other entities. Government agencies also have the power, based on financial difficulties or investigations of their contractors, to deem contractors unsuitable for new contract awards. Because we will engage in the government contracting business, we will be subject to audits and may be subject to investigation by governmental entities. Failure to comply with the terms of any government contracts could result in substantial civil and criminal fines and penalties, as well as suspension from future government contracts for a significant period of time, any of which could adversely affect our business by requiring us to spend money to pay the fines and penalties and prohibiting us from earning revenues from government contracts during the suspension period.

Furthermore, government programs can experience delays or cancellation of funding, which can be unpredictable. For example, the U.S. military’s involvement in Iraq has caused the diversion of some Department of Defense funding away from the certain projects in which we participate, thereby delaying orders under certain of our governmental contracts. This makes it difficult to forecast our revenues on a quarter-by-quarter basis.

If our current business will not generate sufficient revenues to compensate for the loss of revenue resulting from the OTI Transaction, our overall income might decline.

While we currently continue to generate income from the Existing Projects, we do not expect to generate further income from additional projects related to the E-ID Division. If, in the long-term, we fail to generate sufficient revenues from our new business (IRMS and active RFID), our overall income might decline.

We may suffer a loss on our investment in the OTI Transaction due to a decrease in the price of OTI’s shares.

As of December 31, 2006 our investment in OTI’s ordinary shares consisted of $11,077,000 marketable securities (current assets) and $4,431,000 restricted marketable securities (long-term investment). As described above, the shares were restricted and are subject to a lock-up agreement, where one-seventh of the shares (403,885 ordinary shares) will be released from the lock-up restrictions every three months beginning on the closing date, December 31, 2006. OTI shares are traded on the NASDAQ Global Market. Profitability of our investment in OTI’s ordinary shares will depend on the share price and our ability to sell the OTI ordinary shares.

Our dependence on third party distributors, sales agents, and value-added resellers could result in marketing and distribution delays, which would prevent us from generating sales revenues.

We market and sell some of our products using a network of distributors covering several major world regions, including the United States. We establish relationships with distributors and resellers through written agreements that provide prices, discounts and other material terms and conditions under which the reseller is eligible to purchase our systems and products for resale. These agreements generally do not grant exclusivity to the distributors and resellers and, as a general matter, are not long-term contracts, do not have commitments for minimum sales and could be terminated by the distributor. We do not have agreements with all of our distributors. We are currently engaged in discussions with other potential distributors, sales agents, and value-added resellers. Such arrangements may never be finalized and, if finalized, such arrangements may not increase our revenues or enable us to achieve profitability.

Our ability to terminate a distributor who is not performing satisfactorily may be limited. Inadequate performance by a distributor would adversely affect our ability to develop markets in the regions for which the distributor is responsible and could result in substantially greater expenditures by us in order to develop such markets. Our operating results will be highly dependent upon: (i) our ability to maintain our existing distributor arrangements; (ii) our ability to establish and maintain coverage of major geographic areas and establish access to customers and markets; and (iii) the ability of our distributors, sales agents, and value-added resellers to successfully market our products. A failure to achieve these objectives could result in lower revenues.

Third parties could obtain access to our proprietary information or could independently develop similar technologies.

Despite the precautions we take, third parties may copy or obtain and use our proprietary technologies, ideas, know-how and other proprietary information without authorization or may independently develop technologies similar or superior to our technologies. In addition, the confidentiality and non-competition agreements between us and most of our employees, distributors and clients may not provide meaningful protection of our proprietary technologies or other intellectual property in the event of unauthorized use or disclosure. If we are not able to defend successfully our industrial or intellectual property rights, we might lose rights to technology that we need to develop our business, which may cause us to lose potential revenues, or we might be required to pay significant license fees for the use of such technology. To date, we have relied primarily on a combination of patent, trade secret and copyright laws, as well as nondisclosure and other contractual restrictions on copying, reverse engineering and distribution to protect our proprietary technology. Our patent portfolio currently consist of one patent application pending in the United States and an additional PCT application, related to our IRMS and RFID technologies.

Our patent applications may not result in issued patents, and even if they result in issued patents, the patents may not have claims of the scope we seek. Even in the event that these patents are not issued, the applications may become publicly available and proprietary information disclosed in the application will become available to others. In addition, any issued patents may be challenged, invalidated or declared unenforceable. Our present and future patents may provide only limited protection for our technology and may not be sufficient to provide competitive advantages to us. For example, competitors could be successful in challenging any issued patents or, alternatively, could develop similar or more advantageous technologies on their own or design around our patents. Any inability to protect intellectual property rights in our technology could enable third parties to compete more effectively with us and/or could reduce our ability to compete. In addition, these efforts to protect our intellectual property rights could require us to incur substantial costs even when our efforts are successful.

In addition, the laws of certain foreign countries may not protect our intellectual property rights to the same extent as do the laws of Israel or the United States. Our means of protecting our intellectual property rights in Israel, the United States or any other country in which we operate may not be adequate to fully protect our intellectual property rights. For instance, the intellectual property rights of our Asian subsidiary, SuperCom Asia Pacific Ltd. may not be fully protected by the laws of Hong Kong and the People’s Republic of China (“PRC”). The PRC does not yet possess a comprehensive body of intellectual property laws. As a result, the enforcement, interpretation and implementation of existing laws, regulations or agreements may be sporadic, inconsistent and subject to considerable discretion. The PRC’s judiciary has not had sufficient opportunity to gain experience in enforcing laws that exist, leading to a higher than usual degree of uncertainty as to the outcome of any litigation. As the legal system develops, entities such as ours may be adversely affected by new laws, changes to existing laws (or interpretations thereof) and preemption of provincial or local laws by national laws. Even when adequate law exists in the PRC, it may not be possible to obtain speedy and equitable enforcement of the law.

We may face intellectual property litigation, which could be costly, harm our reputation, limit our ability to sell our products, force us to modify our products or obtain appropriate licenses, and divert the attention of management and technical personnel.

Our products employ technology that may infringe on the proprietary rights of others, and, as a result, we could become liable for significant damages and suffer other harm to our business. Other than the ongoing litigation with Secu-Systems Ltd., as described in Item 8 below under the caption “Legal Proceedings,” we have not been subject to intellectual property litigation to date. On August 8, 2003, we received a letter stating that we may be infringing certain patents of third parties with respect to our hot lamination process for plastic cards. We reviewed the claims made in the letter and we do not believe that our products or technology infringe any third party's patents as claimed in the letter. Since the initial letter, we received another letter dated July 13, 2004 from the same party requesting that we respond to their claim and stating that attractive licenses are available. On August 11, 2004 we responded to this letter and indicated that we do not infringe such parties’ patents. To date, no infringement claims have been filed against us in connection with the foregoing letters. We believe that hot lamination of plastic cards is a widely known process that is used by most card manufacturers. Even if it were determined that we are infringing such third party’s patents, we feel that we could use another process to laminate plastic cards and our business would not be materially affected.

Litigation may be necessary in the future to enforce any patents we may receive and other intellectual property rights, to protect our trade secrets, to determine the validity and scope of the proprietary rights of others, or to defend against claims of infringement or invalidity, and we may not prevail in any future litigation. Litigation, whether or not determined in our favor or settled, could be costly, could harm our reputation and could divert the efforts and attention of our management and technical personnel from normal business operations. In addition, adverse determinations in litigation could result in the loss of our proprietary rights, subject us to significant liabilities, require us to seek licenses from third parties, prevent us from licensing our technology or from selling or manufacturing our products, or require us to expend significant resources to modify our products or attempt to develop non-infringing technology, any of which could seriously harm our business.

Our products may contain technology provided to us by third parties. Because we did not develop such technology ourselves, we may have little or no ability to determine in advance whether such technology infringes the intellectual property rights of a third party. Our suppliers and licensors may not be required to indemnify us in the event that a claim of infringement is asserted against us, or they may be required to indemnify us only with respect to intellectual property infringement claims in certain jurisdictions, and/or only up to a maximum amount, above which we would be responsible for any further costs or damages. In addition, we have indemnification obligations to certain customers, as well as to OTI with respect to any infringement of third-party patents and intellectual property rights by our products. If litigation were to be filed against these parties in connection with our technology, we will be required to defend and indemnify such customers.

A security breach of our internal systems or those of our customers could harm our business by adversely affecting the market's perception of our products and services thereby causing our revenues to decline.

For us to penetrate further the marketplace, the marketplace must be confident that we provide effective security protection for national identity and other secured ID documents and cards. Although we have not experienced any act of sabotage or unauthorized access by a third party of our software or technology to date, if an actual or perceived breach of security occurs in our internal systems or those of our customers, regardless of whether we caused the breach, it could adversely affect the market's perception of our products and services. This could cause us to lose customers, resellers, alliance partners or other business partners thereby causing our revenues to decline. If we or our customers were to experience a breach of our internal systems, our business could be severely harmed by adversely affecting the market's perception of our products and services.

We may be exposed to significant liability for actual or perceived failure to provide required products or services which could damage our reputation and adversely affect our business by causing our revenues to decline and our costs to rise.

Products as complex as those we offer may contain undetected errors or may fail when first introduced or when new versions are released. Despite our product testing efforts and testing by current and potential customers, it is possible that errors will be found in new products or enhancements after commencement of commercial shipments. The occurrence of product defects or errors could result in adverse publicity, delay in product introduction, diversion of resources to remedy defects, loss of or a delay in market acceptance, or claims by customers against us, or could cause us to incur additional costs or lose revenues, any of which could adversely affect our business.

Because our customers rely on our products for critical security applications, we may be exposed to claims for damages allegedly caused to a customer as a result of an actual or perceived failure of our products. An actual or perceived breach of security systems of one of our customers, regardless of whether the breach is attributable to our products or solutions, could adversely affect our business reputation. Furthermore, our failure or inability to meet a customer's expectations in the performance of our services, or to do so in the time frame required by the customer, regardless of our responsibility for the failure, could result in a claim for substantial damages against us by the customer, discourage other customers from engaging us for these services, and damage our business reputation. We carry product liability insurance, but existing coverage may not be adequate to cover potential claims.

We carry product liability insurance, errors and omissions for high-technology companies insurance and insurance to guard against losses caused by employees' dishonesty. We believe that this insurance coverage is comparable to that of other similar companies in our industry. However, that insurance may not continue to be available to us on reasonable terms or in sufficient amounts to cover one or more large claims, or the insurer may disclaim coverage as to any future claim. We do not maintain insurance coverage for employee errors or security breaches, nor do we maintain specific insurance coverage for any interruptions in our business operations. The successful assertion of one or more large claims against us that exceed available insurance coverage, or changes in our insurance policies, including premium increases or the imposition of large deductibles or co-insurance requirements, could adversely affect our business by increasing our costs.

Our efforts to expand our international operations are subject to a number of risks, any of which could adversely reduce our future international sales.

Most of our revenues to date have been generated in jurisdictions other than the United States. Our inability to obtain or maintain federal or foreign regulatory approvals relating to the import or export of our products on a timely basis could adversely affect our ability to expand our international business. Additionally, our international operations could be subject to a number of risks, any of which could adversely affect our future international sales, including:

| · | increased collection risks; |

| · | export duties and tariffs; |

| · | uncertain political, regulatory and economic developments; |

| · | inability to protect our intellectual property rights; |

| · | very aggressive competitors; |

| · | lower gross margins in commercial sales in Hong Kong and China; |

| · | business development in Hong Kong and China is time consuming and risky due to the uncertain political, regulatory and legal environment; and |

In addition, in many countries the national security organizations require our employees to obtain clearance before such employees can work on a particular transaction. Failure to receive, or delays in the receipt of, relevant foreign qualifications also could have a material adverse effect on our ability to obtain sales at all or on a timely basis. Additionally, as foreign government regulators have become increasingly stringent, we may be subject to more rigorous regulation by governmental authorities in the future. If we fail to adequately address any of these regulations, our business will be harmed.

The markets that we target for a substantial part of our future growth are in very early stages of development, and if they do not develop our business might not grow as much or as profitably as we hope.

Many of the markets that we target for our future growth are small or non-existent and need to develop if we are to achieve our growth objectives. If some or all of these markets do not develop, or if they develop more slowly than we anticipate, then we will not grow as quickly or profitably as we hope. In February 2006, we announced the introduction of a new technology and solution for actively tracking people, objects and assets. Active RFID Tracking Systems (PureRF) and the establishment of a new subsidiary (VUANCE RFID Inc., formerly PureRF Inc.) that will focus on this growing market. This new technology expands our Homeland Security offerings through a wireless asset tracking system for strategic and high-value assets and objects. We developed this new technology solution in response to growing market demand for asset tracking solutions in the Homeland Security and commercial markets. While the incident management and Homeland Security benefits provided by PureRF are relatively obvious we have also identified other market opportunities in the public and private sectors of the economy.

Our Incident Response Management System (IRMS) has not been widely adopted by state and local governments, largely due to the dependency on federal grants ,cost of the necessary infrastructure and the relatively limited capabilities of previous solutions. We are investing in the credentialing, identification ,active RFID and security networks products and services, but so far we have not deployed our systems on a widespread basis other than a growing demand based on our installed base.

In 2006, our revenues from the government market totaled approximately $7,947,000 compared to $848,000 from the commercial market. As a general matter, our revenues in the commercial market are derived from sales of products that we adapted to the commercial market from the government market. Although we believe the government market is critical to our success in the short term, we believe that both the government and commercial markets especially for the RFID applications will be critical to our long-term future success. The development of these markets will depend on many factors that are beyond our control, including the following factors (and factors that are discussed elsewhere in the Risk Factors); (1) there can be no assurances that we will be able to continue to apply our expertise and solutions developed for the government market into the commercial market; (2) the ability of public safety and other government agencies to access DHS and other homeland security-related grants for incident management and related purposes; (3) The ability of the commercial markets to adopt and adhere the Active RFID solutions; and (4) the ability of our management to successfully market its technologies to such government and/or commercial entities.

The success of our new business lines, comprising of the IRMS and active RFID products, is dependent on several factors.

If our smart card and highly secured document technology will cease to be adopted and used by government and industry organizations, we may lose some of our existing customers and our business might not maintain its profitably or even diminish.

Our ability to grow depends significantly on whether governmental and industrial organizations adopt our technology and solutions as part of their new standards and whether we will be able to leverage our expertise with government products into commercial products. If these organizations do not adopt our technology, then we might not be able to penetrate some of the new markets we are targeting, or we might lose some of our existing customer base. There also can be no assurances that we will be able to continue to apply our expertise and solutions developed for the public sector into the commercial market.

In order for us to achieve our growth objectives, the credentialing ,identification ,tracking and active RFID technologies must be adopted in a variety of areas, including:

| · | public safety and emergency areas |

| · | patient and critical equipment tracking in the health care sector |

| · | Monitoring and controlling of evidence in a crime scene environment |

| · | transportation applications using active RFID as method of monitor and control |

| · | access control in such fields as education and health care. |

Any or all of these areas may not adopt RFID and the IRMS technology.

We cannot accurately predict the future growth rate of this market, if any, or the ultimate size of the RFID and credentialing technology market. The expansion of the market for our products and services depends on a number of factors such as:

| | · | the cost, performance and reliability of our products and services compared to the products and services of our competitors; |

| | · | customers’ perception of the benefits of smart card solutions; |

| | · | public perceptions of the intrusiveness of these solutions and the manner in which organizations use the information collected; |

| | · | public perceptions regarding the confidentiality of private information; |

| | · | customers’ satisfaction with our products and services; and |

| | · | marketing efforts and publicity regarding our products and services. |

Even if credentialing and matching solutions gain wide market acceptance, our products and services may not adequately address market requirements and may not gain wide market acceptance. If smart card solutions or our products and services do not gain wide market acceptance our business and our financial results will suffer.

We need to develop our position as a provider of IRMS and Active RFID systems and services to earn high margins from our technology, and if we are unable to develop such position, our business will not be as profitable as we hope, if profitable at all.

The increasing sophistication of IRMS and Active RFID technologies places a premium on providing innovative software systems and services to customers, in addition to manufacturing and supplying IRMS and Active RFID systems. While we have had some early success positioning ourselves as a provider of services and systems, we may not continue to be successful with this strategy and we may not be able to capture a significant share of the market for the sophisticated services and systems that we believe are likely to produce attractive margins in the future. A significant portion of the value of IRMS and Active RFID technologies lies in the development of software and applications that will permit the use of IRMS and Active RFID systems in new markets. In contrast, the margins involved in manufacturing and selling IRMS and Active RFID systems can be relatively small, and might not be sufficient to permit us to earn an attractive return on our development investments.

The time from our initial contact with a customer to a sale is long and subject to delays, which could result in the postponement of our receipt of revenues from one accounting period to the next, increasing the variability of our results of operations and causing significant fluctuations in our revenue from quarter to quarter.

Our financial and operating results have fluctuated in the past and our financial and operating results could fluctuate in the future from quarter to quarter for the following reasons:

| | · | long customer sales cycles; |

| | · | reduced demand for our products and services; |

| | · | price reductions, new competitors, or the introduction of enhanced products or services from new or existing competitors; |

| | · | changes in the mix of products and services we or our customers and distributors sell; |

| | · | contract cancellations, delays or amendments by customers; |

| | · | the lack of government demand for our products and services or the lack of government funds appropriated to purchase our products and services; |

| | · | unforeseen legal expenses, including litigation costs; |

| | · | expenses related to acquisitions; |

| | · | other non-recurring financial charges; |

| | · | the lack of availability or increase in cost of key components and subassemblies; and |

| | · | the inability to successfully manufacture in volume, and reduce the price of, certain of our products that may contain complex designs and components. |

The period between our initial contact with a potential customer and the purchase of our products and services is often long and subject to delays associated with the budgeting, approval and competitive evaluation processes that frequently accompany significant capital expenditures, particularly by governmental agencies. The typical sales cycle for our government customers has to date ranged from three to 24 months and the typical sales cycle for our commercial customers has ranged from one to six months. A lengthy sales cycle may have an impact on the timing of our revenue, which may cause our quarterly operating results to fall below investor expectations. We believe that a customer's decision to purchase our products and services is discretionary, involves a significant commitment of resources, and is influenced by customer budgetary cycles. To successfully sell our products and services, we generally must educate our potential customers regarding their use and benefits, which can require significant time and resources. This significant expenditure of time and resources may not result in actual sales of our products and services.

The lead-time for ordering parts and materials and building many of our products can be many months. As a result, we must order parts and materials and build our products based on forecasted demand. If demand for our products lags significantly behind our forecasts, we may produce more products than we can sell, which can result in cash flow problems and write-offs or write-downs of obsolete inventory.

Our markets are highly competitive and competition could harm our ability to sell products and services and could reduce our market share.

The market for credentialing and active RFID enabled products and services is intensely competitive. We expect competition to increase as the industry grows and as credentialing and RFID technology begins to converge with the access control and information technology industry. We may not be able to compete successfully against current or future competitors. We face competition from technologically sophisticated companies, many of which have substantially greater technical, financial, and marketing resources than us. In some cases, we compete with entities that have pre-existing relationships with potential customers. As the RFID enabled solutions market expands, we expect additional competitors to enter the market.

Some of our competitors and potential competitors have larger technical staffs, larger customer bases, more established distribution channels, greater brand recognition and greater financial, marketing and other resources than we do. Our competitors may be able to develop products and services that are superior to our products and services, that achieve greater customer acceptance or that have significantly improved functionality as compared to our existing and future products and services. In addition, our competitors may be able to negotiate strategic relationships on more favorable terms than we are able to negotiate. Many of our competitors may also have well established relationships with our existing and prospective customers. Increased competition may result in our experiencing reduced margins, loss of sales or decreased market share.

We may pursue acquisitions or investments in complementary technologies and businesses, which could harm our operating results and may disrupt our business.

In the future, we may pursue acquisitions of, or investments in, complementary technologies and businesses. We may be unable to identify suitable acquisition candidates in the future or to make these acquisitions on a commercially reasonable basis, or at all. Acquisitions present a number of potential risks and challenges that could, if not met, disrupt our business operations, increase our operating costs and reduce the value to us of the acquired company. For example, if we identify an acquisition candidate, we may not be able to successfully negotiate or finance the acquisition on favorable terms. Even if we are successful, we may not be able to integrate the acquired businesses, products or technologies into our existing business and products. Furthermore, potential acquisitions and investments, whether or not consummated, may divert our management’s attention and require considerable cash outlays at the expense of our existing operations. In addition, to complete future acquisitions, we may issue equity securities, incur debt, assume contingent liabilities or have amortization expenses and write-downs of acquired assets, which could adversely affect our profitability.

We rely on the services of certain executive officers and key personnel, the loss of whom could adversely affect our operations by causing a disruption to our business.

Our future success depends largely on the efforts and abilities of our executive officers and senior management and other key employees, including technical and sales personnel. The loss of the services of any of these persons could disrupt our business until replacements, if available, can be found. We do not maintain any key-person insurance for any of our employees.

Our ability to remain competitive depends in part on attracting, hiring and retaining qualified technical personnel and, if we are not successful in such hiring and retention, our business could be disrupted.

Our future success depends in part on the availability of qualified technical personnel, including personnel trained in software and hardware applications within specialized fields. As a result, we may not be able to successfully attract or retain skilled technical employees, which may impede our ability to develop, install implement and otherwise service our software and hardware systems and to efficiently conduct our operations.

The information technology and network security industries are characterized by a high level of employee mobility and the market for technical personnel remains extremely competitive in certain regions, including Israel. This competition means there are fewer highly qualified employees available to hire, the costs of hiring and retaining such personnel are high and highly qualified employees may not remain with us once hired. Furthermore, there may be pressure to provide technical employees with stock options and other equity interests in us, which may dilute our earnings (loss) per share.

Additions of new personnel and departures of existing personnel, particularly in key positions, can be disruptive, might lead to additional departures of existing personnel and could have a material adverse effect on our business, operating results and financial condition.

Our planned growth will place significant strain on our financial and managerial resources and may negatively affect our results of operations and ability to grow.

Our ability to manage our growth effectively will require us:

| · | to continue to improve our operations, financial and management controls, reporting systems and procedures; |

| · | to train, motivate and manage our employees; and |

| · | as required, to install new management information systems. |

Our existing management and any new members of management may not be able to augment or improve existing systems and controls or implement new systems and controls in response to anticipated future growth. If we are successful in achieving our growth plans, such growth is likely to place a significant burden on the operating and financial systems, resulting in increased responsibility for our senior management and other personnel.

Some of our products are subject to government regulation of radio frequency technology which could cause a delay or inability to introduce such products in the United States and other markets.

The rules and regulations of the United States Federal Communications Commission or, the "FCC" limit the radio frequency used by and level of power emitting from electronic equipment. Our readers, controllers and other radio frequency technology scanning equipment are required to comply with these FCC rules which may require certification, verification or registration of the equipment with the FCC. Certification and verification of new equipment requires testing to ensure the equipment's compliance with the FCC's rules. The equipment must be labeled according to the FCC's rules to show compliance with these rules. Testing, processing of the FCC's equipment certificate or FCC registration, and labeling may increase development and production costs and could delay introduction of our verification scanning device and next generation radio frequency technology scanning equipment into the U.S. market. Electronic equipment permitted or authorized to be used by the FCC through our certification or verification procedures must not cause harmful interference to licensed FCC users, and it is subject to radio frequency interference from licensed FCC users. Selling, leasing or importing non compliant equipment is considered a violation of FCC rules and federal law and violators may be subject to an enforcement action by the FCC. Any failure to comply with the applicable rules and regulations of the FCC could have a material adverse effect on our business, operating results and financial by increasing our costs due to compliance and/or limit our sales in the United States.

Conditions in Israel affect our operations in Israel and may limit our ability to sell our products and services.

We are incorporated under Israeli law and our principal executive offices, manufacturing facility and research and development facility are located in Israel. Political, economic and military conditions in Israel will, accordingly, directly affect our operations. Since the establishment of the State of Israel in 1948, a number of armed conflicts have taken place between Israel and its Arab neighbors and a state of hostility, varying from time to time in degree and intensity, has led to security and economic problems for Israel. Although Israel has entered into various agreements with its Arab neighbors and the Palestinian Authority, there has been an increase in unrest and terrorist activity in Israel, in varying levels of severity, since September 2000 through 2006. The election in early 2006 of representatives of the Hamas, an Islamic resistance movement, to a majority of seats in the Palestinian Legislative Council and the resulting tension among the different Palestinian functions may create additional unrest and uncertainty. In July 2006, an armed conflict erupted between Israel and Hezbollah, a Lebanese Islamist Shiite militia group and political party, which involved rocket attacks on populated areas in the northern part of Israel. On August 14, 2006, a cease-fire between Hezbollah and Israel took effect. This situation may have an adverse effect on Israel’s economy, primarily in the geographical areas directly harmed by this conflict. Furthermore, several countries still restrict trade with Israeli companies, which may limit our ability to make sales in, or purchase components from, those countries. Any future-armed conflict, political instability, continued violence in the region or restrictions could have a material adverse effect on our business, operating results and financial condition. No predictions can be made as to whether or when a final resolution of the area’s problems will be achieved or the nature thereof and to what extent the situation will impact Israel’s economic development or our operations.

Our operations could be disrupted as a result of the obligation of management or key personnel to perform military service in Israel.

Generally, all nonexempt male adult citizens and permanent residents of Israel are obligated to perform annual military reserve duty and are subject to being called for active duty at any time under emergency circumstances.Currently, Israeli law requires most male Israeli citizens to perform military reserve duty annually until the age of 45. Generally, between five and ten, representing approximately 8% to 17%, of our officers and employees are at any one time obligated to perform annual reserve duty. We believe that a maximum of approximately 17% of our employees at any one time could be called for active duty under emergency circumstances. While we have operated effectively under these requirements since our incorporation, we cannot predict the full impact of such conditions on us in the future, particularly if emergency circumstances occur. If many of our employees are called for active duty, our operations in Israel and our business, results and financial condition may be adversely affected.

Your rights and responsibilities as a shareholder will be governed by Israeli law and differ in some respects from the rights and responsibilities of shareholders under U.S. law.

We are incorporated under Israeli law. The rights and responsibilities of holders of our ordinary shares are governed by our memorandum of association, articles of association and by Israeli law. These rights and responsibilities differ in some respects from the rights and responsibilities of shareholders in typical U.S. corporations. In particular, a shareholder of an Israeli company has a duty to act in good faith and customary manner, and to refrain from misusing his power, in exercising his or her rights and fulfilling his or her obligations toward the company and other shareholders and to refrain from abusing his power in the company, including, among other things, in voting at the general meeting of shareholders on certain matters. Israeli law provides that these duties are applicable in shareholder votes on, among other things, amendments to a company’s articles of association, increases in a company’s authorized share capital, mergers and interested party transactions requiring shareholder approval. A shareholder also has a general duty to refrain from oppressing any other shareholder of his or her rights as a shareholder. In addition, a controlling shareholder of an Israeli company or a shareholder who knows that it possesses the power to determine the outcome of a shareholder vote or who, under our articles of association, has the power to appoint or prevent the appointment of a director or executive officer in the company, has a duty of fairness toward the company. Israeli law does not define the substance of this duty of fairness, but provides that remedies generally available upon a breach of contract will apply also in the event of a breach of the duty to act with fairness. Because Israeli corporate law has undergone extensive revision in recent years, there is only little case law available to assist in understanding the implications of these provisions that govern shareholder behavior.

Provisions of Israeli law may delay, prevent or otherwise encumber a merger with, or an acquisition of our company, which could prevent a change of control, even when the terms of such transaction are favorable to us and our shareholders.

Israeli corporate law regulates mergers, requires tender offers for acquisitions of shares above specified thresholds, requires special approvals for transactions involving directors, officers or significant shareholders and regulates other matters that may be relevant to these types of transactions. For example, a merger may not be completed unless at least 50 days have passed from the date that a merger proposal was filed by each merging company with the Israel Registrar of Companies and at least 30 days from the date that the shareholders of both merging companies approved the merger. In addition, a majority of each class of securities of the target company is required to approve a merger. Furthermore, Israeli tax considerations may make potential transactions unappealing to us or to some of our shareholders whose country of residence does not have a tax treaty with Israel exempting such shareholders from Israeli tax. For example, Israeli tax law does not recognize tax-free share exchanges to the same extent as U.S. tax law. With respect to mergers, Israeli tax law allows for tax deferral in certain circumstances but makes the deferral contingent on the fulfillment of numerous conditions, including a holding period of two years from the date of the transaction during which time sales and dispositions of shares of the participating companies are restricted. Moreover, with respect to certain share swap transactions, the tax deferral is limited in time, and when the time expires, tax then becomes payable even if no actual disposition of the shares has occurred. These provisions of Israeli law could delay, prevent or impede a merger with, or an acquisition of our company, which could prevent a change of control, even when the terms of such transaction are favorable to us and our shareholders and therefore depress the price of our shares.

Fluctuations in the exchange rate between the United States dollar and foreign currencies may affect our operating results.

We incur expenses for our operations in Israel in New Israeli Shekels (NIS) and translate these amounts into United States dollars for purposes of reporting consolidated results. As a result, fluctuations in foreign currency exchange rates may adversely affect our expenses and results of operations, as well as the value of our assets and liabilities. Fluctuations may adversely affect the comparability of period-to-period results. In addition, we hold foreign currency balances, primarily NIS, that will create foreign exchange gains or losses, depending upon the relative values of the foreign currency at the beginning and end of the reporting period, affecting our net income and earnings per share. Although we may use hedging techniques in the future (which we currently do not use), we may not be able to eliminate the effects of currency fluctuations. Thus, exchange rate fluctuations could have a material adverse impact on our operating results and stock price. In addition, future currency exchange losses may increase if we become subject to exchange control regulations restricting our ability to convert local currencies into United States dollars or other currencies.

We are exposed to special risks in foreign markets which may make it difficult in settling transactions and thereby force us to curtail our business operations.