SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 20-F

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2013

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________ to ___________ __________

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

Commission file number: 000-50790

SUPERCOM LTD.

(Exact name of Registrant as specified in its charter

and translation of Registrant’s name into English)

Israel

(Jurisdiction of incorporation or organization)

1Arie Shenkar Street

Hertzliya Pituach 4672514, Israel

(Address of principal executive offices)

Arie Trabelsi, Chief Executive Officer

SuperCom Ltd.

1Arie Shenkar Street

Hertzliya Pituach 4672514, Israel

+972-9-8890850 (phone); +972-9-8890820 (fax)

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered |

| Ordinary Shares, NIS 0.25 Par Value | NASDAQ Capital Market |

Securities registered or to be registered pursuant to Section 12(g) of the Act:None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:None

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report:

Ordinary Shares, par value NIS 0.25 per share 13,284,144(as of December 31, 2013)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes¨Nox

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes¨Nox

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YesxNo¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

YesxNo¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of accelerated filer and large accelerated filer in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer¨ | Accelerated filer¨ | Non-accelerated filerx |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP x | International Financial Reporting

Standards as issued by the

International Accounting

Standards Board ¨ | Other ¨ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

Item 17¨Item 18¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes¨Nox

This annual report on Form 20-F is incorporated by reference into the registrant’s Registration Statements on Form S-8, File Nos. 333-175785 and 333-121231.

INTRODUCTION

We are a global provider of traditional and digital identity solutions, providing advanced safety, identification, tracking and security products to governments and private and public organizations. We provide cutting edge real-time positioning, tracking, monitoring and verification solutions enabled by our PureRF™ wireless hybrid suite of products and technologies, all connected to a web-based, secure, proprietary, interactive and user-friendly interface. Our product depth and global presence was expanded significantly with our acquisition of the SmartID Division of OTI in December 2013.

Our solutions reliably identify and track the movement of people and objects in real time, enabling our customers to detect unauthorized movement of vehicles as well as trace packages, containers and the access to premises by control personnel and vehicles. We provide all-in-one field-proven radio-frequency identification, or RFID, and mobile technology, accompanied with services specifically tailored to meet the requirements of electronic monitoring. Our industry focus includes public safety, healthcare and animal-related tracking and records management. Our proprietary RFID and Mobile PureRF suite of hybrid hardware and software components are the foundation of these products and services.

On December 26, 2013 we acquired the SmartID Division of On Track Innovations Ltd. (NASDAQ: OTIV), or OTI, including all contracts, software, other related technologies and IP assets. The SmartID Division has a strong international presence, with a broad range of competitive and well-known e-ID solutions and technology. The acquisition significantly expanded the breadth of our e-ID capabilities globally, while providing us with outstanding market and technological experts, together with the leading ID software platforms and technologies.

Since 2012, we have focused on expanding our activities in the ID and e-ID market, including the design, development and marketing of identification technologies and solutions to governments in Europe, Asia and Africa using our e-Government platforms. Our activities include (a) utilizing paper secured by different levels of security patterns (UV, holograms, etc.) and (b) electronic identification secured by biometric data, principally in connection with the issuance of national multi-ID documents (IDs, passports, driver’s licenses, vehicle permits, and visas) and border control applications. The acquisition of the SmartID Division significantly expanded the reach and presence of our e-ID capabilities globally.

We are focused on growing three vertical markets by providing all-in-one field-proven radio-frequency identification, or RFID, and mobile technology, accompanied with services specifically tailored to meet the requirements of electronic monitoring in the following industries: (i) public safety, (ii) healthcare and homecare, and (iii) animal and livestock management.

Statements made in this annual report concerning the contents of any contract, agreement or other document are summaries of such contracts, agreements or documents and are not complete descriptions of all of their terms. If we filed any of these documents as an exhibit to this annual report or to any previous filling with the Securities and Exchange Commission, or the SEC, you may read the document itself for a complete recitation of its terms.

In this Annual Report, all references to "SuperCom," the “Company,” "we," "us" or "our" are to SuperCom Ltd., a company organized under the laws of the State of Israel, and its subsidiaries. On January 24, 2013 we changed our name back to SuperCom Ltd., our original name, from Vuance Ltd.

In this Annual Report, unless otherwise specified or unless the context otherwise requires, all references to "$" or "dollars" are to U.S. dollars and all references to "NIS" are to New Israeli Shekels. Except as otherwise indicated, the financial statements of and information regarding SuperCom are presented in U.S. dollars in accordance with generally acceptable accounting principles in the United States ("US GAAP"). The representative rate exchange rate between the NIS and the dollar as published by the Bank of Israel and effective on December 31, 2013 was NIS 3.471 per $1.00.

This Annual Report contains various "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and the Private Securities Litigation Reform Act of 1995, as amended, with respect to our business, financial condition and results of operations. Such forward-looking statements reflect our current view with respect to future events and financial results. Statements which use the terms “anticipate,” “believe,” “expect,” “plan,” “intend,” “estimate” and similar expressions are intended to identify forward looking statements. We remind readers that forward-looking statements are merely predictions and therefore inherently subject to uncertainties and other factors and involve known and unknown risks that could cause the actual results, performance, levels of activity, or our achievements, or industry results, to be materially different from any future results, performance, levels of activity, or our achievements expressed or implied by such forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Except as required by applicable law, including the securities laws of the United States, we undertake no obligation to publicly release any update or revision to any forward looking statements to reflect new information, future events or circumstances, or otherwise after the date hereof. We have attempted to identify significant uncertainties and other factors affecting forward-looking statements in the Risk Factors section that appears in Item 3D “Key Information - Risk Factors.”

TABLE OF CONTENTS

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS | 1 |

| | | |

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE | 1 |

| | | |

| ITEM 3. | KEY INFORMATION | 1 |

| | | |

| A. | Selected Financial Data | 1 |

| B. | Capitalization and Indebtedness | 2 |

| C. | Reasons for the Offer and Use of Proceeds | 2 |

| D. | Risk Factors | 2 |

| | | |

| ITEM 4. | INFORMATION ON THE COMPANY | 15 |

| | | |

| A. | History and Development of the Company | 15 |

| B. | Business Overview | 17 |

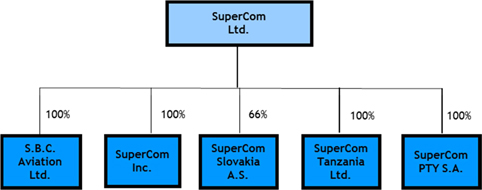

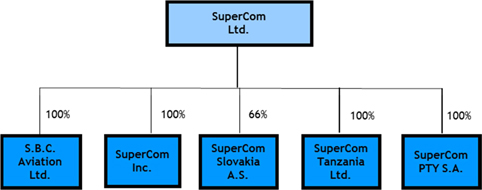

| C. | Organizational Structure | 26 |

| D. | Property, Plants and Equipment | 27 |

| | | |

| ITEM 4 A. | UNRESOLVED STAFF COMMENTS | 27 |

| | | |

| ITEM 5. | OPERATING AND FINANCIAL REVIEW AND PROSPECTS | 27 |

| | | |

| A. | Operating Results | 27 |

| B. | Liquidity and Capital Resources | 35 |

| C. | Research and Development | 39 |

| D. | Trend Information | 39 |

| E. | Off-Balance Sheet Arrangements | 39 |

| F. | Tabular Disclosure of Contractual Obligations | 39 |

| | | |

| ITEM 6. | DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | 39 |

| | | |

| A. | Directors and Senior Management | 39 |

| B. | Compensation | 42 |

| C. | Board Practices | 42 |

| D. | Employees | 49 |

| E. | Share Ownership | 50 |

| | | |

| ITEM 7. | MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS | 53 |

| | | |

| A. | Major Shareholders | 53 |

| B. | Related Party Transactions | 54 |

| C. | Interests of Experts and Counsel | 55 |

| | | |

| ITEM 8. | FINANCIAL INFORMATION | 55 |

| | | |

| A. | Consolidated Statements and Other Financial Information | 55 |

| B. | Significant Changes | 56 |

| | | |

| ITEM 9. | THE OFFER AND LISTING | 56 |

| | | |

| A. | Offer and Listing Details | 56 |

| B. | Plan of Distribution | 57 |

| C. | Markets | 57 |

| D. | Selling Shareholders | |

| E. | Dilution | 57 |

| F. | Expenses of the Issue | 57 |

| | | |

| ITEM 10. | ADDITIONAL INFORMATION | 57 |

| | | |

| A. | Share Capital | 57 |

| B. | Memorandum and Articles of Association | 58 |

| C. | Material Contracts | 58 |

| D. | Exchange Controls | 58 |

| E. | Taxation | 58 |

| F. | Dividends and Paying Agents | 64 |

| G. | Statement by Experts | 64 |

| H. | Documents on Display | 64 |

| I. | Subsidiary Information | 65 |

| | | |

| ITEM 11. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISKS | 65 |

| | | |

| ITEM 12. | DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | 65 |

| | | |

| ITEM 13. | DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES | 65 |

| | | |

| ITEM 14. | MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OFPROCEEDS | 65 |

| | | |

| ITEM 15. | CONTROLS AND PROCEDURES | 66 |

| | | |

| ITEM 16. | RESERVED | 67 |

| | | |

| ITEM 16A. | AUDIT COMMITTEE FINANCIAL EXPERT | 67 |

| | | |

| ITEM 16B. | CODE OF ETHICS | 67 |

| | | |

| ITEM 16C. | PRINCIPAL ACCOUNTANT FEES AND SERVICES | 67 |

| | | |

| ITEM 16D. | EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES | 67 |

| | | |

| ITEM 16E. | PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATEDPURCHASERS | 68 |

| | | |

| ITEM 16F. | CHANGES IN REGISTRANT’S CERTIFYING ACCOUNTANT | 68 |

| | | |

| ITEM 16G. | CORPORATE GOVERNANCE | 68 |

| | | |

| ITEM 16H. | MINE SAFETY DISCLOSURE | 68 |

| | | |

| ITEM 17. | FINANCIAL STATEMENTS | 68 |

| | | |

| ITEM 18. | FINANCIAL STATEMENTS | 69 |

| | | |

| ITEM 19. | EXHIBITS | 69 |

| | | |

| SIGNATURES | 71 |

PART I

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable.

| ITEM 2. | OFFER STATISTICS ANDEXPECTED TIMETABLE |

Not applicable.

| A. | Selected Financial Data |

The following table presents selected consolidated financial data as of the dates and for each of the periods indicated. The selected consolidated financial data set forth below should be read in conjunction with and are qualified entirely by reference to Item 5. “Operating and Financial Review and Prospects” and our consolidated financial statements and notes thereto included elsewhere in this annual report.

The following summary consolidated financial data for and as of the five years ended December 31, 2013 are derived from our audited consolidated financial statements, which have been prepared in accordance with U.S. GAAP. Our audited consolidated financial statements for the three years ended December 31, 2013 and as of December 31, 2012 and 2013 appear elsewhere in this Annual Report. Our selected consolidated financial data as of December 31, 2009, 2010 and 2011 and for the years ended December 31, 2009 and 2010 have been derived from audited consolidated financial statements not included in this Annual Report. All share and per share data has been adjusted to give effect to a 1 share for 4.250002 shares reverse stock split that was effected on August 23, 2013.

Income Statement Data:

| | | Year Ended December 31, | |

| | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009(*) | |

| | | (U.S. dollars in thousands, except per share data) | |

| Summary of Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | |

| Revenues | | | 8,822 | | | | 8,940 | | | | 7,922 | | | | 7,389 | | | | 9,304 | |

| Cost of revenues | | | 1,896 | | | | 1,619 | | | | 3,306 | | | | 2,057 | | | | 3,365 | |

| Gross profit | | | 6,926 | | | | 7,321 | | | | 4,616 | | | | 5,332 | | | | 5,939 | |

| Operating expenses: | | | | | | | | | | | | | | | | | | | | |

| Research and development | | | 564 | | | | 313 | | | | 462 | | | | 386 | | | | 898 | |

| Selling and marketing | | | 3,158 | | | | 3,060 | | | | 3,505 | | | | 4,405 | | | | 5,131 | |

| General and administrative | | | 1,183 | | | | 857 | | | | 732 | | | | 1,985 | | | | 1,648 | |

| Other expenses (income) | | | 507 | | | | 1,085 | | | | (137 | ) | | | (396 | ) | | | 130 | |

| Total operating expenses | | | 5,412 | | | | 5,315 | | | | 4,562 | | | | 6,380 | | | | 7,807 | |

| Operating income (loss) | | | 1,514 | | | | 2,006 | | | | 54 | | | | (1,048 | ) | | | (1,868 | ) |

| Financial income (expenses), net | | | (156 | ) | | | 1,805 | | | | 990 | | | | (678 | ) | | | (620 | ) |

| Income (loss) before income tax | | | 1,358 | | | | 3,811 | | | | 1,044 | | | | (1,726 | ) | | | (2,488 | ) |

| Income tax (expense) benefit | | | 5,108 | | | | 1,006 | | | | (25 | ) | | | (50 | ) | | | (71 | ) |

| Net income (loss) from continuing operations | | | 6,466 | | | | 4,817 | | | | 1,019 | | | | (1,776 | ) | | | (2,559 | ) |

| Loss from discontinued operations | | | - | | | | - | | | | - | | | | (189 | ) | | | (2,526 | ) |

| Net income (loss) | | | 6,466 | | | | 4,817 | | | | 1,019 | | | | (1,965 | ) | | | (5,085 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Per Share Data: | | | | | | | | | | | | | | | | | | | | |

| Basic earnings (loss) from continuing operations | | | 0.71 | | | | 0.75 | | | | 0.47 | | | | (1.22 | ) | | | (1.97 | ) |

| Diluted earnings (loss) from continuing operations | | | 0.70 | | | | 0.59 | | | | 0.37 | | | | (1.22 | ) | | | (1.97 | ) |

| Basic and Diluted loss from discontinued operations | | | - | | | | - | | | | - | | | | (0.13 | ) | | | (1.95 | ) |

| Basic earnings (loss) per share | | | 0.71 | | | | 0.75 | | | | 0.47 | | | | (1.35 | ) | | | (3.92 | ) |

| Diluted earnings (loss) per share | | | 0.70 | | | | 0.59 | | | | 0.37 | | | | (1.35 | ) | | | (3.92 | ) |

* Due to the sale of certain business activities in January 2010, those business activities are presented as discontinued operations in accordance with U.S. GAAP.

| | | December 31, | |

| | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009(*) | |

| | | (U.S. dollars in thousands, except per share data) | |

| Summary of Balance Sheet Data: | | | | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | | 2,673 | | | | 225 | | | | 215 | | | | 197 | | | | 656 | |

| Total Current Assets | | | 12,109 | | | | 2,930 | | | | 2,131 | | | | 1,664 | | | | 4,236 | |

| TOTAL ASSETS | | | 31,708 | | | | 3,743 | | | | 2,455 | | | | 2,008 | | | | 4,682 | |

| Total Current Liabilities | | | 8,157 | | | | 2,796 | | | | 7,829 | | | | 4,500 | | | | 6,332 | |

| Total Long-term Liabilities | | | 4,159 | | | | 236 | | | | 227 | | | | 254 | | | | 304 | |

| SHAREHOLDERS’ EQUITY (DEFICIT) | | | 19,392 | | | | 711 | | | | (5,601 | ) | | | (7,871 | ) | | | (6,271 | ) |

| B. | Capitalization and Indebtedness |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

Investing in our ordinary shares involves a high degree of risk. You should consider carefully the risks described below, together with the financial and other information contained in this prospectus, before you decide to invest in our ordinary shares. If any of the following risks actually occurs, our business, financial condition or results of operations would suffer. In that case, the trading price of our ordinary shares would likely decline and you might lose all or part of your investment.

Risks Related to Our Business

Although we expect that the acquisition ofthe SmartID Division will result in benefits to us, we may not realize those benefits due to unforeseen difficulties.

Integrating the operations of the SmartID Division successfully or otherwise realizing any of the anticipated benefits of the acquisition of the Smart ID Division, including anticipated cost savings and additional revenue opportunities, involves a number of challenges. The failure to meet these integration challenges could seriously harm our results of operations and the market price of our ordinary shares may decline as a result.

Realizing the benefits of the acquisition will depend in part on the integration of intellectual property, products, operations, personnel and sales force and the completion of assignments of current and past contracts and rights. These integration activities are complex and time-consuming and we may encounter unexpected difficulties or incur unexpected costs, including:

| · | our inability to achieve the operating synergies anticipated in the acquisition, which would prevent us from achieving the positive earnings gains expected as a result of the acquisition; |

| · | diversion of management attention from ongoing business concerns to integration matters; |

| · | difficulties in consolidating and rationalizing information technology and intellectual property platforms and administrative infrastructures; |

| · | complexities associated with managing the combined businesses; |

| · | some personnel transferred from OTI, may not integrate well into the new combined business and may leave our company, which may result in the loss of specific business knowledge and our ability to fully capitalize on the acquired assets and perform current contracts; |

| · | challenges in fulfilling assignments and maintaining the contracts and relationships of the SmartID Division thereby demonstrating to our customers and to customers of the SmartID Division that the acquisition will not result in adverse changes in customer service standards or business focus; |

| · | some contracts or agreements with customers of the SmartID division may be terminated by the customers as a result of the acquisition, which will result in major reduction in our anticipated combined business revenue; and |

| · | some contracts or agreements with service providers and suppliers of the SmartID division may be terminated by them as a result of the acquisition which could result in delays and increases in our cost of revenues. |

We may not successfully integrate the operations of the SmartID Division, and may not realize the anticipated net reductions in costs and expenses and other benefits and synergies of the acquisition to the extent, or in the timeframe, anticipated. In addition to the integration risks discussed above, our ability to realize these benefits and synergies could be adversely impacted by practical or legal constraints on our ability to combine operations.

If we are unable to manage our growth profitably, our business, financial results and stock price could suffer.

Our future financial results will depend in part on our ability to profitably manage our growth. Management will need to maintain existing customers and attract new customers, recruit, retain and effectively manage employees, as well as expand operations and integrate customer support and financial control systems. If integration-related expenses and capital expenditure requirements are greater than anticipated or if we are unable to manage our growth profitably after the acquisition, our financial results and the market price of our common stock may decline.

Purchase price allocation in connection with our acquisition of OTI’s SmartID Divisionrequires estimates which may be subject to change in the future. Future changes to these estimates could impact our historical or future operating results.

The application of purchase price allocation requires that the total purchase price we paid for the SmartID Divisionbe allocated to the fair value of assets acquired and liabilities assumed based on their fair values at the acquisition date. All amounts in excess of the fair value are recorded as goodwill. The allocation process requires an analysis and valuation of acquired assets, including fixed assets, technologies, deferred tax assets, customer contracts and relationships, trade names and liabilities assumed, including contractual commitments and legal contingencies. We identified and recorded the assets, including specifically identifiable intangible assets, and liabilities assumed in connection with our recent acquisition of OTI’s SmartID Divisionat their estimated fair values as of the date of the acquisition. This process requires estimates by our management based upon the best available information at the time of the preparation of the financial statements. These estimates of fair value may change in the future as we finalize the purchase price allocation. We expect it may take until December 31, 2014 to complete the purchase price allocation. Any future changes to our estimates of the fair value of the assets and liabilities of OTI’s SmartID Divisionas of the date of the acquisition could impact our historical or future operating results.

In the three years ended December 31, 2013, we depended on large orders from one customer for a substantial portion of our revenues. The loss of this customer or a decrease in its orders could adversely impact our operating results.

In the years ended December 31, 2013, 2012 and 2011, 73%, 64% and 95%, respectively, of our consolidated net revenue are attributable to sales to a European governmental customer. While we expect to be less dependent on this customer in 2014 and in the future because of our acquisition of the SmartID Division, a substantial reduction in sales to, or loss of, this customer would adversely affect our business unless we were able to replace the revenue received from the customer, which replacement we may not be able to find.

Because competition in our industry is intense, our business, operating results and financial condition may be adversely affected.

The global market for RFID and mobile based enabled products and solutions is highly fragmented and intensely competitive. It is characterized by rapidly changing technology, frequent new product introductions and rapidly changing customer requirements. We expect competition to increase as the industry grows and as RFID and mobile technology begin to converge with the access control and information technology industry. We may not be able to compete successfully against current or future competitors. We face competition from technologically sophisticated companies, many of which have substantially greater technical, financial, and marketing resources than we do. In some cases, we compete with entities that have pre-existing relationships with potential customers. As the active RFID and mobile enabled solutions market expands, we expect additional competitors to enter the market. We cannot assure you that we will be able to maintain the quality of our products relative to those of our competitors or continue to develop and market new products effectively. Continued competitive pressures could cause us to lose significant market share.

Some of our competitors and potential competitors have larger technical staffs, larger customer bases, more established distribution channels, greater brand recognition and greater financial, marketing and other resources than we do. Our competitors may be able to develop products and services that (i) are superior to our products and services, (ii) achieve greater customer acceptance or (iii) have significantly improved functionality as compared to our existing and future products and services. In addition, our competitors may be able to negotiate strategic relationships on more favorable terms than we are able to negotiate. Many of our competitors may also have well-established relationships with our existing and prospective customers. Increased competition may result in our experiencing reduced margins, loss of sales or decreased market share.

The average selling prices for our products may decline as a result of competitive pricing pressures, promotional programs and customers who negotiate price reductions in exchange for longer-term purchase commitments. The pricing of products depends on the specific features and functions of the products, purchase volumes and the level of sales and service support required. As we experience pricing pressure, the average selling prices and gross margins for our products may decrease over product lifecycles. These same competitive pressures may require us to write down the carrying value of any inventory on hand, which could adversely affect our operating results and earnings per share.

We have sought in the past and will seek in the future to enter into contracts with governments, as well as state and local governmental agencies and municipalities, which subjects us to certain risks associated with such types of contracts.

Most contracts with governments or with state or local agencies or municipalities, or Governmental Contracts, are awarded through a competitive bidding process, and some of the business that we expect to seek in the future will likely be subject to a competitive bidding process. Competitive bidding presents a number of risks, including:

| · | the frequent need to compete against companies or teams of companies with more financial and marketing resources and more experience than we have in bidding on and performing major contracts; |

| · | the need to compete against companies or teams of companies that may be long-term, entrenched incumbents for a particular contract we are competing for and which have, as a result, greater domain expertise and established customer relations; |

| · | the substantial cost and managerial time and effort necessary to prepare bids and proposals for contracts that may not be awarded to us; |

| · | the need to accurately estimate the resources and cost structure that will be required to service any fixed-price contract that we are awarded; and |

| · | the expense and delay that may arise if our competitors protest or challenge new contract awards made to us pursuant to competitive bidding or subsequent contract modifications, and the risk that any of these protests or challenges could result in the resubmission of bids on modified specifications, or in termination, reduction or modification of the awarded contract. |

We may not be afforded the opportunity in the future to bid on contracts that are held by other companies and are scheduled to expire, if the governments, or the applicable state or local agency or municipality determines to extend the existing contract. If we are unable to win particular contracts that are awarded through the competitive bidding process, we may not be able to operate in the market for the products and services that are provided under those contracts for a number of years. If we are unable to win new contract awards or retain those contracts, if any, that we are awarded over any extended period, our business, prospects, financial condition and results of operations will be adversely affected.

In addition, Governmental Contracts subject us to risks associated with public budgetary restrictions and uncertainties, actual contracts that are less than awarded contract amounts, and cancellation at any time at the option of the governmental agency. Any failure to comply with the terms of any Governmental Contracts could result in substantial civil and criminal fines and penalties, as well as suspension from future contracts for a significant period of time, any of which could adversely affect our business by requiring us to pay significant fines and penalties or prevent us from earning revenues from Governmental Contracts during the suspension period. Cancellation of any one of our major Governmental Contracts could have a material adverse effect on our financial condition.

Governments may be in a position to obtain greater rights with respect to our intellectual property than we would grant to other entities. Governmental agencies also have the power, based on financial difficulties or investigations of their contractors, to deem contractors unsuitable for new contract awards. Because we will engage in the government contracting business, we will be subject to audits, and may be subject to investigation, by governmental entities. Failure to comply with the terms of any Governmental Contract could result in substantial civil and criminal fines and penalties, as well as suspension from future contracts for a significant period of time, any of which could adversely affect our business by requiring us to pay the fines and penalties and prohibiting us from earning revenues from Governmental Contracts during the suspension period.

Furthermore, governmental programs can experience delays or cancellation of funding, which can be unpredictable; this may make it difficult to forecast our revenues on a quarter-by-quarter basis.

We have incurred operating losses in the past and may not be able to sustain profitable operations in the future. We may not have sufficient resources to fund our operations in the future.

Although we had profitable operations in the three years ended December 31, 2013, after three years of losses, there can be no assurance that we will continue to operate profitably in the future. If we do not generate sufficient cash from operations, we will be required to obtain additional financing or reduce our level of expenditure. Such financing may not be available in the future, or, if available, may not be on terms favorable to us.

Disruptions, uncertainty or volatility in the capital and credit markets may also limit our access to capital required to operate our business. Such market conditions may limit our ability to raise additional capital to support business growth. If we are unable to obtain necessary additional financing or generate cash from operations, we may be required to reduce the scope of our operations and may need to implement certain operational changes to decrease our expenses. This would have the potential to decrease both our ability to attain profitability and our financial flexibility. If adequate funds are not available to us, our business, and results of operations and financial condition will be adversely affected.

The market for our products is characterized by changing technology, requirements, standards and products, and we may be adversely affected if we do not respond promptly and effectively to these changes.

The market for our products is characterized by evolving technologies, changing industry standards, changing regulatory environments, frequent new product introductions and rapid changes in customer requirements. The introduction of products embodying new technologies and the emergence of new industry standards and practices can render existing products obsolete and unmarketable. Our future success will depend on our ability to enhance our existing products and to develop and introduce, on a timely and cost-effective basis, new products and product features that keep pace with technological developments and emerging industry standards and address the increasingly sophisticated needs of our customers. In the future:

| · | we may not be successful in developing and marketing new products or product features that respond to technological change or evolving industry standards; |

| · | we may experience difficulties that could delay or prevent the successful development, introduction and marketing of these new products and features; or |

| · | our new products and product features may not adequately meet the requirements of the marketplace and achieve market acceptance. |

If we are unable to respond promptly and effectively to changing technologies and market requirements, we will be unable to compete effectively in the future.

There can be no assurance that we will successfully identify new product opportunities and develop and bring new products to market in a timely manner, or that the products and technologies developed by others will not render our products or technologies obsolete or noncompetitive. The failure of our new product development efforts could have a material adverse effect on our business, results of operations and future growth.

Our dependence on third-party distributors, sales agents and value-added resellers could result in marketing and distribution delays, which would prevent us from generating sales revenues.

We market and sell some of our products and solutions using a network of representatives, distributors and resellers covering the United States, Europe, Asia and Africa. We establish relationships with representatives, distributors and resellers through agreements that provide prices, discounts and other material terms and conditions under which the reseller is eligible to purchase our systems and products for resale. These agreements generally do not grant exclusivity to the distributors and resellers and, as a general matter, are not long-term contracts, do not have commitments for minimum sales, and could be terminated by the distributor. We do not have agreements with all of our distributors. We are currently engaged in discussions with other potential distributors, sales agents, and value-added resellers. Such arrangements may never be finalized and, if finalized, such arrangements may not increase our revenues or enable us to achieve profitability.

Our ability to terminate a distributor who is not performing satisfactorily may be limited. Inadequate performance by a distributor could adversely affect our ability to develop markets in the regions for which the distributor is responsible and could result in substantially greater expenditures by us in order to develop such markets. Our operating results will be highly dependent upon: (i) our ability to maintain our existing distributor arrangements; (ii) our ability to establish and maintain coverage of major geographic areas and establish access to customers and markets; and (iii) the ability of our distributors, sales agents, and value-added resellers to successfully market our products. A failure to achieve these objectives could result in lower revenues.

If our technology and solutions cease to be adopted and used by government and public and private organizations, we may lose some of our existing customers and our operations will be negatively affected.

Our ability to grow depends significantly on whether governmental and public and private organizations adopt our technology and solutions as part of their new standards and whether we will be able to leverage our expertise with government products into commercial products. If these organizations do not adopt our technology, we might not be able to penetrate some of the new markets we are targeting, or we might lose some of our existing customer base.

In order for us to achieve our growth objectives, our e-ID, RFID and mobile based technology and solutions must be adapted to and adopted in a variety of areas, any or all of which may not adopt our e-ID, RFID and mobile based technology. These areas include, among others:

| · | healthcare and homecare; and |

| · | animal and livestock management. |

We cannot accurately predict the future growth rate, if any, or the ultimate size of the e-ID, RFID and mobile based markets. The expansion of the market for our products and services depends on a number of factors such as:

| · | the cost, performance and reliability of our products and services compared to the products and services of our competitors; |

| · | customer perception of the benefits of our products and solutions; |

| · | public perception of the intrusiveness of these solutions and the manner in which organizations use the information collected; |

| · | public perception of the privacy protection for their personal information; |

| · | customer satisfaction with our products and services; and |

| · | marketing efforts and publicity for our products and services. |

Even if our products and solutions gain wide market acceptance, our products and services may not adequately address market requirements and may not gain wide market acceptance. If our solutions or our products and services do not gain wide market acceptance, our business and our financial results will suffer.

We need to develop and sustain our position as a provider of e-ID, RFID and mobile based solutions and services to earn high margins from our technology, and if we are unable to develop such position, our business will not be as profitable as we hope, if at all.

The increasing sophistication of our e-ID, RFID and Mobile based technology places a premium on providing innovative software systems and services to customers, in addition to manufacturing and supplying RFID and mobile technology. While we have had some early success positioning ourselves as a provider of such services and systems, we may not continue to be successful with this strategy and we may not be able to capture a significant share of the market for the sophisticated solutions and services that we believe are likely to produce attractive margins in the future. A significant portion of the value of our e-ID, RFID and mobile based technology lies in the development of software and applications that will permit the use of RFID and mobile based technology in selected new markets. In contrast, the margins involved in manufacturing and selling RFID and mobile based technology can be relatively small, and may not be sufficient to permit us to earn an attractive return on our development investments.

Unfavorable global economic conditions may adversely affect our customers, which directly impact our business and results of operations.

Our operations and performance depend on our target customers, including those from the governmental sector, having adequate resources to purchase our products. The turmoil in the credit markets and the global economic downturn that commenced in 2008 and intensified in Europe in recent years generally adversely impacted our target customers. Companies and governmental authorities have reduced or delayed and may continue to reduce or delay their purchasing activities in response to a lack of credit, economic uncertainty, budget deficits and concern about the general stability of markets. Recently, several European countries encountered severe economic difficulties which affected the entire Euro-zone economy. The financial crisis, among other things, resulted in the downgrade of the credit worthiness of several countries in Europe, which affected our customers’ ability and budget to perform projects within these territories. If such economic and market conditions remain uncertain or weaken further, specifically changes that may negatively impact the political or economic stability and environment of the countries from which we derive most of our consolidated net revenues, our business and future operations may be materially adversely affected.

Our efforts to expand our international operations are subject to a number of risks, any of which could adversely reduce our future international sales and increase our losses.

Most of our revenues to date are attributable to sales in jurisdictions other than the United States. For the years ended December 31, 2011, 2012 and 2013, approximately 95.7%, 97.6% and 97.7%, respectively, of our revenues were derived from sales to markets outside of the United States. Our inability to obtain or maintain federal or foreign regulatory approvals relating to the import or export of our products on a timely basis could adversely affect our ability to expand our international business. Additionally, our international operations could be subject to a number of risks, any of which could adversely affect our future international sales and operating results, including:

| · | increased collection risks; |

| · | export duties and tariffs; |

| · | uncertain political, regulatory and economic developments; |

| · | inability to protect our intellectual property rights; |

| · | highly aggressive competitors; |

| · | difficulties in staffing, managing and supporting foreign operations; |

| · | longer payment cycles; and |

| · | difficulties in collecting accounts receivable. |

Negative developments in any of these areas in one or more countries could result in a reduction in demand for our products, the cancellation or delay of orders already placed, difficulty in collecting receivables, and a higher cost of doing business, any of which could adversely affect our business, results of operations or financial condition.

In addition, in many countries the national security organizations require our employees to obtain clearance before such employees can work on a particular transaction. Failure to receive, or delays in the receipt of, relevant foreign qualifications could also have a material adverse effect on our ability to make sales or fulfill our orders on a timely basis. Additionally, as foreign government regulators have become increasingly stringent, we may be subject to more rigorous regulation by governmental authorities in the future. If we fail to adequately address any of these regulations, our business will be harmed.

We are exposed to risks in operating in foreign markets, which may make operating in those markets difficult and thereby force us to curtail our business operations.

In conducting our business in foreign countries, we are subject to political, economic, legal, operational and other risks that are inherent in operating in other countries. Risks inherent to operating in other countries range from difficulties in settling transactions in emerging markets to possible nationalization, expropriation, price controls and other restrictive governmental actions. We also face the risk that exchange controls or similar restrictions imposed by foreign governmental authorities may restrict our ability to convert local currency received or held by us in their countries into U.S. dollars or other currencies, or to take those dollars or other currencies out of those countries.

Due to the nature of our business, our financial and operating results could fluctuate.

Our financial and operating results have fluctuated in the past and could fluctuate in the future from quarter to quarter. As a result of our dependence on a limited number of customers and our increased reliance on our e-ID, electronic monitoring PureRF suite and products, our revenue has experienced wide fluctuations, and we expect that our revenue will continue to fluctuate in the future as we integrate the operations of the SmartID Division. A portion of our sales is not recurring sales; therefore, quarterly and annual sales levels will likely fluctuate. Sales in any period may not be indicative of sales in future periods. In addition, our result may fluctuate from year to year for the following reasons:

| · | long customer sales cycles; |

| · | reduced demand for our products and services; |

| · | new competitors, or the introduction of enhanced products or services from new or existing competitors; |

| · | changes in the mix of products and services we or our customers and distributors sell; |

| · | contract cancellations, delays or amendments by customers; |

| · | the lack of government demand for our products and services or the lack of government funds appropriated to purchasing our products and services; |

| · | unforeseen legal expenses, including litigation costs; |

| · | expenses related to acquisitions; |

| · | other non-recurring financial charges; |

| · | the lack of availability, or increased cost, of key components and subassemblies; and |

| · | the inability to successfully manufacture in volume, and reduce the price of, certain of our products; |

In addition, the period between our initial contact with a potential customer and the purchase of our products and services is often long and subject to delays associated with the budgeting, approval and competitive evaluation processes that frequently accompany significant capital expenditures, particularly by governmental agencies. The typical sales cycle for our government customers has, to date, ranged from nine to 24 months and the typical sales cycle for our commercial customers has ranged from one to six months. A lengthy sales cycle may have an impact on the timing of our revenue, which may cause our quarterly operating results to fall below investor expectations. We believe that a customer’s decision to purchase our products and services is discretionary, involves a significant commitment of resources, and is influenced by customer budgetary cycles. To successfully sell our products and services, we generally must educate our potential customers regarding their use and benefits, which can require significant time and resources. This significant expenditure of time and resources may not result in actual sales of our products and services.

Our reliance on third party technologies, raw materials and components for the development of some of our products may delay product launches, impair our ability to develop and deliver products and hurt our ability to compete in the market.

Most of our products integrate third-party technology that we license and/or raw materials and components that we purchase or otherwise obtain the right to use, including: operating systems, microchips, security and cryptography technology for card operating systems and dual interface technology. Our ability to purchase and license new technologies and components from third parties is and will continue to be critical to our ability to offer a complete line of products that meets customer needs and technological requirements. We may not be able to renew our existing licenses or to purchase components and raw materials on favorable terms, if at all. If we lose the rights to a patented technology, we may need to stop selling or may need to redesign our products that incorporate that technology. We may also lose the potential competitive advantage such technology gave us. In addition, competitors could obtain licenses for technologies for which we are unable to obtain licenses, and third parties may develop or enable others to develop a similar solution to security issues, either of which could adversely affect our results of operations. Also, dependence on the patent protection of third parties may not afford us any control over the protection of the technologies upon which we rely. If the patent protection of any of these third parties were compromised, our ability to compete in the market could also be impaired.

Although we generally use standard raw materials and components for our systems, some of the key raw materials or components are available only from limited sources. Even where multiple sources are available, we typically obtain components and raw materials from only one vendor to ensure high quality, prompt delivery and low cost. If one of our suppliers were unable to meet our supply demands and we could not quickly replace the source of supply, it could have a material adverse effect on our business, operating results and financial condition, for reasons including a delay of receipt of revenues and damage to our business reputation.

Delays in deliveries from our suppliers, defects in goods or components supplied by our vendors, or delays in projects that are performed by our subcontractors could cause our revenues and gross margins to decline.

We rely on a limited number of vendors and subcontractors for certain components of the products we are supplying and projects we perform. In some cases, we rely on a single source vendor or subcontractor. Any undetected flaws in components or other materials to be supplied by our vendors could lead to unanticipated costs to repair or replace these parts or materials. If one of our suppliers were unable to meet our supply demands and we could not quickly replace the source of supply, it could cause a delay of receipt of revenues and damage our business reputation. We depend on subcontractors to adequately perform a substantial part of our projects. If a subcontractor fails to fulfill its obligations under a certain project, it could delay our receipt of revenues for such project and damage our business reputation, and therefore could have a material adverse effect on our business, operating results and financial condition.

Breaches of network or information technology security, natural disasters or terrorist attacks could have an adverse effect on our business.

Cyber-attacks or other breaches of network or information technology (IT) security, natural disasters, terrorist acts or acts of war may cause equipment failures or disrupt our systems and operations. We may be subject to attempts to breach the security of our networks and IT infrastructure through cyber-attack, malware, computer viruses and other means of unauthorized access. While we maintain insurance coverage for some of these events, the potential liabilities associated with these events could exceed the insurance coverage we maintain. A failure to protect the privacy of customer and employee confidential data against breaches of network or IT security could result in damage to our reputation. To date, we have not been subject to cyber-attacks or other cyber incidents which, individually or in the aggregate, resulted in a material impact to our operations or financial condition.

For us to further penetrate the marketplace, the marketplace must be confident that we provide effective security protection for national and other secured identification documents and cards. Although we have not experienced any act of sabotage or unauthorized access by a third party of our software or technology to date, if an actual or perceived breach of security occurs in our internal systems or those of our customers, regardless of whether we caused the breach, it could adversely affect the market’s perception of our products and services. This could cause us to lose customers, resellers, alliance partners or other business partners, thereby causing our revenues to decline. If we or our customers were to experience a breach of our internal systems, our business could be severely harmed by adversely affecting the market’s perception of our products and services.

Third parties could obtain access to our proprietary information or could independently develop similar technologies.

Despite the precautions we take, third parties may copy or obtain and use our technologies, ideas, know-how and other proprietary information without authorization or may independently develop technologies similar or superior to our technologies. In addition, the confidentiality and non-competition agreements between us and most of our employees, distributors and clients may not provide meaningful protection of our proprietary technologies or other intellectual property in the event of unauthorized use or disclosure. If we are not able to successfully defend our industrial or intellectual property rights, we may lose rights to technologies that we need to develop our business, which may cause us to lose potential revenues, or we may be required to pay significant license fees for the use of such technologies. To date, we have relied primarily on a combination of trade secret and copyright laws, as well as nondisclosure and other contractual restrictions on copying, reverse engineering and distribution to protect our proprietary technology.

Our current patents and any patents that we may register in the future may provide only limited protection for our technology and may not be sufficient to provide competitive advantages to us. For example, competitors could be successful in challenging any issued patents or, alternatively, could develop similar or more advantageous technologies on their own or design around our patents. Any inability to protect intellectual property rights in our technology could enable third parties to compete more effectively with us.

In addition, the laws of certain foreign countries may not protect our intellectual property rights to the same extent as do the laws of Israel or the United States. Our means of protecting our intellectual property rights in Israel, the United States or any other country in which we operate may not be adequate to fully protect our intellectual property rights.

Third parties may assert that we are infringing their intellectual property rights; IP litigation could require us to incur substantial costs even when our efforts are successful.

We may face intellectual property litigation, which could be costly, harm our reputation, limit our ability to sell our products, force us to modify our products or obtain appropriate licenses, and divert the attention of management and technical personnel. Our products employ technology that may infringe on the proprietary rights of others, and, as a result, we could become liable for significant damages and suffer other harm to our business.

Other than the litigation that was initiated over a decade ago and resolved in 2012, we have not been subject to material intellectual property litigation to date. We have received demand letters in the past alleging that products or processes of ours are in breach of patents, which we have denied, but no lawsuits have been filed in respect of such claims.

Litigation may be necessary in the future to enforce any patents we have or may obtain and/or any other intellectual property rights, to protect our trade secrets, to determine the validity and scope of the proprietary rights of others, or to defend against claims of infringement or invalidity, and we may not prevail in any such future litigation. Litigation, whether or not determined in our favor or settled, could be costly, could harm our reputation and could divert the efforts and attention of our management and technical personnel from normal business operations. In addition, adverse determinations in litigation could result in the loss of our proprietary rights, subject us to significant liabilities, require us to seek licenses from third parties, prevent us from licensing our technology or selling or manufacturing our products, or require us to expend significant resources to modify our products or attempt to develop non-infringing technology, any of which could seriously harm our business.

Our products may contain technology provided to us by third parties. Because we did not develop such technology ourselves, we may have little or no ability to determine in advance whether such technology infringes the intellectual property rights of any other party. Our suppliers and licensors may not be required to indemnify us in the event that a claim of infringement is asserted against us, or they may be required to indemnify us only with respect to intellectual property infringement claims in certain jurisdictions, and/or only up to a maximum amount, above which we would be responsible for any further costs or damages. In addition, we have indemnification obligations to certain parties with respect to any infringement of third-party patents and intellectual property rights by our products. If litigation were to be filed against these parties in connection with our technology, we would be required to defend and indemnify such parties.

We may have significant differences between forecasted demands to actual orders received, which may adversely affect our business.

The lead time for ordering parts and materials and building many of our products can be many months. As a result, we must order parts and materials and build our products based on forecasted demand. If demand for our products lags significantly behind our forecasts, we may produce more products than we can sell, which can result in cash flow problems and write-offs or write-downs of obsolete inventory. If demand for our products exceeds our forecasts, our business may be harmed as a result of delays to perform contracts.

We rely on the services of certain executive officers and key personnel, the loss of which could adversely affect our business.

Our future success depends largely on the efforts and abilities of our executive officers and senior management and other key employees, including technical and sales personnel. The loss of the services of any of these persons could adversely affect our business. We do not maintain any “key-person” life insurance with respect to any of our employees.

Our ability to remain competitive depends in part on attracting, hiring and retaining qualified technical personnel; If we are not successful in such efforts, our business could be disrupted.

Our future success depends in part on the availability of qualified technical personnel, including personnel trained in software and hardware applications within specialized fields. As a result, we may not be able to successfully attract or retain skilled technical employees, which may impede our ability to develop, install, implement and otherwise service our software and hardware systems and to efficiently conduct our operations.

The information technology and network security industries are characterized by a high level of employee mobility and the market for technical personnel remains extremely competitive in certain regions, including Israel. This competition means that (i) there are fewer highly qualified employees available for hire, (ii) the costs of hiring and retaining such personnel are high, and (iii) highly qualified employees may not remain with us once hired. Furthermore, there may be pressure to provide technical employees with stock options and other equity interests in us, which may dilute our shareholders and increase our expenses.

The additions of new personnel and the departure of existing personnel, particularly in key positions, can be disruptive, might lead to additional departures of existing personnel and could have a material adverse effect on our business, operating results and financial condition.

Some of our products are subject to government regulation of radio frequency technology, which could cause a delay in introducing, or an inability to introduce, such products in the United States and other markets.

The rules and regulations of the United States Federal Communications Commission, or the FCC, limit the radio frequency used by and level of power emitting from electronic equipment. Our readers, controllers and other radio frequency technology scanning equipment are required to comply with these FCC rules, which may require certification, verification or registration of the equipment with the FCC. Certification and verification of new equipment requires testing to ensure the equipment’s compliance with the FCC’s rules. The equipment must be labeled according to the FCC’s rules to show compliance with these rules. Testing, processing of the FCC’s equipment certificate or FCC registration and labeling may increase development and production costs and could delay introduction of our verification scanning device and next generation radio frequency technology scanning equipment into the U.S. market. Electronic equipment permitted or authorized to be used by us through FCC certification or verification procedures must not cause harmful interference to licensed FCC users, and may be subject to radio frequency interference from licensed FCC users. Selling, leasing or importing non-compliant equipment is considered a violation of FCC rules and federal law, and violators may be subject to an enforcement action by the FCC. Any failure to comply with the applicable rules and regulations of the FCC could have an adverse effect on our business, operating results and financial condition by increasing our compliance costs and/or limiting our sales in the United States.

We may fail to maintain effective internal control over financial reporting, which could result in material misstatements in our financial statements.

The Sarbanes-Oxley Act of 2002 imposes certain duties on us and our executives and directors. Our efforts to comply with the requirements of Section 404 of the Sarbanes-Oxley Act of 2002 governing internal controls and procedures for financial reporting have resulted in increased general and administrative expense and a diversion of management time and attention, and we expect these efforts to require the continued commitment of significant resources. Section 404 of the Sarbanes-Oxley Act requires management’s annual review and evaluation of our internal control over financial reporting in connection with the filing of the annual report on Form 20-F for each fiscal year. We may identify material weaknesses or significant deficiencies in our internal control over financial reporting. Failure to maintain effective internal control over financial reporting could result in material misstatements in our financial statements. Any such failure could also adversely affect the results of our management’s evaluations and annual auditor reports regarding the effectiveness of our internal control over financial reporting. Failure to maintain effective internal control over financial reporting could result in investigation or sanctions by regulatory authorities and could have a material adverse effect on our operating results, investor confidence in our reported financial information and the market price of our ordinary shares.

Risks Related to Our Ordinary Shares

Volatility of the market price of our ordinary shares could adversely affect our shareholders and us.

The market price of our ordinary shares has been, and is likely to be, highly volatile and could be subject to wide fluctuations in response to numerous factors, including the following:

| · | actual or anticipated variations in our quarterly operating results or those of our competitors; |

| · | announcements by us or our competitors of technological innovations or new and enhanced products; |

| · | developments or disputes concerning proprietary rights; |

| · | introduction and adoption of new industry standards; |

| · | changes in financial estimates by securities analysts; |

| · | market conditions or trends in our industry; |

| · | changes in the market valuations of our competitors; |

| · | announcements by us or our competitors of significant acquisitions; |

| · | entry into strategic partnerships or joint ventures by us or our competitors; |

| · | additions or departures of key personnel; |

| · | political and economic conditions, such as a recession or interest rate or currency rate fluctuations or political events; and |

| · | other events or factors in any of the countries in which we do business, including those resulting from war, incidents of terrorism, natural disasters or responses to such events. |

In addition, the stock market in general, and the market for Israeli companies in particular, has been highly volatile. Many of these factors are beyond our control and may materially adversely affect the market price of our ordinary shares, regardless of our performance. In the past, following periods of market volatility, shareholders have often instituted securities class action litigation relating to the stock trading and price volatility of the company in question. If we were involved in any securities litigation, it could result in substantial cost to us to defend and divert resources and the attention of management from our business.

We have a shareholder that is able to exercise substantial influence over us and all matters submitted to our shareholders.

Sigma Wave Ltd., or Sigma, is the beneficial owner of approximately 30% of our outstanding shares. Such ownership interest gives Sigma the ability to influence and direct our activities, subject to approvals that may be required for related-party transactions pursuant to Israeli law. Sigma will have influence over the outcome of most matters submitted to our shareholders, including the election of directors and the adoption of a merger agreement, and such influence could make us a less attractive acquisition or investment target. Because the interests of Sigma may differ from the interests of our other shareholders, actions taken by Sigma with respect to us may not be favorable to our other shareholders.

We do not expect to pay cash dividends.

We have never paid cash dividends on our ordinary shares and do not anticipate paying cash dividends in the foreseeable future. According to the Israeli Companies Law, dividends may only be paid out of profits legally available for distribution and provided that there is no reasonable concern that such payment will prevent us from satisfying our existing and foreseeable obligations as they become due. The payment of dividends will depend on earnings, financial condition, debt covenants in place, and other business and economic factors affecting us at such time as our board of directors may consider relevant. If we do not pay dividends, our ordinary shares may be less valuable because a return on your investment will only occur if our stock price appreciates.

Risks Related to Our Location and Incorporation in Israel

Political, economic and military instability in Israel may disrupt our operations and negatively affect our business condition, harm our results of operations and adversely affect our share price.

We are incorporated under the laws of, and our principal executive offices and manufacturing and research and development facilities are located in, the State of Israel. As a result, political, economic and military conditions affecting Israel directly influence us. Any major hostilities involving Israel, a full or partial mobilization of the reserve forces of the Israeli army, the interruption or curtailment of trade between Israel and its present trading partners, or a significant downturn in the economic or financial condition of Israel could adversely affect our business, financial condition and results of operations.

Since its establishment in 1948, Israel has been involved in a number of armed conflicts with its Arab neighbors and a state of hostility, varying from time to time in intensity and degree, has continued into 2013. Also, since 2011, riots and uprisings in several countries in the Middle East and neighboring regions have led to severe political instability in several neighboring states and to a decline in the regional security situation. Such instability may affect the local and global economy, could negatively affect business conditions and, therefore, could adversely affect our operations. In addition, Iran has threatened to attack Israel and is widely believed to be developing nuclear weapons. Iran is also believed to have a strong influence among extremist groups in areas that neighbor Israel, such as Hamas in Gaza and Hezbollah in Lebanon. To date, these matters have not had any material effect on our business and results of operations; however, the regional security situation and worldwide perceptions of it are outside our control and there can be no assurance that these matters will not negatively affect us in the future.

Furthermore, we could be adversely affected by the interruption or reduction of trade between Israel and its trading partners. Some countries, companies and organizations continue to participate in a boycott of Israeli companies and others doing business with Israel or with Israeli companies. As a result, we are precluded from marketing our products to these countries, companies and organizations. Foreign government defense export policies towards Israel could also make it more difficult for us to obtain the export authorizations necessary for our activities. Also, over the past several years, there have been calls, in Europe and elsewhere, to reduce trade with Israel. Restrictive laws, policies or practices directed towards Israel or Israeli businesses may have an adverse impact on our operations, our financial results or the expansion of our business.

Our financial results may be adversely affected by inflation and currency fluctuations.

We report our financial results in dollars, while a portion of our expenses, primarily salaries, are paid in NIS. Therefore, our NIS related costs, as expressed in U.S. dollars, are influenced by the exchange rate between the U.S. dollar and the NIS. The appreciation of the NIS against the U.S. dollar will result in an increase in the U.S. dollar cost of our NIS expenses. We are also influenced by the timing of, and the extent to which, any increase in the rate of inflation in Israel over the rate of inflation in the United States is not offset by the devaluation of the NIS in relation to the dollar. Our dollar costs in Israel will increase if inflation in Israel exceeds the devaluation of the NIS against the dollar or if the timing of such devaluation lags behind inflation in Israel. In the past, the NIS exchange rate with the dollar and other foreign currencies had fluctuated, generally reflecting inflation rate differentials. We cannot predict any future trends in the rate of inflation in Israel or the rate of devaluation or appreciation of the NIS against the dollar. If the dollar cost of our operations in Israel increases, our dollar measured results of operations will be adversely affected. From time to time, we engage in currency-hedging transactions intended to reduce the effect of fluctuations in foreign currency exchange rates on our financial position and results of operations. However, any such hedging transaction may not materially reduce the effect of fluctuations in foreign currency exchange rates on such results.

Our operations could be disrupted as a result of the obligation of management or key personnel to perform military service in Israel.

Generally, all nonexempt male adult citizens and permanent residents of Israel under the age of 40, or older for reserves officers or citizens with certain occupations, as well as certain female adult citizens and permanent residents of Israel, are obligated to perform annual military reserve duty and are subject to being called for active duty at any time under emergency circumstances. While we have operated effectively under these requirements since our incorporation, we cannot predict the full impact of such conditions on us in the future, particularly if emergency circumstances occur. If many of our employees are called for active duty, our operations in Israel and our business, operating results and financial condition may be adversely affected.

Your rights and responsibilities as a shareholder will be governed by Israeli law and differ in some respects from the rights and responsibilities of shareholders under U.S. law.

We are incorporated under Israeli law. The rights and responsibilities of holders of our ordinary shares are governed by our Memorandum of Association and Articles of Association and by Israeli law. These rights and responsibilities differ in some respects from the rights and responsibilities of shareholders in typical U.S. corporations. In particular, a shareholder of an Israeli company has a duty to act in good faith and customary manner in exercising his or her rights and fulfilling his or her obligations toward the company and other shareholders, and to refrain from misusing his power, including, among other things, when voting at the general meeting of shareholders on certain matters. Israeli law provides that these duties are applicable to shareholder votes on, among other things, amendments to a company’s articles of association, increases in a company’s authorized share capital and mergers and interested party transactions requiring shareholder approval. A shareholder also has a general duty to refrain from exploiting any other shareholder of his or her rights as a shareholder. In addition, a controlling shareholder of an Israeli company or a shareholder who knows that it possesses the power to determine the outcome of a shareholder vote or who, under our Articles of Association, has the power to appoint or prevent the appointment of a director or executive officer in the company, has a duty of fairness toward the company. Israeli law does not define the substance of this duty of fairness, but provides that remedies generally available upon a breach of contract will apply also in the event of a breach of the duty to act with fairness. Because Israeli corporate law has undergone extensive revision in recent years, there is little case law available to assist in understanding the implications of these provisions that govern shareholder behavior.

Provisions of Israeli law may delay, prevent or otherwise encumber a merger with or an acquisition of our company, which could prevent a change of control, even when the terms of such transaction are favorable to us and our shareholders.

Israeli corporate law regulates mergers, requires tender offers for acquisitions of shares above specified thresholds, requires special approvals for transactions involving directors, officers or significant shareholders and regulates other matters that may be relevant to these types of transactions. Furthermore, Israeli tax considerations may make potential transactions unappealing to us or to some of our shareholders whose country of residence does not have a tax treaty with Israel exempting such shareholders from Israeli tax. These provisions of Israeli law could delay, prevent or impede a merger with or an acquisition of our company, which could prevent a change of control, even when the terms of such transaction are favorable to us and our shareholders and therefore potentially depress the price of our shares.

Our shareholders may face difficulties in the enforcement of civil liabilities against us and our officers and directors and Israeli auditors or in asserting U.S. securities law claims in Israel.