Registration No. 333-115998

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

AMENDMENT NO. 2

TO

FORM S-11

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Orange Hospitality, Inc.

(Exact name of Registrant as Specified in Its Governing Instruments)

1775 Broadway, Suite 604

New York, New York, 10019

(212) 247-4590, ext. 12

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Mr. Jeffrey S. Davidson

1775 Broadway, Suite 604

New York, New York, 10019

(212) 247-4590, ext. 12

(Name, Address, Including Zip Code and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

Jeffrey E. Jordan, Esq.

Arent Fox PLLC

1050 Connecticut Avenue, NW

Washington, DC 20036

(202) 857-6473

Approximate date of commencement of proposed sale to the public: As soon as practicable after the registration statement becomes effective.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earliest effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. ¨

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED AUGUST 27, 2004

Preliminary prospectus

Orange Hospitality, Inc.

23,403,510 Shares of Common Stock, $350,000,000 Maximum Offering

1,403,510 Shares of Common Stock, $20,000,000 Minimum Offering

Minimum Purchase—$5,000, or $2,000 for IRAs and Keogh and Pension Plans

Of the 23,403,510 shares of common stock that we have registered, we are offering 23,153,510 shares to investors who meet our suitability standards and up to 250,000 shares to participants in our reinvestment plan.

We intend to qualify and operate as a real estate investment trust for federal income tax purposes. Depending upon the date of the first closing on this offering, we anticipate first electing REIT status for our fiscal year ending December 31, 2004 or December 31, 2005.

See “Risk Factors” beginning on page 12 for a discussion of material risks that you should consider before you invest in the common stock being sold by this prospectus, including:

| | • | This is a “blind pool” offering and, therefore, you will not have an opportunity to evaluate our properties before you invest. |

| | • | We will rely on Orange Advisors, LLC with respect to all investment decisions. Orange Advisors, LLC is controlled by our Chairman, CFO/Treasurer and Director, Mr. Brad Honigfeld, and our President, CEO and Director, Mr. Jeffrey S. Davidson, and will receive substantial fees in connection with our organization and operation. |

| | • | We estimate that up to 6% of the proceeds from the sale of shares, between $1.2 million and $14.6 million, will be paid to our advisor and its affiliates for services and as reimbursement for offering and acquisition related expenses incurred on our behalf. |

| | • | We may incur debt totaling up to 100% of the value of our net assets. Such debt may reduce the return on our assets and the cash available for distributions to stockholders. |

| | • | If our properties do not generate sufficient revenue to meet expenses, our cash flow and our ability to make distributions to stockholders may be adversely affected. |

| | • | If we were to fail to qualify as a REIT, we would be subject to federal income tax on our taxable income at regular corporate rates, which would reduce our ability to make distributions to our stockholders. |

| | • | Because we must annually distribute at least 90% of our taxable income, excluding net capital gains, to qualify as a REIT, our ability to use income or cash flow from operations to finance our growth and acquisition activities may be limited. |

| | • | Ownership and transferability of our shares are subject to limitations intended to preserve our status as a REIT. Redemption of our shares will be at our sole option. |

| | • | There is no public trading market for our shares, and there is no assurance that one will develop. We have no current plan to seek the listing of our shares on any securities market. Therefore, you may not be able to sell your shares at a price equal to or greater than the offering price. |

| | | | | | | | | |

| | | Price to Public

| | Commissions & Marketing Allowance

| | Proceeds to Orange

Hospitality, Inc.

|

Per share(1) | | $ | 14.25 | | $ | 1.2825 | | $ | 12.9675 |

Total Minimum Offering | | $ | 20,000,000 | | $ | 1,800,000 | | $ | 18,200,000 |

Total Maximum Offering | | $ | 350,000,000 | | $ | 31,500,000 | | $ | 318,500,000 |

| (1) | Once the minimum offering of 1,403,510 shares is completed, the per share offering price will increase to $15, the selling commission and marketing allowance per share will be $1.35, and the proceeds per share to Orange Hospitality, Inc. will be $13.65. |

| | • | The managing dealer is Bergen Capital Incorporated. The managing dealer is not required to sell any specific number or dollar amount of shares but will use its best efforts to sell the shares. |

| | • | Prior to closing, all funds received from investors will be deposited into an interest-bearing escrow account with Wachovia Bank, NA. |

| | • | This offering will end no later than September , 2005, unless we elect to extend it to a date no later than March , 2007 in states that permit us to make this extension. If the minimum offering of shares is not sold by September , 2005, the offering will terminate and all funds deposited by investors into the interest-bearing account will be promptly refunded in full, with interest. |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The Attorney General of the State of New York has not passed on or endorsed the merits of this offering. Any representation to the contrary is a criminal offense.

No one is authorized to make any statements about the offering different from those that appear in this prospectus. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted. We will only accept subscriptions from people who meet the suitability standards described in this prospectus. You should also be aware that the description of Orange Hospitality, Inc. contained in this prospectus was accurate on September , 2004 but may no longer be accurate. We will amend or supplement this prospectus if there is a material change in our affairs.

The use of forecasts in this offering is prohibited. Any representation to the contrary and any predictions, written or oral, as to the amount or certainty of any present or future cash benefit or tax consequences which may flow from an investment in this program is not permitted.

September , 2004

SUITABILITY STANDARDS AND HOW TO SUBSCRIBE

Suitability Standards

The shares of common stock offered through this prospectus are suitable only as a long-term investment for persons of adequate financial means who have no need for liquidity in this investment. Initially, there is not expected to be any public market for the shares, which means that it may be difficult to sell shares. See the “Summary of the Articles of Incorporation and Bylaws—Restriction on Ownership” for a description of the transfer requirements. As a result, we have established suitability standards which require investors to have either:

| | • | a net worth (not including home, furnishings, and personal automobiles) of at least $50,000 and an annual gross income of at least $50,000, or |

| | • | a net worth (not including home, furnishings, and personal automobiles) of at least $150,000. Our suitability standards also require that a potential investor (i) can reasonably benefit from an investment in Orange Hospitality based on such investor’s overall investment objectives and portfolio structuring; (ii) is able to bear the economic risk of the investment based on the prospective stockholder’s overall financial situation; and (iii) has apparent understanding of (a) the fundamental risks of the investment, (b) the risk that such investor may lose the entire investment, (c) the lack of liquidity of our shares, (d) the background and qualifications of the advisor, and (e) the tax consequences of the investment. |

New Hampshire, North Carolina, and Pennsylvania have established suitability standards different from those established by us, and shares will be sold only to investors in those states who meet the special suitability standards set forth below.

New Hampshire—The investor has either (i) a net worth (not including home, furnishings, and personal automobiles) of at least $125,000 and an annual gross income of at least $50,000, or (ii) a net worth (not including home, furnishings, and personal automobiles) of at least $250,000.

North Carolina—The investor has either (i) a net worth (not including home, furnishings, and personal automobiles) of at least $60,000 and an annual gross income of at least $60,000, or (ii) a net worth (not including home, furnishings, and personal automobiles) of at least $225,000.

Pennsylvania—The investor has (i) a net worth (not including home, furnishings, and personal automobiles) of at least ten times the investor’s investment in Orange Hospitality; and (ii) either (a) a net worth (not including home, furnishings, and personal automobiles) of at least $50,000 and an annual gross income of at least $50,000, or (b) a net worth (not including home, furnishings, and personal automobiles) of at least $150,000.

Pennsylvania Investors: Because the minimum offering is less than $25,000,000, you are cautioned to carefully evaluate the program’s ability to fully accomplish its stated objectives and to inquire as to the current dollar volume of program subscriptions.

Pursuant to the requirements of the Commissioner of Securities of the State of Pennsylvania, we will not solicit or accept subscriptions from Pennsylvania residents until after subscriptions for shares totaling at least $20,000,000 have been received and the first closing has been completed.

The foregoing suitability standards must be met by the investor who purchases the shares. If the investment is being made for a fiduciary account (such as an IRA, Keogh Plan, or corporate pension or profit-sharing plan), the beneficiary, the fiduciary account, or any donor or grantor that is the fiduciary of the account who directly or indirectly supplies the investment funds must meet such suitability standards.

In addition, under the laws of certain states, investors may transfer their shares only to persons who meet similar standards, and we may require certain assurances that such standards are met. Investors should read carefully the requirements in connection with resales of shares as set forth in the articles of incorporation and as summarized under “Summary of the Articles of Incorporation and Bylaws—Restriction on Ownership.” Stockholders who are residents of New York may not transfer fewer than 250 shares at any time.

i

In purchasing shares, custodians or trustees of employee pension benefit plans or IRAs may be subject to the fiduciary duties imposed by the Employee Retirement Income Security Act of 1974 (“ERISA”) or other applicable laws and to the prohibited transaction rules prescribed by ERISA and related provisions of the Internal Revenue Code. See “The Offering—ERISA Considerations.” In addition, prior to purchasing shares, the trustee or custodian of an employee pension benefit plan or an IRA should determine that such an investment would be permissible under the governing instruments of such plan or account and applicable law. For information regarding “unrelated business taxable income,” see “Federal Income Tax Consequences—Taxation of Stockholders—Tax-Exempt Stockholders.”

In order to ensure adherence to the suitability standards described above, requisite suitability standards must be met, as set forth in the subscription agreement in the form attached hereto as Appendix B. In addition, soliciting dealers, broker-dealers that are members of the National Association of Securities Dealers, Inc. or other entities exempt from broker-dealer registration, who are engaged by the managing dealer to sell shares, have the responsibility to make reasonable efforts to determine that the purchase of shares is a suitable and appropriate investment for an investor. In making this determination, the soliciting dealers will rely on relevant information provided by the investor, including information as to the investor’s age, investment objectives, investment experience, income, net worth, financial situation, other investments and any other pertinent information. See “The Offering—Subscription Procedures.” Executed subscription agreements will be maintained in Orange Hospitality’s records for six years.

How to Subscribe

An investor who meets the suitability standards described above may subscribe for shares by completing and executing the subscription agreement and delivering it to a soliciting dealers, together with a check for the full purchase price of the shares subscribed for, payable to “Wachovia Bank, NA, Escrow Agent.” See “The Offering—Subscription Procedures.” Certain soliciting dealers who have “net capital,” as defined in the applicable federal securities regulations, of $250,000 or more may instruct their customers to make their checks for shares subscribed for payable directly to the soliciting dealer. Care should be taken to ensure that the subscription agreement is filled out correctly and completely. Partnerships, individual fiduciaries signing on behalf of trusts, estates and in other capacities, and persons signing on behalf of corporations and corporate trustees may be required to obtain additional documents from soliciting dealers. We may reject any subscription in whole or in part, regardless of whether the subscriber meets the minimum suitability standards.

Certain soliciting dealers may permit investors who meet the suitability standards described above to subscribe for shares by telephonic order to the soliciting dealer. This procedure may not be available in certain states. See “The Offering—Subscription Procedures” and “The Offering—The Plan of Distribution.”

A minimum investment of $5,000 is required. IRAs, Keogh plans and pension plans must make a minimum investment of at least $2,000.

ii

TABLE OF CONTENTS

iii

iv

v

vi

QUESTIONS AND ANSWERS ABOUT

ORANGE HOSPITALITY, INC.’S PUBLIC OFFERING

| Q: | | WHAT IS ORANGE HOSPITALITY, INC.? |

| A: | Orange Hospitality, Inc., which we refer to as Orange Hospitality, is a corporation organized under the laws of the State of Maryland and intended to qualify as a real estate investment trust, or a REIT, primarily to acquire interests in limited service, extended stay and other hotel properties. Depending upon the date of the first closing on this offering, we anticipate first electing REIT status for our fiscal year ending December 31, 2004 or December 31, 2005. Orange Hospitality intends to lease these properties on a triple-net basis to its taxable REIT subsidiary with management of the properties performed by third-party hotel operators. In addition, Orange Hospitality may invest up to a maximum of 5% of total assets in equity interests in businesses that provide services to or are otherwise ancillary to the lodging industry, such as hotel management, hotel supply and hotel development, and specifically relate to our properties. |

| A: | In general, a REIT is a company that: |

| | • | combines the capital of many investors to acquire real estate, |

| | • | offers benefits of a diversified portfolio under professional management, |

| | • | typically is not subject to federal corporate income taxes on its net income, provided certain income tax requirements are satisfied. This treatment substantially eliminates the “double taxation” (taxation at both the corporate and stockholder levels) that generally results from investments in a corporation, and |

| | • | must pay distributions to investors of at least 90% of its taxable income. |

| Q: | | WHAT KIND OF OFFERING IS THIS? |

| A: | We are offering up to 23,403,510 shares of common stock on a “best efforts” basis. |

| Q: | HOW DOES A “BEST EFFORTS” OFFERING WORK? |

| A: | When shares are offered to the public on a “best efforts” basis, we are not guaranteeing that any minimum number of shares will be sold. If you choose to purchase stock in this offering, you will fill out a subscription agreement, like the one attached to this prospectus as Appendix B, and pay for the shares at the time you subscribe. The purchase price will be placed into escrow with Wachovia Bank, NA. Wachovia Bank, NA will hold your funds, along with those of other subscribers, in an interest-bearing account until such time as you are admitted by Orange Hospitality as a stockholder. Generally, we will admit stockholders no later than the last day of the calendar month following acceptance of their subscription. If the minimum offering of shares is not sold by September 2005, the offering will terminate and all funds deposited by investors into the interest-bearing account will be promptly refunded in full, with interest. |

| Q: | | HOW LONG WILL THE OFFERING LAST? |

| A: | This offering will not last beyond September , 2005 unless we decide to extend the offering until not later than March , 2007, in any state that allows us to extend the offering. If the minimum offering of shares is not sold by September , 2005, the offering will terminate and all funds deposited by investors into the interest-bearing escrow account will be promptly refunded in full, with interest. |

| A: | Anyone who receives this prospectus can buy shares provided that they have a net worth (not including home, furnishings and personal automobiles) of at least $50,000 and annual gross income of at least $50,000; or, a net worth (not including home, furnishings and personal automobiles) of at least $150,000. However, these minimum levels may vary from state to state, so you should carefully read the more detailed description in the “Suitability Standards and How to Subscribe” section of this prospectus. |

1

| Q: | | IS THERE ANY MINIMUM REQUIRED INVESTMENT? |

| A: | Yes. Generally, individuals must initially invest at least $5,000 and IRA, Keogh or other qualified plans must initially invest at least $2,000. However, these minimum investment levels may vary from state to state, so you should carefully read the more detailed description of the minimum investment requirements appearing later in the “Suitability Standards and How to Subscribe” section of this prospectus. |

| Q: | | AFTER I SUBSCRIBE FOR SHARES, CAN I CHANGE MY MIND AND WITHDRAW MY MONEY? |

| A: | If you have subscribed for shares and deposited the subscription price with Wachovia Bank, NA, but your subscription has not yet been accepted, you may revoke your subscription upon five days notice to Wachovia Bank, NA. The procedure is described in more detail in the “The Offering—The Plan of Distribution” section of this prospectus. |

| Q: | | IF I BUY SHARES IN THE OFFERING, HOW CAN I SELL THEM? |

| A: | At the time you purchase shares, they will not be listed for trading on any national securities exchange or on any over-the-counter market. In fact, we expect that there will not be any public market for the shares when you purchase them, and we cannot be sure if one will ever develop. As a result, you may find that if you wish to sell your shares, you may not be able to do so promptly or at a price equal to or greater than the offering price. |

We anticipate selling our properties and other assets or listing our shares on a national securities exchange or on the Nasdaq stock market within five to ten years after commencement of this offering, if market conditions are favorable. Listing does not assure liquidity. If we have not listed the shares on a national securities exchange or on the Nasdaq stock market by December 31, 2014, we will commence an orderly liquidation of our properties and other assets and return the net proceeds from the liquidation to our stockholders through distributions. Beginning one year after you purchase your shares from Orange Hospitality, you may ask us to consider redeeming at least 25% of the shares you own. The redemption procedures are described in the “Redemption of Shares” section of this prospectus. As a result, if a public market for the shares never develops, you may be able to redeem your shares through the redemption plan beginning one year from the date on which you purchased your shares, provided we have sufficient funds available. If we have not listed and we liquidate our assets, you will receive proceeds through the liquidation process. If we list the shares, we expect that you will be able to sell your shares in the same manner as other listed stocks.

| Q: | WHO CAN HELP ANSWER OTHER QUESTIONS? |

| A: | If you have more questions about the offering or if you would like additional copies of this prospectus, you should contact your registered representative or: |

Bergen Capital Incorporated

Heights Plaza

777 Terrace Avenue, 6th floor

Hasbrouck Heights, New Jersey 07604

2

PROSPECTUS SUMMARY

This summary highlights the material terms in this prospectus. Because this is a summary, it may not contain all of the information important to you. Accordingly, you should read this entire prospectus carefully, including the documents attached as appendices, before you decide to invest in shares of our common stock.

ORANGE HOSPITALITY, INC

Orange Hospitality, Inc., which we refer to as “Orange Hospitality,” is a Maryland corporation which intends to qualify and operate for federal income tax purposes as a REIT. Depending upon the date of the first closing on this offering, we anticipate first electing REIT status for our fiscal year ending December 31, 2004 or December 31, 2005. Our address is 1775 Broadway, Suite 604, New York, New York, 10019 and our telephone number is (212) 247-4590, ext. 12.

OUR BUSINESS

We intend to invest the proceeds of this offering primarily in limited service, extended stay and other hotel properties, to be leased principally to a subsidiary of Orange Hospitality with management of the properties performed by third-party hotel brand operators, generally located across the United States. We may invest directly in such properties or indirectly through the acquisition of interests in entities which own hotel properties or interests therein. In addition, we may invest up to a maximum of 5% of total assets in equity interests in businesses that provide services to or are otherwise ancillary to the lodging industry, such as hotel management, hotel supply and hotel development, and specifically relate to our properties. Please read the section of this prospectus under the caption “Business” for a description of the types of properties that may be selected by our advisor, Orange Advisors, LLC, the property selection and acquisition processes and the option we hold to purchase up to five hotel properties currently under development.

Under our articles of incorporation, Orange Hospitality will automatically terminate and dissolve on December 31, 2014 unless the shares of common stock of Orange Hospitality, including the shares offered by this prospectus, are listed on a national securities exchange or on the Nasdaq stock market before that date. If the shares are listed, Orange Hospitality automatically will become a perpetual life entity. If we are not listed by December 31, 2014, we will commence an orderly liquidation of our assets, distribute the net sales proceeds to stockholders and limit our activities to those related to Orange Hospitality’s orderly liquidation, unless the stockholders owning a majority of the shares elect to amend the articles of incorporation to extend the duration of Orange Hospitality.

We may borrow money to acquire properties, pay related fees and for other purposes, and we expect to encumber properties in connection with any such borrowing. We anticipate that the aggregate amount of this financing generally will not exceed 40% of our total assets. However, our articles of incorporation limit the maximum amount of borrowing to 100% of our net assets in the absence of a satisfactory showing that a higher level of borrowing is appropriate. “Net assets” means our total tangible assets valued at cost, before deducting depreciation or other non-cash reserves, less our total liabilities. In order to borrow an amount in excess of 100% of our net assets, a majority of our independent directors must approve the borrowing, and the borrowing will be disclosed and explained to stockholders in our first quarterly report after such approval occurs. Neither our articles of incorporation nor our investment policies limit the amount we may borrow in connection with the acquisition of a single property.

We will depreciate property and equipment on the straight-line method over their estimated useful lives for financial reporting purposes.

RISK FACTORS

An investment in Orange Hospitality is subject to significant risks. We summarize some of the more important risks below. A more detailed list of the risk factors is found in the “Risk Factors” section, which begins on page 12. You should read and understand all of the risk factors before making your decision to invest.

| | • | We have not yet acquired or identified properties for acquisition, except for certain properties subject to an option we hold from affiliates. As a result, you will not have the opportunity to evaluate any of the properties that will be in our portfolio. |

3

| | • | We do not anticipate that there will be a public market for our shares in the near term. Therefore, if you wish to sell your shares, you may not be able to do so promptly or at a price equal to or greater than the offering price. |

| | • | We have no immediate plans to list or apply for listing of our shares. We do not know if we will ever apply to list our shares, or if we do apply for listing, when such application would be made or whether it would be accepted. |

| | • | We will rely on the advisor, Orange Advisors, LLC, which, subject to approval by the board of directors, will have responsibility for the management of Orange Hospitality and our investments. Our advisor is newly formed, which could adversely affect our business. Orange Advisors, LLC is controlled by our chairman, chief financial officer/treasurer and director, Mr. Brad Honigfeld, and our president, chief executive officer and director, Mr. Jeffrey S. Davidson, and will receive substantial fees in connection with organizing and operating Orange Hospitality. |

| | • | Our advisor has no prior performance history for managing an investment entity like Orange Hospitality. In addition, our advisor lacks experience with respect to managing real estate investment trusts. Even though the officers and managers of the advisor have significant real estate experience, due to their inexperience with real estate investment trusts, you cannot be sure how Orange Hospitality will be operated, whether it will achieve its objectives or how it will perform financially. |

| | • | The advisor and its affiliates are or will be engaged in other activities that may result in conflicts of interest with the services that the advisor and affiliates will provide to us. |

| | • | Mr. Honigfeld expects to spend 75% or more of his time on other activities and, as a result, there may be instances when he may not be able to provide assistance to us. This may adversely affect us and our operations. |

| | • | Market and economic conditions that we cannot control will affect the value of our investments. |

| | • | We cannot predict the amount of revenues we will receive from hotel operations or from tenants. |

| | • | If our hotel managers or tenants default, we will have less income with which to make distributions. |

| | • | If our shares are not listed on a national securities exchange or on the Nasdaq stock market by December 31, 2014, we will commence an orderly liquidation of our assets and distribute the proceeds. |

| | • | If we do not obtain financing, we will not be able to acquire as many properties, which could limit diversification of our investments. |

| | • | We may incur debt totaling up to 100% of the value of our net assets. Such debt may reduce the return on our assets and the cash available for distributions to our stockholders. In connection with any borrowing, we may pledge our assets, which would put us at risk of losing the assets if we are unable to pay our debts. |

| | • | We may incur debt, including debt to make distributions to stockholders, in order to maintain our status as a REIT. |

| | • | The vote of stockholders owning a majority of the outstanding shares of common stock will bind all of the stockholders as to matters such as the amendment of our governing documents. The holders of a majority of the common stock present at a meeting at which a quorum is present may bind all of the stockholders as to the election of directors. |

| | • | Ownership and transferability of our shares are subject to limitations intended to preserve our status as a REIT. Redemption of our shares will be at our sole option. |

| | • | Restrictions on ownership of more than 9.8% of the shares of common stock by any single stockholder or certain related stockholders may have the effect of inhibiting a change in control of Orange Hospitality, even if such a change is in the interest of a majority of the stockholders. |

4

| | • | If we were to fail to qualify as a REIT or do not remain qualified as a REIT for federal income tax purposes, we would be subject to federal income tax on our taxable income at regular corporate rates, thereby reducing the amount of funds available to us to pay distributions to you as a stockholder. |

| | • | Because we must annually distribute at least 90% of our taxable income, excluding net capital gains, to qualify as a REIT, our ability to use income or cash flow from operations to finance our growth and acquisition activities may be limited. |

OUR REIT STATUS

Based upon our intention to qualify as a REIT, we generally will not be subject to federal income tax on income that we distribute to our stockholders. Under the Internal Revenue Code of 1986, as amended, REITs are subject to numerous organizational and operational requirements, including a requirement that they distribute at least 90% of their taxable income, as figured on an annual basis. If we fail to qualify for taxation as a REIT in any year, our income will be taxed at regular corporate rates, and we may not be able to qualify for treatment as a REIT for that year and the next four years. Even if we qualify as a REIT for federal income tax purposes, we may be subject to some federal, state and local taxes on some of our income and property and to federal income and excise taxes on our undistributed income.

5

OUR MANAGEMENT AND CONFLICTS OF INTEREST

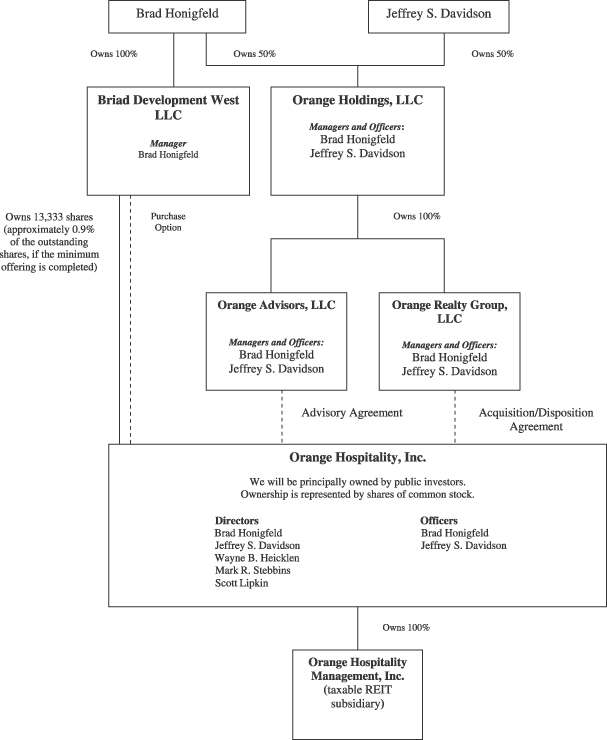

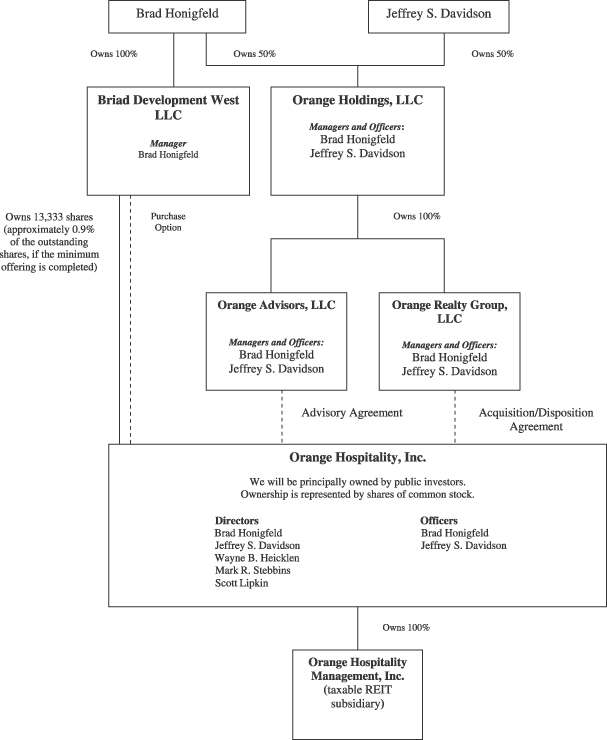

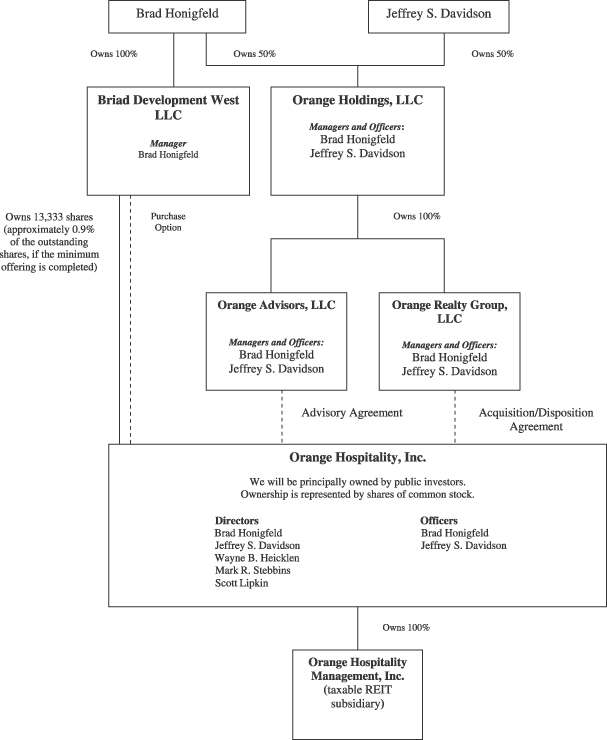

We will be subject to various conflicts of interest arising out of our relationship to our advisor and its affiliates, as described below. The following chart indicates the relationship between Orange Hospitality and Orange Advisors, LLC and Orange Realty Group, LLC, which will provide services to Orange Hospitality.

6

Our board of directors oversee the management of Orange Hospitality and its relationships with Orange Advisors, LLC and Orange Realty Group, LLC. The majority of the directors are independent of the advisor and have responsibility for reviewing its performance. The directors are elected annually to the board of directors by the stockholders.

Mr. Jeffrey Davidson, our president, chief executive officer and director, and Mr. Brad Honigfeld, our chairman, chief financial officer/treasurer and director, are the officers and mangers of our advisor. Our advisor and its affiliates will receive substantial fees in connection with organizing and operating Orange Hospitality, Inc. Please read the section of this prospectus summary under the caption “ Management Compensation” and the sections of this prospectus under the captions “Our Advisor and Our Advisory Agreement—Our Advisory Agreement” and “Orange Realty Group and the Property Acquisition/Disposition Agreement” for more information about fees that we may pay to our advisor and its affiliates.

Our advisor has responsibility for

| | • | selecting the properties that we will acquire, formulating and evaluating the terms of each proposed acquisition and arranging for the acquisition of the property by Orange Hospitality, |

| | • | identifying potential managers or tenants for the properties and formulating, evaluating and negotiating the terms of each management or lease agreement of a property, and |

| | • | negotiating the terms of any borrowing by Orange Hospitality, including any long-term financing. |

All of our advisor’s actions relating to Orange Hospitality are subject to approval by the board of directors. Our advisor also has the authority, subject to approval by a majority of the board of directors, including a majority of the independent directors, to select assets for sale by Orange Hospitality in keeping with Orange Hospitality’s investment objectives and based on an analysis of economic conditions both nationally and in the vicinity of the assets being considered for sale.

Our chairman and our chief executive officer have over 33 years of experience in investing in real estate and developing businesses. The majority of our directors have extensive experience in investing in hotels or other types of real estate. However, neither our officers nor our directors have any experience operating a REIT. Please read the sections of this prospectus under the captions “Management” and “Our Advisor and Our Advisory Agreement” for a description of the business background of the individuals responsible for the management of Orange Hospitality and our advisor, as well as for a description of the services our advisor will provide.

Mr. Honigfeld, who is our chairman, chief financial officer/treasurer and director and also an officer and manager of our advisor, may experience conflicts of interest in his management of Orange Hospitality. These arise principally from his involvement in other activities that may conflict with our business and interests, including matters related to

| | • | allocation of new investments and management time and services between us and various other entities, |

| | • | the timing and terms of the investment in or sale of an asset, |

| | • | development of our properties by affiliates, |

| | • | investments with affiliates of our advisor and |

| | • | compensation to our advisor. |

The “Conflicts of Interest” section of this prospectus discusses in more detail the more significant of these potential conflicts of interest, as well as the procedures that have been established to resolve a number of these potential conflicts.

OUR INVESTMENT OBJECTIVES

Our primary investment objectives are to preserve, protect and enhance our assets, while:

| | • | obtaining current income, |

| | • | making monthly distributions, |

| | • | becoming and remaining qualified as a REIT for federal income tax purposes, and |

| | • | providing you with liquidity for your investment within 10 years after commencement of this offering, either through listing our shares on a national securities exchange or on the Nasdaq stock market or, if |

7

| | listing does not occur by December 31, 2014, commencing the orderly liquidation of our assets and distributing the proceeds. |

Please read the sections of this prospectus under the captions “Business—General,” “Business—Selection and Acquisition of Properties,” “Business—Description of Property Leases” and “Investment Objectives and Policies” for a more complete description of the manner in which the structure of our business facilitates our ability to meet our investment objectives.

MANAGEMENT COMPENSATION

We will pay Orange Advisors, LLC, Orange Realty Group, LLC and their affiliates compensation for services they will perform for us. We will also reimburse them for expenses they pay on our behalf. The following paragraphs summarize the more significant items of compensation and reimbursement. See “Management Compensation” for a complete description.

Offering Stage

Organizational and offering expenses—We will reimburse Briad Development West LLC, an affiliate of the advisor, for organization and offering expenses incurred on our behalf. The amount to be advanced and reimbursed is not determinable at this time. We estimate our total organizational expenses to be $400,000 if the minimum of 1,403,510 shares is sold and $550,000 if the maximum of 23.4 million shares is sold. Expenses paid by Orange Hospitality in connection with formation of the Company, together with all selling commissions and the marketing allowance incurred by the Company, will not exceed fifteen percent of the proceeds raised in connection with this offering.

Acquisition Stage

Acquisition fee—We will pay Orange Realty Group, LLC a fee of up to 3.5% of our total proceeds for services in the selection, purchase, development or construction of real property. We define “total proceeds” to be the sum of the gross proceeds of this offering and any proceeds from financing we obtain to acquire assets and pay related acquisition expenses. In connection with each closing under this offering, we will pay a fee of up to 3.5% of the gross proceeds we receive upon that closing, and in connection with each acquisition loan closing, we will pay a fee of up to 3.5% of the gross proceeds of that loan. We cannot determine the total amount of the acquisition fee at this time. We would pay $700,000 if the minimum offering of 1,403,510 shares is sold and $12.25 million if the maximum offering of 23.4 million shares is sold, plus, in each case, 3.5% of the gross proceeds of each acquisition loan.

Operational Stage

Asset management fee—We will pay Orange Advisors, LLC a monthly asset management fee equal to 10% of our REIT operating expenses paid during the month. We will also reimburse our advisor for all of the costs and expenses paid or incurred by the advisor which in any way relate to the operation of Orange Hospitality or to Orange Hospitality’s business (excluding the operation of the taxable REIT subsidiary). We will not reimburse the advisor at the end of any quarter for REIT operating expenses that, in the four consecutive quarters then ended, exceed the greater of 2% of our average invested assets or 25% of our net income for such four quarters (the “2%/25% Guidelines”), unless a majority of the independent directors shall have made a finding that, based upon such unusual and non-recurring factors which they deem sufficient, a higher level of REIT operating expenses is justified. Within 60 days after the end of any fiscal quarter of Orange Hospitality for which total REIT operating expenses for the expense year exceed the 2%/25% Guidelines and the independent directors do not make such a finding, the advisor will be required to reimburse Orange Hospitality the amount by which the total REIT operating expenses paid or incurred by Orange Hospitality exceed the 2%/25% Guidelines. Average invested assets means, for any period, the average of the aggregate book value of the assets invested

8

before reserves for deprecation or similar non-cash reserves at the end of each month during such period. REIT operating expenses generally mean expenses which relate to our operations of business, excluding the operations of our taxable REIT subsidiary and excluding some non-operational expenses, such as organizational and offering expenses, interest payments, taxes, non-cash items and certain fees.

Operational or Liquidation Stage

Deferred, subordinated disposition fee—We will pay Orange Realty Group, LLC an amount equal to the lesser of one-half of a competitive real estate commission or 3% of the sales price of properties sold.

Deferred, subordinated share of net sales proceeds from the sale of assets—We will pay Orange Advisors, LLC a deferred, subordinated share from sales of assets equal to 10% of net sales proceeds remaining after receipt by the stockholders of distributions equal to the sum of the stockholders’ 8% return and 100% of invested capital. The stockholders’ 8% return, as of each date, means an aggregate amount equal to an 8% cumulative, noncompounded, annual return on invested capital. Invested capital means the total amount invested by stockholders in Orange Hospitality reduced by distributions of net proceeds of the sale of assets and by any amounts paid to repurchase shares. Following (a) listing of our shares on a national securities exchange or on the Nasdaq stock market or (b) the expiration of the advisory agreement without renewal or early termination of the advisory agreement, no share of net sales proceeds will be paid to our advisor.

Subordinated incentive fee—At such time, if any, as our shares are listed on a national securities exchange or on the Nasdaq stock market, we will pay Orange Advisors, LLC a subordinated incentive fee in an amount equal to 10% of the amount by which the market value of Orange Hospitality plus the total distributions made to stockholders from our inception until the date of listing exceeds the sum of their invested capital and the total distributions required to be made to the stockholders in order to pay the stockholders’ 8% return from inception through the date the market value is determined. For purposes of calculating the subordinated incentive fee, the market value of Orange Hospitality shall be the average closing price or average of bid and asked price, as the case may be, over a period of 30 days during which the shares are traded with such period beginning 180 days after listing. The subordinated incentive fee will be reduced by the amount of any prior payment to our advisor of a deferred, subordinated share of net sales proceeds from sales of assets of Orange Hospitality. The subordinated incentive fee will not be payable other than in connection with listing.

Performance fee—Upon expiration without renewal or early termination of the advisory agreement with Orange Advisors, LLC, if listing has not occurred and Orange Advisors has met applicable performance standards, we will pay Orange Advisors, LLC a performance fee equal to 10% of the amount by which the appraised value of our assets on the date of such termination of the advisory agreement, less any indebtedness secured by such assets, plus total distributions paid to stockholders from our inception through such termination date, exceeds the sum of 100% of invested capital plus an amount equal to the stockholders’ 8% return from inception through the termination date. The performance fee will not be payable if the advisory agreement is terminated in connection with listing and the subordinated incentive fee described above is paid.

Please read the section of this prospectus under the caption “Our Advisor and Our Advisory Agreement—Our Advisory Agreement” and “Orange Realty Group and the Property Acquisition/Disposition Agreement” for more information about fees that we may pay to our advisor and its affiliates.

THE OFFERING

Offering Size

Minimum—$20,000,000

Maximum—$350,000,000

9

$346,250,000 of common stock is offered to investors meeting certain suitability standards and up to $3,750,000 of common stock is available to investors who purchased their shares in this offering and who choose to participate in our reinvestment plan.

Briad Development West LLC, an affiliate of Mr. Honigfeld, owns 13,333 shares of our common stock, which it purchased for $200,000 ($15 per share). If the minimum offering is completed, these shares will constitute approximately 0.9% of the outstanding shares.

Minimum Investments

Individuals—$5,000

IRA, Keogh and other qualified plans—$2,000

These amounts apply to most potential investors, but minimum investments may vary from state to state. Please see “The Offering” section, which begins on page 114.

SUITABILITY STANDARDS

Net worth (not including home, furnishings and personal automobiles) of at least $50,000 and annual gross income of at least $50,000; or

Net worth (not including home, furnishings and personal automobiles) of at least $150,000.

Suitability standards may vary from state to state. Please see the “Suitability Standards and How to Subscribe” section, which begins on page i.

DURATION AND LISTING

Anticipated to be within ten years from the commencement of this offering. If the shares are listed on a national securities exchange or on the Nasdaq stock market, Orange Hospitality will become a perpetual life entity, and we will then reinvest proceeds from the sale of assets indefinitely.

DISTRIBUTION POLICY

Consistent with our objective of qualifying as a REIT, we expect to pay monthly distributions and distribute at least 90% of our REIT taxable income. Our cash available for distributions may be less than the 90% of our REIT taxable income, which could require us to borrow funds or sell assets in order to make distributions. To the extent that our distributions exceed our earnings, they constitute a return of capital, rather than a return on investment.

We intend to make monthly distributions commencing with the close of the first full calendar quarter following the closing of the minimum offering.

ORANGE ADVISORS, LLC AND ORANGE REALTY GROUP, LLC

Orange Advisors, LLC will administer the day-to-day operations of Orange Hospitality and select Orange Hospitality’s real estate investments.

Orange Realty Group, LLC will assist us in maintaining a continuing and suitable property investment program.

10

ESTIMATED USE OF PROCEEDS

85%—To acquire hotel properties and make other investments.

6%—To pay fees and expenses to affiliates for their services and as reimbursement of offering and acquisition-related expenses.

9%—To pay selling commissions and marketing allowance to dealers in connection with the offering.

If the minimum of 1,403,510 shares is sold in the offering, we expect to pay up to $1,200,000 in fees and expenses to affiliates and to pay $1,800,000 in brokerage commissions and marketing allowances. If the maximum of 23,403,510 shares is sold in the offering, we expect to pay up to $14,550,000 in fees and expenses to affiliates and to pay $31,500,000 in brokerage commissions and marketing allowances.

OUR REINVESTMENT PLAN

We have adopted a reinvestment plan which will allow stockholders to have the full amount of their distributions reinvested in additional shares that may be available. We have registered 250,000 shares of our common stock for this purpose. Please see the “Summary of Reinvestment Plan” and the “Federal Income Tax Consequences—Taxation of Stockholders” sections and the Form of Reinvestment Plan accompanying this prospectus as Appendix A for more specific information about the reinvestment plan.

TRADEMARKS OF OTHER COMPANIES

This prospectus contains trade names, trademarks and service marks of other companies, including Marriott, Hilton, Starwood, Holiday Inn, Courtyard by Marriott, Residence Inn by Marriott, SpringHill Suites by Marriott, Homewood Suites by Hilton and Hilton Garden Inn. We do not intend our use or display of other parties’ trade names, trademarks or service marks to imply any relationship with, or endorsement or sponsorship of us by, these other parties.

11

RISK FACTORS

An investment in our shares involves significant risks and therefore is suitable only for persons who understand those risks and their consequences and who are able to bear the risk of loss of their investment. You should consider the following risks in addition to other information set forth elsewhere in this prospectus before making your investment decision.

Risks Related to This Offering

This is an unspecified property offering, and therefore you will not have an opportunity to evaluate any of the properties that will be in our portfolio before you decide whether to purchase the shares being offered by this prospectus.

We have not yet acquired or identified properties for acquisition, except for up to five properties currently under development subject to an option we hold from affiliates. We have established certain criteria for evaluating hotel brands, particular properties and the operators of the properties in which we may invest. We have not set fixed minimum standards relating to creditworthiness of managers or tenants, and therefore the board of directors has flexibility in assessing potential managers and tenants. Please read the sections of this prospectus under the captions “Business—Selection and Acquisition of Properties” and “Business—Purchase Option” for a description of the properties subject to the option.

We cannot assure you that we will obtain suitable investments.

We cannot be sure that we will be successful in obtaining suitable investments on financially attractive terms or that, if we make investments, our objectives will be achieved. If we are unable to find suitable investments, our financial condition and ability to pay distributions could be adversely affected.

The price of our shares is subjective and may not bear any relationship to what a stockholder could receive if the shares were resold.

We determined the offering price of our shares in our sole discretion based on the price which we believed investors would pay for the shares, estimated fees to third parties, as well as the fees to be paid to our advisor and its affiliates, the expenses of this offering and the funds we believed should be available to invest in properties and other permitted investments. There is no public market for the shares on which to base market value.

There may be delays in investing the proceeds of this offering.

We may delay investing the proceeds from this offering for up to the later of two years from the initial date of this prospectus or one year after termination of the offering, although we expect to invest substantially all net offering proceeds by the end of that period.

We may delay investing the proceeds from this offering, and therefore delay the receipt of any returns from such investments, due to the inability of our advisor to find suitable properties for investment. Until we invest in properties, our investment returns on offering proceeds will be limited to the rates of return available on short-term, highly liquid investments that provide appropriate safety of principal. We expect these rates of return, which affect the amount of cash available to make distributions to stockholders, to be lower than we would receive for property investments. Further, all net proceeds of this offering must be invested in properties or allocated to working capital reserves within the later of two years after commencement of the offering or one year after termination of the offering. Any net proceeds not invested in properties or allocated to working capital reserves by the end of this time period will be returned to investors.

12

The actual amount of proceeds available for investment in properties is uncertain, and we cannot guarantee that the investors will receive a specific return on their investment.

Although we estimate in this prospectus the net amount of offering proceeds that will be available for investment in properties, the actual amount available for investment may be less. For example, we might deem it necessary to establish a larger than expected reserves to cover liabilities from unexpected lawsuits or governmental regulatory judgments or fines. Any liabilities of this sort, or other unanticipated expenses or debts, would reduce the amount we have available for investment in properties.

Our advisor and its affiliates will receive substantial fees in connection with organizing and operating Orange Hospitality, Inc. Because we will use a portion of the offering price from the sale of shares to pay fees and expenses and the full offering price will not be invested in properties, we will only be able to return all of our stockholders’ invested capital if we sell the properties for a sufficient amount in excess of their original purchase price. We cannot assure you that we will be able to sell our assets so as to return our stockholders’ aggregate invested capital, to generate a profit for the stockholders or to fully satisfy any debt obligations.

If our properties do not generate sufficient revenue to meet operating expenses, our cash flow and our ability to make distributions to stockholders will be adversely affected.

We will be subject to all operating risks common to the hotel business. These risks might adversely affect occupancy or room rates. Increases in operating costs due to inflation and other factors may not necessarily be offset by increased room rates. The local, regional and national hotel markets may limit the extent to which room rates may be increased to meet increased operating expenses without decreasing occupancy rates. While we intend to make monthly distributions to stockholders, there can be no assurance that we will be able to make distributions at any particular time or rate, or at all. Further, there is no assurance that a distribution rate achieved for a particular period will be maintained in the future. Also, while management may establish goals as to particular rates of distribution or have an intention to make distributions at a particular rate, there can be no assurance that such goals or intentions will be realized.

While we will seek generally to make distributions from our operating revenues, we might make distributions (although there is no obligation to do so) in certain circumstances in part from financing proceeds or other sources. While distributions from such sources would result in stockholders receiving cash, the consequences to us would differ from a distribution out of our operating revenues. For example, if financing is the source of a distribution, that financing would have to be repaid, and if proceeds from the offering of shares are distributed, those proceeds would not then be available for other uses, such as property acquisitions or improvements.

The sale of shares by stockholders may be difficult.

Currently there is no public market for the shares, so stockholders may not be able to sell their shares promptly or at a desired price. Therefore, you should consider purchasing the shares as a long-term investment only. Although we anticipate either dissolving or applying for listing on a national securities exchange or on the Nasdaq stock market on or before December 31, 2014, we do not know if we will ever apply to list our shares, or if we do apply for listing, when such application would be made or whether it would be accepted. If our shares are listed, we cannot assure you a public trading market will develop. We cannot assure you that the price you would receive in a sale on a national securities exchange or on the Nasdaq stock market would be representative of the value of the assets we own or that it would equal or exceed the amount you paid for the shares.

Further, our articles of incorporation provide that we will not apply for listing before the completion or termination of this offering. Although we have adopted a redemption plan, we have discretion to not redeem your

13

shares, to suspend the plan and to cease redemptions. Further, the plan has many limitations and should not be relied upon as a method to sell shares promptly or at a desired price. In particular, those limitations include:

| | • | no more than $100,000 of proceeds from the sale of shares pursuant to any offering in any calendar quarter may be used to redeem shares (but the full amount of the proceeds from the sale of shares under the reinvestment plan attributable to any calendar quarter may be used to redeem shares presented for redemption during such quarter and any subsequent quarter), and |

| | • | no more than 5% of the number of shares of our common stock (outstanding at the beginning of any 12-month period) may be redeemed during such 12-month period. |

Some of the compensation to Orange Advisors, LLC and Orange Realty Group, LLC is payable before distributions and, therefore, will tend to reduce the return on our stockholders’ investment.

We will pay Orange Realty Group, LLC a fee of up to 3.5% of the sum of the gross proceeds of this offering and any proceeds from financing in connection with property acquisitions. We will pay, subject to specified limitations, a monthly fee equal to 10% of our REIT operating expenses to Orange Advisors, LLC. The payment of compensation to Orange Advisors, LLC and Orange Realty Group, LLC from proceeds of the offering and operating revenues will reduce the amount of proceeds available for investment in properties or the cash available for distribution, and will therefore tend to reduce the return on our stockholders’ investments. In addition, this compensation is payable prior to distributions and without regard to whether we have sufficient cash for distributions.

Risks Related to Our Business

We have no operating history for you to evaluate.

We have recently been formed, are in the development stage and have no prior performance history. Further, our advisor has no prior performance history for managing a real estate investment trust. As a result, you cannot be sure how Orange Hospitality will be operated, whether it will achieve the objectives described in this prospectus or how it will perform financially.

We will rely on our advisor and our board of directors to manage Orange Hospitality.

If you invest in our company, you will be relying entirely on the management ability of our advisor and on the oversight of our board of directors. You will have no right or power to take part in the management of Orange Hospitality, except through the exercise of your voting rights. Thus, you should not purchase any of the shares offered by this prospectus unless you are willing to entrust all aspects of our management to our advisor and our board of directors.

We are dependent on our advisor, who has no prior experience managing a real estate investment trust.

The advisor, subject to approval by the board of directors, is responsible for our daily management, including all acquisitions, dispositions and financings. Our advisor is newly formed and lacks experience with respect to managing a real estate investment trust. We cannot be sure that the advisor will achieve our objectives or that the board of directors will be able to act quickly to remove the advisor if it deems removal necessary. The board of directors may fire the advisor, with or without cause, but only subject to payment to the advisor and release of the advisor from all guarantees and other obligations incurred as advisor, which are referenced in the “Management Compensation” section of this prospectus. As a result, it is possible that we would be managed for some period by a company that was not acting in our best interests or not capable of helping us achieve our objectives.

14

Our taxable REIT subsidiary structure will subject us to the risk of increased hotel operating expenses.

The performance of our taxable REIT subsidiary will depend on the operations of our hotels. Our operating risks will include not only changes in hotel revenues and changes to our taxable REIT subsidiary’s ability to pay the rent due under the leases, but also increased hotel operating expenses, including, but not limited to, the following:

| | • | repair and maintenance expenses, |

| | • | other operating expenses. |

Any increases in these operating expenses could have a significant adverse impact on our earnings, financial condition and cash flows.

There were no arms-length negotiations for our agreements with Orange Advisors, LLC and Orange Realty Group, LLC, and the terms of those agreements may be more favorable to those entities, and to our detriment, than had the negotiations been arms-length with third parties.

Orange Advisors, LLC and Orange Realty Group, LLC will receive substantial compensation from us in exchange for management/investment services they have agreed to render to us, and their affiliates have also granted us an option to purchase up to five properties currently under development. The terms of these agreements have been established without the benefits of arms-length negotiation. The terms of their agreements may be more favorable to those entities and to our detriment than had the negotiations been arms-length with third parties. Orange Advisors, LLC will supervise and arrange for the day-to-day management of our operations, and Orange Realty Group, LLC will assist us in maintaining a continuing and suitable property investment program.

Stockholders in Orange Hospitality may experience dilution.

Stockholders in Orange Hospitality have no preemptive rights. If we commence a subsequent public offering of shares or securities convertible into shares or otherwise issue additional shares, investors purchasing shares in this offering who do not participate in future stock issuances will experience dilution in the percentage of their equity investment in our company. Stockholders will not be entitled to vote on whether our company engages in additional offerings. In addition, depending on the terms and pricing of an additional offering of our shares and the value of our properties, stockholders in Orange Hospitality may experience a dilution in both the book value and fair value of their shares. Although our board of directors has not yet determined whether it will engage in future offerings or other issuances of shares, it may do so if it is determined to be in our best interests. See “Summary of the Articles of Incorporation and Bylaws—Description of Capital Stock” and “The Offering—The Plan of Distribution.”

Risks Related to Conflicts of Interest

There are conflicts of interest with our chairman and chief executive officer because they have duties as officers, directors or managers of companies with which we contract or with which we may compete for properties.

Generally, conflicts of interest between Brad Honigfeld and Jeffrey Davidson and us arise because they are officers, managers and owners of Orange Advisors, LLC and Orange Realty Group, LLC. These companies will enter into contracts with us to provide us with asset management, property acquisition and disposition services. They will not receive salaries from us but will receive benefits from fees paid to Orange Advisors, LLC and Orange Realty Group, LLC.

15

Under our articles of incorporation and bylaws, we will indemnify our directors and officers, including Messrs. Davidson and Honigfeld, from any liability and related expenses incurred in dealing with us or our stockholders, except if:

| | • | the loss or liability was the result of negligence or misconduct, or if the indemnitee is an independent director, the loss or liability was the result of gross negligence or willful misconduct, |

| | • | the act or omission was material to the loss or liability and was committed in bad faith or was the result of active or deliberate dishonesty, |

| | • | the indemnitee actually received an improper personal benefit in money, property, or services, |

| | • | in the case of any criminal proceeding, the indemnitee had reasonable cause to believe that the act or omission was unlawful, or |

| | • | in a proceeding by or in the right of Orange Hospitality, the indemnitee shall have been adjudged to be liable to Orange Hospitality. |

We may compete with our advisor or its affiliates for properties.

We will experience competition for properties. Our advisor or its affiliates from time to time may acquire properties on a temporary basis with the intention of subsequently transferring the properties to us. The selection of properties to be transferred by our advisor to us may be subject to conflicts of interest. We cannot be sure that our advisor will act in our best interests when deciding whether to allocate any particular property to us. You will not have the opportunity to evaluate the manner in which these conflicts of interest are resolved before making your investment.

The timing of sales and acquisitions may favor our advisor or its affiliates.

Our advisor or its affiliates may immediately realize substantial commissions, fees and other compensation as a result of any investment in or sale of an asset by us. Our board of directors must approve each investment and sale, but our advisor’s recommendation to our board of directors may be influenced by the impact of the transaction on our advisor’s or its affiliates’ compensation.

Our fee structures may encourage our advisor or its affiliates to recommend speculative investments and a high amount of leverage.

Orange Realty Group, LLC will realize substantial compensation in connection with the acquisition of properties, and as a result, may recommend speculative investments to us. In addition, because Orange Realty Group, LLC will receive fees based on the amount of acquisition financing we obtain, it may have an incentive to recommend a high amount of leverage to us. Similarly, because Orange Realty Group, LLC may receive fees upon the sale of properties and other permitted investments, it may have an incentive to recommend to us the premature sale of these assets. The agreements between us and our advisors were not the result of arm’s-length negotiations. Because some of our officers and directors are also officers and managers of our advisors, the terms of the advisory agreements may favor our advisors. As a result, our advisors may not always act in our best interests, which could adversely affect our results of operations.

Our properties may be developed by affiliates who would receive a development fee.

Properties that we acquire may require development. Our affiliates may serve as developer and if so, the affiliates would receive a development fee that would otherwise be paid to an unaffiliated developer. Our board of directors, including the independent directors, must approve employing an affiliate of ours to serve as a developer. There is a risk, however, that we would acquire properties that require development so that an affiliate would receive a development fee.

16

We may invest with affiliates of our advisor and enter into other transactions with them.

We may invest in joint ventures with another program sponsored by our advisor or its affiliates. Our board of directors, including the independent directors, must approve the transaction, but our advisor’s recommendation may be affected by its relationship with one or more of the co-venturers and may be more beneficial to the other programs than to us. Further, because these transactions are, and other transactions we enter into may be, with affiliates, they may not be at arm’s length. Had they been at arm’s length, the terms of the transactions may have been different and may have been more beneficial to us.

Mr. Honigfeld will spend time on other activities with other entities that may compete with us.

Brad Honigfeld, our chairman, chief financial officer/treasurer and director, is the chairman and a manager of Orange Advisors, LLC and Orange Realty Group, LLC. He also serves as an officer and manager of entities that may engage in the ownership of hotels. These entities may share similar investment objectives and policies and may compete for properties against us. Mr. Honigfeld will be required to allocate his time among these entities, and he estimates that he will spend 75% of his time on activities other than our business.

Of the time Mr. Honigfeld has available for Orange Hospitality matters, he will be required to exercise his judgment to allocate his time among Orange Advisers, Orange Realty and Orange Hospitality. Mr. Honigfeld anticipates that the majority of his time spent on Orange Hospitality matters will be devoted to serving as a manager of Orange Advisors, which will manage operational, administrative and other matters for Orange Hospitality. He also anticipates that he will, as a manager of Orange Realty, provide advice with respect to the acquisition and disposition of properties. He will need to determine the amount of time to be allocated to Orange Realty on a case by case basis, depending upon the amount raised in this offering and the number of properties Orange Hospitality will seek to acquire. He anticipates that his direct services to Orange Hospitality will principally involve participating in meetings of the board of directors and that Orange Hospitality will hire another person to serve as chief financial officer/treasurer prior to the completion of the first closing of this offering.

Because Mr. Honigfeld expects to spend time on other activities and because he will be required to divide his time available for Orange Hospitality matters among services for Orange Advisers, Orange Realty and Orange Hospitality, there may be instances when he may not have sufficient time to assist us with some matters. As a result, we may not have the benefit of his assistance on these matters, and we may be adversely affected by the lack of his assistance.

Real Estate and Other Investment Risks

Possible lack of geographic and hotel brand diversification increases the risk of investment.

There is no limit on the number of properties of a particular hotel brand which we may acquire. The board of directors, including a majority of the independent directors, will review our properties and potential investments in terms of geographic and hotel brand diversification. If in the future we concentrate our acquisitions on certain hotel brands, or in certain geographic areas or on certain hotel types, it will increase the risk that our financial condition will be adversely affected by the poor judgment of a particular management group, by poor brand performance, by a downturn in a particular market sub-segment or by market disfavor with a certain hotel type.

Our profitability and our ability to diversify our investments, both geographically and by type of hotel properties purchased, will be limited by the amount of funds at our disposal. If our assets become geographically concentrated, an economic downturn in one or more of the markets in which we have invested could have an adverse effect on our financial condition and our ability to make distributions.

The minimum size of our offering may result in lack of diversification and lower returns.

We initially will be funded with contributions of not less than $20,000,000. Our profitability could be affected if we do not sell more than the minimum offering. If we receive subscriptions for only the minimum

17

offering of 1,403,510 shares, we will invest in fewer properties. The fewer properties purchased, the greater the potential adverse effect of a single unproductive property upon our profitability since a reduced degree of diversification will exist among our properties. In addition, the returns on the shares sold will be reduced as a result of allocating our expenses among the smaller number of shares.

We do not have control over market and business conditions, which may adversely affect performance.

Changes in general or local economic or market conditions, increased costs of energy, increased costs of insurance, increased costs of products, increased costs and shortages of labor, competitive factors, fuel shortages, quality of management, the ability of a hotel brand to fulfill any obligations to operators of its hotel business, limited alternative uses for the building, changing consumer habits, condemnation or uninsured losses, changing demographics, changing traffic patterns, inability to remodel outmoded buildings as required by the franchise or lease agreement, voluntary termination by a manager of its obligations under a management agreement or by a tenant of its obligations under a lease, bankruptcy of a manager or tenant and other factors beyond our control may reduce the value of properties that we acquire in the future, the results of hotel operations, the ability of tenants to pay rent on a timely basis and the amount of the rent. If hotel operations are adversely affected as a result of any of these factors, cash available to make distributions to our stockholders may be reduced.

Adverse trends in the hotel industry may impact our properties.

The success of our hotel properties depends largely on the property operators’ ability to adapt to dominant trends in the hotel industry as well as greater competitive pressures, increased consolidation, industry overbuilding, dependence on consumer spending patterns and changing demographics, the introduction of new concepts and products, availability of labor, price levels and general economic conditions. The “Business—General” section includes a description of the size and nature of the hotel industry and current trends in this industry. The success of a particular hotel brand, the ability of a hotel brand to fulfill any obligations to operators of its business and trends in the hotel industry may affect our income and the funds we have available to distribute to stockholders.

The economic downturn and September 11, 2001 have adversely affected the travel and lodging industries.

As a result of the attacks on the World Trade Center and the Pentagon on September 11, 2001 and the effects of the economic recession, the lodging industry has experienced a significant decline in business caused by a reduction in travel for both business and pleasure.

Although it appears that a recovery is occurring in the business and leisure travel sector, we are unable to predict with certainty when or if travel and lodging demand will be fully restored to prior levels. The impact of events such as future military activities in the United States or foreign countries and future terrorist activities or threats of such activities could have on our business cannot be determined. Our properties and the business of our managers and tenants may be affected, including hotel occupancy and revenues, and as a result, our revenues may be adversely affected. If the reduction in travel is protracted, our results of hotel operations and the ability of our tenants to make rental payments may be adversely affected and cash available for distributions to stockholders may be reduced. In addition, the U.S. participation in the conflict with Iraq or other significant military activity could have additional adverse effects on the economy, including the travel and lodging industry. It is possible that these factors could have a material adverse effect on the value of our assets.

Leasing properties to our subsidiary increases our risks.

For properties leased to our subsidiary, we are less likely to evict the tenant if the property’s poor performance results in a failure to pay rent. We expect, however, to have the right under our agreements with third-party managers to terminate the manager and engage a new manager in the event that the poor performance is attributable to the manager. Therefore, in the event of default due to market conditions and not the manager’s performance, we may experience lower returns.

18

In addition, rent obligations of a tenant that is a subsidiary are based, to a large extent, on gross revenues of properties. This means that poor performance by these properties may affect our results of operations to a much greater extent than would poor performance by properties leased to third parties.

We will not control the management of our properties and our financial condition will be dependent on the performance of our managers or tenants.