UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C.

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended October 1, 2005

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No. 000-50925

GOLD KIST INC.

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 20-1163666 |

| (State of Incorporation) | | (I.R.S. Employer Identification No.) |

| |

244 Perimeter Center Parkway, N. E. Atlanta, Georgia 30346 | | (770) 393-5000 |

| (Address of principal executive offices) | | (Telephone No.) |

| | |

| Securities registered pursuant to Section 12(b) of the Act: | | None |

| Securities registered pursuant to Section 12(g) of the Act: | | Common Stock, $0.01 par value (including rights to purchase shares of common stock or Series A Junior Participating Preferred Stock) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of l934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained to the best of Registrant’s knowledge in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K ¨.

Indicate by check mark whether the registrant is an accelerated filer (as defined in Rule 12b-2 of the Act). Yes x No ¨

Indicate by check mark if the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the outstanding common stock held by non-affiliates of the registrant as of April 2, 2005, the last business day of the registrant’s most recently completed second fiscal quarter (based on the closing price of $16.00 on April 1, 2005) was $803,338,368. There were 51,046,423 shares of voting common stock with a par value of $0.01 outstanding at December 6, 2005.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Proxy Statement for the 2005 Annual Meeting of Stockholders are incorporated by reference into Part III thereof.

TABLE OF CONTENTS

i

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The statements contained in this report regarding our future financial and operating performance and results, business strategy, market prices, future commodity price risk management activities, plans and forecasts and other statements that are not historical facts are forward-looking statements. We have based these forward-looking statements on our current assumptions, expectations and projections about future events.

We use the words “may,” “expect,” “anticipate,” “estimate,” “believe,” “continue,” “intend,” “should,” “would,” “could,” “plan” and other similar words to identify forward-looking statements. You should read statements that contain these words carefully because they discuss future expectations, contain projections of our results of operations or financial condition and/or state other “forward-looking” information. These statements may also involve risks and uncertainties that could cause our actual results of operations or financial condition to materially differ from our expectations in this report. A detailed discussion of these and other risks and uncertainties that could cause actual results and events to differ materially from such forward-looking statements is included in the section entitled “Risk Factors” beginning on page 8 of this report.

Any forward-looking statements in this report are based on certain assumptions and analyses made by us in light of our experience and perception of historical trends, current conditions, expected future developments and other factors that we believe are appropriate under the current circumstances. However, events may occur in the future that we are unable to accurately predict, or over which we have no control. Forward-looking statements are not a guarantee of future performance and actual results or developments may differ materially from expectations. You are therefore cautioned not to place undue reliance on such forward-looking statements. We do not intend to update any forward-looking statements contained in this report. When considering our forward-looking statements, also keep in mind the risk factors and other cautionary statements in this report.

PART I

Overview

We are the third largest integrated broiler company in the United States, accounting for over 9% of chicken, or broiler, meat produced in the United States in 2004. In addition, we believe we are the largest producer in terms of dollar volume of private label broiler products in the United States. We operate a fully-integrated broiler production, processing and marketing business. Our broiler production operations include nine broiler complexes located in Alabama, Florida, Georgia, North Carolina and South Carolina. Each complex operates in a different geographic region and includes pullet (young hens less than 26 weeks old grown as replacement hens for breeding) and breeder (hatching egg) flocks, broiler flocks, one or more hatcheries, one or more feed mills and one or more poultry processing plants. Three complexes also have rendering plants to process by-products.

For the fiscal year ended October 1, 2005, we produced and marketed approximately 3.3 billion pounds of ready-to-cook broiler products. Our broiler products include whole broilers, cut-up broilers, segregated broiler parts and further-processed products packaged in various forms, including fresh bulk ice pack, chill pack and frozen. We sell our products to over 3,000 customers in the retail, industrial, foodservice and export markets. Our registered trademarks include theGold Kist Farms,Young ‘n Tender,Early Bird,Dish in a Dash andMcEver’s brands. We are focusing our growth efforts on value added products, which include our further-processed products. Sales of our value added products represented approximately 52% of our sales in fiscal 2005. For the year ended October 1, 2005, our business generated total net sales of approximately $2.3 billion, net operating income of approximately $205.6 million and net income of approximately $112.2 million.

Industry

General

Prior to 1960, the U.S. poultry industry was highly fragmented with numerous small, independent breeders, growers and processors. The industry has consolidated during the last 40 years, resulting in a relatively small number of larger, more vertically integrated companies. In general, vertical integration of the U.S. poultry industry has led to increased operating cost efficiencies at each stage of the production process. We believe these cost efficiencies have had an adverse effect on less vertically integrated poultry producers, as they have been unable to realize the synergies benefiting their more integrated competitors.

U.S. Market Fundamentals

Broiler products currently are the most consumed meat in the United States, primarily due to growth in broiler consumption in the 1980s and 1990s. Such growth was primarily due to chicken’s distinctive attributes, including consistent quality, high versatility and perceived health benefits, which helped broiler meat gain a competitive edge over red meats and increase market share relative to beef and, to a lesser extent, pork.

Increased exports were also a key factor in the increased demand for chicken during recent decades. Broiler meat exports experienced an eight-fold increase from 1980 to 2000 and proved to be an important outlet for domestically undervalued chicken parts, specifically dark meat. Major export markets for U.S. broilers include Russia and other former Soviet republics, Hong Kong, Mexico, Japan and Canada. Total exports accounted for approximately 14% of overall U.S. broiler production in calendar 2004.

Industry Profitability

Profitability in the broiler industry is materially affected by the prices of feed ingredients and the prevailing market prices of broiler products. As a result, the broiler industry is subject to cyclical earnings fluctuations. For example, feed ingredient costs are dependent on a number of factors unrelated to the broiler industry. Small movements in feed ingredient costs may result in large changes in industry profits from fresh broiler products. By

comparison, feed costs are typically lower as a percentage of total costs in further-processed and prepared broiler products. As a result, increased sales of further-processed and prepared broiler products, as a percentage of total sales, by broiler producers should reduce to some extent the sensitivity of earnings to feed ingredient cost movements.

Chicken Products versus Other Meat Proteins

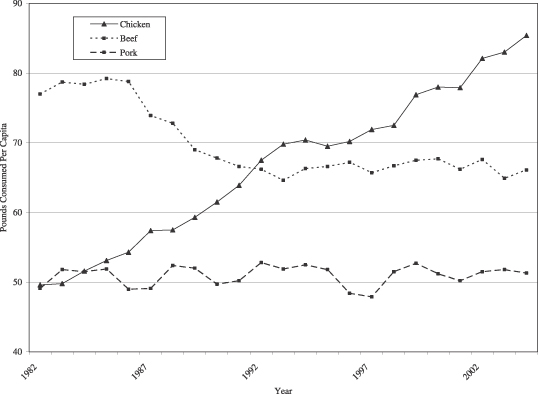

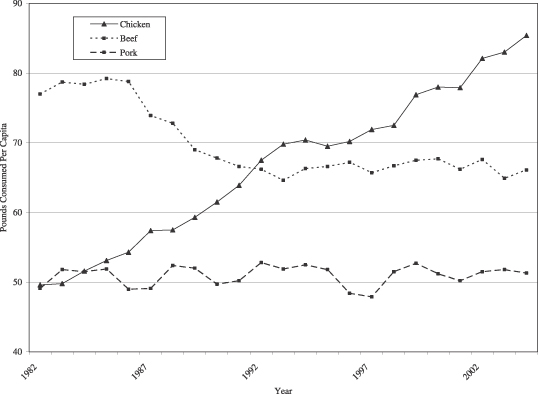

From 1982 to 2004, annual per capita consumption of chicken products in the United States increased approximately 67.3%, while annual per capita consumption of beef declined approximately 14.1% and annual per capita consumption of pork increased approximately 4.5%. The following chart illustrates, for the periods indicated, per capita consumption in pounds of chicken in the United States relative to beef and pork.

Consistent quality, high versatility and perceived health attributes have contributed to the rapid market penetration of chicken products in the last several decades, with marked improvements beginning in the 1980s. Chicken has significantly lower levels of fat and cholesterol in comparison with beef and pork. We believe U.S. consumers highly value these attributes and that they constitute an important factor guiding food purchasing decisions among health conscious consumers. This trend has also benefited from the shifting demographic mix as the U.S. population ages and becomes more health conscious.

Growth in chicken consumption has also been enhanced by new products and packaging which increase convenience and product versatility. These products include breast fillets, tenderloins and strips, formed nuggets and patties and bone-in parts, which are sold fresh, frozen and in various stages of preparation, including blanched, breaded and fully-cooked. Most of these products are targeted towards the foodservice market, which is comprised of chain restaurants, food processors, foodservice distributors and certain other institutions.

2

According to the National Chicken Council, an industry trade association, U.S. production of further-processed chicken products will increase from approximately 6.3 billion ready-to-cook pounds in 1992 to an estimated 18.1 billion ready-to-cook pounds in 2005. This product group is the fastest growing product group in the U.S. chicken industry, and the National Chicken Council estimates that the market share of this product group will increase from 30.0% of U.S. chicken production in 1992 to approximately 50% of such production in 2005.

Consumer preferences in the United States have become increasingly sophisticated, and include consistent quality, convenience and variety in the eating experience. Because of its intrinsic characteristics, mild flavor, ease of cooking and preparation and high versatility, we believe chicken is better suited to a host of applications, including both food manufacturing and foodservice, than competing meat proteins.

Chicken’s taste is well suited for marinating and makes broiler meat compatible with almost any kind of seasoning, sauce, taste-enhancer or flavor-modifier. In addition, chicken’s unique texture allows for considerable flexibility in the form of the final product. Furthermore, chicken cooks faster and more easily than beef and, especially, pork. We believe these distinctive characteristics have helped chicken gain a competitive advantage in terms of delivering innovative products in tune with consumers’ needs and expectations. Value-added and inventive chicken offerings include convenience-enhanced products, such as ready-to-eat and ready-to-cook entrees, flavor-improved items, such as marinated dishes, breaded products, such as nuggets, chicken fingers and popcorn chicken, Buffalo wings and patties.

General

Gold Kist, a Delaware corporation, is headquartered in Atlanta, Georgia. On October 13, 2004, we converted from a cooperative marketing association to a for-profit business corporation and completed our initial public offering of common stock. A substantial number of our former agricultural cooperative members continue to be contract growers for us.

Other Businesses

While 99% of our revenues for fiscal year 2005 were derived from our broiler production operations, we also have several smaller operations which account for less than 1% of our total net revenue in which we do business through subsidiaries and partnerships. Our pork group coordinates the production and marketing of hogs raised by contract growers in Alabama, Georgia and Mississippi. Our other operations include a captive insurance company to provide coverage for the retained losses within the deductibles of our auto liability, general liability and workers’ compensation coverage, an interest in a partnership that owns our headquarters building and a design, fabrication and installation firm primarily serving customers in the meat, poultry, chemical and wood products businesses with a focus on wastewater treatment systems.

Broiler Production

We are a vertically-integrated producer of fresh, frozen and further processed broiler products. Our broiler operation is organized into several divisions, each encompassing one or more of our broiler complexes. Each broiler complex operates within a separate geographical area and includes within that area broiler flocks, pullet and breeder (hatching egg) flocks, one or more hatcheries, a feed mill, poultry processing plant(s), management and accounting office(s) and transportation facilities. Through these complexes, we control the production of hatching eggs, hatching, feed manufacturing, growing, processing and packaging of our product lines.

Integration reduces costs by coordinating each stage of production. All stages are controlled to utilize resources and facilities at maximum efficiency. Integration practices not only improve cost efficiency but also permit the production of higher quality, more uniform birds. In addition, integration contracts are also desirable for growers, as the contracts shift market risk to the integrators. The integrator is also responsible for all processing and marketing activities. We believe these activities are crucial to the success of broiler production and require large scale and specialized expertise.

3

Breeding and Hatching

We maintain our own breeder flocks for the production of hatching eggs. Our breeder flocks are acquired as one-day old chicks (known as pullets) from primary breeding companies that specialize in the production of breeder stock. We maintain contracts with growers in connection with pullet farm operations for the grow-out of pullets (growing the pullet to the point at which it is capable of egg production, which takes approximately six months). Thereafter, we transport the mature breeder flocks to breeder farms that are operated and maintained by our contract growers. Eggs produced from these breeder flocks are transported to our hatcheries in our vehicles.

Growout

We place our chicks on growout farms, farms where broilers are grown to an age of approximately six to eight weeks. The farms provide us with sufficient housing capacity for our operations and are typically grower-owned farms operated under contract with us. The grower provides the housing and the growout equipment, such as feeders, waterers and brooders, as well as water, electricity, fuel, litter, management and labor. We provide the chicks, feed, necessary medication and technical advice and supervision to the growers. Our growers are compensated pursuant to an incentive formula designed to promote production cost efficiency. In addition, bonuses can be earned through lower mortality rates, the rate at which the broilers convert feed into body weight, or conversion rate, and/or through higher than average bird acceptance before processing. Conversely, payments to growers who perform worse than their peers on these measures are discounted.

Feed Mills

An important factor in the growout of broilers is the feed conversion rate. Principal raw materials used by us for the production of poultry include agricultural commodities such as corn and soybean meal utilized as feed ingredients. The quality and composition of the feed are critical to the conversion rate, and accordingly, we formulate and produce our own feed.

Feed grains are commodities subject to volatile price changes caused by weather, size of harvest, transportation and storage costs and the agricultural policies of the United States and foreign governments. Generally, we purchase our corn and other feed supplies at current prices from domestic suppliers, principally in the Midwestern United States. Feed grains are available from an adequate number of sources. Although we have not experienced, and do not anticipate problems in securing adequate supplies of feed grains, price fluctuations of feed grains will likely have a direct and material effect upon our profitability. The availability of feed ingredients at reasonable prices has been generally favorable for us because of the increased stocks of such commodities generated by large domestic crops in the last five years, although prices for such commodities increased in fiscal 2003 due to reduced domestic production. Soybean meal prices further significantly increased in fiscal 2004 due to stronger worldwide demand and reduced U.S. crops due to weather problems in grain producing areas. Increased worldwide corn and soybean production favorably impacted feed ingredient costs in fiscal 2005. Although we sometimes purchase grains in forward markets, such purchases do not eliminate the potentially adverse effect of feed grain price increases.

Processing

Once the chicks reach processing weight, they are transported to our processing plants. These plants use modern, highly automated equipment to process and package the broilers. We also have the capabilities to produce deboned and other further-processed products at some of our processing facilities.

Products

We produce an extensive line of chicken products as required by each of our customers in their respective markets. We have launched new and innovative value-added and further-processed products in close coordination with our retail and foodservice customers. All products not classified below as Value Added or Further-Processed Products are referred to as “fresh, frozen and minimally-processed” products.

4

The following table lists our chicken products:

| | | | |

Fresh, Frozen and Minimally Processed

| | Value Added

| | Further-Processed

|

| | |

• Fresh whole • Boneless • Leg quarters • Frozen • Other (edible parts for rendering) | | • Further-processed products • Portion controlled products • Marinated products • Chill pack products • Mechanically separated chicken | | • Fully-cooked products • Par-fried products • Individually quick frozen parts |

Our fresh, frozen and minimally processed products and certain of our value added products are produced at each of our plants. Our further-processed products are produced at our Sumter, South Carolina, Boaz, Alabama, and Russellville, Alabama plants.

The principal products we market are whole broilers, cut-up broilers, segregated broiler parts and further-processed products packaged in various forms, including fresh bulk ice pack, chill pack and frozen. Our ice pack chickens are packaged in ice or dry ice and sold primarily to distributors, grocery stores and quick serve chains. We produce and market our frozen chickens primarily to school systems, the U.S. military services, quick serve restaurant chains and foreign countries that participate in the U.S. export market. Our further-processed products, which include preformed breaded chicken nuggets and patties and deboned, skinless and marinated products are sold primarily to quick serve restaurant and grocery store chains. We produce and package chill pack chickens for retail sale and keep them chilled by mechanical refrigeration from the packing plant to the store counter. Our chill pack chicken is sold primarily under customers’ private labels and in certain localities under theGold Kist Farms andYoung ‘n Tender brand names. Most of our frozen chicken carries theGold Kist orEarly Bird brand names.

Sales and Marketing

Poultry products are marketed primarily from our corporate headquarters in Atlanta. Our products are sold nationally, although our sales are especially strong in the southeastern region of the United States. Our customers primarily consist of retail, foodservice, industrial and export customers.

Retail Customers

We are a major supplier to all but one of the top ten U.S. food retailers, as measured by fiscal 2005 sales. Our strengths in the retail market include our ability to serve any size customer, our southeastern U.S. location, which gives us access to a large portion of the U.S. population, and our ability to closely coordinate with our retail customers through our state-of-the-art warehouse management and inventory control system in Guntersville, Alabama.

Our retail products are sold to our customers under theGold Kist Farms brand name and under the private labels of certain U.S. supermarkets and other customers. Our retail sales consist principally of fresh and frozen whole and cut-up products, deboned products and further-processed products under theGold Kist Farms,Medallion,Big Value,Early Bird andMcEver’sbrand names.

Foodservice Customers

We are a major supplier to most major quick serve restaurant chains that use bone-in products. We provide a full line of fresh, frozen, partially- and fully-cooked products to meet the varied needs of our foodservice customers from quick serve restaurant chains to full service restaurants. We also sell our products to a diversified base of foodservice distributors and end-use customers, including the USDA School Lunch Program.

5

Industrial Customers

We are a major supplier to companies that further process chicken or use chicken as an ingredient in products that they manufacture. We believe our strengths in this “industrial” market include the breadth of our product line and our willingness to conduct research and development tailored to meet our customers’ specific needs.

Export Customers

We also export broiler products to Russia, Eastern Europe, Commonwealth of Independent States, Asia, the Pacific Rim, the Middle East, Africa, South and Central America, Mexico and the Caribbean Islands. Our product sales managers maintain sales networks overseas through contacts with independent dealers and customers. Our line of products for our export customers includes leg quarters, thighs, drum portions, large and jumbo paws, whole wings, mid-joints and tips, flippers/tips, drumettes, whole frozen chickens (with or without giblets), boneless items and cut-up chicken. Our export sales, which we define as sales other than to customers in the United States or Canada, were $137.6 million in fiscal 2005, $99.2 million in fiscal year 2004 and $56.4 million in fiscal year 2003.

Competition

The broiler industry is highly competitive and some of our competitors have greater financial and marketing resources than we do. In the United States, we compete principally with other vertically integrated broiler companies, but our broiler products compete with all meat proteins.

In general, the competitive factors in the U.S. poultry industry include price, product quality, product development, brand identification, breadth of product line and customer service. Competitive factors vary by major market. In the foodservice market, competition is based on consistent quality, product development, service and price. In the U.S. retail market, we believe that product quality, brand awareness, customer service and price are the primary bases of competition. In addition we compete with non-vertically integrated further processors in the U.S. prepared food business. However, we believe that we have significant, long-term cost and quality advantages over non-vertically integrated further processors.

We face competition for export sales from both domestic and foreign suppliers. In export poultry sales, we face competition from other major U.S. producers as well as companies in France, China, Thailand and Brazil. Tariff and non-tariff barriers to U.S. poultry established by the European Economic Community, or EEC, since 1962 have virtually excluded us and other U.S. poultry exporters from the EEC market. In addition, EEC exporters are aided in price competition with U.S. exporters in certain markets by subsidies from their governments. Continued restrictions placed by Russian authorities on the export of U.S. poultry to Russia beginning in March 2002 adversely impacted the export sales of domestic suppliers into fiscal 2003. In December 2003, Russia implemented import quotas on chicken and other meats that reduced U.S. broiler imports to approximately 70% of 2002 levels.

While the extent of the impacts of the elimination of tariffs and various bans and embargos are uncertain, we believe we are uniquely positioned to limit our relative exposure to fluctuating markets for two reasons. First, we have extensive export operations, yet we export proportionately fewer products than the industry overall. We exported approximately 12% by weight of our products in fiscal year 2005, while the industry as a whole exports approximately 15% by weight of its products. Second, our large size allows us to participate selectively in many international markets in order to limit exposure to any specific export market fluctuation.

Regulation and Environmental Matters

The poultry industry is subject to government regulation, particularly in the health and environmental areas, including provisions relating to the discharge of materials into the environment, by the USDA, the FDA and the

6

Environmental Protection Agency, or the EPA, in the United States and by similar governmental agencies in foreign countries to which we export our products. Our chicken processing facilities in the United States are subject to on-site examination, inspection and regulation by the USDA. The FDA inspects the production of our feed mills in the United States.

Processing plants, such as those we operate, are potential sources of emissions into the atmosphere and, in some cases, of effluent emissions into streams and rivers. On January 29, 1992, the EPA sent General Notice Letters designating us and several other companies as potentially responsible parties, or PRP’s, for alleged environmental contamination at an Albany, Georgia site we previously owned. We have responded to the General Notice Letter denying liability for the contamination. We are unable to estimate at this time our cost of compliance, if any, to be required for the location. We believe that our potential cost of compliance would not have a material effect on our financial condition or results of operations.

The Georgia Environmental Protection Division has listed the site of our former chemical blending facility in Cordele, Georgia on Georgia’s Hazardous Sites Inventory list under the state’s Hazardous Sites Response Act (“HSRA”) due to the presence of pesticide and other residue above regulatory standards. In 2004, the U.S. Environmental Protection Agency assumed control over the analysis and potential remediation of the Cordele property under the Resource Conservation and Recovery Act (“RCRA”). We sold this facility in 1985. Remediation may be required in the future to meet regulatory clean-up standards under RCRA or HSRA. Since the extent of the conditions at the site has not been completely defined at this time, we are unable to estimate cost of our compliance for this location. We believe that our potential cost of compliance will not have a material effect on our financial condition or results of operations.

In May of 2002, the EPA filed a lawsuit against a number of defunct former owners of an allegedly contaminated Superfund Site in Tifton, Georgia. In addition, the EPA has investigated several other parties, including us, with respect to the site. Settlement discussions with all parties began in April 2003. While we are unable to estimate our cost of settlement for this location, we believe that the potential cost of settlement or compliance would not have a material adverse effect on our financial condition or results of operations.

We anticipate increased regulation by the USDA concerning food safety, by the FDA concerning the use of medications in feed and by the EPA and various other state agencies concerning the disposal of chicken byproducts and wastewater discharges. Although we do not anticipate any regulations having a material adverse effect upon us, a material adverse effect may occur.

Avian Influenza

There has been much media attention recently regarding avian influenza (“AI”) that has occurred in certain parts of Asia and Eastern Europe. The version of AI that has received the media attention is the H5N1 high pathogenic Asian strain. There are currently no reported AI cases in commercial chicken in the United States, and the United States has never had an outbreak of the H5N1 high pathogenic Asian strain. There have been occurrences of low pathogenic AI in the United States in the past, but none of such low pathogenic AI strains are known to cause human illness.

Gold Kist chickens are raised in enclosed poultry houses that protect our chickens from contact with wild birds and other animals. As part of comprehensive biosecurity and disease prevention measures, poultry producers do not permit unauthorized visitors on their farms and take other appropriate precautions designed to prevent cross contamination between farms. If a confirmed case of any strain of AI were to occur, additional biosecurity measures would be implemented immediately as directed by USDA and by federal and state public health officials. To prevent these chickens from entering the food markets, Gold Kist would dispose of any infected flocks humanely and in an environmentally safe manner in total compliance with all governmental regulations. See “Risk Factors—Outbreaks of livestock diseases, particularly an outbreak of avian influenza among humans, could adversely affect our business.”

7

Employees

As of October 1, 2005, we had approximately 16,500 full-time employees. Our processing facilities operate year round without significant seasonal fluctuations in labor requirements. We have approximately 2,500 employees who are covered by collective bargaining agreements and approximately 575 employees who are members of unions. In our Live Oak, Florida processing plant, 214 employees are members of the United Food & Commercial Workers Union under a collective bargaining agreement that expires April 1, 2007. In our Athens, Georgia processing plant, 144 employees are members of the United Food & Commercial Workers Union with a current collective bargaining agreement expiring in October 2007. In our Carrollton, Georgia processing plant, 23 employees are members of the Bakery, Confectionary, Tobacco and Grain Millers Union with a current collective bargaining agreement expiring in September 2008. In our Guntersville, Alabama feed hauling facility, 35 employees are members of the International Brotherhood of Teamsters union with a current collective bargaining agreement expiring in February 2006. We consider our employee relations to be generally satisfactory.

Available Information

Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act are available through our website,www.goldkist.com, free of charge as soon as reasonably practicable after electronically filing such material with the SEC. For more information, please visitwww.goldkist.com.

Industry cyclicality, especially fluctuations in the supply of broiler products, affects the prevailing market price of broiler products, our sales and our earnings.

Profitability in the broiler industry is materially affected by the prevailing price of broiler products, which is primarily determined by supply and demand factors in the market. In recent years, the profitability of companies in the broiler industry has been adversely affected from time to time by excess supplies of broiler products in the market. As a result of the efficiencies in the U.S. broiler market, even modest increases in the broiler supply in the United States can significantly decrease the market prices at which we can sell our broiler products. Such increases in domestic supply can arise as a result of unanticipated decreases in export demand, among other reasons. Given the perishable nature of broiler products, we are unable to manage inventories to address any short-term changes in market prices. As a result, from time to time we are forced to sell our broiler products at a loss. Because we sell a relatively small percentage of our products under fixed-price contracts, increases in the overall supply of broiler products and any related decrease in broiler prices adversely affect our operating results. This has resulted and will continue to result in fluctuations in our earnings. Market prices for broiler products reached their highest levels since 1999 during our 2004 fiscal year, but have declined during fiscal 2005.

Fluctuations in commodity prices of feed ingredients materially affect our earnings.

A significant portion of the cost of producing our broiler products consists of amounts spent in connection with purchasing corn and soybean meal, our primary feed ingredients. As a result, fluctuations in feed ingredient prices materially affect our earnings. While prices of these items increase from time to time, we may not be able to pass through any increase in the cost of feed ingredients to our customers. High feed ingredient prices have had a material adverse effect on our operating results in the past. We periodically seek, to the extent available, to enter into advance purchase commitments or commodity futures contracts for the purchase of a portion of our feed ingredients in an effort to manage our feed ingredient costs. However, the use of such instruments may not be successful in limiting our exposure to market fluctuations in the cost of feed and may limit our ability to benefit from favorable price movements.

Furthermore, the production of feed ingredients is positively or negatively affected by weather patterns throughout the world, the global level of supply inventories and demand for feed ingredients, the availability and

8

cost of transportation, as well as the agricultural policies of the United States and foreign governments. In particular, weather patterns often change agricultural conditions in an unpredictable manner. A sudden and significant change in weather patterns could affect the supply of feed ingredients, as well as both the industry’s and our ability to obtain feed ingredients, grow broilers and deliver products. Any such change would have a material negative impact on our business and results of operations. See “Management’s Discussion and Analysis of Consolidated Results of Operations and Financial Condition.”

Significant competition in the broiler industry with other vertically integrated broiler companies, especially companies with greater resources, may make us unable to compete successfully in this industry, which would adversely affect our business.

The broiler industry is highly competitive. Some of our competitors have greater financial and marketing resources than we do. In general, the competitive factors in the U.S. broiler industry include price, product quality, brand identification, breadth of product line and customer service. Competitive factors vary by major market. In the foodservice market, we believe competition is based on consistent quality, product development, customer service and price. In the U.S. retail market, we believe that competition is based on product quality, brand awareness, customer service and price. We also face competition from non-vertically integrated further processors with regard to our further-processed products. The highly competitive conditions in the broiler industry could force us to reduce prices for our products, which would adversely affect our results of operations and financial condition.

The loss of one of our large customers could have a material adverse effect on our results of operations.

Sales to our top ten customers represented approximately 37.73% of our net sales during fiscal 2005 and during such period, approximately 12.25% of our net sales were to our largest customer. We do not have long-term contracts with any of our major customers and, as a result, any of our major customers could significantly decrease or cease their business with us with limited or no notice. If we lost one or more of our major customers, or if one or more of our major customers significantly decreased its purchases from us, our business, sales and results of operations could be materially and adversely affected.

Foreign embargos, decreased export demand, oversupply of broiler products and competing products and bans on exported chicken and livestock would have an adverse effect on our business.

We are an exporter to Russia, Eastern Europe, Commonwealth of Independent States, Asia, the Pacific Rim, the Middle East, Africa, South and Central America, Mexico and the Caribbean Islands. Any decrease in exports to foreign countries based on embargos, decreased demand, oversupply of broiler products or competing products or bans on exported chicken may have an adverse effect on our ability to export chicken and other products. Such occurrences would also likely increase the supply of broilers and competing products in the United States, which would likely result in lower prices for broiler products and could adversely affect our business. For example, in 2002 and 2003, export sales to Russia declined due to an embargo on certain imported meats, leading to a domestic oversupply and a decrease in the market price of chicken. Russia has implemented import quotas on chicken and other meats that reduce U.S. broiler imports to approximately 70% of 2002 levels. In addition, for several months in 2004, China, Japan and several smaller chicken importing countries banned all imports of broiler products from the United States due to several chickens in Delaware and Texas testing positive for avian influenza. Also as a result of this event, Russia and Hong Kong banned the import of broiler products from Delaware and Texas for a period of time. Any implementation of similar bans in the future or the implementation of quotas or other import restrictions would adversely affect our domestic and export sales and our results of operations.

We have been, and may in the future be, subject to claims and liabilities under environmental, health, safety and other laws and regulations, which could be significant.

Our operations are subject to various federal, state, local and foreign environmental, health, safety and other laws and regulations, including those governing air emissions, wastewater discharges and the use, storage,

9

treatment and disposal of hazardous materials. The applicable requirements under these laws are subject to amendment, to the imposition of new or additional requirements and to changing interpretations by governmental agencies or courts. In addition, we anticipate increased regulation by various governmental agencies concerning food safety, the use of medication in feed formulations, the disposal of animal by-products and wastewater discharges. Furthermore, business operations currently conducted by us or previously conducted by others at real property owned or operated by us, business operations of others at real property formerly owned or operated by us and the disposal of waste at third party sites expose us to the risk of claims under environmental, health and safety laws and regulations. For example, we have received notice letters designating us as a potentially responsible party for alleged environmental contamination at a site that we previously owned. Other properties we own or owned in the past have been designated for cleanup under federal and state environmental remediation statutes, which could result in further liabilities to us. In addition, we are subject to potential claims for residual environmental liabilities arising out of our sale of our Agri-Services business in 1998. The agreements related to our disposition of certain properties require that we indemnify the buyer of such properties with regard to any associated environmental liabilities. We could incur material costs or liabilities in connection with claims related to any of the foregoing. The discovery of presently unknown environmental conditions, changes in environmental, health, safety and other laws and regulations, enforcement of existing or new laws and regulations and other unanticipated events could give rise to expenditures and liabilities, including fines or penalties, that could have a material adverse effect on our business, operating results and financial condition.

If our products become contaminated, we may be subject to product liability claims and product recalls.

Our products may be subject to contamination by disease producing organisms, or pathogens, such as Listeria monocytogenes, Salmonella and generic E. coli. These pathogens are found generally in the environment and, therefore, there is a risk that they, as a result of food processing, could be present in our processed products. These pathogens can also be introduced to our products as a result of improper handling at the further processing, foodservice or consumer level. These risks may be controlled, but may not be eliminated, by adherence to good manufacturing practices and finished product testing. We have little, if any, control over proper handling procedures once our products have been shipped for distribution. Even if a product is not contaminated when it leaves our facility, illness and death may result if the pathogens are not also eliminated at the further processing, foodservice or consumer level. Increased sales of further-processed products could lead to increased risks in this area. Even an inadvertent shipment of contaminated products is a violation of law and may lead to increased risk of exposure to product liability claims, product recalls (which may not entirely mitigate the risk of product liability claims) and increased scrutiny by federal and state regulatory agencies and may have a material adverse effect on our business, reputation and prospects.

Outbreaks of livestock diseases, particularly an outbreak of avian influenza among humans, could adversely affect our business.

Events beyond our control, such as the outbreak of disease, could significantly restrict our ability to conduct our operations and adversely affect our business. An outbreak of disease could result in governmental restrictions on the import and export of our fresh broiler products, pork or other products to or from our suppliers, facilities or customers, or require us to destroy one or more of our flocks. This could result in the cancellation of orders by our customers and create adverse publicity that may have a material adverse effect on our ability to market our products successfully and on our business, reputation and prospects. For example, because several chickens in Delaware and Texas tested positive for avian influenza in 2004, several countries imposed import bans and the infected flocks were destroyed. If a similar outbreak were to occur in areas where our contract growers are located, we may be forced to destroy our flocks, even if those flocks were not infected. See “—Foreign embargos, decreased export demand, oversupply of broiler products and competing products and bans on exported chicken and livestock would have an adverse effect on our business.”

These risks are particularly acute if an outbreak of a livestock disease, such as avian influenza, were to occur among humans. Although avian influenza is not spread through the consumption of chicken, increased media attention regarding the risks of avian influenza or consumer panic in the event of a serious outbreak of

10

avian influenza among humans could result in reduced demand for our products. In addition, the risk of an avian influenza outbreak among humans or the perceived risk of such an outbreak could result in aggressive action by the governments of the United States and the countries to which we export our products to limit the spread of such an outbreak. Government action in response to an avian influenza outbreak among humans could adversely affect our ability to export our products and impose burdensome regulations on our operations or those of our contract growers, which would in turn increase our costs of doing business.

Increased water, energy and gas costs would increase our expenses and reduce our profitability.

We require a substantial amount, and as we expand our business we will require additional amounts, of water, electricity and natural gas to produce and process our broiler products. The prices of water, electricity and natural gas fluctuate significantly over time, and prices for natural gas have recently been at historically high levels, partially due to supply disruptions caused by Hurricanes Katrina and Rita. One of the primary competitive factors in the U.S. broiler market is price, and we may not be able to pass on increased costs of production to our customers. As a result, increases in the cost of water, electricity or natural gas could substantially harm our business and results of operations.

Increased costs of transportation would negatively affect our profitability.

Our transportation costs are a material portion of the cost of our products. We primarily ship our products and receive our inputs via truck and rail and rely on third party transportation companies for the delivery of most of our products and inputs. The costs associated with the transportation of our products and inputs fluctuate with the price of fuel, the costs to our transportation providers of labor and the capacity of our transportation sources. Increases in costs of transportation would negatively affect our profitability.

We are exposed to risks relating to product liability, product recalls, property damage and injury to persons for which insurance coverage is expensive, limited and potentially inadequate.

Our business operations entail a number of risks, including risks relating to product liability claims, product recalls, property damage and injury to persons. Insurance for these risks is expensive and difficult to obtain, and we may not be able to maintain this insurance in the future on acceptable terms, in amounts sufficient to protect us against losses due to any such events or at all. Moreover, our insurance coverage may not adequately protect us from all of the liabilities and expenses that we incur in connection with such events. If we were to suffer a loss that is not adequately covered by insurance, our results of operations and financial condition would be adversely affected.

Any acquisition we make could disrupt our business and harm our financial condition.

We may seek to expand our business through the acquisition of companies, technologies, products and services from others. Acquisitions may involve a number of problems, including:

| | • | | difficulty integrating acquired technologies, operations and personnel with our existing business; |

| | • | | diversion of management attention in connection with negotiating acquisitions and integrating the businesses acquired; |

| | • | | exposure to unforeseen liabilities of acquired companies; and |

| | • | | the need to obtain additional debt financing for any acquisition. |

We may not be able to address these problems and successfully develop these acquired companies or businesses into profitable units of Gold Kist.

The loss of key members of our management may adversely affect our business.

We believe our continued success depends on the collective abilities and efforts of our senior management. We do not maintain key person life insurance policies on any of our employees. The loss of one or more key personnel

11

could have a material adverse effect on our results of operations. Additionally, if we are unable to find, hire and retain needed key personnel in the future, our results of operations could be materially and adversely affected.

The inability to maintain good relations with our employees could adversely affect our business.

As of October 1, 2005, we had approximately 16,500 employees, approximately 2,500 of which are covered by collective bargaining agreements and approximately 575 of which are members of labor unions. We may be unable to maintain good relationships with these labor unions or to successfully negotiate new collective bargaining agreements on satisfactory terms in the future. If we fail to maintain good relationships with our employees generally or with such labor unions or fail to negotiate satisfactory collective bargaining agreements, or if non-unionized operations were to become unionized, we could face labor strikes or work stoppages or other activity that could adversely affect our business and operations. Additionally, an employee has filed an action claiming violations of the Fair Labor Standards Act based upon our failure to pay employees for all hours worked by not including time spent donning and doffing specialized protective gear. The plaintiff has filed the lawsuit as an opt-in collective action under the Fair Labor Standards Act, claiming that an unspecified number of allegedly “similarly situated” employees and former employees should be permitted to join together with the employee to pursue this lawsuit as a collective action against us. Although we intend to defend this lawsuit vigorously, an adverse outcome could increase our cost of doing business.

The Public Health Security and Bioterrorism Preparedness and Response Act of 2002 could increase our costs of doing business.

The Public Health Security and Bioterrorism Preparedness and Response Act of 2002, which we refer to as the Bioterrorism Act, includes a number of provisions designed to help guard against the threat of bioterrorism, including new authority for the Secretary of Health and Human Services to take action to protect the nation’s food supply against intentional contamination. The U.S. Food and Drug Administration, or FDA, is responsible for developing and implementing these food safety measures. The FDA has been in the process of issuing new rules, and it is difficult for us to predict what impact they might have on our business. Compliance with these rules may increase our costs of doing business by increasing the amounts that we spend on plant security and product safety. If we are unable to pass these higher costs on to our customers, our results of operations and financial condition may be adversely affected.

| Item 1B. | Unresolved Staff Comments. |

None.

We operate poultry processing plants located in Boaz, Russellville and Guntersville, Alabama; Athens, Douglas, Ellijay and Carrollton, Georgia; Live Oak, Florida; Sumter, South Carolina; and Sanford and Siler City, North Carolina. These plants have an aggregate weekly processing capacity of approximately 14.4 million broilers. Our plants are supported by hatcheries located at Albertville, Crossville, Cullman, Curry, Ranburne, Russellville and Scottsboro, Alabama; Blaine, Bowdon, Calhoun, Commerce, Carrollton, Douglas and Talmo, Georgia; Live Oak, Florida; Siler City and Staley, North Carolina; and Sumter, South Carolina. These hatcheries have an aggregate weekly capacity (assuming 85% hatch) of approximately 15.3 million chicks. Additionally, we operate eleven feed mills to support our poultry operations. The mills have an aggregate annual capacity of approximately 4.7 million tons and are located in Guntersville and Pride, Alabama; Ambrose, Calhoun, Commerce, and Waco, Georgia; Live Oak, Florida; Sumter, South Carolina; and Bonlee and Staley, North Carolina.

We operate five separate distribution centers for the sale and distribution of our poultry products. These centers are located in Tampa, Pompano Beach and Crestview, Florida; Nashville, Tennessee; and Cincinnati, Ohio.

12

Our corporate headquarters building, completed in 1975 and containing approximately 260,000 square feet of office space, is located on fifteen acres of land at 244 Perimeter Center Parkway, N.E., Atlanta, Georgia. The land and building are owned by a partnership of which Cotton States Mutual Insurance Company, a subsidiary of Country Insurance and Financial Services, owns 46% of the equity and we own 54% of the equity. We lease approximately 95,000 square feet of the building from the partnership.

We own all of our facilities, except for our headquarters building, the lease on which expires in April 2010. We also lease our poultry distribution facilities in Tampa, Florida and Nashville, Tennessee under leases that expire in May 2010 and December 2006, respectively, and our poultry hatchery facility in Crossville, Alabama under a lease that expires in February 2088.

| Item 3. | Legal Proceedings. |

In addition to the matters set forth below, we are subject to various other legal proceedings and claims which arise in the ordinary course of business. In the opinion of management, the amount of ultimate liability with respect to these actions will not materially affect our financial position or results of operations.

Ronald Hughes Gaston v. Gold Kist Inc. On February 18, 2004, the plaintiff, who was terminated by Gold Kist as a hatching egg producer, filed a purported class action lawsuit against us in the U.S. District Court for the Northern District of Alabama (Case number CV-04-J-0326-NW). Plaintiff also named four additional chicken-processing firms as defendants. The plaintiff asserted that the defendants conspired to prevent competition for production contracts and sought to represent a putative class of all contract farmers and sellers of hatching eggs and live broilers who produced hatching eggs or live broilers in the United States since February 23, 1998. The plaintiff dismissed the action in July 2005.

Cody, et al v. Gold Kist et al.Four female employees of our Corporate Office Information Services Department, or Corporate I/S Department, filed a sex discrimination suit against Gold Kist in the United States District Court for the Northern District of Georgia asserting gender based claims about employment and promotion decisions in the Corporate I/S Department. The four complainants sought class certification for their claims of gender discrimination, unspecified monetary damages and injunctive relief. The U.S. District Court, in an order entered June 13, 2005, denied the motion of the plaintiffs to certify the litigation as a class action. The court’s ruling, for which the plaintiffs did not seek an interlocutory appeal, means that the litigation will not proceed as a class action and will be litigated as individual claims of the four named plaintiffs. We continue to intend to defend the litigation vigorously.

Nicholas Leech v. Gold Kist Inc.On November 3, 2005, an employee of the Company filed the case ofNicholas Leech v. Gold Kist Inc., in the United States District Court for the Northern District of Alabama claiming that we had violated certain provisions of the Fair Labor Standards Act, or FLSA. The suit alleges that we failed to pay the Plaintiff for time he has spent (i) waiting in line before each shift to receive certain clothing and equipment that he wears while working, (ii) putting on that clothing and equipment, and (iii) taking off the clothing and equipment, and turning it back in, after each shift ends. The plaintiff is seeking an unspecified amount of unpaid overtime wages allegedly earned, plus liquidated damages in the same amount, plus attorneys’ fees, costs and interest. The plaintiff has filed the lawsuit as an opt-in collective action under the FLSA, claiming that an unspecified number of allegedly “similarly situated” employees should be permitted to join together with him to pursue this lawsuit as a collective action against us. The proposed class would consist of any and all persons employed as hourly employees by us at any time during the three years preceding the filing of the plaintiff’s complaint. We believe we have substantial defenses to the claims made in theLeech lawsuit and intend to defend the case vigorously. At this point, however, neither the likelihood of the outcome nor the amount of ultimate liability, if any, can be determined.

| Item 4. | Submission of Matters to a Vote of Security Holders. |

No matter was submitted during the fourth quarter of the fiscal year covered by this report to a vote of security holders.

13

PART II

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. |

Market Information

Our common stock, $0.01 par value per share (the “Common Stock”), is traded on the Nasdaq National Market under the symbol GKIS. The chart below sets forth the high and low closing prices for each quarter of our last completed fiscal year, during which time our Common Stock was traded on the Nasdaq National Market.

| | | | | | |

Quarter Ended

| | High

| | Low

|

October 7, 2004 (1) | | $ | 11.40 | | $ | 11.40 |

January 1, 2005 | | $ | 14.14 | | $ | 11.00 |

April 2, 2005 | | $ | 17.13 | | $ | 13.26 |

July 2, 2005 | | $ | 23.21 | | $ | 13.78 |

October 1, 2005 | | $ | 23.36 | | $ | 16.63 |

| (1) | First date on which our stock was traded. |

Dividend Policy

We have not declared any cash dividends on our common stock since our conversion to a corporation in October 2004, and our Board of Directors does not presently intend to pay cash dividends in the future on our common stock. We currently intend to retain all of our earnings in the foreseeable future to finance the operation and expansion of our business. Additionally, some of our indebtedness currently restricts our ability to declare or pay any dividends on our common stock. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources.” Our future dividend policy will also depend on the requirements of any future financing arrangements to which we may be a party and other factors considered relevant by our Board of Directors.

Stockholder Information

On December 8, 2005, there were approximately 1,775 holders of record of our common stock.

Issuer Purchases of Equity Securities.

None.

14

| Item 6. | Selected Financial Data |

SELECTED HISTORICAL CONSOLIDATED FINANCIAL DATA

The following table sets forth certain selected consolidated financial data as of and for the fiscal years ended June 30, 2001, June 29, 2002, June 28, 2003, June 26, 2004, the three month transition quarter ended October 2, 2004, and the fiscal year ended October 1, 2005. The selected consolidated financial data for the fiscal years ended June 28, 2003, June 26, 2004, the transition quarter ended October 2, 2004, and the fiscal year ended October 1, 2005 and as of June 26, 2004 and October 1, 2005 were derived from our audited consolidated financial statements included elsewhere in this report. The selected consolidated financial data for the fiscal years ended June 30, 2001 and June 29, 2002 and as of June 30, 2001, June 29, 2002 and June 28, 2003 were derived from our audited consolidated financial statements not included in this report. This selected financial data should be read in conjunction with, and is qualified in its entirety by reference to, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our consolidated financial statements and related notes included elsewhere in this report.

| | | | | | | | | | | | | | | | | | | | |

| | | Fiscal Years Ended

| | | Transition

Quarter

Ended

| | | Fiscal Year

Ended

| |

| | | June 30,

2001

| | | June 29,

2002

| | | June 28,

2003

| | | June 26,

2004

| | | October 2,

2004 (7)

| | | October 1,

2005 (7)

| |

| | | (in thousands) | |

Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | |

Net sales | | $ | 1,810,755 | | | 1,863,828 | | | 1,855,126 | | | 2,260,728 | | | 646,511 | | | | 2,304,262 | |

Cost of sales | | | 1,690,437 | | | 1,706,582 | | | 1,813,106 | | | 1,899,395 | | | 554,142 | | | | 1,984,178 | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

|

Gross profit | | | 120,318 | | | 157,246 | | | 42,020 | | | 361,333 | | | 92,369 | | | | 320,084 | |

Distribution, administrative and general expenses (including $9.8 million of share-based compensation expense for fiscal year 2005) | | | 88,507 | | | 87,486 | | | 81,859 | | | 108,772 | | | 31,011 | | | | 112,177 | |

Benefit plans curtailment (gains) (1) | | | (33,727 | ) | | — | | | (20,257 | ) | | — | | | — | | | | — | |

Pension plan settlement loss (1) | | | — | | | — | | | — | | | 10,288 | | | — | | | | 906 | |

Conversion expenses (6) | | | — | | | — | | | — | | | — | | | 2,522 | | | | 1,418 | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

|

Net operating income (loss) | | | 65,538 | | | 69,760 | | | (19,582 | ) | | 242,273 | | | 58,836 | | | | 205,583 | |

Other income (expenses): | | | | | | | | | | | | | | | | | | | | |

Interest and dividend income | | | 11,328 | | | 9,426 | | | 2,283 | | | 1,550 | | | 635 | | | | 5,906 | |

Interest expense | | | (39,996 | ) | | (27,962 | ) | | (24,968 | ) | | (29,349 | ) | | (8,514 | ) | | | (23,619 | ) |

Gain on sale of marketable equity security and other investments (2) | | | — | | | 15,578 | | | — | | | — | | | — | | | | — | |

Debt prepayment interest and write-off of related fees and discount | | | — | | | — | | | — | | | (6,341 | ) | | — | | | | (16,186 | ) |

Loss on investments (3) | | | — | | | — | | | (24,064 | ) | | (57,364 | ) | | — | | | | (2,500 | ) |

Equity in earnings of affiliate (4) | | | 10,048 | | | — | | | — | | | — | | | — | | | | — | |

Miscellaneous, net | | | (241 | ) | | 2,882 | | | (2,428 | ) | | 1,942 | | | 1,833 | | | | 4,653 | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

|

Total other expenses, net | | | (18,861 | ) | | (76 | ) | | (49,177 | ) | | (89,562 | ) | | (6,046 | ) | | | (31,746 | ) |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

|

Income (loss) from continuing operations before income taxes | | | 46,677 | | | 69,684 | | | (68,759 | ) | | 152,711 | | | 52,790 | | | | 173,837 | |

Income tax expense (benefit) | | | 13,397 | | | 22,055 | | | (17,307 | ) | | 41,817 | | | 18,772 | | | | 61,591 | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

|

Income (loss) from continuing operations | | | 33,280 | | | 47,629 | | | (51,452 | ) | | 110,894 | | | 34,018 | | | | 112,246 | |

Loss on discontinued operations (5) | | | (214 | ) | | (13,543 | ) | | — | | | — | | | — | | | | — | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

|

Net income (loss) | | $ | 33,066 | | | 34,086 | | | (51,452 | ) | | 110,894 | | | 34,018 | | | | 112,246 | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

|

Basic net income per share (6) | | | — | | | — | | | — | | | — | | | — | | | $ | 2.24 | |

Diluted net income per share (6) | | | — | | | — | | | — | | | — | | | — | | | $ | 2.22 | |

Basic weighted average common shares outstanding (6) | | | — | | | — | | | — | | | — | | | — | | | | 49,999 | |

Diluted weighted average common shares outstanding (6) | | | — | | | — | | | — | | | — | | | — | | | | 50,636 | |

15

| | | | | | | | | | | | | | | | | | | |

| | | Fiscal Years Ended

| | | Transition

Quarter

Ended

| | | Fiscal Year

Ended

| |

| | | June 30,

2001

| | | June 29,

2002

| | | June 28,

2003

| | | June 26,

2004

| | | October 2,

2004 (7)

| | | October 1,

2005 (7)

| |

| | | (in thousands) | |

Other Data: | | | | | | | | | | | | | | | | | | | |

Net cash provided by (used in) operating activities | | $ | 71,940 | | | 68,000 | | | (35,275 | ) | | 218,681 | | | 75,692 | | | 177,642 | |

Net cash provided by (used in) investing activities | | | (32,782 | ) | | 45,229 | | | (27,040 | ) | | (37,563 | ) | | (23,814 | ) | | (70,677 | ) |

Net cash provided by (used in) financing activities | | | (36,490 | ) | | (115,571 | ) | | 64,344 | | | (55,445 | ) | | (13,288 | ) | | (128,693 | ) |

Depreciation and amortization (including amortization of share-based compensation) | | | 42,747 | | | 39,071 | | | 39,495 | | | 39,592 | | | 10,030 | | | 52,939 | |

Capital expenditures | | | 33,495 | | | 38,899 | | | 34,651 | | | 42,210 | | | 25,160 | | | 80,760 | |

Balance Sheet Data: | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 11,339 | | | 8,997 | | | 11,026 | | | 136,699 | | | 175,289 | | | 153,561 | |

Working capital | | | 121,087 | | | 159,959 | | | 210,227 | | | 345,245 | | | 347,904 | | | 324,301 | |

Working capital, excluding current maturities of debt | | | 242,220 | | | 185,585 | | | 232,389 | | | 366,412 | | | 368,779 | | | 325,819 | |

Total assets | | | 870,056 | | | 789,529 | | | 762,047 | | | 885,857 | | | 922,842 | | | 925,689 | |

Total debt | | | 387,418 | | | 276,270 | | | 346,173 | | | 304,121 | | | 302,283 | | | 145,232 | |

Total patrons’ and other equity/stockholders’ equity | | | 272,550 | | | 283,161 | | | 183,897 | | | 284,615 | | | 317,548 | | | 450,728 | |

| (1) | In January 2001, we substantially curtailed our postretirement medical benefit plan for current employees. In October 2002, we substantially curtailed our postretirement supplemental life insurance plan. In April 2003, we substantially curtailed our postretirement medical plan for existing retirees. Gold Kist recognized pension settlement expense in fiscal 2004 and fiscal 2005. The pension settlement expense resulted from lump sum distribution payments from the plans to electing retiring employees exceeding service and interest cost components of pension expense in the plan year. See Note 8 of Notes to Consolidated Financial Statements. |

| (2) | During fiscal 2002, we sold our marketable equity security, our investment in an interregional fertilizer cooperative and other investments realizing total proceeds of $64.6 million and a gain before income taxes of $15.6 million. |

| (3) | In October 1998, Gold Kist completed the sale of assets of the Agri-Services segment business to Southern States Cooperative, Inc., or SSC. In connection with the transaction, Gold Kist purchased from SSC $60.0 million principal amount of capital trust securities and $40.0 million principal amount of cumulative preferred securities for $98.6 million in October 1999. In October 2002, SSC notified Gold Kist that, pursuant to the provisions of the indenture under which Gold Kist purchased the capital trust securities, SSC would defer the capital trust securities’ quarterly interest payment due on October 5, 2002. Quarterly interest payments for subsequent quarters were also deferred. As a result of the deferral of the interest payments, Gold Kist reduced the carrying value of the capital trust securities by $24.1 million with a corresponding charge against the loss from continuing operations for fiscal 2003. |

As of December 31, 2003, SSC’s total stockholders’ and patrons’ equity fell below Gold Kist’s carrying value of the preferred stock investment, which Gold Kist believed was a triggering event indicating impairment. We recorded an “other-than-temporary” impairment charge of $18.5 million, which was reflected as a loss on investment within other expenses. In June 2004, Gold Kist notified SSC that it was abandoning the investment and returned the securities. As a result of the abandonment, the remaining investment balance of $38.9 million was written off and reflected as a loss on investment within other expenses in the consolidated statement of operations for fiscal 2004. The write down of an investment in fiscal 2005 represents an investment in a supply cooperative in which the Company is no longer a member. See Note 11 of Notes to Consolidated Financial Statements.

| (4) | We had a 25% equity interest in Golden Peanut Company, LLC and its subsidiaries, or Golden Peanut. Our investment in Golden Peanut was accounted for using the equity method. We liquidated our investment in Golden Peanut at its carrying value in August 2001. |

| (5) | In June 2002, we adopted a plan to withdraw from and discontinue participation in a pecan processing and marketing partnership. This withdrawal was completed in January 2003. Accordingly, the operating results of the partnership have been segregated from continuing operations and reported separately in the Consolidated Statements of Operations. Our continuing operations are principally comprised of our broiler production, processing and marketing operations. |

| (6) | The Company converted from an agricultural cooperative to a for-profit corporation and completed its initial public stock offering in October 2004. See Note 2 of Notes to Consolidated Financial Statements. Earnings per share are calculated for fiscal 2005, the initial period the Company operated as a for-profit publicly traded stock corporation. See Note 12 of Notes to Consolidated Financial Statements for the calculation of basic and diluted weighted average common shares outstanding. |

| (7) | On October 20, 2004, the Board of Directors of the Company approved changing the fiscal year-end of the Company from the Saturday after the last Thursday in June to the Saturday after the last Thursday in September. Fiscal 2005 was a 52-week year that began on October 3, 2004 and ended October 1, 2005. |

16

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Summary

After two decades of rapid growth, the broiler industry is maturing and will be dependent on new and value-added product development, as well as expanded export opportunities, for continued revenue growth. Production and operating efficiencies will also be necessary for increased profitability. In addition, the industry is undergoing consolidation as a number of acquisitions and mergers have occurred in the last five years. The market share of the top five U.S. firms in terms of ready-to-cook broiler meat production has increased from approximately 49% in 1997 to 60% in 2004 and this trend is expected to continue. Gold Kist is the third largest producer of broilers and related products accounting for approximately 9% of the industry’s production in calendar 2004. We experienced our two best years in history in fiscal 2004 and fiscal 2005 in terms of operating income, net income, liquidity and financial condition.

We are focusing our growth efforts on value added products. The contracts for the sales of these products typically have longer terms than contracts for the sales of our minimally processed products and include fixed prices. As a result, we believe that increased sales of further-processed products will result in less volatility in the prices at which we sell our products. Sales of our value added products represented approximately 52% of our sales in fiscal 2005.

The industry has experienced volatility in results of operations over the last five years and expects the volatility to continue in the foreseeable future. Volatility in results of operations is generally attributable to fluctuations, which can be substantial, in broiler sales prices and cost of feed grains. Broiler sales prices tend to fluctuate due to changes in the supply of chicken, viability of export markets, supply and prices of competing meats and proteins, such as beef and pork, animal health factors in the global meat sector and general economic conditions.

According to the USDA World Agricultural Outlook Board (“WAOB”), calendar 2004 U.S. broiler meat production was approximately 33.7 billion pounds, ready-to-cook weight, 4.0% above the 32.4 billion pounds produced in calendar 2003. The WAOB October estimate for calendar 2005 broiler meat production is 34.8 billion pounds, which is a 3.3% increase from calendar 2004. The increases are principally due to heavier bird weights and to a lesser extent, projected increased chick placements. Broiler production forecasts for the remainder of calendar 2005 are lower than previous projections primarily because broiler hatchery and laying flock data indicate a slower pace of production. Broiler supply was temporarily impacted by Hurricane Katrina although we did not incur any significant losses from the effects of the storm. We do not have any operating facilities in Louisiana or Mississippi.

Our export sales, which we define as sales other than to customers in the United States or Canada, were $137.6 million for fiscal 2005 or approximately 6.0% of our net sales and 12.0% of our pounds sold. The U.S. poultry industry historically has exported approximately 15% to 20% of domestic production, principally dark meat products to Russia and other former Soviet Republics, Hong Kong, Mexico and China. Our poultry export sales have historically been less than 10% of net sales. Any disruption in the export markets can significantly impact domestic broiler sales prices by creating excess domestic supply. Although Hurricane Katrina has affected broiler exports, the disruptions are expected to be relatively short lived, as firms shift exports to other ports.

The cost of feed grains, primarily corn and soybean meal, averages approximately 55% to 60% of total live broiler production costs or approximately 30% to 35% of our cost of sales. Prices of feed grains fluctuate in response to worldwide supply and demand. Corn and soybean meal prices increased significantly in fiscal 2003 with soybean meal prices further increasing significantly in fiscal 2004, due to stronger worldwide demand and reduced U.S. crops due to weather problems in grain producing areas. Increased worldwide corn and soybean production favorably impacted feed ingredient costs in fiscal 2005. Our average feed ingredient costs were significantly lower in fiscal 2005 as compared to fiscal 2004, but were higher in the fourth quarter as compared to our third quarter of fiscal 2005.

17

Energy costs represent a significant component of product and delivery costs as such costs affect transportation costs, costs to operate poultry facilities and packaging costs. General price increases and recent spikes in energy prices due to the effects of the hurricanes increased our energy costs in fiscal 2005 as compared to fiscal 2004 by 27.5%. Although energy prices have moderated, it is expected that costs in the first half of fiscal 2006 will be higher than the first half of fiscal 2005.

General issues such as increased domestic and global competition in the meat industry, heightened concerns over the security of the U.S. food supply, volatility in feed grain commodity prices and export markets, increasing government regulation over animal production, animal welfare activism and animal disease (including additional outbreaks of avian influenza) continue as significant risks and challenges to profitability and growth, both for Gold Kist and the broiler industry in general. Although there are currently no reported avian influenza (“AI”) cases in commercial chicken in the United States and there has never been an outbreak of the H5N1 high pathogenic Asian strain of AI, confirmed cases in the U.S. commercial poultry industry could have an adverse effect on the supply of chicken, domestic and foreign product demand and sales prices for chicken products and our results of operations and financial position. See “Risk Factors—Outbreaks of livestock diseases, particularly an outbreak of avian influenza among humans, could adversely affect our business.”

References in this report to “fiscal 2005,” “fiscal 2004,” “fiscal 2003,” “fiscal 2002” and “fiscal 2001” refer to our fiscal years ending or ended October 1, 2005, June 26, 2004, June 28, 2003, June 29, 2002 and June 30, 2001, respectively. References in this report to “Transition Quarter” refer to the period from June 27, 2004 to October 2, 2004.

Results of Operations

The following table presents certain statement of operations items as a percentage of net sales for the periods indicated:

| | | | | | | | | | | | |

| | | Fiscal Years Ended

| | | Transition

Quarter

Ended

| | | Fiscal Year

Ended

| |

| | | June 28,

2003

| | | June 26,

2004

| | | October 2,

2004

| | | October 1,

2005

| |