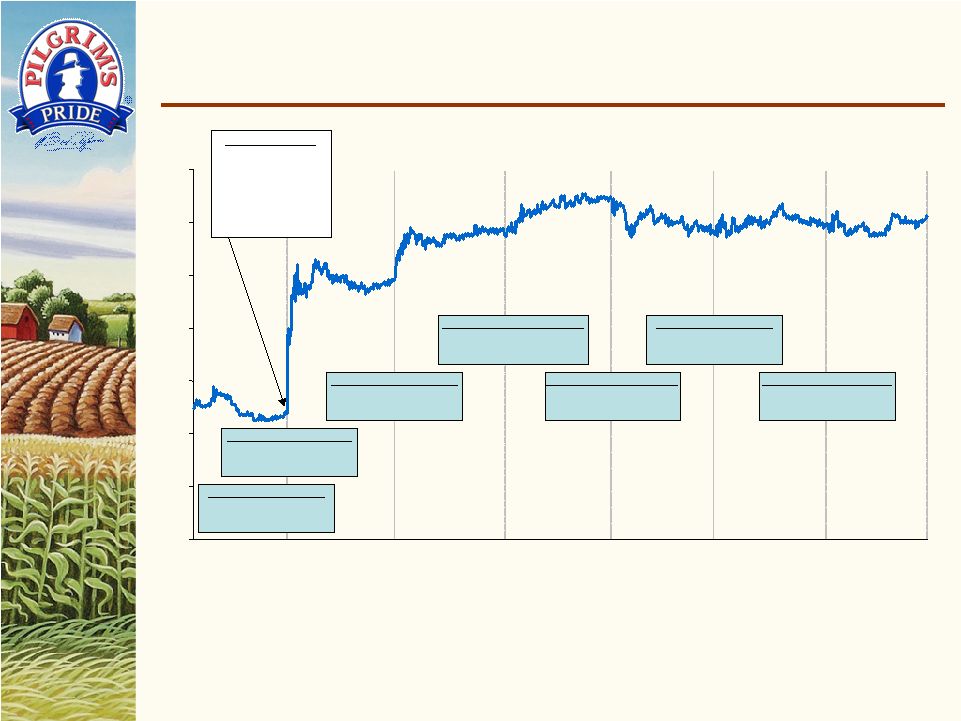

15 339 91 430 Term Loans 450 – 450 Bridge Loan $2,025 $125 795 $225 – $ – Facility Amount $125 $ – Receivables purchase agreement 795 – Revolving/term facility $1,836 $166 Total Available From Debt Facilities $127 $75 Revolving credit facilities Debt Facilities: 137 – Investments in available for sale securities $156 $ – Cash and cash equivalents Net Available Amount Outstanding Source of Liquidity As of September 30, 2006 ($ in millions) Liquidity and Financial Capacity (1) (2) (2) (3) (1) At September 30, 2006, the Company had $23.4 million in letters of credit outstanding relating to normal business transactions. (2) The amount available at September 30, 2006 under these facilities was $535.3 million. If the transaction is successful, the amount of borrowings available will increase by up to $486 million and, with the pledging of additional identified collateral to secure this facility; the full amount of the commitment under this facility will be available. The amounts reflected above contemplate that both of these events will occur. (3) Reflects a bridge loan agreement obtained by the Company from certain investment banks, pursuant to which, subject to specified conditions, the investment banks have agreed to make available to the Company a $450 million senior unsecured bridge loan for the purchase of shares of common stock of Gold Kist. |