UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14F-1

INFORMATION STATEMENT PURSUANT TO

SECTION 14(f) OF THE SECURITIES EXCHANGE ACT

OF 1934 AND RULE 14f-1 THEREUNDER

GOLD KIST INC.

(Exact name of registrant as specified in its charter)

| | | | |

| Delaware | | 000-50925 | | 20-1163666 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| |

| 244 Perimeter Center Parkway, N.E., Atlanta, Georgia | | 30346 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code

(770) 393-5000

GOLD KIST INC.

244 Perimeter Center Parkway, N.E.

Atlanta, Georgia 30346

INFORMATION STATEMENT PURSUANT TO

SECTION 14(f) OF THE SECURITIES EXCHANGE ACT

OF 1934 AND RULE 14f-1 THEREUNDER

This Information Statement is mailed on or about December 15, 2006 to the holders of record of common stock, par value $0.01 per share, of Gold Kist Inc., a Delaware corporation (the “Company”), in connection with the possible appointment, pursuant to the merger agreement (defined below), of persons designated by Pilgrim’s Pride Corporation, a Delaware corporation, to the Board of Directors of the Company (“Pilgrim’s Pride”) who, when appointed, would constitute a majority of the Board of Directors.

On September 29, 2006, Protein Acquisition Corporation, a Delaware corporation and a wholly-owned subsidiary of Pilgrim’s Pride (“Protein”) commenced a tender offer (the “Pending Offer”) to purchase all of the issued and outstanding shares of common stock, par value $0.01 per share, including the associated Series A Junior Participating Preferred Stock Purchase Rights (collectively, the “Company Common Stock”), for a price of $20.00 per share of Company Common Stock, net to the seller in cash, subject to certain terms and conditions. On December 3, 2006, the Company, Pilgrim’s Pride and Protein entered into a definitive Agreement and Plan of Merger (the “Merger Agreement”), dated as of December 3, 2006. The Merger Agreement provides that Protein would amend the Pending Offer (the “Revised Offer”) to provide for the purchase of all of the issued and outstanding shares of Company Common Stock for a price of $21.00 per share of Company Common Stock, net to the seller in cash, subject to certain terms and conditions set forth in the Merger Agreement. Pursuant to the Merger Agreement and subject to the conditions specified therein, in the event Protein accepts for payment and pays for the shares of Company Common Stock pursuant to the Revised Offer, Protein will be merged with and into Gold Kist, with Gold Kist as the surviving entity from the Merger (the “Merger”) and Gold Kist will become a wholly-owned subsidiary of Pilgrim’s Pride. In the Merger, each share of Company Common Stock then outstanding (other than shares held by the Company, Pilgrim’s Pride, Protein or any other direct or indirect wholly owned subsidiary of Pilgrim’s Pride and shares held by stockholders of the Company who shall have demanded properly in writing appraisal for such shares in accordance with Delaware law) shall be canceled and converted automatically into the right to receive $21.00 per share in cash without interest (the “Merger Consideration”).

The Merger Agreement provides that promptly upon the purchase of and payment for shares of Company Common Stock by Protein pursuant to the Revised Offer, which represents a majority of the shares of Company Common Stock outstanding on a fully diluted basis, Protein will be entitled to designate such number of directors, rounded up to the next whole number, on the Company’s Board of Directors as is equal to the product of the total number of directors on the Company’s Board of Directors (giving effect to the directors elected or designated by Protein) multiplied by the percentage that the aggregate number of shares of Company Common Stock beneficially owned by Protein and any of its affiliates bears to the total number of shares of Company Common Stock then outstanding (such directors which Pilgrim’s Pride is entitled to elect, the “Merger Designees”). In the event that the Merger Designees are elected or designated to the Company’s Board of Directors, then, until the Merger is consummated, the Company, Protein and Pilgrim’s Pride have agreed to cause the Company’s Board of Directors to maintain as a director one director who is an independent member of the Company’s Board of Directors on the date of the Merger Agreement (the “Continuing Director”). In the event that the Continuing Director is unable to serve due to death, disability or resignation, the other directors shall designate another director who was an independent member of the Company’s Board of Directors as of the date of the Merger Agreement to fill such vacancy. The affirmative vote of the Continuing Director will be required (i) for the Company to amend or terminate the Merger Agreement in a manner adverse to the stockholders of the Company other than Pilgrim’s Pride or its subsidiaries or (ii) to exercise or waive any of the Company’s rights, benefits or remedies under the Merger Agreement in a manner adverse to the stockholders of the Company other than Pilgrim’s Pride or its subsidiaries. It is anticipated that the Continuing Director will be Gold Kist’s current Chairman of the Board, A. D. Frazier, Jr.

This Information Statement is required by Section 14(f) of the Securities Exchange Act of 1934, as amended, and Rule 14f-1 thereunder in connection with the appointment of the Merger Designees to the Company’s Board of Directors.

You are urged to read this Information Statement carefully. You are not, however, required to take any action. WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

The information contained in this Information Statement (including information herein incorporated by reference) concerning Pilgrim’s Pride, Protein and the Merger Designees has been furnished to the Company by Pilgrim’s Pride, and the Company assumes no responsibility for the accuracy or completeness of such information.

CERTAIN INFORMATION REGARDING THE COMPANY

The authorized capital stock of the Company consists of 900,000,000 shares of Company Common Stock and 100,000,000 shares of preferred stock, without par value (the “Company Preferred Stock”). As of December 14, 2006, 51,024,977 shares of Company Common Stock were issued and outstanding and no shares of Company Preferred Stock were issued and outstanding.

The Company Common Stock is the only class of voting securities of the Company outstanding that is entitled to vote at a meeting of the stockholders of the Company. Each share of Company Common Stock entitles the record holder to one vote on all matters submitted to a vote of the stockholders.

MERGER DESIGNEES

Pilgrim’s Pride has informed the Company that Protein will choose its designees for the Board of Directors of the Company from the list of persons set forth below. In the event that additional Merger Designees are permitted in accordance with the terms of the Merger Agreement, such additional designees will be selected by Protein from and among the directors and executive officers of Pilgrim’s Pride and its subsidiaries. The following table, prepared from information furnished to the Company by Pilgrim’s Pride, sets forth, with respect to each individual who may be designated by Protein as a Merger Designee, the name, age of the individual as of December 14, 2006, present principal occupation and employment history during the past five years. Pilgrim’s Pride has informed the Company that each such individual (unless otherwise specified) is a U.S. citizen and has consented to act as a director of the Company if so appointed or elected. Unless otherwise indicated below, each individual has held his position for the past five years and the business address of each individual is 4845 U.S. Highway 271 North, Pittsburg, Texas 75686.

Pilgrim’s Pride has informed the Company that none of the individuals listed below has, during the past five years, (i) been convicted in a criminal proceeding or (ii) been a party to any judicial or administrative proceeding that resulted in a judgment, decree or final order enjoining the person from future violations of, or prohibiting activities subject to, U.S. federal or state securities laws, or a finding of any violation of U.S. federal or state securities laws. None of the Merger Designees is a director of, or holds any position with the Company. Pilgrim’s Pride has stated in its Schedule TO that it beneficially owns ten shares of Company Common Stock which Mr. O.B. Goolsby Jr., President and Chief Executive Officer of Pilgrim’s Pride, contributed to it on September 19, 2006 and that Mr. Goolsby beneficially owns 2,990 shares of Company Common Stock. Pilgrim’s Pride has also advised the Company that, to its knowledge, except as disclosed in its Schedule TO, dated September 29, 2006, as amended, none of the Merger Designees beneficially owns any equity securities (or rights to acquire any equity securities) of the Company or has been involved in any transactions with the Company or any of its directors, executive officers or affiliates that are required to be disclosed pursuant to the rules of the

2

Securities and Exchange Commission, or the “SEC”. Pilgrim’s Pride has advised the Company that, to its knowledge, none of its designees has any family relationship with any director, executive officer or key employee of the Company.

| | | | |

Name | | Age | | Position |

Lonnie “Bo” Pilgrim | | 78 | | Mr. Pilgrim has served as Chairman of the Board of Pilgrim’s Pride since the organization of Pilgrim’s Pride in July 1968. Mr. Pilgrim was previously Chief Executive Officer from July 1968 to June 1998. Prior to the incorporation of Pilgrim’s Pride, Mr. Pilgrim was a partner in its predecessor partnership business founded in 1946. |

| | |

Clifford E. Butler | | 64 | | Mr. Butler serves as Vice Chairman of the Board of Pilgrim’s Pride. Mr. Butler joined Pilgrim’s Pride as Controller and Director in 1969, was named Senior Vice President of Finance in 1973, became Chief Financial Officer and Vice Chairman of the Board in July 1983, became Executive President in January 1997 and served in such capacity through July 1998. |

| | |

O.B. Goolsby, Jr | | 59 | | Mr. Goolsby has served as President and Chief Executive Officer of Pilgrim’s Pride since September 2004. He became a director in January 2003. Mr. Goolsby served as President and Chief Operating Officer from November 2002 to October 2004. Mr. Goolsby served as Executive Vice President, Prepared Foods Complexes from June 1998 to November 2002. Mr. Goolsby previously served as Senior Vice President, Prepared Foods Operations from August 1992 to June 1998 and Vice President, Prepared Foods Complexes from September 1987 to August 1992 and was previously employed by Pilgrim’s Pride from November 1969 to January 1981. |

| | |

Richard A. Cogdill | | 46 | | Mr. Cogdill has served as Chief Financial Officer, Secretary and Treasurer of Pilgrim’s Pride since January 1997. Mr. Cogdill became a Director in September 1998. Previously he served as Senior Vice President, Corporate Controller, from August 1992 through December 1996 and as Vice President, Corporate Controller from October 1991 through August 1992. Prior to October 1991, he was a Senior Manager with Ernst & Young LLP. Mr. Cogdill is a Certified Public Accountant. |

| | |

J. Clinton Rivers | | 47 | | Mr. Clinton serves as Chief Operating Officer of Pilgrim’s Pride. Prior to being named Chief Operating Officer in October 2004, Mr. Rivers served as Executive Vice President of Prepared Food Operations from November 2002 to October |

3

| | | | |

Name | | Age | | Position |

| | | | 2004. Mr. Rivers was the Senior Vice President of Prepared Foods Operations from 1999 to November 2002, and was the Vice President of Prepared Foods Operations from 1992 to 1999. From 1989 to 1992, he served as Plant Manager of the Mount Pleasant, Texas Production Facility. Mr. Rivers joined Pilgrim’s Pride in 1986 as the Quality Assurance Manager, and also held positions at Perdue Farms and Golden West Foods. |

| | |

Robert A. Wright | | 52 | | Mr. Wright serves as Executive Vice President of Sales and Marketing of Pilgrim’s Pride. Prior to being named Executive Vice President of Sales and Marketing in June 2004, Mr. Wright served as Executive Vice President, Turkey Division since October 2003 when he joined Pilgrim’s Pride. Prior to October 2003, Mr. Wright served as President of Butterball Turkey Company for five years. |

| | |

Vance C. Miller, Sr. | | 73 | | Mr. Miller was elected a Director of Pilgrim’s Pride in September 1986. Mr. Miller has been Chairman of Vance C. Miller Interests, a real estate development Company formed in 1977, and has served as the Chairman of the Board and Chief Executive Officer of Henry S. Miller Cos., a Dallas, Texas, real estate services firm, since 1991. Mr. Miller was appointed by the President of the United States to serve as Director of Fannie Mae from 1986 to 1989. |

| | |

Keith W. Hughes | | 60 | | Mr. Hughes was elected a Director of Pilgrim’s Pride in September 2004. He was Chairman and Chief Executive Officer of Dallas-based Associates First Capital from 1994 to 2000 when it merged with Citigroup, and served as Associates First Capital’s President and Chief Operating Officer from 1991 to 1994. Prior to joining Associates, he held various roles in the financial services industry working for Continental Illinois Bank in Chicago, Northwestern Bank in Minneapolis and Crocker Bank in San Francisco. Mr. Hughes also serves as a director of Texas Industries, Inc., a producer of cement, concrete and aggregate construction material; and Fidelity National Information Services, where he is also a member of the Audit Committee. He is a former Vice Chairman and member of the Board of Directors of Citigroup. |

| | |

Linda Chavez | | 59 | | Ms. Chavez has been Chairman of the Center for Equal Opportunity, a non-profit public policy |

4

| | | | |

Name | | Age | | Position |

| | | | research organization in Sterling, Virginia since January 1, 2006 and previously served as its President from 1995 until her election as Chairman. Previously, Ms. Chavez served as Chairman of the National Commission on Migrant Education, from 1988 to 1992 and as White House Director of Public Liaison in 1985. She was elected a Director in July 2004. She also serves on the board of directors of ABM Industries, Inc., a facilities service contractor, as well as on the boards of several non-profit organizations. |

| | |

Jane Brookshire | | 61 | | Ms. Brookshire has served as Executive Vice President of Human Resources of Pilgrim’s Pride since October 2005. Prior to assuming the position of Executive Vice President of Human Resources, Ms. Brookshire served as Senior Vice President of Human Resources at Pilgrim’s Pride from February 2001 to September 2005. Ms. Brookshire was an officer of WLR Foods, Inc. from 1993 to 2001, as Vice President for Administration from November 1998 to January 2001, as Secretary from September 1998 to January 2001 and as Vice President of Human Resources from October 1993 to October 1998. |

5

DIRECTORS AND EXECUTIVE OFFICERS OF THE COMPANY

The table below sets forth the names, ages and positions of our executive officers and directors as of December 14, 2006:

| | | | | | |

Name | | Age | | Years with the Company | | Position |

John Bekkers | | 61 | | 21 | | President, Chief Executive Officer and Director (Class 1) |

| | | |

Michael A. Stimpert | | 62 | | 22 | | Senior Vice President, Planning and Administration |

| | | |

Stephen O. West | | 60 | | 26 | | Chief Financial Officer, Vice President |

| | | |

Donald W. Mabe | | 52 | | 20 | | Vice President, Operations |

| | | |

William T. Andersen | | 44 | | 5 | | Vice President, Marketing and Sales |

| | | |

R. Randolph Devening | | 64 | | 2 | | Director (Class 2) |

| | | |

A.D. Frazier, Jr. | | 62 | | 2 | | Director (Class 3) |

| | | |

Ray A. Goldberg | | 80 | | 2 | | Director (Class 1) |

| | | |

Jeffery A. Henderson | | 46 | | 6 | | Director (Class 3) |

| | | |

John D. Johnson | | 58 | | 2 | | Director (Class 2) |

| | | |

Douglas A. Reeves | | 64 | | 6 | | Director (Class 2) |

| | | |

Dan Smalley | | 57 | | 21 | | Director (Class 1) |

| | | |

W. Wayne Woody | | 64 | | 2 | | Director (Class 3) |

John Bekkers joined Gold Kist in 1985. Mr. Bekkers joined our Board of Directors in 2004 in connection with our conversion from a cooperative marketing association to a for profit corporation, which we refer to as our “conversion,” and serves on the Executive Committee. Prior to joining Gold Kist, Mr. Bekkers was a management consultant, Gold Kist being one of his clients. Mr. Bekkers’ career with us includes seven years as manager of our Northeast Alabama Poultry Division. In 1994, he was named Executive Vice President and was elected to his present position in 2001. Mr. Bekkers is the past Chairman of the National Chicken Council. A native of the Netherlands, he immigrated to the United States in 1962 and served in the U.S. armed forces in Vietnam. Mr. Bekkers attended college in both the Netherlands and California, and completed the Duke University advanced management program.

Michael A. Stimpert joined Gold Kist in 1974. From 1974 through 1986, his primary responsibilities centered in the Marketing Group of the Company. In 1986, Mr. Stimpert moved to Golden Peanut Company, a joint venture of the Company with three leading global agricultural companies, and stayed there for nine years, spending the last five years there as the Chairman of its Management Executive Committee. He returned to Gold Kist in 1996, assuming his current role. He holds an M.B.A. from Harvard University. Mr. Stimpert has been active in numerous corporate and civic boards of directors. Mr. Stimpert is a veteran of the U.S. Navy, having served in Vietnam.

Stephen O. West joined Gold Kist in 1980 as Director of Financial Analysis. He served as Treasurer from 1983 until 1998, and then as Chief Financial Officer and Treasurer from 1998 until 2004. He holds an undergraduate degree in electrical engineering from the Georgia Institute of Technology and master’s degrees in accounting and finance from Georgia State University. Mr. West is a veteran of the U.S. Navy.

Donald W. Mabe joined Gold Kist in 1978 as a hatchery manager in Carrollton, Georgia. In 1992, Mr. Mabe was promoted to President of Carolina Golden Products Company in Sumter, South Carolina, a

6

partnership between Gold Kist and its former publicly-owned subsidiary, Golden Poultry Company. In 1998, Mr. Mabe was promoted to his current responsibilities for the daily operations of Gold Kist’s Poultry Group. Mr. Mabe is a graduate of Emory University.

William T. Andersen joined Gold Kist in 2001 and was named Vice President of Sales and Marketing in 2005. Prior to joining Gold Kist, he worked as Regional Sales Manager for FMC Corporation from 1998 to 2001. He served as Captain in the U.S. Air Force for six years. He holds a bachelors degree in engineering from the U.S. Air Force Academy and a master’s degree in management from Central Michigan University.

R. Randolph Devening joined our Board of Directors in 2004 in connection with our conversion and serves on the Audit and Compliance Committee and the Compensation, Nominating and Corporate Governance Committee. From 1994 until his retirement in 2001, Mr. Devening served as Chairman, President and Chief Executive Officer of Foodbrands America, Inc. From 1989 to 1994, Mr. Devening held the positions of Executive Vice President, Chief Financial Officer, Vice Chairman and Director of Fleming Companies, Inc. Mr. Devening currently serves as a member of the boards of directors of 7-Eleven, Inc. and Penford Corporation.

A.D. Frazier, Jr. joined our Board of Directors in 2004 in connection with our conversion and serves as Chairman of the Board, Chairman of the Executive Committee and a member of the Compensation, Nominating and Corporate Governance Committee. From January 2005 through March 2006, he was “of counsel” with the law firm of Balch & Bingham LLP. Since March 2006, he has been Chairman of the Board and Chief Executive Officer of Danka Business Systems PLC, a U.S. based publicly traded copier dealer. Mr. Frazier retired as a director, President and Chief Operating Officer of Caremark Rx, Inc. in March 2004, where he served in that role since 2002. From March 2001 to 2002, Mr. Frazier was the Chairman and Chief Executive Officer of the Chicago Stock Exchange. From 1996 to 2001, Mr. Frazier served as a Global Partner of Amvescap PLC, a global investment manager. From 1997 through 2000, Mr. Frazier also served as President and Chief Executive Officer of INVESCO Inc., a division of Amvescap PLC, with overall responsibility for all U.S. based INVESCO institutional business. Mr. Frazier is a director and member of the compensation committee of Apache Corp., a publicly traded oil and gas exploration and development company.

Ray A. Goldberg joined our Board of Directors in 2004 in connection with our conversion and serves as Chairman of the Compensation Committee. Mr. Goldberg is the George Moffett Professor of Agriculture and Business, Emeritus at the Harvard University Graduate School of Business. He is one of the founders and first President of the International Agribusiness Management Association and an advisor and consultant to numerous government agencies and private firms. He currently serves on the board of directors of Smithfield Foods, Inc.

Jeffery A. Henderson joined our Board of Directors in 2004 in connection with our conversion. Mr. Henderson previously served as a director of Gold Kist Inc., the cooperative marketing association which we refer to herein as “Old Gold Kist,” from 2000 to 2004 and as a member of Old Gold Kist’s Executive, Compensation and Grower Relations Committees. Mr. Henderson has been a broiler producer for Gold Kist since 1980.

John D. Johnson joined our Board of Directors in 2004 in connection with our conversion and serves on the Executive Committee and the Audit and Compliance Committee. Mr. Johnson has served as the President and Chief Executive Officer of CHS, Inc. (formerly Cenex Harvest States Cooperatives), the largest U.S. cooperative marketer of grain and oilseed since 2000. From 1998 to 2000, Mr. Johnson served as General Manager and President of CHS. Mr. Johnson is a director of CF Industries Holdings, Inc., a fertilizer manufacturer and distributor.

Douglas A. Reeves joined our Board of Directors in 2004 in connection with our conversion. Mr. Reeves previously served as a director of Old Gold Kist from 2000 to 2004 and served as chairman of that board of directors for two years. Mr. Reeves has operated with his brother, J.C. Reeves, Jr., Reeves Brothers Poultry Farms for the past 37 years. Mr. Reeves attended Clemson University and is chairman of the board of the Edisto

7

Electric Cooperative, vice chairman of the Central Electric Cooperative and chairman of the board of the South Carolina Bank and Trust in St. George, South Carolina. Mr. Reeves is a state director of the South Carolina Farm Bureau, director of the South Carolina Farm Bureau Mutual Insurance Company, commissioner of the Dorchester County Soil Conservation District and a past-president of the South Carolina Poultry Federation.

Dan Smalley joined our Board of Directors in 2004 in connection with our conversion. From 2003 to 2004, Mr. Smalley served as a director of Old Gold Kist. Mr. Smalley had previously served as one of the directors of Old Gold Kist for 18 years and served as chairman of the board of directors of Old Gold Kist for two years. Mr. Smalley has been a broiler producer for Gold Kist since 1975. Mr. Smalley is a member of the Alabama Farmers Federation and is former Marshall County president and a past president of the Alabama Poultry and Egg Association, former chairman of the Farm Foundation in Chicago, Illinois, past-chairman of the Alabama 4-H Foundation and a past-president of the Alabama Agribusiness Council, chairman of the Alabama Conservation Development Commission, chairman of the Alabama Soil and Water Conservation Foundation and a member of the Bennett Agricultural Roundtable of Farm Foundation. Mr. Smalley is a graduate of Samford University.

W. Wayne Woody joined our Board of Directors in 2004 in connection with our conversion and serves as Chairman of the Audit and Compliance Committee. Mr. Woody retired as a senior partner of KPMG LLP in 1999. From September 2000 through March 2001, Mr. Woody served as the interim chief financial officer for Legacy Investment Group, a boutique investment firm. Mr. Woody currently serves on the boards of directors of the Wells Family of Real Estate Funds, Wells Real Estate Investment Trust II Inc., Wells Real Estate Investment Trust Inc. and American HomePatient, Inc.

Currently, our board consists of nine directors, five of whom are independent directors under requirements imposed by the SEC and Nasdaq. Our board or our stockholders may by resolution change the number of directors on the board.

Our board is divided into three classes, each of which consists, as nearly as may be possible, of one-third of the total number of directors constituting the entire board. Each class of directors serves a three-year term. The directors in class 2 have terms that expire at the 2007 annual meeting, those directors in class 3 have terms that expire at the 2008 annual meeting and those directors in class 1 have terms that expire at the 2009 annual meeting. At each annual meeting of our stockholders, successors to the class of directors whose term expires at the annual meeting are elected for three-year terms. There is no family relationship between any of the directors and any of our executive officers. Our executive officers are selected by the board annually. Each of the executive officers listed above holds the title(s) by his or her name with the Company.

LEGAL PROCEEDINGS

Gold Kist Inc. v. Pilgrim’s Pride Corporation et al. Gold Kist filed a lawsuit on October 12, 2006 in the United States District Court for the Northern District of Georgia under the caption Gold Kist Inc. v. Pilgrim’s Pride Corporation, et al., CA No. 1:06-CV-2441-JEC, seeking to enjoin Pilgrim’s Pride from proceeding with its proposed solicitation of the Company’s stockholders to add Pilgrim’s Pride’s officers to the Company’s Board of Directors and to enjoin Pilgrim’s Pride from continuing to violate the federal securities laws. The lawsuit alleges that Pilgrim’s Pride’s attempt to add nine of its officers to the Company’s Board of Directors would, if successful, violate Section 8 of the Clayton Act, which prohibits officers and directors from sitting on the Board of Directors of a competitor. The lawsuit also alleges violations of the SEC’s proxy and tender offer rules by Pilgrim’s Pride for failing to disclose to the Company’s stockholders that the election of the Pilgrim nominees would violate the Clayton Act. The lawsuit seeks to enjoin Pilgrim’s Pride’s efforts to elect its nominees in violation of the Clayton Act and an order requiring Pilgrim’s Pride to withdraw its hostile tender offer permanently or until corrective disclosures are made. Messrs. Goolsby, Rivers and Wright and Ms. Brookshire, who are Merger Designees, are also named as defendants in the lawsuit. On October 23, 2006, Gold Kist filed a

8

motion for a preliminary injunction relating to the matters described above. Under the terms of the Merger Agreement, the Company and Pilgrim’s Pride agreed to stay all proceedings (including discovery) relating to the litigation and the Company has agreed to dismiss with prejudice all claims asserted and or that could be asserted in the suit upon the successful completion of Pilgrim’s Pride’s Revised Offer. Proceedings in the suit were stayed on December 8, 2006.

In re Gold Kist Shareholders Litigation and Ponds Edge Capital, LLC v. John Bekkers, et al. The Company and the members of its Board of Directors have been named as defendants in three substantially identical purported stockholder class actions, two of which have been consolidated in the Court of Chancery of the State of Delaware in and for New Castle County under the caption In re Gold Kist Shareholders Litigation, C.A. No. 2492-N, and one of which has been filed in the Superior Court of Fulton County, Georgia, captioned Ponds Edge Capital, LLC v. John Bekkers, et al., Civil Action File No. 2006CV124898. The lawsuits allege that the defendants are breaching their fiduciary duties in responding to the Pilgrim’s Pride tender offer, including by failing to inform themselves regarding potential strategic alternatives and the value of the Company in a fully negotiated transaction. The lawsuits seek injunctive relief and unspecified damages. The Company and the other defendants deny that they have breached their fiduciary duties, further deny that they are liable to the plaintiffs or the purported plaintiff class in any amount, and are vigorously defending these class actions.

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS

The following table sets forth certain information regarding the beneficial ownership of Company Common Stock as of December 14, 2006 by:

(1) each person known by the Company to beneficially own more than 5% of the outstanding shares of Company Common Stock,

(2) each of our directors and named executive officers, and

(3) all of our directors and executive officers as a group.

Except as otherwise indicated below, each of the persons named in the table will have sole voting and investment power with respect to the shares beneficially owned by such person as set forth opposite such person’s name.

| | |

Name | | Number of Shares Beneficially Owned (1)(2) |

John Bekkers (3)(14) | | 351,599 |

Michael A. Stimpert (4)(14) | | 92,144 |

Stephen O. West (5)(14) | | 68,163 |

Donald W. Mabe (6)(14) | | 47,935 |

William T. Andersen (7)(14) | | 20,081 |

R. Randolph Devening | | 5,374 |

A.D. Frazier, Jr. | | 18,224 |

Ray A. Goldberg | | 5,374 |

Jeffery A. Henderson (8) | | 65,664 |

John D. Johnson (9) | | 9,784 |

Douglas A. Reeves (9) | | 18,721 |

Dan Smalley | | 206,011 |

W. Wayne Woody | | 5,374 |

Citadel Limited Partnership (10) | | 3,540,986 |

Michael A. Roth & Brian J. Stark (11) | | 2,789,830 |

Mario J. Gabelli (12) | | 4,886,884 |

All directors and executive officers as a group (13 persons) (13) | | 914,448 |

9

| (1) | Beneficial ownership is determined in accordance with the rules of the SEC that deem shares to be beneficially owned by any person who has or shares voting power or investment power with respect to such shares. Unless otherwise indicated below, the persons named in the table have sole voting and sole investment power with respect to all shares beneficially owned, subject to community property laws where applicable. Shares of Company Common Stock that will be issuable to the identified person or entity pursuant to the stock appreciation rights that are either immediately exercisable or exercisable within sixty days of December 14, 2006 are deemed to be outstanding and to be beneficially owned by the person holding such stock appreciation rights for the purpose of computing the percentage ownership of such person but are not treated as outstanding for the purpose of computing the percentage ownership of any other person. None of our directors or executive officers beneficially own more than 1.0% of the outstanding shares of Company Common Stock. Our directors and executive officers beneficially own as a group approximately 1.8% of the outstanding shares of Company Common Stock. |

| (2) | The calculations are based on 51,024,977 shares of Company Common Stock outstanding on December 14, 2006. |

| (3) | This amount includes 267,773 shares of restricted stock over which Mr. Bekkers currently has sole voting power. Also includes 39,915 shares issuable as of December 14, 2006 upon the settlement of stock appreciation rights granted to Mr. Bekkers that would have been exercisable if he had elected early retirement on December 14, 2006. |

| (4) | This amount includes 70,759 shares of restricted stock over which Mr. Stimpert currently has sole voting power. Also includes 12,276 shares issuable as of December 14, 2006 upon the settlement of stock appreciation rights granted to Mr. Stimpert that would have been exercisable if he had elected early retirement on December 14, 2006. |

| (5) | This amount includes 53,365 shares of restricted stock over which Mr. West currently has sole voting power and 700 shares of stock held jointly by Mr. West and his wife over which Mr. West shares voting power. Also includes 9,548 shares issuable as of December 3, 2006 upon the settlement of stock appreciation rights granted to Mr. West that would have been exercisable if he had elected early retirement on December 3, 2006. |

| (6) | This amount includes 43,577 shares of restricted stock over which Mr. Mabe currently has sole voting power. |

| (7) | This amount includes 17,081 shares of restricted stock over which Mr. Andersen currently has sole voting power. |

| (8) | This amount includes 1,030 shares of stock held by Mr. Henderson’s wife over which Mr. Henderson does not have voting power. |

| (9) | This amount includes 4,410 shares issuable upon conversion of deferred stock units. |

| (10) | This information as to the beneficial ownership of shares of Company Common Stock is based solely on a Schedule 13G filed jointly by Citadel Limited Partnership (“Limited”), Citadel Investment Group, L.L.C. (“Investment”), Kenneth Griffin (“Griffin”), Citadel Wellington LLC (“Wellington”), Citadel Kensington Global Strategies Fund Ltd. (“Kensington”), Citadel Equity Fund Ltd. (“Equity”) and Citadel Derivatives Group LLC (“Derivatives,” and together with Limited, Investment, Griffin, Wellington, Kensington and Equity, the “Citadel Entities”)) with the Securities Exchange Commission on August 31, 2006. According to the report, the Citadel Entities, whose principal business address is 131 S. Dearborn Street, 32nd Floor Chicago, IL 60603, share voting and dispositive power with respect to 3,540,986 shares, or approximately 6.9% of the Company Common Stock, and none of the Citadel Entities has sole voting or dispositive power with respect to any shares. |

| (11) | This information as to the beneficial ownership of shares of Company Common Stock is based solely on a Schedule 13G filed jointly by Michael A. Roth (“Roth”) and Brian J. Stark (“Stark”) with the Securities Exchange Commission on December 13, 2006. According to the report, Stark and Roth, whose principal business address is 3600 South Lake Drive, St. Francis, WI 53235, share voting and dispositive power with respect to 2,789,830 shares, or approximately 5.5% of the Company Common Stock, held by Stark Master Fund Ltd (“Stark Master”) as managing members of Stark Offshore Management LLC (“Stark Offshore”), which acts as investment manager and has sole power to direct the management of Stark Master, and neither Stark nor Roth have sole voting or dispositive power with respect to any shares. |

10

| (12) | This information as to the beneficial ownership of shares of Company Common Stock is based solely on a Schedule 13D filed with the SEC on December 14, 2006 jointly by Mario J. Gabelli (“Gabelli”) and the following entities which he directly or indirectly controls or for which he acts as chief investment officer: Gabelli Funds, LLC (“Gabelli Funds”), GAMCO Asset Management Inc. formerly known as GAMCO Investors, Inc. (“GAMCO”), GAMCO Investors, Inc. formerly known as Gabelli Asset Management Inc. (“GBL”), Gabelli Securities, Inc. (“GSI”), MJG Associates, Inc. (“MJG Associates”), Gabelli Foundation, Inc. (“Foundation” and together with Gabelli, Gabelli Funds, GAMCO, GBL, GSI, MJG Associates, the “Gambelli Entities”). According to the report, except as noted below, the principal business address of the Gabelli Entities is One Corporate Center, Rye, NY 10580. MJG Associates has its principal business office at 140 Greenwich Avenue, Greenwich, CT 06830. The Foundation has its principal offices at 165 West Liberty Street, Reno, NV 89501. According to the report, the Gabelli Entities hold 4,886,884 shares, or approximately 9.6% of the Company Common Stock. Each of the Gabelli Entities holds the Company Common Stock reported by it for investment for one or more accounts over which it has shared, sole, or both investment and/or voting power, for its own account, or both. |

| (13) | For information regarding the beneficial ownership of Company Common Stock by Pilgrim’s Pride and the Merger Designees, see “Merger Designees,” above. |

| (14) | For information regarding the treatment of stock appreciation rights under the Merger Agreement, see note 1 to the table under “Fiscal Year-End SAR Values.” For information regarding the Merger Agreement provisions for accelerated vesting of performance share awards, see note 1 to the table under “Long-Term Incentive Plan Awards in Last Fiscal Year.” |

11

AUDIT COMMITTEE REPORT

The Audit and Compliance Committee oversees our financial reporting process and internal controls on behalf of the Board of Directors. The Audit and Compliance Committee operates under a written charter which was adopted in October 2004. The full text of the charter is available on our website at www.goldkist.com.

Management has primary responsibility for preparing financial statements, for maintaining effective internal control over financial reporting, and for assessing the effectiveness of internal control over financial reporting. Management has represented to the Audit and Compliance Committee that our 2006 consolidated financial statements are in accordance with accounting principles generally accepted in the United States. In fulfilling its oversight responsibilities, the Audit and Compliance Committee reviewed and discussed the audited consolidated financial statements in our annual report on Form 10-K with management, including a discussion of the quality, not just the acceptability, of the accounting principles; the reasonableness of significant judgments; and the clarity of disclosures in the financial statements.

The Audit and Compliance Committee reviewed with KPMG LLP, our independent registered public accounting firm, which is responsible for expressing an opinion on the conformity of those audited consolidated financial statements with U.S. generally accepted accounting principles, its judgments as to the quality, not just the acceptability, of the accounting principles and such other matters as are required to be discussed with the Audit and Compliance Committee by Statement on Auditing Standards No. 61, as amended, other standards of the Public Company Accounting Oversight Board, United States, rules of the SEC and other applicable regulations. The Committee also received written disclosures and the letter from KPMG LLP required by Independence Standards Board Standard No. 1 and discussed with KPMG LLP their independence from us and our management, and considered the compatibility of non-audit services with KPMG LLP’s independence.

The Audit and Compliance Committee has reviewed and discussed with management its assessment and report on the effectiveness of the Company’s internal control over financial reporting as of September 30, 2006, which it made using the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission in Internal Control-Integrated Framework. The Audit and Compliance Committee has also reviewed and discussed with KPMG LLP its attestation report on management’s assessment of internal control over financial reporting and its review and report on the Company’s internal control over financial reporting. The Company published these reports in its Annual Report on Form 10-K for the fiscal year ended September 30, 2006.

In reliance on the reviews and discussions referred to above, the Audit and Compliance Committee recommended to the board that the audited consolidated financial statements be included in our annual report on Form 10-K for the year ended September 30, 2006, filed with the SEC.

AUDIT AND COMPLIANCE COMMITTEE

W. Wayne Woody (Chairman)

R. Randolph Devening

John D. Johnson

December 12, 2006

12

CORPORATE GOVERNANCE MATTERS

Our Corporate Governance Guidelines, Code of Business Conduct, committee charters and other governance policies are all available on our website at www.goldkist.com.

Board of Directors

Meetings of the Board

Our Corporate Governance Guidelines provide that each director is expected to attend all meetings of the board and committees on which such director serves and is expected to attend our annual meeting. Our board held twelve meetings in fiscal 2006 and acted by unanimous written consent on one other occasion. All directors attended at least 75% of all board and committee meetings during fiscal 2006.

Committees of the Board

In October 2004, our board constituted the following three standing committees—the Executive Committee, the Audit and Compliance Committee and the Compensation, Nominating and Corporate Governance Committee. Membership and principal responsibilities of the board committees are described below.

Executive Committee. During 2006, our Executive Committee was comprised of the following members:

Members

A.D. Frazier, Jr. (Chairman)

John Bekkers

John D. Johnson

Douglas A. Reeves

Our Executive Committee has the authority to exercise the power and authority of the Board of Directors between meetings, except the powers, such as referring certain matters to a vote of our stockholders and amending our bylaws, which are reserved for the Board of Directors by the Delaware General Corporation Law.

Audit and Compliance Committee. During 2006, our Audit and Compliance Committee was comprised of the following members:

Members

W. Wayne Woody (Chairman)

R. Randolph Devening

John D. Johnson

The Audit and Compliance Committee assists the Board of Directors in its general oversight of our financial reporting, internal controls and audit functions. Our Audit and Compliance Committee charter defines this committee’s primary duties, which include, among other things:

| | • | | monitoring and assessing our compliance with legal and regulatory requirements, our financial reporting process and related internal control systems and the general oversight of our internal audit function; |

| | • | | overseeing the services provided by our outside auditors and being directly responsible for the appointment, independence, qualification, compensation and oversight of our outside auditors, who report directly to the Audit and Compliance Committee; |

| | • | | providing an open means of communication among our outside auditors, financial and senior management, our internal audit department and our Board of Directors; |

| | • | | resolving any disagreements between our management and our independent auditors regarding our financial reporting; |

| | • | | meeting periodically with our senior executives, internal auditors and independent auditors; and |

13

| | • | | preparing the Audit and Compliance Committee report for inclusion in our proxy statement for our annual meeting. |

Our Audit and Compliance Committee charter mandates that our Audit and Compliance Committee approve all audit, audit-related, tax and other services conducted by our independent auditors. Our Audit and Compliance Committee met ten times during fiscal 2006. At each meeting, Audit and Compliance Committee members meet privately with representatives of our independent accountants and with our chief financial officer, chief accounting officer and our internal auditors.

Our board has affirmatively determined that each member of our Audit and Compliance Committee is financially literate and that each of Messrs. Woody, Devening and Johnson qualifies as an “audit committee financial expert” within the meaning of SEC rules and regulations. As of the date of the Company’s most recent proxy statement, all three members of our Audit and Compliance Committee are independent directors.

Compensation, Nominating and Corporate Governance Committee. During 2006, our Compensation, Nominating and Corporate Governance Committee was comprised of the following members:

Members

Ray A. Goldberg (Chairman)

A.D. Frazier, Jr.

R. Randolph Devening

Our Compensation, Nominating and Corporate Governance Committee charter defines the committee’s principal duties and responsibilities, which include, among other things:

| | • | | establishing guidelines and standards for determining the compensation of our executive officers and reviewing our executive compensation strategy and recommending to our Board of Directors improvements to our compensation policies; |

| | • | | evaluating the performance of our chief executive officer and determining and approving compensation levels for our executive officers; |

| | • | | administering our equity-based and incentive plans; |

| | • | | preparing a report on executive compensation for inclusion in our proxy statement for our annual meeting; |

| | • | | establishing and periodically reviewing minimum qualification and selection criteria to be used for screening candidates for service on our Board of Directors; |

| | • | | identifying and evaluating individuals qualified to become members of our Board of Directors and recommending director candidates for consideration by our Board of Directors or stockholders; |

| | • | | considering and making recommendations to our Board of Directors regarding board size and composition, committee composition and structure and procedures affecting directors; |

| | • | | developing, establishing and periodically reviewing our corporate governance principles and guidelines; and |

| | • | | overseeing the annual evaluation of management, our Board of Directors and the committees of the Board of Directors. |

Our Compensation, Nominating and Corporate Governance Committee met five times during fiscal 2006. Our board has affirmatively determined that each member of our Compensation, Nominating and Corporate Governance Committee is independent.

14

Director Compensation

Any member of our Board of Directors who is also our employee does not receive additional compensation for serving on our Board of Directors. Compensation for our non-employee directors is awarded under the Gold Kist 2004 Non-Employee Directors Compensation Plan, or the “Directors’ Plan,” which provides for cash and equity compensation for our non-employee directors. The board believes that annual compensation for non-employee directors should consist of both a cash component, to compensate members for their service on the board and its committees, and a vesting equity component, to create an incentive for continued service as well as align their interests with those of our stockholders.

Cash Compensation. Under the Directors’ Plan, our non-employee directors receive a quarterly retainer of $8,750. Additional quarterly retainers are paid to the chairman of the Board of Directors and to the Audit and Compliance Committee chairperson, each in the amount of $1,250. A prorated quarterly retainer is paid to any person who becomes a non-employee director other than at the beginning of the quarter, or who becomes a chairman of the Board of Directors or chairman of the Audit and Compliance Committee on a date other than the beginning of a quarter. We also pay our non-employee directors a fee of $1,000 for personally attending a board meeting and $1,000 for personally attending a committee meeting, plus in each such case reasonable reimbursement of travel expenses in connection with attending meetings of our board and its committees. In addition, we pay $500 for attending telephonic board meetings. The Board of Directors, on September 20, 2006, approved additional compensation for members of the Special Committee, which was formed on August 29, 2006 for the purpose of evaluating Pilgrim’s Pride’s August 18, 2006 proposal and evaluating strategic alternatives to maximize stockholder value, in consideration of the commitment and additional time such persons could be required to spend on Company matters. The Chairman of the Special Committee (Mr. Devening) will receive a one-time payment of $60,000 and the other members of the Special Committee, Messrs. Frazier and Woody, will each receive a one-time payment of $50,000. These one-time payments will be made in lieu of the per-meeting fees that are normally paid to our directors for board and committee meetings and will be made at the conclusion of the Special Committee’s work, which is expected to occur upon to consummation of the Revised Offer.

Equity Compensation. In addition to cash compensation, each non-employee director receives, upon becoming a director, an initial award of shares of restricted stock having a grant date value of $35,000, subject to such restrictions and risk of forfeiture as determined by the Board of Directors. Our current non-employee directors received such initial awards at the time of our initial public offering. On the day following each annual meeting of our stockholders each non-employee director then in office also will receive an award of fully vested shares of Common Stock having a grant date value equal to $35,000. A non-employee director may also elect to defer some or all of his or her annual cash retainer, by conversion of the annual cash retainer to deferred stock units in accordance with the Directors’ Plan. The Directors’ Plan is a sub-plan of our 2004 Long-Term Incentive Plan, or “LTIP,” and any deferred stock units and shares of stock that may be issued pursuant to the Directors’ Plan are issued under the LTIP, subject to all of the terms and conditions of the LTIP.

To further align our non-employee directors’ interest with the interest of our stockholders, each non-employee director is required to acquire and retain within a period of five years from August 1, 2005 or from the date of his or her initial election or appointment to the Board of Directors, whichever is later, shares of Company Common Stock equal or greater in value than two times the amount of the annual retainer initially paid to such director.

Grower Advisory Committee

Our grower advisory committee consisted of Christopher D. Fannon, Billy G. Meeks, Phil Ogletree, Jr., Fred W. Gretch, Jr., Walter C. Dockery, Charles Morris, W. A. Smith and Dorman Grace, each a director of Old Gold Kist prior to the conversion. The grower advisory committee was formed to advise us on issues important to relations with our contract growers and, subject to the discretion of the Board of Directors, generally worked to ensure a smooth transition from a cooperative to a for profit corporation. The grower advisory committee ended by its terms in October 2006. Each member of the grower advisory committee was compensated in a manner

15

consistent with their prior compensation as a member of the board of directors of Old Gold Kist prior to the conversion, including an annual retainer of $20,000 (in the case of Mr. Ogletree, $25,000) and per diem fees of $250 with a $500 minimum, plus expenses while traveling at the request of the Board of Directors, as well as health insurance and other benefits.

For information regarding certain ordinary course payments to certain members of the Board of Directors who are contract growers for the Company, see “Certain Relationships and Related Transactions.”

Director Independence

Our Corporate Governance Guidelines require that our board shall have at all times a majority of independent directors, as such term is defined by the Nasdaq Marketplace Rules. However, if Pilgrim’s Pride acquires at least a majority of the outstanding Company Common Stock in the Revised Offer, we will be a “controlled company” under the Nasdaq Marketplace Rules and we will be exempt from the provisions of those rules requiring that at least a majority of the Board members be independent directors. We expect that upon the election of the Merger Designees to our Board of Directors, the Board will revise our Corporate Governance Guidelines to allow reliance on that exemption. Subject to the foregoing, at least once per year, the board will review each relationship that exists with a director and his or her related interests for the purpose of determining whether the director is independent. This information shall be initially reviewed by the Compensation, Nominating and Corporate Governance Committee or, in the case of members of that committee, the full board.

The board considers all relevant facts and circumstances when making a determination of independence, not merely from the standpoint of a director, but also from that of persons or organizations with which the director has a significant affiliation, so that a director is free of any relationship with the Company or our management that may impair the director’s ability to make independent judgments. As a result of this review, the board affirmatively determined that five of our nine directors are independent (Messrs. Devening, Frazier, Goldberg, Johnson and Woody). Our Compensation, Nomination and Corporate Governance Committee and the Audit and Compliance Committee are comprised solely of independent directors.

Executive Sessions of Non-Management Directors

Our non-management directors are scheduled to meet without management present, which we refer to as meetings in “executive session,” at each regularly scheduled board meeting. The Chairman of the Board, who is an independent director, presides over executive sessions of the non-management directors.

Stockholder Communications with the Board

Any stockholder who wishes to communicate directly with the Chairman of the Board, any other director or the non-management directors as a group may do so by writing to:

Gold Kist Inc.

c/o Office of the General Counsel

244 Perimeter Center Parkway, N.E.

Atlanta, GA 30346.

All communications will be compiled by our Company’s Secretary and submitted to the board at its next regularly scheduled meeting.

Selection of Nominees for Director

Our directors take a critical role in guiding our strategic direction and overseeing our management. Our board has delegated to the Compensation, Nominating and Corporate Governance Committee the responsibility

16

for reviewing and recommending nominees for membership on the board. Directors should possess the highest personal and professional ethics, integrity and values, and be committed to representing the long-term interests of our Company and stockholders. In selecting candidates for nomination as directors, the Compensation, Nominating and Corporate Governance Committee considers such criteria as it deems appropriate, including, among other factors, such nominee’s current or recent experience as a senior executive officer, business expertise, industry experience, general ability to enhance the overall composition of the board, and subscription to our Company’s values philosophy. Such standards and qualification criteria are set forth in our Corporate Governance Guidelines.

Nominees Recommended by Stockholders

Any stockholder may recommend a candidate for nomination, provided the stockholder has continuously held, for at least one year prior to the date the nomination is submitted, at least $2,000 in market value or 1% of our securities entitled to vote for the election of directors, by submitting notice of such recommendation, together with the other information specified herein, in writing, to Gold Kist Inc., c/o Secretary, 244 Perimeter Center Parkway, N.E., Atlanta, Georgia 30346. In order to be considered by the board and the Compensation, Nominating and Corporate Governance Committee, such nominations must be received no less than 120 days prior to the anniversary of the date we mailed notice of our previous year’s annual meeting. However, if no annual meeting was held in the previous year, or, if the date of the next annual meeting has been changed by more than 30 calendar days from the date of the previous year’s annual meeting, such notice by the stockholder, to be timely, must be received no later than the close of business on the 10th day following the date on which the notice of the date of the annual meeting is given to stockholders.

Stockholder recommendations of director nominees must set forth the following information to the extent known to the recommending stockholder:

| | • | | the name, date of birth, business address and residence address of such individual; |

| | • | | the business experience during the past five years of such nominee, including his or her principal occupations and employment during such period, the name and principal business of any corporation or other organization in which such occupations and employment were carried on, and such other information as to the nature of his or her responsibilities and level of professional competence as may be sufficient to permit assessment of his or her prior business experience; |

| | • | | whether the nominee is or has ever been at any time a director, officer or owner of 5% or more of any class of capital stock, partnership interests or other equity interest of any corporation, partnership or other entity; |

| | • | | any directorships held by such nominee in any company with a class of securities registered pursuant to Section 12 of the Exchange Act, or subject to the requirements of Section 15(d) of such act or any company registered as an investment company under the Investment Company Act of 1940, as amended; |

| | • | | whether such nominee has ever been convicted in a criminal proceeding or has ever been subject to a judgment, order, finding or decree of any federal, state or other governmental entity, concerning any violation of federal, state or other law, or any proceeding in bankruptcy, which conviction, order, finding, decree or proceeding may be material to an evaluation of the ability or integrity of the nominee; |

| | • | | the name and business address of the stockholder making the nomination recommendation, as they appear on our record books; and |

| | • | | the class and number of shares of our common stock beneficially owned by the stockholder making the nomination recommendation. |

No stockholder nominee shall be eligible for election unless that person is nominated by the Compensation, Nominating and Corporate Governance Committee after compliance with these procedures.

17

EXECUTIVE COMPENSATION

COMPENSATION, NOMINATING AND CORPORATE GOVERNANCE

COMMITTEE REPORT ON EXECUTIVE COMPENSATION

This report summarizes the policies of the Compensation, Nominating and Corporate Governance Committee (the “Committee”) governing compensation to executive officers, who are the officers in the Summary Compensation Table, and the relationship of corporate performance to that compensation. This report also discusses specifically the Committee’s bases for the compensation reported for the Chief Executive Officer and the other executive officers for the past fiscal year.

The Committee is composed of three non-employee directors, each of whom is “independent” under the Nasdaq Marketplace Rules and the Committee’s Charter. See “Corporate Governance Matters — Director Independence.”

Pursuant to its Charter and as to matters relating to compensation, the Committee establishes guidelines and standards for determining the compensation of the Company’s executive officers and other employees; evaluates the performance of senior executives; reviews the Company’s executive compensation policies; determines the compensation levels for the Company’s executive officers, including the Chief Executive Officer, and administers and implements our equity-based and incentive plans. The Committee reports its decisions regularly to the full Board of Directors and may seek the Board of Directors’ guidance on compensation policy.

Compensation Philosophy and Program

The Committee seeks to ensure that the Company’s compensation program is consistent with, and provides incentives for the attainment of, the Company’s strategic business objectives. In addition, the Committee designed the compensation program to encourage and reward both short-term and long-term individual performance. The Company’s compensation program includes two components:

| | |

Annual Compensation | | Base salary provides a stable annual salary at a level consistent with the individual’s position and contributions to the Company’s performance. Cash bonuses make a portion of each manager’s annual income dependent upon the attainment of specified corporate and individual performance objectives. |

| |

Long-Term Incentives | | Encourages an ownership mindset by aligning the interests of officers and senior managers with other stockholders. |

The Committee believes that this combination of programs provides an appropriate mix of fixed and variable pay, balances short-term operational performance with long-term stock price performance, and encourages executive retention.

Components of Executive Compensation for 2006

Annual Compensation. Annual cash compensation for fiscal year 2006 consisted of base salary and short-term incentives (cash bonuses).

Base Salary. Base salaries for executive officers, including the Chief Executive Officer, are established by considering a number of factors, including the Company’s and the executive officer’s individual performance for the previous year, his or her future potential, scope of responsibilities and experience, and competitive salary practices. Base salaries are reviewed annually. Base salaries paid to the named executive officers in 2006 are included in the “Salary” (base pay) column in the Summary Compensation Table for 2006.

18

Short-Term Incentives (Cash Bonuses). Short-term incentive awards are issued pursuant to the Company’s Executive Management Incentive Plan (the “Annual Incentive Plan”). Executive officers are eligible to receive a bonus in connection with a particular fiscal year during the term of the plan if performance goals for the Company set for that year by the Committee are met or exceeded. At the beginning of each year, the Committee establishes written performance goals based on one or more performance criteria listed in the Annual Incentive Plan based on Company-wide objectives or in terms of objectives that relate to the performance of an affiliate or a division, department, region or function within the Company. Actual bonuses payable for any fiscal year will vary depending on the extent to which actual performance meets, exceeds or falls short of the corporate performance goals approved by the Committee. Target awards for fiscal year 2006 performance were established for each executive officer, expressed as a percentage of base salary. Such target awards were 60% of base salary for the executive officers other than the Chief Executive Officer, and 100% of base salary for the Chief Executive Officer. For fiscal year 2006, the Committee established a performance matrix based on corporate return on equity and net operating margin. Executive officers were eligible to receive a bonus award of 100% of target bonus opportunity if the Company reached “target” levels of performance on the matrix. The range of payment was 50% to 150% of the target bonus award, and no bonus would have been earned if performance had fallen below 50% of the target level of performance. The Company’s 2006 corporate return on equity and net operating margin resulted in payout of no bonuses for fiscal 2006.

Long-Term Incentives. During fiscal year 2006, the Company employed three forms of long-term equity incentives granted under the Company’s 2004 Long-Term Incentive Plan: stock settled stock appreciation rights (“SARs”), performance awards, and restricted stock. The Committee believes these incentives foster the long-term perspective necessary for continued success in the Company’s business and ensure that the Company’s leaders are properly focused on stockholder value.

| | • | | Stock appreciation rights align employee incentives with stockholders because SARs have value only if the stock price increases over time. In 2006, the Company granted SARs having a ten-year term, with a base price equal to the market price of our Common Stock on the date of grant. These SARs are designed to help retain key employees because they cannot be exercised for three years after the grant date (other than in the event of a change in control) and, in most cases, if not exercised will be forfeited at specified times if the employee leaves the Company during such three-year period. |

| | • | | Performance awards granted in fiscal year 2006 provide employees with shares of Company Common Stock if certain performance goals are achieved at the end of a three-year performance cycle, based upon the Company’s relative profitability (expressed as profit-per-bird-processed) compared to the weighted average profits of a peer group of poultry processing companies, as compiled for the final fiscal year in the performance period (fiscal year ending September 30, 2009). All of the performance shares are subject to forfeiture if the executive leaves the Company prior to the end of the performance period except in the case of death, disability or retirement, or the occurrence of a change in control. In the event of a change in control, the performance period will end and the performance shares will be earned at the target level of achievement (100% of the base number of shares), prorated for the number of full months having elapsed in the original performance period. |

| | • | | Restricted stock awards granted in fiscal year 2005 in connection with the Company’s initial public offering vest three years from the date of the grant. Restricted stock awards granted in fiscal year 2005 in connection with the 2005 compensation adjustments vest as to 25% of the shares on each anniversary of the date of grant. The first vesting event occurred in January 2006. All of the restricted stock awards are subject to forfeiture if the executive leaves the Company prior to vesting except in the case of death, disability or retirement, or the occurrence of a change in control. There were no restricted shares issued in fiscal 2006. |

19

Share retention guidelines. The Board of Directors adopted a policy in November 2005 requiring non-employee directors of the Company to own stock in the Company in an amount equal to or greater in value than two times the amount of the annual retainer initially paid to the director. Directors will have five years to achieve these ownership levels. In November 2005, the Board of Directors also adopted a policy of highly encouraging officers of the Company to own our Common Stock.

Employment and Change in Control Agreements with Executive Officers. Mr. Bekkers and Stimpert have employment agreements with the Company. The eleven other officers besides Messrs. Bekkers and Stimpert have change in control agreements with the Company.

Executive Benefits. Certain executive officers of the Company are eligible for benefits that are not available to all employees of the Company. Specifically, the executive benefits programs offered by the Company include:

| | • | | Supplemental Executive Retirement Plan. The Company provides a Supplemental Executive Retirement Plan, or SERP, under which the Company makes payments following termination of employment to certain executives. The SERP is a non-qualified deferred compensation plan that makes up reductions in such executive’s retirement benefits under the Company’s Pension Plan resulting from the Internal Revenue Code’s limitations on compensation taken into account and benefits that may be provided to Pension Plan participants, as well as for reductions caused by salary deferrals to a certain other deferred compensation plan. The Company in the past made, but no longer makes, annual contributions to rabbi trusts held for executives participating in the SERP. As of September 30, 2006, those funds in the rabbi trusts amount to $5,442,692. The Company’s obligations to executives participating in the SERP in excess of amounts held in the rabbi trusts will be paid from the Company’s general assets. A participant becomes fully vested in SERP benefits upon completion of five years of service with the Company. |

| | • | | Other Retirement Benefits. In addition to the retirement benefits provided under the SERP, the Company provides two current and four former executives with benefits upon termination of employment. These benefits are provided pursuant to Deferred Compensation Agreements and are paid following termination of employment in an annual amount equal to 25% of the average annual salary for the 10-year period immediately prior to termination of employment. These benefits may be payable for a 10 or 15-year period following termination of employment to a former key executive or his designated beneficiary. The Company will no longer enter into such Deferred Compensation Agreements. |

Compensation of Chief Executive Officer

The Committee determines the compensation of the Company’s Chief Executive Officer in the same manner as the compensation of other executive officers. In fiscal year 2006, Mr. Bekkers’ salary was set at $778,000 as provided in his Employment Agreement, which was established by considering a number of factors, including the Company’s and Mr. Bekkers’ individual performance in prior years, his future potential, scope of responsibilities and experience. His salary will be reviewed annually and may be increased, if deemed appropriate, based on similar considerations.

Mr. Bekkers did not earn an annual bonus in fiscal year 2006 under the Annual Incentive Plan, based upon the Company’s return on equity and net operating margin. During fiscal year 2006, the Committee approved long-term incentive awards to Mr. Bekkers consisting of (i) SARs with respect to 57,942 shares of Common Stock, and (ii) performance shares having a target payout of 32,261 shares of Common Stock. The Committee determined the size of these awards after reviewing competitive market data and Mr. Bekkers’ individual performance.

20

Review of all Components of Chief Executive Officer Compensation

The Committee has reviewed all components of the Chief Executive Officer’s and other executive officers’ compensation, including salary, bonus, equity and long-term incentive compensation, accumulated gains from equity incentive awards, the dollar value to the executive and cost to the Company of all perquisites and other personal benefits, the earnings and accumulated payout obligations under the Company’s non-qualified deferred compensation program, the actual projected payout obligations under the Company’s SERP and under several potential employment and change in control agreement scenarios. A tally sheet setting forth all the above components was prepared and reviewed affixing dollar amounts under the various payout scenarios.

Based on this review, the Committee finds the Chief Executive Officer’s and other executive officers’ total compensation (and, in the case of the severance and change in control scenarios, the potential payouts) in the aggregate to be reasonable and not excessive.

It should be noted that when the Committee considers any component of the executive officers’ total compensation, the aggregate amounts and mix of all the components, including accumulated restricted stock and other long-term incentive gains are taken into consideration in the Committee’s decisions.

Internal Pay Equity

In the process of reviewing each component separately and in the aggregate, the Committee directs the Company’s human resources department to prepare a spreadsheet showing “internal pay equity” within the Company. This spreadsheet shows the relationship between each executive management level of compensation within the Company (e.g., between the Chief Executive Officer and the Senior Vice President, Planning and Administration and other executive officers). The comparison includes all components of compensation (as previously described), both individually and in the aggregate.

Section 162(m) of the Internal Revenue Code

Section 162(m) of the Internal Revenue Code generally disallows a tax deduction to public companies for compensation over $1,000,000 paid for any fiscal year to the Company’s Chief Executive Officer and four other most highly compensated Executive Officers. Until the annual meeting of stockholders in 2008, or until one of the Company’s incentive plans is materially amended, if earlier, awards issued under the Company’s incentive plans are exempt from the deduction limits of Section 162(m). As such, the Committee believes that all compensation for 2006 paid to named executive officers is properly deductible under the Code.

Compensation, Nominating and Corporate Governance Committee

Ray A. Goldberg (Chair)

R. Randolph Devening

A. D. Frazier, Jr.

21

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth the total annual compensation earned during the fiscal years ended June 26, 2004, October 1, 2005 and September 30, 2006, and for the three month transition period ended October 2, 2004, by our Chief Executive Officer and the four most highly compensated executive officers, all of whom were serving as executive officers as of September 30, 2006, whom we collectively refer to as the “named executive officers.”

| | | | | | | | | | | | | | | | | | | |

| | | | | Annual Compensation | | Long-Term Compensation |

Name and Principal Position | | Fiscal Year | | Salary | | Bonus | | Other Annual Compensation (1) | | Restricted

Stock

Awards ($) (2) | | Securities

Underlying

Options/

SARs (#) (3) | | All Other

Compensation (4) |

John Bekkers President and Chief Executive Officer | | 2006

2005 | | $

| 777,404

708,462 | | $

| 0

1,125,000 | | $

| 157,224

122,329 | | $

| 0

3,862,505 | | 57,942

67,641 | | $

| 7,269

21,000 |

| | Transition

Period (6) | | | 193,846 | | | 473,596 | | | 26,763 | | | | | | | | — |

| | 2004 | | | 733,269 | | | 514,584 | | | 27,077 | | | | | | | | 16,250 |

| | | | | | | |

Michael A. Stimpert Senior Vice President, Planning and Administration | | 2006

2005 | |

| 378,781

343,039 | |

| 0

324,039 | |

| 45,627

42,080 | |

| 0

987,019 | | 17,800

20,779 | |

| 6,676

21,000 |

| | Transition

Period (6) | | | 95,692 | | | 271,866 | | | 10,339 | | | | | | | | 1,687 |

| | 2004 | | | 310,269 | | | 295,395 | | | 11,546 | | | | | | | | 16,138 |

| | | | | | | |

Donald W. Mabe Vice President, Operations | | 2006

2005 | |

| 294,396

264,423 | |

| 0

252,000 | |

| 78,836

59,194 | |

| 0

564,236 | | 13,844

16,162 | |

| 11,207

21,000 |

| | Transition

Period (6) | | | 72,308 | | | 200,414 | | | 11,614 | | | | | | | | 1,816 |

| | 2004 | | | 231,346 | | | 217,759 | | | 10,760 | | | | | | | | 15,410 |

| | | | | | | |

William T. Andersen (5) Vice President, Marketing and Sales | | 2006

2005 | |

| 254,534

217,484 | |

| 0

185,273 | |

| 19,583

15,012 | |

| 0

187,891 | | 12,227

5,535 | |

| 5,639

4,870 |

| | | | | | | |

Stephen O. West Chief Financial Officer and Vice President | | 2006

2005 | |

| 294,396

263,834 | |

| 0

252,000 | |

| 1,982

1,828 | |

| 0

745,638 | | 13,844

16,162 | |

| 8,332

21,000 |

| | Transition

Period (6) | | | 71,785 | | | 205,968 | | | 449 | | | | | | | | 2,004 |

| | 2004 | | | 227,888 | | | 223,794 | | | 498 | | | | | | | | 15,924 |

| (1) | The amounts shown for fiscal 2004, fiscal 2005 and fiscal 2006 and for the three month transition period ended October 2, 2004 set forth that portion of interest earned on voluntary salary and bonus deferrals under nonqualified deferred compensation plans. Other than such amounts, for such periods, no compensation was paid to any of the above named executive officers, except for perquisites and other personal benefits which for each executive officer did not exceed the lesser of $50,000 and 10% of such individual’s salary plus annual bonus. |

| (2) | Amounts reflect the dollar value of restricted stock awards made pursuant to the Gold Kist Inc. Long-Term Incentive Plan during fiscal 2005, calculated by multiplying the closing market price of our Common Stock on the date of grant by the number of shares awarded. The number and value of the aggregate restricted stock holdings at September 30, 2006 for each of the named executive officers was as follows: Mr. Bekkers – 267,773, $5,580,389; Mr. Stimpert – 70,759, $1,474,618; Mr. Mabe – 43,577, $908,145; Mr. Andersen – |

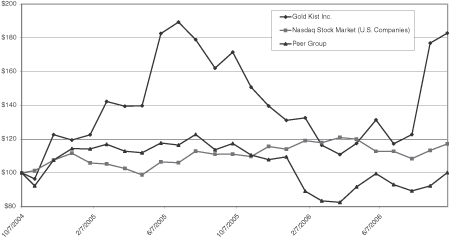

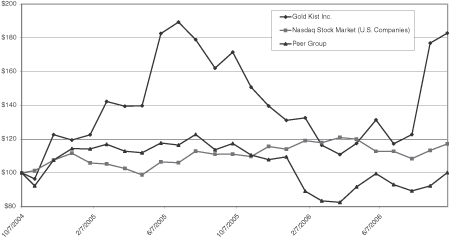

22