QuickLinks -- Click here to rapidly navigate through this documentRegistration No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Cyclacel Group plc

(Exact name of Registrant as specified in its charter)

England and Wales

(State or other jurisdiction of

incorporation or organization) | | 2834

(Primary Standard Industrial

Classification Code Number) | | Not Applicable

(I.R.S. Employer

Identification Number) |

James Lindsay Place

Dundee Technopole

Dundee DD1 5JJ

United Kingdom

Telephone: 44 1382 206 062

(Address, including zip code, and telephone number, including

area code, of Registrant's principal executive offices)

CT Corporation System

111 Eighth Avenue

New York, NY 10011

(212) 894-8600

(Name, address, including zip code, and telephone number, including

area code, of agent for service)

Copies to: |

Daniel Cunningham, Esq.

Daniel Epstein, Esq.

Allen & Overy LLP

One New Change

London EC4M 9QQ

United Kingdom

44 20 7330 3000 | | Paul Kumleben, Esq.

Davis Polk & Wardwell

99 Gresham Street

London EC2V 7NG

United Kingdom

44 20 7418 1300 |

Approximate date of commencement of proposed sale to the public:As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. o

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of

Securities to be Registered(1)

| | Amount to

be Registered(2)

| | Proposed Maximum

Offering Price

Per Unit(3)

| | Proposed Maximum

Aggregate

Offering Price(3)

| | Amount of

Registration Fee

|

|---|

|

| Ordinary shares, 1p nominal value per share | | 18,400,000 | | $3.25 | | $59,800,000 | | $7,577 |

|

- (1)

- A separate registration statement on Form F-6 is being filed for the registration of American Depositary Shares evidenced by American Depositary Receipts issuable upon the deposit of shares registered thereby. Each American Depositary Share represents 4 ordinary share(s).

- (2)

- Includes (i) 2,400,000 ordinary shares that the underwriters will have the option to purchase to cover over-allotments, if any, (ii) shares as to which the Joint Global Coordinators may effect borrowing arrangements with a shareholder and (iii) ordinary shares that are to be offered in the United Kingdom and elsewhere outside the United States that may be resold from time to time in the United States during distribution. Offers and sales made outside the United States are not covered by this Registration Statement.

- (3)

- Estimated solely for the purposes of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

PROSPECTUS (Subject to Completion)

Issued July 2, 2004

16,000,000 Ordinary Shares

Cyclacel Group plc

IN THE FORM OF ORDINARY SHARES OR AMERICAN DEPOSITARY SHARES

Cyclacel Group plc, an English public limited company, is offering 16,000,000 ordinary shares in the form of ordinary shares or American Depositary Shares, which we refer to as ADSs. Each ADS represents 4 shares. ADSs will be evidenced by American Depositary Receipts. This is our initial public offering and no public market exists for our shares or ADSs. We anticipate that the initial public offering price will be between £1.52 and £1.80 per share and $11 and $13 per ADS.

We have applied to have the ADSs approved for quotation on the Nasdaq National Market under the symbol "CYCC." Application has been made to the U.K. Listing Authority under the provisions of the Listing Rules for the shares to be admitted to listing on the official list of the U.K. Listing Authority and to London Stock Exchange plc for the shares to be admitted to trading on the London Stock Exchange's main market for listed securities.

Investing in the shares and ADSs involves risks. See "Risk Factors" beginning on page 9.

Price £ a share or $ an ADS

| | Price to Public

| | Underwriting

Discounts and

Commissions

| | Proceeds to Company

|

|---|

| Per share | | | £ | | | £ | | | £ |

| Per ADS | | $ | | | $ | | | $ | |

| Total | | $ | | | $ | | | $ | |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

We have granted the underwriters the right to purchase an additional 2,400,000 shares in the form of ordinary shares or ADSs at £ per share or $ per ADS to cover over-allotments. Morgan Stanley Securities Limited and SG Cowen & Co., LLC expect to deliver the shares and ADSs to purchasers on , 2004.

| |

|

|---|

| MORGAN STANLEY | | SG COWEN & CO. |

|

NEEDHAM & COMPANY, INC. |

|

LEERINK SWANN & COMPANY |

July 2, 2004

TABLE OF CONTENTS

| | Page

|

|---|

| Prospectus Summary | | 2 |

| Risk Factors | | 9 |

| Special Note Regarding Forward-Looking Statements | | 26 |

| Use of Proceeds | | 27 |

| Dividend Policy | | 28 |

| Capitalization | | 29 |

| Dilution | | 30 |

| Selected Consolidated Financial Data | | 32 |

| Management's Discussion and Analysis of Financial Condition and Results of Operations | | 33 |

| The Cell Cycle and Cancer | | 46 |

| Business | | 48 |

| Management | | 83 |

| Principal Shareholders | | 111 |

| Pre-offering Reorganization into Public Limited Company | | 115 |

| Description of Share Capital | | 116 |

| Description of American Depositary Shares | | 125 |

| Related Party Transactions | | 132 |

| Underwriters | | 134 |

| Taxation | | 139 |

| Shares Eligible for Future Sale | | 147 |

| Where You Can Find More Information About Us | | 148 |

| Legal Matters | | 148 |

| Experts | | 148 |

| Service of Process and Enforcement of Civil Liabilities | | 148 |

| Index to Financial Statements | | F-1 |

NOTICE TO RESIDENTS OF THE UNITED KINGDOM: The shares and ADSs may only be sold or offered to, and this prospectus and any other invitation or inducement to buy or participate in the offer of shares or ADSs may only be communicated to, (A) persons outside the United Kingdom, or (B) persons who have professional experience in matters relating to investments falling within Article 19(5) of the Financial Services and Markets Act (Financial Promotion) Order 2001 (the "FP Order"), or (C) high net worth entities falling within Article 49(2)(a)-(d) of the FP Order (persons of the type described in the foregoing clauses (A), (B) and (C), "Relevant Persons"). The shares and ADSs to which this prospectus relates are available only to Relevant Persons and this prospectus must not be acted on or relied on by persons that are not Relevant Persons. Any investment or investment activity to which this prospectus relates is available only to Relevant Persons and will be engaged in only with Relevant Persons. Any person communicating any information relating to this prospectus or the shares and ADSs in the United Kingdom should comply with all applicable provisions of the Financial Services and Markets Act 2000 and any regulations made thereunder in so doing.

1

PROSPECTUS SUMMARY

This summary highlights key information contained elsewhere in this prospectus. It may not contain all of the information that is important to you. You should read the entire prospectus carefully, including the "Risk Factors" section and the consolidated financial statements and related notes set out in this prospectus.

Cyclacel Group plc

We are a biopharmaceutical company dedicated to the discovery, development and commercialization of novel, mechanism-targeted drugs to treat human cancers and other serious disorders. We describe drugs, compounds or molecules as novel if they have been recently discovered using advanced technologies, and as mechanism-targeted if they are designed to affect identified biological processes through known mechanisms. Our core area of expertise is in cell cycle biology. We focus primarily on the discovery and development of orally available anticancer agents that target the cell cycle with the aim of slowing the progression or shrinking the size of tumors, enhancing quality of life and improving survival rates of cancer patients. Our work with novel molecules that act on the cell cycle has also led us to pursue drug development opportunities in other indications.

We have been focused on the cell cycle since our inception. We were founded in 1996 by Professor Sir David Lane, a recognized leader in the field of tumor suppressor biology who discovered the p53 protein, which operates as one of the body's own anticancer "drugs" by inhibiting cell cycle targets. In 1999, we were joined by Professor David Glover, a recognized leader in the mechanism of mitosis, or cell division, who discovered, among other cell cycle targets, the mitotic kinases, Polo and Aurora, enzymes that act in the mitosis phase of the cell cycle. Our expertise in cell cycle biology is at the center of our business strategy.

We are generating several families of anticancer drugs that act on the cell cycle. These include Cyclin Dependent Kinase (CDK) inhibitors, one of the most sophisticated categories of novel drugs targeting cell cycle mechanisms. Although a number of pharmaceutical and biotechnology companies are currently attempting to develop CDK inhibitor drugs, our lead drug candidate, CYC202, is the only orally available CDK inhibitor drug candidate in Phase II trials.

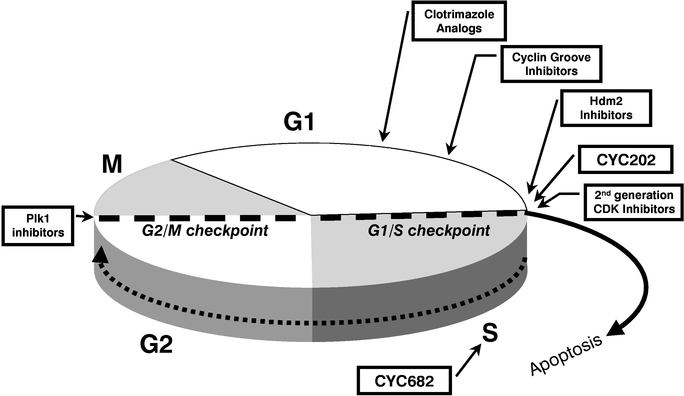

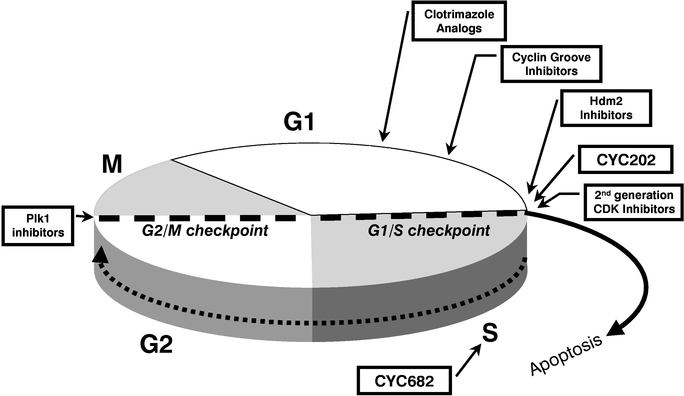

Our Focus on the Cell Cycle and Cancer

The cell cycle is a set of complex mechanisms that the body uses to control the growth and division of cells. Cancer is characterized by uncontrolled cell multiplication when key cell cycle regulatory proteins are absent or malfunction due to genetic mutations. Many approved cancer chemotherapies in everyday clinical use target different phases of the cell cycle. Their effect, however, is not confined to cancer cells. Instead, these chemotherapies are cytotoxic, which means that they act in the body as poisons in an unspecific manner, killing cancer cells and normal cells alike. This limits the doses that patients can be given and gives rise to significant side-effects. Through our expertise in cell cycle biology, we are focused on the discovery and development of novel, cell cycle-based mechanism-targeted cancer therapies that emulate the body's natural processes in order to stop the growth of cancer cells, but can limit the damage to normal cells and the accompanying side-effects caused by conventional chemotherapeutic agents.

Our Pipeline

Our current pipeline comprises nine novel drug series, seven for cancer, one for HIV/AIDS and one for Type 2 Diabetes.

Our lead drug candidate, CYC202, is a novel, orally available CDK inhibitor that is currently in multi-center Phase II clinical trials for cancer. In Phase I trials designed to test safety rather than efficacy, independent investigators nonetheless observed that CYC202 given alone as monotherapy

2

appeared to induce clinical benefit in some patients with various solid tumors. We are currently conducting two Phase II trials of CYC202, one as combination therapy for the treatment of non-small cell lung cancer and one as monotherapy in hematological cancers, or cancers of the blood cells. These clinical trials are being undertaken under the guidelines of the U.K. Medicines and Healthcare products Regulatory Agency and other comparable regulatory authorities in Europe. We expect to report results from these trials during the second half of 2004, and to begin a further clinical trial with CYC202 as combination therapy in solid tumors by the end of the year.

Our second drug candidate, CYC682, is an orally available prodrug of CNDAC, which is a novel nucleoside analog, or a compound with a structure similar to a nucleoside. A prodrug is a compound that has a therapeutic effect only after it is metabolized within the body, and CNDAC has a significantly higher residence time in the blood when it is produced in the body through metabolism of CYC682 than when it is given directly. Like CDK inhibitors, nucleosides, which are the building blocks of genetic material, work through cell cycle inhibition, though they do so at a different phase of the cell cycle. A number of nucleoside drugs, such as gemcitabine, are in wide use as conventional chemotherapies. Preclinical results from independent investigators reported that CYC682 was superior to gemcitabine and 5-FU, another widely used chemotherapy, both in terms of extending survival and blocking metastases to the liver. Two Phase I studies of CYC682 have been completed, and a Phase Ib clinical trial is currently in progress for the treatment of patients with advanced malignancies. These clinical trials have been undertaken under the guidelines of the U.S. Food and Drug Administration, or FDA. We currently expect CYC682 to enter Phase II trials in the first half of 2005.

We are currently considering a new Phase II clinical trial of CYC202 in glomerulonephritis, a form of kidney inflammation, and expect to commence Phase I clinical development of a drug candidate for the treatment of HIV/AIDS in 2006. We also have a preclinical program in cancer based on an analog of clotrimazole, an antifungal agent. An additional five programs, four for cancer and one for Type 2 Diabetes, are in the research stage. Taken together, our pipeline covers all four phases of the cell cycle, which we believe will improve our chances of successfully developing and commercializing novel drugs that work in combination with approved conventional chemotherapies, and could eventually lead to potential combination therapies of our novel drugs that act synergistically across the cell cycle. Based on the current status of our preclinical pipeline and depending on available financial resources, we expect to be in a position to begin Phase I clinical trials with a new molecule each year for the next three years.

Our Business Strategy

The key elements of our business strategy are to:

- •

- focus on the cell cycle and cancer;

- •

- seek to develop anticancer drug candidates in all phases of the cell cycle and multiple compounds for particular cell cycle targets;

- •

- pursue opportunities in other indications based on our anticancer drug development efforts;

- •

- use our proprietary genes-to-drugs approach to identify drug candidates efficiently;

- •

- exploit our biomarker strategy to optimize clinical development; and

- •

- selectively enter into partnering arrangements while developing our own sales and marketing capability.

Passive Foreign Investment Company

Based on our analysis of our current assets and income, it is most likely that we are a passive foreign investment company (aPFIC) for U.S. federal income tax purposes for the current taxable year

3

and we may also be a PFIC for any future year. If we are a PFIC in any taxable year, a U.S. Holder would suffer adverse U.S. federal income tax consequences some of which may be avoided if a U.S. Holder is eligible for and timely makes a mark-to-market or QEF election as described in more detail in "Taxation—U.S. Federal Income Taxation." We urge U.S. investors to consult their own tax advisors about the application of the PFIC rules and the elections available thereunder in their particular circumstances.

Changes in Our Share Capital in Connection with this Offering

Upon admission of our ordinary shares to the Official List of the U.K. Listing Authority, all of our preferred D shares will convert into ordinary shares. The rate at which preferred D shares will convert into ordinary shares will depend on the offering price of the ordinary shares in this offering. As a result, the total number of ordinary shares that will be outstanding following completion of this offering, and thus the full extent of the dilution that new investors in our ordinary shares and ADSs will suffer, will not be known until the offering price has been finally determined.

Immediately upon the conversion of our preferred D shares into ordinary shares, there will be a further bonus issue to holders of existing ordinary shares (including holders of those ordinary shares issued pursuant to the conversion of our preferred D shares) of one new ordinary share for every ordinary share then outstanding. This will, subject to limited exceptions, result in corresponding adjustments to the number of ordinary shares that are subject to outstanding options and warrants and the exercise price of those options and warrants.

Other than in our historical financial statements and in the historical summary and selected financial data that are presented or discussed in this prospectus, we have adjusted all information relating to our outstanding ordinary shares, options and warrants appearing in this prospectus to reflect the impact of the conversion of our preferred D shares and the further bonus issue of ordinary shares described above. In making these adjustments, we have assumed that the initial public offering price will be £1.66 per share and $12 per ADS, being the midpoint of the price range on the cover page of this prospectus.

For further information regarding the conversion of our preferred D shares and the further bonus issue and their potential impact on an investment in our ordinary shares or ADSs, please see "Capitalization" on page 29, "Dilution" beginning on page 30, "Pre-Offering Reorganization into Public Limited Company" beginning on page 114 and "Description of Share Capital" beginning on page 115.

Risk Factors

Our business is at an early stage of development and is subject to a number of risks that we highlight under "Risk Factors". All of our drug candidates, including CYC202 and CYC682, are in clinical or earlier stages of development and we cannot be certain that the clinical development of any of these drug candidates will be successful or that they will receive the regulatory approvals required to commercialize them. As of March 31, 2004, we had incurred net losses of approximately $73.1 million since inception. We expect to incur continuing operating losses for several years, as we continue our research and development of our initial drug candidates, seek regulatory approvals and commercialize any approved drugs.

Company Information

Our operations are conducted by our wholly-owned subsidiary Cyclacel Limited, which was incorporated and registered in England and Wales on August 13, 1996 with registered number 3237549 under the U.K. Companies Act 1985 as a private limited company under the name Intercede 1190 Limited. The principal legislation under which Cyclacel Limited operates is the U.K. Companies Act

4

1985 as amended from time to time. The registered office of Cyclacel Limited is 6-8 Underwood Street, London N1 7JQ.

Cyclacel Group plc was incorporated and registered in England and Wales on April 1, 2004 with registered number 5090795 under the U.K. Companies Act as a private limited company under the name Alnery No. 2428 Limited. On April 20, 2004 we changed our name to Cyclacel Group Limited. Cyclacel Group Limited was re-registered as a public limited company on July 1, 2004 under Section 43 of the U.K. Companies Act and our name changed to Cyclacel Group plc. The principal legislation under which we operate is the U.K. Companies Act. Our registered office is at 6-8 Underwood Street, London N1 7JQ.

Our principal executive offices are located at Dundee Technopole, James Lindsay Place, Dundee, DD1 5JJ, U.K. and our telephone number is +44 1382 206 062. Please note that shareholders and/or investors will not be able to obtain any financial or investment advice from the Company and that, where necessary, they should seek advice from their own independent financial adviser.

5

THE OFFERING

| The offering | | 16,000,000 ordinary shares, in the form of ordinary shares or ADSs, in the United States, the United Kingdom and elsewhere. |

Offering price |

|

£ per share or $ per ADS. |

Ordinary shares outstanding after the offering |

|

60,964,304 ordinary shares. |

ADSs |

|

Each ADS represents the right to receive 4 ordinary shares. The ADSs are evidenced by American Depositary Receipts, or ADRs. See "Description of American Depositary Shares." |

Over-allotment option |

|

2,400,000 ordinary shares, in the form of shares or ADSs. |

Use of proceeds |

|

To continue the development of our drug candidates, including ongoing clinical trials, to expand our research programs and for working capital and other general corporate purposes. See "Use of Proceeds." |

Proposed Nasdaq National Market Symbol |

|

CYCC. |

The number of ordinary shares expected to be outstanding after this offering is based on the number of shares outstanding as of June 30, 2004, immediately following the reorganization described under "Pre-offering Reorganization into Public Limited Company" beginning on page 114, and also reflects the conversion of our preferred D shares into 20,840,344 of our ordinary shares (based on an assumed initial public offering price of £1.66 per ordinary share, being the midpoint of the price range set forth on the cover page of this prospectus) and the further bonus issue of ordinary shares described under "Description of Share Capital" beginning on page 115. This number does not include:

- •

- 3,593,640 ordinary shares issuable upon exercise of options outstanding at June 30, 2004 at a weighted average exercise price of £0.76 per share (as adjusted to reflect the bonus issue);

- •

- 3,441,806 ordinary shares (as adjusted to reflect the bonus issue) issuable on exercise of options granted to Spiro Rombotis, our chief executive officer, at an exercise price of 1 pence per share, and 100,000 ordinary shares (as adjusted to reflect the bonus issue) issuable on exercise of options granted to Paul McBarron, our chief financial officer, at an exercise price of £0.75 per share (as adjusted to reflect the bonus issue), as more particularly described under "Management—Employee Share Option Plans—Senior Executive Incentive Plan" beginning on page 92;

- •

- 47,000 ordinary shares issuable upon exercise of warrants outstanding at June 30, 2004 (as adjusted to reflect the bonus issue) as described in more detail under "Description of Share Capital" beginning on page 115; and

- •

- any ordinary shares that may be issued pursuant to the exercise of options under our employee option plans as more particularly described under "Management—Employee Share Option Plans."

6

In this prospectus, the terms "we," "us," "our," "Cyclacel" and "the Company" refer to Cyclacel Group plc and its subsidiary, Cyclacel Limited. Service marks, trademarks and trade names referred to in this prospectus are the property of their respective owners.

7

SUMMARY FINANCIAL DATA

The following table summarizes our consolidated financial data. The summary consolidated financial data for the years ended March 31, 2002 and 2003, for the nine months ended December 31, 2002 and 2003, and for the three months ended March 31, 2003 and 2004 and as of December 31, 2003 and March 31, 2004 are extracted without material adjustment from our U.S. GAAP consolidated financial statements, which have been audited by Ernst & Young LLP, independent auditors, included in this prospectus. The information set forth below is not necessarily indicative of future results and should be read in conjunction with our consolidated financial statements and accompanying notes and with the information set forth in "Management's Discussion and Analysis of Financial Condition and Results of Operations" appearing elsewhere in this prospectus. Investors should read the whole of this document and not just rely on this summary information.

| | Year Ended March 31,

| | Nine Months

Ended December 31,

| | Three Months

Ended March 31,

| |

|---|

| | 2002

| | 2003

| | 2002

| | 2003

| | 2003

| | 2004

| |

|---|

| | (in thousands, except share and per share data)

| |

|---|

| Consolidated Statements of Operations: | | | | | | | | | | | | | | | | | | | |

| Revenues: | | | | | | | | | | | | | | | | | | | |

| | Collaboration and research and development income | | $ | 1,155 | | $ | 1,250 | | $ | 930 | | $ | 8 | | $ | 319 | | $ | 1 | |

| | Grant income | | | 55 | | | 941 | | | 696 | | | 504 | | | 246 | | | — | |

| | |

| |

| |

| |

| |

| |

| |

| | | | 1,210 | | | 2,191 | | | 1,626 | | | 512 | | | 565 | | | 1 | |

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | Research and development | | | (13,195 | ) | | (19,847 | ) | | (14,581 | ) | | (13,084 | ) | | (5,275 | ) | | (4,870 | ) |

| | General and administrative | | | (3,220 | ) | | (2,536 | ) | | (2,026 | ) | | (2,099 | ) | | (504 | ) | | (1,573 | ) |

| | Amortization of employee stock-based compensation | | | (672 | ) | | (305 | ) | | (229 | ) | | (217 | ) | | (76 | ) | | 618 | |

| | |

| |

| |

| |

| |

| |

| |

| Total operating expenses | | | (17,087 | ) | | (22,688 | ) | | (16,836 | ) | | (15,400 | ) | | (5,855 | ) | | (5,825 | ) |

| | |

| |

| |

| |

| |

| |

| |

| Operating loss | | | (15,877 | ) | | (20,497 | ) | | (15,210 | ) | | (14,888 | ) | | (5,290 | ) | | (5,824 | ) |

| | |

| |

| |

| |

| |

| |

| |

| Interest and other income (expense) | | | 1,024 | | | 558 | | | 481 | | | (1,575 | ) | | 73 | | | 415 | |

| | |

| |

| |

| |

| |

| |

| |

| Loss before taxes | | | (14,853 | ) | | (19,939 | ) | | (14,729 | ) | | (16,463 | ) | | (5,217 | ) | | (5,409 | ) |

| Taxes | | | — | | | (4,397 | ) | | (3,841 | ) | | (1,486 | ) | | (528 | ) | | (521 | ) |

| | |

| |

| |

| |

| |

| |

| |

| Net loss | | | (14,853 | ) | | (15,542 | ) | | (10,888 | ) | | (14,977 | ) | | (4,689 | ) | | (4,888 | ) |

| Dividends on preferred shares | | | (3,289 | ) | | (4,654 | ) | | (3,430 | ) | | (4,425 | ) | | (1,225 | ) | | (2,629 | ) |

| | |

| |

| |

| |

| |

| |

| |

| Net loss applicable to ordinary shareholders | | $ | (18,142 | ) | $ | (20,196 | ) | $ | (14,318 | ) | $ | (19,402 | ) | $ | (5,914 | ) | $ | (7,517 | ) |

| | |

| |

| |

| |

| |

| |

| |

| Net loss per share—basic and diluted | | $ | (2.83 | ) | $ | (3.14 | ) | $ | (2.23 | ) | $ | (2.25 | ) | $ | (0.92 | ) | $ | (0.39 | ) |

| | |

| |

| |

| |

| |

| |

| |

| Weighted average shares used to compute basic and diluted earnings per share | | | 6,399,539 | | | 6,433,996 | | | 6,433,874 | | | 8,623,516 | | | 6,433,996 | | | 19,259,641 | |

| | As of

December 31, 2003

| | As of

March 31, 2004

| |

|---|

| | (in thousands)

| |

|---|

| Consolidated Balance Sheet Data: | | | | | | | |

| Cash and cash equivalents | | $ | 9,670 | | $ | 5,685 | |

| Short-term investments | | | 24,010 | | | 33,826 | |

| Prepaid expenses and other current assets | | | 5,360 | | | 3,892 | |

| Property, plant and equipment | | | 3,760 | | | 4,117 | |

| | |

| |

| |

| Total assets | | | 42,800 | | | 47,520 | |

| Current liabilities | | | (4,657 | ) | | (5,477 | ) |

| Long-term debt, net of current portion | | | (495 | ) | | (334 | ) |

| | |

| |

| |

| Total shareholders' equity | | $ | 37,648 | | $ | 41,709 | |

| | |

| |

| |

8

RISK FACTORS

Before you invest in our ordinary shares or ADSs, you should understand the high degree of risk involved. You should carefully consider the risks described below and other information in this prospectus, including our consolidated financial statements and related notes, before you decide to purchase our ordinary shares or ADSs. Selected financial data set out in this document are extracted without material adjustment from our U.S. GAAP consolidated financial statements, which have been audited by Ernst & Young LLP, independent auditors, included in this document. If any of the following risks actually occur, our business, financial condition and operating results could be adversely affected. As a result, the trading price of our ordinary shares or ADSs could decline and you could lose part or all of your investment.

Risks Related to Our Business

We are at an early stage of development as a company and we do not have, and may never have, any products that generate revenues.

We are at an early stage in the development of our company and have a limited operating history on which to evaluate our business and prospects. Since beginning operations in 1997, we have not generated any product revenues. We currently have no drugs for sale and we cannot guarantee that we will ever have marketable drugs. We must demonstrate that our drug candidates satisfy rigorous standards of safety and efficacy for their intended uses before the Food and Drug Administration, or FDA, and other regulatory authorities in the United States, the United Kingdom, the European Union and elsewhere. Significant additional research, preclinical testing and clinical testing is required before we can file applications with the FDA or other regulatory authorities for premarket approval of our drug candidates. In addition, to compete effectively, our drugs must be easy to administer, cost-effective and economical to manufacture on a commercial scale. We may not achieve any of these objectives. CYC202 and CYC682, our most advanced drug candidates for the treatment of cancer and inflammation, are currently our only drug candidates in clinical trials and we cannot be certain that the clinical development of these or any other drug candidates in preclinical testing or clinical development will be successful, that they will receive the regulatory approvals required to commercialize them or that any of our other research and drug discovery programs will yield a drug candidate suitable for investigation through clinical trials. Our commercial revenues, if any, will be derived from sales of drugs that we do not expect to become marketable for several years, if at all.

We have incurred operating losses in each year since beginning operations in 1997 due to costs incurred in connection with our research and development activities and general and administrative costs associated with our operations, and we may never achieve profitability. As of March 31, 2004, our accumulated deficit was $73.1 million. Our net loss for the three month period ended March 31, 2004, the nine month period ended December 31, 2003 and for the fiscal years ended March 31, 2003 and March 31, 2002 was $4.9 million, $15.0 million, $15.5 million and $14.9 million, respectively. Our net loss for the period 1997 (inception) through March 31, 2004 was $73.1 million. Our initial drug candidates are in the early stages of clinical testing and we must conduct significant additional clinical trials before we can seek the regulatory approvals necessary to begin commercial sales of our drugs. We expect to incur continued losses for several years, as we continue our research and development of our initial drug candidates, seek regulatory approvals and commercialize any approved drugs. If our initial drug candidates are unsuccessful in clinical trials or we are unable to obtain regulatory approvals, or if our drugs are unsuccessful in the market, we will not be profitable. If we fail to become and remain profitable, or if we are unable to fund our continuing losses, you could lose all or part of your investment.

9

If we fail to obtain additional financing, we may be unable to complete the development and commercialization of our drug candidates or continue our research and development programs.

We have funded all of our operations and capital expenditures with proceeds from private placements of our securities, interest on investments, government grants and research and development tax credits. In order to conduct the lengthy and expensive research, preclinical testing and clinical trials necessary to complete the development and marketing of our drug candidates, we will require substantial additional funds. For example, for the nine months ended December 31, 2003, our cash outflow to fund operations was approximately $14.4 million. To meet these financing requirements, we may raise funds through public or private equity offerings, debt financings or strategic alliances. Raising additional funds by issuing equity or convertible debt securities may cause our shareholders to experience additional dilution in their ownership interests. Raising additional funds through debt financing, if available, may involve covenants that restrict our business activities and options. To the extent that we raise additional funds through collaborations and licensing arrangements, we may have to relinquish valuable rights to our drug discovery and other technologies, research programs or drug candidates, or grant licenses on terms that may not be favorable to us. Additional funding may not be available to us on favorable terms, or at all. If we are unable to obtain additional funds, we may be forced to delay or terminate our clinical trials and the development and marketing of our drug candidates.

Clinical trials are expensive, time consuming and subject to delay.

Clinical trials are expensive and complex, can take many years and have uncertain outcomes. We estimate that clinical trials of our most advanced drug candidates will continue for several years, but may take significantly longer to complete. Failure can occur at any stage of the testing and we may experience numerous unforeseen events during, or as a result of, the clinical trial process that could delay or prevent commercialization of our current or future drug candidates, including but not limited to:

- •

- delays in securing clinical investigators or trial sites for our clinical trials;

- •

- delays in obtaining institutional review board, or IRB, and other regulatory approvals to commence a clinical trial;

- •

- slower than anticipated patient recruitment and enrollment;

- •

- negative or inconclusive results from clinical trials;

- •

- unforeseen safety issues;

- •

- uncertain dosing issues; and

- •

- inability to monitor patients adequately during or after treatment or problems with investigator or patient compliance with the trial protocols.

If we suffer any significant delays, setbacks or negative results in, or termination of, our clinical trials we may be unable to continue development of our drug candidates or generate revenue and our development costs could increase significantly.

If our understanding of the role played by CDKs in regulating the cell cycle is incorrect, this may hinder pursuit of our clinical and regulatory strategy.

Our lead drug candidate, CYC202, is a cell cycle inhibitor based on our understanding of Cyclin Dependent Kinases (CDKs). Although a number of pharmaceutical and biotechnology companies are attempting to develop CDK inhibitor drugs for the treatment of cancer, no CDK inhibitors have yet reached the market. Our CYC202 program relies on our understanding of the interaction of CDKs with other cellular mechanisms that regulate key stages of cell growth. If our understanding of the role

10

played by CDKs in regulating the cell cycle is incorrect, our lead drug may fail to produce therapeutically relevant results, hindering our ability to pursue our clinical and regulatory strategy.

If we fail to enter into and maintain successful strategic alliances for our drug candidates, we may have to reduce or delay our drug candidate development or increase our expenditures.

An important element of our strategy for developing, manufacturing and commercializing our drug candidates is entering into strategic alliances with pharmaceutical companies or other industry participants to advance our programs and enable us to maintain our financial and operational capacity. We face significant competition in seeking appropriate alliances. We may not be able to negotiate alliances on acceptable terms, if at all. In addition, these alliances may be unsuccessful. If we fail to create and maintain suitable alliances, we may have to limit the size or scope of, or delay, one or more of our drug development or research programs. If we elect to fund drug development or research programs on our own, we will have to increase our expenditures and will need to obtain additional funding, which may be unavailable or available only on unfavorable terms.

We are making extensive use of biomarkers, which are not yet scientifically validated, and our reliance on biomarker data may thus lead us to direct our resources inefficiently.

We are making extensive use of biomarkers in an effort to facilitate our drug development and to optimize our clinical trials. Biomarkers are proteins or other substances whose presence in the blood can serve as an indicator of specific cell processes. We believe that these biological markers serve a useful purpose in helping us to evaluate whether our drug candidates are having their intended effects through their assumed mechanisms, and thus enable us to identify more promising drug candidates at an early stage and to direct our resources efficiently. We also believe that biomarkers may eventually allow us to improve patient selection in connection with clinical trials and monitor patient compliance with trial protocols.

For most purposes, however, biomarkers have not yet been scientifically validated. If our understanding and use of biomarkers is inaccurate or flawed, or if our reliance on them is otherwise misplaced, then we will not only fail to realize any benefits from using biomarkers, but may also be led to invest time and financial resources inefficiently in attempting to develop inappropriate drug candidates. Moreover, although the FDA has issued for comment a draft guidance document on the potential use of biomarker data in clinical development, such data are not currently accepted by the FDA or other regulatory agencies in the United States, the United Kingdom, the European Union or elsewhere in applications for regulatory approval of drug candidates and there is no guarantee that such data will ever be accepted by the relevant authorities in this connection. Our biomarker data should not be interpreted as evidence of efficacy.

To the extent we elect to fund the development of a drug candidate or the commercialization of a drug at our expense, we will need substantial additional funding.

We plan to market drugs on our own, with or without a partner, that can be effectively commercialized and sold in concentrated markets that do not require a large sales force to be competitive. To achieve this goal, we will need to establish our own specialized sales force, marketing organization and supporting distribution capabilities. The development and commercialization of our drug candidates is very expensive. To the extent we elect to fund the full development of a drug candidate or the commercialization of a drug at our expense, we will need to raise substantial additional funding to:

- •

- fund research and development and clinical trials connected therewith;

- •

- seek regulatory approvals;

- •

- build or access manufacturing and commercialization capabilities;

11

- •

- commercialize and secure coverage, payment and reimbursement of our drug candidates, if any such candidates receive regulatory approval; and

- •

- hire additional management and scientific personnel.

We believe that the net proceeds of this offering, our existing cash equivalents and short-term investments will be sufficient to meet our projected operating requirements for at least the next twenty-four months. Our future funding requirements will depend on many factors, including:

- •

- the scope, rate of progress and cost of our clinical trials and other research and development activities;

- •

- the costs and timing of seeking and obtaining regulatory approvals;

- •

- the costs of filing, prosecuting, defending and enforcing any patent claims and other intellectual property rights;

- •

- the costs associated with establishing sales and marketing capabilities;

- •

- the costs of acquiring or investing in businesses, products and technologies;

- •

- the effect of competing technological and market developments; and

- •

- the payment, other terms and timing of any strategic alliance, licensing or other arrangements that we may establish.

If we are not able to secure additional funding when needed, we may have to delay, reduce the scope of or eliminate one or more of our clinical trials or research and development programs or future commercialization efforts.

Due to our reliance on contract research organizations or other third parties to conduct clinical trials, we are unable to directly control the timing, conduct and expense of our clinical trials.

We do not have the ability to independently conduct clinical trials required to obtain regulatory approvals for our drug candidates. We must rely on third parties, such as contract research organizations, medical institutions, clinical investigators and contract laboratories to conduct our clinical trials. In addition, we rely on third parties to assist with our preclinical development of drug candidates. If these third parties do not successfully carry out their contractual duties or regulatory obligations or meet expected deadlines, if the third parties need to be replaced or if the quality or accuracy of the data they obtain is compromised due to the failure to adhere to our clinical protocols or regulatory requirements or for other reasons, our preclinical development activities or clinical trials may be extended, delayed, suspended or terminated, and we may not be able to obtain regulatory approval for or successfully commercialize our drug candidates.

To the extent we are able to enter into collaborative arrangements or strategic alliances, we will be exposed to risks related to those collaborations and alliances.

Although we are not currently party to any collaboration arrangement or strategic alliance that is material to our business, in the future we expect to be dependent upon collaborative arrangements or strategic alliances to complete the development and commercialization of some of our drug candidates particularly after the Phase II stage of clinical testing. These arrangements may place the development of our drug candidates outside our control, may require us to relinquish important rights or may otherwise be on terms unfavorable to us.

We may be unable to locate and enter into favorable agreements with third parties, which could delay or impair our ability to develop and commercialize our drug candidates and could increase our

12

costs of development and commercialization. Dependence on collaborative arrangements or strategic alliances will subject us to a number of risks, including the risk that:

- •

- we may not be able to control the amount and timing of resources that our collaborators may devote to the drug candidates;

- •

- our collaborators may experience financial difficulties;

- •

- we may be required to relinquish important rights such as marketing and distribution rights;

- •

- business combinations or significant changes in a collaborator's business strategy may also adversely affect a collaborator's willingness or ability to complete its obligations under any arrangement;

- •

- a collaborator could independently move forward with a competing drug candidate developed either independently or in collaboration with others, including our competitors; and

- •

- collaborative arrangements are often terminated or allowed to expire, which would delay the development and may increase the cost of developing our drug candidates.

We have no manufacturing capacity and will rely on third-party manufacturers for the late stage development and commercialization of drugs we may develop.

We do not currently operate manufacturing facilities for clinical or commercial production of our drug candidates under development. We currently lack the resources or the capacity to manufacture any of our products on a clinical or commercial scale. We anticipate future reliance on a limited number of third-party manufacturers until we are able to expand our operations to include manufacturing capacities. Any performance failure on the part of future manufacturers could delay late stage clinical development or regulatory approval of our drug candidates or commercialization of our drugs, producing additional losses and depriving us of potential product revenues.

If the FDA or other regulatory agencies approve any of our drug candidates for commercial sale, or if we significantly expand our clinical trials, we will need to manufacture them in larger quantities. To date, our drug candidates have been manufactured in small quantities for preclinical testing and clinical trials and we may not be able to successfully increase the manufacturing capacity, whether in collaboration with third-party manufacturers or on our own, for any of our drug candidates in a timely or economic manner, or at all. For example, the manufacture of our drug candidate CYC682 requires several steps and it is not yet known if scale up to commercial production is feasible. Significant scale-up of manufacturing may require additional validation studies, which the FDA and other regulatory bodies must review and approve. If we are unable to successfully increase the manufacturing capacity for a drug candidate whether for late stage clinical trials or for commercial sale, the drug development, regulatory approval or commercial launch of any related drugs may be delayed or there may be a shortage in supply. Even if any third-party manufacturer makes improvements in the manufacturing process for our drug candidates, we may not own, or may have to share, the intellectual property rights to such innovation.

We currently have no marketing or sales staff. If we are unable to conclude strategic alliances with marketing partners or if we are unable to develop our own sales and marketing capabilities, we may not be successful in commercializing any drugs we may develop.

Our strategy is to develop compounds through the Phase II stage of clinical testing and market certain discrete drugs on our own. We have no sales, marketing or distribution capabilities. We will depend primarily on strategic alliances with third parties, which have established distribution systems and sales forces, to commercialize our drugs. To the extent that we are unsuccessful in commercializing any drugs ourselves or through a strategic alliance, product revenues will suffer, we will incur significant additional losses and our share price will be negatively affected.

13

If we evolve from a company primarily involved in discovery and development to one also involved in the commercialization of drugs, we may encounter difficulties in managing our growth and expanding our operations successfully.

If we advance our drug candidates through clinical trials, we will need to expand our development and regulatory capabilities and develop manufacturing, marketing and sales capabilities or contract with third parties to provide these capabilities for us. If our operations expand, we expect that we will need to manage additional relationships with various collaborative partners, suppliers and other third parties. Our ability to manage our operations and any growth will require us to make appropriate changes and upgrades (as necessary) to our operational, financial and management controls, reporting systems and procedures where we may operate. Any inability to manage growth could delay the execution of our business plan or disrupt our operations.

The failure to attract and retain skilled personnel could impair our drug development and commercialization efforts.

We are highly dependent on our senior management and key scientific and technical personnel. The loss of the services of any member of our senior management, scientific or technical staff may significantly delay or prevent the achievement of drug development and other business objectives and could have a material adverse effect on our business, operating results and financial condition. We also rely on consultants and advisors to assist us in formulating our research and development strategy. All of our consultants and advisors are either self-employed or employed by other organizations, and they may have conflicts of interest or other commitments, such as consulting or advisory contracts with other organizations, that may affect their ability to contribute to us.

We intend to expand and develop new drug candidates. We will need to hire additional employees in order to continue our clinical trials and market our drug candidates. This strategy will require us to recruit additional executive management and scientific and technical personnel. There is currently intense competition for skilled executives and employees with relevant scientific and technical expertise, and this competition is likely to continue. The inability to attract and retain sufficient scientific, technical and managerial personnel could limit or delay our product development efforts, which would adversely affect the development of our drug candidates and commercialization of our potential drugs and growth of our business.

Risks Related to Regulation

Our drug candidates are subject to extensive regulation, which can be costly and time-consuming, and we may not obtain approvals for the commercialization of some or all of our drug candidates.

The clinical development, manufacturing, selling and marketing of our drug candidates are subject to extensive regulation by the FDA and other regulatory authorities in the United States, the United Kingdom, the European Union and elsewhere. These regulations also vary in important, meaningful ways from country to country. We are not permitted to market a potential drug in the United States until we receive approval of a New Drug Application, or NDA, from the FDA. We have not received an NDA approval from the FDA for any of our drug candidates.

Obtaining an NDA approval is expensive and is a complex, lengthy and uncertain process. The FDA approval process for a new drug involves completion of preclinical studies and the submission of the results of these studies to the FDA, together with proposed clinical protocols, manufacturing information, analytical data and other information in an Investigational New Drug application, or IND, which must become effective before human clinical trials may begin. Clinical development typically involves three phases of study: Phase I, II and III. The most significant costs associated with clinical development are the Phase III clinical trials as they tend to be the longest and largest studies conducted during the drug development process. After completion of clinical trials, an NDA may be

14

submitted to the FDA. In responding to an NDA, the FDA may refuse to file the application, or if accepted for filing, the FDA may grant marketing approval, request additional information or deny the application if it determines that the application does not provide an adequate basis for approval. In addition, failure to comply with FDA and other applicable foreign and U.S. regulatory requirements may subject us to administrative or judicially imposed sanctions. These include warning letters, civil and criminal penalties, injunctions, product seizure or detention, product recalls, total or partial suspension of production and refusal to approve either pending NDAs, or supplements to approved NDAs.

Despite the substantial time and expense invested in preparation and submission of an NDA or equivalents in other jurisdictions, regulatory approval is never guaranteed. The FDA and other regulatory authorities in the United States, the United Kingdom, the European Union and elsewhere, exercise substantial discretion in the drug approval process. The number, size and design of preclinical studies and clinical trials that will be required for FDA or other regulatory approval will vary depending on the drug candidate, the disease or condition for which the drug candidate is intended to be used and the regulations and guidance documents applicable to any particular drug candidate. The FDA or other regulators can delay, limit or deny approval of a drug candidate for many reasons, including, but not limited to:

- •

- those discussed in the risk factor which immediately follows;

- •

- the fact that FDA or other regulatory officials may not approve our or our third-party manufacturer's processes or facilities; or

- •

- the fact that new laws may be enacted by the FDA or other regulators may change their approval policies or adopt new regulations requiring new or different evidence of safety and efficacy for the intended use of a drug candidate.

Adverse events have been observed in our clinical trials and may force us to stop development of our product candidates or prevent regulatory approval of our product candidates.

Adverse or inconclusive results from our clinical trials may substantially delay, or halt entirely, any further development of our drug candidates. Many companies have failed to demonstrate the safety or effectiveness of drug candidates in later-stage clinical trials notwithstanding favorable results in early-stage clinical trials. Previously unforeseen and unacceptable side effects could interrupt, delay or halt clinical trials of our drug candidates and could result in the FDA or other regulatory authorities denying approval of our drug candidates. We will need to demonstrate safety and efficacy for specific indications of use, and monitor safety and compliance with clinical trial protocols throughout the development process. To date, long-term safety and efficacy have not yet been demonstrated in clinical trials for any of our drug candidates. Toxicity and "severe adverse effects" as defined in trial protocols have been noted in preclinical and clinical trials involving certain of our drug candidates. For example, elevation of liver enzymes and decrease in potassium levels has been observed in some patients receiving our lead drug candidate, CYC202. In addition, we may pursue clinical trials for CYC202 in more than one indication. There is a risk that severe toxicity observed in a trial for one indication could result in the delay or suspension of all trials involving the same drug candidate. We are currently conducting two Phase IIa clinical trials to test the safety and efficacy of CYC202, one in the treatment of non-small cell lung cancer and one in the treatment of hematological cancers. We expect to report results of these trials during the second half of 2004. If these trials or any future trials are unsuccessful, our business and reputation could be harmed and our share price could be negatively affected.

Even if we believe the data collected from clinical trials of our drug candidates are promising with respect to safety and efficacy, such data may not be deemed sufficient by regulatory authorities to warrant product approval. Clinical data can be interpreted in different ways. Regulatory officials could interpret such data in different ways than we do, which could delay, limit or prevent regulatory approval. The FDA, other regulatory authorities or we may suspend or terminate clinical trials at any

15

time. Any failure or significant delay in completing clinical trials for our drug candidates, or in receiving regulatory approval for the commercialization of our drug candidates, may severely harm our business and reputation.

Following regulatory approval of any drug candidates, we would be subject to ongoing regulatory obligations and restrictions, which may result in significant expense and limit our ability to commercialize our potential drugs.

If one of our drug candidates is approved by the FDA or by another regulatory authority, we would be held to extensive regulatory requirements over product manufacturing, labeling, packaging, adverse event reporting, storage, advertising, promotion and record keeping. Regulatory approvals may also be subject to significant limitations on the indicated uses or marketing of the drug candidates. Potentially costly follow-up or post-marketing clinical studies may be required as a condition of approval to further substantiate safety or efficacy, or to investigate specific issues of interest to the regulatory authority. Previously unknown problems with the drug candidate, including adverse events of unanticipated severity or frequency, may result in restrictions on the marketing of the drug, and could include withdrawal of the drug from the market.

In addition, the law or regulatory policies governing pharmaceuticals may change. New statutory requirements may be enacted or additional regulations may be enacted that could prevent or delay regulatory approval of our drug candidates. We cannot predict the likelihood, nature or extent of adverse government regulation that may arise from future legislation or administrative action, either in the United States or elsewhere. If we are not able to maintain regulatory compliance, we might not be permitted to market our drugs and our business could suffer.

Our applications for regulatory approval could be delayed or denied due to problems with studies conducted before we in-licensed some of our product candidates.

We currently license some of the compounds and drug candidates used in our research programs from third parties. These include CYC381, licensed from Lorus Therapeutics, Inc., and CYC682, licensed from Sankyo Co., Ltd. Our present research involving these compounds relies upon previous research conducted by third parties over which we had no control and before we in-licensed the drug candidates. In order to receive regulatory approval of a drug candidate, we must present all relevant data and information obtained during its research and development, including research conducted prior to our licensure of the drug candidate. Although we are not currently aware of any such problems, any problems that emerge with preclinical research and testing conducted prior to our in-licensing may affect future results or our ability to document prior research and to conduct clinical trials, which could delay, limit or prevent regulatory approval for our drug candidates.

Risks Related to Our Industry

We face intense competition and our competitors may develop drugs that are less expensive, safer, or more effective than our drug candidates.

We are engaged in a rapidly changing and highly competitive field. We are seeking to develop and market products that will compete with other products and drugs that currently exist or are being developed. We compete with companies that are developing small molecule drugs, as well as companies that have developed drugs or are developing alternative drug candidates for cancer or other serious disorders where there is abnormal cell proliferation. Other companies are currently developing drugs targeting cancer that may compete with our drug candidates, including AstraZeneca's AZD-5438, Bristol-Myers Squibb's BMS-387032 and Eisai's E-7070. In addition, although Aventis has announced that it has ceased Phase II development of flavopiridol, a CDK inhibiting drug, we believe that the National Cancer Institute's Cancer Therapy Evaluation Program is continuing to enroll patients in a

16

Phase II trial. We also believe that several companies such as Aventis, Kyowa Hakko, Pfizer and Roche have, or have recently had, agents in clinical trials that are specific to the Cyclin Dependent Kinases, or CDKs, that are the target of our lead drug candidates and some of our research programs. Others have CDK inhibitor research programs in preclinical studies.

Our competitors, either alone or together with collaborators, may have substantially greater financial resources and research and developments staff. Our competitors may also have more experience:

- •

- developing drug candidates;

- •

- conducting preclinical and clinical trials;

- •

- obtaining regulatory approvals; and

- •

- commercializing drug candidates.

Our competitors may succeed in obtaining patent protection and regulatory approval and may market drugs before we do. If our competitors market drugs that are less expensive, safer, more effective or more convenient to administer than our potential drugs, or that reach the market sooner than our potential drugs, we may not achieve commercial success. Scientific, clinical or technical developments by our competitors may render our drug candidates obsolete or noncompetitive. We anticipate that we will face increased competition in the future as new companies enter the markets and as scientific developments progress. If our drug candidates obtain regulatory approvals, but do not compete effectively in the marketplace, our business will suffer.

The commercial success of our drug candidates depends upon their market acceptance among physicians, patients, healthcare providers and payors and the medical community.

If our drug candidates are approved by the FDA or by another regulatory authority, the resulting drugs, if any, may not gain market acceptance among physicians, healthcare providers and payors, patients and the medical community. The degree of market acceptance of any of our approved drugs will depend on a variety of factors, including:

- •

- timing of market introduction, number and clinical profile of competitive drugs;

- •

- our ability to provide acceptable evidence of safety and efficacy;

- •

- relative convenience and ease of administration;

- •

- cost-effectiveness;

- •

- availability of coverage, reimbursement and adequate payment from health maintenance organizations and other third-party payors;

- •

- prevalence and severity of adverse side effects; and

- •

- other potential advantages over alternative treatment methods.

If our drugs fail to achieve market acceptance, we may not be able to generate significant revenue and our business would suffer.

There is uncertainty related to coverage, reimbursement and payment by healthcare providers and payors for newly approved drugs. The inability or failure to obtain coverage could affect our ability to market our future drugs and decrease our ability to generate revenue.

The availability and levels of coverage and reimbursement of newly approved drugs by healthcare providers and payors is subject to significant uncertainty. The commercial success of our drug candidates in both the U.S. and international markets is substantially dependent on whether third-party

17

coverage and reimbursement is available. The U.S. Centers for Medicare and Medicaid Services, health maintenance organizations and other third-party payors in the United States, the United Kingdom, the European Union and other jurisdictions are increasingly attempting to contain healthcare costs by limiting both coverage and the level of reimbursement of new drugs and, as a result, they may not cover or provide adequate payment for our potential drugs. Our drug candidates may not be considered cost-effective and reimbursement may not be available to consumers or may not be sufficient to allow our drug candidates to be marketed on a competitive basis.

In some countries, including the countries of the European Union, the pricing of prescription drugs is subject to government control. In such countries, pricing negotiations with governmental authorities can take three to 12 months or longer following application to the competent authorities. To obtain reimbursement or pricing approval in such countries may require conducting an additional clinical trial comparing the cost-effectiveness of the drug to other alternatives. In the United States, the Medicare Part D drug benefit to be implemented in 2006 will limit drug coverage through formularies and other cost and utilization management programs, while Medicare Part B limits drug payments to a certain percentage of average price or through restrictive payment policies of "least costly alternatives" and "inherent reasonableness." Our business could be materially harmed if coverage, reimbursement or pricing is unavailable or set at unsatisfactory levels.

We may be exposed to product liability claims which may damage our reputation and we may not be able to obtain adequate insurance.

Because we conduct clinical trials in humans, we face the risk that the use of our drug candidates will result in adverse effects. We believe that we have obtained reasonably adequate product liability insurance coverage for our trials. We cannot predict, however, the possible harm or side effects that may result from our clinical trials. Such claims may damage our reputation and we may not have sufficient resources to pay for any liabilities resulting from a claim excluded from, or beyond the limit of, our insurance coverage.

Once we have commercially available drugs based on our drug candidates, we will be exposed to the risk of product liability claims. This risk exists even with respect to those drugs that are approved for commercial sale by the FDA or other regulatory authorities in the United States, the United Kingdom, the European Union or elsewhere and manufactured in facilities licensed and regulated by the FDA or other such regulatory authorities. We intend to secure limited product liability insurance coverage, but may not be able to obtain such insurance on acceptable terms with adequate coverage, or at reasonable cost. There is also a risk that third parties that we have agreed to indemnify could incur liability. Even if we were ultimately successful in product liability litigation, the litigation would consume substantial amounts of our financial and managerial resources and may create adverse publicity, all of which would impair our ability to generate sales of the litigated product as well as our other potential drugs.

We may be subject to damages resulting from claims that our employees or we have wrongfully used or disclosed alleged trade secrets of their former employers.

Many of our employees were previously employed at universities or other biotechnology or pharmaceutical companies, including our competitors or potential competitors. Although no claims against us are currently pending, we may be subject to claims that these employees or we have inadvertently or otherwise used or disclosed trade secrets or other proprietary information of their former employers. Litigation may be necessary to defend against these claims. If we fail in defending such claims, in addition to paying monetary damages, we may lose valuable intellectual property rights or personnel. A loss of key research personnel or their work product could hamper or prevent our ability to commercialize certain potential drugs, which could severely harm our business. Even if we are

18

successful in defending against these claims, litigation could result in substantial costs and be a distraction to management.

Defending against claims relating to improper handling, storage or disposal of hazardous chemical, radioactive or biological materials could be time consuming and expensive.

Our research and development involves the controlled use of hazardous materials, including chemicals, radioactive and biological materials such as chemical solvents, phosphorus and bacteria. Our operations produce hazardous waste products. We cannot eliminate the risk of accidental contamination or discharge and any resultant injury from those materials. Various laws and regulations govern the use, manufacture, storage, handling and disposal of hazardous materials. We may be sued for any injury or contamination that results from our use or the use by third parties of these materials. Compliance with environmental laws and regulations may be expensive, and current or future environmental regulations may impair our research, development and production efforts.

Risks Related to Our Intellectual Property

If we fail to enforce adequately or defend our intellectual property rights our business may be harmed.

Our commercial success depends in large part on obtaining and maintaining patent and trade secret protection for our drug candidates, the methods used to manufacture those drug candidates and the methods for treating patients using those drug candidates. We will only be able to protect our drug candidates and our technologies from unauthorized use by third parties to the extent that valid and enforceable patents or trade secrets cover them.

Our ability to obtain patents is uncertain because legal means afford only limited protections and may not adequately protect our rights or permit us to gain or keep any competitive advantage. Some legal principles remain unresolved and there has not been a consistent policy regarding the breadth or interpretation of claims allowed in patents in the United States, the United Kingdom, the European Union or elsewhere. In addition, the specific content of patents and patent applications that are necessary to support and interpret patent claims is highly uncertain due to the complex nature of the relevant legal, scientific and factual issues. Changes in either patent laws or in interpretations of patent laws in the United States, the United Kingdom, the European Union or elsewhere may diminish the value of our intellectual property or narrow the scope of our patent protection.

Even if patents are issued regarding our drug candidates or methods of using them, those patents can be challenged by our competitors who can argue such patents are invalid. Patents also will not protect our drug candidates if competitors devise ways of making these product candidates without legally infringing our patents. The U.S. Federal Food, Drug and Cosmetic, or FD&C, Act and FDA regulations and policies and equivalents in other jurisdictions provide incentives to manufacturers to challenge patent validity or create modified, noninfringed versions of a drug in order to facilitate the approval of abbreviated new drug applications for generic substitutes. These same types of incentives encourage manufacturers to submit new drug applications that rely on literature and clinical data not prepared for or by the drug sponsor.

Proprietary trade secrets and unpatented know-how are also very important to our business. We rely on trade secrets to protect our technology, especially where we do not believe that patent protection is appropriate or obtainable. However, trade secrets are difficult to protect. Our employees, consultants, contractors, outside scientific collaborators and other advisors may unintentionally or willfully disclose our confidential information to competitors, and confidentiality agreements may not provide an adequate remedy in the event of unauthorized disclosure of confidential information. Enforcing a claim that a third party illegally obtained and is using our trade secrets is expensive and time consuming, and the outcome is unpredictable. Moreover, our competitors may independently

19

develop equivalent knowledge, methods and know-how. Failure to obtain or maintain trade secret protection could adversely affect our competitive business position.

If we infringe intellectual property rights of third parties, it may increase our costs or prevent us from being able to commercialize our drug candidates.

There is a risk that we are infringing the proprietary rights of third parties because patents and pending applications belonging to third parties exist in the United States, the United Kingdom and elsewhere in the world in the areas our research explores. Others might have been the first to make the inventions covered by each of our or our licensors' pending patent applications and issued patents and might have been the first to file patent applications for these inventions. In addition, because the patent application process can take several years to complete, there may be currently pending applications, unknown to us, which may later result in issued patents that cover the production, manufacture, commercialization or use of our drug candidates. In addition, the production, manufacture, commercialization or use of our product candidates may infringe existing patents of which we are not aware.

There has been substantial litigation and other proceedings regarding patent and other intellectual property rights in the pharmaceutical and biotechnology industries. Defending ourselves against third-party claims, including litigation in particular, would be costly and time consuming and would divert management's attention from our business, which could lead to delays in our development or commercialization efforts. If third parties are successful in their claims, we might have to pay substantial damages or take other actions that are adverse to our business. As a result of intellectual property infringement claims, or to avoid potential claims, we might:

- •

- be prohibited from selling or licensing any product that we may develop unless the patent holder licenses the patent to us, which it is not required to do;

- •

- be required to pay substantial royalties or grant a cross license to our patents to another patent holder; or

- •

- be required to redesign the formulation of a drug candidate so it does not infringe, which may not be possible or could require substantial funds and time.

The development programs for our two lead drug candidates are based in part on intellectual property rights we license from others, and any termination of those licenses could seriously harm our business.

We have in-licensed certain patent rights in connection with the development programs for each of our two lead drug candidates. With respect to CYC202, we hold a license from Centre National de Recherche Scientifique, or CNRS, and Institut Curie. With respect to CYC682, we hold a license from Sankyo Co., Ltd. of Japan. Both of these license agreements impose payment and other material obligations on us. Under the CNRS/Institut Curie license, we are obligated to pay license fees, milestone payments and royalties. We are also obligated to use reasonable efforts to develop and commercialize products based on the licensed patents. Under the Sankyo license we are obligated to pay license fees, milestone payments and royalties. We are also obligated to use commercially reasonable efforts to commercialize products based on the licensed rights and to use reasonable efforts to obtain regulatory approval to sell the products in at least one country by September 2011. Although we are currently in compliance with all of our material obligations under these licenses, if we were to breach any such obligations our counterparties would be permitted to terminate the licenses. This would restrict or delay or eliminate our ability to develop and commercialize these drug candidates, which could seriously harm our business.

20

Intellectual property rights of third parties could adversely affect our ability to commercialize our drug candidates.