Fourth-Quarter and Full-Year 2005 Performance Review Jim McNerney Chairman, President and Chief Executive Officer James Bell Chief Financial Officer February 1, 2006 Exhibit 99.2 |

2 Significantly improved financial results Generated a record $7.0 billion of operating cash flow Grew total backlog 33 percent to a record $202 billion Raised dividend 20% and repurchased 45 million shares Invested in key growth areas (787, 747-8, FCS, MMA) Operating in healthy core markets Driving sustained growth and productivity through new company- wide initiatives Raising EPS guidance for 2006, followed by strong growth in 2007 2005 Summary Solid results… strong growth ahead |

3 2005 Financial Results $3.5B $2.30 3.8% 2.0B $52.5B 2004 1.3 Pts 5.1% Operating Margin 100% $7.0B Operating Cash Flow 39% $3.20 Earnings per Share 40% $2.8B Operating Income 5% $54.8B Revenues Change 2005 Strong earnings growth… outstanding cash flow |

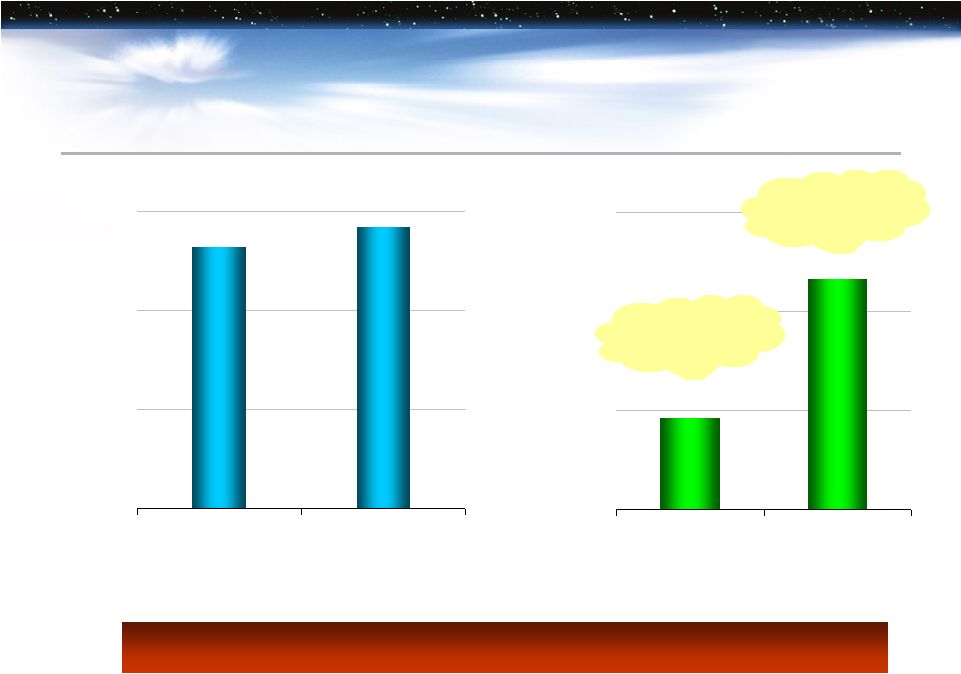

4 13.3 14.2 $0 $5 $10 $15 2004Q4 2005Q4 $0.23 $0.58 $0.00 $0.25 $0.50 $0.75 2004Q4 2005Q4 Fourth-Quarter Revenue and Earnings Revenue, Billions Earnings per Share Fourth-quarter earnings more than doubled $0.55 after special items $0.74 after special items |

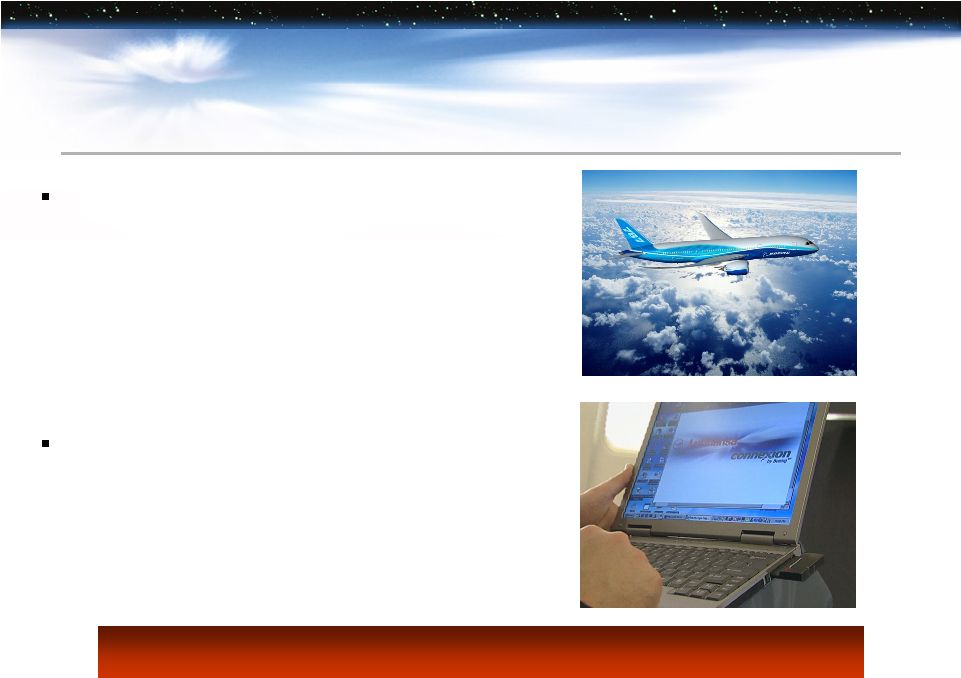

5 Commercial Airplanes Continued focus on growth and margin expansion 747-8 Program Launched $5.9 $5.4 (2.8%) 5.6% $0 $2 $4 $6 2004Q4 2005Q4 -5% 0% 5% 10% Revenues & Operating Margins Billions Strong performance… growth ramping up – Delivered 290 airplanes in 2005… 73 in fourth quarter – Airplane deliveries growing more than 35% in 2006 Won a record 1,029 gross orders in 2005… 388 in fourth quarter – Backlog up 89% this year to $124 billion 787 program made excellent progress – 291 firm orders and 88 additional commitments to date from 27 customers – Completed firm configuration Launched new programs – 777 Freighter – 737-900ER – 747-8 Passenger and Freighter – 767-300 Boeing Converted Freighter Delivered first 747-400 BCF to Cathay Pacific |

6 Record operating performance in 2005 - Record revenues, earnings and margins - Industry-leading margins and backlog Continued success on contract wins - F-15 Singapore contract award - F/A-18E/F FIRST contract extension - Army Chinook order Excellent progress on development programs - GMD flight test - FCS System of Systems Functional Review - P-8A (MMA) Preliminary Design Review - V-22 granted approval for full-rate production Integrated Defense Systems Moderating market . . . focused on execution $7.6 $8.1 8.9% 11.4% $0 $3 $6 $9 2004Q4 2005Q4 0% 5% 10% 15% Revenues & Operating Margins Billions F-15 |

7 Other Businesses Boeing Capital Corporation – Environment continues to improve… aircraft financing market strengthening – Pre-tax income grew 27% in 2005 – Paid cash dividends totaling more than $1 billion to Boeing since 2004 – Maintaining conservative financial position Connexion by Boeing SM – Commercial service operating on 110 aircraft with more than 180 daily flights – Total orders and options from 11 airlines for approximately 500 aircraft; definitizing contracts with two maritime customers for > 150 vessels BCC and Connexion on track |

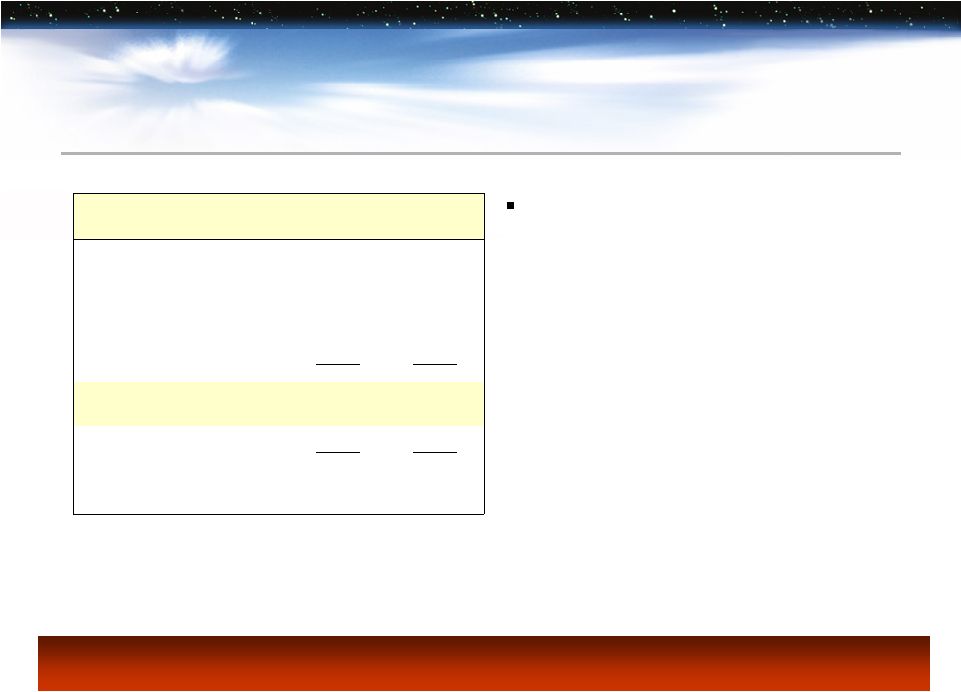

8 Generated a record $7.0 billion in operating cash flow after pensions Cash Flow Pension Plans Strengthened – In 2005 – Pension asset returns ~ 15% – Cash contributions totaled $1.9 billion – Funded status improved to 96% – In 2006 – Expected rate of return remains 8.5% – Discount rate reduced to 5.5% – Pension expense likely to be ~ $1.0 billion – Required cash contributions < $50 million 2.3 (1.2) 3.5 (4.4) 3.0 3.0 1.9 2004 5.5 (1.5) 7.0 (1.9) 3.0 3.3 2.6 2005 Depreciation/non-cash Free cash flow* Capital Expenditures Operating cash flow Pension Contributions Working Capital Net Earnings $ Billions *Non-GAAP measure. Definitions, reconciliations, and further disclosures regarding these non-GAAP measures are provided in the company’s earnings press release dated February 1, 2006. |

9 Cash and Debt Balances Outstanding balance sheet strength and liquidity 3.0 2.9 5.4 3.2 $0 $3 $6 $9 2004 2005 4.4 5.2 6.3 7.0 $0 $3 $6 $9 2004 2005 Billions Billions Boeing debt BCC debt S&P: A Moody’s: A3 * Fitch: A+ S&P: A Moody’s: A3 * Fitch: A+ Cash Marketable Securities * Moody’s announced on January 25, 2006 that it may upgrade Boeing’s credit rating. |

10 Operating Cash Flow ² Earnings per Share Revenues ¹ >$5.5B >$5.5B $4.10 - $4.30 $3.25 - $3.45 $63.5B - $64.5B ~ $60B 2007 2006 Forecasting solid growth Financial Guidance 1 2006 revenue outlook is nearly $2B below prior estimate due solely to a previously disclosed accounting change at Boeing Commercial Airplanes. 2 Includes $0.5 billion in expected pension-plan contributions in 2006 and in 2007. |

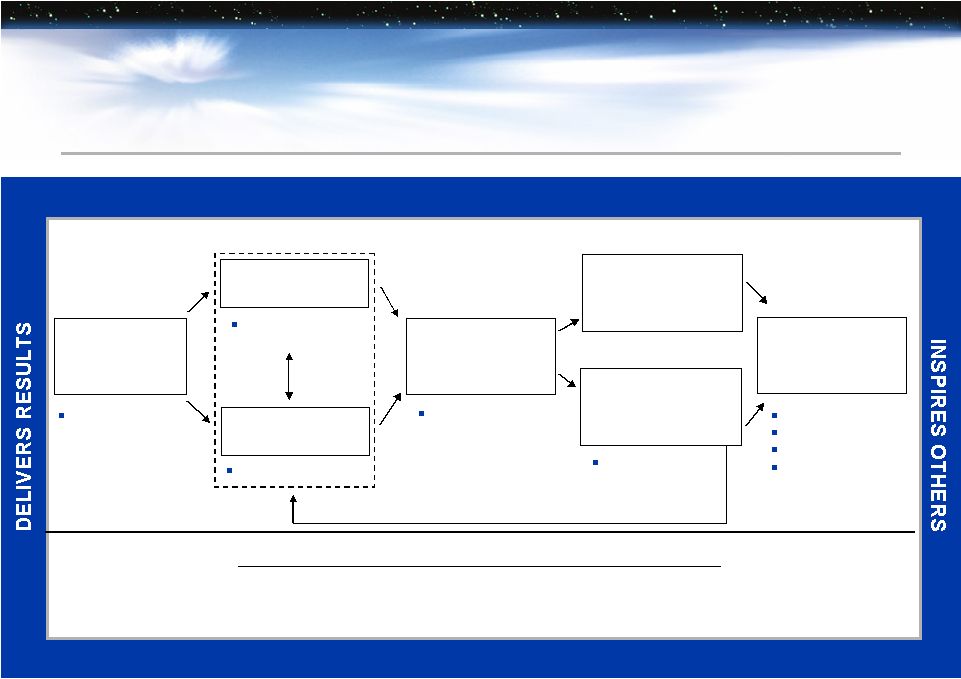

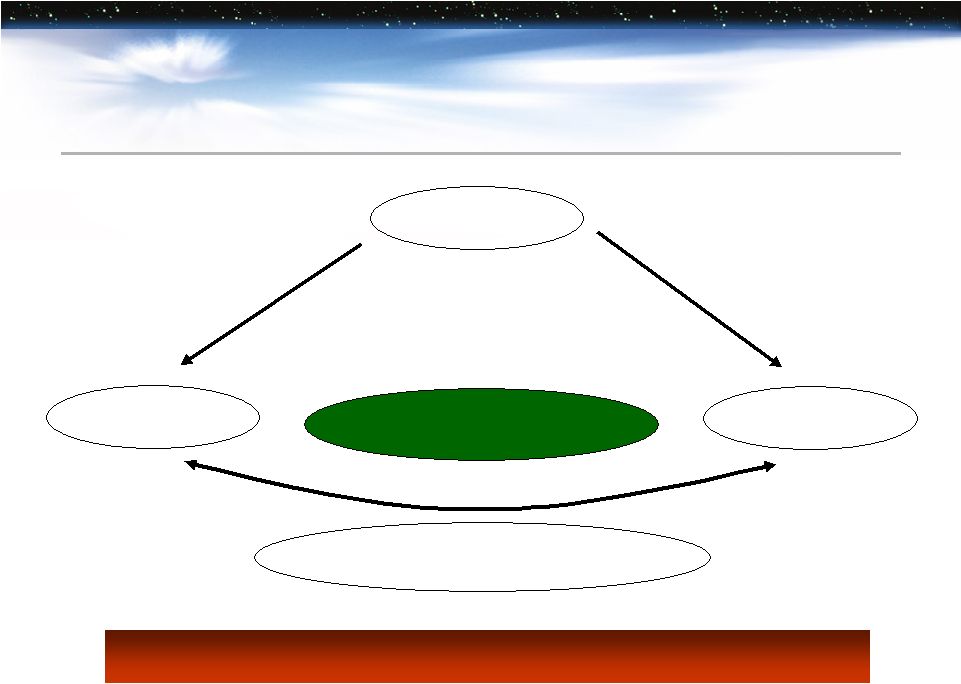

11 Boeing’s Management Model Financial Objectives Growth Productivity Financial Performance Stock Price Performance to Plan Move Toward World-Class: Margins, Earnings, Cash CHARTS THE COURSE LIVES BOEING VALUES Attaining World-Class Growth and Productivity: • Committed, performance-driven management • Maximize learning across the enterprise and from outside • Adapt and apply learnings in clearly defined businesses Initiative Tool Kit Customer Satisfaction Competitiveness Economic Profit Stakeholders Employees Customers Shareholders Communities Employee Accountability SETS HIGH EXPECTATIONS FINDS A WAY |

12 Initiative Sponsor Internal Services Productivity James Bell Global Sourcing Jim Albaugh Lean + Alan Mulally Development Process Excellence Jim Jamieson Teams are up and running… Growth and Productivity Initiatives |

13 Boeing Leadership Model Define It Model It Teach It • Leadership attributes • Performance • Values • Across the Enterprise • In all we do • Action/Words • Every day • Leaders Leading Leaders • Boeing Leadership Center • Candor/Openness • Leaders Teaching Leaders • Step Function Impact • Reinforce in HR processes Growth / Productivity Expect It / Measure It / Reward It Better Leaders Make Better Companies |

14 Businesses are well positioned in healthy markets Forecasting strong growth in 2006 and 2007 Focused on growth and productivity initiatives… driving performance to new levels Embarking on major leadership development journey Delivering value to customers and shareholders Looking Ahead |

15 * * * * * * * * * * * * * * * * * * * * * * * * * * * * |

16 Certain statements in this report may constitute “forward-looking” statements within the meaning of the Private Litigation Reform Act of 1995. Words such as “expects,” “intends,” “plans,” “projects,” “believes,” “estimates,” and similar expressions are used to identify these forward-looking statements. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Forward-looking statements are based upon assumptions as to future events that may not prove to be accurate. Actual outcomes and results may differ materially from what is expressed or forecasted in these forward-looking statements. As a result, these statements speak only as of the date they were made and we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Our actual results and future trends may differ materially depending on a variety of factors, including the continued operation, viability and growth of major airline customers and non-airline customers (such as the U.S. Government); adverse developments in the value of collateral securing customer and other financings; the occurrence of any significant collective bargaining labor dispute; our successful execution of internal performance plans including our company-wide growth and productivity initiatives, production rate increases and decreases (including any reduction in or termination of an aircraft product), acquisition and divestiture plans, and other cost-reduction and productivity efforts; charges from any future SFAS No. 142 review; an adverse development in rating agency credit ratings or assessments; the actual outcomes of certain pending sales campaigns and the launch of the 787 program and U.S. and foreign government procurement activities, including the uncertainty associated with the procurement of tankers by the U.S. Department of Defense (DoD) and funding of the C-17 program; the cyclical nature of some of our businesses; unanticipated financial market changes which may impact pension plan assumptions; domestic and international competition in the defense, space and commercial areas; continued integration of acquired businesses; performance issues with key suppliers, subcontractors and customers; significant disruption to air travel worldwide (including future terrorist attacks); global trade policies; worldwide political stability; domestic and international economic conditions; price escalation; the outcome of political and legal processes, changing priorities or reductions in the U.S. Government or foreign government defense and space budgets; termination of government or commercial contracts due to unilateral government or customer action or failure to perform; legal, financial and governmental risks related to international transactions; legal and investigatory proceedings; tax settlements with the IRS and various states; U.S. Air Force review of previously awarded contracts; and other economic, political and technological risks and uncertainties. Additional information regarding these factors is contained in our SEC filings, including, without limitation, our Annual Report on Form 10-K for the year ended December 31, 2004 and Quarterly Reports on Form 10-Q for the quarters ended March 31, 2005, June 30, 2005 and September 30, 2005. Forward-Looking Information is Subject to Risk and Uncertainty |