GLOSSARY OF TERMS

The following are defined terms used in this annual information form:

"ABCA" means the Business Corporations Act (Alberta), R.S.A. 2000, c. B-9, as amended, including the regulations promulgated thereunder;

“AGCA” means Alberta Gas Cost Allowance;

"affiliate" when used to indicate a relationship with a person or company, has the same meaning as set forth in the Securities Act (Alberta);

"Arrangement" means the plan of arrangement under the ABCA involving the Trust, Vermilion, Clear Energy Inc. and Vermilion Acquisition Ltd., which was completed on January 22, 2003;

"board of directors" or "board" means the board of directors of Vermilion;

"control" means, with respect to control of a body corporate by a person, the holding (other than by way of security) by or for the benefit of that person of securities of that body corporate to which are attached more than 50% of the votes that may be cast to elect directors of the body corporate (whether or not securities of any other class or classes shall or might be entitled to vote upon the happening of any event or contingency) provided that such votes, if exercised, are sufficient to elect a majority of the board of directors of the body corporate;

"Current Market Price of a Trust Unit" means, in respect of a Trust Unit on any date, the weighted average trading price of the Trust Units on the TSX on that date and the nine trading days preceding that date, or, if the Trust Units are not then listed on the TSX, on such other stock exchange or automated quotation system on which the Trust Units are listed or quoted, as the case may be, as may be selected by the board of directors of Vermilion for such purpose; provided, however, that if in the opinion of the board of directors of Vermilion the public distribution or trading activity of Trust Units for that period does not result in a weighted average trading price which reflects the fair market value of a Trust Unit, then the Current Market Price of a Trust Unit shall be determ ined by the board of directors of Vermilion, in good faith and in its sole discretion, and provided further that any such selection, opinion or determination by such board of directors shall be conclusive and binding and for the purposes of this definition, the weighted average trading price shall be determined by dividing (a) the aggregate dollar trading value of all Trust Units sold on the TSX (or other stock exchange or automated quotation system, if applicable) over the applicable ten trading days by (b) the total number of Trust Units sold on such stock exchange or system during such period;

"Distributable Cash" means all amounts available for distribution during any applicable period to Unitholders;

"Distribution" means a distribution paid by the Trust in respect of the Trust Units, expressed as an amount per Trust Unit;

"Distribution Payment Date" means any date that Distributable Cash is distributed to Unitholders, generally being the 15th day of the calendar month following any Distribution Record Date;

"Distribution Record Date" means the last day of each calendar month or such other date as may be determined from time to time by the Trustee, except that December 31 shall in all cases be a Distribution Record Date;

"DRIP Plan" means the Distribution Reinvestment Plan adopted by the Trust;

"Exchangeable Shares" means the Series A exchangeable shares in the capital of Vermilion;

"Exchangeable Share Provisions" means the rights, privileges, restrictions and conditions attaching to the Exchangeable Shares;

| 2009 Annual Information Form – Vermilion Energy Trust | 4 |

"Exchange Ratio" means the exchange ratio used to determine the number of Trust Units a holder of Exchangeable Shares is entitled to receive upon an exchange of Exchangeable Shares which, in respect of each Exchangeable Share, was initially equal to one upon completion of the Arrangement, and shall be cumulatively adjusted thereafter by: (a) increasing the Exchange Ratio on each Distribution Payment Date by an amount, rounded to the nearest five (5) decimal places, equal to a fraction having as its numerator the product of the Exchange Ratio immediately prior to the applicable Distribution Payment Date and the Distribution, expressed as an amount per Trust Unit, paid on that Distribution Payment Date, and having as its denominator the Current Market Price of a Trust Unit on the last business day prior to that Distribution Payment Date; and (b) decreasing the Exchange Ratio on each record date for the payment of dividends to holders of Exchangeable Shares by Vermilion, if any, by an amount, rounded to the nearest five (5) decimal places, equal to a fraction having as its numerator the amount of the dividend payable to holders of Exchangeable Shares, expressed as an amount per Exchangeable Share, and having as its denominator the Current Market Price of a Trust Unit on the date that is the last business day prior to that dividend record date. The Exchange Ratio shall also be adjusted in the event of certain other reorganizations or distributions in respect of the Trust Units as necessary on an economic equivalency basis as further described in the Exchangeable Share Provisions;

“GAAP” means Canadian Generally Accepted Accounting Principles;

"GLJ" means GLJ Petroleum Consultants Ltd., independent petroleum engineering consultants of Calgary, Alberta;

"GLJ Report" means the independent engineering evaluation of certain oil, NGL and natural gas interests of the Trust prepared by GLJ dated February 8, 2010 and effective December 31, 2009;

"Income Tax Act" or "Tax Act" means the Income Tax Act (Canada), R.S.C. 1985, c. 1. (5th Supp.), as amended, including the regulations promulgated thereunder;

"Insolvency Event" means the institution, by Vermilion, of any proceeding to be adjudicated to be a bankrupt or insolvent or to be wound up, or the consent of Vermilion to the institution of bankruptcy, dissolution, insolvency or winding-up proceedings against it, or the filing of a petition, answer or consent seeking dissolution or winding-up under any bankruptcy, insolvency or analogous laws, including without limitation the Companies Creditors' Arrangement Act (Canada) and the Bankruptcy and Insolvency Act (Canada), and the failure by Vermilion to contest in good faith any such proceedings commenced in respect of Vermilion within fifteen (15) days of becoming aware thereof, or the consent by Vermilion to the filing of any such petition or to the appointment of a receiver, or the making by Vermilion of a general assignment for the benefit of creditors, or the admission in writing by Vermilion of its inability to pay its debts generally as they become due, or Vermilion not being permitted, pursuant to solvency requirements of applicable law, to redeem any retracted Exchangeable Shares pursuant to the Exchangeable Share Provisions;

"Meeting" means the annual and special meeting of Unitholders of the Trust to be held on May 7, 2010 (or, if adjourned, such other date on which the meeting is held);

"Non-Resident" means (a) a person who is not a resident of Canada for the purposes of the Tax Act; or (b) a partnership that is not a Canadian partnership for the purposes of the Tax Act;

"Notes" means the unsecured, subordinated notes issued by Vermilion under the Arrangement;

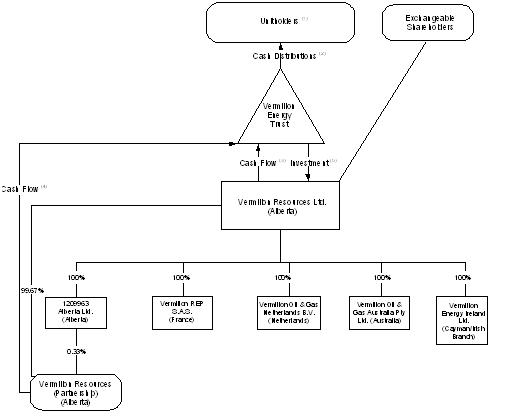

"Partnership" means Vermilion Resources, the partners of which are Vermilion and its wholly-owned subsidiary 1209963 Alberta Ltd.;

"Permitted Investments" means (a) obligations issued or guaranteed by the government of Canada or any province of Canada or any agency or instrumentality thereof, (b) term deposits, guaranteed investment certificates, certificates of deposit or bankers' acceptances of or guaranteed by any Canadian chartered bank or other financial institutions the short-term debt or deposits of which have been rated at least A or the equivalent by Standard & Poor's Corporation, Moody's Investors Service, Inc. or DBRS Limited, and (c) commercial paper rated at least A or the equivalent by DBRS Limited, in each case maturing within 180 days after the date of acquis ition;

"Pro Rata Share" of any particular amount in respect of a Unitholder at any time shall be the product obtained by multiplying the number of Trust Units that are owned by that Unitholder at that time by the quotient obtained when such a number is divided by the total number of all Trust Units that are issued and outstanding at that time;

"Rights Plan" means the unitholders rights plan of the Trust;

| 2009 Annual Information Form – Vermilion Energy Trust | 5 |

"Royalty" means the royalty granted under the Royalty Agreement commencing February 1, 2003, entitling the Trust to approximately 99% of the net cash flow generated from the present and future oil and natural gas interests, rights and related tangibles of the Partnership after certain costs, expenditures and deductions;

"Royalty Agreement" means the amended royalty agreement between the Partnership, Vermilion, 1209963 Alberta Ltd. and the Trust dated January 22, 2003, as amended, providing for the creation of the Royalty;

"Special Resolution" means a resolution proposed to be passed as a special resolution at a meeting of Unitholders and passed by the affirmative votes of the holders of not less than 66 2/3% of the Trust Units represented at the meeting and voted on a poll upon such resolution;

"Special Voting Right" means the special voting right of the Trust, issued and certified under the Trust Indenture for the time being outstanding and entitled to the benefits and subject to the limitations set forth therein;

"Subsequent Investment" means those investments which the Trust is permitted to make pursuant to the Trust Indenture;

"Subsidiary" means, in relation to any person, any body corporate, partnership, joint venture, association or other entity of which more than 50% of the total voting power of shares or units of ownership or beneficial interest entitled to vote in the election of directors (or members of a comparable governing body) is owned or controlled, directly or indirectly, by such person;

"Support Agreement" means the support agreement entered into between the Trust and Vermilion Acquisition Ltd. (prior to its amalgamation with Vermilion) on January 16, 2003;

"Trust" means Vermilion Energy Trust, a trust established under the laws of Alberta pursuant to the Trust Indenture;

"Trustee" means Computershare Trust Company of Canada, the trustee of the Trust, or such other trustee, from time to time, of the Trust;

"Trust Indenture" means the amended and restated trust indenture dated as of January 15, 2003 between Computershare Trust Company of Canada and Vermilion;

"Trust Subsidiary" means Vermilion, 1209963 Alberta Ltd., 1209974 Alberta Ltd., Vermilion Rep S.A.S., Vermilion Resources (Partnership), Vermilion Oil & Gas Netherlands B.V., Vermilion Oil & Gas Australia Pty Ltd. and Vermilion Energy Ireland Ltd.

"Trust Unit" or "Unit" means a unit of the Trust issued by the Trust;

"Trust Unit Award Plan" means the Trust Unit Award Incentive Plan of the Trust;

"TSX" means the Toronto Stock Exchange;

"Unitholder Rights Plan Agreement" means the Unitholder Rights Plan Agreement dated May 5, 2006 as amended on May 9, 2009 between the Trust and Computershare Trust Company of Canada establishing the Unitholder Rights Plan of the Trust;

"Unitholders" means holders from time to time of the Trust Units;

"Vermilion" means Vermilion Resources Ltd.;

"Voting and Exchange Agreement Trustee" means Computershare Trust Company of Canada, the initial trustee under the Voting and Exchange Trust Agreement, or such other trustee, from time to time appointed thereunder; and

"Voting and Exchange Trust Agreement" means the voting and exchange trust agreement entered into on January 16, 2003 between the Trust, Vermilion Acquisition Ltd. (prior to its amalgamation with Vermilion) and the Voting and Exchange Agreement Trustee.

| 2009 Annual Information Form – Vermilion Energy Trust | 6 |

Conventions

Unless otherwise indicated, references herein to "$" or "dollars" are to Canadian dollars. All financial information herein has been presented in Canadian dollars in accordance with generally accepted accounting principles in Canada.

Abbreviations

| Oil and Natural Gas Liquids |

| Bbl | Barrel |

| Mbbl | thousand barrels |

| Bbl/d | barrels per day |

| NGL | natural gas liquids |

| Natural Gas |

| Mcf | thousand cubic feet |

| MMcf | million cubic feet |

| Mcfpd | thousand cubic feet per day |

| MMcfpd | million cubic feet per day |

| MMBtu | million British Thermal Units |

| Other |

| API | American Petroleum Institute |

| °API | An indication of the specific gravity of crude oil measured on the API gravity scale. |

| | Liquid petroleum with a specified gravity of 28 °API or higher is generally referred to as light crude oil |

| boe | barrel of oil equivalent of natural gas and crude oil on the basis of 1 boe for 6 (unless otherwise stated) Mcf of natural gas (this conversion factor is an industry accepted norm and is not based on either energy content or current prices) |

| bopd | barrel of oil equivalent per day |

| $M | thousand dollars |

| $MM | million dollars |

| Mboe | 1,000 barrels of oil equivalent |

| MMboe | million barrels of oil equivalent |

| WTI | West Texas Intermediate, the reference price paid in U.S. dollars at Cushing, Oklahoma for crude oil of |

| | standard grade |

Conversion

The following table sets forth certain standard conversions from Standard Imperial Units to the International System of Units (or metric units).

| To Convert From | To | Multiply By |

| Mcf | Cubic metres | 28.174 |

| Cubic metres | Cubic feet | 35.494 |

| Bbls | Cubic metres | 0.159 |

| Cubic metres | Bbls oil | 6.290 |

| Feet | Metres | 0.305 |

| Metres | Feet | 3.281 |

| Miles | Kilometres | 1.609 |

| Kilometres | Miles | 0.621 |

| Acres | Hectares | 0.405 |

| Hectares | Acres | 2.471 |

| 2009 Annual Information Form – Vermilion Energy Trust | 7 |

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

Certain statements included or incorporated by reference in this annual information form may constitute forward-looking statements under applicable securities legislation. Forward-looking statements or information typically contain statements with words such as "anticipate", "believe", "expect", "plan", "intend", "estimate", "propose", or similar words suggesting future outcomes or statements regarding an outlook. Forward looking statements or information in this annual information form may include, but are not limited to:

| · | business strategy and objectives; |

| · | reserve quantities and the discounted present value of future net cash flows from such reserves; |

| · | future production levels; |

| · | acquisition and disposition plans and the timing thereof; |

| · | operating and other costs; |

| · | Vermilion's additional future payment in connection with the Corrib acquisition; |

| · | the timing of first commercial gas from the Corrib field; |

| · | the decision of the Corrib joint venture consortium to drill an exploratory well at the Corrib field and the timing thereof; and |

| · | estimate of Vermilion’s share of the expected gas rates from the Corrib field. |

Such forward-looking statements or information are based on a number of assumptions which may prove to be incorrect. In addition to any other assumptions identified in this annual information form, assumptions have been made regarding, among other things:

| · | the ability of the Trust to obtain equipment, services and supplies in a timely manner to carry out its activities in Canada and internationally; |

| · | the ability of the Trust to market oil and natural gas successfully to current and new customers; |

| · | the timing and costs of pipeline and storage facility construction and expansion and the ability to secure adequate product transportation; |

| · | the timely receipt of required regulatory approvals; |

| · | the ability of the Trust to obtain financing on acceptable terms; |

| · | currency, exchange and interest rates; and |

| · | future oil and gas prices. |

Although the Trust believes that the expectations reflected in such forward-looking statements or information are reasonable, undue reliance should not be placed on forward looking statements because the Trust can give no assurance that such expectations will prove to be correct. Forward-looking statements or information are based on current expectations, estimates and projections that involve a number of risks and uncertainties which could cause actual results to differ materially from those anticipated by the Trust and described in the forward looking statements or information. These risks and uncertainties include but are not limited to:

| · | the ability of management to execute its business plan; |

| · | the risks of the oil and gas industry both domestically and internationally, such as operational risks in exploring for, developing and producing crude oil and natural gas and market demand; |

| · | risks and uncertainties involving geology of oil and gas deposits; |

| · | risks inherent in the Trust's marketing operations, including credit risk; |

| · | the uncertainty of reserves estimates and reserves life; |

| · | the uncertainty of estimates and projections relating to production, costs and expenses; |

| · | potential delays or changes in plans with respect to exploration or development projects or capital expenditures; |

| · | the Trust's ability to enter into or renew leases; |

| · | fluctuations in oil and gas prices, foreign currency exchange rates and interest rates; |

| · | health, safety and environmental risks; |

| · | uncertainties as to the availability and cost of financing; |

| 2009 Annual Information Form – Vermilion Energy Trust | 8 |

| · | the ability of the Trust to add production and reserves through development and exploration activities; |

| · | general economic and business conditions; |

| · | the possibility that government policies or laws may change or governmental approvals may be delayed or withheld; |

| · | uncertainty in amounts and timing of royalty payments; |

| · | risks associated with existing and potential future law suits and regulatory actions against the Trust; and |

| · | other risks and uncertainties described elsewhere in this annual information form or in the Trust's other filings with Canadian securities authorities. |

The forward-looking statements or information contained in this annual information form are made as of the date hereof and the Trust undertakes no obligation to update publicly or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, unless required by applicable securities laws.

PRESENTATION OF OIL AND GAS RESERVES AND PRODUCTION INFORMATION

All oil and natural gas reserve information contained in this annual information form has been prepared and presented in accordance with National Instrument 51-101 Standards of Disclosure for Oil and Gas Activities ("NI 51-101"). The actual oil and natural gas reserves and future production will be greater than or less than the estimates provided in this annual information form. The estimated future net revenue from the production of the disclosed oil and natural gas reserves does not represent the fair market value of these reserves. The Trust has adopted the standard of 6 Mcf:1 boe when converting natural gas to barrels of oil equivalent. Boes may be misleading, particularly if used in isolation. A boe conversion ratio of 6 Mcf:1 boe is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead.

NON-GAAP MEASURES

This annual information form includes non-GAAP measures as further described herein. These measures do not have standardized meanings prescribed by GAAP and, therefore, may not be comparable with the calculations of similar measures for other entities.

“Cash distributions per unit” represents actual cash distributions paid per unit by the Trust during the relevant periods.

“Cash distributions net” is calculated as actual cash distributions paid or payable for a given period. Cash distributions are reviewed by management and are also assessed as a percentage of fund flows from operations to analyze how much of the cash that is generated by the Trust is being used to fund distributions.

| 2009 Annual Information Form – Vermilion Energy Trust | 9 |

Summary Description of the Business

Vermilion Energy Trust

The Trust was established to acquire and hold, directly and indirectly, interests in petroleum and natural gas properties. Cash flow from the properties flows from Vermilion to the Trust by way of interest payments and principal repayments on the Notes and dividends declared on the common shares of Vermilion, and from the Partnership to the Trust by way of royalty payments under the Royalty Agreement. Under the terms of the Trust Indenture, the Trust is also entitled to:

| (a) | acquire or invest in securities of Vermilion and in the securities of any other entity including without limitation, bodies corporate, partnerships or trusts, and borrowing funds or otherwise obtaining credit for that purpose; |

| (b) | acquire royalties in respect of Canadian resource properties as defined in the Tax Act and making any deferred royalty purchase payments which may be required with respect to such royalties; provided however that in no event shall the Trust invest in any royalties which constitute an interest in land or a covenant running with the properties with respect to which such royalties relate; |

| (c) | dispose of any part of the property of the Trust, including, without limitation, any securities of Vermilion; |

| (d) | temporarily hold cash and investments for the purposes of paying the expenses and the liabilities of the Trust, making other Permitted Investments as contemplated by the Trust Indenture, paying amounts payable by the Trust in connection with the redemption of any Trust Units, and making distributions to Unitholders; and |

| (e) | pay costs, fees and expenses associated with the foregoing purposes or incidental thereto. |

The Trustee is prohibited from acquiring any investment which would result in the Trust not being considered either a "unit trust" or a "mutual fund trust" for purposes of the Tax Act.

The Trustee may declare payable to the Unitholders all or any part of the net income of the Trust. It is currently anticipated that the only income to be received by the Trust will be from the interest received on the principal amount of Notes, royalty income pursuant to the Royalty Agreement, and dividends on the common shares of Vermilion. The Trust currently makes monthly cash distributions to Unitholders of the interest income earned from the Notes, income earned under the Royalty Agreement and dividends received on the common shares of Vermilion, after expenses, if any, and any cash redemptions of Trust Units.

Unitholders receive monthly distributions of the cash flow generated by Vermilion and distributed to Unitholders through the Trust. The Trust currently employs a strategy which: (i) provides Unitholders with a competitive annual cash on cash yield through monthly cash distributions, (ii) ensures that Vermilion's existing assets are maintained at a level that provides sustainable ongoing cash flow, and (iii) continues to expand the business of the Trust through the development of growth opportunities that are intended to provide long-term stable cash flows and be accretive to the existing Unitholders. The Trust intends to finance acquisitions through bank financing and the issuance of additional Trust Units from treasury, while maintaining prudent leverage.

Vermilion Resources Ltd.

Vermilion Resources Ltd. was incorporated under the ABCA on November 23, 1993. On January 1, 2003, Vermilion amalgamated with its wholly-owned subsidiary, 973675 Alberta Ltd. and on January 15, 2003, Vermilion amalgamated with its wholly-owned subsidiaries, Big Sky Resources Inc., Vermilion Gas Marketing Inc. and 962134 Alberta Ltd. On January 22, 2003, Vermilion was amalgamated with Vermilion Acquisition Ltd. pursuant to the Arrangement.

The Trust is the sole holder of Vermilion common shares. Certain former shareholders of Vermilion own Exchangeable Shares of Vermilion in accordance with the elections made by such holders under the Arrangement. Vermilion continues to carry on an oil and natural gas business similar to that carried on by Vermilion prior to the Arrangement becoming effective.

The head office of Vermilion is located at Suite 2800, 400 – 4th Avenue S.W., Calgary, Alberta, T2P 0J4 and its registered office is located at Suite 3700, 400 – 3rd Avenue S.W., Calgary, Alberta, T2P 4H2.

| 2009 Annual Information Form – Vermilion Energy Trust | 11 |

History of Vermilion

The following describes the development of Vermilion's business over the last three completed financial years.

On June 20, 2007, Vermilion completed the acquisition of a 40% interest in the Offshore Wandoo Field. The purchase price, exclusive of the acquired working capital deficiency, was $117.9 million. The transaction added approximately 3,000 bopd.

On January 31, 2008, Vermilion closed the acquisition of a package of producing assets in the Drayton Valley area for $47 million.

On July 30, 2009, Vermilion completed the acquisition of an 18.5% non-operated interest in the Corrib field located approximately 83 kilometres off the northwest coast of Ireland for an aggregate purchase price comprised of US$100 million paid on closing and an obligation for an additional future payment, the amount of which will vary from an estimated US$300 million to US$135 million, depending on the date when first commercial gas from the Corrib field is achieved. Pursuant to the acquisition agreement governing the Corrib acquisition, Vermilion assumed its share of future capital expenditure obligations in order to reach first commercial gas. Beginning at the effective date of January 1, 2009, these costs are anticipated to range up to US$300 million, net to the acquired interest. On September 29, 20 09, Vermilion filed a business acquisition report in connection with the Corrib acquisition, which may be found on SEDAR at www.sedar.com.

On October 30, 2009, Vermilion closed an equity financing of 7,282,000 Trust Units at a price $30.90 per Trust Unit for gross proceeds of $225 million. Subsequently, on December 1, 2009, Vermilion announced that the underwriters had exercised the over-allotment option in connection with the offering and Vermilion issued an additional 809,000 Trust Units at a price of $30.90 per Trust Unit for gross proceeds of approximately $25 million. As a result of exercise of the over-allotment option, the aggregate gross proceeds to Vermilion of the equity offering were approximately $250 million.

On December 21, 2009, Verenex Energy Inc., a company in which Vermilion held 18,760,540 common shares representing a 41.9% equity ownership position was sold to a subsidiary of the Libyan Investment Authority for cash consideration of $7.09 plus an additional amount per share of $0.1976 for aggregate consideration of $7.2876 representing gross proceeds to Vermilion of approximately $136.7 million. The proceeds were used to pay down debt.

During 2010, the Trust plans to convert from a trust to a dividend paying corporation by September 2010. Approval from the Trust's Unitholders to a proposed reorganization and restructuring of Vermilion's income trust structure into a corporate structure form will be sought at a special meeting of Unitholders to be held at a date to be determined by the board of directors.

As at January 31, 2010, Vermilion had 286 full time employees of which 131 employees were located in its head office, 25 employees in its Canadian field offices, 93 employees in France, 16 employees in the Netherlands and 21 employees in Australia.

| 2009 Annual Information Form – Vermilion Energy Trust | 12 |

NARRATIVE DESCRIPTION OF THE BUSINESS

Stated Business Objectives

Vermilion is actively engaged in the business of oil and natural gas exploitation, development, acquisition and production in Australia, Canada, France, Ireland and the Netherlands. Vermilion's business plan is to maximize returns to the Trust from its oil and natural gas properties and related assets. Where possible, Vermilion will seek to expand its reserve base through the selective addition of high-quality, long-life reserves with low risk development opportunities.

In reviewing potential participations or acquisitions, Vermilion will consider a number of factors, including: (a) the present value of the future revenue from such properties from the proved producing, total proved and proved plus probable reserves; (b) the amount of potential for additional reservoir development; (c) whether sufficient infrastructure exists in the prospect to provide for increased activity; (d) the cost of any potential development; (e) investments in properties that exhibit medium to long life reserves and stable production base; and (f) the ability of Vermilion to enhance the value of acquired properties through additional exploitation efforts and additional development drilling. The board of directors of Vermilion may, in its discretion, approve asset or corporate acquisiti ons or investments that do not conform to these guidelines based upon the board's consideration of the qualitative aspects of the subject properties including risk profile, technical upside, reserve life, asset quality and the Trust's business prospects.

Description of Properties

The following is a description of the oil and natural gas properties, plants, facilities and installations in which Vermilion has an interest and that are material to Vermilion's operations and exploration activities. The production numbers stated refer to Vermilion's working interest share before deduction of Crown, freehold and other royalties. Reserve amounts are stated, before deduction of royalties, as at December 31, 2009, based on forecast cost and price assumptions as evaluated in the GLJ Report.

Canada Assets

Vermilion’s production in Canada is located primarily in three areas, all in Alberta: Drayton Valley, Slave Lake and Central Alberta. Vermilion’s main producing gas areas are Drayton Valley and Central Alberta, while Slave Lake is the main oil producing area.

In Canada, Vermilion holds an average working interest of 68% in 398,901 (271,856 net) acres of developed land, 584 (399 net) producing natural gas wells and 479 (172 net) producing oil wells as at December 31, 2009. Vermilion operates five natural gas plants and has an ownership interest in five additional plants, resulting in combined gross processing capacity of over 90 MMcfpd. In addition, Vermilion has treating capacity of over 5,200 Bbl/d of oil in 5 operated oil batteries.

For the year ended December 31, 2009, production in Canada averaged approximately 47.9 MMcfpd of natural gas and 3,654 Bbl/d of oil and NGL.

The GLJ Report assigned 30,214 Mboe of total proved reserves and 44,168 Mboe of proved plus probable reserves to Vermilion's properties located in Canada as at December 31, 2009.

France Assets

Vermilion's main producing areas in France are located in the Aquitaine Basin which is southwest of Bordeaux, France and in the Paris Basin, located just east of Paris. Vermilion's assets in France are primarily oil producing properties. The two major fields in the Paris Basin area are Champotran and Chaunoy. The two major fields in the Aquitaine Basin are Parentis and Cazaux. Vermilion operates 8 oil batteries with current producing capacities of 8,400 bbls/d. Vermilion holds an 81% working interest in 168,286 acres of developed land in the Aquitaine and Paris Basins. Vermilion had 216 (189 net) producing oil wells in France as at December 31, 2009.

For the year ended December 31, 2009, production in France averaged approximately 8,246 Bbl/d of oil and 1.1 MMcfpd of natural gas.

The GLJ Report assigned 28,749 Mboe of total proved reserves and 43,423 Mboe of proved plus probable reserves to Vermilion's properties located in France.

| 2009 Annual Information Form – Vermilion Energy Trust | 13 |

Netherlands Assets

Vermilion's Netherlands assets consist of six onshore concessions and one offshore concession located in the northern part of the country. Production consists solely of natural gas with a small amount of related condensate. The assets include three operated gas treatment centres that have a combined total capacity of 240 MMcfpd. Vermilion holds an approximate 64% working interest over the seven concessions in 451,378 (289,687 net) acres of developed land and 46 (36 net) producing gas wells as at December 31, 2009.

For the year ended December 31, 2009, Vermilion's production in the Netherlands averaged 23 Bbl/d of NGL and 21 MMcfpd of natural gas.

The GLJ Report assigned 7,416 Mboe of total proved reserves and 13,175 Mboe of proved plus probable reserves to Vermilion's properties located in the Netherlands.

Australia Assets

Vermilion's Australia assets consist of a 100% operated interest in an offshore oil field located on Western Australia's northwest shelf. The platform has a current producing capacity of 162,000 Bbl/d. Vermilion holds a 100% working interest in the Wandoo block, which is comprised of 59,553 acres (241 square kilometres) and is considered a production license. All acreage therefore is classified as producing.

For the year ended December 31, 2009, Vermilion's production in the Australia averaged 7,812 Bbl/d of oil.

The GLJ Report assigned 13,083 Mboe of total proved reserves and 19,762 Mboe of proved plus probable reserves to Vermilion's properties located in Australia.

Ireland Assets

In 2009, Vermilion acquired an 18.5% interest in the offshore Corrib gas field, located approximately 83 kilometres off the northwest coast of Ireland. The property is currently non-producing and is subject to obtaining regulatory approval and completion of construction. First commercial gas from the Corrib field was originally expected in late 2011; however, it is now expected to be late 2012 as a result of delays encountered in the ongoing regulatory approval process. The Corrib joint venture consortium is planning to drill an exploration well in the North Corrib field in 2010.

The GLJ Report assigned 15,332 Mboe of total proved reserves and 17,493 Mboe of proved plus probable reserves to Vermilion’s property in Ireland.

STATEMENT OF RESERVES DATA AND OTHER OIL AND GAS INFORMATION

Reserves and Future Net Revenue

The following is a summary of the oil and natural gas reserves and the value of future net revenue of Vermilion as evaluated by GLJ. Pricing used in the forecast price evaluations is set forth in the notes to the tables.

Information contained in this section is effective December 31, 2009 unless otherwise stated. The reserves information was prepared on February 8, 2010.

All evaluations of future net production revenue set forth in the tables below are stated after overriding and lessor royalties, Crown royalties, freehold royalties, mineral taxes, direct lifting costs, normal allocated overhead and future capital investments, including abandonment and reclamation obligations. It should not be assumed that the discounted future net production revenue estimated by the GLJ Report represents the fair market value of the reserves. Other assumptions relating to the costs, prices for future production and other matters are included in the GLJ Report. There is no assurance that the future price and cost assumptions used in the GLJ Report will prove accurate and variances could be material.

| 2009 Annual Information Form – Vermilion Energy Trust | 14 |

Reserves for Australia, Canada, France, Ireland and the Netherlands are established using deterministic methodology. Total proved reserves are established at the 90 percent probability (P90) level. There is a 90 percent probability that the actual reserves recovered will be equal to or greater than the P90 reserves. Total proved plus probable reserves are established at the 50 percent probability (P50) level. There is a 50 percent probability that the actual reserves recovered will be equal to or greater than the P50 reserves.

The Report on Reserves Data by Independent Qualified Reserves Evaluator in Form 51-101F2 and the Report of Management and Directors on Oil and Gas Disclosure in Form 51-101F3 are contained in Schedules "A" and "B", respectively.

The following tables provide reserves data and a breakdown of future net revenue by component and production group using forecast prices and costs. For Canada, the tables following include AGCA.

The following tables may not total due to rounding.

Oil and Gas Reserves - Based on Forecast Prices and Costs(8)

| | | Light and Medium Oil | | | Heavy Oil | | | Natural Gas | | | Natural Gas Liquids | |

| | | Gross(1) | | | Net(1) | | | Gross(1) | | | Net(1) | | | Gross(1) | | | Net(1) | | | Gross(1) | | | Net(1) | |

| | | (Mbbl) | | | (Mbbl) | | | (MMcf) | | | (Mbbl) | | | (MMcf) | | | (MMcf) | | | (Mbbl) | | | (Mbbl) | |

Proved Developed Producing(2)(5) | | | | | | | | | | | | | | | | | | | | | | | | |

| Australia | | | 13,083 | | | | 13,083 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Canada | | | 5,848 | | | | 4,938 | | | | 30 | | | | 27 | | | | 85,953 | | | | 75,554 | | | | 2,723 | | | | 1,723 | |

| France | | | 25,921 | | | | 23,736 | | | | - | | | | - | | | | 1,811 | | | | 1,685 | | | | - | | | | - | |

| Ireland | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Netherlands | | | - | | | | - | | | | - | | | | - | | | | 21,155 | | | | 21,155 | | | | 23 | | | | 23 | |

| Total Proved Developed Producing | | | 44,852 | | | | 41,757 | | | | 30 | | | | 27 | | | | 108,919 | | | | 98,394 | | | | 2,746 | | | | 1,746 | |

Proved Developed Non-Producing(2)(6) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Australia | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Canada | | | 397 | | | | 352 | | | | - | | | | - | | | | 4,969 | | | | 4,434 | | | | 103 | | | | 70 | |

| France | | | 1,087 | | | | 961 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Ireland | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Netherlands | | | - | | | | - | | | | - | | | | - | | | | 23,041 | | | | 23,041 | | | | 26 | | | | 26 | |

| Total Proved Developed Non-Producing | | | 1,484 | | | | 1,313 | | | | - | | | | - | | | | 28,010 | | | | 27,475 | | | | 130 | | | | 96 | |

Proved Undeveloped(2)(7) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Australia | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Canada | | | 594 | | | | 469 | | | | - | | | | - | | | | 29,544 | | | | 26,753 | | | | 441 | | | | 300 | |

| France | | | 1,439 | | | | 1,386 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Ireland | | | - | | | | - | | | | - | | | | - | | | | 91,991 | | | | 91,991 | | | | - | | | | - | |

| Netherlands | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Total Proved Undeveloped | | | 2,034 | | | | 1,854 | | | | - | | | | - | | | | 121,535 | | | | 118,745 | | | | 441 | | | | 300 | |

Proved(2) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Australia | | | 13,083 | | | | 13,083 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Canada | | | 6,839 | | | | 5,759 | | | | 30 | | | | 27 | | | | 120,465 | | | | 106,741 | | | | 3,267 | | | | 2,093 | |

| France | | | 28,447 | | | | 26,083 | | | | - | | | | - | | | | 1,811 | | | | 1,685 | | | | - | | | | - | |

| Ireland | | | - | | | | - | | | | - | | | | - | | | | 91,991 | | | | 91,991 | | | | - | | | | - | |

| Netherlands | | | - | | | | - | | | | - | | | | - | | | | 44,196 | | | | 44,196 | | | | 50 | | | | 50 | |

| Total Proved | | | 48,369 | | | | 44,924 | | | | 30 | | | | 27 | | | | 258,463 | | | | 244,614 | | | | 3,317 | | | | 2,143 | |

Probable(3) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Australia | | | 6,679 | | | | 6,679 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Canada | | | 2,963 | | | | 2,342 | | | | 5 | | | | 5 | | | | 56,514 | | | | 49,339 | | | | 1,566 | | | | 1,005 | |

| France | | | 14,563 | | | | 13,982 | | | | - | | | | - | | | | 666 | | | | 623 | | | | - | | | | - | |

| Ireland | | | - | | | | - | | | | - | | | | - | | | | 12,968 | | | | 12,968 | | | | - | | | | - | |

| Netherlands | | | - | | | | - | | | | - | | | | - | | | | 34,320 | | | | 34,320 | | | | 39 | | | | 39 | |

| Total Probable | | | 24,205 | | | | 23,003 | | | | 5 | | | | 5 | | | | 104,468 | | | | 97,250 | | | | 1,605 | | | | 1,045 | |

Proved Plus Probable(2)(3) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Australia | | | 19,762 | | | | 19,762 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Canada | | | 9,803 | | | | 8,100 | | | | 35 | | | | 32 | | | | 176,979 | | | | 156,081 | | | | 4,833 | | | | 3,099 | |

| France | | | 43,010 | | | | 40,065 | | | | - | | | | - | | | | 2,477 | | | | 2,308 | | | | - | | | | - | |

| Ireland | | | - | | | | - | | | | - | | | | - | | | | 104,959 | | | | 104,959 | | | | - | | | | - | |

| Netherlands | | | - | | | | - | | | | - | | | | - | | | | 78,516 | | | | 78,516 | | | | 89 | | | | 89 | |

| Total Proved Plus Probable | | | 72,574 | | | | 67,927 | | | | 35 | | | | 32 | | | | 362,932 | | | | 341,864 | | | | 4,922 | | | | 3,188 | |

| 2009 Annual Information Form – Vermilion Energy Trust | 15 |

Vermilion has set aside a reclamation fund to help cover these future costs which amounted to $69.0 million as at December 31, 2009.

Tax Information

Income tax laws and administrative policies regarding mutual fund trusts may be changed in a manner which adversely affects the Trust and/or the Unitholders.

On June 22, 2007, legislation was passed to implement proposals originally announced on October 31, 2006 relating to the taxation of certain distributions from certain "specified investment flow-through" ("SIFT") trusts and SIFT partnerships (the "SIFT Rules"). The SIFT Rules impose a tax at the trust level on distributions of certain income from SIFT trusts (which include the Trust) and partnerships at a rate of tax comparable to the combined federal and provincial corporate tax and to treat such distributions as dividends to the Unitholder. Existing SIFT trusts will have a four-year transition period, and subject to the qualifications below, will not be taxable under the SIFT Rules until January 1, 2011. The application of the SIFT Rules to the Trust will result in adverse tax consequences to the Trus t and indirectly certain Unitholders (including most particularly Unitholders that are tax deferred plans and non-residents of Canada) and impact cash distributions from the Trust.

Pursuant to the SIFT Rules, commencing January 1, 2011 (provided the Trust only experiences "normal growth" and no "undue expansion" before then) certain distributions from the Trust which would have otherwise have been taxed as ordinary income generally will be characterized as dividends in addition to being subject to tax at corporate rates at the Trust level. Returns of capital generally are (and under the SIFT Rules will continue to be) tax-deferred for Unitholders who are resident in Canada for purposes of the Tax Act (and reduce such Unitholder's adjusted cost base in the Trust Unit for purposes of the Tax Act). Distributions of income to a Unitholder who is not resident in Canada for purposes of the Tax Act, or that is a partnership that is not a "Canadian partnership" for purposes of the Tax Act, generally will be subject to Canadian withholding tax.

The SIFT Rules provide for a four year transition period for SIFTs in existence on October 31, 2006 provided that there is only "normal growth" of a SIFT during the transition period and no "undue expansion". As a result, the adverse tax consequences associated with the SIFT Rules could be realized by the Trust sooner than January 1, 2011. "Normal growth" would include equity growth within certain "safe harbour" limits, measured by reference to a SIFT trust's market capitalization as of the end of trading on October 31, 2006 (which would include the SIFT's issued and outstanding publicly traded trust units and not any convertible debt, options or other interests convertible into or exchangeable for trust units). The permitted expansion thresholds are the greater of $50 million and 40% of a SIFT trust's October 31 market capitalization for the period from October 31, 2006 to the end of 2007, and the greater of $50 million and 20% of a SIFT trust's October 31 market capitalization for each of 2008, 2009 and 2010. On December 4, 2008, the Department of Finance (Canada) announced changes to the normal growth rules to allow a SIFT trust to accelerate the utilization of the SIFT trust's annual permitted normal growth room for each of 2009 and 2010 so that the amount was available on and after December 4, 2008. This change does not alter the maximum permitted normal growth room for a SIFT trust, but it allows a SIFT trust to use its normal growth room remaining as of December 4, 2008 in a single year, rather than staging a portion of the normal growth room over the 2009 and 2010 years. Additional details of the “normal growth” guidelines include the following:

| (a) | new equity for these purposes includes units and debt that is convertible into units (and may include other substitutes for equity if attempts are made to develop such substitutes); |

| (b) | replacing debt that was outstanding as of October 31, 2006 with new equity, whether by a conversion into trust units of convertible debentures or otherwise, will not be considered growth for these purposes and will therefore not affect the safe harbour limits; and |

| (c) | the exchange for trust units, of exchangeable shares that were outstanding on October 31, 2006 will not be considered growth for those purposes and will therefore not affect the safe harbour where the issuance of the trust units is made in satisfaction of the exercise of the exchange right by a person other than the SIFT. |

The Trust's market capitalization as of the close of trading on October 31, 2006, having regard only to its issued and outstanding publicly-traded Trust Units, was approximately $2,375 million, which means the Trust's aggregate "safe harbour" equity growth amount was $2,375 million (not including equity, including convertible debentures, issued to replace debt that was outstanding on October 31, 2006).

| 2009 Annual Information Form – Vermilion Energy Trust | 24 |

While the guidelines are such that it is unlikely they would affect the Trust's ability to raise the capital required to maintain and grow its existing operations in the ordinary course during the transition period, they could adversely affect the cost of raising capital and the Trust's ability to undertake more significant acquisitions.

Vermilion has evaluated the alternatives available as to the best structure for Unitholders and the Trust in light of the application of the SIFT Rules to the Trust starting in 2011 and has determined that, assuming no further changes in tax laws applicable to income trusts and subject to obtaining Unitholder and other required approvals, the most appropriate action is to complete a conversion of the Trust to a dividend paying corporation by September, 2010. If the Trust completes a conversion to a corporate structure, the nature of a Unitholder's investment will change. For Unitholders resident in Canada, the tax treatment of dividends received will be different than the current tax treatment of distributions. This differential treatment may give rise to tax consequences to Unitholders resident in Canada that are adverse wh en compared to the current tax treatment of distributions to Unitholders. For Unitholders resident in Canada, the tax consequences may differ depending on the particular circumstances of each Unitholder, including whether the Unitholder’s investment in Vermilion is held in a taxable or tax-deferred account.

In France, the Trust is currently subject to a 35% corporate tax rate after eligible deductions. In the Netherlands, the Trust is currently subject to an approximate 45% corporate tax rate after eligible deductions. In Australia, the Trust is currently subject to an approximate 30% corporate tax rate after eligible deductions. Ireland is subject to tax at 25% after eligible deductions.

Production Estimates

The following table sets forth the volume of production estimated for the first year as reflected in the estimates of gross proved reserves and gross proved plus probable reserves:

| | | Light and Medium Oil | | | Heavy Oil | | | Natural Gas | | | Natural Gas Liquids | | | BOE | |

| | | (Bbl/d) | | | (Bbl/d) | | | (Mcf/d) | | | (Bbl/d) | | | (Bbl/d) | |

| Australia | | | | | | | | | | | | | | | |

| Proved | | | 6,174 | | | | - | | | | - | | | | - | | | | 6,174 | |

| Proved Plus Probable | | | 6,716 | | | | - | | | | - | | | | - | | | | 6,716 | |

| Canada | | | | | | | | | | | | | | | | | | | | |

| Proved | | | 2,235 | | | | 16 | | | | 44,829 | | | | 1,416 | | | | 11,139 | |

| Proved Plus Probable | | | 2,486 | | | | 16 | | | | 48,251 | | | | 1,562 | | | | 12,106 | |

| France | | | | | | | | | | | | | | | | | | | | |

| Proved | | | 8,140 | | | | - | | | | 727 | | | | - | | | | 8,261 | |

| Proved Plus Probable | | | 8,532 | | | | - | | | | 759 | | | | - | | | | 8,658 | |

| Ireland | | | | | | | | | | | | | | | | | | | | |

| Proved | | | - | | | | - | | | | - | | | | - | | | | - | |

| Proved Plus Probable | | | - | | | | - | | | | - | | | | - | | | | - | |

| Netherlands | | | | | | | | | | | | | | | | | | | | |

| Proved | | | - | | | | - | | | | 22,454 | | | | 24 | | | | 3,767 | |

| Proved Plus Probable | | | - | | | | - | | | | 25,133 | | | | 27 | | | | 4,216 | |

| Total Proved | | | 16,548 | | | | 16 | | | | 68,010 | | | | 1,441 | | | | 29,340 | |

| Total Proved Plus Probable | | | 17,733 | | | | 16 | | | | 74,142 | | | | 1,589 | | | | 31,695 | |

| 2009 Annual Information Form – Vermilion Energy Trust | 25 |

Production History

The following table sets forth certain information in respect of production, product prices received, royalties, production costs and netbacks received by Vermilion for each quarter of its most recently completed financial year. Vermilion had no production from its Ireland assets in 2009:

| | | Three Months Ended | | | Three Months Ended | | | Three Months Ended | | | Three Months Ended | |

| | | March 31, 2009 | | | June 30, 2009 | | | September 30, 2009 | | | December 31, 2009 | |

| Australia | | | | | | | | | | | | |

| Average Daily Production | | | | | | | | | | | | |

| Light and Medium Oil (Bbl/d) | | | 8,612 | | | | 7,931 | | | | 7,598 | | | | 7,124 | |

| Natural Gas (MMcfpd) | | | - | | | | - | | | | - | | | | - | |

| Natural Gas Liquids (Bbl/d) | | | - | | | | - | | | | - | | | | - | |

| Average Net Prices Received | | | | | | | | | | | | | | | | |

| Light and Medium Oil ($/Bbl) | | | 57.58 | | | | 78.63 | | | | 69.31 | | | | 101.62 | |

| Natural Gas ($/Mcf) | | | - | | | | - | | | | - | | | | - | |

| Natural Gas Liquids ($/Bbl) | | | - | | | | - | | | | - | | | | - | |

| Royalties | | | | | | | | | | | | | | | | |

| Light and Medium Oil ($/Bbl) | | | 14.72 | | | | 16.32 | | | | 18.34 | | | | 34.88 | |

| Natural Gas ($/Mcf) | | | - | | | | - | | | | - | | | | - | |

| Natural Gas Liquids ($/Bbl) | | | - | | | | - | | | | - | | | | - | |

| Transportation | | | | | | | | | | | | | | | | |

| Light and Medium Oil ($/Bbl) | | | - | | | | - | | | | - | | | | - | |

| Natural Gas ($/Mcf) | | | - | | | | - | | | | - | | | | - | |

| Natural Gas Liquids ($/Bbl) | | | - | | | | - | | | | - | | | | - | |

| Production Costs | | | | | | | | | | | | | | | | |

| Light and Medium Oil ($/Bbl) | | | 10.30 | | | | 13.99 | | | | 14.98 | | | | 16.56 | |

| Natural Gas ($/Mcf) | | | - | | | | - | | | | - | | | | - | |

| Natural Gas Liquids ($/Bbl) | | | - | | | | - | | | | - | | | | - | |

| Netback Received | | | | | | | | | | | | | | | | |

| Light and Medium Oil ($/Bbl) | | | 32.56 | | | | 48.32 | | | | 35.99 | | | | 50.18 | |

| Natural Gas ($/Mcf) | | | - | | | | - | | | | - | | | | - | |

| Natural Gas Liquids ($/Bbl) | | | - | | | | - | | | | - | | | | - | |

| Canada | | | | | | | | | | | | | | | | |

| Average Daily Production | | | | | | | | | | | | | | | | |

| Light and Medium Oil (Bbl/d) | | | 2,175 | | | | 2,264 | | | | 2,053 | | | | 2,061 | |

| Natural Gas (MMcfpd) | | | 49.58 | | | | 51.11 | | | | 45.67 | | | | 45.07 | |

| Natural Gas Liquids (Bbl/d) | | | 1,569 | | | | 1,505 | | | | 1,548 | | | | 1,449 | |

| Average Net Prices Received | | | | | | | | | | | | | | | | |

| Light and Medium Oil ($/Bbl) | | | 50.07 | | | | 66.41 | | | | 72.87 | | | | 72.72 | |

| Natural Gas ($/Mcf) | | | 5.26 | | | | 3.65 | | | | 3.03 | | | | 4.68 | |

| Natural Gas Liquids ($/Bbl) | | | 40.09 | | | | 48.39 | | | | 51.01 | | | | 59.71 | |

| Royalties | | | | | | | | | | | | | | | | |

| Light and Medium Oil ($/Bbl) | | | 7.62 | | | | 2.30 | | | | 7.42 | | | | 9.11 | |

| Natural Gas ($/Mcf) | | | 0.78 | | | | (0.30 | ) | | | 0.29 | | | | 0.48 | |

| Natural Gas Liquids ($/Bbl) | | | 10.61 | | | | 1.08 | | | | 3.05 | | | | 4.02 | |

| Transportation | | | | | | | | | | | | | | | | |

| Light and Medium Oil ($/Bbl) | | | 0.55 | | | | 0.55 | | | | 0.58 | | | | 0.56 | |

| Natural Gas ($/Mcf) | | | 0.19 | | | | 0.18 | | | | 0.18 | | | | 0.19 | |

| Natural Gas Liquids ($/Bbl) | | | 0.83 | | | | 0.90 | | | | 0.84 | | | | 0.87 | |

| Production Costs | | | | | | | | | | | | | | | | |

| Light and Medium Oil ($/Bbl) | | | 16.44 | | | | 14.92 | | | | 15.83 | | | | 16.18 | |

| Natural Gas ($/Mcf) | | | 1.61 | | | | 1.48 | | | | 1.59 | | | | 1.65 | |

| Natural Gas Liquids ($/Bbl) | | | 5.64 | | | | 5.55 | | | | 5.19 | | | | 5.69 | |

| Netback Received | | | | | | | | | | | | | | | | |

| Light and Medium Oil ($/Bbl) | | | 25.46 | | | | 48.64 | | | | 49.04 | | | | 51.87 | |

| Natural Gas ($/Mcf) | | | 2.68 | | | | 2.29 | | | | 0.97 | | | | 2.36 | |

| Natural Gas Liquids ($/Bbl) | | | 23.01 | | | | 40.86 | | | | 41.93 | | | | 49.13 | |

| 2009 Annual Information Form – Vermilion Energy Trust | 26 |

| France | | | | | | | | | | | | |

| Average Daily Production | | | | | | | | | | | | |

| Light and Medium Oil (Bbl/d) | | | 8,223 | | | | 8,432 | | | | 8,111 | | | | 8,218 | |

| Natural Gas (MMcfpd) | | | 1.04 | | | | 1.18 | | | | 0.87 | | | | 1.13 | |

| Natural Gas Liquids (Bbl/d) | | | - | | | | - | | | | - | | | | - | |

| Average Net Prices Received | | | | | | | | | | | | | | | | |

| Light and Medium Oil ($/Bbl) | | | 48.40 | | | | 67.69 | | | | 73.64 | | | | 75.68 | |

| Natural Gas ($/Mcf) | | | 10.52 | | | | 6.79 | | | | 7.26 | | | | 8.81 | |

| Natural Gas Liquids ($/Bbl) | | | - | | | | - | | | | - | | | | - | |

| Royalties | | | | | | | | | | | | | | | | |

| Light and Medium Oil ($/Bbl) | | | 5.08 | | | | 5.49 | | | | 5.72 | | | | 5.48 | |

| Natural Gas ($/Mcf) | | | 0.07 | | | | 0.32 | | | | 0.32 | | | | 0.29 | |

| Natural Gas Liquids ($/Bbl) | | | - | | | | - | | | | - | | | | - | |

| Transportation | | | | | | | | | | | | | | | | |

| Light and Medium Oil ($/Bbl) | | | 4.09 | | | | 3.96 | | | | 3.18 | | | | 2.93 | |

| Natural Gas ($/Mcf) | | | - | | | | - | | | | - | | | | - | |

| Natural Gas Liquids ($/Bbl) | | | - | | | | - | | | | - | | | | - | |

| Production Costs | | | | | | | | | | | | | | | | |

| Light and Medium Oil ($/Bbl) | | | 12.60 | | | | 10.60 | | | | 11.43 | | | | 13.95 | |

| Natural Gas ($/Mcf) | | | 3.85 | | | | 3.81 | | | | 4.12 | | | | 4.78 | |

| Natural Gas Liquids ($/Bbl) | | | - | | | | - | | | | - | | | | - | |

| Netback Received | | | | | | | | | | | | | | | | |

| Light and Medium Oil ($/Bbl) | | | 26.63 | | | | 47.64 | | | | 53.31 | | | | 53.32 | |

| Natural Gas ($/Mcf) | | | 6.60 | | | | 2.66 | | | | 2.82 | | | | 3.74 | |

| Natural Gas Liquids ($/Bbl) | | | - | | | | - | | | | - | | | | - | |

| Netherlands | | | | | | | | | | | | | | | | |

| Average Daily Production | | | | | | | | | | | | | | | | |

| Light and Medium Oil (Bbl/d) | | | - | | | | - | | | | - | | | | - | |

| Natural Gas (MMcfpd) | | | 23.47 | | | | 20.20 | | | | 19.98 | | | | 20.65 | |

| Natural Gas Liquids (Bbl/d) | | | 24 | | | | 25 | | | | 20 | | | | 23 | |

| Average Net Prices Received | | | | | | | | | | | | | | | | |

| Light and Medium Oil ($/Bbl) | | | - | | | | - | | | | - | | | | - | |

| Natural Gas ($/Mcf) | | | 12.21 | | | | 8.71 | | | | 6.73 | | | | 7.08 | |

| Natural Gas Liquids ($/Bbl) | | | 34.92 | | | | 33.01 | | | | 32.86 | | | | 123.10 | |

| Royalties | | | | | | | | | | | | | | | | |

| Light and Medium Oil ($/Bbl) | | | - | | | | - | | | | - | | | | - | |

| Natural Gas ($/Mcf) | | | - | | | | - | | | | - | | | | - | |

| Natural Gas Liquids ($/Bbl) | | | - | | | | - | | | | - | | | | - | |

| Production Costs | | | | | | | | | | | | | | | | |

| Light and Medium Oil ($/Bbl) | | | - | | | | - | | | | - | | | | - | |

| Natural Gas ($/Mcf) | | | 2.50 | | | | 2.71 | | | | 2.45 | | | | 2.25 | |

| Natural Gas Liquids ($/Bbl) | | | - | | | | - | | | | - | | | | - | |

| Netback Received | | | | | | | | | | | | | | | | |

| Light and Medium Oil ($/Bbl) | | | - | | | | - | | | | - | | | | - | |

| Natural Gas ($/Mcf) | | | 9.71 | | | | 6.00 | | | | 4.28 | | | | 4.83 | |

| Natural Gas Liquids ($/Bbl) | | | 34.92 | | | | 33.01 | | | | 32.86 | | | | 123.10 | |

| 2009 Annual Information Form – Vermilion Energy Trust | 27 |

Marketing

Vermilion is party to certain derivative financial instruments, such as crude oil, natural gas and power contracts. Vermilion has entered into these contracts for economic hedging purposes only in order to protect its cash flow on future sales from the potential adverse impact of fluctuations in oil, gas and power prices. The contracts reduce the fluctuations in sales revenues and power costs by establishing fixed prices or a trading range on a portion of its oil and gas sales and power costs. All of the economic hedges below are arranged with counter parties representing major financial (banking) institutions with AA to AAA credit ratings thereby reducing counter party credit risk exposure.

Contracts outstanding in respect of economic hedging transactions are as follows:

| Risk Management: Oil | | Funded Cost | | | Bbl/d | | | US $/Bbl | |

| Collar - WTI | | | | | | | | | |

2010 | | US $0.00/Bbl | | | | 1,500 | | | $ | 70.00 - $ 97.80 | |

2010 | | US $1.00/Bbl | | | | 1,500 | | | $ | 72.00 - $ 99.00 | |

2010 | | US $1.00/Bbl | | | | 1,500 | | | $ | 72.00 - $100.65 | |

2010 | | US $1.50/Bbl | | | | 750 | | | $ | 70.00 - $ 97.40 | |

2010 | | US $1.50/Bbl | | | | 750 | | | $ | 69.00 - $ 90.15 | |

| Call Spread - BRENT | | | | | | | | | | | |

2010 | | US $4.94/Bbl | | | | 1,100 | | | $ | 65.00 - $ 85.00 | |

2011 | | US $6.08/Bbl | | | | 960 | | | $ | 65.00 - $ 85.00 | |

2010 | | US $5.64/Bbl | | | | 700 | | | $ | 65.00 - $ 85.00 | |

2011 | | US $5.15/Bbl | | | | 600 | | | $ | 65.00 - $ 85.00 | |

| Risk Management: Natural Gas | | Funded Cost | | | GJ/d | | | $/Bbl | |

| SWAP - AECO | | | | | | | | | | | |

January 2010 to October 2011 | | $ | 0.00/GJ | | | | 700 | | | $ | 5.13 | |

| Put – AECO | | | | | | | | | | | | |

January 2010 to March 2010 | | $ | 0.17/GJ | | | | 10,000 | | | $ | 4.50 | |

January 2010 to March 2010 | | $ | 0.17/GJ | | | | 4,000 | | | $ | 4.50 | |

April 2010 to October 2010 | | $ | 0.35/GJ | | | | 10,000 | | | $ | 4.50 | |

| Collar – AECO | | | | | | | | | | | | |

April 2010 to October 2010 | | $ | 0.25/GJ | | | | 2,000 | | | $ | 4.70 - $ 7.35 | |

ADDITIONAL INFORMATION RESPECTING VERMILION ENERGY TRUST

Trust Units

An unlimited number of Trust Units may be created and issued pursuant to the Trust Indenture. Each Trust Unit shall entitle the holder thereof to one vote at any meeting of the holders of Trust Units and represents an equal fractional undivided beneficial interest in any distribution from the Trust (whether of net income, net realized capital gains or other amounts) and in any net assets of the Trust in the event of termination or winding-up of the Trust. All Trust Units outstanding from time to time shall be entitled to equal shares of any distributions by the Trust, and in the event of termination or winding-up of the Trust, in any net assets of the Trust. All Trust Units shall rank among themselves equally and rateably without discrimination, preference or priority. Each Trust Unit is tran sferable, subject to compliance with applicable Canadian securities laws, is not subject to any conversion or pre-emptive rights and entitles the holder thereof to require the Trust to redeem any or all of the Trust Units held by such holder (see "Redemption Right") and to one vote at all meetings of Unitholders for each Trust Unit held.

The Trust Units do not represent a traditional investment and should not be viewed by investors as "shares" in either Vermilion or the Trust. As holders of Trust Units in the Trust, the Unitholders will not have the statutory rights normally associated with ownership of shares of a corporation including, for example, the right to bring "oppression" or "derivative" actions. The price per Trust Unit will be a function of anticipated distributable income from Vermilion and the ability of Vermilion to effect long term growth in the value of the Trust. The market price of the Trust Units will be sensitive to a variety of market conditions including, but not limited to, interest rates, commodity prices and the ability of the Trust to acquire additional assets. Changes in market conditions may adver sely affect the trading price of the Trust Units.

| 2009 Annual Information Form – Vermilion Energy Trust | 28 |

Special Voting Rights

In order to allow the Trust flexibility in pursuing corporate acquisitions, the Trust Indenture allows for the creation of Special Voting Rights which will enable the Trust to provide voting rights to holders of Exchangeable Shares and, in the future, to holders of other exchangeable shares that may be issued by Vermilion or other subsidiaries of the Trust in connection with other exchangeable share transactions.

An unlimited number of Special Voting Rights may be created and issued pursuant to the Trust Indenture. Holders of Special Voting Rights shall not be entitled to any distributions of any nature whatsoever from the Trust and shall be entitled to attend at meetings of Unitholders and to such number of votes at meetings of Unitholders as may be prescribed by the board of directors of Vermilion in the resolution authorizing the issuance of any Special Voting Rights. Except for the right to attend and vote at meetings of the Unitholders, the Special Voting Rights shall not confer upon the holders thereof any other rights.

Under the terms of the Voting and Exchange Trust Agreement, the Trust has issued a Special Voting Right to the Voting and Exchange Trust Agreement Trustee for the benefit of every Person who holds Exchangeable Shares.

Unitholders' Limited Liability

The Trust Indenture provides that no Unitholder, in its capacity as such, shall incur or be subject to any liability in contract or in tort in connection with the Trust or its obligations or affairs and, in the event that a court determines Unitholders are subject to any such liabilities, the liabilities will be enforceable only against, and will be satisfied only out of the Trust's assets. Pursuant to the Trust Indenture, the Trust will indemnify and hold harmless each Unitholder from any cost, damages, liabilities, expenses, charges or losses suffered by a Unitholder from or arising as a result of such Unitholder not having such limited liability.

The Trust Indenture provides that all contracts signed by or on behalf of the Trust must contain a provision to the effect that such obligation will not be binding upon Unitholders personally. Notwithstanding the terms of the Trust Indenture, Unitholders may not be protected from liabilities of the Trust to the same extent a shareholder is protected from the liabilities of a corporation. Personal liability may also arise in respect of claims against the Trust (to the extent that claims are not satisfied by the Trust) that do not arise under contracts, including claims in tort, claims for taxes and possibly certain other statutory liabilities. The possibility of any personal liability to Unitholders of this nature arising is considered unlikely in view of the fact that the sole activity of the Trust is t o hold securities, and all of the business operations are carried on by Vermilion, directly or indirectly.

The activities of the Trust and its subsidiary, Vermilion, will be conducted, upon the advice of counsel, in such a way and in such jurisdictions as to avoid as far as possible any material risk of liability to the Unitholders for claims against the Trust including by obtaining appropriate insurance, where available, for the operations of Vermilion and having contracts signed by or on behalf of the Trust include a provision that such obligations are not binding upon Unitholders personally.

The Income Trusts Liability Act (Alberta) creates a statutory limitation on the liability of unitholders of Alberta income trusts such as the Trust. The Act provides that a Unitholder will not be, as a beneficiary, liable for any act, default, obligation or liability of the trustee that arises after the legislation comes into effect.

Issuance of Trust Units

The Trust Indenture provides that Trust Units, including rights, warrants and other securities to purchase, to convert into or to exchange into Trust Units, may be created, issued, sold and delivered on such terms and conditions and at such times as the Trustee, upon the recommendation of the board of directors of Vermilion may determine. The Indenture also provides that Vermilion may authorize the creation and issuance of debentures, notes and other evidences of indebtedness of the Trust which debentures, notes or other evidences of indebtedness may be created and issued from time to time on such terms and conditions to such persons and for such consideration as Vermilion may determine.

| 2009 Annual Information Form – Vermilion Energy Trust | 29 |

Cash Distributions

The Trustee may declare payable to the Unitholders all or any part of the net income of the Trust earned from interest income on the Notes, from the income generated under the Royalty Agreement and from any dividends paid on the common shares of Vermilion, less all expenses and liabilities of the Trust due and accrued and which are chargeable to the net income of the Trust. In addition, Unitholders may, at the discretion of the board of directors of Vermilion, receive distributions in respect of prepayments of principal on the Notes made by Vermilion to the Trust before the maturity of the Notes. It is anticipated however, that the Trust may reinvest a portion of the repayments of principal on the Notes to make capital expenditures to develop the business of Vermilion with a view to enhancing Vermilion's cash flow from operations.

Cash distributions will be made on the 15th day of each month to Unitholders of record on the immediately preceding Distribution Record Date.

Record of Cash Distributions

The following table sets forth the amount of monthly cash distributions per Trust Unit declared by the Trust since the completion of the Arrangement on January 22, 2003. Distributions are generally paid on the 15th day of the month following the month of declaration. Until the December 14, 2007 distribution announcement, Vermilion had paid distributions of $0.17 per Trust Unit per month. Starting with the January 15, 2008 payment date, Vermilion has paid distributions of $0.19 per Trust Unit per month.

| Period | | Distribution Amount for Period per Trust Unit | |

| 2003 – January 22 to December 31 | | $ | 1.87 | |

| 2004 – January to December | | $ | 2.04 | |

| 2005 – January to December | | $ | 2.04 | |

| 2006 – January to December | | $ | 2.04 | |

| 2007 – January to December | | $ | 2.06 | |

| 2008 – January to December | | $ | 2.28 | |

| 2009 – January to December | | $ | 2.28 | |

| 2010 – January to March | | $ | 0.57 | |

Total cash distributions since January 22, 2003(1) | | $ | 15.18 | |

Note:

| (1) | On March 15, 2010, the Trust announced that it would pay a cash distribution of $0.19 per Trust Unit to Unitholders of record as of March 31, 2009 on April 15, 2010. The total cash distribution since January 22, 2003 does not include the April distribution of $0.19. |

Redemption Right

Trust Units are redeemable at any time on demand by the holders thereof upon delivery to the Trust of the certificate or certificates representing such Trust Units, accompanied by a duly completed and properly executed notice requiring redemption. Upon receipt of the notice to redeem Trust Units by the Trust, the holder thereof shall only be entitled to receive a price per Trust Unit (the "Market Redemption Price") equal to the lesser of: (a) 90% of the "market price" (as defined in the Trust Indenture) of the Trust Units on the principal market on which the Trust Units are quoted for trading during the 10 trading day period commencing immediately after the date on which the Trust Units are tendered to the Trust for redemption; and (b) the closing market price on the principal market on which the Trust Units are qu oted for trading on the date that the Trust Units are so tendered for redemption.

The aggregate Market Redemption Price payable by the Trust in respect of any Trust Units surrendered for redemption during any calendar month shall be satisfied by way of a cash payment on the last day of the following month. In certain circumstances, the aggregate Market Redemption Price payable by the Trust may be satisfied by distributing notes having an aggregate principal amount equal to the aggregate Market Redemption Price of the Trust Units tendered for redemption.

It is anticipated that this redemption right will not be the primary mechanism for holders of Trust Units to dispose of their Trust Units. Notes which may be distributed in specie to holders of Trust Units in connection with a redemption will not be listed on any stock exchange and no market is expected to develop in such notes.

| 2009 Annual Information Form – Vermilion Energy Trust | 30 |

Non-Resident Unitholders

It is in the best interest of Unitholders that the Trust qualifies as a "unit trust" and a "mutual fund trust" under the Tax Act. Certain provisions of the Tax Act require that the Trust not be established nor maintained primarily for the benefit of Non-Residents. Accordingly, in order to comply with such provisions, the Trust Indenture contains restrictions on the ownership of Trust Units by Unitholders who are Non-Residents. In this regard, the Trust shall, among other things, take all necessary steps to monitor the ownership of the Trust Units to carry out such intentions. If at any time the Trust becomes aware that the beneficial owners of 50% or more of the Trust Units then outstanding are or may be Non-Residents or that such a situation is imminent, the Trust shall take such action as m ay be necessary to carry out such intentions.

Meetings of Unitholders

The Trust Indenture provides that meetings of Unitholders must be called and held for, among other matters, the election or removal of the Trustee, the appointment or removal of the auditors of the Trust, the approval of amendments to the Trust Indenture (except as described under "Amendments to the Trust Indenture"), the sale of the property of the Trust as an entirety or substantially as an entirety, and the commencement of winding-up the affairs of the Trust. Meetings of Unitholders will be called and held annually for, among other things, the election of the directors of Vermilion and the appointment of the auditors of the Trust.

A meeting of Unitholders may be convened at any time and for any purpose by the Trustee and must be convened, except in certain circumstances, if requisitioned by the holders of not less than 5% of the Trust Units then outstanding by a written requisition. A requisition must, among other things, state in reasonable detail the business purpose for which the meeting is to be called.

Unitholders may attend and vote at all meetings of Unitholders either in person or by proxy and a proxyholder need not be a Unitholder. Two persons present in person or represented by proxy and representing in the aggregate at least 5% of the votes attaching to all outstanding Trust Units shall constitute a quorum for the transaction of business at all such meetings. For the purposes of determining such quorum, the holders of any issued Special Voting Rights who are present at the meeting shall be regarded as representing outstanding Trust Units equivalent in number to the votes attaching to such Special Voting Rights.

The Trust Indenture contains provisions as to the notice required and other procedures with respect to the calling and holding of meetings of Unitholders in accordance with the requirements of applicable laws.

Trustee

Computershare Trust Company of Canada is the trustee of the Trust. The Trustee is responsible for, among other things, accepting subscriptions for Trust Units and issuing Trust Units pursuant thereto and maintaining the books and records of the Trust and providing timely reports to holders of Trust Units. The Trust Indenture provides that the Trustee shall exercise its powers and carry out its functions thereunder as Trustee honestly, in good faith and in the best interests of the Trust and, in connection therewith, shall exercise that degree of care, diligence and skill that a reasonably prudent trustee would exercise in comparable circumstances.

The term of the Trustee's appointment is until the annual meeting of Unitholders to be held in 2012. In 2012, the Unitholders shall, at the annual meeting of Unitholders, re-appoint or appoint a successor to the Trustee for an additional three year term, and thereafter, the Unitholders shall appoint or re-appoint a successor to the Trustee at the annual meeting of Unitholders three years following the re-appointment or appointment of the successor to the Trustee. The Trustee may also be removed by Special Resolution of the Unitholders. Such resignation or removal becomes effective upon the acceptance or appointment of a successor trustee.

| 2009 Annual Information Form – Vermilion Energy Trust | 31 |

Delegation of Authority, Administration and Trust Governance

The board of directors of Vermilion has generally been delegated the significant management decisions of the Trust. In particular, the Trustee has delegated to Vermilion responsibility for any and all matters relating to the following: (a) an Offering; (b) ensuring compliance with all applicable laws, including in relation to an Offering; (c) all matters relating to the content of any Offering Documents, the accuracy of the disclosure contained therein, and the certification thereof; (d) all matters concerning the terms of, and amendment from time to time of the material contracts of the Trust; (e) all matters concerning any underwriting or agency agreement providing for the sale of Trust Units or rights to Trust Units; (f) all matters relating to the redemption of Trust Units; (g) all matt ers relating to the voting rights on any investments in the Trust Fund or any Subsequent Investments; and (h) all matters relating to the specific powers and authorities as set forth in the Trust Indenture.

Amendments to the Trust Indenture

The Trust Indenture may be amended or altered from time to time by Special Resolution.

The Trustee may, without the approval of any of the Unitholders, amend the Trust Indenture for the purpose of:

| (a) | ensuring the Trust's continuing compliance with applicable laws or requirements of any governmental agency or authority of Canada or of any province; |

| (b) | ensuring that the Trust will satisfy the provisions of each of subsections 108(2) and 132(6) of the Tax Act as from time to time amended or replaced; |

| (c) | ensuring that such additional protection is provided for the interests of Unitholders as the Trustee may consider expedient; |

| (d) | removing or curing any conflicts or inconsistencies between the provisions of the Trust Indenture or any supplemental indenture and any other agreement of the Trust or any offering document pursuant to which securities of the Trust are issued with respect to the Trust, or any applicable law or regulation of any jurisdiction, provided that in the opinion of the Trustee the rights of the Trustee and of the Unitholders are not prejudiced thereby; or |