Pursuant to Rule 13a-16 or 15d-16 of

Bonanza 80020. Culiacán, Sinaloa, México.

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F ___X___ Form 40-F _______

(Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes _______ No_______

(If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b); 82-)

Desarrolladora Homex, S.A.B. de C.V. announces filing of a pre-packagedconcurso mercantil proceeding and disclosure of information provided to creditors in conjunction with its restructuring negotiations [RE-ISSUE]

Culiacán, Sinaloa, Mexico – April 30, 2014 – Desarrolladora Homex, S.A.B. de C.V. (the “Company”)announces that it has filed a request for a pre-packagedconcurso mercantil proceeding before the federal court in Culiacán. In accordance with Mexican law, the filing was presented, with a proposed restructuring plan and was supported by a group of creditors representing, in the aggregate, over 50% of the outstanding consolidated indebtedness of the Company and its subsidiaries filing for theconcurso mercantil proceeding.. For more information regarding theconcurso mercantil filing, please see the Company’s website: http://www.homex.com.mx/ri/index/htm. Copies of the petition, proposed restructuring plan and related exhibits are available to the public at the First District Court sitting in Culiacan, Sinaloa, Mexico, with file number 000001/2014.

In connection with the negotiations with an ad hoc group (the “Bondholder Group”) of certain holders of the Company’s 7.500% Senior Guaranteed Notes Due 2015, 9.500% Senior Guaranteed Notes Due 2019 and 9.750% Senior Guaranteed Notes Due 2020, the Bondholder Group has received certain information relating to the Company and certain public and non-public information set forth herein and in the Annexes hereto, pertaining to the future possible consummation of a restructuring transaction, which as of this date had been maintained confidential under applicable contractual provisions (collectively, the “Disclosed Information”).

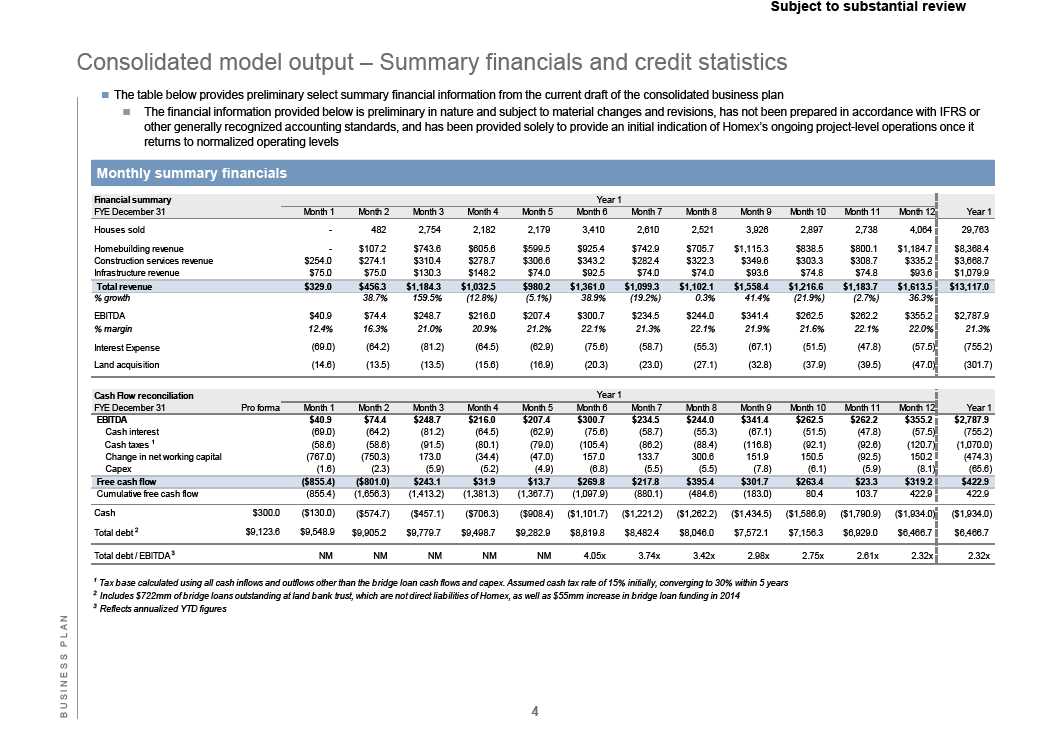

The Disclosed Information includes (i) information with respect to the Company’s homebuilding operations,concurso process considerations, summary of the proposedconcurso plan and the Company’s business and reactivation plan, including projections, the potential mechanics of future bridge loan funding, and certain other information (including non-public information) relating to the Company, as set forth in the Discussion Materials attached asAnnex A hereto, (ii) information regarding the claims of the Company’s creditors (summarized onAnnex B attached hereto), and (iii) a Preliminary Restructuring Term Sheet dated April 30, 2014 setting forth certain terms and conditions of the Company’s proposed restructuring plan and related transactions attached asAnnex C hereto. An Exclusivity and Right of First Refusal Agreement, dated April 30, 2014 among the Company and certain members of the Bondholder Group relating to the potential provision of funding to the Company by such holders is summarized in the Preliminary Restructuring Term Sheet and a copy of the document may be found on the Company website at http://www.homex.com.mx/ri/index/htm.

Pursuant to a confidentiality agreement entered into with certain members of the Bondholder Group, the Company agreed to publicly disclose the Disclosed Information upon the filing ofconcurso mercantilproceedings, among other things. The information disclosed herein is being furnished to comply with the Company’s obligations under such confidentiality agreement and applicable law. The disclosure of these materials should not be regarded as an indication that the Company or any other person considered, or now considers, this information to be predictive of actual future results, and does not constitute an admission or representation by any person that such information is material, or that the expectations, beliefs, opinions and assumptions that underlie these materials remain the same as of the date of this disclosure and the information contained in these materials may have been superseded by subsequent developments. Readers are cautioned not to place undue reliance on these materials. The financial information reflected in the Disclosed Information does not purport to present the Company’s financial condition in accordance with accounting principles generally accepted in the United States, Mexico or anyother country. The Company’s independent accountants have not audited or performed any review procedures on the Disclosed Information (except insofar as certain historical financial information may have been derived in part from the Company’s historical annual financial statements).

1

Projections are included in the Disclosed Information. Such projections have not been examined by auditors. The projections and other material set forth herein contain certain statements that are “forward-looking statements”. These statements are subject to a number of assumptions, risks, and uncertainties, many of which are and will be beyond the control of the Company, including the continuing availability of sufficient borrowing capacity or other financing to fund future principal payments of debt, existing and future governmental regulations and actions of government bodies, natural disasters and unusual weather conditions and other market and competitive conditions. These statements speak as of the date indicated and are not guarantees of future performance. Actual results or developments may differ materially from the expectations expressed or implied in the forward-looking statements, and the Company undertakes no obligation to update any such statements. The projections, while presented with numerical specificity, are necessarily based on a variety of estimates and assumptions which, though considered reasonable by the Company, may not be realized and are inherently subject to significant business, economic, competitive, industry, regulatory, market and financial uncertainties and contingencies, many of which are and will be beyond the Company’s control. The Company cautions that no representations can be made or are made as to the accuracy of the historical financial information or the projections or to the Company’s ability to achieve the projected results. Some assumptions may prove to be inaccurate. Moreover, events and circumstances occurring subsequent to the date on which the projections were prepared may be different from those assumed, or, alternatively, may have been unanticipated, and thus the occurrence of these events may affect financial results in a materially adverse or materially beneficial manner.

Notwithstanding the support of the creditors to theconcurso filing, the Restructuring Term Sheet indicates that there are certain terms remaining to be determined and as a result creditors may not support theconcurso plan submitted for final approval in theconcurso mercantil proceeding; therefore there can be no assurance that the Company will be successful in securing sufficient creditor support required under applicable laws to implement the restructuring transactions through aconcurso mercantilproceeding before Mexican courts.

The Company continues to have limited liquidity to conduct its operations and meet its obligations. The Company is working to obtain additional financing during the course of theconcurso mercantil proceeding. There can be no assurance that the Company will be successful in securing such additional financing, in which case the Company may not be able to continue its operations through the consummation of the restructuring.

About the Company

Desarrolladora Homex, S.A.B. de C.V. [NYSE: HXM, BMV: HOMEX] is a vertically integrated home-development company focused on affordable entry-level and middle-income housing in Mexico and Brazil. The Company is formed by four divisions: Mexico Division, International Division, Government Division and Tourism Division.

Desarrolladora Homex, S.A.B. de C.V. periodic reports and all other written materials may from time to time contain statements about expected future events and financial results that are forward-looking and subject to risks and uncertainties. Forward-looking statements involve inherent risks and uncertainties. We caution investors that a number of important factors can cause actual results to differ materially from the plans, objectives, expectations, estimates and intentions expressed in such forward-looking statements. These factors include economic and political conditions and government policies in Mexico or elsewhere, including changes in housing and mortgage policies, inflation rates, exchange rates, regulatory developments, customer demand and competition. For those statements, the Company claims the protection of the safe harbor for forward-looking statements contained in the Private SecuritiesLitigation Reform Act of 1995. Discussion of factors that may affect future results is contained in our filings with the Securities and Exchange Commission.

*** *** ***

Annexes

Annex A – Discussion Materials

Annex B – List of Creditors Claims

Annex C – Preliminary Restructuring Term Sheet

2

| Annex B - Debt schedule | |||||||

| Guarantor(s) / | Outstanding principal Indispensible | Contingent | |||||

| Borrower(s) | Obligor(s) | Creditor | Type of credit | amount (MXN$mm) | debt | debt | |

| 1. | DECANO | Homex | Banamex | Credito Puente | $1,767.35 |  | |

| PICSA | CBCentro | ||||||

| CBNorte | |||||||

| CBNoroeste | |||||||

| 2. | PICSA | Homex | Santander | Credito Puente | 530.55 |  | |

| DECANO | |||||||

| APICSA | |||||||

| 3. | CBNorte | Homex | Santander | Credito Puente | 243.36 |  | |

| DECANO | |||||||

| APICSA | |||||||

| PICSA | |||||||

| 4. | Hogares | Homex | Santander | Credito Puente | 27.02 |  |  |

| DECANO | |||||||

| APICSA | |||||||

| PICSA | |||||||

| 5. | Homex Atizapán | Homex | Santander | Credito Puente | 85.77 |  |  |

| DECANO | |||||||

| APICSA | |||||||

| PICSA | |||||||

| 6. | PICSA | Homex | Banorte | Credito Puente | 241.39 |  | |

| DECANO | |||||||

| CBCentro | |||||||

| 7. | Aerohomex | Homex | GE Capital | Arrendamiento | 52.03 |  | |

| PICSA | Financiero | ||||||

| 8. | DECANO | Homex | GE Capital | Arrendamiento | 143.59 |  | |

| PICSA | Financiero | ||||||

| 9. | DECANO | Homex | Leasing Operations de | Arrendamiento | 71.21 |  | |

| Mexico | Financiero | ||||||

| 10. | Homex | n/a | Inbursa | Créditos | 375.73 |  | |

| Hipotecarios | |||||||

| 11. | PICSA | n/a | Inbursa | Créditos | 184.00 |  | |

| Hipotecarios | |||||||

| 12. | PICSA | Homex | HSBC | Créditos | 180.00 |  | |

| DECANO | Hipotecarios | ||||||

| 13. | PICSA | Homex Infraestructura | Bank of America | Créditos | 272.48 |  | |

| Homex | DECANO | Hipotecarios | |||||

| 14. | PICSA | Homex | Banorte | Créditos | 25.63 |  | |

| DECANO | Hipotecarios | ||||||

| 15. | DECANO | Homex | Santander | Créditos | 301.72 |  | |

| PICSA | Hipotecarios | ||||||

| APICSA | |||||||

| CT PROP | |||||||

| 16. | Homex | PICSA | Banco Base | Créditos | 191.00 |  | |

| Hipotecarios | |||||||

| 17. | DECANO | PICSA | Nafin | Créditos | 750.00 |  | |

| Homex | Hipotecarios | ||||||

| 18. | Homex | n/a | Banorte | Créditos | 280.00 |  | |

| Hipotecarios | |||||||

| 19. | APICSA | Homex | Santander | Créditos | 40.00 |  | |

| DECANO | Hipotecarios | ||||||

| PICSA | |||||||

| 20. | PICSA | n/a | Santander | Créditos | 27.29 |  | |

| Hipotecarios | |||||||

| 21. | DECANO | Homex | Arrendadora y Factor | Créditos | 536.23 |  | |

| PICSA | Banorte (Grupo Banorte) | Hipotecarios | |||||

| CBCentro | |||||||

| 22. | Homex | PICSA | Scotiabank | Créditos para la | 34.07 |  | |

| CBCentro | Construcción | ||||||

| 23. | DECANO | Homex | Scotiabank | Créditos para la | 36.26 |  | |

| PICSA | Construcción | ||||||

| CBCentro | |||||||

| 24. | PICSA | Homex | HSBC | Factorajes | 1,199.00 |  | |

| Financieros | |||||||

| 25. | PICSA | n/a | INFONAVIT | Factorajes | 505.00 |  | |

| Homex | Financieros | ||||||

| 26. | PICSA | n/a | Nafin | Cadenas | 548.85 |  | |

| Homex | Productivas | ||||||

| 27. | PICSA | n/a | HSBC | Cadenas | 649.96 |  | |

| Productivas | |||||||

| 28. | PICSA | n/a | IFC | Cadenas | 942.36 | ||

| DECANO | Productivas | ||||||

| Guarantor(s) / | Outstanding principal Indispensible | Contingent | |||||

| Borrower(s) | Obligor(s) | Creditor | Type of credit | amount (MXN$mm) | debt | debt | |

| 29. | Homex | n/a | Bancomext | Créditos Simples | 456.70 | ||

| 30. | Homex | n/a | HSBC | Créditos Simples | 120.00 | ||

| 31. | PICSA | n/a | HSBC | Créditos Simples | 882.54 | ||

| 32. | Homex | DECANO | Banorte | Créditos Simples | 205.20 | ||

| PICSA | |||||||

| CBCentro | |||||||

| 33. | PICSA | DECANO | Banorte | Créditos Simples | 250.00 | ||

| Homex | |||||||

| CBCentro | |||||||

| 34. | PICSA | n/a | Banamex | Créditos Simples | 85.14 | ||

| 35. | PICSA | n/a | Banregio | Créditos Simples | 4.93 | ||

| 36. | PICSA | n/a | Banco Monex | Créditos Simples | 37.64 | ||

| 37. | PICSA | n/a | Vector | Créditos Simples | 9.71 | ||

| 38. | PICSA | n/a | Eximbank | Créditos Simples | 6.43 | ||

| 39. | PICSA | Homex | Banco Monex | Créditos Simples | 110.00 | ||

| 40. | Homex | n/a | Sólida Administradora | Crédito de | 1,579.36 |  | |

| Construcción | |||||||

| 41. | Homex Atizapán | DECANO | Sólida Administradora | Crédito | 189.07 | ||

| PICSA | Homex | Quirografario | |||||

| CBCentro | |||||||

| 42. | PICSA | DECANO | Sólida Administradora | Crédito | 291.00 |  * * | |

| Homex | Quirografario | ||||||

| CBCentro | |||||||

| Homex Atizapán | |||||||

| 43. | Homex | n/a | Sólida Administradora | Crédito | 250.00 |  * * | |

| Quirografario | |||||||

| 44. | Homex | n/a | Barclays | Créditos | 545.56 | ||

| Derivados | |||||||

| 45. | Homex | n/a | Credit Suisse | Créditos | 338.75 | ||

| Derivados | |||||||

| 46. | Homex | n/a | Banorte | Créditos | 282.33 | ||

| Derivados | |||||||

| 47. | Homex | n/a | HSBC | Créditos | 43.50 | ||

| Derivados | |||||||

| 48. | Homex | PICSA | The Bank of New York, | Bonos | 3,266.30 | ||

| DECANO | as Trustee | ||||||

| CBCentro | |||||||

| CBNorte | |||||||

| CBNoroeste | |||||||

| Edificaciones Beta | |||||||

| EBNorte | |||||||

| EBNoroeste | |||||||

| 49. | Homex | PICSA | The Bank of New York | Bonos | 3,266.30 | ||

| DECANO | Mellon, as Trustee | ||||||

| CBCentro | |||||||

| 50. | Homex | PICSA | The Bank of New York | Bonos | 5,226.08 | ||

| DECANO | Mellon, as Trustee | ||||||

| CBCentro | |||||||

Legend:

Filing subsidiaries: Desarrolldora Homex, S.A.B. de C.V. ("Homex"), Proyectos Inmobiliarios de Culiacán, S.A. de C.V. ("PICSA"), Desarrolladora de Casas del Noroeste, S.A. de C.V. ("DECANO"), Casas Beta del Centro, S. de R.L. de C.V. ("CBCentro"), Casas Beta del Norte, S. de R.L. de C.V. ("CBNorte"), Casas Beta del Noroeste, S. de R.L. de C.V. ("CBNoroeste"), Aministradora Picsa, S.A. de C.V. ("APICSA"), Homex Amuéblate, S.A. de C.V., Homex Global, S.A. de C.V., CT Loreto, S. de R.L. de C.V., Altos Mandos de Negocios, S.A. de C.V., Aerohomex, S.A. de C.V. ("Aerohomex")

Non-filing subsidiary borrowers and/or guarantors/obligors: Hogares del Noroesta, S.A. de C.V. ("Hogares"), Homex Infraestructura, S.A. de C.V. ("Homex Infraestructura"), Homex Atizapán, S.A. de C.V. ("Homex Atizapán") and CT Prop, S. de R.L. de C.V., Edificaciones Beta, S. de R.L. de C.V. ("Edificaciones Beta"), Edificaciones Beta del Norte, S. de R.L. de C.V. ("EBNorte"), Edificaciones Beta del Noroeste, S. de R.L. de C.V. ("EBNoroeste")

* Subject to debt discovery during the Concurso process

| DESARROLLADORAHOMEX, S.A.B.DEC.V., | |

Preliminary Restructuring Term Sheet |

The terms set out in this term sheet (the “Term Sheet”) are preliminary and indicative only and are notintended to describe or include all of the terms and conditions of the restructuring plan and related transactions referred herein or to set forth the definitive contractual language of any provisions summarized below and are for the purpose of promoting discussion of the structure and other terms applicable of the restructuring of the liabilities of the Company. This Term Sheet is neither an expressed nor an implied commitment to provide any financing or to provide or purchase any loans, securities or assets in connection with the transactions contemplated hereby or to do or take, or to refrain from taking, any action. Nothing in this Term Sheet shall oblige the Company or any of its creditors to restructure any of the debt of the Company or constitute an admission or representation of any fact or circumstance or an admission of any liability or waiver of any right or claim, and nothing contained herein may be used or offered into evidence in any legal, administrative or other proceeding. This Term Sheet is not an offer with respect to any securities or a solicitation of consent with respect to any concurso plan. The consummation of the transactions described herein will have to comply with the provisions of the Mexican Ley de ConcursosMercantiles (as amended from time to time) (the “Concursos Law”), includingthe use of the pre-pack provisions therein(concurso mercantil con plan de reestructura previo), and any other applicable laws, including any applicable United States securities laws, and will require approval by the relevant competent court.The rights of all parties are subject to the agreement and execution of definitive documentation in all respects. Unless and until the execution and delivery of definitive documentation by the necessary parties, the parties shall retain their respective rights and any negotiation of and/or agreement to this Term Sheet shall not be deemed a waiver of any rights of any party. If executed, the terms of such definitive documentation shall control.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

Date: May 2, 2014 | Homex Development Corp. By: /s/ Carlos Moctezuma |