QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| (Mark One) | |

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2004 | |

or | |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to | |

Commission file number 001-32290

GMH Communities Trust

(Exact name of registrant as specified in its charter)

| Maryland (State or other jurisdiction of incorporation or organization) | 201181390 (I.R.S. Employer Identification No.) | |

10 Campus Boulevard Newtown Square, Pennsylvania (Address of principal executive offices) | 19073 (Zip Code) | |

Registrant's telephone number, including area code:(610) 355-8000 | ||

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

|---|---|---|

| Common Shares of Beneficial Interest, $0.001 par value per share | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Indicate by check mark whether the registrant (1) has filed all reports to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is an accelerated filer (as defined in Rule 12b-2 of the Securities Act of 1933). Yes o No ý

The registrant completed its initial public offering of common shares of beneficial interest, par value $0.001 per share ("common shares"), on November 2, 2004 and did not initiate trading of its common shares on the New York Stock Exchange until the fourth fiscal quarter of 2004. As a result, the aggregate market value of the voting common equity held by non-affiliates of the registrant as of the last business day of the registrant's most recently completed second fiscal quarter (June 30, 2004), cannot be computed.

The number of common shares of beneficial interest of the registrant outstanding as of March 23, 2005 was 30,371,989 shares.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's definitive proxy statement for its 2005 annual meeting of shareholders are incorporated by reference into Items 10, 11, 12, 13, and 14 of Part III of this Form 10-K.

GMH COMMUNITIES TRUST

INDEX TO FORM 10-K

| | | Page | ||

|---|---|---|---|---|

| Cautionary Note Regarding Forward-Looking Statements | 1 | |||

PART I | ||||

Item 1. | Business | 3 | ||

| Item 2. | Properties | 38 | ||

| Item 3. | Legal Proceedings | 39 | ||

| Item 4. | Submission of Matters to a Vote of Security Holders | 39 | ||

PART II | ||||

Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 42 | ||

| Item 6. | Selected Financial Data | 45 | ||

| Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | 46 | ||

| Item 7A. | Quantitative and Qualitative Disclosure About Market Risk | 85 | ||

| Item 8. | Financial Statements and Supplementary Data | 86 | ||

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 112 | ||

| Item 9A. | Controls and Procedures | 112 | ||

| Item 9B. | Other Information | 112 | ||

PART III | ||||

Item 10. | Directors and Executive Officers of the Registrant | 112 | ||

| Item 11. | Executive Compensation | 112 | ||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management | 112 | ||

| Item 13. | Certain Relationships and Related Transactions | 113 | ||

| Item 14. | Principal Accountant Fees and Services | 113 | ||

PART IV | ||||

Item 15. | Exhibits and Financial Statement Schedules | 113 | ||

i

Cautionary Note Regarding Forward-Looking Statements

Our disclosure and analysis in this document and in the documents that are or will be incorporated by reference into this document contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements provide our current expectations or forecasts of future events and are not statements of historical fact. These forward-looking statements include information about possible or assumed future events, including, among other things, operating or financial performance, strategic plans and objectives, or regulatory or competitive environments. Statements regarding the following subjects are forward-looking by their nature:

- •

- our ability to successfully implement our business strategy;

- •

- our projected operating results and financial condition;

- •

- our ability to acquire and manage student housing properties and to secure and operate military housing privatization projects;

- •

- completion of any of our targeted acquisitions or developments within our expected timeframe or at all;

- •

- our ability to obtain future financing arrangements on terms acceptable to us, or at all;

- •

- estimates relating to, and our ability to pay, future dividends;

- •

- our ability to qualify as a REIT for federal income tax purposes;

- •

- our understanding of our competition;

- •

- market opportunities and trends;

- •

- projected capital expenditures; and

- •

- the impact of technology on our properties, operations and business.

The forward-looking statements are based on our beliefs, assumptions and expectations of our future performance, taking into account all information currently available to us. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to us. If a change occurs, our business, financial condition, liquidity and results of operations may vary materially from those expressed in our forward-looking statements. Factors that could cause actual results to differ materially from our management's current expectations include, but are not limited to:

- •

- the factors referenced in this Form 10-K, including those set forth under the sections captioned "Risk Factors," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Our Business;"

- •

- changes in our business strategy, including acquisition activities;

- •

- availability, terms and deployment of capital, including equity and debt financing;

- •

- availability of qualified personnel;

- •

- unanticipated costs associated with the acquisition and integration of our student housing property acquisitions and military housing privatization projects;

- •

- the possibility of military base realignment and closures;

- •

- high leverage on the joint ventures that own our military housing privatization projects;

- •

- reductions in government military spending;

1

- •

- changes in student population enrollment at colleges and universities or adverse trends in the off-campus student housing market;

- •

- changes in the student and military housing industry, interest rates or the general economy;

- •

- changes in local real estate conditions (including changes in rental rates and the number of competing properties) and the degree and nature of our competition;

- •

- our failure to lease unoccupied space in accordance with management's projections;

- •

- potential liability under environmental or other laws; and

- •

- the existence of complex regulations relating to our status as a REIT and the adverse consequences of our failure to qualify as a REIT.

When we use the words "believe," "expect," "may," "potential," "anticipate," "estimate," "plan," "will," "could," "intend" or similar expressions, we intend to identify forward-looking statements. You should not place undue reliance on these forward-looking statements. We are not obligated to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except to the extent otherwise required by law.

2

GMH Communities Trust commenced operations on November 2, 2004, upon completion of its initial public offering and the simultaneous acquisition of the sole general partnership interest in GMH Communities, LP, referred to throughout this report as our operating partnership. The historical operations prior to completion of our initial public offering that are described in this report refer to the operations of College Park Management, Inc., GMH Military Housing, LLC, 353 Associates, L.P., and Corporate Flight Services, LLC, which are collectively referred to, together with our operating partnership, as the GMH Predecessor Entities or our predecessor entities.

In connection with our formation transactions completed prior to and simultaneously with completion of our initial public offering, the interests in the GMH Predecessor Entities were contributed to our operating partnership as described in Note 1 of the financial statements included in this report and the section below titled "Our Business—Our Formation Transactions." We have described our operations in this report as if the historical operations of our predecessor entities were conducted by us for the full fiscal year ended December 31, 2004.

We are a self-advised, self-managed, specialty housing company that focuses on providing housing to college and university students residing off-campus and to members of the U.S. military and their families. Through our operating partnership, we own and operate our student housing properties and own interests in joint ventures that own our military housing privatization projects. Additionally, through our taxable REIT subsidiaries, we provide development, construction, renovation and management services for our military housing privatization projects and property management services to third party owners of student housing properties, including colleges, universities and other private owners, as well as certain noncustomary services for our student housing properties. We are a leading provider of housing, lifestyle and community solutions for students and members of the U.S. military and their families.

GMH Communities Trust was formed in May 2004 to continue and expand upon the student and military housing businesses of our predecessor entities and other affiliated entities, collectively referred to as GMH Associates. GMH Associates was founded in 1985 principally to acquire, develop and manage commercial and residential real estate, while focusing on student housing; and since 1999, GMH Associates also had competed for the award of military housing privatization projects to develop, construct, renovate and manage housing units for members of the U.S. military and their families, referred to as military housing privatization projects.

We completed our initial public offering in November 2004, pursuant to which we sold an aggregate of 30,350,989 common shares at an initial public offering price of $12.00 per share. We intend to make an election to be taxed as a REIT under the Code with respect to our taxable year ended December 31, 2004. We also currently perform, and expect to continue to perform, certain management and other services relating to student and military housing that would not be permitted to be performed by a REIT through our taxable REIT subsidiaries, GMH Military Housing, LLC and College Park Management TRS, Inc.

We seek to capitalize on the highly fragmented student housing market at colleges and universities in the U.S. and the related need for quality and affordable off-campus, privately owned student housing. Focusing on this opportunity, we have, and prior to our formation, GMH Associates had, acquired or entered into joint ventures that acquired properties strategically located near college or university campuses. In addition, we have continued to expand upon the military housing business developed by GMH Associates and to seek the award of additional military housing privatization

3

projects granted by the Department of Defense, or DoD, under the 1996 National Defense Authorization Act. Our management team has won more than 40% of the privatization projects on which it has bid (including those projects for which exclusive negotiations have been awarded) and GMH Communities Trust is currently the top winner of military housing privatization projects that have been awarded ranked by number of bases awarded to date.

Overview

Through its development, redevelopment and strategic acquisitions of student housing properties, directly and indirectly through joint ventures, our management team has led GMH Communities Trust, based upon our internal competitive analysis estimates, to become one of the largest private operators of off-campus housing for college and university students in the United States. As of December 31, 2004, we:

- •

- owned 30 student housing properties, containing a total of 5,529 units with 19,085 beds. These properties collectively were approximately 94.2% occupied as of December 31, 2004; and

- •

- managed, or provided management consulting services for, 25 student housing properties owned by others, containing a total of 5,905 units and 16,752 beds.

In addition, since December 31, 2004 and through March 23, 2005, we:

- •

- acquired an additional eight student housing properties, containing a total of 1,607 units with 4,795 beds;

- •

- entered into agreements to acquire an additional three student housing properties, containing a total of 579 units with 1,858 beds, and two undeveloped parcels of land; and

- •

- entered into non-binding letters of intent to acquire an additional five student housing properties, containing a total of 942 units with 2,574 beds, and one undeveloped parcel of land.

The acquisition of each of the properties under agreement or letter of intent is subject to certain conditions, including our completion of satisfactory due diligence with respect to each property, and in the case of acquisitions where we will assume existing debt, consent of lenders to our assumption of such debt. Also, our proposed acquisitions of properties subject to letters of intent are non-binding arrangements, which are subject to completion of binding purchase agreements and the parties may decide not to pursue these proposed acquisitions for any reason.

We seek to acquire and manage high quality student housing strategically located near college or university campuses and other points of interest, such as restaurants or other nightlife destinations that cater to students. The properties we seek to acquire and manage include townhomes, high-rise, mid-rise and garden-style apartment complexes. The amenities we offer residents vary by property, but include many of those commonly sought by students, such as private bedrooms and bathrooms, high quality student furnishings, cable television, wired and wireless high speed Internet access, a washer and dryer in each unit, fitness centers, swimming pools, computer centers, study rooms and game rooms. Additionally, we strive to create safe environments for our residents by providing, among other things, well-lit parking lots, student housing employees living on-site as well as 24-hour maintenance and emergency services. Although we target student residents, a small percentage of our residents are non-students.

We believe there are substantial opportunities to acquire and manage off-campus student housing. According to the Rosen Consulting Group, LLC, a California-based real estate and regional economics research and consulting firm that provides expert viewpoints and forecasts on the economy, the capital markets and the real estate markets for banks, insurance companies and real estate investors, the

4

off-campus student housing market contains approximately 5.3 million beds of an estimated 7.5 million total student housing beds. Based on our experience acquiring and operating student housing properties, we estimate that the aggregate value of all student housing properties is approximately $159 billion, based on an assumed average asset value of $30,000 per bed. We also estimate annual aggregate student housing rental revenues of approximately $23 billion, assuming an average monthly rental rate of $360 per bed. We base these asset value and rental rate assumptions on our own experience acquiring and operating student housing properties. Currently, the student housing market is highly fragmented and primarily served by local property owners. In addition, a significant number of existing student housing properties are obsolete, creating demand by students for high quality housing and premium services. Further, the U.S. Department of Education's National Center for Educational Statistics, or NCES, has projected that enrollment at four-year institutions of higher education in the U.S. will increase from the 15.3 million students that were enrolled in 2000 to 17.5 million students in 2010. This growth in students is projected to impact particular geographic regions of the country disproportionately, highlighting the importance of our acquisition of targeted investment properties in select markets. We further believe that due to budgetary constraints, colleges and universities have not sufficiently expanded, renovated or modernized existing on-campus student housing to meet this increasing demand for student housing. According to the Center for the Study of Education Policy, colleges and universities may be faced with tighter budgets and increasing competition for students, and have less funding available to develop and manage student housing properties themselves.

According to the Rosen Consulting Group, the combination of higher enrollments of full-time students attending four-year programs and the lack of attractive on-campus housing properties available for students will cause a significant increase in demand for high quality off-campus student housing in those regions experiencing high levels of student growth. The NCES data also indicates an increase in the number of students desiring to live off-campus. Currently, 5.3 million of the estimated 7.5 million beds in the student housing market are located in off-campus student housing, compared to 2.2 million beds located on-campus. According to the publicationCollege Planning and Management, in 2003, of 118 colleges and universities surveyed, on-campus student housing capacity was, on average, 23.7% of the total student population. We believe that this demand for high quality, off-campus student housing will afford private owners opportunities to capitalize on the off-campus student housing market.

Furthermore, according to information provided by the Association of College and University Housing Officers—International, or ACUHO, many college and university students favor a distinctive student housing product, unlike that which is typically offered by colleges and universities today, that provides functional housing units with amenities and services designed specifically to meet their particular lifestyles and needs. We also believe that, because of the structural and functional obsolescence of many existing on-campus and off-campus student housing properties, future opportunities may exist to establish joint ventures with colleges and universities to manage, lease, renovate or develop on- and off-campus student housing, although we have not yet entered into any such arrangements. Opportunities may exist for us to participate in these arrangements through the ownership or leasing of properties or otherwise.

Based upon NCES data and our internal analysis of the current student housing marketplace, we believe that the student housing industry has been undermanaged to date, and that the key factors to the successful execution of our business plan include, among other things, the provision of high quality student housing with a high degree of customer interaction, the implementation of well-managed marketing, leasing, maintenance, retention and collection programs for our properties and the ability to incentivize our management by empowering them to achieve specific objectives.

Strategy

From a growth perspective, our strategy in the student housing business is to acquire, own and effectively manage a diverse portfolio of attractive and high quality off-campus student housing

5

properties located near college and university campuses throughout the United States. We focus on owning and operating townhome, high-rise, mid-rise and garden-style apartment complexes. Our operational strategy is to manage our student housing properties, as well as those we manage for colleges, universities and private owners, with a focus on catering to the college and university student, whose needs and lifestyle differ greatly from the needs and lifestyle of a typical apartment resident. We implement these strategies as follows:

Target select properties/markets. We seek to acquire and manage high quality student housing strategically located near college or university campuses and other points of interest, such as restaurants or other nightlife destinations that cater to students. We specifically target those acquisition sites that are located near colleges or universities with a student enrollment of at least 5,000, where the college or university is the primary driver of the local economy and where there is a shortage of existing modern student housing. We typically target sites within approximately two miles of the college or university campus. Our management team has found that most students prefer to live within a narrowly-defined geographic radius around a particular college or university campus because it provides students with the feeling of being a part of the campus community and also eases students' commutes to and from classes. We also believe that we have identified a recent trend that students, particularly upperclassmen, want to live near entertainment venues near campus, such as restaurants or nightlife destinations. In order to capitalize on this growing trend in the market, we intend not only to seek to acquire and manage premium student housing properties strategically located near college or university campuses, but also those properties close to other points of interest close to campus.

We believe that many of the local satellite campuses of large, state-funded colleges and universities have significant growth potential as the main campuses of these institutions, according to NCES data, have begun to cap the number of students accepted. These caps on student enrollment at large, state-funded institutions have also had a positive effect on campus enrollment at competing colleges and universities located near these institutions. For example, the main campus of the University of Georgia in Athens, Georgia, has experienced and is projected to continue to experience minimal enrollment growth because its current enrollment is at or near its capacity. This has produced opportunities at traditionally smaller campuses such as Georgia Southern University, in Statesboro, Georgia, where enrollment has grown on average at an annual rate of 3% to 4% to its enrollment as of Fall 2004 of 15,704 students. We believe that our size and financial strength gives us a competitive advantage over smaller, less established competitors in our target areas.

Given our management team's experience in and knowledge of the student housing market, we believe that we have developed a solid foundation upon which to identify, evaluate and acquire high quality properties in the future. Our management team's identification efforts of prospective properties is enhanced by its affiliations with and active membership in leading university-related organizations such as the National Association of College and University Business Officers, ACUHO and the National Association of College Personnel Administration. We believe we have the opportunity to acquire additional student housing properties, typically with a combination of cash, common shares and/or units of limited partnership interest in our operating partnership, thereby creating the opportunity for tax-deferred transactions for a seller.

Deliver full range of high quality product. We seek to acquire and manage modern, state-of-the-art townhome, high-rise, mid-rise and garden-style apartments that are tailored to the "student lifestyle." The typical design layout of a housing unit consists of one to four bedrooms, with a complementary number of bathrooms, centered around a common area consisting of a living room, a dining area and a kitchen. In addition to functionality and appearance, we have found that students want to be offered a variety of amenities, similar to those found at typical luxury apartment communities. Amenities such as private bedrooms and high quality furnishings, cable television, wired and wireless high-speed Internet access, a washer and dryer in each unit, fitness centers, swimming pools, computer centers, study rooms and game rooms are found in some combination at all of our properties. We also strive to create a safe

6

environment for our residents by providing well-lit parking lots, student housing employees living on-site and 24-hour maintenance and emergency services.

Our message to prospective student residents is that our properties provide a home-like environment with state-of-the-art technological capabilities and amenities and services designed to maximize their college or university experience. In our marketing efforts, we convey the message that living at one of our properties, unlike a typical apartment property, is like becoming a part of a small community within the larger college or university. To this end, we offer regular "events" at our properties, such as athletic competitions, including volleyball and basketball tournaments, "battle of the bands" nights and non-alcoholic social events. We also offer prospective residents a roommate matching program, where students wishing to find roommates provide us with their background information, including their likes and dislikes, so that our property staff may attempt to match these individuals with compatible roommates.

Each of our properties is managed, leased and maintained by an experienced staff of on-site employees. These employees are available to our student residents around the clock to provide routine maintenance service or to assist in emergencies. We also employ four regional managers who are responsible for coordinating the operations of our properties within each of their respective regions. Our management team works closely with the neighboring college and university housing and development staffs near our properties to ensure that the needs of students, parents and the institutions are being met throughout the year. For example, our management team coordinates with colleges and universities to provide students with access, where available, to the college or university computer network from each property's computer room or from student apartment units, and to become an approved provider of student housing for the local college or university.

We have developed specific management systems that are designed to optimize student housing operations and to maintain the value of our properties. These systems include the implementation of standard lease terms that generally require parental guarantees, making frequent and regular apartment inspections conducted during the course of the lease term, and maintaining and distributing a "price list" to our residents for any property damages incurred during the lease term and thereby incentivizing students to maintain their units. During 2004, we received parental guarantees on more than 90% of the student leases in our portfolio, and we intend to match or exceed this rate of parental guarantees for 2005. Two exceptions for which we generally do not seek parental guarantees include leases with international students due to the high burden of obtaining or collecting on guarantees from parents of students who are not located in the U.S. and leases with residents who provide evidence of satisfactory personal income.

Superior execution of operations. We utilize dynamic, professional marketing services primarily to create web- and Internet-based applications to market and make information about us and our properties easily accessible to students, and initiate word of mouth campaigns to attract student residents. Recognizing the importance of the Internet, we have an individualized web site dedicated for each of our student housing properties containing information about each property, amenities and services available at each property and pricing and leasing information. To a lesser degree, we also advertise through more traditional media, such as radio, print and television, particularly focusing on media such as student-run newspapers that target the student market. We also maintain informal "high school feeder programs," through which our local leasing and marketing representatives visit the high schools that send a majority of students to the colleges and universities in our target markets and meet with students and their guidance counselors to inform them of the housing options that we offer.

The support of colleges and universities is beneficial to the continued success of our off-campus properties and, to this end, we actively seek to have these institutions recommend our properties to their students. Specifically, we attempt to enter into informal arrangements with colleges and universities to have them include information about certain off-campus properties that we manage on

7

their home pages and to have them provide direct hyperlinks to these properties' websites, in addition to distributing brochures relating to these properties. We currently have arrangements with several educational institutions that provide their students with informational materials directing them to our properties. In cases where colleges and universities do not offer active recommendations for our off-campus housing, most nonetheless provide lists of suitable off-campus properties to their students. We continually work to ensure that our properties are on these lists in each of the markets that we serve.

We simplify the bill-paying process by including all costs associated with living at our properties, including water, electricity, gas, cable services and Internet services, in one monthly rental check to be paid to us by students or their parents. Most of the properties that we operate implement this billing feature. We limit our exposure to excessive utility bills from residents by setting a reasonable limit on how much we will pay per resident per month for a particular utility, such as water or electricity. If a resident's monthly bill for a utility exceeds the set limit, the excess cost is charged to the resident on the subsequent month's bill.

In addition to our streamlined bill-payment system, we believe that our method of leasing is attractive to student residents and their parents. Under a traditional apartment lease, housing units are leased by the unit and, therefore, all residents living in a particular unit are responsible for any liabilities of their roommates. We circumvent this situation by typically leasing our housing units by the bed, not the unit. As a result, students in our properties are contractually responsible for making only payments associated with their individual or pro-rata use of the properties.

We seek to maximize income by operating at a high level of efficiency through intensive management and prudent capital expenditures. In addition, property acquisitions in our target markets should permit us to increase student awareness of our properties through our cross-marketing programs, gain economies of scale by enabling us to consolidate management and leasing services and reduce costs of capital goods, supplies, furniture and other goods and services bought in bulk.

Student Leases

Our property leases typically contain the following terms:

- •

- a 12 month lease term (rent payable in equal monthly installments);

- •

- rent payments monthly, and typically includes charges for all amenities provided at the property, such as basic cable, a fitness center, a swimming pool and usually parking;

- •

- require a guarantee by parents or legal guardians, relating to, among other things, the amounts payable under the lease, unless a student resident can provide evidence of satisfactory personal income under fair housing laws, or international residence status;

- •

- require that student residents pay a security deposit or a redecorating fee. The deposit is applied against any damages to the unit caused by the student (including furnishings and household items in the unit). Students and their lease guarantors also are required to assume personal responsibility for any damages caused to a unit's or property's common areas;

- •

- restrictions on the subletting of units without our prior written consent; and

- •

- lease default provisions in the event of failure to pay rent when due, breach of any covenant contained in the lease or abandonment of the unit.

Lease Administration and Marketing Systems

We believe we are an industry leader in identifying and implementing e-business solutions to improve the on-site decision-making processes of local management at each of the college and

8

university communities where we either own or manage properties. We continue to focus on student housing information technology innovations, including customizing web-based applications designed to reduce operating costs, reacting quickly to frequent leasing and market changes and improving real-time operating information and services to student residents.

We implement state-of-the-art, real time systems that provide for on-line resident applications, on-line work orders and facilities management and occupancy reporting. We are also testing an on-line payment system at several of our student housing properties, and expect to implement this system at all of our student housing properties in the second half of 2005. These exclusive systems have dramatically improved the efficiency of our operations and have improved services to an increasingly tech-savvy student market.

Additionally, we have created a web-based infrastructure designed to standardize systems and procedures to improve data tracking at all levels within our student housing business. These systems provide us with real-time access to customized data management tools that track leasing, occupancy, cash flows, expenditures and purchases through national accounts, and with other e-business solutions designed to improve the speed and accuracy of our property management services.

Market Opportunity

The Student Housing Market

Demographic patterns and trends in education over the past several years suggest that there is an increasing number of college-aged individuals and an increasing number of students enrolling in colleges and universities in the United States. According to a report dated October 2003 by the NCES, enrollment at four-year institutions of higher education in the U.S. is expected to increase from the 15.3 million students that were enrolled in 2000 to 17.5 million in 2010.

The major catalyst for projected enrollment increases, and subsequent student housing demand in the near future, will be the growth in the college-aged population represented by the "Echo Boom" generation, which is made up of the sons and daughters of the "Baby Boomer" generation, and is equal in size to the Baby Boomer generation. While the Baby Boomers are nearing retirement, much of the Echo Boom generation, which was born between 1977 and 1997 is entering, or has yet to enter, adulthood. According to the U.S. Census Bureau, in 2003, 4.0 million Americans turned 18; by 2010, that number will peak at 4.4 million and remain above 4.0 million annually for some time.

The impact of demographic changes on college enrollment levels will not be felt equally across all states. During the past decade, the fastest growth of post-secondary enrollment has been concentrated primarily in the Rocky Mountain States and the Sunbelt, which consists of the Southeast and Southwest portions of the United States. The Sunbelt, Pacific and Northeast regions of the U.S. are projected to be the fastest growing regions in college enrollment between 2000 and 2010, fueled by above average growth projections, in the young adult population in these regions. According to the U.S. Census Bureau, the top four states projected to have the largest populations of 18 to 24 year-olds during the next decade are California, Texas, New York and Florida.

We believe that these projected increases in the 18-24 year-old population and in college student enrollment will place a greater demand on off-campus student housing. While both on-and off-campus student housing markets will compete for these additional students, we believe that existing on-campus properties will be at a disadvantage because, according to NCES data, those properties tend to be older units that have not been sufficiently expanded, renovated or modernized to meet students' increasing needs and expectations.

9

Highly Fragmented Ownership of Student Housing Properties

The student housing market is highly fragmented, and consolidation in the industry has been limited. Based upon our internal competitive analysis estimates, we believe that there are fewer than 12 firms that own a multi-regional network of off-campus student housing properties and have the ability to offer an integrated range of specialized student housing services, including design, construction and financing.

Our management experience suggests that none of the specialized student housing firms dominates a particular region. Instead, they each seek to maintain a presence in multiple markets with large student populations. Therefore, most are active in the same markets, particularly Texas, California, Florida, Georgia, North Carolina and Pennsylvania, due primarily to the presence of large state university systems that allow developers and operators to take advantage of economies of scale. In contrast, the Northeast, Southwest and Pacific Northwest are three regions in which small, local owner-operators have significant market share.

Status of the On-Campus Student Housing Market

As student enrollment increases, we believe that one of the biggest challenges facing many colleges and universities is an antiquated student housing infrastructure. According to Rosen Consulting Group, LLC, at 20 of the largest universities in the U.S. the average age of student housing dormitories found on campus is over 36 years old. In addition to the need for additional housing to accommodate an expanding student population, universities must also deal with the problems of maintaining, refurbishing and marketing their existing aging inventory. Many schools have undertaken large-scale renovations and others are under pressure to follow suit to stay competitive. In addition to significant cosmetic upgrades, outdated heating and plumbing systems and roofs and windows are being replaced in many on-campus housing facilities. In some cases, institutions are finding that the costs of renovations are often prohibitive and are opting to take existing facilities out of service, thereby creating a greater demand for off-campus student housing.

In addition, various amenities that used to be considered rare luxuries in the student housing industry, such as kitchens, private bedrooms and bathrooms, Internet connectivity and cable television systems, and a washer and dryer in each unit, are now more common and increasingly becoming a factor in a student's housing and university selection. According to Rosen Consulting Group, LLC, in 20 of the largest universities in the country, private bedrooms accounted for only 23% of total on-campus capacity; only 33% of students living in on-campus facilities had a bathroom shared with less than four people; and only 17% had a kitchen in their housing units. Student housing that includes these amenities is more expensive to build. According to a survey by the magazineAmerican School and University, the cost per square foot to construct a new residence hall has nearly doubled over the past 10 years, from $82 in 1993 to $150 in 2002.

In addition to increasing costs associated with the renovation of existing on-campus student housing by colleges and universities, budget deficits or budget restrictions are affecting the amount of funds available to colleges and universities for education, thereby limiting states' abilities to increase funding for student housing projects. According to the Center for the Study of Education Policy, state appropriations for higher education have decreased for a second consecutive year. Each state's ability to boost post-secondary education spending, while simultaneously handling the strain on health care budgets from a rapidly aging population and increasing funding to primary and secondary education, remains to be seen. Traditionally, both health care and primary education have taken precedence over higher education. Based on information provided by the Association of Governing Boards of Colleges and Universities, we believe it is unlikely that states will have enough money to fund all programs completely.

10

As a result of these trends in state budget deficits, we believe public universities' finances are worsening or threatening their capacity to fund significant capital projects such as student housing. A recent survey by the Common Fund for Nonprofit Organizations found that approximately 1,260 colleges and universities in the U.S. plan to make across-the-board cuts in all academic programs. The same number of colleges and universities plan to trim building and maintenance expenditures, including new construction projects. The majority of facilities-related budget cuts have been for maintenance spending, though many new construction projects also have been postponed.

Supply of Student Housing

According to the publicationCollege Planning and Management, of 118 colleges and universities surveyed, on-campus student housing capacity was, on average, 23.7% of the total student population. The remaining percentage of students must look for housing elsewhere. Based upon current projections of enrollment growth, we believe that colleges and universities will be unable to meet the increase in student housing demand with traditional on-campus housing, thereby creating incremental demand for off-campus student housing. Furthermore, our management experience suggests that college and university students increasingly prefer to live in modern, off-campus housing that provides greater privacy and modern amenities, rather than live in on-campus dormitories. Consequently, we believe colleges and universities are turning to private sector developers to bridge the gap between demand for on- and off-campus housing and their ability to provide additional on-campus housing from their own capital resources.

We expect new construction and development by colleges and universities, various commercial developers, real estate companies and other owners of real estate that are engaged in the construction and development of student housing to compete with us in meeting the anticipated increased demand in student housing over the next 10 years. The development and construction of new student housing properties is extremely capital intensive. Since leases are typically executed for an August or September delivery, construction delays can cause late completion and jeopardize rents for an entire year. As a result, we seek to acquire existing properties or acquire newly constructed properties from third party developers in our target markets. In addition, we are also reviewing potential joint venture projects with third party developers to construct new student housing properties that we would operate.

We believe that we are well-positioned to capitalize on the projected shortage of student housing in the U.S. due to our management's experience in the student housing industry, the economies of scale afforded by our size, our access to capital for the acquisition of additional student housing, our high quality student housing product and our systems designed to optimize student housing operations.

Management Services

As of December 31, 2004, we managed all of the student housing properties owned by us and managed, or provided consulting services for, 25 student housing properties not owned by us. We manage the student housing properties not owned by us through our taxable REIT subsidiary. Our operating partnership has entered into a consulting agreement to provide consulting services to GMH Capital Partners, LP, an affiliate of our chairman, president and chief executive officer, relating to property management consulting services that are provided by the affiliate for five student housing properties, as of December 31, 2004, in exchange for consulting fees equal to 80% of the amount of net management fee income the affiliate receives from the property owners. Additionally, we will manage each of the student housing properties that we acquire in the future.

11

Investment Criteria

In analyzing proposed student housing acquisitions, we consider various factors including, among others, the following:

- •

- the ability to increase rent and maximize cash flow from the student housing properties under consideration;

- •

- whether the student housing properties are accretive to our per share financial performance measures;

- •

- the terms of existing or proposed leases, including a comparison of current or proposed rents and market rents;

- •

- the creditworthiness of the student residents and/or parent guarantors;

- •

- local demographics and college and university enrollment trends, and the occupancy of and demand for similar properties in the market area, specifically population and rental trends;

- •

- the ability to efficiently lease or sublease any unoccupied space;

- •

- the ability of the student housing property to achieve long-term capital appreciation;

- •

- the ability of the student housing property to produce free cash flow for distribution to our shareholders;

- •

- the age, location and projected residual value of the student housing property; and

- •

- the opportunity to expand our network of relationships with colleges and universities as well as other strategic firms.

Underwriting Process

We have designed our underwriting strategy to enable us to deliver attractive risk-adjusted returns to our shareholders. Our acquisition selection process includes several factors, including a comprehensive analysis of the proposed property's cash flows, financial trends in a property's revenues and expenses, barriers to competition, the need in the property's market for the type of student housing services provided by a particular property, the strength of the location of a property and the underlying value of the property. We also analyze the operating history of a specific property, including the property's earnings, cash flow, occupancy and student mix, to evaluate its financial and operating strength.

In addition, as part of our due diligence process, we obtain and evaluate title, environmental and other customary third-party reports. Our acquisition policy requires the approval of our board of trustees for any student housing acquisition with a total purchase price of $25 million or greater.

Competition

We compete with other regional or national owners and operators of off-campus student housing in a number of markets, including Education Realty Trust (EDR) and American Campus Communities, Inc. (ACC). Each of EDR and ACC has recently completed initial public offerings and, in connection therewith, has publicly disclosed its intention to grow its student housing business. We also compete in a number of markets with smaller local owner-operators. Currently, the industry is fragmented with no participant holding a dominant market share. We believe that a number of other large national companies with substantial financial resources may be potential entrants in the student housing business. The entry of one or more of these companies could increase competition for students and for the acquisition, management and development of student housing properties.

12

There also are various on- and off-campus student housing complexes that compete directly with us located near or in the same general vicinity of many of our current and targeted properties. We also are subject to competition for students from on-campus housing operated by colleges and universities, other public authorities and privately-held firms. We also are subject to competition for the acquisition of off-campus student housing with other existing local and national owners and operators of student housing. Further, we generally believe that the pace and size of acquisitions in the real estate industry have increased significantly since 1995. Consequently, prices have generally increased while return on invested capital has fallen.

Overview

In order to address poor housing quality, a significant backlog of repairs and rehabilitations to its military housing units on and near bases, and a shortage of affordable, quality private housing available to members of the U.S. military and their families, Congress included the Military Housing Privatization Initiative, or MHPI, in the 1996 National Defense Authorization Act. Under the MHPI, the DoD was granted the authority to award projects to private owners to develop, construct, renovate and manage military housing. According to statistics released by the DoD as of March 11, 2005, since 1996, the U.S. military has awarded to private owners long-term agreements and rights to exclusively negotiate agreements with the U.S. military for 56 domestic projects containing, in the aggregate, a total of 115,610 end-state housing units. End-state housing units are the number of housing units that are approved for completion by the end of the initial development period for a project, or IDP, which is described in greater detail below. The DoD has targeted another 56 domestic projects containing an additional 76,345 housing units that have yet to be awarded by Congress, and agreements for the related development, construction, renovation and management services for these additional projects. According to the DoD, the previously awarded privatization projects and projects under exclusive negotiations, together with these additional targeted projects, reflect the opportunity to develop, construct, renovate and manage a total of 191,955 end-state housing units.

In 1999, GMH Associates recognized the opportunity to leverage the core competencies that it had developed in its student housing and conventional multi-family housing businesses and assembled a highly coordinated, full service, professional team to focus on the procurement of military housing privatization projects. Our management team has won more than 40% of the privatization projects on which it has bid (including those projects for which exclusive negotiations have been awarded) and GMH Communities Trust is currently the top winner of military privatization projects that have been awarded ranked by number of bases awarded to date.

As of December 31, 2004, our operating partnership held an ownership interest in, and operated, through various wholly owned subsidiaries, the privatized military housing projects at the Department of the Army's Fort Carson, Fort Stewart and Hunter Army Airfield, Fort Hamilton and the Walter Reed Army Medical Center/Fort Detrick, and the Department of Navy's Northeast Region. In addition, as of December 31, 2004, we had an interim agreement to provide management and limited development services for the Department of the Army's Fort Eustis and Fort Story bases, which project began operating on December 1, 2004 and for which we obtained final award on March 1, 2005. We refer to these six projects as the Fort Carson project, the Stewart Hunter project, the Fort Hamilton project, the Walter Reed/Fort Detrick project, the Navy Northeast Region project, and the Fort Eustis/Story project, respectively. In addition to these projects, as of March 1, 2005, we were in the exclusive negotiation process for one additional privatization project, Fort Bliss/White Sands Missile Range, from the Army. Exclusive negotiations typically last six to 12 months and culminate in final approval from Congress and the applicable U.S. military branch and the execution of a definitive agreement relating to the terms of the project. Collectively, the Army's Fort Carson project, the Stewart Hunter project, the Fort Hamilton project, the Walter Reed/Fort Detrick project, the Fort Eustis/Story project and the

13

Navy Northeast Region project cover 16 domestic bases and, once full development, construction and renovation have been completed for these projects, the DoD has estimated that they will contain approximately 12,580 end-state housing units. The Fort Bliss/ White Sands Missile Range privatization project that we are currently negotiating covers two domestic bases and, once full development, construction and renovation have been completed for this project, the DoD has estimated that it will contain an aggregate of 3,277 end-state housing units.

Each of these military housing projects includes the renovation and management of existing housing units, as well as the development, construction, renovation and management of new units over a 50-year period, which, in the case of the Army, potentially could extend for up to an additional 25 years. The 50-year duration of each project calls for continuing renovation, rehabilitation, demolition and reconstruction of housing units through various predetermined project phases. Including the final approval of the Fort Bliss/White Sands Missile Range project that is currently under exclusive negotiations, we expect that our management agreements for all seven privatization projects will provide us with the opportunity to manage 15,857 end-state housing units on bases in 11 states and Washington, D.C., including 7,161 units we plan to construct and 6,497 units we plan to renovate.

We believe that we are one of the largest private-sector managers of military housing units in the U.S., based on the number of military bases awarded to date. At each of the projects we managed as of March 11, 2005, the following numbers of units were in operation: Fort Carson—2,663 units, Fort Stewart and Hunter Army Airfield—2,905 units, Fort Hamilton—259 units, Walter Reed/Fort Detrick—284 units, Fort Eustis/Story—1,115 units, and Navy Northeast Region—5,465 units.

We operate our military development, construction/renovation and management services through a taxable REIT subsidiary. As a REIT, we generally are not subject to federal income tax to the extent that we distribute our REIT taxable income to our shareholders, but the taxable income generated by a taxable REIT subsidiary is subject to regular corporate income tax.

Military Housing Privatization Initiative

The MHPI is a program authorized under the 1996 National Defense Authorization Act that allows the DoD to award military housing privatization projects to private owners. Under the MHPI, private-sector developers may own, operate, maintain, improve and assume responsibility for housing on U.S. military bases. According to the authority granted to it by the MHPI, the DoD can work with the private-sector to revitalize military housing over a 50-year ground lease period by employing a variety of financial tools to obtain private capital to leverage government dollars; make efficient use of limited resources; and use a variety of private-sector approaches to build and renovate military housing faster and at a lower cost to U.S. taxpayers.

The MHPI is designed to remedy both the poor condition and shortage of current military housing. According to the DoD, it owned approximately 257,000 family housing units, on and off U.S. military bases, and estimated that more than 50% of these units required renovation or replacement as a result of insufficient maintenance or modernization over the previous 30 years. The DoD believes that improving the poor housing condition as well as the shortage of quality, affordable private housing on military bases will significantly improve the morale and quality of life for members of the U.S. military and their families, thereby boosting retention and enrollment in today's voluntary military forces. The majority of members of the U.S. military and their families live in local communities near U.S. military bases. Most of these members of the U.S. military are enlisted personnel whose salaries are at the lower end of the military pay scale. Their salaries make it difficult for them to find quality, affordable housing within a reasonable commuting distance. Furthermore, many of these communities do not have enough affordable, quality rental housing to accommodate members of the U.S. military and their families. The MHPI provides a creative and effective solution to address the quality housing shortage, and will result in the construction of more housing built to market standards for less money

14

than through the military's own construction process. Furthermore, traditional military construction requires contractors to adhere to stringent military specifications, which make projects significantly more costly than building to market standard. Commercial construction is both faster and less costly than military construction, but private-sector funds significantly stretch and leverage the DoD's limited housing funds and, at the same time, open the military construction market to a greater number of development firms and stimulate the economy through increased building activity.

Competitive Bidding Process for Military Housing Privatization Projects

In order to implement the MHPI and foster a coordinated approach by the military branches, the DoD created the Housing and Competitive Sourcing Office to develop the legal, financial and operational aspects of the MHPI. Each military branch assesses its own current and future housing requirements, and determines the best course of action necessary for revitalizing inadequate housing units and keeping its housing inventory in good condition. Each military branch also individually assesses the viability of a privatization project and makes the final decision whether to privatize housing on a particular installation, taking into consideration housing needs and available resources of that branch. Once the military branch and the Office of the Secretary of Defense approve site development, they will conduct an industry forum to obtain private-sector input. Though each military branch must follow certain general DoD policy guidelines, each branch has its own privatization project award program. The solicitation process differs slightly among the various military branches; however, in all cases, a competitive bidding process is the method by which projects are awarded to private owners. Projects are introduced to the private-sector through the use of a request for proposal or a request for qualifications. Contractors that satisfy the respective military branch's requirements respond with detailed project proposals, and a selection is made from among them. The project winner is awarded the exclusive right to negotiate the final plan, and assuming approval of such final plan, to develop, construct, renovate and manage family housing at a military base, which, based on our experience, is typically for a 50-year period and, in the case of the Army, contains certain extension rights.

Based on our experience, during the exclusivity period for an Army project, which typically lasts between six and 12 months, the project winner initially enters into a contract with the Army pursuant to which it will create a community development and management plan, or CDMP, relating to the planned development of the awarded project. If the CDMP is approved by Congress, the project winner enters a transition period, ranging from 30 to 90 days, during which it prepares to implement its CDMP, finalizes documentation relating to the implementation of the CDMP, including arranging and negotiating necessary financing and negotiating final documents and agreements with the Army, and prepares to take over the base housing operations on the date of closing. Closing occurs after the transition period when all the documentation and negotiations with the Army have been finalized, at which point the project winner may commence its operation of the project.

Based on our experience, during the period of exclusive negotiations with the Navy, the project winner will work towards finalization of required project and environmental documentation; pursue local approvals; develop design plans and working drawings; reach an agreement with the Navy officials regarding all aspects of the project; and arrange and negotiate necessary financing.

The result of these exclusive negotiations will be a business agreement that describes all relevant characteristics of the development, and defines all business terms and conditions, schedules and financial arrangements between the parties. This process generally takes approximately nine to 12 months to complete from the time of the award to the execution of the business agreement.

Organizational Structure of Our Military Housing Projects

The operations of our military housing privatization projects are conducted through an organizational structure that involves a wholly owned subsidiary of our operating partnership, GMH

15

Military Housing Investments, LLC, and our taxable REIT subsidiary, GMH Military Housing, LLC, which develops, manages and sometimes constructs/renovates the military housing in the projects through two of its subsidiaries: GMH Military Housing Development LLC and GMH Military Housing Management LLC, each of which are referred to as GMH Development and GMH Management, respectively, throughout this report. This organizational structure is described as follows:

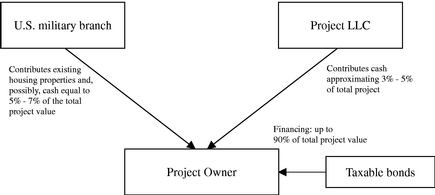

The Project Entity. We typically create a project-specific limited liability company, the Project LLC, to serve as the manager for a project. The Project LLC is a joint venture between GMH Military Housing Investments LLC and a joint venture partner. The joint venture partner typically is a third-party architectural and design company or construction company with whom we have an existing relationship. GMH Military Housing Investments, LLC is the managing member of the Project LLC, which, in the case of Navy projects, typically contracts with GMH Development for project development services, GMH Management for project management and construction/renovation services, and a third-party joint venture partner for project architectural and design or construction services. At the closing on a Navy project, the Project LLC assigns all of its contractual rights and obligations to the Project Owner, the members of which consist of the Project LLC and the Navy. In the case of Army projects, the Project Owner, the members of which consist of the Project LLC and the Army, directly contracts with GMH Development, GMH Management and a third-party joint venture partner for architectural and design and construction services. The Project Owner is created for the purpose of owning the project. The Project Owner also is the ground lessee of the land upon which the project is situated. The Project LLC is the managing member of the Project Owner. A project is financed through a combination of equity, provided by the Project LLC and the U.S. military branch (which typically approximates up to 10% of the total project value), and debt, provided through the issuance of taxable bonds initially for the benefit of the Project LLC (which is typically up to 90% of the total project value).

Debt Financing for the Project. Debt financing for each project is provided by a third party, which could include a government agency, through the issuance of taxable bonds for the benefit of the project. Debt financing is typically obtained at the project closing, which occurs on the date that the relevant branch of the U.S. military transfers operation and management of those housing units at the project to the Project LLC. Based on our management's experience, we believe the terms of the debt are consistent with the terms typically used for conventional multifamily housing projects. In each instance, the debt generally is non-recourse to us and is secured by a first priority lien on the project and requires the assignment of all of the Project Owner's rights for the benefit of the bondholders or the lender, as applicable. The security therefore includes the Project Owner's interest in the ground lease. Based on our experience, the repayment terms require payments of interest only during the first three to seven years of the loan and, thereafter, payments of interest and principal, amortized over a 35- to 45-year period, for the remaining term of the loan. While the Project LLC is able to obtain debt financing for up to 90% of the total value of each project, based on our management's experience, lenders typically will not lend in excess of a specified debt service coverage ratio projected for the first stabilized year following the end of the initial development period (typically ranging from three to eight years, out of the 50-year project term). Accordingly, if interest rates increase, the Project LLC may be required to finance a greater portion of the project cost with equity. In addition, if the minimum debt service coverage is not met, we may not have access to cash flows from the project, other than for project operating expenses, until the coverage is restored.

16

The following diagram shows our typical Project LLC structure:

As its contribution to the project, the U.S. military branch contributes the existing houses and related improvements and may also contribute cash. The Project LLC also contributes cash, typically at the end of the initial development period, but in certain instances at the outset of the initial development period, for the project. Neither the Project LLC nor the U.S. military branch is required to make additional capital contributions to the project, and neither is permitted to make any additional contribution to the project without the approval of the other. The Project LLC's return on investment is dependent on both the structure of the transaction and the U.S. military branch involved.

The Development Company. GMH Development provides development services for a privatization project. These services are provided through development agreements typically having 50-year terms, which extend automatically upon any renewal of the ground lease. GMH Development generally assists the Project Owner by coordinating and monitoring the planning, design, demolition, renovation and construction activities on the Project Owner's behalf, including the evaluation of project sites and requirements for each project, assisting the Project Owner with the development of the project schedule and budget, establishing coordination between the government and primary contractors, reviewing completed construction and renovation work, and certifying payments or primary contractors for such work. GMH Development also establishes and implements administrative and financial controls for the design and construction of the project and assists the Project Owner in obtaining and maintaining general liability insurance and other types of insurance.

The Project Owner pays GMH Development a base fee of approximately 2.5% of the total development costs for the project, from the beginning of the initial development period throughout the life of the project. Additionally, GMH Development typically is entitled to receive incentive development fees from the Project Owner upon the satisfaction of designated milestones. During the initial development period, GMH Development's incentive fee generally does not exceed 1.5% of the total development costs during the period. After the initial development period of a project, the incentive development fees typically are a percentage of total development costs for the remainder of the project term ranging from 0.5% to 1.5%. Milestones for payment of incentive development fees include completing a specified number of homes according to schedule, performing within an approved development budget and delivering homes with a limited number of correctable errors, based upon property management inspections.

The Construction/Renovation Company and Property Manager. GMH Management provides construction/renovation and management services for a privatization project. With regard to project construction/renovation, the Project Owner pays GMH Management a base fee of approximately 3.0% of the total construction/renovation costs for the project, from the beginning of the initial development period throughout the life of the project. Additionally, GMH Management typically is entitled to receive construction/renovation incentive fees from the Project Owner upon the satisfaction of designated milestones. During the initial development period, GMH Management's incentive fee

17

generally does not exceed 1.0% of the total construction/renovation costs during the period. After the initial development period of a project, the construction/renovation incentive fees are a percentage of total construction/renovation costs for the remainder of the project term, ranging from 0.5% to 1.0%. Milestones for payment of construction/renovation incentive fees typically include achieving specific safety records, maintaining financial control of project construction/renovation costs and implementing small business or minority subcontracting plans.

With regard to project management, the Project Owner contracts with GMH Management for GMH Management to provide management services for the project. These services are provided through management agreements, typically having 50-year terms, which extend automatically upon any renewal of the ground lease. GMH Management oversees the leasing of housing units in accordance with the requirements of the ground lease, day-to-day operations of the project, collection of revenues and depositing the revenues into appropriate accounts, day-to-day maintenance of the project, ordinary repairs, decorations, alterations and improvements, completion of backlogged maintenance and repairs, payment of taxes imposed on the project, and compliance with applicable laws and regulations.

GMH Management typically is required to prepare and submit an operating budget for the project to the Project Owner on an annual basis. The management agreement typically grants GMH Management the authority to make expenditures and incur obligations provided for in the operating budget. GMH Management also has the authority to make certain emergency expenditures.

As standard compensation for the services it provides, GMH Management is paid a base fee, typically 2% to 3% of effective gross revenue for the project. In addition, GMH Management is entitled to receive an additional incentive fee from the Project Owner, typically 2% to 3%, upon the satisfaction of designated benchmarks relating to emergency work order response, routine work order completion, occupancy rates, home turnover, resident satisfaction surveys, execution of community service programs and timely delivery of required reports and budgets.

The Project Owner generally may terminate the management agreement upon written notice to GMH Management if it breaches any of its material obligations under the management agreement and fails to cure such breach within 30 days.

The Ground Lease. Based on our experience, the Project Owner and the Army or the Navy enter into a ground lease pursuant to which the U.S. military branch leases to the Project Owner the real property upon which a privatization project is located. We expect future-awarded Army and Navy privatization projects to operate in a similar fashion. Typically, the initial term of a ground lease is 50 years. With respect to Army privatization projects, the ground lease may be renewable for an additional period of up to 25 years upon request by the Army and acceptance by the Project Owner. As partial consideration for the execution of a ground lease and performance of its obligations thereunder, the Project Owner agrees to design, develop, manage, rehabilitate, renovate and maintain the privatization project. At all times during the term of a ground lease, the U.S. military branch provides the Project Owner access to the privatization project. The use and occupancy of the privatization project is subject to the general supervision and approval of the Army or the Navy, as the case may be, and to such rules and regulations as the U.S. military branch prescribes. The Project Owner has the right to lease housing units to non-military or non-DoD tenants if vacancy rates hit certain levels.

Most of the Army ground leases provide that in the event an applicable base is subject to base closure under the U.S. military's Base Realignment and Closure, or BRAC, regulations, the Project LLC has, subject to then-existing applicable law, the option to acquire fee simple title to the real property pursuant to a purchase option agreement by and between the Army and the applicable Project LLC. In the event of a base closure, as to all or a portion of the property, the Project Owner may terminate the ground lease with respect to all or such portion of the property, subject to restrictions and limitations imposed by holder(s) of the debt used to finance the project. There is no guarantee that any purchase option agreement will be enforceable or that any corresponding purchase option will

18

be exercisable in the event of a base closure under BRAC. The Navy's ground leases, unlike the Army's, typically do not provide the Project LLC with a purchase option upon a base closure under BRAC.

Basic Allowance for Housing

The U.S. military's Basic Allowance for Housing, or BAH, is the primary source of operating revenues under our military housing projects. BAH is a cost of living stipend distributed monthly by the DoD to members of the U.S. military to cover their and their families' costs of living (i.e., rent and utility expenses) in privately-owned housing, on or near bases. The intent of BAH is to provide members of the U.S. military equivalent and equitable housing compensation based upon the market prices of rental housing in the local housing markets surrounding the U.S. military bases. Each year, Congress must appropriate an aggregate budget for BAH for all of the military branches.

The DoD adjusts, on an annual basis, the BAH stipend to be received by each individual member of the U.S. military to reflect changes in the profile of that particular individual member of the U.S. military. Specifically, a BAH stipend is currently computed by estimating the market price of housing that the member of the U.S. military would be expected to rent, based upon his or her geographic area, pay grade and number of dependents, adding in average utilities and insurance. The particular geographic area surrounding a military base is called a Military Housing Area, or MHA. In computing a BAH, MHA price data for rentals, average utilities and insurance is collected annually in the spring and summer months when housing markets are most active. Pricing information is surveyed from local apartments, townhouses and duplexes, as well as from single-family rental units of various bedroom sizes. Although BAH rates can decrease for a geographic duty location, members of the U.S. military that collect BAH cannot have the amount of their BAH decreased unless a change in status occurs (except that promotions are specifically excluded in the definition of a change in status), such as a base transfer, a decrease in pay grade or a change in the number of dependents.

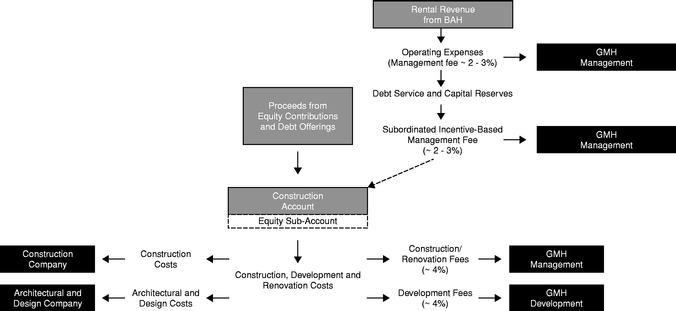

Revenue Stream

Typically, a member of the U.S. military who is leasing a housing unit on one of our project bases will elect for his or her monthly BAH to be directly deposited by the government, via wire transfer, into an operating revenue fund controlled by the Project Owner, subject to certain restrictive covenants required by any outstanding construction finance bonds. Rental revenues derived from BAH are subsequently paid out of the operating revenue fund by the Project Owner according to a distributive "waterfall" plan set forth in the Project Owner operating agreement. Based on our experience, the BAH revenues associated with each privatization project generally "flow out" of the operating revenue fund on a monthly basis as follows:

Funds Flow During Initial Development Period

19

Funds Flow Post-Initial Development Period

- •