QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material Pursuant to §240.14a-12 | |

GMH Communities Trust | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

10 Campus Boulevard

Newtown Square, PA 19073

April 29, 2005

To our Shareholders:

On behalf of the Board of Trustees of GMH Communities Trust, I cordially invite you to attend our 2005 Annual Meeting of Shareholders. The meeting will be held on Wednesday, June 8, 2005 at 10:00 a.m., local time, at the Philadelphia Marriott West, 111 Crawford Avenue, West Conshohocken, PA 19428. During the meeting, shareholders will be asked to vote on the annual election of trustees and any other matters that may be properly brought before the meeting. In addition, we will update you on important developments in our business and respond to any questions that you may have about us.

Information about the matters to be acted upon at the meeting is contained in the accompanying Notice of Annual Meeting of Shareholders and Proxy Statement. Also enclosed with this Proxy Statement are your proxy card instructions for voting and the 2004 Annual Report to shareholders.

I would like to take this opportunity to remind you that your vote is very important. Please take a moment now to cast your vote in accordance with the instructions set forth on the enclosed proxy card. In addition, if you would like to attend the 2005 Annual Meeting in person, please see the admission instructions set forth in the Notice of Annual Meeting of Shareholders accompanying this letter and on the enclosed proxy card.

I look forward to seeing you at the meeting.

Best regards, | ||

| ||

Gary M. Holloway, Sr. Chairman, President and Chief Executive Officer |

| | | ||

|---|---|---|---|

Notice of Annual Meeting of Shareholders | i | ||

Proxy Statement | |||

General Questions and Answers About the Meeting | 1 | ||

Proposal 1—Election of Trustees | 5 | ||

Board of Trustees | 6 | ||

Share Ownership of Our Trustees, Executive Officers and 5% Beneficial Owners | 8 | ||

Corporate Governance | 12 | ||

Board Committees and Trustee Compensation | 14 | ||

Report of the Compensation Committee | 17 | ||

Executive Compensation | 21 | ||

Compensation Committee Interlocks and Insider Participation | 26 | ||

Certain Relationships and Related Transactions | 26 | ||

Report of Audit Committee | 30 | ||

Independent Registered Public Accounting Firm Fees | 31 | ||

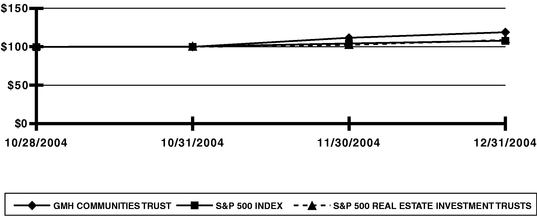

Share Price Performance Graph | 32 | ||

Section 16(a) Beneficial Ownership Reporting Compliance | 32 | ||

2004 Annual Report to Shareholders | 33 | ||

Appendix A Audit Committee Charter | A-1 | ||

10 Campus Boulevard

Newtown Square, PA 19073

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To be held June 8, 2005

NOTICE IS HEREBY GIVEN that the 2005 Annual Meeting of Shareholders of GMH Communities Trust, a Maryland real estate investment trust (the "Trust"), will be held on Wednesday, June 8, 2005 at 10:00 a.m., local time, at the Philadelphia Marriott West, 111 Crawford Avenue, West Conshohocken, PA 19428, for the following purposes:

- 1.

- To elect eight members of the Board of Trustees to hold office until the annual meeting of shareholders to be held in 2006; and

- 2.

- To transact such other business as may properly come before the meeting or any postponements or adjournments thereof.

The Board has fixed the close of business on April 21, 2005, as the record date for the 2005 Annual Meeting ("Record Date"). Only shareholders of record as of that date are entitled to notice of, and to vote at, the meeting and any adjournment or postponement thereof.

If you hold your shares directly in your name, and plan to attend the meeting, you may pre-register by following the instructions for pre-registration on the enclosed proxy card. If your shares are held in the name of a broker or other nominee or holder of record, and plan to attend the meeting, you will need to bring proof of ownership to the meeting. A recent brokerage account statement is an example of proof of ownership. If you hold your shares through a broker or other nominee, you may send a request for pre-registration to: Annual Meeting Pre-Registration, GMH Communities Trust, 10 Campus Boulevard, Newtown Square, Pennsylvania 19073, Attn: Secretary and General Counsel. Your request should include the following information:

- •

- your name and complete mailing address;

- •

- if you have appointed a proxy to attend the 2005 Annual Meeting on your behalf, the name of that proxy; and

- •

- a copy of a brokerage statement reflecting your share ownership as of the Record Date.

The accompanying form of proxy is solicited by the Board of Trustees. Further information about the business to be transacted at the 2005 Annual Meeting is provided in the attached Proxy Statement.

| By Order of the Board of Trustees, | ||

| ||

| Joseph M. Macchione Secretary |

Newtown Square, Pennsylvania

April 29, 2005

Whether or not you plan to attend the 2005 Annual Meeting in person, please mark, execute, date and promptly return the enclosed proxy card in the postage-prepaid envelope provided. Doing so will not prevent you from voting in person at the meeting, if you choose to do so. It will, however, help to assure that a quorum is present for the meeting and to avoid proxy solicitation costs.

i

10 Campus Boulevard

Newtown Square, PA 19073

This Proxy Statement is being furnished in connection with the solicitation of proxies by the Board of Trustees of GMH Communities Trust (the "Board"), a Maryland real estate investment trust (the "Trust" or "we"), for use at the Trust's 2005 Annual Meeting of Shareholders ("2005 Annual Meeting"), to be held at the Philadelphia Marriott West, 111 Crawford Avenue, West Conshohocken, PA 19428 on Wednesday, June 8, 2005 at 10:00 a.m., local time, and any adjournment or postponement thereof, for the purposes set forth in the foregoing notice and more fully discussed herein. This Proxy Statement, the foregoing notice and the enclosed proxy card are first being mailed to shareholders of the Trust on or about April 29, 2005. Only shareholders of record at the close of business on April 21, 2005 (the "Record Date") are entitled to notice of, and to vote at, the 2005 Annual Meeting.

GENERAL QUESTIONS AND ANSWERS ABOUT THE MEETING

The questions and answers set forth below provide general information regarding this Proxy Statement and the 2005 Annual Meeting.

When are our 2004 Annual Report and this Proxy Statement first being sent to shareholders?

Our 2004 Annual Report and this Proxy Statement are being sent to shareholders beginning on or about April 29, 2005.

What will shareholders vote on at the meeting?

- 1.

- To elect eight members of the Board of Trustees to hold office until the annual meeting of shareholders to be held in 2006; and

- 2.

- To transact such other business as may properly come before the meeting or any postponements or adjournments thereof.

Who is entitled to vote at the 2005 Annual Meeting and how many votes do they have?

Common shareholders of record at the close of business on the Record Date may vote at the 2005 Annual Meeting. Each share has one vote. There were 30,374,551 common shares outstanding on the Record Date.

How do I vote?

You must be present, or represented by proxy, at the 2005 Annual Meeting in order to vote your shares. Since many of our shareholders are unable to attend the meeting in person, we send proxy cards to all of our shareholders to enable them to vote.

What is a proxy?

A proxy is a person you appoint to vote on your behalf. If you complete and return the enclosed proxy card, your shares will be voted by the proxies identified on the proxy card.

By completing and returning this proxy card, who am I designating as my proxy?

You will be designating Gary M. Holloway, Sr., our chairman, president and chief executive officer, and Joseph M. Macchione, our senior vice president, general counsel and secretary, as your proxies.

They may act on your behalf together or individually and will have the authority to appoint a substitute to act as proxy.

How will my proxy vote my shares?

Your proxy will vote according to the instructions on your proxy card.If you complete and return your proxy card, but do not indicate your vote on the Proposal 1—Election of Trustees, your proxy will vote "FOR" each of the nominees under Proposal 1. We do not intend to bring any other matter for a vote at the 2005 Annual Meeting, and we do not know of anyone else who intends to do so. However, your proxies will be authorized to vote on your behalf, in their discretion, on other business that properly comes before the 2005 Annual Meeting and for which proxies are permitted to vote.

How do I vote using my proxy card?

Simply sign and date the enclosed proxy card and return it using the enclosed prepaid envelope, or otherwise follow the voting instructions included on each proxy card that you receive.

How do I revoke my proxy?

You may revoke your proxy at any time before your shares are voted at the 2005 Annual Meeting by:

- •

- notifying the Trust's secretary in writing that you are revoking your proxy at: GMH Communities Trust, Attn: Secretary and General Counsel, 10 Campus Boulevard, Newtown Square, PA 19073;

- •

- executing a later dated proxy card; or

- •

- attending and voting by ballot at the 2005 Annual Meeting.

Who will count the votes?

Under our bylaws and Maryland law, the Board may, but need not, appoint one or more persons or entities to serve as inspector(s) of election for the purpose of counting votes at a shareholder meeting. Our Board has delegated the authority to designate an inspector of election to Gary M. Holloway, Sr., our chairman, president and chief executive officer. As of the mailing of this Proxy Statement, Mr. Holloway had not designated an inspector of election for the 2005 Annual Meeting, but he may do so at any time prior to the meeting. Regardless of whether an inspector of election is formally designated prior to the meeting, we expect that representatives of our transfer agent and registrar will assist in the tabulation of affirmative and negative votes and withheld votes and abstentions.

What constitutes a quorum?

As of the Record Date, the Trust had 30,374,551 common shares outstanding. A majority of the outstanding shares entitled to vote at the 2005 Annual Meeting on any matter, present or represented by proxy, will constitute a quorum for the meeting. If you sign and return your proxy card, your shares will be counted in determining the presence of a quorum, even if you withhold your vote. If a quorum is not present at the meeting, the shareholders present in person or by proxy may adjourn the meeting to a date not more than 120 days after the Record Date, until a quorum is present.

Can limited partners in the Trust's operating partnership ("OP") vote their units of limited partnership interest in the OP ("OP units")?

No. Only common shareholders of record at the close of business on the Record Date may vote at the 2005 Annual Meeting. Holders of OP units are not shareholders of the Trust, and therefore may not vote their OP units at meetings of our shareholders. The holders of OP units, other than the Trust, have redemption rights that enable them to redeem their OP units for common shares of the Trust on a one-for-one basis, generally after a one-year holding period. A holder of OP units would have had to

2

redeem OP units into common shares prior to the Record Date in order to vote such common shares at the 2005 Annual Meeting. As of the Record Date, none of the 30,264,678 OP units then outstanding, and not held by the Trust, had been redeemed for common shares of the Trust.

How may my vote be cast and what vote is required for the election of trustees?

With respect to the election of trustees, votes may be cast in favor of or withheld from one or all nominees. Votes that are withheld will not be included in the vote. Trustees are elected by a plurality, and therefore the eight nominees receiving the most votes "for" election will be elected as trustees. Some of our shareholders will not vote, so the shareholders who do vote influence the outcome of the election in greater proportion than their percentage ownership of the Trust.

For the election of trustees, withheld votes do not affect whether a nominee has received sufficient votes to be elected. Shares held by brokers that do not have discretionary authority to vote on a particular matter and that have not received voting instructions from their customers (commonly referred to as "broker non-votes") are not counted or deemed to be present or represented for the purpose of determining whether shareholders have approved that matter, but they are counted as present for the purpose of determining the existence of a quorum at the meeting. Banks and brokers that have not received voting instructions from their clients cannot vote on their clients' behalf on "non-routine" proposals, but may vote their clients' shares on the election of trustees. Since the election of trustees is considered a routine matter for which brokers have the discretionary authority to vote for beneficial owners who have not otherwise provided voting instructions, broker non-votes will not exist with respect to the proposal for election of trustees.

What vote is required on other matters?

The Trust is unaware of any other matters to be brought before the 2005 Annual Meeting. To the extent that such other matters are properly brought before the meeting, however, a majority of the votes cast at a meeting of shareholders is required to approve any other matter, unless a greater vote is required by law or by our Articles of Amendment and Restatement of Declaration of Trust ("Declaration of Trust"). The treatment of broker non-votes and abstentions with respect to such other matters will depend upon the vote required to approve the matter, but in all cases will be considered present for the purpose of determining the presence of a quorum.

Who is soliciting my proxy, how is it being solicited and who pays the cost?

The Board is soliciting your proxy. The solicitation process is being conducted primarily by mail. However, proxies may also be solicited in person, by telephone or facsimile. Georgeson Shareholder, our proxy solicitor, is assisting us with respect to the coordination of mailing of the proxy statements to brokers and other custodians, nominees and fiduciaries for a fee of approximately $2,000, plus out-of-pocket expenses. The Trust pays the cost of soliciting proxies and also reimburses brokers and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation material to the owners of common shares.

What percentage of our common shares do current trustees and executive officers of the Trust own?

Our trustees and executive officers beneficially owned in the aggregate approximately 1.2% of our common shares, excluding OP units, as of the Record Date. (See the section of this Proxy Statement titled "Share Ownership of our Trustees, Executive Officers and 5% Beneficial Owners" for more details.)

When are shareholder proposals and trustee nominations for our 2006 Annual Meeting of Shareholders due?

In accordance with our bylaws, notice relating to nominations for trustees or proposed business to be considered at the 2006 Annual Meeting of Shareholders must be given no earlier than November 30, 2005, and no later than December 30, 2005. These requirements do not affect the

3

deadline for submitting shareholder proposals for inclusion in the proxy statement for the 2006 Annual Meeting (discussed in the question and answer below), nor do they apply to questions a shareholder may wish to ask at the 2005 Annual Meeting. In accordance with our bylaws, a shareholder's notice must set forth:

- •

- as to each individual whom the shareholder proposes to nominate for election or reelection as a trustee (A) the name, age, business address and residence address of such individual, (B) the class, series and number of any shares of the Trust that are beneficially owned by such individual, (C) the date such shares were acquired and the investment intent of such acquisition and (D) all other information relating to such individual that is required to be disclosed in solicitations of proxies for election of trustees in an election contest (even if an election contest is not involved), or is otherwise required to be included in proxy statements in accordance with the rules and regulations of the Securities and Exchange Commission ("SEC") (including such individual's written consent to being named in the proxy statement as a nominee and to serving as a Trustee if elected);

- •

- as to any other business that the shareholder proposes to bring before the meeting, a description of such business, the reasons for proposing such business at the meeting and any material interest in such business of such shareholder and any Shareholder Associated Person, individually or in the aggregate, including any anticipated benefit to the shareholder or the Shareholder Associated Person therefrom. The term "Shareholder Associated Person" means (i) any person controlling, directly or indirectly, or acting in concert with, a shareholder, or (ii) any beneficial owner of common shares;

- •

- as to the shareholder giving the notice and any Shareholder Associated Person, the class, series and number of all shares of the Trust owned by such shareholder and by such Shareholder Associated Person, if any, and the nominee holder for, and number of, shares owned beneficially but not of record by such shareholder and by such Shareholder Associated Person;

- •

- as to the shareholder giving the notice and any Shareholder Associated Person, the name and address of such shareholder and Shareholder Associated Person, as they appear on the Trust's share ledger, if different, their current names and addresses; and

- •

- to the extent known by the shareholder giving the notice, the name and address of any other shareholder supporting the nominee for election or reelection as a trustee or the proposal of other business on the date of such shareholder's notice.

When are shareholder proposals intended to be included in the proxy statement for the 2006 Annual Meeting of Shareholders due?

Shareholders who wish to include proposals in the proxy statement must submit such proposals in accordance with regulations adopted by the SEC. Shareholder proposals for the 2006 Annual Meeting must be submitted in writing by December 30, 2005 to GMH Communities Trust, Attn: Secretary and General Counsel, 10 Campus Boulevard, Newtown Square, PA 19073.

However, if the date of the 2006 Annual Meeting changes by more than 30 days from the date of the 2005 Annual Meeting, the deadline for shareholder proposals to be included in the Proxy Statement is a reasonable time before the Trust begins to print and mail its proxy materials. You should submit any proposal by a method that permits you to prove the date of delivery to us.

How can shareholders communicate with the Board, including non-employee Trustees?

Shareholders may communicate with the full Board, the chairman or the non-employee trustees by writing to such trustees care of GMH Communities Trust, Attn: Secretary and General Counsel, 10 Campus Boulevard, Newtown Square, PA 19073. The secretary and general counsel will review all correspondence for any inappropriate correspondence and correspondence more suitably directed to management. The secretary and general counsel will then summarize and provide to the Board all

4

correspondence not otherwise forwarded to the Board, and forward any appropriate correspondence to the entire Board, the chairman or the non-employee trustees, as the case may be, as requested in such correspondence. In addition, shareholders, employees of the Trust and third parties may submit complaints regarding accounting and auditing matters, which complaints will be reviewed by or under the direction of our Audit Committee, by following the complaint procedures posted on the Corporate Governance section of the "Investor Relations" page of our web site at www.gmhcommunities.com. References to our web site in this Proxy Statement are intended to be inactive textual references only.

PROPOSAL 1—ELECTION OF TRUSTEES

The Trust's Declaration of Trust provides that trustees will be elected at each annual meeting of shareholders of the Trust. The Board consists of such number of trustees as is from time to time set by resolution adopted by the Board as provided in the Trust's bylaws. The Board currently is authorized to have up to eight members.

The Board recommends to the shareholders the election of the following eight designated nominees for election at the 2005 Annual Meeting, to serve as trustees until the Annual Meeting of Shareholders to be held in 2006 and the election and qualification of the trustee's respective successor or until the trustee's earlier death, removal or resignation:

| Gary M. Holloway, Sr. | Steven J. Kessler | |

| Bruce F. Robinson | Denis J. Nayden | |

| Frederick F. Buchholz | Dennis J. O'Leary | |

| RADM James W. Eastwood (Ret) | Richard A. Silfen |

All nominees are currently trustees who have consented to be named, and have agreed to serve if elected. If this should not be the case, however, the proxies may be voted for a substitute nominee to be designated by the Board, or, as an alternative, the Board may reduce the number of trustees to be elected at the 2005 Annual Meeting or leave the position(s) vacant.

In addition to the eight trustees to be elected at the 2005 Annual Meeting, Vornado Realty L.P. ("Vornado"), the operating partnership of Vornado Realty Trust, has the right to designate an additional trustee to our Board pursuant to the terms of a warrant that we and our operating partnership issued prior to the Trust's initial public offering in November 2004 ("IPO"). A more detailed description of this nomination right is included in the section of this Proxy Statement titled "Corporate Governance—Trustee Nomination Process" below. In the event that Vornado elects to exercise this right at any time after the printing of this Proxy Statement, the Trust anticipates that the Board will increase the number of trustees from eight to nine members, and will appoint the Vornado designee to fill the vacancy created by such increase. Proxies submitted by shareholders with respect to the 2005 Annual Meeting, however, will not be entitled to vote on the election of Vornado's designee at the 2005 Annual Meeting.

Biographical information concerning each nominee for election as trustee is set forth below under the heading "Board of Trustees."

The Board unanimously recommends a vote FOR each of the nominees named in Proposal 1—Election of Trustees.

5

Our Board currently consists of eight members. We have provided below information regarding our current trustees, each of whom is nominated for election at the 2005 Annual Meeting.

| Name | Age | Title | ||

|---|---|---|---|---|

| Gary M. Holloway, Sr.(1) | 49 | President, Chief Executive Officer and Chairman of the Board | ||

| Bruce F. Robinson(1) | 49 | President of Military Housing Business and Trustee | ||

| Frederick F. Buchholz | 59 | Trustee | ||

| RADM James W. Eastwood (Ret) | 59 | Trustee | ||

| Steven J. Kessler | 62 | Trustee | ||

| Denis J. Nayden | 51 | Trustee | ||

| Dennis J. O'Leary(1) | 57 | Trustee | ||

| Richard A. Silfen | 42 | Trustee |

- (1)

- Gary M. Holloway, Sr. designated each of these individuals for nomination to our Board pursuant to his right to nominate up to three trustees under the terms of his employment agreement. See the section below titled "Corporate Governance—Trustee Nomination Process" for a more detailed discussion of Mr. Holloway's nomination rights.

Messrs. Holloway and Robinson have served as trustees since the initial formation of the Trust in May 2004. The other trustees have served as trustees since October 28, 2004, the date on which the Trust's common shares were first publicly traded.

Gary M. Holloway, Sr. is our chairman, president and chief executive officer. Since 1985 and prior to our initial public offering, Mr. Holloway founded and operated GMH Associates, our predecessor entities and other affiliated entities, as a fully integrated and diverse real estate company with divisions specializing in the student and military housing industries, as well as the commercial real estate and investment services sectors. Under Mr. Holloway's direction, GMH Associates has acquired, built, managed and expanded residential and commercial properties throughout the U.S. since its inception. Prior to the formation of GMH Associates, Mr. Holloway was involved in various aspects of the real estate industry. He served as chief financial officer for the Holloway Corporation, a closely held business that specialized in residential and senior housing developments, and began his career with Touche Ross & Co., Certified Public Accountants, where he provided accounting and tax services to real estate clients.

Bruce F. Robinson is president of our military housing division, GMH Military Housing, a military housing company which provides development, management, and construction/renovation services for family housing located on military bases throughout the United States. In addition, he manages our military joint venture and partner relationships. Prior to joining the military division, Mr. Robinson directed GMH Capital Partners, LP, an international corporate real estate company. During his tenure at the firm, which began in 1986, he has been a key participant in the formation and operation of all entity structures as well as financing issues, due diligence and global planning. Prior to joining GMH Associates, he was a senior tax manager for Touche Ross & Co., Certified Public Accountants, where he specialized in real estate syndication, partnerships and corporate acquisitions.

Frederick F. Buchholz worked with Lend Lease Real Estate investments or its predecessors from 1968 until retiring in June 1998. Since his retirement, Mr. Buchholz has served as an independent real estate consultant. He was appointed senior vice president of Equitable Real Estate in December 1990 and executive vice president in 1992. Prior to his retirement, Mr. Buchholz was the officer in charge of

6

the Lend Lease Philadelphia region, supervising new business, asset management and restructuring/workout activities on behalf of a total mortgage and equity portfolio exceeding $2.5 billion. At various times, Mr. Buchholz was also the officer in charge of Equitable Real Estate's New York and Washington, D.C. regional offices. Mr. Buchholz is a member of the board of trustees of Liberty Property Trust, and is a member of the Appraisal Institute and the Investment Review Committee of the Delaware Valley Real Estate Investment Fund, L.P.

RADM James W. Eastwood (Ret) is chairman of Granary Associates, a project management, architectural, interior design and real estate development firm, a position he has held since 1990. Admiral Eastwood became executive vice president of Granary Associates in 1983, served as president from 1990 through 2004, and led the company through extraordinary growth and expansion in the healthcare, public and corporate sectors. He retired from the Naval Reserves in November 2001 as a Two Star Admiral having completed his final tour as Deputy, Vice-Commander, Commander-in-Chief Atlantic Fleet. Admiral Eastwood also serves on the board of directors of First Penn Bank. Admiral Eastwood is an NROTC graduate of Villanova University with a Bachelor of Engineering degree.

Steven J. Kessler has been a senior vice president and the chief financial officer of Resource America, Inc., an asset management company that specializes in real estate, energy, financial services and equipment leasing, since 1997. Since March 2005, Mr. Kessler also has served as chief financial officer and treasurer of Resource Capital Corp., a newly formed specialty finance company that is externally managed by an indirect, wholly-owned subsidiary of Resource America, Inc., and intends to elect and qualify to be treated as a real estate investment trust and to invest in a combination of real estate-related securities and commercial finance assets. In addition, from 2002 to 2004, Mr. Kessler served as the chief financial officer of Atlas Pipeline Partners, L.P. Prior to that, Mr. Kessler was vice president-finance and acquisitions at Kravco Company from March 1994 until 1997. From 1983 through March 1994, Mr. Kessler was chief financial officer and chief operating officer at Strouse Greenberg & Co., Inc., a regional full service real estate company, and vice president-finance and chief accounting officer at its successor, The Rubin Organization. Prior thereto, Mr. Kessler was a partner at Touche Ross & Co., Certified Public Accountants. Mr. Kessler received a Bachelor of Science degree in accounting from Temple University in 1965 and became a certified public accountant in 1967.

Denis J. Nayden is a senior vice president of General Electric Company and the former chairman and chief executive officer of GE Capital Corporation. Mr. Nayden joined GE Capital as marketing administrator for Air/Rail Financing in 1977, and in 1986 joined the Corporate Finance Group as vice president and general manager. In 1987, he was appointed senior vice president and general manager of the Structured Finance Group, and executive vice president of GE Capital in 1989. Mr. Nayden was named president and chief operating officer of GE Capital in 1994, and chairman and chief executive officer of GE Capital in June 2000. Mr. Nayden remains Senior Vice President of GE. Currently, Mr. Nayden serves as Senior Advisor to GE's Financial Services Companies. Additionally, he serves as Senior Advisor and Managing Partner of the Oak Hill Partners, L.P., a private investment group. He also is a Member of Alix Partners Holdings/Questor Partners Holdings Advisory Board. Mr. Nayden received his Bachelor of Arts in English and his MBA in Finance from the University of Connecticut in 1976 and 1977, respectively.

Dennis J. O'Leary has been an independent consultant and a private investor since January 2004, working as a consultant to GMH Communities Trust and its predecessor entities on financial, structuring and compensation matters since March 2004. He was a partner with Ernst & Young LLP during 2002 and 2003, heading up the firm's New York Region—Insurance Tax Practice. From 1985 to 2001, Mr. O'Leary was a senior vice president with Reliance Group Holdings, Inc. where he was responsible for worldwide tax planning. Prior to that time, he was a partner with Touche Ross & Co, Certified Public Accountants. Mr. O'Leary received his Bachelor of Arts in Economics from LaSalle University in 1970 and an MBA in Accounting and Finance from Temple University in 1973. He became a certified public accountant in 1974.

7

Richard A. Silfen has been president and chief financial officer of Cangen Biotechnologies, Inc., a biotechnology company developing diagnostic tests for the early detection of cancer and other technologies designed to enhance the selection of cancer therapeutic regimes, since August 2004. From May 2000 until August 2004, Mr. Silfen was a partner of the law firm of Morgan, Lewis & Bockius LLP. Mr. Silfen has extensive experience counseling real estate investment trusts and other publicly traded companies in connection with capital raising transactions and other securities matters, as well as mergers and acquisitions and other business and financial matters. He is also a member of the National Association of Real Estate Investment Trusts. Prior to May 2000, Mr. Silfen was a partner of the law firm of Wolf, Block, Schorr and Solis-Cohen LLP and was vice chairman of its corporate department. From 1987 through 1990, Mr. Silfen worked in the Securities and Exchange Commission's Division of Corporation Finance. Mr. Silfen received his Bachelor of Arts in Physics from Baylor University in 1983 and his J.D. from the University of Alabama in 1987.

SHARE OWNERSHIP OF OUR TRUSTEES, EXECUTIVE OFFICERS

AND 5% BENEFICIAL OWNERS

The following table sets forth the beneficial ownership of common shares, as of March 31, 2005, by (i) each of our trustees, (ii) each of our executive officers, (iii) all of our trustees and executive officers as a group, and (iv) any shareholders known to us to be the beneficial owner of more than 5% of our common shares (based solely on information provided in Schedule 13D or 13G filings made by such beneficial owners with the SEC). The SEC has defined "beneficial" ownership of a security to mean the possession, directly or indirectly, of voting power and/or investment power. A shareholder is also deemed to be, as of any date, the beneficial owner of all securities that such shareholder has the right to acquire within 60 days after that date through (a) the exercise of any option, warrant or right, (b) the conversion of a security, (c) the power to revoke a trust, discretionary account or similar arrangement, or (d) the automatic termination of a trust, discretionary account or similar arrangement.

Under the terms of the Trust's Declaration of Trust, shareholders generally may not have "beneficial" or "constructive" ownership (as those terms are defined in the Declaration of Trust) of more than 7.1% of the outstanding common shares of the Trust at any time. Common shares indicated as beneficially owned in the following table may not be deemed to be "beneficially" and/or "constructively" owned by the shareholder under the Declaration of Trust. The Declaration of Trust provides that the Board may approve exceptions to this limitation of ownership, provided that the ownership exception would not threaten the Trust's ability to qualify as a real estate investment trust under the Internal Revenue Code of 1986, as amended (the "Code"), and currently provides the following exceptions: (i) Mr. Holloway and persons whose share ownership would be attributed to him under the Declaration of Trust's constructive ownership provisions may own no more than 20% of the outstanding shares of the Trust; (ii) Steven Roth, the chief executive officer of Vornado Realty Trust, and persons whose share ownership would be attributed to him under the Declaration Trust's constructive ownership rules may own no more than 8.5% of the outstanding shares of the Trust, and (iii) Vornado Realty, L.P., Vornado Realty Trust, and designated affiliates or permitted transferees of Vornado Realty, L.P. under the terms of a warrant issued by the Trust, generally have no restriction on

8

ownership levels in the Trust (except that any person who is treated as an "individual" for purposes of the Code may not benefit from this unlimited ownership exception).

| Name of Beneficial Owner | Number of Shares Beneficially Owned | Percentage of Outstanding Common Shares(1) | |||

|---|---|---|---|---|---|

| Trustees and Executive Officers | |||||

Gary M. Holloway, Sr.(2) | 171,550 | (2) | * | ||

| Bruce F. Robinson | — | (3) | * | ||

| Joseph M. Coyle | 10,000 | (3) | * | ||

| John DeRiggi | — | (3) | * | ||

| Bradley W. Harris | 9,430 | * | |||

| Joseph M. Macchione | 1,200 | (3) | * | ||

| Frederick F. Buchholz | 6,927 | (4) | * | ||

| RADM James W. Eastwood (Ret) | 73,927 | (4) | * | ||

| Steven J. Kessler | 3,927 | (4) | * | ||

| Denis J. Nayden | 38,927 | (4) | * | ||

| Dennis J. O'Leary | 51,427 | (4) | * | ||

| Richard A. Silfen | 6,927 | (4) | * | ||

| All trustees and executive officers as a group (12 persons) | 374,242 | 1.2 | % | ||

5% Shareholders | |||||

Cohen & Steers(5) | 4,652,545 | 15.3 | % | ||

| Citigroup(6) | 1,740,390 | 5.7 | % | ||

| Farallon Partners, L.L.C.(7) | 1,884,500 | 6.2 | % | ||

| FMR Corp.(8) | 3,833,600 | 12.6 | % | ||

| Franklin Resources, Inc.(9) | 3,016,830 | 9.9 | % | ||

| Teachers Insurance and Annuity Association of America (TIAA)(10) | 1,984,000 | 6.5 | % | ||

| Vornado Realty Trust(11) | 13,009,080 | 30.0 | % |

- *

- Less than 1%.

- (1)

- Based on 30,374,551 common shares outstanding as of March 31, 2005. Under the terms of the partnership agreement of our operating partnership, OP units generally may be redeemed for cash or common shares after the units have been held for one year from the date such units are issued (unless otherwise agreed to be redeemed earlier at the discretion of the general partner of our operating partnership). The OP units beneficially owned by Vornado Realty Trust as of March 31, 2004 are redeemable for common shares beginning six months after issuance (See Footnote 11 below).

- (2)

- The address for Mr. Holloway is c/o GMH Communities Trust, 10 Campus Boulevard, Newtown Square, PA 19073. The number of common shares shown as beneficially owned by Mr. Holloway includes 11,550 common shares beneficially owned by Mr. Holloway's wife, but does not include common shares issuable upon redemption of 16,988,830 OP units that were beneficially owned by Mr. Holloway as of March 31, 2005. Under the terms of the partnership agreement of our operating partnership, Mr. Holloway may require that his OP units be redeemed for common shares rather than cash; provided, however, that he is limited to redeeming such units for a number of common shares equal to no more than 20% of the outstanding common shares at the time of such redemption.

- (3)

- The number of common shares shown as beneficially owned does not include common shares issuable upon redemption of the following OP units beneficially owned as of March 31, 2005:

9

Bruce F. Robinson—1,010,305 units; Joseph M. Coyle (held through a wholly owned corporation, Joseph M. Coyle Enterprises, Inc.)—422,768 units; John DeRiggi—251,250 units; Joseph M. Macchione—62,500 units. All of the OP units held by Messrs. Robinson, Coyle, DeRiggi and Macchione had been held for less than one year as of March 31, 2005 (See Footnote 1), and therefore were not redeemable for common shares within 60 days.

- (4)

- Number of shares presented includes 3,927 restricted common shares issued to each of the non-employee trustees under the Trust's Equity Incentive Plan. Mr. Silfen possesses shared voting and dispositive power with his spouse over 3,000 of the common shares reported as beneficially owned by him.

- (5)

- Based upon information contained in a Schedule 13G filed with the SEC reporting beneficial ownership as of February 28, 2005. The Schedule 13G was filed jointly by Cohen & Steers, Inc. and Cohen & Steers Capital Management, Inc. The address of the reporting persons is 757 Third Avenue, New York, New York 10017. Cohen and Steers, Inc. and Cohen & Steers Capital Management, Inc. possessed sole voting power over 4,504,945 shares and sole dispositive power over 4,652,545 shares.

- (6)

- Based upon information contained in a Schedule 13G filed with the SEC reporting beneficial ownership as of December 31, 2004. The Schedule 13G was filed jointly by Citigroup Global Markets Holdings Inc. ("CGM Holdings") and Citigroup Inc. ("Citigroup"). The address of CGM Holdings is 388 Greenwich Street, New York, NY 10013 and the address of Citigroup is 399 Park Avenue, New York, NY 10043. The reporting persons possessed shared voting and dispositive power over the shares reported.

- (7)

- Based upon information contained in a Schedule 13G filed with the SEC reporting beneficial ownership as of February 11, 2005. The Schedule 13G was filed jointly by Farallon Capital Partners, L.P., Farallon Capital Institutional Partners, L.P., Farallon Capital Institutional Partners II, L.P., Farallon Capital Institutional Partners III, L.P., Tinicum Partners, L.P., Farallon Partners, L.L.C., David I. Cohen, Chun R. Ding ("Ding"), Joseph F. Downes ("Downes"), William F. Duhamel ("Duhamel"), Charles E. Ellwein ("Ellwein"), Richard B. Fried ("Fried"), Monica R. Landry ("Landry"), William F. Mellin ("Mellin"), Stephen L. Millham ("Millham"), Rajiv A. Patel ("Patel"), Derek C. Schrier ("Schrier"), Thomas F. Steyer ("Steyer") and Mark C. Wehrly ("Wehrly"). The address of the reporting persons, except for David I. Cohen, is c/o Farallon Capital Management, L.L.C., One Maritime Plaza, Suite 1325, San Francisco, California 94111. Farallon Capital Partners, L.P. possessed shared voting and dispositive power over 950,800 shares; Farallon Capital Institutional Partners, L.P. possessed shared voting and dispositive power over 747,300 shares; Farallon Capital Institutional Partners II, L.P. possessed shared voting and dispositive power over 79,600 shares; Farallon Capital Institutional Partners III, L.P. possessed shared voting and dispositive power over 80,100 shares; Tinicum Partners, L.P. possessed shared voting and dispositive power over 26,700 shares; and Farallon Partners, L.L.C., Ding, Downes, Duhamel, Ellwein, Fried, Landry, Mellin, Millham, Patel, Schrier, Steyer and Wehrly each possessed shared voting and dispositive power over 1,884,500 shares.

- (8)

- Based upon information contained in a Schedule 13G filed with the SEC reporting beneficial ownership as of February 14, 2005. The Schedule 13G was filed jointly by FMR Corp., Edward C. Johnson 3d and Abigail P. Johnson. The address of the reporting person is 82 Devonshire Street, Boston, Massachusetts 02109. FMR Corp. possessed sole voting power over 231,500 shares and sole dispositive power over 2,348,500 shares and each of Edward C. Johnson 3d and Abigail P. Johnson possessed sole dispositive power over 2,348,500 shares.

- (9)

- Based upon information contained in a Schedule 13G filed with the SEC reporting beneficial ownership as of December 31, 2004. The address of the reporting persons is One Franklin Parkway, San Mateo, CA 94403. The Schedule 13G was filed jointly by Franklin Resources, Inc.,

10

Charles B. Johnson, Rupert H. Johnson, Jr. and Franklin Advisers, Inc. Franklin Advisers, Inc. possessed sole voting and dispositive power over 3,000,000 shares, Franklin Templeton Portfolio Advisers, Inc. possessed sole voting and dispositive power over 16,830 shares, and Franklin Resources, Inc., Charles B. Johnson and Rupert H. Johnson, Jr. did not possess sole voting or dispositive power over any shares.

- (10)

- Based upon information contained in a Schedule 13G filed with the SEC reporting beneficial ownership as of December 31, 2004. The Schedule 13G was filed jointly by Teachers Insurance and Annuity Association of America ("TIAA"), Teachers Advisors, Inc. ("Advisors") and TIAA-CREF Investment Management, LLC ("Investment Management"). The address of the reporting persons is 730 Third Avenue, New York, NY 10017. TIAA possessed sole voting and dispositive power over 912,000 shares and shared voting and dispositive power over 1,072,000 shares; Advisors possessed shared voting and dispositive power over 930,000 shares; and Investment Management possessed shared voting and dispositive power over 142,000 shares.

- (11)

- The number of common shares shown includes: (i) 6,666,667 OP units issued upon exercise of a warrant held by Vornado Realty L.P., (ii) 671,190 OP units issued to Vornado CCA Gainesville, L.L.C., an affiliate of Vornado Realty Trust, and (iii) up to 5,671,223 common shares and/or OP units issuable upon exercise of a warrant held by Vornado Realty L.P. The address of Vornado Realty Trust is 888 Seventh Avenue, New York, NY 10019. The Trust has agreed, through its general partner, to permit Vornado Realty, L.P. and Vornado CCA Gainesville, L.L.C. to redeem their OP units beginning on April 28, 2005 (the six month anniversary of the Trust's IPO).

11

Our business is managed through the oversight and direction of our Board. The Board has adopted and adheres to corporate governance practices that it and senior management believe promote the highest standards of integrity and represent current best practices. The Board periodically reviews these governance practices, the rules and listing standards of the New York Stock Exchange ("NYSE") and regulations of the SEC, as well as best practices suggested by recognized governance authorities and recommended by the Nominating and Corporate Governance Committee of the Board.

We maintain a corporate governance link on the "Investor Relations" section of our web site, which includes key information about our corporate governance initiatives. Each of the following corporate governance documents can be found under the Corporate Governance section of the "Investor Relations" page of our web site atwww.gmhcommunities.com, and are available free of charge to any shareholder upon request in writing to Attn: Investor Relations, GMH Communities Trust, 10 Campus Boulevard, Newtown Square, PA 19073: Code of Business Conduct and Ethics, Corporate Governance Guidelines, Code of Ethics for Chief Executive Officer and Senior Financial Employees, description of procedures for the submission of complaints regarding accounting and auditing matters, and charters of our Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee. Our Declaration of Trust and bylaws have been filed as exhibits to our Registration Statement on Form S-11 (333-116343) and are available at the SEC's web site at www.sec.gov.

Independent Trustees. Our Board currently consists of eight members, five of whom our Board has determined are "independent," with independence being defined in the manner established by our Board and in a manner consistent with corporate governance rules established by the NYSE; two of whom are executive officers (Messrs. Holloway and Robinson); and one of whom is a non-management trustee, but is not considered independent because he was nominated by Mr. Holloway pursuant to a right to nominate three trustees under the terms of Mr. Holloway's employment agreement (see "—Trustee Nomination Process" below). Our Board has adopted categorical standards, which are contained in our Corporate Governance Guidelines and conform to the independence standards established by the NYSE, to assist it in making determinations of independence. Our Corporate Governance Guidelines require that at all times a majority of the members of our Board be independent.

Trustee Nomination Process. All nominees for election as trustee are approved by our Nominating and Corporate Governance Committee. The committee will consider nominations properly submitted by shareholders as described above under the section titled "General Questions and Answers About the Meeting—When are shareholder proposals and trustee nominations for our 2006 Annual Meeting of Shareholders due?" The Trust's Corporate Governance Guidelines indicate that the Board as a whole should collectively possess a broad range of skills, expertise, industry and other knowledge, and business and other experience useful to the effective oversight of the Trust's business.

Gary M. Holloway, Sr., so long as he is our chief executive officer, has the right to designate for nomination a certain number of trustees to the Board based on the following percentages of outstanding common shares owned by him and his affiliates on a fully-diluted basis, assuming the conversion of all outstanding OP units, other than OP units held by the Trust:

- •

- three trustees, including himself, to the extent he owns at least 20%;

- •

- two trustees, including himself, to the extent he owns at least 10% but less than 20%; and

- •

- himself, to the extent he owns less than 10%.

None of the members of our Board designated for nomination by Mr. Holloway is or will be considered independent. These nominations must be submitted to and approved by our Nominating

12

and Corporate Governance Committee, and satisfy the standards established by that committee for membership on our Board.

In addition, under the terms of a warrant that we and our operating partnership issued to Vornado in connection with the formation transactions relating to our IPO, Vornado, or its permitted assignee(s), also has the right, but not the obligation, to appoint to our Board Michael D. Fascitelli, the president of Vornado Realty Trust, or another officer of Vornado Realty Trust who is reasonably acceptable to us, so long as the holder of the warrant holds common shares or OP units acquired at an aggregate price of not less than $10 million. This nominee may serve for so long as he desires to serve and the holder of the warrant owns common shares or OP units acquired at an aggregate price of not less than $10 million. As of the date of printing of this Proxy Statement, Vornado had not exercised its right to appoint Mr. Fascitelli or any other officer of Vornado to the Board. Our Board, however, upon recommendation of the Nominating and Corporate Governance Committee, has considered the possible appointment of Mr. Fascitelli by Vornado in the future, and has approved of Mr. Fascitelli's appointment to the Board to the extent that Vornado elects to exercise its right.

Meetings. Since completion of our IPO in November 2004, the Board met one time during 2004 in December. In addition, our Audit Committee met four times in December 2004, and our Compensation Committee and Nominating and Corporate Governance Committee each met one time in December 2004. Each of the then current trustees attended the Board meeting and all of the meetings of the committees on which he served in 2004. The trustees are regularly kept informed about our business at meetings of the Board and its committees and through supplemental reports and communications. Under the terms of our Corporate Governance Guidelines, our non-employee trustees are required to meet regularly in executive sessions, without the presence of management of the Trust; and at least one time per year, only our independent trustees may be present. At each regularly scheduled meeting of the non-employee trustees, one of the non-employee trustees assumes the role of the presiding trustee for that meeting. Our non-employee trustees are required to devote as much time to our affairs as their duties require. Our full Board generally meets quarterly or more frequently if necessary.

Trustees are strongly encouraged, but not required, to attend our annual meetings of shareholders. All members of our Board are expected to attend the 2005 Annual Meeting. The 2005 Annual Meeting will be the first annual meeting of shareholders following our IPO.

Code of Business Conduct and Ethics. We have adopted a Code of Business Conduct and Ethics in accordance with the corporate governance rules of the NYSE. The code contains a policy that prohibits conflicts of interest between our officers, employees and trustees on the one hand, and the Trust on the other hand, except where our Audit Committee approves of the transaction involving the potential conflict. Our conflicts of interest policy states that a conflict of interest exists when a person's private interest is not aligned or appears to be not aligned, or interferes or appears to interfere, in any way with the Trust's interest. For example, our conflicts of interest policy prohibits our officers, employees and trustees from entering into agreements, transactions or business relationships, or otherwise taking actions, that involve conflicts of interest, other than such agreements, transactions or business relationships or other actions that are (i) otherwise contemplated in the prospectus relating to our IPO, or (ii) approved in advance by our Audit Committee. Except as otherwise permitted as described in the foregoing sentence, the Trust is prohibited from, among other things, engaging in the following activities:

- •

- acquiring any assets or other property from, or selling any assets or other property to, any of our trustees, officers or employees, any of their immediate family members or any entity in which any of our trustees, officers or employees or any of their immediate family members has an interest of 5% or more;

13

- •

- making any loan to, or borrowing from, any of our trustees, officers or employees, any of their immediate family members or any entity in which any of our trustees, officers or employees or any of their immediate family members has an interest of 5% or more;

- •

- engaging in any other transaction with any of our trustees, officers or employees, any of their immediate family members or any entity in which any of our trustees, officers or employees or their immediate family members has an interest of 5% or more; or

- •

- permitting any of our trustees or officers to make recommendations regarding or to approve compensation decisions that will personally benefit such trustees or officers or their immediate family members whom we employ, other than customary compensation for service on our Board and its committees.

A copy of this code may be viewed on the Corporate Governance section of the "Investor Relations" page on our web site atwww.gmhcommunities.com.

Code of Ethics for Chief Executive Officer and Senior Financial Employees. We have adopted a Code of Ethics for Chief Executive Officer and Senior Financial Employees that applies to our principal executive officer, principal financial officer, principal accounting officer or controller and persons performing similar functions. A copy of this code may be viewed on the Corporate Governance section of the "Investor Relations" page on our web site at www.gmhcommunities.com. To the extent permitted by the corporate governance rules of the NYSE, we intend to satisfy the disclosure requirement under Item 10 of Form 8-K regarding the amendment to, or waiver of, a provision of the code by posting such information under the Corporate Governance section of the "Investor Relations" page on our web site at www.gmhcommunities.com.

BOARD COMMITTEES AND TRUSTEE COMPENSATION

The Board has established three standing committees the principal functions of which are briefly described below.

Audit Committee. Our Audit Committee is comprised of three independent trustees, Messrs. Eastwood, Kessler and Silfen. The Audit Committee has been established as a separately-designated standing committee of the Board in accordance with section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended. Each of the members of the Audit Committee meets the financial literacy requirements of the NYSE, and our Board has affirmatively determined that Mr. Kessler is an "audit committee financial expert" and is independent as defined under the Trust's Corporate Governance Guidelines and consistent with the listing standards of the NYSE. Mr. Kessler serves as the chairperson of the Audit Committee. In accordance with the terms of the Audit Committee formal charter, the Audit Committee oversees, reviews and evaluates:

- •

- our financial statements;

- •

- our accounting and financial reporting processes;

- •

- the integrity and audits of our financial statements;

- •

- our disclosure controls and procedures;

- •

- our internal control functions;

- •

- our compliance with legal and regulatory requirements;

- •

- the qualifications and independence of our independent registered public accounting firm; and

- •

- the performance of our internal and independent auditors.

14

The Audit Committee also:

- •

- has sole authority to appoint, compensate, oversee, retain or replace our independent registered public accounting firm;

- •

- has sole authority to approve in advance all audit and permissible non-audit services, if any, by our independent registered public accounting firm and the fees to be paid in connection therewith;

- •

- is responsible for establishing and maintaining whistleblower procedures;

- •

- will conduct an annual self-evaluation;

- •

- prepares an Audit Committee report for publication in our annual proxy statement;

- •

- monitors compliance of our employees with our standards of business conduct and conflict of interest policies; and

- •

- will meet at least quarterly with our senior executive officers, internal audit staff and our independent registered public accounting firm in separate executive sessions.

Our Board has adopted a written charter for the Audit Committee that sets forth its specific functions and responsibilities. A copy of this charter may be viewed under the Corporate Governance section of the "Investor Relations" page on our web site atwww.gmhcommunities.com. A copy of the Audit Committee charter is also attached as Appendix A to this Proxy Statement.

Compensation Committee. Our Board has established a Compensation Committee, which is comprised of three independent trustees, Messrs. Buchholz, Eastwood and Nayden. Admiral Eastwood serves as the chairperson of the Compensation Committee. Under the terms of the written charter of the Compensation Committee, the principal responsibilities of the committee are to:

- •

- approve and evaluate the trustee and executive officer compensation plans, policies and programs of the Trust;

- •

- review and approve the compensation and benefits for our executive officers and other key employees;

- •

- make recommendations to the Board with respect to non-CEO executive officer compensation, and incentive compensation and equity-based plans that are subject to Board approval;

- •

- review and approve annually, for the CEO and other executive officers, (i) annual base salary, (ii) annual incentive opportunity level; (iii) long-term incentive opportunity level; (iv) employment, severance and change-in-control agreements and provisions, and (v) any special or supplemental benefits;

- •

- prepare an executive compensation report for publication in our annual proxy statement; and

- •

- conduct an annual self-evaluation.

The Compensation Committee also has responsibility for reviewing and approving corporate goals and objectives relevant to the chief executive officer's compensation, evaluating the chief executive officer's performance in light of those goals and objectives, and establishing the chief executive officer's compensation levels based on its evaluation. The Compensation Committee has the authority to retain and terminate any compensation consultant to be used to assist in the evaluation of the compensation of the chief executive officer or any other executive officer. The Compensation Committee charter currently delegates authority to approve trustee compensation to the Compensation Committee. In February 2005, our Board, upon recommendation of the Compensation Committee and the Nominating

15

and Corporation Governance Committee, approved the delegation of authority regarding approval of trustee fees to the Nominating and Corporate Governance Committee (pending formal adoption of amended charters for these committees). Our Board has adopted a written charter for the Compensation Committee that sets forth its specific functions and responsibilities. A copy of this charter may be viewed under the Corporate Governance section of the "Investor Relations" page on our web site at www.gmhcommunities.com.

Nominating and Corporate Governance Committee. Our Board has established a Nominating and Corporate Governance Committee, which is comprised of three independent trustees, Messrs. Buchholz, Kessler and Silfen. Mr. Silfen serves as the chairperson of this committee. The Nominating and Corporate Governance Committee is responsible for, among other things, identifying, recruiting, evaluating and nominating qualified individuals to become trustees, recommending the composition of committees of our Board, developing our corporate governance guidelines and policies, developing processes regarding the consideration of trustee candidates recommended by shareholders and shareholder communications with our Board and conducting an annual self-evaluation and assisting our Board and our other Board committees in the conduct of their annual self-evaluations. In addition, our Board has approved the delegation of authority regarding approval of trustee compensation to the Nominating and Corporate Governance Committee. Accordingly, we expect that the Board will approve formal amendments to the Compensation Committee and Nominating and Corporate Governance Committee charters, and that the Nominating and Corporate Governance Committee will consider and approve trustee fees in the future.

The Nominating and Corporate Governance Committee will consider appropriate trustee nominees whose names are submitted in writing by a shareholder in accordance with the procedures described above under the section titled "General Questions and Answers About the Meeting—When are shareholder proposals and trustee nominations for our 2006 Annual Meeting of Shareholders due?" In addition, the Nominating and Corporate Governance Committee will consider trustee nominees from other reasonable sources, including current Board members or other persons. The Nominating and Corporate Governance Committee has the ability to retain a third party to assist in the nomination process, but did not engage any third parties in connection with determining the trustee nominees for the 2005 Annual Meeting. All nominees at the 2005 Annual Meeting currently serve as trustees.

Our Board has adopted a written charter for the Nominating and Corporate Governance Committee that sets forth its specific functions and responsibilities. A copy of this charter may be viewed under the Corporate Governance section of the "Investor Relations" page on our web site atwww.gmhcommunities.com.

Trustee Compensation. As compensation for serving on our Board, each of our non-employee trustees receives an annual fee of $40,000, of which $20,000 is paid in the form of restricted shares and $20,000 is paid in cash. In addition, non-employee trustees receive $1,000 for each Board or committee meeting attended in person and $500 for each Board or committee meeting attended telephonically. Committee chairmen receive an additional annual fee with the lead independent trustee receiving an additional $5,000 per year, the Audit Committee chairman receiving an additional $7,500 per year, and the Compensation Committee chairman and the Nominating and Corporate Governance Committee chairman each receiving an additional $5,000 per year. Trustees who are also officers or employees of our company do not receive additional compensation as trustees. In addition, we reimburse our trustees for their reasonable out-of-pocket expenses incurred in attending Board and committee meetings. Upon joining our Board, each non-employee trustee receives 3,500 restricted common shares that vest in three equal annual installments. Our Board may change the compensation of our non-employee trustees in its discretion, and has delegated this authority to the Nominating and Corporate Governance Committee.

16

On January 5, 2005 (the date on which the shares authorized for issuance under our Equity Incentive Plan were registered with the SEC), each of our non-employee trustees, Messrs. Buchholz, Eastwood, Kessler, Nayden, O'Leary and Silfen, was granted 3,500 restricted common shares in consideration of their joining the Board. These restricted shares vest in three equal annual installments, are considered outstanding common shares for purposes of voting along with our common shareholders, and receive dividend-equivalent cash payments along with our common shareholders. With regard to the pro-rated portion of the $20,000 annual fee payable to non-employee trustees, for the period from October 28, 2004 (the initial appointment date to our board) to December 31, 2004, our Compensation Committee approved of an all cash payment in lieu of distribution of restricted common shares to our non-employee trustees. In February 2005, the Compensation Committee approved the payment of the annual fee to non-employee trustees on a quarterly pro-rata basis, including the quarterly issuance of restricted common shares based on the closing price of our common shares as reported on the NYSE as of the last trading day of the fiscal quarter. Our Board has approved, upon recommendation of both the Compensation Committee and the Nominating and Corporate Governance Committee, the movement of the delegation of authority to approve trustee compensation from the Compensation Committee to the Nominating and Corporate Governance Committee. Accordingly, we anticipate that any modifications to trustee compensation in the future will be approved by the Nominating and Corporate Governance Committee.

REPORT OF THE COMPENSATION COMMITTEE

The Compensation Committee currently is composed of three independent trustees, Messrs. Eastwood (Chairman), Buchholz and Nayden. The Compensation Committee regularly reviews and approves executive officer compensation levels and policies. Prior to completion of the Trust's IPO in November 2004, the Trust had no operations and, therefore, did not have a Compensation Committee or make payments to its executive officers. In connection with the Trust's IPO, the Trust entered into employment agreements with its top three executive officers, Messrs. Holloway, Robinson and Coyle. Set forth below is a discussion of the compensation philosophy utilized to design appropriate forms of compensation under these employment agreements, as well as with respect to other executive officers who do not have employment agreements.

Compensation Philosophy

The Compensation Committee believes that a well-designed compensation program should align the goals of the shareholders with the goals of the executive, and that a significant part of an executive's compensation, over the long term, should be dependent upon the value created for shareholders. Executives should be held accountable through their compensation for the performance of the Trust, and compensation levels also should reflect the executive's individual performance in an effort to encourage individual contributions to the Trust's performance. The compensation philosophy is designed to motivate executives to focus on operating results and create long-term shareholder value by:

- •

- establishing a plan that attracts, retains and motivates executives through compensation that is competitive with a peer group of other publicly-traded real estate investment trusts ("REITs");

- •

- linking a portion of the executives' compensation to the achievement of the Trust's business plan by using measurements of the Trust's operating results and shareholder return; and

- •

- building a pay-for-performance system that encourages and rewards successful initiatives within a team environment.

The Compensation Committee believes that each of the above factors is important when determining compensation levels. In connection with the Trust's IPO in 2004, the Trust engaged an independent consulting firm in determining the appropriate salaries, bonuses and other material terms

17

of the employment agreements with Messrs. Holloway, Robinson and Coyle, and also heavily negotiated the agreements with each of the executives and the managing underwriters for the Trust's IPO. All executive employment agreements were effective as of November 2, 2004, the closing date of the IPO. A description of the employment agreements is set forth below under the section of this Proxy Statement titled "Executive Compensation—Employment Agreements." The independent compensation consultant also prepared reports for, and submitted recommendations to, the Compensation Committee with respect to the Trust's executive officers and other key employees who do not have employment agreements.

Types of Compensation

The executive compensation policies adopted by the Compensation Committee will be structured to provide short- and long-term incentives for executive performance that promote continuing improvements in the Trust's financial results and returns to shareholders. The elements of the Trust's executive compensation are primarily comprised of the following, with all three elements designed to complement each other in satisfying the ultimate goal of creating long-term shareholder value:

- •

- Base salaries. Base salaries are paid for ongoing performance throughout the year. In order to compete for and retain talented executives who are critical to the Trust's long-term success, the Compensation Committee has determined that the base salaries of executive officers should approximate those of executives of other equity REITs that compete with the Trust for employees, investors and business, while also taking into account the executive officers' performance and tenure and the Trust's performance relative to its peer companies within the REIT sector. The initial base salaries included in the Trust's employment agreements were reviewed and recommended by an independent compensation consultant prior to completion of the Trust's IPO in November 2004. The 2005 base salaries for other executive officers who are not subject to employment agreements were also reviewed and recommended by the independent compensation consultant subsequent to the IPO. These employment agreements and the 2005 base salaries were then approved and ratified by the Compensation Committee after completion of the IPO. Under the terms of the Trust's employment agreements, the base salaries for each executive officer will increase each year, at a minimum, by a multiplier based on increases in the Consumer Price Index. In addition, the Compensation Committee will increase base salaries for all executive officers based on a review of base salaries for executive officers at comparable REITs with similar market capitalizations and businesses, as well as based on the executive's performance during the prior fiscal year and the Trust's operating results and financial performance. The Compensation Committee has the authority to engage its own independent compensation consultant to assist in the determination of appropriate levels of compensation for executive officers, and expects to engage such a consultant prior to determining the base salaries for executive officers in 2006;

- •

- Annual Incentive Cash Bonus. The Trust's philosophy of awarding annual cash incentive awards is designed to relate the executive's pay to the Trust's performance and to reward individual contributions to the Trust's performance. The Compensation Committee believes that in order to motivate key executives to achieve annual strategic business goals, executives should receive annual incentive cash bonuses for their contributions in achieving these goals. The 2004 annual incentive cash bonuses for executive officers were approved by the Compensation Committee based on the recommendation of an independent compensation consultant, and were based primarily upon the achievement of the Trust's completion of its IPO. In March 2005, the Compensation Committee approved the performance criteria that will be used to determine executive officer annual incentive cash bonus awards for 2005. Under the terms of the Trust's employment agreements, the Compensation Committee is required to approve annual incentive bonus policies within 90 days after the end of each fiscal year, and awards are to be based on

18

the attainment of individual performance goals for the executives and corporate performance goals set at threshold, target, superior and outperformance levels. The Compensation Committee has adopted a similar allocation of individual and corporate performance goals with respect to the Trust's other executive officers for 2005. The performance criteria for the attainment of corporate goals for all executive officers of the Trust include (i) the Trust's funds from operations (FFO) per share for 2005, (ii) the dollar amount of student housing acquisitions for 2005, and (iii) the number of new military housing units obtained under the Trust's military housing privatization projects for 2005. These three corporate performance goals are broken down into specific threshold, target, superior and outperformance levels (except that outperformance levels are applicable only to Messrs. Holloway, Robinson and Coyle), and then further weighted with respect to executive officers, as follows: FFO per share—50%; student housing acquisitions — 35%; and military housing unit acquisitions — 15%. The individual performance goals with respect to each executive officer consist of a number of defined responsibilities and business objectives prepared by the respective executive officer and tailored to his position within the Company.

- •

- Long-Term Incentives. The Compensation Committee expects to approve a long-term incentive program for executive officers beginning with the fiscal year 2006, which would include the grant of restricted shares or other equity-based awards under the Trust's Equity Incentive Plan and, possibly, equity-based grants under the Trust's Deferred Compensation Plan, all to be determined by the committee. The exact number and form of equity-based awards to be granted to executive officers and other employees is expected to vary depending on the position and salary of the employee and the Trust's success in delivering annual total shareholder returns that meet targets established by the Compensation Committee. The Compensation Committee expects to consult with an independent compensation consultant during 2005 in order to establish an appropriate long-term incentive program for executive officers and other key employees commencing with the 2006 fiscal year. Any equity-based awards granted by the Trust to executive officers and other key employees are expected to be designed to link compensation to the Trust's long-term common share performance and to vest over a period of time, such that the awards will encourage the employees to remain with the Trust.

Actual bonuses for 2005 will be determined by the Compensation Committee based on the satisfaction of the corporate and individual performance goals as described above, and paid in an amount equal to a percentage of the executive officer's base salary based on threshold, target, superior and outperformance levels for each individual as approved by the committee. The Compensation Committee will make the final determinations of 2005 cash bonuses payable to executive officers within 90 days after the end of 2005. The Compensation Committee believes that the Trust's annual incentive bonus policies for executive officers provide a compensation package that is competitive with comparable equity REITs; and

Chief Executive Officer Compensation for 2004

Gary M. Holloway, Sr. served as the Trust's president, chief executive officer and chairman of the Board from formation of the Trust on May 21, 2004 through the end of the 2004 fiscal year. Mr. Holloway's employment agreement, which became effective as of November 2, 2004, set an initial annual base salary of $350,000, subject to annual increases based on a percentage increase in the Consumer Price Index, provided for a 2004 cash bonus of $150,000, subject to Compensation Committee approval and ratification, and included provision for the payment of annual incentive cash bonuses based on the attainment of corporate performance and individual performance goals as approved by the Compensation Committee. Prior to the effective date of his employment agreement, Mr. Holloway was not paid by the Trust, and subsequent to the effective date of his employment agreement, Mr. Holloway was paid only a pro rata portion of the 2004 base salary for the period from

19