| | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

|

| FORM N-CSR |

|

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| MANAGEMENT INVESTMENT COMPANIES |

|

| Investment Company Act file number | 811-21591 |

| |

| AMERICAN CENTURY ASSET ALLOCATION PORTFOLIOS, INC. |

| (Exact name of registrant as specified in charter) |

| |

| 4500 MAIN STREET, KANSAS CITY, MISSOURI | 64111 |

| (Address of principal executive offices) | (Zip Code) |

| |

| CHARLES A. ETHERINGTON |

| 4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 |

| (Name and address of agent for service) |

|

| Registrant’s telephone number, including area code: | 816-531-5575 |

| |

| Date of fiscal year end: | 07-31 |

| |

| Date of reporting period: | 01-31-2010 |

ITEM 1. REPORTS TO STOCKHOLDERS.

| |

| Semiannual Report | January 31, 2010 |

| |

| LIVESTRONG® Portfolios from |

| American Century Investments® |

LIVESTRONG® Income Portfolio

LIVESTRONG® 2015 Portfolio

LIVESTRONG® 2020 Portfolio

LIVESTRONG® 2025 Portfolio

LIVESTRONG® 2030 Portfolio

LIVESTRONG® 2035 Portfolio

LIVESTRONG® 2040 Portfolio

LIVESTRONG® 2045 Portfolio

LIVESTRONG® 2050 Portfolio

| |

| President’s Letter | 2 |

| Independent Chairman’s Letter | 3 |

| |

| LIVESTRONG® Portfolios from American Century Investments | |

| |

| Performance | 4 |

| Portfolio Commentary | 15 |

| Market Index Total Returns | 16 |

| Underlying Fund Allocations | 17 |

| |

| Shareholder Fee Examples | 20 |

| |

| Financial Statements | |

| |

| Schedule of Investments | 26 |

| Statement of Assets and Liabilities | 31 |

| Statement of Operations | 34 |

| Statement of Changes in Net Assets | 37 |

| Notes to Financial Statements | 42 |

| Financial Highlights | 63 |

| |

| Other Information | |

| |

| Additional Information | 99 |

| Index Definitions | 100 |

American Century Investment Services, Inc., has entered into an agreement with the Lance Armstrong Foundation for rights to use the LIVESTRONG name. LIVESTRONG is a trademark of the Lance Armstrong Foundation. For more information about the foundation, visit www.livestrong.org.

The opinions expressed in the Portfolio Commentary reflect those of the portfolio management team as of the date of the report, and do not necessarily represent the opinions of American Century Investments or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for comparative indices and securit ies is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

Dear Investor:

Thank you for taking time to review the following pages, which provide investment performance and portfolio information for the financial reporting period ended January 31, 2010, along with the perspective and commentary of our experienced portfolio management team. We appreciate your trust in American Century Investments at this volatile, transitional time in the economy and investment markets.

As the upheavals associated with the “Great Recession” gradually subside, our senior management team has put considerable thought into how the investment environment has changed and what challenges and opportunities await us. Critical factors that we are anticipating in 2010 include marked shifts in investment and spending behavior compared with the past decade, along with consolidation in our industry.

Most importantly, we think the U.S. economic recovery will be slow and extended. The economy and capital markets have come a long way since Lehman Brothers collapsed in the third quarter of 2008, but 2010 will likely bring continuing challenges. The U.S. stock market’s rebound since last March and the second-half economic surge in 2009 were fueled largely by corporate cost-cutting and unprecedented monetary and fiscal stimulus, including some key programs that have since expired or been scaled back.

Meanwhile, the resilient but struggling consumer sector still faces high unemployment, heavy debt burdens, tight credit conditions, and a housing market that is starting to stabilize, but remains vulnerable. Much of our investment positioning in 2009 cautiously reflected these still unstable economic fundamentals, leading to underperformance, in some cases, versus market benchmarks buoyed by the rally of riskier assets. We still support our fundamentally based positioning because we believe strongly that some markets—driven more by technical factors than fundamentals—have advanced further than underlying economic conditions warrant, and remain susceptible to the possibility of more volatility ahead.

Thank you for your continued confidence in us.

Sincerely,

Jonathan Thomas

President and Chief Executive Officer

American Century Investments

2

|

| Independent Chairman’s Letter |

In my first letter to shareholders of the American Century Investments funds, I invited you to contact me with your questions. I have been gratified with your response. Most shareholder inquiries to date have related to specific fund performance issues. As I noted in my individual responses, your board through the Fund Performance Committee continues to stress improved performance in our quarterly meetings with chief investment officers and fund managers.

An important part of our fund performance review process is a face-to-face meeting with portfolio managers. The board traveled to the American Century Investments office in Mountain View, California to meet with the fund of funds and asset allocation portfolio management teams. These meetings validated the importance of thorough reviews of investment opportunities by the credit management personnel resident in that office. As a result of their efforts, American Century Investments funds were able to avoid the “toxic assets” that plagued many other fund families in 2008.

From April through June 2009, the board conducted its annual review of the advisory contracts between American Century Investments and each fund. Our efforts involved a review of fund information, including assets under management; total expense ratio compared to peers; economies of scale; fee breakpoints that reduce shareholder costs as assets increase; performance compared to peers and benchmarks; and the quality of services provided to fund shareholders. A detailed discussion of board considerations in connection with advisory contract renewal is included annually in each fund’s shareholder reports. During this review, the board focuses on a detailed comparison of the competitive position of each fund and has negotiated more than 60 breakpoints or fee reductions in the past five years.

The board looks forward to another year of work on your behalf and your comments are appreciated. You are invited to email me at dhpratt@fundboardchair.com.

3

| | | | | | | |

| LIVESTRONG Portfolios | | | | | |

| |

| Total Returns as of January 31, 2010 | | | | | |

| | | | | | Average Annual Returns | |

| | | Ticker | | | | Since | Inception |

| | | Symbol | 6 months(1) | 1 year | 5 years | Inception | Date |

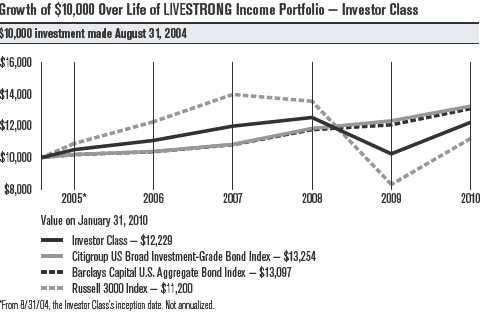

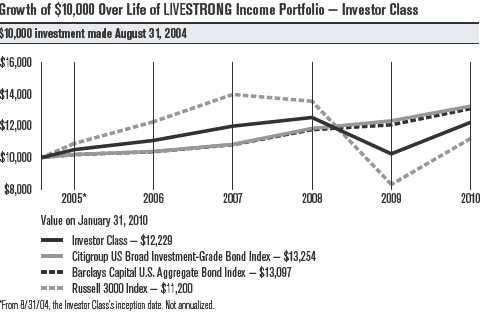

| LIVESTRONG Income Portfolio | | | | | | |

| Investor Class | ARTOX | 6.08% | 19.50% | 3.09% | 3.78% | 8/31/04 |

| Russell 3000 Index(2) | — | 10.16% | 35.05% | 0.57% | 2.12% | — |

| Barclays Capital U.S. | | | | | | |

| Aggregate Bond Index(3) | — | 3.87% | 8.51% | 5.16% | 5.11% | — |

| Citigroup US Broad | | | | | | |

| Investment-Grade Bond Index | — | 3.64% | 7.54% | 5.40% | 5.34% | — |

| Institutional Class | ATTIX | 6.19% | 19.74% | 3.30% | 3.99% | 8/31/04 |

| Advisor Class | ARTAX | 5.94% | 19.20% | 2.84% | 3.53% | 8/31/04 |

| R Class | ARSRX | 5.81% | 18.93% | 2.57% | 3.25% | 8/31/04 |

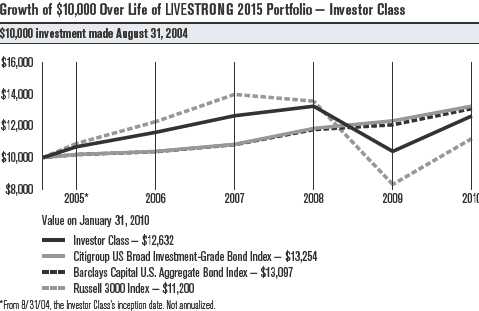

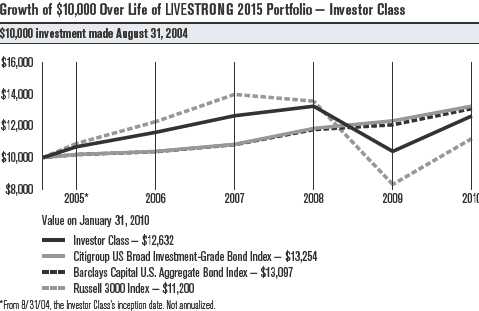

| LIVESTRONG 2015 Portfolio | | | | | | |

| Investor Class | ARFIX | 6.56% | 21.59% | 3.41% | 4.40% | 8/31/04 |

| Russell 3000 Index(2) | — | 10.16% | 35.05% | 0.57% | 2.12% | — |

| Barclays Capital U.S. | | | | | | |

| Aggregate Bond Index(3) | — | 3.87% | 8.51% | 5.16% | 5.11% | — |

| Citigroup US Broad | | | | | | |

| Investment-Grade Bond Index | — | 3.64% | 7.54% | 5.40% | 5.34% | — |

| Institutional Class | ARNIX | 6.66% | 21.81% | 3.64% | 4.62% | 8/31/04 |

| Advisor Class | ARFAX | 6.40% | 21.29% | 3.18% | 4.15% | 8/31/04 |

| R Class | ARFRX | 6.35% | 20.98% | 2.92% | 3.89% | 8/31/04 |

| (1) | Total returns for periods less than one year are not annualized. | | | | |

| (2) | Data provided by Lipper Inc. — A Reuters Company. © 2010 Reuters. All rights reserved. Any copying, republication or redistribution of Lipper |

| | content, including by caching, framing or similar means, is expressly prohibited without the prior written consent of Lipper. Lipper shall not be |

| | liable for any errors or delays in the content, or for any actions taken in reliance thereon. | | | |

| | The data contained herein has been obtained from company reports, financial reporting services, periodicals and other resources believed to be |

| | reliable. Although carefully verified, data on compilations is not guaranteed by Lipper and may be incomplete. No offer or solicitations to buy or |

| | sell any of the securities herein is being made by Lipper. | | | | | |

| (3) | In January 2010, the fund’s fixed-income benchmark changed from the Citigroup US Broad Investment-Grade Bond Index to the Barclays Capital |

| | U.S. Aggregate Bond Index. This reflects a change in the portfolio management analytics software used by American Century Investments’ fixed- |

| | income teams. The investment process is unchanged. | | | | | |

The Russell 3000 Index represents approximately 98% of the investable U.S. equity market and provides a broad measure of equity performance. The Barclays Capital U.S. Aggregate Bond Index represents the U.S. investment-grade fixed-rate bond market and provides a broad measure of bond market performance. Performance for these indices is provided for reference only. Neither index is intended to represent the composition of the portfolio, which invests in a mix of equity and fixed-income securities. (See the Schedule of Investments for the LIVESTRONG Portfolio’s asset allocations as of January 31, 2010.)

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. The performance of LIVESTRONG Portfolios is dependent on the performance of their underlying American Century Investments funds, and will assume the risks associated with these funds. The risks will vary according to each LIVESTRONG Portfolio’s asset allocation, and a fund with a later target date is expected to be more volatile than one with an earlier target date. International investing involves special risks, such as political instability and currency fluctuations. Investing in emerging markets may accentuate these risks. As interest rates rise, bond values will decline.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the indices are provided for comparison. The fund’s total returns include operating expenses (such as administrative fees) that reduce returns, while the total returns of the indices do not.

4

| | | | | | | |

| LIVESTRONG Portfolios | | | | | |

| |

| Total Returns as of January 31, 2010 | | | | | |

| | | | | | Average Annual Returns | |

| | | Ticker | | | | Since | Inception |

| | | Symbol | 6 months(1) | 1 year | 5 years | Inception | Date |

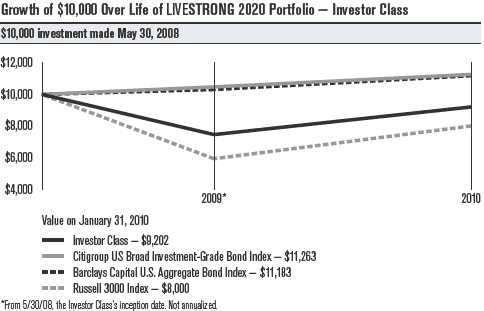

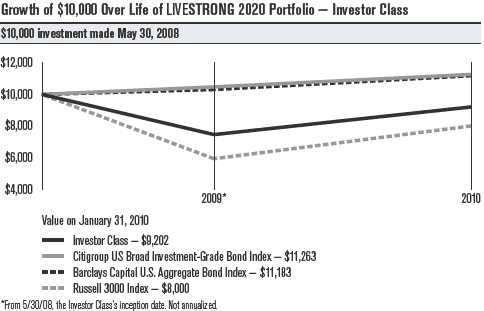

| LIVESTRONG 2020 Portfolio | | | | | | |

| Investor Class | ARBVX | 7.01% | 23.48% | — | -4.84% | 5/30/08 |

| Russell 3000 Index(2) | — | 10.16% | 35.05% | — | -12.51% | — |

| Barclays Capital U.S. | | | | | | |

| Aggregate Bond Index(3) | — | 3.87% | 8.51% | — | 6.94% | — |

| Citigroup US Broad | | | | | | |

| Investment-Grade Bond Index | — | 3.64% | 7.54% | — | 7.40% | — |

| Institutional Class | ARBSX | 6.97% | 23.59% | — | -4.73% | 5/30/08 |

| Advisor Class | ARBMX | 6.87% | 23.03% | — | -5.13% | 5/30/08 |

| R Class | ARBRX | 6.73% | 22.73% | — | -5.36% | 5/30/08 |

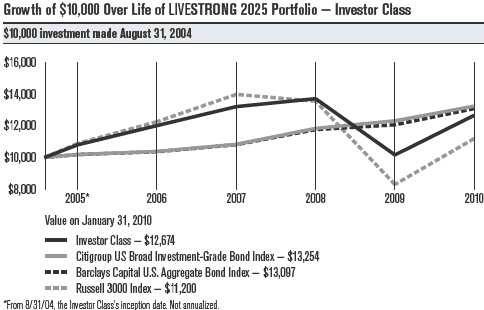

| LIVESTRONG 2025 Portfolio | | | | | | |

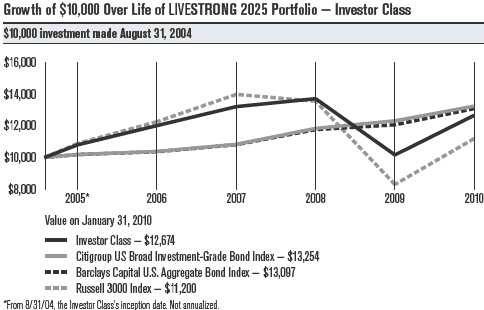

| Investor Class | ARWIX | 7.19% | 24.69% | 3.25% | 4.47% | 8/31/04 |

| Russell 3000 Index(2) | — | 10.16% | 35.05% | 0.57% | 2.12% | — |

| Barclays Capital U.S. | | | | | | |

| Aggregate Bond Index(3) | — | 3.87% | 8.51% | 5.16% | 5.11% | — |

| Citigroup US Broad | | | | | | |

| Investment-Grade Bond Index | — | 3.64% | 7.54% | 5.40% | 5.34% | — |

| Institutional Class | ARWFX | 7.29% | 24.94% | 3.45% | 4.67% | 8/31/04 |

| Advisor Class | ARWAX | 7.14% | 24.38% | 2.99% | 4.21% | 8/31/04 |

| R Class | ARWRX | 6.98% | 24.22% | 2.75% | 3.96% | 8/31/04 |

| (1) | Total returns for periods less than one year are not annualized. | | | | |

| (2) | Data provided by Lipper Inc. — A Reuters Company. © 2010 Reuters. All rights reserved. Any copying, republication or redistribution of Lipper |

| | content, including by caching, framing or similar means, is expressly prohibited without the prior written consent of Lipper. Lipper shall not be |

| | liable for any errors or delays in the content, or for any actions taken in reliance thereon. | | | |

| | The data contained herein has been obtained from company reports, financial reporting services, periodicals and other resources believed to be |

| | reliable. Although carefully verified, data on compilations is not guaranteed by Lipper and may be incomplete. No offer or solicitations to buy or |

| | sell any of the securities herein is being made by Lipper. | | | | | |

| (3) | In January 2010, the fund’s fixed-income benchmark changed from the Citigroup US Broad Investment-Grade Bond Index to the Barclays Capital |

| | U.S. Aggregate Bond Index. This reflects a change in the portfolio management analytics software used by American Century Investments’ fixed- |

| | income teams. The investment process is unchanged. | | | | | |

The Russell 3000 Index represents approximately 98% of the investable U.S. equity market and provides a broad measure of equity performance. The Barclays Capital U.S. Aggregate Bond Index represents the U.S. investment-grade fixed-rate bond market and provides a broad measure of bond market performance. Performance for these indices is provided for reference only. Neither index is intended to represent the composition of the portfolio, which invests in a mix of equity and fixed-income securities. (See the Schedule of Investments for the LIVESTRONG Portfolio’s asset allocations as of January 31, 2010.)

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. The performance of LIVESTRONG Portfolios is dependent on the performance of their underlying American Century Investments funds, and will assume the risks associated with these funds. The risks will vary according to each LIVESTRONG Portfolio’s asset allocation, and a fund with a later target date is expected to be more volatile than one with an earlier target date. International investing involves special risks, such as political instability and currency fluctuations. Investing in emerging markets may accentuate these risks. As interest rates rise, bond values will decline.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the indices are provided for comparison. The fund’s total returns include operating expenses (such as administrative fees) that reduce returns, while the total returns of the indices do not.

5

| | | | | | | |

| LIVESTRONG Portfolios | | | | | |

| |

| Total Returns as of January 31, 2010 | | | | | |

| | | | | | Average Annual Returns | |

| | | Ticker | | | | Since | Inception |

| | | Symbol | 6 months(1) | 1 year | 5 years | Inception | Date |

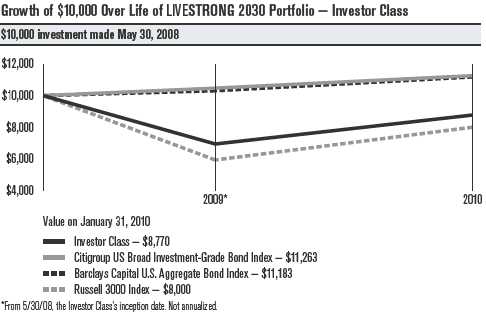

| LIVESTRONG 2030 Portfolio | | | | | | |

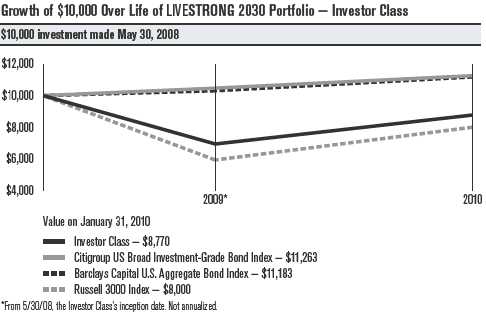

| Investor Class | ARCVX | 7.73% | 26.44% | — | -7.54% | 5/30/08 |

| Russell 3000 Index(2) | — | 10.16% | 35.05% | — | -12.51% | — |

| Barclays Capital U.S. | | | | | | |

| Aggregate Bond Index(3) | — | 3.87% | 8.51% | — | 6.94% | — |

| Citigroup US Broad | | | | | | |

| Investment-Grade Bond Index | — | 3.64% | 7.54% | — | 7.40% | — |

| Institutional Class | ARCSX | 7.81% | 26.88% | — | -7.37% | 5/30/08 |

| Advisor Class | ARCMX | 7.47% | 26.16% | — | -7.82% | 5/30/08 |

| R Class | ARCRX | 7.33% | 25.85% | — | -8.04% | 5/30/08 |

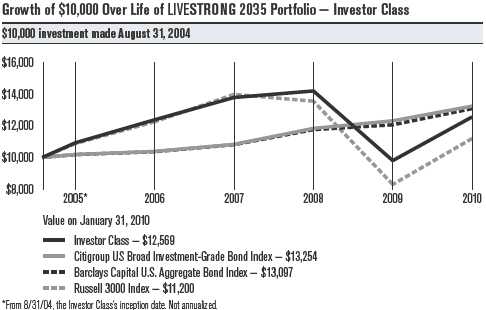

| LIVESTRONG 2035 Portfolio | | | | | | |

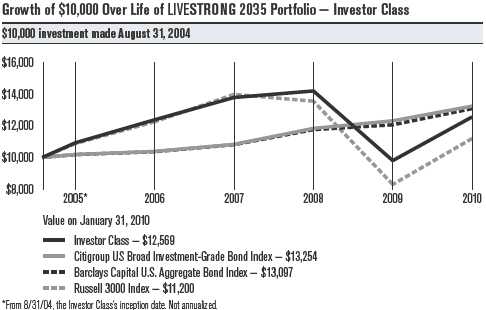

| Investor Class | ARYIX | 8.07% | 28.21% | 2.83% | 4.31% | 8/31/04 |

| Russell 3000 Index(2) | — | 10.16% | 35.05% | 0.57% | 2.12% | — |

| Barclays Capital U.S. | | | | | | |

| Aggregate Bond Index(3) | — | 3.87% | 8.51% | 5.16% | 5.11% | — |

| Citigroup US Broad | | | | | | |

| Investment-Grade Bond Index | — | 3.64% | 7.54% | 5.40% | 5.34% | — |

| Institutional Class | ARLIX | 8.17% | 28.59% | 3.03% | 4.53% | 8/31/04 |

| Advisor Class | ARYAX | 7.91% | 27.89% | 2.57% | 4.05% | 8/31/04 |

| R Class | ARYRX | 7.75% | 27.57% | 2.31% | 3.80% | 8/31/04 |

| (1) | Total returns for periods less than one year are not annualized. | | | | |

| (2) | Data provided by Lipper Inc. — A Reuters Company. © 2010 Reuters. All rights reserved. Any copying, republication or redistribution of Lipper |

| | content, including by caching, framing or similar means, is expressly prohibited without the prior written consent of Lipper. Lipper shall not be |

| | liable for any errors or delays in the content, or for any actions taken in reliance thereon. | | | |

| | The data contained herein has been obtained from company reports, financial reporting services, periodicals and other resources believed to be |

| | reliable. Although carefully verified, data on compilations is not guaranteed by Lipper and may be incomplete. No offer or solicitations to buy or |

| | sell any of the securities herein is being made by Lipper. | | | | | |

| (3) | In January 2010, the fund’s fixed-income benchmark changed from the Citigroup US Broad Investment-Grade Bond Index to the Barclays Capital |

| | U.S. Aggregate Bond Index. This reflects a change in the portfolio management analytics software used by American Century Investments’ fixed- |

| | income teams. The investment process is unchanged. | | | | | |

The Russell 3000 Index represents approximately 98% of the investable U.S. equity market and provides a broad measure of equity performance. The Barclays Capital U.S. Aggregate Bond Index represents the U.S. investment-grade fixed-rate bond market and provides a broad measure of bond market performance. Performance for these indices is provided for reference only. Neither index is intended to represent the composition of the portfolio, which invests in a mix of equity and fixed-income securities. (See the Schedule of Investments for the LIVESTRONG Portfolio’s asset allocations as of January 31, 2010.)

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. The performance of LIVESTRONG Portfolios is dependent on the performance of their underlying American Century Investments funds, and will assume the risks associated with these funds. The risks will vary according to each LIVESTRONG Portfolio’s asset allocation, and a fund with a later target date is expected to be more volatile than one with an earlier target date. International investing involves special risks, such as political instability and currency fluctuations. Investing in emerging markets may accentuate these risks. As interest rates rise, bond values will decline.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the indices are provided for comparison. The fund’s total returns include operating expenses (such as administrative fees) that reduce returns, while the total returns of the indices do not.

6

| | | | | | | |

| LIVESTRONG Portfolios | | | | | |

| |

| Total Returns as of January 31, 2010 | | | | | |

| | | | | | Average Annual Returns | |

| | | Ticker | | | | Since | Inception |

| | | Symbol | 6 months(1) | 1 year | 5 years | Inception | Date |

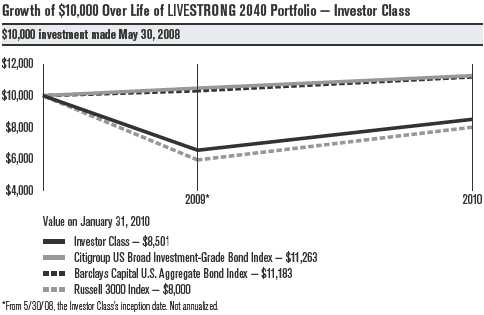

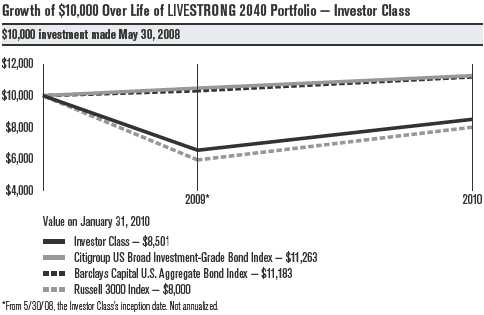

| LIVESTRONG 2040 Portfolio | | | | | | |

| Investor Class | ARDVX | 8.32% | 29.95% | — | -9.25% | 5/30/08 |

| Russell 3000 Index(2) | — | 10.16% | 35.05% | — | -12.51% | — |

| Barclays Capital U.S. | | | | | | |

| Aggregate Bond Index(3) | — | 3.87% | 8.51% | — | 6.94% | — |

| Citigroup US Broad | | | | | | |

| Investment-Grade Bond Index | — | 3.64% | 7.54% | — | 7.40% | — |

| Institutional Class | ARDSX | 8.54% | 30.21% | — | -9.08% | 5/30/08 |

| Advisor Class | ARDMX | 8.33% | 29.63% | — | -9.46% | 5/30/08 |

| R Class | ARDRX | 8.07% | 29.35% | — | -9.74% | 5/30/08 |

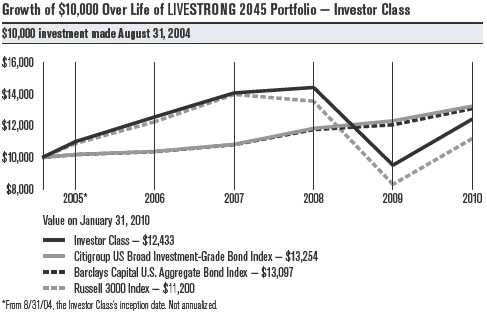

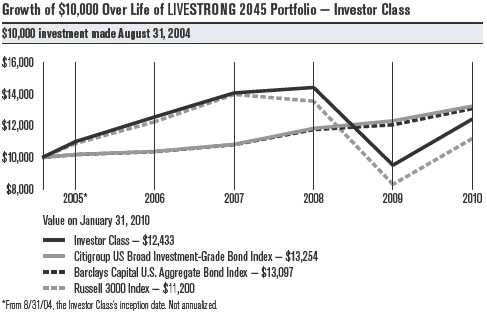

| LIVESTRONG 2045 Portfolio | | | | | | |

| Investor Class | AROIX | 8.46% | 30.67% | 2.46% | 4.10% | 8/31/04 |

| Russell 3000 Index(2) | — | 10.16% | 35.05% | 0.57% | 2.12% | — |

| Barclays Capital U.S. | | | | | | |

| Aggregate Bond Index(3) | — | 3.87% | 8.51% | 5.16% | 5.11% | — |

| Citigroup US Broad | | | | | | |

| Investment-Grade Bond Index | — | 3.64% | 7.54% | 5.40% | 5.34% | — |

| Institutional Class | AOOIX | 8.67% | 31.06% | 2.69% | 4.32% | 8/31/04 |

| Advisor Class | AROAX | 8.42% | 30.51% | 2.23% | 3.85% | 8/31/04 |

| R Class | ARORX | 8.26% | 30.19% | 1.97% | 3.59% | 8/31/04 |

| (1) | Total returns for periods less than one year are not annualized. | | | | |

| (2) | Data provided by Lipper Inc. — A Reuters Company. © 2010 Reuters. All rights reserved. Any copying, republication or redistribution of Lipper |

| | content, including by caching, framing or similar means, is expressly prohibited without the prior written consent of Lipper. Lipper shall not be |

| | liable for any errors or delays in the content, or for any actions taken in reliance thereon. | | | |

| | The data contained herein has been obtained from company reports, financial reporting services, periodicals and other resources believed to be |

| | reliable. Although carefully verified, data on compilations is not guaranteed by Lipper and may be incomplete. No offer or solicitations to buy or |

| | sell any of the securities herein is being made by Lipper. | | | | | |

| (3) | In January 2010, the fund’s fixed-income benchmark changed from the Citigroup US Broad Investment-Grade Bond Index to the Barclays Capital |

| | U.S. Aggregate Bond Index. This reflects a change in the portfolio management analytics software used by American Century Investments’ fixed- |

| | income teams. The investment process is unchanged. | | | | | |

The Russell 3000 Index represents approximately 98% of the investable U.S. equity market and provides a broad measure of equity performance. The Barclays Capital U.S. Aggregate Bond Index represents the U.S. investment-grade fixed-rate bond market and provides a broad measure of bond market performance. Performance for these indices is provided for reference only. Neither index is intended to represent the composition of the portfolio, which invests in a mix of equity and fixed-income securities. (See the Schedule of Investments for the LIVESTRONG Portfolio’s asset allocations as of January 31, 2010.)

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. The performance of LIVESTRONG Portfolios is dependent on the performance of their underlying American Century Investments funds, and will assume the risks associated with these funds. The risks will vary according to each LIVESTRONG Portfolio’s asset allocation, and a fund with a later target date is expected to be more volatile than one with an earlier target date. International investing involves special risks, such as political instability and currency fluctuations. Investing in emerging markets may accentuate these risks. As interest rates rise, bond values will decline.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the indices are provided for comparison. The fund’s total returns include operating expenses (such as administrative fees) that reduce returns, while the total returns of the indices do not.

7

| | | | | | | |

| LIVESTRONG Portfolios | | | | | |

| |

| Total Returns as of January 31, 2010 | | | | | |

| | | | | | Average Annual Returns | |

| | | Ticker | | | | Since | Inception |

| | | Symbol | 6 months(1) | 1 year | 5 years | Inception | Date |

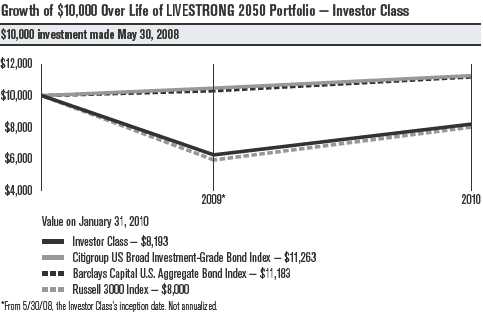

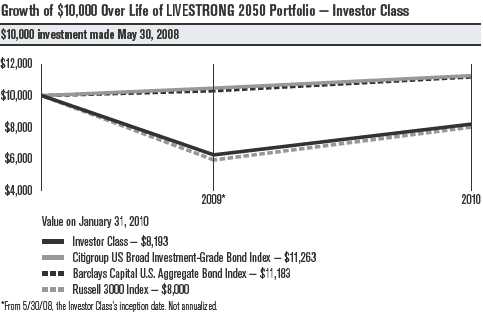

| LIVESTRONG 2050 Portfolio | | | | | | |

| Investor Class | ARFVX | 8.65% | 31.15% | — | -11.22% | 5/30/08 |

| Russell 3000 Index(2) | — | 10.16% | 35.05% | — | -12.51% | — |

| Barclays Capital U.S. | | | | | | |

| Aggregate Bond Index(3) | — | 3.87% | 8.51% | — | 6.94% | — |

| Citigroup US Broad | | | | | | |

| Investment-Grade Bond Index | — | 3.64% | 7.54% | — | 7.40% | — |

| Institutional Class | ARFSX | 8.72% | 31.41% | — | -11.06% | 5/30/08 |

| Advisor Class | ARFMX | 8.52% | 31.04% | — | -11.43% | 5/30/08 |

| R Class | ARFWX | 8.40% | 30.71% | — | -11.64% | 5/30/08 |

| (1) | Total returns for periods less than one year are not annualized. | | | | |

| (2) | Data provided by Lipper Inc. — A Reuters Company. © 2010 Reuters. All rights reserved. Any copying, republication or redistribution of Lipper |

| | content, including by caching, framing or similar means, is expressly prohibited without the prior written consent of Lipper. Lipper shall not be |

| | liable for any errors or delays in the content, or for any actions taken in reliance thereon. | | | |

| | The data contained herein has been obtained from company reports, financial reporting services, periodicals and other resources believed to be |

| | reliable. Although carefully verified, data on compilations is not guaranteed by Lipper and may be incomplete. No offer or solicitations to buy or |

| | sell any of the securities herein is being made by Lipper. | | | | | |

| (3) | In January 2010, the fund’s fixed-income benchmark changed from the Citigroup US Broad Investment-Grade Bond Index to the Barclays Capital |

| | U.S. Aggregate Bond Index. This reflects a change in the portfolio management analytics software used by American Century Investments’ fixed- |

| | income teams. The investment process is unchanged. | | | | | |

The Russell 3000 Index represents approximately 98% of the investable U.S. equity market and provides a broad measure of equity performance. The Barclays Capital U.S. Aggregate Bond Index represents the U.S. investment-grade fixed-rate bond market and provides a broad measure of bond market performance. Performance for these indices is provided for reference only. Neither index is intended to represent the composition of the portfolio, which invests in a mix of equity and fixed-income securities. (See the Schedule of Investments for the LIVESTRONG Portfolio’s asset allocations as of January 31, 2010.)

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. The performance of LIVESTRONG Portfolios is dependent on the performance of their underlying American Century Investments funds, and will assume the risks associated with these funds. The risks will vary according to each LIVESTRONG Portfolio’s asset allocation, and a fund with a later target date is expected to be more volatile than one with an earlier target date. International investing involves special risks, such as political instability and currency fluctuations. Investing in emerging markets may accentuate these risks. As interest rates rise, bond values will decline.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the indices are provided for comparison. The fund’s total returns include operating expenses (such as administrative fees) that reduce returns, while the total returns of the indices do not.

8

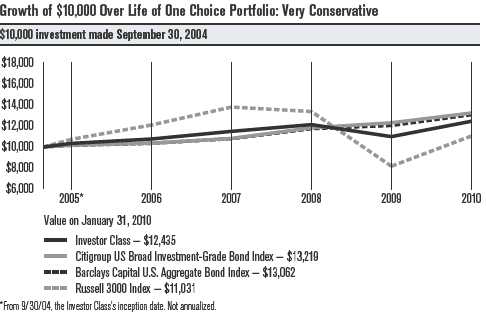

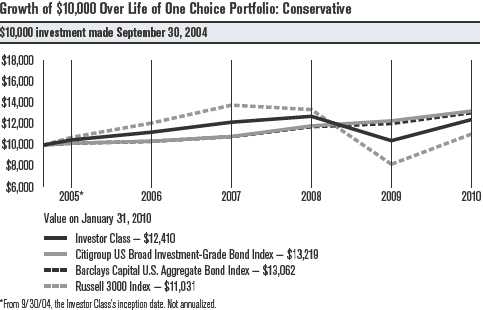

LIVESTRONG Portfolios

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. The performance of LIVESTRONG Portfolios is dependent on the performance of their underlying American Century Investments funds, and will assume the risks associated with these funds. The risks will vary according to each LIVESTRONG Portfolio’s asset allocation, and a fund with a later target date is expected to be more volatile than one with an earlier target date. International investing involves special risks, such as political instability and currency fluctuations. Investing in emerging markets may accentuate these risks. As interest rates rise, bond values will decline.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the indices are provided for comparison. The fund’s total returns include operating expenses (such as administrative fees) that reduce returns, while the total returns of the indices do not.

9

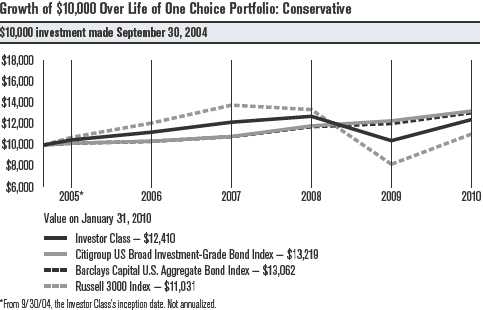

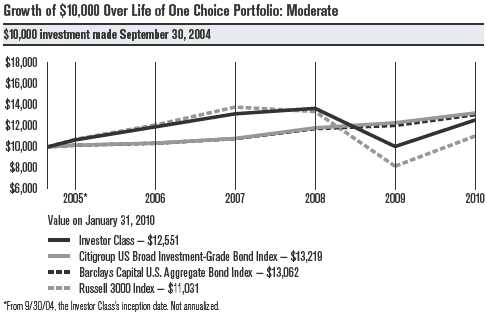

LIVESTRONG Portfolios

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. The performance of LIVESTRONG Portfolios is dependent on the performance of their underlying American Century Investments funds, and will assume the risks associated with these funds. The risks will vary according to each LIVESTRONG Portfolio’s asset allocation, and a fund with a later target date is expected to be more volatile than one with an earlier target date. International investing involves special risks, such as political instability and currency fluctuations. Investing in emerging markets may accentuate these risks. As interest rates rise, bond values will decline.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the indices are provided for comparison. The fund’s total returns include operating expenses (such as administrative fees) that reduce returns, while the total returns of the indices do not.

10

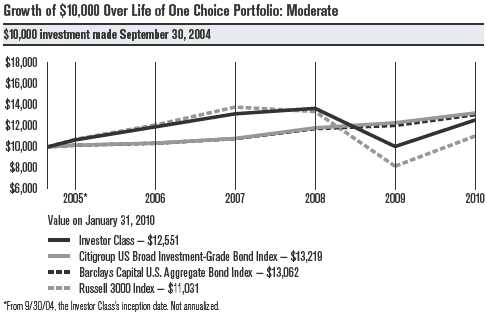

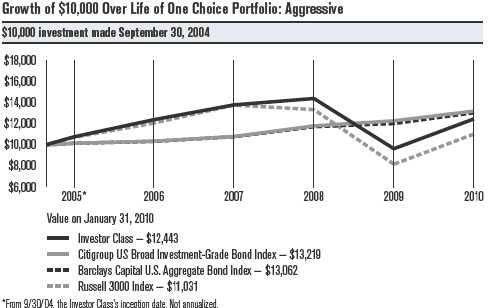

LIVESTRONG Portfolios

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. The performance of LIVESTRONG Portfolios is dependent on the performance of their underlying American Century Investments funds, and will assume the risks associated with these funds. The risks will vary according to each LIVESTRONG Portfolio’s asset allocation, and a fund with a later target date is expected to be more volatile than one with an earlier target date. International investing involves special risks, such as political instability and currency fluctuations. Investing in emerging markets may accentuate these risks. As interest rates rise, bond values will decline.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the indices are provided for comparison. The fund’s total returns include operating expenses (such as administrative fees) that reduce returns, while the total returns of the indices do not.

11

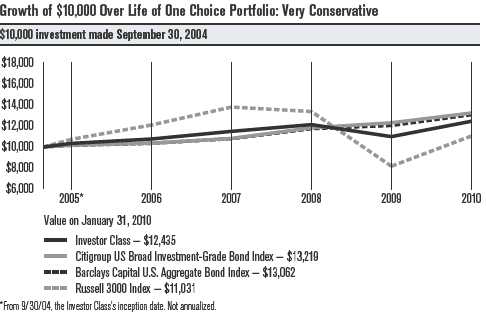

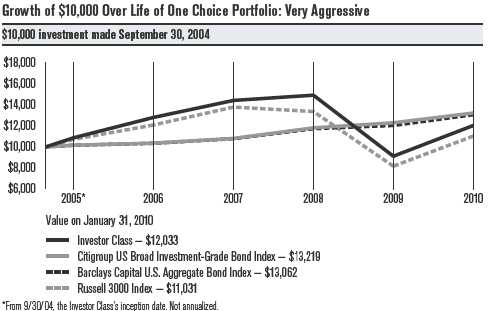

LIVESTRONG Portfolios

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. The performance of LIVESTRONG Portfolios is dependent on the performance of their underlying American Century Investments funds, and will assume the risks associated with these funds. The risks will vary according to each LIVESTRONG Portfolio’s asset allocation, and a fund with a later target date is expected to be more volatile than one with an earlier target date. International investing involves special risks, such as political instability and currency fluctuations. Investing in emerging markets may accentuate these risks. As interest rates rise, bond values will decline.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the indices are provided for comparison. The fund’s total returns include operating expenses (such as administrative fees) that reduce returns, while the total returns of the indices do not.

12

LIVESTRONG Portfolios

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. The performance of LIVESTRONG Portfolios is dependent on the performance of their underlying American Century Investments funds, and will assume the risks associated with these funds. The risks will vary according to each LIVESTRONG Portfolio’s asset allocation, and a fund with a later target date is expected to be more volatile than one with an earlier target date. International investing involves special risks, such as political instability and currency fluctuations. Investing in emerging markets may accentuate these risks. As interest rates rise, bond values will decline.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the indices are provided for comparison. The fund’s total returns include operating expenses (such as administrative fees) that reduce returns, while the total returns of the indices do not.

13

| | | | | | | |

| LIVESTRONG Portfolios | | | | | | |

| |

| One-Year Returns Over Life of Class | | | | | | |

| Periods ended January 31 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 |

| LIVESTRONG Income Portfolio — Investor Class | 5.00%(1) | 5.54% | 8.18% | 4.58% | -18.38% | 19.50% |

| LIVESTRONG 2015 Portfolio — Investor Class | 6.80%(1) | 8.55% | 9.07% | 4.76% | -21.57% | 21.59% |

| LIVESTRONG 2020 Portfolio — Investor Class | — | — | — | — | -25.47%(2) | 23.48% |

| LIVESTRONG 2025 Portfolio — Investor Class | 8.00%(1) | 11.30% | 9.99% | 3.82% | -25.95% | 24.69% |

| LIVESTRONG 2030 Portfolio — Investor Class | — | — | — | — | -30.64%(2) | 26.44% |

| LIVESTRONG 2035 Portfolio — Investor Class | 9.33%(1) | 13.33% | 11.38% | 3.00% | -31.03% | 28.21% |

| LIVESTRONG 2040 Portfolio — Investor Class | — | — | — | — | -34.59%(2) | 29.95% |

| LIVESTRONG 2045 Portfolio — Investor Class | 10.07%(1) | 14.20% | 12.09% | 2.46% | -34.09% | 30.67% |

| LIVESTRONG 2050 Portfolio — Investor Class | — | — | — | — | -37.53%(2) | 31.15% |

| Russell 3000 Index | 8.87%(1) | 12.67% | 14.11% | -3.08% | -38.86% | 35.05% |

| Barclays Capital U.S. Aggregate Bond Index | 1.86%(1) | 1.80% | 4.28% | 8.81% | 2.59% | 8.51% |

| Citigroup US Broad Investment-Grade Bond Index | 1.91%(1) | 1.91% | 4.32% | 9.32% | 4.06% | 7.54% |

| (1) | From 8/31/04, the Investor Class’s inception date. Not annualized. | | | | | |

| (2) | From 5/30/08, the Investor Class’s inception date. Not annualized. | | | | | |

| | | | |

| Total Annual Fund Operating Expenses | | | |

| | Investor Class | Institutional Class | Advisor Class | R Class |

| LIVESTRONG Income Portfolio | 0.77% | 0.57% | 1.02% | 1.27% |

| LIVESTRONG 2015 Portfolio | 0.80% | 0.60% | 1.05% | 1.30% |

| LIVESTRONG 2020 Portfolio | 0.83% | 0.63% | 1.08% | 1.33% |

| LIVESTRONG 2025 Portfolio | 0.86% | 0.66% | 1.11% | 1.36% |

| LIVESTRONG 2030 Portfolio | 0.89% | 0.69% | 1.14% | 1.39% |

| LIVESTRONG 2035 Portfolio | 0.91% | 0.71% | 1.16% | 1.41% |

| LIVESTRONG 2040 Portfolio | 0.94% | 0.74% | 1.19% | 1.44% |

| LIVESTRONG 2045 Portfolio | 0.95% | 0.75% | 1.20% | 1.45% |

| LIVESTRONG 2050 Portfolio | 0.96% | 0.76% | 1.21% | 1.46% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. The performance of LIVESTRONG Portfolios is dependent on the performance of their underlying American Century Investments funds, and will assume the risks associated with these funds. The risks will vary according to each LIVESTRONG Portfolio’s asset allocation, and a fund with a later target date is expected to be more volatile than one with an earlier target date. International investing involves special risks, such as political instability and currency fluctuations. Investing in emerging markets may accentuate these risks. As interest rates rise, bond values will decline.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the indices are provided for comparison. The fund’s total returns include operating expenses (such as administrative fees) that reduce returns, while the total returns of the indices do not.

14

LIVESTRONG Portfolios

Portfolio Managers: Enrique Chang, Scott Wittman, and Irina Torelli

Performance Summary

Each of the nine LIVESTRONG Portfolios advanced for the six months ended January 31, 2010, with returns ranging from 6.08%* for LIVESTRONG Income Portfolio to 8.65% for LIVESTRONG 2050 Portfolio (see pages 4–14 for more detailed performance information). The gains reflected positive performance across all asset classes represented in LIVESTRONG Portfolios during the six-month period.

Because of LIVESTRONG Portfolios’ strategic exposure to a variety of asset classes, a review of the financial markets helps explain much of their performance.

Stock Market Review

The U.S. stock market gained ground for the six-month period, extending a rally that began in March 2009. The market’s advance was driven by increasing investor confidence regarding a potential recovery from the sharp economic downturn in late 2008 and early 2009.

Signs of improvement were evident across many segments of the economy during the six months—home sales began to rise, manufacturing activity picked up, and retail sales figures showed uneven but promising results. Consequently, the U.S. economy grew at a 2.2% annual rate in the third quarter of 2009—its first positive quarterly growth rate in more than a year—and a 5.9% annual rate in the fourth quarter. In addition, cost-management efforts at many companies helped generate better-than-expected corporate earnings during the six-month period.

There were exceptions to the favorable economic data—most notably, the unemployment rate remained persistently elevated, reaching a 26-year high of 10.1% in October 2009 before falling back to 9.7% by the end of January 2010. Nonetheless, the overall economic picture was one of gradual improvement, and the stock market responded with a steady rally that persisted throughout much of the six-month period.

Stocks finished the period on a down note, giving back some of their gains late in the period as investors expressed some skepticism about the sustainability of the nascent economic recovery. Despite this hiccup, however, the broad stock indices gained approximately 10% overall for the six-month period. As the table on the next page indicates, mid-cap stocks posted the best results, while small-cap stocks lagged. Value-oriented shares outpaced growth issues across all market capitalizations, most notably in the small-cap segment of the market.

*All fund returns referenced in this commentary are for Investor Class shares. Total returns for periods less than one year are not annualized.

15

| | | | |

| LIVESTRONG Portfolios | | | | |

| |

| Market Index Total Returns | | | | |

| For the six months ended January 31, 2010(1) | | | | |

| U.S. Stocks | | | U.S. Fixed Income | |

| Russell 1000 Index (Large-Cap) | 10.27% | | Barclays Capital U.S. | |

| Russell Midcap Index | 13.45% | | Aggregate Bond Index | 3.87% |

| Russell 2000 Index (Small-Cap) | 8.86% | | Barclays Capital 10-Year | |

| International Stocks | | | U.S. Treasury Note (Bellwether) | 0.58% |

| MSCI EAFE (Europe, Australasia, Far East) Index | 6.93% | | Barclays Capital Three-Month | |

| MSCI EM (Emerging Markets) Index | 11.40% | | U.S. Treasury Bill (Bellwether) | 0.10% |

| (1) Total returns for periods less than one year are not annualized. | | International Bonds | |

| | | | Citigroup Non-U.S. World | |

| | | | Government Bond Index | 2.47% |

International equity markets also advanced during the six-month period as optimistic investors embraced the hope that the improving economic environment would blossom into a full-fledged global recovery in 2010. Emerging markets generated the best returns, benefiting the most from rising expectations for a global economic expansion. Among developed markets, countries along the Pacific Rim were the top performers, with the notable exception of Japan.

Bond Market Review

U.S. bonds gained ground during the period, though to a lesser degree than the equity market. The bond market’s advance was led primarily by corporate bonds, which benefited substantially from the improving economic environment and higher-than-anticipated corporate profits. In particular, high-yield corporate bonds posted double-digit gains for the period.

In contrast, Treasury and government agency securities generated modestly positive returns and lagged the rest of the bond market. As the economic environment improved, Treasury securities fell out of favor as investors shifted to other higher-yielding segments of the bond market. In addition, an increase in supply—as the government issued more securities to fund its economic stimulus efforts—weighed on the Treasury market.

Mortgage-backed securities performed in line with the broad bond market. The positive impact of the Federal Reserve’s purchases of mortgage-backed securities to support the housing market was largely offset by an increase in mortgage refinancing activity.

International fixed-income markets also advanced for the reporting period, though they lagged the performance of the domestic bond market. While many countries continued to issue new debt to fund economic stimulus programs, much like the U.S., the new supply was more than offset by strong demand from financial institutions seeking to maintain liquidity and rebuild their balance sheets. In addition, a weaker U.S. dollar provided a modest boost to foreign bond returns for U.S. investors. Although the dollar appreciated versus the euro, it declined versus the Japanese yen and other major currencies.

16

LIVESTRONG Portfolios

Underlying Fund Allocations(1) as a % of net assets as of January 31, 2010

| | | | | | |

| | | LIVESTRONG | LIVESTRONG | LIVESTRONG | LIVESTRONG | LIVESTRONG |

| | | Income | 2015 | 2020 | 2025 | 2030 |

| | | Portfolio | Portfolio | Portfolio | Portfolio | Portfolio |

| Equity | | | | | |

| NT Equity | | | | | |

| Growth Fund | 12.8% | 12.6% | 12.1% | 12.3% | 12.3% |

| NT Growth Fund | 6.3% | 7.6% | 8.6% | 10.2% | 12.3% |

| NT Large Company | | | | | |

| Value Fund | 10.8% | 11.1% | 11.1% | 11.6% | 12.4% |

| NT Mid Cap | | | | | |

| Value Fund | 3.9% | 4.6% | 5.4% | 5.2% | 5.2% |

| NT Small | | | | | |

| Company Fund | 2.0% | 1.9% | 2.2% | 3.2% | 4.1% |

| NT VistaSM Fund | 2.3% | 3.3% | 4.3% | 4.8% | 5.1% |

| Real Estate Fund | 1.0% | 1.2% | 1.4% | 1.7% | 1.9% |

| NT Emerging | | | | | |

| Markets Fund | — | 1.0% | 2.2% | 2.6% | 3.1% |

| NT International | | | | | |

| Growth Fund | 4.8% | 5.6% | 6.6% | 8.1% | 9.4% |

| Total Equity | 43.9% | 48.9% | 53.9% | 59.7% | 65.8% |

| Fixed Income | | | | | |

| High-Yield Fund | 3.9% | 3.7% | 3.6% | 3.2% | 2.8% |

| Inflation-Adjusted | | | | | |

| Bond Fund | 7.8% | 7.5% | 7.2% | 6.6% | 5.8% |

| NT Diversified | | | | | |

| Bond Fund | 27.0% | 26.2% | 25.2% | 22.8% | 20.4% |

| International | | | | | |

| Bond Fund | 7.1% | 6.0% | 5.0% | 2.5% | — |

| Total Fixed Income | 45.8% | 43.4% | 41.0% | 35.1% | 29.0% |

| Premium Money | | | | | |

| Market Fund | 10.3% | 7.7% | 5.1% | 5.2% | 5.2% |

| Other Assets | | | | | |

| and Liabilities | —(2) | —(2) | —(2) | —(2) | —(2) |

| (1) | Institutional Class, except Premium Money Market Fund Investor Class. | | | |

| (2) | Category is less than 0.05% of total net assets. | | | | |

17

LIVESTRONG Portfolios

Underlying Fund Allocations(1) as a % of net assets as of January 31, 2010

| | | | | |

| | | LIVESTRONG | LIVESTRONG | LIVESTRONG | LIVESTRONG |

| | | 2035 | 2040 | 2045 | 2050 |

| | | Portfolio | Portfolio | Portfolio | Portfolio |

| Equity | | | | |

| NT Equity Growth Fund | 13.3% | 14.4% | 14.6% | 15.2% |

| NT Growth Fund | 13.3% | 14.4% | 14.6% | 15.2% |

NT Large Company Value Fund | 13.4% | 14.4% | 14.9% | 15.5% |

| NT Mid Cap Value Fund | 6.2% | 7.2% | 7.3% | 7.4% |

| NT Small Company Fund | 4.1% | 3.9% | 4.4% | 4.9% |

| NT VistaSM Fund | 6.0% | 7.1% | 7.1% | 7.4% |

| Real Estate Fund | 2.2% | 2.4% | 2.7% | 3.0% |

| NT Emerging Markets Fund | 4.1% | 5.2% | 5.9% | 6.4% |

| NT International Growth Fund | 9.7% | 10.2% | 9.9% | 9.5% |

| Total Equity | 72.3% | 79.2% | 81.4% | 84.5% |

| Fixed Income | | | | |

| High-Yield Fund | 2.5% | 2.1% | 1.8% | 1.5% |

| Inflation-Adjusted Bond Fund | 5.0% | 4.2% | 3.7% | 3.1% |

| NT Diversified Bond Fund | 17.6% | 14.5% | 13.1% | 10.9% |

| Total Fixed Income | 25.1% | 20.8% | 18.6% | 15.5% |

| Premium Money Market Fund | 2.6% | — | — | — |

| Other Assets and Liabilities | —(2) | —(2) | —(2) | —(2) |

| (1) | Institutional Class, except Premium Money Market Fund Investor Class. | | | |

| (2) | Category is less than 0.05% of total net assets. | | | | |

Fund Information

Each LIVESTRONG Portfolio is a “fund of funds” that invests in other American Century Investments mutual funds to achieve its investment objective and target asset allocation. (See pages 17–18 for the specific underlying fund allocations for each LIVESTRONG Portfolio.) A LIVESTRONG Portfolio’s target date is the approximate year when investors plan to start withdrawing their money. LIVESTRONG Income Portfolio is generally intended for investors near, at, or in retirement. There is no guarantee that an investment in any of the funds will provide adequate income at or through an investor’s retirement.

Each target-date LIVESTRONG Portfolio seeks the highest total return consistent with its asset mix. Each year, the asset mix and weightings are adjusted to be more conservative. In general, as the target year approaches, the portfolio’s allocation becomes more conservative by decreasing the allocation to stocks and increasing the allocation to bonds and money market instruments. By the time each fund reaches its target year, its target asset mix will become fixed and will match that of LIVESTRONG Income Portfolio.

18

LIVESTRONG Portfolios

Portfolio Performance

Within LIVESTRONG Portfolios, every stock fund gained ground during the six-month period. The top performer was the Real Estate Fund, which gained 24% amid improving economic conditions, continued access to capital, and a potential buyer’s market for commercial real estate in 2010 as financial institutions look to unload foreclosed properties. The NT Mid Cap Value Fund and NT Emerging Markets Fund also generated double-digit gains for the reporting period. The weakest performer on the equity side was the NT Vista Fund, LIVESTRONG Portfolios’ mid-cap growth component, which faced performance headw inds as stocks exhibiting accelerating growth and price momentum were out of favor for much of the period.

The leading performers among LIVESTRONG Portfolios’ fixed-income components were the High-Yield Fund, which returned more than 11% for the reporting period, and the Inflation-Adjusted Bond Fund, which benefited from concerns that the economic recovery could lead to higher inflation down the road. The International Bond Fund (which is represented only in LIVESTRONG Income Portfolio, LIVESTRONG 2015 Portfolio, LIVESTRONG 2020 Portfolio, and LIVESTRONG 2025 Portfolio) posted a fractionally positive return for the six-month period.

The NT Diversified Bond Fund, LIVESTRONG Portfolios’ main fixed-income holding, performed in line with the broad domestic bond market. Sector allocation contributed positively to NT Diversified Bond’s performance, particularly an overweight position in corporate bonds and an underweight position in Treasury bonds. During the period, the management team positioned NT Diversified Bond for a flatter yield curve—a narrower gap between short- and long-term interest rates—as this gap reached historically wide levels in late 2009.

Outlook

Despite improving economic conditions over the past six months, we believe that the global recovery still faces several headwinds. Unemployment remains persistently high, consumers and businesses continue to deleverage amid elevated debt levels, and the federal government is producing sizable budget deficits in its efforts to sustain the recovery. Perhaps the greatest challenge will be whether the economy can maintain its momentum when the government’s temporary stimulus programs end. LIVESTRONG Portfolios’ broad diversification should prove valuable in an uncertain investment environment.

19

|

| Shareholder Fee Examples (Unaudited) |

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/ exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds. As a shareholder in the underlying American Century Investments funds, your fund will indirectly bear its pro rata share of the expenses incurred by the underlying funds. These expenses are not included in the fund’s annualized expense ratio or the expenses paid during the period. These expenses are, however, included in the effective expenses paid during the period.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from August 1, 2009 to January 31, 2010.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

If you hold Investor Class shares of any American Century Investments fund, or Institutional Class shares of the American Century Diversified Bond Fund, in an American Century Investments account (i.e., not a financial intermediary or retirement plan account), American Century Investments may charge you a $12.50 semiannual account maintenance fee if the value of those shares is less than $10,000. We will redeem shares automatically in one of your accounts to pay the $12.50 fee. In determining your total eligible investment amount, we will include your investments in all personal accounts (including American Century Investments Brokerage accounts) registered under your Social Security number. Personal accounts include individual accounts, joint accounts, UGMA/UTMA accounts, personal trusts, Coverdell Education Savings Accounts and IRAs (including traditional, Roth, Rollover, SEP-, SARSEP- and SIMPLE-IRAs), and certain other retirement accounts. If you have only business, business retirement, employer-sponsored or American Century Investments Brokerage accounts, you are currently not subject to this fee. We will not charge the fee as long as you choose to manage your accounts exclusively online. If you are subject to the Account Maintenance Fee, your account value could be reduced by the fee amount.

20

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | |

| | | | | | | Effective | |

| | | | | Expenses | | Expenses | |

| | | Beginning | Ending | Paid During | | Paid During | Effective |

| | | Account | Account | Period(1) | Annualized | Period(2) | Annualized |

| | | Value | Value | 8/1/09 – | Expense | 8/1/09 – | Expense |

| | | 8/1/09 | 1/31/10 | 1/31/10 | Ratio(1) | 1/31/10 | Ratio(2) |

| |

| LIVESTRONG Income Portfolio | | | | | |

| Actual | | | | | | |

| Investor Class | $1,000 | $1,060.80 | $1.04 | 0.20% | $3.95 | 0.76% |

| Institutional Class | $1,000 | $1,061.90 | $0.00 | 0.00%(3) | $2.91 | 0.56% |

| Advisor Class | $1,000 | $1,059.40 | $2.34 | 0.45% | $5.24 | 1.01% |

| R Class | $1,000 | $1,058.10 | $3.63 | 0.70% | $6.54 | 1.26% |

| Hypothetical | | | | | | |

| Investor Class | $1,000 | $1,024.20 | $1.02 | 0.20% | $3.87 | 0.76% |

| Institutional Class | $1,000 | $1,025.21 | $0.00 | 0.00%(3) | $2.85 | 0.56% |

| Advisor Class | $1,000 | $1,022.94 | $2.29 | 0.45% | $5.14 | 1.01% |

| R Class | $1,000 | $1,021.68 | $3.57 | 0.70% | $6.41 | 1.26% |

| (1) | Expenses are equal to the class’s annualized expense ratio listed in the table above, multiplied by the average account value over the period, |

| | multiplied by 184, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. The fees and |

| | expenses of the underlying American Century Investments funds in which the fund invests are not included in the class’s annualized expense ratio. |

| (2) | Effective expenses reflect the sum of expenses borne directly by the class plus the fund’s pro rata share of the weighted average expense |

| | ratio of the underlying funds in which it invests. The effective annualized expense ratio combines the class’s annualized expense ratio and the |

| | annualized weighted average expense ratio of the underlying funds. The annualized weighted average expense ratio of the underlying funds |

| | for the one-half year period reflects the actual expense ratio of each underlying fund from its most recent shareholder report, annualized and |

| | weighted for the fund’s relative average investment therein during the period. | | | |

| (3) | Other expenses, which include the fees and expenses of the fund’s independent directors and its legal counsel, as well as interest, did not |

| | exceed 0.005%. | | | | | | |

21

| | | | | | | |

| | | | | | | Effective | |

| | | | | Expenses | | Expenses | |

| | | Beginning | Ending | Paid During | | Paid During | Effective |

| | | Account | Account | Period(1) | Annualized | Period(2) | Annualized |

| | | Value | Value | 8/1/09 – | Expense | 8/1/09 – | Expense |

| | | 8/1/09 | 1/31/10 | 1/31/10 | Ratio(1) | 1/31/10 | Ratio(2) |

| LIVESTRONG 2015 Portfolio | | | | | |

| Actual | | | | | | |

| Investor Class | $1,000 | $1,065.60 | $1.04 | 0.20% | $4.17 | 0.80% |

| Institutional Class | $1,000 | $1,066.60 | $0.00 | 0.00%(3) | $3.13 | 0.60% |

| Advisor Class | $1,000 | $1,064.00 | $2.34 | 0.45% | $5.46 | 1.05% |

| R Class | $1,000 | $1,063.50 | $3.64 | 0.70% | $6.76 | 1.30% |

| Hypothetical | | | | | | |

| Investor Class | $1,000 | $1,024.20 | $1.02 | 0.20% | $4.08 | 0.80% |

| Institutional Class | $1,000 | $1,025.21 | $0.00 | 0.00%(3) | $3.06 | 0.60% |

| Advisor Class | $1,000 | $1,022.94 | $2.29 | 0.45% | $5.35 | 1.05% |

| R Class | $1,000 | $1,021.68 | $3.57 | 0.70% | $6.61 | 1.30% |

| LIVESTRONG 2020 Portfolio | | | | | |

| Actual | | | | | | |

| Investor Class | $1,000 | $1,070.10 | $1.04 | 0.20% | $4.33 | 0.83% |

| Institutional Class | $1,000 | $1,069.70 | $0.00 | 0.00%(3) | $3.29 | 0.63% |

| Advisor Class | $1,000 | $1,068.70 | $2.35 | 0.45% | $5.63 | 1.08% |

| R Class | $1,000 | $1,067.30 | $3.65 | 0.70% | $6.93 | 1.33% |

| Hypothetical | | | | | | |

| Investor Class | $1,000 | $1,024.20 | $1.02 | 0.20% | $4.23 | 0.83% |

| Institutional Class | $1,000 | $1,025.21 | $0.00 | 0.00%(3) | $3.21 | 0.63% |

| Advisor Class | $1,000 | $1,022.94 | $2.29 | 0.45% | $5.50 | 1.08% |

| R Class | $1,000 | $1,021.68 | $3.57 | 0.70% | $6.77 | 1.33% |

| (1) | Expenses are equal to the class’s annualized expense ratio listed in the table above, multiplied by the average account value over the period, |

| | multiplied by 184, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. The fees and |

| | expenses of the underlying American Century Investments funds in which the fund invests are not included in the class’s annualized expense ratio. |

| (2) | Effective expenses reflect the sum of expenses borne directly by the class plus the fund’s pro rata share of the weighted average expense |

| | ratio of the underlying funds in which it invests. The effective annualized expense ratio combines the class’s annualized expense ratio and the |

| | annualized weighted average expense ratio of the underlying funds. The annualized weighted average expense ratio of the underlying funds |

| | for the one-half year period reflects the actual expense ratio of each underlying fund from its most recent shareholder report, annualized and |

| | weighted for the fund’s relative average investment therein during the period. | | | |

| (3) | Other expenses, which include the fees and expenses of the fund’s independent directors and its legal counsel, as well as interest, did not |

| | exceed 0.005%. | | | | | | |

22

| | | | | | | |

| | | | | | | Effective | |

| | | | | Expenses | | Expenses | |

| | | Beginning | Ending | Paid During | | Paid During | Effective |

| | | Account | Account | Period(1) | Annualized | Period(2) | Annualized |

| | | Value | Value | 8/1/09 – | Expense | 8/1/09 – | Expense |

| | | 8/1/09 | 1/31/10 | 1/31/10 | Ratio(1) | 1/31/10 | Ratio(2) |

| LIVESTRONG 2025 Portfolio | | | | | |

| Actual | | | | | | |

| Investor Class | $1,000 | $1,071.90 | $1.04 | 0.20% | $4.44 | 0.85% |

| Institutional Class | $1,000 | $1,072.90 | $0.00 | 0.00%(3) | $3.40 | 0.65% |

| Advisor Class | $1,000 | $1,071.40 | $2.35 | 0.45% | $5.74 | 1.10% |

| R Class | $1,000 | $1,069.80 | $3.65 | 0.70% | $7.04 | 1.35% |

| Hypothetical | | | | | | |

| Investor Class | $1,000 | $1,024.20 | $1.02 | 0.20% | $4.33 | 0.85% |

| Institutional Class | $1,000 | $1,025.21 | $0.00 | 0.00%(3) | $3.31 | 0.65% |

| Advisor Class | $1,000 | $1,022.94 | $2.29 | 0.45% | $5.60 | 1.10% |

| R Class | $1,000 | $1,021.68 | $3.57 | 0.70% | $6.87 | 1.35% |

| LIVESTRONG 2030 Portfolio | | | | | |

| Actual | | | | | | |

| Investor Class | $1,000 | $1,077.30 | $1.05 | 0.20% | $4.61 | 0.88% |

| Institutional Class | $1,000 | $1,078.10 | $0.00 | 0.00%(3) | $3.56 | 0.68% |

| Advisor Class | $1,000 | $1,074.70 | $2.35 | 0.45% | $5.91 | 1.13% |

| R Class | $1,000 | $1,073.30 | $3.66 | 0.70% | $7.21 | 1.38% |

| Hypothetical | | | | | | |

| Investor Class | $1,000 | $1,024.20 | $1.02 | 0.20% | $4.48 | 0.88% |

| Institutional Class | $1,000 | $1,025.21 | $0.00 | 0.00%(3) | $3.47 | 0.68% |

| Advisor Class | $1,000 | $1,022.94 | $2.29 | 0.45% | $5.75 | 1.13% |

| R Class | $1,000 | $1,021.68 | $3.57 | 0.70% | $7.02 | 1.38% |

| (1) | Expenses are equal to the class’s annualized expense ratio listed in the table above, multiplied by the average account value over the period, |

| | multiplied by 184, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. The fees and |

| | expenses of the underlying American Century Investments funds in which the fund invests are not included in the class’s annualized expense ratio. |

| (2) | Effective expenses reflect the sum of expenses borne directly by the class plus the fund’s pro rata share of the weighted average expense |

| | ratio of the underlying funds in which it invests. The effective annualized expense ratio combines the class’s annualized expense ratio and the |

| | annualized weighted average expense ratio of the underlying funds. The annualized weighted average expense ratio of the underlying funds |

| | for the one-half year period reflects the actual expense ratio of each underlying fund from its most recent shareholder report, annualized and |

| | weighted for the fund’s relative average investment therein during the period. | | | |

| (3) | Other expenses, which include the fees and expenses of the fund’s independent directors and its legal counsel, as well as interest, did not |

| | exceed 0.005%. | | | | | | |

23

| | | | | | | |

| | | | | | | Effective | |

| | | | | Expenses | | Expenses | |

| | | Beginning | Ending | Paid During | | Paid During | Effective |

| | | Account | Account | Period(1) | Annualized | Period(2) | Annualized |

| | | Value | Value | 8/1/09 – | Expense | 8/1/09 – | Expense |

| | | 8/1/09 | 1/31/10 | 1/31/10 | Ratio(1) | 1/31/10 | Ratio(2) |

| LIVESTRONG 2035 Portfolio | | | | | |

| Actual | | | | | | |

| Investor Class | $1,000 | $1,080.70 | $1.05 | 0.20% | $4.77 | 0.91% |

| Institutional Class | $1,000 | $1,081.70 | $0.00 | 0.00%(3) | $3.73 | 0.71% |

| Advisor Class | $1,000 | $1,079.10 | $2.36 | 0.45% | $6.08 | 1.16% |

| R Class | $1,000 | $1,077.50 | $3.67 | 0.70% | $7.38 | 1.41% |

| Hypothetical | | | | | | |

| Investor Class | $1,000 | $1,024.20 | $1.02 | 0.20% | $4.63 | 0.91% |

| Institutional Class | $1,000 | $1,025.21 | $0.00 | 0.00%(3) | $3.62 | 0.71% |

| Advisor Class | $1,000 | $1,022.94 | $2.29 | 0.45% | $5.90 | 1.16% |

| R Class | $1,000 | $1,021.68 | $3.57 | 0.70% | $7.17 | 1.41% |

| LIVESTRONG 2040 Portfolio | | | | | |

| Actual | | | | | | |

| Investor Class | $1,000 | $1,083.20 | $1.05 | 0.20% | $4.88 | 0.93% |

| Institutional Class | $1,000 | $1,085.40 | $0.00 | 0.00%(3) | $3.84 | 0.73% |

| Advisor Class | $1,000 | $1,083.30 | $2.36 | 0.45% | $6.20 | 1.18% |

| R Class | $1,000 | $1,080.70 | $3.67 | 0.70% | $7.50 | 1.43% |

| Hypothetical | | | | | | |

| Investor Class | $1,000 | $1,024.20 | $1.02 | 0.20% | $4.74 | 0.93% |

| Institutional Class | $1,000 | $1,025.21 | $0.00 | 0.00%(3) | $3.72 | 0.73% |

| Advisor Class | $1,000 | $1,022.94 | $2.29 | 0.45% | $6.01 | 1.18% |

| R Class | $1,000 | $1,021.68 | $3.57 | 0.70% | $7.27 | 1.43% |

| (1) | Expenses are equal to the class’s annualized expense ratio listed in the table above, multiplied by the average account value over the period, |

| | multiplied by 184, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. The fees and |

| | expenses of the underlying American Century Investments funds in which the fund invests are not included in the class’s annualized expense ratio. |

| (2) | Effective expenses reflect the sum of expenses borne directly by the class plus the fund’s pro rata share of the weighted average expense |

| | ratio of the underlying funds in which it invests. The effective annualized expense ratio combines the class’s annualized expense ratio and the |

| | annualized weighted average expense ratio of the underlying funds. The annualized weighted average expense ratio of the underlying funds |

| | for the one-half year period reflects the actual expense ratio of each underlying fund from its most recent shareholder report, annualized and |

| | weighted for the fund’s relative average investment therein during the period. | | | |

| (3) | Other expenses, which include the fees and expenses of the fund’s independent directors and its legal counsel, as well as interest, did not |

| | exceed 0.005%. | | | | | | |

24

| | | | | | | |

| | | | | | | Effective | |

| | | | | Expenses | | Expenses | |

| | | Beginning | Ending | Paid During | | Paid During | Effective |

| | | Account | Account | Period(1) | Annualized | Period(2) | Annualized |

| | | Value | Value | 8/1/09 – | Expense | 8/1/09 – | Expense |

| | | 8/1/09 | 1/31/10 | 1/31/10 | Ratio(1) | 1/31/10 | Ratio(2) |

| LIVESTRONG 2045 Portfolio | | | | | |

| Actual | | | | | | |

| Investor Class | $1,000 | $1,084.60 | $1.05 | 0.20% | $4.99 | 0.95% |

| Institutional Class | $1,000 | $1,086.70 | $0.00 | 0.00%(3) | $3.94 | 0.75% |

| Advisor Class | $1,000 | $1,084.20 | $2.36 | 0.45% | $6.30 | 1.20% |

| R Class | $1,000 | $1,082.60 | $3.67 | 0.70% | $7.61 | 1.45% |

| Hypothetical | | | | | | |

| Investor Class | $1,000 | $1,024.20 | $1.02 | 0.20% | $4.84 | 0.95% |

| Institutional Class | $1,000 | $1,025.21 | $0.00 | 0.00%(3) | $3.82 | 0.75% |

| Advisor Class | $1,000 | $1,022.94 | $2.29 | 0.45% | $6.11 | 1.20% |

| R Class | $1,000 | $1,021.68 | $3.57 | 0.70% | $7.37 | 1.45% |

| LIVESTRONG 2050 Portfolio | | | | | |

| Actual | | | | | | |

| Investor Class | $1,000 | $1,086.50 | $1.05 | 0.20% | $5.00 | 0.95% |

| Institutional Class | $1,000 | $1,087.20 | $0.00 | 0.00%(3) | $3.95 | 0.75% |

| Advisor Class | $1,000 | $1,085.20 | $2.37 | 0.45% | $6.31 | 1.20% |

| R Class | $1,000 | $1,084.00 | $3.68 | 0.70% | $7.62 | 1.45% |

| Hypothetical | | | | | | |

| Investor Class | $1,000 | $1,024.20 | $1.02 | 0.20% | $4.84 | 0.95% |

| Institutional Class | $1,000 | $1,025.21 | $0.00 | 0.00%(3) | $3.82 | 0.75% |

| Advisor Class | $1,000 | $1,022.94 | $2.29 | 0.45% | $6.11 | 1.20% |

| R Class | $1,000 | $1,021.68 | $3.57 | 0.70% | $7.37 | 1.45% |

| (1) | Expenses are equal to the class’s annualized expense ratio listed in the table above, multiplied by the average account value over the period, |

| | multiplied by 184, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. The fees and |

| | expenses of the underlying American Century Investments funds in which the fund invests are not included in the class’s annualized expense ratio. |

| (2) | Effective expenses reflect the sum of expenses borne directly by the class plus the fund’s pro rata share of the weighted average expense |

| | ratio of the underlying funds in which it invests. The effective annualized expense ratio combines the class’s annualized expense ratio and the |

| | annualized weighted average expense ratio of the underlying funds. The annualized weighted average expense ratio of the underlying funds |

| | for the one-half year period reflects the actual expense ratio of each underlying fund from its most recent shareholder report, annualized and |

| | weighted for the fund’s relative average investment therein during the period. | | | |

| (3) | Other expenses, which include the fees and expenses of the fund’s independent directors and its legal counsel, as well as interest, did not |

| | exceed 0.005%. | | | | | | |

25

| | | | | | | | |

| LIVESTRONG Portfolios | | | | | |

| |

| JANUARY 31, 2010 (UNAUDITED) | | | | | | |

| | | Shares | Value | | | | Shares | Value |

| LIVESTRONG Income Portfolio | | | LIVESTRONG 2015 Portfolio | |

| Mutual Funds(1) — 100.0% | | | Mutual Funds(1) — 100.0% | |

| DOMESTIC EQUITY FUNDS — 39.1% | | | DOMESTIC EQUITY FUNDS — 42.3% | |

| NT Equity Growth Fund | | | | NT Equity Growth Fund | | |

| Institutional Class | 3,083,049 | $ 25,188,510 | | Institutional Class | 6,532,807 | $ 53,373,033 |

| NT Growth Fund | | | | NT Growth Fund | | |

| Institutional Class | 1,286,901 | 12,444,333 | | Institutional Class | 3,330,216 | 32,203,189 |

| NT Large Company Value | | | | NT Large Company Value | | |

| Fund Institutional Class | 2,852,295 | 21,363,689 | | Fund Institutional Class | 6,306,583 | 47,236,307 |

| NT Mid Cap Value Fund | | | | NT Mid Cap Value Fund | | |

| Institutional Class | 873,112 | 7,770,697 | | Institutional Class | 2,221,611 | 19,772,338 |

| NT Small Company Fund | | | | NT Small Company Fund | | |

| Institutional Class | 589,928 | 3,869,928 | | Institutional Class | 1,253,305 | 8,221,681 |

| NT Vista Fund | | | | NT Vista Fund | | |

| Institutional Class | 597,050 | 4,633,108 | | Institutional Class | 1,824,483 | 14,157,988 |

| Real Estate Fund | | | | Real Estate Fund | | |

| Institutional Class | 138,998 | 1,880,643 | | Institutional Class | 375,659 | 5,082,666 |

| | | | 77,150,908 | | | | | 180,047,202 |

| DOMESTIC FIXED INCOME FUNDS — 38.7% | | DOMESTIC FIXED INCOME FUNDS — 37.4% |

| High-Yield Fund | | | | High-Yield Fund | | |

| Institutional Class | 1,303,092 | 7,583,996 | | Institutional Class | 2,723,372 | 15,850,025 |