Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common stock is listed on the Nasdaq Global Market under the trading symbol “TTGT”. The following table sets forth the high and low sales prices of our common stock, as reported by the Nasdaq Global Market, for each quarterly period within our most recent fiscal year since our initial public offering:

| | | High | | | Low | |

| Fiscal 2007 | | | | | | |

Quarter ended June 30, 2007 (since May 16, 2007) | | | | | | | | |

Quarter ended September 30, 2007 | | | | | | | | |

Quarter ended December 31, 2007 | | | | | | | | |

| | | | | | | | | |

The closing sale price of our common stock, as reported by the Nasdaq Global Market, was $11.62 on February 29, 2008.

Holders

As of February 29, 2008 there were approximately 313 stockholders of record of our common stock based on the records of our transfer agent.

Dividends

We did not declare or pay any cash dividends on our common stock during the two most recent fiscal years. We currently intend to retain earnings, if any, to fund the development and growth of our business and do not anticipate paying other cash dividends on our common stock in the foreseeable future. Our payment of any future dividends will be at the discretion of our board of directors after taking into account various factors, including our financial condition, operating results, cash needs and growth plans.

Recent Sales of Unregistered Securities

Since January 1, 2005, we have issued the following securities that were not registered under the Securities Act:

(a) Issuances of Capital Stock

As of November 2006, there were outstanding options to purchase 17,456 shares of our common stock at an exercise price of $2.36 per share, the issuance of which may not have been exempt from registration or certain qualification requirements under federal or state securities laws. To address this issue, we made a rescission offer that was completed in December 2006 to all holders of these options pursuant to which we offered to repurchase these options for cash or shares of our common stock. In connection with the completion of the rescission offer, we issued 10,726 shares and paid out $6,561 in cash, which included statutory interest. The sales of securities pursuant to the rescission offer were made in reliance upon the exemption from registration provided by Section 3(b) of the Securities Act of 1933 for transactions by an issuer not involving a public offering. All of the foregoing securities are deemed restricted securities for purposes of the Securities Act.

(b) Grants and Exercises of Stock Options.

During 2007, prior to our initial public offering, we granted stock options to purchase 75,000 shares of our common stock with an exercise price of $13.00 per share to a director. During 2007, prior to our initial public offering, pursuant to our 1999 Stock Option Plan, we issued and sold 333,636 shares of our common stock upon the exercise of stock options for aggregate consideration of $211,938.

During 2006, pursuant to our 1999 Stock Option Plan, we granted stock options to purchase 4,243,500 shares of common stock with a weighted average exercise price of $7.36 per share to our employees. During 2006, 371,634 options were exercised for aggregate consideration of $553,659. During 2005, pursuant to our 1999 Stock Option Plan, we granted stock options to purchase 42,500 shares of common stock with a weighted average exercise price of $6.44 per share to our employees. During 2005, 141,725 options were exercised for aggregate consideration of $237,227.

The issuance of common stock upon exercise of the options was exempt either pursuant to Rule 701, as a transaction pursuant to a compensatory benefit plan, or pursuant to Section 4(2), as a transaction by an issuer not involving a public offering.

(c) Exercises of Warrants

During 2006, we issued and sold 184,233 shares of our common stock upon the exercise of a warrant for aggregate consideration of $338,988.

During 2007, we issued 52,764 shares of our common stock upon the cashless exercise of warrants. We did not receive any consideration from the cashless exercises apart from the surrender of the underlying warrants.

The issuances of common stock upon the exercise of the warrants were made in reliance upon the exemption from registration proved by Section 4(2) of the Securities Act for transactions by an issuer not involving a public offering. All of the foregoing securities are deemed restricted securities for purposes of the Securities Act.

Use of Proceeds from Public Offering of Common Stock

In May 2007, we completed our initial public offering (IPO) pursuant to a registration statement on Form S-1 (File No. 333-140503) that was declared effective by the SEC on May 16, 2007. Under the registration statement, we registered the offering and sale of an aggregate of 7,700,000 shares of our common stock, $0.001 par value, of which 6,427,152 shares were sold by the Company and 1,272,848 were sold by certain selling stockholders. All of the shares of common stock issued pursuant to the registration statement, including the shares sold by the selling stockholders, were sold at a price to the public of $13.00 per share.

As a result of the IPO, we raised a total of $83.2 million in net proceeds after deducting underwriting discounts and commissions of approximately $6.4 million and offering expenses of approximately $2.3 million. In May 2007 we repaid $12.0 million that we had borrowed against our revolving credit facility in conjunction with the acquisition of TechnologyGuide.com in April 2007. In November 2007 we acquired KnowledgeStorm, Inc. for approximately $58 million, consisting of approximately $52 million in cash and 359,820 shares of unregistered common stock of TechTarget valued at $6.0 million.

We have applied the remaining net proceeds from the IPO to our working capital for general corporate purposes. We have no current agreements or commitments with respect to any material acquisitions. We have invested the remaining net proceeds in cash, cash equivalents and short-term investments, in accordance with our investment policy. None of the remaining net proceeds were paid, directly or indirectly, to directors, officers, persons owning ten percent or more of our equity securities, or any of our other affiliates.

Equity Compensation Plan Information

Information relating to compensation plans under which our equity securities are authorized for issuance is set forth under “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” in our definitive proxy statement for our 2008 Annual Meeting of Stockholders.

Stock Performance Graph

The following graph compares the cumulative total return to stockholders of our common stock for the period from May 16, 2007, the date of our initial public offering, to December 31, 2007, to the cumulative total return of the Russell 2000 Index and the S&P 500 Media Industry Index for the same period. This graph assumes the investment of $100.00 on May 16, 2007 in our common stock, the Russell 2000 Index and the S&P 500 Media Industry Index and assumes any dividends are reinvested.

COMPARATIVE STOCK PERFORMANCE

Among TechTarget, Inc.

The Russell 2000 Index and

The S&P 500 Media Industry Index

| | | May 16, 2007 | | | June 30, 2007 | | | September 30, 2007 | | | December 31, 2007 | |

| | | | | | | | | | | | | |

| TechTarget, Inc. | | $ | 100.00 | | | $ | 98.85 | | | $ | 130.00 | | | $ | 113.69 | |

| Russell 2000 Index | | $ | 100.00 | | | $ | 102.57 | | | $ | 99.40 | | | $ | 94.85 | |

| S&P 500 Media Industry Index | | $ | 100.00 | | | $ | 101.07 | | | $ | 94.21 | | | $ | 86.34 | |

The information included under the heading “Stock Performance Graph” in Item 5 of this Annual Report on Form 10-K is “furnished” and not “filed” and shall not be deemed to be “soliciting material” or subject to Regulation 14A, shall not be deemed “filed” for purposes of Section 18 of the Securities Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities Act of 1934, as amended.

Item 6. Selected Consolidated Financial Data

The following selected consolidated financial data should be read in conjunction with our audited consolidated financial statements, the related notes and Management's Discussion and Analysis of Financial Condition and Results of Operations, which are included in this Annual Report on Form 10-K. The consolidated statement of operations data for the years ended December 31, 2007, 2006 and 2005, and the selected consolidated balance sheet data as of December 31, 2007 and 2006 have been derived from our audited consolidated financial statements and related notes included in this Annual Report on Form 10-K. The consolidated statement of operations data for the years ended December 31, 2004 and 2003, and the consolidated balance sheet data as of December 31, 2005, 2004 and 2003 have been derived from audited consolidated financial statements and related notes, which are not included in this Annual Report on Form 10-K. The historical results are not necessarily indicative of the results to be expected for any future period.

| | | Years Ended December 31, | |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| | | (in thousands, except share and per share data) | |

| Consolidated Statement of Operations Data: | | | | | | | | | | | | | | | |

| Revenues: | | | | | | | | | | | | | | | |

| Online | | $ | 63,686 | | | $ | 51,176 | | | $ | 43,662 | | | $ | 31,342 | | | $ | 21,023 | |

| Events | | | 24,254 | | | | 19,708 | | | | 14,595 | | | | 9,647 | | | | 7,845 | |

| Print | | | 6,725 | | | | 8,128 | | | | 8,489 | | | | 5,738 | | | | 3,598 | |

| Total revenues | | | 94,665 | | | | 79,012 | | | | 66,746 | | | | 46,727 | | | | 32,466 | |

| | | | | | | | | | | | | | | | | | | | | |

| Cost of revenues: | | | | | | | | | | | | | | | | | | | | |

Online (1) | | | 15,575 | | | | 12,988 | | | | 10,476 | | | | 7,632 | | | | 5,826 | |

Events (1) | | | 8,611 | | | | 6,493 | | | | 6,202 | | | | 5,948 | | | | 4,798 | |

Print (1) | | | 3,788 | | | | 5,339 | | | | 5,322 | | | | 3,073 | | | | 2,318 | |

| Total cost of revenues | | | 27,974 | | | | 24,820 | | | | 22,000 | | | | 16,653 | | | | 12,942 | |

| | | | | | | | | | | | | | | | | | | | | |

| Gross profit | | | 66,691 | | | | 54,192 | | | | 44,746 | | | | 30,074 | | | | 19,524 | |

| | | | | | | | | | | | | | | | | | | | | |

| Operating expenses: | | | | | | | | | | | | | | | | | | | | |

Selling and marketing (1) | | | 28,048 | | | | 20,305 | | | | 18,174 | | | | 15,138 | | | | 10,736 | |

Product development (1) | | | 7,320 | | | | 6,295 | | | | 5,756 | | | | 4,111 | | | | 3,728 | |

General and administrative (1) | | | 12,592 | | | | 8,756 | | | | 7,617 | | | | 11,756 | | | | 3,991 | |

| Depreciation | | | 1,610 | | | | 1,144 | | | | 1,792 | | | | 1,168 | | | | 1,153 | |

| Amortization of intangible assets | | | 4,740 | | | | 5,029 | | | | 5,172 | | | | 1,304 | | | | 428 | |

| Total operating expenses | | | 54,310 | | | | 41,529 | | | | 38,511 | | | | 33,477 | | | | 20,036 | |

| | | | | | | | | | | | | | | | | | | | | |

| Operating income (loss) | | | 12,381 | | | | 12,663 | | | | 6,235 | | | | (3,403 | ) | | | (512 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Interest income (expense), net | | | 1,831 | | | | 321 | | | | (30 | ) | | | 143 | | | | (21 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Income (loss) before provision for (benefit from) income taxes | | | 14,212 | | | | 12,984 | | | | 6,205 | | | | (3,260 | ) | | | (533 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Provision for (benefit from) income taxes | | | 6,046 | | | | 5,811 | | | | (2,681 | ) | | | 32 | | | | - | |

| | | | | | | | | | | | | | | | | | | | | |

| Net income (loss) | | $ | 8,166 | | | $ | 7,173 | | | $ | 8,886 | | | $ | (3,292 | ) | | $ | (533 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Net income (loss) per common share (2): | | | | | | | | | | | | | | | | | | | | |

| Basic | | $ | 0.15 | | | $ | (0.46 | ) | | $ | (0.24 | ) | | $ | (1.34 | ) | | $ | (0.51 | ) |

| Diluted | | $ | 0.13 | | | $ | (0.46 | ) | | $ | (0.24 | ) | | $ | (1.34 | ) | | $ | (0.51 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Weighted average common shares outstanding: | | | | | | | | | | | | | | | | | | | | |

| Basic | | | 28,384,303 | | | | 7,824,374 | | | | 7,370,680 | | | | 7,594,470 | | | | 7,901,256 | |

| Diluted | | | 31,346,738 | | | | 7,824,374 | | | | 7,370,680 | | | | 7,594,470 | | | | 7,901,256 | |

| | | | | | | | | | | | | | | | | | | | | |

| Other Data: | | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA (unaudited) (3) | | $ | 24,565 | | | $ | 20,086 | | | $ | 13,277 | | | $ | 5,352 | | | $ | 1,104 | |

| | | As of December 31, | |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| | | (in thousands) | |

| Consolidated Balance Sheet Data: | | | | | | | | | | | | | | | |

| Cash, cash equivalents and short-term investments | | $ | 62,001 | | | $ | 30,830 | | | $ | 46,879 | | | $ | 7,214 | | | $ | 7,988 | |

| Total assets | | | 199,887 | | | | 92,647 | | | | 95,160 | | | | 92,920 | | | | 15,692 | |

| Total liabilities | | | 19,239 | | | | 21,107 | | | | 32,879 | | | | 39,841 | | | | 7,131 | |

| Total redeemable convertible preferred stock | | | - | | | | 136,766 | | | | 126,004 | | | | 115,383 | | | | 40,392 | |

| Total stockholders' equity (deficit) | | | 180,648 | | | | (65,226 | ) | | | (63,723 | ) | | | (62,304 | ) | | | (31,831 | ) |

| | | Years Ended December 31, | |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| | | (in thousands) | |

(1) Amounts include stock-based compensation expense as follows: | | | | | | | | | | | | | | | |

| Cost of online revenue | | $ | 189 | | | $ | 87 | | | $ | - | | | $ | 78 | | | $ | - | |

| Cost of events revenue | | | 53 | | | | 31 | | | | - | | | | 236 | | | | - | |

| Cost of print revenue | | | 15 | | | | 12 | | | | - | | | | - | | | | - | |

| Selling and marketing | | | 2,999 | | | | 606 | | | | - | | | | 1,025 | | | | - | |

| Product development | | | 334 | | | | 90 | | | | - | | | | 7 | | | | - | |

| General and administrative | | | 2,244 | | | | 424 | | | | 78 | | | | 4,937 | | | | 35 | |

| Total | | $ | 5,834 | | | $ | 1,250 | | | $ | 78 | | | $ | 6,283 | (a) | | $ | 35 | |

| | (a) | In May 2004, we offered to repurchase for cash (i) up to 100% of the issued and outstanding shares of our series A preferred stock; and (ii) up to 45% of the aggregate issued and outstanding shares of common stock and/or options to purchase the same (provided the option holder had either completed four years of service with us as of May 1, 2004, or had held the option for at least four years as of May 1, 2004), effected to provide certain stockholders and option holders with liquidity. We recorded stock-based compensation expense of $6,012,382 related to the purchase of 1,429,157 options. |

| (2) | Basic and diluted net income (loss) per common share is computed by dividing the net income (loss) applicable to common stockholders by the basic and diluted weighted-average number of common shares outstanding for the fiscal period. See "Note 2 of our Notes to Consolidated Financial Statements." |

| (3) | The following table reconciles net income (loss) to Adjusted EBITDA for the periods presented and is unaudited: |

| | | Years Ended December 31, | |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| | | (in thousands) | |

| | | | | | | | | | | | | | | | |

| Net income (loss) | | $ | 8,166 | | | $ | 7,173 | | | $ | 8,886 | | | $ | (3,292 | ) | | $ | (533 | ) |

| Interest income (expense), net | | | 1,831 | | | | 321 | | | | (30 | ) | | | 143 | | | | (21 | ) |

| Provision for (benefit from) income taxes | | | 6,046 | | | | 5,811 | | | | (2,681 | ) | | | 32 | | | | - | |

| Depreciation | | | 1,610 | | | | 1,144 | | | | 1,792 | | | | 1,168 | | | | 1,153 | |

| Amortization of intangible assets | | | 4,740 | | | | 5,029 | | | | 5,172 | | | | 1,304 | | | | 428 | |

| EBITDA | | | 18,731 | | | | 18,836 | | | | 13,199 | | | | (931 | ) | | | 1,069 | |

| Stock-based compensation | | | 5,834 | | | | 1,250 | | | | 78 | | | | 6,283 | (a) | | | 35 | |

| Adjusted EBITDA | | $ | 24,565 | | | $ | 20,086 | | | $ | 13,277 | | | $ | 5,352 | | | $ | 1,104 | |

| | (a) | In May 2004, we offered to repurchase for cash (i) up to 100% of the issued and outstanding shares of our series A preferred stock; and (ii) up to 45% of the aggregate issued and outstanding shares of common stock and/or options to purchase the same (provided the option holder had either completed four years of service with us as of May 1, 2004, or had held the option for at least four years as of May 1, 2004), effected to provide certain stockholders and option holders with liquidity. We recorded stock-based compensation expense of $6,012,382 related to the purchase of 1,429,157 options. |

Adjusted EBITDA is a metric used by management to measure operating performance. EBITDA represents net income (loss) before interest income (expense) net, provision for (benefit from) income taxes, depreciation and amortization. Adjusted EBITDA represents EBITDA less stock-based compensation expense. We present Adjusted EBITDA as a supplemental performance measure because we believe it facilitates operating performance comparisons from period to period and company to company by backing out potential differences caused by variations in capital structures (affecting interest expense), tax positions (such as the impact on periods or companies of changes in effective tax rates or net operating losses), the age and book depreciation of fixed assets (affecting relative depreciation expense), and the impact of non-cash stock-based compensation expense costs. Because Adjusted EBITDA facilitates internal comparisons of operating performance on a more consistent basis, we also use Adjusted EBITDA in measuring our performance relative to that of our competitors. We also use Adjusted EBITDA in connection with our compensation of our executive officers. Adjusted EBITDA is not a measurement of our financial performance under GAAP and should not be considered as an alternative to net income, operating income or any other performance measures derived in accordance with GAAP or as an alternative to cash flow from operating activities as a measure of our profitability or liquidity. We understand that although Adjusted EBITDA is frequently used by securities analysts, lenders and others in their evaluation of companies, Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are:

| · | Adjusted EBITDA does not reflect our cash expenditures, or future requirements for capital expenditures or contractual commitments; |

| · | Adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs; |

| · | Adjusted EBITDA does not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on our debts; |

| · | Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and Adjusted EBITDA does not reflect any cash requirements for such replacements; and |

| · | Other companies in our industry may calculate Adjusted EBITDA differently than we do, limiting its usefulness as a comparative measure. |

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with the consolidated financial statements and accompanying notes included elsewhere in this Annual Report on Form 10-K. In this discussion and analysis, dollar, share and per share amounts are not rounded to thousands unless otherwise indicated. This discussion and analysis contains forward-looking statements that involve risks, uncertainties and assumptions. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including those discussed below and elsewhere in this Annual Report on Form 10-K particularly under the heading "Risk Factors."

Overview

Background

We are a leading provider of specialized online content that brings together buyers and sellers of corporate IT products. We sell customized marketing programs that enable IT vendors to reach corporate IT decision makers who are actively researching specific IT purchases.

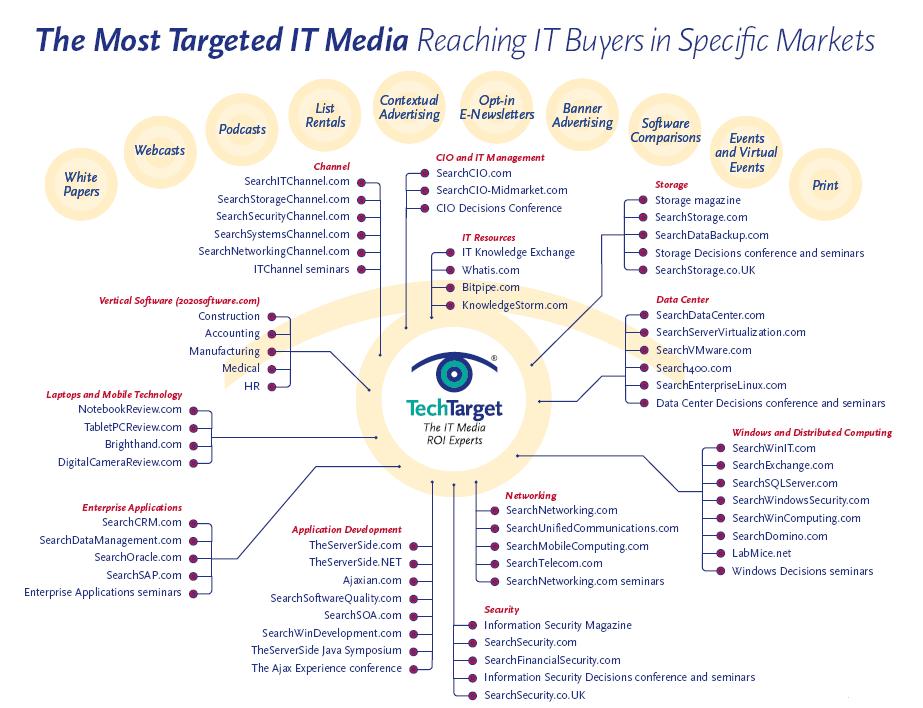

Our integrated content platform consists of a network of websites that we complement with targeted in-person events and two specialized IT magazines. Throughout all stages of the purchase decision process, these content offerings meet IT professionals' needs for expert, peer and IT vendor information, and provide a platform on which IT vendors can launch targeted marketing campaigns that generate measurable, high ROI. As IT professionals have become increasingly specialized, they have come to rely on our sector-specific websites for purchasing decision support. Our content enables IT professionals to navigate the complex and rapidly changing IT landscape where purchasing decisions can have significant financial and operational consequences. Based upon the logical clustering of our users' respective job responsibilities and the marketing focus of the products that our customers are advertising, we currently categorize our content offerings across eleven distinct media groups: Application Development; Channel; CIO and IT Management; Data Center; Enterprise Applications; Laptops and Mobile Technology; Networking; Security; Storage; Vertical Software; and Windows and Distributed Computing.

In May 2007, we completed our initial public offering of 8.9 million shares of our common stock, of which 7.1 million shares were sold by us and 1.8 million shares were sold by certain of our existing shareholders at a price to the public of $13.00 per share. We raised a total of $91.9 million in gross proceeds from the offering, or $83.2 million in net proceeds after deducting underwriting discounts and commissions of $6.4 million and other offering costs of approximately $2.3 million. Upon the closing of the offering, all shares of our redeemable convertible preferred stock automatically converted into 24.4 million shares of common stock.

Sources of Revenues

We sell advertising programs to IT vendors targeting a specific audience within a particular IT sector or sub-sector. We maintain multiple points of contact with our customers to provide support throughout their organizations and the sales cycle. As a result, our customers often run multiple advertising programs with us in order to reach discrete portions of our targeted audience. There are multiple factors that can impact our customers' advertising objectives and spending with us, including but not limited to, product launches, increases or decreases to their advertising budgets, the timing of key industry marketing events, responses to competitor activities and efforts to address specific marketing objectives such as creating brand awareness or generating sales leads. Our services are generally delivered under short-term contracts that run for the length of a given advertising program, typically less than 90 days.

We generate substantially all of our revenues from the sale of targeted advertising campaigns that we deliver via our network of websites, events and print publications.

Online. The majority of our revenue is derived from the delivery of our online offerings from our media groups. Online revenue represented 67%, 65% and 65% of total revenues for the years ended December 31, 2007, 2006 and 2005, respectively. We expect the majority of our revenues to be derived through the delivery of online offerings for the foreseeable future. As a result of our customers' advertising objectives and preferences, the specific allocation of online advertising offerings sold and delivered by us, on a period by period basis, can fluctuate.

Through our websites we sell a variety of online media offerings to connect IT vendors to IT professionals. Our lead generation offerings allow IT vendors to capture qualified sales leads from the distribution and promotion of content to our audience of IT professionals. Our branding offerings provide IT vendors exposure to targeted audiences of IT professionals actively researching information related to their products and services.

Our branding offerings include banners and e-newsletters. Banner advertising can be purchased on specific websites within our network. We also offer the ability to advertise in e-newsletters focused on key site sub-topics across our portfolio of websites. These offerings give IT vendors the ability to increase their brand awareness to highly specialized IT sectors.

Our lead generation offerings include the following:

| - | White Papers. White papers are technical documents created by IT vendors to describe business or technical problems that are addressed by the vendors' products or services. IT vendors pay us to have their white papers distributed to our users and receive targeted promotions on our relevant websites. When viewing white papers, our registered members and visitors supply their corporate contact and qualification information and agree to receive further information from the vendor. The corporate contact and other qualification information for these leads are supplied to the vendor in real time through our proprietary lead management software. |

| - | Webcasts and Podcasts. IT vendors pay us to sponsor and host webcasts and podcasts that bring informational sessions directly to attendees' desktops and, in the case of podcasts, directly to their mobile devices. As is the case with white papers, our users supply their corporate contact and qualification information to the webcast or podcast sponsor when they view or download the content. Sponsorship includes access to the registrant information and visibility before, during and after the event. |

| - | Software Package Comparisons. Through our 2020software.com website, IT vendors pay us to post information and specifications about their software packages, typically organized by application category. Users can request further information, which may include downloadable trial software from multiple software providers in sectors such as customer relationship management, or CRM, accounting, and business analytics. IT vendors, in turn, receive qualified leads based upon the users who request their information. |

| - | Dedicated E-mails. IT vendors pay us to further target the promotion of their white papers, webcasts, podcasts or downloadable trial software by including their content in our periodic e-mail updates to registered users of our websites. Users who have voluntarily registered on our websites receive an e-mail update from us when vendor content directly related to their interests is listed on our sites. |

| - | List Rentals. We also offer IT vendors the ability to message relevant registered members on topics related to their interests. IT vendors can rent our e-mail and postal lists of registered members using specific criteria such as company size, geography or job title. |

| - | Contextual Advertising. Our contextual advertising programs associate IT vendor white papers, webcasts, podcasts or other content on a particular topic with our related sector-specific content. IT vendors have the option to purchase exclusive sponsorship of content related to their product or category. |

Events. Events revenue represented 26%, 25% and 22% of total revenues for the years ended December 31, 2007, 2006 and 2005, respectively. Most of our media groups operate revenue generating events. The majority of our events are free to IT professionals and are sponsored by IT vendors. Attendees are pre-screened based on event-specific criteria such as sector-specific budget size, company size, or job title. We offer three types of events: multi-day conferences, single-day seminars and custom events. Multi-day conferences provide independent expert content for our attendees and allow vendors to purchase exhibit space and other sponsorship offerings that enable interaction with the attendees. We also hold single-day seminars on various topics in major cities. These seminars provide independent content on key sub-topics in the sectors we serve, are free to qualified attendees, and offer multiple vendors the ability to interact with specific, targeted audiences actively focused on buying decisions. Our custom events differ from our conferences and seminars in that they are exclusively sponsored by a single IT vendor, and the content is driven primarily by the sole sponsor.

Print. Print revenue represented 7%, 10% and 13% of total revenues for the years ended December 31, 2007, 2006 and 2005, respectively. As of December 31, 2007, we publish monthly two controlled-circulation magazines that are free to subscribers and generate revenue solely based on advertising fees. The highly targeted magazines we publish are: Storage magazine (Storage Media Group), which we began publishing in 2002; and Information Security magazine (Security Media Group), which we began publishing in 2003. We discontinued publishing CIO Decisions magazine in November 2007. Our magazines provide readers with strategic guidance on important enterprise-level technology decisions. We expect print revenue to decrease as a percentage of total revenue in the foreseeable future.

Cost of Revenues, Operating Expenses and Other

Expenses consist of cost of revenues, selling and marketing, product development, general and administrative, depreciation, and amortization expenses. Personnel-related costs are a significant component of most of these expense categories. We grew from 307 employees at December 31, 2004 to 584 employees at December 31, 2007. We expect personnel-related expenses to continue to increase in absolute dollars, but to decline over time as a percentage of total revenues due to anticipated economies of scale in our business support functions.

Cost of Online Revenue. Cost of online revenue consists primarily of: salaries and related personnel costs; member acquisition expenses (primarily keyword purchases from leading Internet search sites); freelance writer expenses; website hosting costs; vendor expenses associated with the delivery of webcast, podcast and list rental offerings; stock-based compensation expenses; and related overhead.

Cost of Events Revenue. Cost of events revenue consists primarily of: facility expenses, including food and beverages for the event attendees; salaries and related personnel costs; event speaker expenses; stock-based compensation expenses; and related overhead.

Cost of Print Revenue. Cost of print revenue consists primarily of: printing and graphics expenses; mailing costs; salaries and related personnel costs; freelance writer expenses; subscriber acquisition expenses (primarily telemarketing); stock-based compensation expenses; and related overhead.

Selling and Marketing. Selling and marketing expense consists primarily of: salaries and related personnel costs; sales commissions; travel, lodging and other out-of-pocket expenses; stock-based compensation expenses; and related overhead. Sales commissions are recorded as expense when earned by the employee.

Product Development. Product development includes the creation and maintenance of our network of websites, advertiser offerings and technical infrastructure. Product development expense consists primarily of salaries and related personnel costs; stock-based compensation expenses; and related overhead.

General and Administrative. General and administrative expense consists primarily of: salaries and related personnel costs; facilities expenses; accounting, legal and other professional fees; stock-based compensation expenses; and related overhead. General and administrative expense may continue to increase as a percentage of total revenue for the foreseeable future as we invest in infrastructure to support continued growth and incur additional expenses related to being a publicly traded company, including increased audit and legal fees, costs of compliance with securities and other regulations, investor relations expense, and higher insurance premiums.

Depreciation. Depreciation expense consists of the depreciation of our property and equipment. Depreciation of property and equipment is calculated using the straight-line method over their estimated useful lives ranging from three to five years.

Amortization of Intangible Assets. Amortization of intangible assets expense consists of the amortization of intangible assets recorded in connection with our acquisitions. Separable intangible assets that are not deemed to have an indefinite life are amortized over their useful lives using the straight-line method over periods ranging from one to nine years.

Interest Income (Expense), Net. Interest income (expense) net consists primarily of interest income earned on cash and cash equivalent balances less interest expense incurred on bank term loan balances. We historically have invested our cash in money market accounts, commercial paper corporate debt securities, municipal bonds, auction rate securities and variable rate demand notes.

Application of Critical Accounting Policies and Use of Estimates

The discussion of our financial condition and results of operations is based upon our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these financial statements requires us to make estimates, judgments and assumptions that affect the reported amount of assets, liabilities, revenues and expenses and related disclosure of contingent assets and liabilities. On an ongoing basis, we evaluate our estimates, including those related to revenue, long-lived assets, the allowance for doubtful accounts, stock-based compensation, and income taxes. We based our estimates of the carrying value of certain assets and liabilities on historical experience and on various other assumptions that we believe to be reasonable. In many cases, we could reasonably have used different accounting policies and estimates. In some cases, changes in the accounting estimates are reasonably likely to occur from period to period. Our actual results may differ from these estimates under different assumptions or conditions.

We believe the following critical accounting policies affect our more significant judgments used in the preparation of our consolidated financial statements. See the notes to our financial statements for information about these critical accounting policies as well as a description of our other accounting policies.

Revenue Recognition

We generate substantially all of our revenue from the sale of targeted advertising campaigns that we deliver via our network of websites, events and print publications. We recognize this revenue in accordance with Staff Accounting Bulletin, or SAB, No. 104, Revenue Recognition, and Financial Accounting Standards Board's, or FASB, Emerging Issues Task Force, or EITF, Issue No. 00-21, Revenue Arrangement With Multiple Deliverables. In all cases, we recognize revenue only when the price is fixed or determinable, persuasive evidence of an arrangement exists, the service is performed and collectibility of the resulting receivable is reasonably assured.

Online. We recognize revenue from our specific online media offerings as follows:

| - | White Papers. We recognize white paper revenue ratably in the period in which the white paper is available on our websites. |

| - | Webcasts and Podcasts. We recognize webcast revenue in the period in which the webcast occurs. We recognize podcast revenue in the period in which it is posted and becomes available on our websites. |

| - | Software Package Comparisons. We recognize software package comparison revenue ratably over the period in which the software information is available on our websites. |

| - | Dedicated E-mails and E-newsletters. We recognize dedicated e-mail and e-newsletter revenue in the period in which the e-mail or e-newsletter is sent. |

| - | List Rentals. We recognize list rental revenue in the period in which the e-mails are sent to the list of registered members. |

| - | Banners. We recognize banner revenue in the period in which the banner impressions occur. |

We offer customers the ability to purchase integrated ROI program offerings, which can include any of our online media offerings packaged together to address the particular customer's specific advertising requirements. As part of these offerings, we will guarantee a minimum number of qualified sales leads to be delivered over the course of the advertising campaign. Throughout the advertising campaign, revenue is recognized as individual offerings are delivered, and the lead guarantee commitments are closely monitored to assess campaign performance. If the minimum number of qualified sales leads is not met by the scheduled completion date of the advertising campaign, the advertising campaign is extended, and we will defer recognition of revenue in an amount equal to the value of the estimated inventory that will be required to fulfill the guarantee. These estimates are based on our extensive experience in managing and fulfilling these integrated ROI program offerings. Typically, shortfalls in fulfilling lead guarantees before the scheduled completion date of an advertising campaign are satisfied within an average of 45 days of such scheduled completion date.

As of December 31, 2007, substantially all of the integrated ROI program offerings that have guaranteed a minimum number of qualified sales leads have been delivered within the original contractual term. Integrated ROI program offerings have not required us to defer a more than $25,000 in any quarter during 2007, nor have we been required to refund or extend payment terms to customers to account for these guarantees. These integrated ROI program offerings represented approximately 35% and 29% of our online revenues, and 23% and 19% of our total revenues for the years ended December 31, 2007 and 2006, respectively.

Amounts collected or billed prior to satisfying the above revenue recognition criteria are recorded as deferred revenue.

While each of our online media offerings can be sold separately, most of our online media sales involve multiple online offerings. At inception of the arrangement, we evaluate the deliverables to determine whether they represent separate units of accounting under EITF Issue No. 00-21. Deliverables are deemed to be separate units of accounting if all of the following criteria are met: the delivered item has value to the customer on a standalone basis; there is objective and reliable evidence of the fair value of the item(s); and delivery or performance of the item(s) is considered probable and substantially in our control. We allocate revenue to each unit of accounting in a transaction based upon its fair value as determined by vendor objective evidence. Vendor objective evidence of fair value for all elements of an arrangement is based upon the normal pricing and discounting practices for those online media offerings when sold to other similar customers. If vendor objective evidence of fair value has not been established for all items under the arrangement, no allocation can be made, and we recognize revenue on all items over the term of the arrangement.

Events. We recognize event sponsorship revenue upon completion of the event in the period the event occurs. The majority of our events are free to qualified attendees, however certain events are based on a paid attendee model. We recognize revenue for paid attendee events upon completion of the event and receipt of payment from the attendee. Amounts collected or billed prior to satisfying the above revenue recognition criteria are recorded as deferred revenue.

Print. We recognize print revenue at the time the applicable magazine is distributed. Amounts collected or billed prior to satisfying the above revenue recognition criteria are recorded as deferred revenue.

Stock-Based Compensation Expense

Through December 31, 2005, we accounted for stock option grants in accordance with Accounting Principles Board, or APB, Opinion No. 25, Accounting for Stock Issued to Employees, and complied with the disclosure provisions of Statement of Financial Accounting Standards, or SFAS, No. 123, Accounting for Stock-Based Compensation, as amended by SFAS No. 148, Accounting for Stock-Based Compensation—Transition and Disclosure. Under APB 25, deferred stock-based compensation expense is recorded for the intrinsic value of options (the difference between the deemed fair value of our common stock and the option exercise price) at the grant date and is amortized ratably over the option's vesting period. We also accounted for non-employee option grants on a fair-value basis using the Black-Scholes model and recognized this expense over the applicable vesting period.

On January 1, 2006, we adopted the requirements of SFAS No. 123(R), Share Based Payment. SFAS No. 123(R) requires us to measure the cost of employee services received in exchange for an award of equity instruments, based on the fair value of the award on the date of grant, and to recognize the cost over the period during which the employee is required to provide the services in exchange for the award. We adopted SFAS 123(R) using the prospective method, which requires us to apply its provisions only to stock-based awards to employees granted on or after January 1, 2006. For the years ended December 31, 2007 and 2006, we recorded expense of $5.83 million and $1.25 million, respectively, in connection with share-based payment awards. Unrecognized stock-based compensation expense for non-vested options and restricted stock awards of $18.9 million and $8.7 million is expected to be recognized using the straight-line method over a weighted-average period of 1.65 years and 2.05 years, respectively. The actual amount of stock-based compensation expense we record in any fiscal period will depend on a number of factors, including the number of equity instruments issued and the volatility of our stock price over time.

Long-Lived Assets

Our long-lived assets consist of property and equipment, goodwill and other intangible assets. Goodwill and other intangible assets have arisen principally from our acquisitions. The amount assigned to intangible assets is subjective and based on our estimates of the future benefit of the intangible assets using accepted valuation techniques, such as discounted cash flow and replacement cost models. Our long-lived assets, other than goodwill, are amortized over their estimated useful lives, which we determined based on the consideration of several factors including the period of time the asset is expected to remain in service. We evaluate the carrying value and remaining useful lives of long-lived assets, other than goodwill, whenever indicators of impairment are present. We evaluate the carrying value of goodwill annually, and whenever indicators of impairment are present. Because we have one reporting segment under SFAS No. 142, Goodwill and Other Intangible Assets, we utilize the entity-wide approach to assess goodwill for impairment and compare our market value to our net book value to determine if an impairment exists.

Income Taxes

We are subject to income taxes in both the United States and foreign jurisdictions, and we use estimates in determining our provision for income taxes. We account for income taxes in accordance with SFAS No. 109, Accounting for Income Taxes, which is the asset and liability method for accounting and reporting for income taxes. Under SFAS No. 109, deferred tax assets and liabilities are recognized based on temporary differences between the financial reporting and income tax bases of assets and liabilities using statutory rates.

Our deferred tax assets are comprised primarily of net operating loss, or NOL, carryforwards. As of December 31, 2007, we had federal and state NOL carryforwards of approximately $18.1 million and $18.2 million, respectively, which may be used to offset future taxable income. The NOL carryforwards expire at various times through 2027, and are subject to review and possible adjustment by the Internal Revenue Service. The Internal Revenue Code contains provisions that limit the NOL and tax credit carryforwards available to be used in any given year in the event of certain changes in the ownership interests of significant stockholders. The federal NOL carryforwards of $18.1 million available at December 31, 2007 were acquired from KnowledgeStorm and are subject to limitations on their use in future years.

In evaluating the ability to realize our net deferred tax assets, we consider all available evidence, both positive and negative, including past operating results, the existence of cumulative losses in the most recent fiscal years, tax planning strategies that are prudent, and feasible and forecasts of future taxable income. In 2005, we reversed a $6.75 million valuation allowance because sufficient positive evidence existed to ascertain that it was more likely than not that we would be able to realize our deferred tax assets. This conclusion was based on our operating performance over the past few years and our operating plans for the foreseeable future. In the event that we are unable to generate taxable earnings in the future and determine that it is more likely than not that we can not realize our deferred tax assets, an adjustment to the valuation allowance would be made which may decrease income in the period that such determination is made, and may increase income in subsequent periods.

We adopted the provisions of FIN 48, an interpretation of SFAS No. 109, Accounting for Income Taxes, on January 1, 2007. FIN 48 clarifies the accounting for uncertainty in income taxes recognized in an enterprise’s financial statements in accordance with SFAS No. 109 and prescribes a recognition threshold and measurement process for financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. We did not recognize any liability for unrecognized tax benefits as a result of adopting FIN 48 on January 1, 2007 and during the year ended December 31, 2007.

Net Income (Loss) Per Share

We calculate net income (loss) per share in accordance with SFAS No. 128, Earnings Per Share (SFAS No. 128). Through May 17, 2007, we calculated net income per share in accordance with SFAS No. 128, as clarified by EITF Issue No. 03-6, Participating Securities and the Two-Class Method Under FASB Statement No. 128, Earnings Per Share. EITF Issue No. 03-6 clarifies the use of the "two-class" method of calculating earnings per share as originally prescribed in SFAS No. 128. Effective for periods beginning after March 31, 2004, EITF Issue No. 03-6 provides guidance on how to determine whether a security should be considered a "participating security" for purposes of computing earnings per share and how earnings should be allocated to a participating security when using the two-class method for computing basic earnings per share. We determined that our convertible preferred stock represented a participating security and therefore adopted the provisions of EITF Issue No. 03-6.

Under the two-class method, basic net income (loss) per share is computed by dividing the net income (loss) applicable to common stockholders by the weighted-average number of common shares outstanding for the fiscal period. Diluted net income (loss) per share is computed using the more dilutive of (a) the two-class method or (b) the if-converted method. We allocate net income first to preferred stockholders based on dividend rights under our charter and then to preferred and common stockholders based on ownership interests. Net losses are not allocated to preferred stockholders.

As of May 16, 2007, the effective date of our initial public offering, we transitioned from having two classes of equity securities outstanding, common and preferred stock, to a single class of equity securities outstanding, common stock, upon automatic conversion of shares of redeemable convertible preferred stock into shares of common stock. In calculating diluted earnings per share for the period January 1, 2007 to May 16, 2007 shares related to redeemable convertible preferred stock were excluded because they were anti-dilutive. In calculating diluted earnings per share for 2006 and 2005, shares related to redeemable convertible preferred stock and outstanding stock options and warrants were excluded because they were anti-dilutive.

Subsequent to our initial public offering, basic earnings per share is computed based only on the weighted average number of common shares outstanding during the period. Diluted earnings per share is computed using the weighted average number of common shares outstanding during the period, plus the dilutive effect of potential future issuances of common stock relating to stock option programs and other potentially dilutive securities using the treasury stock method. In calculating diluted earnings per share, the dilutive effect of stock options is computed using the average market price for the respective period. In addition, under SFAS No. 123(R), the assumed proceeds under the treasury stock method include the average unrecognized compensation expense of stock options that are in-the-money. This results in the “assumed” buyback of additional shares, thereby reducing the dilutive impact of stock options.

Allowance for Doubtful Accounts

We reduce gross trade accounts receivable with an allowance for doubtful accounts. The allowance for doubtful accounts is our best estimate of the amount of probable credit losses in our existing accounts receivable. We review our allowance for doubtful accounts on a regular basis, and all past due balances are reviewed individually for collectibility. Account balances are charged against the allowance after all means of collection have been exhausted and the potential for recovery is considered remote. Provisions for allowance for doubtful accounts are recorded in general and administrative expense. If our historical collection experience does not reflect our future ability to collect outstanding accounts receivables, our future provision for doubtful accounts could be materially affected. To date, we have not incurred any write-offs of accounts receivable significantly different than the amounts reserved. As of December 31, 2007 and 2006, the allowance for doubtful accounts was $424 and $580, respectively.

Results of Operations

The following table sets forth our results of operations for the periods indicated:

| | | Years Ended December 31, | |

| | | 2007 | | | 2006 | | | 2005 | |

| | | (in thousands) | |

| Revenues: | | | | | | | | | | | | | | | | | | |

| Online | | $ | 63,686 | | | | 67 | % | | $ | 51,176 | | | | 65 | % | | $ | 43,662 | | | | 65 | % |

| Events | | | 24,254 | | | | 26 | | | | 19,708 | | | | 25 | | | | 14,595 | | | | 22 | |

| Print | | | 6,725 | | | | 7 | | | | 8,128 | | | | 10 | | | | 8,489 | | | | 13 | |

| Total revenues | | | 94,665 | | | | 100 | | | | 79,012 | | | | 100 | | | | 66,746 | | | | 100 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Cost of revenues: | | | | | | | | | | | | | | | | | | | | | | | | |

| Online | | | 15,575 | | | | 17 | | | | 12,988 | | | | 16 | | | | 10,476 | | | | 16 | |

| Events | | | 8,611 | | | | 9 | | | | 6,493 | | | | 8 | | | | 6,202 | | | | 9 | |

| Print | | | 3,788 | | | | 4 | | | | 5,339 | | | | 7 | | | | 5,322 | | | | 8 | |

| Total cost of revenues | | | 27,974 | | | | 30 | | | | 24,820 | | | | 31 | | | | 22,000 | | | | 33 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Gross profit | | | 66,691 | | | | 70 | | | | 54,192 | | | | 69 | | | | 44,746 | | | | 67 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating expenses: | | | | | | | | | | | | | | | | | | | | | | | | |

| Selling and marketing | | | 28,048 | | | | 30 | | | | 20,305 | | | | 26 | | | | 18,174 | | | | 27 | |

| Product development | | | 7,320 | | | | 8 | | | | 6,295 | | | | 8 | | | | 5,756 | | | | 9 | |

| General and administrative | | | 12,592 | | | | 13 | | | | 8,756 | | | | 11 | | | | 7,617 | | | | 11 | |

| Depreciation | | | 1,610 | | | | 2 | | | | 1,144 | | | | 1 | | | | 1,792 | | | | 3 | |

| Amortization of intangible assets | | | 4,740 | | | | 5 | | | | 5,029 | | | | 6 | | | | 5,172 | | | | 8 | |

| Total operating expenses | | | 54,310 | | | | 58 | | | | 41,529 | | | | 53 | | | | 38,511 | | | | 58 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating income | | | 12,381 | | | | 13 | | | | 12,663 | | | | 16 | | | | 6,235 | | | | 9 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest income (expense), net | | | 1,831 | | | | 2 | | | | 321 | | | | * | | | | (30 | ) | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Income before provision for (benefit from) income taxes | | | 14,212 | | | | 15 | | | | 12,984 | | | | 16 | | | | 6,205 | | | | 9 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Provision for (benefit from) income taxes | | | 6,046 | | | | 6 | | | | 5,811 | | | | 7 | | | | (2,681 | ) | | | (4 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income | | $ | 8,166 | | | | 9 | % | | $ | 7,173 | | | | 9 | % | | $ | 8,886 | | | | 13 | % |

* Percentage not meaningful.

Comparison of Fiscal Years Ended December 31, 2007 and 2006

Revenues

| | | Years Ended December 31, | |

| | | 2007 | | | 2006 | | | Increase (Decrease) | | | Percent Change | |

| | | ($ in thousands) | |

| Revenues: | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Online. The increase in online revenue was attributable to a $14.7 million increase in revenue from lead generation offerings due primarily to an increase in webcast and white paper sales volumes as well as revenues from TechnologyGuide.com, which we acquired in April 2007 and KnowledgeStorm, which we acquired in November 2007. The increase is offset by a $2.3 million decrease in revenue from branding offerings due primarily to decreases in banner and e-newsletter sales volume.

Events. The increase in events revenue was primarily attributable to a $4.2 million increase in seminar series revenue due to an increase in the number of seminar series events produced in 2007 as compared to 2006.

Print. The decrease in print revenue was attributable to the continued shift of advertising budgets towards online offerings. Additionally, we discontinued publishing CIO Decisions magazine in November 2007.

Cost of Revenues and Gross Profit

| | | Years Ended December 31, | |

| | | 2007 | | | 2006 | | | Increase (Decrease) | | | Percent Change | |

| | | ($ in thousands) | |

| Cost of revenues: | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Cost of Online Revenue. The increase in cost of online revenue was in part attributable to a $888,000 increase in member acquisition expenses, primarily related to keyword purchases for 2020software.com which we acquired in May 2006. The increase also reflects $594,000 in additional webcast cost of sales due to increased webcast sales volume in 2007. Approximately $516,000 of the increase is attributable to salaries and benefits due to an increase in average headcount of 10 employees in our online editorial and operations organizations, as well as an additional $193,000 related to increased freelancer expenses in 2007. We increased headcount and freelancers expenditures to support the increase in online revenue volume and to provide additional editorial content. Approximately $420,000 of the increase related to the acquisition of KnowledgeStorm, which we completed in November 2007.

Cost of Events Revenue. The increase in cost of events revenue was primarily attributable to a $1.2 million increase in seminar and custom event cost of sales due to an increase in the number of seminar series and custom events produced in 2007 as compared to 2006. Approximately $547,000 of the increase was related to salaries, bonuses, benefits and temporary staffing expenses to support the increase in seminar series and custom event volume. Three additional multi-day conferences were held in 2007 as compared to 2006 resulting in increased conference expenses of approximately $305,000.

Cost of Print Revenue. The decrease in cost of print revenue was attributable to our efforts in 2007 to reduce production costs for all three magazines in response to our customer’s advertising budgets continuing to shift away from print and towards online offerings. Additionally, we discontinued publishing CIO Decisions magazine in November 2007.

Gross Profit. The increase in gross profit reflects a $9.9 million increase in online gross profit and a $2.4 million increase in events gross profit. The increase in online gross profit is attributable to an increase in online revenue at a consistent gross profit percentage. The increase in events gross profit is attributable to an increase in custom event and seminar series revenue at a higher gross profit percentage on these events when compared to 2006. We expect our gross profit to fluctuate from period to period depending on our mix of revenues.

Operating Expenses and Other

| | | For the Years Ended December 31, | |

| | | 2007 | | | 2006 | | | Increase (Decrease) | | | Percent Change | |

| | | ($ in thousands) | |

| Operating expenses: | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

General and administrative | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Amortization of intangible assets | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Provision for income taxes | | | | | | | | | | | | | | | | |

* Percent change not meaningful.

Selling and Marketing. The increase in selling and marketing expense was primarily attributable to a $3.9 million increase in salaries, commissions, and benefits related to an increase in average headcount of 45 employees in our sales and marketing organizations, as well as increases to employee compensation. The increase in headcount was to support the growth in revenues. The increase also reflects a $2.4 million increase in stock-based compensation expense and a $347,000 increase in travel expense resulting from the growth in sales personnel. Approximately $945,000 of selling and marketing expense related to the results of operations of KnowledgeStorm which we acquired in November 2007.

Product Development. The increase in product development expense was primarily attributable to $612,000 of expense related to the results of operations of KnowledgeStorm which we acquired in November 2007. An additional $144,000 of the increase was for consulting expenses related to IT infrastructure improvements to support the growing number of online offerings. The increase also reflects a $244,000 increase in stock-based compensation.

General and Administrative. The increase in general and administrative expense was primarily attributable to a $1.8 million increase in stock-based compensation and a $482,000 increase in other employee compensation. The increase was also attributable to a $955,000 increase in audit, legal, and insurance expenses related to operating as a publicly traded company since May 2007. The increase also reflects a $259,000 increase in facilities expense due to leasing additional office space in our Needham, MA headquarters beginning in July 2007.

Depreciation. The increase in depreciation expense was attributable to purchases of property and equipment of $2.7 million in the year ended December 31, 2007 compared to $1.3 million in 2006.

Amortization of Intangible Assets. The decrease in amortization of intangible assets expense was attributable to intangible assets related to acquisitions in prior years becoming fully amortized, offset in part by the amortization of intangible assets related to our acquisitions of TechnologyGuide.com in May 2007 and KnowledgeStorm in November 2007.

Interest Income (Expense), Net. The increase in interest income (expense), net reflected an increase in average cash and short-term investment balances during 2007 compared to 2006.

Provision for Income Taxes. The provision for income taxes as a percentage of income before taxes, or our annual effective tax rate, was 43% in 2007 and 45% in 2006. The decrease in the effective tax rate was primarily due to an increase in interest income exempt from Federal taxation.

Comparison of Fiscal Years Ended December 31, 2006 and 2005

Revenues

| | | Years Ended December 31, | |

| | | 2006 | | | 2005 | | | Increase (Decrease) | | | Percent Change | |

| | | ($ in thousands) | |

| Revenues: | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Online. The increase in online revenue was attributable to a $5.2 million increase in revenue from lead generation offerings due primarily to an increase in software package comparison and webcast sales volumes. The increase also reflects a $2.6 million increase in revenue from branding offerings due primarily to an increase in banner sales volume.

Events. The increase in events revenue was attributable to a $3.0 million increase in seminar series revenue and a $2.2 million increase in custom event revenue. We introduced both custom event and seminar series offerings in 2005 and, therefore, more events associated with these revenue streams were produced in 2006 as compared to 2005.

Print. The decrease in print revenue was attributable to the continued shift of advertising budgets towards online offerings.

Cost of Revenues and Gross Profit

| | | Years Ended December 31, | |

| | | 2006 | | | 2005 | | | Increase | | | Percent Change | |

| | | ($ in thousands) | |

| Cost of revenues: | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Cost of Online Revenue. The increase in cost of online revenue was attributable to a $1.2 million increase in member acquisition expenses primarily related to keyword purchases for 2020software.com, which we acquired in May 2006. The increase also reflects a $857,000 increase in salaries and benefits primarily related to an increase in average headcount of 19 employees in our online editorial and operations organizations, as well as increases in employee compensation. We increased headcount to support the increase in online revenue volume and to provide additional editorial content.

Cost of Events Revenue. The increase in cost of events revenue was primarily attributable to a $801,000 increase in salaries and benefits primarily related to an increase in average headcount of 20 employees in our event organizations, as well as increases in employee compensation. We increased headcount to support the increase in seminar series and custom event volume. The increase was offset in part by a decrease in hotel related costs associated with the operation of multi-day conferences.

Cost of Print Revenue. The increase in cost of print revenue was attributable to three additional months of publishing CIO Decisions magazine during 2006 compared to 2005, offset primarily by a decrease in non-compensation related expenses incurred publishing our other two magazines.

Gross Profit. The increase in gross profit reflects a $5.0 million increase in online gross profit and a $4.8 million increase in events gross profit. The increase in online gross profit is attributable to an increase in online revenue at a consistent gross profit percentage. The increase in events gross profit is attributable to an increase in custom event and seminar series revenue at a higher gross profit percentage on these events when compared to 2005. We expect our gross profit to fluctuate from period to period depending on our mix of revenues.

Operating Expenses and Other

| | | For the Years Ended December 31, | |

| | | 2006 | | | 2005 | | | Increase (Decrease) | | | Percent Change | |

| | | ($ in thousands) | |

| Operating expenses: | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

General and administrative | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Amortization of intangible assets | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Interest income (expense), net | | | | | | | | | | | | | | | | |

Provision for (benefit from) income taxes | | | | | | | | | | | | | | | | |

* Percent change not meaningful.

Selling and Marketing. The increase in selling and marketing expense was primarily attributable to a $884,000 increase in salaries, commissions, and benefits related to an increase in average headcount of 22 employees in our sales and marketing organizations, as well as increases to employee compensation. The increase in headcount was to support the growth in revenues. The increase also reflects a $606,000 increase in stock-based compensation and a $498,000 increase in travel expense resulting from the growth in sales personnel.

Product Development. The increase in product development expense was primarily attributable to a $369,000 increase in salaries and benefits primarily related to an increase in average headcount of six employees in our product development organizations, as well as increases in employee compensation. We increased our headcount to support the growing number of online offerings and to maintain and upgrade our IT infrastructure.

General and Administrative. The increase in general and administrative expense was primarily attributable to a $553,000 increase in employee compensation and a $491,000 increase in bad debt expense. The increase in bad debt expense was attributable to bad debt expense of $366,000 in 2006 compared to ($124,000) in 2005 due to a reduction in the allowance for doubtful accounts recorded in 2005.

Depreciation. The decrease in depreciation expense was attributable to a change effective January 1, 2006, in the estimated useful life for computer equipment and software from two years to three years to more closely approximate the service lives of the assets placed in service to date.

Amortization of Intangible Assets. The decrease in amortization of intangible assets expense was attributable to intangible assets related to acquisitions in prior years becoming fully amortized, offset in part by the amortization of intangible assets related to our acquisition of 2020software.com in May 2006.

Interest Income (Expense), Net. The increase in interest income (expense), net reflected an increase in interest income attributable to higher interest rates in 2006.

Provision for Income Taxes. We recorded a provision for income taxes in 2006 based upon a 45% effective tax rate. Our effective tax rate increased after the adoption of SFAS No. 123(R) because stock-based compensation is a nondeductible expense in our tax provision. The provision for income taxes is net of an $85,000 deferred tax benefit recorded to revalue our deferred tax assets using a federal tax rate of 35%. The $2.7 million benefit from income taxes in 2005 was primarily attributable to the release of the valuation allowance against our deferred tax assets. In the fourth quarter of 2005, we determined that it was more likely than not that we would generate sufficient future taxable income from operations to realize tax benefits arising from the use of our existing net operating loss carryforwards.

Selected Quarterly Results of Operations

The following table presents our unaudited quarterly consolidated results of operations and our unaudited quarterly consolidated results of operations as a percentage of revenue for the eight quarters ended December 31, 2007. The unaudited quarterly consolidated information has been prepared on the same basis as our audited consolidated financial statements. You should read the following table presenting our quarterly consolidated results of operations in conjunction with our audited consolidated financial statements and the related notes included elsewhere in this prospectus. The operating results for any quarter are not necessarily indicative of the operating results for any future period.

| | | For the Three Months Ended | |

| | | 2007 | | | 2006 | |

| | | Mar. 31 | | | Jun. 30 | | | Sep. 30 | | | Dec. 31 | | | Mar. 31 | | | Jun. 30 | | | Sep. 30 | | | Dec. 31 | |

| | | (in thousands, except per share data) | |

| Revenues: | | | | | | | | | | | | | | | | | | | | | | | | |

| Online | | $ | 13,709 | | | $ | 16,330 | | | $ | 14,687 | | | $ | 18,960 | | | $ | 10,375 | | | $ | 12,812 | | | $ | 12,565 | | | $ | 15,424 | |

| Events | | | 2,939 | | | | 6,350 | | | | 6,912 | | | | 8,053 | | | | 2,327 | | | | 5,742 | | | | 5,893 | | | | 5,746 | |

| Print | | | 1,697 | | | | 1,924 | | | | 1,702 | | | | 1,402 | | | | 2,209 | | | | 2,163 | | | | 1,809 | | | | 1,947 | |

| Total revenues | | | 18,345 | | | | 24,604 | | | | 23,301 | | | | 28,415 | | | | 14,911 | | | | 20,717 | | | | 20,267 | | | | 23,117 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cost of revenues: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Online | | | 3,525 | | | | 3,900 | | | | 3,769 | | | | 4,381 | | | | 2,621 | | | | 2,992 | | | | 3,644 | | | | 3,731 | |

| Events | | | 1,372 | | | | 2,410 | | | | 2,283 | | | | 2,546 | | | | 1,274 | | | | 1,735 | | | | 1,632 | | | | 1,852 | |

| Print | | | 1,129 | | | | 999 | | | | 862 | | | | 798 | | | | 1,407 | | | | 1,423 | | | | 1,385 | | | | 1,124 | |

| Total cost of revenues | | | 6,026 | | | | 7,309 | | | | 6,914 | | | | 7,725 | | | | 5,302 | | | | 6,150 | | | | 6,661 | | | | 6,707 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gross profit | | | 12,319 | | | | 17,295 | | | | 16,387 | | | | 20,690 | | | | 9,609 | | | | 14,567 | | | | 13,606 | | | | 16,410 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating expenses: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Selling and marketing | | | 6,152 | | | | 6,388 | | | | 7,271 | | | | 8,237 | | | | 4,432 | | | | 5,191 | | | | 4,932 | | | | 5,750 | |

| Product development | | | 1,748 | | | | 1,596 | | | | 1,677 | | | | 2,299 | | | | 1,564 | | | | 1,559 | | | | 1,617 | | | | 1,555 | |

| General and administrative | | | 2,610 | | | | 2,943 | | | | 3,364 | | | | 3,675 | | | | 1,791 | | | | 2,084 | | | | 2,126 | | | | 2,755 | |

| Depreciation | | | 330 | | | | 364 | | | | 401 | | | | 515 | | | | 218 | | | | 238 | | | | 241 | | | | 447 | |

| Amortization of intangible assets | | | 759 | | | | 1,041 | | | | 1,171 | | | | 1,769 | | | | 1,084 | | | | 1,424 | | | | 1,378 | | | | 1,143 | |

| Total operating expenses | | | 11,599 | | | | 12,332 | | | | 13,884 | | | | 16,495 | | | | 9,089 | | | | 10,496 | | | | 10,294 | | | | 11,650 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating income | | | 720 | | | | 4,963 | | | | 2,503 | | | | 4,195 | | | | 520 | | | | 4,071 | | | | 3,312 | | | | 4,760 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest income (expense), net | | | (67 | ) | | | 377 | | | | 897 | | | | 624 | | | | 96 | | | | 42 | | | | (16 | ) | | | 199 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Income before provision for income taxes | | | 653 | | | | 5,340 | | | | 3,400 | | | | 4,819 | | | | 616 | | | | 4,113 | | | | 3,296 | | | | 4,959 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Provision for income taxes | | | 336 | | | | 2,092 | | | | 1,568 | | | | 2,050 | | | | 175 | | | | 1,739 | | | | 1,709 | | | | 2,188 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income | | $ | 317 | | | $ | 3,248 | | | $ | 1,832 | | | $ | 2,769 | | | $ | 441 | | | $ | 2,374 | | | $ | 1,587 | | | $ | 2,771 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income (loss) per share basic | | $ | (0.28 | ) | | $ | 0.07 | | | $ | 0.05 | | | $ | 0.07 | | | $ | (0.29 | ) | | $ | (0.03 | ) | | $ | (0.16 | ) | | $ | 0.00 | |

| Net income (loss) per share diluted | | $ | (0.28 | ) | | $ | 0.06 | | | $ | 0.04 | | | $ | 0.06 | | | $ | (0.29 | ) | | $ | (0.03 | ) | | $ | (0.16 | ) | | $ | 0.00 | |

Seasonality

The timing of our revenues is affected by seasonal factors. Our revenues are seasonal primarily as a result of the annual budget approval process of many of our customers and the historical decrease in advertising activity in July and August. Revenues are usually the lowest in the first quarter of each calendar year, increase during the second quarter, decrease during the third quarter, and increase again during the fourth quarter. Events revenue may vary depending on which quarters we produce the event, which may vary when compared to previous periods. The timing of revenues in relation to our expenses, much of which does not vary directly with revenue, has an impact on the cost of online revenue, selling and marketing, product development, and general and administrative expenses as a percentage of revenue in each calendar quarter during the year.

The majority of our expenses are personnel-related and include salaries, stock-based compensation, benefits and incentive-based compensation plan expenses. As a result, we have not experienced significant seasonal fluctuations in the timing of our expenses period to period.

Liquidity and Capital Resources

| | | As of and for the Years Ended December 31, | |

| | | 2007 | | | 2006 | | | 2005 | |

| | | (in thousands) | |

Cash, cash equivalents and short-term investments | | | | | | | | | | | | |

| | | | | | | | | | | | |

Cash provided by operating expenses | | | | | | | | | | | | |

Cash used in investing activities (1) | | | | | | | | | | | | |

Cash provided by (used in) financing activities | | | | | | | | | | | | |

(1) Cash used in investing activities shown net of short-term investment activity.

Cash, Cash Equivalents and Short-Term Investments

Our cash, cash equivalents and short-term investments at December 31, 2007 were held for working capital purposes and were invested primarily in money market accounts, municipal bonds, auction rate securities and variable rate demand notes. We do not enter into investments for trading or speculative purposes.

At March 20, 2008, we held $6.2 million in auction rate securities. Auction rate securities are variable-rate bonds tied to short-term interest rates with maturities in excess of 90 days. Interest rates on these securities typically reset through a modified Dutch auction at predetermined short-term intervals, usually every 1, 7, 28 or 35 days. These auctions have historically provided a liquid market for these securities. In February and March 2008, our investment in auction rate securities of $6.2 million failed at auction due to sell orders exceeding buy orders. Our ability to liquidate our auction rate securities and fully recover the carrying value of our auction rate securities in the near term may be limited or not exist and we may in the future be required to record an impairment charge on these investments. The vast majority of our auction rate securities, including those that have failed, were rated AAA at the time of purchase. We believe we will be able to liquidate our investments without significant loss within the next year, and we currently believe these securities are not impaired, primarily due to the credit worthiness of the issuers of the underlying securities and their ability to refinance if auctions continue to fail. However, it could take until the final maturity of the underlying notes (up to 25 years) to realize its investments' recorded value.

Accounts Receivable, Net