Exhibit 99.1

KaloBios Corporate Overview August 2016 Corporate Overview 1

Forward - Looking Statements This presentation contains forward - looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward - looking statements reflect management’s current knowledge, assumptions, judgment and expectations regarding future performance or events. Although management believes that the expectations reflected in such statements are reasonable, they give no assurance that such expectations will prove to be correct, and actual results could d iff er materially from the forward - looking statements . Words such as “will,” “expect,” “intend,” “plan,” “predict,” “potential,” “possible,” and similar expressions identify forward - looking statements, including, without limitation, statements related to the scope, progress, expansion, and costs of developing and commercializing our product candidates, anticipated regulatory incentives for product candidates, and anticipated expenses related to development activities, clinical trials and the development and potential commercialization of product candidates . Forward - looking statements are subject to risks and uncertainties including, but not limited to, the Company’s ability to execute its revised strategy and business plan; the ability of the Company to regain compliance with reporting requirements of the Securi tie s and Exchange Commission and to list its common stock on a national securities exchange; the success of the Company’s clinical trials for its product pipeline; the Company’s access to limited cash reserves and its ability to obtain additional capital, inc luding the additional capital which will be necessary to complete the clinical trials that the Company has initiated or plans to initiat e; the potential timing and outcomes of clinical studies of benznidazole , lenzilumab , ifabotuzumab or any other product candidates; the commercial viability of the Company’s proposed drug pricing program; the ability of the Company to timely source adequate sup ply of its development products from third - party manufacturers on whom the Company depends; the potential, if any, for future development of any of its present or future products; the Company's ability to successfully progress, partner or complete fur the r development of its programs; the ability of the Company to identify and develop additional products; the uncertainties inhere nt in clinical testing; the timing, cost and uncertainty of obtaining regulatory approvals; the uncertainty of receiving a Priority Re view Voucher; the Company's ability to protect the Company's intellectual property; competition; and changes in the regulatory landscape or the imposition of regulations that affect the Company's products; and the various risks described in the "Risk F act ors" and elsewhere in the Company's periodic and other filings with the Securities and Exchange Commission . You are cautioned not to place undue reliance on any forward - looking statements, which speak only as of the date of this release. The company has no obligation, and expressly disclaims any obligation to update, revise or correct any of the forward - looking statements, whether as a result of new information, future events or otherwise. Corporate Overview 2

KaloBios Value Model Punching above weight with high - performance talent Reorient around specialty assets with various paths for significant commercial return – standalone commercial value, partnering and/or Priority Review Vouchers Reposition and drive pipeline to benefit from regulatory incentives offered by FDA – which could result in periods of exclusivity , expedited review and potentially higher probability of success, among other benefits Identify asset opportunities where significant value can be created to help overlooked patients in need with neglected and/or rare or orphan conditions 3 Corporate Overview

History • San Francisco R&D company, monoclonal antibody platform • Funding dead - end, winding down Oct 2015 , market cap < $ 4 MM • Martin Shkreli investment in late Nov 2015 • Shkreli arrest/indictment and Chapter 11 filing Dec 2015 • D elisted from NASDAQ Jan 2016 • Two new Board members Jan 2016 (one became new CEO March 2016 ) • Transformational effort to alter perception of company • Improbable bankruptcy exit June 30 , 2016 • Execution momentum immediately upon bankruptcy exit • Market cap ~ $ 50 - 60 MM (Aug 2016 ), new management, stronger fit between key management expertise and assets 4 Corporate Overview

Execution Mindset • Emerged from bankruptcy six months after declaring Chapter 11 – Successfully overcame multiple complex obstacles and defies predictions that it will either go into Chapter 7 or take years to emerge – Resolved all outstanding lawsuits • E xecuted deal for key product and raised $14MM in equity upon emergence from bankruptcy • Disassociated company from Martin Shkreli, including all of his shareholding, nine months after his initial investment • W orking to regain compliance with SEC periodic reporting requirements and intending to seek relisting on a national stock exchange • F anatically focused on execution of a revised and exciting strategy 5 Corporate Overview

Right Vision, Right People • “Rising from the ashes” - new company, new strategy, new vision • Neglected and rare diseases with high unmet need and pediatric possibilities • Clear, focused, differentiated vision : x Strategy based on leveraging existing FDA regulatory incentives x Highly focused on specialty markets x Multiple paths to commercial value creation x Sustainable and transparent pricing x Pursuing innovative stakeholder partnering models x Laser focus on execution 6 Corporate Overview • Experienced new management team with domain expertise and record of swift, successful execution • Strong investor alignment

Leadership Cameron Durrant , MD, MBA - Chairman and CEO • Senior pharmaceutical and biotech exec, turnaround specialist • Senior exec roles at global blue - chip pharma companies ; experience as Exec Chairman, CEO and CFO ; CEO roles at three specialty pharma groups • Expertise in anti - infectives , pediatrics, oncology Niv Caviar, MBA – Consultant focused on corporate and business d evelopment • Senior functional roles in marketing, business development, strategic planning • Senior exec roles, CEO, EVP - CBO, CFO, VP Bus Dev • La Jolla Pharma, Allergan, Suneva , SpineOvations , Affymetrix , Accenture Steve Pal, MBA – Consultant focused on commercial • Global pharma and consumer healthcare product commercialisation • Corporate VP Global Strategic Marketing, Health Outcomes, Strategy and Research, Global Medical Affairs, Allergan 7 Corporate Overview (slide 1 of 2)

Leadership Kip Witter, MBA, CPA - Interim Chief Financial Officer • Senior Consultant with The Brenner Group LLC, a financial consultancy group • CFO, Interim CFO, Secretary and Principal Accounting Officer roles • Board member of several privately held companies Dave Tousley, MBA, CPA - Consultant focused on finance and a dministration • >35 years experience in biotech, spec pharma, full pharma • Senior exec roles, President, COO, CFO • Pasteur, Merieux , Connaught, AVAX, airPharma , PediaMed , DARA Biosciences Morgan Lam – Chief Operating Officer • Extensive industry experience in clinical research • Head of Clinical Operations and Development KaloBios • Executive Director, Medical Affairs, Geron Christopher Bowe – Consultant focused on corporate a ffairs • Deep experience advising CEOs on articulating strategy through corp affairs • Former Strategic Affairs advisor at Schering - Plough • Industry thought leader and prior award - winning writer for Financial Times 8 Corporate Overview

Board of Directors Cameron Durrant , MD, MBA • Chairman Ronald Barliant, JD • Of Counsel at Goldberg Kohn, extensive experience representing debtors and creditors in complex bankruptcy cases • United States bankruptcy judge for the Northern District of Illinois 1988 to 2002 Dale Chappell, MD, MBA • Managing member of Black Horse Capital Management, LLC • Previously associate at Chilton Investment Company specializing in healthcare Timothy Morris • CFO AcelRx Pharmaceuticals ; also Head of Business Development • CFO, SVP Finance and Global Corporate Development VIVUS, Inc . Ezra Friedberg • Founder and general partner of Multiplier Capital, LP • >20 years investing experience across public and private companies 9 Corporate Overview

10 Corporate Overview Strategy Develop specialty products with strong societal, market and investor interest Utilize existing FDA regulatory incentives Advance medicines for neglected and rare diseases through innovative business models

11 Corporate Overview Priority Review Vouchers (PRVs) • Two PRV programs • Neglected Tropical Disease (NTD) • Rare Pediatric Disease (RPD) • Incentivizes sponsors to bring medicines through FDA approval to U . S . patients • 10 vouchers awarded, 6 have been sold • Highest disclosed sale price of $ 350 MM

Disclosed PRV Sale Prices 12 Corporate Overview Publicly disclosed PRV sale prices as of August 1 , 2016 . D oes not include undisclosed , private transaction between Wellstat Therapeutics and AstraZeneca ( Sep 2015 ) or currently undisclosed Gilead PRV purchase (Jul 2016 ) . Drug Approval Date PRV Type PRV S eller PRV Buyer Sale Price Transaction Disclosure Date Vimizim ® Feb 20 14 RPD Biomarin Regeneron & Sanofi $67.5MM July 2014 Impavido ® Mar 20 14 NTD Knight Therapeutics Gilead $125MM Nov 2014 Cholbam ® Mar 20 15 RPD Retrophin Sanofi $245MM May 2015 Unituxin ® Mar 20 15 RPD United Therapeutics AbbVie $350MM Aug 2015

13 Corporate Overview KaloBios PRV Approach • KaloBios is not a PRV - only company • PRVs are an important incentive for developing drugs for conditions that other companies may have neglected . Seeking them is consistent with our strategy of leveraging existing regulatory incentives • Benznidazole is the exception and a one - off opportunity – furthest in development and the PRV is the key value driver • Remaining pipeline and deals being considered have standalone commercial opportunity and/or Orphan D esignation with PRV possibility as a further benefit

Responsible Pricing Model • Strategic initiative to transform company and build a sustainable platform to execute strategy • Affordable for patients and payers whilst delivering a reasonable return for the company • Collaborate with key stakeholders on what constitutes a reasonable return • Publicly share key elements that make up our pricing decisions • Right price with right investment model for right product 14 Corporate Overview Intended to lead to productive and potentially preferential discussions with payers and strong KOL support

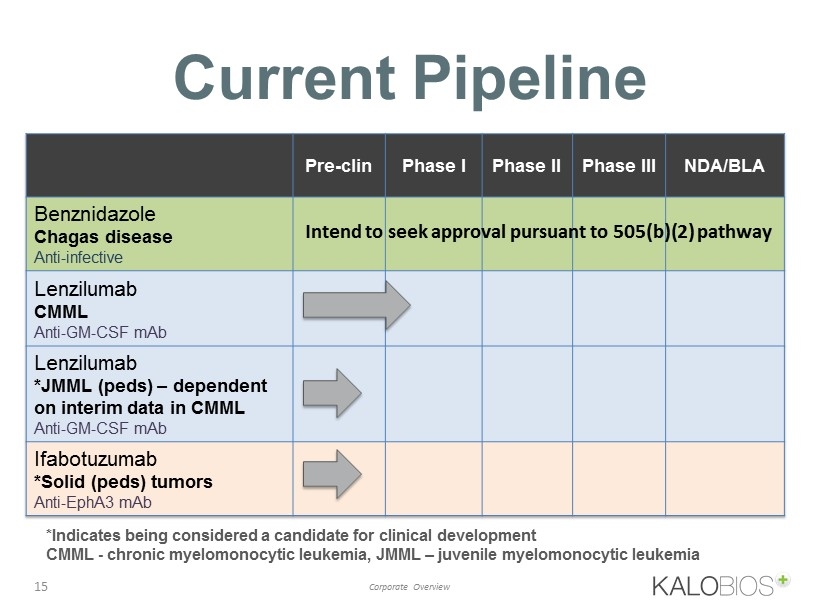

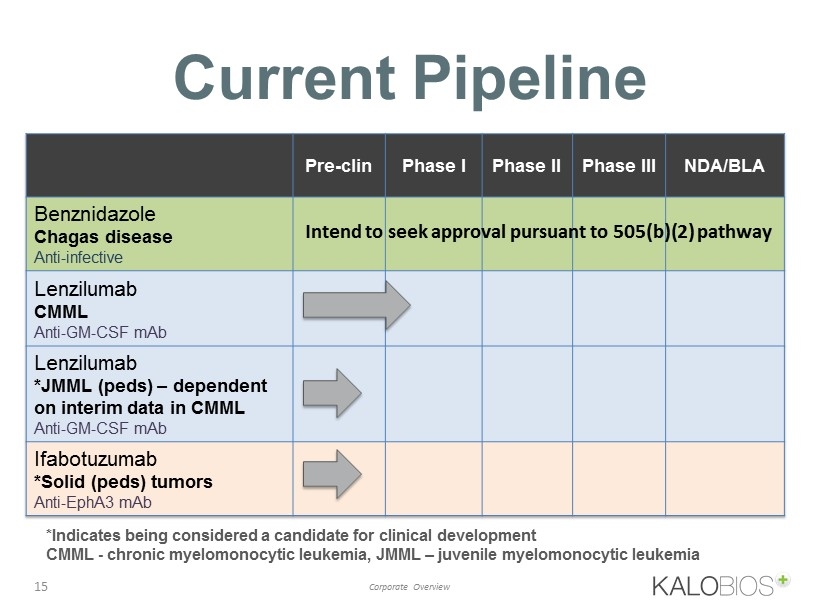

Current Pipeline 15 Corporate Overview Pre - clin Phase I Phase II Phase III NDA/BLA Benznidazole Chagas disease Anti - infective Lenzilumab CMML Anti - GM - CSF mAb Lenzilumab *JMML ( peds ) – dependent on interim data in CMML Anti - GM - CSF mAb Ifabotuzumab *Solid ( peds ) tumors Anti - EphA3 mAb *Indicates being considered a candidate for clinical development CMML - chronic myelomonocytic leukemia, JMML – j uvenile myelomonocytic leukemia Intend to seek approval pursuant to 505(b)(2) pathway

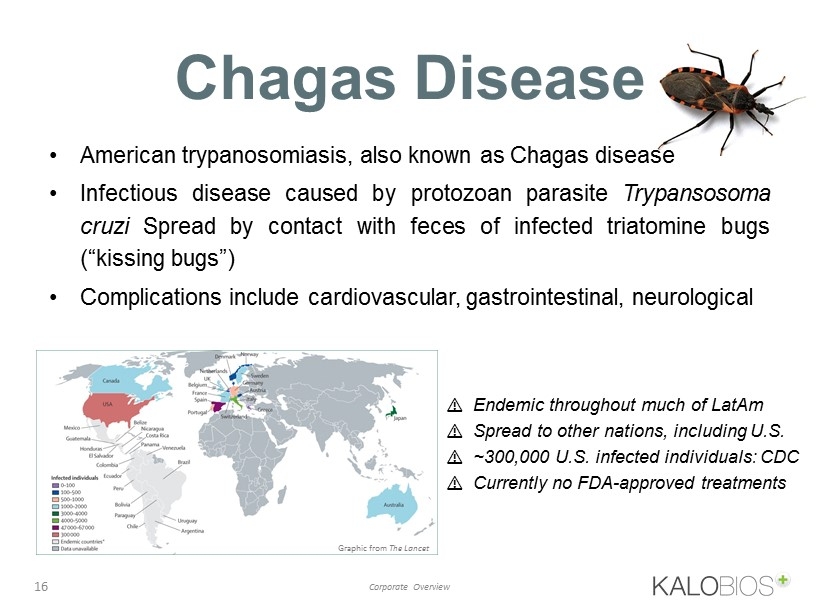

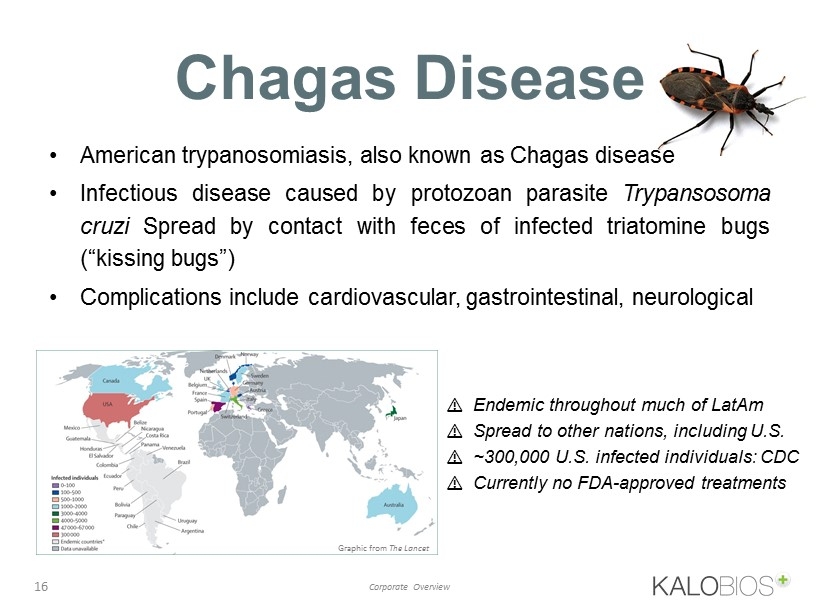

Chagas Disease 16 Corporate Overview • American trypanosomiasis , also known as Chagas disease • Infectious disease caused by protozoan parasite Trypansosoma cruzi Spread by contact with feces of infected triatomine bugs (“kissing bugs”) • Complications include cardiovascular, gastrointestinal, neurological ⚠ Endemic throughout much of LatAm ⚠ S pread to other nations, including U . S . ⚠ ~ 300 , 000 U . S . infected individuals : CDC ⚠ Currently no FDA - approved treatments Graphic from The Lancet

Benznidazole • Orally active, nitroimidazole derivative for the treatment of Chagas disease • Currently approved in several Latin American countries, not in the U.S. - only available from CDC • Current preferred treatment for Chagas • Chagas disease on FDA’s Neglected Tropical Disease list that would qualify for a PRV • Potential for expedited FDA approval based on both existing foreign clinical data to which KaloBios has acquired, or intends to acquire, the right – and other foreign clinical data on which KaloBios intends to rely under a 505(b)(2) 17 Corporate Overview

Lenzilumab • Favorable safety profile • Multiple phase 1 - 2 studies, no drug - related serious adverse events (>90 patients dosed) • Potential in CMML and JMML (both orphan conditions) • Potential Breakthrough Therapy designation • Potential for a PRV in JMML as a Rare Pediatric Disease 18 Corporate Overview Humaneered ® monoclonal antibody 〒 GM - CSF is cytokine driving certain hematologic malignancies 〒 mAB is antagonist of GM - CSF

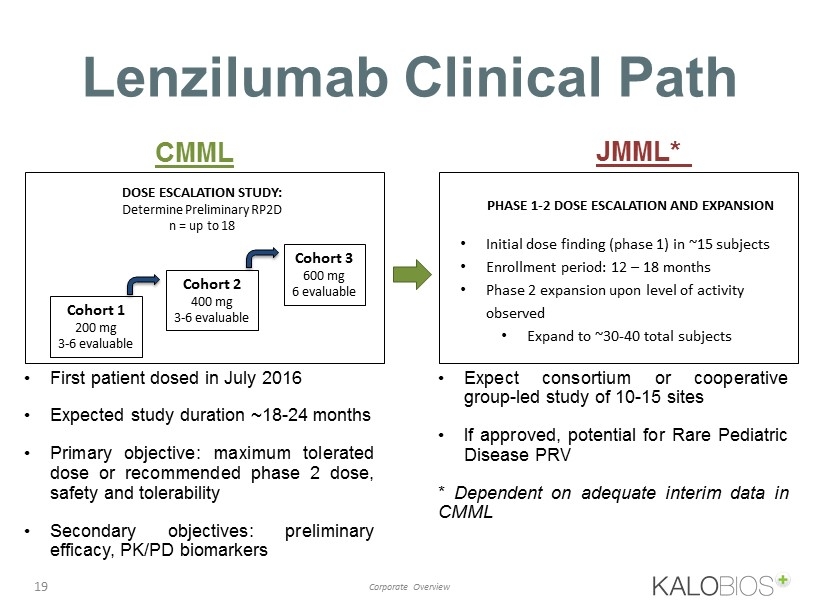

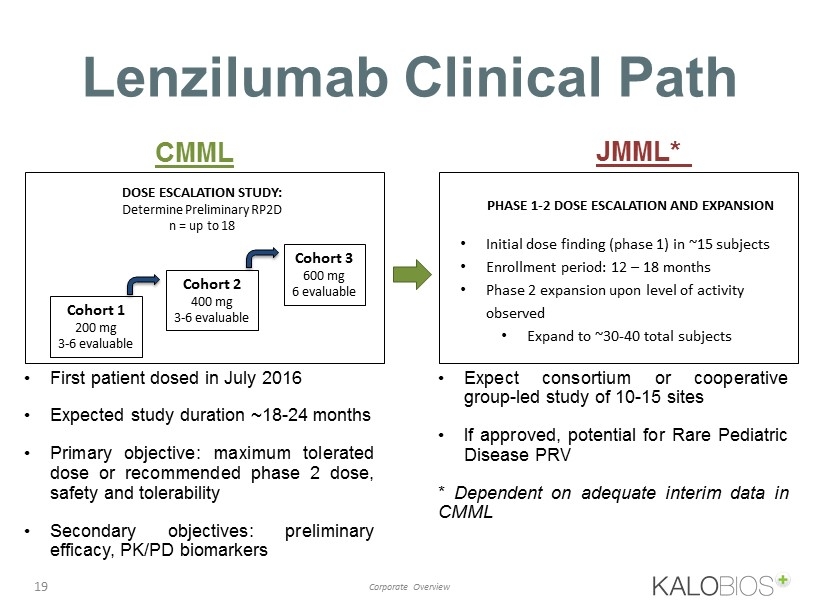

Lenzilumab Clinical Path 19 Corporate Overview PHASE 1 - 2 DOSE ESCALATION AND EXPANSION • Initial dose finding (phase 1) in ~15 subjects • Enrollment period: 12 – 18 months • Phase 2 expansion upon level of activity observed • Expand to ~30 - 40 total subjects CMML JMML* DOSE ESCALATION STUDY: Determine Preliminary RP2D n = up to 18 Cohort 1 200 mg 3 - 6 evaluable Cohort 2 4 00 mg 3 - 6 evaluable Cohort 3 6 00 mg 6 evaluable • First patient dosed in July 2016 • E xpected study duration ~ 18 - 24 months • Primary objective : maximum tolerated dose or recommended phase 2 dose, safety and tolerability • Secondary objectives : preliminary efficacy, PK/PD biomarkers • Expect consortium or cooperative group - led study of 10 - 15 sites • If approved, potential for Rare Pediatric Disease PRV * Dependent on adequate interim data in CMML

Ifabotuzumab • Prior clinical experience, Phase 1 study completed in hematologic malignancies, > 50 patients dosed • Potential in solid tumors, including rare pediatric tumors • RPD PRV potential if approved • Phase 0 /I bio - distribution study in rare solid tumors such as glioblastoma or other brain cancers in children and rare hematologic cancers being evaluated 20 Corporate Overview Humaneered ® monoclonal antibody for Ephrin type - A receptor 3 (EphA3), a receptor tyrosine kinase

Increases number of early investor value catalysts 21 Corporate Overview KaloBios Strategic Rationale Buys down regulatory risk: Potential to be Faster/Cheaper/Better 1. Expedited clinical development and regulatory pathway 2. Less costly clinical development due to speed, low patient numbers and regulatory mechanisms (e.g. 505(b)(2) if available) 3. Expedited programs get increased FDA face time and guidance during the development and application process 4. Orphan drugs appear to have higher rate of approval , faster trials and shorter FDA review time 5. Political will , overall desire to get NTDs and Rare Pediatric products approved Commercially attractive and differentiated 1. PRV use or sale – solid upfront return possible regardless of market potential 2. Tax credits, development grants, fee waivers 3. Market exclusivity (NCE, Orphan) 4. Stand - alone commercial opportunity particularly in Orphan, (Rare) Pediatric 5. Specialty focus (v. primary care) 6. Partnering environment more vigorous 7. Easily digestible investment thesis 8. Track record of delivering attractive investor returns (double annual growth in orphan drug sector vs. general drug market)

Extinguished Shkreli stake per 8 - K Accelerate benznidazole program + FDA meeting Continue to enroll and accelerate lenzilumab Ph I Become current with financial filings Strengthen financial platform Summary • KaloBios is “rising from the ashes” • Unusual history creates a unique setting for transformational thinking, bold strategy, new coalitions and path to value creation • Strategy focuses on US regulatory/development incentives and highly focused commercially valuable products • Swift, efficient execution via highly experienced new management team with can - do attitude demonstrating momentum 22 Corporate Overview Potential near - term value catalysts:

www.kalobios.com Thank You Corporate Overview 23