March 28, 2006

Dear Stockholder:

You are cordially invited to attend the annual meeting of stockholders of Naugatuck Valley Financial Corporation. We will hold the meeting in the Community Room at Naugatuck Valley Savings and Loan’s main office at 333 Church Street, Naugatuck, Connecticut, on May 4, 2006 at 10:30 a.m., local time.

The notice of annual meeting and proxy statement appearing on the following pages describe the formal business to be transacted at the meeting. During the meeting, we will also report on the operations of the Company. Directors and officers of the Company, as well as a representative of Whittlesey & Hadley, P.C., the Company’s independent registered public accountants, will be present to respond to appropriate questions of stockholders.

It is important that your shares are represented at this meeting, whether or not you attend the meeting in person and regardless of the number of shares you own. To make sure your shares are represented, we urge you to complete and mail the enclosed proxy card. If you attend the meeting, you may vote in person even if you have previously mailed a proxy card.

We look forward to seeing you at the meeting.

| | Sincerely, |

| | |

| | /s/ John C. Roman |

| | |

| | John C. Roman |

| | President and Chief Executive Officer |

333 Church Street

Naugatuck, Connecticut 06770

(203) 720-5000

____________________

NOTICE OF 2006 ANNUAL MEETING OF STOCKHOLDERS

____________________

| | |

TIME AND DATE | 10:30 a.m. on Thursday, May 4, 2006 |

| | |

PLACE | The Community Room in Naugatuck Valley Savings and Loan’s main office at 333 Church Street, Naugatuck, Connecticut |

| | | |

ITEMS OF BUSINESS | (1) | The election of three directors of the Company; |

| | (2) | The ratification of the appointment of Whittlesey &Hadley, P.C. as independent registered public accountants for the Company for the fiscal year ending December 31, 2006; and |

| | | |

| | (3) | Such other matters as may properly come before the annual meeting or any postponements or adjournments of the annual meeting. The Board of Directors is not aware of any other business to come before the annual meeting. |

| | | |

RECORD DATE | In order to vote, you must have been a stockholder at the close of business on March 15, 2006. |

| | | |

PROXY VOTING | It is important that your shares be represented and voted at the meeting. You can vote your shares by completing and returning the proxy card or voting instruction card sent to you. Voting instructions are printed on your proxy card. You can revoke a proxy at any time prior to its exercise at the meeting by following the instructions in the proxy statement |

| | | |

| | | |

| | /s/ Bernadette A. Mole |

| | Bernadette A. Mole |

| | Corporate Secretary |

NOTE: Whether or not you plan to attend the annual meeting, please vote by marking, signing, dating and promptly returning the enclosed proxy card in the enclosed envelope.

NAUGATUCK VALLEY FINANCIAL CORPORATION

PROXY STATEMENT

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors of Naugatuck Valley Financial Corporation (“Naugatuck Valley Financial” or the “Company”) to be used at the annual meeting of stockholders of the Company. Naugatuck Valley Financial is the holding company for Naugatuck Valley Savings and Loan (“Naugatuck Valley Savings” or the “Bank”) and the majority-owned subsidiary of Naugatuck Valley Mutual Holding Company (“Naugatuck Valley Mutual”). The annual meeting will be held in the Community Room at Naugatuck Valley Savings and Loan’s main office at 333 Church Street, Naugatuck, Connecticut, on May 4, 2006 at 10:30 a.m., local time. This proxy statement and the enclosed proxy card are being first mailed on or about March 28, 2006 to stockholders of record.

General Information About Voting

Who Can Vote at the Meeting

You are entitled to vote your shares of Naugatuck Valley Financial common stock only if the records of the Company show that you held your shares as of the close of business on March 15, 2006. As of the close of business on March 15, 2006, a total of 7,604,375 shares of Naugatuck Valley Financial common stock were outstanding, including 4,182,407 shares of common stock held by Naugatuck Valley Mutual. Each share of common stock has one vote. The Company’s Charter provides that, until September 30, 2009, record holders of the Company’s common stock, other than Naugatuck Valley Mutual, who beneficially own, either directly or indirectly, in excess of 10% of the Company’s outstanding shares are not entitled to any vote in respect of the shares held in excess of the 10% limit.

Vote By Naugatuck Valley Mutual

Naugatuck Valley Mutual, the mutual holding company for Naugatuck Valley Financial, owns 55% of the outstanding shares of common stock of Naugatuck Valley Financial as of March 15, 2006. All shares of common stock owned by Naugatuck Valley Mutual will be voted in accordance with the instructions of the Board of Directors of Naugatuck Valley Mutual, the members of which are identical to the members of the Board of Directors of Naugatuck Valley Financial. Naugatuck Valley Mutual is expected to vote such shares “FOR” each nominee for election as a director and “FOR” the other proposal.

Attending the Meeting

If you are a beneficial owner of Naugatuck Valley Financial common stock held by a broker, bank or other nominee (i.e., in “street name”), you will need proof of ownership to be admitted to the meeting. A recent brokerage statement or letter from a bank or broker are examples of proof of ownership. If you want to vote your shares of Naugatuck Valley Financial common stock held in street name in person at the meeting, you must obtain a written proxy in your name from the broker, bank or other nominee who is the record holder of your shares.

Quorum and Vote Required

The annual meeting will be held only if there is a quorum. A quorum exists if a majority of the outstanding shares of common stock entitled to vote is represented at the meeting. If you return valid proxy instructions or attend the meeting in person, your shares will be counted for purposes of determining whether there is a quorum, even if you abstain from voting. Broker non-votes also will be counted for purposes of determining the existence of a quorum. A broker non-vote occurs when a broker, bank or other nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that item and has not received voting instructions from the beneficial owner.

The Company’s Board of Directors consists of eight members. At this year’s annual meeting, stockholders will elect two directors to serve a term of three years. In voting on the election of directors, you may vote in favor of all nominees, withhold votes as to all nominees, or withhold votes as to specific nominees. There is no cumulative voting for the election of directors. Directors must be elected by a plurality of the votes cast at the annual meeting. “Plurality” means that the nominees receiving the largest number of votes cast will be elected as directors up to the maximum number of directors to be elected at the annual meeting. At the annual meeting, the maximum number of directors to be elected is two. Votes that are withheld and broker non-votes will have no effect on the outcome of the election.

In voting on the ratification of the appointment of Whittlesey & Hadley, P.C. as independent registered public accountants, you may vote in favor of the proposal, vote against the proposal or abstain from voting. This proposal will be decided by the affirmative vote of a majority of the shares represented at the annual meeting and entitled to vote. On this matter abstentions will have the same effect as a negative vote and broker non-votes will have no effect on the voting.

Because Naugatuck Valley Mutual owns more than 50% of Naugatuck Valley Financial’s outstanding shares, the votes it casts will ensure the presence of a quorum and control the outcome of the vote on Proposal 1 (Election of Directors) and Proposal 2 (Ratification of Appointment of Independent Registered Public Accountants). See “Vote by Naugatuck Valley Mutual” above.

Voting by Proxy

The Board of Directors of Naugatuck Valley Financial is sending you this proxy statement for the purpose of requesting that you allow your shares of Naugatuck Valley Financial common stock to be represented at the annual meeting by the persons named in the enclosed proxy card. All shares of Naugatuck Valley Financial common stock represented at the annual meeting by properly executed and dated proxy cards will be voted according to the instructions indicated on the proxy card. If you sign, date and return a proxy card without giving voting instructions, your shares will be voted as recommended by the Company’s Board of Directors.

The Board of Directors recommends a vote:

| | · | “FOR” all of the nominees for director; and |

| | · | “FOR” ratification of Whittlesey & Hadley, P.C. as independent registered public accountants. |

If any matters not described in this proxy statement are properly presented at the annual meeting, the persons named in the proxy card will use their own best judgment to determine how to vote your shares. This includes a motion to adjourn or postpone the annual meeting in order to solicit additional proxies. If the annual meeting is postponed or adjourned, your Naugatuck Valley Financial common

stock may be voted by the persons named in the proxy card on the new annual meeting date as well, unless you have revoked your proxy. The Company does not know of any other matters to be presented at the annual meeting.

You may revoke your proxy at any time before the vote is taken at the meeting. To revoke your proxy you must either advise the Corporate Secretary of the Company in writing before your common stock has been voted at the annual meeting, deliver a later-dated proxy, or attend the meeting and vote your shares in person. Attendance at the annual meeting will not in itself constitute revocation of your proxy.

If your Naugatuck Valley Financial common stock is held in “street name,” you will receive instructions from your broker, bank or other nominee that you must follow in order to have your shares voted. Your broker, bank or other nominee may allow you to deliver your voting instructions via the telephone or the Internet. Please see the instruction form provided by your broker, bank or other nominee that accompanies this proxy statement.

Participants in the Bank’s ESOP or 401(k) Plan

If you participate in the Naugatuck Valley Savings and Loan Employee Stock Ownership Plan (the “ESOP”) or if you hold shares through the Naugatuck Valley Savings and Loan 401(k) Profit Sharing Plan and Trust (the “401(k) Plan”), you will receive a voting instruction form for each plan that reflects all shares you may direct the trustees to vote on your behalf under the plans. Under the terms of the ESOP, the ESOP trustee votes all shares held by the ESOP, but each ESOP participant may direct the trustee how to vote the shares of common stock allocated to his or her account. The ESOP trustee, subject to the exercise of its fiduciary duties, will vote all unallocated shares of Company common stock held by the ESOP and allocated shares for which no voting instructions are received in the same proportion as shares for which it has received timely voting instructions. Under the terms of the 401(k) Plan, a participant is entitled to direct the trustee as to the shares in the Naugatuck Valley Financial Stock Fund credited to his or her account. The trustee will vote all shares for which no directions are given or for which instructions were not timely received in the same proportion as shares for which the trustee received voting instructions. The deadline for returning your voting instructions to each plan’s trustee is April 27, 2006.

Corporate Governance

General

Naugatuck Valley Financial periodically reviews its corporate governance policies and procedures to ensure that Naugatuck Valley Financial meets the highest standards of ethical conduct, reports results with accuracy and transparency and maintains full compliance with the laws, rules and regulations that govern Naugatuck Valley Financial’s operations. As part of this periodic corporate governance review, the Board of Directors reviews and adopts best corporate governance policies and practices for Naugatuck Valley Financial.

Corporate Governance Policies and Procedures

Naugatuck Valley Financial has adopted a corporate governance policy to govern certain activities, including:

(1) the duties and responsibilities of each director;

(2) the composition, responsibilities and operation of the Board of Directors;

| | (3) | the establishment and operation of Board committees; |

| | (5) | convening executive sessions of independent directors; |

| | (6) | the Board of Directors’ interaction with management and third parties; and |

| | (7) | the evaluation of the performance of the Board of Directors and of the chief executive officer. |

Code of Ethics and Business Conduct

Naugatuck Valley Financial has adopted a Code of Ethics and Business Conduct that is designed to ensure that the Company’s directors, executive officers and employees meet the highest standards of ethical conduct. The Code of Ethics and Business Conduct requires that the Company’s directors, executive officers and employees avoid conflicts of interest, comply with all laws and other legal requirements, conduct business in an honest and ethical manner and otherwise act with integrity and in the Company’s best interest. Under the terms of the Code of Ethics and Business Conduct, directors, executive officers and employees are required to report any conduct that they believe in good faith to be an actual or apparent violation of the Code.

As a mechanism to encourage compliance with the Code of Ethics and Business Conduct, the Company has established procedures to receive, retain and treat complaints received regarding accounting, internal accounting controls or auditing matters. These procedures ensure that individuals may submit concerns regarding questionable accounting or auditing matters in a confidential and anonymous manner. The Code of Ethics and Business Conduct also prohibits the Company from retaliating against any director, executive officer or employee who reports actual or apparent violations of the Code.

Meetings of the Board of Directors

The Company and the Bank conduct business through meetings and activities of their Boards of Directors and their committees. During the year ended December 31, 2005, the Board of Directors of the Company met seven times and the Board of Directors of the Bank met 25 times. No director attended fewer than 75% of the total meetings of the Company’s and the Bank’s respective Board of Directors and the committees on which such director served.

Committees of the Board of Directors of Naugatuck Valley Financial

The following table identifies our standing committees and their members as of March 15, 2006.

Director | | Audit Committee | | Nominating and Corporate Governance Committee | | Compensation Committee |

| Carlos S. Batista | | | | X | | X |

| Richard M. Famiglietti | | X* | | X | | X* |

| Ronald D. Lengyel | | X | | X | | X |

| James A. Mengacci | | | | X* | | X |

| Michael S. Plude | | X | | X | | X |

| John C. Roman | | | | | | |

| Camilo P. Vieira | | | | X | | X |

| Jane H. Walsh | | | | | | |

Number of Meetings in 2005 *Chairman | | 9 | | 2 | | 13 |

Audit Committee. The Board of Directors has a separately-designated standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended. Each member of the Audit Committee is “independent” in accordance with the listing standards of the Nasdaq Stock Market (“Nasdaq”). This committee meets periodically with the independent auditors and management to review accounting, auditing, internal control structure and financial reporting matters. The Board of Directors has determined that Mr. Plude is an audit committee financial expert under the rules of the Securities and Exchange Commission. The Audit Committee acts under a written charter adopted by the Board of Directors, a copy of which was included as an appendix to the Company’s proxy statement for its 2005 annual meeting of stockholders. The report of the Audit Committee required by the rules of the Securities and Exchange Commission is included in this proxy statement. See “Proposal 2-Ratification of Independent Registered Public Accountants-Report of Audit Committee.”

Compensation Committee. The Compensation Committee is responsible for all matters regarding the Company’s and the Bank’s employee compensation and benefit programs. Each member of the Compensation Committee is “independent” in accordance with the listing standards of Nasdaq. The report of the Compensation Committee required by the rules of the Securities and Exchange Commission is included in this proxy statement. See “Compensation Committee Report on Executive Compensation.”

Nominating and Corporate Governance Committee. The committee takes a leadership role in shaping governance policies and practices, including recommending to the Board of Directors the corporate governance policies and guidelines applicable to Naugatuck Valley Financial and monitoring compliance with these policies and guidelines. In addition, the Nominating and Corporate Governance Committee is responsible for identifying individuals qualified to become Board members and recommending to the Board the director nominees for election at the next annual meeting of stockholders. It leads the Board in its annual review of the Board’s performance and recommends director candidates for each committee for appointment by the Board. Each member of the Nominating and Corporate Governance Committee is “independent” in accordance with the listing standards of Nasdaq. The

Nominating and Corporate Governance Committee acts under a written charter adopted by the Board of Directors. The charter is not available on the Company’s website, but a copy of the charter was included as an appendix to the Company’s proxy statement for its 2005 annual meeting of stockholders. The procedures of the Nominating and Corporate Governance Committee required to be disclosed by the rules of the Securities and Exchange Commission are included in this proxy statement. See “Nominating and Corporate Governance Committee Procedures.”

Attendance at the Annual Meeting

The Board of Directors encourages directors to attend the annual meeting of stockholders. All of the Company’s directors attended the Company’s 2005 annual meeting of stockholders.

Directors’ Compensation

Cash Retainer and Meeting Fees for Non-Employee Directors. The following tables set forth the applicable retainers and fees that will be paid to non-employee directors for their service on the Board of Directors of Naugatuck Valley Savings and the Board of Directors of Naugatuck Valley Financial during 2006. Employee directors do not receive any retainers or fees for their services on the Boards of Directors.

Naugatuck Valley Savings:

| Annual Retainer | $7,500 ($11,500 for Chairman) |

| Fee per Board Meeting (Regular or Special) | $500 |

Fee per Committee Meeting | $400 |

| Additional Monthly Fee for Chairman of the Board as Asset/Liability Committee liaison | $400 |

| | |

| Naugatuck Valley Financial: | |

| Quarterly Retainer | $500 |

| Fee per Audit Committee Meeting | $400 |

In addition, each non-employee director receives an annual retainer of $1,000 for his or her service on the Board of Directors of Naugatuck Valley Mutual Holding Company.

Non-Employee Director Compensation. The following table sets forth the total cash and equity compensation paid to our non-employee directors for their service on the Boards of Directors of Naugatuck Valley Savings, Naugatuck Valley Financial and Naugatuck Valley Mutual Holding Company during 2005.

Director | | Cash | | Restricted Stock Awards (1) | | Stock Option Awards (2) |

| Carlos S. Batista | | $56,400 | | 7,452 | | 18,630 |

| Richard M. Famiglietti | | $51,900 | | 7,452 | | 18,630 |

| Ronald D. Lengyel | | $61,833 | | 7,452 | | 18,630 |

| James A. Mengacci | | $51,100 | | 7,452 | | 18,630 |

| Michael S. Plude | | $49,100 | | 7,452 | | 18,630 |

| Camilo P. Vieira | | $46,500 | | 7,452 | | 18,630 |

______________________________

| (1) | All awards vest in five equal annual installments beginning one year from the date of grant, which was July 26, 2005. |

| (2) | All options have an exercise price of $11.10, the fair market value of our common stock on the date of grant, which was July 26, 2005. All options vest in five equal annual installments beginning one year from the date of grant. |

Additionally, in 2005 Naugatuck Valley Savings paid $4,957 on behalf of Ronald D. Lengyel, its Chairman of the Board, for his membership in a country club.

Director Retirement Policy. Naugatuck Valley Savings maintains a retirement benefits policy for certain non-employee directors. The policy provides for an annual retirement benefit for directors who served as non-employee directors at the time the policy was created equal to the total amounts paid to all non-employee directors during the calendar year preceding the director’s retirement date divided by the number of non-employee directors for that year. For all other non-employee directors who have served on the Board for at least 10 years as of the time he or she attains age 70, the annual retirement benefit is equal to 60% of the benefit calculated as above. For all non-employee directors, the benefits vest 10% per year for each year for the director serves between the ages of 60 and 70. These annual retirement benefits are payable to each director in semi-annual installments for five years. If the director dies before receiving each of the semi-annual installments, his or her beneficiary will receive the remaining installments that would have been paid to the director but for his or her death.

Stock Ownership

The following table provides information as of March 15, 2006 about the persons and entities known to Naugatuck Valley Financial to be the beneficial owners of more than 5% of the Company’s outstanding common stock. A person or entity may be considered to beneficially own any shares of common stock over which the person or entity has, directly or indirectly, sole or shared voting or investing power.

Name and Address | | Number of Shares Owned | | Percent of Common Stock Outstanding (1) |

| | | | | |

Naugatuck Valley Mutual Holding Company 333 Church Street Naugatuck, Connecticut 06770 | | 4,182,407 (2) | | 55.0% |

______________________________

| (1) | Based on 7,604,375 shares of the Company’s common stock outstanding and entitled to vote as of March 15, 2006. |

| (2) | Acquired in connection with the Company’s minority stock offering, which was completed on September 30, 2004. The members of the Board of Directors of Naugatuck Valley Financial and Naugatuck Valley Savings also constitute the Board of Directors of Naugatuck Valley Mutual. |

The following table provides information as of March 15, 2006 about the shares of Naugatuck Valley Financial common stock that may be considered to be beneficially owned by each director, nominee for director, named executive officers listed in the Summary Compensation Table and all directors and executive officers of the Company as a group. A person may be considered to beneficially own any shares of common stock over which he or she has, directly or indirectly, sole or shared voting or investment power. Unless otherwise indicated, each of the named individuals has sole voting power and sole investment power with respect to the number of shares shown.

Name | Number of Shares Owned (1)(2) | | Percent of Common Stock Outstanding (3) |

| Dominic J. Alegi | | 24,971 | (4) | | | * | |

| Carlos S. Batista | | 18,752 | (5) | | | * | |

| Richard M. Famiglietti | | 17,452 | | | | * | |

| Ronald D. Lengyel | | 12,902 | (6) | | | * | |

| James A. Mengacci | | 13,658 | | | | * | |

| William C. Nimons | | 29,446 | (7) | | | * | |

| Michael S. Plude | | 9,031 | (8) | | | * | |

| John C. Roman | | 30,570 | | | | * | |

| Camilo P. Vieira | | 10,398 | (9) | | | * | |

| Jane H. Walsh | | 22,127 | (10) | | | * | |

All directors and executive officers as a group (12 persons) | | 189,307 | | | | 2.49% | |

__________________________

* Less than 1.0%.

| (1) | Includes shares of unvested restricted stock held in trust as part of the Naugatuck Valley Financial Corporation 2005 Equity Incentive Plan (the “2005 Incentive Plan”) with respect to which individuals have voting but not investment power as follows: Mr. Alegi—14,000 shares, Messrs. Batista, Famiglietti, Lengyel, Mengacci, Plude and Vieira—7,452 shares each, Mr. Roman—22,000 shares, Ms. Walsh—14,000 shares and Mr. Nimons—10,000 shares. All restricted stock awards vest in five equal annual installments commencing one year from the date of grant, which was July 26, 2005. |

| (2) | Includes shares allocated to the account of individuals under the Bank’s ESOP with respect to which individuals have voting but not investment power as follows: Mr. Alegi—896 shares, Mr. Nimons— 829 shares, Mr. Roman—1,407 shares, and Ms. Walsh—724 shares. |

| (3) | Based on 7,604,375 shares of the Company’s common stock outstanding and entitled to vote as of March 15, 2006. |

| (4) | Includes 200 shares held by Mr. Alegi’s spouse and 100 shares held in a custodian’s account for Mr. Alegi’s grandchild. |

| (5) | Includes 300 shares held in three custodian accounts for Mr. Batista’s grandchildren. |

| (6) | Includes 450 shares held in nine custodian accounts for Mr. Lengyel’s grandchildren. |

| (7) | Includes 8,700 shares held in Mr. Nimons’ spouse’s individual retirement account and 200 shares held by Mr. Nimons’ son. |

| (8) | Includes 579 shares held by a corporation controlled by Mr. Plude. |

| (9) | Includes 1,839 shares held in Mr. Vieira’s spouse’s individual retirement account. |

| (10) | Includes 1,435 shares held in Ms. Walsh’s spouse’s individual retirement account. |

Proposal 1 — Election of Directors

The Company’s Board of Directors consists of eight members, all of whom are independent under the listing standards of the Nasdaq Stock Market, except for Mr. Roman, President and Chief Executive Officer of Naugatuck Valley Financial and Naugatuck Valley Savings, and Ms. Walsh, Senior Vice President of Naugatuck Valley Financial and Naugatuck Valley Savings. The Board is divided into three classes with three-year staggered terms, with approximately one-third of the directors elected each year. The Board of Directors’ nominees for election this year, to serve for a three-year term or until their respective successors have been elected and qualified, are Messrs. Famiglietti and Lengyel, both of whom are currently directors of Naugatuck Valley Financial and Naugatuck Valley Savings.

Unless you indicate on the proxy card that your shares should not be voted for certain nominees, the Board of Directors intends that the proxies solicited by it will be voted for the election of both of the Board’s nominees. If any nominee is unable to serve, the persons named in the proxy card would vote your shares to approve the election of any substitute nominee proposed by the Board of Directors. At this time, the Board of Directors knows of no reason why either nominee might be unable to serve.

The Board of Directors recommends a vote “FOR” the election of Messrs. Famiglietti and Lengyel.

Information regarding the Board of Directors’ nominees and the directors continuing in office is provided below. Unless otherwise stated, each individual has held his or her current occupation for the last five years. The age indicated for each individual is as of December 31, 2005. The indicated period of service as a director includes the period of service as a director of Naugatuck Valley Savings.

Board Nominees for Election of Directors

Richard M. Famiglietti has been the owner of CM Property Management, a property management firm, since 2002. Previously, Mr. Famiglietti was a Vice President of sales for Naugatuck Glass Company, a glass fabricator. Age 58. Director since 2000.

Ronald D. Lengyel serves as the Chairman of the Board of Directors of Naugatuck Valley Financial, Naugatuck Valley Mutual and Naugatuck Valley Savings. Mr. Lengyel previously served as President and Chief Executive Officer of Naugatuck Valley Savings before his retirement in September 1999. Mr. Lengyel is a director of Connecticut Water Service, Inc., a Nasdaq-listed company. Age 67. Director since 1971.

Directors Continuing in Office

The following directors have terms ending in 2007:

James A. Mengacci has been the owner of James A. Mengacci Associates LLC, a consulting firm, since 1999. Mr. Mengacci previously was the Secretary and Treasurer of Fitzgerald Funeral Home, Inc. Age 47. Director since 1988.

Michael S. Plude is a certified public accountant and the managing partner of Kaskie, Plude & Pacotwa, LLC, an accounting firm located in Monroe, Connecticut. Mr. Plude previously was an accountant with Pricewaterhouse. Age 46. Director since 2003.

Jane H. Walsh has served as Senior Vice President of Naugatuck Valley Financial and Naugatuck Valley Mutual since 2004 and has been Senior Vice President of Naugatuck Valley Savings

since 2000. Ms. Walsh has served with Naugatuck Valley Savings for over 30 years. Age 62. Director since 2001.

The following directors have terms ending in 2008:

Carlos S. Batista is a Vice President of Bristol Babcock, Inc., a manufacturer and world-wide supplier of products and services in the oil, gas, water, wastewater, process control and power industries. Age 56. Director since 1999.

John C. Roman has served as President and Chief Executive Officer of Naugatuck Valley Financial and Naugatuck Valley Mutual since 2004 and has been President and Chief Executive Officer of Naugatuck Valley Savings since September 1999. Mr. Roman previously was the Vice President and Chief Lending Officer of Naugatuck Valley Savings. Age 52. Director since 1999.

Camilo P. Vieira is a consultant with, and previously served as the President of, CM Property Management, a property management firm. Mr. Vieira previously served with IBM Corp. as a project and financial manager for over 30 years. Age 62. Director since 2002.

Proposal 2 — Ratification of Independent Registered Public Accountants

Snyder & Haller, P.C. was the Company’s independent registered public accountants for 2005. In connection with the merger of Snyder & Haller with Whittlesey & Hadley, P.C., Snyder & Haller resigned as the independent registered public accounting firm of the Company on January 13, 2006. On the same date, the Company engaged Whittlesey & Hadley as its successor independent registered public accounting firm.

The reports of Snyder & Haller on the consolidated financial statements of the Company as of and for the fiscal years ended December 31, 2003 and 2004, did not contain an adverse opinion or a disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope, or accounting principles.

During the Company’s fiscal years ended December 31, 2003 and 2004 and subsequent interim periods preceding the resignation of Snyder & Haller, there were no disagreements between the Company and Snyder & Haller on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Snyder & Haller, would have caused Snyder & Haller to make reference to the subject matter of the disagreements in connection with its audit reports on the Company’s consolidated financial statements.

During the Company’s fiscal years ended December 31, 2003 and 2004 and subsequent interim periods preceding the engagement of Whittlesey & Hadley, the Company did not consult with Whittlesey & Hadley regarding the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s consolidated financial statements.

The Audit Committee of the Company’s Board of Directors approved the engagement of Whittlesey & Hadley to be its independent registered public accountants for the 2006 fiscal year, subject to ratification by stockholders. A representative of Whittlesey & Hadley is expected to be present at the annual meeting to respond to appropriate questions from stockholders and will have the opportunity to make a statement should he or she desire to do so.

If the ratification of the appointment of the independent registered public accountants is not approved by a majority of the shares represented at the annual meeting and entitled to vote, the Audit Committee of the Company’s Board of Directors will consider other independent registered public accountants.

The Board of Directors recommends that stockholders vote “FOR” the ratification of the appointment of independent registered public accountants.

Audit Fees

The following table sets forth the fees billed to the Company for the fiscal years ending December 31, 2005 and 2004 by its independent registered public accountants:

| | | 2005 | | 2004 | |

Audit fees(1) | | $ | 75,350 | | $ | 53,250 | |

| Audit related fees | | | -- | | | -- | |

Tax fees(2) | | | 10,625 | | | 7,500 | |

All other fees(3) | | | 3,550 | | | -- | |

_____________

| (1) | Consists of fees for professional services rendered for the audit of the consolidated financial statements and the review of financial statements included in quarterly reports on Form 10-Q. |

| (2) | Consists of fees for tax return preparation, planning and tax advice. |

| (3) | Consists of fees charged for the review of the Company’s implementation of new accounting standards surrounding stock-based compensation and a special branch audit. |

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Auditor

The Audit Committee is responsible for appointing, setting compensation and overseeing the work of the independent auditor. In accordance with its charter, the Audit Committee approves, in advance, all audit and permissible non-audit services to be performed by the independent auditor to ensure that the external auditor does not provide any non-audit services to the Company that are prohibited by law or regulation.

In addition, the Audit Committee has established a policy regarding pre-approval of all audit and permissible non-audit services provided by the independent auditor. Requests for services by the independent auditor for compliance with the auditor services policy must be specific as to the particular services to be provided. The request may be made with respect to either specific services or a type of service for predictable or recurring services.

During the year ended December 31, 2005, all services were approved, in advance, by the Audit Committee in compliance with these procedures.

Report of the Audit Committee

The Company’s management is responsible for the Company’s internal controls and financial reporting process. The independent registered public accountants (“independent accountants”) are responsible for performing an independent audit of the Company’s consolidated financial statements and issuing an opinion on the conformity of those financial statements with generally accepted accounting principles. The Audit Committee oversees the Company’s internal controls and financial reporting process on behalf of the Board of Directors.

In this context, the Audit Committee has met and held discussions with management and the independent accountants. Management represented to the Audit Committee that the Company’s consolidated financial statements were prepared in accordance with generally accepted accounting principles, and the Audit Committee has reviewed and discussed the consolidated financial statements with management and the independent accountants. The Audit Committee discussed with the independent accountants matters required to be discussed by Statement on Auditing Standards No. 61 (Communication With Audit Committees), including the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of the disclosures in the financial statements.

In addition, the Audit Committee has received the written disclosures and the letter from the independent accountants required by the Independence Standards Board Standard No. 1 (Independence Discussions With Audit Committees) and has discussed with the independent accountants the auditors’ independence from the Company and its management. In concluding that the auditors are independent, the Audit Committee considered, among other factors, whether the non-audit services provided by the auditors were compatible with its independence.

The Audit Committee discussed with the Company’s independent accountants the overall scope and plans for their audit. The Audit Committee meets with the independent accountants, with and without management present, to discuss the results of their examination, their evaluation of the Company’s internal controls, and the overall quality of the Company’s financial reporting.

In performing all of these functions, the Audit Committee acts only in an oversight capacity. In its oversight role, the Audit Committee relies on the work and assurances of the Company’s management, which has the primary responsibility for financial statements and reports, and of the independent accountants who, in their report, express an opinion on the conformity of the Company’s financial statements to generally accepted accounting principles. The Audit Committee’s oversight does not provide it with an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or policies, or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the Audit Committee’s considerations and discussions with management and the independent accountants do not assure that the Company’s financial statements are presented in accordance with generally accepted accounting principles, that the audit of the Company’s consolidated financial statements has been carried out in accordance with the standards of the Public Company Accounting Oversight Board (United States) or that the Company’s independent accountants are in fact “independent.”

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors, and the Board has approved, that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2005 for filing with the Securities and Exchange Commission. The Audit Committee and the Board of Directors also have approved, subject to stockholder ratification, the selection of the Company’s independent registered public accountants.

The Audit Committee

Richard M. Famiglietti, Chairman

Ronald D. Lengyel

Michael S. Plude

Executive Compensation

Summary Compensation Table

The following information is provided for John C. Roman, President and Chief Executive Officer, Dominic J. Alegi, Jr., Executive Vice President, and William C. Nimons, Senior Vice President. Messrs. Roman, Alegi and Nimons are the only executive officers who received salary and bonus totaling $100,000 or more during 2005.

| | | Annual Compensation (2) | | Long-Term Compensation Awards | | |

Name and Position | | Year | | Salary (1) | | Bonus | | Restricted Stock Awards (3) | | Securities Underlying Options (4) | | All Other Compensation (5) |

| | | | | | | | | | | | | |

John C. Roman President and Chief Executive Officer | | 2005 2004 2003 | | $157,177 150,065 133,313 | | $ 1,000 10,298 13,271 | | $244,200 - - | | 37,000 - - | | $16,892 7,269 4,028 |

| | | | | | | | | | | | | |

Dominic J. Alegi, Jr. Executive Vice President | | 2005 2004 2003 | | $100,106 98,900 94,208 | | $ 1,000 6,972 9,383 | | $155,400 - - | | 22,000 - - | | $11,160 5,401 2,848 |

| | | | | | | | | | | | | |

William C. Nimons Senior Vice President | | 2005 2004 2003 | | $101,223 85,046 68,174 | | $ 1,000 4,183 6,962 | | $111,000 - - | | 18,000 - - | | $10,587 3,830 1,967 |

___________________________

| (1) | Salaries for 2004 and 2003 have been restated to reflect disclosure of reimbursements for the payment of taxes under “Other Annual Compensation.” |

| (2) | Does not include the aggregate amount of perquisites or other personal benefits, which was less than the lesser of $50,000 or 10% of the total annual salary and bonus reported. |

| (3) | Represents the market value of 22,000, 14,000 and 10,000 shares of restricted stock granted to Messrs. Roman, Alegi and Nimons, respectively, on July 26, 2005, based on a per share value of $11.10, the closing price of the Company’s common stock on the date of grant. The restricted stock awards vest in five equal annual installments commencing one year from the date of grant. Dividends, if any, will be paid on the restricted stock. The number and value of all unvested shares of restricted stock held under the 2005 Incentive Plan by each named executive officer as of December 31, 2005, based on a per share value of $10.25, the closing price of the Company’s common stock on December 30, 2005, the last day that the Company’s common stock was traded during 2005, is as follows: Mr. Roman—22,000 shares, valued at $225,500; Mr. Alegi—14,000 shares, valued at $143,500; and Mr. Nimons—10,000 shares, valued at $102,500. |

| (4) | Options become exercisable in five equal annual installments commencing one year from the date of grant, which for all options shown was July 26, 2005. |

| (5) | For 2005, represents matching contributions under the 401(k) Plan of $5,577, $4,004 and $3,757 for Messrs. Roman, Alegi and Nimons, respectively, and allocations under the employee stock ownership plan of $11,315, $7,156 and $6,830 for Messrs. Roman, Alegi and Nimons, respectively. |

Option Grants in Last Fiscal Year

The following table lists all grants of options in 2005 to the named executive officers listed in the Summary Compensation Table and contains certain information about the potential value of those options based upon certain assumptions as to the appreciation of the Company’s stock over the life of the option.

Name | | Number of Securities Underlying Options Granted (1) | | % of Total Options Granted to Employees in Fiscal Year | | Exercise Price or Base Price | | Expiration Date | | Grant Date Present Value (2) |

| | | | | | | | | | | |

| John C. Roman | | 37,000 | | 10.4% | | $11.10 | | July 26, 2015 | | $93,610 |

| | | | | | | | | | | |

| Dominic J. Alegi, Jr. | | 22,000 | | 6.2 | | 11.10 | | July 26, 2015 | | 55,660 |

| | | | | | | | | | | |

| William C. Nimons | | 18,000 | | 5.1 | | 11.10 | | July 26, 2015 | | 45,540 |

| | | | | | | | | | | |

_____________________________

(1) Options become exercisable in five equal annual installments commencing one year from the date of grant, which for all options shown was July 26, 2005.

(2) The estimated present value of the options granted during fiscal year 2005 have been calculated using the Black-Scholes option pricing model, based on the following assumptions: estimated time until exercise of 6.5 years; a risk-free interest rate of 4.18%; a volatility rate of 11.47%; and a dividend yield of 1.44%. The values associated with the option pricing variables described above are hypothetical and have been provided solely to comply with the rules of the SEC. The actual gain, if any, that will be realized by each officer on any option will depend on the difference between the exercise price of the option and the market price of the Company’s common stock on the date that the option is exercised.

Fiscal Year-End Option Values

The following table sets forth information at December 31, 2005 concerning the number and value of options held by the named executive officers listed in the Summary Compensation Table. The named executive officers did not exercise any options during 2005.

| | | Number of Securities Underlying Unexercised Options at Fiscal Year End | | Value of Unexercised In-the-Money Options at Year End (1) |

Name | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable |

| John C. Roman | | -- | | 37,000 | | -- | | -- |

| Dominic J. Alegi, Jr. | | -- | | 22,000 | | -- | | -- |

| William C. Nimons | | -- | | 18,000 | | -- | | -- |

________________________________

(1) None of the options held by the named executive officers were in-the-money at December 31, 2005. Options are considered in-the-money if the market value of the underlying securities exceeds the exercise price of the shares of Company common stock represented by the outstanding options. The closing price of the Company’s common stock on December 30, 2005, the last day that the Company’s common stock was traded during 2005, was $10.25 per share, which was below the exercise price of $11.10 per share for all options held by the named executive officers.

Employment Agreements

Naugatuck Valley Savings and Naugatuck Valley Financial are both parties to an employment agreement with John C. Roman. The employment agreement provides for a three-year term. The term of the employment agreement may be renewed on an annual basis after review by the respective Board of Directors. The employment agreement establishes a base salary of $156,000, subject to increase. The Boards of Directors reviews Mr. Roman’s base salary each year in order to consider any appropriate changes. In addition to base salary, the employment agreement provides for, among other things, participation in stock-based benefit plans and fringe benefits applicable to Mr. Roman.

The employment agreement provides that Naugatuck Valley Savings and Naugatuck Valley Financial may terminate the executive’s employment for cause, as described in the employment agreement, at any time. If Naugatuck Valley Savings or Naugatuck Valley Financial terminates the executive’s employment for reasons other than for cause, or if the executive resigns from Naugatuck Valley Savings or Naugatuck Valley Financial after specified circumstances that would constitute constructive termination, the executive or, if he dies, his beneficiary, would be entitled to receive an amount equal to the remaining base salary payments due for the remaining term of the employment agreement and the contributions that would have been made on his behalf to any employee benefit plans of Naugatuck Valley Savings and Naugatuck Valley Financial during the remaining term of the employment agreement. Naugatuck Valley Savings would also continue and/or pay for the executive’s life, health and dental coverage for the remaining term of the employment agreement. The executive must agree not to compete with Naugatuck Valley Savings or Naugatuck Valley Financial for one year following his termination of employment other than in connection with a change in control.

Under the employment agreement, if the executive voluntarily (upon circumstances discussed in the agreement) or involuntarily terminates employment following a change in control of Naugatuck Valley Savings or Naugatuck Valley Financial, the executive or, if the executive dies, the executive’s beneficiary, would receive a severance payment equal to the greater of: (1) the payments due for the remaining term of the agreement; or (2) three times the average of the five preceding taxable years’ annual compensation. Naugatuck Valley Savings would also continue the executive’s life, health, and dental coverage for 36 months following termination of employment. Internal Revenue Code Section 280G provides that severance payments that equal or exceed three times the individual’s base amount are deemed to be “excess parachute payments” if they are contingent upon a change in control. Individuals receiving excess parachute payments are subject to a 20% excise tax on the amount of the payment in excess of the base amount, and the employer would not be entitled to deduct such amount. The agreements limit payments made to the executive in connection with a change in control to amounts that will not exceed the limits imposed by Internal Revenue Code Section 280G.

Naugatuck Valley Savings or Naugatuck Valley Financial will pay or reimburse the executive for all reasonable costs and legal fees paid or incurred by the executive in any dispute or question of interpretation relating to the employment agreement if the executive is successful on the merits in a legal judgment, arbitration or settlement. The employment agreement also provides that Naugatuck Valley Savings and Naugatuck Valley Financial will indemnify Mr. Roman to the fullest extent legally allowable.

Change in Control Agreements

Naugatuck Valley Savings has entered into change in control agreements with certain individuals, including Mr. Alegi, Mr. Nimons and Ms. Walsh. Each change in control agreement has either a two- or three-year term, subject to renewal by the Board of Directors on an annual basis. Mr. Alegi, Mr. Nimons and Ms. Walsh have three-year agreements. If, following a change in control of Naugatuck Valley

Savings or Naugatuck Valley Financial, Naugatuck Valley Savings or Naugatuck Valley Financial or their successors terminates the employment of an individual who has entered into a change in control agreement for reasons other than for cause, or if the individual voluntarily resigns upon the occurrence of circumstances specified in the agreements, the officer will receive a severance payment under the agreements equal to two or three times, based on the term of the agreement, the officer’s average annual compensation for the five most recent taxable years. Naugatuck Valley Savings will also continue health and welfare benefit coverage for 24 or 36 months, based on the term of the agreement, following termination of employment. The agreements limit payments made to the executives in connection with a change in control to amounts that will not exceed the limits imposed by Internal Revenue Code Section 280G.

Death Benefit Agreements

Naugatuck Valley Savings has entered into death benefit agreements with certain employees, including Messrs. Roman and Alegi. Under Mr. Roman’s agreement, Mr. Roman’s beneficiary becomes entitled to a single lump sum payment of $193,000 upon Mr. Roman’s death while still an employee of Naugatuck Valley Savings, or $25,000 upon Mr. Roman’s death at any other time. Under Mr. Alegi’s agreement, Mr. Alegi’s beneficiary becomes entitled to a single lump sum payment of $25,000 upon Mr. Alegi’s death at any time.

Employee Severance Compensation Plan

Naugatuck Valley Savings has adopted the Naugatuck Valley Savings and Loan Employee Severance Compensation Plan to provide severance benefits to eligible employees whose employment terminates in connection with a change in control of Naugatuck Valley Savings or Naugatuck Valley Financial. Employees become eligible for severance benefits under the plan if they have a minimum of one year of service with Naugatuck Valley Savings. Individuals who enter into employment or change in control agreements with Naugatuck Valley Savings or Naugatuck Valley Financial will not participate in the severance plan. Under the severance plan, if, within 24 months of a change in control, Naugatuck Valley Savings or Naugatuck Valley Financial or their successors terminate an employee’s employment or if the individual voluntarily terminates employment upon the occurrence of events specified in the severance plan, then that individual will receive a severance payment equal to one month’s compensation for each year of service with Naugatuck Valley Savings, up to a maximum payment equal to 24 months of compensation.

Retirement Plan

Naugatuck Valley Savings participates in the Financial Institutions Retirement Fund (the “Retirement Plan”) to provide retirement benefits for eligible employees. However, the accrual of benefits under the Retirement Plan was frozen as of September 1, 2005. The following table shows the estimated annual benefits payable under the pension plan based upon the respective years of service and compensation indicated below as calculated under the Retirement Plan. As of December 31, 2005, Messrs. Roman, Alegi and Nimons had credited years of service of 6, 35 and 29 years, respectively.

| | | Years of Benefit Service |

Final Average Earnings | | 15 | | 20 | | 25 | | 30 | | 35 |

| | | | | | | | | | | |

| $ 75,000 | | $16,875 | | $22,500 | | $28,125 | | $33,750 | | $39,375 |

| 100,000 | | 22,500 | | 30,000 | | 37,500 | | 45,000 | | 52,500 |

| 125,000 | | 28,125 | | 37,500 | | 46,875 | | 56,250 | | 65,625 |

| 150,000 | | 33,750 | | 45,000 | | 56,250 | | 67,500 | | 78,750 |

| 175,000 | | 39,375 | | 52,500 | | 65,625 | | 78,750 | | 91,875 |

| 200,000 | | 45,000 | | 60,000 | | 75,000 | | 90,000 | | 105,000 |

| 250,000 | | 56,250 | | 75,000 | | 93,750 | | 112,500 | | 131,250 |

| 300,000 | | 67,500 | | 90,000 | | 112,500 | | 135,000 | | 157,500 |

| 350,000 | | 78,750 | | 105,000 | | 131,250 | | 157,500 | | 183,750 |

Compensation Committee Report on Executive Compensation

The following is the report of the Compensation Committee of the Board of Directors of Naugatuck Valley Financial (the “Compensation Committee”) regarding executive compensation. The following discussion addresses compensation information relating to executive officers of Naugatuck Valley Financial and Naugatuck Valley Savings for fiscal 2005.

Compensation Policies

The Compensation Committee bases its executive compensation policy on the same principles that guide Naugatuck Valley Financial in establishing all of its compensation programs. Naugatuck Valley Financial designs programs to attract, retain and motivate highly talented individuals at all levels of the organization while balancing the interests of stockholders. Naugatuck Valley Savings emphasizes using a competitive base salary and program of retirement benefits as a means of attracting and retaining employees. Naugatuck Valley Savings maintains a bonus program that provides all employees with the opportunity to receive a bonus based upon the performance of Naugatuck Valley Savings. In the case of officers and managers of Naugatuck Valley Savings, a portion of the bonus is based upon individual performance.

Components of Executive Compensation

Base Salary. Salary levels of all employees, including executive officers, are set so as to reflect the duties and levels of responsibilities inherent in the position and to reflect competitive conditions in the banking business in Naugatuck Valley Savings’ market area. Comparative salaries paid by other financial institutions are considered in establishing the salary for a given position. The Compensation Committee utilizes the Compensation Survey compiled by the Connecticut Bankers Association as well as other surveys prepared by trade groups and independent benefits consultants. Base salaries for executive officers are reviewed annually by the Compensation Committee which takes into account the competitive level of pay as reflected in the surveys consulted. In setting base salaries, the Compensation Committee also considers a number of factors relating to the particular executive, including individual performance, job responsibilities, level of experience, ability and knowledge of the position. These factors are considered in the aggregate and none of the factors are accorded a specific weight.

Bonus and Participation in Employee Benefit Plans. Compensation for executive officers is also composed of bonus and participation in various employee benefit plans, such as the Retirement Plan, the 401(k) Plan and the employee stock ownership plan.

Long-Term Incentive Compensation. Under the Naugatuck Valley Financial Corporation 2005 Equity Incentive Plan (the “2005 Incentive Plan”), the Compensation Committee is authorized, in its discretion, to grant stock options and restricted stock awards in such proportions and upon such terms and conditions as the Compensation Committee may determine. All stock options granted have an exercise price equal to the fair market value of the Company’s common stock at the time of grant and are exercisable within a 10-year period. In order to assure the retention of high level executives and to tie the compensation of those executives to the creation of long-term value for stockholders, the Compensation Committee requires that stock options granted under the 2005 Incentive Plan become exercisable in equal portions over a five-year period.

The awards of restricted stock to executive officers and other key employees represent shares of Company common stock that the recipient cannot sell or otherwise transfer until the applicable restriction period lapses. Restricted stock awards also are intended to increase the ownership of executives in the Company, thereby further integrating the compensation of the executive with the creation of long-term value for stockholders. The Compensation Committee has provided that restricted stock awards granted under the 2005 Incentive Plan vest in equal portions over five years.

Chief Executive Officer Compensation. The Compensation Committee fixed the 2005 base salary for the Naugatuck Valley Savings President and Chief Executive Officer, John C. Roman, in a manner consistent with the base salary guidelines applied for executive officers of Naugatuck Valley Savings as described above. In general, the Compensation Committee considers Naugatuck Valley Savings’ financial performance, peer group financial performance and compensation survey data when making decisions regarding the Chief Executive Officer’s compensation, including salary, bonus, and awards made under the 2005 Incentive Plan. In recognition of Mr. Roman’s leadership and contribution to the success of the Company, the Compensation Committee increased Mr. Roman’s base salary for 2005 to $157,177 from $150,065 in 2004. In addition, in 2005 Mr. Roman was awarded 22,000 restricted stock awards and 37,000 stock options under the 2005 Incentive Plan. Mr. Roman also participates in the Naugatuck Valley Financial’s employee benefit plans, including the Retirement Plan, the 401(k) Plan and the employee stock ownership plan. In addition, Naugatuck Valley Financial supplies Mr. Roman with an automobile and fuel. The annual depreciation charge for the automobile during 2005 was $8,498. The value of the personal use of the automobile and fuel is added to Mr. Roman’s income for tax purposes.

The Compensation Committee

| Richard M. Famiglietti, Chairman | Carlos S. Batista |

| Ronald D. Lengyel | Camilo P. Vieira |

| James A. Mengacci | Michael S. Plude |

Compensation Committee Interlocks and Insider Participation

Mr. Lengyel, who serves on the Compensation Committee, previously served as President and Chief Executive Officer of Naugatuck Valley Savings before his retirement in September 1999.

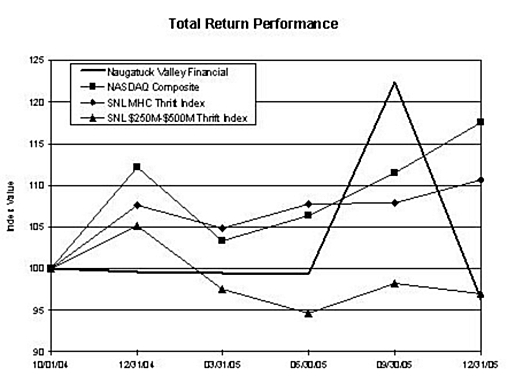

Stock Performance Graph

The following graph compares the cumulative total stockholder return on the Company’s common stock with the cumulative total return on the NASDAQ Composite (U.S. Companies), SNL MHC Thrift Index and the SNL $250M-$500M Thrift Index. Total return assumes the reinvestment of all dividends. The graph assumes $100 was invested at the close of business on October 1, 2004, the initial day of trading of the Company’s common stock.

| | | Period Ending |

Index | | 10/01/04 | 12/31/04 | 03/31/05 | 06/30/05 | 09/30/05 | 12/31/05 |

| Naugatuck Valley Financial Corp. | | $100.00 | $ 99.63 | $ 99.52 | $ 99.36 | $122.35 | $ 96.31 |

| NASDAQ Composite | | 100.00 | 112.19 | 103.27 | 106.44 | 111.53 | 117.50 |

| SNL MHC Thrift Index | | 100.00 | 107.69 | 104.90 | 107.72 | 107.90 | 110.64 |

| SNL $250M-$500M Thrift Index | | 100.00 | 105.16 | 97.52 | 94.62 | 98.27 | 96.98 |

Other Information Relating to Directors and Executive Officers

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s executive officers and directors, and persons who own more than 10% of any registered class of the Company’s equity securities, to file reports of ownership and changes in ownership with the Securities and Exchange Commission. Executive officers, directors and greater than 10% stockholders are required by regulation to furnish the Company with copies of all Section 16(a) reports they file.

Based solely on the Company’s review of copies of the reports it has received and written representations provided to it from the individuals required to file the reports, the Company believes that each of its executive officers and directors has complied with applicable reporting requirements for transactions in Naugatuck Valley Financial common stock during the year ended December 31, 2005, except for one late report on Form 4 filed by Mark Graveline with regard to a single purchase of Company common stock.

Transactions with Management

Loans and Extensions of Credit. The Sarbanes-Oxley Act of 2002 generally prohibits loans by Naugatuck Valley Financial to its executive officers and directors. However, the Sarbanes-Oxley Act contains a specific exemption from such prohibition for loans by Naugatuck Valley Savings to its executive officers and directors in compliance with federal banking regulations. Federal regulations require that all loans or extensions of credit to executive officers and directors of insured institutions must be made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with other persons and must not involve more than the normal risk of repayment or present other unfavorable features. Naugatuck Valley Savings is therefore prohibited from making any new loans or extensions of credit to executive officers and directors at different rates or terms than those offered to the general public, except for loans made pursuant to programs generally available to all employees. Notwithstanding this rule, federal regulations permit Naugatuck Valley Savings to make loans to executive officers and directors at reduced interest rates if the loan is made under a benefit program generally available to all other employees and does not give preference to any executive officer or director over any other employee.

In addition, loans made to a director or executive officer in an amount that, when aggregated with the amount of all other loans to the person and his or her related interests, are in excess of the greater of $25,000 or 5% of Naugatuck Valley Savings’ capital and surplus, up to a maximum of $500,000, must be approved in advance by a majority of the disinterested members of the Board of Directors.

Nominating and Corporate Governance Committee Procedures

General

It is the policy of the Nominating and Corporate Governance Committee of the Board of Directors of Company to consider director candidates recommended by stockholders who appear to be qualified to serve on the Company’s Board of Directors. The Nominating and Corporate Governance Committee may choose not to consider an unsolicited recommendation if no vacancy exists on the Board of Directors and the Nominating and Corporate Governance Committee does not perceive a need to increase the size of the Board of Directors. In order to avoid the unnecessary use of the Nominating and Corporate Governance Committee’s resources, the Nominating and Corporate Governance Committee

will consider only those director candidates recommended in accordance with the procedures set forth below.

Procedures to be Followed by Stockholders

To submit a recommendation of a director candidate to the Nominating and Corporate Governance Committee, a stockholder should submit the following information in writing, addressed to the Chairman of the Nominating and Corporate Governance Committee, care of the Corporate Secretary, at the main office of the Company:

| | 1. | The name of the person recommended as a director candidate; |

| | 2. | All information relating to such person that is required to be disclosed in solicitations of proxies for election of directors pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended; |

| | 3. | The written consent of the person being recommended as a director candidate to being named in the proxy statement as a nominee and to serving as a director if elected; |

| | 4. | As to the stockholder making the recommendation, the name and address, as they appear on the Company’s books, of such stockholder; provided, however, that if the stockholder is not a registered holder of the Company’s common stock, the stockholder should submit his or her name and address along with a current written statement from the record holder of the shares that reflects ownership of the Company’s common stock; and |

| | 5. | A statement disclosing whether such stockholder is acting with or on behalf of any other person and, if applicable, the identity of such person. |

In order for a director candidate to be considered for nomination at the Company’s annual meeting of stockholders, the recommendation must be received by the Nominating and Corporate Governance Committee at least 120 calendar days before the date the Company’s proxy statement was released to stockholders in connection with the previous year’s annual meeting, advanced by one year.

Minimum Qualifications

The Nominating and Corporate Governance Committee has adopted a set of criteria that it considers when it selects individuals to be nominated for election to the Board of Directors. First, a candidate must meet the eligibility requirements set forth in the Company’s Bylaws, which include a requirement that the candidate not have been subject to certain criminal or regulatory actions. A candidate also must meet any qualification requirements set forth in any Board or committee governing documents.

The Nominating and Corporate Governance Committee will consider the following criteria in selecting nominees: financial, regulatory and business experience; familiarity with and participation in the local community; integrity, honesty and reputation; dedication to the Company and its stockholders; independence; and any other factors the Nominating and Corporate Governance Committee deems relevant, including age, diversity, size of the Board of Directors and regulatory disclosure obligations.

In addition, before nominating an existing director for re-election to the Board of Directors, the Nominating and Corporate Governance Committee will consider and review an existing director’s Board

and committee attendance and performance; length of Board service; experience, skills and contributions that the existing director brings to the Board; and independence.

Process for Identifying and Evaluating Nominees

The Nominating and Corporate Governance Committee’s process for identifying and evaluating individuals to be nominated for election to the Board of Directors is as follows:

Identification. For purposes of identifying nominees for the Board of Directors, the Nominating and Corporate Governance Committee relies on personal contacts of committee members and other members of the Board of Directors as well as its knowledge of members of Naugatuck Valley Savings’ local communities. The Nominating and Corporate Governance Committee will also consider director candidates recommended by stockholders in accordance with the policy and procedures set forth above. The Nominating and Corporate Governance Committee has not used an independent search firm to identify nominees.

Evaluation. In evaluating potential nominees, the Nominating and Corporate Governance Committee determines whether the candidate is eligible and qualified for service on the Board of Directors by evaluating the candidate under the selection criteria set forth above. In addition, the Nominating and Corporate Governance Committee will conduct a check of the individual’s background and interview the candidate.

Submission of Business Proposals and Stockholder Nominations

The Company must receive proposals that stockholders seek to include in the proxy statement for the Company’s next annual meeting no later than November 28, 2006. If next year’s annual meeting is held on a date more than 30 calendar days from May 4, 2007, a stockholder proposal must be received by a reasonable time before the Company begins to print and mail its proxy solicitation material for such annual meeting. Any stockholder proposals will be subject to the requirements of the proxy rules adopted by the Securities and Exchange Commission.

The Company’s Bylaws provides that in order for a stockholder to make nominations for the election of directors or proposals for business to be brought before the annual meeting, a stockholder must deliver notice of such nominations and/or proposals to the Secretary not less than 30 days before the date of the annual meeting; provided that if less than 40 days’ notice or prior public disclosure of the date of the annual meeting is given to stockholders, such notice must be received not later than the close of business on the 10th day following the day on which notice of the date of the annual meeting was mailed to stockholders or prior public disclosure of the meeting date was made. A copy of the Bylaws may be obtained from the Company.

Stockholder Communications

The Company encourages stockholder communications to the Board of Directors and/or individual directors. Communications regarding financial or accounting policies may be made in writing to the Chairman of the Audit Committee, Richard M. Famiglietti, at Naugatuck Valley Financial Corporation, c/o Corporate Secretary, 333 Church Street, Naugatuck, Connecticut 06770. Other communications to the Board of Directors may be made in writing to the Chairman of the Nominating and Corporate Governance Committee, James A. Mengacci, at Naugatuck Valley Financial Corporation, c/o Corporate Secretary, 333 Church Street, Naugatuck, Connecticut 06770. Communications to

individual directors may be made to such director in writing to such director at Naugatuck Valley Financial Corporation, c/o Corporate Secretary, 333 Church Street, Naugatuck, Connecticut 06770.

Miscellaneous

The Company will pay the cost of this proxy solicitation. The Company will reimburse brokerage firms and other custodians, nominees and fiduciaries for the reasonable expenses they incur in sending proxy materials to the beneficial owners of Naugatuck Valley Financial common stock. In addition to soliciting proxies by mail, directors, officers and regular employees of the Company may solicit proxies personally or by telephone without receiving additional compensation.

The Company’s Annual Report to Stockholders has been mailed to persons who were stockholders as of the close of business on March 15, 2006. Any stockholder who has not received a copy of the Annual Report may obtain a copy by writing to the Corporate Secretary of the Company. The Annual Report is not to be treated as part of the proxy solicitation material or as having been incorporated in this proxy statement by reference.

A copy of the Company’s Annual Report on Form 10-K, without exhibits, for the year ended December 31, 2005, as filed with the Securities and Exchange Commission, will be furnished without charge to persons who were stockholders as of the close of business on March 15, 2006 upon written request to Bernadette A. Mole, Naugatuck Valley Financial Corporation, 333 Church Street, Naugatuck, Connecticut 06770.

If you and others who share your address own your shares in street name, your broker or other holder of record may be sending only one annual report and proxy statement to your address. This practice, known as “householding,” is designed to reduce our printing and postage costs. However, if a stockholder residing at such an address wishes to receive a separate Annual Report or proxy statement in the future, he or she should contact the broker or other holder of record. If you own your shares in street name and are receiving multiple copies of our Annual Report and proxy statement, you can request householding by contacting your broker or other holder of record.

Whether or not you plan to attend the annual meeting, please vote by marking, signing, dating and promptly returning the enclosed proxy card in the enclosed envelope.

| | BY ORDER OF THE BOARD OF DIRECTORS |

| | |

| | /s/ Bernadette A. Mole |

| | |

| | Bernadette A. Mole |

| | Corporate Secretary |

Naugatuck, Connecticut

March 28, 2006

REVOCABLE PROXY

NAUGATUCK VALLEY FINANCIAL CORPORATION

ANNUAL MEETING OF STOCKHOLDERS

May 4, 2006

10:30 a.m., Eastern Time

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned hereby appoints James Mengacci and Carlos Batista, each with full power of substitution, to act as proxy for the undersigned, and to vote all shares of common stock of the Company which the undersigned is entitled to vote only at the Annual Meeting of Stockholders, to be held on May 4, 2006, at 10:30 a.m. local time, at the Community Room in Naugatuck Valley Savings and Loan’s main office at 333 Church Street, Naugatuck, Connecticut, and at any and all adjournments of the meeting, with all of the powers the undersigned would possess if personally present at such meeting, as indicated to the right:

| | 1. | The election as directors of all nominees listed (except as marked to the contrary below). |

Richard M. Famiglietti and Ronald D. Lengyel

| | | INSTRUCTION: To withhold your vote for any individual nominee, mark “For All Except” and write that nominee’s name on the line provided below. |

| | 2. | The ratification of the appointment of Whittlesey & Hadley, P.C. as independent registered public accountants of Naugatuck Valley Financial Corporation for the year ending December 31, 2006. |

The Board of Directors recommends that you vote “FOR” each of the nominees and the listed proposal.

This proxy, properly signed and dated, is revocable and will be voted as directed, but if no instructions are specified, this proxy will be voted “FOR” the nominees and the proposal listed. If any other business is presented at the annual meeting, including whether or not to adjourn the meeting, this proxy will be voted by the proxies in their best judgment. At the present time, the Board of Directors knows of no other business to be presented at the annual meeting. This proxy also confers discretionary authority on the Board of Directors to vote with respect to the election of any person as director where the nominees are unable to serve or for good cause will not serve and matters incident to the conduct of the meeting.

Please be sure to sign below and date this Proxy in the box provided.

Stockholder sign above

Co-holder (if any) sign above

Detach above card, sign, date and mail in postage paid envelope provided.

NAUGATUCK VALLEY FINANCIAL CORPORATION

The above signed acknowledges receipt from the Company prior to the execution of this proxy of a Notice of Annual Meeting of Stockholders, a Proxy Statement for the Annual Meeting of Stockholders and the Annual Report to Stockholders.

Please sign exactly as your name appears on this card. When signing as attorney, executor, administrator, trustee or guardian, please give your full title. If shares are held jointly, each holder may sign but only one signature is required.

PLEASE COMPLETE, DATE, SIGN AND PROMPTLY MAIL THIS PROXY IN THE ENCLOSED POSTAGE-PAID ENVELOPE.

VOTE AUTHORIZATION FORM

I understand that First Bankers Trust Services, Inc., the ESOP Trustee, is the holder of record and custodian of all shares of Naugatuck Valley Financial Corporation (the “Company”) common stock under the Naugatuck Valley Savings and Loan Employee Stock Ownership Plan. I understand that my voting instructions are solicited on behalf of the Company's Board of Directors for the Annual Meeting of Stockholders to be held on May 4, 2006.

You are to vote my shares as follows:

1. The election as directors of all nominees listed (except as marked to the contrary below).

Richard M. Famiglietti and Ronald D. Lengyel

INSTRUCTION: To withhold authority to vote for any individual nominee, mark the “For All Except” and write that nominee’s name on the line provided below.

2. The ratification of the appointment of Whittlesey & Hadley, P.C. as independent registered public accountants of Naugatuck Valley Financial Corporation for the year ending December 31, 2006.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH OF THE NOMINEES AND THE LISTED PROPOSAL.

The ESOP Trustee is hereby authorized to vote all shares of Company common stock allocated to me in its trust capacity as indicated above.

Please date, sign and return this form in the enclosed postage-paid envelope no later than April 27, 2006.

VOTE AUTHORIZATION FORM

I understand that ING National Trust (the “Trustee”) is the holder of record and custodian of all shares of Naugatuck Valley Financial Corporation (the “Company”) common stock credited to me under the Naugatuck Valley Savings and Loan 401(k) Profit Sharing Plan and Trust. I understand that my voting instructions are solicited on behalf of the Company's Board of Directors for the Annual Meeting of Stockholders to be held on May 4, 2006.

You are to vote my shares as follows: