|

|---|

| Exhibit 99.2 |

| |

| |

| |

|

| |

| |

| |

| |

| |

| |

|

| INVESTOR PRESENTATION |

ACB Community Bank Investor Conference

November 2, 2006

During the course of this presentation, management may make projections and other forward-looking statements regarding events or the future financial performance of Naugatuck Valley Financial Corporation (“NVSL”). We wish to caution you that these forward-looking statements may differ materially from actual results due to a number of risks and uncertainties. These statements are based on the beliefs and assumptions of the management of NVSL, and on the information available to management at the time the presentation materials were prepared. For a more detailed description of the factors that may affect NVSL’s operating results, we refer you to our filings with the Securities & Exchange Commission, including the Quarterly Report on Form 10-Q, the Annual Report on Form 10-K, and other required filings. Naugatuck Valley Financial Corporation assumes no obligation to update the forward-looking statements made during this presentation. This presentation is not an offer to sell nor a solicitation to buy any securities. An offer to sell or a solicitation to buy any securities may only be made through a prospectus.

Forward Looking Statements

2

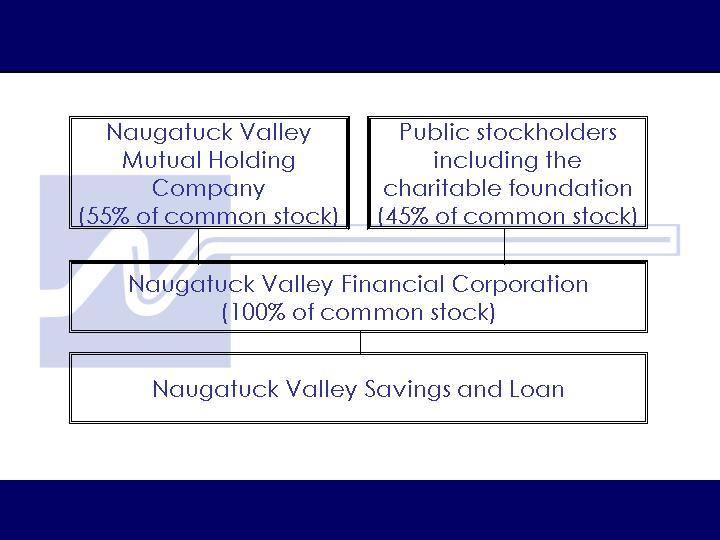

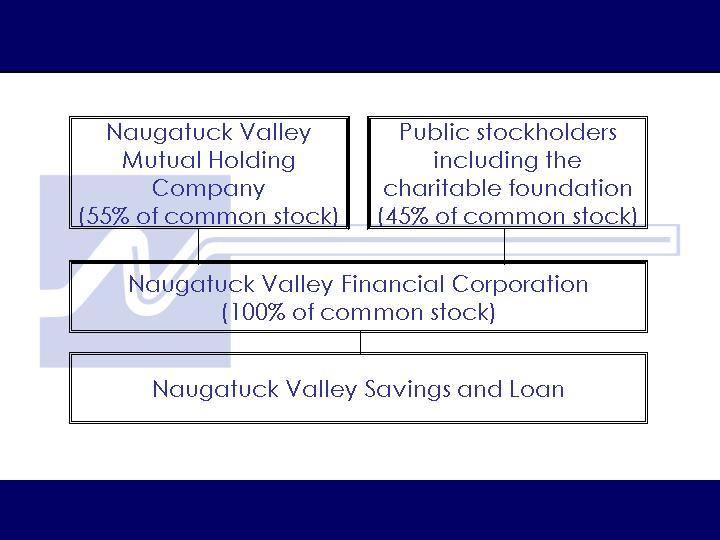

MHC Structure

3

Corporate Overview

4

Originally organized in 1922, the Bank is a federally

chartered stock savings bank headquartered in

Naugatuck, Connecticut.

Naugatuck Valley Financial Corporation was formed on

September 30, 2004 through a minority MHC offering selling

$32.7 million or 3,269,881 shares and currently trades on the

NASDAQ Global Market under the symbol “NVSL”.

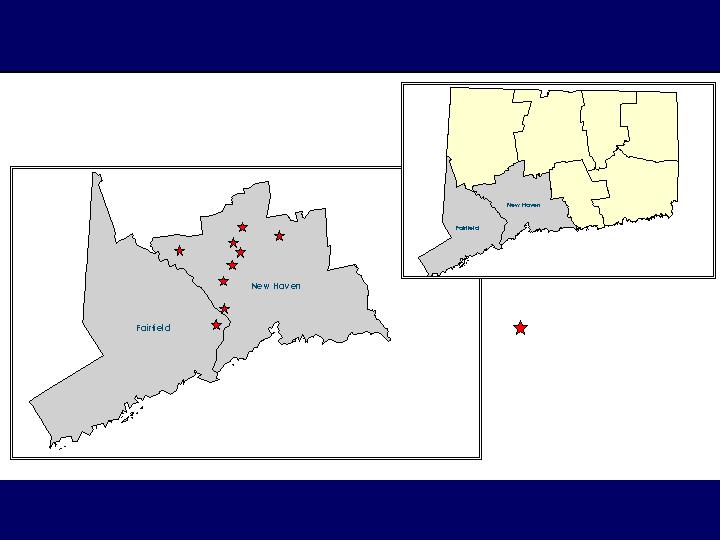

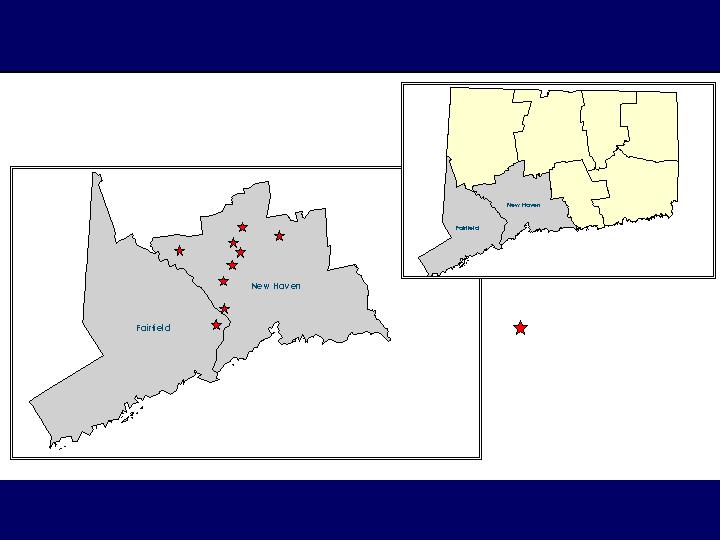

Currently operates 9 branch offices located in Fairfield and

New Haven Counties, Connecticut.

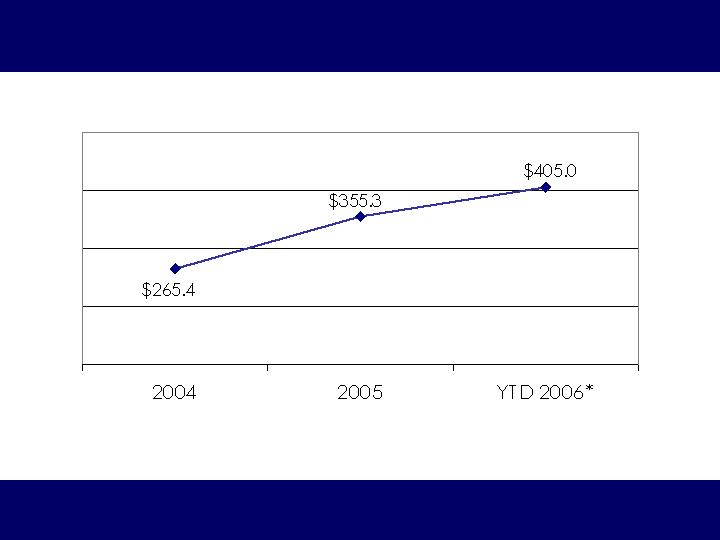

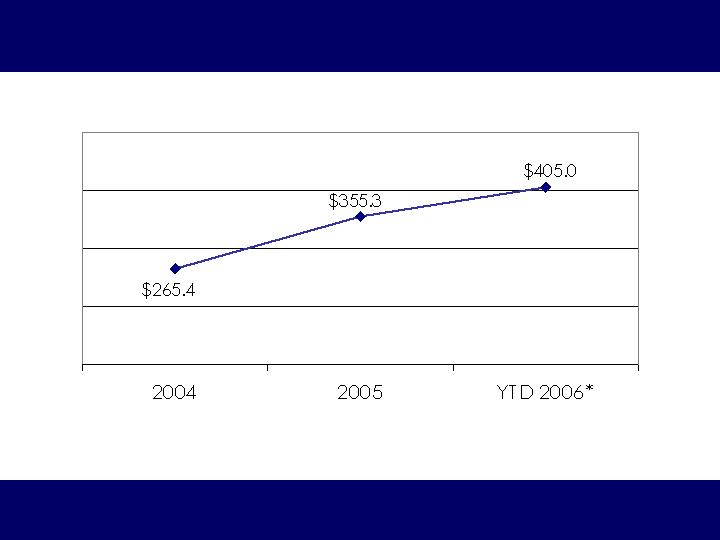

Total assets of $405.0 million, net loans of $293.8 million,

deposits of $287.1 million and stockholders’ equity of $51.0

million at September 30, 2006.

Overview of Naugatuck Valley Financial

5

Branch Map

NVSL Branches

6

Our Mission

7

Our mission is to operate and

grow a profitable community

oriented financial institution

serving primarily retail

customers and small

businesses in our market area.

Management Team

8

Business Strategy & Financial Highlights

9

Post Conversion (2004)

Our business strategy is designed to build shareholder value by:

Growing Deposits and Diversifying the Mix;

Growing Loans and Diversifying the Mix;

Growing and Diversifying Non Interest Income;

Controlling Expenses;

Enhancing Our Branch Network and Alternative Delivery Systems.

Business Strategy

10

Asset Growth (in millions)

11

* As of September 30, 2006

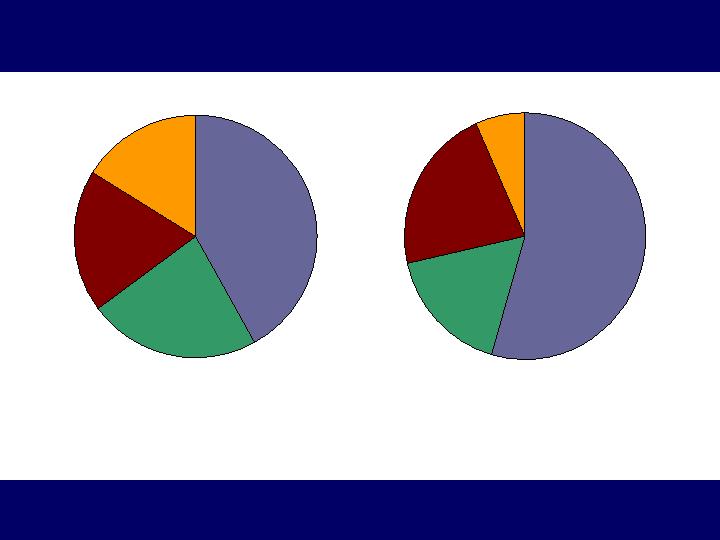

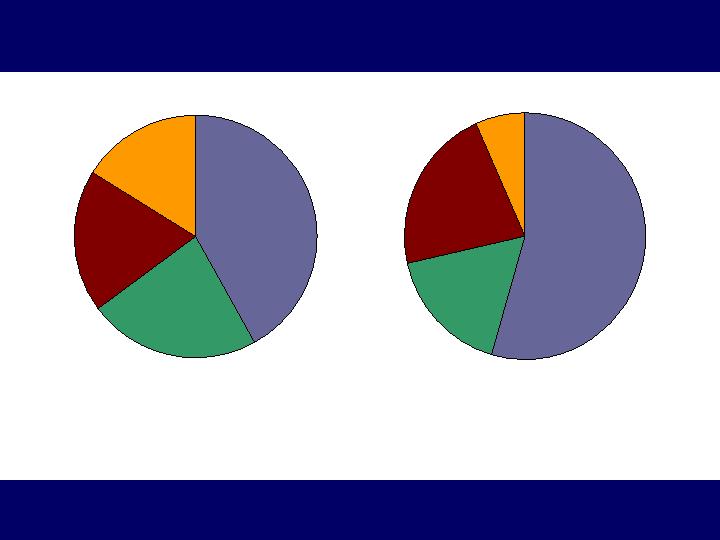

Growing Deposits & Diversifying The Mix

12

MMDA

16.2%

CD’s

42.0%

Savings

22.7%

DDA

19.1%

CD’s

54.5%

DDA

21.7%

Savings

17.0%

MMDA

6.8%

As of 12/31/04

$193,366,000

As of 09/30/06

$287,054,000

Up 48%

13

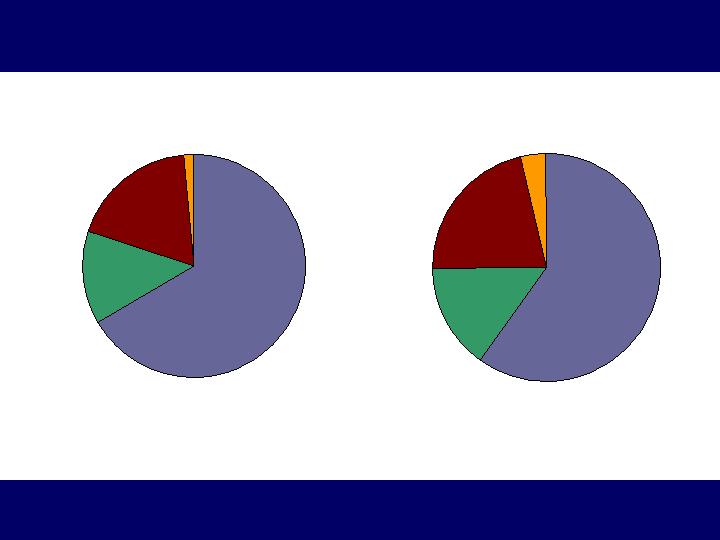

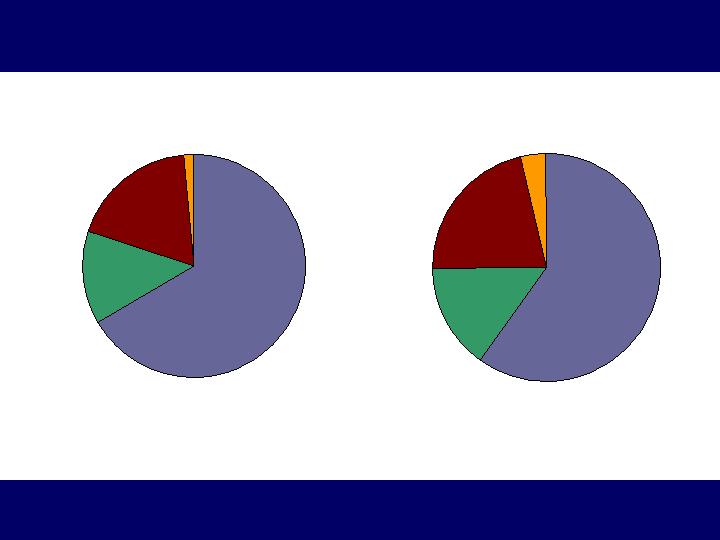

Growing Loans & Diversifying The Mix

As of 12/31/04

$206,000,000

As of 09/30/06

$296,200,000

Up 44%

CML MTGE

18.4%

RES MTGE

66.4%

Other

Commercial

1.5%

Consumer

13.7%

Other

Commercial

3.7%

CML MTGE

21.7%

RES MTGE

59.7%

Consumer

14.9%

Loan to Deposit Ratio

14

Growing & Diversifying Non Interest Income

15

1,462,000

1,078,000

Totals

325,000

113,000

All Other

78,000

N/A

Res. Brokerage &

Reverse Mortgage

77,000

87,000

229,000

666,000

YTD 2006*

100,000

ATM Fees

107,000

Ins & Invest Serv

201,000

BOLI

557,000

DDA Fees

2004

Up 36%

Significant Sources of Non-Interest Income

* For the nine months ended September 30, 2006.

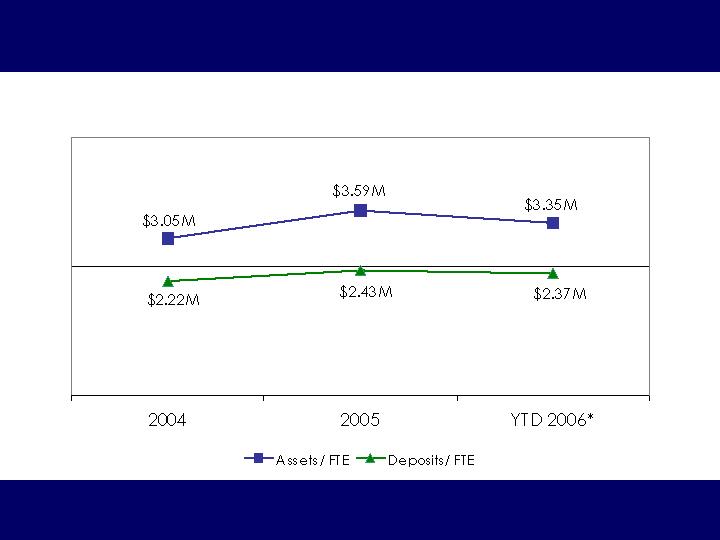

Control Expenses

16

* For the nine months ended September 30, 2006

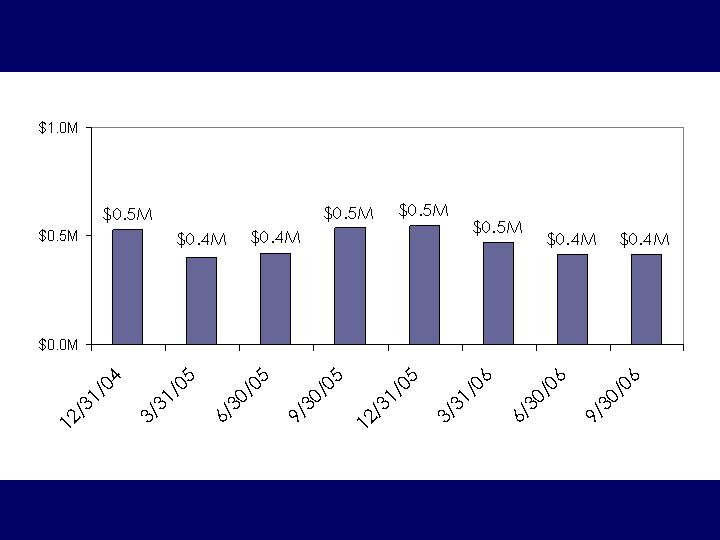

Total Operating Expenses

17

Control Expenses

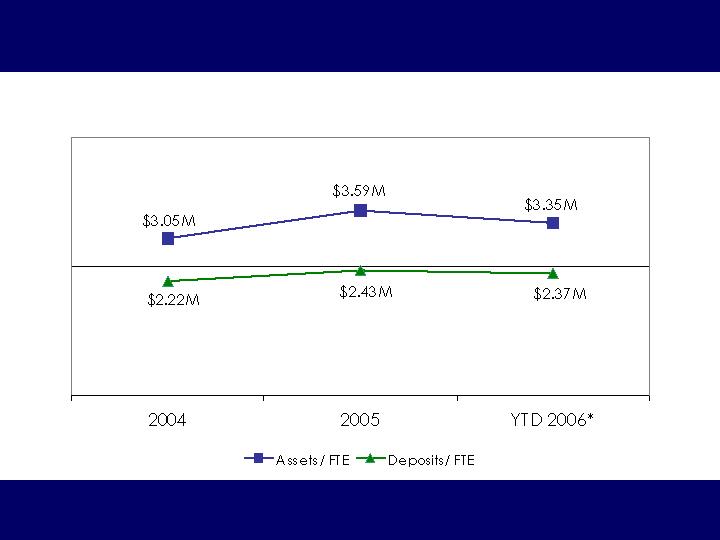

Per Full Time Employee

* As of September 30, 2006.

18

Enhance Branch Network and Delivery Systems

287,054

1,497

2,398

2,505

34,095

246,559

Deposits (000s)

09/30/06

193,366

Totals

0

Cheshire – Aug 2006

0

Waterbury – Aug 2006

0

Southford – Aug 2006

0

Seymour – 2005

193,366

Pre 2005 Branches

Deposits (000s)

12/31/04

Opened

09/30/06

489

325

Bill Pay

1,828

12/31/04

1,147

Total Evalley

Internet Banking

Reserves / Loans

NPLs / Loans

Credit Quality

19

* As of September 30, 2006

Credit Quality

0.69%

189.08%

0.32%

0.26%

Nationwide

MHC’s 2

0.83%

167.47%

0.35%

0.25%

Nationwide

Thrifts 3

0.68%

LLR/Loans

339.36%

LLR/NPL

0.20%

NPL’s/Loans

0.15%

NPA’s/Assets

Naugatuck

Valley

Financial

Corporation 1

1 Ratios as of 09/30/06.

2 Source: SNL Database. Data as of 06/30/06.

3 Source: SNL Database. Excludes MHC’s. Data as of 06/30/06.

20

Spread

21

* As of September 30, 2006

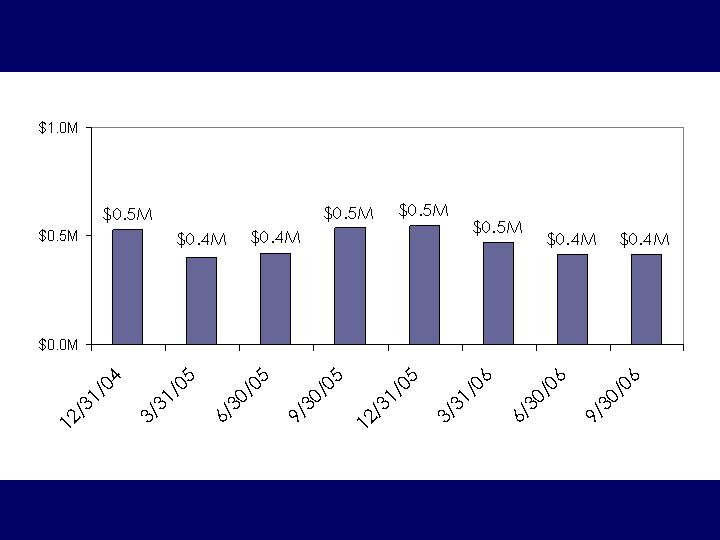

Net Interest Income (in millions)

22

Net Income (in millions)

23

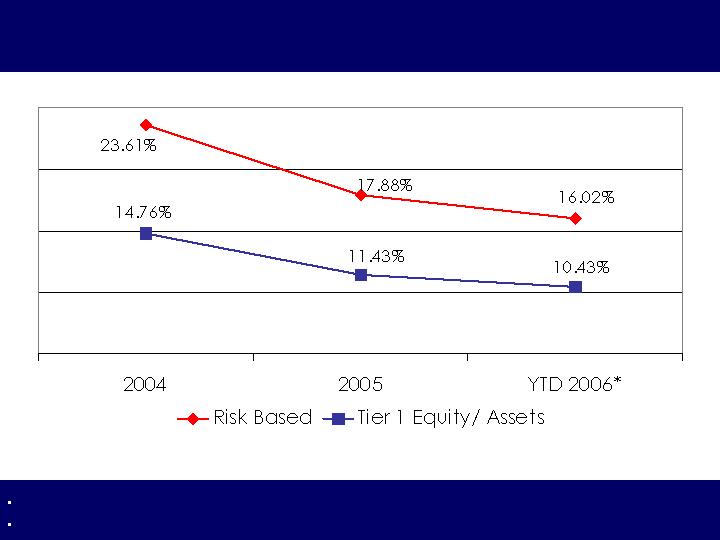

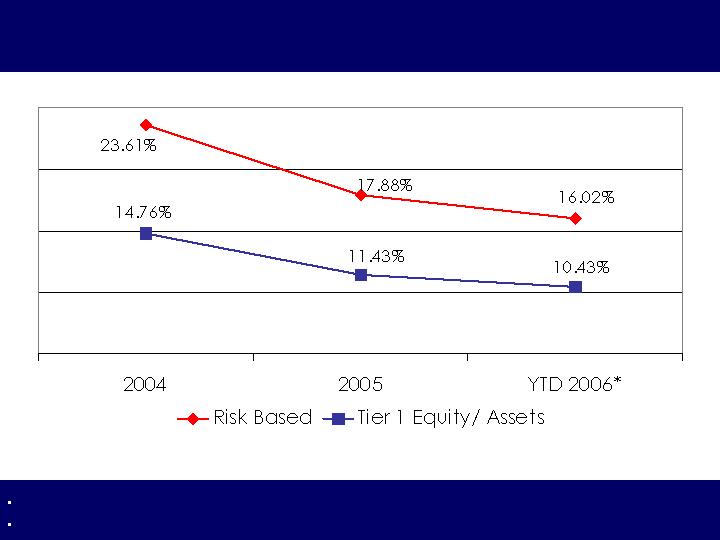

Capital Ratios

24

As of June 30, 2006

Based on Bank Level Numbers.

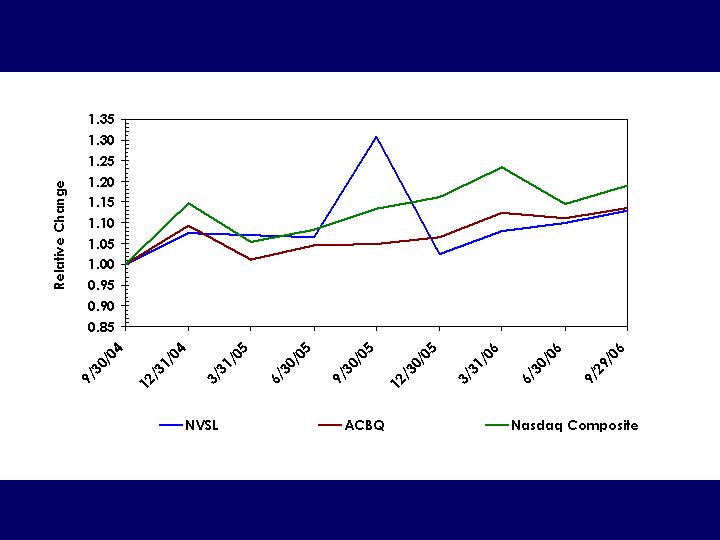

Market Data

25

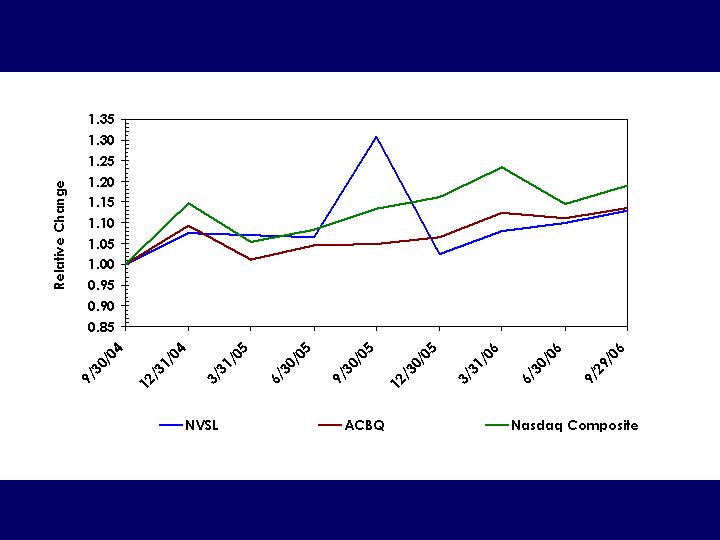

Index Graph

26

Peer Group Comparison

179.1%

174.6%

40.5x

Medians

Nationwide

MHC’s 3

179.1%

172.9%

45.7x

Medians

New

England

MHC’s 3

165.8%

Price / Tang Book

165.1%

Price / Book

45.9x

Price / Earnings

NVSL 1

1Pricing ratios for NVSL are based on the closing price of $11.02 as of 10/20/06.

2 The fully-converted valuation is based on RBCOs Research Department.

3 Source: SNL Database for the latest reported twelve month period. Ratios are based on closing prices as of 10/20/06. Excludes merger targets.

4 Source: SNL Database for the latest reported twelve month period. Ratios are based on closing prices as of 10/20/06. Excludes MHCs and merger targets.

27

143.6%

134.4%

22.5x

New

England

Thrifts 4

140.1%

127.0%

16.0x

Nationwide

Thrifts 4

81.8%

Price / Tang Book

81.7%

Price / Book

27.5x

Price / Earnings

NVSL 1,2

NVSL on an

MHC Basis

NVSL on a

fully-converted

basis

Peer Group Comparison

69.03%

1.50%

$0.05

Medians

Nationwide

MHC’s 2

57.69%

1.41%

$0.05

Medians

New England

MHC’s 2

37.50%

Dividend Payout Ratio 4

1.81%

Current Dividend Yield 3

$0.05

Quarterly Dividend Rate

Naugatuck

Valley

Financial

Corporation 1

1 Source: SNL Database.

2 Source: SNL Database. Excludes merger targets.

3 Dividend Yield is based on stock prices at 10/20/06.

4 Dividend Payout Ratio is on a minority basis.

28

Stock Buy Back Program

29

On May 2, 2006, the board of directors

authorized the company to repurchase up to

380,218 shares or approximately 5% of the

outstanding shares held by persons other than

Naugatuck Valley Mutual Holding Co.

As of September 30, 2006, 105,350 shares had

been repurchased under this program at at

weighted average price of approximately $11.40

per share.

Investment Attributes

30

Trades at a Discount to Fully-Converted Thrifts on

Book Value;

Attractive Dividend;

Solid Growth in Assets, Loans and Deposits;

Appealing Market Area; and

Strong Asset Quality.

Investment Attributes

31

NAUGATUCK VALLEY

FINANCIAL CORPORATION

(www.nvsl.com)

Contact:

President and Chief Executive Officer:

John C. Roman

203.720.5000

32