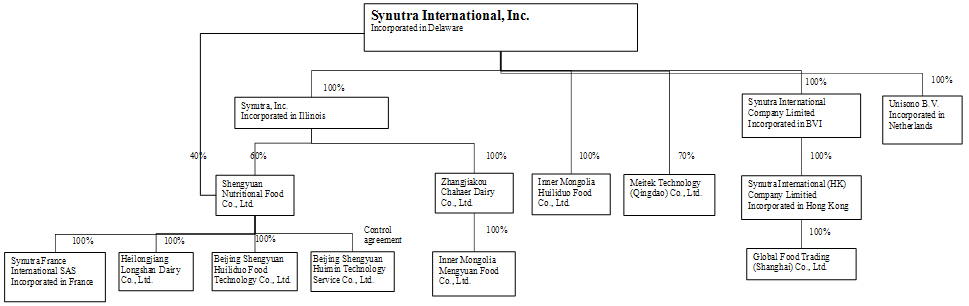

The following chart shows the structure of our control agreements and the affiliated entities consolidated into our group consolidated financial results as a result of the control agreements:

| | * | Control Agreements include: |

| | (a) | Exclusive Consulting and Service Agreement entered into by and between Shengyuan Nutrition and Huimin; |

| | (b) | Business Operating Agreement entered into by and among Shengyuan Nutrition, Huimin, Jibin Zhang (who is our Director of Loans) and Yunpeng Jiang (who is our Director of Strategic Acquisitions); |

| | (c) | Call Option Agreement entered into by and among Shengyuan Nutrition, Huimin, Jibin Zhang and Yunpeng Jiang; |

| | (d) | Pledge Agreement entered into by and among Shengyuan Nutrition, Jibin Zhang and Yunpeng Jiang; and |

| | (e) | Entrustment Agreement entered into by and among Shengyuan Nutrition, Jibin Zhang and Yunpeng Jiang. |

| | ** | Entrustment Agreement entered into by and among Shengyuan Nutrition, Jibin Zhang, Yunpeng Jiang and Honnete. |

For a more detailed description of the control agreements, see “Item 13. Certain Relationships and Related Transactions, and Director Independence.”

Our Brands

We primarily market our products under the Synutra, or Shengyuan, brand which has been associated with infant formula products in China for more than 10 years. In addition to the Synutra, or Shengyuan brand, our products are marketed in China under brands that we have developed through our national sales and marketing efforts.

Brands for Powdered Formula Products

Powdered formula product brands include several of China’s leading infant and adult formula brands, which mainly include Super, U-Smart, My Angel and Dutch Cow. We have positioned these brands as high quality brands, which provide unique, clinically supported health and developmental benefits. Our infant powdered formula products include DHA and ARA, which support brain and immune system development of infants.

Complementary Brands

Building upon the strength of our brands, we are extending into the fast growing prepared baby food and adult food market, using the Huiliduo brand.

We market under the Meitek brand to meet the nutritional needs of the broader consumer population in China. The products of our Meitek brand use raw materials of type II collagen, which are believed to help relieve joint discomfort, and glucosamine and chondroitin, which clinical studies indicate may help slow down the aging of joints.

In addition, we have recently launched Chondro Gold and Chodro Cal brands of chondroitin sulfate sodium and chondroitin sulfate calcium materials intended for the dietary ingredients industry in North America and the rest of the world. We believe these two branded materials lead the industry and differentiate our dietary ingredients from the rest of the field and feature our unique and proprietary manufacturing processes at Meitek that help to ensure material purity and quality with innovation.

Stages of Development

Generally, there are five stages of pediatric development and we produce different products for each of these stages. The general stages of pediatric development are as below:

| Stage 0: | For expectant and nursing mothers |

| Stage 1: | For infants 0-12 months old |

| Stage 2: | For infants 6-18 months old |

| Stage 3: | For children 1-3 years old |

| Stage 4: | For children 3-7 years old |

Our Dutch Cow brand also provides powdered formula products for students, women and older people, to address their special needs.

Our Products

Our products are grouped by category of production process and usage as well as internal resource allocation: (1) Powdered Formula, (2) Foods, (3) Nutritional Ingredients and Supplements, and (4) Other business. Sales of Powdered Formula, Foods, Nutritional Ingredients and Supplements, and Other business comprised 84%, 0%, 3%, and 13% of our net sales for the fiscal year ended March 31, 2013, respectively.

Powdered Formula Products

Infant Formula (Stage 1 and Stage 2)

Our infant formula products include formulas for regular feeding and specialty formula products. The following illustrates our key infant formula brands and products:

Regular Infant Formula

We design regular infant formula as a breast milk substitute for healthy, full-term infants without special nutritional needs, both for use as the infant’s sole source of nutrition and as a supplement to breastfeeding. We endeavor to develop regular infant formula closer to breast milk.

Each product is referred to as a “formula,” as it is formulated for the specific nutritional needs of an infant of a given age. Generally, our regular infant formula has the following four main components: (1) protein from cow’s milk that is processed to have an amino acid profile similar to human milk, (2) a blend of vegetable fats (including DHA/ARA) to replace bovine milk fat in order to better resemble the composition of human milk, (3) a carbohydrate, generally lactose from cow’s milk and (4) a vitamin and mineral “micronutrient” pre-mix that is blended into the product to meet the specific needs of the infant at a given age. Patterned after breast milk, which changes composition to meet the infant’s changing nutritional needs, we produce two stages of formula. Stage 1 formulas are consumed by newborn infants up to twelve months of age. Stage 2 formulas are generally consumed by infants from six to eighteen months.

Specialty Infant Formula

| | l | Formulas for Preterm and Low Birth Weight Infants |

| | l | Formulas addressing Calcium, Iron or Zinc Deficiency |

| | l | Formulas of Partially Hydrolyzed Whey Protein |

In March 2012, we obtained the license to produce specialty infant formulas in five categories from Shandong Bureau of Quality and Technical Supervision and were the first domestic manufacturer in China to receive such a license. Special infant formulas are designed for infants with special conditions who cannot consume regular infant formulas. We market these products under the Shengyuan Specialty Formula brand name.

Lactose free formulas are designed for infants that are lactose intolerant. Lactose is substituted by maltodextrin in this formula, and it is mainly for infants with diarrhea.

Formulas for preterm and low birth weight infants are designed to meet these infants’ unique needs. Typically, such infants need extra assistance obtaining the requisite nutrition. They require a higher density of nutrients and calories because they cannot take in enough volume of breast milk or regular infant formula. We have formula for infants both when they are under intensive care in the hospital, and after they are discharged from the hospital.

We designed formulas addressing calcium, iron or zinc deficiency for infants with special needs from stage 1 to stage 3.

Formulas of partially hydrolyzed whey protein are designed for use by infants that are allergic to the protein in cow’s milk. We introduced this product to the market in April 2013.

We produce medical formula, or formulas for special medical purposes, for nutritional management of infants who are born with rare metabolism disorders. Currently, we have formula for infants under twelve months of age with phenylketonuria (“PKU”). We plan to develop more formulas targeting other specific disorders in the future.

Children’s Formula (Stage 3 and Stage 4)

We market children’s formula products under the Synutra family of brands. Super, U-Smart, My Angel, Dutch Cow and Formulas addressing Calcium, Iron or Zinc Deficiency are produced for stage 3 and 4. We design these products to meet the changing nutrition needs of children at different stages of development. We offer products at stages 3 and 4 that are designed for children’s nutritional needs at one to three years of age and three to seven years of age, respectively. These products are not breast milk substitutes and are not designed for use as the sole source of nutrition but instead are designed to be a part of a child’s appropriate diet. Our use of the Synutra brand allows for a consistent image across our stages 3 and 4 products.

We produce rice cereal products as supplements for children over 6 months. Currently we have ten formulas of rice cereal products which are produced using rice, fruit, vegetable, meat, vitamins and minerals. We believe that rice cereal products are essential supplements to formula milk.

Adult Formula

We produce Stage 0 powdered formulas for expectant and nursing mothers under Super and U-Smart brand. Our products for expectant or nursing mothers provide the developing fetus or breastfed infant with vitamin supplements and/or an increased supply of DHA for brain development. These products also supplement the mother’s diet by providing either DHA or ARA with increased proteins, as well as vitamins and minerals.

We produce powdered formulas for adult, such as formula with multi-vitamin, formula with high calcium, formula for the elderly, formula for women, and formula for students under the Dutch Cow brand. These products are developed to address specific types of consumer profiles and nutritional needs.

Food Products

Food segment covers the sale of prepared pureed food for babies and children and starting fiscal 2014, we plan to expand the segment to include sales of prepared pureed adult food. Baby food products are designed to be part of a child’s healthy diet with enhanced nutritional value. Adult food products will be designed for patients with special nutritional needs after surgical operations.

Nutritional Ingredients and Supplements

Nutritional ingredients and supplements segment covers the production and sale of nutritional ingredients and supplements such as chondroitin sulfate, collagen, microencapsulated DHA and ARA. Chondroitin sulfate and collagen is mainly for industrial sales and export, with a small portion used in our self-developed nutritional products. Microencapsulated DHA and ARA powders are produced mainly for internal use in powdered formula production process.

Other business

Other business principally includes ancillary sales of surplus milk powder and whey protein to industrial customers.

Production

Powdered Formula Processing

In the fiscal year ended March 31, 2013, we import whole milk powder used for our powdered formula products from Fonterra Co-operative Group (“Fonterra”) in New Zealand. We import whey protein and high oil whey protein used for infant powdered formula products from Eurosérum S.A.S (“Eurosérum”) in France. We purchase other ingredients for our formula from domestic suppliers.

If the high oil whey protein purchased from Eurosérum is not enough for our production, we use whey protein and oil to produce high oil whey protein, or engage a third party to produce high oil whey protein using whey protein and oil provided by us. In rare cases, when whey protein powder is in short supply, we use whey protein concentrates and lactose instead in the production.

At our Qingdao facility, milk powder is mixed in large automated mechanical mixers with high oil whey protein powder and other additives in a method known as dry-mixing. Our dry-mixing equipment can automatically adjust the level of ingredients to achieve the complex formulations required by our premium products. The resulting milk powder is then checked to ensure proper granule size before packaging and distribution.

Imported Super product is contract manufactured by Arla, a Danish company, and Dutch Cow infant formula product is contract manufactured by FrieslandCampina, a Dutch company. These products are produced according to our specification and the quality standards of both companies/countries.

Production and Packaging Facilities

Our processing and packaging facilities, which are all owned by us, are located in various locations in China, including Qingdao, Zhangjiakou, Fengzhen and Zhenglanqi. These facilities encompass approximately 137,000 square meters of office, plant, and warehouse space. Our distribution center located in Qingdao includes approximately 25,000 square meters of owned space. All of our production facilities are built based on the GMP standard, with equipment imported from Europe and all of our facilities that have commenced operations have ISO9000 and HACCP series qualifications with some also being ISO14000 certified.

Qingdao, Zhangjiakou and Fengzhen facilities are for our powdered formula production. As of March 31, 2013, we had high oil whey protein processing capacity of approximately 12,000 tons per year for the Zhangjiakou facility and the Fengzhen facility, and had packaging capacity of approximately 108,000 tons per year and dry-mixing processing capacity of approximately 62,000 tons per year for the Qingdao facility.

Our Qingdao facility serves as our dry-mixing and packaging plant. Various ingredients, such as milk powder, high oil whey protein powder and nutritional additives arrive at our Qingdao facility from our production facilities and our suppliers, and are mixed using the dry-mixing method. Qingdao facility packages the mixed ingredients into retail-size tin canisters or stand up/display pouches or sealed packages in boxes. This packaging facility also provides inventory control and logistics management, product quality monitoring and product development assistance.

Our production facility for prepared foods is located in Zhenglanqi. As of March 31, 2013, the Zhenglanqi facility had a processing capacity for prepared foods of 9,000 tons per year.

Our production facility for nutritional ingredients and supplements is located in Qingdao. As of March 31, 2013, this facility had a processing capacity of 500 tons per year for chondroitin sulfate, 500 tons per year for collagen protein, and 700 tons for microencapsulated DHA and ARA powders.

For information with respect to the installed capacity, location and function of our processing and packaging facilities, see “Item 2. Properties”.

Retail Packaging

The bulk of our powdered formula and other nutritional products come in three types of retail packaging: tin canisters, standup/display pouches, or sealed packages in a box. All packaging labels carry product information, nutritional profile, user instructions, product tracing data and shelf life date, product certification status, quality control and assurance remarks, manufacturer contact information, as well as customer service information that comply with PRC labeling requirements. Selected products are also retail-packaged in single-use sizes. Before any product leaves our packaging facility to distributors, we engage in an extensive testing and inspection of the final product.

Raw Materials and Suppliers

Raw Materials

Our business depends on maintaining a regular and adequate supply of high-quality raw materials. In the aftermath of the melamine contamination incident, we decided to use imported milk powder for the production of our powdered formula products. Currently, all of the milk powder used in our production is from New Zealand.

Whey protein powder is the other key ingredient used in the production of our powdered infant formula products. Like all powdered milk producers, we use whey protein powder as the active ingredient to help reconstituted dairy-based formula to mimic the consistency of breast milk, which can constitute approximately 55% of the final powdered infant formula product by weight. Whey protein powder is a byproduct of cheese-making processes, and is difficult and costly to produce as a stand-alone product. Since China is not a large consumer or producer of cheese and cheese products, we typically obtain whey protein powder in volume from overseas sources, such as France.

Based on our experience, prices of milk powder and whey protein powder can fluctuate over relatively short periods of time depending on market conditions. Our sourcing team monitors price movements and makes major purchases at times when prices are attractive, subject to projected customer order flow and other factors.

Our powdered milk products, including our powdered infant formulas, also include additives such as DHA and ARA fatty acids and other nutritional additives. DHA and ARA fatty acids are long-chain poly-unsaturated fatty acids found in breast milk that are believed to aid in the development of an infant’s brain, eyes and nervous system. Studies have suggested that DHA and ARA fortification can replicate some of the nutritional benefits of breast milk in infant formulas. Currently we purchase DHA oil and ARA oil from third parties, and produce microencapsulated DHA and ARA powders at our Meitek facility for internal use.

We use vegetable oils in our spray-drying powder infant formula production processes as a binder for the dry ingredients, helping diminish the occurrence of “lumpiness” or uneven texture when reconstituting powdered infant formula.

We purchase animal cartilage from third-party suppliers for the production of chondroitin sulfate, a substance that provides nutrients for joints, tendon, ligaments and bones, in our Meitek facility.

Suppliers and Supplier Arrangements

Currently, we purchase all of our milk powder from Fonterra in New Zealand. The purchase prices are determined through Fonterra’s online auction process and we do not sign long term contracts with our suppliers.

We purchase all of our whey protein powder from Eurosérum.

On September 17, 2012 we entered into a partnership agreement, a milk supply agreement, a whey supply agreement, a whey powder supply agreement, and a technical assistance agreement with Sodiaal Union, a French agricultural cooperative company (“Sodiaal”), and Euroserum SAS, a French subsidiary of Sodiaal (“Euroserum”). Under these agreements, we intend to build a new drying facility in Carhaix, France, to manufacture powdered milk and fat-enriched demineralized whey (the “French Project”). For details, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources”.

Sales and Distribution

Sales

We generally sell our products to distributors and in limited circumstances directly to retailers such as supermarkets. With the introduction of My Angel series infant powdered formula products in the fourth quarter of fiscal year 2011, we began to sell directly to baby stores. Our sales and marketing approach combines advertising, brand-building and store-level promotions. Our customer relations management team, or CRM, of approximately 140 employees uses our customer relations management database in order to acquire, process, and manage targeted customer information.

We have built a sales network that covers all the provinces and provincial-level municipalities in mainland China. Our sales group is divided into multiple sub-sales regions. Each sub-sales region covers between eight to twenty urban sales areas which act as independent operating units, while each urban sales area covers three to twenty county sales areas. As of March 31, 2013, we had a sales and marketing force of approximately 2,000 employees, complemented by approximately 11,000 full time or part time commissioned field nutrition consultants or retail site promoters employed by our distributors and sub-distributors to promote and sell our products.

Our sales teams work directly with each retail outlet to manage the sales process and to collect customer and purchasing related data. We use multiple criteria to select our distributors, including reviewing each potential distributor’s financial condition. City managers are rotated periodically among various cities. We have set up a sales budget management team to manage our sales expenses and to supervise the execution of our budgeting plan. This team reports directly to the director of marketing and sales.

We compensate our sales personnel through a combination of fixed salaries and bonuses based on sales volume. Our targeted sales incentive programs compensate our sales personnel on a product-specific level, thereby enabling us to incentivize our sales personnel to focus their sales and promotion efforts on certain product lines, such as our premium product lines or larger product packages.

Distribution

We primarily work directly with over 670 independent distributors, who in turn work with over 680 independent sub-distributors, and approximately 27,000 retail outlets. Our dry-mixing and packaging subsidiary, Shengyuan Nutritional Food Co., Ltd., also serves as our national distribution center for our distributors in China. Through the personal digital assistant (“PDA”) devices and cell phone applications we installed for each distributor, we can monitor their inventory level closely. We accept purchase orders each month from the distributors. Our sales personnel also regularly inspect and perform stocktaking on distributors’ inventories to identify and control any potential inventory buildup. We employ trucking companies locally and nationally to distribute retail packaged products to various regional and provincial distributors.

Distributors normally have exclusive distribution rights in their respective regions and cities to distribute our products, and are also responsible for developing the sub-distributors in their own region and cities. We typically enter into a contract with each of our distributors that establishes the range of sales obligations and their respective discount level on top of our standard manufacturer’s prices. However, our obligation to sell and the distributor’s obligation to purchase arise only at the time a purchase order is accepted. We seek to carefully manage our distributors through an evaluation system that monitors and grades each distributor with respect to performance criteria such as monthly sales and investment in promotional activities. We seek to incentivize well-performing distributors by providing larger discounts, larger sales territory and other incentives. While we do not directly manage our sub-distributors, we do track sub-distributor performance through coordinated efforts between our own sales personnel in the field and the distributors. We do not accept product returns except in the event of package damage during delivery and for a limited number of supermarket retailers.

We currently distribute our nutritional products across mainland China. Our logistics center in our Qingdao facilities occupies an area of 25,000 square meters. This logistics center can currently dispatch 6,900 tons of our products for shipment to our distributors per month. Our Qingdao facility also has the capability to respond to urgent requests for product shipments within an average of five days.

We currently work with more than 20 transportation companies that transport our goods directly from our Qingdao facilities to distributors in a timely and efficient manner.

We have an enterprise resource planning system, or ERP system, which is a financial information system with an inventory module that manages and records inventory transactions.

Seasonality

Our business experiences some seasonal fluctuations. Summer time is typically a slow time for the infant formula market because Chinese parents tend to choose the summer time to switch from milk feeding to more concrete food for their babies. As a result, we generally experience weaker sales in our first and second fiscal quarters.

Marketing, Advertising and Promotion

Advertising

We advertise through various media, including television, print media and the Internet. We supplement nationwide television coverage with local television coverage. We also purchase advertising over the Internet. Our advertising spending was $11.9 million, $11.5 million and $22.6 million for the fiscal years ended March 31, 2013, 2012 and 2011, respectively. Our advertising spending has enabled us to secure prime-time placements with China Central Television and other premium regional or satellite television stations.

Marketing and Promotion

As part of our sales and marketing approach, our sales force works with more than 15,000 healthcare facilities across China to provide maternity, infant nutrition and health education programs. We have also established a national customer service call center providing live assistance and a toll-free line to provide consumers with prenatal, nursing, baby care education, product information, and address complaints and dispute resolution.

We provide displays, posters and other printed promotional materials to retail outlets and sales consultants employed by our distributors at each point of sale. We also pay entry fees to various retail outlets to place our products within such outlets. We collect customer information through surveys voluntarily provided by each customer via the point of sale or via mailed forms provided to our customers in each product package. We also have promotional activities with supermarket chains and entertainment companies in order to reach our target market.

Quality Control

We place primary importance on quality. We have established quality control and food safety management systems for the purchasing, acceptance checks, processing, packaging, storage and transportation. All of our processing facilities are equipped with in-house laboratories for quality assurance and quality control purposes. Our quality test laboratory in Qingdao has been qualified as a National Standard Laboratory by the China National Accreditation Service for Conformity Assessment.

In order to ensure the quality and safety of our ingredients and products, we have also installed testing equipment and have implemented control procedures at each stage of production, including at the initial raw material purchase stage. There are over 1,100 quality control points throughout the entire production process. We employ strict internal procedures and monitoring by highly trained employees during production, transportation and storage. Additionally, we have been increasing our investment in quality control equipment and training. All policies relating to quality control are subject to PRC laws and regulations.

In the dietary ingredients and supplements sector, we believe we have led our domestic industry in applying well established standards in production documentation, including those under the U.S. Pharmacopeia (UPS), to help ensure the integrity of the supply chain and to discourage adulteration of chondroitin sulfate materials. In addition to our quality assurance laboratory facilities in Qingdao, we have recently established a wet lab in Rockville, MD dedicated to dietary ingredients material screening and research on supplement products in the US market.

Highlights of our quality control procedures are summarized below, organized by the main stages of production:

Imported Milk Powder and Whey Protein:

| | ● | Procurement staff inspects the Certificate of Analysis to ensure the products are manufactured and tested according to production countries’ national standard; |

| | ● | Entry-Exit Inspection and Quarantine of the People’s Republic of China performs quality test to ensure the products are up to national standard and issue a Sanitary Certificate; and |

| | ● | Quality test staff of the Company performs detailed test on quality and nutritional ingredients of the products before using them in production. |

Powder Formula Production:

| | ● | Compliance with production process control procedure, HACCP Plan implemented at all plants; |

| | ● | All raw materials are subject to prior inspection; |

| | ● | Detailed process designed for all parts of the production process including pretreatment, dry-mixing, powder receiving, and packaging; |

| | ● | Maintain hygiene standards for staff, equipment, environment and any other object; and |

| | ● | Inspection conducted throughout the production process. |

Packaging, Storage and Transport:

| | ● | Establishment and practice of total process management with respect to product identification and traceability; |

| | ● | Inspection before warehousing of products; |

| | ● | Maintain hygiene standards in the course of transport and storage; and |

| | ● | Products must be positioned according to their category during transport and storage. |

Research and Development

Our research and development activities focus on new product formulation, new ingredient development, creation of new methods to incorporate certain nutrients in our products, and improvement in product tastes and ingredient shelf stabilities. We engage in regular product refinement and new product development for our dairy-based formula products, as well as other forms of foods and nutritional supplements.

We utilize our research and development facilities to engage in the development of bringing our infant formula products closer to the quality of breast milk and promote our brand image. We also engage third-party research institutions to research and develop such trial products for us.

We seek to leverage our research and development resources in order to extend our new product pipeline. We believe we can accomplish this goal with new formulations and product concepts in dairy-based formula products as well as other nutritional food products and supplements.

During each of the fiscal years ended March 31, 2013, 2012 and 2011, we spent approximately 1.0%, 0.3% and 0.4% of net sales per year on research and development, respectively.

Competition

The infant formula industry in China is highly competitive. We generally compete with both multinational and domestic infant formula producers. Competitive factors include brand recognition, distribution network, quality, advertising, formulation, packaging and price. Many of our competitors have significant market share in the markets we compete in. Our principal competitors can be classified generally into the following two groups:

Multinational Brands

| | ● | Abbot Laboratories’ Ross Products Division, a U.S. producer and distributor of infant formulas marketed under the brand names of Similac and Enfalac family of formulas; |

| | ● | Mead Johnson Nutrition Co., or Mead Johnson, formerly a Bristol-Myers Squibb Company Division, a U.S. producer and distributor of the Enfamil family of formulas; |

| | ● | Groupe Danone SA’s Numico division, or Numico, a Dutch producer of baby foods, which sells and markets infant formula products in China under the Dumex brand; |

| | ● | Nestlé Suisse SA, or Nestlé, a Swiss producer and distributor of starter and follow-up formulas, milk, cereals, oral supplements and performance foods marketed under Nestlé brands such as Carnation; and |

| | ● | Wyeth, a U.S. producer and distributor of infant formula sold under private label brands. |

Domestic Brands

| | ● | Inner Mongolia Yili Industrial Group Co., Ltd., or Yili, a PRC producer and distributor of liquid and powdered milk under their Yili brand; |

| | ● | Beingmate Group Company Limited, or Beingmate, a PRC producer and distributor of infant formula products under their Beingmate brand; |

| | ● | Guangdong Yashili Group Co., Ltd., or Yashili, a PRC consumer brand marketer which sells a line of infant formula products under their Yashili brand; and |

| | ● | Feihe International, Inc., a PRC producer and distributor of milk formula products under their Feihe brand. |

According to data collected by the PRC National Commercial Information Center, or CIC, an entity affiliated with the PRC General Chamber of Commerce responsible for collecting retail sales data, the top ten brands accounted for 83% of total infant formulas sold in China in calendar year 2012.

Intellectual Property

All of our product formulations have been developed in-house and are proprietary. We have not registered or applied for protections in China for most of our intellectual property or proprietary technologies relating to the formulations of our powdered infant formula. See Item 1A. Risk factors—Risks Related to Our Business—Failure to adequately protect our intellectual property rights may undermine our competitive position, and litigation to protect our intellectual property rights may be costly. Although we believe that, as of today, patents and copyrights have not been essential to maintaining our competitive market position, we intend to assess in the future whether to seek patent and copyright protections for those aspects of our business that provide significant competitive advantages.

As of March 31, 2013, we had 251 registered trademarks in China, and 8 registered trademarks in other districts and countries. Additionally, we had 65 trademark applications pending approval in China.

We rely on trade secret protection and confidentiality agreements to protect our proprietary information and know-how. Our management and each of our research and development personnel have entered into annual employment contracts, each of which includes a confidentiality clause and a clause acknowledging that all inventions, designs, trade secrets, works of authorship, developments and other processes generated by them on our behalf are our property, and assigning to us any ownership rights that they may claim in those works. Despite our precautions, it may be possible for third parties to obtain and use, without our consent, intellectual property that we own or are licensed to use. Unauthorized use of our intellectual property by third parties, and the expenses incurred in protecting our intellectual property rights, may adversely affect our business. See Item 1A. Risk factors—Risks Related to Our Business—Failure to adequately protect our intellectual property rights may undermine our competitive position, and litigation to protect our intellectual property rights may be costly.

Environmental Matters

Our manufacturing facilities are subject to various pollution control regulations in China with respect to noise, water and air pollution and the disposal of waste and hazardous materials. We are also subject to periodic inspections by local environmental protection authorities in China. We are not currently subject to any pending actions alleging any violations of applicable PRC environmental laws.

Our Employees

As of March 31, 2013, we employed approximately 3,400 employees in all of our facilities, with approximately 160 head office management staff and research and development employees, approximately 1,330 production employees, and approximately 1,910 sales and marketing employees. Our employees are not represented by a labor organization or covered by a collective bargaining agreement. We have not experienced any work stoppages.

We offer our employees both a base salary and a performance bonus. As required by PRC regulations, we participate in various employee benefit plans that are organized by municipal and provincial governments, including pension, work-related injury benefits, maternity insurance, medical and unemployment benefit plans. We are required under PRC law to make contributions to the employee benefit plans at specified percentages of the salaries, bonuses and certain allowances of our employees, up to a maximum amount specified by the local government from time to time. The pension amount is determined by a number of factors, including the member’s salary amount at retirement date, contribution period, social average salary level and price index.

Regulation

The food industry, of which nutritional and infant formula products form a part, and medical institutions, are subject to extensive regulations in China. This section summarizes the most significant PRC regulations governing our business in China.

Food Hygiene and Safety Laws and Regulations

As a producer of nutritional products, and particularly dairy-based infant formula products, in China, we are subject to a number of PRC laws and regulations governing the manufacturing (including composition of ingredients), labeling, packaging, safety and hygiene of food products:

| | ● | the PRC Product Quality Law; |

| | ● | the PRC Food Safety Law; |

| | ● | the Implementation Rules on the PRC Food Safety Law; |

| | ● | the Dairy Product Industrial Policies (2009 Version); |

| | ● | the Regulation on the Supervision and Administration of the Quality and Safety of Dairy Products; |

| | ● | The Outlines of the Rectification and Revival of the Dairy Industry; |

| | ● | the Measures of the Administration on the New Food-Additives; |

| | ● | the Measures of the Filing of the Enterprise Standard of the Food Safety; |

| | ● | the Implementation Rules on the Administration and Supervision of Quality and Safety in Food Producing and Processing Enterprises; |

| | ● | the Regulation on the Administration of Production Licenses for Industrial Products; |

| | ● | the General Standards for the Labeling of Prepackaged Foods; |

| | ● | the Implementation Measures on Examination of Dairy Product Production Permits; |

| | ● | the Standardization Law; |

| | ● | the Raw Milk Collection Standard; |

| | ● | the Whole Milk Powder, Skimmed Milk Powder, Sweetened Whole Milk Powder and Flavored Milk Powder Standards; |

| | ● | the General Technical Requirements for Infant Formula Powder and Supplementary Cereal for Infants and Children; |

| | ● | Rules for the Examination of Licensing Criteria for Enterprises Producing Formula Milk Powder of Infant Use (2010 version); and |

| | ● | Rules for the Examination of Licensing Criteria for Enterprises Producing Milk Products (2010 version) |

These laws and regulations set out safety and hygiene standards and requirements for various aspects of food production, such as the use of additives, production, packaging, handling, labeling and storage, as well as facilities and equipment. Failure to comply with these laws and regulations may result in confiscation of our products and proceeds from the sales of non-compliant products, destruction of our products and inventory, fines, suspension of production and operation, product recalls, revocation of licenses, and, in extreme cases, criminal liability.

On October 7, 2008, the State General Administration of Quality Supervision, Inspection and Quarantine (“AQSIQ”) issued a national standard on the detection of melamine in raw milk and dairy based products. On October 9, 2008, the State Council promulgated with immediate effect a Regulation for the Quality and Safety Supervision of Dairy Based Products, which, among other things, imposes more stringent requirements for inspection, production, packaging, labeling and product recall on dairy product producers. This regulation also established a “Black-List” system to ensure that illegal business operators in the dairy production chain are timely disclosed and severely punished.

On April 22, 2010, MOH issued 66 food safety national standards (“New National Standard”), including the national standard for infant powdered formula, which impose strict requirement for production of infant powdered formula.

On November 1, 2010, AQSIQ issued Rules for the Examination of Licensing Criteria for Enterprise Producing Formula Milk Powder of Infant Use (2010 version) and Rules for the Examination of Licensing Criteria for Enterprise Producing Milk Products (2010 version) to tighten the supervision of milk product quality and safety. Under the new rules, milk producers are required to pass higher safety and quality tests in order to have their licenses re-issued.

Environmental Regulations

We are subject to various governmental regulations related to environmental protection. The major environmental regulations applicable to us include:

| | ● | the Environmental Protection Law of the PRC; |

| | ● | the Law of PRC on the Prevention and Control of Water Pollution; |

| | ● | Implementation Rules of the Law of PRC on the Prevention and Control of Water Pollution; |

| | ● | the Law of PRC on the Prevention and Control of Air Pollution; |

| | ● | Implementation Rules of the Law of PRC on the Prevention and Control of Air Pollution; |

| | ● | the Law of PRC on the Prevention and Control of Solid Waste Pollution; and |

| | ● | the Law of PRC on the Prevention and Control of Noise Pollution. |

We are periodically inspected by local environmental protection authorities. Our operating subsidiaries have received certifications from the relevant PRC government agencies in charge of environmental protection indicating that their business operations are in compliance with the relevant PRC environmental laws and regulations.

Dairy Industry Access Conditions and Policies

In June 2009, the PRC National Development and Reform Commission, or the NDRC, and the Ministry of Industry and Information Technology, or the MIIT, jointly promulgated and issued Dairy Industry Policies (2009 Version), or the Policies. The Policies set forth the conditions an entity must satisfy in order to engage, or continue to engage, in the dairy products processing business, including technique and equipment, product quality, energy and water consumption, sanitation and environmental protection, as well as production safety. Any new or continuing dairy products processing projects or enterprises will be required to meet all the conditions and requirements set forth in the Policies. For projects or enterprises that already commenced operations before the promulgation of the Policies, improvements or rectification actions may need to be taken in order to have such projects or enterprises meet the conditions before the end of 2010.

The Policies also set forth some requirements relating to the location, processing capacity and raw milk source for any new or continuing dairy products processing project or enterprise. Any new or continuing dairy products processing projects or enterprises that fail to meet the requirements will not be able to procure land, license, permits, loan facility and electricity necessary for the processing of dairy products, and those projects or enterprises already in operation before the promulgation of the Policies will be deregistered and ordered to shut down if they fail to meet the conditions before the end of 2010. We believe that all of our existing entities and facilities for powdered formula production meet the requirements under the Access Conditions. See Item 1A. Risk Factors—Risks Associated with Doing Business in China—Changes in the regulatory environment for dairy and infant nutrition products in China could negatively impact our business.

Medical Institutions

On February 26, 1994, the State Council promulgated the Regulations of Administration on Medical Institutions which established the regulations for establishing, managing and supervision of medical institutions. In particular, the regulations required a medical institution to be approved by and register with the applicable administrative department of public health prior to establishment. On December 14, 2009, the Ministry of Public Health promulgated the Standards of Medical Inspection Laboratory which set forth the standards for establishing and managing medical inspection laboratories. On August 21, 2012 we received the approval from Beijing Bureau of Health to set up Shengyuan Huimin Medical Inspection Laboratory in Beijing which will be a wholly-owned subsidiary of Beijing Shengyuan Huimin Technology Service Co., Ltd. We are in the process of setting up this lab with commencement of operations expected by the end of calendar year 2013.

Financial Information about Segments and Geographic Areas

We have four reportable segments, which are powdered formula, foods, nutritional ingredients and supplements and other business. Other business includes non-core operations such as ancillary sales of surplus milk powder and whey protein. Please refer to Note 16 to the Consolidated Financial Statements for further discussion about segments and geographic areas.

Available Information

Our Internet website address is www.synutra.com. We make available at this address, free of charge, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with or furnished to the United States Securities and Exchange Commission, or SEC. Information available on our website is not incorporated by reference in and is not deemed a part of this Form 10-K. The public may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F. Street, N.E., Washington, DC, 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issues that file electronically with the SEC at www.sec.gov.

Because of the following factors, as well as other factors affecting our financial condition and operating results, past financial performance should not be considered to be a reliable indicator of future performance, and investors should not use historical trends to anticipate results or trends in future periods.

You should carefully consider the following risks and other information in this Form 10-K before making an investment decision with respect to our common stock. The following risks and uncertainties could materially and adversely affect our business, results of operations and financial condition. The risks described below are not the only ones we face. Additional risks that we are not presently aware of or that we currently believe are immaterial may also impair our business operations.

Risks Related to Our Business

We may face liquidity challenges to meet our debt obligations and may require additional funding in the future.

We had loss before income tax expense of $27.0 million and negative cash flow from operation of $5.7 million for the fiscal year ended March 31, 2013. Our operations rely heavily on debt, and at March 31, 2013, we had short-term debt of $127.4 million, long-term debt due within one year of $82.7 million and long term debt due between one and three years of $102.2 million. The asset liability ratio, which is defined as total liabilities divided by total assets, was 94% at March 31, 2013. Our ability to meet our debt obligations will depend on our future performance, which will be affected by financial, business, domestic and foreign economic conditions and other factors, many of which we are unable to control. As a result, there can be no assurance that our operation will generate sufficient cash flows to meet our liquidity needs, and we therefore may continue have negative cash flows in the future. If our cash flow is not sufficient to service our debt, we may be required to obtain additional financing in the future, and such additional financing may not be available at times, in amounts or on terms acceptable to us or at all. We may not be able to repay such borrowings in full or at all when due and, if we were to default on the repayment of these borrowings, we may not be able to continue our operations as a going concern.

We are highly dependent upon consumers’ perception of the safety and quality of our products. Any ill effects, product liability claims, recalls, adverse publicity or negative public perception regarding particular ingredients or products or our industry in general could harm our reputation, damage our brand and adversely affect our results of operations.

We sell products for human consumption, which involves risks such as product contamination, spoilage and tampering. We may be subject to liability if the consumption of any of our products causes injury, illness or death. Adverse publicity or negative public perception regarding particular ingredients, our products, our actions relating to our products, or our industry in general could result in a substantial drop in demand for our products. This negative public perception may include publicity regarding the safety or quality of particular ingredients or products in general, of other companies or of our products or ingredients specifically. Negative public perception may also arise from regulatory investigations or product liability claims, regardless of whether those investigations involve us or whether any product liability claim is successful against us.

On September 16, 2008, China’s Administration of Quality Supervision, Inspection and Quarantine, or China AQSIQ, announced its finding that the formula products of 22 Chinese formula producers, including certain lots of our U-Smart products, were contaminated by melamine, a substance not approved for use in food and linked to the illness and deaths of infants and children in China. There were six reported deaths and approximately 300,000 children suffered kidney-related illnesses due to the contaminated infant formula of one of our competitors. This contamination incident resulted in significant negative publicity for the entire domestic dairy and formula industries in China and demand for domestically-produced dairy and formula products, including our products, declined significantly since September 2008 until late 2009. We recalled our affected U-Smart products as well as all other products produced at the same facilities in the Hebei and Inner Mongolia regions of China, where we believe the contaminated milk supplies originated. We also suspended production at our facilities in Qingdao, Hebei and Inner Mongolia for two weeks pending government and internal investigations. The total cost of this action was $100.6 million which was recognized as a charge to cost of sales, selling and distribution expenses and general and administrative expenses in our consolidated statement of income mostly in fiscal year 2009.

Although we have not confirmed any cases of kidney-related or other illnesses caused by our products, we cannot assure you that such cases will not surface in the future. The Chinese government has provided medical screening, treatment, and care for consumers affected by melamine contamination in infant formula products. We have contributed a net amount of $2.3 million to a compensation fund set up by China Dairy Industry Association to settle existing and potential claims arising in China from families of infants affected by melamine contamination. We cannot assure you that the Chinese government will not seek further reimbursement from dairy and formula product manufacturers, including us.

We believe the melamine contamination incident negatively impacted our brand and reputation in China. It also affected investor confidence in us as reflected by the significant decrease in our stock price after September 16, 2008. We cannot predict whether there will be similar future incidents and what impact such incidents may have on our operations and reputation.

In August 2010, several media reports alleging our infant formula products caused symptoms of hormone-triggered sexual prematurity in infants in the Hubei province of China. Our business was significantly and negatively impacted since then as a result of these media reports, and our sales volume decreased significantly. We increased the spending on advertising after the prematurity event to repair our reputation and regain market share. As a result, we had a significant net loss for the fiscal year ended March 31, 2011.

In January 2012, several Chinese media outlets reported that a pair of 4-month old twins in Jiangxi province became ill with severe intestinal symptoms. One passed away from hyperthermia and multi-functional organ failure on January 7, 2012. The other has recovered following hospitalization. Both infants were reported to have been consuming our powdered milk formula products for weeks before the sudden onset of their illnesses. In response to this event, the Jiangxi Province Center for Disease Control and Prevention and the Jiangxi Dairy Quality Supervision and Inspection Center conducted tests on samples of our products that were sold in the store where the infants’ family purchased the formula and concluded that there was no link between the infant milk powder products and the death of the baby or the illness of his twin sister. However, it is unclear what adverse impact this event has had on our reputation and results of operations.

In the past, there have also been occurrences of counterfeiting and imitation of products in China that have been widely publicized. We cannot guarantee that contamination or counterfeiting or imitation of our or similar products will not occur in the future or that we will be able to detect it and deal with it effectively. Any occurrence of contamination or counterfeiting or imitation could negatively impact our corporate and brand image or consumers’ perception of our products or similar nutritional products generally, particularly if the counterfeit or imitation products cause injury or death to consumers. For example, in April 2004, sales of counterfeit and substandard infant formula in Anhui, China caused the deaths of 13 infants as well as harming many others. Although this incident did not involve the counterfeiting of our products, it caused significant negative publicity for the entire infant formula industry in China. The mere publication of information asserting that infant formula ingredients or products may be harmful could have a material adverse effect on us, regardless of whether these reports are scientifically supported or concern our products or the raw materials used in our products.

We believe that the melamine contamination incident, the prematurity event and any other adverse news related to formula products in China will also result in increased regulatory scrutiny of our industry, which may result in increased costs and reduce our margins and profitability. The government has enhanced its regulations on the industry aimed to ensure the safety and quality of dairy products, including but not limited to compulsory batch by batch inspection. This is likely to increase our operating costs and capital expenditure.

If we fail to obtain raw materials in the quantity and the quality we need, and at commercially acceptable prices, our results of operations, financial condition and business prospects would be materially and adversely affected.

Our business requires certain key raw materials, such as milk powder and whey protein powder. We may experience a shortage in the supply of certain raw materials in the future, which could materially and adversely affect our production and results of operations. While our agreements with Sodiaal and Euroserum are intended to provide our supplies in the future, the drying facility in Carhaix, France is not expected to be operational until 2015. See “Liquidity and Capital Resources”. Other than these agreements, we currently do not have guaranteed supply contracts with any other raw material suppliers, and some of our suppliers may, without notice or penalty, terminate their relationship with us at any time. We also rely on a small number of suppliers for some of our raw materials, such as whey protein powder and imported milk powder. We now use imported milk powder from New Zealand for all of our powered formula products as consumers have less confidence in domestically-produced milk powder. If any supplier is unwilling or unable to provide us with high quality raw materials in required quantities and at acceptable prices, we may be unable to find alternative sources or at commercially acceptable prices, on satisfactory terms, in a timely manner, or at all. Our inability to find or develop alternative sources could result in delays or reductions in production, product shipments or a reduction in our profit margins. Moreover, these suppliers may delay material shipments or supply us with inferior quality raw materials that may adversely impact the timely delivery or the quality of our products. If any of these events were to occur, our product quality, competitive position, reputation and business could suffer.

In addition, most of the raw materials used in our business are imported, such as whey protein powder and milk powder. Our imported raw materials are subject to various PRC governmental permit requirements, approval procedures and import duties, and may also, from time to time, be subject to export controls and other legal restrictions imposed by foreign countries. Should the PRC government refuse to issue the necessary permits or approvals to us or our suppliers, or take any administrative actions to limit imports of certain raw materials, or if we or our suppliers fail to pay any required import duties, or if governmental agencies or laws of foreign countries prevent the timely export of certain raw materials we require to China, our ability to produce and sell our products in China could be materially and adversely affected. In addition, import duties increase the cost of our products and may make them less competitive.

Finally, certain suppliers of raw materials within our supply chain may contaminate our raw material supplies or provide us with substandard raw material supplies that adversely impact the quality of our products exposing our customers to health risks and damaging our reputation, brand and financial condition. For a more detailed description of this risk, and in particular the impact of the melamine contamination incident in China, see Part 1 - Item 1A. Risk Factors — We are highly dependent upon consumers’ perception of the safety and quality of our products. Any ill effects, product liability claims, recalls, adverse publicity or negative public perception regarding particular ingredients or products or our industry in general could harm our reputation, damage our brand and adversely affect our results of operations.

Any interruption in our supply of milk powder could materially and adversely affect our results of operations, financial condition and business prospects.

We currently import all of the milk powder used in the powdered formula production from New Zealand. The continuity of the milk powder supplies is of critical importance to our business. The importation of milk powder is influenced by numerous factors beyond our control, including, among other: (1) export control policy in the originating countries, (2) China’s government policy and regulation on milk powder importation as well as China’s custom inspection standards and (3) acts of God such as natural disasters. Any interruption in our milk powder supplies could have a material adverse effect on our results of operations, financial condition and business prospects. In addition, we currently source all of our milk powder from one supplier, Fonterra. If Fonterra fails to deliver the milk powder we need on the terms we have agreed, we may not be able to find an alternative source at a comparable price or on other favorable terms, and any delays in securing an alternative source could result in production delays and late shipments of our products to distributors and end customers.

Our results of operations may be affected by fluctuations in availability and price of raw materials.

The raw materials we use are subject to price fluctuations due to various factors beyond our control, including increasing market demand, inflation, severe climatic and environmental conditions, commodity price fluctuations, currency fluctuations, changes in governmental and agricultural regulations and programs and other factors. We also expect that our raw material prices will continue to fluctuate and be affected by inflation in the future. Changes to our raw materials prices may result in increases in production and packaging costs, and we may be unable to raise the prices of our products to offset these increased costs in the short-term or at all. As a result, our results of operations may be materially and adversely affected.

We might face inventory write-downs if we are unable to effectively manage inventory levels and/or prices decline. We maintain inventories of raw materials and finished products, and our inventories may spoil.

Most of our finished products have an average shelf life of 18 to 24 months before the product is opened. Milk powder has a shelf life of 24 months. Whey protein has a shelf life of 12 months. Other additives have a shelf life from several months to several years. Our inventory levels are based, in part, on our expectations regarding future sales. We may in future periods experience inventory buildup if our sales slow for any reason. Any significant shortfall in sales may result in higher inventory levels of raw materials and finished products than we require, thereby increasing our risk of inventory spoilage and corresponding inventory write-downs and write-offs, which may materially and adversely affect our results of operations.

Any major outbreak of illness or disease relating to cows in the regions in which we import milk powder could lead to significant shortfalls in the supply of our milk powder, and could result in consumers avoiding dairy products, which could result in substantial declines in our sales and possibly substantial losses.

We import all of our milk powder from New Zealand, and all of our whey protein powder from France. A major outbreak of any illness or disease in cows globally could lead to a serious loss of consumer confidence in, and demand for, dairy products. A major outbreak of mad cow disease (bovine spongiform encephalopathy), bovine tuberculosis, or bovine TB, or other serious disease in the principal regions supplying milk powder could lead to significant shortfalls in the supply of milk powder. Furthermore, adverse publicity about these types of concerns, whether or not valid, may discourage consumers from buying dairy products or cause production and delivery disruptions. If consumers generally were to avoid our products, our sales would decline substantially and we could suffer substantial losses.

We may experience problems with product quality or product performance, or the perception of such problems, which could materially and adversely affect our reputation or result in a decrease in customers and revenue, unexpected expenses and loss of market share.

Our operating results depend, in part, on our ability to deliver high quality products on a timely and cost-effective manner. Our quality control and food safety management systems are complex. For example, there are over 1,100 quality control points throughout the whole production process. If the quality of any of our products deteriorated, it could result in delays in shipments, cancellations of orders or customer returns and complaints, loss of goodwill, and harm to our brand and reputation. In addition, following the melamine contamination incident, we purchase all of the milk powder used for our powdered formula products from New Zealand. We may be unable to exercise the same degree of quality control over this overseas supplier as we can over our own facilities. Any quality problems associated with the milk powder produced by this supplier would also affect our products’ quality and lead to negative publicity against us, materially and adversely affecting our reputation and brand, and causing a decrease in sales of our products and a loss of market share. For example, the melamine contamination incident in China has resulted in certain of our products being contaminated, impacting our brand and reputation.

Product liability claims against us could result in adverse publicity and potentially significant monetary damages.

As with other infant formula producers, we are also exposed to risks associated with product liability claims if the consumption of infant formula products we sell results in injury or death. We cannot predict what impact such product liability claims or resulting negative publicity would have on our business or on our brand image. The successful assertion of product liability claims against us could result in potentially significant monetary damages, diversion of management resources and require us to make significant payments and incur substantial legal expenses. We do not have product liability insurance for powdered formula products sold in China and have not made provisions for potential product liability claims. Therefore, we may not have adequate resources to satisfy a judgment if a successful claim is brought against us. Even if a product liability claim is not successfully pursued to judgment by a claimant, we may still incur substantial legal expenses defending against such a claim and our brand image and reputation would suffer. Finally, serious product quality concerns could result in governmental actions against us, which, among other things, could result in the suspension of production or distribution of our products, loss of certain licenses, or other governmental penalties.

Our sales, results of operations, brand image and reputation could be materially and adversely affected if we fail to efficiently manage our operations without interruption, or fail to ensure that our products are delivered on time.

Our business requires successful coordination of several sequential and complex processes, the disruption of any of which could interrupt our operations and materially and adversely affect our relationships with our distributors, sub-distributors and end-customers, our brand name and reputation, and our financial performance. Our operations involve the coordination of raw material sourcing from third parties, internal production processes and external distribution processes. We may face difficulties in coordinating the various aspects of our production processes, resulting in downtime and delays.

In addition, we may encounter interruptions in our production processes due to a catastrophic loss or events beyond our control, such as fires, explosions, labor disturbances, earthquakes or other natural disasters. If there is a stoppage in production at any of our facilities, even if only temporary, or delays in deliveries to our customers, our business and reputation could be materially and adversely affected. Along with many other producers of dairy and consumer products in China, we generally rely on third-party logistics companies and distributors for the delivery of our products. Delivery may be disrupted for various reasons, many of which are beyond our control, including natural disasters, weather conditions or social unrest and strikes, which could lead to delayed or lost deliveries. In addition, transportation and related infrastructure conditions are often generally under-developed in some of the regions where we sell our products. We currently do not have business interruption insurance to offset these potential losses, delays and risks, so a material interruption of our business operations could materially damage our business.

We rely primarily on third-party distributors and cannot assure you that their marketing and distribution of our products will be effective or will not harm our brand and reputation. Moreover, if we fail to timely identify and appoint additional or replacement distributors as needed, or are unable to successfully manage our distribution network, our operating results could suffer.

We primarily rely on third-party distributors and sub-distributors for the distribution and sales of our products. We sell our products through an extensive nationwide distribution and sales network covering all of the provinces and provincial-level municipalities in mainland China. As of March 31, 2013, this network comprised over 670 independent distributors and over 680 independent sub-distributors who sell our products in approximately 27,000 retail outlets. Our distributors normally have exclusive distribution rights in their respective regions, and are also responsible for developing the sub-distributors located in their own regions. In addition, our distributors are not required to exclusively distribute our products. We typically do not enter into long-term agreements with distributors and have no control over their everyday business activities. Consequently, our distributors may engage in activities that are prohibited under our arrangements with them, that violate PRC laws and regulations governing the dairy industry or other PRC laws and regulations generally, or that are otherwise harmful to our business or our reputation. Due to our dependence on distributors for the sale and distribution of our products to retail outlets, any one of the following events could cause material fluctuations or declines in our revenue and have a material adverse effect on our financial condition and results of operations:

| | ● | reduction, delay or cancellation of orders from one or more of our distributors; |

| | ● | selection or increased sales by our distributors of our competitors’ products; and |

| | ● | our failure to timely identify and appoint additional or replacement distributors upon the loss of one or more of our distributors. |

The competition for distributors is intense in our industry in China and many of our competitors are expanding their distribution networks in China. We may not be able to compete successfully against the larger and better-funded sales and marketing operations of some of our current or future competitors, especially if these competitors provide more favorable arrangements for distributors. As a result, we may lose some of our distributors to our competitors, which may cause us to lose some or all of our favorable arrangements with such distributors and may even result in the termination of our relationships with some of our distributors. While we do not believe we are substantially dependent upon any individual distributor, finding replacement distributors could be time-consuming and any resulting delay may be disruptive and costly to our business. In addition, we may not be able to successfully manage our distributors and the cost of any consolidation or further expansion of our distribution network may exceed the revenue generated from these efforts. The occurrence of any of these factors could result in a significant decrease in the sales volume of our products and therefore materially harm our financial condition and results of operations.

We initiated a “gold mining” marketing strategy (“Strategy“) in September 2012 to strengthen our management of the sales channel, the goal of which is to use marketing and promotional expenditures more effectively and to improve net profit by centrally monitoring the spending in each retail outlet. We have terminated our relationship with those retail outlets with low sales volume and a low yield rate on the slotting fees, to focus our resources on those retail outlets with high sales volume and a higher yield rate on the slotting fees. As a result, our number of retail outlets reduced from more than 60,000 at June 30, 2012 to approximately 27,000 at March 31, 2013. The Strategy had been substantially completed by March 31, 2013. We cannot be certain that the Strategy will produce the results as planned in the long term.

Our results of operations and business prospects may be impaired by changing consumer preferences if we do not develop and offer products to meet changing preferences.

Consumer preferences evolve over time and the success of our products depends on our ability to identify the tastes and nutritional needs of our customers and to offer products that appeal to their preferences. We introduce new products and improved products from time to time and incur significant development and marketing costs. If our products fail to meet consumer preferences, then our strategy to grow sales and profits with new products will be less successful.

More mothers may breastfeed their babies rather than use our products, resulting in reduced demand for our products and adversely affecting our revenues.

Our results of operations are affected by the number of mothers who choose to use our products rather than breastfeeding their babies. Much publicly available data suggests that breastfeeding has many health benefits for the baby that cannot be replicated by dairy-based infant formula products. Additionally, popular literature, cultural pressure, government policies and medical advice in China generally promote the benefits of breastfeeding. For example, on August 1, 2007, China’s Ministry of Health issued an Infant Feeding Strategy which promoted breastfeeding and requested all local relevant departments to publicize the benefits of breastfeeding through radio broadcasting, television and newspapers during World Breastfeeding Week, which took place in early August 2007. In November 2011, the MOH of China submitted a proposal for public review that could ban promotions and advertising of infant formula for babies younger than six months. Thus, to the extent that private, public and government sources increasingly promote the benefits of breastfeeding, there could be a reduced demand for our products and our revenues could be adversely affected.

A severe and prolonged downturn in the Chinese or global economy or continued disruptions in the financial markets may adversely impact our business and results of operations and may limit our access to additional financing.

The infant formula industry can be affected by macro economic factors, including changes in national, regional, and local economic conditions, employment levels and consumer spending patterns. A prolonged slowdown in the Chinese or global economy could erode consumer confidence which could result in changes to consumer spending patterns, which could be harmful to our financial position and results of operations.

In addition, if the capital and credit markets continue to experience volatility and the availability of funds remains limited, we will incur increased costs associated with equity and/or debt financing. It is possible that our ability to access the capital and credit markets may be limited by these or other factors at a time when we would like, or need, to do so, which could have an adverse impact on our ability to refinance maturing debt and/or react to changing economic and business conditions. In addition, fluctuations in interest rates could impact our floating rate debt negatively and increase our debt obligations.

Failure to execute our future expansion plan could adversely affect our financial condition and results of operations.

We may increase our annual production capacity in the future to meet any expected increase in demand for our products. Our decision to increase our production capacity is based in part on our projections of increases in our sales volume and growth in the size of the infant formula product market in China. If actual customer demand does not meet our projections, we will likely suffer overcapacity problems and have idle capacity, which may materially and adversely affect our financial condition and results of operations. Our future success depends on our ability to expand our business to address expected growth in demand for our current and future products. Our ability to add production capacity and increase output is subject to significant risks and uncertainties, including:

| | ● | the availability and cost of additional funding to expand our production capacity, build new processing and packaging facilities, make additional investments in our subsidiaries, acquire additional businesses or production facilities, purchase additional fixed assets and purchase raw materials on favorable terms or at all; |

| | ● | delays and cost overruns as a result of a number of factors, many of which may be beyond our control, such as problems with equipment vendors and suppliers of raw materials; |

| | ● | failure to maintain high quality control standards; |

| | ● | global or local shortage of raw materials, such as raw milk or whey protein powder; |

| | ● | our inability to obtain, or delays in obtaining, required approvals by relevant government authorities; |

| | ● | diversion of significant management attention and other resources; and |

| | ● | failure to execute our expansion plan effectively. |

As our business grows, we will need to implement a variety of new and upgraded operational and financial systems, procedures and controls, including improvements to our accounting and other internal management systems by dedicating additional resources to our reporting and accounting functions, and improvements to our record keeping and contract tracking system. We will need to respond to competitive market conditions and continue to enhance existing products and develop new products, and retain existing customers and attract new customers. We will also need to recruit more personnel and train and manage our growing employee base. Furthermore, we will need to maintain and expand our relationships with our current and future customers, suppliers, distributors and other third parties, and there is no guarantee that we will succeed.

If we encounter any of the risks described above, or are otherwise unable to establish or successfully operate additional production capacity or to increase production output, we may be unable to grow our business and revenues, reduce our operating costs, maintain our competitiveness or improve our profitability, and our business, financial condition, results of operations and prospects may be adversely affected.

As discussed in “Liquidity and Capital Resources”, we entered into a series of agreements with Sodiaal Union and Euroserum SAS relating to a long-term industrial and commercial partnership. Under the agreements, we are committed to building a new drying facility in Carhaix, France, intended to manufacture powdered milk and fat-enriched demineralized whey. The estimated cost to build the facility is approximately Euro 90 million ($117 million), and we are currently negotiating with certain banks to obtain financing for this project. There is no assurance whether we will be able to obtain financing on satisfactory terms. In addition, we cannot be certain whether there will be delays in the building of the facility. If there is a delay, we are obligated to compensate Sodiaal and Euroserum for any losses that are incurred as a result of such delay. In addition, we cannot be certain whether the facility will produce the quality and quantity of products as planned and whether the facility will encounter any mechanical or other issues in the future. Any of these issues could have a material adverse impact on our future operations and financial results.