Michael J. O’Neil

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

The report of Kayne Anderson Energy Infrastructure Fund, Inc. (the “Registrant”) to stockholders for the semi-annual period ended May 31, 2022 is attached below.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS: This report of Kayne Anderson Energy Infrastructure Fund, Inc. (the “Company”) contains “forward-looking statements” as defined under the U.S. federal securities laws. Generally, the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “will” and similar expressions identify forward-looking statements, which generally are not historical in nature. Forward-looking statements are subject to certain risks and uncertainties that could cause actual results to materially differ from the Company’s historical experience and its present expectations or projections indicated in any forward-looking statements. These risks include, but are not limited to, changes in economic and political conditions; regulatory and legal changes; energy infrastructure company industry risk; leverage risk; valuation risk; interest rate risk; tax risk; and other risks discussed in the Company’s filings with the Securities and Exchange Commission (“SEC”). You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. The Company undertakes no obligation to update or revise any forward-looking statements made herein. There is no assurance that the Company’s investment objectives will be attained.

All investments in securities involve risks, including the possible loss of principal. The value of an investment in the Company could be volatile, and you could suffer losses of some or a substantial portion of the amount invested. The Company’s concentration of investments in energy infrastructure companies subjects it to the risks of midstream, renewable infrastructure and utility entities and the energy sector, including the risks of declines in energy and commodity prices, decreases in energy demand, adverse weather conditions, natural or other disasters, changes in government regulation, and changes in tax laws. Leverage creates risks that may adversely affect return, including the likelihood of greater volatility of net asset value and market price of common shares and fluctuations in distribution rates, which increases a stockholder’s risk of loss.

Performance data quoted in this report represent past performance and are for the stated time period only. Past performance is not a guarantee of future results. Current performance may be lower or higher than that shown based on market fluctuations from the end of the reported period.

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

ADOPTION OF AN OPTIONAL DELIVERY METHOD FOR SHAREHOLDER REPORTS

Rule 30e-3 Notice

Paper copies of Kayne Anderson Energy Infrastructure Fund, Inc.’s (the “Company”) annual and semi-annual shareholder reports are no longer being sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Company’s website (www.kaynefunds.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

You may elect to receive paper copies of shareholder reports and other communications from the Company anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling the Company at 1-877-657-3863. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held directly with KA Fund Advisors, LLC.

1

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

LETTER TO STOCKHOLDERS

July 5, 2022

Dear Fellow Stockholders:

We hope this letter finds you and your families well. Though summer is upon us, there is no lack of news flow regarding the state of the global economy. Investors are on edge, with financial assets reacting violently as market sentiment shifts. In our last quarterly update, we pointed to the many factors driving volatility in financial markets, including “concerns about inflation, rising interest rates, and the potential for a slower global recovery.” Many of these challenges have only become more pronounced, with inflation hovering at 40-year highs and central banks rapidly increasing interest rates to rein in inflation expectations. Energy prices are featured prominently in the inflation discussion, and energy security remains squarely in focus as geopolitical events roil global energy and commodity markets. Despite the nearer-term headwinds facing equity valuations, we believe the long-term investment case for energy infrastructure equities is even more compelling, and we believe KYN is ideally suited to give investors exposure to this asset class. Our portfolio of equity investments in high-quality, well-capitalized companies focused primarily on North American midstream, utilities, and renewable infrastructure should generate attractive returns across a range of economic conditions. This quarter’s relative performance is an excellent case study highlighting this point.

In this letter, we discuss the energy infrastructure markets, KYN’s portfolio positioning, and the Company’s strong quarterly performance. In summary:

• KYN had another impressive quarter performance-wise, generating a Net Asset Return of 10.8%;(1)

• We achieved this return while maintaining conservative leverage levels with ample “downside cushion” given the overall market volatility;(2) and

• Announced a quarterly distribution of $0.20 per share.

Market Conditions

The S&P 500 declined 5.2% during KYN’s fiscal second quarter (ended May 31st) and was down 8.8% during the first six months of fiscal 2022.(3) Volatility remained stubbornly high as the market assessed accelerating and widespread inflation amidst skepticism about the Federal Reserve’s ability to engineer a “soft landing.” As the Fed and other Central Banks rapidly increased interest rates to quell inflation expectations, the prospects for a global recession have increased. Bond yields continued to increase at an extraordinary pace during the quarter, with the 10-year U.S. Treasury bond yield up 101 basis points (bps) to 2.8% — double the rate at the start of fiscal 2022. Against a backdrop of heightened uncertainty, we expect continued periods of above-average volatility in equity markets.

Energy commodity prices remained strong (but volatile) during the fiscal quarter, as WTI crude oil prices ended the quarter at a 14-year high of $114 per barrel (up 19% during fiscal Q2). Global crude oil and refined product inventories were tight even before Russia’s invasion of Ukraine, and we are now witnessing a delicate global balancing act. Global demand is still growing materially, but at a slower rate due to high prices. Meanwhile, unprecedented strategic petroleum reserve releases are helping offset lower Russian exports. Despite this, oil prices remain high as the market weighs the prospects of lower Russian supply by the end of this year and limited alternatives to offset this decline (global “spare capacity” to increase production is very low). Domestically, capital discipline by U.S. upstream companies

2

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

LETTER TO STOCKHOLDERS

and supply chain/labor constraints continue to act as meaningful governors on domestic supply growth. That said, virtually all domestic producing basins are profitable at today’s prices, and the U.S. rig count reached 727 as of quarter-end, its highest point since March 2020.(4) Taking these and other factors into account, we continue to forecast U.S. upstream companies to grow production in the range of 5-7% during 2022. Barring a severe global recession, we anticipate robust demand growth and believe oil prices will remain above “mid-cycle” levels, as there is no quick fix to today’s supply constraints.

Natural gas and LNG (liquified natural gas) prices remain in focus, given that Russia (pre-war) supplied roughly 40% of the natural gas consumed by Europe. During the quarter, U.S. natural gas prices approached levels not experienced in well over a decade, averaging $6.46 per million British thermal units (MMBtu) and ended the period at $8.46/MMBtu. As stunning as these price levels are for American consumers, prices in Europe averaged $31/MMBtu during the same period. It is hard to overstate the importance of access to cheap and abundant natural gas to global manufacturing and power generation, and consumers are bearing the brunt of this dramatic price increase in the form of higher prices for finished goods and unprecedented utility bills. This dynamic has accelerated the sanctioning and development of additional LNG import/export infrastructure while simultaneously promoting the need for additional sources of renewable energy. The recent emphasis on newbuild energy infrastructure, combined with a corporate and political mandate for lower-carbon energy sources, provides an extremely attractive commercial backdrop for our natural gas and renewable infrastructure investments. Policymakers and investors alike have a heightened awareness of the importance of cheap, reliable energy to modern life, driving incremental investor interest in companies throughout our portfolio.

The parallel themes of energy security and energy transition continue to resonate globally as countries struggle to reconcile their acute need for inexpensive sources of non-Russian energy today with longer-term climate commitments. The myriad geopolitical and economic crises have become something of an energy Rorschach test, in which the subjects’ perception of events is informed by their respective pre-crisis political and business agendas. Global leaders and management teams throughout our investable universe have articulated seemingly divergent energy takeaways in recent months, and there is no shortage of pundits offering a “silver bullet” solution for global energy supply woes.

Our view is that there is no universal solution to the systemic challenges we face today; countries will require energy infrastructure tailored to their respective economic, geographic, and political constraints. To reiterate our long-held belief: The quest for energy security does not conflict with the energy transition. We believe that responsibly produced, low-carbon intensity hydrocarbons will be part of the global mix for decades to come, complementing growing renewable energy sources and providing raw materials necessary to manufacture consumer and medical products that are fundamental to daily life in modern society. KYN is designed to provide direct and curated exposure to the durable megatrends of decarbonization and energy security.

Portfolio and Performance

Returns across KYN’s three energy infrastructure sectors — midstream, U.S. utilities, and renewable infrastructure — were mixed during the second fiscal quarter of 2022.

• Midstream energy, our largest sector, had another outstanding quarter, with the Alerian Midstream Energy Index (AMNA) up 11.4%, outperforming the S&P 500 by approximately 1,700 bps.

3

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

LETTER TO STOCKHOLDERS

• U.S. utilities were up meaningfully for the quarter as investors searched for relative safety amid a volatile backdrop, with the Utilities Select Sector SPDR Fund (XLU) returning 10.2% — the sector’s best quarterly performance in the last year.

• Renewable infrastructure returns were down slightly, at negative 1.9%.(5)

We should also note that post quarter-end, each of these sectors declined during June along with many other financial assets as investors weigh the prospect of slowing economic growth and the potential for recession. During June, the AMNA, XLU, and our renewable infrastructure composite declined 12.2%, 4.9%, and 9.3%, respectively. While unsettling, we recognize that these corrections occur from time to time. KYN’s diversified portfolio of liquid investments and conservative leverage allow us to navigate these corrections efficiently so that we can focus on generating attractive long-term returns.

Over the last 24 months (June 2020 to May 2022), the AMNA returned 86%, which is approximately 4,600 bps greater than the S&P 500’s return of 40% over the same time period. U.S. utilities returned 32% over this period, and renewable infrastructure was up 24%. While renewable infrastructure and utilities have lagged the midstream sector over this two-year period, it is important to recall both sectors’ outstanding returns in 2019 and 2020 when midstream investments performed poorly. As we emphasized in past letters, the diversity among these returns is expected, and we believe this portfolio diversification reduces KYN’s overall risk without unduly sacrificing returns. We continue to believe each sector’s fundamental long-term prospects are very favorable, and our team actively monitors near-term prospects for each in pursuit of maximizing total returns.

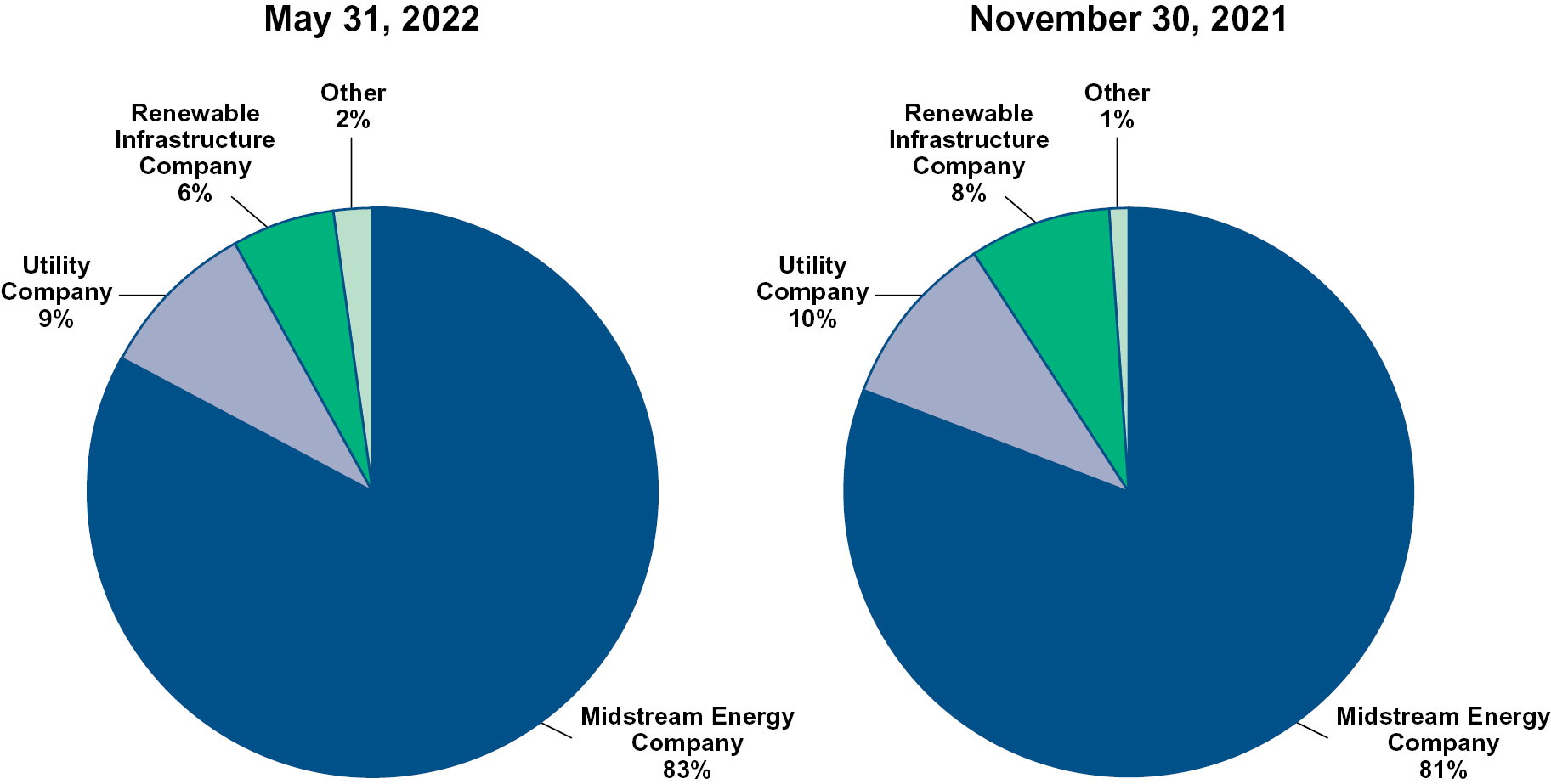

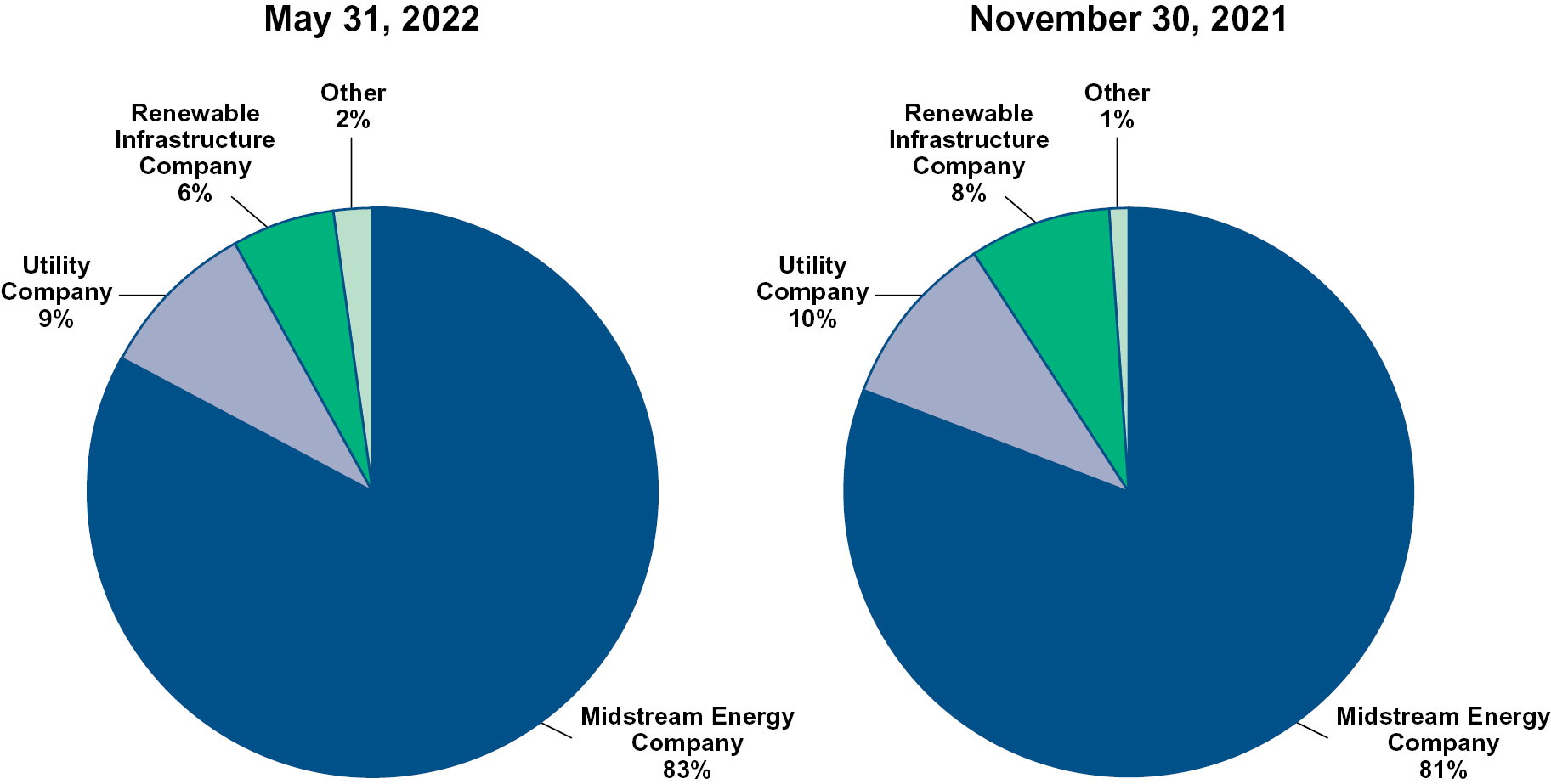

As shown below, KYN’s sector allocations remain skewed toward midstream compared to the weightings that make up KYN’s Composite Energy Infrastructure Index benchmark. As a reminder, the benchmark index is a blend of midstream, U.S. utilities, and renewable infrastructure sectors, as measured by the AMNA, XLU, and our renewable infrastructure composite, respectively.(6)

KYN’s NAV Return of 10.8% was approximately 150 basis points better than the benchmark index return of 9.3%, primarily due to KYN’s higher allocation to midstream, the best performing sector during the quarter. KYN’s midstream holdings continue to consist of larger, diversified midstream companies that have exposure to the most attractive upstream producing basins and own assets that link the production of oil, natural gas, and natural gas liquids to domestic customers and export markets. We expect continued outperformance for midstream equities and anticipate remaining “overweight” in this subsector for the foreseeable future.

4

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

LETTER TO STOCKHOLDERS

KYN’s Market Return was 11.0% for the quarter, or approximately 20 bps higher than NAV Return, as KYN’s share price ended the quarter at a marginally tighter discount to NAV.(7) We are disappointed in the stock price to NAV discount, and we continue to assess all options to narrow the discount. Our core mission of providing attractive risk-adjusted returns while maintaining conservative balance sheet leverage and ample liquidity in the portfolio remains unchanged. We expect that our consistent performance, along with a substantial return of cash to shareholders through quarterly distributions, will be recognized by the market over time.

Distribution

Given KYN’s consistently strong performance in recent quarters and on the heels of last quarter’s 14% distribution increase, the Company has elected to maintain its quarterly distribution of $0.20 per share.(8) Based on our current outlook, we believe this distribution level is sustainable and consistent with our distribution policy, which considers net distributable income as well as realized and unrealized gains from KYN’s portfolio investments. While we are cognizant of the heightened risks in broader markets, we remain optimistic about the long-term outlook for energy infrastructure companies and their role in the energy transition and in facilitating increased energy security for our allies across the globe.

We encourage investors to visit our website at kaynefunds.com for more information about the Company, including the podcasts posted on the “Insights” page that discuss performance and key industry trends. For more details on KYN’s performance, please refer to the “Quarterly Performance” section of our website at kaynefunds.com/kyn. We appreciate your investment in KYN and look forward to providing future updates.

KA Fund Advisors, LLC

5

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

Portfolio Summary

(UNAUDITED)

Portfolio of Long-Term Investments by Category

Top 10 Holdings by Issuer(1)

| | | | | | Percent of Long-Term

Investments as of |

| | | Holding | | Category | | May 31,

2022 | | November 30,

2021 |

1. | | MPLX LP(2) | | Midstream Energy Company | | 10.8% | | 12.9% |

2. | | Enterprise Products Partners L.P.(2) | | Midstream Energy Company | | 10.3 | | 10.5 |

3. | | Energy Transfer LP | | Midstream Energy Company | | 8.7 | | 7.8 |

4. | | Targa Resources Corp. | | Midstream Energy Company | | 7.8 | | 7.4 |

5. | | The Williams Companies, Inc. | | Midstream Energy Company | | 7.5 | | 6.4 |

6. | | Plains All American Pipeline, L.P.(3) | | Midstream Energy Company | | 5.6 | | 5.2 |

7. | | Western Midstream Partners, LP | | Midstream Energy Company | | 4.7 | | 4.5 |

8. | | Cheniere Energy, Inc. | | Midstream Energy Company | | 4.5 | | 3.2 |

9. | | ONEOK, Inc. | | Midstream Energy Company | | 3.5 | | 4.0 |

10. | | Magellan Midstream Partners, L.P. | | Midstream Energy Company | | 3.5 | | 3.6 |

6

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

MANAGEMENT DISCUSSION

(UNAUDITED)

Company Overview

Kayne Anderson Energy Infrastructure Fund, Inc. (the “Company” or “KYN”) is a non-diversified, closed-end fund that commenced operations in September 2004. Our investment objective is to provide a high after-tax total return with an emphasis on making cash distributions to stockholders. We intend to achieve our investment objective by investing at least 80% of our total assets in the securities of Energy Infrastructure Companies. Please refer to the Glossary of Key Terms for the meaning of capitalized terms not otherwise defined herein.

As of May 31, 2022, we had total assets of $2.1 billion, net assets applicable to our common stockholders of $1.5 billion (net asset value of $11.01 per share), and 136.1 million shares of common stock outstanding.

Results of Operations — For the Three Months Ended May 31, 2022

Investment Income. Investment income totaled $12.1 million for the quarter. We received $29.2 million of dividends and distributions, of which $15.8 million was treated as return of capital and $1.4 million was treated as distributions in excess of cost basis. Interest income was $0.1 million.

Operating Expenses. Operating expenses totaled $11.2 million, including $6.8 million of investment management fees, $2.8 million of interest expense, $0.9 million of preferred stock distributions and $0.7 million of other operating expenses.

Net Investment Income. Our net investment income totaled $0.9 million and included a current tax expense of $1.7 million and a deferred tax benefit of $1.7 million.

Net Realized Gains. We had net realized gains from our investments of $8.9 million, consisting of realized gains from long term investments of $11.4 million, $0.1 million of realized gains from option activity, $0.1 million of realized gains from securities sold short, a current income tax expense of $4.9 million and a deferred tax benefit of $2.2 million.

Net Change in Unrealized Gains. We had a net increase in our unrealized gains of $130.8 million. The net change consisted of a $166.1 million increase in unrealized gains on investments and a deferred tax expense of $35.3 million.

Net Increase in Net Assets Resulting from Operations. As a result of the above, we had a net increase in net assets resulting from operations of $140.6 million.

Distributions to Common Stockholders

On June 23, 2022, KYN declared a quarterly distribution of $0.20 per common share for the second quarter, which was paid on July 12, 2022. Payment of future distributions is subject to Board of Directors approval, as well as meeting the covenants on our debt agreements and terms of our preferred stock.

7

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

MANAGEMENT DISCUSSION

(UNAUDITED)

The Board of Directors considers several items in setting our distributions to common stockholders including net distributable income (as defined below), realized and unrealized gains and expected returns for portfolio investments. For instance, we expect earnings growth and/or excess free cash flows generated by our holdings will enhance shareholder value and, in turn, result in appreciation in our portfolio investments. Taking this into consideration when setting our distribution gives us an effective way to pass along these benefits to our stockholders.

Net Distributable Income (“NDI”) is the amount of income received by us from our portfolio investments less operating expenses, subject to certain adjustments as described below. NDI is not a financial measure under the accounting principles generally accepted in the United States of America (“GAAP”). Refer to the Reconciliation of NDI to GAAP section below for a reconciliation of this measure to our results reported under GAAP.

For the purposes of calculating NDI, income from portfolio investments includes (a) cash dividends and distributions, (b) paid-in-kind dividends received (i.e., stock dividends), (c) interest income from debt securities and commitment fees from private investments in public equity (“PIPE investments”) and (d) net premiums received from the sale of covered calls.

For the purposes of calculating NDI, operating expenses include (a) investment management fees paid to our investment adviser, (b) other expenses (mostly comprised of fees paid to other service providers), (c) interest expense and preferred stock distributions and (d) current and deferred income tax expense/benefit on net investment income/loss.

Net Distributable Income (NDI)

(amounts in millions, except for per share amounts)

| | Three Months

Ended

May 31, 2022 |

Distributions and Other Income from Investments | | | | |

Dividends and Distributions | | $ | 29.2 | |

Net Premiums Received from Call Options Written | | | 0.1 | |

Total Distributions and Other Income from Investments | | | 29.3 | |

Expenses | | | | |

Net Investment Management Fee | | | (6.8 | ) |

Other Expenses | | | (0.6 | ) |

Interest Expense | | | (2.8 | ) |

Preferred Stock Distributions | | | (0.9 | ) |

Net Distributable Income (NDI) | | $ | 18.2 | |

Weighted Shares Outstanding | | | 135.8 | |

NDI per Weighted Share Outstanding | | $ | 0.134 | |

Adjusted NDI per Weighted Share Outstanding(1) | | $ | 0.130 | |

8

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

MANAGEMENT DISCUSSION

(UNAUDITED)

Reconciliation of NDI to GAAP

The difference between distributions and other income from investments in the NDI calculation and total investment income as reported in our Statement of Operations is reconciled as follows:

• A significant portion of the cash distributions received from our investments is characterized as return of capital. For GAAP purposes, return of capital distributions are excluded from investment income, whereas the NDI calculation includes the return of capital portion of such distributions.

• GAAP recognizes distributions received from our investments that exceed the cost basis of our securities to be realized gains and are therefore excluded from investment income, whereas the NDI calculation includes these distributions.

• NDI includes the value of paid-in-kind dividends and distributions (if any), whereas such amounts are not included as investment income for GAAP purposes, but rather are recorded as unrealized gains upon receipt.

• NDI includes commitment fees from PIPE investments (if any), whereas such amounts are generally not included in investment income for GAAP purposes, but rather are recorded as a reduction to the cost of the investment.

• We may sell covered call option contracts to generate income or to reduce our ownership of certain securities that we hold. In some cases, we are able to repurchase these call option contracts at a price less than the call premium that we received, thereby generating a profit. The premium we receive from selling call options, less (i) the premium that we pay to repurchase such call option contracts and (ii) the amount by which the market price of an underlying security is above the strike price at the time a new call option is written (if any), is included in NDI. For GAAP purposes, premiums received from call option contracts sold are not included in investment income. See Note 2 — Significant Accounting Policies for the GAAP treatment of option contracts.

Liquidity and Capital Resources

At May 31, 2022, we had total leverage outstanding of $483 million, which represented 23% of total assets. Our current policy is to utilize leverage in an amount that represents approximately 25% to 30% of our total assets. Total leverage was comprised of $243 million of senior unsecured notes (“Notes”), $98 million of borrowings outstanding under our unsecured revolving credit facility (the “Credit Facility”), $50 million outstanding under our unsecured term loan (the “Term Loan”) and $92 million of mandatory redeemable preferred stock (“MRP Shares”). At such date we had $1 million of cash. As of July 22, 2022, we had $136 million of borrowings outstanding under our Credit Facility, $50 million outstanding under our Term Loan and we had $2 million of cash.

Our Credit Facility has a total commitment of $200 million and matures on February 24, 2023. The interest rate on borrowings under the Credit Facility may vary between the secured overnight financing rate (“SOFR”) plus 1.40% and SOFR plus 2.25%, depending on our asset coverage ratios. We pay a fee of 0.20% per annum on any unused amounts of the Credit Facility.

9

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

MANAGEMENT DISCUSSION

(UNAUDITED)

Our $50 million Term Loan has a three-year term, maturing August 6, 2024. The interest rate on $25 million of the Term Loan is fixed at a rate of 1.735% and the interest rate on the remaining $25 million is LIBOR plus 1.30%. Amounts repaid under the Term Loan cannot be reborrowed.

As of May 31, 2022, we had $243 million of Notes outstanding that mature between 2022 and 2032 and we had $92 million of MRP Shares outstanding that are subject to mandatory redemption between 2027 and 2030. On May 2, 2022, we redeemed all $11 million of our Series P MRP Shares at par (originally scheduled to mature on October 29, 2022). On May 18, 2022, we executed a definitive agreement for the private placement of $90 million of Notes and $20 million of MRP Shares. In conjunction with this agreement, on May 18, 2022, we issued $45 million of 4.57% Series RR Notes. The remaining $45 million of Notes and $20 million of MRP Shares will be funded on August 2, 2022. We expect to have sufficient borrowing capacity on our Credit Facility to refinance the remaining $27 million of Notes that mature in fiscal 2022.

At May 31, 2022, our asset coverage ratios under the Investment Company Act of 1940, as amended (“1940 Act”), were 507% for debt and 410% for total leverage (debt plus preferred stock). We target asset coverage ratios that give us the ability to withstand declines in the market value of the securities we hold before breaching the financial covenants in our leverage. These targets are dependent on market conditions as well as certain other factors and may vary from time to time. Currently, we are targeting asset coverage ratios that provide approximately 30% to 40% of cushion relative to our financial covenants (i.e., market values could decline by approximately this amount before our asset coverage ratios would be equal to our financial covenants).

As of May 31, 2022, our total leverage consisted 64% of fixed rate obligations and 36% of floating rate obligations. At such date, the weighted average interest/dividend rate on our total leverage was 3.05%.

10

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

SCHEDULE OF INVESTMENTS

MAY 31, 2022

(amounts in 000’s)

(UNAUDITED)

Description | | No. of

Shares/Units | | Value |

Long-Term Investments — 141.6% | | | | | |

Equity Investments(1) — 141.0% | | | | | |

Midstream Energy Company(2) — 117.2% | | | | | |

Aris Water Solutions, Inc. | | 667 | | $ | 13,627 |

Cheniere Energy, Inc. | | 702 | | | 96,067 |

Cheniere Energy Partners, L.P. | | 325 | | | 17,501 |

Crestwood Equity Partners LP | | 98 | | | 2,845 |

DCP Midstream, LP | | 573 | | | 20,572 |

DT Midstream, Inc. | | 966 | | | 56,113 |

Enbridge Inc.(3) | | 932 | | | 43,031 |

Energy Transfer LP | | 15,774 | | | 183,921 |

EnLink Midstream, LLC | | 268 | | | 3,060 |

Enterprise Products Partners L.P. | | 7,087 | | | 194,313 |

Enterprise Products Partners L.P. — Convertible Preferred

Units(4)(5)(6) | | 23 | | | 23,864 |

Excelerate Energy, Inc.(7) | | 208 | | | 5,549 |

Hess Midstream LP | | 334 | | | 10,885 |

Kinder Morgan, Inc. | | 2,019 | | | 39,744 |

Kinetik Holdings Inc. | | 300 | | | 25,212 |

Magellan Midstream Partners, L.P. | | 1,426 | | | 73,723 |

MPLX LP | | 4,586 | | | 151,121 |

MPLX LP — Convertible Preferred Units(4)(5)(8) | | 2,255 | | | 78,600 |

ONEOK, Inc. | | 1,141 | | | 75,160 |

Pembina Pipeline Corporation(3) | | 789 | | | 31,729 |

Plains All American Pipeline, L.P.(9) | | 8,613 | | | 98,106 |

Plains GP Holdings, L.P. — Plains AAP, L.P.(5)(9)(10) | | 1,622 | | | 19,402 |

Targa Resources Corp. | | 2,305 | | | 166,021 |

TC Energy Corporation(3) | | 1,145 | | | 66,222 |

The Williams Companies, Inc. | | 4,291 | | | 159,025 |

Western Midstream Partners, LP | | 3,632 | | | 100,419 |

| | | | | | 1,755,832 |

Utility Company(2) — 12.0% | | | | | |

American Electric Power Company, Inc. | | 79 | | | 8,009 |

Dominion Energy, Inc. | | 486 | | | 40,956 |

Duke Energy Corporation | | 183 | | | 20,580 |

Evergy, Inc. | | 121 | | | 8,477 |

Eversource Energy | | 132 | | | 12,149 |

NextEra Energy, Inc. | | 151 | | | 11,399 |

Sempra Energy | | 259 | | | 42,374 |

TransAlta Corporation(3) | | 1,150 | | | 13,108 |

Xcel Energy Inc. | | 309 | | | 23,243 |

| | | | | | 180,295 |

See accompanying notes to financial statements.

11

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

SCHEDULE OF INVESTMENTS

MAY 31, 2022

(amounts in 000’s)

(UNAUDITED)

Description | | No. of

Shares/Units | | Value |

Renewable Infrastructure Company(2) — 8.6% | | | | | |

Atlantica Sustainable Infrastructure plc(3) | | 751 | | $ | 24,508 |

Brookfield Renewable Partners L.P.(3) | | 625 | | | 22,247 |

Clearway Energy, Inc. — Class A | | 111 | | | 3,625 |

Clearway Energy, Inc. — Class C | | 365 | | | 12,793 |

Enviva Inc. | | 326 | | | 25,385 |

Innergex Renewable Energy Inc.(3) | | 735 | | | 9,911 |

NextEra Energy Partners, LP | | 269 | | | 19,282 |

Northland Power Inc.(3) | | 377 | | | 11,418 |

| | | | | | 129,169 |

Energy Company(2) — 3.2% | | | | | |

Phillips 66 | | 391 | | | 39,449 |

Shell plc — ADR(3)(11) | | 140 | | | 8,291 |

| | | | | | 47,740 |

Total Equity Investments (Cost — $1,810,347) | | | | | 2,113,036 |

| | Interest

Rate | | Maturity

Date | | Principal

Amount | | |

Debt Investments — 0.6% | | | | | | | | | | | | |

Midstream Energy Company(2) — 0.6% | | | | | | | | | | | | |

Energy Transfer LP | | 5.300 | % | | 4/15/47 | | $ | 750 | | | 684 | |

EQM Midstream Partners, LP | | 7.500 | | | 6/1/30 | | | 667 | | | 667 | |

EQM Midstream Partners, LP | | 6.500 | | | 7/15/48 | | | 6,000 | | | 5,115 | |

Kinder Morgan, Inc. | | 5.550 | | | 6/1/45 | | | 750 | | | 756 | |

Plains All American Pipeline, L.P.(9) | | 4.900 | | | 2/15/45 | | | 750 | | | 646 | |

The Williams Companies, Inc. | | 5.100 | | | 9/15/45 | | | 750 | | | 727 | |

Total Debt Investments (Cost — $9,250) | | | 8,595 | |

Total Long-Term Investments — 141.6% (Cost — $1,819,597) | | | 2,121,631 | |

| | | | | | | | | | | | | |

Debt | | | (391,111 | ) |

Mandatory Redeemable Preferred Stock at Liquidation Value | | | (91,603 | ) |

Deferred Income Tax Liability, net | | | (136,270 | ) |

Other Liabilities in Excess of Other Assets | | | (4,262 | ) |

Net Assets Applicable to Common Stockholders | | $ | 1,498,385 | |

See accompanying notes to financial statements.

12

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

SCHEDULE OF INVESTMENTS

MAY 31, 2022

(amounts in 000’s)

(UNAUDITED)

At May 31, 2022, the Company’s geographic allocation was as follows:

Geographic Location | | % of Long-Term

Investments |

United States | | 89.1% |

Canada | | 9.3% |

Europe/U.K. | | 1.6% |

See accompanying notes to financial statements.

13

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

STATEMENT OF ASSETS AND LIABILITIES

MAY 31, 2022

(amounts in 000’s, except share and per share amounts)

(UNAUDITED)

ASSETS | | | | |

Investments at fair value: | | | | |

Non-affiliated (Cost — $1,700,310) | | $ | 2,003,477 | |

Affiliated (Cost — $119,287) | | | 118,154 | |

Cash | | | 1,334 | |

Deposits with brokers | | | 338 | |

Interest, dividends and distributions receivable (Cost — $2,466) | | | 2,482 | |

Deferred credit facility offering costs and other assets | | | 1,100 | |

Total Assets | | | 2,126,885 | |

| | | | | |

LIABILITIES | | | | |

Payable for securities purchased | | | 667 | |

Investment management fee payable | | | 6,791 | |

Accrued directors’ fees | | | 183 | |

Accrued expenses and other liabilities | | | 4,273 | |

Deferred income tax liability, net | | | 136,270 | |

Credit facility | | | 98,000 | |

Term loan | | | 50,000 | |

Unamortized term loan issuance costs | | | (121 | ) |

Notes | | | 243,111 | |

Unamortized notes issuance costs | | | (1,142 | ) |

Mandatory redeemable preferred stock, $25.00 liquidation value per share (3,664,117 shares issued and outstanding) | | | 91,603 | |

Unamortized mandatory redeemable preferred stock issuance costs | | | (1,135 | ) |

Total Liabilities | | | 628,500 | |

NET ASSETS APPLICABLE TO COMMON STOCKHOLDERS | | $ | 1,498,385 | |

NET ASSETS APPLICABLE TO COMMON STOCKHOLDERS CONSIST OF | | | | |

Common stock, $0.001 par value (136,131,530 shares issued and outstanding, 196,335,883 shares authorized) | | $ | 136 | |

Paid-in capital | | | 1,853,702 | |

Total distributable earnings (loss) | | | (355,453 | ) |

NET ASSETS APPLICABLE TO COMMON STOCKHOLDERS | | $ | 1,498,385 | |

NET ASSET VALUE PER COMMON SHARE | | $ | 11.01 | |

See accompanying notes to financial statements.

14

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

STATEMENT OF OPERATIONS

(amounts in 000’s)

(UNAUDITED)

| | For the Three

Months Ended

May 31, 2022 | | For the Six

Months Ended

May 31, 2022 |

INVESTMENT INCOME | | | | | | | | |

Income | | | | | | | | |

Dividends and distributions: | | | | | | | | |

Non-affiliated investments | | $ | 26,958 | | | $ | 49,669 | |

Affiliated investments | | | 2,226 | | | | 3,812 | |

Total dividends and distributions (after foreign taxes withheld of $342 and $673, respectively) | | | 29,184 | | | | 53,481 | |

Return of capital | | | (15,777 | ) | | | (30,952 | ) |

Distributions in excess of cost basis | | | (1,407 | ) | | | (1,859 | ) |

Net dividends and distributions | | | 12,000 | | | | 20,670 | |

Interest Income | | | | | | | | |

Non-affiliated investments | | | 62 | | | | 62 | |

Affiliated investments | | | 3 | | | | 3 | |

Total Investment Income | | | 12,065 | | | | 20,735 | |

| | | | | | | | | |

Expenses | | | | | | | | |

Investment management fees | | | 6,792 | | | | 12,553 | |

Directors’ fees | | | 174 | | | | 326 | |

Administration fees | | | 151 | | | | 315 | |

Professional fees | | | 116 | | | | 240 | |

Insurance | | | 56 | | | | 112 | |

Reports to stockholders | | | 46 | | | | 98 | |

Stock exchange listing fees | | | 45 | | | | 76 | |

Custodian fees | | | 23 | | | | 42 | |

Other expenses | | | 67 | | | | 111 | |

Total Expenses — before interest expense, preferred distributions and taxes | | | 7,470 | | | | 13,873 | |

Interest expense including amortization of offering costs | | | 2,786 | | | | 5,164 | |

Distributions on mandatory redeemable preferred stock including amortization of offering costs | | | 921 | | | | 1,871 | |

Total Expenses — before taxes | | | 11,177 | | | | 20,908 | |

Net Investment Income (Loss) — Before Taxes | | | 888 | | | | (173 | ) |

Current income tax expense | | | (1,669 | ) | | | (2,088 | ) |

Deferred income tax benefit | | | 1,725 | | | | 2,474 | |

Net Investment Income | | | 944 | | | | 213 | |

REALIZED AND UNREALIZED GAINS (LOSSES) | | | | | | | | |

Net Realized Gains (Losses) | | | | | | | | |

Investments — non-affiliated | | | 10,727 | | | | (10,315 | ) |

Investments — affiliated | | | 677 | | | | 1,129 | |

Foreign currency transactions | | | (27 | ) | | | (146 | ) |

Securities sold short | | | 84 | | | | 84 | |

Options | | | 94 | | | | 220 | |

Current income tax (expense) | | | (4,857 | ) | | | (10,673 | ) |

Deferred income tax benefit | | | 2,251 | | | | 12,646 | |

Net Realized Gains (Losses) | | | 8,949 | | | | (7,055 | ) |

Net Change in Unrealized Gains (Losses) | | | | | | | | |

Investments — non-affiliated | | | 148,524 | | | | 387,449 | |

Investments — affiliated | | | 17,541 | | | | 29,837 | |

Foreign currency translations | | | 15 | | | | 24 | |

Deferred income tax expense | | | (35,326 | ) | | | (91,214 | ) |

Net Change in Unrealized Gains | | | 130,754 | | | | 326,096 | |

Net Realized and Unrealized Gains | | | 139,703 | | | | 319,041 | |

NET INCREASE IN NET ASSETS APPLICABLE TO COMMON STOCKHOLDERS RESULTING FROM OPERATIONS | | $ | 140,647 | | | $ | 319,254 | |

See accompanying notes to financial statements.

15

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

STATEMENT OF CHANGES IN NET ASSETS APPLICABLE TO COMMON STOCKHOLDERS

(amounts in 000’s, except share amounts)

| | For the

Six Months

Ended

May 31, 2022

(Unaudited) | | For the

Fiscal Year

Ended

November 30,

2021 |

OPERATIONS | | | | | | | | |

Net investment income (loss), net of tax(1) | | $ | 213 | | | $ | (9,857 | ) |

Net realized gains (losses), net of tax | | | (7,055 | ) | | | 142,221 | |

Net change in unrealized gains, net of tax | | | 326,096 | | | | 203,391 | |

Net Increase in Net Assets Resulting from Operations | | | 319,254 | | | | 335,755 | |

DIVIDENDS AND DISTRIBUTIONS TO COMMON STOCKHOLDERS(1) | | | | | | | | |

Dividends | | | — | (2) | | | — | |

Distributions — return of capital | | | (49,355 | )(2) | | | (82,190 | ) |

Dividends and Distributions to Common Stockholders | | | (49,355 | ) | | | (82,190 | ) |

CAPITAL STOCK TRANSACTIONS | | | | | | | | |

Issuance of 9,683,976 shares of common stock in connection with the merger of Fiduciary/Claymore Energy Infrastructure Fund | | | 102,007 | | | | — | |

Total Increase in Net Assets Applicable to Common Stockholders | | | 371,906 | | | | 253,565 | |

NET ASSETS APPLICABLE TO COMMON STOCKHOLDERS | | | | | | | | |

Beginning of period | | | 1,126,479 | | | | 872,914 | |

End of period | | $ | 1,498,385 | | | $ | 1,126,479 | |

See accompanying notes to financial statements.

16

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

STATEMENT OF CASH FLOWS

FOR THE SIX MONTHS ENDED MAY 31, 2022

(amounts in 000’s)

(UNAUDITED)

CASH FLOWS FROM OPERATING ACTIVITIES | | | | |

Net increase in net assets resulting from operations | | $ | 319,254 | |

Adjustments to reconcile net increase in net assets resulting from operations to net cash provided by operating activities: | | | | |

Return of capital distributions | | | 30,952 | |

Distributions in excess of cost basis | | | 1,859 | |

Net realized losses (excluding securities sold short and foreign currency transactions) | | | 8,966 | |

Net realized gain on securities sold short | | | (84 | ) |

Net change in unrealized gains (excluding foreign currency translations) | | | (417,286 | ) |

Purchase of long-term investments | | | (169,024 | ) |

Proceeds from sale of long-term investments | | | 137,480 | |

Purchases of securities to cover securities sold short | | | (41,056 | ) |

Proceeds from securities sold short | | | 41,140 | |

Amortization of deferred debt offering costs | | | 612 | |

Amortization of mandatory redeemable preferred stock offering costs | | | 104 | |

Increase in deposits with brokers | | | (47 | ) |

Increase in dividends and distributions receivable | | | (802 | ) |

Decrease in current income tax receivable | | | 17,519 | |

Increase in other assets | | | (57 | ) |

Increase in payable for securities purchased | | | 647 | |

Increase in investment management fee payable | | | 1,343 | |

Increase in accrued directors’ fees | | | 45 | |

Decrease in accrued expenses and other liabilities | | | (148 | ) |

Increase in deferred income tax liability | | | 76,097 | |

Net Cash Provided by Operating Activities | | | 7,514 | |

CASH FLOWS FROM FINANCING ACTIVITIES | | | | |

Increase in borrowings under credit facility | | | 35,000 | |

Costs associated with renewal of credit facility | | | (895 | ) |

Repayment of borrowings acquired in merger | | | (15,042 | ) |

Proceeds from offering of notes | | | 45,000 | |

Costs associated with offering of notes | | | (399 | ) |

Redemption of notes | | | (11,575 | ) |

Redemption of mandatory redeemable preferred stock | | | (10,067 | ) |

Cash distributions paid to common stockholders | | | (49,355 | ) |

Net Cash Used in Financing Activities | | | (7,333 | ) |

NET CHANGE IN CASH | | | 181 | |

CASH — BEGINNING OF PERIOD | | | 1,153 | |

CASH — END OF PERIOD | | $ | 1,334 | |

See accompanying notes to financial statements.

17

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

FINANCIAL HIGHLIGHTS

(amounts in 000’s, except share and per share amounts)

| | For the

Six Months

Ended

May 31, 2022

(Unaudited) | |

For the Fiscal Year Ended November 30,

|

| | | 2021 | | 2020 | | 2019 |

Per Share of Common Stock(1) | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 8.91 | | | $ | 6.90 | | | $ | 13.89 | | | $ | 16.37 | |

Net investment income (loss)(2) | | | — | | | | (0.08 | ) | | | (0.34 | ) | | | (0.26 | ) |

Net realized and unrealized gain (loss) | | | 2.48 | | | | 2.74 | | | | (5.87 | ) | | | (0.75 | ) |

Total income (loss) from operations | | | 2.48 | | | | 2.66 | | | | (6.21 | ) | | | (1.01 | ) |

Common dividends(3) | | | — | | | | — | | | | — | | | | — | |

Common distributions — return of capital(3) | | | (0.38 | ) | | | (0.65 | ) | | | (0.78 | ) | | | (1.47 | ) |

Total dividends and distributions — common | | | (0.38 | ) | | | (0.65 | ) | | | (0.78 | ) | | | (1.47 | ) |

Offering expenses associated with the issuance of common stock | | | — | | | | — | | | | — | | | | — | |

Effect of issuance of common stock | | | — | | | | — | | | | — | | | | — | |

Effect of shares issued in reinvestment of distributions | | | — | | | | — | | | | — | | | | — | |

Total capital stock transactions | | | — | | | | — | | | | — | | | | — | |

Net asset value, end of period | | $ | 11.01 | | | $ | 8.91 | | | $ | 6.90 | | | $ | 13.89 | |

Market value per share of common stock, end of period | | $ | 9.42 | | | $ | 7.77 | | | $ | 5.89 | | | $ | 12.55 | |

Total investment return based on common stock market value(4) | | | 26.4 | %(5) | | | 44.0 | % | | | (47.3 | )% | | | (12.4 | )% |

Total investment return based on net asset value(6) | | | 28.9 | %(5) | | | 41.0 | % | | | (44.3 | )% | | | (6.1 | )% |

Supplemental Data and Ratios(7) | | | | | | | | | | | | | | | | |

Net assets applicable to common stockholders, end of period | | $ | 1,498,385 | | | $ | 1,126,479 | | | $ | 872,914 | | | $ | 1,755,216 | |

Ratio of expenses to average net assets | | | | | | | | | | | | | | | | |

Management fees (net of fee waiver) | | | 1.9 | % | | | 1.8 | % | | | 2.3 | % | | | 2.3 | % |

Other expenses | | | 0.2 | | | | 0.3 | | | | 0.3 | | | | 0.1 | |

Subtotal | | | 2.1 | | | | 2.1 | | | | 2.6 | | | | 2.4 | |

Interest expense and distributions on mandatory redeemable preferred stock(2) | | | 1.1 | | | | 1.3 | | | | 3.6 | | | | 2.1 | |

Income tax expense(8) | | | 6.8 | (5) | | | 5.1 | | | | — | | | | — | |

Total expenses | | | 10.0 | % | | | 8.5 | % | | | 6.2 | % | | | 4.5 | % |

Ratio of net investment income (loss) to average net assets(2) | | | 0.0 | % | | | (0.9 | )% | | | (4.0 | )% | | | (1.6 | )% |

Net increase (decrease) in net assets to common stockholders resulting from operations to average net assets | | | 24.4 | %(5) | | | 31.4 | % | | | (73.8 | )% | | | (6.3 | )% |

Portfolio turnover rate | | | 6.2 | %(5)(9) | | | 50.8 | % | | | 22.3 | % | | | 22.0 | % |

Average net assets | | $ | 1,308,871 | | | $ | 1,068,396 | | | $ | 1,063,404 | | | $ | 2,032,591 | |

Notes outstanding, end of period(10) | | $ | 243,111 | | | $ | 209,686 | | | $ | 173,260 | | | $ | 596,000 | |

Borrowings under credit facilities, end of period(10) | | $ | 98,000 | | | $ | 63,000 | | | $ | 62,000 | | | $ | 35,000 | |

Term loan outstanding, end of period(10) | | $ | 50,000 | | | $ | 50,000 | | | $ | — | | | $ | 60,000 | |

Mandatory redeemable preferred stock, end of period(10) | | $ | 91,603 | | | $ | 101,670 | | | $ | 136,633 | | | $ | 317,000 | |

Average shares of common stock outstanding | | | 131,183,125 | | | | 126,447,554 | | | | 126,420,698 | | | | 126,326,087 | |

Asset coverage of total debt(11) | | | 506.5 | % | | | 480.6 | % | | | 529.1 | % | | | 399.9 | % |

Asset coverage of total leverage (debt and preferred stock)(12) | | | 410.4 | % | | | 365.5 | % | | | 334.7 | % | | | 274.1 | % |

Average amount of borrowings per share of common stock during the period(1) | | $ | 2.79 | | | $ | 2.43 | | | $ | 2.88 | | | $ | 6.09 | |

See accompanying notes to financial statements.

18

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

FINANCIAL HIGHLIGHTS

(amounts in 000’s, except share and per share amounts)

| | For the Fiscal Year Ended November 30, |

| | | 2018 | | 2017 | | 2016 | | 2015 |

Per Share of Common Stock(1) | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 15.90 | | | $ | 19.18 | | | $ | 19.20 | | | $ | 36.71 | |

Net investment income (loss)(2) | | | (0.45 | ) | | | (0.45 | ) | | | (0.61 | ) | | | (0.53 | ) |

Net realized and unrealized gain (loss) | | | 2.74 | | | | (0.92 | ) | | | 2.80 | | | | (14.39 | ) |

Total income (loss) from operations | | | 2.29 | | | | (1.37 | ) | | | 2.19 | | | | (14.92 | ) |

Common dividends(3) | | | (1.80 | ) | | | (0.53 | ) | | | — | | | | (2.15 | ) |

Common distributions — return of capital(3) | | | — | | | | (1.37 | ) | | | (2.20 | ) | | | (0.48 | ) |

Total dividends and distributions —

common | | | (1.80 | ) | | | (1.90 | ) | | | (2.20 | ) | | | (2.63 | ) |

Offering expenses associated with the issuance of common stock | | | (0.01 | )(13) | | | — | | | | — | | | | — | |

Effect of issuance of common stock | | | — | | | | — | | | | — | | | | 0.03 | |

Effect of shares issued in reinvestment of distributions | | | (0.01 | ) | | | (0.01 | ) | | | (0.01 | ) | | | 0.01 | |

Total capital stock transactions | | | (0.02 | ) | | | (0.01 | ) | | | (0.01 | ) | | | 0.04 | |

Net asset value, end of period | | $ | 16.37 | | | $ | 15.90 | | | $ | 19.18 | | | $ | 19.20 | |

Market value per share of common stock, end of period | | $ | 15.85 | | | $ | 15.32 | | | $ | 19.72 | | | $ | 18.23 | |

Total investment return based on common stock market value(4) | | | 14.8 | % | | | (13.8 | )% | | | 24.1 | % | | | (47.7 | )% |

Total investment return based on net asset value(6) | | | 14.2 | % | | | (8.0 | )% | | | 14.6 | % | | | (42.8 | )% |

Supplemental Data and Ratios(7) | | | | | | | | | | | �� | | | | | |

Net assets applicable to common stockholders, end of period | | $ | 2,066,269 | | | $ | 1,826,173 | | | $ | 2,180,781 | | | $ | 2,141,602 | |

Ratio of expenses to average net assets | | | | | | | | | | | | | | | | |

Management fees (net of fee waiver) | | | 2.3 | % | | | 2.5 | % | | | 2.5 | % | | | 2.6 | % |

Other expenses | | | 0.2 | | | | 0.1 | | | | 0.2 | | | | 0.1 | |

Subtotal | | | 2.5 | | | | 2.6 | | | | 2.7 | | | | 2.7 | |

Interest expense and distributions on mandatory redeemable preferred stock(2) | | | 1.9 | | | | 2.0 | | | | 2.8 | | | | 2.4 | |

Income tax expense(8) | | | — | | | | — | | | | 7.9 | | | | — | |

Total expenses | | | 4.4 | % | | | 4.6 | % | | | 13.4 | % | | | 5.1 | % |

Ratio of net investment income (loss) to average net assets(2) | | | (2.5 | )% | | | (2.4 | )% | | | (3.4 | )% | | | (1.8 | )% |

Net increase (decrease) in net assets to common stockholders resulting from operations to average net assets | | | 10.8 | % | | | (7.5 | )% | | | 12.5 | % | | | (51.7 | )% |

Portfolio turnover rate | | | 25.8 | % | | | 17.6 | % | | | 14.5 | % | | | 17.1 | % |

Average net assets | | $ | 2,127,407 | | | $ | 2,128,965 | | | $ | 2,031,206 | | | $ | 3,195,445 | |

Notes outstanding, end of period(10) | | $ | 716,000 | | | $ | 747,000 | | | $ | 767,000 | | | $ | 1,031,000 | |

Borrowings under credit facilities, end of period(10) | | $ | 39,000 | | | $ | — | | | $ | 43,000 | | | $ | — | |

Term loan outstanding, end of period(10) | | $ | 60,000 | | | $ | — | | | $ | — | | | $ | — | |

Mandatory redeemable preferred stock, end of period(10) | | $ | 317,000 | | | $ | 292,000 | | | $ | 300,000 | | | $ | 464,000 | |

Average shares of common stock outstanding | | | 118,725,060 | | | | 114,292,056 | | | | 112,967,480 | | | | 110,809,350 | |

Asset coverage of total debt(11) | | | 392.4 | % | | | 383.6 | % | | | 406.3 | % | | | 352.7 | % |

Asset coverage of total leverage (debt and preferred stock)(12) | | | 282.5 | % | | | 275.8 | % | | | 296.5 | % | | | 243.3 | % |

Average amount of borrowings per share of common stock during the period(1) | | $ | 6.52 | | | $ | 7.03 | | | $ | 7.06 | | | $ | 11.95 | |

See accompanying notes to financial statements.

19

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

FINANCIAL HIGHLIGHTS

(amounts in 000’s, except share and per share amounts)

| | For the Fiscal Year Ended November 30, |

| | | 2014 | | 2013 | | 2012 |

Per Share of Common Stock(1) | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 34.30 | | | $ | 28.51 | | | $ | 27.01 | |

Net investment income (loss)(2) | | | (0.76 | ) | | | (0.73 | ) | | | (0.71 | ) |

Net realized and unrealized gain (loss) | | | 5.64 | | | | 8.72 | | | | 4.27 | |

Total income (loss) from operations | | | 4.88 | | | | 7.99 | | | | 3.56 | |

Common dividends(3) | | | (2.28 | ) | | | (1.54 | ) | | | (1.54 | ) |

Common distributions — return of capital(3) | | | (0.25 | ) | | | (0.75 | ) | | | (0.55 | ) |

Total dividends and distributions — common | | | (2.53 | ) | | | (2.29 | ) | | | (2.09 | ) |

Offering expenses associated with the issuance of common stock | | | — | | | | — | | | | — | |

Effect of issuance of common stock | | | 0.06 | | | | 0.09 | | | | 0.02 | |

Effect of shares issued in reinvestment of distributions | | | — | | | | — | | | | 0.01 | |

Total capital stock transactions | | | 0.06 | | | | 0.09 | | | | 0.03 | |

Net asset value, end of period | | $ | 36.71 | | | $ | 34.30 | | | $ | 28.51 | |

Market value per share of common stock, end of period | | $ | 38.14 | | | $ | 37.23 | | | $ | 31.13 | |

Total investment return based on common stock market value(4) | | | 9.9 | % | | | 28.2 | % | | | 19.3 | % |

Total investment return based on net asset value(6) | | | 14.8 | % | | | 29.0 | % | | | 13.4 | % |

Supplemental Data and Ratios(7) | | | | | | | | | | | | |

Net assets applicable to common stockholders, end of period | | $ | 4,026,822 | | | $ | 3,443,916 | | | $ | 2,520,821 | |

Ratio of expenses to average net assets | | | | | | | | | | | | |

Management fees (net of fee waiver) | | | 2.4 | % | | | 2.4 | % | | | 2.4 | % |

Other expenses | | | 0.1 | | | | 0.1 | | | | 0.2 | |

Subtotal | | | 2.5 | | | | 2.5 | | | | 2.6 | |

Interest expense and distributions on mandatory redeemable preferred stock(2) | | | 1.8 | | | | 2.1 | | | | 2.4 | |

Income tax expense(8) | | | 8.3 | | | | 14.4 | | | | 7.2 | |

Total expenses | | | 12.6 | % | | | 19.0 | % | | | 12.2 | % |

Ratio of net investment income (loss) to average net assets(2) | | | (2.0 | )% | | | (2.3 | )% | | | (2.5 | )% |

Net increase (decrease) in net assets to common stockholders resulting from operations to average net assets | | | 13.2 | % | | | 24.3 | % | | | 11.6 | % |

Portfolio turnover rate | | | 17.6 | % | | | 21.2 | % | | | 20.4 | % |

Average net assets | | $ | 3,967,458 | | | $ | 3,027,563 | | | $ | 2,346,249 | |

Notes outstanding, end of period(10) | | $ | 1,435,000 | | | $ | 1,175,000 | | | $ | 890,000 | |

Borrowings under credit facilities, end of period(10) | | $ | 51,000 | | | $ | 69,000 | | | $ | 19,000 | |

Term loan outstanding, end of period(10) | | $ | — | | | $ | — | | | $ | — | |

Mandatory redeemable preferred stock, end of period(10) | | $ | 524,000 | | | $ | 449,000 | | | $ | 374,000 | |

Average shares of common stock outstanding | | | 107,305,514 | | | | 94,658,194 | | | | 82,809,687 | |

Asset coverage of total debt(11) | | | 406.2 | % | | | 412.9 | % | | | 418.5 | % |

Asset coverage of total leverage (debt and preferred stock)(12) | | | 300.3 | % | | | 303.4 | % | | | 296.5 | % |

Average amount of borrowings per share of common stock during the period(1) | | $ | 13.23 | | | $ | 11.70 | | | $ | 10.80 | |

See accompanying notes to financial statements.

20

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

FINANCIAL HIGHLIGHTS

(amounts in 000’s, except share and per share amounts)

See accompanying notes to financial statements.

21

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

NOTES TO FINANCIAL STATEMENTS

(amounts in 000’s, except number of option contracts, share and per share amounts)

(UNAUDITED)

1. Organization

Kayne Anderson Energy Infrastructure Fund, Inc. (the “Company” or “KYN”) was organized as a Maryland corporation on June 4, 2004, and is a non-diversified, closed-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Company’s investment objective is to obtain a high after-tax total return with an emphasis on making cash distributions to shareholders. The Company intends to achieve this objective by investing at least 80% of its total assets in the securities of Energy Infrastructure Companies. The Company commenced operations on September 28, 2004. The Company’s shares of common stock are listed on the New York Stock Exchange, Inc. (“NYSE”) under the symbol “KYN.” For more information about the Company’s investment objective, policies and principal risks, see Investment Objective, Policies and Risks in the Company’s most recently filed annual report.

On March 4, 2022, the Company completed its merger with Fiduciary/Claymore Energy Infrastructure Fund (“FMO”). Pursuant to the terms of the merger agreement approved by FMO shareholders, FMO was merged with and into KYN, and FMO shareholders received newly issued shares of KYN common stock in exchange for their shares of FMO, the aggregate net asset value of which equaled the aggregate net asset value of FMO common shares, as determined at the close of business on March 4, 2022. A total of 9,683,976 shares of new KYN common stock were issued as a result of the merger. The merger qualified as a tax-free reorganization under Section 368(a) of the Internal Revenue Code. Immediately following the merger, KYN’s combined net assets were $1,433,834 and the Company had 136,131,530 shares of common stock outstanding.

The Company’s results of operations for the three and six month periods ended May 31, 2022 are not directly comparable to prior periods as these results include income and earnings associated with assets acquired in connection with the merger (included as of the date such merger was completed). Assuming the merger had been completed on December 1, 2021, the beginning of the annual reporting period for the Company, the pro forma results in the Statement of Operations for the three and six months ended May 31, 2022 would be as follows:

| | Pro Forma

For the Three

Months Ended

May 31, 2022 | | Pro Forma

For the Six

Months Ended

May 31, 2022 |

Net investment income, net of tax | | $ | 429 | | $ | (302 | ) |

Net realized gains, net of tax | | | 9,468 | | | (6,536 | ) |

Net change in unrealized gains (losses), net of tax | | | 151,304 | | | 346,646 | |

Net increase (decrease) in net assets resulting from operations | | $ | 161,201 | | $ | 339,808 | |

Because the combined entity has been managed as a single integrated entity since the merger was completed, it is not practicable to separate the amounts of income and earnings of FMO that have been included in the Company’s Statement of Operations since the merger.

2. Significant Accounting Policies

The following is a summary of the significant accounting policies that the Company uses to prepare its financial statements in accordance with accounting principles generally accepted in the United States of America (“GAAP”). The Company is an investment company and follows accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) Topic 946 — “Financial Services — Investment Companies.”

22

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

NOTES TO FINANCIAL STATEMENTS

(amounts in 000’s, except number of option contracts, share and per share amounts)

(UNAUDITED)

A. Use of Estimates — The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of income and expenses during the period. Actual results could differ materially from those estimates.

B. Cash and Cash Equivalents — Cash and cash equivalents include short-term, liquid investments with an original maturity of three months or less and include money market fund accounts.

C. Calculation of Net Asset Value — The Company determines its net asset value on a daily basis and reports its net asset value on its website. Net asset value is computed by dividing the value of the Company’s assets (including accrued interest and distributions and current and deferred income tax assets), less all of its liabilities (including accrued expenses, distributions payable, current and deferred accrued income taxes, and any borrowings) and the liquidation value of any outstanding preferred stock, by the total number of common shares outstanding.

D. Investment Valuation — Readily marketable portfolio securities listed on any exchange (including a foreign exchange) other than the NASDAQ Stock Market, Inc. (“NASDAQ”) are valued, except as indicated below, at the last sale price on the business day as of which such value is being determined. If there has been no sale on such day, the securities are valued at the mean of the most recent bid and ask prices on such day. Securities admitted to trade on the NASDAQ are valued at the NASDAQ official closing price. Portfolio securities traded on more than one securities exchange are valued at the last sale price on the business day as of which such value is being determined at the close of the exchange representing the principal market for such securities. The value of foreign securities traded outside of the Americas may be adjusted to reflect events occurring after a foreign exchange closes that may affect the value of the foreign security. In such cases, these foreign securities are valued by an independent pricing service and are categorized as Level 2 securities for purposes of the fair value hierarchy. See Note 3 — Fair Value.

Equity securities traded in the over-the-counter market, but excluding securities admitted to trading on the NASDAQ, are valued at the closing bid prices. Debt securities that are considered bonds are valued by using the bid price provided by an independent pricing service or, if such prices are not available or in the judgment of KA Fund Advisors, LLC (“KAFA”) such prices are stale or do not represent fair value, by an independent broker. For debt securities that are considered bank loans, the fair market value is determined by using the bid price provided by the agent or syndicate bank or principal market maker. When price quotes for securities are not available, or such prices are stale or do not represent fair value in the judgment of KAFA, fair market value will be determined using the Company’s valuation process for securities that are privately issued or otherwise restricted as to resale.

Exchange-traded options and futures contracts are valued at the last sales price at the close of trading in the market where such contracts are principally traded or, if there was no sale on the applicable exchange on such day, at the mean between the quoted bid and ask price as of the close of such exchange.

The Company may hold securities that are privately issued or otherwise restricted as to resale. For these securities, as well as any security for which (a) reliable market quotations are not available in the judgment of KAFA, or (b) the independent pricing service or independent broker does not provide prices or provides a price that in the judgment of KAFA is stale or does not represent fair value, each

23

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

NOTES TO FINANCIAL STATEMENTS

(amounts in 000’s, except number of option contracts, share and per share amounts)

(UNAUDITED)

shall be valued in a manner that most fairly reflects fair value of the security on the valuation date. Unless otherwise determined by the Board of Directors, the following valuation process is used for such securities:

• Investment Team Valuation. The applicable investments are valued by senior professionals of KAFA who are responsible for the portfolio investments. The investments will be valued monthly with new investments valued at the time such investment was made.

• Investment Team Valuation Documentation. Preliminary valuation conclusions will be determined by senior management of KAFA. Such valuations and supporting documentation are submitted to the Valuation Committee (a committee of the Company’s Board of Directors) and the Board of Directors on a quarterly basis.

• Valuation Committee. The Valuation Committee meets to consider the valuations submitted by KAFA at the end of each quarter. Between meetings of the Valuation Committee, a senior officer of KAFA is authorized to make valuation determinations. All valuation determinations of the Valuation Committee are subject to ratification by the Board of Directors at its next regular meeting.

• Valuation Firm. Quarterly, a third-party valuation firm engaged by the Board of Directors reviews the valuation methodologies and calculations employed for these securities, unless the aggregate fair value of such security is less than 0.1% of total assets.

• Board of Directors Determination. The Board of Directors meets quarterly to consider the valuations provided by KAFA and the Valuation Committee and ratify valuations for the applicable securities. The Board of Directors considers the report provided by the third-party valuation firm in reviewing and determining in good faith the fair value of the applicable portfolio securities.

At May 31, 2022, the Company held 6.8% of its net assets applicable to common stockholders (4.8% of total assets) in securities that were fair valued pursuant to procedures adopted by the Board of Directors (Level 3 securities). The aggregate fair value of these securities at May 31, 2022, was $102,464. See Note 3 — Fair Value and Note 7 — Restricted Securities.

E. Security Transactions — Security transactions are accounted for on the date these securities are purchased or sold (trade date). Realized gains and losses are calculated using the specific identification cost basis method for GAAP purposes. For tax purposes, the Company utilizes the average cost method to compute the adjusted tax cost basis of its MLP securities.

F. Return of Capital Estimates — Dividends and distributions received from the Company’s investments generally are comprised of income and return of capital. At the time such dividends and distributions are received, the Company estimates the amount of such payments that is considered investment income and the amount that is considered a return of capital. The Company estimates the return of capital portion of dividends and distributions received from investments based on historical information available and other information provided by certain investments. Return of capital estimates are adjusted to actual in the subsequent fiscal year when final tax reporting information related to the Company’s investments is received.

The return of capital portion of the distributions is a reduction to investment income that results in an equivalent reduction in the cost basis of the associated investments and increases net realized gains (losses) and net change in unrealized gains (losses). If the distributions received by the Company exceed its cost basis (i.e. its cost basis has been reduced to zero), the distributions are treated as realized gains.

24

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

NOTES TO FINANCIAL STATEMENTS

(amounts in 000’s, except number of option contracts, share and per share amounts)

(UNAUDITED)

The Company includes all distributions received on its Statement of Operations and reduces its investment income by (i) the estimated return of capital and (ii) the distributions in excess of cost basis, if any. Distributions received that were in excess of cost basis were treated as realized gains.

In accordance with GAAP, the return of capital cost basis reductions for the Company’s investments are limited to the total amount of the cash distributions received from such investments.

The following table sets forth the Company’s estimated return of capital portion of the dividends and distributions received from its investments that were not treated as distributions in excess of cost basis.

| | For the

Three Months

Ended

May 31,

2022 | | For the

Six Months

Ended

May 31,

2022 |

Dividends and distributions (before foreign taxes withheld of $342 and $673, respectively, and excluding distributions in excess of cost basis) | | $ | 28,119 | | | $ | 52,295 | |

Dividends and distributions — % return of capital | | | 56 | % | | | 59 | % |

Return of capital — attributable to net realized gains (losses) | | $ | 215 | | | $ | 653 | |

Return of capital — attributable to net change in unrealized gains (losses) | | | 15,562 | | | | 30,299 | |

Total return of capital | | $ | 15,777 | | | $ | 30,952 | |

G. Investment Income — The Company records dividends and distributions on the ex-dividend date. Interest income is recognized on the accrual basis, including amortization of premiums and accretion of discounts. When investing in securities with paid-in-kind interest, the Company will accrue interest income during the life of the security even though it will not be receiving cash as the interest is accrued. To the extent that interest income to be received is not expected to be realized, a reserve against income is established.

The Company may receive paid-in-kind and non-cash dividends and distributions in the form of additional units or shares from its investments. For paid-in-kind dividends, the additional units are not reflected in investment income during the period received, but are recorded as unrealized gains upon receipt. Non-cash distributions are reflected in investment income because the Company has the option to receive its distributions in cash or in additional units of the security. During the six months ended May 31, 2022, the Company did not receive any paid-in-kind dividends or non-cash distributions.

H. Distributions to Stockholders — Distributions to common stockholders are recorded on the ex- dividend date. Distributions to holders of MRP Shares are accrued on a daily basis. As required by the Distinguishing Liabilities from Equity topic of the FASB Accounting Standards Codification (ASC 480), the Company includes the accrued distributions on its MRP Shares as an operating expense due to the fixed term of this obligation. For tax purposes, payments made to the holders of the Company’s MRP Shares are treated as dividends or distributions.

The characterization of the distributions paid to holders of MRP Shares and common stock as either a dividend (eligible to be treated as qualified dividend income) or a distribution (return of capital) is determined after the end of the fiscal year based on the Company’s actual earnings and profits and may differ substantially from preliminary estimates.

I. Partnership Accounting Policy — The Company records its pro-rata share of the income (loss), to the extent of distributions it has received, allocated from the underlying partnerships and adjusts the cost basis of the underlying partnerships accordingly. These amounts are included in the Company’s Statement of Operations.

25

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

NOTES TO FINANCIAL STATEMENTS

(amounts in 000’s, except number of option contracts, share and per share amounts)

(UNAUDITED)

J. Taxes — The Company, as a corporation, is obligated to pay federal and state income tax on its taxable income. The Company invests in MLPs, which generally are treated as partnerships for federal income tax purposes. As a limited partner in the MLPs, the Company includes its allocable share of the MLP’s taxable income or loss in computing its own taxable income. Deferred income taxes reflect (i) taxes on unrealized gains (losses), which are attributable to the difference between fair value and tax cost basis, (ii) the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes and (iii) the net tax benefit of accumulated net operating and capital losses.

To the extent the Company has a deferred tax asset, consideration is given as to whether or not a valuation allowance is required. The need to establish a valuation allowance for deferred tax assets is assessed periodically by the Company based on the Income Tax Topic of the FASB Accounting Standards Codification (ASC 740), that it is more likely than not that some portion or all of the deferred tax asset will not be realized. In the assessment for a valuation allowance, consideration is given to all positive and negative evidence related to the realization of the deferred tax asset. This assessment considers, among other matters, the nature, frequency and severity of current and cumulative losses, forecasts of future profitability (which are highly dependent on future cash distributions from the Company’s holdings), the duration of statutory carryforward periods and the associated risk that certain loss carryforwards may expire unused.

The Company may rely to some extent on information provided by portfolio investments, which may not necessarily be timely, to estimate taxable income allocable to the units/shares of such companies held in the portfolio and to estimate the associated current and/or deferred tax liability. Such estimates are made in good faith. From time to time, as new information becomes available, the Company modifies its estimates or assumptions regarding the deferred tax liability. See Note 6 — Income Taxes.

The Company may be subject to withholding taxes on foreign-sourced income and accrues such taxes when the related income is earned.

The Company utilizes the average cost method to compute the adjusted tax cost basis of its MLP securities.

The Company’s policy is to classify interest and penalties associated with underpayment of federal and state income taxes, if any, as income tax expense on its Statement of Operations. Tax years subsequent to fiscal year 2017 remain open and subject to examination by the federal and state tax authorities.

K. Derivative Financial Instruments — The Company may utilize derivative financial instruments in its operations.

Interest rate swap contracts. The Company may use hedging techniques such as interest rate swaps to mitigate potential interest rate risk on a portion of the Company’s leverage. Such interest rate swaps would principally be used to protect the Company against higher costs on its leverage resulting from increases in interest rates. The Company does not hedge any interest rate risk associated with portfolio holdings. Interest rate transactions the Company may use for hedging purposes may expose it to certain risks that differ from the risks associated with its portfolio holdings. A decline in interest rates may result in a decline in the value of the swap contracts, which, everything else being held constant, would result in a decline in the net assets of the Company. In addition, if the counterparty to an interest rate swap defaults, the Company would not be able to use the anticipated net receipts under the interest rate swap to offset its cost of financial leverage.

26

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

NOTES TO FINANCIAL STATEMENTS

(amounts in 000’s, except number of option contracts, share and per share amounts)

(UNAUDITED)

Interest rate swap contracts are recorded at fair value with changes in value during the reporting period, and amounts accrued under the agreements, included as unrealized gains or losses in the Statement of Operations. Monthly cash settlements under the terms of the interest rate swap agreements or termination payments are recorded as realized gains or losses in the Statement of Operations. The Company generally values its interest rate swap contracts based on dealer quotations, if available, or by discounting the future cash flows from the stated terms of the interest rate swap agreement by using interest rates currently available in the market. See Note 8 — Derivative Financial Instruments.

Option contracts. The Company is also exposed to financial market risks including changes in the valuations of its investment portfolio. The Company may purchase or write (sell) call options. A call option on a security is a contract that gives the holder of the option, in return for a premium, the right to buy from the writer of the option the security underlying the option at a specified exercise price at any time during the term of the option.

The Company would realize a gain on a purchased call option if, during the option period, the value of such securities exceeded the sum of the exercise price, the premium paid and transaction costs; otherwise the Company would realize either no gain or a loss on the purchased call option. The Company may also purchase put option contracts. If a purchased put option is exercised, the premium paid increases the cost basis of the securities sold by the Company.

The Company may also write (sell) call options with the purpose of generating realized gains or reducing its ownership of certain securities. If the Company writes a call option on a security, the Company has the obligation upon exercise of the option to deliver the underlying security upon payment of the exercise price. The Company will only write call options on securities that the Company holds in its portfolio (i.e., covered calls).