QuickLinks -- Click here to rapidly navigate through this document

Filed pursuant to Rule 424(b)(3)

Registration No. 333-117152

PROSPECTUS

Prestige Brands, Inc.

Exchange Offer for

$210,000,000

91/4% Senior Subordinated Notes due 2012

We are offering to exchange:

up to $210,000,000 of our new 91/4% Senior Subordinated Notes due 2012, series B

for

a like amount of our outstanding 91/4% Senior Subordinated Notes due 2012.

Material Terms of Exchange Offer

- •

- The terms of the exchange notes to be issued in the exchange offer are identical to the outstanding notes, except that the transfer restrictions and registration rights relating to the outstanding notes will not apply to the exchange notes.

- •

- The exchange notes will be guaranteed jointly and severally by Prestige Brands International, LLC, which is the intermediate parent of the issuer, and by all of Prestige Brands International, LLC's domestic subsidiaries other than the issuer of the notes.

- •

- There is no existing public market for the outstanding notes or the exchange notes. We do not intend to list the exchange notes on any securities exchange or seek approval for quotation through any automated trading system.

- •

- You may withdraw your tender of notes at any time before the expiration of the exchange offer. We will promptly exchange all of the outstanding notes that are validly tendered and not withdrawn following the expiration of the exchange offer.

- •

- The exchange offer expires at 5:00 p.m., New York City time, on January 13, 2005, unless extended.

- •

- The exchange of notes will not be a taxable event for U.S. federal income tax purposes.

- •

- The exchange offer is not subject to any condition other than that it not violate applicable law or any applicable interpretation of the Staff of the Securities and Exchange Commission.

- •

- We will not receive any proceeds from the exchange offer.

For a discussion of risk factors that you should consider before participating in this exchange offer, see "Risk Factors" beginning on page 23 of this prospectus.

Neither the SEC nor any state securities commission has approved the notes to be distributed in the exchange offer, nor have any of these organizations determined that this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

December 14, 2004

| Summary | 1 | |

| Risk Factors | 23 | |

| Cautionary Statement Regarding Forward-Looking Statements | 35 | |

| Exchange Offer | 36 | |

| Use of Proceeds | 44 | |

| Capitalization | 45 | |

| Unaudited Pro Forma Combined Financial Data | 46 | |

| Selected Financial Data | 55 | |

| Management's Discussion and Analysis of Financial Condition and Results Of Operations | 59 | |

| Market, Ranking and Other Data | 84 | |

| Business | 85 | |

| Management | 100 | |

| Certain Relationships and Related Transactions | 107 | |

| Security Ownership of Certain Beneficial Owners and Management | 112 | |

| Description of Senior Credit Facility | 114 | |

| Description of the Notes | 117 | |

| Material United States Federal Income Tax Consequences | 171 | |

| Plan of Distribution | 176 | |

| Legal Matters | 177 | |

| Experts | 177 | |

| Where You Can Find More Information | 178 |

Trademarks and Trade Names

Trademarks and tradenames used in this prospectus are the property of their respective owners. We have utilized the ® and ™ symbols the first time each brand appears in this prospectus.

i

The following is a summary of the principal features of this exchange offer and should be read together with the more detailed information and other financial data included elsewhere in this prospectus.

Our Business

We sell well-recognized, brand name consumer products in the over-the-counter drug, household cleaning and personal care categories. Our core brands, set forth in the table below, have established high levels of consumer awareness and strong retail distribution across all major channels.

| Major Brands | Gross Sales for the Most Recent Fiscal Year(1) | Percentage of Gross Sales for the Most Recent Fiscal Year(1) | ||||

|---|---|---|---|---|---|---|

| | (unaudited) | |||||

| | ($ thousands) | (%) | ||||

| Over-the-Counter Drug: | ||||||

| Chloraseptic® (sore throat relief) | $ | 40,067 | 12.5 | |||

| Clear eyes® (eye redness relief) | 32,502 | 10.2 | ||||

| Compound W® (wart remover) | 29,163 | 9.1 | ||||

| Murine® (ear/eye care treatment) | 16,089 | 5.0 | ||||

| Little Remedies® (pediatric medicine) | 14,241 | 4.5 | ||||

| New-Skin® (liquid bandage) | 11,830 | 3.7 | ||||

| Household Cleaning: | ||||||

| Comet® (household cleaning products) | 84,279 | 26.3 | ||||

| Spic and Span® (household cleaning products) | 24,978 | 7.8 | ||||

| Personal Care: | ||||||

| Cutex® (nail care products) | 15,872 | 5.0 | ||||

| Denorex® (medicated shampoo) | 14,706 | 4.6 | ||||

- (1)

- Year ended December 31, 2003 forChloraseptic, Clear eyes, Murine, Little Remedies, Comet andSpic and Span and year ended March 31, 2004 forCompound W, New-Skin, Cutex andDenorex.

We have grown our company by acquiring strong and well-recognized brands from larger consumer products and pharmaceutical companies. We believe that these brands were considered non-core under previous ownership and, in most cases, did not benefit from the focus of senior level management or strong marketing support.

Our products are sold by mass merchandisers and in drug, grocery, dollar and club stores. Our senior management team and dedicated sales force maintain long-standing relationships with our top 50 customers, which accounted for approximately 81% of our gross sales on a pro forma basis, excluding the Vetco acquisition, for the year ended March 31, 2004.

Competitive Strengths

Strong Operating Margins and Stable Cash Flows. We believe our well recognized, diversified portfolio of brands and efficient operating model enable us to generate strong operating margins and stable cash flows. Our operating model focuses on marketing, sales, customer service and product development. We outsource manufacturing, warehousing, distribution and logistics to experienced, low-cost third-party providers. This operating model enables us to focus on maintaining and building the value associated with our brands, benefit from the economies of scale of our third-party providers, maintain a highly variable cost structure, minimal capital expenditures and low working capital needs

1

and use the product development and manufacturing expertise of our suppliers to meet customer and end consumer demand. Our operating model, however, requires us to depend on third-party providers for manufacturing and logistics services. In the event that our third-party providers are unable or unwilling to supply or ship our products, our inventory levels, sales, gross margins and, ultimately, our results of operations, could be adversely affected.

Diversified Portfolio of Leading Brands. We own and market brands that have high levels of consumer awareness and widespread retail distribution. On average, our major brands were established over 45 years ago and we believe they are widely recognized by consumers. The industry categories in which we sell our products, however, are highly competitive. These markets include numerous national manufacturers, distributors, marketers and retailers, many of which have greater resources than we do and may be able to spend more aggressively on advertising and marketing, which may have an adverse effect on our competitive position.

Stable and Attractive Industry Segments. We compete in the over-the-counter drug, household cleaning and personal care categories. We target brands in categories that generally receive less focus from large consumer products and pharmaceutical companies and we are highly responsive to product innovations, which facilitates category expansion. Although we believe these attributes enable us to maintain close and lasting relationships with our top customers, we depend on these large customers for a significant portion of our gross sales. For the year ended March 31, 2004, on a pro forma basis, excluding the Vetco acquisition, our top five and ten customers accounted for approximately 38.6% and 49.7% of our gross sales, respectively, and Wal-Mart itself accounted for approximately 22.5% of our gross sales. The loss of one or more of our top customers or any significant decrease in sales to these customers could have a material adverse effect on our business, financial condition and results of operation.

Experienced Senior Management Team with Proven Ability to Acquire, Integrate and Grow Brands. Led by chief executive officer, Peter Mann, we have an experienced senior management team averaging over 30 years of experience in marketing, sales, customer service and product development. Peter Mann and his management team have successfully managed the Medtech and Spic and Span businesses and have been responsible for integrating numerous brands into the portfolio. Unlike many large consumer products companies, which we believe often entrust their smaller brands to rotating junior employees, our experienced managers are dedicated to specific brands and remain with those brands as they grow and evolve.

Business Strategy

Our business strategy is to focus on our marketing, sales, customer service and product development efforts in order to drive growth and to continue to enhance the value associated with our brands. We plan to execute this strategy through:

- •

- Maintaining and Growing the Significant Value Associated with Our Brands. We will continue to reinvest in advertising and promotion to continue to drive the value of our brands. We will continue to support our brands through focused and creative marketing strategies. Our marketing programs include advertising, targeted couponing programs and in-store advertising. Given the high levels of competition in our industry, however, our marketing efforts may not result in increased sales and profitability.

- •

- Creating Successful Line Extensions and Innovative New Products. We believe that our brands' high consumer awareness and our focus on marketing and product development, coupled with the difficulty of creating new competing brands, provides a unique opportunity for us to extend our brands through line extensions. Although line extensions and the introduction of new

2

- •

- Increasing Distribution in High-Growth Channels. Our broad and diversified distribution capabilities enable us to participate in changing consumer retail trends. Recently, we have expanded our sales in dollar and club stores by introducing customized packaging and sizes of our brand name products for these higher growth channels. In the event dollar and club store sales growth is adversely affected by reduced consumer purchases, our focus on dollar and club store sales could hurt our sales and profitability.

- •

- Pursue Strategic Acquisitions. We intend to pursue strategic add-on acquisitions that enhance our product portfolio. Our outsourced manufacturing business model allows us to add new brands that we believe can be easily integrated into our business while providing opportunities to realize significant cost savings. Our operating results could be adversely affected in the event we do not realize all of the anticipated operating synergies and cost savings from any future acquisitions. We intend to pursue highly complementary market leading brands that further diversify our category, customer and channel focus.

products is critical to our continued growth, our efforts in this regard have in the past resulted in reduced sales of existing products.

The Acquisitions

The Medtech Acquisition

Our company was formed by GTCR Golder Rauner II, LLC, or GTCR, a Chicago-based private equity firm, to acquire Medtech Holdings, Inc., The Denorex Company and The Spic and Span Company. These acquisitions were completed in February and March 2004. After the acquisitions, Medtech, Denorex and Spic and Span continued to be managed by the same executive team, led by our chief executive officer, Peter Mann, that managed these businesses prior to the acquisition. In this prospectus, we refer to the acquisitions of Medtech, Denorex and Spic and Span collectively as the "Medtech acquisition." We acquired the following major brands in the Medtech acquisition:Compound W, New Skin, Spic and Span, Cutex andDenorex.

The Bonita Bay Acquisition

In April 2004, we acquired Bonita Bay Holdings, Inc. Bonita Bay was the parent holding company of Prestige Brands International, Inc. and conducted its business under the "Prestige" name. After we completed this acquisition, we renamed our top-tier holding company Prestige International Holdings, LLC and began to conduct our business under the "Prestige" name. We acquired the following major brands in connection with this acquisition:Chloraseptic, Comet, Clear Eyes and Murine.

In order to finance the Bonita Bay acquisition, repay existing indebtedness, including debt incurred in connection with the Medtech acquisition, and pay related fees and expenses, we (i) entered into a new $505.0 million senior secured credit facility, which we refer to as the "senior credit facility,"; (ii) issued the outstanding notes; and (iii) received a $58.5 million capital contribution from GTCR, its affiliates and co-investors and management. The financing transactions described above, along with the Bonita Bay acquisition, are referred to in this prospectus collectively as the "Bonita Bay acquisition."

Recent Developments

The Vetco Acquisition

On October 6, 2004, we acquired the rights to the Little Remedies® umbrella brand through our purchase of Vetco, Inc. Vetco is engaged in the development, distribution and marketing of pediatric over-the-counter healthcare products, primarily marketed under the Little Remedies brand name. Vetco's products include Little Noses® nasal products, Little Tummys® digestive health products, Little Colds® cough/cold remedies and Little Remedies New Parents Survival Kits. The Little Remedies

3

products deliver safe, gentle and effective relief of common childhood ailments without unnecessary additives such as saccharin, alcohol, artificial flavors, coloring dyes or harmful preservatives. Vetco distributes its products to drug and food stores, mass merchandisers and specialty retailers throughout the United States. Under our purchase agreement, we acquired all of Vetco's outstanding capital stock for approximately $49 million, subject to decrease based on Vetco's outstanding working capital as of the closing date. We financed this acquisition with approximately $30 million of borrowings under our senior credit facility and $19 million of cash on hand.

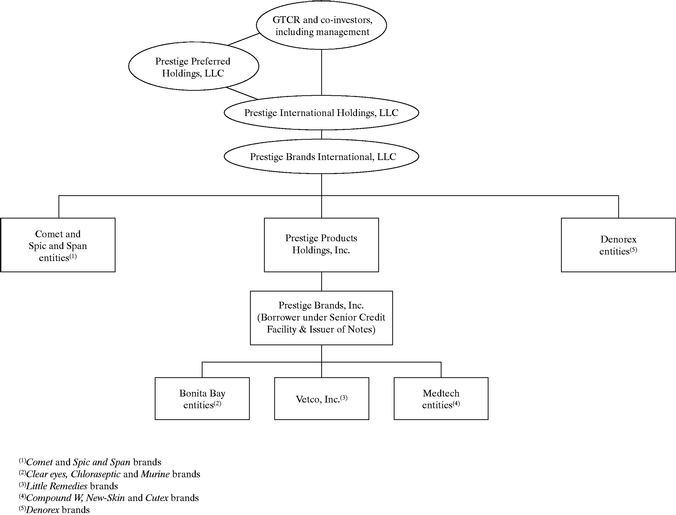

Corporate Structure

The following chart illustrates our organizational structure and also identifies the major brands owned by our subsidiaries.

In this prospectus, unless the context requires otherwise, the terms:

- •

- "We," "us," "our," the "Company" and "Prestige Holdings" refers to Prestige International Holdings, LLC, together with its consolidated subsidiaries, unless the context otherwise requires; and

- •

- "Prestige International" refers to Prestige Brands International, LLC, our intermediate holding company and the parent of Prestige Brands, Inc., the issuer of the notes.

4

Common Stock Offering

On November 12, 2004, Prestige Brands Holdings, Inc., which we refer to as "new parent," a newly created entity formed by affiliates of GTCR, filed an amendment to its registration statement initially filed on July 28, 2004, with the SEC. Pursuant to the amended offering terms, new parent proposes an initial public offering of its common stock in lieu of an initial public offering of income deposit securities, as contemplated by its initial registration statement.

Prior to the completion of the common stock offering, we expect that GTCR and its co-investors, including management, will exchange with new parent all their common units of Prestige Holdings for a proportionate number of shares of new parent common stock. Immediately following this exchange, new parent will become our ultimate parent. We refer to this exchange as the "reorganization."

New parent intends to use a portion of the net proceeds of the common stock offering to:

- •

- repay a portion of the borrowings under the senior credit facility;

- •

- redeem up to 40% of the notes; and

- •

- purchase all of Prestige Holdings' senior preferred units and class B preferred units.

At this time, we are unable to determine when the reorganization and common stock offering will occur, if at all. For more information on the common stock offering, see new parent's registration statement on Form S-1 which is on file with the SEC.

5

| The Initial Offering of Outstanding Notes | We sold the outstanding notes on April 6, 2004 to Citigroup Global Markets Inc., Banc of America Securities LLC and Merrill Lynch, Pierce, Fenner & Smith Incorporated. We collectively refer to those parties in this prospectus as the "initial purchasers." The initial purchasers subsequently resold the outstanding notes: (i) to qualified institutional buyers pursuant to Rule 144A; or (ii) outside the United States in compliance with Regulation S, each as promulgated under the Securities Act of 1933, as amended. | |||

Registration Rights Agreement | Simultaneously with the initial sale of the outstanding notes, we entered into a registration rights agreement for the exchange offer. In the registration rights agreement, we agreed, among other things, to use our reasonable best efforts to file a registration statement with the SEC and to commence and complete this exchange offer within 210 days of issuing the outstanding notes. The exchange offer is intended to satisfy your rights under the registration rights agreement. After the exchange offer is complete, you will no longer be entitled to any exchange or registration rights with respect to your outstanding notes. | |||

The Exchange Offer | We are offering to exchange the exchange notes, which have been registered under the Securities Act, for your outstanding notes, which were issued on April 6, 2004 in the initial offering. In order to be exchanged, an outstanding note must be properly tendered and accepted. All outstanding notes that are validly tendered and not validly withdrawn will be exchanged. We will issue exchange notes promptly after the expiration of the exchange offer. | |||

Resales | We believe that the exchange notes issued in the exchange offer may be offered for resale, resold and otherwise transferred by you without compliance with the registration and prospectus delivery requirements of the Securities Act provided that: | |||

• | the exchange notes are being acquired in the ordinary course of your business; and | |||

• | you are not participating, do not intend to participate, and have no arrangement or understanding with any person to participate, in the distribution of the exchange notes issued to you in the exchange offer. | |||

If any of these conditions are not satisfied and you transfer any exchange notes issued to you in the exchange offer without delivering a prospectus meeting the requirements of the Securities Act or without an exemption from registration of your exchange notes from these requirements you may incur liability under the Securities Act. If you are an affiliate of ours, you are not permitted to participate in this exchange offer. We will not assume, nor will we indemnify you against, any such liability. | ||||

6

Each broker-dealer that is issued exchange notes in the exchange offer for its own account in exchange for outstanding notes that were acquired by that broker-dealer as a result of market-making or other trading activities, must acknowledge that it will deliver a prospectus meeting the requirements of the Securities Act in connection with any resale of the exchange notes. A broker-dealer may use this prospectus for an offer to resell, resale or other retransfer of the exchange notes issued to it in the exchange offer. | ||||

Record Date | We mailed this prospectus and the related exchange offer documents to registered holders of outstanding notes on December 14, 2004. | |||

Expiration Date | The exchange offer will expire at 5:00 p.m., New York City time, January 13, 2005, unless we decide to extend the expiration date. | |||

Conditions to the Exchange Offer | The exchange offer is not subject to any condition other than that the exchange offer not violate applicable law or any applicable interpretation of the staff of the SEC. | |||

Procedures for Tendering Outstanding Notes | If you wish to tender your notes for exchange in this exchange offer, you must transmit to the exchange agent on or before the expiration date either: | |||

• | an original or a facsimile of a properly completed and duly executed copy of the letter of transmittal, which accompanies this prospectus, together with your outstanding notes and any other documentation required by the letter of transmittal, at the address provided on the cover page of the letter of transmittal; or | |||

• | If the notes you own are held of record by The Depository Trust Company, or "DTC," in book-entry form and you are making delivery by book-entry transfer, a computer-generated message transmitted by means of the Automated Tender Offer Program System of DTC, or "ATOP," in which you acknowledge and agree to be bound by the terms of the letter of transmittal and which, when received by the exchange agent, forms a part of a confirmation of book-entry transfer. As part of the book-entry transfer, DTC will facilitate the exchange of your notes and update your account to reflect the issuance of the exchange notes to you. ATOP allows you to electronically transmit your acceptance of the exchange offer to DTC instead of physically completing and delivering a letter of transmittal to the notes exchange agent. | |||

7

In addition, you must deliver to the exchange agent on or before the expiration date: | ||||

• | a timely confirmation of book-entry transfer of your outstanding notes into the account of the notes exchange agent at DTC if you are effecting delivery of book-entry transfer, or | |||

• | if necessary, the documents required for compliance with the guaranteed delivery procedures. | |||

Special Procedures for Beneficial Owners | If you are the beneficial owner of book-entry interests and your name does not appear on a security position listing of DTC as the holder of the book-entry interests or if you are a beneficial owner of outstanding notes that are registered in the name of a broker, dealer, commercial bank, trust company or other nominee and you wish to tender the book-entry interest or outstanding notes in the exchange offer, you should contact the person in whose name your book-entry interests or outstanding notes are registered and promptly instruct that person to tender on your behalf. | |||

Withdrawal Rights | You may withdraw the tender of your outstanding notes at any time prior to 5:00 p.m., New York City time on January 13, 2005. | |||

Federal Income Tax Considerations | The exchange of outstanding notes will not be a taxable event for United States federal income tax purposes. | |||

Use of Proceeds | We will not receive any proceeds from the issuance of exchange notes pursuant to the exchange offer. We will pay all of our expenses incident to the exchange offer. | |||

Exchange Agent | U.S. Bank National Association is serving as the exchange agent in connection with the exchange offer. | |||

8

Summary of Terms of the Exchange Notes

The form and terms of the exchange notes are the same as the form and terms of the outstanding notes, except that the exchange notes will be registered under the Securities Act. As a result, the exchange notes will not bear legends restricting their transfer and will not contain the registration rights and liquidated damage provisions contained in the outstanding notes. The exchange notes represent the same debt as the outstanding notes. Both the outstanding notes and the exchange notes are governed by the same indenture.

| Issuer | Prestige Brands, Inc. | |||

Securities | $210.0 million aggregate principal amount of 9 1/4% Senior Subordinated Notes due 2012, Series B. | |||

Maturity | April 15, 2012 | |||

Interest payment dates | April 15 and October 15, commencing October 15, 2004. | |||

Guarantees | The exchange notes will be fully and unconditionally guaranteed, jointly and severally, on a senior subordinated unsecured basis, by Prestige International, the intermediate holding company of the issuer of the exchange notes, and all of its domestic subsidiaries, other than the issuer of the exchange notes, as set forth below: | |||

• | Prestige Brands International, LLC | |||

• | Prestige Household Holdings, Inc. | |||

• | Prestige Household Brands, Inc. | |||

• | The Comet Products Corporation | |||

• | The Spic and Span Company | |||

• | Prestige Products Holdings, Inc. | |||

• | Prestige Acquisition Holdings, LLC | |||

• | Bonita Bay Holdings, Inc. | |||

• | Prestige Brands Holdings, Inc. | |||

• | Prestige Brands International, Inc. | |||

• | Prestige Brands Financial Corporation | |||

• | Medtech Holdings, Inc. | |||

• | Medtech Products, Inc. | |||

• | Pecos Pharmaceuticals, Inc. | |||

• | The Cutex Company | |||

• | Prestige Personal Care Holdings, Inc. | |||

• | Prestige Personal Care, Inc. | |||

• | The Denorex Company | |||

• | Vetco, Inc. | |||

Future domestic subsidiaries may also be required to guarantee the exchange notes. | ||||

9

Ranking | The exchange notes will be unsecured senior subordinated obligations and will be subordinated to our senior credit facility and other existing and future senior indebtedness. The exchange notes will rank equally to our senior subordinated indebtedness and will rank senior to our subordinated indebtedness. Each guarantee will be unsecured and subordinated to senior indebtedness of the guarantor. In addition, the exchange notes will effectively rank junior to all existing and future indebtedness and other liabilities of our subsidiaries that are not guarantors, which will initially consist of our non-domestic subsidiaries and our non-wholly owned subsidiaries. Because the exchange notes are subordinated, in the event of bankruptcy, liquidation or dissolution and acceleration of or payment default on senior indebtedness, holders of the exchange notes will not receive any payment until holders of senior indebtedness and senior guarantor indebtedness have been paid in full. The exchange notes will also be subordinated to our secured indebtedness, including our new senior secured credit facility, as to the assets securing such indebtedness. | |||

As of October 31, 2004, we had the following amount of indebtedness that ranks senior orpari passu with the exchange notes, not including trade payables and the outstanding notes, which will be replaced by the exchange notes in equal principal amounts to the extent tendered: | ||||

| | | October 31, 2004 | |||

|---|---|---|---|---|---|

| | | (dollars in millions) | |||

| Indebtedness senior to the exchange notes | $ | 483.2 | |||

| Indebtednesspari passu with the exchange notes | — | ||||

| Total | $ | 483.2 | |||

| Optional redemption | We may redeem some or all of the exchange notes, at any time on or prior to April 15, 2008 at a redemption price equal to 100% plus a make-whole premium and on or after April 15, 2008 at the redemption prices described elsewhere in this prospectus. | |||

Public equity offering optional redemption | Before April 15, 2007, we may redeem up to 40% of the aggregate principal amount of the exchange notes with the net proceeds of public equity offerings at 109.250% of the principal amount of the exchange notes, plus accrued interest, if at least 40% of the aggregate principal amount of the exchange notes originally issued remains outstanding after such redemption. If we complete our common stock offering, we intend to redeem 40% of the aggregate principal amount of the exchange notes. See "—Common Stock Offering." | |||

10

Change of control | When a change of control occurs, each holder of exchange notes may require us to repurchase some or all of its exchange notes at a purchase price equal to 101% of the principal amount of the exchange notes, plus accrued interest. Under the indenture, a change of control will occur when any of the following occur: | |||

• | a person or group, other than the existing equity investors or their affiliates, becomes the beneficial owner of 50% or more of the voting securities of Prestige Holdings; | |||

• | all or substantially all of the assets of Prestige Holdings are sold or it merges with or into another entity such that its voting securities no longer exist; | |||

• | during any 2-year period, the members of the board of managers of Prestige Holdings at the beginning of the period no longer constitute at least a majority of the board; or | |||

• | the equity holders of Prestige Holdings approve any plan of liquidation or dissolution. | |||

This definition is subject to important exceptions and qualifications, which are described under the heading "Description of the Notes" in this prospectus. | ||||

Covenants | The indenture under which the outstanding notes were issued will govern the exchange notes. The indenture contains covenants that, among other things, will limit our ability and the ability of our subsidiaries to: | |||

• | incur additional indebtedness; | |||

• | pay dividends on, redeem or repurchase our capital stock; | |||

• | make investments; | |||

• | create liens; | |||

• | sell assets; | |||

• | in the case of our restricted subsidiaries, incur obligations that restrict their ability to make dividend or other payments to us; | |||

• | in the case of our restricted subsidiaries, guarantee or secure indebtedness; | |||

• | enter into transactions with affiliates; | |||

• | create unrestricted subsidiaries; and | |||

• | consolidate, merge or transfer all or substantially all of our assets and the assets of our subsidiaries on a consolidated basis. | |||

These covenants are subject to important exceptions and qualifications, which are described under the heading "Description of the Notes" in this prospectus. | ||||

Risk Factors

You should refer to the section entitled "Risk Factors" elsewhere in this prospectus for an explanation of specified risks of participating in the exchange offer.

11

Summary Unaudited Pro Forma Financial Data

The following table sets forth our summary unaudited pro forma combined financial data for the fiscal year ended March 31, 2004 and as of and for the six months ended September 30, 2004.

The summary unaudited pro forma income statement and other financial data for the fiscal year ended March 31, 2004 and the six months ended September 30, 2004 have been prepared to illustrate the effects of the Medtech acquisition, the Bonita Bay acquisition and the Vetco acquisition as if they had occurred on April 1, 2003. Bonita Bay, Spic and Span and Vetco historically utilized a December 31 fiscal year. For purposes of the year ended March 31, 2004 data presented herein, the historical December 31, 2003 period was used for these businesses. The summary unaudited pro forma balance sheet as of September 30, 2004 gives effect to the Vetco acquisition as if it had occurred on that date.

The summary unaudited pro forma financial data and accompanying notes are provided for informational purposes only and are not necessarily indicative of the operating results that would have occurred had the Medtech acquisition, the Bonita Bay acquisition and the Vetco acquisition been consummated on the dates indicated above, nor are they necessarily indicative of our future results of operations.

Management believes that the summary unaudited pro forma financial data is a meaningful presentation because the issuer's ability to satisfy debt and other obligations is dependent upon cash flow from the businesses acquired in the Medtech, Bonita Bay and Vetco acquisitions.

The following information is qualified by reference to and should be read in conjunction with "Capitalization," "Unaudited Pro Forma Combined Financial Data," "Selected Financial Data," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the financial statements and notes thereto included elsewhere in this prospectus.

| | Pro Forma Combined | ||||||

|---|---|---|---|---|---|---|---|

| | Year Ended March 31, 2004 | Six Months Ended September 30, 2004 | |||||

| | (unaudited) (dollars in thousands) | ||||||

| Income Statement Data: | |||||||

| Net sales | $ | 285,521 | $ | 155,319 | |||

| Cost of sales (includes $1,805 and $5,249, respectively, of charges related to the step-up of inventory) | 133,774 | 76,249 | |||||

| Gross profit | 151,747 | 79,070 | |||||

| Advertising and promotion expenses | 39,931 | 24,396 | |||||

| Depreciation and amortization expenses | 10,740 | 5,245 | |||||

| General and administrative expenses | 26,330 | 10,157 | |||||

| Interest expense, net | 44,309 | 22,059 | |||||

| Other expense (income), net | (1,737 | ) | (134 | ) | |||

| Income before taxes | 32,174 | 17,347 | |||||

| Provision for income taxes | 12,226 | 6,592 | |||||

| Net income | $ | 19,948 | $ | 10,755 | |||

Other Financial Data: | |||||||

| EBITDA (1),(2) | $ | 87,223 | $ | 44,651 | |||

| Cash interest expense (3) | 41,466 | 20,640 | |||||

| Capital expenditures (4) | 612 | 143 | |||||

| Cash taxes paid (5) | 5,327 | 388 | |||||

| Ratio of earnings to fixed charges (6) | 1.7 | x | 1.8 | x | |||

12

| | | Pro Forma as of September 30, 2004 | |||

|---|---|---|---|---|---|

| | | (unaudited) (dollars in thousands) | |||

Balance Sheet Data: | |||||

| Cash and cash equivalents | $ | 9,009 | |||

| Total assets | 1,008,557 | ||||

| Total long-term debt including current maturities | 693,225 | ||||

| Members' equity | 189,624 | ||||

- (1)

- "EBITDA" represents net income before interest expense, income taxes and depreciation and amortization. EBITDA does not represent and should not be considered as an alternative to net income or cash flow from operations, as determined by generally accepted accounting principles, and our calculation thereof may not be comparable to that reported by other companies. We present EBITDA because we understand that it is used by some investors and lenders to determine a company's historical ability to service and/or incur indebtedness and to fund ongoing capital expenditures. This belief is based in part on our negotiations with our lenders, who have indicated that the amount of indebtedness we will be permitted to incur will be based, in part, on our EBITDA. EBITDA has limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are:

- •

- EBITDA does not reflect our capital expenditures or future requirements for capital expenditures or contractual commitments;

- •

- EBITDA does not reflect changes in, or cash requirements for, our working capital needs;

- •

- EBITDA does not reflect the significant interest expense, or the cash requirement necessary to service interest or principal payments, on our debts;

- •

- Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and EBITDA does not reflect any cash requirements for such replacements; and

- •

- Other companies in our industry may calculate EBITDA differently than we do, limiting its usefulness as a comparative measure.

- Because of these limitations, you should not consider EBITDA as a measure of discretionary cash available to us to invest in the growth of our business. We compensate for these limitations by relying primarily on our GAAP results and using EBITDA only supplementally. See the Prestige International, Bonita Bay and Spic and Span statements of cash flows set forth in the financial statements included elsewhere in this prospectus. The following is a reconciliation of pro forma cash flows from operations to pro forma EBITDA.

| | Pro Forma Combined Year Ended March 31, 2004 | Pro Forma Combined Six Months Ended September 30, 2004 | ||||

|---|---|---|---|---|---|---|

| | (unaudited) (dollars in thousands) | |||||

| Cash flows from operations | $ | 23,378 | $ | 16,451 | ||

| Interest expense, net of non-cash interest | 41,208 | 20,511 | ||||

| Net change in operating assets and liabilities | 8,046 | 840 | ||||

| Income tax provision | 12,226 | 6,592 | ||||

| Gain on sale of trademark | 2,900 | — | ||||

| Other | (535 | ) | 257 | |||

EBITDA | $ | 87,223 | $ | 44,651 | ||

13

- (2)

- In connection with the Medtech acquisition, the Bonita Bay acquisition and the Vetco acquisition, we identified significant historical expenses which management believes will not be incurred on a going forward basis. In addition, we identified cash cost reductions that we have realized as a result of our integration plans with respect to the Medtech acquisition, the Bonita Bay acquisition and the Vetco acquisition and that have resulted in a positive annualized effect on pro forma EBITDA when compared to recent operating history of the separate companies. See "Management's Discussion and Analysis of Financial Condition and Results of Operations—General—Acquisition-Related Synergies." In addition, covenants in our senior credit facility and indenture provide for adjustments to EBITDA when calculating important ratios. Permitted adjustments include, but are not limited to, the purchase accounting impact of acquisitions, the exclusion of certain transaction costs, cost savings associated with acquisitions and other non-cash gains and losses. While we believe the expenses set forth below will not recur in future periods after implementation of such cost reduction measures, we may incur other expenses similar to the expenses described below in future periods. Therefore, the following items should not be viewed as indicative of future results.

| | Combined Year Ended March 31, 2004 | Combined Six Months Ended September 30, 2004 | ||||||

|---|---|---|---|---|---|---|---|---|

| | (unaudited) (dollars in thousands) | |||||||

| Historical adjustments: | ||||||||

| Purchase accounting impact of Medtech acquisition, Prestige acquisition and Vetco acquisition | 1,805 | (a) | 5,249 | (a) | ||||

| Purchase accounting impact of Clear eyes andMurine acquisitions | 2,957 | (a) | — | |||||

| Loss on forgiveness of loan | 1,404 | (b) | — | |||||

| Gain on sale ofSpic and Span license in Italy | (2,900 | )(c) | — | |||||

| Clear eyes andMurine international acquisitions | 900 | (d) | — | |||||

| IncrementalClear eyes andMurine transition services agreement costs | 300 | (e) | — | |||||

| Cost savings: | ||||||||

| Permanent headcount reductions | 5,645 | (f) | 1,287 | (f) | ||||

| Consolidation of warehousing and distribution | 3,546 | (f) | 645 | (f) | ||||

| Consolidation of sales, marketing, and other programs | 3,025 | (f) | 819 | (f) | ||||

| Facilities rationalization | 394 | (f) | 123 | (f) | ||||

| Total(g) | $ | 17,076 | $ | 8,123 | ||||

- (a)

- In connection with the Medtech acquisition, Prestige acquisition and Vetco acquisition and Bonita Bay's acquisition ofClear eyes andMurine, inventory was written up to its estimated selling price, less cost of disposal and a reasonable profit allowance for the selling effort. These adjustments represent the amount by which the cost of goods sold recorded exceeded the original inventory costs.

- (b)

- Reflects the loss incurred, prior to the acquisition of Spic and Span, in connection with the forgiveness of a loan to Spic and Span.

- (c)

- In November 2003, we sold the exclusive right to use the Spic and Span brand name in Italy and recognized a one-time gain of $2.9 million.

14

- (d)

- During fiscal 2003, Bonita Bay completed its transition of the exclusive rights to sellClear eyes andMurine products from Abbott Laboratories in the following countries:

- •

- Australia (Sept. 2003);

- •

- Canada (Sept. 2003);

- •

- Hong Kong (July 2003);

- •

- Venezuela (Nov. 2003);

- •

- United Kingdom (Oct. 2003);

- •

- Ireland (Dec. 2003); and

- •

- New Zealand (Sept. 2003).

- (e)

- Represents costs charged to us during the transition services period with Abbott Laboratories that were duplicative in nature. The domestic transition services agreement extended through March 2003 and the international transition services agreement extended through December 2003. During this same time period, we had hired internal resources to perform the same services.

- (f)

- We have undertaken a detailed review of the combined operations of Medtech, Denorex, Spic and Span, Bonita Bay and Vetco and identified areas of overlap and cost savings. Set forth below is a summary of these savings:

- (i)

- We have eliminated approximately 14 full-time equivalent positions as part of a permanent headcount reduction of our employees in connection with the Medtech acquisition and the Prestige acquisition. In addition, we have a formal plan in place to eliminate approximately 13 full-time equivalent positions at Vetco upon integrating Vetco's operations.

- (ii)

- We have contracted with one logistics services provider, which provides warehouse services such as receiving, storage, processing, tracking and shipping, that has allowed us to consolidate from the three logistics services providers, including three warehouses, that historically served the companies. This adjustment represents the cost savings of placing all of our warehouse and distribution needs with this service provider.

- (iii)

- We have contracted with one advertising agency, one brokerage structure and one media buying group that are handling the collective sales and marketing needs for the combined companies following the Medtech acquisition and the Bonita Bay acquisition. These service providers will also handle the Vetco operations once integration is complete. Additionally, we have eliminated certain corporate overhead costs, principally legal, banking and insurance, that upon completion of the Medtech acquisition and the Bonita Bay acquisition were no longer required for each of the separate companies. This adjustment represents the net impact of placing all of our advertising and media buying needs under Medtech's existing contracts, moving the existing brokerage arrangements for all of our other subsidiaries under Medtech's brokerage contract or in-house and the elimination of certain historical overhead costs.

Prior to this transition in 2003, under the terms of the original purchase agreement with Abbott Laboratories, we received a percentage of sales on theClear eyes andMurine products in these international markets with an option to transition such rights in the future once we met applicable regulatory requirements. We continue to operate under this royalty arrangement for smaller countries for which the international rights have not yet been transitioned. This adjustment reflects the approximate net impact on the statement of operations had these seven countries' rights been fully transitioned on January 1, 2003.

15

- (iv)

- We have eliminated one leased location, and identified one additional leased location that will be eliminated, in connection with the Medtech acquisition and the Bonita Bay acquisition. This amount represents the direct and indirect costs associated with maintaining these two redundant facilities.

- (g)

- The cost savings set forth above specifically exclude any one-time costs expected in order to achieve the anticipated cost savings estimated at $2.4 million.

- (3)

- Cash interest expense represents total interest expense less amortization of deferred financing fees.

- (4)

- Capital expenditures for the year ended March 31, 2004 represents the sum of Prestige International of $108, Bonita Bay of $370, Spic and Span of $59 and Vetco of $75. Capital expenditures for the six months ended September 30, 2004 represents the sum of Prestige International of $143 and Vetco of $0.

- (5)

- Cash taxes paid for the year ended March 31, 2004 represents the sum of Prestige International of $128, Bonita Bay of $5,167, Spic and Span of $10 and Vetco of $22. Cash taxes paid for the six months ended September 30, 2004 represents the sum of Prestige International of $388 and Vetco of $0.

- (6)

- For the purposes of determining the ratio of earnings to fixed charges, earnings are defined as earnings before income taxes and extraordinary items, plus fixed charges. Fixed charges consist of interest expense, including amortization of debt issuance costs and a portion of operating lease rental expense deemed to be representative of the interest factor.

16

Summary Historical Financial Data of Prestige International and Predecessor

Summary historical financial data for the fiscal years ended March 31, 2001, 2002, 2003, for the period from April 1, 2003 to February 5, 2004 and for the six months ended September 30, 2003 is referred to as the "predecessor" information. On February 6, 2004, an indirect subsidiary of Prestige International acquired Medtech Holdings, Inc. and the Denorex Company, which at the time were both under common control and management, in a transaction accounted for using the purchase method. On April 6, 2004, an indirect subsidiary of Prestige International acquired Bonita Bay Holdings, Inc. in a transaction accounted for using the purchase method. The summary financial data after such dates includes the financial statement impact of recording fair value adjustments arising from such acquisitions. The income statement and other financial data of Prestige International and its predecessor for the fiscal years ended March 31, 2002 and 2003, the period from April 1, 2003 to February 5, 2004 and the period from February 6, 2004 to March 31, 2004 and the balance sheet data at March 31, 2003 and 2004 are derived from audited consolidated financial statements included elsewhere in this prospectus. The income statement and other financial data of Prestige International and its predecessor for the six months ended September 30, 2003 and 2004 and the balance sheet data at September 30, 2003 and 2004 are derived from unaudited consolidated financial statements included elsewhere in this prospectus. The income statement and other financial data for predecessor for the fiscal year ended March 31, 2001 are derived from audited consolidated financial statements not included in this prospectus.

The summary historical financial data set forth below is not necessarily indicative of the results of future operations and should be read in conjunction with the discussion under the headings "Selected Financial Data—Prestige International and Predecessor" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the historical combined consolidated financial statements and accompanying notes included elsewhere in this prospectus.

17

| | Predecessor | Prestige International | Predecessor | Prestige International | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Fiscal Year Ended March 31, | Period From April 1, 2003 to February 5, 2004 | Period From February 6, 2004 to March 31, 2004 | Six Months Ended September 30, | |||||||||||||||||||

| | 2001 | 2002 | 2003 | 2003 | 2004 | ||||||||||||||||||

| | | | | | | (unaudited) | |||||||||||||||||

| | (dollars in thousands) | ||||||||||||||||||||||

| Income Statement Data: | |||||||||||||||||||||||

| Net sales | $ | 8,655 | $ | 46,201 | $ | 76,439 | $ | 69,059 | $ | 18,861 | $ | 43,158 | $ | 149,103 | |||||||||

| Cost of sales (1) | 3,075 | 18,699 | 27,475 | 26,254 | 10,023 | 16,087 | 73,966 | ||||||||||||||||

| Gross profit | 5,580 | 27,502 | 48,964 | 42,805 | 8,838 | 27,071 | 75,137 | ||||||||||||||||

| Advertising and promotion expenses | 149 | 5,230 | 14,274 | 12,601 | 1,689 | 9,254 | 24,075 | ||||||||||||||||

| Depreciation and amortization expenses | 305 | 3,992 | 5,274 | 4,498 | 931 | 2,630 | 4,543 | ||||||||||||||||

| General and administrative expenses | 560 | 8,576 | 12,075 | 12,068 | 1,649 | 4,934 | 9,423 | ||||||||||||||||

| Interest expense, net | 2,051 | 8,766 | 9,747 | 8,157 | 1,725 | 4,388 | 21,883 | ||||||||||||||||

| Other expense | 124 | — | 685 | 1,404 | — | — | 7,567 | ||||||||||||||||

| Income from continuing operations before taxes | 2,391 | 938 | 6,909 | 4,077 | 2,844 | 5,865 | 7,646 | ||||||||||||||||

| Provision/(benefit) for income taxes | (77 | ) | 311 | 3,902 | 1,684 | 1,054 | 2,312 | 3,110 | |||||||||||||||

| Income from continuing operations | 2,468 | 627 | 3,007 | 2,393 | 1,790 | 3,553 | 4,536 | ||||||||||||||||

| Income/(loss) from discontinued operations | 60 | (67 | ) | (5,644 | ) | — | — | — | — | ||||||||||||||

| Cumulative effect of change in accounting principle | — | — | (11,785 | ) | — | — | — | — | |||||||||||||||

| Net income/(loss) | $ | 2,528 | $ | 560 | $ | (14,422 | ) | $ | 2,393 | $ | 1,790 | $ | 3,553 | $ | 4,536 | ||||||||

18

Other Financial Data: | |||||||||||||||||||||||

| EBITDA (2) | $ | 4,747 | $ | 13,696 | $ | 21,930 | $ | 16,732 | $ | 5,500 | $ | 12,883 | $ | 34,072 | |||||||||

| Capital expenditures | 123 | 95 | 421 | 66 | 42 | 63 | 143 | ||||||||||||||||

| Cash provided by (used in): | |||||||||||||||||||||||

| Operating activities | 1,978 | 3,940 | 12,519 | 7,843 | (1,706 | ) | 3,541 | 26,405 | |||||||||||||||

| Investing activities | (37,542 | ) | (4,412 | ) | (2,165 | ) | (576 | ) | (166,874 | ) | (465 | ) | (373,393 | ) | |||||||||

| Financing activities | 36,491 | 5,526 | (14,708 | ) | (8,629 | ) | 171,973 | (1,022 | ) | 372,404 | |||||||||||||

| Ratio of earnings to fixed charges (3) | 2.1 | x | 1.1 | x | 1.7 | x | 1.5 | x | 2.6 | x | 2.2 | x | 1.3 | x | |||||||||

Balance Sheet Data (at period end): | |||||||||||||||||||||||

| Cash and cash equivalents | $ | 2,830 | $ | 7,884 | $ | 3,530 | $ | 3,393 | $ | 28,809 | |||||||||||||

| Total assets | 151,292 | 174,783 | 143,910 | 326,622 | 977,428 | ||||||||||||||||||

| Total long-term debt, including current maturities | 80,918 | 93,530 | 81,021 | 148,694 | 663,225 | ||||||||||||||||||

| Stockholders' equity | 46,030 | 59,201 | 44,797 | 126,509 | 189,624 | ||||||||||||||||||

- (1)

- For the period from February 6, 2004 to March 31, 2004 and the six months ended September 30, 2004, cost of sales includes $1,805 and $5,249, respectively, of charges related to the step-up of inventory.

- (2)

- "EBITDA" represents net income (loss) before loss (income) from discontinued operations, cumulative effect of change in accounting principle, interest expense, income taxes and depreciation and amortization. EBITDA does not represent and should not be considered as an alternative to net income or cash flow from operations, as determined by generally accepted accounting principles, and our calculation thereof may not be comparable to that reported by other companies. We present EBITDA because we understand that it is used by some investors and lenders to determine a company's historical ability to service and/or incur indebtedness and to fund ongoing capital expenditures. This belief is based, in part, on our negotiations with our lenders, who have indicated that the amount of indebtedness we will be permitted to incur will be based, in part, on our EBITDA. EBITDA has limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are:

- •

- EBITDA does not reflect our capital expenditures, or future requirements for capital expenditures or contractual commitments;

- •

- EBITDA does not reflect changes in, or cash requirements for, our working capital needs;

- •

- EBITDA does not reflect the significant interest expense, or the cash requirement necessary to service interest or principal payments, on our debts;

- •

- although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and EBITDA does not reflect any cash requirements for such replacements; and

- •

- other companies in our industry may calculate EBITDA differently than we do, limiting its usefulness as a comparative measure.

19

- Because of these limitations, you should not consider EBITDA as a measure of discretionary cash available to us to invest in the growth of our business. We compensate for these limitations by relying primarily on our GAAP results and using EBITDA only supplementally. See the Combined Statements of Cash Flow of predecessor and Prestige International set forth in the financial statements included elsewhere herein. The following is a reconciliation of cash flows from operating activities to EBITDA:

| | Predecessor | Prestige International | Predecessor | | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | Period From April 1, 2003 to February 5, 2004 | | | | |||||||||||||||

| | Fiscal Year Ended March 31, | Period From February 6, 2004 to March 31, 2004 | Six Months Ended September 30, | |||||||||||||||||||

| | 2001 | 2002 | 2003 | 2003 | 2004 | |||||||||||||||||

| | | | | | | (unaudited) | ||||||||||||||||

| | (dollars in thousands) | |||||||||||||||||||||

| Cash flows from operating activities | $ | 1,978 | $ | 3,940 | $ | 12,519 | $ | 7,843 | $ | (1,706 | ) | $ | 3,541 | $ | 26,405 | |||||||

| Loss (income) from discontinued operations net of non-cash amortization of goodwill | (1,540 | ) | (1,413 | ) | 5,644 | — | — | — | — | |||||||||||||

| Interest expense, net of non-cash interest | 1,901 | 7,870 | 7,505 | 6,443 | 1,591 | 3,347 | 20,381 | |||||||||||||||

| Net change in operating assets and liabilities | 1,901 | 3,365 | (5,242 | ) | 2,480 | 5,328 | 6,188 | (37 | ) | |||||||||||||

| Income tax provision | (77 | ) | 311 | 3,902 | 1,684 | 1,054 | 2,312 | 3,110 | ||||||||||||||

| Deferred income taxes | 708 | (377 | ) | (1,622 | ) | (1,718 | ) | (696 | ) | (2,505 | ) | (8,220 | ) | |||||||||

| Loss on extinguishment of debt | (124 | ) | — | (685 | ) | — | — | — | (7,567 | ) | ||||||||||||

| Loss on disposal of property and equipment | — | — | (91 | ) | — | — | — | — | ||||||||||||||

| Other | — | — | — | — | (71 | ) | — | — | ||||||||||||||

EBITDA | $ | 4,747 | $ | 13,696 | $ | 21,930 | $ | 16,732 | $ | 5,500 | $ | 12,883 | $ | 34,072 | ||||||||

- (3)

- For the purposes of determining the ratio of earnings to fixed charges, earnings are defined as earnings before income taxes and extraordinary items, plus fixed charges. Fixed charges consist of interest expense, including amortization of debt issuance costs and a portion of operating lease rental expense deemed to be representative of the interest factor.

20

Summary Historical Financial Data of Bonita Bay Holdings, Inc.

The following table sets forth summary historical financial data of Bonita Bay Holdings, Inc., the parent of Prestige Brands International, Inc., which was acquired in the Bonita Bay acquisition. We have derived the summary historical consolidated financial data as of and for the fiscal years ended December 31, 2001, 2002 and 2003 from the audited financial statements of Bonita Bay which are included elsewhere in this prospectus. We have derived the selected historical financial data for the three month periods ended March 31, 2003 and 2004 from the unaudited financial statements and the related notes of Bonita Bay included elsewhere in this prospectus. In the opinion of management, the unaudited financial statements contain all adjustments, consisting only of normal recurring adjustments, necessary for a fair presentation of financial position and operating results. The results of operations for the three month period ended March 31, 2004 are not necessarily indicative of the operating results to be expected for the full year. The summary historical financial data set forth below should be read in conjunction with the discussion under the headings "Selected Financial Data—Bonita Bay Holdings, Inc.," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the historical consolidated financial statements of Bonita Bay Holdings, Inc. and accompanying notes included elsewhere in this prospectus.

| | Year Ended December 31, | Three Months Ended March 31, | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2001 | 2002 | 2003 | 2003 | 2004 | ||||||||||||

| | | | | (unaudited) | |||||||||||||

| | (dollars in thousands) | ||||||||||||||||

| Income Statement Data: | |||||||||||||||||

| Net sales | $ | 54,968 | $ | 110,566 | $ | 167,070 | $ | 35,978 | $ | 35,075 | |||||||

| Cost of sales | 26,489 | 58,448 | 82,663 | 19,528 | 19,101 | ||||||||||||

| Gross profit | 28,479 | 52,118 | 84,407 | 16,450 | 15,974 | ||||||||||||

| Advertising and promotion expenses | 7,425 | 10,133 | 19,525 | 4,061 | 4,690 | ||||||||||||

| Depreciation and amortization expenses | 4,156 | 745 | 1,745 | 531 | 406 | ||||||||||||

| General and administrative expenses | 4,138 | 5,556 | 9,733 | 2,516 | 2,012 | ||||||||||||

| Interest expense, net | 6,199 | 8,008 | 17,308 | 4,627 | 3,951 | ||||||||||||

| Other expense (income) | 1,604 | — | — | (159 | ) | — | |||||||||||

| Income before taxes | 4,957 | 27,676 | 36,096 | 4,874 | 4,915 | ||||||||||||

| Provision for income taxes | 1,874 | 11,107 | 13,823 | 1,767 | 1,910 | ||||||||||||

| Net income | $ | 3,083 | $ | 16,569 | $ | 22,273 | $ | 3,107 | $ | 3,005 | |||||||

| Other Financial Data: | |||||||||||||||||

| EBITDA (1) | $ | 15,312 | $ | 36,429 | $ | 55,149 | $ | 10,032 | $ | 9,272 | |||||||

| Capital expenditures | 120 | 242 | 370 | 85 | 114 | ||||||||||||

| Cash provided by (used in): | |||||||||||||||||

| Operating activities | 9,903 | 22,009 | 34,964 | 8,412 | 7,574 | ||||||||||||

| Investing activities | (144,926 | ) | (110,942 | ) | (875 | ) | (189 | ) | (114 | ) | |||||||

| Financing activities | 134,220 | 95,587 | (34,398 | ) | (7,711 | ) | (6,921 | ) | |||||||||

| Ratio of earnings to fixed charges | 1.8 | x | 4.4 | x | 3.1 | x | 2.0 | x | 2.2 | x | |||||||

Balance Sheet Data (at period end): | |||||||||||||||||

| Cash and cash equivalents | $ | 809 | $ | 7,464 | $ | 7,154 | $ | 7,693 | |||||||||

| Total assets | 230,486 | 362,827 | 363,490 | 359,143 | |||||||||||||

| Total long-term debt, including current maturities and warrants | 114,425 | 201,375 | 181,432 | 175,245 | |||||||||||||

| Stockholders' equity | 107,965 | 138,491 | 148,138 | 150,999 | |||||||||||||

21

- (1)

- "EBITDA" represents net income before interest expense, income taxes and depreciation and amortization. EBITDA does not represent and should not be considered as an alternative to net income or cash flow from operations, as determined by generally accepted accounting principles, and our calculation thereof may not be comparable to that reported by other companies. We present EBITDA because we understand that it is used by some investors and lenders to determine a company's historical ability to service and/or incur indebtedness and to fund ongoing capital expenditures. This belief is based on our negotiations with our lenders, who have indicated that the amount of indebtedness we will be permitted to incur will be based, in part, on our EBITDA. EBITDA has limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are:

- •

- EBITDA does not reflect our capital expenditures, or future requirements for capital expenditures or contractual commitments;

- •

- EBITDA does not reflect changes in, or cash requirements for, our working capital needs;

- •

- EBITDA does not reflect the significant interest expense, or the cash requirement necessary to service interest or principal payments, on our debts;

- •

- Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and EBITDA does not reflect any cash requirements for such replacements; and

- •

- Other companies in our industry may calculate EBITDA differently than we do, limiting its usefulness as a comparative measure.

- Because of these limitations, you should not consider EBITDA as a measure of discretionary cash available to us to invest in the growth of our business. We compensate for these limitations by relying primarily on our GAAP results and using EBITDA only supplementally. See the Consolidated Statement of Cash Flow of Bonita Bay included in the financial statements included elsewhere herein. The following is a reconciliation of cash flows from operating activities to EBITDA:

| | Year Ended December 31, | Three Months Ended March 31, | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2001 | 2002 | 2003 | 2003 | 2004 | |||||||||||

| | | | | (unaudited) | ||||||||||||

| | (dollars in thousands) | |||||||||||||||

| Cash flows from operating activities | $ | 9,903 | $ | 22,009 | $ | 34,964 | $ | 8,412 | $ | 7,574 | ||||||

| Interest expense, net of non-cash interest | 4,219 | 7,069 | 14,345 | 4,001 | 3,340 | |||||||||||

| Net change in operating assets and liabilities | 2,307 | 1,655 | 1,448 | (2,062 | ) | (1,344 | ) | |||||||||

| Income tax provision | 1,874 | 11,107 | 13,823 | 1,767 | 1,910 | |||||||||||

| Deferred income taxes | (1,387 | ) | (5,411 | ) | (8,688 | ) | (2,086 | ) | (2,208 | ) | ||||||

| Loss on extinguishment of debt | (1,604 | ) | — | — | — | — | ||||||||||

| Other | — | — | (743 | ) | — | — | ||||||||||

EBITDA | $ | 15,312 | $ | 36,429 | $ | 55,149 | $ | 10,032 | $ | 9,272 | ||||||

- (2)

- For the purposes of determining the ratio of fixed charges, earnings are defined as earnings before income taxes and extraordinary items, plus fixed charges. Fixed charges consist of interest expense, including amortization of debt issuance costs and a portion of operating lease rental expense deemed to be representative of the interest factor.

22

You should read and consider carefully each of the following factors, as well as the other information contained in this prospectus, before making a decision on whether to participate in the exchange offer.

Risks Associated with the Exchange Offer

Because there is no public market for the notes, you may not be able to resell your notes.

The exchange notes will be registered under the Securities Act, but will constitute a new issue of securities with no established trading market. As a result, it is difficult to predict:

- •

- the liquidity of any trading market that may develop;

- •

- the ability of holders to sell their exchange notes; or

- •

- the price at which the holders would be able to sell their exchange notes.

If a trading market were to develop, the exchange notes might trade at higher or lower prices than their principal amount or purchase price, depending on many factors, including prevailing interest rates, the market for similar debentures and our financial performance. Historically, the market for non-investment grade debt has been subject to disruptions that have caused substantial volatility in the price of securities similar to the notes offered by this prospectus. For example, the difference in yield between investment grade and non-investment grade debt increased dramatically in 2001 and 2002, driving prices down on non-investment grade debt, following the September 11 terrorist attack on the United States and a number of corporate accounting issues. The market for the notes, if any, may be subject to similar disruptions. Any such disruptions may adversely affect the value of your notes.

We understand that the initial purchasers presently intend to make a market in the notes. However, they are not obligated to do so, and any market-making activity with respect to the notes may be discontinued at any time without notice. In addition, any market-making activity will be subject to the limits imposed by the Securities Act and the Securities Exchange Act of 1934, and may be limited during the exchange offer or the pendency of an applicable shelf registration statement. In addition, some investors are prohibited from purchasing, or have policies against purchasing non-investment grade debt. As a result, an active trading market may not exist for the notes or any trading market that does develop may not be liquid. We do not intend to list the exchange notes on any securities exchange or seek approval for quotation through any automated trading system.

In addition, any holder of outstanding notes who tenders in the exchange offer for the purpose of participating in a distribution of the exchange notes may be deemed to have received restricted securities, and if so, will be required to comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale transaction. For a description of these requirements, see "Exchange Offer."

Your outstanding notes will not be accepted for exchange if you fail to follow the exchange offer procedures and, as a result, your notes will continue to be subject to existing transfer restrictions and you may not be able to sell your outstanding notes.

We will not accept your notes for exchange if you do not follow the exchange offer procedures. We will issue exchange notes as part of this exchange offer only after a timely receipt of your outstanding notes, a properly completed and duly executed letter of transmittal and all other required documents. Therefore, if you want to tender your outstanding notes, please allow sufficient time to ensure timely delivery. If we do not receive your notes, letter of transmittal and other required documents by the expiration date of the exchange offer, we will not accept your notes for exchange. We are under no duty to give notification of defects or irregularities with respect to the tenders of outstanding notes for exchange. If there are defects or irregularities with respect to your tender of notes, we may not accept your notes for exchange. For more information, see "Exchange Offer."

23

If you do not exchange your outstanding notes, your outstanding notes will continue to be subject to the existing transfer restrictions and you may not be able to sell your outstanding notes.

We did not register the outstanding notes, nor do we intend to do so following the exchange offer. Outstanding notes that are not tendered will therefore continue to be subject to the existing transfer restrictions and may be transferred only in limited circumstances under the securities laws. If you do not exchange your outstanding notes, you will lose your right to have your outstanding notes registered under the federal securities laws. As a result, if you hold outstanding notes after the exchange offer, you may not be able to sell your outstanding notes.

Risks Relating To The Notes

Our substantial indebtedness could adversely affect our financial health and prevent us from fulfilling our obligations under the notes.

As a result of the Medtech acquisition, Bonita Bay acquisition and Vetco acquisition, we have a significant amount of indebtedness. As of October 31, 2004, we had $693.2 million of total indebtedness and approximately $38.0 million would have been available for borrowing as additional senior debt under the revolving credit facility. The following table sets forth the aggregate amount of our debt payment obligations, including estimated interest, for the current fiscal year and each of the next five subsequent fiscal years (dollars in thousands):

| | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 6 Year Total | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Scheduled principal payments | 3,550 | 3,550 | 3,550 | 3,550 | 3,550 | 3,550 | 21,300 | |||||||

| Projected interest payments | 41,050 | 44,516 | 44,282 | 44,107 | 43,932 | 43,754 | 261,642 | |||||||

Total | 44,600 | 48,066 | 47,832 | 47,657 | 47,482 | 47,304 | 282,942 |

Our substantial indebtedness could have important consequences to you as an investor in our notes. For example, it could:

- •

- make it more difficult for the issuer to satisfy its obligations with respect to the notes;

- •

- increase our vulnerability to general adverse economic and industry conditions;

- •

- require us to dedicate a substantial portion of our cash flow from operations to payments on our indebtedness, thereby reducing the availability of our cash flow to fund working capital, capital expenditures, acquisitions and investments and other general corporate purposes;

- •

- limit our flexibility in planning for, or reacting to, changes in our business and the markets in which we operate;

- •

- place us at a competitive disadvantage compared to our competitors that have less debt; and

- •

- limit, among other things, our ability to borrow additional funds.

As of October 31, 2004, we had the following amount of indebtedness that ranks senior orpari passu with the exchange notes, not including trade payables and the outstanding notes, which will be replaced by the exchange notes in equal principal amounts to the extent tendered:

| | October 31, 2004 | |||

|---|---|---|---|---|

| | (dollars in millions) | |||

| Indebtedness senior to the notes | $ | 483.2 | ||

| Indebtednesspari passu with the notes | — | |||

| Total | $ | 483.2 | ||

The issuer and the guarantors also had $34.2 million in other balance sheet liabilities (including trade payables) as of October 31, 2004, which rankpari passu to the outstanding notes and exchange notes.

24

However, because the indenture relating to the notes requires that amounts otherwise payable to holders of the notes in a bankruptcy or similar proceeding be paid to holders of senior debt instead, holders of the notes may receive less, ratably, than holders of these other liabilities in any such proceeding. As of October 31, 2004, our non-guarantor subsidiary had total balance sheet liabilities (including trade payables) of approximately $0.7 million, all of which effectively rank senior to the notes.

The terms of the indenture governing the notes and the senior credit facility will allow us to issue and incur additional debt upon satisfaction of conditions set forth in the indenture and credit agreement. If new debt is added to current debt levels, the related risks described above could intensify.

Your right to receive payments on the notes is junior to the issuer's and guarantors' existing senior indebtedness and possibly all future borrowings. Accordingly, upon any distribution in a bankruptcy, liquidation, reorganization or similar proceeding, the holders of senior debt will be entitled to be paid in full in cash before any payment may be made with respect to the notes or the guarantees.

The notes and the guarantees rank behind all of the issuer's and the guarantors' existing and future senior indebtedness. As of October 31, 2004, the notes and the guarantees were subordinated to approximately $483.2 million of senior debt of the issuer and approximately $38.0 million was available for borrowing as additional senior debt under the revolving credit facility.

As a result of this subordination, upon any distribution to the issuer's or the guarantors' creditors in a bankruptcy, liquidation or reorganization or similar proceeding relating to the issuer or the guarantors, as applicable, or the issuer's or the guarantors' property, the holders of senior debt of the issuer and the guarantors will be entitled to be paid in full in cash before any payment may be made with respect to the notes or the guarantees.

In addition, all payments on the notes and the guarantees will be blocked in the event of a payment default on senior debt and may be blocked for up to 180 of 360 consecutive days in the event of non-payment defaults on designated senior debt.

In the event of a bankruptcy, liquidation or reorganization or similar proceeding relating to the issuer or the guarantors, as applicable, holders of the notes will participate with trade creditors and all other holders of subordinated indebtedness of the issuer and the guarantors in the assets remaining after the issuer and the guarantors have paid all of the senior debt. However, because the indenture relating to the notes requires that amounts otherwise payable to holders of the notes in a bankruptcy or similar proceeding be paid to holders of senior debt instead, holders of the notes may receive less, ratably, than holders of trade payables in any such proceeding. In any of these cases, the issuer and the guarantors may not have sufficient funds to pay all of their creditors and holders of notes may receive less, ratably, than the holders of senior debt.

Since the notes are unsecured, your right to enforce remedies is limited by the rights of holders of secured debt.

In addition to being contractually subordinated to all existing and future senior debt, the issuer's obligations under the notes and the guarantors' obligations under the guarantees are unsecured, while obligations of the issuer and the guarantors under the senior credit facility are secured by substantially all of their assets. As of October 31, 2004, approximately $483.2 million of senior debt of the issuer and approximately $38.0 million available for borrowing as additional senior debt under the revolving credit facility was secured by $1.0 billion of assets. However, as of October 31, 2004, the issuer and the guarantors had $70.8 million in current assets available to satisfy creditors if this debt were to be accelerated. Moreover, approximately $925.9 million of the issuer's and the guarantors' total assets are intangible assets, the vast majority of which are illiquid and may not be available to satisfy creditors if this debt were to be accelerated. If the issuer becomes insolvent or is liquidated, or if payment under the senior credit facility is accelerated, the lenders under the senior credit facility will be entitled to

25

exercise the remedies available to a secured lender under applicable law. These lenders have a claim on all assets securing the senior credit facility before the holders of unsecured debt, including the notes. In such event, it is possible that there would be little or no assets remaining after payment to these lenders from which claims to the holders of the exchange notes could be satisfied.

Our ability to generate cash depends on many factors beyond our control. Should these factors prove adverse in the future, we may not be able to generate sufficient cash to meet our liquidity needs, including fulfilling our obligations under the notes.

Our ability to make payments on and to refinance our indebtedness, including the notes and amounts borrowed under the senior credit facility, and to fund any strategic acquisitions we may make in the future, if any, will depend on our ability to generate cash in the future. This, to a certain extent, is subject to general economic, financial, competitive and other factors that are beyond our control.

Based on our current level of operations, we believe our cash flow from operations, together with available cash and available borrowings under the senior credit facility, will be adequate to meet future liquidity needs for at least the next 12 months. However, our business may not generate sufficient cash flow from operations in the future, our currently anticipated growth in net sales and cash flow may not be realized on schedule or our future borrowings may not be available to us under the senior credit facility in an amount sufficient to enable the issuer to repay indebtedness, including the notes, or to fund other liquidity needs. We may need to refinance all or a portion of our indebtedness, including these notes, on or before maturity. We may not be able to refinance any of our indebtedness, including the senior credit facility and the notes, on commercially reasonable terms or at all.

Our operating flexibility is limited in significant respects by the restrictive covenants in the senior credit facility and the indenture governing the notes.

The senior credit facility and the indenture governing the notes impose restrictions on us that could increase our vulnerability to adverse economic and industry conditions by limiting our flexibility in planning for and reacting to changes in our business and industry. Specifically, these restrictions limit our ability to:

- •

- borrow money or issue guarantees;

- •

- pay dividends or purchase stock;

- •