As filed with the Securities and Exchange Commission on June 25, 2018

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21597

PRIMECAP Odyssey Funds

(Exact name of registrant as specified in charter)

177 East Colorado Boulevard, 11th Floor

Pasadena, CA 91105

(Address of principal executive offices) (Zip code)

Michael J. Ricks

PRIMECAP Management Company

177 East Colorado Boulevard, 11th Floor

Pasadena, CA 91105

(Name and address of agent for service)

(626) 304-9222

Registrant’s telephone number, including area code

Date of fiscal year end: October 31

Date of reporting period: April 30, 2018

Item 1. Reports to Stockholders.

Item 1. Reports to Stockholders.

SEMIANNUAL REPORT

For the Six Months Ended April 30, 2018

PRIMECAP ODYSSEY STOCK (POSKX)

PRIMECAP ODYSSEY GROWTH (POGRX)

PRIMECAP ODYSSEY AGGRESSIVE GROWTH (POAGX)

| 2 | ||||

| 8 | ||||

| 8 | ||||

| 9 | ||||

| 10 | ||||

| 11 | ||||

| 13 | ||||

| 13 | ||||

| 18 | ||||

| 23 | ||||

| 29 | ||||

| 30 | ||||

| 31 | ||||

| 31 | ||||

| 32 | ||||

| 33 | ||||

| 34 | ||||

| 34 | ||||

| 35 | ||||

| 36 | ||||

| 37 | ||||

| 46 | ||||

| 48 | ||||

| 49 | ||||

1

Dear Fellow Shareholders,

For the six months ended April 30, 2018, the PRIMECAP Odyssey Stock Fund, PRIMECAP Odyssey Growth Fund, and PRIMECAP Odyssey Aggressive Growth Fund produced total returns of +3.64%, +10.82%, and +14.31%, respectively. The unmanaged S&P 500 Index produced a total return of +3.82% during the period.

The six-month period was a tale of two halves. Through late January, the market’s positive sentiment seemed unflappable. The economy finished 2017 on very solid footing. Tax reform legislation passed in December, catalyzing an optimism not seen since before the 2008-2009 recession. Consumer confidence climbed to decade-high levels, and consumption increased at a robust pace in last year’s fourth quarter, buoyed by continued gains in employment levels and household net worth. Industrial production and business investment also increased at a solid pace. Treasury yields rose but remained accommodative, and the U.S. dollar weakened on account of foreign economies’ growth and central bank commentary. The U.S. stock market reacted favorably to these developments, climbing steadily to record highs in late January – and doing so with historically-low levels of volatility.

Sentiment shifted in the second half of the period, starting in late January. Underlying economic measures remained robust, but volatility in the market spiked. Potential regulatory scrutiny of key technology companies and combative trade rhetoric added to the level of uncertainty. Interest rates and energy prices continued to rise, with the U.S. 10-year Treasury yield and Brent crude oil briefly surpassing 3% and 75 dollars per barrel, respectively, during April. Furthermore, the U.S. dollar bottomed in early 2018 before strengthening throughout April. In response to these developments, the U.S. equity market trended lower, finishing the period 8% below January highs.

Despite the second half retreat, cyclicals outperformed during the period, led by the consumer discretionary sector’s 14% total return. Energy (+10%) and information technology (+5%) also outperformed. More defensive sectors underperformed, particularly consumer staples (-4%) and utilities (-5%). The materials and real estate sectors also lost absolute ground during the period.

With over 90% of companies in the S&P 500 having reported, first quarter S&P 500 earnings are expected to have grown 25% year-over-year, enjoying a sizeable boost from tax reform. This result is significantly better than the 17% expected growth at quarter-end and represents the highest earnings growth since the third quarter of 2010. Record percentages of companies are exceeding consensus estimates on both revenues (77%) and earnings (78%).

Each of the PRIMECAP Odyssey Funds continued to be overweight in the health care, information technology, and industrials sectors, and underweight in the financials, energy, consumer staples, materials, utilities, and real estate sectors.

A more detailed discussion of the results of each PRIMECAP Odyssey Fund follows.

2

Letter to Shareholders

PRIMECAP Odyssey Funds

continued

PRIMECAP Odyssey Stock Fund

For the six months ended April 30, 2018, the Stock Fund’s total return of +3.64% slightly trailed the S&P 500’s total return of +3.82%.

Sector allocations modestly boosted relative performance, while unfavorable stock selection detracted from results. In sector allocation, underweight positions in consumer staples and utilities more than offset the fund’s underweight position in energy. Positive stock selection in financials, industrials, and information technology was not sufficient to offset underperformance elsewhere, particularly in consumer discretionary. Within information technology, Top 10 holdings NetApp (+51%) and Hewlett Packard Enterprise (+24%) outperformed, while Micro Focus International (-50%) provided a partial offset. Stock selection struggled most in consumer discretionary, where the portfolio suffered from its CarMax (-17%) and Newell Brands (-31%) holdings and no exposure to surging index heavyweights Amazon (+42%) and Netflix (+59%).

The Stock Fund was heavily invested in industrials stocks with a 20% weighting compared to 10% for the sector in the S&P 500.

The top 10 holdings, which collectively represented 26.5% of the portfolio at the period end, are listed below:

| PRIMECAP Odyssey Stock Fund Top 10 Holdings as of 4/30/18 | Ending % of Total Portfolio* | |||

JPMorgan Chase & Co. | 3.8 | |||

Hewlett Packard Enterprise Co. | 3.0 | |||

Astrazeneca PLC Sponsored ADR | 2.9 | |||

NetApp, Inc. | 2.9 | |||

Eli Lilly and Company | 2.6 | |||

FedEx Corporation | 2.4 | |||

HP Inc. | 2.3 | |||

Southwest Airlines Co. | 2.3 | |||

Discover Financial Services | 2.2 | |||

Sony Corporation Sponsored ADR | 2.1 | |||

Total % of Portfolio | 26.5 | % | ||

| * | The percentage is calculated by using the ending market value of the security divided by the ending market value of the total investments of the Fund. |

3

Letter to Shareholders

PRIMECAP Odyssey Funds

continued

PRIMECAP Odyssey Growth Fund

For the six months ended April 30, 2018, the Growth Fund returned +10.82%, ahead of both the S&P 500’s +3.82% total return and the Russell 1000 Growth Index’s total return of +5.68%.

The Growth Fund’s outperformance was driven by strong stock selection, particularly in the health care sector, where the fund’s holdings returned 20% relative to the benchmark’s 2% total return. Nektar Therapeutics (+247%) was the primary driver. ABIOMED (+56%) also played a helpful role, only partially offset by the underperformance of Seattle Genetics (-17%) and Alkermes (-9%). Elsewhere in the portfolio, strong stock selection in financials and information technology further benefited relative results; E*TRADE (+39%), NetApp (+51%), and Splunk (+53%) all outperformed. Selection in consumer discretionary was the lone significant detractor as the portfolio owned neither Amazon (+42%) nor Netflix (+59%).

The top 10 holdings, which collectively represented 29.1% of the portfolio at the period end, are listed below:

| PRIMECAP Odyssey Growth Fund Top 10 Holdings as of 4/30/18 | Ending % of Total Portfolio* | |||

Nektar Therapeutics | 5.0 | |||

ABIOMED, Inc. | 4.5 | |||

Alkermes Plc | 2.8 | |||

Seattle Genetics, Inc. | 2.6 | |||

United Continental Holdings, Inc. | 2.5 | |||

E*TRADE Financial Corporation | 2.5 | |||

Micron Technology, Inc. | 2.4 | |||

Adobe Systems Incorporated | 2.3 | |||

Alibaba Group Holding Ltd. Sponsored ADR | 2.3 | |||

Eli Lilly and Company | 2.2 | |||

Total % of Portfolio | 29.1 | % | ||

| * | The percentage is calculated by using the ending market value of the security divided by the ending market value of the total investments of the Fund. |

PRIMECAP Odyssey Aggressive Growth Fund

For the six months ended April 30, 2018, the Aggressive Growth Fund’s total return of +14.31% exceeded both the S&P 500’s total return of +3.82% and the Russell Midcap Growth Index’s total return of +5.16%.

4

Letter to Shareholders

PRIMECAP Odyssey Funds

continued

The Aggressive Growth Fund’s significant outperformance was driven almost entirely by its health care holdings, which returned 38% during the period. Nektar Therapeutics, the fund’s largest position, returned +247% and alone generated dramatic portfolio-level outperformance. The rest of the portfolio also contributed in aggregate, with ABIOMED (+56%) and Shutterfly (+90%) further boosting relative results.

The top 10 holdings, which collectively represented 34.2% of the portfolio at the period end, are listed below:

| PRIMECAP Odyssey Aggressive Growth Fund Top 10 Holdings as of 4/30/18 | Ending % of Total Portfolio* | |||

Nektar Therapeutics | 9.7 | |||

ABIOMED | 4.4 | |||

Sony Corporation Sponsored ADR | 3.3 | |||

Micron Technology, Inc. | 3.0 | |||

Alkermes Plc | 2.7 | |||

BlackBerry Limited | 2.3 | |||

United Continental Holdings, Inc. | 2.3 | |||

American Airlines Group, Inc. | 2.3 | |||

Shutterfly, Inc. | 2.1 | |||

Splunk Inc. | 2.1 | |||

Total % of Portfolio | 34.2 | % | ||

| * | The percentage is calculated by using the ending market value of the security divided by the ending market value of the total investments of the Fund. |

Outlook

The current bull market recently eclipsed the 9-year mark, and yet there are reasons for late-cycle optimism. Earnings growth has been exceptional in this year’s first quarter, and earnings strength is expected to continue throughout 2018, driven in part by the substantial corporate tax cut enacted in December 2017. Valuation is not excessive; following its late-period decline, the S&P 500 trades at a forward price/earnings multiple roughly in line with its 25-year historical average (16.1x). And we remain constructive on the U.S. economy, with 2.9% real GDP growth in last year’s fourth quarter and comparable growth expected during 2018 despite the 2.3% initial estimate for the March quarter. U.S. equities thus continue to be attractive, particularly relative to the 3.0% 10-year Treasury yield.

5

Letter to Shareholders

PRIMECAP Odyssey Funds

continued

There are, as always, reasons for concern. Today these include the heightened possibility of a trade war. While legitimate U.S. trade grievances certainly exist, President Trump’s threats are fraught with legal, economic, and geopolitical risks. We remain hopeful that this protectionist impulse will fade.

We are also watching closely the steady rise in oil prices. Our portfolio maintains a meaningful underweight position in the energy sector; additionally, we have large holdings in oil-consuming industries, such as airlines, cruise lines, and transportation companies. In perhaps a 21st century variant of the famous 1980 Julian Simon-Paul Ehrlich wager, our portfolio has consistently been more aligned with Professor Simon’s view of resource scarcity. Put another way, our portfolio suggests a broad preference for ‘mind’ – technology, innovation, and the like – over ‘matter’ – commodities and other real assets. This preference primarily reflects our view of company-level opportunities over the long term relative to current market prices. But rising energy prices clearly pose a multi-pronged risk to our portfolio.

Importantly, many of our holdings have opportunity sets that do not rely on near-term macroeconomic trends. Our largest sector positions are in information technology and health care, and in both sectors the forward P/E ratio is below its 20-year average despite, in our view, strong secular growth trajectories.

As bottom-up stock pickers, we spend our time searching for opportunities to invest in stocks with long-term prospects we find to be materially better than market prices imply. We believe, as Nobel laureate Alexander Fleming said, that it is the “lone worker who makes the first advance” and that “the prime idea is due to enterprise, thought, and perception of an individual.” This approach to stock selection, which drives portfolio composition and thus sector allocation, often results in portfolios that bear little resemblance to market indices, creating the possibility for lengthy periods of relative outperformance or underperformance. We nonetheless believe that this approach can generate superior results for shareholders over the long term.

Sincerely,

PRIMECAP Management Company

May 15, 2018

Past performance is not a guarantee of future results.

The funds invest in smaller companies, which involve additional risks such as limited liquidity and greater volatility. All funds may invest in foreign securities, which involves: 1) greater volatility; 2) political, economic, and currency risks; and 3) differences in accounting methods. Mutual fund investing involves risk, and loss of principal is possible. Growth stocks typically are more volatile than value stocks; however, value stocks have a lower expected growth rate in earnings and sales.

Please refer to the Schedule of Investments for details of fund holdings. Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security.

6

Letter to Shareholders

PRIMECAP Odyssey Funds

continued

The S&P 500 Index is a market capitalization-weighted index of 500 large-capitalization stocks commonly used to represent the U.S. equity market. The Russell 1000 Growth Index is an index that measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values (the Russell 1000 Index measures the performance of the large-cap segment of the U.S. equity universe). The Russell Midcap Growth Index measures the performance of those Russell Midcap companies with higher price-to-book ratios and higher forecasted growth values. You cannot invest directly in an index.

Price-to-earnings ratio is calculated by dividing the current share price of a stock by its earnings per share.

Earnings per share is calculated by taking the total earnings divided by the number of shares outstanding.

Earnings growth is not a prediction of a fund’s future performance.

The information provided herein represents the opinions of PRIMECAP Management Company and is not intended to be a forecast of future events, a guarantee of future results, or investment advice.

7

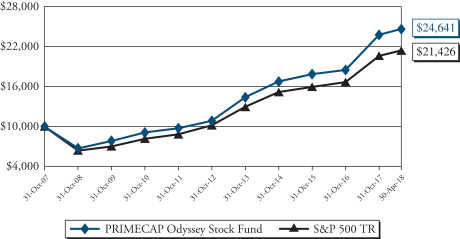

The following chart compares the value of a hypothetical $10,000 investment in the PRIMECAP Odyssey Stock Fund from October 31, 2007 to April 30, 2018, compared to the S&P 500. This chart illustrates the performance of a hypothetical $10,000 investment made October 31, 2007 and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

| Total Return Period Ended April 30, 2018 | ||||||||||||||||

| 1 Year | Annualized 5 Year | Annualized 10 Year | Annualized Since Inception^ | |||||||||||||

Stock Fund | 15.27% | 13.89% | 10.62% | 10.37% | ||||||||||||

S&P 500* | 13.27% | 12.96% | 9.02% | 8.76% | ||||||||||||

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-729-2307.

| * | The S&P 500 is a market capitalization-weighted index of 500 large-capitalization stocks commonly used to represent the U.S. equity market. |

| ^ | November 1, 2004 |

8

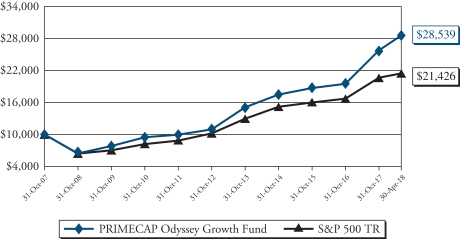

The following chart compares the value of a hypothetical $10,000 investment in the PRIMECAP Odyssey Growth Fund from October 31, 2007 to April 30, 2018, compared to the S&P 500. This chart illustrates the performance of a hypothetical $10,000 investment made October 31, 2007 and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

| Total Return Period Ended April 30, 2018 | ||||||||||||||||

| 1 Year | Annualized 5 Year | Annualized 10 Year | Annualized Since Inception^ | |||||||||||||

Growth Fund | 23.96% | 16.21% | 12.54% | 11.86% | ||||||||||||

S&P 500* | 13.27% | 12.96% | 9.02% | 8.76% | ||||||||||||

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-729-2307.

| * | The S&P 500 is a market capitalization-weighted index of 500 large-capitalization stocks commonly used to represent the U.S. equity market. |

| ^ | November 1, 2004 |

9

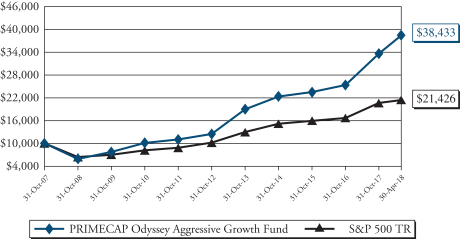

The following chart compares the value of a hypothetical $10,000 investment in the PRIMECAP Odyssey Aggressive Growth Fund from October 31, 2007 to April 30, 2018, compared to the S&P 500. This chart illustrates the performance of a hypothetical $10,000 investment made October 31, 2007 and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

| Total Return Period Ended April 30, 2018 | ||||||||||||||||

| 1 Year | Annualized 5 Year | Annualized 10 Year | Annualized Since Inception^ | |||||||||||||

Aggressive Growth Fund | 27.34% | 20.47% | 16.88% | 14.54% | ||||||||||||

S&P 500* | 13.27% | 12.96% | 9.02% | 8.76% | ||||||||||||

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-729-2307.

| * | The S&P 500 is a market capitalization-weighted index of 500 large-capitalization stocks commonly used to represent the U.S. equity market. |

| ^ | November 1, 2004 |

10

PRIMECAP Odyssey Stock Fund

Consumer Discretionary | 11.9% | |||

Consumer Staples | 0.6% | |||

Energy | 0.6% | |||

Financials | 12.6% | |||

Health Care | 17.2% | |||

Industrials | 20.3% | |||

Information Technology | 29.2% | |||

Materials | 0.6% | |||

Utilities | 0.2% | |||

Closed-End Funds (Information Technology) | 1.6% | |||

Short-Term Investments, net of Other Liabilities | 5.2% | |||

Total | 100.0% |

PRIMECAP Odyssey Growth Fund

Consumer Discretionary | 10.2% | |||

Consumer Staples | 0.1% | |||

Energy | 0.3% | |||

Financials | 7.3% | |||

Health Care | 32.1% | |||

Industrials | 12.8% | |||

Information Technology | 30.7% | |||

Materials | 0.5% | |||

Closed-End Funds (Information Technology) | 0.3% | |||

Rights (Health Care) | 0.0% | |||

Short-Term Investments, net of Other Liabilities | 5.7% | |||

Total | 100.0% |

The tables above list sector allocations as a percentage of each fund’s total net assets as of April 30, 2018. The management report may make reference to average allocations during the period. As a result, the sector allocations above may differ from those discussed in the management report.

11

Sector Breakdown

PRIMECAP Odyssey Funds

continued

PRIMECAP Odyssey Aggressive Growth Fund

Consumer Discretionary | 14.5% | |||

Consumer Staples | 0.1% | |||

Energy | 0.3% | |||

Financials | 3.9% | |||

Health Care | 35.6% | |||

Industrials | 11.4% | |||

Information Technology | 28.1% | |||

Materials | 0.4% | |||

Telecommunication Services | 1.3% | |||

Preferred Stocks (Financials) | 0.3% | |||

Rights (Health Care) | 0.2% | |||

Closed-End Funds (Information Technology) | 0.1% | |||

Short-Term Investments, net of Other Liabilities | 3.8% | |||

Total | 100.0% |

The table above lists sector allocations as a percentage of the fund’s total net assets as of April 30, 2018. The management report may make reference to average allocations during the period. As a result, the sector allocations above may differ from those discussed in the management report.

12

| Shares | Value | |||||||

| COMMON STOCKS – 93.2% | ||||||||

| Consumer Discretionary – 11.9% | ||||||||

| 13,000 | Adient PLC | $ | 796,770 | |||||

| 4,100,000 | Ascena Retail Group, Inc. (a) | 9,102,000 | ||||||

| 40,600 | Bed Bath & Beyond, Inc. | 708,876 | ||||||

| 1,460,200 | CarMax, Inc. (a) | 91,262,500 | ||||||

| 2,634,600 | Carnival Corp. | 166,137,876 | ||||||

| 385,028 | CBS Corp. – Class B | 18,943,378 | ||||||

| 442,000 | Comcast Corp. – Class A | 13,874,380 | ||||||

| 658,909 | Entercom Communications Corp. – Class A | 6,687,926 | ||||||

| 1,385,700 | L Brands, Inc. | 48,374,787 | ||||||

| 304,982 | Las Vegas Sands Corp. | 22,364,330 | ||||||

| 7,927,800 | Mattel, Inc. | 117,331,440 | ||||||

| 10,000 | McDonald’s Corp. | 1,674,400 | ||||||

| 1,100,000 | MGM Resorts International | 34,562,000 | ||||||

| 1,200,000 | Newell Brands, Inc. | 33,156,000 | ||||||

| 205,000 | Restaurant Brands International, Inc. | 11,156,100 | ||||||

| 1,394,000 | Ross Stores, Inc. | 112,704,900 | ||||||

| 380,000 | Royal Caribbean Cruises Ltd. | 41,112,200 | ||||||

| 4,390,000 | Sony Corp. – ADR | 201,193,700 | ||||||

| 225,000 | Tempur Sealy International, Inc. (a) | 10,068,750 | ||||||

| 160,000 | TJX Cos., Inc. | 13,576,000 | ||||||

| 1,231,200 | Tribune Media Co. – Class A | 46,527,048 | ||||||

| 1,716,600 | tronc, Inc. (a) | 31,516,776 | ||||||

| 310,000 | V.F. Corp. | 25,069,700 | ||||||

| 225,000 | Walt Disney Co. (The) | 22,574,250 | ||||||

| 549,939 | Whirlpool Corp. | 85,213,048 | ||||||

|

| |||||||

| 1,165,689,135 | ||||||||

|

| |||||||

| Consumer Staples – 0.6% | ||||||||

| 300,000 | Altria Group, Inc. | 16,833,000 | ||||||

| 150,000 | Philip Morris International, Inc. | 12,300,000 | ||||||

| 370,000 | Tyson Foods, Inc. – Class A | 25,937,000 | ||||||

|

| |||||||

| 55,070,000 | ||||||||

|

| |||||||

| Energy – 0.6% | ||||||||

| 20,000 | EOG Resources, Inc. | 2,363,400 | ||||||

| 95,000 | Exxon Mobil Corp. | 7,386,250 | ||||||

| 45,000 | National Oilwell Varco, Inc. | 1,740,150 | ||||||

| 955,000 | Range Resources Corp. | 13,226,750 | ||||||

| 246,534 | Schlumberger Ltd. | 16,902,371 | ||||||

The accompanying notes are an integral part of these financial statements.

13

Schedule of Investments

PRIMECAP Odyssey Stock Fund

April 30, 2018 (Unaudited) – continued

| Shares | Value | |||||||

| Energy (continued) | ||||||||

| 2,000,000 | Southwestern Energy Co. (a) | $ | 8,200,000 | |||||

| 751,300 | Transocean Ltd. (a) | 9,293,581 | ||||||

|

| |||||||

| 59,112,502 | ||||||||

|

| |||||||

| Financials – 12.6% | ||||||||

| 75,000 | American Express Co. | 7,406,250 | ||||||

| 1,483,500 | Bank of America Corp. | 44,386,320 | ||||||

| 2,430,200 | Charles Schwab Corp. (The) | 135,313,536 | ||||||

| 1,800,000 | Citigroup, Inc. | 122,886,000 | ||||||

| 387,963 | CME Group, Inc. | 61,174,006 | ||||||

| 103,400 | CNA Financial Corp. | 5,217,564 | ||||||

| 3,081,200 | Discover Financial Services | 219,535,500 | ||||||

| 3,389,400 | JPMorgan Chase & Co. | 368,698,932 | ||||||

| 384,950 | Marsh & McLennan Cos., Inc. | 31,373,425 | ||||||

| 281,600 | Mercury General Corp. | 12,877,568 | ||||||

| 645,800 | Northern Trust Corp. | 68,939,150 | ||||||

| 235,000 | Progressive Corp. (The) | 14,168,150 | ||||||

| 2,785,708 | Wells Fargo & Co. | 144,745,388 | ||||||

|

| |||||||

| 1,236,721,789 | ||||||||

|

| |||||||

| Health Care – 17.2% | ||||||||

| 1,354,400 | Abbott Laboratories | 78,731,272 | ||||||

| 1,362,000 | Agilent Technologies, Inc. | 89,537,880 | ||||||

| 934,000 | Amgen, Inc. | 162,964,320 | ||||||

| 7,985,100 | AstraZeneca PLC – ADR | 283,710,603 | ||||||

| 329,400 | Biogen, Inc. (a) | 90,123,840 | ||||||

| 677,900 | Boston Scientific Corp. (a) | 19,469,288 | ||||||

| 2,489,370 | Bristol-Myers Squibb Co. | 129,770,858 | ||||||

| 286,000 | CVS Health Corp. | 19,971,380 | ||||||

| 3,180,000 | Eli Lilly & Co. | 257,802,600 | ||||||

| 266,735 | GlaxoSmithKline PLC – ADR | 10,698,741 | ||||||

| 11,600 | Johnson & Johnson | 1,467,284 | ||||||

| 429,600 | Medtronic PLC | 34,423,848 | ||||||

| 1,100,000 | Merck & Co., Inc. | 64,757,000 | ||||||

| 1,306,850 | Novartis AG – ADR | 100,222,326 | ||||||

| 1,077,391 | PerkinElmer, Inc. | 79,037,404 | ||||||

| 333,044 | Roche Holding AG – CHF | 73,998,203 | ||||||

| 344,000 | Sanofi – ADR | 13,526,080 | ||||||

| 1,366,000 | Siemens Healthineers AG – EUR (a) (b) | 53,256,663 | ||||||

The accompanying notes are an integral part of these financial statements.

14

Schedule of Investments

PRIMECAP Odyssey Stock Fund

April 30, 2018 (Unaudited) – continued

| Shares | Value | |||||||

| Health Care (continued) | ||||||||

| 437,000 | Thermo Fisher Scientific, Inc. | $ | 91,922,950 | |||||

| 196,400 | Zimmer Biomet Holdings, Inc. | 22,619,388 | ||||||

|

| |||||||

| 1,678,011,928 | ||||||||

|

| |||||||

| Industrials – 20.3% | ||||||||

| 3,119,000 | AECOM (a) | 107,418,360 | ||||||

| 1,553,500 | Airbus Group SE – EUR | 182,354,494 | ||||||

| 95,200 | Alaska Air Group, Inc. | 6,181,336 | ||||||

| 4,665,700 | American Airlines Group, Inc. | 200,298,501 | ||||||

| 45,000 | Boeing Co. (The) | 15,010,200 | ||||||

| 1,150,000 | Caterpillar, Inc. | 166,014,000 | ||||||

| 170,000 | CSX Corp. | 10,096,300 | ||||||

| 233,000 | Curtiss-Wright Corp. | 29,833,320 | ||||||

| 1,036,319 | Deere & Co. | 140,245,050 | ||||||

| 1,475,000 | Delta Air Lines, Inc. | 77,024,500 | ||||||

| 946,900 | FedEx Corp. | 234,073,680 | ||||||

| 103,950 | Honeywell International, Inc. | 15,039,486 | ||||||

| 812,400 | Jacobs Engineering Group, Inc. | 47,192,316 | ||||||

| 199,761 | Matson, Inc. | 5,839,014 | ||||||

| 275,000 | Norfolk Southern Corp. | 39,454,250 | ||||||

| 140,000 | Pentair PLC | 9,419,200 | ||||||

| 807,200 | Ritchie Bros. Auctioneers, Inc. | 26,419,656 | ||||||

| 30,000 | Rockwell Automation, Inc. | 4,935,900 | ||||||

| 50,000 | Rockwell Collins, Inc. | 6,627,000 | ||||||

| 125,000 | Safran S.A. – EUR | 14,661,250 | ||||||

| 1,367,466 | Siemens AG – EUR | 173,660,924 | ||||||

| 4,175,500 | Southwest Airlines Co. | 220,591,665 | ||||||

| 57,000 | Union Pacific Corp. | 7,616,910 | ||||||

| 2,858,900 | United Continental Holdings, Inc. (a) | 193,090,106 | ||||||

| 361,300 | United Parcel Service, Inc. – Class B | 41,007,550 | ||||||

| 56,000 | United Technologies Corp. | 6,728,400 | ||||||

|

| |||||||

| 1,980,833,368 | ||||||||

|

| |||||||

| Information Technology – 29.2% | ||||||||

| 1,040,000 | Activision Blizzard, Inc. | 69,004,000 | ||||||

| 509,600 | Adobe Systems, Inc. (a) | 112,927,360 | ||||||

| 35,000 | Alphabet, Inc. – Class A (a) | 35,650,300 | ||||||

| 35,000 | Alphabet, Inc. – Class C (a) | 35,606,550 | ||||||

| 719,200 | Analog Devices, Inc. | 62,822,120 | ||||||

| 1,690,000 | Applied Materials, Inc. | 83,942,300 | ||||||

| 3,052,700 | Cisco Systems, Inc. | 135,204,083 | ||||||

The accompanying notes are an integral part of these financial statements.

15

Schedule of Investments

PRIMECAP Odyssey Stock Fund

April 30, 2018 (Unaudited) – continued

| Shares | Value | |||||||

| Information Technology (continued) | ||||||||

| 750,000 | Corning, Inc. | $ | 20,265,000 | |||||

| 80,553 | Dell Technologies Inc. – Class V (a) | 5,781,289 | ||||||

| 675,000 | Diebold, Inc. | 10,361,250 | ||||||

| 740,102 | DXC Technology Co. | 76,274,912 | ||||||

| 3,419,300 | eBay, Inc. (a) | 129,523,084 | ||||||

| 6,409,199 | Flex Ltd. (a) | 83,319,587 | ||||||

| 17,447,900 | Hewlett Packard Enterprise Co. | 297,486,695 | ||||||

| 10,409,800 | HP, Inc. | 223,706,602 | ||||||

| 2,300,000 | Intel Corp. | 118,726,000 | ||||||

| 1,724,000 | Keysight Technologies, Inc. (a) | 89,096,320 | ||||||

| 1,229,500 | KLA-Tencor Corp. | 125,089,330 | ||||||

| 13,777,800 | L.M. Ericsson Telephone Co. – ADR | 104,022,390 | ||||||

| 4,081,423 | Micro Focus International PLC – ADR | 70,690,246 | ||||||

| 1,943,100 | Microsoft Corp. | 181,718,712 | ||||||

| 4,218,500 | NetApp, Inc. | 280,867,730 | ||||||

| 477,000 | NVIDIA Corp. | 107,277,300 | ||||||

| 1,470,000 | PayPal Holdings, Inc. (a) | 109,676,700 | ||||||

| 1,712,105 | QUALCOMM, Inc. | 87,334,476 | ||||||

| 640,100 | Teradyne, Inc. | 20,835,255 | ||||||

| 1,563,800 | Texas Instruments, Inc. | 158,616,234 | ||||||

| 136,800 | Visa, Inc. – Class A | 17,357,184 | ||||||

|

| |||||||

| 2,853,183,009 | ||||||||

|

| |||||||

| Materials – 0.6% | ||||||||

| 2,320 | AdvanSix, Inc. (a) | 83,102 | ||||||

| 50,000 | Celanese Corp. – Series A | 5,433,500 | ||||||

| 675,000 | DowDuPont, Inc. | 42,687,000 | ||||||

| 135,900 | Monsanto Co. | 17,037,783 | ||||||

|

| |||||||

| 65,241,385 | ||||||||

|

| |||||||

| Utilities – 0.2% | ||||||||

| 372,379 | Public Service Enterprise Group, Inc. | 19,419,565 | ||||||

|

| |||||||

| | TOTAL COMMON STOCKS | $ | 9,113,282,681 | |||||

|

| |||||||

| CLOSED-END FUNDS – 1.6% | ||||||||

| Information Technology – 1.6% | ||||||||

| 2,190,000 | Altaba, Inc. (a) | 153,475,200 | ||||||

|

| |||||||

| | TOTAL CLOSED-END FUNDS | 153,475,200 | ||||||

|

| |||||||

The accompanying notes are an integral part of these financial statements.

16

Schedule of Investments

PRIMECAP Odyssey Stock Fund

April 30, 2018 (Unaudited) – continued

| Shares | Value | |||||||

| SHORT-TERM INVESTMENTS – 5.3% | ||||||||

| 514,629,580 | Dreyfus Treasury Securities Cash Management | $ | 514,629,580 | |||||

|

| |||||||

| | TOTAL SHORT-TERM INVESTMENTS | 514,629,580 | ||||||

|

| |||||||

| | TOTAL INVESTMENTS IN SECURITIES | 9,781,387,461 | ||||||

| Liabilities in Excess of Other Assets – (0.1)% | (10,194,170 | ) | ||||||

|

| |||||||

TOTAL NET ASSETS – 100.0% | $ | 9,771,193,291 | ||||||

|

| |||||||

| ADR | American Depository Receipt |

| CHF | Swiss Francs |

| EUR | Euros |

| (a) | Non-Income Producing |

| (b) | Restricted security |

| (c) | Rate quoted is seven-day yield at period end. |

The Global Industry Classification Standard (GICS®) was developed by and is the exclusive property of MSCI Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by the fund’s administrator.

The accompanying notes are an integral part of these financial statements.

17

| Shares | Value | |||||||

| COMMON STOCKS – 94.0% | ||||||||

| Consumer Discretionary – 10.2% | ||||||||

| 2,145,000 | Ascena Retail Group, Inc. (a) | $ | 4,761,900 | |||||

| 2,026,100 | CarMax, Inc. (a) | 126,631,250 | ||||||

| 1,985,746 | Carnival Corp. | 125,221,143 | ||||||

| 282,000 | CBS Corp. – Class B | 13,874,400 | ||||||

| 485,000 | Entercom Communications Corp. – Class A | 4,922,750 | ||||||

| 379,500 | Gildan Activewear, Inc. | 11,054,835 | ||||||

| 125,000 | Hilton Worldwide Holdings, Inc. | 9,855,000 | ||||||

| 2,195,200 | IMAX Corp. (a) | 50,928,640 | ||||||

| 855,000 | iRobot Corp. (a) | 49,897,800 | ||||||

| 2,074,598 | L Brands, Inc. | 72,424,216 | ||||||

| 373,999 | Las Vegas Sands Corp. | 27,425,347 | ||||||

| 5,500,100 | Mattel, Inc. | 81,401,480 | ||||||

| 1,250,000 | MGM Resorts International | 39,275,000 | ||||||

| 1,850,000 | Norwegian Cruise Line Holdings Ltd. (a) | 98,919,500 | ||||||

| 85,000 | Ross Stores, Inc. | 6,872,250 | ||||||

| 1,496,371 | Royal Caribbean Cruises Ltd. | 161,892,378 | ||||||

| 1,523,027 | Shutterfly, Inc. (a) | 123,243,345 | ||||||

| 50,000 | Skechers U.S.A., Inc. – Class A (a) | 1,425,000 | ||||||

| 4,075,000 | Sony Corp. – ADR | 186,757,250 | ||||||

| 43,000 | Tesla, Inc. (a) | 12,637,700 | ||||||

| 126,000 | TJX Cos., Inc. | 10,691,100 | ||||||

| 38,000 | Ulta Beauty, Inc. (a) | 9,534,580 | ||||||

|

| |||||||

| 1,229,646,864 | ||||||||

|

| |||||||

| Consumer Staples – 0.1% | ||||||||

| 200,000 | Altria Group, Inc. | 11,222,000 | ||||||

|

| |||||||

| Energy – 0.3% | ||||||||

| 240,000 | Cabot Oil & Gas Corp. | 5,738,400 | ||||||

| 15,000 | EOG Resources, Inc. | 1,772,550 | ||||||

| 72,900 | Schlumberger Ltd. | 4,998,024 | ||||||

| 3,000,000 | Southwestern Energy Co. (a) | 12,300,000 | ||||||

| 872,000 | Transocean Ltd. (a) | 10,786,640 | ||||||

|

| |||||||

| 35,595,614 | ||||||||

|

| |||||||

| Financials – 7.3% | ||||||||

| 100,000 | Bank of America Corp. | 2,992,000 | ||||||

| 2,318,223 | Charles Schwab Corp. (The) | 129,078,657 | ||||||

| 815,000 | Citigroup, Inc. | 55,640,050 | ||||||

| 106,000 | CME Group, Inc. | 16,714,080 | ||||||

The accompanying notes are an integral part of these financial statements.

18

Schedule of Investments

PRIMECAP Odyssey Growth Fund

April 30, 2018 (Unaudited) – continued

| Shares | Value | |||||||

| Financials (continued) | ||||||||

| 1,219,790 | Discover Financial Services | $ | 86,910,037 | |||||

| 5,015,000 | E*TRADE Financial Corp. (a) | 304,310,200 | ||||||

| 1,500,000 | JPMorgan Chase & Co. | 163,170,000 | ||||||

| 390,350 | Marsh & McLennan Cos., Inc. | 31,813,525 | ||||||

| 12,000 | Moody’s Corp. | 1,946,400 | ||||||

| 285,000 | Northern Trust Corp. | 30,423,750 | ||||||

| 157,000 | Progressive Corp. (The) | 9,465,530 | ||||||

| 788,800 | Wells Fargo & Co. | 40,986,048 | ||||||

|

| |||||||

| 873,450,277 | ||||||||

|

| |||||||

| Health Care – 32.1% | ||||||||

| 852,018 | Abbott Laboratories | 49,527,806 | ||||||

| 1,791,100 | ABIOMED, Inc. (a) | 539,031,545 | ||||||

| 2,783,900 | Accuray, Inc. (a) | 13,919,500 | ||||||

| 411,300 | Agilent Technologies, Inc. | 27,038,862 | ||||||

| 7,644,747 | Alkermes PLC (a) | 338,432,950 | ||||||

| 1,304,900 | Amgen, Inc. | 227,678,952 | ||||||

| 2,871,700 | AstraZeneca PLC – ADR | 102,031,501 | ||||||

| 410,000 | BeiGene Ltd. – ADR (a) | 69,527,800 | ||||||

| 538,900 | Biogen, Inc. (a) | 147,443,040 | ||||||

| 1,707,536 | BioMarin Pharmaceutical, Inc. (a) | 142,596,331 | ||||||

| 1,437,800 | Boston Scientific Corp. (a) | 41,293,616 | ||||||

| 2,257,570 | Bristol-Myers Squibb Co. | 117,687,124 | ||||||

| 151,000 | CVS Health Corp. | 10,544,330 | ||||||

| 3,349,100 | Eli Lilly & Co. | 271,511,537 | ||||||

| 3,339,743 | Epizyme, Inc. (a) | 42,915,697 | ||||||

| 289,300 | Illumina, Inc. (a) | 69,701,049 | ||||||

| 2,400,000 | ImmunoGen, Inc. (a) | 26,376,000 | ||||||

| 2,614,521 | Insulet Corp. (a) | 224,848,806 | ||||||

| 350,900 | Medtronic PLC | 28,117,617 | ||||||

| 400,000 | Merck & Co., Inc. | 23,548,000 | ||||||

| 727,200 | Momenta Pharmaceuticals, Inc. (a) | 15,125,760 | ||||||

| 7,187,959 | Nektar Therapeutics (a) | 601,344,650 | ||||||

| 995,636 | Novartis AG – ADR | 76,355,325 | ||||||

| 200,000 | NuVasive, Inc. (a) | 10,642,000 | ||||||

| 200,000 | OraSure Technologies, Inc. (a) | 3,546,000 | ||||||

| 411,000 | PerkinElmer, Inc. | 30,150,960 | ||||||

| 2,917,961 | QIAGEN N.V. (a) | 95,446,504 | ||||||

| 384,032 | Roche Holding AG – CHF | 85,327,098 | ||||||

| 6,118,700 | Seattle Genetics, Inc. (a) | 313,216,253 | ||||||

The accompanying notes are an integral part of these financial statements.

19

Schedule of Investments

PRIMECAP Odyssey Growth Fund

April 30, 2018 (Unaudited) – continued

| Shares | Value | |||||||

| Health Care (continued) | ||||||||

| 202,200 | Siemens Healthineers AG – EUR (a) (b) | $ | 7,883,234 | |||||

| 315,400 | Thermo Fisher Scientific, Inc. | 66,344,390 | ||||||

| 48,500 | Waters Corp. (a) | 9,137,885 | ||||||

| 954,017 | Xencor, Inc. (a) | 27,656,953 | ||||||

| 64,817 | Zimmer Biomet Holdings, Inc. | 7,464,974 | ||||||

|

| |||||||

| 3,863,414,049 | ||||||||

|

| |||||||

| Industrials – 12.8% | ||||||||

| 2,902,400 | AECOM (a) | 99,958,656 | ||||||

| 737,700 | Airbus Group SE – EUR | 86,593,441 | ||||||

| 5,857,201 | American Airlines Group, Inc. | 251,449,639 | ||||||

| 400,000 | Avis Budget Group, Inc. (a) | 19,764,000 | ||||||

| 450,000 | Caterpillar, Inc. | 64,962,000 | ||||||

| 145,000 | CIRCOR International, Inc. | 6,143,650 | ||||||

| 274,000 | Curtiss-Wright Corp. | 35,082,960 | ||||||

| 1,925,100 | Delta Air Lines, Inc. | 100,528,722 | ||||||

| 200,000 | FedEx Corp. | 49,440,000 | ||||||

| 175,500 | IDEX Corp. | 23,457,330 | ||||||

| 1,425,794 | Jacobs Engineering Group, Inc. | 82,824,373 | ||||||

| 2,727,550 | JetBlue Airways Corp. (a) | 52,341,685 | ||||||

| 489,000 | Ritchie Bros. Auctioneers, Inc. | 16,004,970 | ||||||

| 1,014,932 | Siemens AG – EUR | 128,890,977 | ||||||

| 3,297,700 | Southwest Airlines Co. | 174,217,491 | ||||||

| 560,000 | Textron, Inc. | 34,798,400 | ||||||

| 4,571,200 | United Continental Holdings, Inc. (a) | 308,738,848 | ||||||

| 86,000 | United Parcel Service, Inc. – Class B | 9,761,000 | ||||||

|

| |||||||

| 1,544,958,142 | ||||||||

|

| |||||||

| Information Technology – 30.7% | ||||||||

| 1,252,353 | Adobe Systems, Inc. (a) | 277,521,425 | ||||||

| 1,528,000 | Alibaba Group Holding Ltd. – ADR (a) | 272,809,120 | ||||||

| 132,067 | Alphabet, Inc. – Class A (a) | 134,520,805 | ||||||

| 115,530 | Alphabet, Inc. – Class C (a) | 117,532,135 | ||||||

| 644,400 | Altair Engineering, Inc. – Class A (a) | 18,674,712 | ||||||

| 280,000 | Analog Devices, Inc. | 24,458,000 | ||||||

| 151,700 | Applied Materials, Inc. | 7,534,939 | ||||||

| 213,600 | ASML Holding N.V. | 40,252,920 | ||||||

| 15,211,850 | BlackBerry Ltd. (a) | 159,268,069 | ||||||

| 2,016,100 | Cisco Systems, Inc. | 89,293,069 | ||||||

| 1,255,000 | comScore, Inc. (a) | 26,606,000 | ||||||

| 1,320,100 | Cree, Inc. (a) | 49,266,132 | ||||||

The accompanying notes are an integral part of these financial statements.

20

Schedule of Investments

PRIMECAP Odyssey Growth Fund

April 30, 2018 (Unaudited) – continued

| Shares | Value | |||||||

| Information Technology (continued) | ||||||||

| 255,939 | Dell Technologies Inc. – Class V (a) | $ | 18,368,742 | |||||

| 417,130 | DXC Technology Co. | 42,989,418 | ||||||

| 251,900 | eBay, Inc. (a) | 9,541,972 | ||||||

| 225,000 | Electronic Arts, Inc. (a) | 26,545,500 | ||||||

| 658,595 | Ellie Mae, Inc. (a) | 63,798,098 | ||||||

| 6,624,729 | Flex Ltd. (a) | 86,121,477 | ||||||

| 524,718 | FormFactor, Inc. (a) | 6,021,139 | ||||||

| 9,132,300 | Hewlett Packard Enterprise Co. | 155,705,715 | ||||||

| 3,669,700 | HP, Inc. | 78,861,853 | ||||||

| 1,600,000 | Intel Corp. | 82,592,000 | ||||||

| 100,000 | Intuit, Inc. | 18,479,000 | ||||||

| 725,000 | Jabil Circuit, Inc. | 19,285,000 | ||||||

| 547,150 | Keysight Technologies, Inc. (a) | 28,276,712 | ||||||

| 698,300 | KLA-Tencor Corp. | 71,045,042 | ||||||

| 8,154,600 | L.M. Ericsson Telephone Co. – ADR | 61,567,230 | ||||||

| 1,771,109 | Micro Focus International PLC – ADR | 30,675,608 | ||||||

| 6,315,000 | Micron Technology, Inc. (a) | 290,363,700 | ||||||

| 2,267,100 | Microsoft Corp. | 212,019,192 | ||||||

| 3,567,354 | NetApp, Inc. | 237,514,429 | ||||||

| 1,619,000 | Nuance Communications, Inc. (a) | 23,831,680 | ||||||

| 590,000 | NVIDIA Corp. | 132,691,000 | ||||||

| 1,922,300 | QUALCOMM, Inc. | 98,056,523 | ||||||

| 112,249 | Rambus, Inc. (a) | 1,515,361 | ||||||

| 2,290,000 | Splunk, Inc. (a) | 235,068,500 | ||||||

| 4,914,300 | Stratasys Ltd. (a) (c) | 94,207,131 | ||||||

| 53,100 | Teradyne, Inc. | 1,728,405 | ||||||

| 1,621,395 | Texas Instruments, Inc. | 164,458,095 | ||||||

| 945,600 | Trimble, Inc. (a) | 32,717,760 | ||||||

| 810,000 | Visa, Inc. – Class A | 102,772,800 | ||||||

| 410,000 | VMware, Inc. – Class A (a) | 54,636,600 | ||||||

| 74,900 | Western Digital Corp. | 5,901,371 | ||||||

|

| |||||||

| 3,705,094,379 | ||||||||

|

| |||||||

| Materials – 0.5% | ||||||||

| 394,500 | Monsanto Co. | 49,458,465 | ||||||

| 100,000 | Praxair, Inc. | 15,252,000 | ||||||

|

| |||||||

| 64,710,465 | ||||||||

|

| |||||||

| | TOTAL COMMON STOCKS | $ | 11,328,091,790 | |||||

|

| |||||||

The accompanying notes are an integral part of these financial statements.

21

Schedule of Investments

PRIMECAP Odyssey Growth Fund

April 30, 2018 (Unaudited) – continued

| Shares | Value | |||||||

| CLOSED-END FUNDS – 0.3% | ||||||||

| Information Technology – 0.3% | ||||||||

| 578,000 | Altaba, Inc. (a) | $ | 40,506,240 | |||||

|

| |||||||

| | TOTAL CLOSED-END FUNDS | 40,506,240 | ||||||

|

| |||||||

| RIGHTS – 0.0% | ||||||||

| Health Care – 0.0% | ||||||||

| 30,000 | Dyax Corp. Contingent Value Rights (a) (d) (e) | 90,000 | ||||||

|

| |||||||

| | TOTAL RIGHTS | 90,000 | ||||||

|

| |||||||

| SHORT-TERM INVESTMENTS – 5.8% | ||||||||

| 702,894,833 | Dreyfus Treasury Securities Cash Management Fund – 1.55% (f) | $ | 702,894,833 | |||||

|

| |||||||

| | TOTAL SHORT-TERM INVESTMENTS | 702,894,833 | ||||||

|

| |||||||

| | TOTAL INVESTMENTS IN SECURITIES | 12,071,582,863 | ||||||

Liabilities in Excess of Other Assets – (0.1)% | (16,550,241 | ) | ||||||

|

| |||||||

TOTAL NET ASSETS – 100.0% | $ | 12,055,032,622 | ||||||

|

| |||||||

| ADR | American Depository Receipt |

| CHF | Swiss Francs |

| EUR | Euros |

| (a) | Non-Income Producing |

| (b) | Restricted security |

| (c) | Considered an affiliated company of the fund as the fund owns 5% or more of the outstanding voting securities of such company (Note 7). |

| (d) | Illiquid security |

| (e) | Fair-valued security (Note 4) |

| (f) | Rate quoted is seven-day yield at period end. |

The Global Industry Classification Standard (GICS®) was developed by and is the exclusive property of MSCI Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by the fund’s administrator.

The accompanying notes are an integral part of these financial statements.

22

| Shares | Value | |||||||

| COMMON STOCKS – 95.6% | ||||||||

| Consumer Discretionary – 14.5% | ||||||||

| 100 | Amazon.com, Inc. (a) | $ | 156,613 | |||||

| 2,248,000 | Ascena Retail Group, Inc. (a) | 4,990,560 | ||||||

| 825,000 | Boot Barn Holdings, Inc. (a) | 16,145,250 | ||||||

| 3,200 | Burlington Stores, Inc. (a) | 434,720 | ||||||

| 1,642,900 | CarMax, Inc. (a) | 102,681,250 | ||||||

| 7,800,900 | Chegg, Inc. (a) (b) | 181,058,889 | ||||||

| 9,521,000 | DHX Media Ltd. – Class A – CAD | 25,953,892 | ||||||

| 510,000 | DHX Media Ltd. – Class B – CAD | 1,370,381 | ||||||

| 9,400 | Entercom Communications Corp. – Class A | 95,410 | ||||||

| 265,000 | Gildan Activewear, Inc. | 7,719,450 | ||||||

| 96,000 | Habit Restaurants, Inc. (The) – Class A (a) | 969,600 | ||||||

| 3,333,700 | IMAX Corp. (a) (b) | 77,341,840 | ||||||

| 835,000 | iRobot Corp. (a) | 48,730,600 | ||||||

| 1,848,186 | Lions Gate Entertainment Corp. – Class A (a) | 46,001,350 | ||||||

| 2,802,500 | Lions Gate Entertainment Corp. – Class B (a) | 64,513,550 | ||||||

| 5,750 | Netflix, Inc. (a) | 1,796,645 | ||||||

| 555,000 | Norwegian Cruise Line Holdings Ltd. (a) | 29,675,850 | ||||||

| 7,400 | Restaurant Brands International, Inc. | 402,708 | ||||||

| 3,500 | Roku, Inc. (a) | 113,890 | ||||||

| 1,646,800 | Royal Caribbean Cruises Ltd. | 178,167,292 | ||||||

| 2,739,700 | Shutterfly, Inc. (a) (b) | 221,696,524 | ||||||

| 7,380,000 | Sony Corp. – ADR | 338,225,400 | ||||||

| 264,490 | Tesla, Inc. (a) | 77,733,611 | ||||||

| 1,034,500 | Tribune Media Co. – Class A | 39,093,755 | ||||||

| 1,031,501 | tronc, Inc. (a) | 18,938,358 | ||||||

| 1,599,000 | Tuesday Morning Corp. (a) | 5,676,450 | ||||||

| 49,700 | Ulta Beauty, Inc. (a) | 12,470,227 | ||||||

|

| |||||||

| 1,502,154,065 | ||||||||

|

| |||||||

| Consumer Staples – 0.1% | ||||||||

| 114,000 | Calavo Growers, Inc. | 10,681,800 | ||||||

|

| |||||||

| Energy – 0.3% | ||||||||

| 581,750 | Cabot Oil & Gas Corp. | 13,909,643 | ||||||

| 40,000 | EOG Resources, Inc. | 4,726,800 | ||||||

| 85,000 | Rex Energy Corp. (a) | �� | 69,700 | |||||

| 1,074,882 | Transocean Ltd. (a) | 13,296,290 | ||||||

|

| |||||||

| 32,002,433 | ||||||||

|

| |||||||

The accompanying notes are an integral part of these financial statements.

23

Schedule of Investments

PRIMECAP Odyssey Aggressive Growth Fund

April 30, 2018 (Unaudited) – continued

| Shares | Value | |||||||

| Financials – 3.9% | ||||||||

| 250,671 | CME Group, Inc. | $ | 39,525,803 | |||||

| 552,013 | Discover Financial Services | 39,330,926 | ||||||

| 2,154,713 | E*TRADE Financial Corp. (a) | 130,747,985 | ||||||

| 755,820 | MarketAxess Holdings, Inc. | 150,128,527 | ||||||

| 2,154,049 | NMI Holdings, Inc. – Class A (a) | 29,833,579 | ||||||

| 139,000 | Progressive Corp. (The) | 8,380,310 | ||||||

|

| |||||||

| 397,947,130 | ||||||||

|

| |||||||

| Health Care – 35.6% | ||||||||

| 2,066,300 | Abaxis, Inc. (b) | 137,553,591 | ||||||

| 1,503,300 | Abbott Laboratories | 87,386,829 | ||||||

| 1,508,873 | ABIOMED, Inc. (a) | 454,095,329 | ||||||

| 1,650,600 | Accuray, Inc. (a) | 8,253,000 | ||||||

| 472,100 | Adverum Biotechnologies, Inc. (a) | 2,950,625 | ||||||

| 6,214,822 | Alkermes PLC (a) | 275,130,170 | ||||||

| 4,000,400 | Arbutus Biopharma Corp. (a) (b) | 22,802,280 | ||||||

| 825,000 | Axovant Sciences Ltd. (a) | 882,750 | ||||||

| 314,647 | BeiGene Ltd. – ADR (a) | 53,357,838 | ||||||

| 284,500 | Biogen, Inc. (a) | 77,839,200 | ||||||

| 1,481,075 | BioMarin Pharmaceutical, Inc. (a) | 123,684,573 | ||||||

| 264,000 | Boston Scientific Corp. (a) | 7,582,080 | ||||||

| 10,300,000 | Cerus Corp. (a) (b) | 53,560,000 | ||||||

| 17,000 | Charles River Laboratories International, Inc. (a) | 1,771,230 | ||||||

| 530,650 | Dextera Surgical, Inc. (a) | 20,695 | ||||||

| 1,588,800 | Eli Lilly & Co. | 128,804,016 | ||||||

| 4,374,484 | Epizyme, Inc. (a) (b) | 56,212,120 | ||||||

| 3,067,900 | Exact Sciences Corp. (a) | 153,425,679 | ||||||

| 1,461,900 | Flex Pharma, Inc. (a) (b) | 7,017,120 | ||||||

| 3,861,932 | Fluidigm Corp. (a) (b) | 22,785,399 | ||||||

| 163,500 | Glaukos Corp. (a) | 5,506,680 | ||||||

| 13,000 | Illumina, Inc. (a) | 3,132,090 | ||||||

| 325,000 | ImmunoGen, Inc. (a) | 3,571,750 | ||||||

| 1,964,956 | Insulet Corp. (a) | 168,986,216 | ||||||

| 1,792,583 | Momenta Pharmaceuticals, Inc. (a) | 37,285,727 | ||||||

| 11,974,776 | Nektar Therapeutics (a) (b) | 1,001,809,760 | ||||||

| 490,000 | NuVasive, Inc. (a) | 26,072,900 | ||||||

| 3,763,700 | OncoMed Pharmaceuticals, Inc. (a) (b) | 11,178,189 | ||||||

| 943,400 | OraSure Technologies, Inc. (a) | 16,726,482 | ||||||

| 14,600 | Penumbra, Inc. (a) | 1,815,510 | ||||||

| 2,297,100 | Pfenex, Inc. (a) (b) | 12,771,876 | ||||||

The accompanying notes are an integral part of these financial statements.

24

Schedule of Investments

PRIMECAP Odyssey Aggressive Growth Fund

April 30, 2018 (Unaudited) – continued

| Shares | Value | |||||||

| Health Care (continued) | ||||||||

| 3,935,573 | QIAGEN N.V. (a) | $ | 128,732,593 | |||||

| 307,700 | Roche Holding AG – CHF | 68,367,084 | ||||||

| 4,205,500 | Seattle Genetics, Inc. (a) | 215,279,545 | ||||||

| 9,465,000 | Spectrum Pharmaceuticals, Inc. (a) (b) | 150,682,800 | ||||||

| 5,081,182 | Xencor, Inc. (a) (b) | 147,303,466 | ||||||

|

| |||||||

| 3,674,337,192 | ||||||||

|

| |||||||

| Industrials – 11.4% | ||||||||

| 555,000 | AECOM (a) | 19,114,200 | ||||||

| 750,000 | Alaska Air Group, Inc. | 48,697,500 | ||||||

| 5,500 | Allegiant Travel Co. | 881,375 | ||||||

| 5,455,400 | American Airlines Group, Inc. | 234,200,322 | ||||||

| 462,000 | Axon Enterprise, Inc. (a) | 19,394,760 | ||||||

| 191,000 | CIRCOR International, Inc. | 8,092,670 | ||||||

| 41,000 | Controladora Vuela Compania de Aviacion, S.A.B. de C.V. – ADR (a) | 255,840 | ||||||

| 188,400 | Curtiss-Wright Corp. | 24,122,736 | ||||||

| 3,970,700 | Delta Air Lines, Inc. | 207,349,954 | ||||||

| 9,900 | Fedex Corp. | 2,447,280 | ||||||

| 149,000 | Gibraltar Industries, Inc. (a) | 5,237,350 | ||||||

| 752,500 | Hawaiian Holdings, Inc. | 31,003,000 | ||||||

| 1,633 | Herc Holdings, Inc. (a) | 85,977 | ||||||

| 101,417 | ICF International, Inc. | 6,805,081 | ||||||

| 1,168,600 | Jacobs Engineering Group, Inc. | 67,883,974 | ||||||

| 6,634,225 | JetBlue Airways Corp. (a) | 127,310,778 | ||||||

| 355,000 | NCI Building Systems, Inc. (a) | 6,212,500 | ||||||

| 1,760,000 | NN, Inc. (b) | 35,728,000 | ||||||

| 22,000 | Old Dominion Freight Line, Inc. | 2,944,920 | ||||||

| 560,372 | Ritchie Bros. Auctioneers, Inc. | 18,340,975 | ||||||

| 4,000 | Ryanair Holdings PLC – ADR (a) | 439,880 | ||||||

| 930,000 | Southwest Airlines Co. | 49,131,900 | ||||||

| 427,500 | Spirit Airlines, Inc. (a) | 15,270,300 | ||||||

| 4,500 | TransDigm Group, Inc. (a) | 1,442,565 | ||||||

| 3,574,450 | United Continental Holdings, Inc. (a) | 241,418,353 | ||||||

|

| |||||||

| 1,173,812,190 | ||||||||

|

| |||||||

| Information Technology – 28.1% | ||||||||

| 805,900 | Adobe Systems, Inc. (a) | 178,587,440 | ||||||

| 908,850 | Alibaba Group Holding Ltd. – ADR (a) | 162,266,079 | ||||||

| 84,520 | Alphabet, Inc. – Class A (a) | 86,090,382 | ||||||

| 84,736 | Alphabet, Inc. – Class C (a) | 86,204,475 | ||||||

The accompanying notes are an integral part of these financial statements.

25

Schedule of Investments

PRIMECAP Odyssey Aggressive Growth Fund

April 30, 2018 (Unaudited) – continued

| Shares | Value | |||||||

| Information Technology (continued) | ||||||||

| 1,500 | Arista Networks, Inc. (a) | $ | 396,825 | |||||

| 100,000 | ASML Holding N.V. | 18,845,000 | ||||||

| 2,510,000 | Axcelis Technologies, Inc. (a) (b) | 55,220,000 | ||||||

| 23,243,918 | BlackBerry Ltd. (a) | 243,363,821 | ||||||

| 5,666,160 | comScore, Inc. (a) (b) | 120,122,592 | ||||||

| 163,000 | Cray, Inc. (a) | 3,887,550 | ||||||

| 1,675,300 | Cree, Inc. (a) | 62,522,196 | ||||||

| 200,000 | Dell Technologies Inc. – Class V (a) | 14,354,000 | ||||||

| 415,000 | Digimarc Corp. (a) | 11,972,750 | ||||||

| 41,233 | DXC Technology Co. | 4,249,473 | ||||||

| 312,100 | eBay, Inc. (a) | 11,822,348 | ||||||

| 125,000 | Electronic Arts, Inc. (a) | 14,747,500 | ||||||

| 2,227,700 | Ellie Mae, Inc. (a) (b) | 215,797,299 | ||||||

| 1,498,322 | FARO Technologies, Inc. (a) (b) | 75,665,261 | ||||||

| 8,896,900 | Flex Ltd. (a) | 115,659,700 | ||||||

| 1,132,800 | FormFactor, Inc. (a) | 12,998,880 | ||||||

| 7,000 | GTT Communications, Inc. (a) | 336,350 | ||||||

| 1,186,000 | Hewlett Packard Enterprise Co. | 20,221,300 | ||||||

| 535,000 | HP, Inc. | 11,497,150 | ||||||

| 466,050 | HubSpot, Inc. (a) | 49,354,695 | ||||||

| 178,000 | Intuit, Inc. | 32,892,620 | ||||||

| 765,000 | Jabil Circuit, Inc. | 20,349,000 | ||||||

| 270,000 | Keysight Technologies, Inc. (a) | 13,953,600 | ||||||

| 764,400 | KLA-Tencor Corp. | 77,770,056 | ||||||

| 42,000 | Materialise NV – ADR (a) | 503,580 | ||||||

| 640,100 | MaxLinear, Inc. – Class A (a) | 14,293,433 | ||||||

| 208,196 | Micro Focus International PLC – ADR | 3,605,955 | ||||||

| 6,670,000 | Micron Technology, Inc. (a) | 306,686,600 | ||||||

| 543,877 | MINDBODY, Inc. – Class A (a) | 21,564,723 | ||||||

| 2,157,467 | NetApp, Inc. | 143,644,153 | ||||||

| 59,100 | nLIGHT, Inc. (a) | 1,473,363 | ||||||

| 1,874,000 | Nuance Communications, Inc. (a) | 27,585,280 | ||||||

| 745,582 | Nutanix, Inc. – Class A (a) | 37,718,993 | ||||||

| 467,945 | NVIDIA Corp. | 105,240,830 | ||||||

| 237,981 | OSI Systems, Inc. (a) | 15,235,544 | ||||||

| 1,232,000 | PROS Holdings, Inc. (a) | 36,368,640 | ||||||

| 1,435,200 | QUALCOMM, Inc. | 73,209,552 | ||||||

| 1,243,600 | Rubicon Project, Inc. (The) (a) | 2,711,048 | ||||||

| 8,822,000 | ServiceSource International, Inc. (a) (b) | 33,435,380 | ||||||

The accompanying notes are an integral part of these financial statements.

26

Schedule of Investments

PRIMECAP Odyssey Aggressive Growth Fund

April 30, 2018 (Unaudited) – continued

| Shares | Value | |||||||

| Information Technology (continued) | ||||||||

| 2,133,200 | Splunk, Inc. (a) | $ | 218,972,980 | |||||

| 2,307,000 | Stratasys Ltd. (a) | 44,225,190 | ||||||

| 740,300 | Trimble, Inc. (a) | 25,614,380 | ||||||

| 280,000 | Universal Display Corp. | 24,654,000 | ||||||

| 325,000 | VMware, Inc. – Class A (a) | 43,309,500 | ||||||

| 64,000 | Western Digital Corp. | 5,042,560 | ||||||

|

| |||||||

| 2,906,244,026 | ||||||||

|

| |||||||

| Materials – 0.4% | ||||||||

| 2,900 | Ingevity Corp. (a) | 222,807 | ||||||

| 2,325,000 | Marrone Bio Innovations, Inc. (a) | 4,068,750 | ||||||

| 284,300 | Monsanto Co. | 35,642,691 | ||||||

| 200,300 | Syrah Resources Ltd. – AUD (a) | 479,556 | ||||||

|

| |||||||

| 40,413,804 | ||||||||

|

| |||||||

| Telecom Services – 1.3% | ||||||||

| 23,430,000 | Sprint Corp. (a) | 131,442,300 | ||||||

|

| |||||||

| | TOTAL COMMON STOCKS | $ | 9,869,034,940 | |||||

|

| |||||||

| PREFERRED STOCKS – 0.3% | ||||||||

| Financials – 0.3% | ||||||||

| 2,473,500 | Fannie Mae Fixed-to-Floating Rate Non-Cumulative Preferred Stock Series S, Perpetual Maturity (a) | 15,830,400 | ||||||

| 2,923,500 | Freddie Mac Fixed-to-Floating Rate Non-Cumulative Preferred Stock Series Z, Perpetual Maturity (a) | 18,973,515 | ||||||

|

| |||||||

| 34,803,915 | ||||||||

|

| |||||||

| | TOTAL PREFERRED STOCKS | 34,803,915 | ||||||

|

| |||||||

| RIGHTS – 0.2% | ||||||||

| Health Care – 0.2% | ||||||||

| 7,639,720 | Dyax Corp. Contingent Value Rights (a) (c) (d) | 22,919,160 | ||||||

|

| |||||||

| | TOTAL RIGHTS | 22,919,160 | ||||||

|

| |||||||

| CLOSED-END FUNDS – 0.1% | ||||||||

| Information Technology – 0.1% | ||||||||

| 141,580 | Altaba, Inc. (a) | 9,921,926 | ||||||

|

| |||||||

| | TOTAL CLOSED-END FUNDS | 9,921,926 | ||||||

|

| |||||||

The accompanying notes are an integral part of these financial statements.

27

Schedule of Investments

PRIMECAP Odyssey Aggressive Growth Fund

April 30, 2018 (Unaudited) – continued

| Shares | Value | |||||||

| SHORT-TERM INVESTMENTS – 3.8% | ||||||||

| 391,315,560 | Dreyfus Treasury Securities Cash Management Fund – 1.55% (e) | $ | 391,315,560 | |||||

|

| |||||||

| | TOTAL SHORT-TERM INVESTMENTS | 391,315,560 | ||||||

|

| |||||||

| | TOTAL INVESTMENTS IN SECURITIES | 10,327,995,501 | ||||||

Liabilities in Excess of Other Assets – (0.0)% | (788,704 | ) | ||||||

|

| |||||||

TOTAL NET ASSETS – 100.0% | $ | 10,327,206,797 | ||||||

|

| |||||||

| ADR | American Depository Receipt |

| AUD | Australian Dollars |

| CAD | Canadian Dollars |

| CHF | Swiss Francs |

| (a) | Non-Income Producing |

| (b) | Considered an affiliated company of the fund as the fund owns 5% or more of the outstanding voting securities of such company (Note 7). |

| (c) | Illiquid security |

| (d) | Fair-valued security (Note 4) |

| (e) | Rate quoted is seven-day yield at period end. |

The Global Industry Classification Standard (GICS®) was developed by and is the exclusive property of MSCI Inc. and Standard & Poor's Financial Services LLC ("S&P"). GICS is a service mark of MSCI and S&P and has been licensed for use by the fund's administrator.

The accompanying notes are an integral part of these financial statements.

28

| PRIMECAP Odyssey Stock Fund | PRIMECAP Odyssey Growth Fund | PRIMECAP Odyssey Aggressive Growth Fund | ||||||||||

ASSETS | ||||||||||||

Investments, at cost (unaffiliated) | $ | 6,958,751,979 | $ | 7,113,472,506 | $ | 4,342,523,859 | ||||||

|

|

|

|

|

| |||||||

Investments, at cost (affiliated) | — | 127,034,487 | 1,341,034,622 | |||||||||

|

|

|

|

|

| |||||||

Investments, at value (unaffiliated) | 9,781,387,461 | 11,977,375,732 | 7,688,253,115 | |||||||||

Investments, at value (affiliated) | — | 94,207,131 | 2,639,742,386 | |||||||||

Cash | 6,508,034 | 4,386,733 | 661,138 | |||||||||

Receivable for investments sold | — | — | 664,798 | |||||||||

Receivable for dividends and interest | 9,540,463 | 8,489,436 | 4,655,209 | |||||||||

Receivable for fund shares sold | 27,922,391 | 29,490,715 | 17,181,238 | |||||||||

Prepaid expenses and other assets | 108,868 | 123,491 | 53,124 | |||||||||

|

|

|

|

|

| |||||||

Total assets | 9,825,467,217 | 12,114,073,238 | 10,351,211,008 | |||||||||

|

|

|

|

|

| |||||||

| LIABILITIES | ||||||||||||

Payable for investments purchased | 29,425,212 | 33,499,736 | 4,140,734 | |||||||||

Payable for fund shares repurchased | 9,524,823 | 6,733,616 | 3,457,725 | |||||||||

Payable to the advisor (Note 6) | 13,216,291 | 16,141,268 | 14,333,877 | |||||||||

Other accrued expenses and liabilities | 2,107,600 | 2,665,996 | 2,071,875 | |||||||||

|

|

|

|

|

| |||||||

Total liabilities | 54,273,926 | 59,040,616 | 24,004,211 | |||||||||

|

|

|

|

|

| |||||||

NET ASSETS | $ | 9,771,193,291 | $ | 12,055,032,622 | $ | 10,327,206,797 | ||||||

|

|

|

|

|

| |||||||

Number of shares issued and outstanding (unlimited shares authorized, $0.01 par value) | 310,471,805 | 309,867,309 | 220,064,177 | |||||||||

|

|

|

|

|

| |||||||

NET ASSET VALUE, OFFERING AND REDEMPTION PRICE PER SHARE | $ | 31.47 | $ | 38.90 | $ | 46.93 | ||||||

|

|

|

|

|

| |||||||

| COMPONENTS OF NET ASSETS | ||||||||||||

Paid-in capital | $ | 6,820,688,989 | $ | 7,094,672,790 | $ | 5,308,773,881 | ||||||

Undistributed net investment income | 36,459,476 | 9,417,802 | — | |||||||||

Accumulated net realized gain | 91,518,202 | 120,021,017 | 374,109,163 | |||||||||

Net unrealized appreciation | 2,822,526,624 | 4,830,921,013 | 4,644,323,753 | |||||||||

|

|

|

|

|

| |||||||

Net assets | $ | 9,771,193,291 | $ | 12,055,032,622 | $ | 10,327,206,797 | ||||||

|

|

|

|

|

| |||||||

The accompanying notes are an integral part of these financial statements.

29

| PRIMECAP Odyssey Stock Fund | PRIMECAP Odyssey Growth Fund | PRIMECAP Odyssey Aggressive Growth Fund | ||||||||||

INVESTMENT INCOME | ||||||||||||

Dividends (unaffiliated)(1) | $ | 80,504,819 | $ | 48,550,322 | $ | 18,343,682 | ||||||

Dividends (affiliated) | — | — | 864,216 | |||||||||

Interest income | 2,627,208 | 2,684,344 | 1,638,548 | |||||||||

|

|

|

|

|

| |||||||

Total investment income | 83,132,027 | 51,234,666 | 20,846,446 | |||||||||

|

|

|

|

|

| |||||||

Expenses | ||||||||||||

Advisory fees | 26,095,550 | 30,876,958 | 27,666,262 | |||||||||

Shareholder servicing | 3,003,404 | 4,208,442 | 3,447,525 | |||||||||

Custody | 231,672 | 196,099 | 154,192 | |||||||||

Trustee fees | 58,562 | 58,561 | 58,561 | |||||||||

Other | 1,128,047 | 1,124,660 | 854,285 | |||||||||

|

|

|

|

|

| |||||||

Total expenses | 30,517,235 | 36,464,720 | 32,180,825 | |||||||||

|

|

|

|

|

| |||||||

Net investment income (loss) | 52,614,792 | 14,769,946 | (11,334,379 | ) | ||||||||

|

|

|

|

|

| |||||||

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY | ||||||||||||

Net realized gain (loss) on: | ||||||||||||

Investments (unaffiliated) | 94,834,468 | 126,735,116 | 264,453,816 | |||||||||

Investments (affiliated) | (202,861 | ) | — | 130,497,577 | ||||||||

Foreign currency transactions | (17,475 | ) | (16,339 | ) | (19,857 | ) | ||||||

Change in unrealized appreciation/depreciation on: | ||||||||||||

Investments (unaffiliated) | 142,365,985 | 919,422,178 | 54,292,902 | |||||||||

Investments (affiliated) | 6,862,345 | (16,344,810 | ) | 820,959,051 | ||||||||

Foreign currency translations | (19,828 | ) | (8,488 | ) | (6,882 | ) | ||||||

|

|

|

|

|

| |||||||

Net realized and unrealized gain on investments and foreign currency | 243,822,634 | 1,029,787,657 | 1,270,176,607 | |||||||||

|

|

|

|

|

| |||||||

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | 296,437,426 | $ | 1,044,557,603 | $ | 1,258,842,228 | ||||||

|

|

|

|

|

| |||||||

| (1) | Net of foreign taxes withheld of $2,383,300, $1,524,567, and $660,179, respectively. |

The accompanying notes are an integral part of these financial statements.

30

| Six Months Ended April 30, 2018(1) | Year Ended October 31, 2017 | |||||||

INCREASE (DECREASE) IN NET ASSETS FROM: | ||||||||

| OPERATIONS | ||||||||

Net investment income | $ | 52,614,792 | $ | 85,250,094 | ||||

Net realized gain (loss) on: | ||||||||

Investments | 94,631,607 | 122,367,808 | ||||||

Foreign currency transactions | (17,475 | ) | 18,720 | |||||

Change in unrealized appreciation/depreciation on: | ||||||||

Investments | 149,228,330 | 1,555,631,684 | ||||||

Foreign currency translations | (19,828 | ) | (8,536 | ) | ||||

|

|

|

| |||||

Net increase in net assets resulting from operations | 296,437,426 | 1,763,259,770 | ||||||

|

|

|

| |||||

| DISTRIBUTIONS TO SHAREHOLDERS | ||||||||

Net investment income | (86,731,198 | ) | (70,477,502 | ) | ||||

Net realized gain on investments | (110,178,297 | ) | (104,713,329 | ) | ||||

|

|

|

| |||||

Net decrease in net assets resulting from distributions paid | (196,909,495 | ) | (175,190,831 | ) | ||||

|

|

|

| |||||

| CAPITAL SHARE TRANSACTIONS | ||||||||

Proceeds from shares sold | 1,740,719,069 | 2,546,194,117 | ||||||

Proceeds from reinvestment of distributions | 152,175,213 | 123,145,414 | ||||||

Cost of shares repurchased | (919,814,217 | ) | (1,213,094,664 | ) | ||||

|

|

|

| |||||

Net increase from capital share transactions | 973,080,065 | 1,456,244,867 | ||||||

|

|

|

| |||||

Total increase in net assets | 1,072,607,996 | 3,044,313,806 | ||||||

|

|

|

| |||||

| NET ASSETS | ||||||||

Beginning of period | 8,698,585,295 | 5,654,271,489 | ||||||

|

|

|

| |||||

End of period (includes undistributed net investment income of $36,459,476 and $70,575,882, respectively) | $ | 9,771,193,291 | $ | 8,698,585,295 | ||||

|

|

|

| |||||

| CHANGE IN CAPITAL SHARES | ||||||||

Shares outstanding, beginning of period | 280,436,108 | 227,626,425 | ||||||

|

|

|

| |||||

Shares sold | 53,600,127 | 91,501,127 | ||||||

Shares issued on reinvestment of distributions | 4,748,056 | 4,718,215 | ||||||

Shares repurchased | (28,312,486 | ) | (43,409,659 | ) | ||||

|

|

|

| |||||

Increase in capital shares | 30,035,697 | 52,809,683 | ||||||

|

|

|

| |||||

Shares outstanding, end of period | 310,471,805 | 280,436,108 | ||||||

|

|

|

| |||||

| (1) | Unaudited |

The accompanying notes are an integral part of these financial statements.

31

| Six Months Ended April 30, 2018(1) | Year Ended October 31, 2017 | |||||||

INCREASE (DECREASE) IN NET ASSETS FROM: | ||||||||

| OPERATIONS | ||||||||

Net investment income | $ | 14,769,946 | $ | 32,547,966 | ||||

Net realized gain (loss) on: | ||||||||

Investments | 126,735,116 | 148,020,080 | ||||||

Foreign currency transactions | (16,339 | ) | 18,294 | |||||

Change in unrealized appreciation/depreciation on: | ||||||||

Investments | 903,077,368 | 2,063,079,096 | ||||||

Foreign currency translations | (8,488 | ) | (21,121 | ) | ||||

|

|

|

| |||||

Net increase in net assets resulting from operations | 1,044,557,603 | 2,243,644,315 | ||||||

|

|

|

| |||||

| DISTRIBUTIONS TO SHAREHOLDERS | ||||||||

Net investment income | (31,171,704 | ) | (32,875,526 | ) | ||||

Net realized gain on investments | (129,120,628 | ) | (206,383,770 | ) | ||||

|

|

|

| |||||

Net decrease in net assets resulting from distributions paid | (160,292,332 | ) | (239,259,296 | ) | ||||

|

|

|

| |||||

| CAPITAL SHARE TRANSACTIONS | ||||||||

Proceeds from shares sold | 2,271,894,171 | 2,756,401,466 | ||||||

Proceeds from reinvestment of distributions | 154,711,162 | 231,748,942 | ||||||

Cost of shares repurchased | (957,331,890 | ) | (1,895,506,240 | ) | ||||

|

|

|

| |||||

Net increase from capital share transactions | 1,469,273,443 | 1,092,644,168 | ||||||

|

|

|

| |||||

Total increase in net assets | 2,353,538,714 | 3,097,029,187 | ||||||

|

|

|

| |||||

| NET ASSETS | ||||||||

Beginning of period | 9,701,493,908 | 6,604,464,721 | ||||||

|

|

|

| |||||

End of period (includes undistributed net investment income of $9,417,802 and $25,819,560, respectively) | $ | 12,055,032,622 | $ | 9,701,493,908 | ||||

|

|

|

| |||||

| CHANGE IN CAPITAL SHARES | ||||||||

Shares outstanding, beginning of period | 272,228,484 | 236,736,118 | ||||||

|

|

|

| |||||

Shares sold | 58,041,838 | 87,030,442 | ||||||

Shares issued on reinvestment of distributions | 4,125,631 | 7,947,494 | ||||||

Shares repurchased | (24,528,644 | ) | (59,485,570 | ) | ||||

|

|

|

| |||||

Increase in capital shares | 37,638,825 | 35,492,366 | ||||||

|

|

|

| |||||

Shares outstanding, end of period | 309,867,309 | 272,228,484 | ||||||

|

|

|

| |||||

| (1) | Unaudited |

The accompanying notes are an integral part of these financial statements.

32

| Six Months Ended April 30, 2018(1) | Year Ended October 31, 2017 | |||||||

INCREASE (DECREASE) IN NET ASSETS FROM: | ||||||||

| OPERATIONS | ||||||||

Net investment loss | $ | (11,334,379 | ) | $ | (5,715,831 | ) | ||

Net realized gain (loss) on: | ||||||||

Investments | 394,951,393 | 93,877,627 | ||||||

Foreign currency transactions | (19,857 | ) | 52,988 | |||||

Change in unrealized appreciation/depreciation on: | ||||||||

Investments | 875,251,953 | 2,093,843,292 | ||||||

Foreign currency translations | (6,882 | ) | (15,294 | ) | ||||

|

|

|

| |||||

Net increase in net assets resulting from operations | 1,258,842,228 | 2,182,042,782 | ||||||

|

|

|

| |||||

| DISTRIBUTIONS TO SHAREHOLDERS | ||||||||

Net realized gain on investments | (81,924,081 | ) | (554,428,603 | ) | ||||

|

|

|

| |||||

| CAPITAL SHARE TRANSACTIONS | ||||||||

Proceeds from shares sold | 970,809,001 | 1,098,827,318 | ||||||

Proceeds from reinvestment of distributions | 77,951,618 | 527,670,101 | ||||||

Cost of shares repurchased | (777,948,856 | ) | (1,096,038,243 | ) | ||||

|

|

|

| |||||

Net increase from capital share transactions | 270,811,763 | 530,459,176 | ||||||

|

|

|

| |||||

Total increase in net assets | 1,447,729,910 | 2,158,073,355 | ||||||

|

|

|

| |||||

| NET ASSETS | ||||||||

Beginning of period | 8,879,476,887 | 6,721,403,532 | ||||||

|

|

|

| |||||

End of period (includes undistributed net investment income of $0 and $85,734, respectively) | $ | 10,327,206,797 | $ | 8,879,476,887 | ||||

|

|

|

| |||||

| CHANGE IN CAPITAL SHARES | ||||||||

Shares outstanding, beginning of period | 214,433,583 | 198,997,068 | ||||||

|

|

|

| |||||

Shares sold | 20,484,703 | 29,829,897 | ||||||

Shares issued on reinvestment of distributions | 1,750,935 | 15,483,278 | ||||||

Shares repurchased | (16,605,044 | ) | (29,876,660 | ) | ||||

|

|

|

| |||||

Increase in capital shares | 5,630,594 | 15,436,515 | ||||||

|

|

|

| |||||

Shares outstanding, end of period | 220,064,177 | 214,433,583 | ||||||

|

|

|

| |||||

| (1) | Unaudited |

The accompanying notes are an integral part of these financial statements

33

| For a capital share outstanding throughout each period. |

| Six Months Ended Apr. 30, 2018(1) | Year Ended Oct. 31, 2017 | Year Ended Oct. 31, 2016 | Year Ended Oct. 31, 2015 | Year Ended Oct. 31, 2014 | Year Ended Oct. 31, 2013 | |||||||||||||||||||

Net asset value, beginning of the period | $ | 31.02 | $ | 24.84 | $ | 24.45 | $ | 23.59 | $ | 20.56 | $ | 15.75 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Income from investment operations: | ||||||||||||||||||||||||

Net investment income | 0.17 | 0.33 | 0.29 | 0.31 | 0.25 | 0.27 | ||||||||||||||||||

Net realized and unrealized gain on investments and foreign currency | 0.97 | 6.61 | 0.55 | 1.21 | 3.09 | 4.79 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total from investment operations | 1.14 | 6.94 | 0.84 | 1.52 | 3.34 | 5.06 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Less: | ||||||||||||||||||||||||

Dividends from net investment income | (0.30 | ) | (0.31 | ) | (0.24 | ) | (0.31 | ) | (0.24 | ) | (0.25 | ) | ||||||||||||

Distributions from net realized gain | (0.39 | ) | (0.45 | ) | (0.21 | ) | (0.35 | ) | (0.07 | ) | — | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total distributions | (0.69 | ) | (0.76 | ) | (0.45 | ) | (0.66 | ) | (0.31 | ) | (0.25 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Net asset value, end of period | $ | 31.47 | $ | 31.02 | $ | 24.84 | $ | 24.45 | $ | 23.59 | $ | 20.56 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total return | 3.64 | %(2) | 28.51 | % | 3.52 | % | 6.64 | % | 16.45 | % | 32.55 | % | ||||||||||||

Ratios/supplemental data: | ||||||||||||||||||||||||

Net assets, end of period (millions) | $ | 9,771.2 | $ | 8,698.6 | $ | 5,654.3 | $ | 5,126.0 | $ | 3,532.5 | $ | 2,134.7 | ||||||||||||

Ratio of expenses to average net assets | 0.64 | %(3) | 0.65 | % | 0.67 | % | 0.65 | % | 0.62 | % | 0.63 | % | ||||||||||||

Ratio of net investment income to average net assets | 1.11 | %(3) | 1.18 | % | 1.22 | % | 1.38 | % | 1.34 | % | 1.65 | % | ||||||||||||

Portfolio turnover rate | 3 | %(2) | 6 | % | 8 | % | 7 | % | 8 | % | 15 | % | ||||||||||||

| (1) | Unaudited |

| (2) | Not Annualized |

| (3) | Annualized |

The accompanying notes are an integral part of these financial statements.

34

| Financial Highlights For a capital share outstanding throughout each period. |

| Six Months Ended Apr. 30, 2018(1) | Year Ended Oct. 31, 2017 | Year Ended Oct. 31, 2016 | Year Ended Oct. 31, 2015 | Year Ended Oct. 31, 2014 | Year Ended Oct. 31, 2013 | |||||||||||||||||||

Net asset value, beginning of the period | $ | 35.64 | $ | 27.90 | $ | 27.09 | $ | 26.14 | $ | 23.09 | $ | 16.83 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Income from investment operations: | ||||||||||||||||||||||||

Net investment income | 0.05 | 0.12 | 0.12 | 0.14 | 0.13 | 0.10 | ||||||||||||||||||

Net realized and unrealized gain on investments and foreign currency | 3.78 | 8.62 | 1.04 | 1.62 | 3.45 | 6.26 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total from investment operations | 3.83 | 8.74 | 1.16 | 1.76 | 3.58 | 6.36 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Less: | ||||||||||||||||||||||||

Dividends from investment income | (0.11 | ) | (0.14 | ) | (0.10 | ) | (0.16 | ) | (0.08 | ) | (0.10 | ) | ||||||||||||

Distributions from net realized gain | (0.46 | ) | (0.86 | ) | (0.25 | ) | (0.65 | ) | (0.45 | ) | — | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||