As filed with the Securities and Exchange Commission on July 1, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21597

PRIMECAP Odyssey Funds

(Exact name of registrant as specified in charter)

177 East Colorado Boulevard, 11th Floor

Pasadena, CA 91105

(Address of principal executive offices) (Zip code)

Julietta Martikyan

PRIMECAP Management Company

177 East Colorado Boulevard, 11th Floor

Pasadena, CA 91105

(Name and address of agent for service)

(626) 304-9222

Registrant’s telephone number, including area code

Date of fiscal year end: October 31

Date of reporting period: April 30, 2024

Item 1. Reports to Stockholders.

(a)

Item 1. Reports to Stockholders.

SEMIANNUAL REPORT

For the Six Months Ended April 30, 2024

PRIMECAP ODYSSEY STOCK (POSKX)

PRIMECAP ODYSSEY GROWTH (POGRX)

PRIMECAP ODYSSEY AGGRESSIVE GROWTH (POAGX)

The Securities and Exchange Commission has adopted new regulations that will change the content and design of annual and semi-annual shareholder reports beginning in July 2024. Certain types of information, including investment portfolio and financial statements, will not be included in the shareholder reports but will be available online, delivered free of charge upon request, and filed on a semi-annual basis on Form N-CSR. Under the new regulations, shareholder letters will also be excluded from the shareholder reports that are required to be mailed or electronically delivered to shareholders. Please be assured that PRIMECAP intends to continue communication with its shareholders through shareholder letters either by physical delivery, electronic delivery, or posting the shareholder letters to its website at www.primecap.com.

| | |

| | Table of Contents PRIMECAP Odyssey Funds |

1

| | |

| | Letter to Shareholders PRIMECAP Odyssey Funds |

Dear Fellow Shareholders,

For the six months ended April 30, 2024, the PRIMECAP Odyssey Stock Fund, PRIMECAP Odyssey Growth Fund, and PRIMECAP Odyssey Aggressive Growth Fund produced total returns of +21.35%, +18.83%, and +18.47%, respectively. The unmanaged S&P 500® Index produced a total return of +20.98% during the period.

The torrid U.S. equity market started 2024 as it finished 2023, notching five consecutive months of positive performance on a steady rise to record-high levels at March-end. Growing optimism in a “soft landing” outcome for the U.S. economy pushed stocks higher. Indeed, bolstered by a firm labor market and steady consumer spending, the domestic economy delivered solid (albeit slowing) real growth. And the Federal Reserve seemed intent to lower its policy rate in the coming months. The market increasingly assessed this well-telegraphed maneuver – the resilient economy’s controlled glide back into the orbit of a more supportive Fed – as likely to succeed.

But the period ended on a less rosy note, with April registering a 4 percent decline in the S&P 500®. This landing maneuver was always data-dependent, and the data has not cooperated of late. The economy may be slowing more quickly than anticipated; real GDP in the first quarter missed expectations, and recent economic data has skewed somewhat softer. Meanwhile, inflation has proven intransigent at levels notably above the Fed’s 2 percent target. Core CPI’s +3.8% March reading barely budged from October’s +4.0% print, and shorter-term pricing measures have worsened in recent months. The Fed has postponed its rate cuts, and investors have been forced to acknowledge a fraught path ahead.

The benchmark’s large growth stocks again outperformed – a familiar refrain over the last decade – but the performance gap moderated. Equity strength was broad-based, and smaller-capitalization stocks nearly kept pace with their bigger brethren. Communication Services (+28%) and information technology (+25%), home to AI-fueled performances from mega-capitalization Meta (+43%) and NVIDIA (+112%), respectively, were among the sector leaders. Financials (+26%) and industrials (+25%) also spiked higher. Defensive sectors generated less lift, while flattish oil prices also limited upside in the energy sector (+12%).

The Funds’ divergent relative performances mostly reflected stock-specific idiosyncrasies. All three Funds experienced comparable sector allocation headwinds, driven by significant health care exposure (+14% sector benchmark return) and modest cash positions amid the market upswing. The Stock Fund overcame this allocation hurdle via an eclectic collection of prominent holdings, including banks (Wells Fargo), European industrials (Siemens), and pharmaceuticals (Eli Lilly). But whereas growth stocks, both large and small, outperformed during the period, the two growth-oriented Odyssey Funds trailed the S&P 500®. Neither the Growth Fund nor the Aggressive Growth Fund resemble conventional growth funds. Both have largely eschewed Big Tech, much to their historic detriment, preferring less orthodox alternatives. During the period, those alternative exposures’ mixed results were unable to offset the Funds’ allocation shortfalls.

All three Funds held an overweight position in the health care and industrials sectors, and an underweight position in the information technology, energy, financials, real estate, consumer sta-

2

Letter to Shareholders

PRIMECAP Odyssey Funds

continued

ples, communication services, materials, and utilities sectors. The Stock Fund and Growth Fund were also underweight the consumer discretionary sector, whereas the Aggressive Growth Fund featured a modest overweight position.

A more detailed discussion of the results of each PRIMECAP Odyssey Fund follows.

PRIMECAP Odyssey Stock Fund

For the six months ended April 30, 2024, the Stock Fund’s total return of +21.35% led the S&P 500®’s total return of +20.98%. Relative to the S&P 500®, favorable stock selection more than offset unfavorable sector allocation.

The Fund’s sector positioning detracted from relative results. The Stock Fund’s large overweight position in health care (27% of average assets versus a 13% benchmark weighting) and modest cash position were the primary culprits. The Fund was also underweight information technology (22% versus 29%), financials (10% versus 13%), and communication services (3% versus 9%), the three best-performing sectors. A large overweight position in industrials (19% versus 9%) and an underweight position in consumer staples (2% versus 6%) were partial offsets.

Favorable stock selection drove the Fund’s outperformance during the period. Health care and financials were the bright spots. Within health care, Eli Lilly (+41%), the Fund’s largest position, extended its remarkable multi-year run, while animal health company Elanco (+49%), now five years removed from Lilly’s ownership, recovered somewhat after enduring numerous setbacks as a separate company. These performances more than offset biotechnology laggards Biogen (-10%) and Amgen (+9%). Within financials, several large bank holdings, most notably Citigroup (+59%) and Wells Fargo (+52%), benefited from a resilient economy and the prospect of lower short-term interest rates, overcoming a modest headwind from derivatives exchange CME (+2%).

Selection elsewhere was mixed. Within industrials, automation giant Siemens (+46%) was a key contributor. But Big Tech generally outperformed, a recurring theme, creating a performance headwind for the Fund yet again. Even a sizable tailwind from avoiding Apple (flat) and Tesla (-9% ) failed to overcome the Fund’s limited exposure to NVIDIA (+112%), Meta (+43%), and Amazon (+31%). Within information technology, key holdings Flex (+50%) and KLA (+47%) offset underperformance from Intel (-16%), while Sony (-1%) and Mattel (-4%) weighed on results in consumer discretionary.

3

Letter to Shareholders

PRIMECAP Odyssey Funds

continued

The top 10 holdings, which collectively represented 38.7% of the portfolio at the period end, are listed below:

| | | | |

| | |

PRIMECAP Odyssey Stock Fund

Top 10 Holdings as of 4/30/24 | | Ending % of

Total Portfolio* | |

Eli Lilly & Co. | | | 11.2 | |

AstraZeneca PLC – ADR | | | 4.4 | |

KLA Corp. | | | 3.5 | |

AECOM | | | 3.3 | |

Microsoft Corp. | | | 3.0 | |

Siemens AG | | | 2.8 | |

FedEx Corp. | | | 2.8 | |

Amgen, Inc. | | | 2.6 | |

Wells Fargo & Co. | | | 2.6 | |

Flex Ltd. | | | 2.5 | |

Total % of Portfolio | | | 38.7 | |

| | * | The percentage is calculated by using the ending market value of the security divided by the ending market value of the total investments of the Fund. |

PRIMECAP Odyssey Growth Fund

For the six months ended April 30, 2024, the Growth Fund returned +18.83%, trailing both the S&P 500®’s +20.98% total return and the Russell 1000 Growth Index’s total return of +23.56%. Relative to the S&P 500®, sector allocation was unfavorable while stock selection had a neutral impact overall.

The Growth Fund’s sector allocation headwind approximated that of the Stock Fund. An even larger overweight in health care (32%) detracted from Fund performance, but this was roughly offset by reduced cash and a less pronounced underweight position in communication services (6%).

Stock selection was broadly less favorable than the Stock Fund across most sectors. Within health care, Rhythm Pharmaceuticals (+72%) soared as its solutions for genetic obesity gained traction, but a smaller Eli Lilly position and greater biotechnology exposure, particularly BeiGene (-17%) and BioMarin (-1%), provided a partial offset. Within information technology, Micron (+69%) was a major incremental contributor; the Growth Fund also had less exposure to Intel and more exposure to NVIDIA than the Stock Fund. And within consumer discretionary and communication services, Chinese internet companies Alibaba (-8%) and Baidu (-2%), respectively, detracted from results. Also, robot vacuum maker iRobot (-74%) plummeted after Amazon responded to

4

Letter to Shareholders

PRIMECAP Odyssey Funds

continued

regulatory pushback by walking away from its acquisition plans, exacerbating the Fund’s consumer discretionary weakness.

The top 10 holdings, which collectively represented 34.1% of the portfolio at the period end, are listed below:

| | | | |

| | |

PRIMECAP Odyssey Growth Fund

Top 10 Holdings as of 4/30/24 | | Ending % of

Total Portfolio* | |

Eli Lilly & Co. | | | 9.6 | |

Alphabet, Inc. – Class A & Class C | | | 3.9 | |

Micron Technology, Inc. | | | 3.4 | |

AECOM | | | 2.6 | |

Biogen, Inc. | | | 2.6 | |

Raymond James Financial, Inc. | | | 2.6 | |

Microsoft Corp. | | | 2.5 | |

KLA Corp. | | | 2.4 | |

AstraZeneca PLC – ADR | | | 2.3 | |

Amgen, Inc. | | | 2.2 | |

Total % of Portfolio | | | 34.1 | |

| | * | The percentage is calculated by using the ending market value of the security divided by the ending market value of the total investments of the Fund. |

PRIMECAP Odyssey Aggressive Growth Fund

For the six months ended April 30, 2024, the Aggressive Growth Fund’s total return of +18.47% trailed both the S&P 500®’s total return of +20.98% and the Russell Midcap Growth Index’s total return of +24.49%. Relative to the S&P 500®, both sector allocation and stock selection were unfavorable.

As with its Odyssey Fund peers, sector allocation registered a headwind. Greater exposure to information technology (28%) helped, but the Fund’s smaller overweight position in industrials (12%) and larger underweight in financials (5%) offset the benefit.

Stock selection was modestly unfavorable overall but featured varied performances by sector. Information technology, health care, and industrials contributed positively. The Fund’s larger stakes in Micron (+69%) and Nutanix (+68%) bolstered information technology, even as Axcelis (-19%) detracted from results. Health care results were comparable to the Growth Fund, with a larger Rhythm position offsetting the Fund’s BioNTech (-5%) exposure. And greater ownership of several airlines, most notably Delta (+61%) and United (+47%), propelled results within industrials.

5

Letter to Shareholders

PRIMECAP Odyssey Funds

continued

But brisker headwinds elsewhere ultimately tipped the Fund’s selection impact negative. Within consumer discretionary, despite Royal Caribbean’s (+65%) resurgence, bigger positions in Tesla and Sony, plus exposure to Chinese EV producer XPeng (-44%), weighed on results. MarketAxess (-6%) within financials and more exposure to Baidu in communication services were also incremental headwinds.

The top 10 holdings, which collectively represented 31.7% of the portfolio at the period end, are listed below:

| | | | |

| | |

PRIMECAP Odyssey Aggressive Growth Fund

Top 10 Holdings as of 4/30/24 | | Ending % of

Total Portfolio* | |

Eli Lilly & Co. | | | 6.7 | |

Micron Technology, Inc. | | | 4.8 | |

Alphabet, Inc. – Class A & Class C | | | 3.1 | |

Rhythm Pharmaceuticals, Inc. | | | 3.0 | |

Biogen Inc. | | | 2.8 | |

Sony Group Corp. – ADR | | | 2.5 | |

Flex Ltd. | | | 2.4 | |

BioMarin Pharmaceutical, Inc. | | | 2.3 | |

AECOM | | | 2.2 | |

Tesla, Inc. | | | 1.9 | |

Total % of Portfolio | | | 31.7 | |

| | * | The percentage is calculated by using the ending market value of the security divided by the ending market value of the total investments of the Fund. |

Outlook

Notwithstanding April’s swoon, the equity market’s posture still reflects a certain exuberance. Investors, underwriting not just a soft landing but a subsequent boom, as well, chased stocks higher ahead of the Fed’s long-awaited pivot back to a dovish regime. The market may now be wrestling with the wisdom in that conviction, but the aggressive buying propelled the S&P 500® Index’s valuation into rarefied air (20.9x forward P/E at March-end before dropping modestly to 19.8x at period-end). Other than mid-pandemic, when earnings were artificially constrained, this multiple represented the Index’s loftiest valuation in more than 20 years.

We have been skeptical of the consensus view that the economy’s safe return to the warm embrace of a pliant Fed was a near certainty. More generally, we have been surprised at how hastily the market has reverted to its historic Fed-centric orientation. Indeed, we originally assessed 2022’s equity weakness (the S&P 500® dropped 18 percent) amid rising inflation and interest rates as

6

Letter to Shareholders

PRIMECAP Odyssey Funds

continued

indicative of a paradigm-shifting reset – the demise of the low growth, low inflation, low interest rate regime (and its implied “Fed put”) that had defined the prior decade, and which provided fertile conditions for Big Tech’s ascendance. But our assessment proved incorrect, or at least premature. Last year the equity market soared – punctuated by the Magnificent Seven’s concentrated dominance – as investors imagined the Fed solving post-pandemic imbalances and aggressively cutting rates. Fed theater was back in force, with meeting minutes and official speeches again serving as cue cards for Fed-obsessed market actors.

But no matter how important or effective the Fed has been since the Great Recession and through the pandemic – contestable, unresolved claims – it is worth remembering the Fed is not almighty. After all, just two years ago, the Fed got inflation completely wrong. The Fed reacts to data, and the data (broadly defined) is messy. Stubborn inflation, unsustainable deficit spending, worsening geopolitical strife – not to mention two key leading indicators (an inverted yield curve and M2 money supply contraction) sounding an alarm for more than a year.

To be clear, we are not predicting doom per se. We are ardent admirers of America’s unique brand of creative destruction and free enterprise. We simply observe an underlying sanguinity in the equity market that we do not share. And this is true even as the market rally broadened beyond Big Tech to include smaller-capitalization stocks and, to a lesser degree, value stocks.

Our optimism is instead more tempered, and more targeted. From airlines to biotechnology to the Chinese internet, the Funds own many stocks where exuberance is non-existent, where expectations have withered, and where, admittedly, performance has generally been woeful. But these are also pockets of the market where, in our estimation, intrinsic values compare quite favorably to current prices.

The airlines logged a robust six months overall – of the largest Fund holdings, Delta (+61%) and United (+47%) were particularly strong, while American (+21%) and Southwest (+18%) tracked the benchmark – but have endured a very difficult five-year run. The Funds’ ownership (3-5 percent by Fund at period-end) dwarfs the Index’s weighting (0.2 percent). The Funds’ industry exposure has been punitive, especially during the Covid era. Most airline stocks remain well below their pre-pandemic peaks even as the S&P 500® sits 50 percent higher. Some of this degradation in equity value reflects higher debt burdens. But the equities are also heavy-laden with investor frustration and fatigue. Despite the negativity, demand for flying grows at a healthy clip; the industry is mission-critical for the modern economy; and a consolidated industry structure should ultimately allow well-managed airlines to generate sufficient returns on invested capital. Relative to still anemic valuations (the industry trades at 7.0x forward P/E), and despite Wall Street apathy, we believe our airline holdings can be high fliers yet.

Biotechnology is another portfolio staple that has struggled. Fund exposure to the industry ranges from roughly 5 percent (Stock Fund) to 15 percent (Aggressive Growth Fund), an order of magnitude greater than the Index (1.9 percent). Individual stock performance has been predictably varied and volatile, with some notable wins along the way, but the Funds’ largest positions

7

Letter to Shareholders

PRIMECAP Odyssey Funds

continued

have generally fared poorly of late. Biogen, for instance, has declined one-half from its pre-pandemic high; as a frequent Top 10 holding across all three Funds over time, this relative weakness has been costly. But as with the Funds’ other outsized biotechnology positions, our Biogen thesis is largely intact. Biogen sports an underrated collection of both commercial assets and pipeline opportunities. The company botched the 2021 launch of its landmark Alzheimer’s drug, Aduhelm, souring the company’s fundamental outlook (and its reputation). But the opportunity for its second such drug, Leqembi, despite a slow initial ramp, compares favorably to Biogen’s relatively paltry market capitalization ($31 billion). When sentiment is decidedly negative, as it is with Biogen, small signs of progress can deliver outsized returns. The Funds’ biotechnology portfolios are replete with such out-of-favor opportunities.

Lastly, the Chinese internet stocks have been doubly painful. Alibaba and Baidu, the so-called Amazon and Alphabet of China, respectively, have, as securities, behaved nothing like Amazon and Alphabet. The stocks have declined two-thirds or more from peak levels just over three years ago, a period when their US-based Big Tech peers have generally surged in value. Even zooming out and including earlier outperformance, both companies’ five-year returns are bleak. The resultant performance drag for the Growth and Aggressive Growth Funds, where these stocks currently represent nearly 3 percent of the portfolio, has been stark. (Both Funds also have exposure to China biotech BeiGene, and the Aggressive Growth Fund has exposure to China automaker XPeng; all four companies have suffered from their association with China.) Our thesis, battered but not broken, is that these giants, as market leaders in key technology verticals, are critical enablers of China’s digital transformation. Alibaba, like Amazon, leads in e-commerce and cloud computing; Baidu, like Alphabet, leads in search and has even better competitive prospects in generative AI and autonomous driving. But their credentials have succumbed to their circumstances; bad news has been constant, from regulatory pressure to macro weakness to geopolitical tension. The stocks, now nearly untouchable, trade at high-single digit P/E valuations (mid-single digit net of cash stockpiles) – multiples befitting dying businesses, not China’s most important technology companies.

For several years now, the above “ABC” (airlines, biotechnology, and China) headwinds have been brisk and relentless. Combined with the gale force headwind stemming from the Funds’ Big Tech underweight position, it is unsurprising that recent results have been challenging for the Funds. But over forty years as equity investors we have weathered several multi-year storms. We are optimistic this particular dynamic is at an inflection. And, particularly relative to an expensive benchmark, our aggregate underperformance only narrows and deepens our conviction in the Funds’ unconventional holdings.

Sincerely,

PRIMECAP Management Company

May 6, 2024

8

Letter to Shareholders

PRIMECAP Odyssey Funds

continued

Past performance is not a guarantee of future results.

The Funds invest in smaller companies, which involve additional risks such as limited liquidity and greater volatility. All Funds may invest in foreign securities, which involves: 1) greater volatility; 2) political, economic, and currency risks; and 3) differences in accounting methods. Mutual fund investing involves risk, and loss of principal is possible. Growth stocks typically are more volatile than value stocks; however, value stocks have a lower expected growth rate in earnings and sales.

Please refer to the Schedule of Investments for details of fund holdings. Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security.

The S&P 500® Index is a market capitalization-weighted index of 500 large-capitalization stocks commonly used to represent the U.S. equity market. The Russell 1000 Growth Index is an index that measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values (the Russell 1000 Index measures the performance of the large-cap segment of the U.S. equity universe). The Russell Midcap Growth Index measures the performance of those Russell Midcap companies with higher price-to-book ratios and higher forecasted growth values. You cannot invest directly in an index.

Price-to-earnings ratio is calculated by dividing the current share price of a stock by its earnings per share.

Earnings per share is calculated by taking the total earnings divided by the number of shares outstanding.

Earnings growth is not a prediction of a Fund’s future performance.

The information provided herein represents the opinions of PRIMECAP Management Company and is not intended to be a forecast of future events, a guarantee of future results, or investment advice.

9

| | |

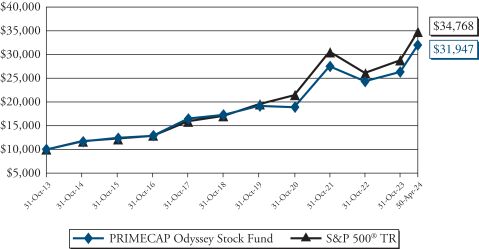

| | Performance Graphs PRIMECAP Odyssey Stock Fund |

The chart below illustrates the performance of a hypothetical $10,000 investment made on October 31, 2013 and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of dividends and capital gains for the fund and dividends for the index.

| | | | | | | | | | | | | | | | |

| | | Total Return

Period Ended April 30, 2024 | |

| | | 1 Year | | | Annualized

5 Year | | | Annualized

10 Year | | | Annualized

Since Inception^ | |

Stock Fund | | | 22.19% | | | | 11.35% | | | | 11.55% | | | | 10.57% | |

S&P 500®* | | | 22.66% | | | | 13.19% | | | | 12.41% | | | | 10.12% | |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-729-2307.

| | * | The S&P 500® is a market capitalization-weighted index of 500 large-capitalization stocks commonly used to represent the U.S. equity market. |

10

| | |

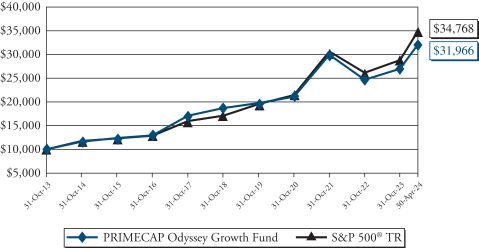

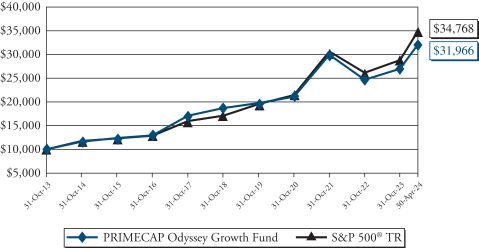

| | Performance Graphs PRIMECAP Odyssey Growth Fund |

The chart below illustrates the performance of a hypothetical $10,000 investment made on October 31, 2013 and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of dividends and capital gains for the fund and dividends for the index.

| | | | | | | | | | | | | | | | |

| | | Total Return

Period Ended April 30, 2024 | |

| | | 1 Year | | | Annualized

5 Year | | | Annualized

10 Year | | | Annualized

Since Inception^ | |

Growth Fund | | | 19.66% | | | | 10.01% | | | | 11.84% | | | | 11.03% | |

S&P 500®* | | | 22.66% | | | | 13.19% | | | | 12.41% | | | | 10.12% | |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-729-2307.

| | * | The S&P 500® is a market capitalization-weighted index of 500 large-capitalization stocks commonly used to represent the U.S. equity market. |

11

| | |

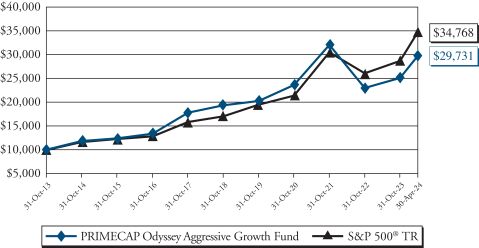

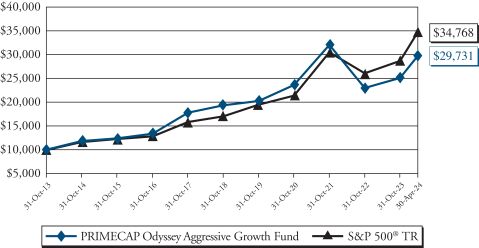

| | Performance Graphs PRIMECAP Odyssey Aggressive Growth Fund |

The chart below illustrates the performance of a hypothetical $10,000 investment made on October 31, 2013 and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of dividends and capital gains for the fund and dividends for the index.

| | | | | | | | | | | | | | | | |

| | | Total Return

Period Ended April 30, 2024 | |

| | | 1 Year | | | Annualized

5 Year | | | Annualized

10 Year | | | Annualized

Since Inception^ | |

Aggressive Growth Fund | | | 16.62% | | | | 7.24% | | | | 10.95% | | | | 12.01% | |

S&P 500®* | | | 22.66% | | | | 13.19% | | | | 12.41% | | | | 10.12% | |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-729-2307.

| | * | The S&P 500® is a market capitalization-weighted index of 500 large-capitalization stocks commonly used to represent the U.S. equity market. |

12

| | |

| | Sector Breakdown PRIMECAP Odyssey Funds |

PRIMECAP Odyssey Stock Fund

| | | | |

Communication Services | | | 3.5% | |

Consumer Discretionary | | | 7.9% | |

Consumer Staples | | | 1.7% | |

Energy | | | 2.7% | |

Financials | | | 10.2% | |

Health Care | | | 28.3% | |

Industrials | | | 19.7% | |

Information Technology | | | 22.1% | |

Materials | | | 2.0% | |

Short-Term Investments, net of Liabilities in Excess of Other Assets | | | 1.9% | |

Total | | | 100.0% | |

PRIMECAP Odyssey Growth Fund

| | | | |

Communication Services | | | 6.8% | |

Consumer Discretionary | | | 7.9% | |

Consumer Staples | | | 0.8% | |

Energy | | | 2.8% | |

Financials | | | 7.7% | |

Health Care | | | 31.0% | |

Industrials | | | 15.9% | |

Information Technology | | | 24.2% | |

Materials | | | 0.7% | |

Rights (Health Care) | | | 0.0% | |

Short-Term Investments and Other Assets | | | 2.2% | |

Total | | | 100.0% | |

The tables above list sector allocations as a percentage of each fund’s total net assets as of April 30, 2024. The management report may make reference to average allocations during the period. As a result, the sector allocations above may differ from those discussed in the management report.

13

Sector Breakdown

PRIMECAP Odyssey Funds

continued

PRIMECAP Odyssey Aggressive Growth Fund

| | | | |

Communication Services | | | 6.8% | |

Consumer Discretionary | | | 11.2% | |

Consumer Staples | | | 0.1% | |

Energy | | | 1.7% | |

Financials | | | 4.8% | |

Health Care | | | 29.1% | |

Industrials | | | 12.8% | |

Information Technology | | | 29.4% | |

Materials | | | 1.0% | |

Real Estate | | | 0.1% | |

Rights (Health Care) | | | 0.0% | |

Warrants (Materials) | | | 0.0% | |

Short-Term Investments, net of Liabilities in Excess of Other Assets | | | 3.0% | |

Total | | | 100.0% | |

The table above lists sector allocations as a percentage of the fund’s total net assets as of April 30, 2024. The management report may make reference to average allocations during the period. As a result, the sector allocations above may differ from those discussed in the management report.

14

| | |

| | Schedule of Investments PRIMECAP Odyssey Stock Fund April 30, 2024 (Unaudited) |

| | | | | | | | |

| Shares | | | | | Value | |

| | COMMON STOCKS – 98.1% | | | | |

| |

| Communication Services – 3.5% | | | |

| | 346,650 | | | Alphabet, Inc. – Class A (a) | | $ | 56,427,687 | |

| | 361,400 | | | Alphabet, Inc. – Class C (a) | | | 59,500,896 | |

| | 138,600 | | | Comcast Corp. – Class A | | | 5,282,046 | |

| | 55,200 | | | Meta Platforms, Inc. – Class A | | | 23,745,384 | |

| | 300,000 | | | Nintendo Co. Ltd. – JPY | | | 14,630,701 | |

| | 303,200 | | | Walt Disney Co. (The) | | | 33,685,520 | |

| | | | | | | | |

| | | | | | | 193,272,234 | |

| | | | | | | | |

| Consumer Discretionary – 7.9% | | | |

| | 422,600 | | | Bath & Body Works, Inc. | | | 19,194,492 | |

| | 25,700 | | | Burlington Stores, Inc. (a) | | | 4,624,458 | |

| | 125,700 | | | Capri Holdings Ltd. (a) | | | 4,459,836 | |

| | 471,500 | | | CarMax, Inc. (a) | | | 32,047,855 | |

| | 933,500 | | | Carnival Corp. (a) | | | 13,834,470 | |

| | 193,200 | | | eBay, Inc. | | | 9,957,528 | |

| | 217,800 | | | Leslie’s, Inc. (a) | | | 855,954 | |

| | 3,383,300 | | | Mattel, Inc. (a) | | | 61,982,056 | |

| | 77,500 | | | MGM Resorts International (a) | | | 3,056,600 | |

| | 1,500,000 | | | Newell Brands, Inc. | | | 11,910,000 | |

| | 728,800 | | | Ross Stores, Inc. | | | 94,416,040 | |

| | 179,350 | | | Royal Caribbean Cruises Ltd. (a) | | | 25,042,640 | |

| | 1,120,719 | | | Sony Group Corp. – ADR | | | 92,537,768 | |

| | 184,700 | | | TJX Cos., Inc. (The) | | | 17,378,423 | |

| | 123,033 | | | Victoria’s Secret & Co. (a) | | | 2,167,841 | |

| | 494,739 | | | Whirlpool Corp. | | | 46,930,942 | |

| | | | | | | | |

| | | | | | | 440,396,903 | |

| | | | | | | | |

| Consumer Staples – 1.7% | | | |

| | 140,900 | | | Altria Group, Inc. | | | 6,172,829 | |

| | 290,600 | | | BJ’s Wholesale Club Holdings, Inc. (a) | | | 21,702,008 | |

| | 230,300 | | | Dollar Tree, Inc. (a) | | | 27,232,975 | |

| | 71,400 | | | Philip Morris International, Inc. | | | 6,778,716 | |

| | 300,700 | | | Sysco Corp. | | | 22,348,024 | |

| | 140,000 | | | Tyson Foods, Inc. – Class A | | | 8,491,000 | |

| | | | | | | | |

| | | | | | | 92,725,552 | |

| | | | | | | | |

| Energy – 2.7% | | | |

| | 144,500 | | | Cameco Corp. | | | 6,593,535 | |

| | 183,000 | | | ConocoPhillips | | | 22,988,460 | |

| | 181,100 | | | EOG Resources, Inc. | | | 23,928,743 | |

| | 332,600 | | | Hess Corp. | | | 52,381,174 | |

The accompanying notes are an integral part of these financial statements.

15

Schedule of Investments

PRIMECAP Odyssey Stock Fund

April 30, 2024 (Unaudited) – continued

| | | | | | | | |

| Shares | | | | | Value | |

| Energy (continued) | | | |

| | 57,300 | | | Pioneer Natural Resources Co. | | $ | 15,432,036 | |

| | 1,070,000 | | | Southwestern Energy Co. (a) | | | 8,014,300 | |

| | 230,000 | | | TechnipFMC PLC | | | 5,892,600 | |

| | 1,622,800 | | | Transocean Ltd. (a) | | | 8,471,016 | |

| | 27,000 | | | Valero Energy Corp. | | | 4,316,490 | |

| | | | | | | | |

| | | | | | | 148,018,354 | |

| | | | | | | | |

| Financials – 10.2% | | | |

| | 643,200 | | | Bank of America Corp. | | | 23,804,832 | |

| | 90,000 | | | Bank of New York Mellon Corp. (The) | | | 5,084,100 | |

| | 1,004,550 | | | Citigroup, Inc. | | | 61,609,051 | |

| | 220,400 | | | CME Group, Inc. – Class A | | | 46,204,656 | |

| | 110,000 | | | Discover Financial Services | | | 13,940,300 | |

| | 9,790 | | | Evercore, Inc. – Class A | | | 1,776,885 | |

| | 70,900 | | | Fidelity National Information Services, Inc. | | | 4,815,528 | |

| | 342,000 | | | JPMorgan Chase & Co. | | | 65,575,080 | |

| | 240,000 | | | KeyCorp | | | 3,477,600 | |

| | 583,600 | | | Northern Trust Corp. | | | 48,082,804 | |

| | 94,200 | | | PayPal Holdings, Inc. (a) | | | 6,398,064 | |

| | 65,910 | | | Progressive Corp. (The) | | | 13,725,758 | |

| | 760,575 | | | Raymond James Financial, Inc. | | | 92,790,150 | |

| | 124,900 | | | Visa, Inc. – Class A | | | 33,549,389 | |

| | 2,464,018 | | | Wells Fargo & Co. | | | 146,165,548 | |

| | 21,440 | | | WEX, Inc. (a) | | | 4,529,414 | |

| | | | | | | | |

| | | | | | | 571,529,159 | |

| | | | | | | | |

| Health Care – 28.3% | | | |

| | 66,000 | | | Abbott Laboratories | | | 6,994,020 | |

| | 345,900 | | | Agilent Technologies, Inc. | | | 47,402,136 | |

| | 46,400 | | | Alcon, Inc. | | | 3,599,712 | |

| | 536,900 | | | Amgen, Inc. | | | 147,078,386 | |

| | 3,248,500 | | | AstraZeneca PLC – ADR | | | 246,496,180 | |

| | 575,600 | | | Biogen, Inc. (a) | | | 123,650,392 | |

| | 347,500 | | | Boston Scientific Corp. (a) | | | 24,974,825 | |

| | 1,432,030 | | | Bristol-Myers Squibb Co. | | | 62,923,398 | |

| | 171,100 | | | CVS Health Corp. | | | 11,585,181 | |

| | 3,365,471 | | | Elanco Animal Health, Inc. (a) | | | 44,289,599 | |

| | 795,813 | | | Eli Lilly & Co. | | | 621,609,534 | |

| | 749,880 | | | GSK PLC – ADR | | | 31,075,027 | |

| | 390,700 | | | LivaNova PLC (a) | | | 21,781,525 | |

| | 31,000 | | | Medtronic PLC | | | 2,487,440 | |

The accompanying notes are an integral part of these financial statements.

16

Schedule of Investments

PRIMECAP Odyssey Stock Fund

April 30, 2024 (Unaudited) – continued

| | | | | | | | |

| Shares | | | | | Value | |

| Health Care (continued) | | | |

| | 57,600 | | | Merck & Co., Inc. | | $ | 7,443,072 | |

| | 365,050 | | | Novartis AG – ADR | | | 35,457,307 | |

| | 159,500 | | | Revvity, Inc. | | | 16,343,965 | |

| | 18,700 | | | Roche Holding AG – CHF | | | 4,480,786 | |

| | 81,900 | | | Sanofi – ADR | | | 4,031,937 | |

| | 124,100 | | | Siemens Healthineers AG – EUR | | | 6,882,280 | |

| | 16,200 | | | Stryker Corp. | | | 5,451,300 | |

| | 107,800 | | | Thermo Fisher Scientific, Inc. | | | 61,308,016 | |

| | 5,480 | | | Waters Corp. (a) | | | 1,693,539 | |

| | 327,500 | | | Zimmer Biomet Holdings, Inc. | | | 39,391,700 | |

| | | | | | | | |

| | | | | | | 1,578,431,257 | |

| | | | | | | | |

| Industrials – 19.7% | | | |

| | 2,014,060 | | | AECOM | | | 186,018,582 | |

| | 264,566 | | | Airbus SE – EUR | | | 43,536,458 | |

| | 54,050 | | | Alaska Air Group, Inc. (a) | | | 2,325,231 | |

| | 2,230,650 | | | American Airlines Group, Inc. (a) | | | 30,136,082 | |

| | 15,700 | | | AMETEK, Inc. | | | 2,742,162 | |

| | 159,962 | | | Carrier Global Corp. | | | 9,836,063 | |

| | 38,170 | | | Caterpillar, Inc. | | | 12,770,537 | |

| | 90,400 | | | CSX Corp. | | | 3,003,088 | |

| | 209,610 | | | Curtiss-Wright Corp. | | | 53,119,366 | |

| | 922,450 | | | Delta Air Lines, Inc. | | | 46,187,072 | |

| | 587,095 | | | FedEx Corp. | | | 153,689,729 | |

| | 66,300 | | | General Dynamics Corp. | | | 19,034,067 | |

| | 58,200 | | | GXO Logistics, Inc. (a) | | | 2,890,212 | |

| | 411,900 | | | Jacobs Solutions, Inc. | | | 59,120,007 | |

| | 250,000 | | | JELD-WEN Holding, Inc. (a) | | | 5,125,000 | |

| | 291,100 | | | Kirby Corp. (a) | | | 31,767,743 | |

| | 34,000 | | | Knight-Swift Transportation Holdings, Inc. | | | 1,571,820 | |

| | 23,300 | | | L3Harris Technologies, Inc. | | | 4,987,365 | |

| | 118,100 | | | Matson, Inc. | | | 12,728,818 | |

| | 84,400 | | | Moog, Inc. – Class A | | | 13,425,508 | |

| | 689,508 | | | Nextracker, Inc. – Class A (a) | | | 29,504,047 | |

| | 74,500 | | | Norfolk Southern Corp. | | | 17,158,840 | |

| | 30,581 | | | Otis Worldwide Corp. | | | 2,788,987 | |

| | 17,000 | | | Rockwell Automation, Inc. | | | 4,606,320 | |

| | 9,562 | | | RTX Corp. | | | 970,734 | |

| | 320,100 | | | RXO, Inc. (a) | | | 6,053,091 | |

| | 15,900 | | | Saia, Inc. (a) | | | 6,309,597 | |

The accompanying notes are an integral part of these financial statements.

17

Schedule of Investments

PRIMECAP Odyssey Stock Fund

April 30, 2024 (Unaudited) – continued

| | | | | | | | |

| Shares | | | | | Value | |

| Industrials (continued) | | | |

| | 837,159 | | | Siemens AG – EUR | | $ | 156,828,233 | |

| | 2,203,050 | | | Southwest Airlines Co. | | | 57,147,117 | |

| | 30,400 | | | Union Pacific Corp. | | | 7,209,664 | |

| | 1,292,400 | | | United Airlines Holdings, Inc. (a) | | | 66,506,904 | |

| | 198,600 | | | United Parcel Service, Inc. – Class B | | | 29,289,528 | |

| | 164,400 | | | XPO, Inc. (a) | | | 17,666,424 | |

| | | | | | | | |

| | | | | | | 1,096,054,396 | |

| | | | | | | | |

| Information Technology – 22.1% | | | |

| | 96,600 | | | Adobe, Inc. (a) | | | 44,709,378 | |

| | 172,400 | | | Analog Devices, Inc. | | | 34,585,164 | |

| | 5,000 | | | Apple, Inc. | | | 851,650 | |

| | 422,150 | | | Applied Materials, Inc. | | | 83,860,098 | |

| | 243,398 | | | Corning, Inc. | | | 8,124,625 | |

| | 4,817,399 | | | Flex Ltd. (a) | | | 138,018,481 | |

| | 3,492,200 | | | Hewlett Packard Enterprise Co. | | | 59,367,400 | |

| | 1,158,800 | | | HP, Inc. | | | 32,550,692 | |

| | 4,168,990 | | | Intel Corp. | | | 127,029,125 | |

| | 50,000 | | | Jabil, Inc. | | | 5,868,000 | |

| | 118,850 | | | Keysight Technologies, Inc. (a) | | | 17,582,669 | |

| | 280,210 | | | KLA Corp. | | | 193,145,951 | |

| | 4,572,830 | | | L.M. Ericsson Telephone Co. – ADR | | | 22,955,607 | |

| | 434,700 | | | Microsoft Corp. | | | 169,241,751 | |

| | 637,400 | | | NetApp, Inc. | | | 65,148,654 | |

| | 12,700 | | | NVIDIA Corp. | | | 10,973,054 | |

| | 770,700 | | | Oracle Corp. | | | 87,667,125 | |

| | 215,447 | | | QUALCOMM, Inc. | | | 35,731,885 | |

| | 116,500 | | | Seagate Technology Holdings PLC | | | 10,008,515 | |

| | 134,100 | | | Teradyne, Inc. | | | 15,598,512 | |

| | 390,100 | | | Texas Instruments, Inc. | | | 68,821,442 | |

| | | | | | | | |

| | | | | | | 1,231,839,778 | |

| | | | | | | | |

| Materials – 2.0% | | | |

| | 253,910 | | | Albemarle Corp. | | | 30,547,912 | |

| | 128,000 | | | Corteva, Inc. | | | 6,928,640 | |

| | 125,650 | | | Dow, Inc. | | | 7,149,485 | |

| | 137,700 | | | DuPont de Nemours, Inc. | | | 9,983,250 | |

| | 504,900 | | | Freeport-McMoRan, Inc. | | | 25,214,706 | |

| | 4,615,760 | | | Glencore PLC – GBP | | | 26,857,034 | |

| | 325,200 | | | Tronox Holdings PLC | | | 5,525,148 | |

| | | | | | | | |

| | | | | | | 112,206,175 | |

| | | | | | | | |

| TOTAL COMMON STOCKS

(Cost $2,459,893,254) | | $ | 5,464,473,808 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

18

Schedule of Investments

PRIMECAP Odyssey Stock Fund

April 30, 2024 (Unaudited) – continued

| | | | | | | | |

| Shares | | | | | Value | |

| | SHORT-TERM INVESTMENTS – 2.0% | | | | |

| | 112,298,083 | | | Dreyfus Treasury Securities Cash Management Fund –Institutional Shares – 5.18% (b) | | $ | 112,298,083 | |

| | | | | | | | |

| TOTAL SHORT-TERM INVESTMENTS

(Cost $112,298,083) | | | 112,298,083 | |

| | | | | | | | |

| TOTAL INVESTMENTS IN SECURITIES

(Cost $2,572,191,337) – 100.1% | | | 5,576,771,891 | |

| | Liabilities in Excess of Other Assets – (0.1)% | | | (3,528,560 | ) |

| | | | | |

| | TOTAL NET ASSETS – 100.0% | | $ | 5,573,243,331 | |

| | | | | | | | |

| ADR | American Depository Receipt |

| GBP | British Pound Sterling |

| (b) | Rate quoted is seven-day yield at period end. |

The Global Industry Classification Standard (GICS®) was developed by and is the exclusive property of MSCI Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by the fund’s administrator.

The accompanying notes are an integral part of these financial statements.

19

| | |

| | Schedule of Investments PRIMECAP Odyssey Growth Fund April 30, 2024 (Unaudited) |

| | | | | | | | |

| Shares | | | | | Value | |

| | COMMON STOCKS – 97.8% | | | | |

| |

| Communication Services – 6.8% | | | |

| | 793,970 | | | Alphabet, Inc. – Class A (a) | | $ | 129,242,436 | |

| | 677,320 | | | Alphabet, Inc. – Class C (a) | | | 111,513,965 | |

| | 651,600 | | | Baidu, Inc. – ADR (a) | | | 67,375,440 | |

| | 74,000 | | | Electronic Arts, Inc. | | | 9,384,680 | |

| | 294,700 | | | IMAX Corp. (a) | | | 4,718,147 | |

| | 54,200 | | | Live Nation Entertainment, Inc. (a) | | | 4,818,922 | |

| | 30,200 | | | Meta Platforms, Inc. – Class A | | | 12,991,134 | |

| | 14,500 | | | Netflix, Inc. (a) | | | 7,984,280 | |

| | 550,000 | | | Nintendo Co. Ltd. – JPY | | | 26,822,952 | |

| | 85,900 | | | Shutterstock, Inc. | | | 3,668,789 | |

| | 101,300 | | | Trade Desk, Inc. (The) – Class A (a) | | | 8,392,705 | |

| | 164,416 | | | Universal Music Group N.V. – EUR | | | 4,836,333 | |

| | 301,200 | | | Walt Disney Co. (The) | | | 33,463,320 | |

| | | | | | | | |

| | | | | | | 425,213,103 | |

| | | | | | | | |

| Consumer Discretionary – 7.9% | | | |

| | 1,272,940 | | | Alibaba Group Holding Ltd. – ADR | | | 95,279,559 | |

| | 2,000 | | | Amazon.com, Inc. (a) | | | 350,000 | |

| | 499,498 | | | Bath & Body Works, Inc. | | | 22,687,199 | |

| | 282,100 | | | Bowlero Corp. – Class A | | | 3,314,675 | |

| | 61,500 | | | Burlington Stores, Inc. (a) | | | 11,066,310 | |

| | 92,800 | | | Capri Holdings Ltd. (a) | | | 3,292,544 | |

| | 617,500 | | | CarMax, Inc. (a) | | | 41,971,475 | |

| | 193,400 | | | Carnival Corp. (a) | | | 2,866,188 | |

| | 15,400 | | | DoorDash, Inc. – Class A (a) | | | 1,990,604 | |

| | 110,300 | | | eBay, Inc. | | | 5,684,862 | |

| | 2,015,833 | | | Entain PLC – GBP | | | 19,666,847 | |

| | 24,477 | | | Flutter Entertainment PLC – GBP (a) | | | 4,534,571 | |

| | 820,458 | | | iRobot Corp. (a) | | | 7,023,120 | |

| | 247,900 | | | Leslie’s, Inc. (a) | | | 974,247 | |

| | 30,000 | | | Marriott International, Inc. – Class A | | | 7,083,900 | |

| | 2,617,600 | | | Mattel, Inc. (a) | | | 47,954,432 | |

| | 9,300 | | | McDonald’s Corp. | | | 2,539,272 | |

| | 80,200 | | | MGM Resorts International (a) | | | 3,163,088 | |

| | 497,900 | | | Norwegian Cruise Line Holdings Ltd. (a) | | | 9,420,268 | |

| | 75,700 | | | Ollie’s Bargain Outlet Holdings, Inc. (a) | | | 5,536,698 | |

| | 11,000 | | | Restaurant Brands International, Inc. | | | 834,350 | |

| | 95,700 | | | Ross Stores, Inc. | | | 12,397,935 | |

| | 361,171 | | | Royal Caribbean Cruises Ltd. (a) | | | 50,430,307 | |

The accompanying notes are an integral part of these financial statements.

20

Schedule of Investments

PRIMECAP Odyssey Growth Fund

April 30, 2024 (Unaudited) – continued

| | | | | | | | |

| Shares | | | | | Value | |

| Consumer Discretionary (continued) | | | |

| | 650,077 | | | Sony Group Corp. – ADR | | $ | 53,676,858 | |

| | 10,000 | | | Tapestry, Inc. | | | 399,200 | |

| | 379,900 | | | Tesla, Inc. (a) | | | 69,628,072 | |

| | 65,300 | | | TJX Cos., Inc. (The) | | | 6,144,077 | |

| | 166,699 | | | Victoria’s Secret & Co. (a) | | | 2,937,236 | |

| | | | | | | | |

| | | | | | | 492,847,894 | |

| | | | | | | | |

| Consumer Staples – 0.8% | | | |

| | 102,300 | | | Altria Group, Inc. | | | 4,481,763 | |

| | 131,800 | | | BJ’s Wholesale Club Holdings, Inc. (a) | | | 9,842,824 | |

| | 230,200 | | | Dollar Tree, Inc. (a) | | | 27,221,150 | |

| | 141,103 | | | Performance Food Group Co. (a) | | | 9,578,072 | |

| | 1,000 | | | US Foods Holding Corp. (a) | | | 50,250 | |

| | | | | | | | |

| | | | | | | 51,174,059 | |

| | | | | | | | |

| Energy – 2.8% | | | |

| | 14,505 | | | ConocoPhillips | | | 1,822,118 | |

| | 340,000 | | | Coterra Energy, Inc. | | | 9,302,400 | |

| | 86,400 | | | EOG Resources, Inc. | | | 11,416,032 | |

| | 357,021 | | | Hess Corp. | | | 56,227,237 | |

| | 192,760 | | | Pioneer Natural Resources Co. | | | 51,914,123 | |

| | 48,500 | | | Schlumberger Ltd. | | | 2,302,780 | |

| | 1,180,000 | | | Southwestern Energy Co. (a) | | | 8,838,200 | |

| | 22,500 | | | TechnipFMC PLC | | | 576,450 | |

| | 5,818,304 | | | Transocean Ltd. (a) | | | 30,371,547 | |

| | | | | | | | |

| | | | | | | 172,770,887 | |

| | | | | | | | |

| Financials – 7.7% | | | |

| | 182,800 | | | Bank of America Corp. | | | 6,765,428 | |

| | 313,800 | | | Citigroup, Inc. | | | 19,245,354 | |

| | 119,100 | | | CME Group, Inc. – Class A | | | 24,968,124 | |

| | 69,000 | | | Discover Financial Services | | | 8,744,370 | |

| | 60,960 | | | Evercore, Inc. – Class A | | | 11,064,240 | |

| | 96,500 | | | JPMorgan Chase & Co. | | | 18,502,910 | |

| | 129,100 | | | MarketAxess Holdings, Inc. | | | 25,831,619 | |

| | 3,900 | | | Mastercard, Inc. – Class A | | | 1,759,680 | |

| | 498,960 | | | Northern Trust Corp. | | | 41,109,314 | |

| | 1,313,605 | | | Raymond James Financial, Inc. | | | 160,259,810 | |

| | 164,700 | | | Tradeweb Markets, Inc. – Class A | | | 16,751,637 | |

| | 195,650 | | | Visa, Inc. – Class A | | | 52,553,547 | |

| | 1,524,610 | | | Wells Fargo & Co. | | | 90,439,865 | |

| | 7,800 | | | WEX, Inc. (a) | | | 1,647,828 | |

| | | | | | | | |

| | | | | | | 479,643,726 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

21

Schedule of Investments

PRIMECAP Odyssey Growth Fund

April 30, 2024 (Unaudited) – continued

| | | | | | | | |

| Shares | | | | | Value | |

| Health Care – 31.0% | | | |

| | 101,800 | | | Agilent Technologies, Inc. | | $ | 13,950,672 | |

| | 61,100 | | | Alcon, Inc. | | | 4,740,138 | |

| | 310,700 | | | Alkermes PLC (a) | | | 7,624,578 | |

| | 497,240 | | | Amgen, Inc. | | | 136,213,926 | |

| | 1,852,880 | | | AstraZeneca PLC – ADR | | | 140,596,534 | |

| | 681,427 | | | BeiGene Ltd. – ADR (a) | | | 104,898,872 | |

| | 754,250 | | | Biogen, Inc. (a) | | | 162,027,985 | |

| | 1,617,256 | | | BioMarin Pharmaceutical, Inc. (a) | | | 130,609,595 | |

| | 439,400 | | | BioNTech SE – ADR (a) | | | 39,027,508 | |

| | 1,050,300 | | | Boston Scientific Corp. (a) | | | 75,485,061 | |

| | 190,300 | | | Bridgebio Pharma, Inc. (a) | | | 4,875,486 | |

| | 884,550 | | | Bristol-Myers Squibb Co. | | | 38,867,127 | |

| | 176,850 | | | CVS Health Corp. | | | 11,974,513 | |

| | 3,802,771 | | | Elanco Animal Health, Inc. (a) | | | 50,044,466 | |

| | 759,278 | | | Eli Lilly & Co. | | | 593,072,046 | |

| | 43,333 | | | Enovis Corp. (a) | | | 2,393,282 | |

| | 2,418,300 | | | FibroGen, Inc. (a) | | | 2,708,496 | |

| | 9,000 | | | Glaukos Corp. (a) | | | 864,000 | |

| | 249,480 | | | GSK PLC – ADR | | | 10,338,451 | |

| | 2,000 | | | Humana, Inc. | | | 604,180 | |

| | 25,300 | | | Illumina, Inc. (a) | | | 3,113,165 | |

| | 249,037 | | | Insulet Corp. (a) | | | 42,819,422 | |

| | 20,260 | | | IQVIA Holdings, Inc. (a) | | | 4,695,660 | |

| | 978,379 | | | LivaNova PLC (a) | | | 54,544,629 | |

| | 17,500 | | | Merck & Co., Inc. | | | 2,261,350 | |

| | 2,072,356 | | | Nektar Therapeutics (a) | | | 3,025,640 | |

| | 72,400 | | | Neurocrine Biosciences, Inc. (a) | | | 9,957,896 | |

| | 382,836 | | | Novartis AG – ADR | | | 37,184,861 | |

| | 23,800 | | | Omnicell, Inc. (a) | | | 638,078 | |

| | 108,700 | | | OraSure Technologies, Inc. (a) | | | 575,023 | |

| | 134,800 | | | QIAGEN N.V. – EUR (a) | | | 5,628,134 | |

| | 53,900 | | | Revvity, Inc. | | | 5,523,133 | |

| | 2,202,502 | | | Rhythm Pharmaceuticals, Inc. (a) | | | 87,571,479 | |

| | 13,000 | | | Roche Holding AG – CHF | | | 3,114,985 | |

| | 73,000 | | | Siemens Healthineers AG – EUR | | | 4,048,400 | |

| | 10,800 | | | Stryker Corp. | | | 3,634,200 | |

| | 71,200 | | | Thermo Fisher Scientific, Inc. | | | 40,492,864 | |

| | 4,000 | | | Waters Corp. (a) | | | 1,236,160 | |

| | 2,551,470 | | | Xencor, Inc. (a) | | | 53,427,782 | |

The accompanying notes are an integral part of these financial statements.

22

Schedule of Investments

PRIMECAP Odyssey Growth Fund

April 30, 2024 (Unaudited) – continued

| | | | | | | | |

| Shares | | | | | Value | |

| Health Care (continued) | | | |

| | 288,120 | | | Zimmer Biomet Holdings, Inc. | | $ | 34,655,074 | |

| | | | | | | | |

| | | | | | | 1,929,064,851 | |

| | | | | | | | |

| Industrials – 15.9% | | | |

| | 1,780,052 | | | AECOM | | | 164,405,603 | |

| | 192,601 | | | Airbus SE – EUR | | | 31,694,040 | |

| | 2,513,901 | | | American Airlines Group, Inc. (a) | | | 33,962,802 | |

| | 40,000 | | | AMETEK, Inc. | | | 6,986,400 | |

| | 142,400 | | | Curtiss-Wright Corp. | | | 36,087,008 | |

| | 1,290,900 | | | Delta Air Lines, Inc. | | | 64,635,363 | |

| | 43,333 | | | ESAB Corp. | | | 4,588,098 | |

| | 188,700 | | | FedEx Corp. | | | 49,397,886 | |

| | 62,400 | | | General Dynamics Corp. | | | 17,914,416 | |

| | 41,700 | | | IDEX Corp. | | | 9,193,182 | |

| | 54,700 | | | J.B. Hunt Transport Services, Inc. | | | 8,892,579 | |

| | 718,384 | | | Jacobs Solutions, Inc. | | | 103,109,656 | |

| | 129,800 | | | JetBlue Airways Corp. (a) | | | 737,264 | |

| | 325,300 | | | Lyft, Inc. – Class A (a) | | | 5,087,692 | |

| | 822,649 | | | Nextracker, Inc. – Class A (a) | | | 35,201,151 | |

| | 12,300 | | | Norfolk Southern Corp. | | | 2,832,936 | |

| | 19,600 | | | Saia, Inc. (a) | | | 7,777,868 | |

| | 654,841 | | | Siemens AG – EUR | | | 122,673,897 | |

| | 2,193,000 | | | Southwest Airlines Co. | | | 56,886,420 | |

| | 1,788,299 | | | Stratasys Ltd. (a) | | | 17,382,266 | |

| | 273,000 | | | Textron, Inc. | | | 23,093,070 | |

| | 14,100 | | | TransDigm Group, Inc. | | | 17,597,223 | |

| | 107,900 | | | Uber Technologies, Inc. (a) | | | 7,150,533 | |

| | 48,000 | | | Union Pacific Corp. | | | 11,383,680 | |

| | 1,658,300 | | | United Airlines Holdings, Inc. (a) | | | 85,336,118 | |

| | 3,759,058 | | | Xometry, Inc. – Class A (a) (b) | | | 67,174,366 | |

| | | | | | | | |

| | | | | | | 991,181,517 | |

| | | | | | | | |

| Information Technology – 24.2% | | | |

| | 126,300 | | | Adobe, Inc. (a) | | | 58,455,429 | |

| | 252,763 | | | Altair Engineering, Inc. – Class A (a) | | | 20,334,783 | |

| | 149,700 | | | Analog Devices, Inc. | | | 30,031,317 | |

| | 185,300 | | | Applied Materials, Inc. | | | 36,809,845 | |

| | 92,000 | | | Arm Holdings PLC – ADR (a) | | | 9,311,320 | |

| | 39,100 | | | ASML Holding N.V. – ADR | | | 34,113,577 | |

| | 3,000 | | | Autodesk, Inc. (a) | | | 638,550 | |

| | 4,827,043 | | | BlackBerry Ltd. (a) | | | 13,467,450 | |

The accompanying notes are an integral part of these financial statements.

23

Schedule of Investments

PRIMECAP Odyssey Growth Fund

April 30, 2024 (Unaudited) – continued

| | | | | | | | |

| Shares | | | | | Value | |

| Information Technology (continued) | | | |

| | 2,850 | | | Broadcom, Inc. | | $ | 3,705,770 | |

| | 43,700 | | | Dell Technologies, Inc. – Class C | | | 5,446,768 | |

| | 269,900 | | | Descartes Systems Group, Inc. (The) (a) | | | 25,044,021 | |

| | 13,000 | | | DocuSign, Inc. (a) | | | 735,800 | |

| | 4,737,229 | | | Flex Ltd. (a) | | | 135,721,611 | |

| | 532,558 | | | FormFactor, Inc. (a) | | | 23,746,761 | |

| | 1,300 | | | Gartner, Inc. (a) | | | 536,367 | |

| | 1,581,400 | | | Hewlett Packard Enterprise Co. | | | 26,883,800 | |

| | 402,936 | | | HP, Inc. | | | 11,318,472 | |

| | 2,840,500 | | | Intel Corp. | | | 86,550,035 | |

| | 8,400 | | | Intuit, Inc. | | | 5,255,208 | |

| | 447,700 | | | Jabil, Inc. | | | 52,542,072 | |

| | 16,300 | | | Keysight Technologies, Inc. (a) | | | 2,411,422 | |

| | 216,624 | | | KLA Corp. | | | 149,316,757 | |

| | 1,443,200 | | | L.M. Ericsson Telephone Co. – ADR | | | 7,244,864 | |

| | 135,000 | | | Marvell Technology, Inc. | | | 8,897,850 | |

| | 413,000 | | | MaxLinear, Inc. (a) | | | 8,586,270 | |

| | 1,853,400 | | | Micron Technology, Inc. | | | 209,360,064 | |

| | 400,700 | | | Microsoft Corp. | | | 156,004,531 | |

| | 432,911 | | | NetApp, Inc. | | | 44,247,833 | |

| | 471,500 | | | Nutanix, Inc. – Class A (a) | | | 28,620,050 | |

| | 69,000 | | | NVIDIA Corp. | | | 59,617,380 | |

| | 25,500 | | | Okta, Inc. – Class A (a) | | | 2,370,990 | |

| | 341,200 | | | Oracle Corp. | | | 38,811,500 | |

| | 55,000 | | | OSI Systems, Inc. (a) | | | 7,229,200 | |

| | 30,400 | | | Palo Alto Networks, Inc. (a) | | | 8,843,056 | |

| | 203,400 | | | QUALCOMM, Inc. | | | 33,733,890 | |

| | 46,600 | | | Salesforce, Inc. | | | 12,532,604 | |

| | 135,900 | | | Teradyne, Inc. | | | 15,807,888 | |

| | 353,695 | | | Texas Instruments, Inc. | | | 62,398,872 | |

| | 341,800 | | | Trimble, Inc. (a) | | | 20,531,926 | |

| | 220,819 | | | Universal Display Corp. | | | 34,884,986 | |

| | 663,200 | | | Wolfspeed, Inc. (a) | | | 17,926,296 | |

| | | | | | | | |

| | | | | | | 1,510,027,185 | |

| | | | | | | | |

| Materials – 0.7% | | | |

| | 259,100 | | | Albemarle Corp. | | | 31,172,321 | |

| | 600,000 | | | Ivanhoe Mines Ltd. – Class A – CAD (a) | | | 8,132,786 | |

| | 10,900 | | | Linde PLC | | | 4,806,464 | |

| | | | | | | | |

| | | | | | | 44,111,571 | |

| | | | | | | | |

| TOTAL COMMON STOCKS

(Cost $2,971,960,254) | | $ | 6,096,034,793 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

24

Schedule of Investments

PRIMECAP Odyssey Growth Fund

April 30, 2024 (Unaudited) – continued

| | | | | | | | |

| Shares | | | | | Value | |

| | RIGHTS – 0.0% | | | | |

| |

| Health Care – 0.0% | | | |

| | 387,250 | | | ABIOMED, Inc. – CVR (Issue Date 12/23/22) (a) (c) (d) | | $ | 394,995 | |

| | 4,207,543 | | | Epizyme, Inc. – CVR (Issue Date 8/15/22) (a) (c) (d) | | | 84,151 | |

| | | | | | | | |

| | | | 479,146 | |

| | | | | | | | |

| TOTAL RIGHTS

(Cost $0) | | | 479,146 | |

| | | | | | | | |

| | SHORT-TERM INVESTMENTS – 1.5% | | | | |

| | 90,773,278 | | | Dreyfus Treasury Securities Cash Management Fund –Institutional Shares – 5.18% (e) | | $ | 90,773,278 | |

| | | | | | | | |

| TOTAL SHORT-TERM INVESTMENTS

(Cost $90,773,278) | | | 90,773,278 | |

| | | | | | | | |

| TOTAL INVESTMENTS IN SECURITIES

(Cost $3,062,733,532) – 99.3% | | | 6,187,287,217 | |

| | Other Assets in Excess of Liabilities – 0.7% | | | 43,906,924 | |

| | | | | | | | |

| | TOTAL NET ASSETS – 100.0% | | $ | 6,231,194,141 | |

| | | | | | | | |

| ADR | American Depository Receipt |

| CVR | Contingent Value Rights |

| GBP | British Pound Sterling |

| (b) | Considered an affiliated company of the fund as the fund owns 5% or more of the outstanding voting securities of such company. (Note 7) |

| (d) | Fair-valued security (Note 4) |

| (e) | Rate quoted is seven-day yield at period end. |

The Global Industry Classification Standard (GICS®) was developed by and is the exclusive property of MSCI Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by the fund’s administrator.

The accompanying notes are an integral part of these financial statements.

25

| | |

| | Schedule of Investments PRIMECAP Odyssey Aggressive Growth Fund April 30, 2024 (Unaudited) |

| | | | | | | | |

| Shares | | | | | Value | |

| | COMMON STOCKS – 97.0% | | | | |

| |

| Communication Services – 6.8% | | | |

| | 714,350 | | | Alphabet, Inc. – Class A (a) | | $ | 116,281,893 | |

| | 584,990 | | | Alphabet, Inc. – Class C (a) | | | 96,312,754 | |

| | 1,011,200 | | | Baidu, Inc. – ADR (a) | | | 104,558,080 | |

| | 94,000 | | | Electronic Arts, Inc. | | | 11,921,080 | |

| | 13,600 | | | Ibotta, Inc. – Class A (a) | | | 1,390,872 | |

| | 599,700 | | | IMAX Corp. (a) | | | 9,601,197 | |

| | 68,970 | | | Live Nation Entertainment, Inc. (a) | | | 6,132,123 | |

| | 77,200 | | | Madison Square Garden Entertainment Corp. – Class A (a) | | | 3,022,380 | |

| | 33,300 | | | Meta Platforms, Inc. – Class A | | | 14,324,661 | |

| | 16,900 | | | Netflix, Inc. (a) | | | 9,305,816 | |

| | 1,310,750 | | | Pinterest, Inc. – Class A (a) | | | 43,844,587 | |

| | 92,500 | | | Snap, Inc. – Class A (a) | | | 1,392,125 | |

| | 570,528 | | | Sphere Entertainment Co. – Class A (a) | | | 22,170,718 | |

| | 91,100 | | | T-Mobile US, Inc. | | | 14,955,887 | |

| | 5,458,000 | | | WildBrain Ltd. – CAD (a) | | | 4,043,991 | |

| | 219,469 | | | ZoomInfo Technologies, Inc. (a) | | | 3,480,778 | |

| | | | | | | | |

| | | | | | | 462,738,942 | |

| | | | | | | | |

| Consumer Discretionary – 11.2% | | | |

| | 1,258,200 | | | Alibaba Group Holding Ltd. – ADR | | | 94,176,270 | |

| | 173,000 | | | Amazon.com, Inc. (a) | | | 30,275,000 | |

| | 65,700 | | | Boot Barn Holdings, Inc. (a) | | | 6,995,079 | |

| | 96,230 | | | Burlington Stores, Inc. (a) | | | 17,315,626 | |

| | 207,937 | | | Capri Holdings Ltd. (a) | | | 7,377,605 | |

| | 747,700 | | | CarMax, Inc. (a) | | | 50,821,169 | |

| | 2,600 | | | Deckers Outdoor Corp. (a) | | | 2,128,022 | |

| | 3,600 | | | Duolingo, Inc. (a) | | | 812,700 | |

| | 228,660 | | | eBay, Inc. | | | 11,785,136 | |

| | 4,186,609 | | | Entain PLC – GBP | | | 40,845,346 | |

| | 39,200 | | | Etsy, Inc. (a) | | | 2,691,864 | |

| | 3,000 | | | Five Below, Inc. (a) | | | 439,020 | |

| | 22,700 | | | Flutter Entertainment PLC – GBP (a) | | | 4,205,367 | |

| | 99,000 | | | Gildan Activewear, Inc. | | | 3,431,340 | |

| | 846,100 | | | GrowGeneration Corp. (a) | | | 2,529,839 | |

| | 646,145 | | | iRobot Corp. (a) | | | 5,531,001 | |

| | 339,100 | | | Mobileye Global, Inc. – Class A (a) | | | 9,342,205 | |

| | 1,039,565 | | | Norwegian Cruise Line Holdings Ltd. (a) | | | 19,668,570 | |

| | 145,670 | | | Ollie’s Bargain Outlet Holdings, Inc. (a) | | | 10,654,304 | |

The accompanying notes are an integral part of these financial statements.

26

Schedule of Investments

PRIMECAP Odyssey Aggressive Growth Fund

April 30, 2024 (Unaudited) – continued

| | | | | | | | |

| Shares | | | | | Value | |

| Consumer Discretionary (continued) | | | |

| | 35,000 | | | Restaurant Brands International, Inc. | | $ | 2,654,750 | |

| | 58,660 | | | Rivian Automotive, Inc. – Class A (a) | | | 522,074 | |

| | 645,200 | | | Royal Caribbean Cruises Ltd. (a) | | | 90,089,276 | |

| | 2,068,550 | | | Sony Group Corp. – ADR | | | 170,800,174 | |

| | 330,700 | | | Tapestry, Inc. | | | 13,201,544 | |

| | 701,450 | | | Tesla, Inc. (a) | | | 128,561,756 | |

| | 23,730 | | | Ulta Beauty, Inc. (a) | | | 9,606,853 | |

| | 108,400 | | | Victoria’s Secret & Co. (a) | | | 1,910,008 | |

| | 3,583,880 | | | XPeng, Inc. – ADR (a) | | | 29,136,944 | |

| | | | | | | | |

| | | | | | | 767,508,842 | |

| | | | | | | | |

| Consumer Staples – 0.1% | | | |

| | 7,000 | | | Dollar General Corp. | | | 974,330 | |

| | 77,600 | | | Performance Food Group Co. (a) | | | 5,267,488 | |

| | | | | | | | |

| | | | | | | 6,241,818 | |

| | | | | | | | |

| Energy – 1.7% | | | |

| | 504,350 | | | Coterra Energy, Inc. | | | 13,799,016 | |

| | 124,200 | | | EOG Resources, Inc. | | | 16,410,546 | |

| | 1,525,800 | | | New Fortress Energy, Inc. | | | 39,975,960 | |

| | 8,429,982 | | | Transocean Ltd. (a) | | | 44,004,506 | |

| | | | | | | | |

| | | | | | | 114,190,028 | |

| | | | | | | | |

| Financials – 4.8% | | | |

| | 20,000 | | | AssetMark Financial Holdings, Inc. (a) | | | 676,200 | |

| | 164,171 | | | CME Group, Inc. – Class A | | | 34,416,808 | |

| | 185,903 | | | Discover Financial Services | | | 23,559,487 | |

| | 1,201,449 | | | Flywire Corp. (a) | | | 24,629,704 | |

| | 116,700 | | | Galaxy Digital Holdings Ltd. – CAD (a) | | | 1,025,729 | |

| | 54,600 | | | LPL Financial Holdings, Inc. | | | 14,694,498 | |

| | 545,620 | | | MarketAxess Holdings, Inc. | | | 109,173,106 | |

| | 437,000 | | | Marqeta, Inc. – Class A (a) | | | 2,425,350 | |

| | 250,733 | | | Morgan Stanley | | | 22,776,586 | |

| | 460,200 | | | NMI Holdings, Inc. – Class A (a) | | | 14,201,772 | |

| | 103,390 | | | Progressive Corp. (The) | | | 21,530,968 | |

| | 503,900 | | | Tradeweb Markets, Inc. – Class A | | | 51,251,669 | |

| | 38,750 | | | WEX, Inc. (a) | | | 8,186,325 | |

| | | | | | | | |

| | | | | | | 328,548,202 | |

| | | | | | | | |

| Health Care – 29.1% | | | |

| | 143,300 | | | 10x Genomics, Inc. – Class A (a) | | | 4,195,824 | |

| | 140,000 | | | Accuray, Inc. (a) | | | 298,200 | |

| | 104,230 | | | Adaptive Biotechnologies Corp. (a) | | | 273,083 | |

| | 956,200 | | | Alkermes PLC (a) | | | 23,465,148 | |

The accompanying notes are an integral part of these financial statements.

27

Schedule of Investments

PRIMECAP Odyssey Aggressive Growth Fund

April 30, 2024 (Unaudited) – continued

| | | | | | | | |

| Shares | | | | | Value | |

| Health Care (continued) | | | |

| | 1,951,671 | | | Allogene Therapeutics, Inc. (a) | | $ | 5,386,612 | |

| | 1,094,200 | | | Amicus Therapeutics, Inc. (a) | | | 10,931,058 | |

| | 10,000 | | | Amylyx Pharmaceuticals, Inc. (a) | | | 18,100 | |

| | 709,157 | | | BeiGene Ltd. – ADR (a) | | | 109,167,629 | |

| | 882,939 | | | Biogen, Inc. (a) | | | 189,672,956 | |

| | 1,950,510 | | | BioMarin Pharmaceutical, Inc. (a) | | | 157,523,188 | |

| | 1,362,792 | | | BioNTech SE – ADR (a) | | | 121,043,185 | |

| | 525,800 | | | Boston Scientific Corp. (a) | | | 37,789,246 | |

| | 439,730 | | | Bridgebio Pharma, Inc. (a) | | | 11,265,883 | |

| | 8,584,000 | | | Cerus Corp. (a) | | | 14,335,280 | |

| | 13,950 | | | Charles River Laboratories International, Inc. (a) | | | 3,194,550 | |

| | 630,892 | | | Elanco Animal Health, Inc. (a) | | | 8,302,539 | |

| | 588,394 | | | Eli Lilly & Co. | | | 459,594,553 | |

| | 437,600 | | | Exact Sciences Corp. (a) | | | 25,971,560 | |

| | 4,240,951 | | | FibroGen, Inc. (a) | | | 4,749,865 | |

| | 601,200 | | | Galapagos NV – ADR (a) | | | 17,104,140 | |

| | 840,935 | | | Glaukos Corp. (a) | | | 80,729,760 | |

| | 42,650 | | | Globus Medical, Inc. – Class A (a) | | | 2,123,543 | |

| | 22,490 | | | Guardant Health, Inc. (a) | | | 404,820 | |

| | 2,237,906 | | | Health Catalyst, Inc. (a) | | | 13,919,775 | |

| | 11,310 | | | Illumina, Inc. (a) | | | 1,391,695 | |

| | 134,130 | | | Immunocore Holdings PLC – ADR (a) | | | 7,924,400 | |

| | 180,000 | | | Immunome, Inc. (a) | | | 2,530,800 | |

| | 338,916 | | | Insulet Corp. (a) | | | 58,273,217 | |

| | 1,105,370 | | | LivaNova PLC (a) | | | 61,624,378 | |

| | 10,000 | | | Mereo Biopharma Group PLC – ADR (a) | | | 30,500 | |

| | 46,160 | | | Mural Oncology PLC (a) | | | 170,792 | |

| | 4,233,380 | | | Nektar Therapeutics (a) | | | 6,180,735 | |

| | 218,000 | | | Nurix Therapeutics, Inc. (a) | | | 2,620,360 | |

| | 575,620 | | | OraSure Technologies, Inc. (a) | | | 3,045,030 | |

| | 19,220 | | | Penumbra, Inc. (a) | | | 3,776,153 | |

| | 1,166,216 | | | PolyPeptide Group AG – CHF (a) | | | 38,478,833 | |

| | 25,200 | | | Prothena Corp. PLC (a) | | | 512,568 | |

| | 3,857,571 | | | Pulmonx Corp. (a) (b) | | | 29,356,115 | |

| | 185,852 | | | QIAGEN N.V. – EUR (a) | | | 7,759,643 | |

| | 21,386 | | | Repligen Corp. (a) | | | 3,511,581 | |

| | 5,163,835 | | | Rhythm Pharmaceuticals, Inc. (a) (b) | | | 205,314,080 | |

| | 118,800 | | | Roche Holding AG – CHF | | | 28,466,169 | |

| | 215,300 | | | Shockwave Medical, Inc. (a) | | | 71,089,907 | |

The accompanying notes are an integral part of these financial statements.

28

Schedule of Investments

PRIMECAP Odyssey Aggressive Growth Fund

April 30, 2024 (Unaudited) – continued

| | | | | | | | |

| Shares | | | | | Value | |

| Health Care (continued) | | | |

| | 2,162,669 | | | Standard BioTools, Inc. (a) | | $ | 5,363,419 | |

| | 2,804,290 | | | Wave Life Sciences Ltd. (a) | | | 13,825,150 | |

| | 5,851,457 | | | Xencor, Inc. (a) (b) | | | 122,529,510 | |

| | 854,250 | | | Zentalis Pharmaceuticals, Inc. (a) | | | 9,448,005 | |

| | | | | | | | |

| | | | | | | 1,984,683,537 | |

| | | | | | | | |

| Industrials – 12.8% | | | |

| | 1,598,230 | | | AECOM | | | 147,612,523 | |

| | 390,800 | | | Alaska Air Group, Inc. (a) | | | 16,812,216 | |

| | 25,100 | | | Allegiant Travel Co. | | | 1,369,456 | |

| | 4,638,200 | | | American Airlines Group, Inc. (a) | | | 62,662,082 | |

| | 817,900 | | | Array Technologies, Inc. (a) | | | 10,092,886 | |

| | 90,500 | | | Axon Enterprise, Inc. (a) | | | 28,386,230 | |

| | 49,600 | | | Bloom Energy Corp. – Class A (a) | | | 552,048 | |

| | 41,000 | | | Controladora Vuela Compania de Aviacion, S.A.B. de C.V. – ADR (a) | | | 335,790 | |

| | 192,400 | | | Curtiss-Wright Corp. | | | 48,758,008 | |

| | 2,179,697 | | | Delta Air Lines, Inc. | | | 109,137,429 | |

| | 33,500 | | | FedEx Corp. | | | 8,769,630 | |

| | 193,000 | | | Frontier Group Holdings, Inc. (a) | | | 1,165,720 | |

| | 356,300 | | | GFL Environmental, Inc. | | | 11,365,970 | |

| | 95,600 | | | Gibraltar Industries, Inc. (a) | | | 6,831,576 | |

| | 176,400 | | | Griffon Corp. | | | 11,557,728 | |

| | 296,200 | | | Hertz Global Holdings, Inc. (a) | | | 1,347,710 | |

| | 845,300 | | | Jacobs Solutions, Inc. | | | 121,325,909 | |

| | 1,301,100 | | | JetBlue Airways Corp. (a) | | | 7,390,248 | |

| | 3,125,400 | | | Li-Cycle Holdings Corp. (a) | | | 2,047,449 | |

| | 3,400 | | | Loar Holdings, Inc. (a) | | | 177,888 | |

| | 563,000 | | | Lyft, Inc. – Class A (a) | | | 8,805,320 | |

| | 3,000 | | | Masonite International Corp. (a) | | | 397,650 | |

| | 980,483 | | | Nextracker, Inc. – Class A (a) | | | 41,954,868 | |

| | 353,600 | | | NN, Inc. (a) | | | 1,258,816 | |

| | 5,200 | | | Old Dominion Freight Line, Inc. | | | 944,892 | |

| | 69,600 | | | RXO, Inc. (a) | | | 1,316,136 | |

| | 15,800 | | | Ryanair Holdings PLC – ADR | | | 2,151,960 | |

| | 1,627,800 | | | Southwest Airlines Co. | | | 42,225,132 | |

| | 865,400 | | | Stratasys Ltd. (a) | | | 8,411,688 | |

| | 101,815 | | | Sun Country Airlines Holdings, Inc. (a) | | | 1,355,158 | |

| | 35,800 | | | TransDigm Group, Inc. | | | 44,679,474 | |

| | 318,200 | | | Uber Technologies, Inc. (a) | | | 21,087,114 | |

The accompanying notes are an integral part of these financial statements.

29

Schedule of Investments

PRIMECAP Odyssey Aggressive Growth Fund

April 30, 2024 (Unaudited) – continued

| | | | | | | | |

| Shares | | | | | Value | |

| Industrials (continued) | | | |

| | 1,897,440 | | | United Airlines Holdings, Inc. (a) | | $ | 97,642,262 | |

| | 111,800 | | | WillScot Mobile Mini Holdings Corp. (a) | | | 4,132,128 | |

| | 40,000 | | | XPO, Inc. (a) | | | 4,298,400 | |

| | | | | | | | |

| | | | | | | 878,359,494 | |

| | | | | | | | |

| Information Technology – 29.4% | | | |

| | 130,250 | | | Adobe, Inc. (a) | | | 60,283,608 | |

| | 31,300 | | | Ambarella, Inc. (a) | | | 1,438,861 | |

| | 87,400 | | | Applied Materials, Inc. | | | 17,362,010 | |

| | 3,048,700 | | | Arlo Technologies, Inc. (a) | | | 37,742,906 | |

| | 35,100 | | | ASML Holding N.V. – ADR | | | 30,623,697 | |

| | 3,305,200 | | | Aurora Innovation, Inc. – Class A (a) | | | 9,171,930 | |

| | 37,700 | | | Autodesk, Inc. (a) | | | 8,024,445 | |

| | 945,946 | | | Axcelis Technologies, Inc. (a) | | | 97,924,330 | |

| | 8,995,866 | | | BlackBerry Ltd. (a) | | | 25,098,466 | |

| | 15,026 | | | Broadcom, Inc. | | | 19,537,857 | |

| | 644,000 | | | Credo Technology Group Holding Ltd. (a) | | | 11,508,280 | |

| | 123,099 | | | CrowdStrike Holdings, Inc. – Class A (a) | | | 36,011,381 | |

| | 59,600 | | | CyberArk Software Ltd. (a) | | | 14,259,300 | |

| | 84,200 | | | Dell Technologies, Inc. – Class C | | | 10,494,688 | |

| | 252,541 | | | Descartes Systems Group, Inc. (The) (a) | | | 23,433,279 | |

| | 194,000 | | | DocuSign, Inc. (a) | | | 10,980,400 | |

| | 5,787,600 | | | Flex Ltd. (a) | | | 165,814,740 | |

| | 837,255 | | | FormFactor, Inc. (a) | | | 37,333,200 | |

| | 108,500 | | | Freshworks, Inc. – Class A (a) | | | 1,936,725 | |

| | 81,800 | | | GitLab, Inc. – Class A (a) | | | 4,292,046 | |

| | 567,150 | | | Hewlett Packard Enterprise Co. | | | 9,641,550 | |

| | 184,000 | | | HP, Inc. | | | 5,168,560 | |

| | 91,150 | | | HubSpot, Inc. (a) | | | 55,133,901 | |

| | 7,467,620 | | | indie Semiconductor, Inc. – Class A (a) | | | 41,968,024 | |

| | 86,600 | | | Intuit, Inc. | | | 54,178,692 | |

| | 545,500 | | | Jabil, Inc. | | | 64,019,880 | |

| | 94,900 | | | Jamf Holding Corp. (a) | | | 1,847,703 | |

| | 35,500 | | | Keysight Technologies, Inc. (a) | | | 5,251,870 | |

| | 184,370 | | | KLA Corp. | | | 127,084,397 | |

| | 146,400 | | | Marvell Technology, Inc. | | | 9,649,224 | |

| | 1,522,900 | | | MaxLinear, Inc. (a) | | | 31,661,091 | |

| | 2,922,925 | | | Micron Technology, Inc. | | | 330,173,608 | |

| | 13,550 | | | MongoDB, Inc. (a) | | | 4,948,189 | |

| | 751,077 | | | NetApp, Inc. | | | 76,767,580 | |

| | 184,743 | | | nLIGHT, Inc. (a) | | | 2,104,223 | |

The accompanying notes are an integral part of these financial statements.

30

Schedule of Investments

PRIMECAP Odyssey Aggressive Growth Fund

April 30, 2024 (Unaudited) – continued

| | | | | | | | |

| Shares | | | | | Value | |

| Information Technology (continued) | | | |

| | 1,503,925 | | | Nutanix, Inc. – Class A (a) | | $ | 91,288,248 | |

| | 127,250 | | | NVIDIA Corp. | | | 109,946,545 | |

| | 322,000 | | | Okta, Inc. – Class A (a) | | | 29,939,560 | |

| | 190,000 | | | OSI Systems, Inc. (a) | | | 24,973,600 | |

| | 72,140 | | | Palo Alto Networks, Inc. (a) | | | 20,984,805 | |

| | 280,380 | | | PROS Holdings, Inc. (a) | | | 9,182,445 | |

| | 330,983 | | | QUALCOMM, Inc. | | | 54,893,531 | |

| | 142,800 | | | Rapid7, Inc. (a) | | | 6,397,440 | |

| | 7,500 | | | RingCentral, Inc. – Class A (a) | | | 222,150 | |

| | 42,999 | | | Tenable Holdings, Inc. (a) | | | 1,933,665 | |

| | 500,970 | | | Trimble, Inc. (a) | | | 30,093,268 | |

| | 248,533 | | | Unity Software, Inc. (a) | | | 6,031,896 | |

| | 687,339 | | | Universal Display Corp. | | | 108,585,815 | |

| | 210,000 | | | Western Digital Corp. (a) | | | 14,874,300 | |

| | 1,315,400 | | | Wolfspeed, Inc. (a) | | | 35,555,262 | |

| | 287,400 | | | Zoom Video Communications, Inc. – Class A (a) | | | 17,560,140 | |

| | | | | | | | |

| | | | | | | 2,005,333,311 | |

| | | | | | | | |

| Materials – 1.0% | | | |

| | 113,330 | | | Albemarle Corp. | | | 13,634,732 | |

| | 30,000 | | | Bioceres Crop Solutions Corp. (a) | | | 354,000 | |

| | 54,500 | | | Ingevity Corp. (a) | | | 2,787,130 | |

| | 333,100 | | | Ivanhoe Electric, Inc. (a) | | | 3,364,310 | |

| | 2,865,600 | | | Ivanhoe Mines Ltd. – Class A – CAD (a) | | | 38,842,187 | |

| | 1,212,452 | | | Perimeter Solutions SA (a) | | | 8,487,164 | |

| | | | | | | | |

| | | | | | | 67,469,523 | |

| | | | | | | | |

| Real Estate – 0.1% | | | |

| | 133,800 | | | EPR Properties | | | 5,430,942 | |

| | 53,600 | | | Safehold, Inc. | | | 977,664 | |

| | | | | | | | |

| | | | | | | 6,408,606 | |

| | | | | | | | |

| TOTAL COMMON STOCKS

(Cost $3,722,266,063) | | $ | 6,621,482,303 | |

| | | | | | | | |

| | RIGHTS – 0.0% | | | | |

| |

| Health Care – 0.0% | | | |

| | 349,922 | | | ABIOMED, Inc. – CVR (Issue Date 12/23/22) (a) (c) (d) | | | 356,921 | |

| | 10,344,756 | | | Epizyme, Inc. – CVR (Issue Date 8/15/22) (a) (c) (d) | | | 206,895 | |

| | 3,786,300 | | | Mereo BioPharma Group PLC – CVR

(Issue Date 4/23/19) (a) (c) (d) | | | 0 | |

| | | | | | | | |

| | | | | | | 563,816 | |

| | | | | | | | |

| TOTAL RIGHTS

(Cost $0) | | | 563,816 | |

| | | | | |

The accompanying notes are an integral part of these financial statements.

31

Schedule of Investments

PRIMECAP Odyssey Aggressive Growth Fund

April 30, 2024 (Unaudited) – continued

| | | | | | | | |

| Shares | | | | | Value | |

| | WARRANTS – 0.0% | | | | |

| |

| Materials – 0.0% | | | |

| | 364,100 | | | Perimeter Solutions SA (Expiration Date 11/8/24) (a) | | $ | 1,802 | |

| | | | | | | | |

| TOTAL WARRANTS

(Cost $3,641) | | | 1,802 | |

| | | | | |

| | SHORT-TERM INVESTMENTS – 3.1% | | | | |

| | 214,802,861 | | | Dreyfus Treasury Securities Cash Management Fund – Institutional Shares – 5.18% (e) | | $ | 214,802,861 | |

| | | | | | | | |

| TOTAL SHORT-TERM INVESTMENTS

(Cost $214,802,861) | | | 214,802,861 | |

| | | | | |

| TOTAL INVESTMENTS IN SECURITIES

(Cost $3,937,072,565) – 100.1% | | | 6,836,850,782 | |

| | Liabilities in Excess of Other Assets – (0.1)% | | | (10,403,350 | ) |

| | | | | | | | |

| | TOTAL NET ASSETS – 100.0% | | $ | 6,826,447,432 | |

| | | | | | | | |

| ADR | American Depository Receipt |

| CVR | Contingent Value Rights |

| GBP | British Pound Sterling |

| (b) | Considered an affiliated company of the fund as the fund owns 5% or more of the outstanding voting securities of such company. (Note 7) |

| (d) | Fair-valued security (Note 4) |

| (e) | Rate quoted is seven-day yield at period end. |

The Global Industry Classification Standard (GICS®) was developed by and is the exclusive property of MSCI Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by the fund’s administrator.