|

|

SCHEDULE 14A INFORMATION Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. ) |

Filed by the Registrant ý Filed by a Party other than the Registrant ¨

Check the appropriate box:

|

| | |

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to § 240.14a-12 |

Ruckus Wireless, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box) |

| | | | |

| ý | | No fee required. |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | 1. | | Title of each class of securities to which transaction applies:

|

| | | 2. | | Aggregate number of securities to which transaction applies:

|

| | | 3. | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | 4. | | Proposed maximum aggregate value of transaction:

|

| | | 5. | | Total fee paid:

|

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

| | | 6. | | Amount Previously Paid:

|

| | | 7. | | Form, Schedule or Registration Statement No.:

|

| | | 8. | | Filing Party:

|

| | | 9. | | Date Filed:

|

RUCKUS WIRELESS, INC.

350 West Java Drive

Sunnyvale, California 94089

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On June 10, 2015

To the Stockholders of Ruckus Wireless, Inc.:

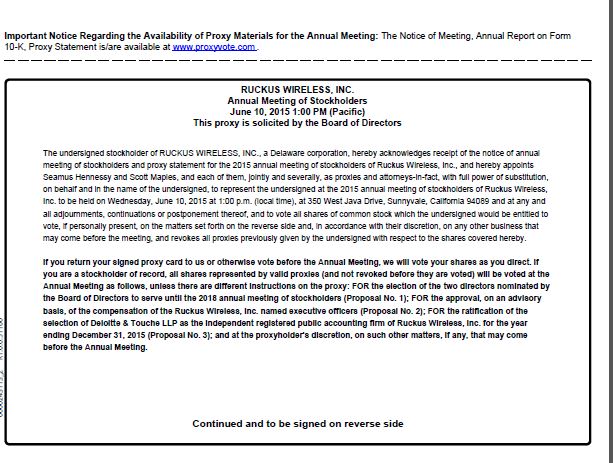

The 2015 Annual Meeting of Stockholders of Ruckus Wireless, Inc. will be held on Wednesday, June 10, 2015 at 1:00 p.m., local time, at our headquarters located at 350 West Java Drive, Sunnyvale, California, 94089 for the following purposes: |

| | |

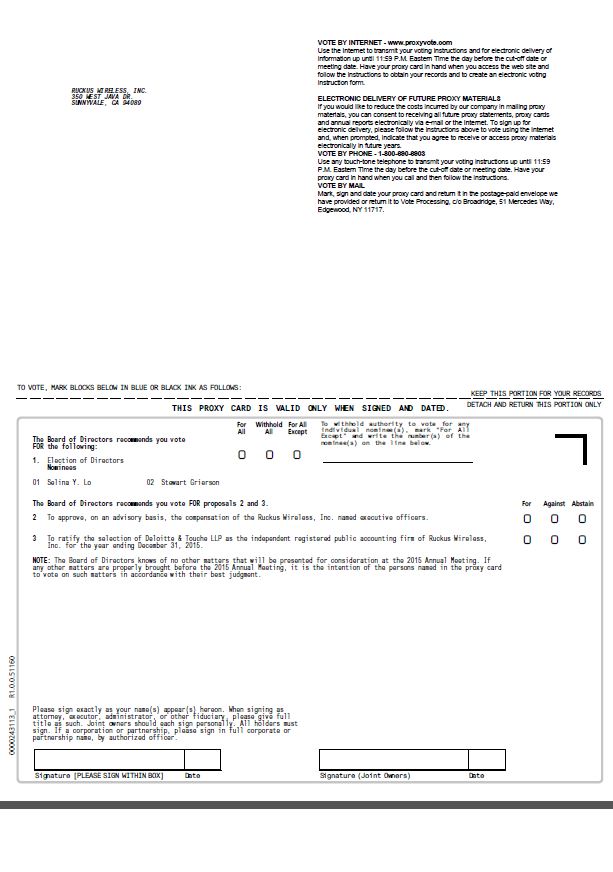

| 1. | | To elect two directors nominated by the Board of Directors of Ruckus Wireless, Inc. (the “Board”) to serve until the 2018 Annual Meeting of Stockholders, as described in the accompanying proxy statement. |

| 2. | | To approve, on an advisory basis, the compensation of the Ruckus Wireless, Inc. named executive officers as disclosed in this proxy statement. |

| 3. | | To ratify the selection by the Audit Committee of the Board of Deloitte & Touche LLP as the independent registered public accounting firm of Ruckus Wireless, Inc. for the year ending December 31, 2015. |

| 4. | | To transact any other business that may properly come before the annual meeting or any adjournment or postponement thereof. |

These items of business are more fully described in the proxy statement accompanying this notice. The record date for the annual meeting is April 13, 2015. Only stockholders of record at the close of business on that date are entitled to notice of and to vote at the annual meeting and any adjournment or postponement thereof.

Important notice regarding the availability of proxy materials for the Annual Meeting of Stockholders to be held on June 10, 2015. This proxy statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2014, including consolidated financial statements, are available to you at: http://www.proxyvote.com.

Please see the map at http://www.ruckuswireless.com/company/directions for directions to our headquarters. We look forward to seeing you at the annual meeting.

|

|

| By Order of the Board of Directors, |

| /s/ Scott Maples |

| Scott Maples |

| Vice President Legal, General Counsel and Corporate Secretary |

Sunnyvale, California

April 29, 2015

You are cordially invited to attend the annual meeting in person. Whether or not you expect to attend the annual meeting, please vote as promptly as possible in order to ensure your representation at the meeting. You may vote your shares by telephone or over the Internet as instructed in these materials. If you received a proxy card or voting instruction card by mail, you may submit your proxy card or voting instruction card by completing, signing, dating and mailing your proxy card or voting instruction card in the envelope provided. Even if you have voted by proxy, you may still vote in person if you attend the meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the meeting, you must obtain a proxy issued in your name from that record holder.

TABLE OF CONTENTS

RUCKUS WIRELESS, INC.

350 West Java Drive

Sunnyvale, California 94089

PROXY STATEMENT

FOR THE 2015 ANNUAL MEETING OF STOCKHOLDERS

JUNE 10, 2015

INFORMATION CONCERNING SOLICITATION AND VOTING

The Board of Ruckus Wireless, Inc. (“Ruckus,” the “Company” or “we”) is soliciting proxies for our 2015 Annual Meeting of Stockholders to be held on Wednesday, June 10, 2015 at 1:00 p.m., local time, at our headquarters located at 350 West Java Drive, Sunnyvale, California 94089.

The proxy materials, including this proxy statement, proxy card or voting instruction card and our 2014 Annual Report, are being distributed and made available on or about April 29, 2015. This proxy statement contains important information for you to consider when deciding how to vote on the matters brought before the meeting. Please read it carefully.

In accordance with rules and regulations adopted by the U.S. Securities and Exchange Commission (the “SEC”), we have elected to provide our stockholders access to our proxy materials over the Internet. Accordingly, a Notice of Internet Availability of Proxy Materials (the “Notice”) will be mailed on or about April 29, 2015 to stockholders who owned our common stock at the close of business on April 13, 2015. Stockholders will have the ability to access the proxy materials on a website referred to in the Notice or request a printed set of the proxy materials be sent to them by following the instructions in the Notice.

The Notice will also provide instructions on how you can elect to receive future proxy materials electronically or in printed form by mail. If you choose to receive future proxy materials electronically, you will receive an email next year with instructions containing a link to the proxy materials and a link to the proxy voting site. Your election to receive proxy materials electronically or in printed form by mail will remain in effect until you terminate such election.

Choosing to receive future proxy materials electronically will allow us to provide you with the information you need in a timelier manner, will save us the cost of printing and mailing documents to you and will conserve natural resources.

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why am I receiving these materials?

We have sent you these proxy materials because the Board is soliciting your proxy to vote at the 2015 Annual Meeting of Stockholders, including at any adjournments or postponements of the meeting. You are invited to attend the annual meeting to vote on the proposals described in this proxy statement. However, you do not need to attend the meeting to vote your shares. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice.

We intend to mail the Notice on or about April 29, 2015 to all stockholders of record entitled to vote at the annual meeting.

Will I receive any other proxy materials by mail?

We may send you a proxy card, along with a second Notice, on or after May 11, 2015.

How can I access the proxy materials over the Internet?

You may view and also download our proxy materials, including the 2014 Annual Report on Form 10-K and the Notice on our website at http://www.ruckuswireless.com as well as http://proxyvote.com. Please see the instructions below regarding how to submit your vote.

How do I attend the annual meeting?

The meeting will be held on Wednesday, June 10, 2015 at 1:00 p.m. (local time) at 350 West Java Drive, Sunnyvale, California 94089. Directions to the annual meeting may be found at http://www.ruckuswireless.com/company/directions. Information on how to vote in person at the annual meeting is discussed below. We do not intend to provide any management presentations or corporate updates at the annual meeting.

Who can vote at the annual meeting?

Only stockholders of record at the close of business on April 13, 2015 will be entitled to vote at the annual meeting. On this record date, there were 86,551,101 shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If on April 13, 2015 your shares were registered directly in your name with our transfer agent, Computershare Trust Company, N.A., then you are a stockholder of record. As a stockholder of record, you may vote in person at the meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted if you later decide not to attend the meeting.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on April 13, 2015 your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and the Notice is being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the annual meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the meeting unless you request and obtain a valid proxy from your broker or other agent.

What am I voting on?

There are three matters scheduled for a vote:

|

| |

| • | Election of the two directors nominated by the Board to serve as Class III directors until the 2018 Annual Meeting of Stockholders; |

| • | Advisory approval of the compensation of the Ruckus named executive officers as disclosed in this proxy statement in accordance with SEC rules; and |

| • | Ratification of selection by the Audit Committee of the Board of Deloitte & Touche LLP as independent registered public accounting firm of Ruckus for its fiscal year ending December 31, 2015. |

What if another matter is properly brought before the meeting?

The Board knows of no other matters that will be presented for consideration at the 2015 annual meeting. If any other matters are properly brought before the meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

How do I vote?

You may either vote “For” all the nominees to the Board or you may “Withhold” your vote for any nominee you specify. For each of the other matters to be voted on, you may vote “For” or “Against” or select “Abstain” from voting.

The procedures for voting are fairly simple:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the annual meeting, over the Internet, by telephone, or by proxy using a proxy card that you may request or a proxy card that we may elect to deliver at a later time. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the annual meeting and vote in person even if you have already voted by proxy. |

| |

| • | To vote in person, come to the annual meeting and we will give you a ballot when you arrive. |

| • | If you received printed proxy materials, you may submit your proxy by simply completing, signing and dating the proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the annual meeting, we will vote your shares as you direct. |

| • | To submit your proxy by telephone, dial toll-free 1-800-690-6903 using a touch-tone phone and follow the recorded instructions. You will be asked to provide the company number and control number from the Notice. Your telephone vote must be received by 11:59 p.m., Eastern Time on June 9, 2015 to be counted. |

| • | To submit your proxy over the Internet, go to http://www.proxyvote.com to complete an electronic proxy card. You will be asked to provide the company number and control number from the Notice. Your internet vote must be received by 11:59 p.m., Eastern Time on June 9, 2015 to be counted. |

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a Notice containing voting instructions from that organization rather than from us. Simply follow the voting instructions in the Notice to ensure that your vote is counted. Alternatively, you may vote by telephone or over the Internet as instructed by your broker or bank. To vote in person at the annual meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form.

Internet proxy voting is provided to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone companies.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you owned as of April 13, 2015.

What happens if I do not vote?

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record and do not vote by completing your proxy card, by telephone, over the Internet or in person at the annual meeting, your shares will not be voted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner and do not instruct your broker, bank, or other agent how to vote your shares, the question of whether your broker or nominee will still be able to vote your shares depends on whether the New York Stock Exchange (“NYSE”) deems the particular proposal to be a “routine” matter. Brokers and nominees can use their discretion to vote “uninstructed” shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. Under the rules and interpretations of the NYSE, “non-routine” matters are matters that may substantially affect the rights or privileges of stockholders, such as mergers, stockholder proposals, elections of directors (even if not contested), executive compensation (including any advisory stockholder votes on executive compensation and on the frequency of stockholder votes on executive compensation), and certain corporate governance proposals, even if management-supported. Accordingly, your broker or nominee may not vote your shares on Proposals 1 and 2 without your instructions, but may vote your shares on Proposal 3.

What if I return a proxy card or otherwise vote but do not make specific choices?

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted, as applicable, “For” the election of both nominees for director, “For” the advisory approval of the compensation of our named executive officers, as disclosed in this proxy statement in accordance with SEC rules, and “For” the ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2015. If any other matter is properly presented at the meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We will also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one Notice?

If you receive more than one Notice, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on the Notices to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Stockholder of Record: Shares Registered in Your Name

Yes. You can revoke your proxy at any time before the final vote at the meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

|

| |

| • | You may submit another properly completed proxy card with a later date. |

| • | You may grant a subsequent proxy by telephone or through the Internet. |

| • | You may send a timely written notice that you are revoking your proxy to our Corporate Secretary at 350 West Java Drive, Sunnyvale, California 94089. |

| • | You may attend the annual meeting and vote in person. Simply attending the meeting will not, by itself, revoke your proxy. |

Your most current proxy card or telephone or Internet proxy is the one that is counted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

When are stockholder proposals and director nominations due for next year’s annual meeting?

To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by December 31, 2015 to our Corporate Secretary at 350 West Java Drive, Sunnyvale, California 94089, and must comply with all applicable requirements of Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended; provided, however, that if our 2016 Annual Meeting of Stockholders is held before May 11, 2016 or after July 10, 2016, then the deadline is a reasonable amount of time prior to the date we begin to print and mail our proxy statement for the 2016 Annual Meeting of Stockholders. You are also advised to review our bylaws, which contain additional requirements about advance notice of stockholder proposals and director nominations.

How are votes counted?

Votes will be counted by the inspector of election appointed for the meeting, who will separately count, for the proposal to elect directors, votes “For,” “Withhold” and broker non-votes; and, with respect to other proposals, votes “For” and “Against,” abstentions and, if applicable, broker non-votes. Broker non-votes have no effect and will not be counted towards the vote total for any proposal.

What are “broker non-votes”?

Broker non-votes occur when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed “non-routine.” Generally, if shares are held in street name, the beneficial owner of the shares is entitled to give voting instructions to the broker or nominee holding the shares. If the beneficial owner does not provide voting instructions, the broker or nominee can still vote the shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. Under the rules and interpretations of the NYSE, “non-routine” matters are matters that may substantially affect the rights or privileges of stockholders, such as mergers, stockholder proposals, elections of directors (even if not contested) and, executive compensation, including advisory stockholder votes on executive compensation and on frequency of stockholder votes on executive compensation. Proposals 1 and 2 are “non-routine” matters and Proposal 3 is a “routine” matter.

How many votes are needed to approve each proposal?

|

| |

| • | For the election of directors, the two nominees to serve as Class III directors until the 2018 Annual Meeting of Stockholders receiving the most “For” votes from the holders of shares present in person or represented by proxy and entitled to vote on the election of directors will be elected. Only votes “For” or “Withheld” will affect the outcome. |

| • | For Proposal No. 2, advisory approval of the compensation of the our named executive officers as disclosed in this proxy statement in accordance with SEC rules, will be considered to be approved if it receives “For” votes from the holders of a majority of shares present in person or represented by proxy and entitled to vote on this matter. If you “Abstain” from voting on Proposal No. 2, it will have the same effect as an “Against” vote. Broker non-votes will have no effect. |

| • | To be approved, Proposal No. 3, ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal year ending December 31, 2015, must receive “For” votes from the holders of a majority of shares present in person or represented by proxy and entitled to vote on this matter. If you select to “Abstain” from voting on Proposal No. 3, it will have the same effect as an “Against” vote. Broker non-votes will have no effect; however, Proposal No. 3 is considered a routine matter, and therefore no broker non-votes are expected to exist in connection with Proposal No. 3. |

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority of the outstanding shares entitled to vote are present at the meeting in person or represented by proxy. On the record date, there were 86,551,101 shares outstanding and entitled to vote.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the chairperson or the holders of a majority of shares present at the meeting in person or represented by proxy may adjourn the meeting to another date.

How can I find out the results of the voting at the annual meeting?

Preliminary voting results will be announced at the annual meeting. Final voting results will be published in a Current Report on Form 8-K that we expect to file within four business days after the annual meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the annual meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Our Board is divided into three classes. Each class consists, as nearly as possible, of one-third of the total number of directors, and each class has a three-year term. Vacancies on the Board may be filled only by persons elected by a majority of the remaining directors. A director elected by the Board to fill a vacancy in a class, including vacancies created by an increase in the number of directors, serves for the remainder of the full term of that class and until the director’s successor is duly elected and qualified.

The Board presently has seven members. There are two directors in the class whose term of office expires in 2015. Each of the nominees listed below is currently a director of Ruckus Wireless, Inc. If elected at the annual meeting, each of these nominees would serve as a Class III director until the 2018 Annual Meeting of Stockholders and until his or her successor has been duly elected and qualified, or, if sooner, until the director’s death, resignation or removal. It is our policy to invite directors and nominees for director to attend the annual meeting. In 2014, Ms. Lo attended the annual meeting.

The two nominees for Class III director are Ms. Selina Y. Lo and Mr. Stewart Grierson, each of whom currently serves as a Class III director whose term expires at the 2015 annual meeting. If re-elected at the 2015 annual meeting, each of these nominees would serve until our 2018 Annual Meeting of Stockholders and until his or her successor is elected and qualified, or, if sooner, until his or her death, resignation or removal. Each nominee has indicated his or her willingness to continue to serve as a director if re-elected. Our management has no reason to believe that any nominee will be unable to serve. In the event that any of the nominees should be unavailable for election as a result of an unexpected occurrence, shares represented by executed proxies will be voted for the election of a substitute nominee proposed by management.

Directors are elected by a plurality of the votes of the shares present in person or represented by proxy and entitled to vote at the annual meeting. Proxies cannot be voted for more than two persons. The two nominees nominated by the Board to serve as Class III directors must receive the most “For” votes (among votes properly cast in person or represented by proxy) of nominees for the vacancies in such director class in order to be elected. Shares represented by executed proxies will be voted, if authority to do so is not withheld, “For” the election of the nominees named below. Only votes “For” or “Withheld” will affect the outcome.

The following table sets forth certain information as of February 15, 2015 with respect to our directors, including the two persons nominated for election by our Board at the 2015 annual meeting. |

| | | | |

| Name | | Age | | Director Since |

| Selina Y. Lo | | 55 | | 2004 |

| William Kish | | 43 | | 2004 |

| Gaurav Garg | | 49 | | 2002 |

| Mohan Gyani | | 63 | | 2009 |

| Georges Antoun | | 52 | | 2011 |

| Richard Lynch | | 66 | | 2012 |

| Stewart Grierson | | 48 | | 2012 |

The brief biographies below include information, as of the date of this proxy statement, regarding the specific and particular experience, qualifications, attributes or skills of each nominee for director. In addition, following the biographies of the nominees are the biographies of Class I and Class II directors containing information of each director continuing to serve on the Board.

Class III Nominees for Election to the Board of Directors for a Three-Year Term Expiring in 2018

Stewart Grierson has served as one of our directors since June 2012. From January 2013 to January 2015, Mr. Grierson served as Chief Financial Officer and Senior Vice President of Operations of Coraid, Inc., a data storage company. From October 2004 to June 2011, Mr. Grierson served as Chief Financial Officer of ArcSight Inc., an enterprise security and software compliance management company, and also served as Vice President of Finance from March 2003 to April 2007 and Secretary from January 2003 to January 2006. From November 1999 to July 2002, Mr. Grierson served in several positions for ONI Systems Corp., a provider of optical communications equipment, including most recently as Vice President and Corporate Controller. From 1992 to 1999, he served in various roles in the audit practice at KPMG LLP. Mr. Grierson holds a BA in economics and a Graduate Diploma in Chartered Accountancy, both from McGill University. Mr. Grierson is also a chartered accountant.

Mr. Grierson was selected to serve on our Board based on his extensive experience with technology and communications companies and his financial and accounting background. Mr. Grierson qualifies as an “audit committee financial expert” within the meaning of the SEC regulations.

Selina Y. Lo has served as our President and Chief Executive Officer since July 2004 and as a member of our Board since May 2004. From 2000 to 2001, Ms. Lo held various positions at Nortel Networks Inc., a telecommunications equipment manufacturing company, including Vice President of Architecture of the Data Networking Unit. From 1996 to 2000, Ms. Lo served as Vice President of Marketing and Product Management at Alteon WebSystems, Inc., an Internet infrastructure company, until Alteon WebSystems was acquired by Nortel Networks Inc. in

2000. From 1993 to 1995, Ms. Lo served as Vice President of Marketing at Centillion Networks Inc., a telecommunications equipment manufacturing company, which was acquired by Bay Networks, Inc., a network hardware company, in 1995. Ms. Lo continued to serve as the Vice President of Product Development for the Centillion Business Unit of Bay Networks until 1996. Ms. Lo holds a BA in Computer Science from the University of California, Berkeley.

Ms. Lo was selected to serve on our Board based on the perspective and experience she brings as our Chief Executive Officer and her extensive experience in the networking industry.

Class II Directors Continuing in Office Until the 2017 Annual Meeting

Georges Antoun has served as one of our directors since December 2011. Mr. Antoun has been Chief Operating Officer of First Solar, Inc., a provider of fully integrated solar solutions, since July 2012. From July 2011 to June 2012, Mr. Antoun was a Venture Partner at Technology Crossover Partners and part of the Infrastructure team. From January 2007 to July 2011, Mr. Antoun was the Head of Product Area IP & Broadband Networks for Telefonaktiebolaget L.M. Ericsson. Before joining Ericsson, from August 2001 to January 2007, Mr. Antoun was Senior Vice President of Worldwide Sales & Operations at Redback Networks, which Ericsson acquired in January 2007. After the acquisition of Redback Networks, Mr. Antoun was promoted to Chief Executive Officer of the Redback entity at Ericsson until 2009. Prior to Redback Networks, from 1996 to 2001, Mr. Antoun worked at Cisco Systems where he served in various roles including Vice President of Worldwide Systems Engineering and Field Marketing, Vice President of Worldwide Optical Operations and Vice President of Carrier Sales. Mr. Anton serves as a member of the board of directors of Violin Memory. Mr. Antoun holds a BS in Engineering from the University of Louisiana at Lafayette, and a Masters in Information Systems Engineering from New York Polytechnic, now NYU Poly.

Mr. Antoun was selected to serve on our Board based on his extensive experience with technology and networking companies, including as an executive and venture capitalist.

Mohan Gyani has served as one of our directors since December 2009 and as lead independent director since July 2012. Since May 2005, Mr. Gyani has served in various roles at Roamware, Inc., a mobile roaming solutions company, most recently as Vice Chairman. From March 2000 to January 2003, Mr. Gyani served as President and Chief Executive Officer of AT&T Wireless Services, Inc., a telecommunications company. From September 1995 to 1999, Mr. Gyani was an Executive Vice President and Chief Financial Officer of AirTouch Communications, Inc., a wireless telephone services provider. Prior to AirTouch Communications, Mr. Gyani spent 15 years with the Pacific Telesis Group, Inc. of Pacific Bell, a telecommunications company. Mr. Gyani holds a BA in business administration and an MBA from San Francisco State University. From June 2007 to June 2010, Mr. Gyani served on the board of directors of Mobile Telesystems, Inc. Mr. Gyani also previously served on the board of directors of Keynote Systems, Inc. and Safeway, Inc. Currently, Mr. Gyani serves on the boards of directors of Audience, Inc., Blackhawk Network Holdings, Inc. and Union Bank, N.A., as well as on the boards of directors of certain private companies.

Mr. Gyani was selected to serve on our Board based on his extensive experience with technology and networking companies and broad experience in the telecommunications industry.

Richard Lynch has served as one of our directors since March 2012. Mr. Lynch has been president of FB Associates, LLC, an advisory and consulting services company, since September 2011. From October 2010 to August 2011, Mr. Lynch served as Executive Vice President of Enterprise-wide Strategic Technology Initiatives at Verizon Communications Inc., and from July 2007 to October 2010, as Executive Vice President and Chief Technology Officer. From 2000 to 2007, Mr. Lynch served as Chief Technology Officer at Verizon Wireless. He is a Fellow of The Institute of Electrical and Electronic Engineers and has been awarded patents in the field of wireless communications. Mr. Lynch is a graduate of Lowell Technological Institute, now University of Massachusetts, where he received BS and MS degrees in Electrical Engineering. He has also completed post graduate work at The Wharton School at the University of Pennsylvania and the Johnson School of Management at Cornell University. Mr. Lynch serves as a member of the board of directors of Blackberry (formerly known as Research In Motion Limited), Sonus Networks, Inc. and Telecordia dba iconectiv and syncreon, and was previously a member of the board of directors of TranSwitch Corporation.

Mr. Lynch was selected to serve on our Board based on his extensive experience with technology and networking companies.

Class I Directors Continuing in Office Until the 2016 Annual Meeting

Gaurav Garg has served as one of our directors since August 2002. Mr. Garg is currently an active investor in enterprise and mobile focused technology companies and serves on the board of directors of MobileIron, Inc. and a number of privately held companies. He served on the board of directors of FireEye, Inc. until 2014. From 2001 to 2010, Mr. Garg was a non-managing member at Sequoia Capital. Prior to joining Sequoia Capital, Mr. Garg was a founder, board member and Senior Vice President of Product Management at Redback Networks, which was acquired by Telefonaktiebolaget L.M. Ericsson in January 2007. Prior to Redback Networks, Mr. Garg held various engineering positions at SynOptics and Bay Networks. Mr. Garg holds a BS and MS in Electrical Engineering and a BS in Computer Science, all from Washington University in St. Louis.

Mr. Garg was selected to serve on our Board based on his extensive experience with technology and networking companies, including as a founder, executive and venture capitalist.

William Kish, one of our co-founders, has served as our Chief Technology Officer since 2002 and as a member of our Board since May 2004. From 1998 to 2000, Mr. Kish served as a member of the technical staff at Lightera Networks, Inc., a telecommunications equipment company. From 1997 to 1998, Mr. Kish served as Principal Engineer at Berkeley Networks, Inc., a computer equipment company. From 1993 to 1997, Mr. Kish served as a Software Engineer and later as a Principal Engineer at FORE Systems, Inc., a computer networking company. Mr. Kish holds a BS in Computer Engineering from Carnegie Mellon University.

Mr. Kish was selected to serve on our Board based on the perspective and experience he brings as our Chief Technology Officer and his extensive experience in the networking industry.

There are no family relationships among any of our executive officers, directors or persons nominated to become one of our directors.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE FOR THE ELECTION OF THE DIRECTORS

COVERED BY PROPOSAL NO. 1.

INFORMATION REGARDING THE BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Director Independence

Under the listing requirements and rules of the NYSE, independent directors must comprise a majority of our Board as a listed company. The Board has undertaken a review of its composition, the composition of its committees and the independence of each director. Based upon information requested from and provided by each director concerning his background, employment and affiliations, including family relationships, the Board has determined that Messrs. Antoun, Garg, Grierson, Gyani and Lynch do not have any relationships that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is “independent” as that term is defined under the applicable rules and regulations of the SEC and the listing requirements and rules of the NYSE. In making this determination, the Board considered the current and prior relationships that each non-employee director has with our company and all other facts and circumstances our Board deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director.

Board Leadership Structure

Mr. Gyani serves as our Board’s lead independent director. Currently, meetings of the Board are generally chaired by the lead independent director or, at his request, Ms. Lo, our President and Chief Executive and also a member of the Board. The Board currently has no member serving in the position of chairperson of the Board.

The Board appointed Mr. Gyani as the lead independent director to reinforce the independence of the Board as a whole for purposes of calling and conducting meetings of the Board. We believe that the lead independent director helps ensure the effective independent functioning of the Board in its oversight responsibilities. The lead independent director is empowered to, among other things, preside over Board meetings, including, if applicable, executive sessions of the independent directors, approve information to be sent to the Board if requested to do so by the Board, approve proposed meeting agendas and schedules and call meetings of the Board and/or independent directors.

The Board does not currently have a chairperson and we have not adopted any policy regarding a chairperson’s independence. The Board would however consider appointing either an independent or non-independent director as chairperson, depending on what the Board determined to be in the best interests of the Company and its stockholders when selecting a chairperson. We believe that having the President and Chief Executive Officer serve also as a director helps to ensure that the Board and management act with a common purpose, and that Ms. Lo helps to act as a bridge between management and the Board, facilitating the regular flow of information and providing the Board with valuable insight into the day-to-day operations of the Company. For similar reasons, we do not preclude that the President and Chief Executive could additionally serve as chairperson of the Board.

Role of the Board in Risk Oversight

Risk is inherent with every business. Management is responsible for the day-to-day management of the risks that we face, while the Board, as a whole and through its committees, has responsibility for the oversight of risk management. In its risk oversight role, the Board is responsible for satisfying itself that the risk management processes designed and implemented by management are adequate and functioning as designed.

One of the Board’s key functions is informed oversight of the Company’s risk management process. The Board does not have a standing risk management committee, but rather administers this oversight function directly through the Board as a whole, as well as through various Board standing committees that address risks inherent in their respective areas of oversight. In particular, our Board is responsible for monitoring and assessing strategic risk exposure, including a determination of the nature and level of risk appropriate for the Company. Our Audit Committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. The Audit Committee also monitors compliance with legal and regulatory requirements, in addition to oversight of the performance of our internal audit function. Our Nominating and Corporate Governance Committee monitors the effectiveness of our corporate governance guidelines, including whether they are successful in preventing illegal or improper liability-creating conduct. Our Compensation Committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking.

Meetings of The Board of Directors

The Board met five times during 2014. Each Board member attended 75% or more of the aggregate number of meetings of the Board and of the committees on which they served, held during the portion of the last fiscal year for which they were a director or committee member.

The independent directors meet in executive session without management directors, non-independent directors or management present. These sessions take place prior to or following regularly scheduled Board meetings.

Information Regarding Committees of the Board of Directors

The Board has three standing committees: an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee.

Each of these three standing committees has a written charter approved by our Board that reflects the applicable standards and requirements adopted by the SEC and NYSE. A copy of each charter can be found on our website, http://www.ruckuswireless.com, under the section titled “Investors Relations” and under the subsection “Corporate Governance.” Information contained in, or accessible through, our website is not a part of this proxy statement. The following table provides membership and meeting information for 2014 for each of the committees of the Board |

| | | | | | |

| Name | | Audit | | Compensation | | Nominating and

Corporate

Governance |

| Selina Y. Lo | | | | | | |

| William Kish | | | | | | |

| Georges Antoun | | X | | X | | |

| Gaurav Garg | | X | | X* | | |

| James Goetz(1) | | | | | | X |

| Stewart Grierson | | X*+ | | | | |

| Mohan Gyani^ | | | | | | X |

| Richard Lynch | | | | X | | X* |

| Total meetings in 2014 | | 8 | | 10 | | 2 |

|

| |

| * | denotes committee chairperson |

| + | denotes financial expert |

| ^ | denotes lead independent director |

| (1) | Mr. Goetz resigned from the Board effective on February 5, 2015. |

Below is a description of each standing committee of the Board. The Board has determined that each committee member meets the applicable NYSE rules and regulations regarding “independence” and is free of any relationship that would impair his individual exercise of independent judgment with regard to the Company. The standing committees regularly report to the Board on their actions and recommendations. The committees periodically review their charters and assess their own performance. In addition, the Board, through the Nominating and Corporate Governance Committee, conducts an annual review of the role, function, roster and operation of each of the Board’s standing committees.

Audit Committee

The Audit Committee was established to oversee our corporate accounting and financial reporting processes and audits of its financial statements.

Our Audit Committee currently consists of Messrs. Antoun, Garg and Grierson, each of whom, the Board has determined, satisfies the independence requirements under the NYSE listing standards and Rule 10A-3(b)(1) of the Exchange Act. The chair of the Audit Committee is Mr. Grierson, whom the Board has determined is an “audit committee financial expert” within the meaning of the SEC regulations. Each member of our Audit Committee can read and understand fundamental financial statements in accordance with applicable requirements. In arriving at these determinations, the Board has examined each Audit Committee member’s scope of experience and the nature of their employment in the corporate finance sector. The Audit Committee met eight times during 2014.

The functions of this committee include:

|

| |

| • | reviewing and pre-approving the engagement of our independent registered public accounting firm to perform audit services and any permissible non-audit services; |

| • | evaluating the performance of our independent registered public accounting firm and deciding whether to retain its services; |

| • | monitoring the rotation of partners of our independent registered public accounting firm on our engagement team as required by law; |

| • | reviewing our annual and quarterly financial statements and reports and discussing the statements and reports with our independent registered public accounting firm and management, including a review of disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations”; |

| • | considering and approving or disapproving of all related party transactions; |

| • | reviewing, with our independent registered public accounting firm and management, significant issues that may arise regarding accounting principles and financial statement presentation, as well as matters concerning the scope, adequacy and effectiveness of our financial controls; |

| • | establishing procedures for the receipt, retention and treatment of any complaints received by us regarding financial controls, accounting or auditing matters; and |

| • | conducting an annual assessment of the performance of the Audit Committee and its members and the adequacy of its charter. |

Compensation Committee

Our Compensation Committee consists of Messrs. Antoun, Garg and Lynch. The Board has determined that each of Messrs. Antoun, Garg and Lynch is independent under the NYSE listing standards, is a “non-employee director” as defined in Rule 16b-3 promulgated under the Exchange Act and is an “outside director” as that term is defined in Section 162(m) of the Internal Revenue Code of 1986, as amended. The chair of our Compensation Committee is Mr. Garg. The Compensation Committee met ten times during 2014.

The functions of this committee include:

|

| |

| • | reviewing and recommending to the full board of directors the compensation and other terms of employment of our chief executive officer; |

| • | reviewing and approving the compensation and other terms of employment of our executive officers other than the chief executive officer; |

| • | reviewing and approving corporate performance goals and objectives relevant to such compensation; |

| • | reviewing and recommending to the full board of directors the compensation of our directors; |

| • | evaluating, adopting and administering equity incentive plans, compensation plans and similar programs, as well as modification or termination of plans and programs; |

| • | establishing policies with respect to equity compensation arrangements; |

| • | reviewing with management our disclosures under the caption “Compensation Discussion and Analysis” and recommending to the full board its inclusion in our periodic reports to be filed with the SEC; and |

| • | reviewing and assessing, at least annually, the performance of the Compensation Committee and the adequacy of its charter. |

Compensation Committee Processes and Procedures

Typically, the Compensation Committee meets quarterly and with greater frequency if necessary. The Compensation Committee meets in executive session as needed and, from time to time, various members of management and other employees as well as outside advisers or consultants may be invited by the Compensation Committee to make presentations, to provide financial or other background information or advice or to otherwise participate in Compensation Committee meetings. The chief executive officer may not participate in, or be present during, any deliberations or determinations of the Compensation Committee or the Board regarding her compensation. The charter of the Compensation Committee grants the Compensation Committee full access to all books, records, facilities and personnel of the Company, as well as authority to obtain, at the expense of the Company, advice and assistance from internal and external legal, accounting or other advisers and consultants and other external resources that the Compensation Committee considers necessary or appropriate in the performance of its duties. In particular, the Compensation Committee has the sole authority to retain compensation consultants to assist in its evaluation of executive and director compensation, including the authority to approve the consultant’s reasonable fees and other retention terms. Under the charter, the Compensation Committee may

select, or receive advice from, a compensation consultant, legal counsel or other adviser to the Compensation Committee, other than in-house counsel and certain other types of advisers, only after taking into consideration six factors, prescribed by the SEC and NYSE, that bear upon the adviser’s independence; however, there is no requirement that any adviser be independent.

In 2014, after taking into consideration the six factors prescribed by the SEC and NYSE described above, at the direction of the Compensation Committee, we engaged Radford, an Aon Hewitt Consulting Company (“Radford”), to support management and the Compensation Committee in reviewing and making decisions regarding the compensation of our directors and executive officers. Radford is a well-known and respected management consulting firm that provides compensation advisory services to compensation committees and management.

The Compensation Committee relied on data and advice from Radford in reviewing and determining the following decisions with respect to our executive compensation policies and practices:

|

| |

| • | peer company groups composed of public and private companies with comparable revenues, taking into consideration market capitalization, industry segment, total employees, and geographic location; |

| • | cash and equity compensation data for the peer groups; |

| • | best practices in our market for executive compensation policies and practices, including base salaries, short term cash incentives, long-term equity compensation and severance program design; |

| • | our director compensation program; and |

| • | equity grant guidelines for our executive officers and our broad-based employee population. |

We pay for the costs of Radford’s work, and management has the ability to direct their work under the supervision of the Compensation Committee. In 2014, Radford was not present at any deliberations of our Board, however they did participate in Compensation Committee meetings when necessary. In 2014, the total cost of the services provided by Radford did not exceed 1% of Radford’s revenue. The Board and the Compensation Committee were aware that Radford was retained and instructed by management, and did not believe that this created an impermissible conflict of interest or impaired their ability to provide thoughtful guidance and appropriate company peer data. The Compensation Committee may retain its own independent compensation consultant in the future.

In 2012, the Compensation Committee formed an Equity Subcommittee, currently composed of the Company’s Chief Executive Officer, Chief Financial Officer and Vice President of Human Resources, to which it delegated authority to grant, without any further action required by the Compensation Committee, stock options and restricted stock units (“RSUs”) to employees who are not officers of the Company within certain pre-approved guidelines. The purpose of this delegation of authority was to enhance the flexibility of equity administration within the Company and to facilitate the timely grant of equity to non-officer employees within specified limits approved by the Compensation Committee based on the employee’s geographic location, level and job function. During 2014, the subcommittee exercised its authority to grant RSUs and options to purchase stock for an aggregate of 2,628,550 shares to non-officer employees.

The Compensation Committee determines most of the significant adjustments to annual compensation programs, recommends to the Board bonus and equity awards for our chief executive officer, determines bonus and equity awards for executive officers other than our chief executive officer, and recommends to the Board new performance objectives at one or more meetings held during the first quarter of the year. However, the Compensation Committee also considers matters related to individual compensation, such as compensation for new executive hires, as well as high-level strategic issues, such as the efficacy of the Company’s compensation strategy, potential modifications to that strategy and new trends, plans or approaches to compensation, at various meetings throughout the year. Generally, the Compensation Committee’s process comprises two related elements: the determination of compensation levels and the establishment of performance objectives for the current year. For executives other than the chief executive officer, the Compensation Committee solicits and considers evaluations and recommendations submitted to the Committee by the chief executive officer. In the case of the chief executive officer, the evaluation of her performance is conducted by the Compensation Committee, which recommends to the Board for its adoption any adjustments to her compensation as well as awards to be granted to her. For all its deliberations, the Compensation Committee may review and consider, as appropriate, materials such as financial reports and projections, operational data, tax and accounting information, tally sheets that set forth the total compensation that may become payable to executives in various hypothetical scenarios, executive and director stock ownership information, company stock performance data, analyses of historical executive compensation levels and current Company-wide compensation levels and recommendations of the Compensation Committee’s compensation consultant, including analyses of executive and director compensation paid at other companies identified by the consultant.

Compensation Committee Interlocks and Insider Participation

As noted above, the Compensation Committee consists of Messrs. Antoun, Garg and Lynch. None of the members of the Compensation Committee has at any time been an officer or employee of Ruckus Wireless, Inc. No member of the Board or of the Compensation Committee served as an executive officer of another entity that had one or more of our executive officers serving as a member of that entity’s board or compensation committee.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee consists of Messrs. Gyani and Lynch. Mr. Goetz was a member of the Nominating and Corporate Governance Committee until his resignation effective February 5, 2015. The Board has determined that Messrs. Gyani and Lynch are independent under the NYSE listing standards. The chair of our Nominating and Corporate Governance Committee is Mr. Lynch. The Nominating and Corporate Governance Committee meet three times during 2014.

The functions of this committee include: |

| |

| • | reviewing periodically and evaluating performance of the Board and its applicable committees, and recommending to the Board and management areas for improvement; |

| • | interviewing, evaluating, nominating and recommending individuals for membership on the Board;

|

| • | reviewing and recommending to the Board the terms of, and any amendments to, our corporate governance policies; and |

| • | reviewing and assessing, at least annually, the performance of the Nominating and Corporate Governance Committee and the adequacy of its charter. |

The Nominating and Corporate Governance Committee believes that candidates for director should have certain minimum qualifications, including the highest professional and personal ethics and values, consistent with our Code of Business Conduct. Candidates should have broad experience and demonstrated excellence in their fields. They should possess relevant expertise upon which to be able to offer advice and guidance to management and be committed to enhancing stockholder value. They should have sufficient time to devote to our affairs and to carry out their duties. They should have the ability to exercise sound business judgment and to provide insight and practical wisdom based on experience. Each director must represent the interests of all stockholders. Their service on other boards of public companies should be limited to a number that permits them, given their individual circumstances, to perform responsibly all director duties. However, the Nominating and Corporate Governance Committee retains the right to modify these qualifications from time to time.

The Nominating and Corporate Governance Committee utilizes a variety of methods for identifying and evaluating nominees for director. The Nominating and Corporate Governance Committee periodically assesses the appropriate size of our Board, and whether any vacancies on our Board are expected due to retirement or otherwise. If vacancies are anticipated, or otherwise arise, the Nominating and Corporate Governance Committee considers various potential candidates for director. Candidates may come to the attention of the Nominating and Corporate Governance Committee through current members of our Board, professional search firms, stockholders or other persons. The Nominating and Corporate Governance Committee conducts any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of our Board. The Nominating and Corporate Governance Committee meets to discuss and consider the candidates’ qualifications and then selects a nominee for recommendation to our Board by majority vote. These candidates are evaluated at meetings of the Nominating and Corporate Governance Committee and may be considered at any point during the year.

The Nominating and Corporate Governance Committee will consider properly submitted stockholder recommendations for candidates for our Board who meet the minimum qualifications as described above. The Nominating and Corporate Governance Committee does not intend to alter the manner in which it evaluates candidates, including the minimum criteria set forth above, based on whether or not the candidate was recommended by a stockholder. Any stockholder recommendations proposed for consideration by the Nominating and Corporate Governance Committee should be in writing and delivered to the Nominating and Corporate Governance Committee at the following address: 350 West Java Drive, Sunnyvale, California 94089. Submissions must include the full name, age and address of the proposed nominee, a description of the proposed nominee’s business experience for at least the previous five years, complete biographical information, a description of the proposed nominee’s qualifications as a director and a representation that the nominating stockholder is a beneficial or record holder of our stock, including the class and number of shares of each class of capital stock owned and date(s) the shares were acquired. Any such submission must be accompanied by the written consent of the proposed nominee to be named as a nominee and to serve as a director if elected. Following verification of the stockholder status of persons proposing candidates, the Nominating and Corporate Governance Committee aggregates the recommendations and considers them at a regularly scheduled meeting prior to the issuance of the proxy statement for our next Annual Meeting of Stockholders. If any materials are provided by a stockholder in connection with the recommendation of a director candidate, such materials are forwarded to the Nominating and Corporate Governance Committee.

All proposals of stockholders that are intended to be presented by such stockholder at the Annual Meeting of Stockholders must be in writing and received by us no later than 120 calendar days in advance of the first anniversary date of mailing of the Company’s proxy statement released to stockholders in connection with the previous year’s Annual Meeting of Stockholders, including any proposals to be included in that year’s proxy materials. Stockholders are also advised to review our bylaws, which contain additional requirements with respect to advance notice of stockholder proposals and director nominations.

Stockholder Communications with the Board of Directors

Our stockholders and other interested parties may communicate with the Board by writing to our Corporate Secretary at Ruckus Wireless, Inc., 350 West Java Road, Sunnyvale, California 94089. Our Corporate Secretary will review these communications and will determine whether they should be presented to our Board. The purpose of this screening is to allow the Board to avoid having to consider irrelevant or inappropriate communications. All communications directed to the Audit Committee in accordance with our Whistleblower Policy that relate to questionable accounting or auditing matters involving Ruckus Wireless, Inc. will be promptly and directly forwarded to the chairman of the Audit Committee.

Code of Business Conduct

We have adopted the Ruckus Wireless, Inc. Code of Business Conduct that applies to all officers, directors and employees. The Code of Business Conduct is available on our website at http://investors.ruckuswireless.com. If we make any substantive amendments to the Code of Business Conduct or grant any waiver from a provision of the Code of Business Conduct to any executive officer or director, we will promptly disclose the nature of the amendment or waiver on our website.

Corporate Governance Guidelines

In July 2012, the Board documented, and in July 2013 revised, the governance practices followed by the Company by adopting Corporate Governance Guidelines to assure that the Board and Nominating and Corporate Governance Committee will have the necessary authority and practices in place to review and evaluate our business operations as needed and to make decisions that are independent of the our management. The guidelines are also intended to align the interests of directors and management with those of our stockholders. The Corporate Governance Guidelines set forth the practices the Board intends to follow with respect to board composition and selection, board meetings and involvement of senior management, chief executive officer performance evaluation and succession planning, and board committees and compensation. The Corporate Governance Guidelines, as well as the charters for each committee of the Board, may be viewed at http://investors.ruckuswireless.com. Information contained in, or accessible through, our website is not a part of this proxy statement.

PROPOSAL NO. 2

ADVISORY VOTE ON NAMED EXECUTIVE OFFICER COMPENSATION

Under the Dodd-Frank Wall Street Reform and Consumer Protection Act, or the Dodd-Frank Act, and Section 14A of the Exchange Act, our stockholders are entitled to vote to approve, on an advisory basis, the compensation of our named executive officers as disclosed in this proxy statement in accordance with SEC rules.

This vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and the philosophy, policies and practices described in this proxy statement. The compensation of our named executive officers subject to the vote is disclosed in the Compensation Discussion and Analysis, the compensation tables, and the related narrative disclosure contained in this proxy statement. As discussed in those disclosures, we believe that our compensation policies and decisions promote a long-term connection between pay and performance. Compensation of our named executive officers is designed to enable us to attract and retain talented and experienced executives to lead us successfully in a competitive environment.

Accordingly, the Board is asking the stockholders to indicate their support for the compensation of our named executive officers as described in this proxy statement by casting a non-binding advisory vote “FOR” the following resolution:

“RESOLVED, that the compensation paid to our named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion is hereby APPROVED.”

Because the vote is advisory, it is not binding on the Board or the Company. Nevertheless, the views expressed by the stockholders, whether through this vote or otherwise, are important to management and the Board and, accordingly, the Board and the Compensation Committee intend to consider the results of this vote in making determinations in the future regarding executive compensation arrangements.

Advisory approval of this proposal requires the vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote on the matter at the annual meeting. Unless the Board decides to modify its policy regarding the frequency of soliciting advisory votes on the compensation of our named executives, the next scheduled advisory vote on compensation will be at the 2016 Annual Meeting of Shareholders.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE FOR PROPOSAL NO. 2

PROPOSAL NO. 3

RATIFICATION OF THE SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board has selected Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2015 and has further directed that management submit the selection of independent registered public accounting firm for ratification by the stockholders at the annual meeting. Deloitte & Touche LLP has audited our financial statements since December 2010. Representatives of Deloitte & Touche LLP are expected to be present at the 2015 annual meeting. They will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Neither our bylaws nor other governing documents or law require stockholder ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm. However, the Audit Committee is submitting the selection of Deloitte & Touche LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of different independent auditors at any time during the year if they determine that such a change would be in the best interests of the Company and its stockholders.

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the annual meeting will be required to ratify the selection of Deloitte & Touche LLP. Abstentions will be counted toward the tabulation of votes on proposals presented to the stockholders and will therefore have the same effect as negative votes. Broker non-votes are counted towards a quorum, but are not counted for any purpose in determining whether this matter has been approved.

Principal Accountant Fees and Services

The following table represents aggregate fees billed to the Company for the fiscal years ended December 31, 2014 and 2013, by Deloitte & Touche LLP, our principal accountant.

|

| | | | | | | |

| | Fiscal Year Ended |

| | 2014 | | 2013 |

| Audit Fees(1) | $ | 1,262,120 |

| | $ | 1,233,555 |

|

| Audit-related Fees(2) | 5,505 |

| | 10,234 |

|

| Tax Fees | — |

| | — |

|

| All Other Fees | 19,400 |

| | 23,765 |

|

| Total Fees | $ | 1,287,025 |

| | $ | 1,267,554 |

|

|

| |

| (1) | Audit fees consist of professional services rendered in connection with the audit of our consolidated financial statements and review of our quarterly consolidated financial statements. |

| (2) | Audit-related fees consist of fees for professional services rendered that are reasonably related to the performance of the audit or review of our consolidated financial statements. |

All fees described above were pre-approved by the Board or Audit Committee. In connection with the audit of the 2014 financial statements, we entered into an engagement agreement with Deloitte & Touche LLP which sets forth the terms by which Deloitte & Touche LLP will perform audit services for us. That agreement is subject to alternative dispute resolution procedures and an exclusion of punitive damages.

Pre-Approval Policies and Procedures

The Audit Committee has adopted procedures for the pre-approval of audit and non-audit services rendered by our independent registered public accounting firm, Deloitte & Touche LLP. The Audit Committee generally pre-approves specified services in the defined categories of audit services, audit-related services and tax services up to specified amounts. Pre-approval may also be given as part of the Audit Committee’s approval of the scope of the engagement of the independent auditor or on an individual, explicit, case-by-case basis before the independent auditor is engaged to provide each service. The pre-approval of services may be delegated to one or more of the Audit Committee’s members, but the decision must be reported to the full Audit Committee at its next scheduled meeting.

The Audit Committee has determined that the rendering of the services other than audit services by Deloitte & Touche LLP is compatible with maintaining the principal accountant’s independence.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE FOR PROPOSAL NO. 3.

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS(1)

The Audit Committee has reviewed and discussed the audited financial statements for the fiscal year ended December 31, 2014 with management of the Company. The Audit Committee has discussed with the independent registered public accounting firm the matters required to be discussed by Auditing Standard No. 16, Communications with Audit Committees, as adopted by the Public Company Accounting Oversight Board (“PCAOB”). The Audit Committee has also received the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the PCAOB regarding the independent accountants’ communications with the Audit Committee concerning independence, and has discussed with the independent registered public accounting firm the accounting firm’s independence.

Based on the foregoing, the Audit Committee has recommended to the Board that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014.

Stewart Grierson, Chairman

Georges Antoun

Gaurav Garg

|

| |

| (1) | The material in this report is not “soliciting material,” is not deemed “filed” with the SEC and is not to be incorporated by reference in any of our filings under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, other than our Annual Report on Form 10-K, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership of our common stock as of February 15, 2015, for:

|

| |

| • | each of our named executive officers; |

| • | each of our directors; |

| • | all of our directors and executive officers as a group; and |

| • | each person, or group of affiliated persons, known by us to beneficially own more than 5% of our common stock. |

Beneficial ownership is determined in accordance with the rules of the SEC and generally includes any shares over which a person exercises sole or shared voting or investment power. Shares of common stock issuable under options or warrants that are exercisable within 60 days after February 15, 2015 are deemed beneficially owned and such shares are used in computing the percentage ownership of the person holding the options or warrants but are not deemed outstanding for the purpose of computing the percentage ownership of any other person. The information contained in the following table is not necessarily indicative of beneficial ownership for any other purpose and the inclusion of any shares in the table does not constitute an admission of beneficial ownership of those shares.

Unless otherwise indicated below, to our knowledge, all persons named in the table have sole voting and dispositive power with respect to their shares of common stock, except to the extent authority is shared by spouses under community property laws. Unless otherwise indicated below, the address of each beneficial owner listed in the table below is c/o Ruckus Wireless, Inc., 350 West Java Drive, Sunnyvale, California 94089. The table lists applicable percentage ownership based on 85,261,083 shares of common stock outstanding as of February 15, 2015.

|

| | | | | |

| | | Beneficial Ownership(1) |

Name of Beneficial Owner Named Executive Officers and Directors: | | Common

Stock(1) | | Percentage

of Class |

| Selina Y. Lo(2) | | 7,659,706 | | 8.3 | % |

| Seamus Hennessy(3) | | 875,949 | | * |

|

| Daniel Rabinovitsj(4) | | 250,000 | | * |

|

| Scott Maples(5) | | 249,346 | | * |

|

| William Kish(6) | | 629,940 | | * |

|

| Gaurav Garg(7) | | 670,029 | | * |

|

| Mohan Gyani(8) | | 341,875 | | * |

|

| Georges Antoun(8) | | 183,148 | | * |

|

| Richard Lynch(8) | | 162,286 | | * |

|

| Stewart Grierson(8) | | 153,346 | | * |

|

| Directors and officers as a group (total of 12 persons)(9) | | 11,321,439 | | 12.3 | % |

| Greater than 5% Stockholders: | | | | |

| Entities affiliated with Waddell & Reed Investment | | 7,477,700 | | 8.8 | % |

| Management Company(10) | | | | |

| The Vanguard Group(11) | | 4,530,173 | | 5.3 | % |

| BlackRock, Inc.(12) | | 4,713,380 | | 5.5 | % |

|

| |

| * | Represents beneficial ownership of less than 1% of the outstanding common stock. |

| (1) | This table is based on information provided to us by our executive officers and directors and upon information about principal stockholders known to us based on Schedules 13G and 13D filed with the SEC. |

| (2) | Consists of: (a) 2,532,960 shares of common stock held by The Selina Y. Lo Trust U/T/D 7/22/97; (b) stock options exercisable for 4,384,279 shares of common stock within 60 days after February 15, 2015; (c) 293,097 shares of common stock held by The Lo 1999 Family Trust for the benefit of certain family members of Ms. Lo; (d) 16,099 shares of common stock held by The 2004 Irrevocable Trust for the benefit of a certain family member of Ms. Lo; (e) 11,100 shares of common stock held by The 2003 Irrevocable Trust for the benefit of a certain family member of Ms. Lo; (f) 253,871 shares of common stock held by Selina Y. Lo Family Trust Dated December 4, 2012; (g) 2,647 shares of common stock held by Moonlight, LLC; and (h) 165,653 restricted stock awards for which Ms. Lo has voting power subject to certain restrictions, including vesting. Ms. Lo is a Trustee of The Selina Y. Lo Trust U/T/D 7/22/97, The Lo 1999 Family Trust, The 2004 Irrevocable Trust and The 2003 Irrevocable Trust. Ms. Lo is the Grantor of the Selina Y. Lo Family Trust Dated December 4, 2012. Ms. Lo is the managing member of Moonlight, LLC. |

| (3) | Consists of: (a) 4,352 shares of common stock; (b) 831,597 shares of common stock issuable pursuant to stock options exercisable within 60 days after February 15, 2015; and (c) 40,000 restricted stock awards for which Mr. Hennessy has voting power subject to certain restrictions, including vesting. |

| (4) | Consists of 250,000 restricted stock awards for which Mr. Rabinovitsj has voting power subject to certain restrictions, including vesting. |

| (5) | Consists of: (a) 5,471 shares of common stock: (b) 224,375 shares of common stock issuable pursuant to stock options exercisable within 60 days after February 15, 2015; and (c) 19,500 restricted stock awards for which Mr. Maples has voting power subject to certain restrictions, including vesting. |

| (6) | Consists of: (a) 494,739 shares of common stock; (b) stock options exercisable for 119,451 shares of common stock within 60 days after February 15, 2015; and (c) 15,750 restricted stock awards for which Mr. Kish has voting power subject to certain restrictions, including vesting. |

| (7) | Consists of 524,404 shares of common stock and 145,625 shares of common stock issuable pursuant to stock options exercisable within 60 days after February 15, 2015. |

| (8) | Represents shares of common stock issuable pursuant to stock options exercisable within 60 days after February 15, 2015. |

| (9) | In addition to the individuals listed above, includes (a) 6,095 shares of common stock held by the executive officers; (b) stock options exercisable for 114,406 shares of common stock within 60 days after February 15, 2015 held by the executive officers; and (c) 25,313 restricted stock awards for which certain executive officers have voting power subject to certain restrictions, including vesting. |