UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

JER Investors Trust Inc.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

As filed with the Commission on April 28, 2006

[logo] JER INVESTORS TRUST INC.

April 28, 2006

Dear Fellow Stockholders:

On behalf of the Board of Directors, I cordially invite you to attend the Annual Meeting of Stockholders of JER Investors Trust Inc. (the “Annual Meeting”) to be held at The Hilton McLean, 7920 Jones Branch Drive, McLean, Virginia 22102, on Monday, June 5, 2006, at 1:00 p.m., Eastern Time. The matters to be considered by the stockholders at the Annual Meeting are described in detail in the accompanying materials.

IT IS IMPORTANT THAT YOU BE REPRESENTED AT THE ANNUAL MEETING REGARDLESS OF THE NUMBER OF SHARES YOU OWN OR WHETHER YOU ARE ABLE TO ATTEND THE ANNUAL MEETING IN PERSON. Let me urge you to mark, sign and date your proxy card today and to return it in the envelope provided.

Sincerely,

Joseph E. Robert, Jr.

Chairman of the Board of Directors

For the Board of Directors of JER Investors Trust Inc.

JER INVESTORS TRUST INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 5, 2006

To the Stockholders of JER Investors Trust Inc.:

The annual meeting of stockholders of JER Investors Trust Inc., a Maryland corporation, will be held at The Hilton McLean, 7920 Jones Branch Drive, McLean, Virginia 22102, on Monday, June 5, 2006, at 1:00 p.m., Eastern Time (the “Annual Meeting”). The matters to be considered by stockholders at the Annual Meeting, which are described in detail in the accompanying materials, are:

| | (i) | the election of seven directors to serve until the 2007 annual meeting of stockholders or until their respective successors are elected and duly qualified; |

| | (ii) | the approval of the appointment of Ernst & Young LLP as independent registered public accounting firm for the Company for fiscal year 2006; and |

| | (iii) | any other business that may properly come before the Annual Meeting or any adjournment of the Annual Meeting. |

Stockholders of record at the close of business on April 28, 2006 will be entitled to notice of, and to vote at, the Annual Meeting. It is important that your shares be represented at the Annual Meeting regardless of the size of your holdings. A Proxy Statement, proxy card and self-addressed envelope are enclosed.WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING IN PERSON, PLEASE COMPLETE, DATE AND SIGN THE PROXY CARD. Return it promptly in the envelope provided, which requires no postage if mailed in the United States. If you are the record holder of your shares and you attend the meeting, you may withdraw your proxy and vote in person, if you so choose.

Our stock transfer books will remain open for the transfer of our common stock. A list of all shareholders entitled to vote at the meeting will be available for examination at our principal executive office for the 10 days before the meeting between 9:00 a.m. and 5:00 p.m. local time, and at the place of the meeting during the meeting for any purpose germane to the meeting.

By Order of the Board of Directors,

Daniel T. Ward

Secretary

1650 Tysons Blvd, Suite 1600

McLean, Virginia 22012

April 28, 2006

JER INVESTORS TRUST INC.

1650 Tysons Blvd, Suite 1600, McLean, Virginia 22012

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 5, 2006

This Proxy Statement and the accompanying proxy card and notice of annual meeting are provided in connection with the solicitation of proxies by and on behalf of the board of directors of JER Investors Trust Inc., a Maryland corporation, for use at the annual meeting of stockholders to be held on Monday, June 5, 2006, and any adjournments or postponements thereof (the “Annual Meeting”). “We,” “our,” “us,” “the Company” and “JER” each refers to JER Investors Trust Inc.

The mailing address of our executive office is 1650 Tysons Blvd, Suite 1600, McLean, Virginia 22012. This Proxy Statement, the accompanying proxy card and the notice of annual meeting are first being mailed to holders of our common stock, par value $0.01 per share (the “Common Stock”), on or about May 8, 2006.

A proxy may confer discretionary authority to vote with respect to any matter presented at the Annual Meeting. At the date hereof, management has no knowledge of any business that will be presented for consideration at the Annual Meeting and which would be required to be set forth in this proxy statement or the related proxy card other than the matters set forth in the Notice of Annual Meeting of Stockholders. If any other matter is properly presented at the Annual Meeting for consideration, it is intended that the persons named in the enclosed form of proxy and acting thereunder will vote in accordance with their best judgment on such matter.

Date, Time and Place for the Annual Meeting

The 2006 Annual Meeting of Stockholders will be held on Monday, June 5, 2006 at 1:00 p.m. Eastern Time at The Hilton McLean, 7920 Jones Branch Drive, McLean, Virginia 22102.

Matters to be Considered at the Annual Meeting

At the Annual Meeting, holders of the Company’s Common Stock will vote upon:

| | (i) | a proposal to elect seven directors to serve until the 2007 annual meeting of stockholders or until their respective successors are elected and duly qualified; |

| | (ii) | a proposal to approve the appointment of Ernst & Young LLP as independent registered public accounting firm for the Company for fiscal year 2006; and |

| | (iii) | any other business that may properly come before the annual meeting of stockholders or any adjournment of the annual meeting. |

TABLE OF CONTENTS

GENERAL INFORMATION ABOUT VOTING

Solicitation of Proxies

The enclosed proxy is solicited by and on behalf of our board of directors. The expense of preparing, printing and mailing this proxy statement and the proxies solicited hereby will be borne by the Company. In addition to the use of the mail, proxies may be solicited by officers and directors, without additional remuneration, by personal interview, telephone, telegraph or otherwise. The Company will also request brokerage firms, nominees, custodians and fiduciaries to forward proxy materials to the beneficial owners of shares held of record on April 28, 2006 and will provide reimbursement for the cost of forwarding the material. In addition, we have engaged The Altman Group to assist in soliciting proxies from brokers, banks and other nominee holders of our common stock at a cost of approximately $5,000, plus reasonable out-of-pocket expenses.

Stockholders Entitled To Vote

As of the date hereof, there are outstanding and entitled to vote 25,687,035 shares of our Common Stock. Each share of our Common Stock entitles the holder to one vote. Stockholders of record at the close of business on April 28, 2006 are entitled to vote at the Annual Meeting or any adjournment thereof. A stockholder list will be available for examination by stockholders at the Annual Meeting and at the office of the Company at 1650 Tysons Blvd, Suite 1600, McLean, Virginia, 22012, during ordinary business hours during the ten-day period prior to the Annual Meeting for any purpose germane to the meeting.

Required Vote

A quorum will be present if the holders of a majority of the outstanding shares entitled to vote are present, in person or by proxy, at the Annual Meeting. If you have returned a valid proxy or, if you hold your shares in your own name as holder of record and you attend the Annual Meeting in person, your shares will be counted for the purpose of determining whether there is a quorum. If a quorum is not present, the Annual Meeting may be adjourned by the chairman of the meeting or by the vote of a majority of the shares represented at the Annual Meeting until a quorum has been obtained.

For the election of the nominees to our board of directors, the affirmative vote of a plurality of all the votes cast at the Annual Meeting is sufficient to elect the director if a quorum is present. For the approval of Ernst & Young LLP, the affirmative vote of a majority of the shares of our Common Stock cast at the Annual Meeting is required to approve the matter.

If the enclosed proxy is properly executed and returned to us in time to be voted at the Annual Meeting, it will be voted as specified on the proxy unless it is properly revoked prior thereto. If no specification is made on the proxy as to any one or more of the proposals, the shares of Common Stock represented by the proxy will be voted as follows:

| | (i) | FOR the election of each of the nominees to our board of directors; |

| | (ii) | FOR the approval of the appointment of Ernst & Young LLP as independent registered public accounting firm for the Company for fiscal year 2006; and |

| | (iii) | in the discretion of the proxy holder on any other business that properly comes before the Annual Meeting or any adjournment or postponement thereof. |

Abstentions (and broker non-votes) will have no effect on the outcome of the election of our board of directors, the appointment of Ernst & Young LLP or any other matter for which the required vote is a majority of the votes cast. We will not count shares that abstain from voting on a particular matter or broker non-votes as votes in favor of such matter. In the election of directors, abstentions and broker non-votes will be disregarded and will have no effect on the outcome of the vote. With respect to the approval of Ernst & Young LLP, abstentions from voting will have the same effect as voting against such matter and broker non-votes will be disregarded and will have no effect on the outcome of the vote.

If any other matters are properly presented at the Annual Meeting for consideration, the persons named in the proxy will have the discretion to vote on those matters for you. As of the date of this Proxy Statement, we are not aware of any other matter to be raised at the Annual Meeting.

Abstentions and broker non-votes will be counted in determining the presence of a quorum. “Broker non-votes” are instances where a broker holding shares of record for a beneficial owner does not vote the shares because it is precluded by rules of a stock exchange or the NASD from voting on a matter.

Under the rules of the New York Stock Exchange, brokers who hold shares in “street name” may have the authority to vote on certain matters when they do not receive instructions from beneficial owners. Brokers that do not receive instructions are entitled to vote on the election of directors and the ratification of the independent registered public accounting firm. In determining whether the proposal to ratify the appointment of the independent registered public accounting firm has received the requisite vote, abstentions will be disregarded and will have no effect on the outcome of the vote. A vote “withheld” from a director nominee will have no effect on the outcome of the vote because a plurality of the votes cast at the Annual Meeting is required for the election of each director.

Voting

If you hold your shares of our Common Stock in your own name as a holder of record, you may instruct the proxies to vote your shares by signing, dating and mailing the proxy card in the postage-paid envelope provided. In addition, you may vote your shares of our Common Stock in person at the Annual Meeting.

If your shares of our Common Stock are held on your behalf by a broker, bank or other nominee, you will receive instructions from them that you must follow to have your shares voted at the Annual Meeting.

Right to Revoke Proxy

If you hold shares of our Common Stock in your own name as a holder of record, you may revoke your proxy instructions at any time prior to the date and time of the Annual Meeting through any of the following methods:

| | • | | send written notice of revocation, prior to the Annual Meeting, to our Secretary, Mr. Daniel T. Ward, at 1650 Tysons Blvd, Suite 1600, McLean, Virginia 22012; |

| | • | | sign, date and mail a new proxy card to our Secretary; or |

| | • | | attend the Annual Meeting and vote your shares in person. |

If shares of our Common Stock are held on your behalf by a broker, bank or other nominee, you must contact them to receive instructions as to how you may revoke your proxy instructions.

Copies of Annual Report to Stockholders

A copy of our Annual Report on Form 10-K filed with the Securities and Exchange Commission (the “SEC”) for our latest fiscal year will be mailed to stockholders entitled to vote at the Annual Meeting with these proxy materials and is also available on our website, www.jer.com, and available without charge to stockholders upon written request to: JER Investors Trust Inc., 1650 Tysons Blvd, Suite 1600, McLean, Virginia, 22012, Attention: Investor Relations.

Voting Results

American Stock Transfer & Trust Company, our independent tabulating agent, will count the votes and act as the Inspector of Election. We will publish the voting results in our Quarterly Report on Form 10-Q for the fiscal quarter ending June 30, 2006, which we plan to file with the SEC in August 2006.

2

Confidentiality of Voting

We keep all proxies, ballots and voting tabulations confidential as a matter of practice. We permit only our Inspector of Election, American Stock Transfer & Trust Company, to examine these documents.

Recommendations of the Board of Directors

The board of directors recommends a vote:

| | (i) | FOR the election of each of the nominees to our board of directors; and |

| | (ii) | FOR the approval of the appointment of Ernst & Young LLP as independent registered public accounting firm for the Company for fiscal year 2006. |

3

BOARD OF DIRECTORS

Our board of directors consists of seven directors, five of whom are independent directors, as determined by our board of directors, consistent with the rules of the New York Stock Exchange, Inc. Upon the expiration of their current terms at the annual meeting of stockholders in 2006, directors will be elected to serve a term of one year. Our bylaws provide that a majority of the entire board of directors may establish, increase or decrease the number of directors, provided that the number of directors shall never be less than one, which is the minimum number required by the Maryland General Corporation Law, nor more than 15. All officers serve at the discretion of our board of directors.

The following table sets forth certain information about our current directors, each of whom is a director nominee:

| | | | |

Name | | Age | | Position With Us |

Joseph E. Robert, Jr. | | 54 | | Chairman of the Board of Directors and Chief Executive Officer |

Keith W. Belcher | | 46 | | Vice Chairman of the Board of Directors and Executive Vice President |

Daniel J. Altobello | | 64 | | Independent Director(1) |

Peter D. Linneman | | 54 | | Independent Director |

W. Russell Ramsey | | 45 | | Independent Director |

Frank J. Caufield | | 65 | | Independent Director |

James V. Kimsey | | 65 | | Independent Director |

| (1) | Serves as our lead independent director. |

Information Concerning Directors and the Director Nominees

Set forth below is certain biographical information for our directors, as well as the month and year each was first elected as one of our directors and the beneficial ownership of shares of our Common Stock as of April 28, 2006. For a description of beneficial ownership, see the “Security Ownership of Management and Certain Beneficial Owners” section, and the footnotes thereto, included in this proxy statement.

| | |

Joseph E. Robert, Jr. Chairman of the Board of Directors and Chief Executive Officer since inception 963,340 shares of our Common Stock beneficially owned Age: 54 | | Joseph E. Robert, Jr. is our chairman and chief executive officer, and the chairman and chief executive officer of J.E Robert Company, Inc. and our manager. Mr. Robert also serves on our investment committee. Mr. Robert founded J.E. Robert Company in 1981. Mr. Robert served as vice chairman of the board of the National Realty Committee and was a member of its executive committee and is a founding member of the Real Estate Roundtable. He is also a member of the board and member of the executive committee of the Institute for International Economics. Mr. Robert is a member of the international advisory board of EuroHypo, a German based commercial mortgage bank. |

| |

Keith W. Belcher Vice Chairman of the Board of Directors and Executive Vice President since inception 20,000 shares of our Common Stock beneficially owned Age: 46 | | Keith W. Belcher is a managing director of J.E Robert Company, Inc. and our manager, vice chairman of our board of directors and executive vice president. Mr. Belcher also serves on our investment committee. Mr. Belcher joined J.E. Robert Company in 1991. Mr. Belcher is responsible for all CMBS acquisitions made by the JER Funds and performs the same function for us. He also oversees the asset management of the underlying assets in CMBS issuances assigned to J.E. Robert Company as special servicer. Previously, Mr. Belcher managed J.E. Robert Company’s asset management contracts with the RTC, which exceeded $3.5 billion in asset value. |

4

| | |

| | Mr. Belcher holds a B.B.A. degree in finance and a B.A. degree in economics from Southern Methodist University. |

| |

Daniel J. Altobello Director since April 2004 4,000 shares of our Common Stock beneficially owned Age: 64 | | Daniel J. Altobello has been a director since April 2004. Since 1991, Mr. Altobello has been chairman of Altobello Family LP. Mr. Altobello also served as chairman of the board of Onex Food Services, Inc., the parent corporation of Caterair International, Inc. and LSG/SKY Chefs from 1995 to 2001. From 1989 to 1995, Mr. Altobello was the chairman, chief executive officer and president of Caterair International Corporation. He currently serves on the board of directors of MESA Air Group, World Airways, Inc., DiamondRock Hospitality Company and Friedman, Billings, Ramsey Group, Inc. In addition, Mr. Altobello serves on the board for a number of non-public entities, including the Advisory Board of Thayer Capital Partners, Mercury Air Centers and Associated Asphalt. |

| |

Peter D. Linneman Director since April 2004 4,000 shares of our Common Stock beneficially owned Age: 54 | | Peter D. Linneman has been a director since April 2004. Dr. Linneman is the Albert Sussman Professor of Real Estate, Finance and Public Policy at the Wharton School of Business, the University of Pennsylvania. A member of Wharton’s faculty since 1979, Dr. Linneman served as the founding chairman of Wharton’s real estate department, the director of Wharton’s Zell-Lurie Real Estate Center for 13 years and the founding co-editor of The Wharton Real Estate Review. Dr. Linneman is currently the principal of Linneman Associates. He serves on the board of directors of Equity One, Inc. and Bedford Property Investors. Dr. Linneman holds a Ph.D. in economics from the University of Chicago. |

| |

W. Russell Ramsey Director since April 2004 37,300 shares of our Common Stock beneficially owned Age: 45 | | W. Russell Ramsey has been a director since April 2004. He is also the chairman and chief executive officer of Ramsey Asset Management, a Washington, D.C.-based investment firm, which he founded in 2001. Prior to 2001, Mr. Ramsey was president and co-chief executive officer of Friedman, Billings, Ramsey Group, Inc., which he co-founded in 1989. He is currently a member of Friedman, Billings, Ramsey Group’s board of directors, and currently sits on the board of Quanta Capital Holdings Ltd. as well as the boards of several private and non-profit companies. He is also on the National Geographic Society’s Council of Advisors, and is a vice chairman of George Washington University’s 2004-2005 board of trustees. He received a B.S. in Business Administration from George Washington University. |

| |

Frank J. Caufield Director since June 2004 137,333 shares of our Common Stock beneficially owned Age: 65 | | Frank J. Caufield has been a director since June 2004. He is a co-founder of Kleiner Perkins Caufield & Byers (KPCB). KPCB is one of the largest and most prominent venture capital firms in the United States. Since 1978, it has invested in over 250 companies that today have revenues of over $150 billion and employ over 300,000 people. Mr. Caufield has served on the board of Quantum Corporation, Caremark, Inc., Megabios, Verifone, Inc., Wyse Technology, Quickturn Corporation, and AOL, Inc., as well as many other private and public companies. He is currently on the board of Time Warner. |

5

| | |

| | He also serves as a director of The U.S. Russia Investment Fund, Refugees International, Business Executives for National Security, is a member of the Council on Foreign Relations and serves as Chairman of the Child Abuse Prevention Society of San Francisco. Prior to the formation of KPCB, Mr. Caufield was a general partner and manager of Oak Grove Ventures, a venture capital partnership located in Menlo Park, California. He is a past president of both the Western Association of Venture Capitalists and the National Venture Capital Association. Mr. Caufield is a graduate of the United States Military Academy and holds an MBA from the Harvard Business School. |

| |

James V. Kimsey Director since June 2004 137,000 shares of our Common Stock beneficially owned Age: 65 | | James V. Kimsey has been a director since June 2004. Mr. Kimsey is the Founding CEO of America Online, Inc. In 1996, he became AOL Chairman Emeritus and turned his energies to new challenges in business, philanthropy and personal diplomacy through the creation of the Kimsey Foundation. He currently holds a presidential appointment to the Kennedy Center Board of Trustees and is chairman of the International Commission on Missing Persons. He is a member of the board of directors of Capital One Financial Corporation, Thayer Capital, the American Film Institute, Innisfree, the JFK Center for Performing Arts, the National Symphony Orchestra, Refugees International, the Washington Scholarship Fund, the International Crisis Group, and the US Russia Investment Fund as well as civic and charitable organizations. He serves on the Executive Committee of the Washington National Opera and the National Symphony. Mr. Kimsey is a graduate of the United States Military Academy. |

Compensation of Directors

We pay a $30,000 annual director’s fee to each of our independent directors. All members of our board of directors are reimbursed for their costs and expenses in attending all meetings of our board of directors. We pay an annual fee of $10,000 to the chair of the audit committee of our board of directors and an annual fee of $5,000 to the chair of any other committee of our board of directors. Fees to the directors may be made by issuance of common stock, based on the value of such common stock at the date of issuance, rather than in cash. In addition, pursuant to our incentive plan, we provided to each director who was not our officer or employee an initial restricted stock grant of 2,000 shares of our common stock on the closing of our private placement in 2004. On June 30, 2004, Frank Caufield and James Kimsey joined our board of directors and in July 2004, each was granted 2,000 shares of restricted stock. Any director who joins the board in the future will receive an initial restricted stock grant of 2,000 shares upon attendance of his or her first board of directors meeting. One half of the shares subject to each director’s initial restricted stock grant vested on the date of grant, and the other half vested on the first anniversary of the date of grant. The incentive plan also provides for automatic, annual restricted stock awards of 2,000 shares of our common stock on the first business day after our annual meeting of stockholders (or, in the absence of an annual meeting, such other date as determined by the Board of Directors) to each director who is not our officer or employee and who is on our board of directors at the time of such meeting. One half of the shares subject to each director’s annual restricted stock grant fully vest on the date of grant, and the other half vests on the first anniversary of the date of grant, as long as the director is serving as a board member on the first anniversary of the date of grant. All of the shares subject to each director’s annual restricted stock grant will be subject to restrictions on transferability for a period of one year from the date of grant. In September 2005, we granted each of our independent directors an additional 2,000 shares of restricted stock pursuant to the automatic annual restricted stock awards provision in our incentive plan. In March 2006, the

6

board of directors approved an additional $10,000 for each member of a special committee comprised of Messrs. Altobello, Ramsey and Linneman that was created for a limited time to consider a specific transaction.

Determination of Director Independence

In 2004, the Board of Directors affirmatively determined that Messrs. Altobello, Linneman, Ramsey, Caufield and Kimsey are “independent” under Section 303A.02(b) of the New York Stock Exchange listing standards. The NYSE rules require that at least a majority of the directors serving on the board of directors must be independent directors and that the nominating/corporate governance committee, the compensation committee and the audit committee of the Board of Directors consist entirely of independent directors. For a director to be considered independent, the board must determine that the director does not have any direct or indirect material relationship with the Company. In determining director independence, the board of directors reviewed, among other things, whether any transactions or relationships exist currently or, since our incorporation existed, between each director and the Company and its subsidiaries, affiliates and equity investors or independent registered public accounting firm. In particular, the board reviewed current or recent business transactions or relationships or other personal relationships between each director and the Company, including such director’s immediate family and companies owned or controlled by the director or with which the director was affiliated. The purpose of this review was to determine whether any such transactions or relationships failed to meet any of the objective tests promulgated by the NYSE for determining independence or were otherwise sufficiently material as to be inconsistent with a determination that the director is independent.

In addition, the board of directors annually reviews all commercial and charitable relationships of directors.

Whether directors meet these independence tests will be reviewed and will be made public annually prior to their standing for re-election to the board. The board may determine, in its discretion, that a director is not independent notwithstanding qualification under the categorical standards. The board has determined that each of Messrs. Altobello, Linneman, Ramsey, Caufield and Kimsey are independent for purposes of New York Stock Exchange Rule 303A and each such director has no material relationship with the Company.

Statement on Corporate Governance

Overview. We emphasize the importance of professional business conduct and ethics through our corporate governance initiatives. Our board of directors consists of a majority of independent directors (in accordance with the rules of the New York Stock Exchange). Our Audit Committee, Nominating and Corporate Governance Committee and Compensation Committee are each composed exclusively of independent directors.

We have adopted Corporate Governance Guidelines and a Code of Business Conduct and Ethics, which delineate our standards for our officers, directors and employees of J.E. Robert Company, Inc with respect to their dealings with the Company. Our internet address is http://www.jer.com. We make available, free of charge through a link on our site, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to such reports, if any, as filed with the SEC as soon as reasonably practicable after such filing. Our site also contains our Code of Business Conduct and Ethics, Code of Ethics for senior officers, Corporate Governance Guidelines, and the charters of the Audit Committee, Nominating and Corporate Governance Committee and Compensation Committee of our board of directors. You may also obtain these documents free of charge by writing the Company at 1650 Tysons Blvd, Suite 1600, McLean, Virginia 22102, Attention: Investor Relations.

The board of directors has adopted a Code of Business Conduct and Ethics that applies to all employees of J.E. Robert Company, Inc. who provide services to us, and each of our directors and officers, including our principal executive officer and principal financial officer. The purpose of the Code of Business Conduct and Ethics is to promote, among other things, honest and ethical conduct, full, fair, accurate, timely and understandable disclosure in public communications and reports and documents that the Company files with, or

7

submits to, the SEC, compliance with applicable governmental laws, rules and regulations, accountability for adherence to the code and the reporting of violations thereof.

The Company has also adopted a Code of Ethics for Principal Executive Officers and Senior Financial Officers which sets forth specific policies to guide the Company’s senior officers in the performance of their duties. This code supplements the Code of Business Conduct and Ethics described above.

Board and Committee Meetings

During the year ended December 31, 2005, our board of directors held ten meetings. No director attended fewer than 75 percent of all meetings of our board of directors and the committees on which such director served. The board has three standing committees: the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. During 2005, the Audit Committee met seven times, the Compensation Committee met once and the Nominating and Corporate Governance Committee met once. Although director attendance at the Company’s annual meeting each year is encouraged, the Company does not have an attendance policy.

Audit Committee. The members of the Audit Committee are Messrs. Altobello (Chairman), Ramsey and Linneman, each an independent director (in accordance with the rules of the New York Stock Exchange). The Audit Committee is governed by a written charter adopted by our board of directors (which is attached as Appendix A to this proxy statement). The board has determined that each member of the Audit Committee has the ability to read and understand fundamental financial statements. The board has determined that Mr. Altobello qualifies as an “Audit Committee Financial Expert” as defined by the rules of the SEC. In addition, the Board has determined that although Mr. Altobello serves on the audit committees of three public companies in addition to our Audit Committee, such simultaneous service does not impair Mr. Altobello’s ability to serve on our Audit Committee. Actions taken by the Audit Committee are reported to the board of directors, usually at its next meeting.

The purpose of the Audit Committee is to provide assistance to the board in fulfilling its legal and fiduciary obligations with respect to matters involving the accounting, auditing, financial reporting, internal control and legal compliance functions of the Company and its subsidiaries, including, without limitation, assisting the board’s oversight of (a) the integrity of the Company’s financial statements; (b) the Company’s compliance with legal and regulatory requirements; (c) the Company’s independent registered public accounting firm’s qualifications and independence; and (d) the performance of the Company’s independent registered public accounting firm and the Company’s internal audit function. The Audit Committee is responsible for pre-approval of audit and, subject to de minimis exceptions, permitted non-audit services.

Compensation Committee. The members of the Compensation Committee are Messrs. Kimsey (Chairman), Caufield and Altobello, each an independent director (in accordance with the rules of the New York Stock Exchange). It is responsible for overseeing the annual review of the amended and restated management agreement with the Company’s manager, to administer and approve the grant of awards under any incentive compensation plan, including any equity-based plan, of the Company and to make recommendations to the board regarding director compensation. The Compensation Committee met once in 2005 and conducted its annual review of the management agreement after which it advised the full board of directors that, in its view, there was no contractual basis for the independent directors to recommend a termination of the management agreement and that the management fees earned by the manager are fair.

Nominating and Corporate Governance Committee. The members of the Nominating and Corporate Governance Committee (the “Nominating/Governance Committee”) are Messrs. Linneman (Chairman), Ramsey and Kimsey, each an independent director (in accordance with the rules of the New York Stock Exchange). The Nominating/Governance Committee met once during 2005. The functions of the Nominating/Governance

8

Committee include the following: (a) recommending to the board individuals qualified to serve as directors of the Company and on committees of the board; (b) advising the board with respect to board composition, procedures and committees; (c) advising the board with respect to the corporate governance principles applicable to the Company; and (d) overseeing the evaluation of the board.

The Nominating/Governance Committee, as required by the Company’s bylaws, will consider director candidates recommended by stockholders. In considering candidates submitted by stockholders, the Nominating/Governance Committee will take into consideration the needs of the board of directors and the qualifications of the candidate and may take into consideration the number of shares held by the recommending stockholder and the length of time that such shares have been held.

The Company’s bylaws provide certain procedures that a stockholder must follow to nominate persons for election to the board of directors. Nominations for director at an annual stockholder meeting must be submitted in writing to the Company’s Secretary at JER Investors Trust Inc., 1650 Tysons Blvd, Suite 1600, McLean, Virginia 22012. The Secretary must receive the notice of a stockholder’s intention to introduce a nomination at an annual stockholders meeting (together with certain required information set forth in the Company’s bylaws) not later than the close of business on the 90th day nor earlier than the close of business on the 120th day prior to the first anniversary of the mailing date of notice for the preceding year’s annual meeting; or in the event that the date of the annual meeting is advanced or delayed by more than 30 days from the anniversary of such mailing date, not earlier than the close of business on the 120th day prior to the date of mailing of the notice for such annual meeting and not later than the close of business on the later of the 90th day prior to the date of mailing of the notice for such annual meeting or the 10th day following the day on which public announcement of the date of such meeting is first made by the Company.

The Nominating/Governance Committee will identify potential nominees by asking current directors and executive officers to notify the Committee if they become aware of suitable candidates. The Nominating/Governance Committee also may, from time to time, engage firms that specialize in identifying director candidates. As described above, the Committee will also consider candidates recommended by stockholders.

The Nominating/Governance Committee believes that the qualifications for serving as a director of the Company are possession, taking into account such person’s familiarity with the Company, of such knowledge, experience, skills, expertise, integrity and diversity as would enhance the board’s ability to manage and direct the affairs and business of the Company, including, when applicable, the ability of committees of the board to fulfill their duties and/or to satisfy any independence requirements imposed by law, regulation or NYSE listing requirement.

Stockholder Communications with Directors

The Company provides the opportunity for shareholders to communicate with the members of the Board. You can contact the Board of Directors to provide comments, to report concerns, or to ask a question, at the following address:

The Board of Directors of JER Investors Trust Inc. c/o Mr. Daniel Ward, Secretary 1650 Tysons Blvd, Suite 1600 McLean, Virginia 22012

9

AUDIT COMMITTEE REPORT

The report of our Audit Committee is provided below.

Report of the Audit Committee

In accordance with and to the extent permitted by the rules of the Securities and Exchange Commission (the “SEC”), the information contained in the following Report of the Audit Committee shall not be incorporated by reference into any of the Company’s future filings made under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and shall not be deemed to be “soliciting material” or to be “filed” under the Exchange Act or the Securities Act of 1933, as amended.

We operate under a written charter approved by the Board, consistent with the corporate governance rules issued by the SEC and the NYSE. Our charter is available on the Company’s website at http://www.jer.com.

The Audit Committee oversees the Company’s financial reporting process on behalf of the board of directors. It is not the duty of the Audit Committee to prepare the Company’s financial statements, to plan or conduct audits or to determine that the Company’s financial statements are complete and accurate in accordance with generally accepted accounting principles. Management has the primary responsibility for the financial statements and the reporting process including the systems of internal controls. The independent registered public accounting firm is responsible for auditing the financial statements and expressing an opinion as to whether those audited financial statements fairly present the financial position, results of operations and cash flows of the Company in conformity with generally accepted accounting principles.

The Audit Committee has reviewed and discussed with management the audited financial statements in the annual report to stockholders.

The Audit Committee has discussed with the independent registered public accounting firm the matters required to be discussed by Statement of Auditing Standards 61, as modified or supplemented, other standards of the Public Company Accounting Oversight Board (United States), rules of the Securities and Exchange Commission, and other applicable regulations, including the auditor’s judgment as to the quality, not just the acceptability, of the accounting principles, the consistency of their application and the clarity and completeness of the audited financial statements.

The Audit Committee has received the written disclosures and the letter from the independent registered public accounting firm required by Independent Standards Board Standard No. 1, as modified or supplemented, and has discussed with the independent registered public accounting firm their independence.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the board of directors (and the board agreed) that the audited financial statements be included in the annual report on Form 10-K for the year ended December 31, 2005 for filing with the SEC. The Audit Committee and the board of directors also have recommended, subject to stockholder approval, the selection of the Company’s independent registered public accounting firm for fiscal year 2006.

THE AUDIT COMMITTEE

Daniel J. Altobello

W. Russell Ramsey

Peter D. Linneman

10

EXECUTIVE OFFICERS

The following table shows the names and ages of our present executive officers and the positions held by each individual. A description of the business experience of each for at least the past five years follows the table.

| | | | |

Name | | Age | | Position |

Joseph E. Robert, Jr. | | 54 | | Chief Executive Officer and Chairman of the Board of Directors |

| | |

Keith W. Belcher | | 46 | | Vice Chairman of the Board of Directors and Executive Vice President |

| | |

Tae-Sik Yoon | | 38 | | Chief Financial Officer and Executive Vice President |

| | |

Todd E. Eagle | | 37 | | Executive Vice President |

| | |

Kenneth D. Krejca | | 36 | | Vice President |

| | |

Daniel T. Ward | | 48 | | Secretary |

For information regarding Messrs. Robert and Belcher, see the “Board of Directors” section of this proxy statement.

Tae-Sik Yoon is a managing director, chief financial officer and treasurer of J.E. Robert Company, Inc. and our manager and also serves as our executive vice president, chief financial officer and treasurer. Mr. Yoon also serves on our investment committee. Mr. Yoon joined J.E. Robert Company in 1999. He has primary responsibility for risk and portfolio management, capital markets (debt and equity) and finance and accounting for J.E. Robert Company. From 1989 to 1991, and then again from 1997 to 1999, Mr. Yoon worked in the real estate investment banking group of Morgan Stanley & Co. in New York City and Los Angeles, CA, and from 1994 to 1997 was a corporate attorney at the law firm of Williams & Connolly in Washington, D.C. Mr. Yoon received a B.A. degree in biology from the Johns Hopkins University and a J.D. degree from Harvard Law School. He is a member of the bars of Washington, D.C., the State of Maryland and the United States Patent & Trademark Office.

Todd E. Eagle is a principal of J.E. Robert Company, Inc. and our manager and also serves as our executive vice president. Mr. Eagle also serves on our investment committee. Mr. Eagle’s primary responsibilities include the acquisition and origination of whole loans, bridge loans, mezzanine loans, B-Notes, preferred equity and net leased real estate. Mr. Eagle joined J.E. Robert Company in 2005 from Golden Tree Asset Management, where he was portfolio manager, director of real estate fixed income, and a member of the investment committee. Prior to Golden Tree, Mr. Eagle spent 13 years at Goldman, Sachs & Co., most recently as a vice president and co-head of Goldman Sachs’s transitional loan program. From 1999-2004, Mr. Eagle was the head of European real estate investment banking for Goldman Sachs based in London. Mr. Eagle holds an A.B. degree from Dartmouth College and an M.B.A. degree from the Harvard Business School.

Kenneth D. Krejca is a director of J.E. Robert Company, Inc. and our manager and also serves as our vice president. Mr. Krejca’s primary responsibilities include sourcing, underwriting and managing CMBS investments for us. Before joining J.E. Robert Company, from 1996 to 2004, Mr. Krejca was a director in Bank One’s CMBS investment group. In his capacity as a director, Mr. Krejca has been involved in all facets of the CMBS investment process, including originating, underwriting, syndicating and managing loan pools. Mr. Krejca has over 9 years experience in subordinate CMBS investments. Mr. Krejca holds a B.S. degree in accounting from DePaul University.

Daniel T. Ward is a senior managing director and general counsel of J.E Robert Company, Inc. and our manager and our secretary. Mr. Ward also serves on our investment committee. Mr. Ward joined J.E. Robert Company in 1991. Mr. Ward is responsible for all legal matters involving investment structuring, document negotiation and transaction closings and capital raising activities for the JER Funds. Mr. Ward holds a B.S. degree in accounting from Villanova University and a J.D. degree from The National Law Center, George Washington University. Mr. Ward is a member of the Washington, D.C. Bar.

11

EXECUTIVE COMPENSATION

We are externally managed and advised by JER Commercial Debt Advisors LLC, an affiliate of J.E. Robert Company. JER Commercial Debt Advisors LLC was formed in April 2004 for the sole purpose of managing us.

We and our manager have no employees. Each of our executive officers is also an officer of our manager. We rely on the facilities, resources and personnel of J.E. Robert Company to conduct our operations. See “Services Agreement with J.E. Robert Company” below.

We are party to a management agreement with JER Commercial Debt Advisors LLC, dated as of May 27, 2004, pursuant to which JER Commercial Debt Advisors LLC, our manager, provides for the day-to-day management of our operations.

Because our management agreement provides that our manager, JER Commercial Debt Advisors LLC, assumes principal responsibility for managing our affairs, certain of our executive officers, who are provided to us through our manager, do not receive compensation from us for serving as our executive officers. However, in their capacities as officers or employees of J.E. Robert Company, Inc,, they devote such portion of their time to our affairs as is required for the performance of the duties of our manager under the management agreement. Mr. Joseph E. Robert, Jr., our chairman of the board of directors and chief executive officer, serves as the chairman and chief executive officer of our manager. Mr. Keith Belcher, our vice chairman of the board of directors and executive vice president, serves as the managing director of our manager. Mr. Tae-Sik Yoon, our chief financial officer, also serves as chief financial officer of our manager. Mr. Todd Eagle, our executive vice president, serves as a principal of our manager. Mr. Kenneth Krejca, our vice president, serves as a director of our manager. Mr. Daniel T. Ward, our secretary, serves as senior managing director and general counsel of our manager. Each of Messrs. Robert, Belcher, Yoon, Eagle, Krejca and Ward receives his compensation from our manager. Our manager has informed us that, because the services to be performed by its officers or employees in their capacities as such is not performed exclusively for us, it cannot segregate and identify that portion of the compensation awarded to, earned by or paid to our executive officers by the manager that relates solely to their services to us.

JER Commercial Debt Advisors LLC is 77% directly owned by Mr. Joseph E. Robert, Jr., 20% owned by Deborah L. Harmon, president and chief investment officer of J.E. Robert Company and a member of our investment committee, 2% owned by Keith W. Belcher, vice chairman of our board of directors, executive vice president and a member of our investment committee, and 1% owned by J.E. Robert Company, Inc. J.E. Robert Company is wholly owned by Mr. Robert.

Management Agreement Services

The management agreement requires our manager to oversee our business affairs in conformity with the policies and the investment guidelines that are approved and monitored by our board of directors. Our manager operates under the direction of our board of directors. Our manager is responsible for (i) our purchase and sale of real estate securities and other real estate-related assets, (ii) management of our real estate, including arranging for acquisitions, sales, leases, maintenance and insurance, (iii) the purchase, sale and servicing of mortgages for us, and (iv) providing us with investment advisory services. Our manager is responsible for our day-to-day operations and performs (or causes to be performed) services and activities relating to our assets and operations as may be appropriate, including, without limitation, the following:

| | • | | serving as our consultant with respect to formulation of investment criteria and preparation of policy guidelines by our board of directors; |

| | • | | counseling us in connection with policy decisions to be made by our board of directors; |

| | • | | investigating, analyzing and selecting potential investment opportunities for us; |

12

| | • | | making decisions concerning the evaluation, purchase, negotiation, structuring, monitoring, and disposition of our investments, including the accumulation of assets for securitization; however, the board of directors will review all investments where an affiliate or related party is involved. Additionally, from time to time the manager may present certain investments to the board of directors for approval either because of the size of the investment, the parties involved or some other term or feature of the investment; |

| | • | | evaluating, recommending and approving all decisions regarding any financings, securitizations, hedging activities or borrowings undertaken by us; |

| | • | | arranging for the issuance of mortgage backed securities from pools of mortgage loans or mortgage backed securities owned by us; |

| | • | | making available to us its knowledge and experience with respect to real estate, real estate related assets and real estate operating companies; |

| | • | | engaging and supervising, on our behalf and at our expense, independent contractors that provide real estate brokerage, legal, accounting, transfer agent, registrar and leasing services, master servicing, special servicing, mortgage brokerage, securities brokerage, banking, investment banking and other financial services and such other services as may be required relating to our investments or potential investments; |

| | • | | engaging and supervising, on our behalf and at our expense, other service providers to us; and |

| | • | | providing certain general management services to us relating to our day-to-day operations and administration (including, e.g., communicating with the holders of our equity and debt securities as required to satisfy the reporting and other requirements of any governing bodies or agencies and to maintain effective relations with these holders, causing us to qualify to do business in all applicable jurisdictions, complying with all regulatory requirements applicable to us in respect of our business activities, including preparing all financial statements required under applicable regulations and contractual undertakings and all reports and documents, if any, required under the Exchange Act, and causing us to comply with all applicable laws). |

Our manager has not assumed any responsibility other than to render the services called for under the management agreement and is not responsible for any action of our board of directors in following or declining to follow its advice or recommendations. Our manager, its directors and its officers are not liable to us, any subsidiary of ours, our directors, our stockholders or any subsidiary’s stockholders for acts performed in accordance with and pursuant to the management agreement, except by reason of acts constituting bad faith, willful misconduct, gross negligence, or reckless disregard of their duties under the management agreement. We have agreed to indemnify J.E. Robert Company and our manager, and their respective directors and officers with respect to all expenses, losses, damages, liabilities, demands, charges and claims arising from acts not constituting bad faith, willful misconduct, gross negligence, or reckless disregard of their respective duties, performed in good faith in accordance with and pursuant to the management agreement and the related services agreement. Our manager has agreed to indemnify us, our directors and officers with respect to all expenses, losses, damages, liabilities, demands, charges and claims arising from acts of our manager not constituting bad faith, willful misconduct, gross negligence or reckless disregard of its duties under the management agreement. Our manager carries errors and omissions and other customary insurance.

J.E. Robert Company, through our manager, provides to us key personnel whose primary responsibility is to provide management services to us. These persons devote as much of their time to our management as our board of directors reasonably deems necessary and appropriate, commensurate with our level of activity. Through J.E. Robert Company and our manager, we are seeking additional senior officers. There is no assurance that such additional senior officers will be identified.

Pursuant to a services agreement among us, our manager and J.E. Robert Company, J.E. Robert Company has agreed to provide our manager with the personnel, services and resources as needed by our manager to enable

13

it to carry out its obligations and responsibilities under the management agreement. Pursuant to the management agreement, J.E. Robert Company is not liable to us or our manager for any acts or omissions performed in accordance with and pursuant to the agreement except by reason of acts constituting bad faith, willful misconduct, gross negligence or reckless disregard for its duties. Our manager is not significantly capitalized and does not have its own facilities or employees separate from J.E. Robert Company.

Management Agreement Term and Termination Rights

The management agreement has an initial term of two years from June 4, 2004, and will be automatically renewed for one-year terms thereafter unless terminated by either us or our manager. The management agreement does not limit the number of renewal terms. The management agreement may only be terminated without cause upon the date of completion of the initial term of the management agreement, which is June 4, 2006. Our manager must be provided 180 days prior notice of any termination without cause or non-renewal of the agreement and under those circumstances will be paid a termination fee, within ninety days of termination, equal to four times the sum of our manager’s base management fees and incentive fees for the 12-month period preceding the date of termination, calculated as of the end of the most recently completed fiscal quarter prior to the date of termination. In addition, following any termination of the management agreement, we must pay our manager all compensation accruing to the date of termination. We also may not assign the management agreement in whole or in part to a third party without the written consent of our manager.

In addition, if we decide to terminate the management agreement without cause due to fees that our independent directors have determined to be unfair, our manager may agree to perform its management services at fees our independent directors determine to be fair, and the management agreement will not terminate. Our manager may give us notice that it wishes to renegotiate the fees, in which case we and our manager must negotiate in good faith, and if we cannot agree on a revised fee structure at the end of our 180 day notice period, the agreement will terminate, and we must pay the termination fees described above.

We may also terminate the management agreement with 60 days’ prior notice for cause, which is defined as (i) our manager’s fraud or gross negligence, (ii) our manager’s willful noncompliance with the management agreement, (iii) the commencement of any proceeding relating to our manager’s bankruptcy or insolvency or a material breach of any provision of the management agreement, uncured for a period of 60 days or (iv) a change in control of our manager. Our manager may at any time assign certain duties under the management agreement to any affiliate of our manager provided that our manager shall remain liable to us for the affiliate’s performance.

Management Fees and Incentive Compensation

The management fee is payable monthly in arrears in cash, and the incentive fee is payable quarterly in arrears in cash. The base management fee and incentive fee are intended to reimburse J.E. Robert Company for providing personnel to our manager to satisfy our manager’s obligation to provide certain services to us. Our manager and J.E. Robert Company may also be entitled to certain expense reimbursements as described below. Expense reimbursements to our manager or J.E. Robert Company are made monthly.

Base Management Fee. We pay our manager a base management fee monthly in arrears in an amount equal to 1/12 of the sum of (i) 2.0% of the first $400 million of our equity and (ii) 1.5% of our equity in an amount in excess of $400 million and up to $800 million and (iii) 1.25% of our equity in excess of $800 million. For purposes of calculating the base management fee, our equity equals the month-end value, computed in accordance with generally accepted accounting principles, of our stockholders’ equity, adjusted to exclude the effect of any unrealized gains, losses or other items that do not affect realized net income. Our manager uses the proceeds from its management fee in part to pay compensation to J.E. Robert Company officers and employees provided to us through our manager who, notwithstanding that certain of them also are our officers, receive no cash compensation directly from us.

14

Incentive Compensation. Our manager is entitled to receive quarterly incentive compensation pursuant to the terms of the management agreement with us. The purpose of the incentive compensation is to provide an additional incentive for our manager to achieve targeted levels of Funds From Operations and to increase our stockholder value. Our manager is entitled to receive quarterly incentive compensation in an amount equal to the product of:

| | (i) | 25% of the dollar amount by which |

| | (a) | our Funds From Operations per share of common stock for such quarter (before calculation of the incentive fee but after taking into account the base management fee), exceed |

| | (b) | an amount equal to (A) the weighted average prices per share of our common stock in all offerings by us multiplied by (B) the greater of (1) 2.25% or (2) .875% plus one fourth of the 10-year U.S. treasury rate (as defined below) for such quarter |

multiplied by

| | (ii) | the weighted average number of shares of common stock outstanding in such quarter. |

“Funds From Operations” means net income (computed in accordance with generally accepted accounting principles), excluding gains (losses) from debt restructuring and gains (or losses) from sales of property, plus depreciation and amortization on real estate assets, and after adjustments for unconsolidated partnerships and joint ventures. Funds From Operations does not represent cash generated from operating activities in accordance with GAAP and should not be considered as an alternative to net income as an indication of our performance or to cash flows as a measure of liquidity or ability to make distributions.

“10-year U.S. treasury rate” means the arithmetic average of the weekly average yield to maturity for actively traded current coupon U.S. Treasury fixed interest rate securities (adjusted to a constant maturity of 10 years) published by the Federal Reserve board during a quarter, or, if such rate is not published by the Federal Reserve board, any Federal Reserve bank or agency or department or the federal government selected by us. If we determine in good faith that the 10-year U.S. treasury rate cannot be calculated as provided above, then the rate shall be the arithmetic average of the per annum average yields to maturities, based upon closing asked prices on each business day during a quarter, for each actively traded marketable U.S. Treasury fixed interest rate security with a final maturity date not less than eight nor more than 12 years from the date of the closing asked prices as chosen and quoted for each business day in each such quarter in New York City by at least three recognized dealers in United States government securities selected by us.

The following example illustrates how we would calculate our quarterly incentive compensation in accordance with the management agreement.

Assume the following:

| | • | | Funds From Operations for the quarter equals $10,000,000; |

| | • | | 25,687,035 shares of common stock are outstanding and the weighted average number of shares of common stock outstanding during the quarter is 25,687,035; |

| | • | | U.S. treasury rate is 4.5%; and |

| | • | | weighted average offering price per share of common stock is $16.50. |

15

Under these assumptions, the quarterly incentive fee payable to our manager would be $115,592 as calculated below:

| | | | | |

1. | | Funds From Operations per share ($10,000,000/25,687,035) | | $ | 0.3893 |

| | |

2. | | Weighted average offering price per share of common stock ($16.50) multiplied by the greater of (A) 2.25% or (B) 0.875% plus one-fourth of 10-year U.S. Treasury rate | | $ | 0.3713 |

| | |

3. | | Excess of Funds From Operations per share over amount calculated in 2 above ($0.3893-$0.3713) | | $ | 0.018 |

| | |

4. | | Weighted average number of shares outstanding multiplied by the amount calculated in 3 above (25,687,035 x $0.018) | | $ | 462,367 |

| | |

5. | | Incentive Fee equals 25% of amount calculated in 4 above | | $ | 115,592 |

Pursuant to the calculation formula, if Funds From Operations increases and the weighted average share price and shares of common stock outstanding remain constant, the incentive fee will increase.

Reimbursement of Expenses. We pay all our operating expenses. The expenses required to be paid by us include, but are not limited to, transaction costs incident to the acquisition, disposition and financing of our investments, legal and auditing fees and expenses, the compensation and expenses of our independent directors, the costs associated with our establishment and maintenance of any credit facilities and other indebtedness (including commitment fees, legal fees, closing costs and similar expenses), expenses associated with other securities offerings by us, expenses relating to the payment of dividends, costs incurred by personnel of J.E. Robert Company for travel on our behalf, costs associated with any computer software or hardware that is used primarily for us, all taxes and license fees, all insurance costs incurred by us and our pro rata portion of rent, telephone, utilities, office furniture, equipment, machinery and other office, internal and overhead expenses of J.E. Robert Company and its affiliates required for our operations.

Under the management agreement, our manager may engage J.E. Robert Company or its affiliates to perform certain legal, accounting, due diligence, asset management, securitization, property management, brokerage, loan servicing, leasing and other services that outside professionals or outside consultants otherwise would perform on our behalf. J.E. Robert Company and its affiliates may be reimbursed or paid for the cost of performing such tasks, provided that such costs and reimbursements are no greater than those that would be paid to outside professionals or consultants on an arm’s-length basis. In addition, our manager is reimbursed for any expenses incurred in contracting with third parties. In addition, each CMBS securitization requires that a special servicer be appointed by the purchaser controlling the most subordinated non-investment grade class of securities. As our manager does not have special servicer status, it is required to appoint J.E. Robert Company or another entity that has special servicer status as the special servicer whenever we acquire a controlling interest in the most subordinated non-investment grade class of a CMBS securitization. All fees due J.E. Robert Company as special servicer are paid by the securitization vehicle and not by us. Under the management agreement, our manager is responsible for all costs incident to the performance of its duties under the management agreement, including the employment compensation of J.E. Robert Company personnel who perform services for us pursuant to the management agreement.

Below is a summary of the fees and other amounts earned by our manager.

| | | | | | |

| | | 2005 | | 2004 |

Base Management and Incentive Fees | | $ | 5.6 million | | $ | 1.9 million |

Expense Reimbursements | | $ | 0.6 million | | $ | 0.3 million |

Incentive Compensation | | $ | 0 | | $ | 0 |

Stock Grants (1) | | | 0 shares | | | 335,000 shares |

| | (1) | This reflects the number of shares of common stock granted to our manager pursuant to our Nonqualified Stock Option and Incentive Award Plan during each of our last two fiscal years. $5 million dollars was recorded on the Company’s financials related to the issuance of the 335,000 shares. |

16

Services Agreement with J.E. Robert Company

Because neither we nor our manager have any employees, we and our manager have entered into a services agreement with J.E. Robert Company to provide our manager with the personnel, services and resources necessary for our manager to perform its obligations and responsibilities under the management agreement, including due diligence, asset management and credit risk management. No employee of J.E. Robert Company will dedicate all of his or her time to us. For the year ended December 31, 2005, we and/or our manager paid an aggregate of $6.2 million to J.E. Robert Company for services provided under the Services Agreement.

JER Investors Trust Inc. Nonqualified Stock Option and Incentive Award Plan

We have adopted the JER Investors Trust Nonqualified Stock Option and Incentive Award Plan, referred to in this proxy as the incentive plan, to provide incentives to attract and retain qualified directors, officers, employees, advisors, consultants and other personnel. J.E. Robert Company and our manager and their respective directors, officers, employees and affiliates and our officers, directors, employees, consultants and advisors are eligible to receive awards under the incentive plan. The incentive plan is administered by the compensation committee of our board of directors. The incentive plan has a term of ten years from May 27, 2004. A maximum of 1,150,000 shares may be issued during the plan’s life.

The incentive plan permits the granting of options that do not qualify as incentive stock options under section 422 of the Internal Revenue Code to purchase shares of our common stock. The exercise price of each option will be determined by the compensation committee and may be less than the fair market value of our common stock subject to the option on the date of grant. The committee will determine the terms of each option, including when each option may be exercised and the period of time, if any, after retirement, death, disability or termination of employment during which options may be exercised. Options become vested and exercisable in installments, and the exercisability of options may be accelerated by the committee. Upon exercise of options, the option exercise price must be paid in full either in cash or its equivalent, by certified or bank check, by delivery of a promissory note or other instrument acceptable to the committee or, if the committee so permits, by delivery of shares of common stock already owned by the optionee or by a broker pursuant to irrevocable instructions to the broker from the optionee. All options granted under the incentive plan will become immediately and fully exercisable upon a change in control of us.

The incentive plan also allows for awards of restricted stock. A restricted stock award is an award of shares of common stock that may be subject to forfeiture (vesting), restrictions on transferability and such other restrictions, if any, as the committee may impose at the date of grant. The shares may vest and the restrictions may lapse separately or in combination at such times, under such circumstances, including, without limitation, a specified period of employment or the satisfaction of pre-established criteria, in such installments or otherwise, as our board of directors or a committee of our board of directors may determine. Except to the extent restricted under the award agreement relating to the restricted stock, a participant granted restricted stock has all of the rights of a stockholder, including, without limitation, the right to vote and the right to receive dividends on the restricted shares. Although dividends are paid on all restricted stock, whether or not vested, at the same rate and on the same date as on shares of our common stock, holders of restricted stock are prohibited from selling the shares until they vest. All shares of restricted stock granted under the incentive plan will become immediately and fully vested upon a change of control of us.

The committee may also grant shares of our common stock, stock appreciation rights, performance awards and other stock and non-stock-based awards under the incentive plan. These awards may be subject to such conditions and restrictions as the committee may determine, including, but not limited to, the achievement of certain performance goals or continued employment with us through a specific period. Each award under the plan may not be exercisable more than 10 years after the date of grant.

Our board of directors may at any time amend, alter or discontinue the incentive plan, but cannot, without a participant’s consent, take any action that would impair the rights of such participant under any award granted

17

under the plan. To the extent required by law, the board of directors will obtain approval of the stockholders for any amendment that would:

| | • | | other than through adjustment as provided in the incentive plan, increase the total number of shares of our common stock reserved for issuance under the incentive plan; |

| | • | | change the class of eligible participants under the incentive plan; or |

| | • | | otherwise require such approval. |

Incentive Award Grants in Last Fiscal Year and Since Inception

On June 4, 2004, we granted 335,000 shares of common stock to our manager, and 6,000 shares of common stock to our then three independent directors pursuant to our incentive plan. On June 30, 2004, Frank Caufield and James Kimsey joined our board of directors and in July 2004, each was granted 2,000 shares of restricted stock. In September 2005, we granted each of our independent directors an additional 2,000 shares of restricted stock pursuant to the automatic annual restricted stock awards provision in our incentive plan.

Compensation Committee Interlocks and Insider Participation

None.

18

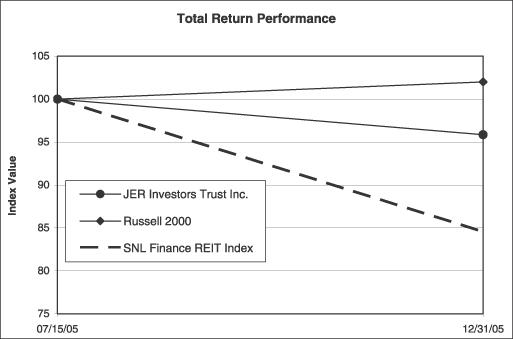

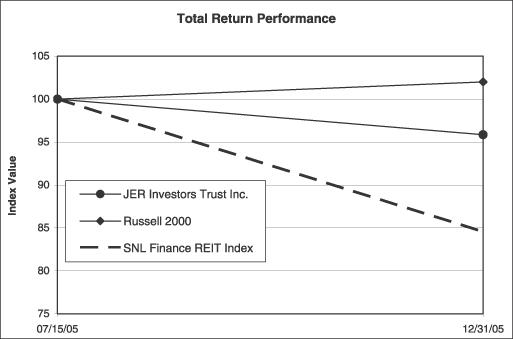

Performance Graph

Set forth below is a line graph comparing the cumulative total stockholder return on shares of our Common Stock with the cumulative total return of the SNL Finance REIT Index and the Russell 2000 Stock Index. The period shown commences on July 15, 2005, the date that our Common Stock was registered under Section 12 of the Securities Exchange Act of 1934, and ends on December 31, 2005, the end of our last fiscal year. The graph assumes an investment of $100 on July 15, 2005 and the reinvestment of any dividends. The stock price performance shown on the graph is not necessarily indicative of future price performance. The information included in the graph and table below was obtained from SNL Financial LC, Charlottesville, Va.© 2006.

| | | | |

Index | | As of July 15, 2005 | | As of December 31, 2005 |

JER Investors Trust Inc. | | 100.00 | | 95.85 |

Russell 2000 | | 100.00 | | 102.00 |

SNL Finance REIT Index | | 100.00 | | 84.56 |

In accordance with the rules of the SEC, this section entitled “Performance Graph” shall not be incorporated by reference into any of our future filings under the Securities Act or the Exchange Act, and shall not be deemed to be soliciting material or to be filed under the Securities Act or the Exchange Act.

19

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS

For purposes of this proxy statement, a “beneficial owner” means any person who, directly or indirectly, through any contract, arrangement, understanding, relationship or otherwise has or shares:

| | (i) | voting power, which includes the power to vote, or to direct the voting of, shares of our Common Stock; and/or |

| | (ii) | investment power, which includes the power to dispose, or to direct the disposition of, shares of our Common Stock. |

A person is also deemed to be the beneficial owner of a security if that person has the right to acquire beneficial ownership of such security at any time within 60 days.

Listed in the following table and the notes thereto is certain information with respect to the beneficial ownership of shares of our Common Stock as of April 28, 2006 by each person known by us to be the beneficial owner of more than five percent of our Common Stock, and by each of our directors and executive officers, individually and as a group. Unless otherwise indicated, all shares are owned directly, and the indicated person has sole voting and investment power.

| | | | | | |

Name and Address of Beneficial Owner(1)(2) | | Number of

Shares Beneficially

Owned | | | Percentage of Class | |

Munder Capital Management | | 2,226,201 | (3) | | 8.7 | % |

Hunter Global Associates L.L.C. | | 1,995,500 | (4) | | 7.8 | % |

Third Avenue Management LLC | | 1,586,900 | (5) | | 6.2 | % |

Joseph E. Robert, Jr. | | 963,340 | (6) | | 3.8 | % |

JER Commercial Debt Advisors LLC | | 335,000 | | | 1.3 | % |

Frank J. Caufield | | 137,333 | | | * | |

James V. Kimsey | | 137,000 | | | * | |

W. Russell Ramsey | | 37,300 | (7) | | * | |

Keith W. Belcher | | 20,000 | | | * | |

Tae-Sik Yoon | | 10,000 | | | * | |

Daniel T. Ward | | 3,500 | | | * | |

Daniel J. Altobello | | 4,000 | | | * | |

Peter D. Linneman | | 4,000 | | | * | |

Kenneth D. Krejca | | 1,667 | | | * | |

All directors and officers as a group (10 persons) | | 1,318,140 | | | 5.1 | % |

| (1) | Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and generally includes securities over which a person has voting or investment power. Shares of common stock subject to options or warrants currently exercisable, or exercisable within 60 days of the date hereof, are deemed beneficially owned for computing the percentage of the person holding such options or warrants but are not deemed outstanding for computing the percentage of any other person. |

| (2) | The address of JER Commercial Debt Advisors LLC and all officers and directors listed above is c/o J.E. Robert Company, Inc., 1650 Tysons Blvd., Suite 1600, McLean, Virginia 22102. |

| (3) | Based on information included in the Schedule 13G filed by Munder Capital Management (“Munder”) on March 30, 2006. The address for Munder is Munder Capital Center, 480 Pierce Street, Birmingham, MI 48009. |

| (4) | Based on information included in the Schedule 13G filed by Hunter Global Associates L.L.C. (“Hunter”) on February 15, 2006. Hunter has advised us that Duke Buchan III controls Hunter Global Investors L.P., the |

20

| | investment manager of Hunter, and has sole voting and investment power over the shares held by this entity. The foregoing should not be construed in and of itself as an admission by Mr. Buchan of beneficial ownership of the shares. The address for Hunter is 485 Madison Avenue, 22nd Floor, New York, New York 10022. |

| (5) | Based on information included in the Schedule 13G filed by Third Avenue Management LLC (“TAM”) on February 15, 2006. Third Avenue Real Estate Value Fund, an investment company registered under the Investment Company Act of 1940, has the right to receive dividends from, and the proceeds from the sale of, 1,444,800 of the shares reported by TAM, and various separately managed accounts for whom TAM acts as investment advisor have the right to receive dividends from, and the proceeds of the sale of, 115,000 of the shares reported by TAM. |

| (6) | Includes 335,000 shares granted to JER Commercial Debt Advisors LLC pursuant to our incentive plan upon closing of the private placement. Joseph E. Robert, Jr. is the managing member of JER Commercial Debt Advisors LLC and owns, directly or indirectly 78% of its membership interests. |

| (7) | Mr. Ramsey holds all shares of common stock, other than 4,000 shares, through RNR, LLC, which is jointly owned by Mr. Ramsey and his wife, Norma Ramsey. |

Section 16(a) Beneficial Ownership Reporting Compliance