UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended March 31, 2013

or

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number: 001-33345

RAND LOGISTICS, INC.

(Exact name of registrant as specified in its charter)

|

| |

| Delaware | No. 20-1195343 |

| (State or other jurisdiction of | (I.R.S. Employer |

| Incorporation or organization) | Identification No.) |

| 500 Fifth Avenue, 50th Floor | |

| New York, NY | 10110 |

| (Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code:

(212) 644-3450

Securities registered pursuant to Section 12(b) of the Act:

|

| |

| Title of Each Class | Name of Each Exchange on Which Registered |

| Common Stock, $.0001 par value per share | The NASDAQ Capital Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No X

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes No X

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to the filing requirements for at least the past 90 days. Yes X No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months. Yes X No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

|

| |

| Large accelerated filer | Accelerated filer X |

| Non-accelerated filer | Smaller reporting company |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes No X

The aggregate market value of voting stock held by non-affiliates of the registrant as of September 30, 2012 was $106,616,870.91.

17,914,603 shares of Common Stock were outstanding at June 11, 2013

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's definitive Proxy Statement, to be filed with the Securities and Exchange Commission within 120 days after the end of the registrant's fiscal year covered by this Annual Report on Form 10-K, with respect to the Annual Meeting of Stockholders to be held on September 24, 2013, are incorporated by reference into Part III of this Annual Report on Form 10-K.

RAND LOGISTICS, INC.

TABLE OF CONTENTS

|

| | | |

| | | |

| | | Business | |

| | | Risk Factors | |

| | | Unresolved Staff Comments | |

| | | Properties | |

| | | Legal Proceedings | |

| | | Mine Safety Disclosures | |

| | | | |

| | | |

| | | Market for the Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |

| | | Selected Financial Data | |

| | | Management's Discussion and Analysis of Financial Condition and Results of Operations | |

| | | Quantitative and Qualitative Disclosures About Market Risk | |

| | | Financial Statements and Supplementary Data | |

| | | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |

| | | Controls and Procedures | |

| | | Other Information | |

| | | | |

| | | |

| | | Directors, Executive Officers and Corporate Governance | |

| | | Executive Compensation | |

| | | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

| | | Certain Relationships and Related Transactions, and Director Independence | |

| | | Principal Accountant Fees and Services | |

| | | | |

| | | |

| | | Exhibits and Financial Statement Schedules | |

PART I

In this Annual Report on Form 10-K, unless the context otherwise requires, references to Rand Logistics, Inc. (“Rand”), “we,” “our,” “us” and the “Company” include Rand and its wholly-owned direct and indirect subsidiaries, and references to Lower Lakes' business or the business of Lower Lakes mean the combined businesses of Lower Lakes Towing Ltd. (“Lower Lakes Towing”), Lower Lakes Transportation Company (“Lower Lakes Transportation”), Grand River Navigation Company, Inc. (“Grand River”), Black Creek Shipping Company, Inc. (“Black Creek”) and Lower Lakes Ship Repair Company Ltd. ("Lower Lakes Ship Repair").

Cautionary Note Regarding Forward-Looking Statements

This annual report on Form 10-K contains forward-looking statements, including those relating to our capital needs, business strategy, expectations and intentions. Statements that use the terms “believe”, “anticipate”, “expect”, “plan”, “estimate”, “intend” and similar expressions of a future or forward-looking nature identify forward-looking statements for purposes of the U.S. federal securities laws or otherwise. For these statements and all other forward-looking statements, we claim the protection of the Safe Harbor for Forward-Looking Statements contained in the Private Securities Litigation Reform Act of 1995.

Forward-looking statements are inherently subject to risks and uncertainties, many of which cannot be predicted with accuracy or are otherwise beyond our control and some of which might not even be anticipated. Forward-looking statements reflect our current views with respect to future events and because our business is subject to such risks and uncertainties, actual results, our strategic plan, our financial position, results of operations and cash flows could differ materially from those described in or contemplated by the forward-looking statements contained in this report.

Important factors that contribute to such risks include, but are not limited to, those factors set forth under Item 1A of this Form 10-K as well as the following: the continuing effects of the economic downturn in our markets; the weather conditions on the Great Lakes; and our ability to maintain and replace our vessels as they age. The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with other cautionary statements that are included in this report. We undertake no obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise.

ITEM 1. BUSINESS

Background

Rand (formerly Rand Acquisition Corporation) was incorporated in the State of Delaware in 2004 as a blank check company. In 2006, we acquired all of the outstanding shares of capital stock of Lower Lakes Towing and its affiliate, Grand River.

Subsequent to our acquisition of Lower Lakes Towing and Grand River, we have added ten vessels to our fleet through acquisition transactions, including the 2011 acquisitions of three articulated tug and self-unloading barge units and two bulk carriers, and we also retired two smaller vessels.

Vessel Acquisitions

Since February 2011, we have added five vessels to our fleet.

On February 11, 2011, our subsidiary Black Creek acquired two articulated tug and barge units for consideration consisting of (i) $35.5 million cash paid at closing, (ii) $3.6 million cash to be paid by Black Creek Shipping Holding Company, Inc. (“Black Creek Holdings”) in 72 monthly installments of $0.05 million beginning on April 15, 2011; (iii) a promissory note of Black Creek Holdings in the principal amount of $1.5 million, which was subsequently repaid on December 15, 2011; and (iv) 1,305,963 shares of our common stock.

On July 21, 2011, Lower Lakes Towing acquired a Canadian-flagged bulk carrier for CDN $2.7 million with borrowings under its Canadian term loan.

On October 14, 2011, Lower Lakes Towing purchased a bulk carrier from United Ocean Service, LLC (“USUOS”) for a purchase price of approximately $5.3 million, which acquisition was financed with proceeds from a September 2011 public offering of our common stock.

On December 1, 2011, Grand River purchased a tug from USUOS for a purchase price of approximately $7.8 million. Also on December 1, 2011, Grand River acted as USUOS's third-party designee to purchase a self-unloading barge from U.S. Bank National Association, as Trustee of the GTC Connecticut Statutory Trust, for a purchase price of approximately $12.0 million. The acquisitions of the tug and barge were financed with additional borrowings under the US term loan. Subsequent to these acquisitions, the Company undertook modifications to the tug/barge vessel to meet Great Lakes standards. This tug/barge vessel was put into service on October 23, 2012.

Business Overview

Introduction

Our shipping business is operated in Canada by Lower Lakes Towing and in the United States by Lower Lakes Transportation. Lower Lakes Towing was organized in March 1994 under the laws of Canada to provide marine transportation services to dry bulk goods suppliers and purchasers operating in ports on the Great Lakes and has grown from its origin as a small tug and barge operator to a full service shipping company with a fleet of sixteen cargo-carrying vessels. We have grown to become one of the largest bulk shipping companies operating on the Great Lakes and the leading service provider in the River Class market segment, which we define as vessels less than 650 feet in overall length. We transport construction aggregates, coal, iron ore, salt, grain and other dry bulk commodities for customers in the construction, electric utility, integrated steel and food industries.

We believe that Lower Lakes is the only company providing significant domestic port-to-port services to both Canada and the United States in the Great Lakes region. Lower Lakes maintains this operating flexibility by operating both U.S. and Canadian flagged vessels in compliance with the Shipping Act, 1916, and the Merchant Marine Act, 1920, commonly referred to as the Jones Act in the U.S. and the Coasting Trade Act in Canada.

Fleet

Lower Lakes' fleet consists of five self-unloading bulk carriers and four conventional bulk carriers in Canada and seven self-unloading bulk carriers in the U.S., including one integrated tug and barge unit and three articulated tug and barge units. Lower Lakes Towing owns the nine Canadian vessels. Lower Lakes Transportation time charters the seven U.S. vessels, including the four tug and barge units, from Grand River. With the exception of one barge (which Grand River bareboat charters from an unrelated third party) and two of the articulated tug and barge units (which Grand River bareboat charters from Black Creek), Grand River owns the vessels that it time charters to Lower Lakes Transportation.

Lower Lakes operates over one-half of all River Class vessels and boom-forward equipped vessels servicing the Great Lakes. River Class vessels represent the smaller end of Great Lakes vessels, with maximum dimensions of approximately 650 feet in length and 72 feet in beam and carrying capacities of 15,000 to 20,000 tons, and are ideal for customers seeking to move significant quantities of dry bulk product to or from ports that restrict non-River Class vessels due to size and capacity constraints. Boom forward self-unloading vessels - those with their booms located in front of the cargo holds - offer greater accessibility for delivery of cargo to locations where only forward access is possible. Six of the vessels used in Lower Lakes' operations are boom forward self-unloaders and six vessels are boom aft self-unloaders.

As of March 31, 2013, our fleet consisted of the following vessels:

|

| | | | |

| Self-Unloading Bulk Carriers |

| Vessel Name | Dimensions | Horsepower | Year Built/Rebuilt | Cargo capacity at mid-summer draft in gross tons |

| Canadian-flagged: |

| Cuyahoga | 620x60x35 | 3,084 | 1943/1974/2000 | 15,675 |

| Michipicoten | 698x70x37 | 8,160 | 1952/1980/2011 | 22,300 |

| Mississagi | 620x60x35 | 4,500 | 1943/1967/1985 | 15,800 |

| Robert S. Pierson | 630x68x37 | 5,598 | 1974 | 19,650 |

| Saginaw | 640x72x36 | 8,160 | 1953/2008 | 20,200 |

| U.S.-flagged: |

| Calumet | 630x68x37 | 5,598 | 1973 | 19,650 |

| Manitowoc | 630x68x37 | 5,598 | 1973 | 19,650 |

| Manistee | 620x60x35 | 2,950 | 1943/1964/1976 | 14,900 |

|

| | | | |

| Straight Deck Bulk carriers (all Canadian-flagged) |

| Vessel Name | Dimensions | Horsepower | Year Built/Rebuilt | Cargo capacity at mid-summer draft in gross tons |

| Kaministiqua | 730x75x48 | 11,679 | 1983 | 33,824 |

| Manitoba | 608x62x36 | 5,328 | 1967 | 19,093 |

| Ojibway | 642x67x35 | 4,100 | 1952/2005 | 20,668 |

| Tecumseh | 640x78x45 | 12,000 | 1972 | 29,984 |

|

| | | | |

| Self-Unloading Articulated Tug and Barge Units (all U.S.-flagged) |

| Vessel Name | Dimensions | Horsepower | Year Built/Rebuilt | Cargo capacity at mid-summer draft in gross tons |

| Barge Ashtabula | 700x78x51 | | 1982 | 28,959 |

| Tug Defiance | | 7,200 | 1982 | |

| Barge James L. Kuber | 815x70x36 | | 1953/1983/2007 | 25,500 |

| Tug Victory | | 7,994 | 1981 | |

| Barge Lewis J Kuber | 728x70x37 | | 1952/1980/2006 | 22,300 |

| Tug Olive L. Moore | | 6,600 | 1928 | |

| Tug Invincible | | 5,750 | 1979 | |

| Barge McKee Sons | 610x72x39 | | 1953/1991 | 19,900 |

Customers

Lower Lakes services approximately 50 customers in a diverse array of end markets by shipping dry bulk commodities such as construction aggregates, coal, grain, iron ore and salt. Lower Lakes' top ten customers accounted for approximately 60% of its revenue during the fiscal year ended March 31, 2013. Lower Lakes is the sole-source shipping provider to several of its customers. With few exceptions, Lower Lakes' customers are under long-term contracts with Lower Lakes, which typically average three to five years in duration and provide for minimum and maximum annual tonnage requirements, annual price escalation features, and fuel surcharge adjustments. Certain of our customer contracts also provide for water level adjustments. Lower Lakes' key customers include ADM Agri-Industries; Bunge Canada; Cargill; CARMEUSE S.A.; Essar Steel Algoma Inc.; Holcim Inc.; James Richardson International Ltd.; and Lafarge S.A. Essar Steel Algoma Inc. is the only customer that represents more than 10% of our business.

Industry and Competition

Lower Lakes faces competition from other marine and land-based transporters of dry bulk commodities in and around the Great Lakes area. In the River Class market segment, Lower Lakes generally faces two primary competitors: Algoma Central Corporation and American Steamship Company. Algoma Central Corporation is a Canadian company that owns 19 self-unloading vessels, three of which are River Class boom-forward vessels. American Steamship Company operates in the U.S. and maintains a fleet of 17 vessels, three of which are River Class vessels. We believe that industry participants compete on the basis of customer relationships, price and service, and that the ability to meet a customer's schedule and offer shipping flexibility is a key competitive factor. Moreover, we believe that customers are generally willing to continue to use the same carrier assuming such carrier provides satisfactory service with competitive pricing.

Employees

As of March 31, 2013, Lower Lakes had approximately 543 full-time employees, 84 of whom were shoreside and management and 459 of whom were shipboard employees. Approximately 40% of Lower Lakes' shipboard employees (all U.S. based Grand River crews) are unionized with the International Organization of Masters, Mates and Pilots, AFL-CIO. Lower Lakes has never experienced a work stoppage on its crewed vessels as a result of labor issues, and we believe that our employee relations are good.

Our executive officers are Laurence S. Levy, who serves as our executive chairman; Edward Levy, who serves as our president; and Joseph W. McHugh, Jr., who serves as our chief financial officer. Carol Zelinski is the secretary of Rand.

Seasonality

Lower Lakes operates in a seasonal waterway system, primarily due to the cold weather patterns on the Great Lakes from December through March which cause lock closures, waterway ice, and customer facility closings, which typically shut down Great Lakes shipping for a period of up to 90 days commencing from late December until late March. Lower Lakes also experiences a seasonal pattern for its capital spending cycle, typically off-season from the shipping revenues, to permit annual maintenance and investment in the vessels. This pattern causes seasonal fluctuations in Lower Lakes' liquidity and capital resources. Such winter work, capital expenditures and drydocking costs are incurred during a period when customer collections have largely ended in February from the prior season, and fit-out and vessel operating costs will be incurred at the beginning of the season as much as 30 to 60 days prior to the receipt of significant customer collections for services provided at the beginning of the shipping season. To manage working capital cycles, Lower Lakes' Third Amended and Restated Credit Facility includes a revolver feature with a seasonal overadvance facility which provides working capital from the April through June period, after which customer collections typically exceed cash disbursements.

Government Regulations

General. The Company's marine transportation operations are subject to regulation by the United States Coast Guard (USCG), the Environmental Protection Agency (EPA), various federal laws, Canadian laws, state laws and certain international conventions.

Jones Act. In the United States, the Merchant Marine Act of 1920 (the “Jones Act”) reserves domestic marine transportation to vessels built and registered in the United States, manned by United States citizens, and owned and operated by United States citizens. For a corporation to qualify a United States citizen for the purpose of domestic trade it must be 75% owned and controlled by United States citizens. The Company monitors citizenship and meets the requirements of the Jones Act for its vessels. The Canadian Coasting Trade Act reserves Canadian domestic marine transportation to Canadian registered and crewed vessels.

Compliance with United States and Canadian domestic trade requirements are important to the operations of the Company. The loss of Jones Act status could have a material negative effect on the Company. The Company monitors the citizenship of its employees and stockholders.

Environmental

The Company's operations are affected by various regulations and legislation enacted for protection of the environment by the United States government, the Canadian government, as well as many coastal and inland waterway states and provinces.

Water Pollution Regulations. The Federal Water Pollution Control Act of 1972, as amended by the Clean Water Act of 1977, the Comprehensive Environment Response, Compensation and Liability Act of 1981 ("CERCLA") and the Oil Pollution Act of 1990 ("OPA") impose strict prohibitions against the discharge of oil and its derivatives and of other discharges that are incidental to the normal operation of our vessels. These acts impose civil and criminal penalties for any prohibited discharges and impose substantial strict liability for cleanup of these discharges and any associated damages. Certain states have water pollution laws that prohibit discharges into waters that traverse the state or adjoin the state, and impose civil and criminal penalties and liabilities similar in nature to those imposed under federal laws. The EPA discharge rules are enforced under Vessel General Permit (VGP) regulations that are the subject of public rulemaking proceedings.

Ballast Water Discharges. The USCG has been involved with ballast water management issues for almost 30 years. Its current “Standards for Living Organisms in Ships Ballast Water Discharged in U.S. Waters” became effective on June 21, 2012 and apply generally to all vessels operating in U.S. waters. The EPA has parallel compliance rules to regulate ballast water discharges under its VGP system.

The Company's vessel operations are limited to the Great Lakes and St. Lawrence River ecosystem services. Ballast water management for these services is governed by overlapping by USCG and EPA and Canadian rules. Also, Canada is a signatory to the International Maritime Organization (“IMO”) Convention on ballast water discharges. These regimes have certain applications to vessels in international trade that are entering the Great Lakes /St. Lawrence ecosystem. However, there is U.S. and Canadian agreement that there is no ballast water treatment technology available that will be effective to control possible intra-Great Lakes ecosystem transfers by services such as the Company's. Also, U.S. and Canadian authorities have agreed to a continuation of current “best practices” operations by the Company and similar vessel operators.

Clean Air Regulations. The Company's Great Lakes and St. Lawrence River services are subject to North American Emissions Control Area ("ECA") rules. These rules limit the sulfur content of marine fuels to 1.0% effective as of August 1, 2012 and 0.1% as of August 1, 2015.

Under a reciprocal agreement between the U.S. and Canada, a "Fleet Averaging" framework for Canadian flag vessels, including those of the Company, will be put in place to coincide with the imposition of the U.S. ECA. Fleet Averaging will allow Canadian flag ship owners to achieve a reduction in emissions across their fleets in a phased in manner through the period ending 2020. The Company anticipates achieving its required marine emissions through a variety of improvement programs such as the use of exhaust gas scrubbers, switching to low sulfur content fuels (including, potentially, liquefied natural gas) and through other means.

Financial Information About Geographic Areas

Our shipping business is operated in Canada by Lower Lakes Towing and in the United States by Lower Lakes Transportation. Lower Lakes provides domestic port-to-port services to both Canada and the United States in the Great Lakes region and operates both U.S. and Canadian flagged vessels.

Information about our geographic operations is as follows:

|

| | | | | | | | | | | | |

| | | Year ended March 31, 2013 | | Year ended March 31, 2012 | | Year ended March 31, 2011 |

| Revenue by country: | | | | | | |

| Canada | | $ | 92,813 |

| | $ | 79,381 |

| | $ | 73,177 |

|

| United States | | 63,825 |

| | 68,444 |

| | 44,801 |

|

| | | $ | 156,638 |

| | $ | 147,825 |

| | $ | 117,978 |

|

Revenues from external customers are allocated based on the country of the legal entity of the Company in which the revenues were recognized.

|

| | | | | | | |

| | March 31, 2013 | | March 31, 2012 |

| Property and equipment by country: | | | |

| Canada | $ | 100,887 |

| | $ | 103,640 |

|

| United States | 118,197 |

| | 97,222 |

|

| | $ | 219,084 |

| | $ | 200,862 |

|

| Intangible assets by country: | |

| | |

|

| Canada | $ | 8,081 |

| | $ | 10,954 |

|

| United States | 4,531 |

| | 5,147 |

|

| | $ | 12,612 |

| | $ | 16,101 |

|

| Goodwill by country: | |

| | |

|

| Canada | $ | 8,284 |

| | $ | 8,284 |

|

| United States | 1,909 |

| | 1,909 |

|

| | $ | 10,193 |

| | $ | 10,193 |

|

Availability of Information

We file annual, quarterly and current reports and other information with the Securities and Exchange Commission (the “SEC”). The public may read and copy any materials we file with the SEC at the SEC's Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1 800-SEC-0330. The SEC also maintains an Internet site that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. The address of that site is http://www.sec.gov.

We make available through our Internet website (http://www.randlogisticsinc.com) our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) as soon as reasonably practicable after electronically filing such material with the SEC. The reference to our website address is a textual reference only, meaning that it does not constitute incorporation by reference of the information contained on the website and should not be considered part of this document.

ITEM 1A. RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the following material risks before you decide to buy our common stock. If any of the following risks actually occur, our business, results of operations and financial condition would likely suffer. In these circumstances, the market price of our common stock could decline and you may lose all or part of your investment.

Risks Associated with our Business

The recent worldwide financial and credit crisis could lead to an extended worldwide economic recession and have a material adverse effect on our financial results and financial condition.

During recent years, there has been substantial volatility and losses in worldwide equity markets that could lead to an extended worldwide economic recession. In addition, due to the substantial uncertainty in the global economies, there has been deterioration in the credit and capital markets and access to financing is uncertain. These conditions could have an adverse effect on our industry and our business and future operating results. Our customers may curtail their capital and operating expenditure programs, which could result in a decrease in demand for our vessels and a reduction in rates and/or utilization. In addition, certain of our customers could experience an inability to pay suppliers, including us, in the event they are unable to access the capital markets to fund their business operations. Likewise, our suppliers may be unable to sustain their current level of operations, fulfill their commitments and/or fund future operations and obligations, each of which could adversely affect our operations.

Capital expenditures and other costs necessary to operate and maintain Lower Lakes' vessels tend to increase with the age of the vessel and may also increase due to changes in governmental regulations, safety or other equipment standards.

Capital expenditures and other costs necessary to operate and maintain Lower Lakes' vessels tend to increase with the age of each vessel. Accordingly, it is likely that the operating costs of Lower Lakes' older vessels will increase. In addition, changes in governmental regulations, safety or other equipment standards, as well as compliance with standards imposed by maritime self-regulatory organizations and customer requirements or competition, may require Lower Lakes to make additional expenditures. For example, if the U.S. Coast Guard, Transport Canada or independent classification societies (including organizations such as the American Bureau of Shipping and Lloyd's Register that inspect the hull and machinery of commercial ships to assess compliance with minimum criteria as set by U.S., Canadian and international regulations) enact new standards, Lower Lakes may be required to incur significant costs for alterations to its fleet or the addition of new equipment. To satisfy any such requirement, Lower Lakes may be required to take its vessels out of service for extended periods of time, with corresponding losses of revenues. In the future, market conditions may not justify these expenditures or enable Lower Lakes to operate its older vessels profitably during the remainder of their anticipated economic lives.

If Lower Lakes is unable to fund its capital expenditures, drydock costs and winter work expenses, Lower Lakes may not be able to continue to operate some of its vessels, which would have a material adverse effect on our business.

In order to fund Lower Lakes' capital expenditures, drydock costs and winter work expenses, we may be required to incur borrowings or raise capital through the sale of debt or equity securities. Our ability to access the capital markets for future offerings may be limited by our financial condition at the time of any such offering as well as by adverse market conditions resulting from, among other things, general economic conditions and contingencies and uncertainties that are beyond its control. Our failure to obtain the funds for necessary future capital expenditures and winter work expenses would limit our ability to continue to operate some of our vessels and could have a material adverse effect on our business, results of operations and financial condition.

The climate in the Great Lakes region limits Lower Lakes' vessel operations to approximately nine months per year.

Lower Lakes' operating business is seasonal, meaning that it experiences higher levels of activity in some periods of the year than in others. Ordinarily, Lower Lakes is able to operate its vessels on the Great Lakes for approximately nine months per year beginning in late March or April and continuing through December or mid-January. However, weather conditions and customer demand cause increases and decreases in the number of days Lower Lakes actually operates.

The shipping industry has inherent operational risks that may not be adequately covered by Lower Lakes' insurance.

Lower Lakes maintains insurance on its fleet for risks commonly insured against by vessel owners and operators, including hull and machinery insurance, war risks insurance and protection and indemnity insurance (which includes environmental damage and pollution insurance). Lower Lakes does not, however, insure the loss of a vessel's income when it is being repaired due to an insured hull and machinery claim. We can give no assurance that Lower Lakes will be adequately insured against all risks or that its insurers will pay a particular claim. Even if its insurance coverage is adequate to cover its losses, Lower Lakes may not be able to timely obtain a replacement vessel in the event of a loss. Furthermore, in the future, Lower Lakes may not be able to obtain adequate insurance coverage at reasonable rates for Lower Lakes' fleet. Lower Lakes may also be subject to calls, or premiums,

in amounts based not only on its own claims record but also the claims record of all other members of the protection and indemnity associations through which Lower Lakes may receive indemnity insurance coverage. Lower Lakes' insurance policies will also contain deductibles, limitations and exclusions which, although we believe are standard in the shipping industry, may nevertheless increase its costs.

Lower Lakes is subject to certain credit risks with respect to its counterparties on contracts and failure of such counterparties to meet their obligations could cause us to suffer losses on such contracts, decreasing our revenues and earnings.

Lower Lakes enters into contracts of affreightment (COAs) pursuant to which Lower Lakes agrees to carry cargoes, typically for industrial customers, who export or import dry bulk cargoes. Lower Lakes also enters into spot market voyage contracts, where Lower Lakes is paid a rate per ton to carry a specified cargo. All of these contracts subject Lower Lakes to counterparty credit risk. As a result, we are subject to credit risks at various levels, including with charterers, cargo interests, or terminal customers. If the counterparties fail to meet their obligations, Lower Lakes could suffer losses on such contracts which would decrease our revenues and earnings.

Lower Lakes may not be able to generate sufficient cash flows to meet its debt service obligations.

Lower Lakes' ability to make payments on its indebtedness will depend on its ability to generate cash from its future operations. Lower Lakes' business may not generate sufficient cash flow from operations or from other sources sufficient to enable it to repay its indebtedness and to fund its liquidity needs, including capital expenditures and winter work expenses. Lower Lakes' indebtedness under its credit facility bears interest at floating rates, and therefore, if interest rates increase, Lower Lakes' debt service requirements will increase, except for that portion of Lower Lakes' term debt that is limited by interest rate caps. Lower Lakes may need to refinance or restructure all or a portion of its indebtedness on or before maturity. Lower Lakes may not be able to refinance any of its indebtedness on commercially reasonable terms, or at all. If Lower Lakes cannot service or refinance its indebtedness, it may have to take actions such as selling assets, seeking additional equity or reducing or delaying capital expenditures, any of which could have a material adverse effect on our operations. Additionally, Lower Lakes may not be able to effect such actions, if necessary, on commercially reasonable terms, or at all.

A default under Lower Lakes' indebtedness may have a material adverse effect on our financial condition.

In the event of a default under Lower Lakes' indebtedness, the holders of the indebtedness under Lower Lakes' credit facility generally would be able to declare all of the indebtedness under such facility, together with accrued interest, to be due and payable. In addition, borrowings under the existing Lower Lakes senior credit facility are secured by a first priority lien on all of the assets of Lower Lakes Towing, Lower Lakes Transportation, Grand River and Black Creek and, in the event of a default under that facility, the lenders thereunder generally would be entitled to seize the collateral, including assets which are necessary to operate our business. In addition, default under one debt instrument within Lower Lakes' credit facility could in turn permit lenders under other debt instruments within Lower Lakes' credit facility to declare borrowings outstanding under those other instruments to be due and payable pursuant to cross default clauses. Moreover, upon the occurrence of an event of default under the Lower Lakes credit facility, the commitment of the lenders to make any further loans to us would be terminated. Accordingly, the occurrence of a default under any debt instrument, unless cured or waived, would likely have a material adverse effect on our results of operations.

Servicing debt could limit funds available for other purposes, such as the payment of dividends.

Lower Lakes will use cash to pay the principal and interest on its debt, and to fund capital expenditures, drydock costs and winter work expenses. Such payments limit funds that would otherwise be available for other purposes, including distributions of cash to our stockholders.

Lower Lakes' credit facility contains restrictive covenants that will limit its liquidity and corporate activities.

Lower Lakes' credit facility imposes operating and financial restrictions that limit its ability to:

| |

| o | incur additional indebtedness; |

| |

| o | create additional liens on its assets; |

| |

| o | engage in mergers or acquisitions; |

| |

| o | sell any of Lower Lakes' vessels or any other assets outside the ordinary course of business. |

Therefore, Lower Lakes will need to seek permission from its lenders in order to engage in some corporate actions. Lower Lakes' lenders' interests may be different from those of Lower Lakes and no assurance can be given that Lower Lakes will be able to obtain its lenders' permission when needed. This may prevent Lower Lakes from taking actions that are in its best interest.

Because Lower Lakes generates approximately 59% of its revenues and incurs approximately 57% of its expenses in Canadian dollars, exchange rate fluctuations could cause us to suffer reduced U.S. dollar earnings.

Lower Lakes generates a significant portion of its revenues and incurs a significant portion of its expenses in Canadian dollars. This could lead to fluctuations in our net income due to changes in the value of the U.S. Dollar relative to the Canadian Dollar.

Lower Lakes depends upon unionized labor for its U.S. operations. Any work stoppages or labor disturbances could disrupt its business.

All of Grand River's shipboard employees are unionized with the International Organization of Masters, Mates and Pilots, AFL-CIO. Any work stoppages or other labor disturbances could have a material adverse effect on our business, results of operations and financial condition.

A labor union has attempted to unionize Lower Lakes' Canadian employees.

The Seafarers International Union of Canada, or SIU, has attempted without success to organize Lower Lakes' unlicensed Canadian employees periodically over the past several years. Although we believe that support for this union is low, if SIU is successful in organizing a union among Lower Lakes' Canadian employees, it could result in increased labor costs or reduced productivity for Lower Lakes, which could have a material adverse effect on our results of operations.

Lower Lakes' employees are covered by U.S. Federal laws that may subject it to job-related claims in addition to those provided by state laws.

All of Grand River's shipboard employees are covered by the Jones Act and general maritime law. These laws typically operate to make liability limits established by state workers' compensation laws inapplicable to these employees and to permit these employees and their representatives to pursue actions against employers for job-related injuries in Federal courts. Because Lower Lakes is not generally protected by the limits imposed by state workers' compensation statutes, Lower Lakes has greater exposure for claims made by these employees as compared to employers whose employees are not covered by these provisions.

Our capital stock is subject to restriction on foreign ownership and possible required divestiture by non-U.S. citizen stockholders.

Under U.S. maritime laws, in order for us to maintain our eligibility to own and operate vessels in the U.S. domestic trade, 75% of our outstanding capital stock and voting power is required to be held by U.S. citizens. Although our amended and restated certificate of incorporation contains provisions limiting non-citizenship ownership of our capital stock, we could lose our ability to conduct operations in the U.S. domestic trade if such provisions prove unsuccessful in maintaining the required level of citizen ownership. Such loss would have a material adverse effect on our results of operations. If our board of directors determines that persons who are not citizens of the U.S. own more than 23% of our outstanding capital stock or more than 23% of our voting power, we may redeem such stock or, if redemption is not permitted by applicable law or if our board of directors, in its discretion,

elects not to make such redemption, we may require the non-citizens who most recently acquired shares to divest such excess shares to persons who are U.S. citizens in such manner as our board of directors directs. The required redemption would be at a price equal to the average closing price during the preceding 30 trading days, which price could be materially different from the current price of the common stock or the price at which the non-citizen acquired the common stock. If a non-citizen purchases the common stock, there can be no assurance that he or she will not be required to divest the shares and such divestiture could result in a material loss. Such restrictions and redemption rights may make Rand's equity securities less attractive to potential investors, which may result in Rand's publicly traded common stock having a lower market price than it might have in the absence of such restrictions and redemption rights.

Our business is dependent upon key personnel whose loss may adversely impact our business.

We depend on the expertise, experience and continued services of Lower Lakes' senior management employees, especially Scott Bravener, its President. Mr. Bravener has acquired specialized knowledge and skills with respect to Lower Lakes and its operations and most decisions concerning the business of Lower Lakes are made or significantly influenced by him. Although Lower Lakes maintains life insurance with respect to Mr. Bravener, the proceeds of such insurance may not be adequate to compensate Lower Lakes in the event of Mr. Bravener's death. The loss of Mr. Bravener or other senior management employees, or an inability to attract or retain other key individuals, could materially adversely affect our business. We seek to compensate and incentivize executives, as well as other employees, through competitive salaries and bonus plans, but there can be no assurance that these programs will allow us to retain key employees or hire new key employees. As a result, if Mr. Bravener were to leave Lower Lakes, we could face substantial difficulty in hiring a qualified successor and could experience a loss in productivity while any such successor obtains the necessary training and experience.

Our officers and directors may allocate their time to other businesses thereby causing conflicts of interest in their determination as to how much time to devote to our affairs.

Our officers and directors are not required to commit their full time to our affairs, which may result in a conflict of interest in allocating their time between our operations and other businesses. Laurence S. Levy, our Executive Chairman, and Edward Levy, our President, are each engaged in several other business endeavors and are not obligated to contribute any specific number of hours per week to our affairs.

Some of our officers and directors may have conflicts of interest in business opportunities.

Some of our officers and directors may become aware of business opportunities which may be appropriate for presentation to us as well as the other entities with which they are or may be affiliated. Due to our officers' and directors' existing affiliations with other entities, they may have fiduciary obligations to present potential business opportunities to those entities in addition to presenting them to us which could cause additional conflicts of interest. Accordingly, they may have conflicts of interest in determining to which entity a particular business opportunity should be presented.

The conversion of our series A convertible preferred stock will result in significant and immediate dilution of our existing stockholders and the book value of their common stock.

The shares of series A convertible preferred stock issued in connection with the acquisition of Lower Lakes are convertible into 2,419,355 shares of our common stock, subject to certain adjustments, which, on an “as converted” basis, representing approximately 12% of our aggregate outstanding common stock. The conversion price of our series A convertible preferred stock is subject to weighted average anti-dilution provisions whereby, if Rand issues shares in the future for consideration below the existing conversion price of $6.20, then the conversion price of the series A convertible preferred stock would automatically be decreased, allowing the holders of the series A convertible preferred stock to receive additional shares of common stock upon conversion. Upon any conversion of the series A convertible preferred stock, the equity interests of our existing common stockholders, as a percentage of the total number of the outstanding shares of our common stock, and the net book value of the shares of our common stock will be significantly diluted.

We may issue shares of our common stock and preferred stock to raise additional capital, including to complete a future acquisition, which would reduce the equity interest of our stockholders.

Our amended and restated certificate of incorporation authorizes the issuance of up to 50,000,000 shares of common stock, par value $.0001 per share, and 1,000,000 shares of preferred stock, par value $.0001 per share. We currently have 31,659,949 authorized but unissued shares of our common stock available for issuance (after appropriate reservation for the issuance of shares upon full exercise of our outstanding employee stock options) and 700,000 shares of preferred stock available for issuance. Although we currently have no other commitments to issue any additional shares of our common or preferred stock, we may in the future determine to issue additional shares of our common or preferred stock to raise additional capital for a variety of purposes, including to complete a future acquisition. The issuance of additional shares of our common stock or preferred stock may significantly reduce the equity interest of stockholders and may adversely affect prevailing market prices for our common stock.

Future acquisitions of vessels or businesses by Rand or Lower Lakes would subject Rand and Lower Lakes to additional business, operating and industry risks, the impact of which cannot presently be evaluated, and could adversely impact Rand's or Lower Lakes' capital structure.

Rand intends to pursue acquisition opportunities in an effort to diversify its investments and/or grow its business. While neither Rand nor Lower Lakes is presently committed to any acquisition, Rand is currently actively pursuing one or more potential acquisition opportunities.

Future acquisitions may be of individual or groups of vessels or of businesses operating in the shipping or other industries. Rand is not limited to any particular industry or type of business that it may acquire. Accordingly, there is no current basis for you to evaluate the possible merits or risks of the particular business or assets that Rand may acquire, or of the industry in which any such business may operate. To the extent Rand acquires an operating business, we may be affected by numerous risks inherent in the acquired business's operations.

In addition, the financing of any acquisition completed by Rand could adversely impact Rand's capital structure as any such financing could include the issuance of additional equity securities and/or the borrowing of additional funds. The issuance of additional equity securities may significantly reduce the equity interest of existing stockholders and/or adversely affect prevailing market prices for Rand's common stock. Increasing Rand's indebtedness could increase the risk of a default that would entitle the holder to declare all of such indebtedness due and payable and/or to seize any collateral securing the indebtedness. In addition, default under one debt instrument could in turn permit lenders under other debt instruments to declare borrowings outstanding under those other instruments to be due and payable pursuant to cross default clauses. Accordingly, the financing of future acquisitions could adversely impact our capital structure and your equity interest in Rand.

Except as required by law or the rules of any securities exchange on which our securities might be listed at the time we seek to consummate an acquisition, you will not be asked to vote on any proposed acquisition.

Risks Associated with the Shipping Industry

The cyclical nature of the Great Lakes dry bulk shipping industry may lead to decreases in shipping rates, which may reduce Lower Lakes' revenue and earnings.

The shipping business, including the dry cargo market, has been cyclical in varying degrees, experiencing fluctuations in charter rates, profitability and, consequently, vessel values. Rand anticipates that the future demand for Lower Lakes' dry bulk carriers and dry bulk charter rates will be dependent upon continued demand for commodities, economic growth in the United States and Canada, seasonal and regional changes in demand, and changes to the capacity of the Great Lakes fleet which cannot be predicted. Adverse economic, political, social or other developments could decrease demand and growth in the shipping industry and thereby reduce revenue and earnings. Fluctuations, and the demand for vessels, in general, have been influenced by, among other factors:

| |

| o | global and regional economic conditions; |

| |

| o | developments in international and Great Lakes trade; |

| |

| o | changes in seaborne and other transportation patterns, such as port congestion and canal closures; |

| |

| o | weather, water levels and crop yields; |

| |

| o | political developments; and |

The market values of Lower Lakes' vessels may decrease, which could cause Lower Lakes to breach covenants in its credit facilities, which could reduce earnings and revenues as a result of potential foreclosures.

Vessel values are influenced by several factors, including:

| |

| o | changes in environmental and other regulations that may limit the useful life of vessels; |

| |

| o | changes in Great Lakes dry bulk commodity supply and demand; |

| |

| o | types and sizes of vessels; |

| |

| o | development of and increase in use of other modes of transportation; |

| |

| o | governmental or other regulations; and |

| |

| o | prevailing level of contract of affreightment rates and charter rates. |

If the market values of Lower Lakes' owned vessels decrease, Lower Lakes may breach some of the covenants contained in its credit facility. If Lower Lakes breaches such covenants and is unable to remedy the relevant breach, Lower Lakes' lenders could accelerate its debt and foreclose on the collateral, including Lower Lakes' vessels. Any loss of vessels would significantly decrease the ability of Rand to generate revenue and income. In addition, if the book value of a vessel is impaired due to unfavorable market conditions, or a vessel is sold at a price below its book value, Rand would incur a loss that would reduce earnings.

A failure to pass inspection by classification societies and regulators could result in one or more vessels being unemployable unless and until they pass inspection, resulting in a loss of revenues from such vessels for that period and a corresponding decrease in earnings, which may be material.

The hull and machinery of every commercial vessel must be classed by a classification society authorized by its country of registry, as well as being subject to inspection by shipping regulatory bodies such as Transport Canada. The classification society certifies that a vessel is safe and seaworthy in accordance with the applicable rules and regulations of the country of registry of the vessel and the United Nations Safety of Life at Sea Convention. Lower Lakes' owned fleet is currently enrolled with either the American Bureau of Shipping or Lloyd's Register.

A vessel must undergo Annual Surveys, Intermediate Surveys, and Special Surveys by its classification society, as well as periodic inspections by shipping regulators. As regards classification surveys, in lieu of a Special Survey, a vessel's machinery may be on a continuous survey cycle, under which the machinery would be surveyed periodically over a five-year period. Lower Lakes' vessels are on Special Survey cycles for hull inspection and continuous survey cycles for machinery inspection. Every vessel is also required to be drydocked every five years for inspection of the underwater parts of such vessel.

Due to the age of several of the vessels, the repairs and remediations required in connection with such classification society surveys and other inspections may be extensive and require significant expenditures. Additionally, until such time as certain repairs and remediations required in connection with such surveys and inspections are completed (or if any vessel fails such a survey or inspection), the vessel may be unable to trade between ports and, therefore, would be unemployable. Any such loss of the use of a vessel could have an adverse impact on Rand's revenues, results of operations and liquidity, and any such impact may be material.

Lower Lakes' business would be adversely affected if Lower Lakes failed to comply with U.S. maritime laws or the Coasting Trade Act (Canada) provisions on coastwise trade, or if those provisions were modified or repealed.

Rand is subject to the Jones Act and related regulations, and the Coasting Trade Act (Canada), all of which restrict domestic maritime transportation to vessels operating under the flag of the subject state. In the case of the United States, vessels must be at least 75% owned and operated by U.S. citizens and manned by U.S. crews and, in addition, the vessels must have been built in the United States. Compliance with the foregoing legislation increases the operating costs of the vessels. With respect to its U.S. flagged vessels, Rand is responsible for monitoring the ownership of its capital stock to ensure compliance with U.S. maritime laws. If Rand does not comply with these restrictions, Rand will be prohibited from operating its vessels in U.S. coastwise trade, and under certain circumstances Rand will be deemed to have undertaken an unapproved foreign transfer, resulting in severe penalties, including permanent loss of U.S. coastwise trading rights for its vessels, and fines or forfeiture of the vessels.

Over the past decade, interest groups have lobbied Congress to modify or repeal U.S. maritime laws so as to facilitate foreign flag competition. Foreign vessels generally have lower construction costs and generally operate at significantly lower costs than vessels in the U.S. markets, which would likely result in reduced charter rates. Rand believes that continued efforts will be made to modify or repeal these laws. If these efforts are successful, it could result in significantly increased competition and have a material adverse effect on our business, results of operations and financial condition.

We may be unable to maintain or replace our vessels as they age.

As of March 31, 2013, the average age of the vessels operated by Lower Lakes was approximately 52 years. The expense of maintaining, repairing and upgrading Lower Lakes' vessels typically increases with age, and after a period of time the cost necessary to satisfy required marine certification standards may not be economically justifiable. There can be no assurance that Lower Lakes will be able to maintain its fleet by extending the economic life of existing vessels, or that our financial resources will be sufficient to enable us to make expenditures necessary for these purposes. In addition, the supply of replacement vessels is very limited and the costs associated with acquiring a newly constructed vessel are prohibitively high. In the event that Lower Lakes were to lose the use of any of its vessels, our financial performance would be adversely affected.

Lower Lakes is subject to environmental laws that could require significant expenditures both to maintain compliance with such laws and to pay for any uninsured environmental liabilities resulting from a spill or other environmental disaster.

The Company's shipping business and vessel operations are materially affected by environmental and other government regulations in the form of international conventions, United States and Canadian treaties, national, state, provincial, and local laws, and regulations in force in the jurisdictions in which vessels operate. Because such conventions, treaties, laws and regulations are often revised, Rand cannot predict the ultimate cost of compliance or its impact on the resale price or useful life of Lower Lakes' vessels. Additional conventions, treaties, laws and regulations may be adopted which could limit Rand's ability to do business or increase the cost of its doing business, which may materially adversely affect its operations, as well as the shipping industry generally. Lower Lakes is required by various governmental and quasi-governmental agencies to obtain certain permits, licenses, and certificates with respect to its operations and any increased cost in connection with obtaining such permits, licenses and certificates, or the imposition on Lower Lakes of the obligation to obtain additional permits, licenses and certificates, could adversely affect Rand's results of operations. Lower Lakes currently maintains pollution liability coverage insurance. However, if the damages from a catastrophic incident exceed this insurance coverage, it could have a significant adverse impact on Rand's cash flow, profitability and financial position.

The operation of Lower Lakes' vessels is dependent on the price and availability of fuel. Continued periods of historically high fuel costs may materially adversely affect Rand's operating results.

Rand's operating results may be significantly impacted by changes in the availability or price of fuel for Lower Lakes' vessels. Fuel prices have increased substantially since 2004. Although fuel price escalation clauses are included in substantially all of Lower Lakes' contracts of affreightment, which enable Lower Lakes to pass the majority of its increased fuel costs on to its customers, these measures may not be sufficient to enable Lower Lakes to fully recoup increased fuel costs or assure the continued availability of its fuel supplies. Although we are currently able to obtain adequate supplies of fuel, it is impossible to predict the price of fuel. Political disruptions or wars involving oil-producing countries (including, but not limited to, recent political unrest the Middle East), changes in government policy, changes in fuel production capacity, environmental concerns and other unpredictable events may result in fuel supply shortages and additional fuel price increases in the future. There can be no assurance

that Lower Lakes will be able to fully recover its increased fuel costs by passing these costs on to its customers. In the event that Lower Lakes is unable to do so, Rand's operating results will be adversely affected.

Governments could requisition Lower Lakes' vessels during a period of war or emergency, resulting in loss of revenues and earnings from such requisitioned vessels.

The United States or Canada could requisition title or seize Lower Lakes' vessels during a war or national emergency. Requisition of title occurs when a government takes a vessel and becomes the owner. A government could also requisition Lower Lakes vessels for hire, which would result in the government's taking control of a vessel and effectively becoming the charterer at a dictated charter rate. Requisition of one or more of Lower Lakes' vessels would have a substantial negative effect on Rand, as Rand would potentially lose all or substantially all revenues and earnings from the requisitioned vessels and/or permanently lose the vessels. Such losses might be partially offset if the requisitioning government compensated Rand for the requisition.

The operation of Great Lakes-going vessels entails the possibility of marine disasters including damage or destruction of the vessel due to accident, the loss of a vessel due to piracy or terrorism, damage or destruction of cargo and similar events that may cause a loss of revenue from affected vessels and damage Lower Lakes' business reputation, which may in turn, lead to loss of business.

The operation of Great Lakes-going vessels entails certain inherent risks that may adversely affect Lower Lakes' business and reputation, including:

| |

| o | damage or destruction of a vessel due to marine disaster such as a collision; |

| |

| o | the loss of a vessel due to piracy and terrorism; |

| |

| o | cargo and property losses or damage as a result of the foregoing or less drastic causes such as human error, mechanical failure, low water levels and bad weather; |

| |

| o | environmental accidents as a result of the foregoing; and |

| |

| o | business interruptions and delivery delays caused by mechanical failure, human error, war, terrorism, political action in various countries, labor strikes or adverse weather conditions. |

Any of these circumstances or events could substantially increase Lower Lakes' costs, as for example, the costs of replacing a vessel or cleaning up a spill, or lower its revenues by taking vessels out of operation permanently or for periods of time. The involvement of Lower Lakes' vessels in a disaster or delays in delivery or damages or loss of cargo may harm its reputation as a safe and reliable vessel operator and cause it to lose business.

If Lower Lakes' vessels suffer damage, they may need to be repaired at Lower Lakes' cost at a drydocking facility. The costs of drydock repairs are unpredictable and can be substantial. Lower Lakes may have to pay drydocking costs that insurance does not cover. The loss of earnings while these vessels are being repaired and repositioned, as well as the actual cost of these repairs, could decrease its revenues and earnings substantially, particularly if a number of vessels are damaged or drydocked at the same time.

Maritime claimants could arrest Lower Lakes' vessels, which could interrupt its cash flow.

Crew members, suppliers of goods and services to a vessel, shippers of cargo, and other parties may be entitled to a maritime lien against a vessel for unsatisfied debts, claims or damages against such vessel. In many jurisdictions, a maritime lien holder may enforce its lien by arresting a vessel through foreclosure proceedings. The arrest or attachment of one or more of Lower Lakes' vessels could interrupt its cash flow and require it to pay large sums of funds to have the arrest lifted.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

We maintain our executive offices at 500 Fifth Avenue, 50th Floor, New York, New York 10110 pursuant to an agreement with Hyde Park Real Estate LLC, an affiliate of Laurence S. Levy, our executive chairman, and Edward Levy, our president. We also currently lease the following properties:

| |

| o | Lower Lakes Towing leases approximately 12,000 square feet of warehouse space at 107 Greenock Street, Port Dover, Ontario under a lease that expires on August 31, 2022. |

| |

| o | Lower Lakes Towing leases approximately 24,800 square feet of warehouse space at 109 Greenock Street, Port Dover, Ontario under a lease that expires on August 31, 2022. |

| |

| o | Lower Lakes Towing leases approximately 5,000 square feet of office space at 517 Main Street, Port Dover, Ontario under a lease that expires in October, 2018. |

| |

| o | Grand River leases approximately 1,300 square feet of space at 32861 Pin Oak Parkway, Suite B, Avon Lake, Ohio under a lease that expires on March 31, 2014. |

| |

| o | Grand River leases approximately 1,194 square feet at 3301 Veterans Drive, Suite 210, Traverse City, Michigan under a lease that expires October 31, 2015. |

| |

| o | Rand Finance Corp. (“Rand Finance”), a wholly-owned subsidiary of the Company, leases approximately 400 square feet at 17 Wilson Road, Chelmsford, Massachusetts under a lease that is renewed on a monthly basis. |

We consider our current office space adequate for our current operations.

| |

| Item 3. | Legal Proceedings. |

The nature of our business exposes us to the potential for legal proceedings related to labor and employment, personal injury, property damage, and environmental matters. Although the ultimate outcome of any legal matter cannot be predicted with certainty, based on present information, including our assessment of the merits of each particular claim, as well as our current reserves and insurance coverage, we do not expect that any known legal proceeding will in the foreseeable future have a material adverse impact on our financial condition or the results of our operations.

| |

Item 4. | Mine Safety Disclosures. |

Not applicable.

PART II. OTHER INFORMATION

ITEM 5. MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock is currently traded on the NASDAQ Capital Market under the symbol RLOG. The following table sets forth the high and low sales prices for each full quarterly period within the two most recent fiscal years.

|

| | |

| | Common Stock |

| Quarter Ended | High | Low |

| June 30, 2011 | $8.22 | $6.35 |

| September 30, 2011 | $7.96 | $5.80 |

| December 31, 2011 | $7.00 | $5.73 |

| March 31, 2012 | $9.10 | $6.26 |

| June 30, 2012 | $9.25 | $7.11 |

| September 30, 2012 | $8.50 | $6.59 |

| December 31, 2012 | $7.79 | $5.91 |

| March 31, 2013 | $7.39 | $5.47 |

Holders

As of June 10, 2013, there were 20 holders of record of our common stock.

Dividends

We have not paid any dividends on our common stock to date and do not intend to pay dividends on our common stock in the near future. The payment of dividends in the future will be contingent upon our revenues, earnings, capital requirements and general financial condition. The payment of dividends is within the discretion of our board of directors. Other than dividends which our board of directors may determine to pay on our preferred stock, it is the present intention of our board of directors to retain all earnings for future investment and use in our business operations. Accordingly, our board of directors does not anticipate declaring any dividends in the foreseeable future on our common stock. In addition, no dividends may be declared or paid on our common stock unless all accrued dividends on our preferred stock have been paid.

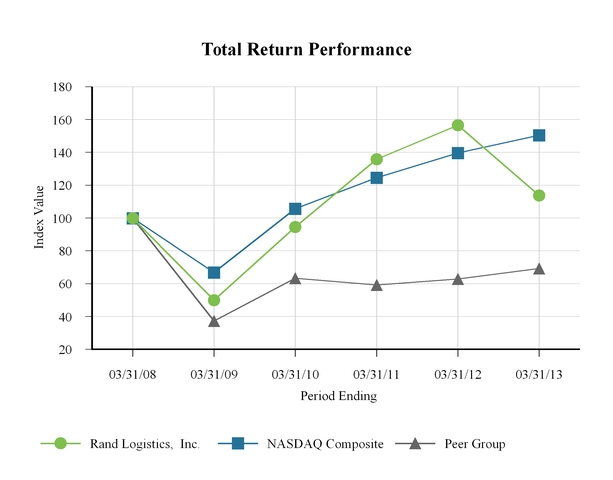

Stock Performance Graph

The following graph compares from March 31, 2008 the cumulative total stockholder return on our common stock over the cumulative total returns of The NASDAQ Composite Index and an industry peer group consisting of Algoma Central Corp., International Shipholding Company, and Horizon Lines Inc. The following graph is based on the closing price of our common stock from March 31, 2008 through March 31, 2013.

ITEM 6. SELECTED FINANCIAL DATA

The following table sets forth selected consolidated financial data of the Company as of and for the years ended March 31, 2013, 2012, 2011, 2010 and 2009. The information in the following table should be read together with the Company's consolidated financial statements and accompanying notes as of and for the years ended March 31, 2013, 2012, 2011, 2010 and 2009 and “Management's Discussion and Analysis of Financial Condition and Results of Operations” included under Item 7 of this report. These historical results are not necessarily indicative of the results to be expected in the future. |

| | | | | | | | | | | | | | | |

| Selected Financial Data (USD millions except share data) | 2013 | 2012 | 2011 | 2010 | 2009 |

| Revenue | | | | | |

| Freight and related revenue | $ | 117.8 |

| $ | 107.6 |

| $ | 90.4 |

| $ | 85.1 |

| $ | 85.8 |

|

| Fuel and other surcharges | $ | 37.4 |

| $ | 38.9 |

| $ | 20.5 |

| $ | 15.4 |

| $ | 29.1 |

|

| Outside voyage charter revenue | $ | 1.4 |

| $ | 1.3 |

| $ | 7.1 |

| $ | 7.7 |

| $ | 19.2 |

|

| | $ | 156.6 |

| $ | 147.8 |

| $ | 118 |

| $ | 108.2 |

| $ | 134.2 |

|

| Operating income | $ | 8.1 |

| $ | 15.2 |

| $ | 6.8 |

| $ | 7.6 |

| $ | 9.3 |

|

| | | | | | |

| Net (loss) income applicable to common shareholders | $ | (7.0 | ) | $ | 5.3 |

| $ | (2.2 | ) | $ | 0.8 |

| $ | (8.8 | ) |

| | | | | | |

| Net (loss) income per share -basic | $ | (0.39 | ) | $ | 0.33 |

| $ | (0.16 | ) | $ | 0.06 |

| $ | (0.70 | ) |

| Net (loss) income per share - diluted | $ | (0.39 | ) | $ | 0.33 |

| $ | (0.16 | ) | $ | 0.06 |

| $ | (0.70 | ) |

| | | | | | |

| Weighted average shares - basic | 17,740,372 | 16,336,930 | 13,632,961 | 13,071,651 | 12,558,956 |

| Weighted average shares - diluted | 17,740,372 | 16,336,930 | 13,632,961 | 13,071,651 | 12,558,956 |

| | | | | | |

| Other Operating Data | | | | | |

| Depreciation | $ | 15.4 |

| $ | 11.6 |

| $ | 7.7 |

| $ | 9.2 |

| $ | 6.8 |

|

| Amortization of drydock costs | $ | 3.5 |

| $ | 3.0 |

| $ | 2.8 |

| $ | 2.5 |

| $ | 2.1 |

|

| Amortization of intangibles | $ | 1.3 |

| $ | 1.3 |

| $ | 1.2 |

| $ | 1.4 |

| $ | 1.7 |

|

| | | | | | |

| Property and equipment, net | $ | 219.1 |

| $ | 200.9 |

| $ | 166.7 |

| $ | 98.5 |

| $ | 86.2 |

|

| Total assets | $ | 270.8 |

| $ | 257.8 |

| $ | 215.5 |

| $ | 148.0 |

| $ | 135.9 |

|

| | | | | | |

| Long-term debt, including current portion | $ | 143.4 |

| $ | 133.6 |

| $ | 112.2 |

| $ | 62.7 |

| $ | 58.3 |

|

| Total equity | $ | 72.4 |

| $ | 79.3 |

| $ | 58.3 |

| $ | 51.5 |

| $ | 41.8 |

|

| | | | | | |

| Number of vessels operated as of the year end date | 16 |

| 14 |

| 12 |

| 12 |

| 12 |

|

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

All dollar amounts are presented in millions except share, per share and per day amounts. The following management's discussion and analysis (“MD&A”) is written to help the reader understand our company. The MD&A is provided as a supplement to, and should be read in conjunction with, the Consolidated Financial Statements and the accompanying financial statement notes of the Company appearing elsewhere in this Annual Report on Form 10-K for the fiscal year ended March 31, 2013.

Overview

Business

Rand (formerly Rand Acquisition Corporation) was incorporated in the State of Delaware in 2004 as a blank check company. In 2006, we acquired all of the outstanding shares of capital stock of Lower Lakes Towing and its affiliate, Grand River.

Subsequent to the acquisition of Lower Lakes Towing and Grand River, we have added ten vessels to our fleet through acquisition transactions, including the 2011 acquisitions of three self-unloading articulated tug and barge units and two bulk carriers. We have also retired two smaller vessels.

Our shipping business is operated in Canada by Lower Lakes Towing and in the United States by Lower Lakes Transportation. Lower Lakes Towing was organized in March 1994 under the laws of Canada to provide marine transportation services to dry bulk goods suppliers and purchasers operating in ports on the Great Lakes and has grown from its origin as a small tug and barge operator to a full service shipping company with a fleet of sixteen cargo-carrying vessels. We have grown to become one of the largest bulk shipping companies operating on the Great Lakes and the leading service provider in the River Class market segment, which we define as vessels less than 650 feet in overall length. We transport construction aggregates, coal, iron ore, salt, grain and other dry bulk commodities for customers in the construction, electric utility, integrated steel and food industries.

We believe that Lower Lakes is the only company providing significant domestic port-to-port services to both Canada and the United States in the Great Lakes region. Lower Lakes maintains this operating flexibility by operating both U.S. and Canadian flagged vessels in compliance with the Shipping Act, 1916, and the Merchant Marine Act, 1920, commonly referred to as the Jones Act in the U.S. and the Coasting Trade Act in Canada.

Results of Operations

Fiscal year ended March 31, 2013 compared to fiscal years ended March 31, 2012 and 2011

Selected Financial Information

|

| | | | | | | | | |

| (USD in 000's) | Fiscal year ended March 31, 2013 | Fiscal year ended March 31, 2012 | Fiscal year ended March 31, 2011 |

Revenue: | | | |

| Freight and related revenue | $ | 117,797 |

| $ | 107,618 |

| $ | 90,433 |

|

| Fuel and other surcharges | $ | 37,404 |

| $ | 38,886 |

| $ | 20,471 |

|

| Outside voyage charter revenue | $ | 1,437 |

| $ | 1,321 |

| $ | 7,074 |

|

| Total | $ | 156,638 |

| $ | 147,825 |

| $ | 117,978 |

|

Expenses: | | | |

| Outside voyage charter fees | $ | 1,447 |

| $ | 1,312 |

| $ | 7,052 |

|

| Vessel operating expenses | $ | 104,896 |

| $ | 97,274 |

| $ | 77,177 |

|

| Repairs and maintenance | $ | 8,350 |

| $ | 7,179 |

| $ | 5,456 |

|

Sailing days: | 3,922 |

| 3,721 |

| 3,338 |

|

Per day in whole USD: | | | |

Revenue per sailing day: | | | |

| Freight and related revenue | $ | 30,035 |

| $ | 28,922 |

| $ | 27,092 |

|

| Fuel and other surcharges | $ | 9,537 |

| $ | 10,450 |

| $ | 6,133 |

|

Expenses per sailing day: | | | |

| Vessel operating expenses | $ | 26,746 |

| $ | 26,142 |

| $ | 23,121 |

|

| Repairs and maintenance | $ | 2,129 |

| $ | 1,929 |

| $ | 1,635 |

|

Fiscal year ended March 31, 2013 compared to the fiscal year ended March 31, 2012

Selected Financial Information

|

| | | | | | | | | | | |

| (USD in 000's) | Fiscal year ended March 31, 2013 | Fiscal year ended March 31, 2012 | Change | % Change |

Revenue: | | | | |

| Freight and related revenue | $ | 117,797 |

| $ | 107,618 |

| $ | 10,179 |

| 9.5 | % |

| Fuel and other surcharges | $ | 37,404 |

| $ | 38,886 |

| $ | (1,482 | ) | (3.8 | )% |

| Outside voyage charter revenue | $ | 1,437 |

| $ | 1,321 |

| $ | 116 |

| 8.8 | % |

| Total | $ | 156,638 |

| $ | 147,825 |

| $ | 8,813 |

| 6.0 | % |

Expenses: | | | | |

| Outside voyage charter fees | $ | 1,447 |

| $ | 1,312 |

| $ | 135 |

| 10.3 | % |

| Vessel operating expenses | $ | 104,896 |

| $ | 97,274 |

| $ | 7,622 |

| 7.8 | % |

| Repairs and maintenance | $ | 8,350 |

| $ | 7,179 |

| $ | 1,171 |

| 16.3 | % |

Sailing days: | 3,922 |

| 3,721 |

| 201 |

| 5.4 | % |

| Number of vessels operated: | 16 |

| 14 |

| 2 |

| 14.3 | % |

Per day in whole USD: | | | | |

Revenue per sailing day: | | | | |

| Freight and related revenue | $ | 30,035 |

| $ | 28,922 |

| $ | 1,113 |

| 3.8 | % |

| Fuel and other surcharges | $ | 9,537 |

| $ | 10,450 |

| $ | (913 | ) | (8.7 | )% |

Expenses per sailing day: | | | | |

| Vessel operating expenses | $ | 26,746 |

| $ | 26,142 |

| $ | 604 |

| 2.3 | % |

| Repairs and maintenance | $ | 2,129 |

| $ | 1,929 |

| $ | 200 |

| 10.4 | % |

The following table summarizes the changes in the components of our revenue and vessel operating expenses as a result of changes in Sailing Days, which we define as days a vessel is crewed and available for sailing, during the fiscal year ended March 31, 2013 compared to the fiscal year ended March 31, 2012:

|

| | | | | | | | | | | | | | | | | | |

| (USD in 000's) | Sailing Days | Freight and related revenue | Fuel and other surcharges | Outside voyage charter | Total revenue | Vessel operating expenses |

| Fiscal year ended March 31, 2012 | 3,721 |

| | 107,618 |

| | 38,886 |

| | 1,321 |

| | 147,825 |

| | 97,274 |

| |

Changes in fiscal year ended March 31, 2013: | | | | | | | | | | | | |

| Decrease attributable to weaker Canadian dollar | | | (470 | ) | | (139 | ) | | (7 | ) | | (616 | ) | | (434 | ) | |

| Net decrease attributable to vessel incidents | (123 | ) | | (3,428 | ) | | (2,101 | ) | | | | (5,529 | ) | | (1,525 | ) | |

| Net increase attributable to customer demand and pricing (excluding currency impact) | 324 |

| | 14,077 |

| | 758 |

| | | | 14,835 |

| | 9,581 |

| |

| Changes in outside voyage charter revenue (excluding currency impact) | | |

| | | | 123 |

| | 123 |

| | | |

| Sub-total | 201 |

| | 10,179 |

| | (1,482 | ) | | 116 |

| | 8,813 |

| | 7,622 |

| |

| Fiscal year ended March 31, 2013 | 3,922 |

| | 117,797 |

| | 37,404 |

| | 1,437 |

| | 156,638 |

| | 104,896 |

| |

Total revenue during the fiscal year ended March 31, 2013 was $156.6 million, an increase of $8.8 million, or 6.0%, compared to $147.8 million during the fiscal year ended March 31, 2012. This increase was primarily attributable to higher freight revenue, partially offset by reduced fuel surcharges and the effect of the slightly weaker Canadian dollar.