UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

[ ] REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

[ X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended June 30, 2012

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

[ ] SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report

For the transition period from ________to ________

Commission file number: 001-32712

KIMBER RESOURCES INC.

(Exact name of Registrant as specified in its charter)

________

(Translation of Registrant’s name into English)

Province of British Columbia, Canada

(Jurisdiction of incorporation or organization)

Suite 215 – 800 West Pender Street, Vancouver, British Columbia, Canada, V6C 2V6

(Address of principal executive offices)

Gordon Cummings, President and Chief Executive Officer

SUITE 215 – 800 WEST PENDER STREET, VANCOUVER, BRITISH COLUMBIA, CANADA V6C 2V6

TEL: (604) 669-2251

E-MAIL: GCUMMINGS@KIMBERRESOURCES.COM

(NAME, TELEPHONE, E-MAIL AND/OR FACSIMILE NUMBER AND ADDRESS OF COMPANYCONTACT PERSON)

2

Securities registered pursuant to Section 12(b) of the Act.

| |

| Title of each class | Name of each exchange on which registered |

| |

| Common Shares, without par value | NYSE MKT |

Securities registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the Registrant’s classes of capital or common stock as of the close of the period covered by the annual report:82,459,937 COMMON SHARES AS AT JUNE 30, 2012

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

[ ]Yes[ X]No

If this report is an annual or transition report, indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

[ ]Yes[ X]No

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

[ X]Yes[ ]No

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulations S-T during the preceding 12 months (or such shorter period that the Registrant was required to submit and post such files)

[ X]Yes[ ]No

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one)

| | |

| Large accelerated filer[ ] | Accelerated filer[ ] | Non-accelerated filer[ X] |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| | |

| U.S. GAAP[ ] | International Financial Reporting Standards as issued[ X ] | Other[ ] |

| | by the International Accounting Standards Board | |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

[ ]Item 17[ ] Item 18

If this is an annual report, indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

[ ]Yes[ X]No

3

TABLE OF CONTENTS

| |

| GLOSSARY OF TERMS | 6 |

Glossary of Non-Geological Terms | 6 |

Geological and Technical Terms | 8 |

| CAUTIONARY NOTE TO U.S. INVESTORS REGARDING MINERAL RESOURCE AND MINERAL RESERVE ESTIMATES | 11 |

| CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS | 13 |

| PART I | 14 |

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS | 14 |

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE | 14 |

ITEM 3. KEY INFORMATION | 14 |

A. Selected Financial Data | 14 |

B. Capitalization and Indebtedness | 15 |

C. Reasons for the Offer and Use of Proceeds | 15 |

D. Risk Factors | 15 |

ITEM 4. INFORMATION ON KIMBER | 25 |

A. History and Development of Kimber | 25 |

B. Business Overview | 26 |

C. Organizational Structure | 28 |

D. Property, Plants and Equipment | 28 |

The Monterde Property | 29 |

E. Mineral Resource Estimates | 48 |

Non-Reserves | 48 |

F. Metallurgy | 54 |

Monterde Property - Carmen | 54 |

G. Preliminary Economic Assessment | 56 |

Non-Reserves | 56 |

H. Other Properties | 58 |

Pericones Property | 59 |

Setago Property | 59 |

Technical Disclosure | 60 |

Other Significant Acquisitions and Dispositions | 60 |

ITEM 4A. UNRESOLVED STAFF COMMENTS | 60 |

ITEM 5. OPERATING AND FINANCIAL REVIEW AND PROSPECTS | 60 |

A. Operating Results | 62 |

B. Liquidity and Capital Resources | 66 |

C. Research and Development, Patents and Licenses, Etc. | 68 |

4

| |

D. Trend Information | 68 |

E. Off-Balance Sheet Arrangements | 68 |

F. Tabular Disclosure of Contractual Obligations | 68 |

G. Safe Harbour | 68 |

ITEM 6. DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | 68 |

A. Directors and Senior Management | 68 |

B. Compensation | 72 |

C. Board Practices | 74 |

D. Employees | 75 |

E. Share Ownership | 75 |

ITEM 7. MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS | 79 |

A. Major Shareholders | 79 |

B. Related Party Transactions | 80 |

C. Interests of Experts and Counsel | 81 |

ITEM 8. FINANCIAL INFORMATION | 81 |

A. Consolidated Statements and Other Financial Information | 81 |

B. Significant Changes | 81 |

ITEM 9. THE OFFER AND LISTING | 81 |

A. The Offer and Listing Details | 81 |

B. Plan of Distribution | 83 |

C. Markets | 83 |

D. Selling Shareholders | 83 |

E. Dilution | 83 |

F. Expense of the issue | 83 |

ITEM 10. ADDITIONAL INFORMATION | 83 |

A. Share Capital | 83 |

B. Notice of Articles and Articles | 84 |

C. Material Contracts | 89 |

D. Exchange Controls | 89 |

E. Taxation | 89 |

F. Certain United States Federal Income Tax Considerations | 90 |

F. Dividends and Paying Agents | 98 |

G. Statement by Experts | 98 |

H. Documents on Display | 98 |

I. Subsidiary Information | 99 |

ITEM 11. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 99 |

ITEM 12. DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | 99 |

A. to C | 99 |

D. American Depositary Receipts | 99 |

5

| |

| PART II | 99 |

ITEM 13. DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES | 99 |

ITEM 14. MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | 99 |

A. to D | 99 |

E. Use of Proceeds | 99 |

ITEM 15. CONTROLS AND PROCEDURES | 99 |

A. Disclosure Controls and Procedures | 99 |

B. Management’s Annual Report on Internal Control over Financial Reporting | 100 |

C. Changes in Internal Control Over Financial Reporting | 100 |

ITEM 16. [RESERVED] | 100 |

ITEM 16A. AUDIT COMMITTEE FINANCIAL EXPERT | 100 |

ITEM 16B. CODE OF ETHICS | 101 |

ITEM 16C. PRINCIPAL ACCOUNTANT FEES AND SERVICES | 101 |

ITEM 16D. EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES | 102 |

ITEM 16E. PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS | 102 |

ITEM 16F. CHANGE IN REGISTRANT’S CERTIFYING ACCOUNTANT | 102 |

ITEM 16G. CORPORATE GOVERNANCE | 102 |

ITEM 16H. MINE SAFETY DISCLOSURES | 102 |

| PART III | 103 |

ITEM 17. FINANCIAL STATEMENTS | 103 |

ITEM 18. FINANCIAL STATEMENTS | 103 |

ITEM 19. EXHIBITS | 103 |

SIGNATURE PAGE | 109 |

6

GLOSSARY OF TERMS

Certain terms and abbreviations used in this Annual Report are defined below:

Glossary of Non-Geological Terms

“ALS”means ALS Laboratory Group, a division of Campbell Brothers Limited, an Australian based public company;

“BCBCA”means theBusiness Corporations Act(British Columbia), as amended;

“Canadian GAAP”means financial data prepared in accordance with Canadian generally accepted accounting principles;

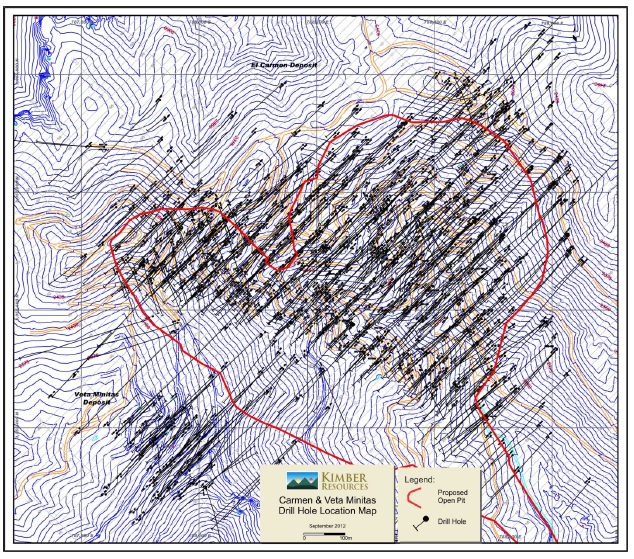

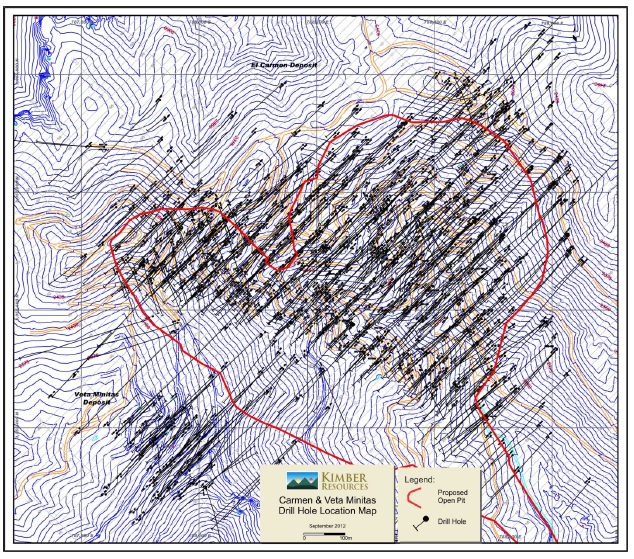

“Carmen deposit”or“Carmen”is the name given to a volume of gold and silver-bearing rock in and around the former Monterde mine. Until drilling is complete, the boundaries of this mineralization will remain undefined (SeeFigure 2, Figure 3andFigure 5);

“Carotare deposit”or“Carotare”is the name given to a volume of gold and silver-bearing rock located 2 kilometres west of the Carmen deposit. Until drilling is complete, the boundaries of this mineralization will remain undefined (SeeFigure 3andFigure 5);

“Common Shares”or“Shares”means the common shares without par value in the capital of Kimber Resources Inc.;

“Ejido”(aa-hee-do) is a Mexican legal entity which owns a specific area of land and holds it collectively for its members. Ejidos were formed by way of a resolution from the Federal Government of Mexico under the Agrarian Act for the administration and development of collective property rights over agricultural land owned by the Federal Government of Mexico. Ejidos are administered and controlled by an Ejido council. The consent of the general assembly of Ejido members is a requirement for access to such lands for mineral exploration and development. Since 1990, Mexican law has permitted the "partition and privatization" of Ejido land from the Federal Government of Mexico to the Ejidos and from the Ejidos to individual members;

“El Coronel Concessions”means the mineral concessions located in the Monterde Mining District, State of Chihuahua, Mexico, listed under the heading “El Coronel Concessions” inTable 1of this Annual Report;

“Golden Treasure”means Golden Treasure Explorations Ltd.;

“Gold equivalent ounce”Gold equivalent ounces are based on prices of US$1,050/oz gold and US$18/oz silver for recovered ounces, giving a ratio of 58.3 to convert recoverable silver ounces to gold equivalent ounces.

“Group 1 Concessions”means the mineral concessions forming part of the Monterde Property, located in the Monterde Mining District, State of Chihuahua, Mexico, listed under the heading “Group 1 Concessions” inTable 1of this Annual Report;

“Group 2 Concessions”means the mineral concessions forming part of the Monterde Property, located in the Monterde Mining District, State of Chihuahua, Mexico, listed under the heading “Group 2 Concessions” inTable 1of this Annual Report;

7

“Group 3 Concessions”means the mineral concession forming part of the Monterde Property, located in the Monterde Mining District, State of Chihuahua, Mexico, listed under the heading “Group 3 Concessions” inTable 1of this Annual Report;

“Group 4 Concessions”means the mineral concession forming part of the Monterde Property, located in the Monterde Mining District, State of Chihuahua, Mexico, listed under the heading “Group 4 Concessions” inTable 1of this Annual Report;

“IFRS”means International Financial Reporting Standards as issued by the International Accounting Standards Board (“IASB”);

“IRR”means Internal Rate of Return, which on a project is the accumulative effective compounded rate of return that makes the NPV of all cash flows equal to zero;

“Kimber”or the“Company”means, as the context requires, Kimber Resources Inc. and its wholly owned subsidiaries Minera Monterde, S. de R.L. de C.V, Kimber Resources de Mexico, S.A de C.V and Minera Pericones, S.A. de C.V. collectively;

“Kimber Resources de Mexico”means Kimber Resources de Mexico, S.A. de C.V., a wholly owned subsidiary of Kimber Resources Inc.;

“Minera Monterde”means Minera Monterde, S. de R.L. de C.V., a wholly owned subsidiary of Kimber Resources Inc. and the holder of the Monterde Property and the Setago Property;

“Minera Pericones”means Minera Pericones, S.A. de C.V., a wholly owned subsidiary of Kimber Resources Inc. and the holder of the Pericones Property;

“Monterde Property”means the Monterde Concessions, the El Coronel Concessions, the Staked Concessions and the San Francisco Concession all located in the Monterde Mining District, State of Chihuahua, Mexico and listed inTable 1of this Annual Report;

“Monterde Concessions”means the mineral concessions located in the Monterde Mining District, State of Chihuahua, Mexico, listed under the heading “Monterde Concessions” inTable 1of this Annual Report;

“NPV”means Net Present Value, a value calculated for a project, based on its assumed future cash receipts and disbursements, discounted by an estimated risk free return;

“NYSE MKT”means the NYSE MKT stock exchange;

“Pericones Property”or“Pericones”means a staked mineral concession located approximately 180 kilometres southwest of Mexico City in the Municipality of Tejupilco in Estado de Mexico;

“San Francisco Concession”means the mineral concession located in the Monterde Mining District, State of Chihuahua, Mexico, listed under the heading “San Francisco Concession” inTable 1of this Annual Report;

“SEC”means the United States Securities and Exchange Commission;

“Setago Property”or“Setago”means a staked mineral concession located in the Monterde Mining District, State of Chihuahua, Mexico, approximately 24 kilometres to the west of the Monterde Property;

8

“Staked Concessions”means the mineral concessions forming part of the Monterde Property located in the Monterde Mining District, State of Chihuahua, Mexico, listed under the heading “Staked Concessions” inTable 1of this Annual Report;

“TSX”means the Toronto Stock Exchange;

“U.S. GAAP”means financial data prepared in accordance with United States generally accepted accounting principles;

“U.S. Securities Act” means the United States Securities Act of 1933, as amended;

“Veta Minitas deposit”or“Veta Minitas”is the name given to a volume of gold and silver-bearing rock located 250 metres southwest of the Carmen deposit. Until drilling is complete, the boundaries of the mineralization will remain undefined (SeeFigure 3andFigure 5);

“Warrant”means a warrant of Kimber Resources Inc. entitling the holder to purchase one Common Share of Kimber Resources Inc. at the price and until the date stated in the said warrant;

“2002 Plan”means the Kimber Resources Inc. 2002 Stock Option Plan;

“2007 Plan”means the Kimber Resources Inc. 2007 Stock Option Plan;

Geological and Technical Terms

“alteration”is a change in the chemical and mineralogical composition of a rock caused by hydrothermal fluids;

“andesite”is a fine-grained volcanic rock, typically grey to dark grey, containing plagioclase, hornblende, biotite, or pyroxene phenocrysts;

“argillic alteration”is an alteration type characterized by the development of clay minerals at the expense of the original constituents of the rock;

“breccia”is a rock that has been broken by natural forces such as fault movements or volcanic explosions into very irregular fragments of varying sizes with the spaces between the larger fragments filled by smaller fragments of the same material;

“caldera”is a large basin-shaped volcanic depression, more or less circular in shape;

“CIM”is the Canadian Institute of Mining, Metallurgy and Petroleum;

“CIM Standards”means the standards and best practices for mineral projects under the guidelines set out in “Mineral Resources/Reserves and Valuation Standards”, Special Volume 56 published byThe Canadian Institute of Mining, Metallurgy and Petroleum;

“comagmatic”is a term describing igneous rocks regarded as having been derived from common parent magma;

“dikes”are tabular bodies of igneous rock that cut structurally across adjacent rock;

“dip”is the maximum angle that a structural surface, such as layering in a rock or a fault, makes with the horizontal, measured perpendicular to the strike and in the vertical plane;

9

“epithermal”refers to a hydrothermal mineral deposit formed within about 1 kilometre of the Earth’s surface and in the temperature range of 50oto 200oC;

“fault”is a fracture or fracture zone along which there has been displacement of the sides relative to one another;

“feldspars”are a group of aluminum-silica minerals with calcium, sodium or potassium. They are major rock-forming minerals in igneous rocks;

“g/t”means grams per tonne;

“grade”is the relative quantity or the percentage of a commodity content in a Mineral Resource, expressed as grams per tonne or ounces per ton for precious minerals, such as gold, or as a weight percentage for most other metals;

“hematite”or“hematitic”refers to a common iron mineral consisting of iron and oxygen;

“hydrothermal”pertains to hot water or the action of heated water, often considered heated by magma or in association with magma;

“igneous rocks”are rocks that have formed from lava;

“Indicated Mineral Resource”is, in accordance with the CIM Standards, that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics, can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed;

“Inferred Mineral Resource”is, in accordance with the CIM Standards, that part of a Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes;

“intrusive”is an igneous rock that has solidified below the Earth's surface;

“leaching”means the separation, selective removal or dissolving-out of soluble constituents from a rock or ore body by the natural actions of percolating water or applied solutions;

“lithologies”are groupings of rocks displaying similar physical characteristics including colour, mineral composition and grain size;

“magma”is molten rock located below the Earth's surface. When a volcano erupts or a deep crack occurs in the Earth, the magma rises and overflows. When it flows out of the volcano or crack, usually mixed with steam and gas, it is called lava;

“Measured Mineral Resource”is, in accordance with the CIM Standards, that part of Mineral Resource for which quantity, grade or quality, densities, shape, and physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information

10

gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity;

“Mineral Reserve”means, in accordance with the CIM Standards, that portion of a Measured Mineral Resource or an Indicated Mineral Resource that is economically mineable as demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A Mineral Reserve includes diluting materials and allowances for losses that may occur when the material is mined.

“Mineral Resource”is, in accordance with the CIM Standards, a concentration or occurrence of diamonds, natural solid inorganic material or natural solid fossilized organic material including base and precious metals, coal, and industrial minerals in or on the Earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge. The terms “Mineral Resource”, “Measured Mineral Resource”, “Indicated Mineral Resource”, “Inferred Mineral Resource” used in this Annual Report are Canadian mining terms as defined in accordance with NI 43-101 under the guidelines set out in the CIM Standards;

“NI 43-101”means National Instrument 43-101 – Standards of Disclosure for Mineral Projects, rules developed by the Canadian Securities Administrators (an umbrella group of Canada’s provincial and territorial securities regulators) that govern public disclosure by mining and mineral exploration issuers. The rules establish certain standards for all public disclosure of scientific and technical information concerning mineral projects;

“Ocupación Temporal”means an agreement analogous to a surface easement in that the area agreed upon with the surface rights holder is registered with the government and as such, the surface owner must allow the mining concession owner access and use;

“ore”is a naturally occurring material from which a mineral or minerals of economic value can be extracted at a profit under economic conditions that are specified and are generally accepted as reasonable, also, the mineral or minerals thus extracted;

“phenocrysts”are the larger crystals embedded in a finer-grained groundmass of surrounding igneous rock;

“Preliminary Economic Assessment”or“PEA”means a study that includes an economic analysis of the potential viability of Mineral Resources taken at an early stage of the project prior to the completion of a preliminary feasibility study;

“Preliminary Feasibility Study”means a comprehensive study of the viability of a mineral project that has advanced to a stage where the mining method, in the case of underground mining, or the pit configuration, in the case of an open pit, has been established, and which, if an effective method of mineral processing has been determined, includes a financial analysis based on reasonable assumptions of technical, engineering, operating, economic factors and the evaluation of other relevant factors which are sufficient for a Qualified Person, acting reasonably, to determine if all or part of the Mineral Resource may demonstrate that economic extraction can be justified;

“Probable Mineral Reserve”means, in accordance with the CIM Standards, the economically mineable part of an Indicated and, in some circumstances, a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified;

11

“Proven Mineral Reserve”means, in accordance with the CIM Standards, the economically mineable part of a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified;

“propylitic” is a hydrothermal chemical alteration of a rock, caused by iron and magnesium bearing hydrothermal fluids, altering biotite or amphibole within the rock groundmass. It typically results in epidote - chlorite-albite alteration and veining or fracture filling with the mineral assemblage along with pyrite:

“pyrophyllitic”rock containing pyrophillite, a relatively rare clay mineral formed during metamorphism;

“Qualified Person”is a term defined in NI 43-101 and means an individual who (a) is an engineer or geoscientist with a university degree, or equivalent accreditation, in an area of geoscience, or engineering, relating to mineral exploration or mining; (b) has at least five years of experience in mineral exploration, mine development or operation or mineral project assessment, or any combination of these, that is relevant to his or her professional degree or area of practice; (c) has experience relevant to the subject matter of the mineral project and the technical report; (d) is in good standing with a professional association; and (e) in the case of a professional association in a foreign jurisdiction, has a membership designation that (i) requires attainment of a position of responsibility in their profession that requires the exercise of independent judgment; and (ii) requires A. a favourable confidential peer evaluation of the individual’s character, professional judgement, experience, and ethical fitness; or B. a recommendation for membership by at least two peers, and demonstrated prominence or expertise in the field of mineral exploration or mining;

“RC”means a reverse circulation drill, a type of percussion drill used in mineral exploration, where a continuous flow of high pressure air is pumped to the bottom of the drill hole via the annulus of the double walled drill pipe, through the bit and back out of the drill hole via the center of the pipe, carrying the drill cuttings to surface free of contamination from the formations drilled;

“shear”is a fracture or fracture zone along which there has been differential movement of the sides relative to one another, typically leading to crushing, brecciation, and subsidiary fractures;

“tuff”is a general term for all volcanic rocks explosively or aerially ejected from a volcanic vent;

“UTM coordinates”means Universal Transverse Mercator coordinates, measured in metres from some fixed datum; and

“welded”is a term that refers to a tuff that has been indurated by the welding together of the glass shards that constitute the tuff.

CAUTIONARY NOTE TO U.S. INVESTORS REGARDING MINERAL RESOURCE AND MINERAL RESERVE ESTIMATES

As used in this Annual Report on Form 20-F, the terms “Mineral Reserve,” “Proven Mineral Reserve” and “Probable Mineral Reserve” are Canadian mining terms defined in accordance with NI 43-101 and the CIM Standards. These definitions differ from the definitions in SEC Industry Guide 7 under the U.S. Securities Act. Under SEC Industry Guide 7, a reserve is defined as that part of a mineral deposit which could be economically and legally extracted or produced at the time the reserve determination is made. Under SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

In addition, the terms “Mineral Resource,” “Measured Mineral Resource,” “Indicated Mineral Resource” and “Inferred Mineral Resource” are defined in and required to be used by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any all,

12

or any part of a mineral deposits in these categories will ever be converted into reserves. “Indicated Mineral Resource” and “Inferred Mineral Resource” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all, or any part, of an Indicated Mineral Resource or an Inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or preliminary feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an Inferred Mineral Resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade without reference to unit measures.

Accordingly, information contained in this Annual Report on Form 20-F and the exhibits filed herewith or incorporated by reference herein contain descriptions of our mineral deposits that may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under United States federal securities laws and the rules and regulations promulgated thereunder.

Further, the term “mineralized material” as used in this Annual Report on Form 20-F, although permissible under SEC Industry Guide 7, does not indicate “reserves” by SEC standards. We cannot be certain that any part of the mineralized material will ever be confirmed or converted into SEC Industry Guide 7 compliant "reserves". Investors are cautioned not to assume that all or any part of the mineralized material will ever be confirmed or converted into reserves or that mineralized material can be economically or legally extracted.

| | | | |

| C onversion T able | | | |

| | | | |

| Metric | | Imperial | |

| 1.0 millimetre (mm) | = | 0.039 inches (in) | |

| 1.0 metre (m) | = | 3.28 feet (ft) | |

| 1.0 kilometre (km) | = | 0.621 miles (mi) | |

| 1.0 hectare (ha) | = | 2.471 acres (ac) | |

| 1.0 gram (g) | = | 0.032 troy ounces (oz) | |

| 1.0 metric tonne (t) | = | 1.102 short tons (ton) | |

| 1.0 g/t | = | 0.029 oz/ton | |

Unless otherwise indicated, all dollar ($) amounts referred to herein are in Canadian dollars.

13

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This Annual Report on Form 20-F and the exhibits attached hereto contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements concern our anticipated results and developments in our operations in future periods, planned exploration and development of our properties, plans related to our business and other matters that may occur in the future. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. Statements concerning Mineral Reserve and Mineral Resource estimates may also be deemed to constitute forward-looking statements to the extent that they involve estimates of the mineralization that will be encountered if a property is developed, and in the case of Mineral Reserve, such statements reflect the conclusion based on certain assumptions that the mineral deposit can be economically exploited. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “estimates” or “intends”, or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” (or the negative and grammatical variations of any of these terms and similar expressions) be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements. Some of the important risks and uncertainties that could affect forward-looking statements are described further in the sections entitled “ITEM 3. D. KEY INFORMATION - Risk Factors”, “ITEM 4. B. INFORMATION ON KIMBER - Business Overview”, “ITEM 4. D. INFORMATION ON KIMBER - Property, Plants and Equipment” and “ITEM 5. OPERATING AND FINANCIAL REVIEW AND PROSPECTS” and in the exhibits attached to this Annual Report on Form 20-F. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in our forward-looking statements. Our forward-looking statements are based on beliefs, expectations and opinions of our management on the date the statements are made and we do not assume any obligation to update forward-looking statements if circumstances or management’s beliefs, expectations or opinions change, except as required by law. For the reasons set forth above, investors should not place undue reliance on forward-looking statements.

14

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not Applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIM ETABLE

Not Applicable.

ITEM 3. KEY INFORMATION

A. Selected Financial Data

We have summarized in the tables below selected consolidated financial data for Kimber. This information has been prepared under IFRS for the years ended June 30, 2012 and 2011.

For each of the fiscal years ended June 30 presented, the information in the tables was extracted from our consolidated audited financial statements for those years. The information contained in the selected financial data is qualified in its entirety by reference to the consolidated financial statements and related notes included in “ITEM 18. FINANCIAL STATEMENTS”, and should be read in conjunction with such financial statements and with the information appearing in “ITEM 5. OPERATING AND FINANCIAL REVIEW AND PROSPECTS”.

Under IFRS 2012 and 2011, (Selected Financial Information)

| | | | | | |

| | | Year | | | Year | |

| | | Ended | | | Ended | |

| | | June 30, | | | June 30, | |

| | | 2012 | | | 2011 | |

| | | $ | | | $ | |

| | | | | | |

| Current Assets | | 3,243,348 | | | 9,607,731 | |

| Equipment | | 598,354 | | | 549,084 | |

| Mineral interests | | 58,966,941 | | | 48,839,128 | |

| Total Assets | | 62,808,643 | | | 58,995,943 | |

| Current Liabilities | | 822,827 | | | 1,915,016 | |

| Total Liabilities | | 822,827 | | | 1,915,016 | |

| Share Capital | | 82,235,232 | | | 74,543,371 | |

| Share Option Reserve | | 5,072,985 | | | 4,292,758 | |

| Warrant Reserve | | 1,270,474 | | | 1,271,032 | |

| Deficit | | (26,592,875 | ) | | (23,026,234 | ) |

| Net Loss for the Period | | (3,566,641 | ) | | (2,967,411 | ) |

| Basic and Diluted Loss per Share | | (0.04 | ) | | (0.04 | ) |

| Weighted Average Number of Common Shares Outstanding | | 82,052,869 | | | 73,104,638 | |

Under IFRS applicable to junior mining companies, mineral exploration expenditures are deferred for mineral properties under exploration or development until such time as it is determined that further exploration or development is not warranted, at which time the property costs are written-off.

Except where otherwise indicated, all information extracted from or based on our consolidated financial statements are presented in accordance with IFRS for the years ended June 30, 2012 and 2011.

15

Dividends

No cash dividends have been declared nor are any currently expected to be declared in respect of our Common Shares. We anticipate that all available cash will be required to further our exploration activities for the foreseeable future. We are not subject to contractual restrictions respecting the payment of dividends.

Exchange Rates

Unless otherwise indicated, all reference to dollar ($ or C$) amounts in this Annual Report on Form 20-F are in Canadian dollars. References to US$ are to the United States dollar. The following table sets out the nominal noon exchange rates for one Canadian dollar expressed in terms of U.S. dollars for the periods indicated. Rates of exchange are obtained from the Bank of Canada.Bank of Canada exchange rates arenominal quotations- not buying or selling rates - and are intended for statistical or analytical purposes. Rates available from financial institutions will differ. The noon exchange rate for the Canadian dollar against the U.S. dollar is calculated to reflect the trades that take place between 11:59 a.m. and 12:01 p.m.

| | | | | |

| Period End and Average - C$ vs. US$ |

| | | | | |

| | June 30, | June 30, | June 30, | June 30, | June 30, |

| | 2012 | 2011 | 2010 | 2009 | 2008 |

| | | | | |

| Period End | 0.9822 | 1.0370 | 0.9429 | 0.8602 | 0.9817 |

| Average | 0.9968 | 1.0005 | 0.9474 | 0.8575 | 0.9897 |

| | | | | | |

| Monthly High and Low - C$ vs. US$ |

|

| | June | May | April | March | February | January |

| | 2012 | 2012 | 2012 | 2012 | 2012 | 2012 |

| | | | | | |

| High for Month | 0.9837 | 1.0173 | 1.0200 | 1.0161 | 1.0158 | 1.0034 |

| Low for Month | 0.9576 | 0.9647 | 0.9950 | 0.9965 | 0.9960 | 0.9713 |

As of September 26, 2012, the exchange rate for the conversion of one Canadian dollar into U.S. dollars was C$1.00 = US$0.9842.

B. Capitalization and Indebtedness

Not Applicable.

C. Reasons for the Offer and Use of Proceeds

Not Applicable

D. Risk Factors

We are subject to a number of significant risks due to the nature of our business and the present stage of our business development. Readers should carefully consider the risks and uncertainties described below before deciding whether to invest in our Common Shares. Our failure to successfully address the risks and uncertainties described below could have a material adverse effect on our business, financial condition and/or results of operations, and the trading price of our Common Shares may decline and investors may lose all or part of their investment. Estimates of mineralized material are inherently forward-looking statements subject to error. Although Mineral Resource estimates require a high degree of assurance in the underlying data when the estimates are made, unforeseen events and uncontrollable factors can have significant adverse or positive impacts on the estimates. Actual results will inherently

16

differ from estimates. The unforeseen events and uncontrollable factors include: geologic uncertainties including inherent sample variability, metal price fluctuations, variations in mining and processing parameters, and adverse changes in environmental or mining laws and regulations. The timing and effects of variances from estimated values cannot be accurately predicted.

The following risks should be considered:

Industry Risks

Mineral resource exploration and development is a high risk, speculative business.

Mineral resource exploration and development is a speculative business, characterized by a high number of failures. Substantial expenditures are required to discover new properties and to develop the infrastructure, mining and processing facilities at any site chosen for mining. Most exploration projects do not result in the discovery of commercially mineable ore deposits and no assurance can be given that any particular level of recovery or Mineral Reserves will in fact be realized by us or that any identified mineral deposit identified by us will ever qualify as a commercially mineable (or viable) ore body which can be economically and lawfully exploited.

Mineral exploration is subject to numerous industry operating hazards and risks, many of which are beyond our control and any one of which may have an adverse effect on our financial condition and operations.

The operations in which we have a direct or indirect interest are subject to all the hazards and risks normally incidental to resource companies. Fires, power outages, labour disruptions, flooding, explosions, cave-ins, landslides and the inability to obtain suitable or adequate machinery, equipment or labour are some of the industry operating risks involved in the operation of mines and the conduct of exploration programs. If any of these events were to occur, they could cause injury or loss of life, severe damage to or destruction of property. As a result, we could be the subject of a regulatory investigation, potentially leading to penalties and suspension of operations. In addition, we may have to make expensive repairs and could be subject to legal liability. The occurrence of any of these operating risks and hazards may have an adverse effect on our financial condition and operations, and correspondingly on the value and price of our Common Shares.

Metal prices have fluctuated widely in the past and are expected to continue to do so in the future which may adversely affect our ability to finance our exploration and development activities and may adversely affect the amount of revenues derived from any future production at our properties.

The commercial feasibility of our properties and our ability to arrange funding to conduct our planned exploration activities is dependent on, among other things, the price of gold and silver. Depending on the price to be received for any minerals produced, we may determine that it is impractical to commence or continue commercial production. A reduction in the price of gold or silver may prevent our properties from being economically mined or result in the write-off of assets whose value is impaired as a result of low precious metals prices.

Future revenues, if any, are expected to be in large part derived from the future mining and sale of gold and silver or interests related thereto. The prices of these commodities fluctuate and are affected by numerous factors beyond our control, including, among others:

international economic and political conditions,

expectations of inflation or deflation,

international currency exchange rates,

interest rates,

17

global or regional consumptive patterns,

speculative activities,

levels of supply and demand,

increased production due to new mine developments,

decreased production due to mine closures,

improved mining and production methods,

availability and costs of metal substitutes,

metal stock levels maintained by producers and others, and

inventory carrying costs.

The effect of these factors on the price of precious and base metals cannot be accurately predicted. If the price of gold and silver decreases, the value of our assets would be materially and adversely effected, thereby materially and adversely impacting the value and price of our Common Shares.

Exploration activities are subject to geologic uncertainty and inherent variability.

There is inherent variability between duplicate samples taken adjacent to each other and between sampling points that cannot be reasonably eliminated. There may also be unknown geologic details that have not been identified or correctly appreciated at the current level of delineation. This results in uncertainties that cannot be reasonably eliminated from the estimation process. Some of the resulting variances can have a positive effect and others can have a negative effect on mining and processing operations.

The quantification of Mineral Resources is based on estimates and is subject to great uncertainty.

Calculations of amounts of mineralized material are estimates only. Actual recoveries of gold and silver from mineralized material may be lower than those indicated by test work. Any material change in the quantity of mineralization, grade or stripping ratio, or the gold and silver price may affect the economic viability of our mineral properties. In addition, there can be no assurance that gold and silver recoveries in small-scale laboratory tests will be duplicated in larger scale tests under on-site conditions or during production. Notwithstanding pilot plant tests for metallurgy and other factors there remains the possibility that the ore may not react in commercial production in the same manner as it did in testing. Mining and metallurgy are an inexact science and accordingly there always remains an element of risk that a mine may not prove to be commercially viable.

Until a deposit is actually mined and processed, the quantity of Mineral Reserves, Mineral Resources and grades must be considered as estimates only. In addition, the quantity of Mineral Reserves and Mineral Resources may vary depending on, among other things, metal prices. Any material change in quantity of Mineral Reserves, Mineral Resources, grade, percent extraction of those Mineral Reserves recoverable by underground mining techniques or stripping ratio for those Mineral Reserves recoverable by open pit mining techniques may affect the economic viability of a mining project.

The deterioration of global financial markets has had a profound impact on the global economy, in general and on the mining industry in particular.

Many industries, including the precious and base metal mining industry, are impacted by global market conditions. Some of the key impacts of the recent financial market turmoil include contraction in credit markets resulting in a widening of credit risk, devaluations and high volatility in global equity, commodity, foreign exchange and precious metal markets, and a lack of market liquidity. A continued or

18

worsened slowdown in the financial markets or other economic conditions, including but not limited to, reduced consumer spending, increased unemployment rates, deteriorating business conditions, inflation, deflation, volatile fuel and energy costs, increased consumer debt levels, lack of available credit, changes in interest rates and tax rates may adversely affect our growth and profitability potential. Specifically:

a repeat of a global credit/liquidity crisis could impact the cost and availability of financing and our overall liquidity;

the volatility of gold and silver prices may impact our future revenues, profits and cash flow;

volatile energy prices, commodity and consumables prices and currency exchange rates impact potential production costs; and

the devaluation and volatility of global stock markets impacts the valuation of our equity securities, which may impact our ability to raise funds through the issuance of equity.

These factors could have a material adverse effect on our financial condition and results of operations.

Increased operating and capital costs may adversely affect the viability of existing and proposed mining projects.

Increases in the prices of labour and materials, to some extent caused by an increase in commodity prices, including the prices of the metals being mined by the industry, may lead to significantly increased capital and operating costs for mining projects. Increasing costs are a factor that must be built in to the economic model for any mining project. Significant increases in operating costs have had the effect of reducing profit margins for some mining projects. Accordingly increases in both operating and capital costs need to be factored into economic assessments of existing and proposed mining projects and may increase the financing requirements for such projects or render such projects uneconomic.

Company Risks

There may be substantial doubt regarding our ability to continue as a going concern.

Kimber’s consolidated financial statements for the year ended June 30, 2012 have been prepared on the basis that the Company is a going concern, which contemplates the realization of its assets and the settlement of its liabilities in the normal course of operations. Kimber has no sources of revenues and has operated at a loss since inception. As such, the ability of the Company to continue as a going concern is uncertain and is dependent upon obtaining financing necessary to meet its financial commitments and complete the development of its properties, and/or is dependent upon the Company realizing proceeds from the sale of one or more of its properties. The continuation of the Company as a going concern is dependent upon the continued financial support from its shareholders, the ability of the company to obtain necessary equity financing to continue operations, confirmation of the Company’s interests in the underlying properties, and the attainment of profitable operations.

We face substantial competition within the mining industry from other mineral companies with much greater financial and technical resources and may not be able to effectively compete which would have an adverse effect on our financial condition and operations.

The mineral resource industry is intensively competitive in all of its phases, and we compete with many companies possessing much greater financial and technical research resources. Competition is particularly intense with respect to the acquisition of desirable undeveloped gold and silver properties. The principal competitive factors in the acquisition of such undeveloped properties include having the staff and data necessary to identify, investigate and purchase such properties, and having the financial resources necessary to acquire and develop such properties. Competition could adversely affect our ability to acquire suitable prospects for exploration in the future.

19

Our exploration efforts may be unsuccessful.

Resource exploration and, if warranted, development is a speculative business, characterized by a number of significant risks, including, among other things, unprofitable efforts resulting not only from the failure to discover mineral deposits but also from finding mineral deposits, which, though present, are insufficient in volume and/or grade to return a profit from production.

There is no certainty that the expenditures that have been made and may be made in the future by us related to the exploration of our properties will result in discoveries of mineralized material in commercial quantities.

Most exploration projects do not result in the discovery of commercially mineable ore deposits and no assurance can be given that any particular level of recovery or Mineral Reserves will in fact be realized or that any identified mineral deposit will ever qualify as a commercially mineable (or viable) ore body which can be legally and economically exploited. Mineral Resource estimates are not indicative of actual gold and silver that can be mined.

If we are unable to develop acceptable overall gold and silver recovery levels, the Monterde Property may not be a viable project and we will have to continue to explore for a viable deposit or cease operations.

Recovery levels for gold and silver are based upon metallurgical testing of samples taken from drill samples. Numerous factors may affect the recoverability of gold and silver from any given rock and tests of such samples may not be representative of recoveries to be obtained from the entire deposit. Our overall metallurgical recoveries may not be adequate for the Monterde Property to be commercially viable.

We have a limited history as an exploration company and do not have any experience in putting a mining project into production.

We have been actively engaged in mineral exploration since 1999. We do not hold any Mineral Reserves and do not generate any revenues from production. Our success will depend largely upon our ability to locate and develop commercially viable Mineral Reserves, which may never happen. Further, putting a mining project into production requires substantial planning and expenditures and we do not have any experience in taking a mining project to production. As a result of these factors, it is difficult to evaluate our prospects, and our future success is more uncertain than if we had a longer or more proven history.

We have operated at a loss since inception, expect to continue to incur losses and may never achieve profitability, which in turn may harm the future operating performance and may cause the market price of our Common Shares to decline.

We have incurred net losses every year since inception on March 31, 1995 and as of June 30, 2012 had an accumulated deficit of $26,592,875. We incurred a net loss of $3,566,641 for the year ended June 30, 2012 and $2,967,411 for the year ended June 30, 2011. We currently have no commercial production and have never recorded any revenues from mining operations. We expect to continue to incur losses, and will continue to do so until such time, if ever, as our properties commence commercial production and generate sufficient revenues to fund continuing operations.

The development of new exploration or, if warranted, mining operations will require the commitment of substantial resources for operating expenses and capital expenditures, which may increase in subsequent years as we add, as needed, consultants, personnel and equipment associated with advancing exploration, development and commercial production of our properties. The amounts and timing of expenditures will depend on the progress of ongoing exploration and development, the results of consultants’ analyses and recommendations, the rate at which operating losses are incurred, the execution of any joint venture or other agreements with others in the future, our acquisition of additional properties, and other factors, many of which are unknown today and may be beyond our control. We may never generate any revenues

20

or achieve profitability. If we do not achieve profitability we will have to raise additional funds through future financings or shut down our operations.

Our title to our mineral properties and their validity may be disputed in the future by others claiming title to all or part of such properties.

Our properties consist of various mining concessions in Mexico. Under the Mexican law, the concessions may be subject to prior unregistered agreements or transfers, which may affect the validity of our ownership of such concessions. A claim by a third party asserting prior unregistered agreements or transfer on any of our mineral properties could have an adverse effect on the Company. Even if a claim is unsuccessful, it may potentially affect our current operations due to the high costs of defending against such claims and their impact on senior management's time.

Our properties are located in Mexico, which can lead to difficulty with changes in political conditions and regulations, currency exchange, obtaining financing, finding and hiring qualified people or obtaining all necessary services for our operations in M exico.

All of our properties, including our Monterde Property, are located in Mexico. Mexico has in the past been subject to political instability, changes and uncertainties, which, if they were to arise again, could cause changes to existing governmental regulations affecting mineral exploration and mining activities. Our mineral exploration and mining activities in Mexico may be adversely affected in varying degrees by changing government regulations relating to the mining industry or shifts in political conditions that increase the costs related to our activities or maintaining our properties. In addition, recent increases in kidnapping and violent drug related criminal activity in Mexico, and in particular Mexican States bordering the United States, may adversely affect our ability to carry on business safely.

The cost of exploration and future capital and operating costs are affected by foreign exchange rates for the Canadian dollar, United States dollar and Mexican peso. Fluctuations in foreign exchange rates for the United States dollar and Mexican peso versus the Canadian dollar could lead to increased costs reported in Canadian dollars or foreign exchange losses in respect to United States dollar or Mexican peso working capital balances held by us. There can be no assurance that foreign exchange fluctuations will not materially adversely affect our financial performance and results of operations.

It may be difficult for us to obtain necessary financing for our planned exploration or development activities because of their location in Mexico. Also, it may be difficult to find and hire qualified people in the mining industry who are situated in Mexico or to obtain all of the necessary services or expertise in Mexico or to conduct operations on our projects at reasonable rates. If qualified people and services or expertise cannot be obtained in Mexico, we may need to seek and obtain those services from people located outside of Mexico which will require work permits and compliance with applicable laws and could result in delays and higher costs to us to conduct our operations in Mexico.

The occurrence of the various foregoing factors and uncertainties cannot be accurately predicted and could have an adverse effect on our operations or future profitability.

We originally contemplated an open pit mining operation on the Carmen deposit at the Monterde Property, however we are currently contemplating the possibility of a combined open pit and underground mining operation, the effect of which, if it were to proceed to production, would expose us to increased costs, potential time delays and risks to underground workers.

The change in concept from an open pit to a combined open pit and underground mining operation would, if we proceed on this basis, expose us to the inherent risks of underground mining including increased costs, time delays in developing underground operations and safety issues. The development of any mine plan and feasibility study must take these factors into consideration and may negatively impact the viability of the project. If the Carmen deposit is not a viable project as a combined open pit/underground mine we would have to continue to explore for a viable deposit or cease operations.

21

We are subject to numerous government regulations which could cause delays in carrying out our operations, and increase costs related to our business.

Our mineral exploration and development activities are subject to various laws and regulations governing operations, taxes, labour standards and occupational health, mine safety, toxic substances, land use, water use, land claims of local people and other matters. No assurance can be given that new rules and regulations will not be enacted or that existing rules and regulations will not be applied in a manner which could limit or curtail exploration, development or production. Amendments to current laws and regulations governing operations, or more stringent implementation thereof could substantially increase the costs associated with our business or prevent us from exploring or developing our properties.

Amendments to current laws, regulations and permits governing operations and activities of mining and exploration companies, or more stringent implementation thereof, could have a material adverse impact on us and cause increases in exploration expenses, capital expenditures or production costs or reduction in levels of production at producing properties or require abandonment or delays in development of new mining properties.

Our activities are subject to environmental laws that may increase our costs and restrict our operations.

All of our exploration activities are in Mexico and are subject to regulation by governmental agencies under various environmental laws. These laws address emissions into the air, discharges into water, management of waste, management of hazardous substances, protection of natural resources, antiquities and endangered species and reclamation of lands disturbed by mining operations. Environmental legislation in many countries is evolving and the trend has been towards stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and increasing responsibility for companies and their officers, directors and employees. Compliance with environmental laws and regulations and future changes in these laws and regulations may require significant capital outlays and may cause material changes or delays in our operations and future activities. It is possible that future changes in these laws or regulations could have a significant adverse effect on the viability of the Monterde Property and the Carmen deposit or some other portion of our business, causing a re-evaluation of those activities.

We have not completed an environmental impact statement, nor have we received the necessary permits for water or explosives to conduct mining operations.

The department responsible for environmental protection in Mexico is SEMARNAT (Secretaria de Medio Ambiente y Recursos Naturales) and it has broad authority to shut down and/or levy fines against facilities that do not comply with applicable Mexican environmental regulations or standards.

Regulations require that an environmental impact statement, known in Mexico as aManifiesto de Impacto Ambiental or“MIA”, be prepared by a third-party contractor for submittal to SEMARNAT. An MIA is required prior to mine construction. Studies required to support the MIA include a detailed analysis of the following areas: soil, water, vegetation, wildlife, cultural resources and socio-economic impacts. The regulatory process in Mexico does not have a public review component but proof of local community support for a project is required to gain final MIA approval. A risk analysis must also be prepared in conjunction with the MIA for approval by SEMARNAT. To date this risk analysis has not been prepared

A number of other approvals, licenses and permits are required for various aspects of a mine’s development. The most significant permits for the development of the Monterde Property, other than MIA approval, are water rights concessions, or permits to extract water, issued by the National Water Commission (Comisión Nacional del Agua), and a permit for consumption, use and storage of explosives, or blasting permit, issued by the Mexican National Defence Secretariat (Secretaría de la Defensa Nacional).

22

Failure to obtain the necessary permits would adversely affect progress of our operations and would delay or could prevent the commencement of commercial operations.

The Monterde Property is located in the Sierra Madre mountains of Mexico which have been subject to episodes of unusually high rainfall in past years resulting in washouts and erosion of soil. Increased rainfall may result in increased costs and delays in operations.

Seasonal rains are a factor that must be considered when carrying on operations in areas such as the Sierra Madre where excessive rain fall may hamper operations. Some other companies carrying on operations in areas of heavy seasonal rains have been severely impacted by the rainfall and on occasion have been required to cease operations. If our operations are severely impacted by the weather, then we may be required to carry out remedial work and/or cease operations until the seasonal rains come to an end.

We depend on key personnel for critical management decisions and industry contacts but do not maintain key person insurance.

We are dependent on a relatively small number of key personnel, the loss of any of whom could have an adverse effect on our operations.

Our success is dependent to a great degree on our ability to attract and retain highly qualified management personnel. The loss of such key personnel, through incapacity or otherwise, would require us to seek and retain other qualified personnel and could compromise the pace and success of our exploration activities. We do not maintain key person insurance in the event of a loss of any such key personnel.

We do not have a full staff of technical personnel and rely upon outside consultants to provide critical services.

We have a relatively small staff and depend upon our ability to hire consultants with the appropriate background and expertise as they are required to carry out specific tasks. Our inability to hire the appropriate consultants at the appropriate time could adversely impact our ability to advance our exploration activities.

Certain of our directors also serve as officers and/or directors of other mineral resource companies, which may give rise to conflicts.

Certain of our directors and officers are also directors, officers and/or shareholders of other companies that are similarly engaged in the business of acquiring, developing and exploiting natural resource properties. Such associations may give rise to conflicts of interest from time to time. See ITEM 6. A. DIRECTORS SENIOR MANAGEMENT AND EMPLOYEES - Directors and Senior Management.

Our business involves risks for which we may not be adequately insured, if we are insured at all. In the course of exploration, development and production of mineral properties, certain risks, and in particular, unexpected or unusual geological operating conditions including rock bursts, cave-ins, fires, flooding and earthquakes may occur. It is not always possible to fully insure against such risks. We do not currently have insurance against all such risks and may decide not to take out insurance against all such risks as a result of high premiums or other reasons. Should such liabilities arise, they could reduce or eliminate any future profitability and result in increasing costs and a decline in the value of our securities.

Our activities are potentially subject to environmental liabilities, which would have an adverse effect on our financial condition and operations.

We are not aware of any claims for damages related to any impact that our operations have had on the environment but we may become subject to such claims in the future. An environmental claim could

23

adversely affect our business due to the high costs of defending against such claims and its impact on senior management's time.

A shortage of supplies and equipment could adversely affect our ability to operate our business.

We are dependent on various supplies and equipment to carry out our operations. The shortage of such supplies, equipment and parts could have a material adverse effect on our ability to carry out our operations and therefore have a material adverse effect on the cost of doing business.

Risks Related to Our Common Shares

We will need to raise additional capital through the sale of our securities, resulting in dilution to the existing shareholders, and if such funding is not available, our operations would be adversely effected.

We do not generate any revenues from production and do not have sufficient financial resources to undertake by ourselves all of our planned exploration programs. We have limited financial resources and have financed our operations primarily through the sale of our securities such as common shares. We will need to continue our reliance on the sale of our securities for future financing, resulting in potential dilution to existing shareholders.

Further exploration programs will depend on our ability to obtain additional financing which may not be available under favourable terms, if at all. If adequate financing is not available, we may not be able to commence development or continue with our exploration programs.

Future sales of our Common Shares into the public market by holders of our options and warrants may lower the market price, which may result in losses to our shareholders.

As of June 30, 2012, we had 82,459,937 Common Shares issued and outstanding. In addition, as of June 30, 2012, 6,221,965 Common Shares were issuable upon exercise of outstanding stock options, all of which may be exercised in the future resulting in dilution to our shareholders. Of these amounts, our senior officers and directors own, as a group, 6,343,324 Common Shares (7.69%), and stock options to acquire an additional 5,079,465 Common Shares. As of June 30, 2012 we may issue stock options to purchase an additional 1,492,843 Common Shares, (1.81%) under our existing stock option plan. Most of these Common Shares, including the Common Shares to be issued upon exercise of the outstanding options, are freely tradable.

Our 2007 stock option plan (the “2007 Plan”) provides for the reservation of a rolling 10% of the issued and outstanding Common Shares from time to time for the issuance of stock options, provided that the number reserved for issue is reduced by the number of options outstanding pursuant to the 2002 Plan. As of June 30, 2012, an additional 531,186 Common Shares (0.64% of the issued and outstanding Common Shares) can be reserved for issue under our 2007 Plan upon an additional listing application being made to and approved by the TSX and NYSE MKT.

In addition, as of June 30, 2012 there were 5,072,800 outstanding Warrants to purchase our Common Shares at an exercise price of $1.40 to $1.80 per share.

Sales of substantial amounts of our Common Shares into the public market, by our officers or directors or pursuant to the exercise of options or warrants, or even the perception by the market that such sales may occur, may lower the market price of our Common Shares.

24

We have no history of paying dividends, do not expect to pay dividends in the immediate future and may never pay dividends.

Since incorporation, we have not paid any cash or other dividends on our Common Shares and do not expect to pay such dividends in the foreseeable future. Our intention is that all available funds will be invested primarily to finance our mineral exploration programs.

Risks for U.S. Holders

U.S. investors may not be able to enforce their civil liabilities against us or our directors and officers.

It may be difficult to bring and enforce suits against us, because we are incorporated and situated in the Province of British Columbia, Canada and do not have assets located in the United States. With the exception of four (4) directors who are residents of the United States, our officers and directors are residents of the Canadian provinces British Columbia and Ontario, and all or a substantial portion of their assets are located outside of the United States. As a result, it may be difficult for our U.S. shareholders to effect service of process on us or these persons within the United States or to enforce judgements obtained in the United States based on the civil liability provisions of the U.S. federal securities laws against us or our officers and most of our directors. In addition, our U.S. shareholders should not assume that the courts of Canada (i) would enforce judgments of U.S. courts obtained in actions against us, our officers or directors predicated upon the civil liability provisions of the U.S. federal securities laws or other laws of the United States, or (ii) would enforce, in original actions, liabilities against us, our officers or directors predicated upon the U.S. federal securities laws or other laws of the United States.

As a foreign private issuer, our shareholders may have less complete and timely data.

We are a “foreign private issuer” as defined in Rule 3b-4 under the United States Securities Exchange Act of 1934, as amended (the “Exchange Act”). Our equity securities are accordingly exempt from Sections 14(a), 14(b), 14(c), 14(f) and 16 of the Exchange Act pursuant to Rule 3a12-3 of the Exchange Act.

Therefore, we are not required to file a Schedule 14A proxy statement in relation to the annual meeting of shareholders. The submission of proxy and annual meeting of shareholder information on Form 6-K may result in shareholders having less complete and timely information in connection with shareholder actions. The exemption from Section 16 rules regarding reports of beneficial ownership and purchases and sales of Common Shares by insiders and restrictions on insider trading in our securities may result in shareholders having less data and there being fewer restrictions on insiders’ activities in our securities.

We believe we were a Passive Foreign Investment Company during the fiscal year ended June 30, 2012 and may qualify as a Passive Foreign Investment Company in subsequent years, which could have negative consequences for U.S. investors.

Potential investors who are U.S. taxpayers should be aware that we believe that we were a Passive Foreign Investment Company (a “PFIC”) for our most recent taxable year and based on current business plans and financial projections, may qualify as a PFIC in subsequent years. See ITEM 10. E. ADDITIONAL INFORMATION - Taxation - Certain United States Federal Income Tax Considerations. If we are a PFIC for any year during a U.S. taxpayer’s holding period, then such U.S. taxpayer generally will be required to treat any so-called “excess distribution” received on our Common Shares, or any gain realized upon a disposition of Common Shares, as ordinary income and to pay an interest charge on a portion of such distribution or gain, unless the taxpayer makes a valid qualified electing fund (a “QEF”) election or a mark-to-market election with respect to our Common Shares. In certain circumstances, the sum of the tax and the interest charge may exceed the amount of the excess distribution received, or the amount of proceeds of disposition realized, by the taxpayer. A U.S. taxpayer who makes a QEF election generally must report on a current basis its share of our net capital gain and ordinary earnings for any year in which we are a PFIC, whether or not we distribute any amounts to our shareholders. A QEF election

25

will only be effective if we provide certain information to the U.S. holders. There can be no assurances we can, or will comply with these requirements. A U.S. taxpayer who makes the mark-to-market election generally must include as ordinary income each year the excess of the fair market value of the Common Shares over the taxpayer’s tax basis therein.

If we are (or have been) a PFIC and at any time we have a non-U.S. corporate subsidiary that is a PFIC, U.S. Holders generally would be deemed to own, and also would be subject to the PFIC rules with respect to, their indirect ownership interests in any such lower-tier PFIC. A mark-to-market election under the PFIC rules with respect to Kimber would not apply to a lower-tier PFIC, and a U.S. Holder would not be able to make such an election with respect to our indirect ownership interest in any lower-tier PFIC.

Differences in U.S. and Canadian reporting of Mineral Reserves and Mineral Resources

Our Mineral Reserve and Mineral Resource estimates are not directly comparable to those made in filings subject to SEC reporting and disclosure requirements, as we report Mineral Reserves and Mineral Resources in accordance with the Canadian requirements set forth in NI 43-101. NI 43-101 requires us to report Mineral Reserve and Mineral Resource estimates differently from the way such estimates are reported by U.S. issuers in reports and other materials filed with the SEC. Canadian reporting issuers like the Company are required to report Measured, Indicated and Inferred Mineral Resources, as defined in NI43-101, which are not permitted in disclosure filed with the SEC by United States issuers. In the United States, mineralization may not be classified as a "reserve" unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the Mineral Reserve determination is made. U.S. investors are cautioned not to assume that all or any part of measured or indicated Mineral Resources will ever be converted into Mineral Reserves.

Further, "Inferred Mineral Resources" have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Disclosure of "contained ounces" is permitted disclosure under Canadian regulations; however, the SEC permits issuers to report "resources" only as in-place tonnage and grade without reference to unit of metal measures.

Accordingly, information concerning descriptions of mineralization, Mineral Reserves and Mineral Resources contained in this Annual Report on Form 20-F may not be comparable to information made public by United States companies subject to the reporting and disclosure requirements of the SEC.

See the “Cautionary Note to U.S. Investors Regarding Mineral Reserve and Mineral Resource Estimates” above.

ITEM 4. INFORMATION ON KIMBER

A. History and Development of Kimber

Kimber Resources Inc., a Canadian junior exploration company, was incorporated on March 31, 1995 by registration of its Memorandum and Articles under the Company Act (British Columbia) (which was replaced by the BCBCA, the Company’s present governing legislation on March 29, 2004), which were amended effective on April 23, 1998, May 19, 1999, May 21, 2002, June 3, 2004 and December 21, 2007.

We became a reporting issuer under the applicable securities legislation of the provinces of British Columbia and Alberta on June 5, 2002 and our Common Shares were listed on the TSX Venture Exchange and commenced trading on July 16, 2002. We voluntarily delisted our Shares from the TSX Venture Exchange at the end of trading on June 17, 2004 and our Shares were listed and commenced trading on the TSX on June 18, 2004. We are also a reporting issuer in the Province of Ontario. On July 21, 2005 we filed an amended Form 20-F Registration Statement with the SEC and subsequently applied for and were listed on the American Stock Exchange (now the NYSE MKT). Trading of our Shares on the American Stock Exchange commenced on December 22, 2005.

26