UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): May 15, 2007

WEST COAST CAR COMPANY

(Exact Name of Registrant as Specified in Charter)

Delaware | 0-51312 | 54-2155579 |

| (State or Other Jurisdiction | (Commission File Number) | (IRS Employer |

| of Incorporation) | | Identification No.) |

45 Old Millstone Drive, Unit 6, East Windsor, NJ | 08520 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant's telephone number, including area code: (609) 4268996

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

£ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

£ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

£ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

£ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

TABLE OF CONTENTS

Item No. | | Description of Item | | Page No. |

| | | | | |

| Item 1.01 | | Entry Into a Material Definitive Agreement | | 3 |

| | | | | |

| Item 2.01 | | Completion of Acquisition or Disposition of Assets | | 6 |

| | | | | |

| Item 3.02 | | Unregistered Sale of Securities | | 67 |

| | | | | |

| Item 3.03 | | Material Modification of Rights of Security Holders | | |

| | | | | |

| Item 4.01 | | Changes in Registrant’s Certifying Accountant | | 68 |

| | | | | |

| Item 5.01 | | Change In Control of Registrant | | 69 |

| | | | | |

| Item 5.06 | | Change in Shell Company Status | | 70 |

| | | | | |

| Item 8.01 | | Other Events | | 70 |

| | | | | |

| Item 9.01 | | Financial Statements and Exhibits | | 70 |

CAUTIONARY NOTE REGARDING PREDICTIVE STATEMENTS

Our disclosure and analysis in this Current Report on Form 8-K contains statements that depend upon or refer to future events or conditions or that include words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates” and similar expressions. Although we believe that these statements are based upon reasonable assumptions, including projections of operating margins, earnings, cashflow, working capital, capital expenditures and other projections, they are subject to several risks and uncertainties, and therefore, we can give no assurance that such projections will be achieved.

Investors are cautioned that our statements are not guarantees of future performance and the actual results or developments may differ materially from the expectations expressed.

As for the statements that relate to future financial results and other projections, actual results will be different due to the inherent uncertainty of estimates, forecasts and projections and may be better or worse than projected. Given these uncertainties, you should not place any reliance on these statements. These statements also represent our estimates and assumptions only as of the date that they were made and we expressly disclaim any duty to provide updates to them or the estimates and assumptions associated with them after the date of this filing to reflect events or changes in circumstances or changes in expectations or the occurrence of anticipated events.

We undertake no obligation to publicly update any predictive statement in this Current Report, whether as a result of new information, future events or otherwise. You are advised, however, to consult any additional disclosures we make in our Form 10-K, Form 10-Q and Form 8-K reports to the SEC.

Unless otherwise noted, all currency figures in this filing are in U.S. dollars. References to “Yuan” or “RMB” are to the Chinese Yuan (also known as “renmimbi”). According to Xe.com, as of May 14, 2007, $1.00 = 7.681 Yuan.

Explanatory Note

This Current Report on Form 8-K is being filed by West Coast Car Company (“we”, “us” or the “Company”) in connection with (i) a transaction in which the Company acquired all the issued and outstanding shares of common stock of Shengtai Holding, Inc. in exchange for 9,125,000 shares of the Company’s common stock and (ii) a private placement in which the Company sold 8,750,000 shares of the Company’s common stock and warrants to purchase 4,375,000 shares of the Company’s common stock to certain investors as described below for $17.5 million.

Shengtai Holding, Inc. is a United States holding company for Weifang Shengtai Pharmaceutical Co., Ltd., a company incorporated and operating in the People’s Republic of China (“PRC”) which is in the business of manufacturing and supplying medical grade glucose products as well as other glucose and starch products used for food, beverage and industrial production.

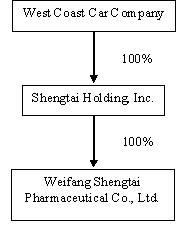

The Company’s current structure, after the aforementioned transactions, is set forth in the diagram below:

Item 1.01. Entry into a Material Definitive Agreement.

The Company entered into and consummated the following agreements:

The Share Exchange Agreement

On May 15, 2007, the Company entered into a share exchange agreement (the “Share Exchange Agreement”) with the shareholders of Shengtai Holding, Inc. (“SHI”), a New Jersey corporation. Pursuant to the Share Exchange Agreement, Messrs Qingtai Liu and Chenghai Du, shareholders of all the issued and outstanding shares of common stock of SHI, exchanged them for 9,125,000 newly-issued shares of the Company. The share exchange transaction closed on May 15, 2007.

Messrs Qingtai Liu and Chenghai Du became shareholders of 8,212,500 and 912,500 shares of common stock of the Company respectively.

The Share Purchase Agreement

On May 15, 2007 (the “Closing Date”), the Company entered into and consummated a share purchase agreement (the “Share Purchase Agreement”) with nineteen accredited investors (the “Purchasers”). Pursuant to the Share Purchase Agreement, the Purchasers purchased from the Company an aggregate of 8,750,000 shares of common stock (the “Placement Shares”) and 4,375,000 attached warrants (the “Warrants”) for $2.00 per share (the “Issue Price”) and for a total of $17,500,000 (the “Total Issue Price”). The exercise price of the Warrants $2.60 is per share and the term of the warrants is five years.

The following is a summary of the material terms of the Share Purchase Agreement and Warrants, which is qualified in its entirety by the text of the Share Purchase Agreement and Warrants annexed to this Current Report as Exhibit 10.2.

Warrant Call Rights

The Company may force the holders of all Warrants to exercise all, or the remaining portion of, any Warrant outstanding and unexercised at the exercise price of $2.60 in the event (i) the Volume Weighted Average Price of the Company’s common stock equals or exceeds $8.00 per share during any twenty (20) consecutive trading days and (ii) all shares for which the Warrant is exercisable are registered for resale by the holder of the Warrant.

Registration Statement

Within 45 days of the Closing Date (the “Filing Date”), the Company is required to file a Registration Statement on Form S-1 (or such other form as may be applicable) to register the resale by the Purchasers of the Placement Shares and common stock for which the Warrants are exercisable (the “Warrant Shares”). If the Registration Statement is not filed by the Filing Date, damages are to be paid to each Purchaser in cash in an amount equal to 1.0% of the purchase amount subscribed for by such Purchaser. Such amounts are to be paid each month until the Registration Statement is filed.

If the Registration Statement is not declared effective within 200 days of the Closing Date (the “Effective Date”), the Company is to pay liquidated damages to the Purchasers. Such damages shall be paid in cash to each Purchaser in the amount equal to 0.50% of the purchase amount subscribed for by such Purchaser. Such 0.5% damage amount is to be paid monthly until the Registration Statement is declared effective, provided, however, that the Company shall not have any obligation to pay liquidated damages pursuant to this provision for any delay arising from (i) issues raised by the SEC relating to Rule 415 of the Securities Act, as amended, or to the structure of the sale and resale of the Securities to be registered, (ii) information required from person or entities other than the Company or its subsidiary, or (iii) issues resulting from or relating to acts or omissions of persons or entities other than the Company or its subsidiary. The liquidated damages, together with the damages arising from a Maintenance Failure (as defined below), are subject to a cap of 10% of the purchase price paid by the Purchasers (the "Registration Damages Cap").

In addition to the obligation to file an initial Registration Statement, the Company is obligated to file subsequent Registration Statements (each a “Subsequent Registration Statement”), in the event all Placement Shares and Warrant Shares cannot be registered for resale in the initial Registration Statement, until all such shares have been registered for resale. The Subsequent Registration Statements are to be filed at the earliest dates permissible under then current SEC guidance (each, a “Relevant Date”) and the Purchasers’ shares shall be registered for resale pro-rata to their investment in each Subsequent Registration Statement. If any Subsequent Registration Statement is not filed by the Relevant Date, liquidated damages equal to the amount of 1.0% of the purchase amount of the remaining unregistered Placement Shares and Warrant Shares shall be paid pro-rata in cash to the Purchasers on the first business day after the Relevant Date, and on each monthly anniversary of said date (applied on a daily pro rata basis) until the Subsequent Registration Statement is filed, provided, however, that the Company shall not have any obligation to pay liquidated damages pursuant to this provision for any delay arising from (i) issues raised by the SEC relating to Rule 415 of the Securities Act, as amended, or to the structure of the sale and resale of the Placement Shares and Warrant Shares, (ii) information required from person or entities other than the Company or its subsidiary, or (iii) issues resulting from or relating to acts or omissions of persons or entities other than the Company or its subsidiary. These liquidated damages, are also subject to the Registration Damages Cap.

If a Subsequent Registration Statement is not declared effective within 200 days of the Relevant Date, liquidated damages are to be paid in cash pro-rata to the Purchasers holding unregistered Placement Shares and Warrant Shares in an amount equal to 0.50% of the purchase price of the remaining unregistered Placement Shares and Warrant Shares subscribed for by the Investors monthly until the Registration Statement is declared effective; provided, however, that the Company shall not have any obligation to pay liquidated damages pursuant to this provision for any delay arising from (i) issues raised by the SEC relating to Rule 415 of the Securities Act, as amended, or to the structure of the sale and resale of the Securities, (ii) information required from person or entities other than the Company or its subsidiary, or (iii) issues resulting from or relating to acts or omissions of persons or entities other than the Company or its subsidiary. These liquidated damages, are also subject to the Registration Damages Cap.

The Company is obligated to keep all Registration Statements and Subsequent Registration Statements effective and (b) disclose such information as is necessary for sales to be made pursuant to such Registration Statement or Subsequent Registration Statement, as applicable. The failure to do so will subject the Company to liquidated damages equal to 0.50% of the Purchaser’s purchase price of the Placement Shares and Warrant Shares permitted to be registered for the first ninety (90) days and thereafter, 1% from the ninety-first day thereafter (a “Maintenance Failure”).

Make Good Provisions

In the event the consolidated financial statements of the Company prepared in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”) reflect less than $7,000,000 of After-Tax Net Income (“ATNI”) or fully diluted earnings per share (“EPS”) of $0.33 for the fiscal year ending December 31, 2007 (the “First Guaranteed NI”), the Company shall cause its management to transfer to the Purchasers, on a pro-rated basis, and for no purchase price, 2,500,000 shares of common stock owned by said management (the “2007 Make Good Shares”).

Similarly, in the event the U.S. GAAP consolidated financial statements of the Company reflect less than $9,000,000 of ATNI, or EPS of $0.43 for the fiscal year ending December 31, 2008 (the “Second Guaranteed NI”), the Company shall cause its management to transfer to the Purchasers, on a pro-rated basis and for no purchase price, 2,500,000 shares of common stock owned by said management (the “2008 Make Good Shares”).

Mr. Qingtai Liu placed the 2007 Make Good Shares and the 2008 Make Good Shares in an escrow account held with Tri-State Title & Escrow, LLC upon closing of the Share Purchase Agreement .

Lock-Up

Mr. Qingtai Liu entered into a “lock-up” agreement pursuant to which he, and his wife and daughter have agreed not to offer, pledge, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, sell a stock short, grant any option, right or warrant to purchase, lend or otherwise transfer or dispose of any of their shares of common stock of the Company or enter into any swap or other arrangement that transfers any economic consequences of ownership of such shares of common stock for the period commencing on the Closing Date under the Stock Purchase Agreement, continuing through the Effective Date of the initial Registration Statement filed by the Company and ending twelve (12) months thereafter.

Right of First Refusal

From the Closing Date of the Stock Purchase Agreement and continuing for the longer of (a) a period of one (1) year following the Effective Date of the initial Registration Statement covering the resale of the Placement Shares and Warrant Shares, or (b) two years following the Closing Date, the Company shall give the Purchasers the right of first refusal on any placement or offering of any future debt or equity securities (the “Future Securities”). The Company is to notify the Purchasers of the Future Securities, and, so long as a Purchaser wishes to negotiate the purchase of the Future Securities, the Company shall for a period not exceeding ten (10) business days, in good faith, negotiate with the Purchaser to issue the Future Securities to the Purchaser on such terms as the parties may agree.

Item 2.01 Completion of Acquisition or Disposition of Assets.

On May 15, 2007, the Company acquired all of the outstanding capital stock of SHI as described in Item 1.01 under “The Share Exchange Agreement.” Because SHI owns 100% of Weifang Shengtai Pharmaceutical Co., Ltd (“Weifang Shengtai”), a corporation organized and existing under the laws of the PRC, Weifang Shengtai is now an indirect wholly-owned subsidiary of the Company.

Weifang Shengtai is a privately-held corporation engaged in the business of the manufacture and supply of medical grade glucose products as well as other glucose and starch products used for food, beverage and industrial production.

As set forth in the following diagram, following the closing of the Share Exchange Agreement, SHI is now a wholly-owned subsidiary of the Company and Weifang Shengtai, in turn, is now a subsidiary of SHI.

BUSINESS

Our History

In March 2004, the Company was incorporated in the State of Delaware as West Coast Car Company. In the State of California, the Company has operated as West Coast Car Company d/b/a So Cal Car Company.

We were previously a pre-owned retail automobile dealership in Southern California. We were doing business as So Cal Car Company and commenced operations in Temecula, California in November 2004.

Robert Worthington, our ex-President, had been licensed to sell used cars and motorcycles by the State of California. Prior to his affiliation with us, he sold more than 83 vehicles through private party transactions.

The Company operated as a "traditional" pre-owned dealership, whereby it sought out vehicles from various sources, such as auctions, private parties, wholesalers, etc. and then sell the vehicles to the general public. The Company generally acquired the vehicles prior to identifying a buyer. Where appropriate, the Company had third parties repair, modify or enhance cars before sale.

SHI’s and Weifang Shengtai’s Organizational History

SHI was incorporated in the state of New Jersey on February 27, 2006. The Company now, through its PRC subsidiary Weifang Shengtai Pharmaceutical Co., Ltd. (hereinafter known as “Weifang Shengtai”) manufactures and supplies medical grade glucose products as well as other glucose and starch products used for food, beverage and industrial production.

Weifang Shengtai was established in Changle County, Weifang City, Shandong Province, PRC on February 4, 1999 and Mr. Qingtai Liu and Weifang Shengtai’s management were the original shareholders. These shareholders used Weifang Shengtai to acquire all the assets (which include both production equipment and 150,000 sq. meters of land) of Weifang Fifth Pharmaceutical Plant, a former PRC state-owned enterprise which defaulted on an approximate $5 million bank loan and which had its pledged assets taken over by the lending bank, for $775,000.

In 2006, SHI was formed as a holding company for Weifang Shengtai and SHI acquired the shares of Weifang Shengtai for cash.

Consequently, Weifang Shengtai became a Wholly Foreign Owned Entity or “WFOE” and obtained the approval of the local branch of the Ministry of Commerce in the City of Weifang on June 21, 2006. Its business term is 20 years starting on February 10, 2004, the date of approval of a previous joint venture which was not pursued. Weifang Shengtai’s registered capital is RMB32 million (approximately $3.92 million) of which $1,925,996 remains to be contributed by a deadline of June 21, 2007. This balance has already been sent to the Company from the money that was raised under the Share Purchase Agreements.

Overview of Weifang Shengtai’s Business

Weifang Shengtai manufactures and supplies pharmaceutical grade glucose used for medical purposes, as well as glucose and starch products for the food and beverage industry and for industrial production, in the PRC. The D-glucose form of glucose (also called dextrose) is one of the most important carbohydrates in biology and is the chief source of energy in the human body. As such it is used in a wide array of pharmaceutical products such as transfusions and intravenous drips.

The Company believes that the market for pharmaceutical grade glucose (dextrose) is approximately 3 billion bottles per year and growing (Source: China Medical Glass Bottle website, www.bbmt.com, report titled “The International Big Infusion Drugs Plastic Packing Market is Huge” dated September 29, 2006). In PRC alone, the demand for glucose has increased significantly - from 2002-2004, it increased from 250,000 tons to 800,000 tons per year, and the annual demand for glucose is expected to increase to 1.7 million tons per year by 2009 (Source: An extract from “Analysis on Present Situation and Prospect of Chinese Starch Sugar Industry” published by Starch and Sugar, Volume I of 2007)

In addition to its pharmaceutical glucose series of products, Weifang Shengtai also produces the other medicinal product lines set forth below and glucose and starch products such as Industrial glucose, Syrup, Starch, Avermectins, Dextrin, Maltose and Maltitol, which are used for food, beverage and industrial production

Products

Weifang Shengtai manufactures two categories of products.

| (i) | Pharmaceutical and medicinal grade products |

These products are the Company’s major products:

| | · | Dextrose Monohydrate Series |

Dextrose Monohydrate Transfusion (25kg/bag)

Dextrose Monohydrate Oral in big bags (720kg/bag)

Dextrose Monohydrate Oral in small bags (25kg/bag)

Dextrose Anhydrous (25kg/bag)

Dextrose Monohydrate Oral for export (25kg/bag)

Dextrose Monohydrate transfusion for export (25kg/bag)

Dextrose Anhydrous for export (25kg/bag)

| | · | Starch, Dextrin, Polypropylene Resin II, Polypropylene Resin III, and Polypropylene Resin IV |

Weifang Shengtai also supplies the following glucose and starch products to the pharmaceutical and hospital markets:

Multivitamin glucose (500g/bag)

Glucose base solution

Pharmaceutical grade starch (25kg/bag)

| (ii) | Raw Materials for the Food, Beverage and Processing Industries |

Weifang Shengtai produces raw materials for the food, beverage and processing industries:

Industrial glucose

Industrial glucose for export

Syrup for export

Starch for export

Avermectins

Dextrin

Dextrin for export

Avermectins Ointment

Avermectins refinement

Maltose

Maltitol

Sale of Products by Type and Geographic Locations

Most of Weifang Shengtai’s products are sold in the PRC, with an approximately 15% of the products being sold internationally. Sales are carried out directly by Weifang Shengtai’s sales personnel and it is not dependent on distributors or middlemen.

Below is a breakdown of the principal products sold by the Company in different geographic locations over the previous three fiscal years and the revenues attributed to such sales.

Sales by Product | | FY 6/30/2004 (Revenue) ($) | | FY 6/30/2005 (Revenue) ($) | | FY 6/30/2006 (Revenue) ($) | |

Dextrose Monohydrate Domestic International | | | 5,663,189 — | | | 9,655,570 207,293 | | | 9,474,787 1,363,569 | |

Dextrose Anhydrate Domestic International | | | 579,433 — | | | 1,606,832 256,261 | | | 762,238 534,253 | |

Pharmaceutical Grade Oral Glucose Domestic International | | | 12,068,635 — | | | 9,892,962 1,000,550 | | | 16,578,570 2,824,816 | |

Industrial Grade Oral Glucose Domestic | | | 665,648 | | | 1,452,959 | | | 2,003,386 | |

Corn Starch Domestic International | | | — — | | | 265,223 2,359 | | | 946,436 1,933 | |

Delivery Methods

Weifang Shengtai utilizes the following delivery methods: ground transportation, shipment by sea and by rail. Products sold internationally are shipped by sea. Approximtely 80% of the Company’s products are delivered by ground transportation. Weifang Shengtai generally bears the costs and risks of transportation unless a customer specifies a particular mode of delivery.

The Glucose Production Process

Weifang Shengtai’s glucose is made from enzyme-converted cornstarch. Glucose produced by Weifang Shengtai has the following characteristics: low heat, endotoxin in bacteria lower than 0.125Eu/ml, high purity, and a production standard of lower than 0.06Eu/ml.

The steps required to produce glucose from cornstarch are:

| | 1. | The cornstarch is converted into an emulsion; |

| | 2. | Alpha-Amylase Glucoamylase is added; |

| | 3. | The emulsion from the chemical reaction of the two is cleaned and dried after filtering, discoloring, ion exchange, inspissation, crystallization and separation; and |

| | 4. | The cleaned and dried end-product of the above process is glucose |

Under normal operating conditions, the finished product rate is 100%, with no rejects and wasted products. In case of a power outage or equipment malfunction, sub-standard output is detected by our quality control procedures, and is placed back into the production process for re-processing.

Major Suppliers

The three principal ingredients for glucose production are starch, enzyme preparations and active carbon. The major suppliers for these raw materials are as follows:

Starch

Shouguang Shengtai Starch Company Ltd (“Shougang Shengtai”) is our main supplier of starch. Shouguang Shengtai is a contracted production facility. Mr. Qingtai Liu, our Chief Executive Officer and President, owns 40% of the stock of Shouguang Shengtai and manages Shougang Shengtai pursuant to a management contract. Shouguang Shengtai supplies cornstarch to Weifang Shengtai based on sales contracts, but there is no long-term supply agreement between Shouguang Shengtai and Weifang Shengtai. This contracted production facility has been used for the past five years to ensure stable supplies of quality starch to Weifang Shengtai. It represented approximately 77%, 81% and 86% of Weifang Shengtai’s purchases of cornstarch for the years ended June 30, 2006, 2005 and 2004, respectively.

Enzyme Preparations

Weifang Shengtai purchased a total of 369 tons of enzyme preparations from its sole supplier for the past three years, Novozymes (China) Biotechnology Co. Ltd, a Wholly Foreign Owned Enterprise of Novozymes, a Danish company. Although we have not purchased enzyme preparations from any other source, there are numbers other suppliers from which we can make purchases.

Active Carbon

Fujian Sha County Qingshan Chemical Carbon Corporation, is one of the major active carbon producers in the PRC. Weifang Shengtai purchased a total of 4,100 tons of active carbon from Fujian Sha County Qingshan Chemical Carbon Corporation over the past three years. There are numerous other suppliers of a active carbon from which we can make purchases. if necessary.

Weifang Shengtai is not dependent on any one supplier for raw materials and machinery nor has it ever experienced a shortage of supply of raw materials or machinery.

New Cornstarch Manufacturing Facility

Weifang Shengtai is in the process of building a new cornstarch production complex with annual production capacity of 300,000 tons. The new complex is next to our existing glucose production plant. Although it is partially completed, it has started producing cornstarch. When completed, we believe its production capability will be in excess of 2.5 times the 120,000 ton per year production capacity of Shougang Shengtai. The new cornstarch production facility was commissioned at the end of 2006 and started production in January 2007. Currently, the production capacity of the new cornstarch production plant is 240,000 tons per year.

The new cornstarch facility will allow us to supplement and eventually replace our purchases from Shougang Shengtai, which has inadequate production to meet our needs. In addition, Shougang Shengtai utilizes older equipment which leads to unpredictable quality and it is approximately 60 kilometers from our facility and has resulted in additional shipping costs, which resulted in higher manufacturing costs.

Because Weifang Shengtai was managing Shougang Shengtai, we believe that our management will be able to make a smooth transition to manufacturing our own cornstarch.

During Calendar 2007, approximately 50% of the new cornstarch production plant’s output (i.e. 150,000 tons per year) will be used as raw materials for glucose production, and the other 50% will be sold to customers in the food, beverage, pharmaceutical and industrial industries.

Our cornstarch production complex consists of the following parts:

| | · | Cornstarch production line |

| | · | Warehouse for finished product (cornstarch) |

| | · | Logistical and delivery coordination center |

| | · | Environmentally friendly waste water treatment facilities |

The new cornstarch production has the following benefits:

| | · | Low-cost and stable supply of high-quality raw materials for glucose production |

| | · | The stable supply of cornstarch will enable Weifang Shengtai’s existing glucose production plant to operate at full capacity |

| | · | Reduced transportation costs of raw materials |

| | · | Quality assurance of cornstarch since we are producing our own cornstarch |

Glucose Manufacturing Facility Upgrade

Weifang Shengtai plans to upgrade its existing glucose production facility by replacing its old machinery to produce more complex glucose products such as such as anhydrous glucose transfusion, monohydrate glucose transfusion and oral glucose.

After this upgrade, at least 70% of the cornstarch produced by the new cornstarch production plant will be used as raw materials for glucose production. This upgrade will also allow for an increased production capacity of glucose.

Quality Control

Weifang Shengtai’s production facilities are fully certified for cGMP, ISO9002 and HACCP international quality standards. The rate of quality output (output conforming to pharmaceutical-grade glucose product specifications) is maintained at 100% because non-conforming products can be reprocessed.

A three-tier quality control system (production team level, workshop level, and management accountability for quality) ensures that all products are produced in a pollution-free, contamination-free and efficient production environment following strict quality-oriented procedures:

| | 1. | A team of workers on-duty is responsible for the smooth operation of the production process by adhering to proper procedures. The intermediate output from each production step is sampled and checked to ensure that the final output is of specified quality standards. |

| | 2. | Equipment is checked regularly and maintained to ensure proper operation. The quality of the water used in the production process is regularly checked as well. The level of airborne particles and microbes in the production sites is regularly checked to eliminate contamination. |

| | 3. | The quality of all output is reviewed by the General Manager of the Quality Control Department, and ultimately approved by the CEO. A full set of written quality control records is maintained. |

The qualities of the Company’s manufactured glucose can be summarized as follows:

Properties: white crystal, granular powder, odorless, sweet taste, easy soluble in water, slightly soluble in alcohol

Specific rotatory power: +52.0 degrees--- +53.5degrees

Dry loss: ≤9.5%

Chloride: <0.02%

Sulfate: <0.02%

Alcohol-insoluble matter: ≤5mg

Ferrous salt: <0.002%

Ignition residue: 0.08%

Heavy metal: ≤20ppm

Arsenide: <2ppm

Sulfite and soluble starch: appear yellow when added to an iodine test solution.

The qualities of the Company’s Dextrose Monohydrate Transfusion (Liquid glucose) may be summarized as follows:

Perceptual index:

Appearance: colorless without the impurity that can be seen by naked eye

Odor: no unusual odor

Taste: Clear sweet

Physical and chemical index

Solid substance: more than 84%

DE: 38-42

PH: 4.6 -6.0

Maltose content: 8% - 20%

Transmittance (426nm): more than 94

Coke Temperature: more than or equal to 125

Ash: no more than 0.3%

Hygienic index:

As: not more than 0.5mg/Kg

Pb: not more than 0.5mg/Kg

Bacterium total: not more than 1,000/g

E. coli: not more than 30/100g

Pathogen: No

Market Analysis

Industry Overview and Trends

The pharmaceutical transfusion was first put to use in 1832. In the past 160 years, clinical transfusion has grown from its rather limited choice of original physiological brine to more than 200 different kinds of transfusion media.

The diverse range of transfusion media could be grouped into five categories:

| | · | Body fluid balance (Isohydria) |

| | · | Therapeutic transfusion (including herbal transfusion) |

Dextrose Monohydrate is widely used in the medical and clinical environment for restorative and nutritional purposes. For example, a solution of pure glucose (Dextrose or D-glucose) has been recommended for use by subcutaneous injection as a restorative measure after major operations or as a nutritive measure in debilitating diseases.

Dextrose Monohydrate is widely used in hospitals and clinical institutions in the PRC and is covered by the PRC Government-subsidized Medical Insurance Scheme.

Glucose exists in nature in many forms in nature, including plants, fruits, in honey and animal products. In humans, every 100ml of blood typically contains 80-120 mg glucose. Glucose is the ingredient for many saccharide compounds such as saccharose, maltose, starch, glycogen and vitamins. The properties of glucose are summarized as: white crystal with sweet taste, easily soluble in water, difficult to dissolve in alcohol, insoluble in organic solvents such as ether, chloroform and neutral reaction to litmus.

Liquid glucose is a transparent and viscous liquid, and is produced by the action of enzymes on refined cornstarch. Glucose is formed by the hydrolysis of many carbohydrates, including sucrose, maltose, cellulose, starch and glycogen. Fermentation of glucose by yeast produces ethyl alcohol and carbon dioxide. Glucose is made industrially by the hydrolysis of starch under the influence of diluted aid, or more commonly, under that of enzymes.

Glucose is used for many different purposes, e.g. as being one of the raw materials for food and beverages, or as a substitute for sucrose. With the technological advances in food and beverage production, and as also in response to the demand from consumers for healthier food and drinks, producers are using more and more glucose as a raw material. Glucose is also used in veterinary medicine as a carrier of animal medicines.

Glucose is used by the pharmaceutical and chemical industries in a variety of ways. By using different reaction mechanisms, different types of chemical compounds are produced, - using the self-oxidation and combination mechanism to produce calcium gluconte, zinc gluconate, and glucorone; using the hydroreduction mechanism to produce sorbic alcohol and mannoalcohol, or to produce Vitamin B2, glutamine, ribose, and other vitamins.

World Pharmaceutical Market

The world markets for pharmaceutical products are growing at a significant rate and are projected to continue to do so in the immediate future. Pharmaceutical Market Trends, 2006-2010 by BioPortfolio showed the global pharmaceutical market forecast increasing 6.9% in aggregate over the next five years to $842 billion in 2010.

The Pharmaceutical Business Review reported, “Positive economic growth, stabilizing political structures, growing patient populations, and increasing direct foreign investment in the emerging markets of Brazil, Russia, India and China (BRIC) are creating significant opportunities for pharmaceutical companies to expand into these markets and maximize future revenue potential. Pharmaceutical sales across the BRIC economies grew by 22.3% in 2005, compared to single digit growth in the major markets of the US, Europe and Japan.”

According to IMS, a leading forecast provider of market intelligence to the pharmaceutical and healthcare industries, 2005 total global pharmaceutical sales grew 7% at constant exchange rates, to $602 billion. In the ten major markets, audited growth was 5.7% in 2005. IMS audits covers 95% of the market, while the remaining 5% are estimates.

The PRC Pharmaceutical Market

With annual growth rates in the PRC pharmaceutical industry exceeding 15% per year, the PRC has become a critically important market (see “China’s Pharmaceutical Market is World’s Ninth Largest” , October 22, 2005, available on www.100md.com). Demand for better drugs and medical equipment is driving this market. The Company believes it will continue to grow as the country modernizes and provides healthcare to a population of 1.3 billion people. The population of the PRC is served by approximately 310,000 medical and clinical institutions.

The PRC is one of the top 10 emerging pharmaceutical markets of the world, and is the second largest market in Asia after Japan as reported in an article dated May 6, 2005 titled “Experts Forecast China will become the World’s Fifth Biggest Medicine Market in 2010” on the Chinese Small-Medium Enterprises website (http://www.ynetc.gov.cn/Article_Show.asp?ArticleID=387). By 2010, it is believed the PRC will become world’s fifth largest pharmaceutical market after the USA, Japan, Germany, and France according to a report dated November 13, 2002 titled “Asia Pacific Medical Industrial Council Forecasts China will become the World’s Fifth Largest Pharmaceutical Market by 2010” on People’s Website (www.people.com.cn). It is projected that the Chinese pharmaceutical market would be valued at $75 billion by 2010, accounting for 10% of global demand, and $120 billion by 2020 (Source: www.http://managert.bokee.com/4173614.html).

The value of PRC pharmaceutical goods produced in 1970 was only $21.7 billion. (as reported on the Szechuan News Website, www.newssc.org, in an article titled “Discussion on the Development and State of China’s Pharmaceutical Industry”). Currently the PRC pharmaceutical market produces goods with a value of over $54.6 billion, according to an article in the July/August 2006 edition of the magazine Pharmaceutical Manufacturing. The PRC produces a little less than 25% of what is produced by the U.S. pharmaceutical market, which is valued at $240 billion. Projections show that the total value of global pharmaceuticals will expand to $750 billion in 2010 (Source: Western Medical People website (www.yd210.com)).

IMS reported that the total pharmaceutical market will expand at a compound annual growth rate of 5-8% over the next five years. North America and Europe are each projected to grow at a 5-8% pace; Asia Pacific/Africa, 9-12%; Latin America, 7-10%; and Japan, 3-6%. Emerging markets including the PRC, Korea, Mexico, Russia and Turkey, will all experience double-digit growth, outpacing global performance and signaling important shifts in the marketplace.

We believe that the global demand for pharmaceuticals is likely to continue to increase; with developing countries now being economically more prosperous and capable of spending more money on improving health care.

Major Import and Export Markets for Pharmaceutical Products

The major producers of chemical pharmaceutical raw materials are Western Europe, North America, Japan, China and India. Western Europe is a net exporter exporting 50% of its total production. North America is a major importer, with its own products only able to satisfy 20% of its total demand. Japan is believed to be evolving to become a net importer. The PRC and India have emerged into two major exporters for pharmaceutical raw materials, exporting 30-40% of its total output. (Source: Article titled “2002-2003 Analysis of the World’s Pharmaceutical Market” as reported on the Shanghai Information Services Platform website, http://www.istis.sh.cn/)

The total annual chemical drug-base production of the PRC is approximately 500,000 tons, consisting of raw materials for the production of anti-biotic, vitamins, pain-killers and hormonal and other drugs, and is second only to United States. The PRC and India are emerging as the major exporters in these product and raw material categories.

The Pharmaceutical Raw Material Manufacturing Industry in the PRC

The PRC, as a country, has put a lot of emphasis on the production of pharmaceutical raw materials in the past 40-50 years. Additionally, in the past ten years, a number of large international pharmaceutical companies have moved their productions to the PRC, such as Cargill, CPI and Roquette. Both factors have contributed to the growth of this specific segment in the PRC.

This industry segment can be categorized into three groups: first, the state-owned or government-subsidized pharmaceutical companies taking up 30% of market share; second, the foreign-owned or Sino-foreign Joint ventures taking up 60% of market share, and with the bulk of smaller firms competing for the remaining 10%. Weifang Shengtai falls into the second category.

Market Analysis and Projections for Clinical Transfusion Products in the PRC

Transfusion solutions are one of most commonly used clinical prescriptions in hospitals and health care institutions. Dextrose Monohydrate is one of the five most important types of medical prescriptions in the PRC and is one of the most widely used pharmaceutical product.

The total production volume of transfusion solutions grew from 1.38 billion bottles in 1995 to 2.91 billion bottles in 2001, i.e. annual growth of around 16.1% (source: http://www.chinapharm.com.en/html/scfx/20034815219.html). The types of transfusion solutions grew from 40 to more than 80 types of medical transfusion formulations.

There are more than 200 types of transfusion solutions developed and used in overseas countries, and the annual per capital consumption is more than 3 bottles. The PRC has only approximately 50 types of transfusion products, and the per capital consumption is around 2.15 bottles. Most of the consumption is for Dextrose Monohydrate.

(Source: Report titled “Major Transportation of Liquid Pharmaceutical Products: Entering the Speedway” dated April 21, 2003 published on Chinapharm website, www.chinapharm.com.cn)

Weifang Shengtai is one of the top producers of Dextrose Monohydrate transfusion solutions as well as Dextrose Anhydrous solutions. These products are the raw material or base solutions for pharmaceutical manufacturers to add specific medical formulations to produce medicated transfusion. The industrial customers of Shengtai are the producers of medical transfusion solutions.

The growth in demand for Dextrose Monohydrate transfusion solutions is correlated to the growth of the pharmaceutical production and consumption trends and patterns. Medical transfusion is a common and well-accepted treatment routine all over the PRC for many ailments, ranging from the common cold, influenza, and intestinal disorders to clinical restorative or recuperative prescriptions after surgical operations. There are altogether 310,000 medical service providers such as hospitals, clinics, and health-care institutions serving the 1.3 billion people in the PRC.

Target Market

Weifang Shengtai’s principal customers are:

| | · | Health Care Institutions |

| | · | Medical supply companies |

| | · | Pharmaceutical companies |

| | · | Medical supply exporters |

| | · | Food and beverage companies |

It markets its products to these types of businesses within the PRC and plans to expand its export business as it increases its production capabilities, particularly in wholesale sales to foreign distributors.

Weifang Shengtai utilizes the following factors/incentives to encourage the purchase of its products:

| | · | High quality, pharmaceutical grade products |

| | · | Certified product reliability |

| | · | New and improved medicinal products and packaging |

| | · | Excellent service and support |

Domestic and International Market

The market in the PRC for Weifang Shengtai’s products is very large and growing rapidly. There are more than 310,000 medical service providers such as hospitals and health care institutions all over the PRC.

The Company believes that the export market is a lucrative market that Weifang Shengtai plans to further develop and expand. Due to very strong domestic demand and its production constraints, we historically could only serve a fraction of the export market.

The export figures for the Dextrose Monohydrate series products, which also includes anhydrous glucose and oral glucose, to the top four export markets are summarized as follows:

South Korea

Import approval permit issued in 2003

Products exported: Dextrose Monohydrate Oral & Dextrose Anhydrous

| 2003 | | 2004 | | 2005 | | 2006 Jan-July | |

| $54,100 | | $ | 342,955 | | $ | 149,280 | | $ | 65,180 | |

Russia

Import approval permit issued in 2004

Products exported: Dextrose Monohydrate Oral, Dextrose Monohydrate transfusion

| 2004 | | 2005 | | 2006 Jan-July | |

| $317,016 | | $ | 100,000 | | $ | 132,115 | |

Australia

Import approval permit issued in 2003

Product exported: Dextrose Monohydrate Oral

| 2003 | | 2004 | | 2005 | | 2006 Jan-Jul | |

| $20,000 | | $ | 124,450 | | $ | 42,780 | | $ | 37,335 | |

Singapore (plus re-export to Thailand)

Import approval permit issued in2003

Products exported: Dextrose Monohydrate Injection

| 2003 | | 2004 | | 2005 | | 2006 Jan-Jul | |

| $5,510 | | $ | 216,750 | | $ | 89,725 | | $ | 7,200 | |

Competitive Adavantages of the Company

With the PRC being a major corn-producing region of Asia, and Shandong being the major corn-producing province of the PRC, the Company, which is located in Shandong, has the advantage of a steady supply of raw materials, which are located nearby with low transportation costs.

Among our assets is a total of 150,000 square meters of land, of which approximately half is being utilized, leaving room for expansion.

Weifang Shengtai has only started to export to markets such as South Korea, Russia, Australia and Singapore and sixty other overseas countries. Taking into consideration the geographical proximity and cross-cultural similarities with the Northern and South-Eastern Asian markets, Weifang Shengtai believes that it can be competitive in terms of product price, delivery lead-time and customer service responsiveness.

With its new cornstarch facility and a planned upgrade of its glucose manufacturing facility, Weifang Shengtai believes it will be able to stabilize its raw material costs and production, enable its glucose production facility to function at maximum capacity and produce more products for both the domestic and export markets.

Weifang Shengtai is the one of the leading producers of Dextrose Monohydrate transfusion solution in the PRC, with an estimated 30% of the overall PRC market share (Source: “Compilation of the Means of Production for Starch, Modified Starch, Crystal Glucose and Liquid Starch Sugars in 2005” published by the China Starch Industry Association in July 2006). The other suppliers of Dextrose Monohydrate transfusion solutions have pharmaceutical production lines with a diversified range of medicinal products. Weifang Shengtai believes it is the only manufacturer that has its primary focus on producing high-quality Dextrose Monohydrate transfusion solutions in the PRC.

The other competitors are manufacturing companies with a diversified range of industrial glucose and cornstarch products. Weifang Shengtai believes that most of its competitors put more emphasis on volume production of medium to low value-added products, while it focuses more on quality production of high value-added products.

Competition

Some of Weifang Shengtai’s competitors of its main products are listed below. They are coded as follows:

(trans = competitor in Dextrose Monohydrate transfusion solution)

(oral = competitor in oral Dextrose Monohydrate)

(andh = competitor in Dextrose Anhydrous)

| | · | Dong Ping Rui Xing Petrochemical Company Ltd (trans) |

| | · | North China Pharmaceutical Production Company Ltd (trans) |

| | · | Ci Feng Pharmaceutical Production Company Ltd (trans) |

| | · | Yi Kan Pharmaceutical Production Company Ltd (trans) |

| | · | Hebei Shengxue Company Ltd (andh) |

| | · | Northern China Kan Yin Pharmaceutical Product Company Ltd (trans) |

| | · | Shandong Xi Wang Company Ltd (oral) |

| | · | QingHuangDao Lihua Glucose Company Ltd (oral) |

| | · | Hebei Hua Ying Glucose Company Ltd (oral) |

| | · | Cargill USA (trans), (oral) |

| | · | Roquette (trans), (andh) |

| | · | Cerestar (trans), (andh) |

| | · | Hebei Zhou Ping Rui Xue Glucose Company Ltd (andh) |

| | · | Hebei Linhua Glucose and Medicinal Production Company Ltd (andh) |

Among Weifang Shengtai’s domestic competitors, Weifang Shengtai is the largest manufacturer of pharmaceutical grade glucose. However, its foreign competitors are better-capitalized and are more technologically advanced.

Growth Initiative

Weifang Shengtai has developed and is implementing the following initiatives to achieve its growth goals:

| | · | Vertically integrate its manufacturing capabilities by building and operating a cornstarch plant. |

The Company believes the new cornstarch processing plant will lower production costs and improve profit margin because higher-quality and lower cost raw materials will be produced in-house and there will be no transportation costs because the cornstarch processing plant is next to the glucose production line.

This will somewhat shield Weifang Shengtai from external cornstarch price fluctuation, thus protecting or improving its profit margins.

| | · | Increase its glucose production capabilities to be able to meet market demand |

Overseas demand had not been fully satisfied in the past because products have been sold out due to strong domestic demand in the PRC. The Company believes that its new 300,000 ton cornstarch processing plant will supply enough raw materials to increase production volumes and sales to an expanding domestic client base and fulfill more overseas orders which offer higher profit margins.

Beyond the pharmaceutical-grade products, some of the industrial-grade products can be further refined and transformed into higher-margin products, such as modified starch and glucose-transformed nutraceutical raw materials. The Company has in its pipeline biotechnology product formulas that could be deployed to serve emerging market segments in the next few years.

| | · | Expand its marketing and sales efforts to identify and secure additional domestic customers and increase its export sales. The Company plans to (i) optimize its web site to describe and promote its business, (ii) take out advertisements in trade publications, (iii) buy advertisements for various search words and phrases (e.g. “glucose”) on Google and Yahoo and major PRC search engines, (iv) conduct seminars at various trade show events to promote its products, and (v) optimize its web site so that people doing ‘natural’ searches will see the web site link on the first page of the search by refining its Search Engine Optimization |

Major Customers

Weifang Shengtai’s customers are principally located in the PRC but it hopes to expands its international customer base. Its principal customers are hospitals and pharmaceutical companies. Below is a list of its largest PRC customers:

| · | Zhejiang Hsin Pharmaceutical Co Ltd |

| · | Shouguang Tianli Biological Technology Co Ltd |

| · | Guangdong Weishiya Health Food Co Ltd |

| · | Lianyungang Roquette Co Ltd |

| · | Sichuan Kelun Pharmaceutical Co Ltd |

| · | Beijing Double-Crane Pharmaceutical Co Ltd |

| · | Huayuan Changfu Pharmaceutical Group |

| · | Anhui Fengyuan Pharmaceutical Group |

| · | Huayu Wuxi Pharmaceutical Co Ltd |

| · | Chengdu Qingshan Pharmaceutical Co Ltd |

| · | Guangdong Duole Dairy Co Ltd |

Intellectual Property

Weifang Shengtai formally acquired the registered “Heng De Bao” trade mark from Changle Medical Starch Factory on or about July 28, 2000. The trade mark was assigned by the Chinese Trademark Bureau and registered under classes 31 (pharmaceutical starch and white dextrin) and 5 (pharmaceutical glucose). The former class registration was renewed till June 10, 2009 while the later was renewed and valid till May 9, 2011. International Class Code 5 covers pharmaceuticals, veterinary and sanitary preparations; dietetic substances adapted for medical use; food for babies; plasters, materials for dressings; material for stopping teeth, dental wax; disinfectants; preparations for destroying vermin; fungicides, herbicides. International Class Code 31 covers agricultural, horticultural, and forestry products and grains not included in other classes; live animals, fresh fruits and vegetables; seeds, natural plans, and flowers ; foodstuffs for animal, malt.

Insurance

Weifang Shengtai purchased automobile insurance with third party liability coverage for its vehicles and life insurance for its key personnel. It does not have other insurance such as property insurance, business liability or disruption insurance coverage for its operations in the PRC. While a lawsuit against a company such as Weifang Shengtai in the PRC would be rare, it cannot make any assurance that it will not have exposure for liability in the event of a lawsuit.

Research and Development Activities

Weifang Shengtai develops new products through cooperation with universities and science research institutes such as the Shandong University. Under the direction of Professor Wu of Shandong University, Weifang Shengtai has cooperated with the Shandong University to conduct an experimental study on polyacrylic resin products. The research and development expense was approximately $170,000. The intellectual property belongs to Shandong University, but Weifang Shengtai has a priority to use the intellectual property derived from the experiments.

Government Regulations

Because Weifang Shengtai manufactures medicinal and pharmaceutical products, it is subject to the laws governing the Good Practice in the Manufacturing and Quality Control of Drugs (as amended in 1998) as promulgated by the PRC State Food and Drug Administration on March 18, 1999.

It is also subject to business license and approval regulations that are required for all corporations in the PRC.

Weifang Shengtai has obtained Certificates of Good Manufacturing Practices for Pharmaceutical Products (“GMP Certificates”) issued by the PRC State Drug Administration. The GMP Certificates certify that Weifang Shengtai is compliant with the requirements of Chinese Current Good Manufacturing Practices for Pharmaceutical Products in the manufacture of bulk Dextrose Monohydrate, glucose and anhydrous glucose and are valid through May 18, 2009, March 23, 2008 and April 18, 2009 respectively.

Additionally, Weifang Shengtai has obtained Drug Registration Certificates for glucose and glucosum pro orale from the State Food and Drug Administration in accordance with the PRC Medical Products Governance Law and its implementing regulations.

Environmental Compliance

Weifang Shengtai is subject to PRC environmental laws, rules and regulations that are standard to manufacturing facilities.

Weifang Shengtai’s production line has passed inspection by the Environmental Protection Bureau of PRC and was issued a Certificate of Qualification.

Employees

Weifang Shengtai currently employs 750 full-time employees.

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and the other information contained in this prospectus before deciding to invest in our common stock.

Risks related to doing business in the People’s Republic of China

Our business operations take place primarily in the PRC. Because Chinese laws, regulations and policies are continually changing, our Chinese operations will face several risks summarized below.

Our ability to operate in the PRC may be harmed by changes in its laws and regulations

Our offices and manufacturing plants are located in the PRC and the production, sale and distribution of our products are subject to Chinese rules and regulations. In particular, the manufacture and supply of pharmaceutical grade and medicinal products are subject to the PRC rules and regulations, such as the Good Practice in the Manufacturing and Quality Control of Drugs (as amended in 1998) as promulgated by the PRC State Food and Drug Administration on March 18, 1999 and the PRC Medical Products Governance Law.

In addition, because we operate a cornstarch production facility which produces waste water and we are subject to the environmental rules and regulations such as the Integrated Wastewater Discharge Standard(GB8978-1996).

The PRC only recently has permitted provincial and local economic autonomy and private economic activities. The Chinese government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership.

Our ability to operate in the PRC may be harmed by changes in its laws and regulations, including those relating to taxation, import and export tariffs, environmental regulations, land use rights, property and other matters.

Also, we are a state-licensed corporation and production and manufacturing facility and subject to Chinese regulation and environmental laws. The Chinese government has been active in regulating the pharmaceutical and medicinal goods industry. Our business and products are subject to government regulations mandating the use of good manufacturing practices. Changes in such laws or regulations in the PRC, or other countries we sell into, that govern or apply to our operations could have a materially adverse effect on our business. For example, the law could change so as to prohibit the use of certain chemical agents in our products. If such chemical agents are found in our products, then such a change would reduce our productivity of that product.

If we were to lose our state-licensed status, we would no longer be able to manufacture our products in the PRC, which is our sole operation.

There is no assurance that PRC economic reforms will not adversely affect our operations in the future

Although the Chinese government owns the majority of productive assets in the PRC, in the past several years the government has implemented economic reform measures that emphasize decentralization and encourage private economic activity.

Because these economic reform measures may be inconsistent or ineffectual, there are no assurances that:

· We will be able to capitalize on economic reforms;

| | · | The Chinese government will continue its pursuit of economic reform policies; |

· The economic policies, even if pursued, will be successful;

· Economic policies will not be significantly altered from time to time; and

| | · | Business operations in the PRC will not become subject to the risk of nationalization. |

Since 1979, the Chinese government has reformed its economic systems. Because many reforms are unprecedented or experimental, they are expected to be refined and improved. Other political, economic and social factors, such as political changes, changes in the rates of economic growth, unemployment or inflation, or in the disparities in per capita wealth between regions within the PRC, could lead to further readjustment of the reform measures. This refining and readjustment process may negatively affect our operations.

Over the last few years, the PRC's economy has registered a high growth rate. During the past ten years, the rate of inflation in the PRC has been as high as 20.7% and as low as -2.2%. Recently, there have been indications that rates of inflation have increased. In response, the Chinese government recently has taken measures to curb this excessively expansive economy. These corrective measures were designed to restrict the availability of credit or regulate growth and contain inflation. These measures have included devaluations of the Chinese currency, the Renminbi (RMB), restrictions on the availability of domestic credit, reducing the purchasing capability of certain of its customers, and limited re-centralization of the approval process for purchases of some foreign products. These austerity measures alone may not succeed in slowing down the economy's excessive expansion or control inflation, and may result in severe dislocations in the Chinese economy. The Chinese government may adopt additional measures to further combat inflation, including the establishment of freezes or restraints on certain projects or markets.

While inflation has been more moderate since 1995, high inflation may in the future cause Chinese government to impose controls on credit and/or prices, or to take other action, which could inhibit economic activity in the PRC, and thereby harm the market for our products. Future inflation in the PRC may inhibit our activity to conduct business in the PRC.

To date, reforms to the PRC's economic system have not adversely impacted our operations and are not expected to adversely impact operations in the foreseeable future; however, there can be no assurance that the reforms to the PRC's economic system will continue or that we will not be adversely affected by changes in the PRC's political, economic, and social conditions and by changes in policies of the Chinese government, such as changes in laws and regulations, measures which may be introduced to control inflation, changes in the rate or method of taxation, imposition of additional restrictions on currency conversion and remittance abroad, and reduction in tariff protection and other import restrictions.

Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in the PRC or particular regions thereof, and could require us to divest ourselves of any interest we then hold in Chinese properties or businesses.

For example, changes in policy could result in imposition of restrictions on currency conversion, imports or the source of suppliers, as well as new laws affecting joint ventures and foreign-owned enterprises doing business in the PRC. Although the PRC has been pursuing economic reforms for the past two decades, events such as a change in leadership or social disruptions that may occur upon the proposed privatization of certain state-owned industries could significantly affect the government's ability to continue with its reform.

We face economic risks in doing business in the PRC. As a developing nation, the PRC's economy is more volatile than that of developed Western industrial economies. It differs significantly from that of the U.S. or a Western European Country in such respects as structure, level of development, capital reinvestment, resource allocation and self-sufficiency. Only in recent years has the Chinese economy moved from what had been a command economy through the 1970s to one that during the 1990s encouraged substantial private economic activity. In 1993, the Constitution of the PRC was amended to reinforce such economic reforms. The trends of the 1990s indicate that future policies of the Chinese government will emphasize greater utilization of market forces. The PRC government has confirmed that economic development will follow the model of a market economy. For example, in 1999 the Government announced plans to amend the Chinese Constitution to recognize private property, although private business will officially remain subordinated to the state-owned companies, which are the mainstay of the Chinese economy. However, there can be no assurance that, under some circumstances, the government's pursuit of economic reforms will not be restrained or curtailed. Actions by the central government of the PRC could have a significant adverse effect on economic conditions in the country as a whole and on the economic prospects for our Chinese operations. Economic reforms could either benefit or damage our operations and profitability. Some of the things that could have this effect are: i) level of government involvement in the economy; ii) control of foreign exchange; methods of allocating resources; iv) international trade restrictions; and v) international conflict.

Under the present direction, we believe that the PRC will continue to strengthen its economic and trading relationships with foreign countries and business development in the PRC will follow market forces. While we believe that this trend will continue, there can be no assurance that this will be the case. A change in policies by the PRC government could adversely affect our interests by, among other factors: changes in laws, regulations or the interpretation thereof, confiscatory taxation, restrictions on currency conversion, imports or sources of supplies, or the expropriation or nationalization of private enterprises. Although the PRC government has been pursuing economic reform policies for more than two decades, there is no assurance that the government will continue to pursue such policies or that such policies may not be significantly altered, especially in the event of a change in leadership, social or political disruption, or other circumstances affecting the PRC's political, economic and social life.

The PRC legal and judicial system may not adequately protect foreign investors and enforce their rights

The Chinese legal and judicial system may negatively impact foreign investors. In 1982, the National People's Congress amended the Constitution of China to authorize foreign investment and guarantee the "lawful rights and interests" of foreign investors in the PRC. However, the PRC's system of laws is not yet comprehensive. The legal and judicial systems in the PRC are still rudimentary, and enforcement of existing laws is inconsistent. Many judges in the PRC lack the depth of legal training and experience that would be expected of a judge in a more developed country. Because the Chinese judiciary is relatively inexperienced in enforcing the laws that do exist, anticipation of judicial decision-making is more uncertain than would be expected in a more developed country. It may be impossible to obtain swift and equitable enforcement of laws that do exist, or to obtain enforcement of the judgment of one court by a court of another jurisdiction. The PRC's legal system is based on written statutes; a decision by one judge does not set a legal precedent that is required to be followed by judges in other cases. In addition, the interpretation of Chinese laws may be varied to reflect domestic political changes.

The promulgation of new laws, changes to existing laws and the pre-emption of local regulations by national laws may adversely affect foreign investors. However, the trend of legislation over the last 20 years has significantly enhanced the protection of foreign investment and allowed for more control by foreign parties of their investments in Chinese enterprises. There can be no assurance that a change in leadership, social or political disruption, or unforeseen circumstances affecting the PRC's political, economic or social life, will not affect the Chinese government's ability to continue to support and pursue these reforms. Such a shift could have a material adverse effect on our business and prospects.

The practical effect of the People's Republic of China legal system on our business operations in the PRC can be viewed from two separate but intertwined considerations. First, as a matter of substantive law, the Foreign Invested Enterprise laws provide significant protection from government interference. In addition, these laws guarantee the full enjoyment of the benefits of corporate Articles and contracts to Foreign Invested Enterprise participants. These laws, however, do impose standards concerning corporate formation and governance, which are not qualitatively different from the general corporation laws of the several states. Similarly, the PRC accounting laws mandate accounting practices, which are not consistent with U.S. Generally Accepted Accounting Principles. PRC’s accounting laws require that an annual "statutory audit" be performed in accordance with PRC accounting standards and that the books of account of Foreign Invested Enterprises are maintained in accordance with Chinese accounting laws. Article 14 of the People's Republic of China Wholly Foreign-Owned Enterprise Law requires a Wholly Foreign-Owned Enterprise to submit certain periodic fiscal reports and statements to designated financial and tax authorities, at the risk of business license revocation. Second, while the enforcement of substantive rights may appear less clear than United States procedures, the Foreign Invested Enterprises and Wholly Foreign- Owned Enterprises are Chinese registered companies, which enjoy the same status as other Chinese registered companies in business-to-business dispute resolution.

Since the Articles of Association of Weifang Shengtai do not provide for the resolution of disputes business, the parties are free to proceed to either the Chinese courts or if they are in agreement, to arbitration.

Any award rendered by an arbitration tribunal is enforceable in accordance with the United Nations Convention on the Recognition and Enforcement of Foreign Arbitral Awards (1958). Therefore, as a practical matter, although no assurances can be given, the Chinese legal infrastructure, while different in operation from its United States counterpart, should not present any significant impediment to the operation of Foreign Invested Enterprises.

The Chinese legal system is a civil law system based on written statutes. Unlike common law systems, it is a system in which precedents set in earlier legal cases are not generally used. The overall effect of legislation enacted over the past 20 years has been to enhance the protections afforded to foreign invested enterprises in the PRC. However, these laws, regulations and legal requirements are relatively recent and are evolving rapidly, and their interpretation and enforcement involve uncertainties. These uncertainties could limit the legal protections available to foreign investors, such as the right of foreign invested enterprises to hold licenses and permits such as requisite business licenses.

In addition, some of our present and future executive officers and our directors, most notably, Mr. Qingtai Liu, may be residents of the PRC and not of the United States, and substantially all the assets of these persons are located outside the U.S. As a result, it could be difficult for investors to affect service of process in the United States, or to enforce a judgment obtained in the United States against us or any of these persons.

The PRC laws and regulations governing our current business operations are sometimes vague and uncertain. There are substantial uncertainties regarding the interpretation and application of PRC laws and regulations, including but not limited to the laws and regulations governing our business, or the enforcement and performance of our arrangements with customers in the event of the imposition of statutory liens, death, bankruptcy and criminal proceedings. We and any future subsidiaries are considered foreign persons or foreign funded enterprises under PRC laws, and as a result, we are required to comply with PRC laws and regulations. These laws and regulations are sometimes vague and may be subject to future changes, and their official interpretation and enforcement may involve substantial uncertainty. The effectiveness of newly enacted laws, regulations or amendments may be delayed, resulting in detrimental reliance by foreign investors. New laws and regulations that affect existing and proposed future businesses may also be applied retroactively. We cannot predict what effect the interpretation of existing or new PRC laws or regulations may have on our business.

Governmental control of currency conversion may affect the value of your investment.

The majority of our revenues will be settled in Renminbi and U.S. Dollars, and any future restrictions on currency exchanges may limit our ability to use revenue generated in Renminbi to fund any future business activities outside the PRC or to make dividend or other payments in U.S. dollars. Although the Chinese government introduced regulations in 1996 to allow greater convertibility of the Renminbi for current account transactions, significant restrictions still remain, including primarily the restriction that foreign-invested enterprises may only buy, sell or remit foreign currencies after providing valid commercial documents, at those banks in the PRC authorized to conduct foreign exchange business.

In addition, conversion of Renminbi for capital account items, including direct investment and loans, is subject to governmental approval in the PRC, and companies are required to open and maintain separate foreign exchange accounts for capital account items. We cannot be certain that the Chinese regulatory authorities will not impose more stringent restrictions on the convertibility of the Renminbi.

The value of our securities will be affected by the foreign exchange rate between U.S. dollars and Renminbi.

The value of our common stock will be affected by the foreign exchange rate between U.S. dollars and Renminbi, and between those currencies and other currencies in which our sales may be denominated. For example, to the extent that we need to convert U.S. dollars into Renminbi for our operational needs and should the Renminbi appreciate against the U.S. dollar at that time, our financial position, the business of the Company, and the price of our common stock may be harmed. Conversely, if we decide to convert our Renminbi into U.S. dollars for the purpose of declaring dividends on our common stock or for other business purposes and the U.S. dollar appreciates against the Renminbi, the U.S. dollar equivalent of our earnings from our subsidiary in the PRC would be reduced.

The PRC government imposes controls on the convertibility of Renminbi into foreign currencies and, in certain cases, the remittance of currency out of the PRC. We receive substantially all of our revenues in RMB, which is currently not a freely convertible currency. Shortages in the availability of foreign currency may restrict our ability to remit sufficient foreign currency to pay dividends, or otherwise satisfy foreign currency dominated obligations. Under existing PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and expenditures from the transaction, can be made in foreign currencies without prior approval from the PRC State Administration of Foreign Exchange by complying with certain procedural requirements. However, approval from appropriate governmental authorities is required where RMB is to be converted into foreign currency and remitted out of the PRC to pay capital expenses, such as the repayment of bank loans denominated in foreign currencies.

The PRC government may also at its discretion restrict access in the future to foreign currencies for current account transactions. If the foreign exchange control system prevents us from obtaining sufficient foreign currency to satisfy our currency demands, we may not be able to pay certain expenses as they come due.

The fluctuation of the RMB may materially and adversely affect your investment.

The value of the RMB against the U.S. Dollar and other currencies may fluctuate and is affected by, among other things, changes in the PRC's political and economic conditions. As we rely almost entirely on revenues earned in the PRC, any significant revaluation of the RMB may materially and adversely affect our cash flows, revenues and financial condition. For example, to the extent that we need to convert U.S. Dollars we receive from an offering of our securities into RMB for our operations, appreciation of the RMB against the U.S. Dollar could have a material adverse effect on our business, financial condition and results of operations. Conversely, if we decide to convert our RMB into U.S. Dollars for the purpose of making payments for dividends on our common shares or for other business purposes and the U.S. Dollar appreciates against the RMB, the U.S. Dollar equivalent of the RMB we convert would be reduced. In addition, the depreciation of significant U.S. Dollar denominated assets could result in a charge to our income statement and a reduction in the value of these assets.

On July 21, 2005, the PRC government changed its decade-old policy of pegging the value of the RMB to the U.S. Dollar. Under the new policy, the RMB is permitted to fluctuate within a narrow and managed band against a basket of certain foreign currencies. This change in policy has resulted in an approximately 2.0% appreciation of the RMB against the U.S. Dollar. While the international reaction to the RMB revaluation has generally been positive, there remains significant international pressure on the PRC government to adopt an even more flexible currency policy, which could result in a further and more significant appreciation of the RMB against the U.S. Dollar.

Recent PRC State Administration of Foreign Exchange ("SAFE") Regulations regarding offshore financing activities by PRC residents have undergone a number of changes which may increase the administrative burden we face. The failure by our shareholders who are PRC residents to make any required applications and filings pursuant to such regulations may prevent us from being able to distribute profits and could expose us and our PRC resident shareholders to liability under PRC law.

SAFE issued a public notice ("October Notice") effective from November 1, 2005, which requires registration with SAFE by the PRC resident shareholders of any foreign holding company of a PRC entity. Without registration, the PRC entity cannot remit any of its profits out of the PRC as dividends or otherwise; however, it is uncertain how the October Notice will be interpreted or implemented regarding specific documentation requirements for a foreign holding company formed prior to the effective date of the October Notice, such as in our case. In addition, the October Notice requires that any monies remitted to PRC residents outside of the PRC be returned within 180 days; however, there is no indication of what the penalty will be for failure to comply or if shareholder non-compliance will be considered to be a violation of the October Notice by us or otherwise affect us.