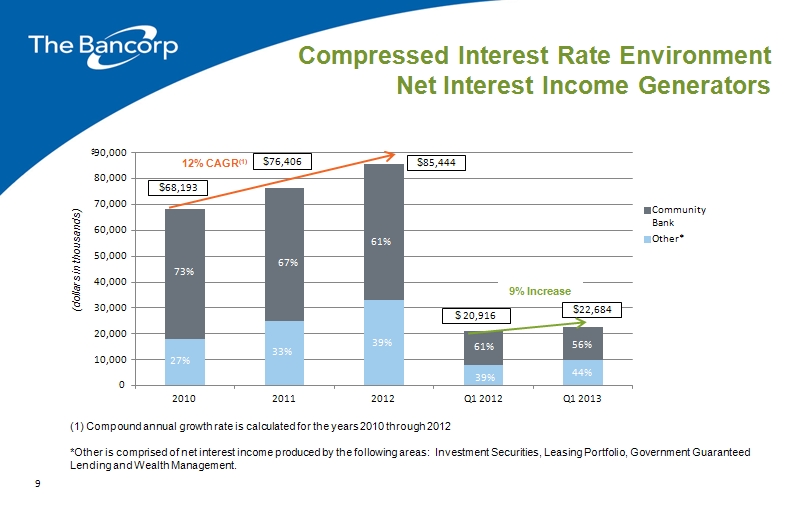

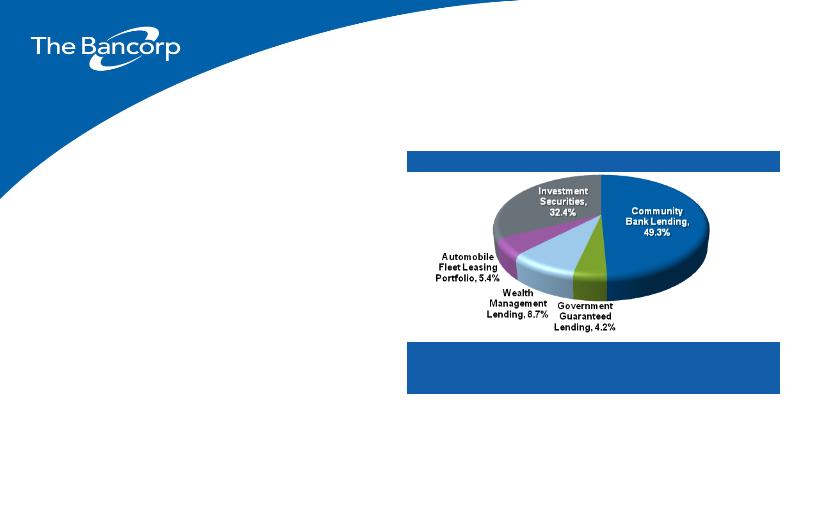

Primary Asset-Generating Strategies:

Business Line Overview

As with funding, TBBK employs a multi-channel growth strategy for loan origination, with the primary

driver being its regional commercial banking operations.

• Community Bank

– Offers traditional community banking products and services

targeting the highly fragmented Philadelphia/Wilmington

banking market

• Automobile Fleet Leasing

– Well-collateralized automobile fleet leasing

• Average transaction: 8-15 automobiles, $350,000

• 30% of portfolio leased by government agencies

• Wealth Management

– 15 affinity groups, managing & administering $1.8 trillion in assets

• SEI Investments, Legg Mason, Genworth Financial Trust Company,

Franklin Templeton

– Generates securities backed and other loans

• Government Guaranteed Lending

– Loans from $150,000 to $5.0 million primarily to franchisees such as UPS

Stores, Massage Envy, FASTSIGNS and Save a Lot which have a 75%

guaranty by the U.S. Small Business Administration. Approved Franchise

and Medical Guidance lines of over $500 million

• Securities

– Primarily:

• High credit quality tax exempt municipal obligations

• U.S. Government agency securities primarily 2-4 year average lives

and other highly rated mortgage-backed securities

• Corporate securities which, like other purchases, are validated and

monitored by independent credit advisory specialists

Category | March 31, 2013 Balance | March 31, 2012 Balance | March 31,

2013 Avg. Yield |

| (in thousands) | |

Community Bank | $1,437,359 | $1,408,910 | 4.12% |

Government Guaranteed

Lending | 120,902 | 43,378 | 5.03% |

Wealth Management | 253,121 | 166,258 | 2.72% |

Leasing Portfolio | 157,508 | 130,321 | 7.26% |

Investment Securities | 943,717 | 499,524 | 2.31% |

11