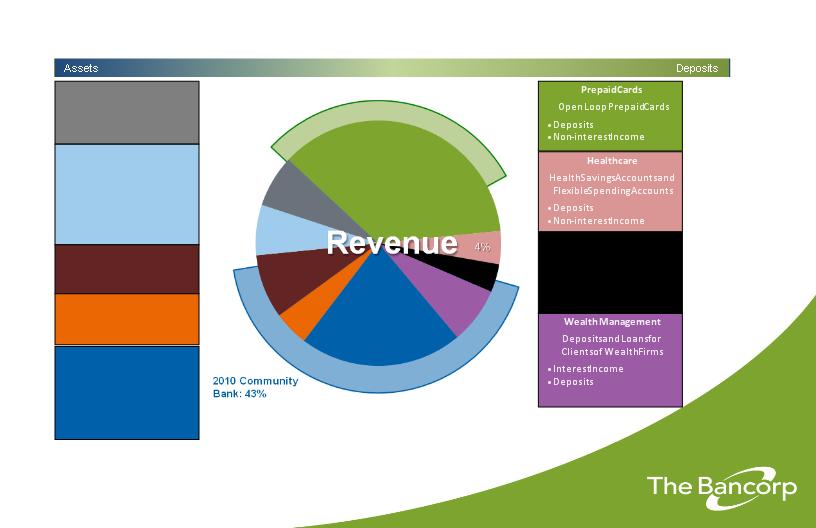

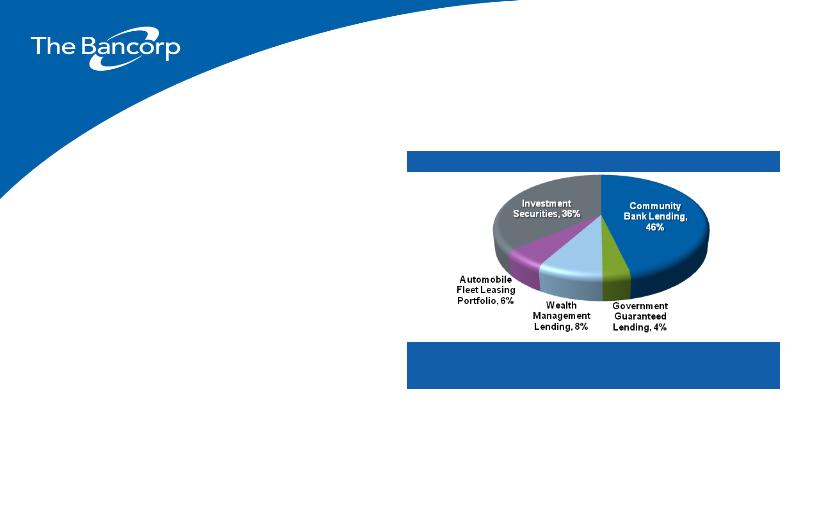

Primary Asset-Generating Strategies:

Business Line Overview

As with funding, The Bancorp employs a multi-channel growth strategy for loan origination, with the

primary driver being its regional commercial banking operations.

• Community Bank

– Offers traditional community banking products and services

targeting the highly fragmented Philadelphia/Wilmington

banking market

• Automobile Fleet Leasing

– Well-collateralized automobile fleet leasing

• Average transaction: 8-15 automobiles, $350,000

• 36% of portfolio leased by local, state, and federal

government agencies

• Wealth Management

– 15 affinity groups, managing & administering $1.8 trillion in assets

• SEI Investments, Legg Mason, Genworth Financial Trust Company,

Franklin Templeton

– Generates securities backed and other loans

• Government Guaranteed Lending

– Loans from $150,000 to $5.0 million including loans to franchisees such

as UPS Stores, Massage Envy, FASTSIGNS and Save a Lot which have

a 75% guaranty by the U.S. Small Business Administration. Approved

Franchise and Medical Guidance lines of over $400 million

• Securities

– Primarily:

• High credit quality tax exempt municipal obligations

• U.S. Government agency securities primarily 2-4 year average lives

and other highly rated mortgage-backed securities

• Corporate securities which, like other purchases, are validated and

monitored by independent credit advisory specialists

Category | June 30, 2013 Balance | June 30, 2012 Balance | June 30, 2013 Avg. Yield |

| (in thousands) | |

Community Bank | $1,432,010 | $1,397,066 | 4.05% |

Government Guaranteed

Lending | 108,614 | 53,583 | 4.78% |

Wealth Management | 254,508 | 213,651 | 2.75% |

Leasing Portfolio | 172,250 | 140,012 | 7.16% |

Investment Securities | 1,117,510 | 600,015 | 1.97% |

11