CATEGORY | | | |

(in thousands) |

| | | | |

| | 421,862 | 293,109 | 2.57% |

| | 211,364 | 148,109 | 4.23% |

| | 194,464 | 175,610 | 6.12% |

| | 178,376 | 55,196 | 3.33% |

| | 42,743 | 53,068 | 3.36% |

| | 46,990 | 67 | 2.50% |

Discontinued Business Line*

(formerly Community Bank) | 898,134 | 1,303,125 | 3.65% |

13

• Investment Securities

– High credit quality tax exempt municipal obligations

– U.S. Government agency securities and other highly rated mortgage-backed

securities

– Corporate securities which, like other purchases, are validated and monitored

by independent credit advisory specialists

• Institutional Banking

– 15 affinity groups, managing & administering $2.7 trillion in assets

• SEI Investments, Legg Mason, AssetMark Trust Company, Franklin Templeton

– Generates security backed lines of credit and other loans

• Government Guaranteed Lending

– Loans from $150,000 to $5.0 million including loans to franchisees such as

UPS Stores, Massage Envy, FASTSIGNS and Save a Lot, approximately 51% of

which have a 75% guaranty by the U.S. Small Business Administration

– National lending in Financial Practice Acquisitions, Franchise and Healthcare-

professionals

• Leasing

– Well-collateralized automobile fleet leasing

• Average transaction: 8-15 automobiles, $350,000

• 31% of portfolio leased by local, state, and federal government agencies

• CMBS

– Loans which are generated for sale into CMBS markets that are

held until sold

• Consumer/Other

– Home equity lines of credit and other consumer loans; commercial financing

related to student loans

(1) Yield is on a tax equivalent basis.

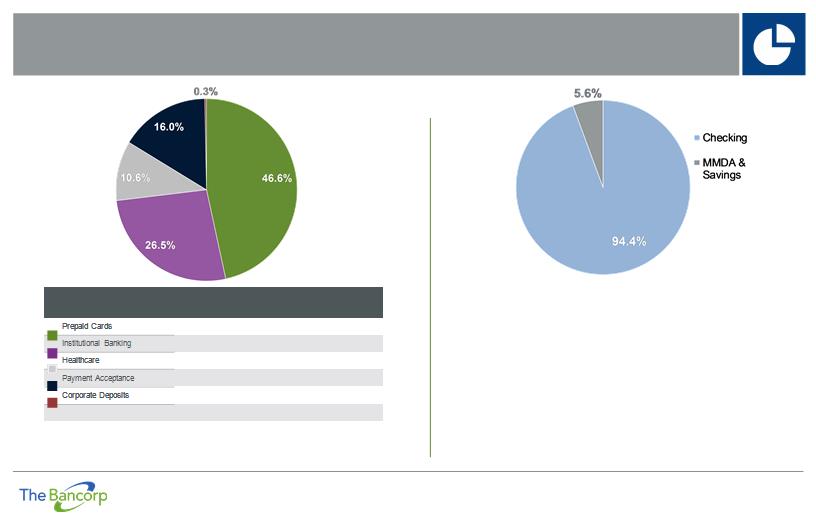

*Discontinued Business Line is not included in the pie chart.