Exhibit 99.2

THE BANCORP INVESTOR PRESENTATION APRIL 2024

2 DISCLOSURES Statements in this presentation regarding The Bancorp, Inc.’s (“The Bancorp”) business that are not historical facts or concern earnings guidance or the 2030 plan are “forward - looking statements”. These statements may be identified by the use of forward - looking terminology, including the words “may,” “believe,” “will,” “expect,” “anticipate,” “estimate,” “intend,” “plan," or similar words, and are based on current expectations about important business, economic, political, and technological factors, among others, and are subject to risks and uncertainties, which could cause the actual results, events or achievements to differ materially from those set forth in or implied by the forward - looking statements and related assumptions. 2024 guidance and long - term financial targets in this presentation assume achievement of management’s credit roadmap growth goals as described herein and other growth goals. If such assumptions are not met, guidance and long - term financial targets might not be reached. For further discussion of these risks and uncertainties, see the “risk factors” sections contained, in The Bancorp’s Annual Report on Form 10 - K for the year ended December 31, 2023, and in its other public filings with the SEC. In addition, these forward - looking statements are based upon assumptions with respect to future strategies and decisions that are subject to change. Annualized, pro forma, projected and estimated numbers are used for illustrative purposes only, are not forecasts and may not reflect actual results. The forward - looking statements speak only as of the date of this presentation. The Bancorp does not undertake to publicly revise or update forward - looking statements in this presentation to reflect events or circumstances that arise after the date of this presentation, except as may be required under applicable law. This presentation contains information regarding financial results that is calculated and presented on the basis of methodologies other than in accordance with accounting principles generally accepted in the United States (“GAAP”), such as those identified in the Appendix. As a result, such information may not conform to SEC Regulation S - X and may be adjusted and presented differently in filings with the SEC. Any non - GAAP financial measures used in this presentation are in addition to, and should not be considered superior to, or a substitute for, financial statements prepared in accordance with GAAP. Non - GAAP financial measures are subject to significant inherent limitations. The non - GAAP measures presented herein may not be comparable to similar non - GAAP measures presented by other companies. This information may be presented differently in future filings by The Bancorp with the SEC. This presentation may contain statistics and other data that in some cases has been obtained from or compiled from information made available by third - party service providers. The Bancorp makes no representation or warranty, express or implied, with respect to the accuracy, reasonableness or completeness of such information. Past performance is not indicative nor a guarantee of future results. Copies of the documents filed by The Bancorp with the SEC are available free of charge from the website of the SEC at www.sec.gov as well as on The Bancorp’s website at www.thebancorp.com . This presentation is for information purposes only and shall not constitute an offer to sell or the solicitation of an offer to buy any securities. Neither the SEC nor any other regulatory body has approved or disapproved of the securities of The Bancorp or passed upon the accuracy or adequacy of this presentation. Any representation to the contrary is a criminal offense. FORWARD LOOKING STATEMENTS & OTHER DISCLOSURES

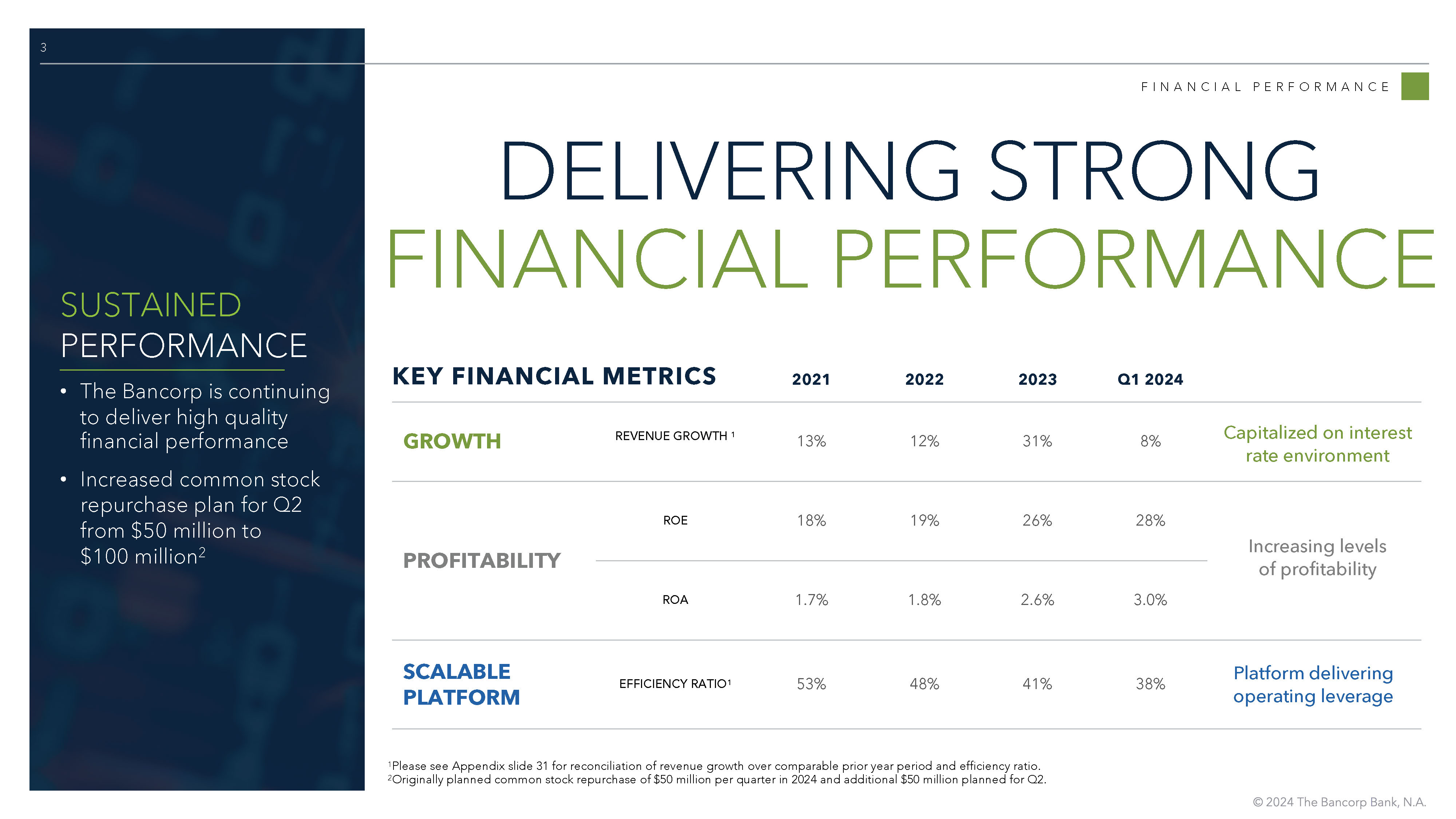

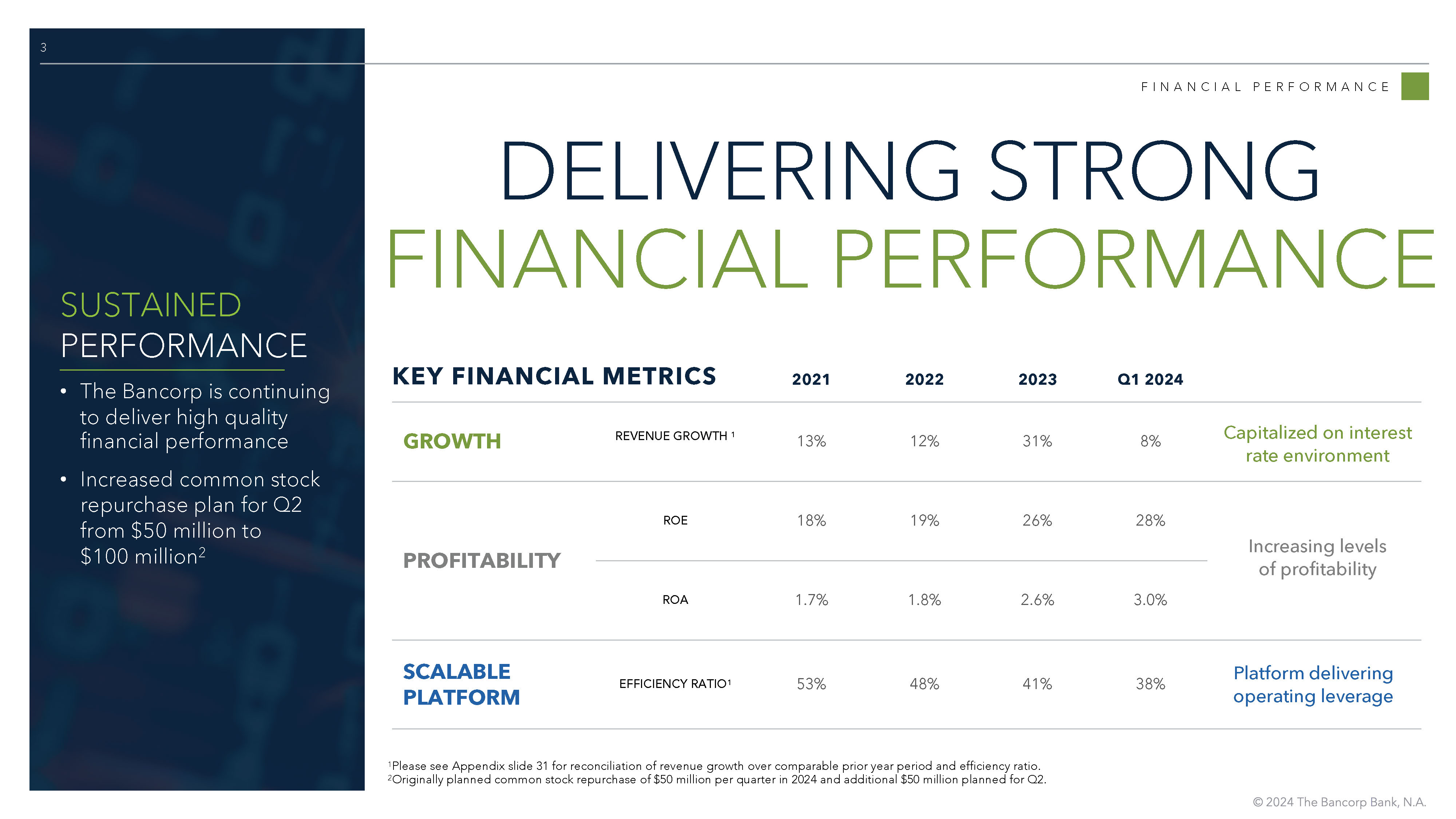

3 FINANCIAL PERFORMANCE DELIVERING STRONG FINANCIAL PERFORMANCE Q1 2024 2023 2022 2021 8% 31% 12% 13% REVENUE GROWTH 1 GROWTH 28% 26% 19% 18% ROE PROFITABILITY 3.0% 2.6% 1.8% 1.7% ROA 38% 41% 48% 53% EFFICIENCY RATIO 1 SCALABLE PLATFORM KEY FINANCIAL METRICS 1 Please see Appendix slide 31 for reconciliation of revenue growth over comparable prior year period and efficiency ratio. 2 Originally planned common stock repurchase of $50 million per quarter in 2024 and additional $50 million planned for Q2. Increasing levels of profitability Platform delivering operating leverage Capitalized on interest rate environment SUSTAINED PERFORMANCE • The Bancorp is continuing to deliver high quality financial performance • Increased common stock repurchase plan for Q2 from $50 million to $100 million 2

4 EARNINGS GUIDANCE DELIVERING STRONG FINANCIAL PERFORMANCE GUIDANCE Our 2024 guidance 1 is $4.25 per share as we maintain strong momentum across our platform 1 2024 guidance assumes achievement of management’s strategic goals as described elsewhere in this presentation and other budge tar y goals. $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 $4.00 $4.50 2021 2022 2023 2024 Guidance EARNINGS PER SHARE $1.88 $2.27 $3.49 $4.25

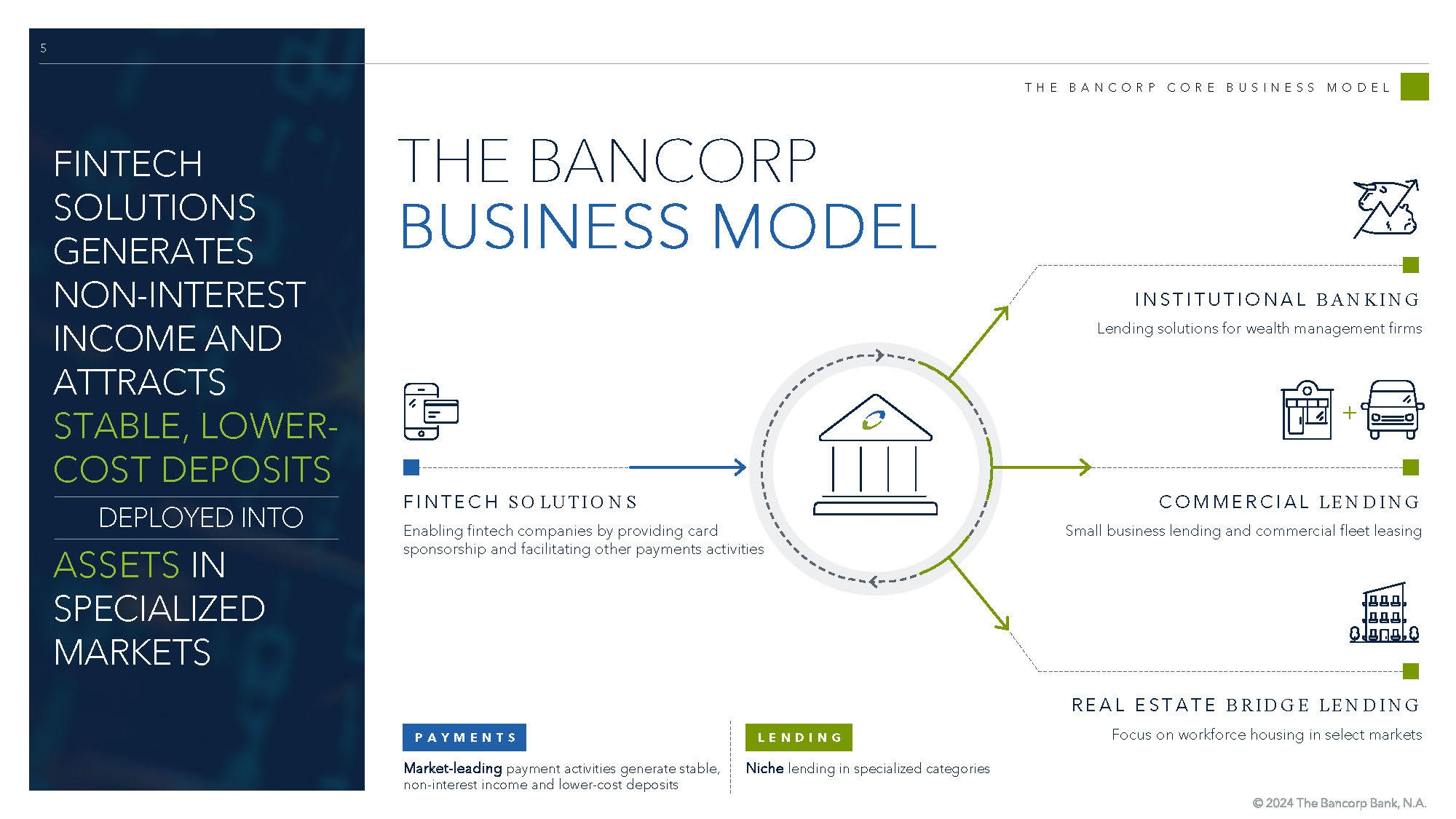

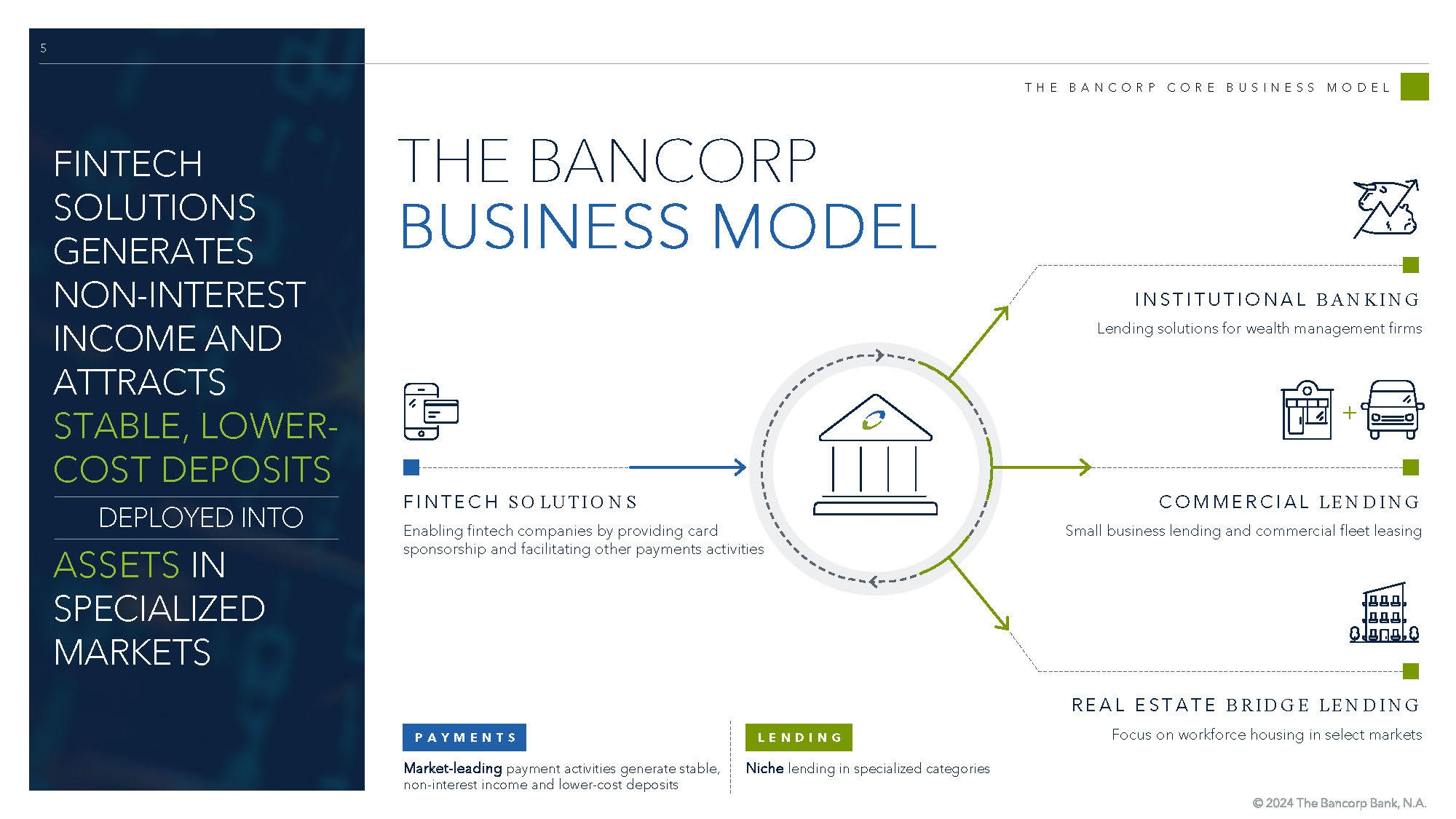

5 THE BANCORP CORE BUSINESS MODEL FINTECH SOLUTIONS GENERATES NON - INTEREST INCOME AND ATTRACTS STABLE, LOWER - COST DEPOSITS DEPLOYED INTO ASSETS IN SPECIALIZED MARKETS THE BANCORP BUSINESS MODEL FINTECH SOLUTIONS Enabling fintech companies by providing card sponsorship and facilitating other payments activities COMMERCIAL LENDING Small business lending and commercial fleet leasing + INSTITUTIONAL BANKING Lending solutions for wealth management firms REAL ESTATE BRIDGE LENDING Focus on workforce housing in select markets PAYMENTS Market - leading payment activities generate stable, non - interest income and lower - cost deposits LENDING Niche lending in specialized categories

6 FINTECH PARTNER BANK FINTECH LEADERSHIP PAYMENT NETWORKS FACILITATE payments between parties via the card networks. PROGRAM MANAGERS CLIENT FACING platforms deliver highly scalable banking solutions to customers with emphasis on customer acquisition and technology. REGULATORS OVERSIGHT of domestic banking and payments activities. PROCESSORS BACK - OFFICE support for program managers providing record keeping and core platform services. FINTECH ECOSYSTEM Enabling fintech companies by providing industry leading card issuing, payments facilitation and regulatory expertise to a diversified portfolio of clients

7 SPECIALIZED LENDING SPECIALIZED LENDING BUSINESS LINES LENDING BUSINESSES Core lending businesses are comprised of our specialized lending activities Institutional Banking $1.8B Emphasize core business lines and add related products and enter adjacent markets Remain positioned to capitalize on credit sponsorship opportunities Maintain balance sheet flexibility as we approach $10B in total assets Real Estate Bridge Lending $2.3B Small Business $0.9B Leasing $ 0.7B CORE LENDING BUSINESSES AS OF Q1 2024 TOTAL $ 5.7 B Established Operating Platform Scalable technology, operations and sales platforms across lending business to support sustained growth STRATEGIC OUTLOOK

8 NEW 2030 STRATEGY OUR 2030 STRATEGY OVERVIEW Our new 2030 strategy encompasses previous goals outlined in Vison 700 while adding new fintech opportunities Build on our strengths Create new opportunities Sustain revenue growth Enhance profitability Averting substantial event - risk Keeping the balance sheet under $10B Avoiding potential regulatory issues + + + + EVALUATION FRAMEWORK BEING MINDFUL OF: How can we build on our leading fintech partner bank model and specialized lending businesses?

NEW 2030 STRATEGY *Without competing with our partners 1 PROVIDE NEW FINTECH SERVICES 3 SUPPORT FINTECH LENDING 2 MONETIZE CORE COMPETENCIES Our new 2030 plan comprises new opportunities identified across various strategic pathways: 1 Long term guidance assumes achievement of management’s long - term strategic plan as described elsewhere in this presentation, imp act of realized and expected interest rate movement, and other budgetary goals. TOTAL REVENUE >$1 Billion ROE >40% ROA >4.0% LEVERAGE > 10% LONG - TERM FINANCIAL TARGETS 1 • Niche program management • Embedded Finance • Regulatory services • Middle - office technologies • Diversified holdings across many programs with significant distribution of assets APEX 2030

FINTECH SOLUTIONS: DEPOSIT & FEE GENERATION

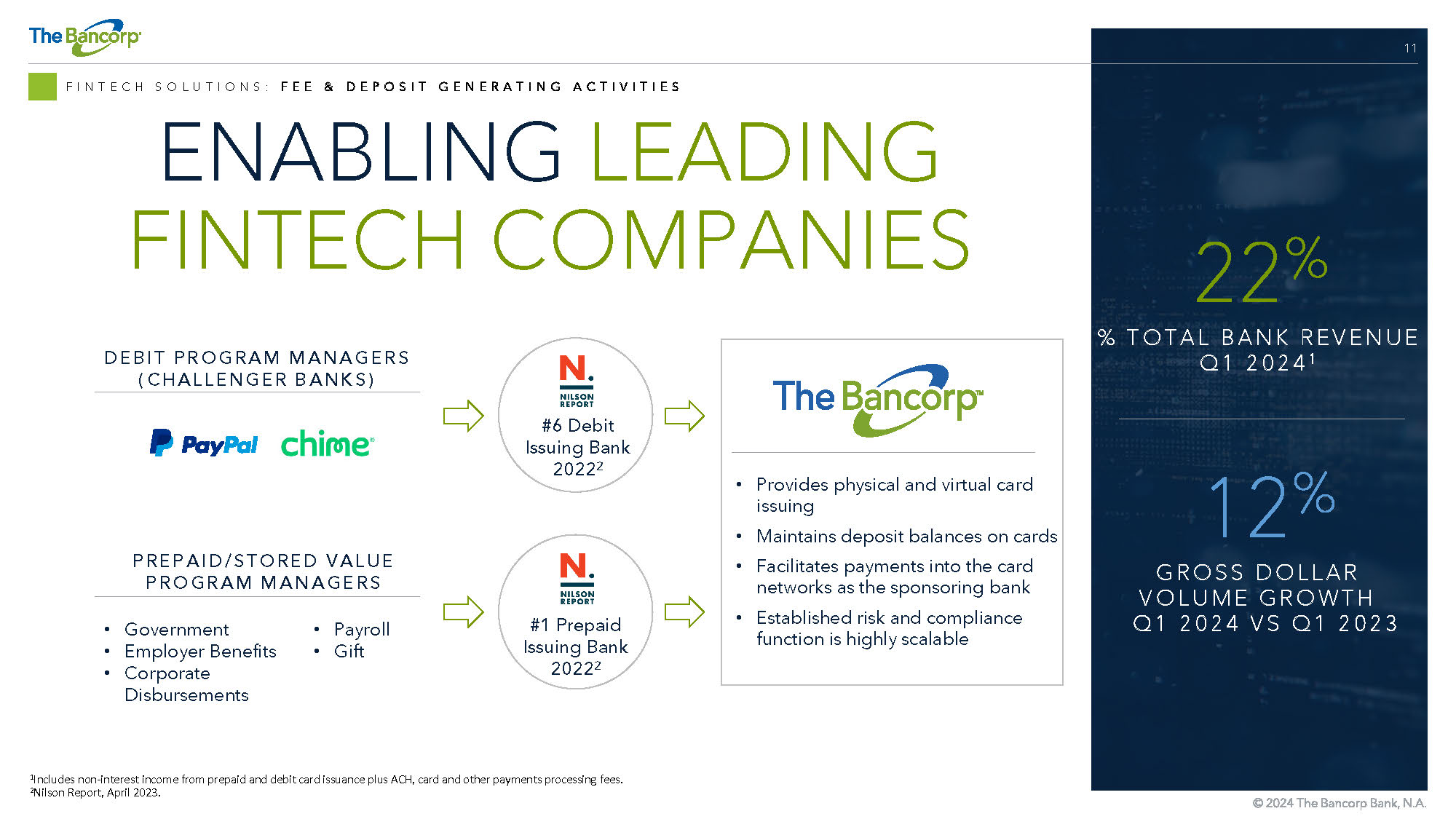

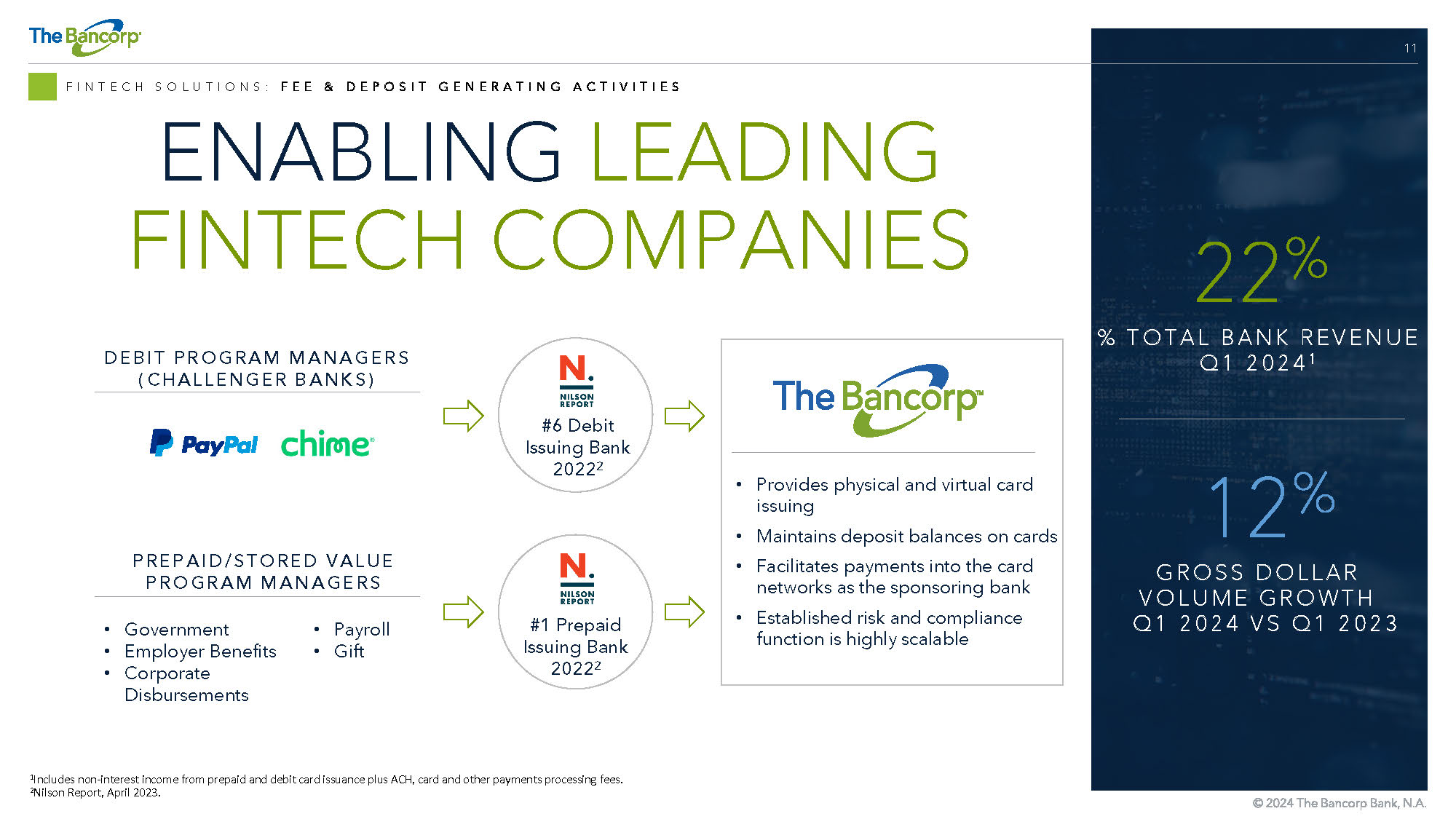

11 FINTECH SOLUTIONS: FEE & DEPOSIT GENERATING ACTIVITIES ENABLING LEADING FINTECH COMPANIES DEBIT PROGRAM MANAGERS (CHALLENGER BANKS) PREPAID/STORED VALUE PROGRAM MANAGERS • Provides physical and virtual card issuing • Maintains deposit balances on cards • Facilitates payments into the card networks as the sponsoring bank • Established risk and compliance function is highly scalable #6 Debit Issuing Bank 2022 2 #1 Prepaid Issuing Bank 2022 2 • Government • Employer Benefits • Corporate Disbursements • Payroll • Gift 1 Includes non - interest income from prepaid and debit card issuance plus ACH, card and other payments processing fees. 2 Nilson Report, April 2023. % TOTAL BANK REVENUE Q1 2024 1 22 % GROSS DOLLAR VOLUME GROWTH Q1 2024 VS Q1 2023 12 %

12 FINTECH SOLUTIONS : ESTABLISHED OPERATING PLATFORM SCALABLE PLATFORM ESTABLISHED OPERATING PLATFORM • Infrastructure in place to support significant growth • Long - term relationships with multiple processors enable efficient onboarding • Continued technology investments without changes to expense base REGULATORY EXPERTISE • Financial Crimes Risk Management program with deep experience across payments ecosystem • Customized risk and compliance tools specific to the Fintech Industry OTHER PAYMENTS OFFERINGS • Rapid Funds instant payment transfer product • Potential to capitalize on credit - linked payments opportunities • Additional payments services include ACH processing for third parties INNOVATIVE SOLUTIONS Our platform supports a wide variety of strategic fintech partners through our established processor relationships, regulatory expertise, and suite of other payments products

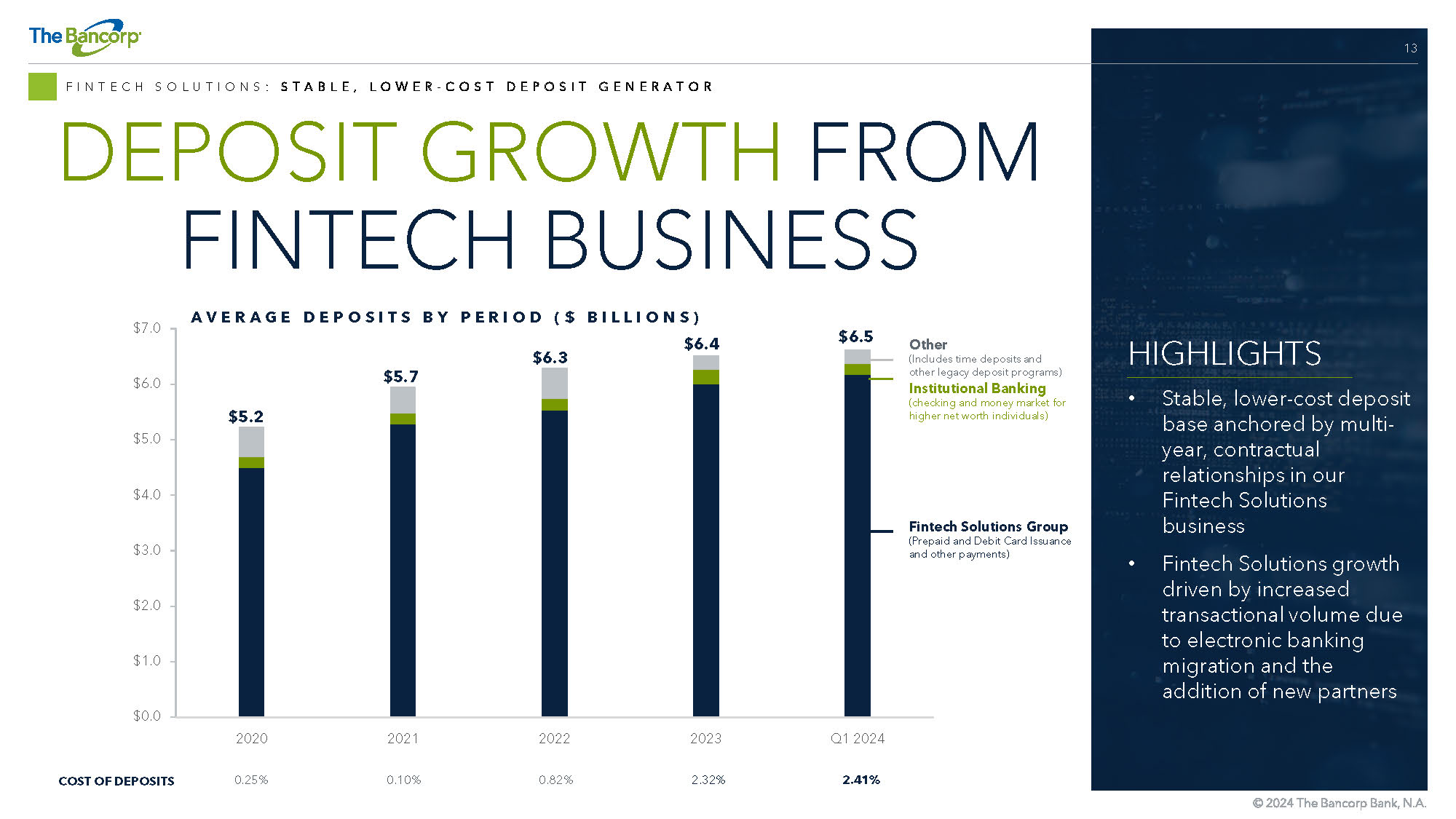

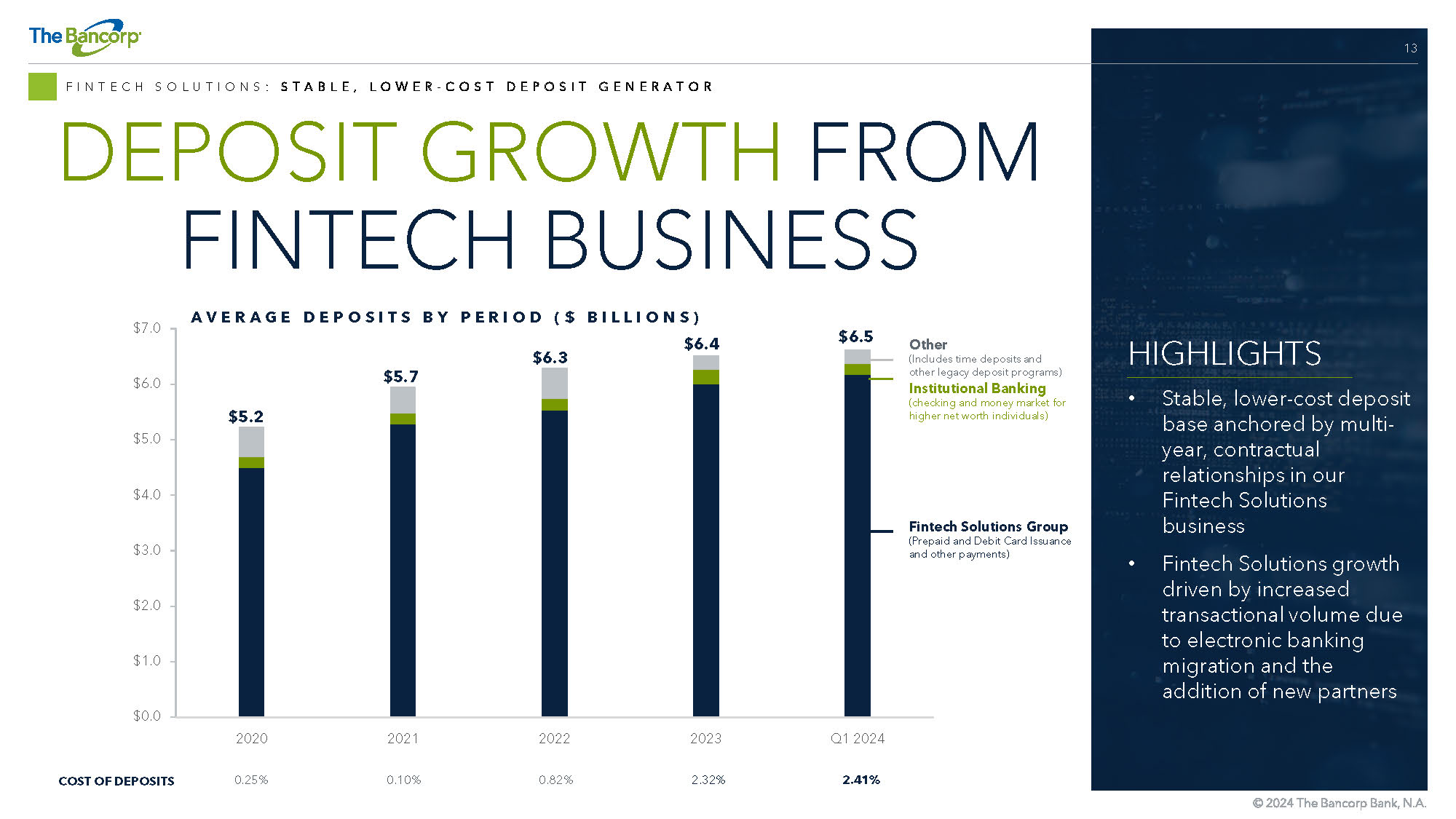

13 FINTECH SOLUTIONS : STABLE, LOWER - COST DEPOSIT GENERATOR DEPOSIT GROWTH FROM FINTECH BUSINESS HIGHLIGHTS • Stable, lower - cost deposit base anchored by multi - year, contractual relationships in our Fintech Solutions business • Fintech Solutions growth driven by increased transactional volume due to electronic banking migration and the addition of new partners $0.0 $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 2020 2021 2022 2023 Q1 2024 AVERAGE DEPOSITS BY PERIOD ($ BILLIONS) Fintech Solutions Group (Prepaid and Debit Card Issuance and other payments) Institutional Banking (checking and money market for higher net worth individuals) Other (Includes time deposits and other legacy deposit programs) 2.41% 2.32% 0.82% 0.10% 0.25% COST OF DEPOSITS $5.2 $5.7 $6.3 $6.4 $6.5

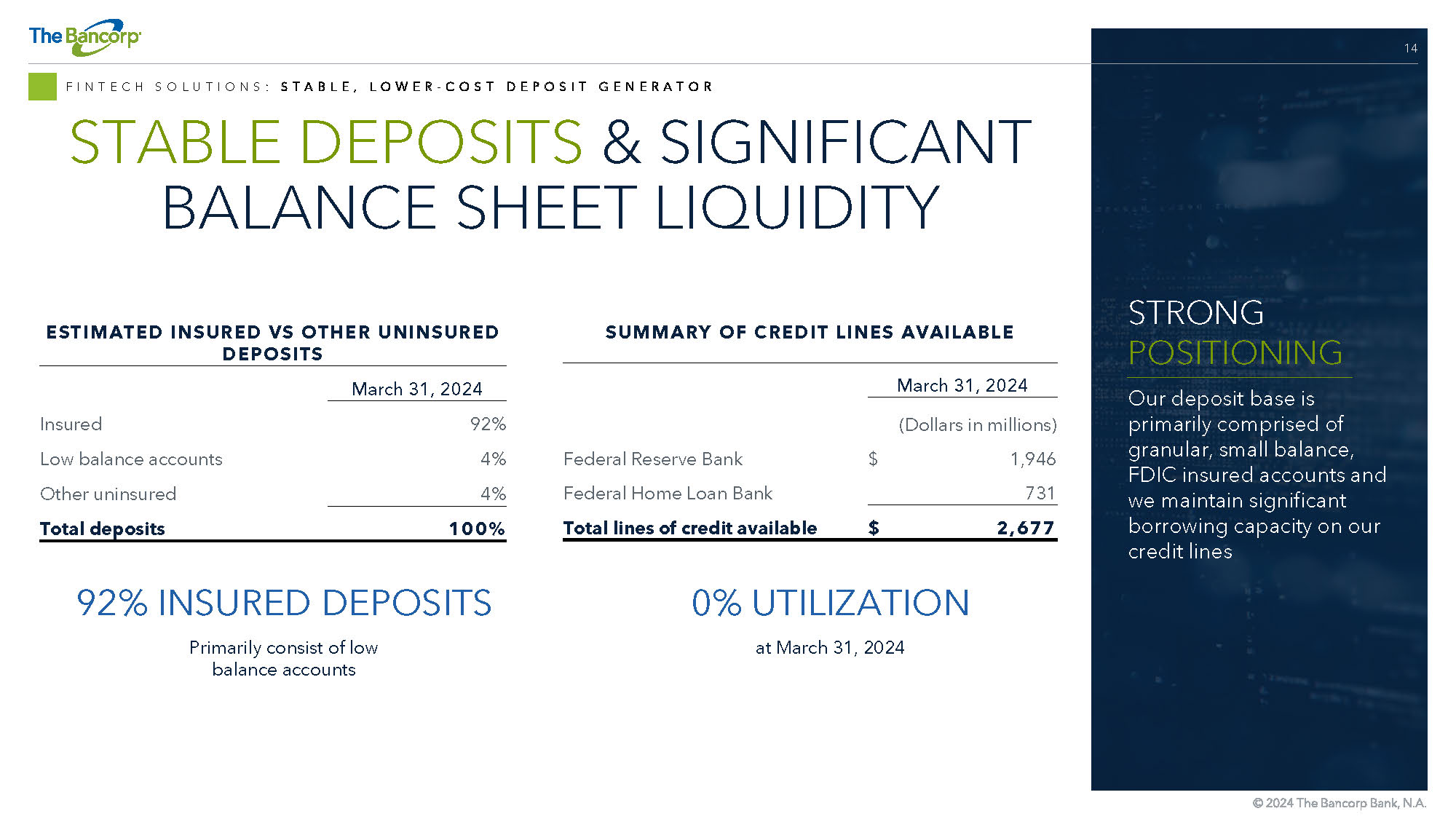

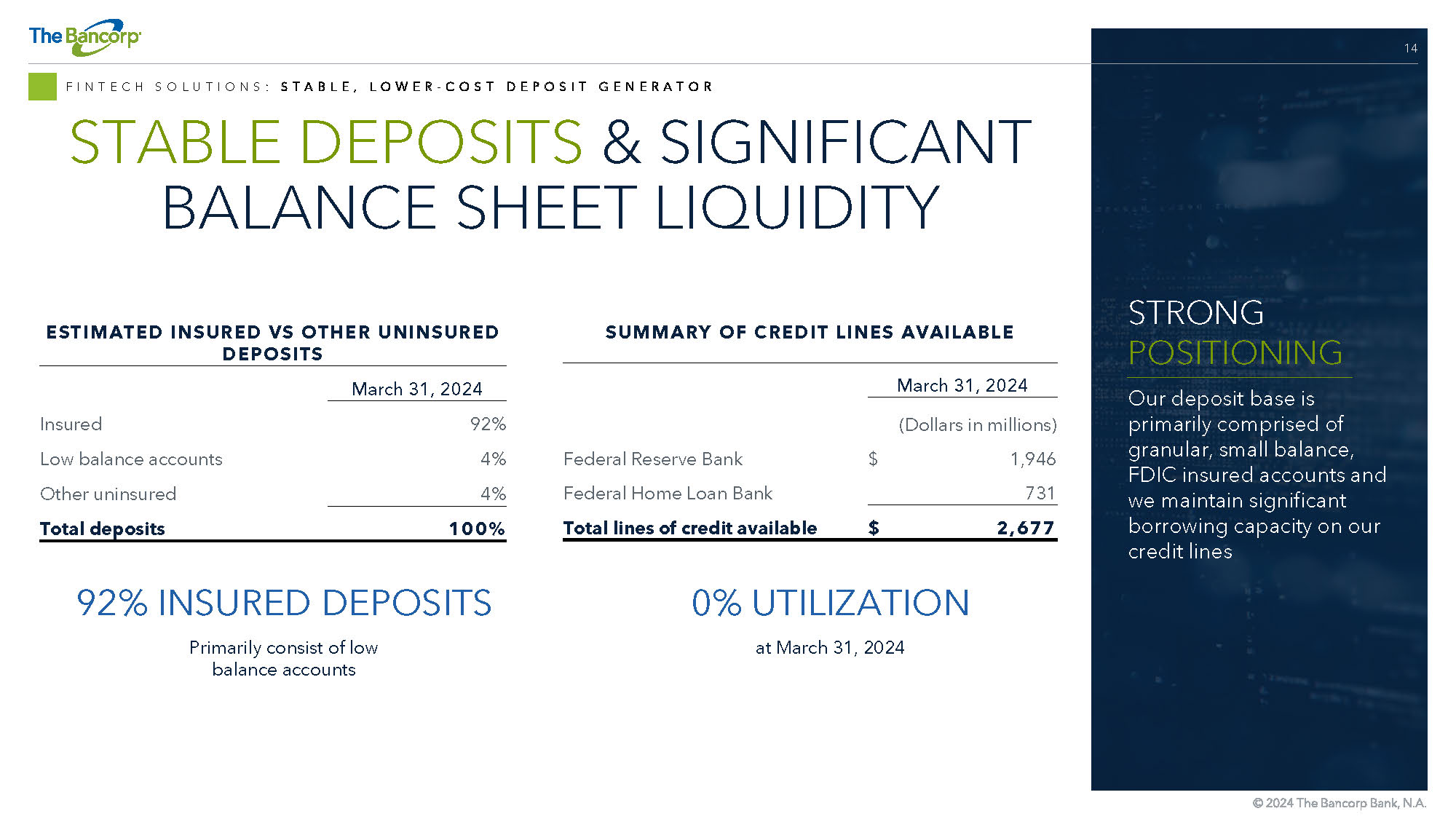

14 FINTECH SOLUTIONS : STABLE, LOWER - COST DEPOSIT GENERATOR STABLE DEPOSITS & SIGNIFICANT BALANCE SHEET LIQUIDITY STRONG POSITIONING Our deposit base is primarily comprised of granular, small balance, FDIC insured accounts and we maintain significant borrowing capacity on our credit lines ESTIMATED INSURED VS OTHER UNINSURED DEPOSITS March 31, 2024 92% Insured 4% Low balance accounts 4% Other uninsured 100% Total deposits SUMMARY OF CREDIT LINES AVAILABLE March 31, 2024 (Dollars in millions) 1,946 $ Federal Reserve Bank 731 Federal Home Loan Bank 2,677 $ Total lines of credit available 92% INSURED DEPOSITS Primarily consist of low balance accounts 0% UTILIZATION at March 31, 2024

LOANS, LEASES & SUPPORTING COLLATERAL

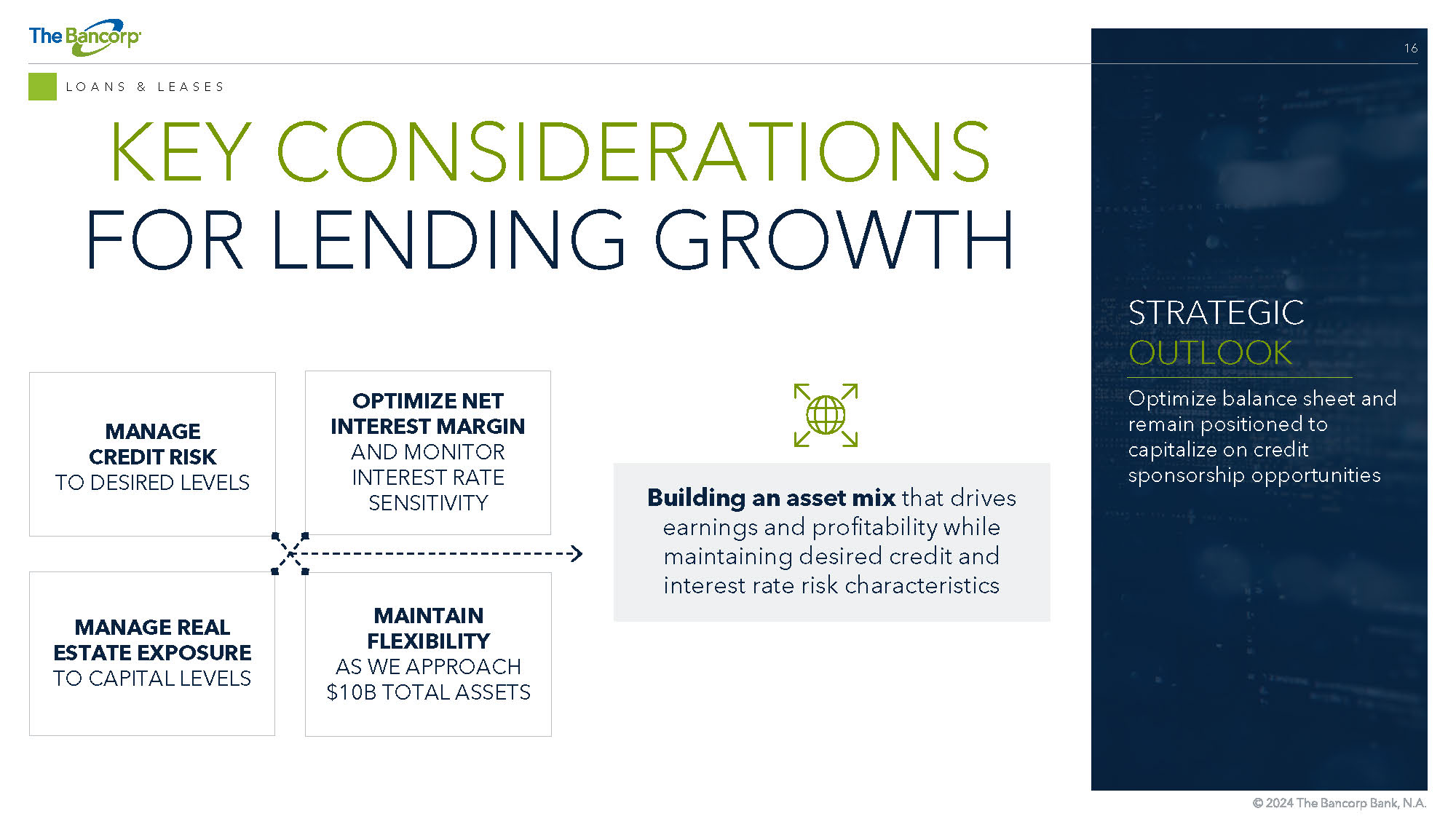

16 LOANS & LEASES STRATEGIC OUTLOOK Optimize balance sheet and r emain positioned to capitalize on credit sponsorship opportunities KEY CONSIDERATIONS FOR LENDING GROWTH MANAGE CREDIT RISK TO DESIRED LEVELS OPTIMIZE NET INTEREST MARGIN AND MONITOR INTEREST RATE SENSITIVITY MANAGE REAL ESTATE EXPOSURE TO CAPITAL LEVELS MAINTAIN FLEXIBILITY AS WE APPROACH $10B TOTAL ASSETS Building an asset mix that drives earnings and profitability while maintaining desired credit and interest rate risk characteristics

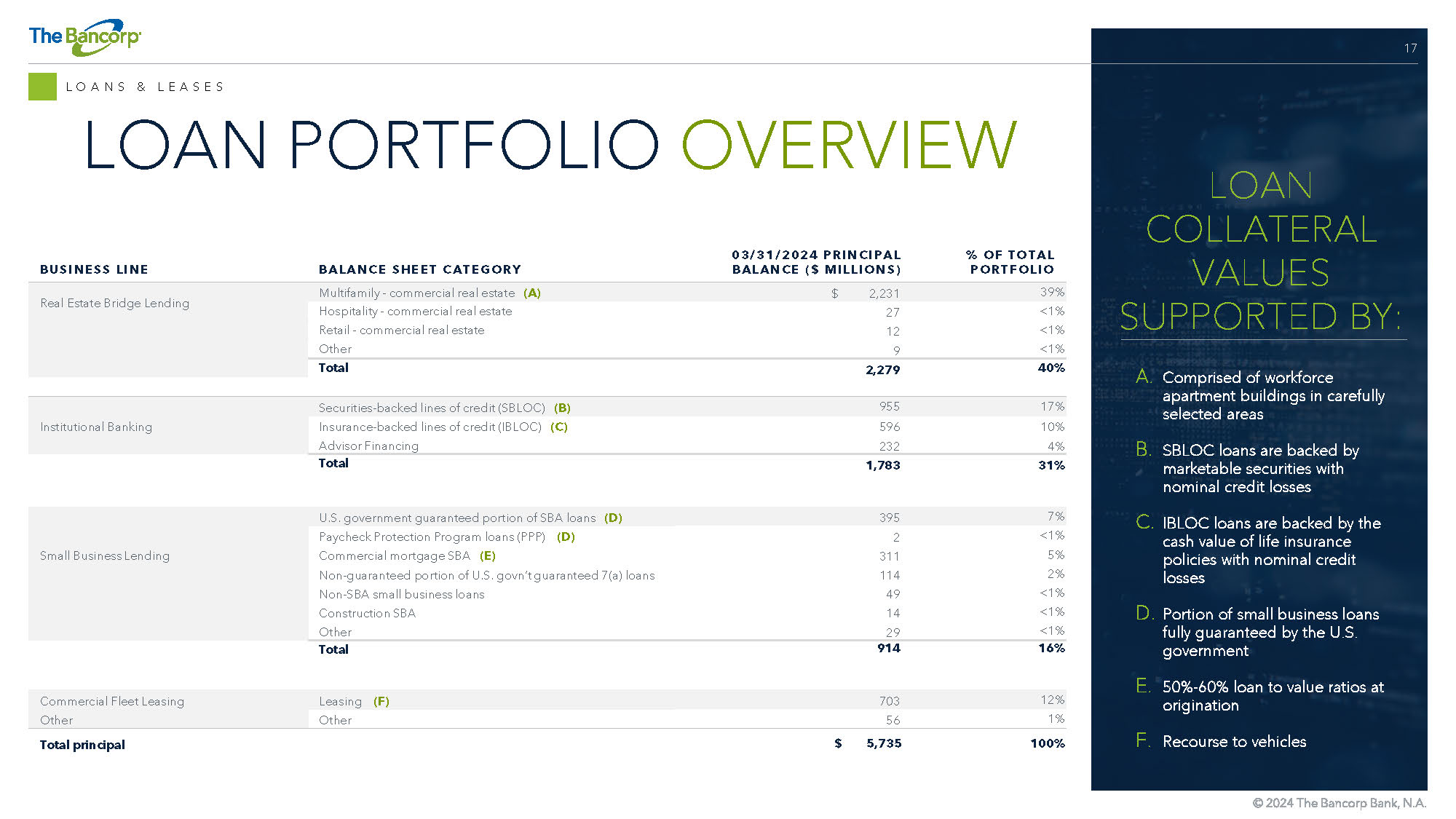

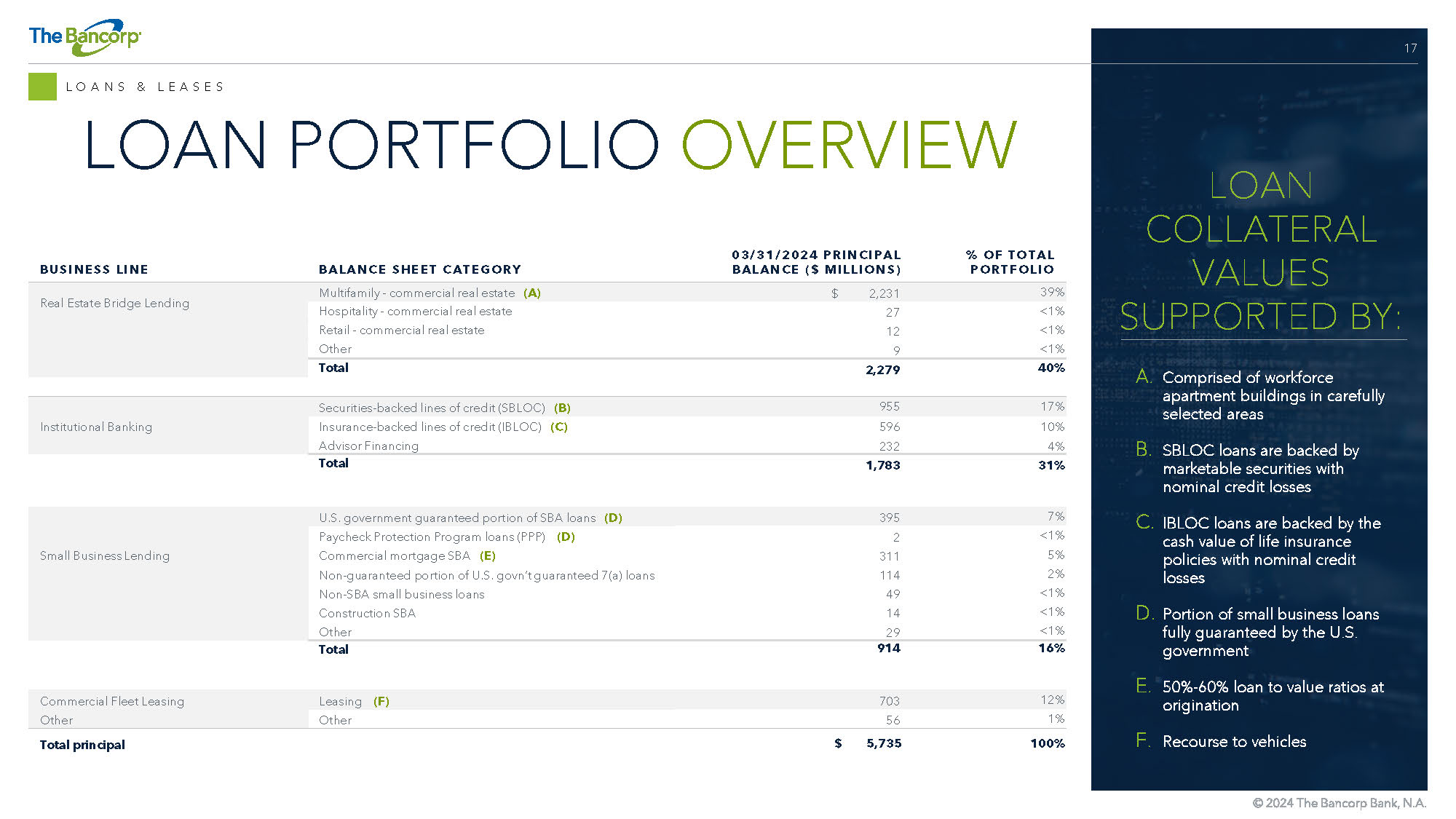

17 LOANS & LEASES LOAN PORTFOLIO OVERVIEW % OF TOTAL PORTFOLIO 03/31/2024 PRINCIPAL BALANCE ($ MILLIONS) BALANCE SHEET CATEGORY BUSINESS LINE 39% $ 2,231 Multifamily - commercial real estate (A) Real Estate Bridge Lending <1% 27 Hospitality - commercial real estate <1% 12 Retail - commercial real estate <1% 9 Other 40% 2,279 Total 17% 955 Securities - backed lines of credit (SBLOC) ( B) Institutional Banking 10% 596 Insurance - backed lines of credit (IBLOC) (C) 4% 232 Advisor Financing 31% 1,783 Total 7% 395 U.S. government guaranteed portion of SBA loans ( D) Small Business Lending <1% 2 Pay check Protection Program loans (PPP) ( D) 5% 311 Commercial mortgage SBA ( E) 2% 114 Non - guaranteed portion of U.S. govn’t guaranteed 7(a) loans <1% 49 Non - SBA small business loans <1% 14 Construction SBA <1% 29 Other 16% 914 Total 12% 703 Leasing ( F) Commercial Fleet Leasing 1% 56 Other Other 100% $ 5,735 Total principal LOAN COLLATERAL VALUES SUPPORTED BY: A. Comprised of workforce apartment buildings in carefully selected areas B. SBLOC loans are backed by marketable securities with nominal credit losses C. IBLOC loans are backed by the cash value of life insurance policies with nominal credit losses D. Portion of small business loans fully guaranteed by the U.S. government E. 50% - 60% loan to value ratios at origination F. Recourse to vehicles

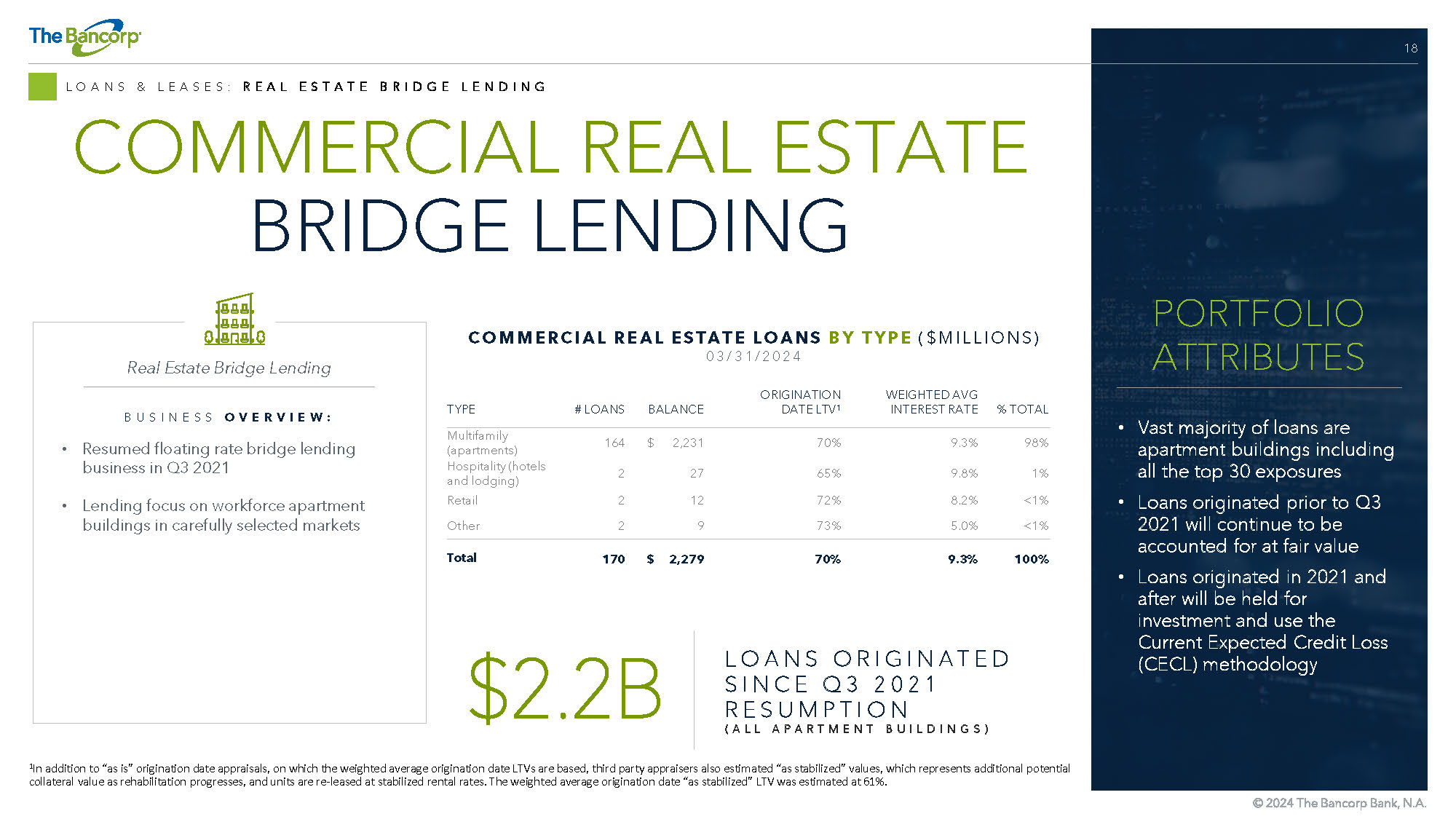

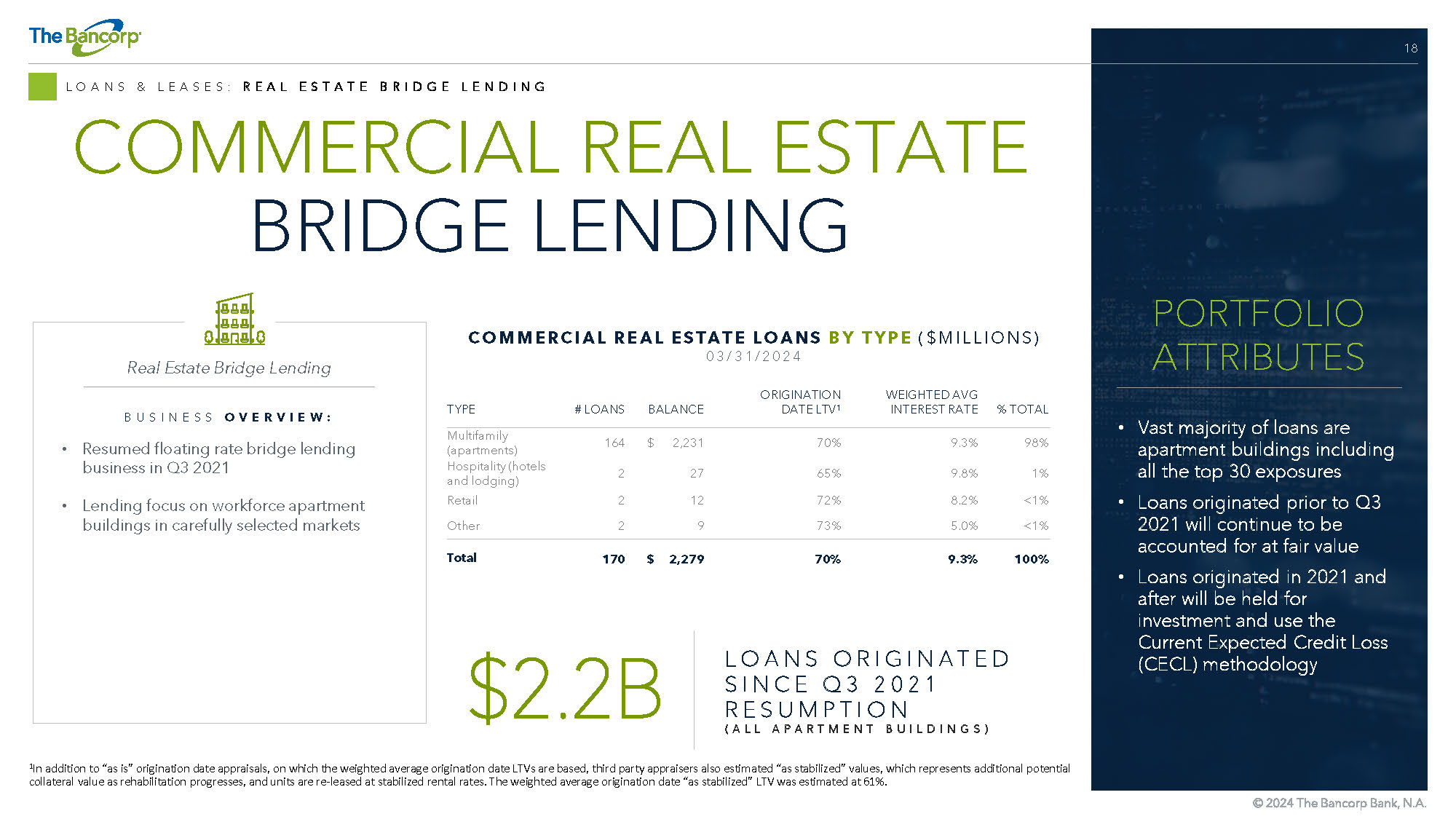

18 LOANS & LEASES: REAL ESTATE BRIDGE LENDING COMMERCIAL REAL ESTATE BRIDGE LENDING % TOTAL WEIGHTED AVG INTEREST RATE ORIGINATION DATE LTV 1 BALANCE # LOANS TYPE 98% 9.3% 70% $ 2,231 164 Multifamily (apartments) 1% 9.8% 65% 27 2 Hospitality (hotels and lodging) <1% 8.2% 72% 12 2 Retail <1% 5.0% 73% 9 2 Other 100% 9.3% 70% $ 2,279 170 Total COMMERCIAL REAL ESTATE LOANS BY TYPE ($MILLIONS) 03/31/2024 $2.2B PORTFOLIO LOANS ORIGINATED SINCE Q3 2021 RESUMPTION (ALL APARTMENT BUILDINGS) BUSINESS OVERVIEW: • Resumed floating rate bridge lending business in Q3 2021 • Lending focus on workforce apartment buildings in carefully selected markets Real Estate Bridge Lending • Vast majority of loans are apartment buildings including all the top 30 exposures • Loans originated prior to Q3 2021 will continue to be accounted for at fair value • Loans originated in 2021 and after will be held for investment and use the Current Expected Credit Loss (CECL) methodology PORTFOLIO ATTRIBUTES 1 In addition to “as is” origination date appraisals, on which the weighted average origination date LTVs are based, third part y a ppraisers also estimated “as stabilized” values, which represents additional potential collateral value as rehabilitation progresses, and units are re - leased at stabilized rental rates. The weig hted average origination date “as stabilized” LTV was estimated at 61%.

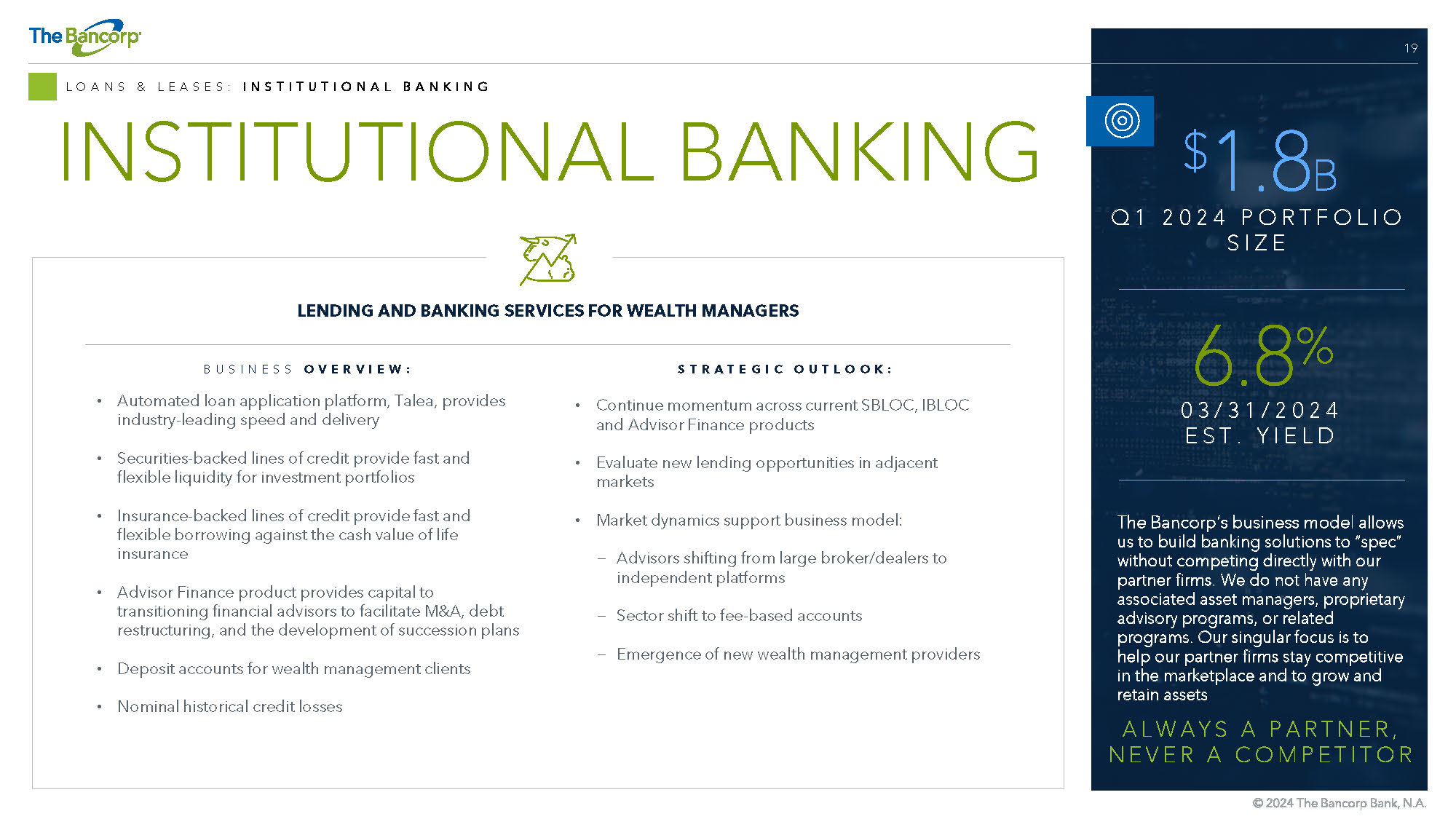

19 LOANS & LEASES: INSTITUTIONAL BANKING INSTITUTIONAL BANKING BUSINESS OVERVIEW: • Automated loan application platform, Talea, provides industry - leading speed and delivery • Securities - backed lines of credit provide fast and flexible liquidity for investment portfolios • Insurance - backed lines of credit provide fast and flexible borrowing against the cash value of life insurance • Advisor Finance product provides capital to transitioning financial advisors to facilitate M&A, debt restructuring, and the development of succession plans • Deposit accounts for wealth management clients • Nominal historical credit losses STRATEGIC OUTLOOK: • Continue momentum across current SBLOC, IBLOC and Advisor Finance products • Evaluate new lending opportunities in adjacent markets • Market dynamics support business model: − Advisors shifting from large broker/dealers to independent platforms − Sector shift to fee - based accounts − Emergence of new wealth management providers LENDING AND BANKING SERVICES FOR WEALTH MANAGERS The Bancorp’s business model allows us to build banking solutions to “spec” without competing directly with our partner firms. We do not have any associated asset managers, proprietary advisory programs, or related programs. Our singular focus is to help our partner firms stay competitive in the marketplace and to grow and retain assets ALWAYS A PARTNER, NEVER A COMPETITOR $ 1.8 B Q1 2024 PORTFOLIO SIZE 6.8 % 03/31/2024 EST. YIELD

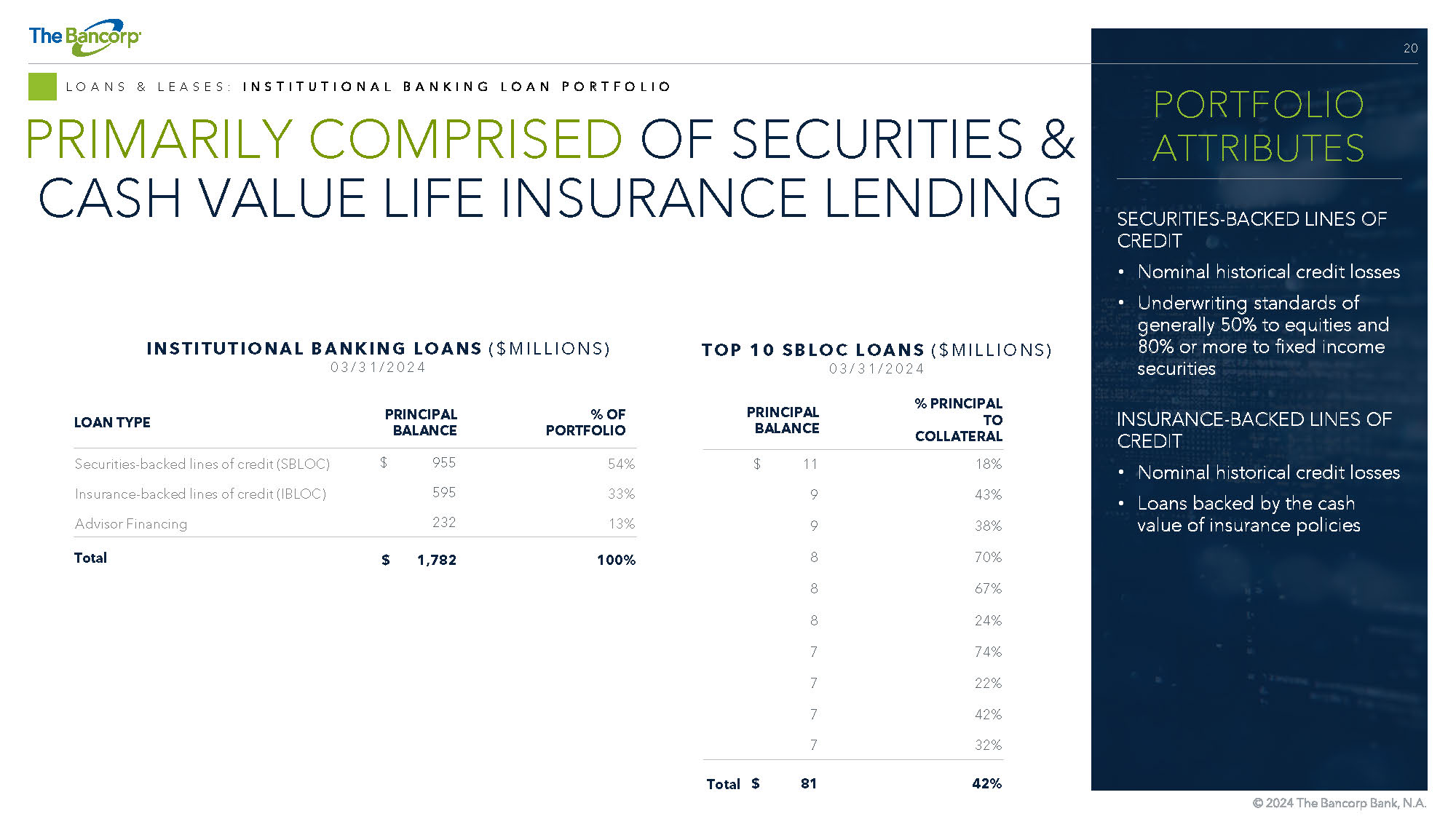

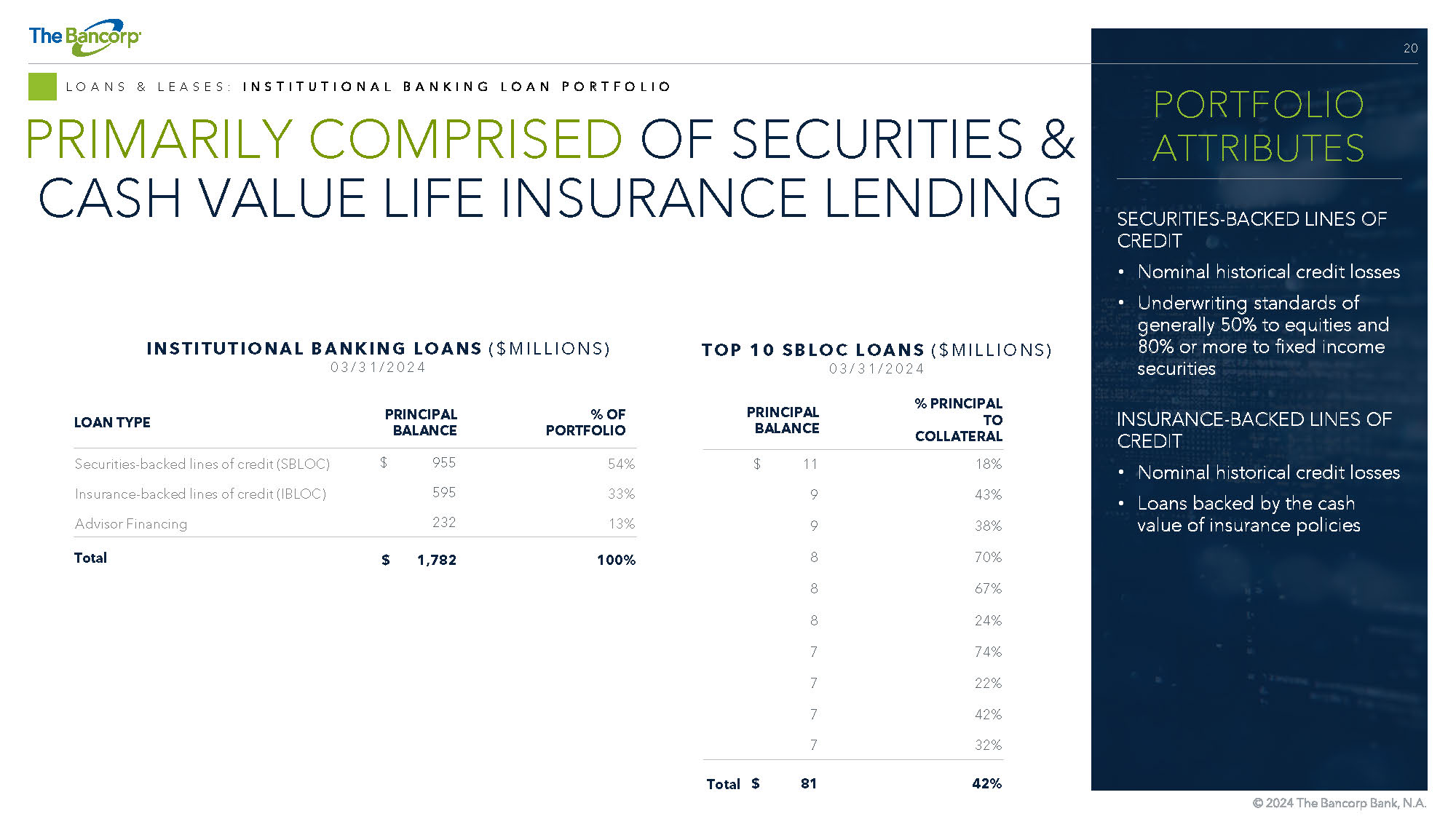

20 LOANS & LEASES: INSTITUTIONAL BANKING LOAN PORTFOLIO PRIMARILY COMPRISED OF SECURITIES & CASH VALUE LIFE INSURANCE LENDING % OF PORTFOLIO PRINCIPAL BALANCE LOAN TYPE 54% $ 955 Securities - backed lines of credit (SBLOC) 33% 595 Insurance - backed lines of credit (IBLOC) 13% 232 Advisor Financing 100% $ 1,782 Total INSTITUTIONAL BANKING LOANS ($MILLIONS) 03/31/2024 % PRINCIPAL TO COLLATERAL PRINCIPAL BALANCE 18% $ 11 43% 9 38% 9 70% 8 67% 8 24% 8 74% 7 22% 7 42% 7 32% 7 42% $ 81 Total TOP 10 SBLOC LOANS ($MILLIONS) 03/31/2024 SECURITIES - BACKED LINES OF CREDIT • Nominal historical credit losses • Underwriting standards of generally 50% to equities and 80% or more to fixed income securities INSURANCE - BACKED LINES OF CREDIT • Nominal historical credit losses • Loans backed by the cash value of insurance policies PORTFOLIO ATTRIBUTES

21 LOANS & LEASES: SMALL BUSINESS LENDING SMALL BUSINESS LENDING $ 914 B Q1 2024 PORTFOLIO SIZE 7.1 % 03/31/2024 EST. YIELD BUSINESS OVERVIEW: • Established a distinct platform within the fragmented SBA market − National portfolio approach allows pricing and client flexibility − Solid credit performance demonstrated over time − Client segment strategy tailored by market STRATEGIC OUTLOOK: • Continue delivering growth within existing small business lending platform while entering new verticals and growing the SBAlliance ® • SBAlliance ® program provides lending support to banks and financial institutions who need SBA lending capabilities through products such as: − Wholesale loan purchases − Vertical focus with expansion of funeral home lending program SBA AND OTHER SMALL BUSINESS LENDING ~$ 800 K AVERAGE 7(a) LOAN SIZE

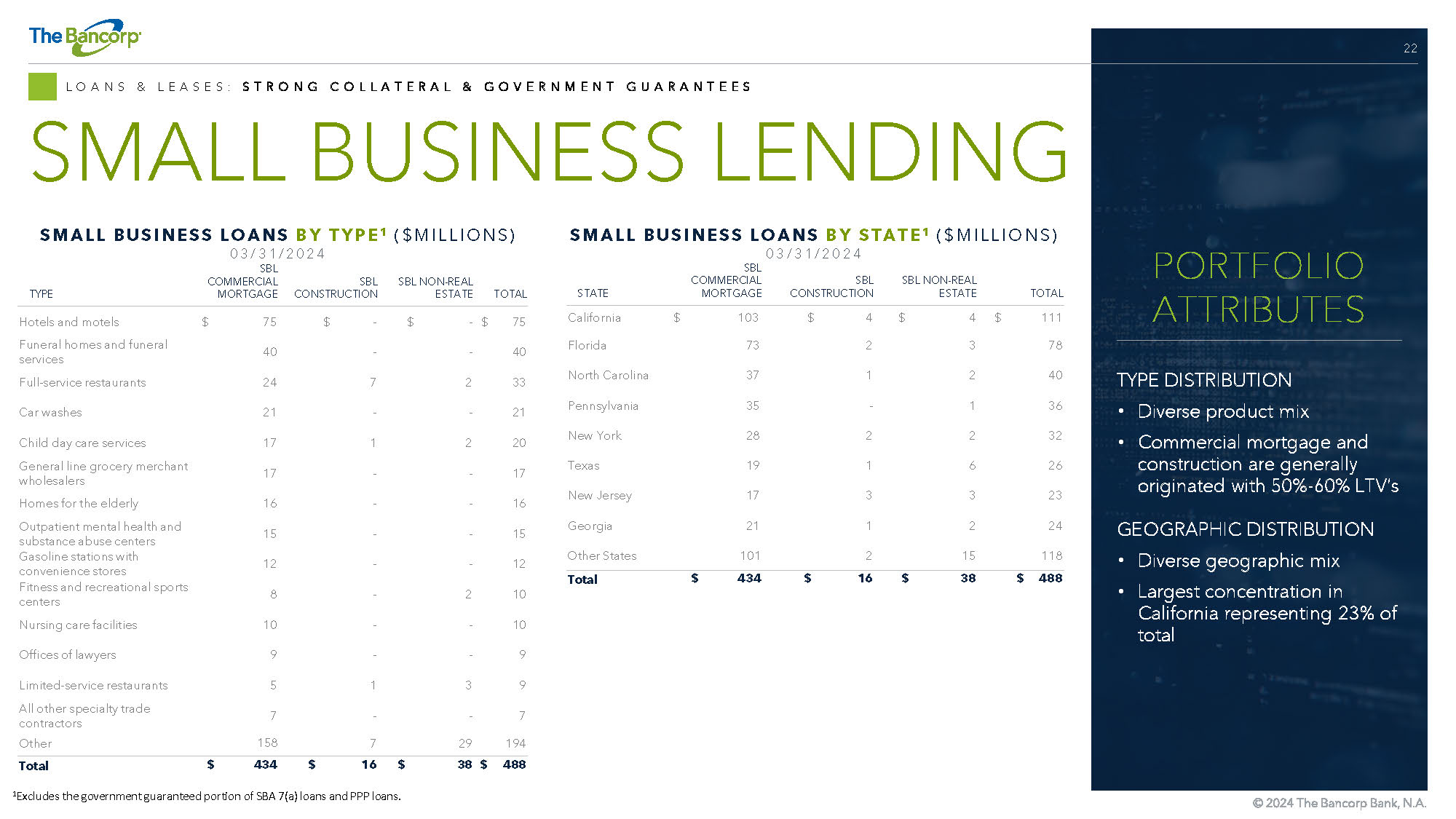

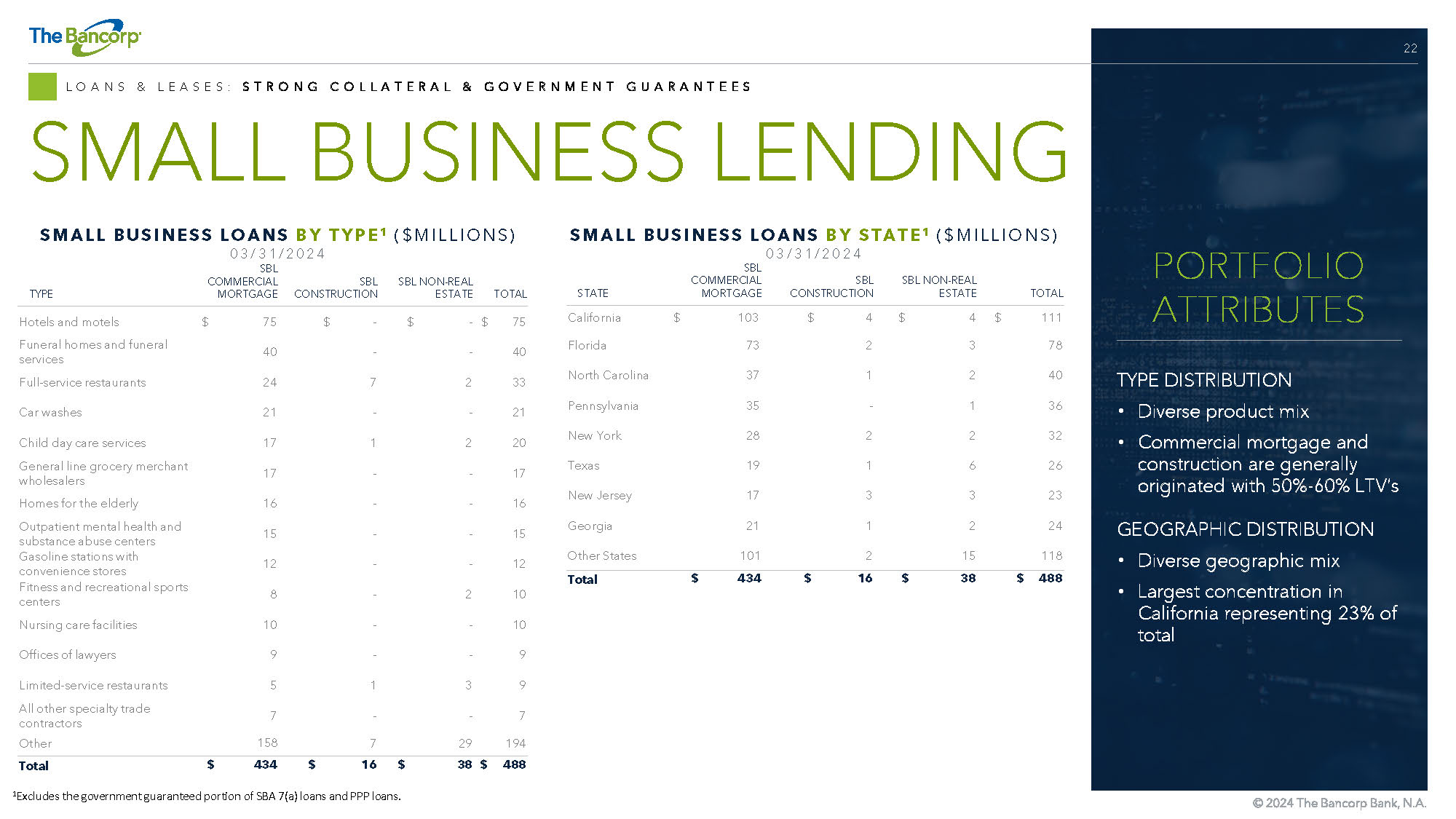

22 LOANS & LEASES: STRONG COLLATERAL & GOVERNMENT GUARANTEES SMALL BUSINESS LENDING SMALL BUSINESS LOANS BY TYPE 1 ($MILLIONS) 03/31/2024 SMALL BUSINESS LOANS BY STATE 1 ($MILLIONS) 03/31/2024 TOTAL SBL NON - REAL ESTATE SBL CONSTRUCTION SBL COMMERCIAL MORTGAGE STATE $ 111 $ 4 $ 4 $ 103 California 78 3 2 73 Florida 40 2 1 37 North Carolina 36 1 - 35 Pennsylvania 32 2 2 28 New York 26 6 1 19 Texas 23 3 3 17 New Jersey 24 2 1 21 Georgia 118 15 2 101 Other States $ 488 $ 38 $ 16 $ 434 Total TOTAL SBL NON - REAL ESTATE SBL CONSTRUCTION SBL COMMERCIAL MORTGAGE TYPE $ 75 $ - $ - $ 75 Hotels and motels 40 - - 40 Funeral homes and funeral services 33 2 7 24 Full - service restaurants 21 - - 21 Car washes 20 2 1 17 Child day care services 17 - - 17 General line grocery merchant wholesalers 16 - - 16 Homes for the elderly 15 - - 15 Outpatient mental health and substance abuse centers 12 - - 12 Gasoline stations with convenience stores 10 2 - 8 Fitness and recreational sports centers 10 - - 10 Nursing care facilities 9 - - 9 Offices of lawyers 9 3 1 5 Limited - service restaurants 7 - - 7 All other specialty trade contractors 194 29 7 158 Other $ 488 $ 38 $ 16 $ 434 Total 1 Excludes the government guaranteed portion of SBA 7(a) loans and PPP loans. TYPE DISTRIBUTION • Diverse product mix • Commercial mortgage and construction are generally originated with 50% - 60% LTV’s GEOGRAPHIC DISTRIBUTION • Diverse geographic mix • Largest concentration in California representing 23% of total PORTFOLIO ATTRIBUTES

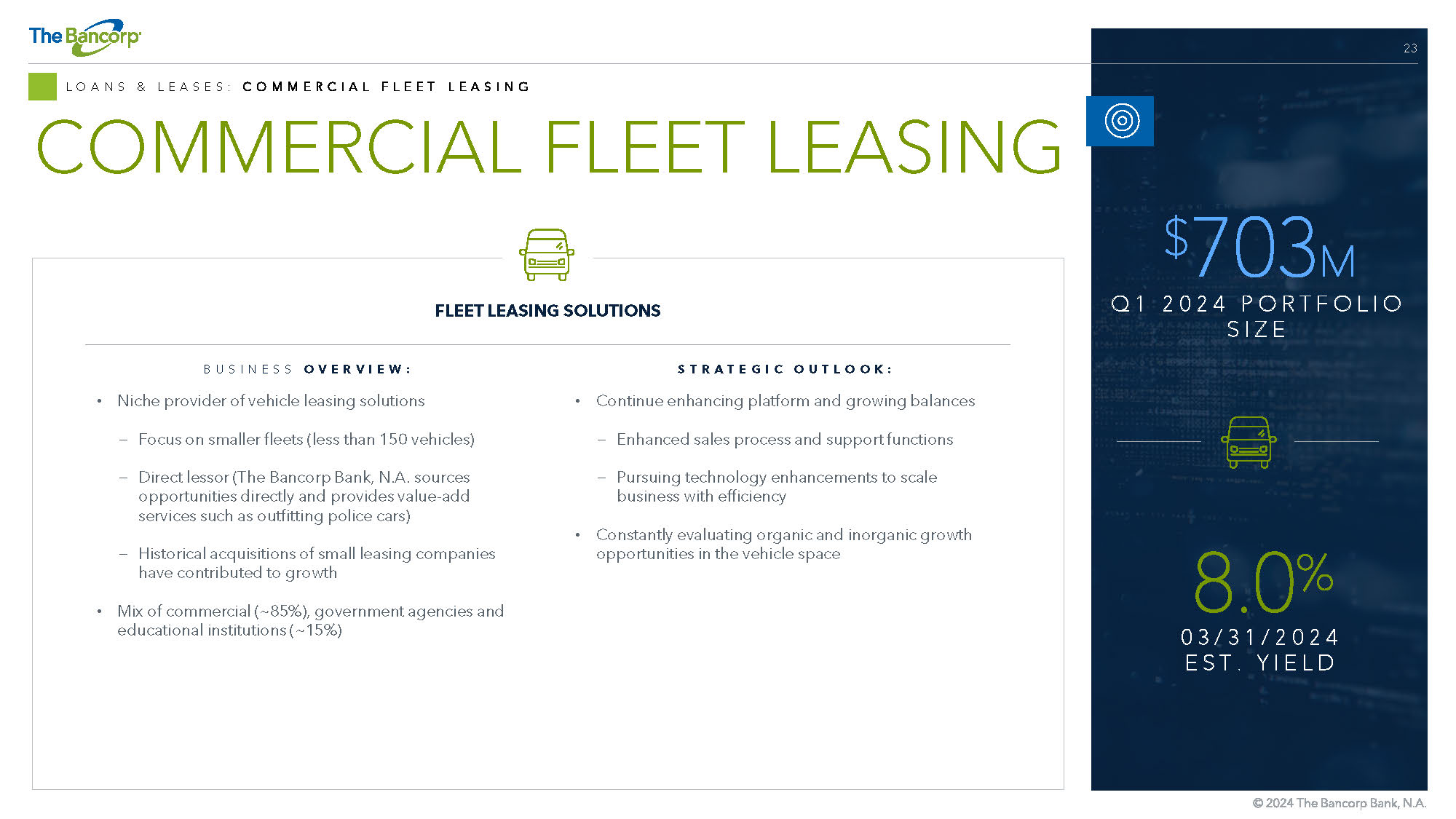

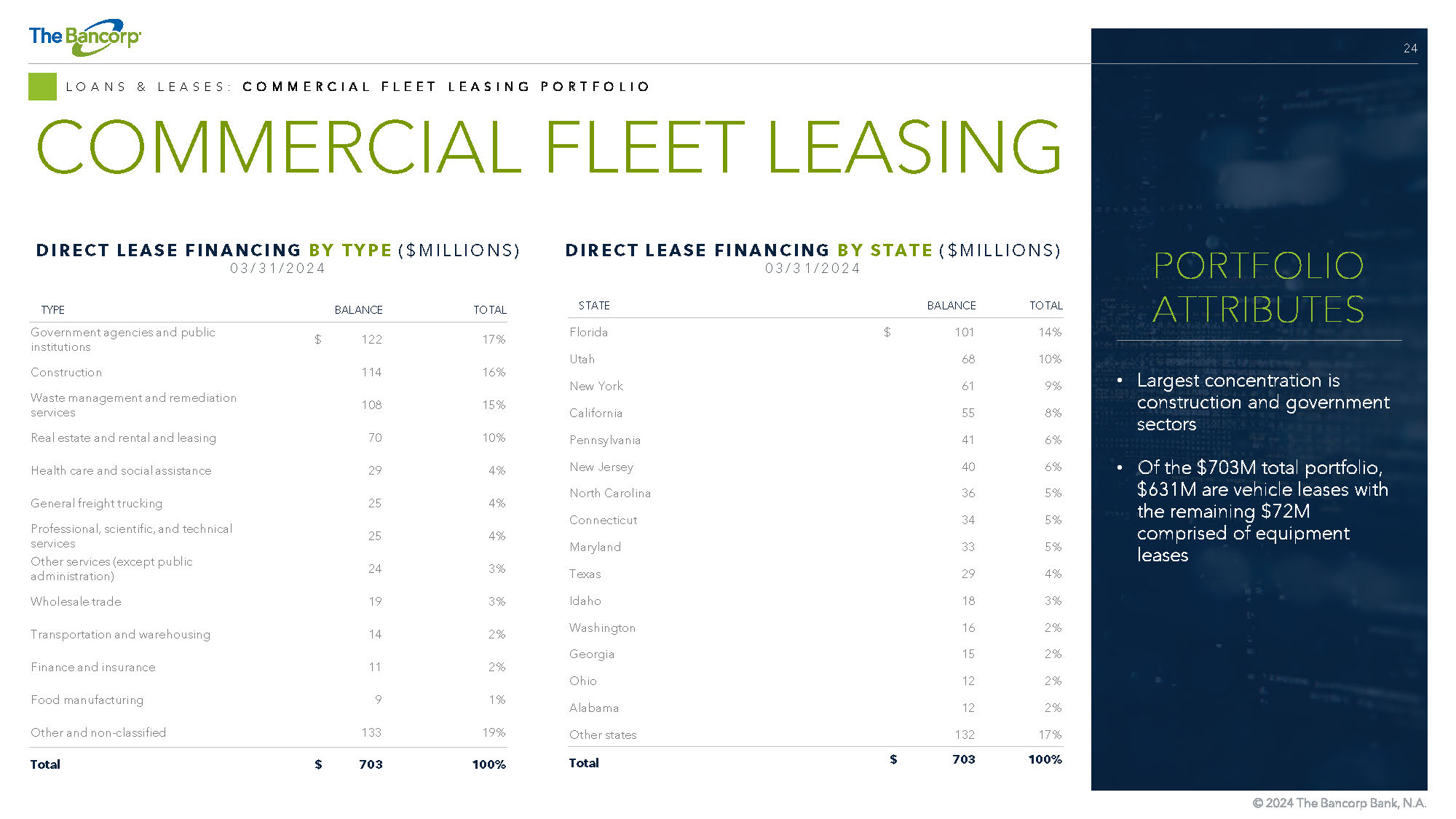

23 LOANS & LEASES: COMMERCIAL FLEET LEASING COMMERCIAL FLEET LEASING BUSINESS OVERVIEW: • Niche provider of vehicle leasing solutions − Focus on smaller fleets (less than 150 vehicles) − Direct lessor (The Bancorp Bank, N.A. sources opportunities directly and provides value - add services such as outfitting police cars) − Historical acquisitions of small leasing companies have contributed to growth • Mix of commercial (~85%), government agencies and educational institutions (~15%) STRATEGIC OUTLOOK: • Continue enhancing platform and growing balances − Enhanced sales process and support functions − Pursuing technology enhancements to scale business with efficiency • Constantly evaluating organic and inorganic growth opportunities in the vehicle space FLEET LEASING SOLUTIONS $ 703 M Q1 2024 PORTFOLIO SIZE 8.0 % 03/31/2024 EST. YIELD

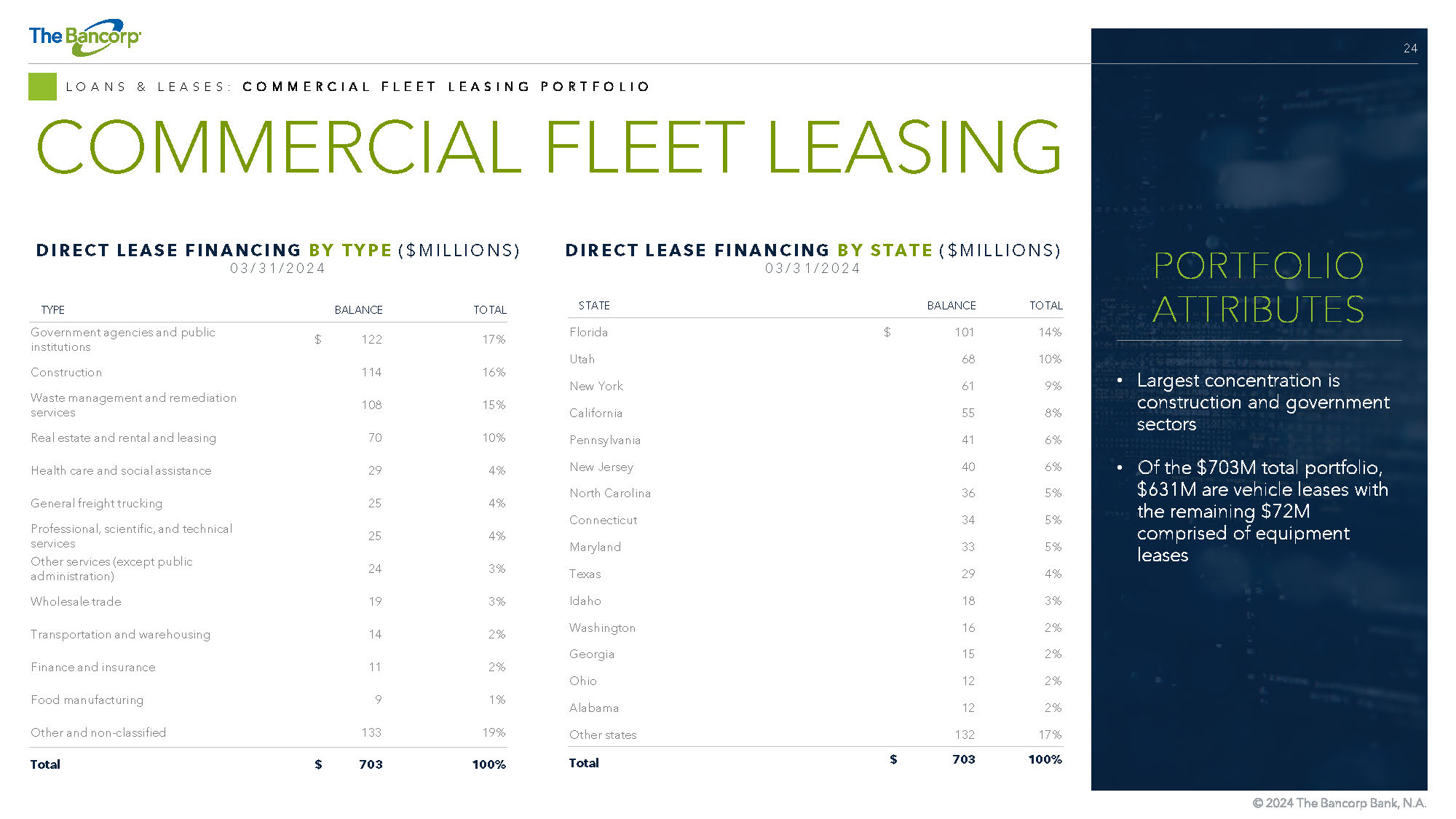

24 LOANS & LEASES: COMMERCIAL FLEET LEASING PORTFOLIO COMMERCIAL FLEET LEASING • Largest concentration is construction and government sectors • Of the $703M total portfolio, $631M are vehicle leases with the remaining $72M comprised of equipment leases PORTFOLIO ATTRIBUTES TOTAL BALANCE TYPE 17% $ 122 Government agencies and public institutions 16% 114 Construction 15% 108 Waste management and remediation services 10% 70 Real estate and rental and leasing 4% 29 Health care and social assistance 4% 25 General freight trucking 4% 25 Professional, scientific, and technical services 3% 24 Other services (except public administration) 3% 19 Wholesale trade 2% 14 Transportation and warehousing 2% 11 Finance and insurance 1% 9 Food manufacturing 19% 133 Other and non - classified 100% $ 703 Total DIRECT LEASE FINANCING BY STATE ($MILLIONS) 03/31/2024 TOTAL BALANCE STATE 14% $ 101 Florida 10% 68 Utah 9% 61 New York 8% 55 California 6% 41 Pennsylvania 6% 40 New Jersey 5% 36 North Carolina 5% 34 Connecticut 5% 33 Maryland 4% 29 Texas 3% 18 Idaho 2% 16 Washington 2% 15 Georgia 2% 12 Ohio 2% 12 Alabama 17% 132 Other states 100% $ 703 Total DIRECT LEASE FINANCING BY TYPE ($MILLIONS) 03/31/2024

FINANCIAL REVIEW

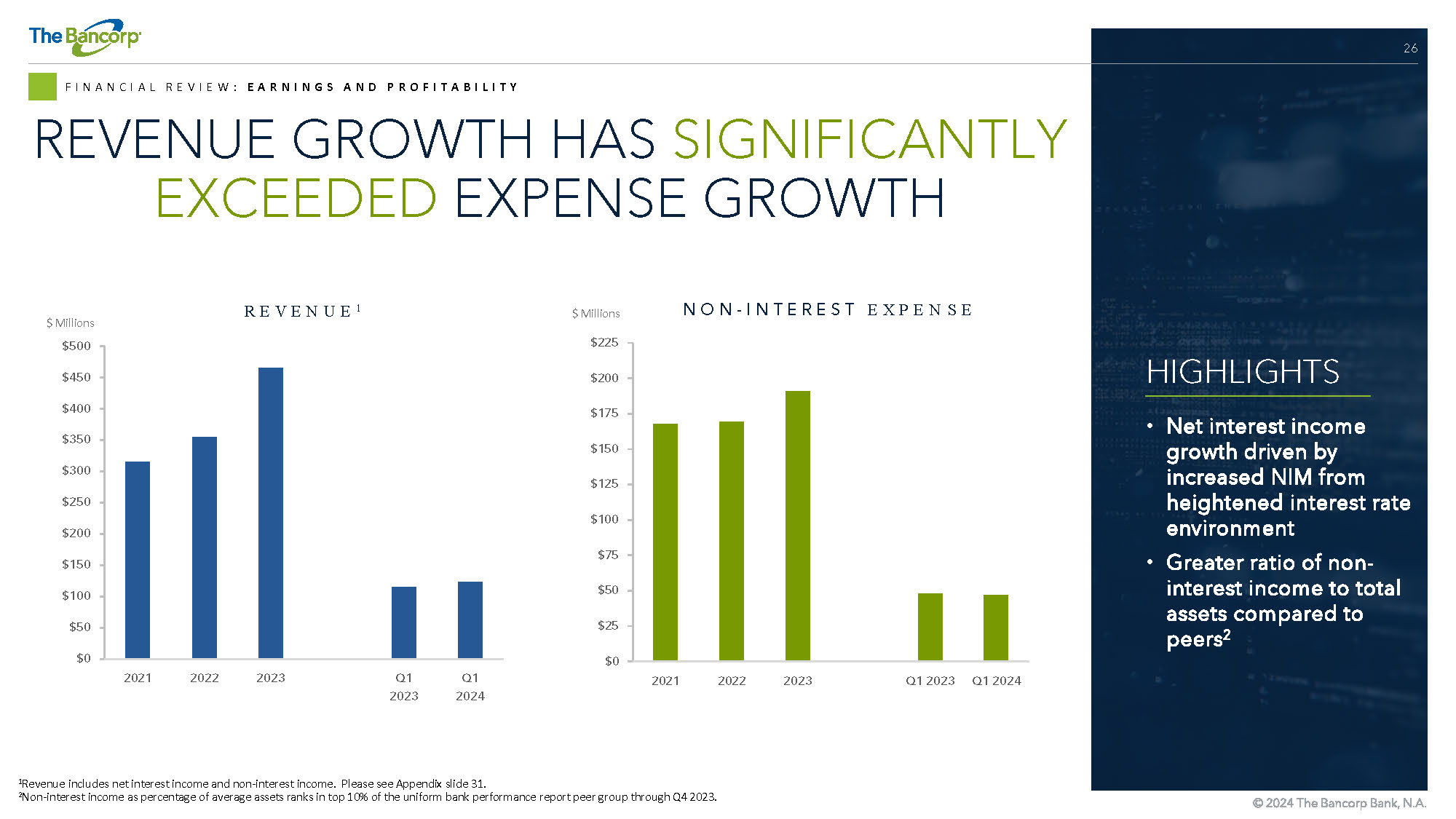

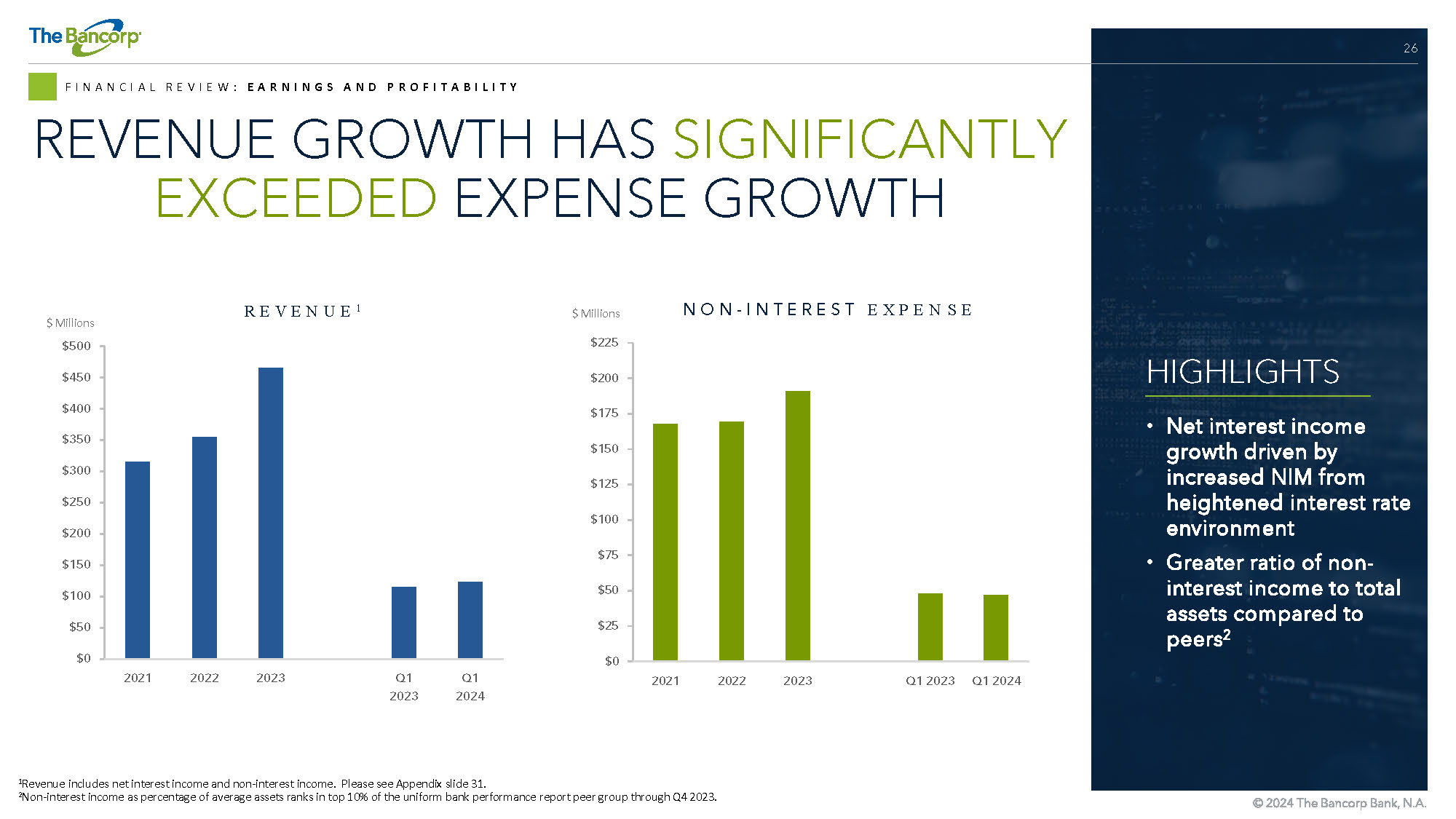

26 FINANCIAL REVIEW: EARNINGS AND PROFITABILITY REVENUE GROWTH HAS SIGNIFICANTLY EXCEEDED EXPENSE GROWTH 1 Revenue includes net interest income and non - interest income. Please see Appendix slide 31. 2 Non - interest income as percentage of average assets ranks in top 10% of the uniform bank performance report peer group through Q 4 2023. $0 $25 $50 $75 $100 $125 $150 $175 $200 $225 2021 2022 2023 Q1 2023 Q1 2024 NON - INTEREST EXPENSE $ Millions $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 2021 2022 2023 Q1 2023 Q1 2024 REVENUE 1 $ Millions HIGHLIGHTS • Net interest income growth driven by increased NIM from heightened interest rate environment • Greater ratio of non - interest income to total assets compared to peers 2

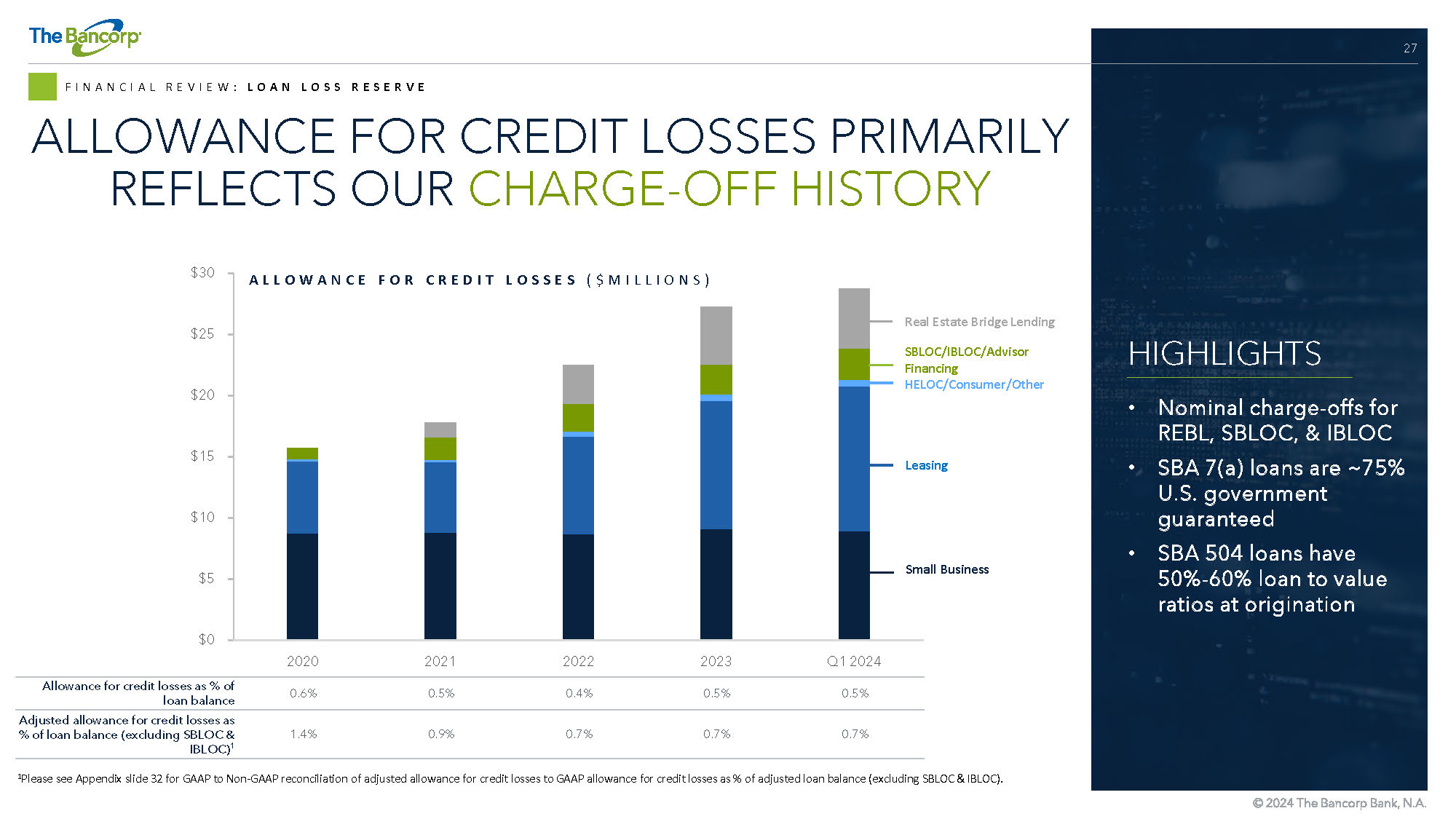

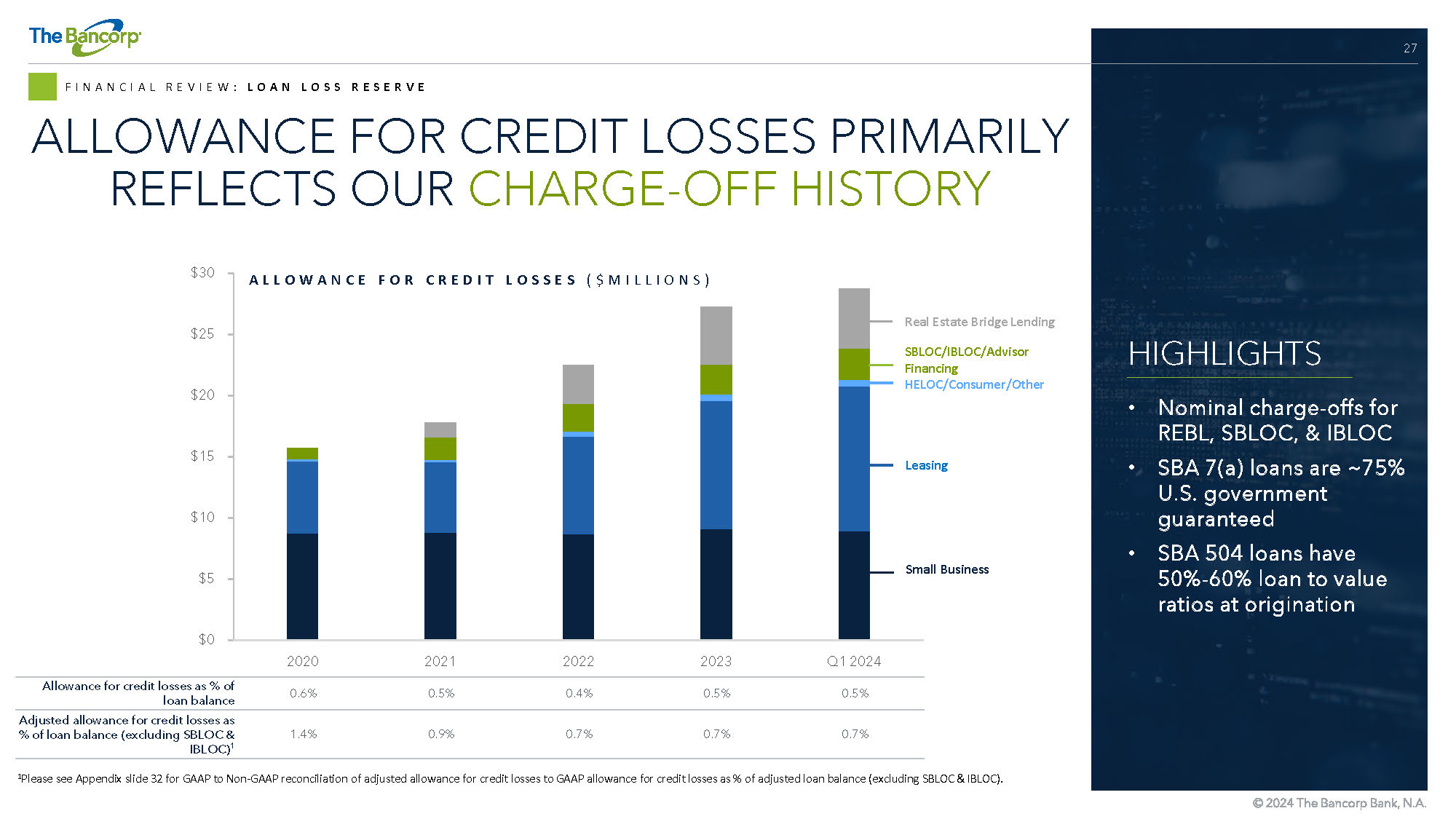

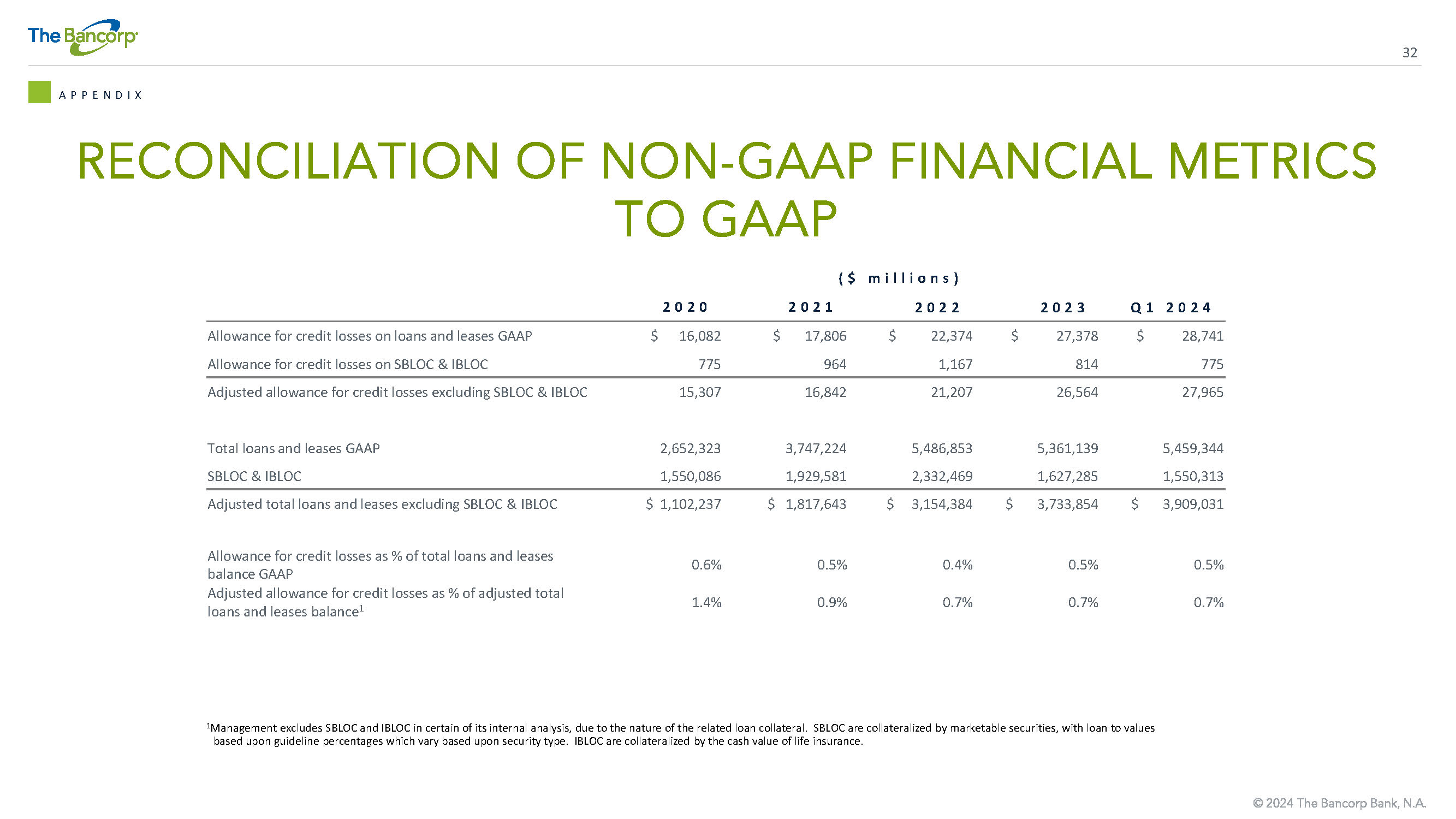

27 FINANCIAL REVIEW: LOAN LOSS RESERVE ALLOWANCE FOR CREDIT LOSSES PRIMARILY REFLECTS OUR CHARGE - OFF HISTORY 1 Please see Appendix slide 32 for GAAP to Non - GAAP reconciliation of adjusted allowance for credit losses to GAAP allowance for c redit losses as % of adjusted loan balance (excluding SBLOC & IBLOC). HIGHLIGHTS • Nominal charge - offs for REBL, SBLOC, & IBLOC • SBA 7(a) loans are ~75% U.S. government guaranteed • SBA 504 loans have 50% - 60% loan to value ratios at origination $0 $5 $10 $15 $20 $25 $30 2020 2021 2022 2023 Q1 2024 ALLOWANCE FOR CREDIT LOSSES ($MILLIONS) Small Business HELOC/Consumer/Other SBLOC/IBLOC/Advisor Financing 0.5% 0.5% 0.4% 0.5% 0.6% Allowance for credit losses as % of loan balance 0.7% 0.7% 0.7% 0.9% 1.4% Adjusted allowance for credit losses as % of loan balance (excluding SBLOC & IBLOC) 1 Leasing Real Estate Bridge Lending

28 FINANCIAL REVIEW: HISTORICAL CAPITAL POSITION CAPITAL POSITION HIGHLIGHTS • Completed $50M common stock repurchase in Q1 • Planned common stock repurchase increase in Q2 from $50 million to $100 million 2 • Corporate governance requires periodic assessment of capital minimums • Capital planning includes stress testing for unexpected conditions and events 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% 20% 2021 2022 2023 Q1 2024 5.0% 12.1% 12.4% 10.7% 10.9% Tier 1 Leverage Ratio 8% 17% 17% 15% 15% Tier 1 Risk - based Capital Ratio (RBC) 1 10% 18% 18% 15% 16% Total Risk - based Capital Ratio Tier 1 Capital Ratio Total RBC Ratio Tier 1 Leverage Ratio THE BANCORP BANK, N.A. CAPITAL RATIOS Well - capitalized minimum 1 Common Equity Tier 1 to risk weighted assets is identical to Tier 1 risk - based ratio and has a 6.5% well capitalized minimum. 2 Common stock repurchase may be modified without notice at any time.

29 HISTORICAL PERFORMANCE AND LONG - TERM TARGETS FINANCIAL REVIEW: EARNINGS AND PROFITABILITY LONG - TERM TARGETS Q1 2024 2023 2022 2021 PERFORMANCE METRICS >40% 28.0% 25.6% 19.3% 17.9% ROE > 4.0% 3.0% 2.59% 1.81% 1.68% ROA $1.06 $3.49 $2.27 $1.88 EPS >10% 12.1% 12.4% 10.7% 10.9% Bancorp Bank, N.A. Leverage Ratio <$10B $7.9B $7.7B $7.9B $6.8B Total Assets 38% 41% 48% 53% Efficiency Ratio 1 1 Please see Appendix slide 31 for calculation of efficiency ratio. Decreases in the efficiency ratio indicate greater efficien cy, i.e., lower expenses vs higher revenue.

APPENDIX

31 GAAP REVENUE & EFFICIENCY RATIO CALCULATIONS APPENDIX ($ millions) Q1 2024 Q1 2023 2023 2022 2021 The Bancorp $ 94,418 $ 85,816 $ 354,052 $ 248,841 $ 210,876 Net interest income 29,382 28,989 112,094 105,683 104,749 Non - interest income 123,800 114,805 466,146 354,524 315,625 Total revenue 8% 31% 12% 13% Growth (Current period over previous period) $ 46,712 $ 48,030 $ 191,042 $ 169,502 $ 168,350 Non - interest expense 38% 42% 41% 48% 53% Efficiency Ratio 1 Payments non - interest income (Fintech Solutions business line) $ 2,964 $ 2,171 $ 9,822 $ 8,935 $ 7,526 ACH, card, and other payment processing fees 24,286 23,323 89,417 77,236 74,654 Prepaid, debit card, and related fees $ 27,250 $ 25,494 $ 99,239 $ 86,171 $ 82,180 Total payments (Fintech Solutions) non - interest income 22% 22% % of Total revenue 1 The efficiency ratio is calculated by dividing GAAP total non - interest expense by the total of GAAP net interest income and non - interest income. This ratio compares revenues generated with the amount of expense required to generate such revenues, and may be used as one measure of overall efficiency .

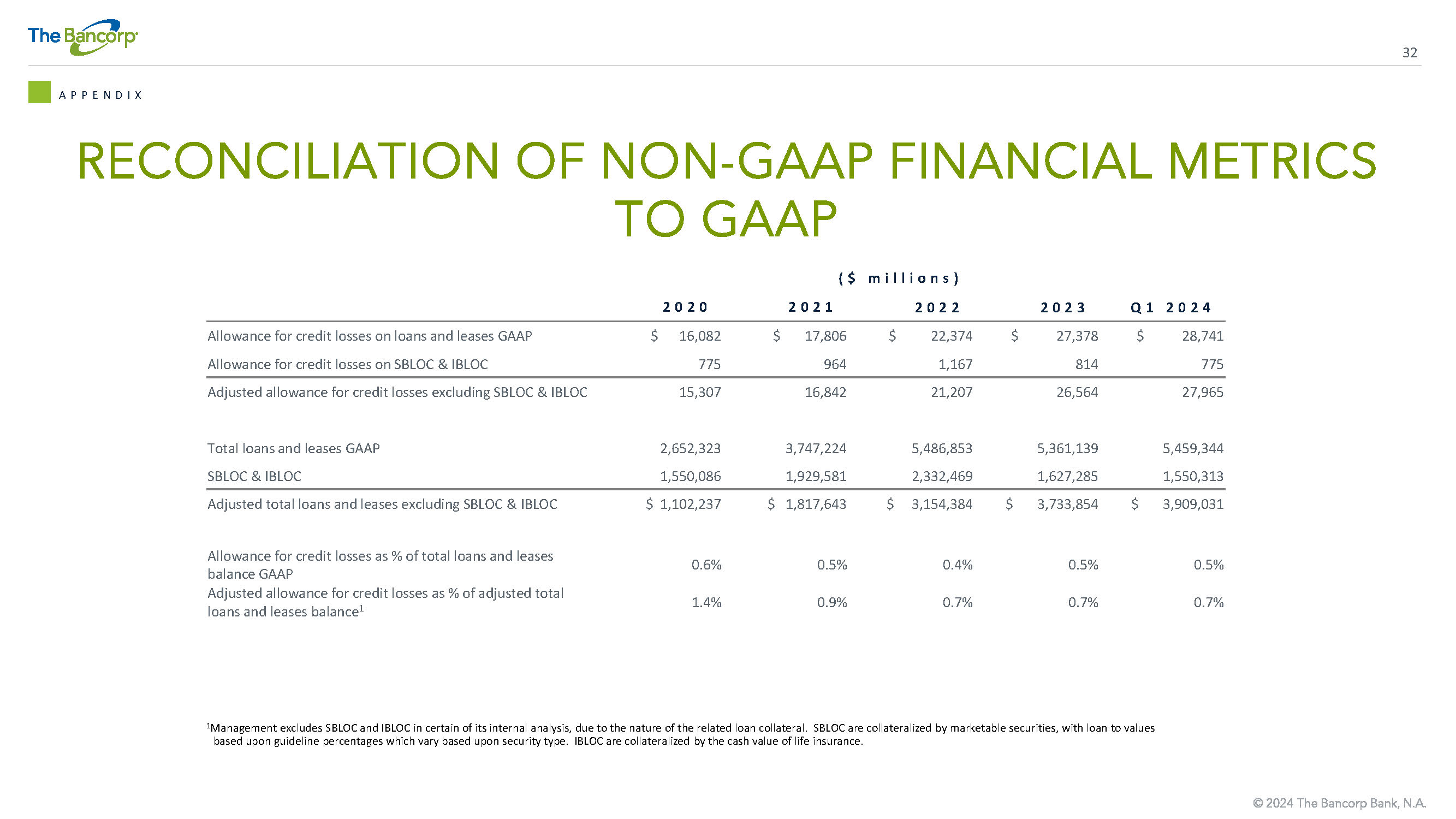

32 RECONCILIATION OF NON - GAAP FINANCIAL METRICS TO GAAP APPENDIX ($ millions) Q1 2024 2023 2022 2021 2020 $ 28,741 $ 27,378 $ 22,374 $ 17,806 $ 16,082 Allowance for credit losses on loans and leases GAAP 775 814 1,167 964 775 Allowance for credit losses on SBLOC & IBLOC 27,965 26,564 21,207 16,842 15,307 Adjusted allowance for credit losses excluding SBLOC & IBLOC 5,459,344 5,361,139 5,486,853 3,747,224 2,652,323 Total loans and leases GAAP 1,550,313 1,627,285 2,332,469 1,929,581 1,550,086 SBLOC & IBLOC $ 3,909,031 $ 3,733,854 $ 3,154,384 $ 1,817,643 $ 1,102,237 Adjusted total loans and leases excluding SBLOC & IBLOC 0.5% 0.5% 0.4% 0.5% 0.6% Allowance for credit losses as % of total loans and leases balance GAAP 0.7% 0.7% 0.7% 0.9% 1.4% Adjusted allowance for credit losses as % of adjusted total loans and leases balance 1 1 Management excludes SBLOC and IBLOC in certain of its internal analysis, due to the nature of the related loan collateral. S BLO C are collateralized by marketable securities, with loan to values based upon guideline percentages which vary based upon security type. IBLOC are collateralized by the ca sh value of life insurance.