SECURITIES AND EXCHANGE COMMISSION

WASHINGTON DC 20549

SCHEDULE 13D/A

Amendment No. 5

Under the Securities Exchange Act of 1934

INTREorg Systems, Inc.

(Name of Issuer)

Common Stock

(Title of Class of Securities)

46122 B 10 1

(CUSIP Number)

C.E. MCMILLAN FAMILY TRUST

and

HARRY MCMILLAN, MANAGER AND TRUSTEE

1224 N. Hwy 377, Ste 303, PMB 56

Roanoke, TX 76262

(817)491-9733

-------------------------------------------------------------------

(Name, Address and Telephone Number of Person Authorized to

Receive Notices and Communications)

December 17, 2012

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of ss.ss. 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box.[ ]

Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid 0MB control number.

| CUSIP No. 46122B 10 1 | 13D | Page 2 of 10 Pages |

| (1) | | NAMES OF REPORTING PERSONS C.E. MCMILLAN FAMILY TRUST |

| (2) | | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions) (a) o (b) o |

| (3) | | SEC USE ONLY |

| (4) | | SOURCE OF FUNDS (see instructions) OO |

| (5) | | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e) o |

| (6) | | CITIZENSHIP OR PLACE OF ORGANIZATION TX |

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | | (7) | | SOLE VOTING POWER 0 shares |

| | (8) | | SHARED VOTING POWER 2,014,468 shares |

| | (9) | | SOLE DISPOSITIVE POWER 0 shares |

| | (10) | | SHARED DISPOSITIVE POWER 2,014,468 shares |

| (11) | | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON 2,014,468 shares |

| (12) | | CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions) o |

| (13) | | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| (14) | | TYPE OF REPORTING PERSON (see instructions) OO |

| CUSIP No. 46122B 10 1 | 13D | Page 3 of 10 Pages |

| (1) | | NAMES OF REPORTING PERSONS HARRY MCMILLAN Manager of J.H. Brech, LLC, Cicerone Corporate Development, LLC and Public Issuer Stock Analytics, LLC Trustee of the C.E. McMillan Family Trust |

| (2) | | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions) (a) o (b) o |

| (3) | | SEC USE ONLY |

| (4) | | SOURCE OF FUNDS (see instructions) OO |

| (5) | | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e) o |

| (6) | | CITIZENSHIP OR PLACE OF ORGANIZATION US |

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | | (7) | | SOLE VOTING POWER 0 shares |

| | (8) | | SHARED VOTING POWER 2,014,468 shares |

| | (9) | | SOLE DISPOSITIVE POWER 0 shares |

| | (10) | | SHARED DISPOSITIVE POWER 2,014,468 shares |

| (11) | | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON 2,014,468 shares |

| (12) | | CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions) o |

| (13) | | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| (14) | | TYPE OF REPORTING PERSON (see instructions) IN |

| CUSIP No. 46122B 10 1 | 13D | Page 4 of 10 Pages |

| (1) | | NAMES OF REPORTING PERSONS J.H. BRECH, LLC |

| (2) | | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions) (a) o (b) o |

| (3) | | SEC USE ONLY |

| (4) | | SOURCE OF FUNDS (see instructions) OO |

| (5) | | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e) o |

| (6) | | CITIZENSHIP OR PLACE OF ORGANIZATION TX |

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | | (7) | | SOLE VOTING POWER 0 shares |

| | (8) | | SHARED VOTING POWER 1,424,468 shares |

| | (9) | | SOLE DISPOSITIVE POWER 0 shares |

| | (10) | | SHARED DISPOSITIVE POWER 1,424,468 shares |

| (11) | | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON 1,424,468 shares |

| (12) | | CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions) o |

| (13) | | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| (14) | | TYPE OF REPORTING PERSON (see instructions) CO |

| CUSIP No. 46122B 10 1 | 13D | Page 5 of 10 Pages |

| (1) | | NAMES OF REPORTING PERSONS CICERONE CORPORATE DEVELOPMENT, LLC |

| (2) | | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions) (a) o (b) o |

| (3) | | SEC USE ONLY |

| (4) | | SOURCE OF FUNDS (see instructions) OO |

| (5) | | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e) o |

| (6) | | CITIZENSHIP OR PLACE OF ORGANIZATION TX |

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | | (7) | | SOLE VOTING POWER 0 shares |

| | (8) | | SHARED VOTING POWER 340,000 shares |

| | (9) | | SOLE DISPOSITIVE POWER 0 shares |

| | (10) | | SHARED DISPOSITIVE POWER 340,000 shares |

| (11) | | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON 340,000 shares |

| (12) | | CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions) o |

| (13) | | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| (14) | | TYPE OF REPORTING PERSON (see instructions) CO |

| CUSIP No. 46122B 10 1 | 13D | Page 6 of 10 Pages |

| (1) | | NAMES OF REPORTING PERSONS PUBLIC ISSUER STOCK ANALYTICS, LLC |

| (2) | | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions) (a) o (b) o |

| (3) | | SEC USE ONLY |

| (4) | | SOURCE OF FUNDS (see instructions) OO |

| (5) | | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e) o |

| (6) | | CITIZENSHIP OR PLACE OF ORGANIZATION TX |

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | | (7) | | SOLE VOTING POWER 0 shares |

| | (8) | | SHARED VOTING POWER |

| | (9) | | SOLE DISPOSITIVE POWER 0 shares |

| | (10) | | SHARED DISPOSITIVE POWER 250,000 shares |

| (11) | | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| (12) | | CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions) o |

| (13) | | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| (14) | | TYPE OF REPORTING PERSON (see instructions) CO |

| CUSIP No. 46122B 10 1 | 13D | Page 7 of 10 Pages |

ITEM 1. SECURITY AND ISSUES.

This amendment number 5 to Schedule 13D relates to shares of common stock, no par value (the "Common Stock"), of INTREorg Systems, Inc., a Texas corporation (“ISI” or “the Company”). The address of its principal office is 2600 E. Southlake Boulevard, Ste 120-366, Southlake, Texas 76092. We are filing this amendment to reflect a change in the ownership of the subject shares to more accurately disclose that they are managed by Mr. Harry McMillan and the trust named herein as a Reporting Person. See Item 5.

ITEM 2. IDENTITY AND BACKGROUND.

| (a) | The names of the persons filing this Statement (the “Reporting Persons”) are: |

| i. | J.H. Brech, LLC (“JHB”); |

| ii. | Cicerone Corporate Development, LLC (“CCD”); |

| iii. | Public Issuers Stock Analytics, LLC (“PISA”); |

| iv. | C.E. McMillan Family Trust (“CE Family Trust”)( referred to collectively as “the entities” or “the parties”); and |

| v. | Harry McMillan ("McMillan"). |

__________________

McMillan, on behalf of the CE McMillan Family Trust, is the manager of JHB, CCD and PISA (JHB, CCD and PISA are collectively referred to herein as the "Entities"). Mr. McMillan is the Trustee of the C.E. McMillan Family Trust, for the benefit of his wife, Christy McMillan, and their children.

| (b) | The principal business address for all of the Reporting Persons is 1224 N. Hwy 377, Ste 303, PMB 56, Roanoke, Texas 76262. |

| (c) | Each of the Entities are Texas Limited Liability Companies. The principal business of JH Brech is investment. The principal business of CCD is corporate consulting services. The principal business of PISA is software development. The CE Family Trust is a trust for the benefit of Mr. McMillan’s wife and four children. McMillan's principal business is consulting and the principal place of such business is 1224 N. Hwy 377, Ste 303, PMB 56, Roanoke, Texas 76262. |

| (d) | JHB, CCD, PISA, CE Family Trust and Mr. McMillan have not, during the last five years, been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors.) |

| (e) | JHB, CCD, PISA, CE Family Trust and Mr. McMillan have not, during the last five years, been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject or, federal or state securities laws or finding any violation with respect to such laws. |

| (f) | State of Organization for the Entities: Texas |

Citizenship of McMillan: US

| CUSIP No. 46122B 10 1 | 13D | Page 8 of 10 Pages |

ITEM 3. SOURCE OF FUNDS OR OTHER CONSIDERATION.

Except as noted below in Item 6 where shares were earned as part of compensation associated with certain consulting agreements or other arrangements with the Issuer, all of the shares of Common Stock to which this Statement relates were purchased by each of the Reporting Persons using its respective capital.

ITEM 4. PURPOSE OF THE TRANSACTION.

The Reporting Persons purchased the shares of Common Stock for investment purposes, and such purchases have been made in the Reporting Persons’ ordinary course of business.

ITEM 5. INTEREST IN SECURITIES OF THE ISSUER.

| (a) | The aggregate number and percentage of shares of the Issuer's common stock (the "Common Stock") to which this Schedule 13D relates is 2,014,468 shares of Common Stock, constituting approximately 16.57% of the Issuer’s outstanding Common Stock. The aggregate number and percentage of shares of Common Stock reported herein are based upon the 12,158,166 shares of Common Stock outstanding as of February 3, 2013. |

| i. | JHB owns 1,424,468 shares (11.72%) of Common Stock. |

| ii. | CCD (i) owns 180,000 shares (1.48%) of Common Stock, (ii) has the ability to acquire up to 160,000 shares of Common Stock through the exercise of warrants and (iii) thus beneficially owns 340,000 shares of Common Stock, representing 2.80% of all of the Issuer’s outstanding Common Stock. |

| iii. | PISA owns 250,000 shares (2.06%) of Common Stock. (See Item 6(d) below.) |

McMillan, as trustee of the CE McMillan Family Trust and the CE McMillan Family Trust may each be deemed to beneficially own the shares of Common Stock beneficially owned by the Entities. Each disclaims beneficial ownership of such shares.

| (b) | McMillan and the CE Family Trust have shared power (with each other and not with any third party), to vote or direct the vote of and to dispose or direct the disposition of the 2,014,468 shares of Common Stock reported herein. However, JHB shares in the voting and dispositive power over the 1,424,468 shares of Common Stock it beneficially owns; CCD shares in the voting and dispositive power of the 340,000 shares of Common Stock it beneficially owns; and PISA shares in the voting and dispositive power over the 250,000 shares of Common Stock it beneficially owns. |

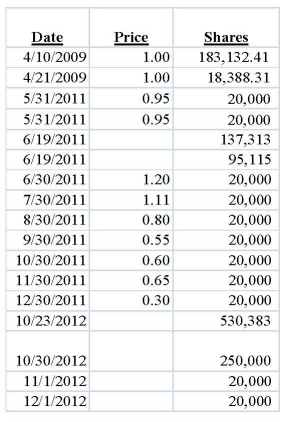

| (c) | Other than the purchases as set forth below, there have been no other transactions in the shares of Common Stock effected by the entities and Mr. McMillan during the past 60 days, except for those purchases reflected in prior amendments to Schedule 13d, as filed, specifically, amendments 2-4, inclusive. |

| CUSIP No. 46122B 10 1 | 13D | Page 9 of 10 Pages |

| (d) | No person other than the entities or Mr. McMillan has the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the shares of ISI common stock reported as being beneficially owned (or which may be deemed to be beneficially owned) by the entities and/or Mr. McMillan. |

ITEM 6. CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER.

| a) | JHB (Harry McMillan, trustee of the CE McMillan Family Trust beneficially) entered into a Convertible Promissory Note with the Company on April 21, 2009. The Note has a principal amount of $406,960.90, an annual interest rate of 6%, and a due date of April 10, 2011. The Note was converted into 491,787 shares of Common Stock at a conversion rate of $1 per share. |

| b) | JHB (Harry McMillan, trustee of the CE McMillan Family Trust beneficially) entered into a Convertible Promissory Note with the Company on April 10, 2009. The Note has a principal amount of $34,400, an annual interest rate of 6%, and a due date of April 10, 2011. The Note was converted into approximately 40,863 shares of Common Stock at a conversion rate of $1 per share. |

| c) | Both CCD and JHB have, in the past, entered into various Consulting Agreements with ISI, which provide for payment for services in the form of shares of common stock and warrants exercisable for shares of the Company’s common stock. Although the consulting agreement with CCD was terminated as of December 12, 2012, CCD continues to hold warrants exercisable for up to an aggregate of 160,000 shares of the Company’s common stock at exercise prices ranging from $0.95 to $1.20 per share, which were issued during the term of the Consulting Agreement. |

| d) | On October 30, 2012, PISA and the Issuer entered into an Intellectual Property License and Consulting Agreement that provides the Issuer with the exclusive right to market and sell certain of PISA's proprietary intellectual property/software. PISA also agreed to act as consultant to the Issuer to provide services associated with the intellectual property that is the subject of the license. The term of the agreement is for three years. Under the PISA Agreement, PISA is entitled to the following compensation: 250,000 shares of Common Stock upon execution of the PISA Agreement; 20,000 shares per month based on the closing price of the Common Stock on the last business day of each respective month (the "Share Royalty"); and 1%, 2% or 3% of gross sales, due on a quarterly basis, up and until the second anniversary, third anniversary or termination of the agreement, respectively (the "Gross Sales Royalty"). If no gross sales exist for a given period, PISA's only compensation for such period shall be the Share Royalty. The Gross Sales Royalty may be paid in cash or restricted shares of Common Stock; if paid in Common Stock, such stock shall be issued based on the market close on the last business day of each month in each quarter as such market close is found in Bloomberg. At the time of this filing, PISA has only received the initial 250,000 shares of Common Stock due upon signing the PISA Agreement; the Issuer has not issued, booked or paid the Share Royalty due for November - January, nor has PISA received any Gross Sales Royalty as of the date of this filing. Additionally, the Issuer maintains the right to pay the Share Royalty and Gross Sales Royalty due in the next 60 days in cash. Accordingly, no Share Royalties or Gross Sales Royalties are included in the amount of shares PISA beneficially owns or in the amount of Common Shares issued and outstanding used in this Schedule. |

ITEM 7. MATERIAL TO BE FILED AS EXHIBITS.

Statement of J.H. Brech, LLC, Cicerone Corporate Development, LLC, Public Issuer Analytics, LLC, C.E. McMillan Family Trust, and Harry McMillan as to the joint filing of Schedule 13D/A No. 5, dated December 17, 2012.

| CUSIP No. 46122B 10 1 | 13D | Page 10 of 10 Pages |

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: February 11, 2013

| | JH BRECH, LLC

/s/ Harry McMillan Harry McMillan, Manager of J.H. Brech, LLC

CICERONE CORPORATE DEVELOPMENT, LLC

Harry McMillan, Manager of Cicerone Corporate Development, LLC

PUBLIC ISSUER ANALYTICS, LLC

Harry McMillan, Manager of Public Issuer Analytics, LLC

C.E. MCMILLAN FAMILY TRUST

Harry McMillan, Trustee of C.E. McMillan Family Trust

HARRY MCMILLAN

Harry McMillan, Individually

|