Exhibit (a)(1)(A)

This document is important and requires your immediate attention. If you are in any doubt as to how to deal with it, you should consult your investment dealer, stock broker, bank manager, lawyer or other professional advisor. The Offer has not been approved or disapproved by any securities regulatory authority nor has any securities regulatory authority passed upon the fairness or merits of the Offer or upon the adequacy of the information contained in this document. Any representation to the contrary is unlawful.

OFFER TO PURCHASE

all of the issued and outstanding 4.25% Convertible Senior Notes due 2035

at a purchase price of Cdn$900

per $1,000 principal amount of 4.25% Convertible Senior Notes due 2035

ACE Aviation Holdings Inc. ("ACE" or the "Corporation") hereby offers to purchase from holders (the "Noteholders") of 4.25% Convertible Senior Notes due 2035 (the "Notes") of the Corporation their Notes for cancellation by the Corporation, at a purchase price of Cdn$900 in cash per Cdn$1,000 principal amount of Notes (the "Purchase Price"), on the terms and subject to the conditions set forth herein.

The Offer and all deposits of Notes are subject to the terms and conditions set forth in this offer to purchase (the "Offer to Purchase"), its accompanying issuer bid circular (the "Circular"), and the related letter of transmittal (the "Letter of Transmittal") (which together constitute and are hereinafter referred to as the "Offer").

Each Noteholder who has properly deposited Notes and who has not withdrawn such Notes will receive the Purchase Price, payable in cash (subject to applicable withholding taxes, if any), for all Notes purchased, on the terms and subject to the conditions of the Offer.

This Offer expires at 5:00 p.m. (Montreal time) on January 19, 2009, unless extended, varied or withdrawn by ACE (the "Expiration Date"). Notwithstanding anything to the contrary contained in the Offer or the Circular or the Letter of Transmittal, Noteholders accepting the Offer will not be entitled to receive accrued and unpaid interest on the Notes.

The Offer is not conditional upon any minimum principal amount of Notes being deposited. The Offer is, however, subject to certain other conditions. ACE reserves the right to withdraw the Offer and not take up and pay for any Notes deposited under the Offer unless certain conditions are satisfied. See "Offer to Purchase — Conditions of the Offer".

| December 12, 2008 | (continued on insider cover) |

This document does not constitute an offer or a solicitation to any person in any jurisdiction in which such offer or solicitation is unlawful. The Offer is not being made to, and deposits will not be accepted from or on behalf of, Noteholders in any jurisdiction in which the making or acceptance thereof would not be in compliance with the laws of any such jurisdiction. However, ACE may, in its sole discretion, take such action as it may deem necessary to extend the Offer to Noteholders in any such jurisdiction.

The Class A variable voting shares ("Variable Voting Shares"), Class B voting shares ("Voting Shares and, together with the Variable Voting Shares, the "Shares") and the Notes of ACE are listed on the Toronto Stock Exchange (the "TSX"), under the symbols "ACE.A", "ACE.B" and "ACE.NT.A", respectively. The convertible preferred shares of ACE ("Preferred Shares") are not listed for trading on an exchange. The Notes are convertible at the option of the Noteholders into Voting Shares (if the Notes are owned and controlled by a Canadian) or into Variable Voting Shares (if the Notes are not owned and controlled by a Canadian) at a conversion ratio of approximately 40.6917 Shares per Cdn$1,000 principal amount of Notes, subject to adjustment in certain events in accordance with the indenture governing the Notes.

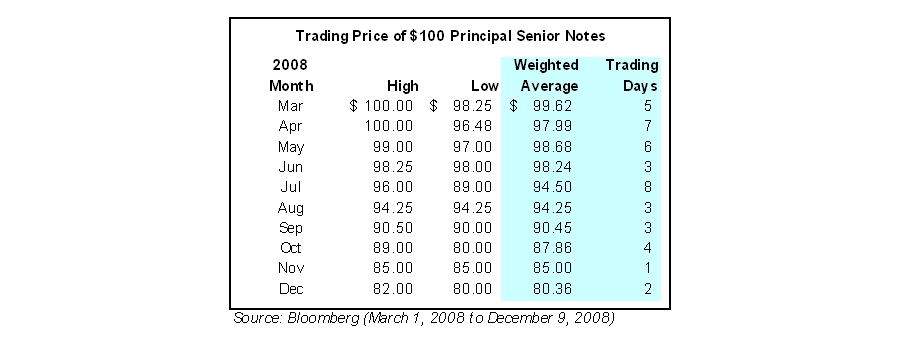

The intention to make the Offer was announced on December 10, 2008. The closing prices of the Notes and the Shares on the TSX on December 10, 2008, the last full trading day immediately preceding the announcement of the Offer, were Cdn$83.00 per Cdn$100 principal amount of Notes, Cdn$3.30 per Variable Voting Share and Cdn$3.34 per Voting Share.

The Corporation announced on December 10, 2008 that it intends to seek court and shareholder approvals for a plan of arrangement pursuant to which a court appointed liquidator will proceed with the distribution of the Corporation’s net assets, including its shares in Air Canada, in an orderly fashion, after providing for outstanding liabilities and costs of the transaction, and thereafter to voluntarily dissolve. See "Issuer Bid Circular - Concurrent Transactions".

Noteholders should carefully consider the income tax consequences of accepting the Offer and depositing Notes in the Offer. See "Issuer Bid Circular — Income Tax Considerations".

Registration of interests in and transfers of Notes may currently only be made through a book entry only system administered by CDS Clearing and Depository Services Inc. ("CDS"). As such, in order to tender their Notes to the Offer, as described herein, Noteholders must complete the documentation and follow the instructions provided by their investment dealer, broker or other nominee prior to 5:00 p.m. (Montreal time) on January 19, 2009. Your investment dealer, broker or other nominee may set a deadline that is earlier than this deadline, and as such you should contact your investment dealer, broker or other nominee for assistance. See "Offer to Purchase – Procedure for Depositing Notes".

Neither ACE nor its board of directors (the "Board of Directors"), in making the decision to present the Offer to Noteholders, makes any recommendation to any Noteholder as to whether to deposit or refrain from depositing Notes. Noteholders are urged to consult their own investment and tax advisors and make their own decision whether to deposit Notes to the Offer and, if so, what principal amount of Notes to deposit. See "Issuer Bid Circular – Valuation".

All dollar references in the Offer to Purchase and the Circular are in Canadian dollars (Cdn$), except where otherwise indicated.

TABLE OF CONTENTS

| | Page | | Page |

| SUMMARY TERM SHEET INFORMATION FOR UNITED STATES NOTEHOLDERS SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS IMPORTANT NOTICE RELATING TO ACQUISITIONS AND DISPOSITIONS OF NOTES OFFER TO PURCHASE THE OFFER PROCEDURE FOR DEPOSITING NOTES WITHDRAWAL RIGHTS CONDITIONS OF THE OFFER ACCEPTANCE FOR PAYMENT AND PAYMENT FOR NOTES EXTENSION AND VARIATION OF THE OFFER ENCUMBRANCES AND ACCRUED INTEREST NOTICE OTHER TERMS OF THE OFFER ISSUER BID CIRCULAR ACE AVIATION HOLDINGS INC. CONCURRENT TRANSACTIONS PURPOSE AND EFFECT OF THE OFFER VALUATION WITHDRAWAL RIGHTS FINANCIAL STATEMENTS PRICE RANGE OF NOTES | 1 6 6 7 8 8 9 11 12 14 14 15 16 16 18 18 25 27 29 30 30 30 | PRICE RANGE OF SHARES DIVIDEND POLICY PREVIOUS PURCHASES AND SALES PREVIOUS DISTRIBUTIONS OWNERSHIP OF ACE'S SECURITIES; ARRANGEMENTS CONCERNING NOTES CONTRACTS, ARRANGEMENTS OR UNDERTAKINGS WITH NOTEHOLDERS ACCEPTANCE OF OFFER COMMITMENTS TO ACQUIRE NOTES BENEFITS FROM THE OFFER PRIOR SECURITIES TRANSACTIONS MATERIAL CHANGES IN THE AFFAIRS OF THE CORPORATION GOING PRIVATE TRANSACTION OR BUSINESS COMBINATION INCOME TAX CONSIDERATIONS LEGAL MATTERS AND REGULATORY APPROVALS SOURCE OF FUNDS DEPOSITARY FEES AND EXPENSES STATUTORY RIGHTS APPENDIX 1 - VALUATION REPORT APPROVAL AND CERTIFICATE CONSENT OF STIKEMAN ELLIOTT LLP CONSENT OF VALUATOR | 31 32 33 33 36 41 41 41 41 41 41 42 42 47 47 47 48 48 51 A-1 C-1 C-1 |

SUMMARY TERM SHEET

We are providing this summary term sheet for your convenience. It highlights material information relating to the Offer, but you should understand that it does not describe all of the details of the Offer to the same extent described elsewhere herein. We urge you to read the entire Offer to Purchase, Circular and Letter of Transmittal because they contain important information. We have included references to the sections of the Offer where you will find a more complete discussion.

| Who is offering to purchase my Notes? | ACE Aviation Holdings Inc., which we refer to as "we," "us", the "Corporation" or "ACE". |

| What securities are included in this Offer? | We are offering to purchase all of the issued and outstanding 4.25% Convertible Senior Notes due 2035 of ACE. |

| What will the purchase price of the Notes be? | The Purchase Price for the Notes will be Cdn$900 per Cdn$1,000 principal amount of Notes. If your Notes are purchased under the Offer, you will be paid the Purchase Price (subject to applicable withholding taxes, if any (See "Income Tax Considerations — Non-Residents of Canada")) in cash, promptly following the expiration of the Offer. Other than as described above, under no circumstances will we pay you interest on the Purchase Price, even if there is a delay in making payment. See "Offer to Purchase — The Offer". On December 10, 2008, Ernst & Young LLP (the "Valuator") delivered its valuation report to the Board of Directors. The valuation report has been prepared in compliance with the provisions of applicable Canadian securities laws. A copy of the valuation report is attached to this Circular as Appendix 1. Noteholders should carefully review and consider the valuation report in its entirety. The valuation report is subject to the assumptions, limitations and qualifications set out therein. The valuation report, dated December 10, 2008 and effective as at December 9, 2008, contains the Valuator's opinion that, based on the scope of their review and subject to the assumptions, restrictions and limitations provided therein, the fair market value of the Notes, per $1,000 principal amount of Notes, at December 9, 2008, ranges from approximately $825 to $875, or a mid-point of $850. See "Issuer Bid Circular — Valuation" and the complete copy of the valuation report attached to the Circular as Appendix 1. |

| What principal amount of Notes will ACE purchase? | We are offering to purchase all of the issued and outstanding Notes. |

| Will I receive accrued and unpaid interest on the Notes I tender? | The Notes bear interest at a rate of 4.25% per year, payable semi-annually in arrears on June 1st and December 1st of each year. Notwithstanding anything to the contrary contained in the Offer or the Circular or the Letter of Transmittal, if you deposit your Notes under the Offer, you will not be entitled to receive accrued and unpaid interest on such Notes. |

| Why is ACE making this Offer? | The Board of Directors believes that the purchase of Notes pursuant to the Offer is in the best interests of the Corporation. See "Offer to Purchase – Purpose and Effect of the Offer". |

| How will ACE pay for the Notes? | We expect to fund the purchase of Notes under the Offer and the payment of related fees and expenses with cash on hand. See "Issuer Bid Circular – Source of Funds". |

| In what currency will ACE pay for the Notes I tender? | We will pay the Purchase Price (less applicable withholding taxes, if any) in Canadian dollars. On December 10, 2008, the inverse of the noon buying rate in the City of New York for cable transfers as certified for customs purposes by the Federal Reserve Bank of New York was Cdn$1.00 = US$0.7966. See "Issuer Bid Circular – ACE Aviation Holdings Inc. – Presentation of Financial Information and Exchange Rate Data". |

| How do I tender my Notes? | Registration of interests in and transfers of Notes may currently only be made through a book entry only system administered by CDS Clearing and Depository Services Inc. ("CDS"). As such, in order to tender your Notes to the Offer, you must complete the documentation and follow the instructions provided by your investment dealer, broker or other nominee prior to 5:00 p.m. (Montreal time) on January 19, 2009. Your investment dealer, broker or other nominee may set a deadline that is earlier than this deadline, and as such you should contact your investment dealer, broker or other nominee for assistance. Your investment dealer, broker or other nominee must tender your Notes in accordance with the procedures for book-entry transfer established by CDS. See "Offer to Purchase – Procedure for Depositing Notes". |

| How long do I have to tender my Notes? Can the Offer be extended, varied or terminated? | You may tender your Notes until the Offer expires. The Offer expires at 5:00 p.m. (Montreal time) on January 19, 2009, unless extended, varied or withdrawn by ACE. It is likely that your investment dealer, broker or other nominee holding your Notes has established an earlier deadline for you to act to instruct the nominee to accept the Offer on your behalf. We urge you to contact your investment dealer, broker, or other nominee to find out the nominee's deadline. We can extend or vary the Offer in our sole discretion. See "Offer to Purchase — Extension and Variation of the Offer". We can also terminate the Offer under certain circumstances. See "Offer to Purchase — Conditions of the Offer". |

| How will I be notified if ACE extends the Offer? | We will issue a press release by 9:00 a.m. (Montreal time) on the business day after the previously scheduled expiration date if we decide to extend the Offer. See "Offer to Purchase – Extension and Variation of the Offer". |

| Are there any conditions to the Offer? | Yes. The Offer is subject to a number of conditions, such as the absence of court and governmental action prohibiting the Offer and changes in general market conditions or our business that, in our judgment, make it inadvisable to proceed with the Offer. See "Offer to Purchase — Conditions of the Offer". |

| Once I have tendered Notes in the Offer, can I withdraw my tender? | Yes. You may withdraw any Notes you have tendered (i) at any time prior to the Expiration Date, (ii) at any time if the Notes have not been taken up by the Corporation before actual receipt by the Depositary of a notice of withdrawal with respect to such Notes, (iii) if the Notes have been taken up but not paid for by the Corporation within three business days of being taken up, and, (iv) if the Notes have not been taken up after 12:00 midnight (Montreal time) on February 10, 2009. See "Offer to Purchase – Withdrawal Rights". |

| How do I withdraw Notes I previously tendered? | Withdrawals of Notes deposited pursuant to the Offer must be effected via CDS and through your investment dealer, broker or other nominee holding your Notes. A notice of withdrawal of Notes deposited must actually be received by the Depositary in a manner such that the Depositary has a written or printed copy of such notice of withdrawal. You should contact your investment dealer, broker or other nominee holding your Notes for assistance. See "Offer to Purchase – Withdrawal Rights". |

| What impact will the Offer have on the liquidity of the market for ACE's Notes? | The purchase of Notes by us pursuant to the Offer will reduce the amount of Notes that might otherwise trade publicly, as well as the number of Noteholders, and, depending on the number of Noteholders depositing and the amount of Notes purchased under the Offer, could adversely affect the liquidity and market value of the remaining Notes held by the public. The rules and regulations of the TSX establish certain distribution criteria which, if not met, could lead to the delisting of the Notes from such exchange. Among such criteria are the minimum number of Noteholders, the minimum number of Notes publicly held and the aggregate market value of the Notes publicly held. Depending on the amount of Notes purchased pursuant to the Offer, it is possible that the Notes would fail to meet the criteria for continued listing on the TSX. If this were to happen, the Notes could be delisted and this could, in turn, adversely affect the market or result in a lack of an established market for such Notes. See "Issuer Bid Circular – Purpose and Effect of the Offer". |

| How will ACE accept and pay for the Notes I tender? | We will take up the Notes to be purchased pursuant to the Offer promptly after the Expiration Date, but in any event not later than ten days after such time. ACE will pay for such Notes within three business days after taking up the Notes. See "Offer to Purchase — Acceptance for Payment and Payment for Notes". |

| Has ACE or its Board of Directors adopted a position on this Offer? | In making the decision to present the Offer to Noteholders, neither ACE nor its Board of Directors makes any recommendation to any Noteholder as to whether to deposit or refrain from depositing Notes. You are urged to consult your own investment and tax advisors and make your own decision whether to deposit Notes to the Offer and, if so, what principal amount of Notes to deposit. See "Issuer Bid Circular – Valuation". |

| Will I have to pay brokerage commissions? | In depositing your Notes, you will not be obligated to pay brokerage fees or commissions to us or the Depositary. However, we recommend that you consult with your own investment dealer, broker or other nominee to determine whether any fees or commissions are payable to your own |

| | investment dealer, broker or other nominee in connection with your deposit of Notes pursuant to the Offer. |

| What are the income tax consequences if I tender my Notes? | You should carefully consider the income tax consequences of depositing Notes pursuant to the Offer. We urge you to consult your own investment and tax advisors. See "Issuer Bid Circular — Income Tax Considerations". |

| What is a recent market price of my ACE Notes? | On December 10, 2008, the last full trading day prior to the announcement of the approval by our Board of Directors of the Offer, the closing price on the TSX of $100 principal amount of Notes was $83.00. See "Issuer Bid Circular— Price Range of Notes". |

| Can I still convert my Notes into ACE Shares? | Yes. However, if you tender your Notes in the Offer, you may convert your Notes only if you first properly withdraw your Notes from the Offer before your right to withdraw has expired. The Notes are convertible at the option of the Noteholders into Voting Shares (if the Notes are owned and controlled by a Canadian) or into Variable Voting Shares (if the Notes are not owned and controlled by a Canadian), at a conversion ratio of approximately 40.6917 Shares per $1,000 principal amount of the Notes, subject to adjustment in certain events in accordance with the indenture governing the Notes. On December 10, 2008, the closing prices of the Shares on the TSX was $3.30 per Variable Voting Share and $3.34 per Voting Share. |

| What is the impact on my Notes of the Corporation's intention to liquidate? | ACE announced on December 10, 2008 that it intends to seek court and shareholder approvals for a plan of arrangement pursuant to which a court appointed liquidator will proceed with the distribution of ACE's net assets, including its shares in Air Canada, in an orderly fashion, after providing for outstanding liabilities and costs of the transaction, and thereafter to voluntarily dissolve. See "Issuer Bid Circular – Concurrent Transactions". Subject to court and regulatory approvals, the special meeting of shareholders of ACE is expected to be held in February 2009. Subject to the approval of the plan of arrangement by the shareholders of ACE and the court, and the obtention of any required tax clearance certificate and any other regulatory approvals, payments and distributions under the liquidation process would occur at the discretion of the liquidator and no assurances can be given as to the amount, timing and order of payments under the liquidation process. See "Issuer Bid Circular – Concurrent Transactions". In the event of a dissolution or liquidation of the Corporation, the Corporation shall mail to Noteholders and file with the trustee under the indenture governing the Notes a notice stating the proposed effective date of such liquidation or dissolution. The Corporation has to mail such notice at least 20 days before the proposed effective date. Noteholders that do not exercise their right to convert their Notes into underlying Shares will remain creditors of the Corporation and payment of the principal amount of their Notes and any accrued and unpaid interest will be a matter for the liquidation process. |

| Who can I talk to if I have questions? | For further information regarding the Offer, you may contact the Depositary or you may consult your own investment dealer, broker or other nominee. The addresses and telephone and facsimile numbers of the Depositary are set forth on the last page of this Offer. |

NO PERSON HAS BEEN AUTHORIZED TO MAKE ANY RECOMMENDATION ON BEHALF OF THE CORPORATION AS TO WHETHER NOTEHOLDERS SHOULD DEPOSIT OR REFRAIN FROM DEPOSITING NOTES PURSUANT TO THE OFFER. NO PERSON HAS BEEN AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATIONS IN CONNECTION WITH THE OFFER OTHER THAN AS SET FORTH IN THIS OFFER. IF GIVEN OR MADE, ANY SUCH RECOMMENDATION OR ANY SUCH INFORMATION OR REPRESENTATION MUST NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED BY THE CORPORATION.

INFORMATION FOR UNITED STATES NOTEHOLDERS

The Notes are not registered under Section 12 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). The Corporation has filed with the United States Securities and Exchange Commission (the "SEC") an Issuer Tender Offer Statement on Schedule TO with respect to the Offer, pursuant to Section 13(e)(1) of the Exchange Act, and Rule 13e-4(c)(2) promulgated thereunder. See "Issuer Bid Circular – ACE Aviation Holdings Inc. – Additional Information".

The enforcement by Noteholders of civil liabilities under the United States federal securities laws may be adversely affected by the fact that the Corporation is incorporated under the laws of Canada and a majority of its officers and directors are residents of countries other than the United States. Enforcement of civil liabilities under U.S. securities laws may further be adversely affected by the fact that some or all of the experts named in this Offer to Purchase and the Circular may be residents of Canada.

Financial statements referenced herein have been prepared in accordance with Canadian generally accepted accounting principles and thus are not comparable in all respects to financial statements of United States companies.

Noteholders should be aware that acceptance of the Offer may have tax consequences under United States and Canadian law. Noteholders should consult their own tax advisors regarding the U.S. federal, state, local and non-U.S. tax considerations applicable to them with respect to the disposition of Notes pursuant to the Offer. See "Issuer Bid Circular – Income Tax Considerations – Certain United States Federal Income Tax Considerations".

All dollar amounts set forth herein are expressed in Canadian dollars, except where otherwise indicated. This transaction has not been approved or disapproved by the SEC or any state securities commission, nor has the SEC or any state securities commission passed on the accuracy or adequacy of the Offer. Any representation to the contrary is a criminal offence.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Offer to Purchase and this Circular may contain statements that constitute forward-looking information or statements ("forward-looking statements"), that include, but are not limited to, statements respecting: the Corporation continuing to have sufficient financial resources and working capital to conduct its business affairs; the market for the Notes of the Corporation being materially less liquid than the market that exists at the time of the making of the Offer; future purchases of additional Notes of the Corporation following expiry of the Offer; the intention of the Corporation to seek Court and shareholder approval for a plan of arrangement pursuant to which a Court appointed liquidator will distribute the Corporation's net assets and thereafter voluntarily dissolve. Forward-looking statements may also include, without limitation, any statement relating to future events, conditions or circumstances. The Corporation cautions you not to place undue reliance upon such forward-looking statements, which speak only as of the date they are made. The words "anticipate", "believe", "estimate", and "expect" and similar expressions or the negative of such expressions are intended to identify forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual events or the Corporation's actual results or performance to differ from the projected events, results or performance contained in such forward-looking statements. Such risks, uncertainties and other factors include, but are not limited to, the following: general economic and business conditions; changes in competition; interest rate fluctuations; currency exchange rate fluctuations; volatility in the market price of the securities of the Corporation; satisfaction of the Offer conditions; the extent to which holders of Notes determine to tender their Notes to any offer; dependence upon and availability of qualified personnel; changes in government regulation; and other factors discussed in the Corporation's filings with applicable securities regulators. Should one or more of these risks or uncertainties materialize, or should

assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those indicated in any forward-looking statements. The forward-looking statements contained in this Offer to Purchase and Circular represent the Corporation's expectations as of the date of this Circular, and are subject to change after such date. However, the Corporation disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required under applicable securities regulations.

IMPORTANT NOTICE RELATING TO ACQUISITIONS AND DISPOSITIONS OF NOTES

We and our affiliates, including our executive officers and directors, will be prohibited by Rule 13e−4 under the Exchange Act, from purchasing any of the Notes outside of the Offer until the expiration of at least ten business days after the expiration or termination of the Offer.

In addition, under applicable Canadian securities laws, except in limited circumstances, we are not permitted to acquire, or make or enter into an agreement, commitment or understanding to acquire, beneficial ownership of the Notes, otherwise than under the Offer until after the Expiration Date. In addition, except for purchases made through the facilities of the TSX and in accordance with applicable Canadian securities laws, during the period commencing on the Expiration Date and ending at the end of the 20th business day after the Expiration Date, whether or not any Notes are take up under the Offer, we must not acquire or offer to acquire beneficial ownership of any Notes except by way of a transaction that is generally available to all Noteholders on identical terms.

Following the dates set forth above, we expressly reserve the absolute right, in our sole discretion from time to time in the future, to purchase any of the Notes, whether or not any Notes are purchased pursuant to the Offer, through open market purchases, privately negotiated transactions, tender offers, exchange offers or otherwise, upon such terms and at such prices as we may determine, which may be more or less than the price to be paid pursuant to the Offer and could be for cash or other consideration. We cannot assure you as to which, if any, of these alternatives, or combinations thereof, we will pursue.

We also expressly reserve the absolute right, in our sole discretion from time to time, to purchase any of the Notes through redemption pursuant to the terms of the indenture governing the Notes, whether or not any Notes are purchased pursuant to the Offer.

We cannot assure you as to which, if any, of these alternatives, or combinations thereof, we will pursue.

OFFER TO PURCHASE

To the holders of 4.25% Convertible Senior Notes due 2035 of ACE Aviation Holdings Inc.

The Offer

ACE Aviation Holdings Inc. ("ACE" or the "Corporation") hereby offers to purchase from holders (the "Noteholders") of 4.25% Convertible Senior Notes due 2035 (the "Notes") their Notes for cancellation by the Corporation for a purchase price of Cdn$900 per $1,000 principal amount of Notes (the "Purchase Price"), payable in cash and on the terms and subject to the conditions set forth in this offer to purchase (the "Offer to Purchase"), the accompanying issuer bid circular (the "Circular"), the related letter of transmittal (the "Letter of Transmittal") (which together constitute and are hereinafter referred to as the "Offer").

The Offer will expire at 5:00 p.m. (Montreal time) on January 19, 2009, unless withdrawn or extended by ACE (the "Expiration Date").

The Corporation announced on December 10, 2008 that it intends to seek court and shareholder approvals for a plan of arrangement pursuant to which a court appointed liquidator will proceed with the distribution of the Corporation’s net assets, including its shares in Air Canada, in an orderly fashion, after providing for outstanding liabilities and costs of the transaction, and thereafter to voluntarily dissolve. See "Issuer Bid Circular - Concurrent Transactions".

All Noteholders who have, prior to the Expiration Date, properly deposited and not withdrawn their Notes will receive in cash the Purchase Price (subject to applicable withholding taxes, if any), all on the terms and subject to the conditions of the Offer. Notwithstanding anything to the contrary contained in the Offer, the Circular or the Letter of Transmittal, Noteholders accepting the Offer will not be entitled to receive accrued and unpaid interest on the Notes.

For purposes of the Offer, the Corporation will be deemed to have taken up and accepted for payment Notes properly deposited, and not withdrawn, if, as and when the Corporation gives oral (to be confirmed in writing) or written notice to the Depositary of its acceptance of such Notes for payment pursuant to the Offer. ACE will take up such Notes promptly after the Expiration Date, but in any event not later than ten days after such time. The Corporation will pay for such Notes within three business days after taking up the Notes. The Corporation will acquire Notes to be purchased pursuant to the Offer and title thereto under this Offer upon having taken up such Notes even if payment therefore shall have not yet been effected.

The Purchase Price will be denominated in Canadian dollars. All dollar amounts set forth herein are expressed in Canadian dollars, except where otherwise indicated.

The Offer is not conditional upon any minimum principal amount of Notes being deposited. The Offer is, however, subject to certain other conditions. See "Offer to Purchase — Conditions of the Offer".

The accompanying Circular and Letter of Transmittal contain important information and should be read carefully before making a decision with respect to the Offer.

Procedure for Depositing Notes

Manner of Acceptance

The following should be carefully reviewed by Noteholders wishing to deposit their Notes to the Offer.

Registration of interests in and transfers of Notes may currently only be made through a book entry only system administered by CDS. Noteholders may accept the Offer by following the procedures for a book-entry transfer established by CDS, provided that a Book-Entry Confirmation through CDSX is received by the Depositary at its offices in Toronto, Ontario prior to the Expiration Date. As such, in order to deposit their Notes to the Offer, Noteholders must complete the documentation and follow the instructions provided by their investment dealer, broker or other nominee prior to the Expiration Date. Investment dealers, brokers and other nominees may set a deadline that is earlier than this deadline, and as such Noteholders should contact their investment dealer, broker or other nominee for assistance.

The Depositary will establish an account with respect to the Notes at CDS for purposes of the Offer. Any financial institution that is a participant in CDS may make book-entry delivery of the Notes through CDSX by causing CDS to transfer such Notes into the Depositary's account in accordance with CDS procedures for such transfer. Delivery of Notes to the Depositary by means of a book-entry transfer through CDSX will constitute a valid tender under the Offer.

A Noteholder desiring to deposit only a portion of the aggregate principal amount of a Note to the Offer may do so, provided that the principal amount of Notes which is deposited to the Offer is in a denomination of $1,000 or an integral multiple thereof, by advising their investment dealer, broker or other nominee prior to the Expiration Date of the portion of the principal amount thereof that the Noteholder wishes to deposit to the Offer.

Given the settlement rules of the TSX, Noteholders who purchase Notes less than three trading days prior to the Expiration Date should contact their investment dealer, broker or other nominee to confirm how to make an election to participate in the Offer.

Noteholders, through their respective CDS participants, who utilize CDSX to accept the Offer through a book-entry transfer of their holdings into the Depositary's account with CDS shall be deemed to have completed and submitted a Letter of Transmittal and to be bound by the terms thereof and therefore such instructions received by the Depositary are considered a valid tender in accordance with the terms of the Offer and the Corporation may enforce such terms against them. Delivery of documents to CDS does not constitute delivery to the Depositary.

A copy of the Letter of Transmittal may be obtained at www.sedar.com, or without charge from the Corporate Secretary of the Corporation at 5100 de Maisonneuve Boulevard West, Montreal, Québec, H4A 3T2. The telephone number of the Corporate Secretary's office of ACE is (514) 205-7855 and facsimile number is (514) 205-7859.

Each Noteholder utilizing CDSX, through its CDS participant, to accept the Offer through a book-entry transfer of their holdings into the Depositary's account with CDS shall be deemed to have made the representations and warranties that: (i) it has full power and authority to deposit, sell, assign and transfer the Notes deposited under the Offer, (ii) it owns such Notes free and clear of any hypothecs,

mortgages, liens, charges, restrictions, security interests, claims, pledges, equitable interests and encumbrances of any nature or kind whatsoever and has not sold, assigned or transferred, or agreed to sell, assign or transfer, any of such Notes to any other person, (iii) the deposit of such Notes complies with applicable securities laws, and (iv) if and when such Notes are taken up by the Corporation, the Corporation will acquire good title thereto, free and clear of hypothecs, mortgages, liens, charges, restrictions, security interests, claims, pledges, equitable interests and encumbrances of any nature or kind whatsoever.

Noteholders, through their respective CDS participants, who utilize CDSX to accept the Offer through a book-entry transfer of their holdings into the Depositary's account with CDS irrevocably constitute and appoint the Corporation, and any other persons designated by the Corporation in writing, as the true and lawful agents, attorneys and attorneys-in-fact of CDS, on behalf of the beneficial owners of the Notes deposited under the Offer, with respect to such Notes, effective from and after 5:00 p.m. (Montreal time) on the Expiration Date, with full power of substitution, in the name of and on behalf of CDS and the beneficial owners of such Notes (such power of attorney being deemed to be an irrevocable power coupled with an interest) (see the Letter of Transmittal):

| (a) | to register or record the transfer and/or cancellation of such Notes on the appropriate registers (as applicable); |

| (b) | to exercise any and all rights in respect of such Notes, including, without limitation, to vote any or all such Notes, to execute and deliver any and all instruments of proxy, authorizations or consents in a form and on terms satisfactory to the Corporation in respect of any or all such Notes, to revoke any such instrument, authorization or consent given prior to or after 5:00 p.m. (Montreal time) on the Expiration Date, to designate in such instrument, authorization or consent and/or designate in any such instruments of proxy any person or persons as the proxy of CDS, on behalf of the beneficial owners of such Notes, in respect of such Notes, for all purposes including, without limitation, in connection with any meeting or meetings (whether annual, special or otherwise, or any adjournment thereof) or resolutions of Noteholders; and |

| (c) | to exercise any other rights of a holder of such Notes. |

A Noteholder who has deposited Notes under the Offer also agrees, pursuant to the terms of the Letter of Transmittal, to execute, upon request, any additional documents, transfers and other assurances as may be necessary or desirable in connection with the foregoing or the Offer in order to complete the sale, assignment and transfer of the Notes deposited under the Offer.

The Corporation reserves the right to permit the Offer to be accepted in a manner other than that set forth above under "Procedure for Depositing Notes - Manner of Acceptance".

Determination of Validity

All questions as to the form of documents and the validity, eligibility (including time of receipt) and acceptance for payment of any deposit of Notes, will be determined by the Corporation, in its sole discretion, which determination will be final and binding on all parties, except as otherwise finally determined in a subsequent judicial proceeding in a court of competent jurisdiction or as required by law. ACE reserves the absolute right to reject any or all deposits of Notes determined by it in its sole discretion not to be in proper form nor completed in accordance with the instructions set forth herein and in the Letter of Transmittal or the acceptance for payment of, or payment for, which may, in the opinion of the Corporation's counsel, be unlawful under the laws of any jurisdiction. ACE also reserves the absolute right to waive any of the conditions of the Offer or any defect or irregularity in any deposit of Notes. No deposit of Notes will be deemed to be properly made until all defects and irregularities have been cured or waived. None of the Corporation, the Depositary or any other person will be under any duty to give notification of any defect or irregularity in deposits or incur any liability for failure to give any such notice. The Corporation's interpretation of the terms and conditions of the Offer (including the Letter of Transmittal) will be final and binding, except as otherwise finally determined in a subsequent judicial proceeding in a court of competent jurisdiction or as required by law.

Formation of Agreement

The proper deposit of Notes pursuant to the procedures described above will constitute a binding agreement between the depositing Noteholder and the Corporation, effective as of the Expiration Date, upon the terms and subject to the conditions of the Offer.

Withdrawal Rights

Except as otherwise expressly provided herein, deposits of Notes pursuant to the Offer will be irrevocable. Notes deposited pursuant to the Offer may be withdrawn by a Noteholder:

| | (i) | at any time prior to the Expiration Date; |

| | (ii) | at any time if the Notes have not been taken up by the Corporation before actual receipt by the Depositary of a notice of withdrawal with respect to such Notes; |

| | (iii) | if the Notes have been taken up but not paid for by the Corporation within three business days of being taken up; and |

| | (iv) | if the Notes have not been taken up after 12:00 midnight (Montreal time) on February 10, 2009. |

Noteholders who wish to withdraw Notes tendered pursuant to the Offer should immediately contact their investment dealer, broker or other nominee in order to take the necessary steps to be able to withdraw such Notes. Participants of CDS should contact the Depository with respect to the withdrawal of Notes tendered pursuant to the Offer.

Withdrawals of Notes deposited pursuant to the Offer must be effected via CDS and through your investment dealer, broker or other nominee holding your Notes. A notice of withdrawal of Notes deposited must actually be received by the Depositary in a manner such that the Depositary has a written or printed copy of such notice of withdrawal. Any such notice of withdrawal (i) must be signed by the CDS participant who tendered the Notes through CDSX in the same manner as the participant's name is listed on the applicable Book-Entry Confirmation or be accompanied by evidence sufficient to the Depositary that the person withdrawing the tender has succeeded to the beneficial ownership of the Notes, and (ii) must specify the name of the person who deposited the Notes to be withdrawn, the name of the registered holder, if different from that of the person who deposited such Notes, and the principal amount of Notes to be withdrawn. A withdrawal of Notes deposited pursuant to the Offer can only be accomplished in accordance with the foregoing procedure. The withdrawal shall take effect only upon actual receipt by the Depositary of a properly completed and executed notice of withdrawal in writing.

All questions as to the form and validity (including time of receipt) of notices of withdrawal will be determined by the Corporation, in its sole discretion, which determination shall be final and binding. None of the Corporation, the Depositary or any other person shall be obligated to give any notice of any defects or irregularities in any notice of withdrawal and none of them shall incur any liability for failure to give any such notice.

Any Notes properly withdrawn will thereafter be deemed not deposited for purposes of the Offer. However, withdrawn Notes may be redeposited prior to the Expiration Date by again following the procedures described herein. See "Procedure for Depositing Notes".

If a Noteholder tenders Notes in the Offer, such Noteholder may convert such Notes only if the Noteholder withdraws such Notes from the Offer prior to the time the Noteholder’s right to withdraw has expired.

The Notes are convertible at the option of the Noteholders into Voting Shares (if the Notes are owned and controlled by a Canadian) or into Variable Voting Shares (if the Notes are not owned and controlled by a Canadian), at a conversion ratio of approximately 40.6917 Shares per $1,000 principal amount of the Notes, subject to adjustment in certain events in accordance with the indenture governing the Notes.

If ACE extends the period of time during which the Offer is open, is delayed in its purchase of Notes or is unable to purchase Notes pursuant to the Offer for any reason, then, without prejudice to ACE's rights under the Offer, the Depositary may, subject to applicable law, retain on behalf of ACE all Notes deposited under the Offer. The Corporation's reservation is limited by Rule 13e-4(f)(5) promulgated under the Exchange Act, which requires that the Corporation must pay the consideration offered or return the Notes tendered promptly after termination or withdrawal of the Offer. In the event of such retention, such Notes may not be withdrawn except to the extent depositing Noteholders are entitled to withdrawal rights as described under this section.

Conditions of the Offer

Notwithstanding any other provision of the Offer, the Corporation shall not be required to accept for purchase, to purchase or to pay for any Notes deposited, and may withdraw, terminate, cancel or amend the Offer or may postpone the payment for Notes deposited, if, at any time before the payment for any such Notes, any of the following events shall have occurred (or shall have been determined by the Corporation to have occurred) which, in the Corporation's sole judgment in any such case and regardless of the circumstances, makes it inadvisable to proceed with the Offer or with such acceptance for purchase or payment:

| (a) | there shall have been threatened, taken or pending any action, suit or proceeding by any government or governmental authority or regulatory or administrative agency in any jurisdiction, or by any other person in any jurisdiction, before any court or governmental authority or regulatory or administrative agency in any jurisdiction (i) challenging or seeking to cease trade, make illegal, delay or otherwise directly or indirectly restrain or prohibit the making of the Offer, the acceptance for payment of some or all of the Notes by the Corporation or otherwise directly or indirectly relating in any manner to or affecting the Offer, or (ii) seeking material damages or that otherwise, in the sole judgment of the Corporation, acting reasonably, has or may have a material adverse effect on the Notes or the business, income, assets, liabilities, condition (financial or otherwise), properties, operations, results of operations or prospects of the Corporation or its affiliates taken as a whole or has impaired or may materially impair the contemplated benefits of the Offer to the Corporation; |

| (b) | there shall have been any action or proceeding threatened, pending or taken or approval withheld or any statute, rule, regulation, stay, decree, judgment or order or injunction proposed, sought, enacted, enforced, promulgated, amended, issued or deemed applicable to the Offer or the Corporation or its affiliates by any court, government or governmental authority or regulatory or administrative agency in any jurisdiction that, in the sole judgment of the Corporation, acting reasonably, might directly or indirectly result in any of the consequences referred to in clauses (i) or (ii) of paragraph (a) above or, in the sole judgment of ACE, acting reasonably, would or might prohibit, prevent, restrict or delay consummation of or materially impair the contemplated benefits to the Corporation of the Offer; |

| (c) | there shall have occurred (i) any general suspension of trading in, or limitation on prices for, securities on any securities exchange or in the over-the-counter market in Canada or the United States, (ii) the declaration of a banking moratorium or any suspension of payments in respect of banks in Canada or the United States (whether or not mandatory), (iii) a natural disaster or the commencement of a war, armed hostilities or other international or national calamity directly or indirectly involving Canada, the United States, Europe, Asia or any other region where the Corporation maintains significant business activities, (iv) any limitation by any government or governmental authority or regulatory or administrative agency or any other event that, in the sole judgment of the Corporation, acting reasonably, might affect the |

| | extension of credit by banks or other lending institutions, (v) any significant decrease in the market price of the Variable Voting Shares, Voting Shares or the Notes since the close of business on December 10, 2008, (vi) any change in the general political, market, economic or financial conditions that has or may have a material adverse effect on the Corporation's business, operations or prospects or the trading in, or value of, the Variable Voting Shares, the Voting Shares or the Notes, or (vii) any decline in any of the S&P/TSX Composite Index, the Dow Jones Industrial Average or the Standard and Poor's Index of 500 Industrial Companies by an amount in excess of 10%, measured from the close of business on December 10, 2008; |

| | |

| (d) | there shall have occurred any change or changes (or any development involving any prospective change or changes) in the business, assets, liabilities, properties, condition (financial or otherwise), operations, results of operations or prospects of the Corporation or its affiliates that, in the sole judgment of the Corporation, acting reasonably, has, have or may have material adverse significance with respect to the Corporation or its affiliates taken as a whole; |

| (e) | any take-over bid or tender or exchange offer with respect to some or all of the securities of the Corporation, or any merger, business combination or acquisition proposal, disposition of assets, or other similar transaction with or involving the Corporation or its affiliates, other than the Offer, shall have been proposed, announced or made by any individual or entity, excluding the substantial issuer bid by ACE with respect to its Preferred Shares announced on December 10, 2008 concurrently with the announcement of the Offer; |

| (f) | the Corporation shall have concluded, in its sole judgment, acting reasonably, that the Offer or the taking up and payment for any or all of the Notes by the Corporation is illegal or not in compliance with applicable law, or that necessary exemptions under applicable securities legislation are not available to the Corporation for the Offer and, if required under any such legislation, the Corporation shall not have received the necessary exemptions from or approvals or waivers of the appropriate courts or applicable securities regulatory authorities in respect of the Offer; |

| (g) | any change shall have occurred or been proposed to the Income Tax Act (Canada) or the Income Tax Regulations, as amended, or to the publicly available administrative policies or assessing practices of the Canada Revenue Agency, or to the Canada Transportation Act, as amended, that, in the sole judgment of the Corporation, acting reasonably, is detrimental to ACE or its affiliates taken as a whole or to a Noteholder, or with respect to making the Offer or taking up and paying for Notes deposited under the Offer; or |

| (h) | any change shall have occurred or been proposed to the United States Internal Revenue Code of 1986, as amended, the Treasury regulations promulgated thereunder, or publicly available administrative policies of the U.S. Internal Revenue Service that, in the sole judgment of the Corporation, acting reasonably, is detrimental to ACE or its affiliates taken as a whole or to a Noteholder, or with respect to making the Offer or taking up and paying for Notes deposited under the Offer. |

The foregoing conditions are for the sole benefit of the Corporation and may be asserted by the Corporation regardless of the circumstances, except with respect to any action or inaction by the Corporation, giving rise to any such conditions, or may be waived by the Corporation, in whole or in part, if not satisfied on or prior to the Expiration Date. The failure by the Corporation at any time to exercise its rights under any of the foregoing conditions shall not be deemed a waiver of any such right; and the waiver of any such right with respect to particular facts and other circumstances shall not be deemed a waiver with respect to any other facts and circumstances. The Corporation confirms that if it fails to exercise or waives a condition to the Offer, it may be required, depending upon the materiality of such failure or waiver and the number of days remaining in the Offer, to extend the Offer and circulate new disclosure to Noteholders.

Any waiver of a condition or the withdrawal of the Offer by the Corporation shall be deemed to be effective on the date on which notice of such waiver or withdrawal by the Corporation is delivered or otherwise communicated, in writing, to the Depositary at its principal office in Montreal, Québec. ACE, after giving notice to the Depositary of any waiver of a condition or the withdrawal of the Offer, shall immediately make a public announcement of such waiver or withdrawal and provide and cause to be provided notice of such waiver or withdrawal to the TSX and the applicable Canadian and U.S. securities regulatory authorities. In addition, if required by applicable securities laws, the Corporation will cause the Depositary to provide to CDS, as the registered holder of all Notes, a copy of the notice in the manner set forth below under "Notice" as soon as practicable thereafter. If the Offer is withdrawn, the Corporation shall not be obligated to take up, accept for purchase or pay for any Notes deposited under the Offer.

Acceptance for Payment and Payment for Notes

The Corporation will take up the Notes to be purchased pursuant to the Offer promptly after the Expiration Date, but in any event not later than ten days after such time. The Corporation will pay for such Notes within three business days after taking up the Notes. The Corporation will acquire Notes to be purchased pursuant to the Offer and title thereto upon having taken up such Notes even if payment therefore shall have not been effected.

Principal Amount of Notes

For purposes of the Offer, the Corporation will be deemed to have taken up and accepted for payment Notes properly deposited, and not withdrawn if, as and when the Corporation gives oral (to be confirmed in writing) or written notice to the Depositary at its principal office in Montreal, Québec of its acceptance of such Notes for payment pursuant to the Offer.

Payment

The Purchase Price payable by the Corporation will be denominated in Canadian dollars.

Payment for Notes accepted for purchase pursuant to the Offer will be made by depositing the aggregate Purchase Price for such Notes with the Depositary (by bank transfer or other means satisfactory to the Depositary), who will act as agent for the depositing Noteholders for the purposes of receiving payment from the Corporation and transmitting such payment to CDS for the account of the CDS participants of the depositing Noteholders. Receipt by the Depositary from the Corporation of payment for such Notes will be deemed to constitute receipt of payment by such depositing Noteholders. Under no circumstances will interest be paid by the Corporation or the Depositary to Noteholders depositing Notes by reason of any delay in paying for any Notes or otherwise.

The Offer provides Noteholders with the opportunity to sell their Notes without incurring brokerage commissions. However, Noteholders are cautioned to consult with their own investment dealers, brokers or other nominees to determine whether any fees or commissions are payable to their investment dealers, brokers or other nominees in connection with a deposit of Notes pursuant to the Offer. ACE will pay all fees and expenses of the Depositary in connection with the Offer.

Extension and Variation of the Offer

Subject to applicable law, the Corporation expressly reserves the right, in its sole discretion, and regardless of whether or not any of the conditions specified herein shall have occurred, at any time or from time to time, to extend the period of time during which the Offer is open or to vary the terms and conditions of the Offer by giving written notice, or oral notice (to be confirmed in writing), of extension or variation to the Depositary and by causing the Depositary to provide to CDS, as the registered holder of all Notes, a copy of the notice in the

manner set forth below under "Notice" as soon as practicable thereafter. Promptly after giving notice of an extension or variation to the Depositary, the Corporation will make a public announcement of the extension or variation (such announcement, in the case of an extension, to be issued no later than 9:00 a.m. (Montreal time), on the next business day after the last previously scheduled or announced expiration date) and provide or cause to be provided notice of such extension or variation to the TSX and the applicable Canadian and U.S. securities regulatory authorities. Any notice of extension or variation will be deemed to have been given and be effective on the day on which it is delivered or otherwise communicated, in writing, to the Depositary at its principal office in Montreal, Québec.

Where the terms of the Offer are varied (other than a variation consisting solely of a waiver of a condition of the Offer or a variation consisting solely of an increase in the consideration offered under the Offer where the Expiration Date is not extended for a period of greater than ten business days), the period during which Notes may be deposited pursuant to the Offer shall not expire before ten business days after the notice of variation has been mailed, delivered or otherwise properly communicated to Noteholders unless otherwise permitted by applicable legislation. During any such extension or in the event of any variation, all Notes previously deposited and not taken up or withdrawn will remain subject to the Offer and may be accepted for purchase by the Corporation in accordance with the terms of the Offer, subject to the terms and conditions set forth in this Offer to Purchase under "Acceptance for Payment and Payment for Notes" and "Withdrawal Rights". An extension of the Expiration Date or a variation of the Offer does not constitute a waiver by the Corporation of its rights in this Offer to Purchase.

Notwithstanding the foregoing, except as required by applicable Canadian and U.S. securities legislation, the Offer may not be extended by the Corporation if all the terms and conditions of the Offer have been complied with (except those waived by the Corporation), unless the Corporation first takes up and pays for all Notes properly deposited under the Offer and not withdrawn.

The Corporation also expressly reserves the right, in its sole and absolute discretion (i) to terminate the Offer and not take up and pay for any Notes not theretofore taken up and paid for upon the occurrence of any of the conditions specified in this Offer to Purchase under "Conditions of the Offer", and/or (ii) at any time or from time to time, to amend the Offer in any respect, including decreasing the aggregate principal amount of Notes the Corporation may purchase or increasing or decreasing the price it may pay pursuant to the Offer, subject to applicable Canadian and U.S. securities legislation.

Any such extension, delay, termination or amendment will be followed as promptly as practicable by a public announcement. Without limiting the manner in which the Corporation may choose to make any public announcement, except as provided by applicable law, the Corporation shall have no obligation to publish, advertise or otherwise communicate any such public announcement other than by making a release through its usual news wire service.

If the Corporation makes a material change in the terms of the Offer or the information concerning the Offer, the Corporation will extend the time during which the Offer is open to the extent required under applicable Canadian and U.S. securities legislation.

Encumbrances and Accrued Interest

Notes acquired pursuant to the Offer shall be acquired by the Corporation free and clear of all hypothecs, liens, charges, encumbrances, security interests, claims, restrictions and equities whatsoever, together with all rights and benefits arising therefrom.

The Notes bear interest at a rate of 4.25% per year, payable semi annually in arrears on June 1st and December 1st of each year. Notwithstanding anything to the contrary contained in the Offer, the Circular or the Letter of

Transmittal, Noteholders accepting the Offer will not be entitled to receive accrued and unpaid interest on the Notes.

Notice

Without limiting any other lawful means of giving notice under the indenture governing the Notes, any notice that the Corporation or the Depositary may give or cause to be given under the Offer will be deemed to have been properly given if it is mailed by first class mail or delivered by an overnight delivery service to CDS, unless otherwise specified by applicable securities legislation. The Corporation understands that, upon receipt of any such notice, CDS will provide a notice to its CDS participants in accordance with the applicable CDS policies and procedures for the book entry system then in effect.

These provisions apply notwithstanding any accidental omission to give notice and notwithstanding any interruption of mail services in Canada or the United States following mailing. In the event of an interruption of mail service following mailing, the Corporation will use reasonable efforts to disseminate any notice required under applicable securities legislation by other means, such as publication. If post offices in Canada or the United States are not open for deposit of mail, or there is reason to believe there is or could be a disruption in all or any part of the postal service, any notice which the Corporation or the Depositary may give or cause to be given under the Offer, and which is required to be given under applicable securities legislation, will be deemed to have been properly given and to have been received if it is issued by way of a news release and if it is published once in the National Post or The Globe and Mail, in La Presse and in The Wall Street Journal.

Other Terms of the Offer

| (a) | No broker, dealer or other person has been authorized to give any information or to make any representation on behalf of the Corporation other than as contained in the Offer, and, if any such information or representation is given or made, it must not be relied upon as having been authorized by the Corporation. |

| (b) | The Offer and all contracts resulting from the acceptance thereof shall be governed by and construed in accordance with the laws of the Province of Québec and the laws of Canada applicable therein. Each party to a contract resulting from an acceptance of the Offer unconditionally and irrevocably attorns to the jurisdiction of the courts of the Province of Québec. |

| (c) | ACE, in its sole discretion, shall be entitled to make a final and binding determination of all questions relating to the interpretation of the Offer, the validity of any acceptance of the Offer and the validity of any withdrawals of Notes, except as otherwise finally determined in a subsequent judicial proceeding in a court of competent jurisdiction or as required by law. |

| (d) | The Offer is not being made to, and deposits of Notes will not be accepted from or on behalf of, Noteholders residing in any jurisdiction in which the making of the Offer or the acceptance thereof would not be in compliance with the laws of such jurisdiction. ACE may, in its sole discretion, take such action as it may deem necessary to extend the Offer to Noteholders in any such jurisdiction. |

Neither ACE nor its Board of Directors in making the decision to present the Offer to Noteholders, makes any recommendation to any Noteholder as to whether to deposit or refrain from depositing Notes. Noteholders are urged to consult their own investment and tax advisors and make their own decision whether to deposit Notes to the Offer and, if so, what principal amount of Notes to deposit.

The accompanying Circular, together with this Offer to Purchase, constitutes the issuer bid circular required under Canadian securities legislation and the tender offer information required to be delivered to security holders under U.S. securities legislation applicable to the Corporation with respect to the Offer.

The accompanying Circular contains additional information relating to the Corporation and the Offer and the Corporation urges you to read it and the Letter of Transmittal.

DATED this 12th day of December 2008.

| | ACE AVIATION HOLDINGS INC. | |

| | | | |

| | | | |

| | By: | (Signed) ROBERT A. MILTON | |

| | | Chairman, President and Chief Executive Officer | |

| | | | |

| | By: | (Signed) BRIAN DUNNE | |

| | | Executive Vice President and Chief Financial Officer | |

ISSUER BID CIRCULAR

This Circular is being furnished in connection with the offer by ACE to purchase all of the issued and outstanding Notes. Terms defined in the Offer to Purchase and not otherwise defined herein have the same meaning in this Circular. The terms and conditions of the Offer to Purchase are incorporated into and form part of this Circular. Reference is made to the Offer to Purchase for details of its terms and conditions.

ACE Aviation Holdings Inc.

Nature of Business

ACE is a holding company with interests in Air Canada and Aero Technical Support & Services Holdings sarl. ACE's cash and cash equivalents amounted to approximately Cdn$811 million as of December 10, 2008. The Variable Voting Shares, Voting Shares and Notes of ACE are listed on the TSX under the symbols "ACE.A", "ACE.B" and "ACE.NT.A", respectively. The Preferred Shares of ACE are not listed for trading on an exchange.

The head office of ACE is located at 5100 de Maisonneuve Boulevard West, Montreal, Québec, H4A 3T2. The telephone number of the Corporate Secretary's office of ACE is (514) 205-7855 and facsimile number is (514) 205-7859. Its website is www.aceaviation.com (for greater certainty, the content of such website is not in any way incorporated by reference herein).

Air Canada

Air Canada is Canada's largest domestic and international airline and the largest provider of scheduled passenger services in the Canadian market, the Canada – U.S. transborder market and in the international market to and from Canada. The Class A variable voting shares and Class B voting shares of Air Canada are listed on the TSX under the symbols "AC.A" and "AC.B", respectively. As of December 10, 2008 ACE held a 75% ownership interest in Air Canada.

The head office of Air Canada is located at 7373 Côte Vertu Boulevard West, Saint-Laurent, Québec, H4Y 1H4.

Aero Technical Support & Services Holdings

ACE has a 27.8% interest in Aero Technical Support & Services Holdings sarl, an entity incorporated in Luxembourg which purchased the assets and conducts the business previously operated by ACTS LP. Through its subsidiaries, including Aveos Fleet Performance Inc. and Aeroman, it is a full service provider of airframe, engine, component and maintenance solutions with facilities in Montreal, Winnipeg, Vancouver and Toronto in Canada and San Salvador in El Salvador.

Corporate Structure and Share Capital

ACE was incorporated on June 29, 2004 under the Canada Business Corporations Act ("CBCA") and became the parent holding company of the reorganized Air Canada and its subsidiaries upon the implementation of the consolidated plan of reorganization, compromise and arrangement of Air Canada and certain of its subsidiaries under the CBCA, the Companies' Creditors Arrangement Act ("CCAA") and the Business Corporations Act (Alberta) which was implemented on September 30, 2004 (referred to herein as the "Plan").

As part of the Plan, ACE offered rights to Air Canada's creditors with proven claims to subscribe for up to Cdn$850 million of Voting Shares and/or Variable Voting Shares. Pursuant to its standby purchase agreement with Air Canada, Deutsche Bank Securities Inc. ("Deutsche Bank") agreed to act as the exclusive standby

purchaser in respect of the rights offering. Deutsche Bank and the participants in its syndicate subscribed for all the Shares not otherwise subscribed for by the creditors at a subscription price per Share of Cdn$21.50, which represented the subscription price of Cdn$20 paid by creditors, plus a premium of Cdn$1.50. On September 30, 2004, ACE completed the issuance of Shares under such rights offering for total gross proceeds of Cdn$865 million, including the amount of the premium paid by Deutsche Bank and the participants of its syndicate pursuant to the standby purchase agreement.

On September 30, 2004, Promontoria Holding III B.V. ("Cerberus Affiliate") invested Cdn$250 million in ACE in consideration for the issuance to it of 12,500,000 Preferred Shares initially convertible into 9.16% of the fully diluted equity of ACE upon emergence from the CCAA proceedings. For a summary of the terms of the Preferred Shares, see "Issuer Bid Circular — Corporate Structure and Share Capital — Convertible Preferred Shares".

Pursuant to the investment agreement with the Cerberus Affiliate dated June 23, 2004 (the "Investment Agreement"), two of the nine current members of the board of directors of ACE are designated by the Cerberus Affiliate. For as long as the Cerberus Affiliate and its affiliates continue to hold at least 50% but less than 75% of the Preferred Shares (or Shares into which they are converted or convertible) originally purchased under the Investment Agreement, the Cerberus Affiliate will have the right to designate two individuals to the board of directors of ACE. If the Cerberus Affiliate and its affiliates hold at least 25% but less than 50% of the Preferred Shares (or Shares into which they are converted or convertible) originally purchased under the Investment Agreement, the Cerberus Affiliate has the right to designate one member of the board of directors of ACE. If the Cerberus Affiliate and its affiliates hold at least 2.5% of the economic equity interests of ACE, the Cerberus Affiliate has the right, at reasonable times and upon reasonable notice, to have access to the management of ACE and to all reasonable financial and operating information of ACE, including business plans, budgets and quarterly results, in order to consult with management of ACE and express its views on the business and affairs of ACE and its subsidiaries.

The terms attached to the Preferred Shares provide the holders of Preferred Shares with pre-emptive rights on any issuance or sale by ACE of Variable Voting Shares or Voting Shares or other equity securities, rights, options, warrants or other convertible securities which represent rights to purchase Variable Voting Shares or Voting Shares. As of December 10, 2008, the Cerberus Affiliate was the registered holder of 6,550,000 Preferred Shares, representing 52.4% of all outstanding Preferred Shares.

On April 6, 2005, ACE completed a public offering of an aggregate of 11,350,000 Voting Shares and Variable Voting Shares at a price of Cdn$37 per share for gross proceeds of approximately Cdn$420 million. On April 6, 2005, ACE also completed a public offering of approximately Cdn$300 million of Notes. ACE used approximately Cdn$553 million of the aggregate net cash proceeds of the offerings to repay all of its outstanding debt under the exit credit facility with General Electric Capital Corporation ("GECC"). On April 13, 2005, following the exercise of the over-allotment option by the underwriters, ACE issued an additional 1,135,000 Variable Voting Shares at a price of Cdn$37 per share and Cdn$30 million of Notes for additional aggregate gross proceeds of approximately Cdn$72 million. ACE used the additional proceeds for general corporate purposes.

On October 16, 2007, ACE completed the sale of a 70% interest in ACTS. On closing, ACE received net cash proceeds of Cdn$723 million, which included the settlement of a Cdn$200 million inter-company note payable from ACTS to ACE. Within six months of closing, ACE was entitled to receive up to an additional Cdn$40 million in cash proceeds, from funds held in escrow, conditional upon the completion of certain supplier contracts within specified terms. On January 14, 2008, ACE announced that it had received the full balance of Cdn$40 million. Following the redemption of the exchangeable share issued to a party related to Grupo TACA Holdings Limited, the establishment of an initial ACTS Long Term Incentive Plan and the exercise of a put option by an entity related to Grupo TACA, ACE holds a 27.8% equity interest in Aero Technical Support & Services Holdings sarl which purchased the assets and conducts the business previously operated by ACTS LP.

On October 22, 2007, ACE completed the sale of 22.0 million trust units of Aeroplan Income Fund at a price of Cdn$21.90 per unit, for net proceeds of approximately Cdn$463 million. Immediately following the closing of the offering, ACE's interest in Aeroplan Income Fund represented approximately 20.1% of the units issued and outstanding.

On October 22, 2007, ACE completed the sale of 35.5 million trust units of Jazz Air Income Fund at a price of Cdn$7.75 per unit, for net proceeds of approximately Cdn$263 million. Immediately following the closing of the offering, ACE's interest in Jazz Air Income Fund represented approximately 20.1% of the units issued and outstanding.

On December 3, 2007, ACE announced a substantial issuer bid to purchase for cancellation up to Cdn$1.5 billion of its Variable Voting Shares and Voting Shares for an aggregate of up to 54,151,624 shares. On January 10, 2008, ACE announced the final results of its offer to purchase, and confirmed that it had taken up and accepted for purchase and cancellation a total of 40,023,427 Variable Voting Shares and 9,894,166 Voting Shares at Cdn$30.00 per share for an aggregate purchase price of approximately Cdn$1.498 billion.

On January 24, 2008, ACE sold 13.0 million trust units of Jazz Air Income fund on an exempt trade basis for gross proceeds of approximately Cdn$96.85 million reducing its ownership interest in Jazz Air Income Fund to approximately 9.5%.

On April 21, 2008, ACE completed the sale of 20.4 million trust units of Aeroplan Income Fund at a price of Cdn$17.50 per unit, for net proceeds of approximately Cdn$343 million. Immediately following the closing of the offering, ACE's interest in Aeroplan Income Fund represented approximately 9.9% of the units issued and outstanding.

On May 9, 2008, ACE announced a substantial issuer bid to purchase for cancellation up to Cdn$500 million of its Variable Voting Shares and Voting Shares for an aggregate of up to 23,809,523 Shares. On June 18, 2008, ACE announced the final results of its offer to purchase and confirmed that it had taken up and accepted for purchase and cancellation a total of 12,537,084 Variable Voting Shares and 10,190,187 Voting Shares at Cdn$22.00 per Share for an aggregate purchase price of approximately Cdn$500 million.

On May 28, 2008, ACE announced that it had sold in the market a total of 19,892,088 units of Aeroplan Income Fund for total net proceeds to ACE of approximately $349.3 million and a total of 11,726,920 units of Jazz Air Income Fund for total net proceeds to ACE of approximately $85.0 million. Immediately following such transactions, ACE retained no further interest in Aeroplan Income Fund and Jazz Air Income Fund.

In addition, see "Previous Distributions" for a description of the distributions made by ACE to its shareholders of units of Aeroplan Income Fund and of Jazz Air Income Fund, as well as the exchanges by ACE of units of Aeroplan Limited Partnership for units of Aeroplan Income Fund and the exchanges of units of Jazz Air LP for units of Jazz Air Income Fund.

In addition, concurrently with the announcement of the Offer, ACE also announced the transactions or plans described under "Issuer Bid Circular - Concurrent Transactions".

Authorized and Issued and Outstanding Capital

The share capital of ACE is composed of an unlimited number of Variable Voting Shares and Voting Shares and of 12,500,000 Preferred Shares. As of December 10, 2008, 25,345,812 Variable Voting Shares,

9,561,127 Voting Shares and 12,500,000 Preferred Shares were issued and outstanding. In addition, as of December 10, 2008, ACE has a principal amount of Cdn$322,746,000 of Notes issued and outstanding. As of December 10, 2008, the 12,500,000 issued and outstanding Preferred Shares were convertible at the option of their holders into an aggregate of 11,829,669 Variable Voting Shares and Voting Shares. The Conversion Rate of the Preferred Shares is subject to adjustment in certain circumstances, as summarized below. As of December 10, 2008, the Cdn$322,746,000 issued and outstanding principal amount of Notes were convertible at the option of their holders into an aggregate of 13,133,083 Variable Voting Shares and Voting Shares. The conversion ratio of the Notes is subject to adjustment in certain events in accordance with the indenture governing the Notes. In addition, as of December 10, 2008, there were 70,275 ACE stock options issued and outstanding, all of which were vested, exercisable for an aggregate of 70,275 Shares.

The issued and outstanding Shares of ACE as of December 10, 2008, along with potential Shares, are as follows:

| | Outstanding Shares | December 10, 2008 | |

| | Issued and outstanding Shares Class A Variable Voting Shares Class B Voting Shares | 25,345,812 9,561,127 | |

| | Total issued and outstanding Shares | 34,906,939 | |

| | | | |

| | Potential Shares Convertible Preferred Shares Convertible Notes Stock Options | 11,829,669 13,133,083 70,275 | |

| | Total potential Shares | 25,033,027 | |

| | Total Shares (fully diluted basis) | 59,939,966 | |

| | | | |

The Variable Voting Shares, Voting Shares and Notes of ACE are listed on the TSX, under the symbols "ACE.A", "ACE.B" and "ACE.NT.A", respectively. The Preferred Shares of ACE are not listed for trading on an exchange.

Variable Voting Shares and Voting Shares

The description of the share capital of ACE provided for in its Articles contains provisions to ensure compliance with the foreign ownership restrictions of the Canada Transportation Act. The Variable Voting Shares may only be owned or controlled by persons who are not Canadians. As a result, an issued and outstanding Variable Voting Share shall be converted into one Voting Share, automatically and without any further act of ACE or of the holder, if such Variable Voting Share becomes owned and controlled by a Canadian. The Voting Shares may only be owned and controlled by a Canadian. An issued and outstanding Voting Share shall be converted into one Variable Voting Share, automatically and without any further act of ACE or the holder, if such Voting Share becomes owned or controlled by a person who is not a Canadian. Hence, upon a transfer of Variable Voting Shares to a Canadian, such Variable Voting Shares will automatically be converted into Voting Shares and upon a transfer of Voting Shares to a non-Canadian, such Voting Shares will automatically be converted into Variable Voting Shares.

The Variable Voting Shares are entitled to one vote per Variable Voting Share unless (i) the number of Variable Voting Shares outstanding (including the Preferred Shares, on an as converted basis), as a percentage of the total