UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal period ended December 31, 2008

OR

| ¨ | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 000-50931

AURELIO RESOURCE CORPORATION

(Exact name of registrant as specified in its charter)

| | |

| Nevada | | 33-1086828 |

(State or other jurisdiction of

incorporation or organization) | | (IRS Employer

Identification No.) |

Suite 202, 12345 Alameda Pkwy

Lakewood, Colorado, 80228

(Address of principal executive offices) (zip code)

303.795.3030

(Registrant’s telephone number)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for at least the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-KSB or any amendment to this Form 10- K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | |

| Large accelerated filer ¨ | | Accelerated filer ¨ |

| Non-accelerated filer ¨ | | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of voting stock held by non-affiliates of the registrant, based upon the closing sales price of its common stock March 24, 2009 was $2,233,160.

The number of shares of the registrant’s common stock, $.001 par value, outstanding as of March 24, 2009 was 44,638,913.

Documents incorporated by reference: See Part III, Item 15, and “EXHIBIT INDEX” on page 61 for a listing of documents incorporated by reference into this Annual Report on FORM 10-K.

PART I

PRELIMINARY NOTE REGARDING FORWARD-LOOKING STATEMENTS AND CURRENCY DISCLOSURE

This annual report on Form 10-K, including Management’s Discussion and Analysis of Financial Condition and Results of Operations, contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (“1934 Act”). Aurelio Resource Corporation intends that such forward-looking statements be subject to the safe harbors for such statements under such sections. Our forward-looking statements include, among other things, the plans and objectives of management for future operations, plans and objectives relating to our business strategy, planned asset development and other related planned future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential”, “could”, “intends”, “objective”, or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors that are described throughout this Form 10-K, including the risks in the section entitled “Risk Factors”. Many of these factors are beyond our control. Aurelio Resource Corporation cautions that these risks may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we undertake no obligation to update any of the forward-looking statements to conform these statements to actual results or for circumstances occurring after the date of this Form 10-K.

Our financial statements are stated in United States dollars and are prepared in accordance with United States Generally Accepted Accounting Principles.

| ITEM 1 | DESCRIPTION OF BUSINESS |

As used in this annual report, the terms “we”, “us”, “Aurelio”, “Company” and “our” mean Aurelio Resource Corporation, our wholly owned subsidiaries, Bolsa Resources, Inc., and Minera Milenium S.A. de C.V., which is 98% owned by Aurelio Resource Corporation, unless otherwise indicated.

Corporate History

Aurelio is an exploration stage company and, since inception has conducted no operations nor earned any revenues.

We were incorporated in the State of Nevada on February 19, 2004 under the name Furio Resources, Inc. We are an exploration stage company engaged in the exploration of mineral properties and we may also, from time to time, acquire additional mineral properties to explore. Since incorporation, we have focused our efforts on acquiring mineral properties and carrying out exploration activities on those mineral properties.

We changed our name to Aurelio Resource Corporation effective June 16, 2006 and implemented a six and one-half (6.5) for one (1) forward stock split of our authorized, issued and outstanding common stock. As a result, our authorized capital has increased from 75,000,000 shares of common stock with a par value of $0.001 to 487,500,000 shares of common stock with a par value of $0.001. Except as otherwise stated, all references to shares and prices per share have been adjusted to give retroactive effect to the stock split.

On August 17, 2006 we completed our acquisition of all of the issued and outstanding common stock of Aurelio Resources, Inc., a privately-owned Colorado corporation engaged in mineral exploration, pursuant to an agreement we entered into with Aurelio Resources, Inc. (“ARI”) and its shareholders dated April 27, 2006, as amended on June 9, 2006 and further amended on July 13, 2006 and on July 21, 2006.

Current Business

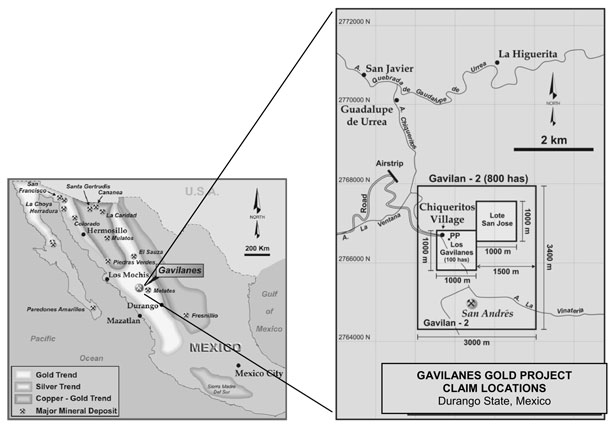

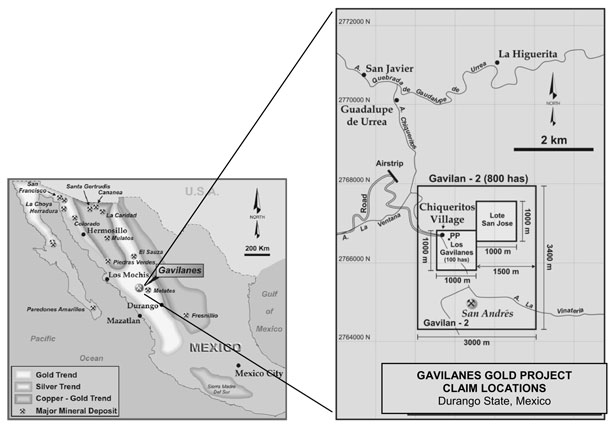

As a result of our acquisition of ARI, we indirectly acquired all of its assets in 2006. In particular, we acquired properties in Arizona, now held through our wholly-owned Arizona subsidiary Bolsa Resources, Inc. (“Bolsa”), and a 98% interest in Minera Milenium S.A. de C.V. (“Minera Milenium”), a company incorporated in Mexico which holds an option to acquire a 100% interest in a gold property in Mexico.

During 2008, the Company conducted the following financing:

On February 15th of 2008, the Aurelio Board of Directors approved a US$1,000,000 equity financing agreement with the Investors consisting of 3,333,334 Units, with each Unit equal to one common share and one half-warrant, with each full warrant permitting the holder to purchase one additional common share at $0.50/share for five years. As noted in the press release announcing this financing, the parties intended that the February 2008 equity financing would be the first tranche in a long-term strategic alliance between the Company and the Investors that would be structured over the coming weeks and months.

2

On February 27th of 2008, Telifonda, and affiliates of the Investors, approached the Aurelio Board of Directors with an expression of interest in providing additional financing for the Company. The Board of Directors considered that expression of interest and indicated a willingness to consider a transaction. On April 7th of 2008, the Company received an initialInvestment Proposal and Term Sheet fromTelifonda Holdings Co. Ltd. The Board of Directors evaluated this financing offer and determined that it was not in the best interests of stockholders due to high interest charges, complex structure and the potential for extremely significant dilution.

On July 3rd of 2008, the Company received a revisedInvestment Proposal and Term Sheet fromTelifonda through its Director, Amicorp Management Ltd. At a meeting of the Aurelio Board of Directors on July 8, 2008, the Board considered the potential conflicts of interests of Mr. Warnaars, Mr. Roes and Mr. Vermeulen in the transaction (see “—Interests of Directors and Officers in the Telifonda Sale Transaction that Differ from Your Interests”). As a result of these potential conflicts of interest, the Board of Directors appointed an independent committee (the Special Committee) of the Board consisting of Mr. Johnson and Mr. Doppler to continue negotiations with Telifonda. The Board and the Special Committee evaluated the revised financing offer and again determined that it was not in the best interests of stockholders due to high interest charges, complex structure and the potential for extremely significant dilution.

Representatives of Telifonda and the Special Committee continued to have discussions in July and early August. On August 14th of 2008, a new term sheet for a proposal for an investment in Aurelio and Bolsa was provided by Telifonda through its Director, Amicorp Management Ltd. The Special Committee presented the revised proposal to the Board of Directors in early August, 2008.

Between August 22, 2008 and September 29, 2008, the officers of the Company worked with Telifonda to negotiate definitive agreements for the Telifonda Sale Transaction. On September 29, 2008, the definitive agreements were presented to the Aurelio Board of Directors. The Board of Directors discussed the definitive agreements as well as the factors set forth above, considered the continuing market contraction in all equity markets, again reviewed the capital requirements of the Company required to advance the Bolsa Hill Copper-Zinc Project, and other factors. The Board then unanimously determined that the Telifonda Sale Transaction was in the best interests of the Aurelio stockholders and authorized the officers of the Company to execute and deliver the definitive agreements and to seek the approval of the Aurelio stockholders with regard to the Telifonda Sale Transaction.

Following the execution of the initial Stock Purchase Agreement, it became apparent to management of the Company that despite the advance of the Bridge Loan to the Company by Telifonda, due to the significant further downturn in global economic conditions, the continuing contraction occurring in the equity and credit markets, particularly for similarly situated companies, the transaction contemplated in the original Stock Purchase Agreement was possibly at risk. The parties mutually agreed to reopen discussions about a possible modification to the agreements to address both parties’ needs given the extremely difficult global economic and market conditions. Between early October and into November, Company’s management worked with Telifonda to negotiate a restructuring to the transaction which would better reflect the valuations of the Company’s assets, which would ensure Company’s preservation of capital following closing of the transaction, and which would facilitate the ultimate closing of the transaction subject to the approval of the stockholders of the Company. On November 14, 2008, definitive agreements incorporating these amendments were presented to the Aurelio Board of Directors for consideration. The Board of Directors discussed these amended agreements in the context of current global economic and market conditions, again considered all of the many factors previously addressed in its earlier deliberations, and reviewed in detail the nearly $2,000,000 required over the next 2 years to simply maintain the properties comprising Bolsa Resource Inc.’s Hill Copper-Zinc Project. The Board then authorized the officers of the Company to execute and deliver the definitive agreements and to seek the approval of the Aurelio stockholders with regard to the amended Telifonda Sale Transaction which was later approved by the shareholders on February 13, 2009. As the Board also authorized the officers to execute the bridge loan agreement, funds for which were received by the company, and used to retire in full the $1.5 million convertible debenture financing with three U.S.-based institutional investors dated February 26, 2008 as described in the 2007 Form 10-KSB.

On November 17, 2008, the Company entered into an Amended Stock Purchase Agreement (the “Amended Agreement”) with Telifonda (Cayman) Ltd. (“Telifonda”). Telifonda is a shareholder of the Company and the Company appointed two members of Telifonda to the Company’s Board of Directors in April 2008. On October 2, 2008, the Company filed a report on Form 8-K to announce that previously it had signed a letter of intent pursuant to which the Company had agreed to sell to Telifonda its

3

wholly-owned subsidiary, Bolsa Resources, Inc., which owns the Hill Copper-Zinc Project, and also to sell Telifonda a 3% Net Smelter Return royalty in the Company’s Gavilanes gold project. Finalization of these transactions was subject to the approval of the Company’s shareholders, which occurred February 13, 2009.

The total value of the proposed transaction and the cash proceeds to be realized by the Company is $4 million, consisting of the sale of assets from total proceeds of $2.55 million and a non-recourse loan as described below for $1.45 million.

Pursuant to the Amended Agreement and as approved by the shareholders, the Company sold all of the outstanding common stock of Bolsa Resources, Inc. to Telifonda in exchange for $2,500,000 cash and retained a 3% Net Smelter Return Royalty (“NSR”) on all future precious and base metal production from the Hill Copper-Zinc Project (the “Bolsa NSR”). All such proceeds will be accounted for using the cost recovery method and, accordingly, no gain or loss was realized at the closing date. The Company is also entitled to recover certain Bolsa related costs it incurred during the period from August 15, 2008 to closing.

The Amended Agreement requires Telifonda to complete a Bankable Feasibility Study within the next four years. Upon completion of the Bankable Feasibility Study, Telifonda will have a right to purchase the Bolsa NSR at fair market value on the terms set forth in the Amended Bolsa NSR Agreement. Should Telifonda fail to complete the Bankable Feasibility Study or otherwise maintain the 5,000+ acre land position, the Company will have the exclusive right to re-acquire the Hill Copper-Zinc Project by reimbursing Telifonda for its $2,500,000 investment and any of its out-of-pocket expenditures.

The transaction also requires Telifonda to fund Bolsa Resources, Inc. after closing in the amount of $8 million to facilitate further development of the Hill Copper-Zinc Project.

In addition to purchasing all of the common stock of Bolsa under the terms of the Amended Agreement, Telifonda will also purchase a 3% NSR interest in the Gavilanes gold project for $50,000 cash prior to December 31, 2009 (the “Minera NSR”) which is expected to result in a realized gain of the same amount. The Company will retain the right to repurchase the Gavilanes NSR at fair market value on the terms set forth in the Gavilanes NSR Agreement. The Minera NSR Agreement will be executed simultaneously with the closing of the transactions contemplated by the Amended Agreement and is subject to shareholder approval.

Bridge Loan Agreement

In connection with the Amended Agreement, on October 1, 2008 Telifonda advanced $2,000,000 to the Company (the “Bridge Loan”) that was repaid upon the closing of the transactions contemplated by the Amended Agreement by offsetting the principal outstanding under the Bridge Loan against the cash consideration due under the Amended Agreement. The Bridge Loan was non-interest bearing. The Bridge Loan was secured by all of the assets of the Company, including all shares of common stock held by the Company in its two subsidiaries, as set forth in the related General Security Agreement.

Of the proceeds from the Bridge Loan, $1,500,000 was used on October 1, 2008 to retire all outstanding Convertible Debentures as of September 30, 2008. The remaining proceeds will be used for working capital purposes.

Loan to the Company

As part of the transaction contemplated by the Amended Agreement, an affiliate of Telifonda has agreed to loan, as approved by the shareholders, $1.45 million to a newly-created subsidiary of the Company (the “NewCo” loan) prior to December 31, 2009. The NewCo Loan Agreement will be an unsecured loan and will be non-recourse to Aurelio Resource Corporation, the parent company. Interest will accrue at LIBOR + 3 over the term of the loan. NewCo has been renamed AIEX Corporation, a corporation formed in Colorado as of January 27, 2009.

The Company intends to use the proceeds of the NewCo Loan facility to fund further exploration of its assets, as well as for other property acquisitions and general working capital.

4

Also during 2008, the Company added to its property interests for the Hill Copper-Zinc Project as follows:

| | • | | On March 20, 2008 Bolsa entered into an agreement to acquire 20 patented mining claims from View Sites LLC; |

| | • | | On April 10, 2008 Bolsa completed the purchase of interests in two patented mining claims from Newmont Realty Company; |

| | • | | On May 5, 2008 Bolsa located two additional unpatented mining claims (MAN #37 and 38); and, |

| | • | | On June 23, 2008 Bolsa acquired two Courtland Town site lots from the Hernandez Trust. |

The assets held by Aurelio Resource Corporation as of December 31, 2008 are described below under “Item 2 - Description of Properties”. Note that the assets held in Arizona have been transferred to Telifonda as of closing of the Amended Stock Purchase Agreement on February 18, 2009.

We are an exploration stage company engaged in the exploration of mineral properties and we may also, from time to time, acquire additional mineral properties to explore. Since we are an exploration stage company, there is no assurance that a commercially viable mineral deposit exists on any of our properties, and a great deal of further exploration will be required before a final evaluation as to the economic and legal feasibility for our future exploration is determined. We have no known reserves of any type of mineral. To date, we have not discovered an economically viable mineral deposit on the mineral property, and there is no assurance that we will discover one.

Mineral property exploration is typically conducted in phases. Before it is carried out, each subsequent phase of exploration work is recommended by our professional geologists based on the results from the most recent phase of exploration. We have only recently commenced the initial phase of exploration on the properties held by Bolsa and Minera Milenium. Once we complete a phase of exploration, we will make a decision as to whether or not we proceed with each successive phase based upon the analysis of the results of that program. Our directors will make these decisions subject to available finance and based upon the recommendations of the independent geologist who oversees the program and records the results.

Our plan of operation is to conduct exploration work on each of our properties in order to ascertain whether any possess commercially exploitable quantities of minerals. There can be no assurance that such mineral deposits exist on any of our properties.

Even if we complete our proposed exploration programs on our properties and we are successful in identifying a mineral deposit, we will have to spend substantial funds on further drilling and engineering studies before we will know whether we have a commercially viable mineral deposit.

We are interested in exploring for minerals such as copper, gold, silver, lead and zinc on our properties but we are not restricting our exploration to any one type or select types of minerals. We may also seek to acquire other properties for mineral exploration in the United States, Mexico, Latin America or elsewhere.

Our objective is to pursue deposits of any type of mineral and to develop, sell or otherwise assign the rights to develop the properties if and when any commercially viable deposits of minerals are found on our properties.

Employees

We have no employees on the payroll, but as of the date of this annual report, we have one officer who is also a director, and a second director who provides services for a portion of his time under consulting contracts. We also have three part-time contract support staff providing various services in our corporate office. We have retained and intend in the future to retain independent geologists and consultants on an as-needed contract basis to conduct the work programs on the mineral properties.

Offices

We maintain an executive office in Lakewood, Colorado and field offices in Elfrida, Arizona and in Culiacan, Mexico. We believe these spaces are adequate for our current needs and that suitable space will be available to accommodate our future needs. Note that as of the February 18, 2009 closing of the Amended Stock Purchase Agreement (the “Amended Agreement”) with Telifonda (Cayman) Ltd. (“Telifonda”) for the sale of Bolsa, the field office in Elfrida, Arizona is no longer maintained by the Company.

Available Information

Aurelio’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to reports filed pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended, are available free of charge on the Securities and Exchange Commission’s (“SEC”) website: http:/www.sec.gov. You may also read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE., Washington, DC 20549 or you may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. Additional information about the Company and our products and services is also available on our website at http://www.aurelioresource.com.

5

Our common stock is currently trading on the OTC Bulletin Board. OTC Bulletin Board stocks are not required to send annual reports directly to their shareholders. Our shareholders have direct electronic access to all of our SEC filings via a link to the Securities and Exchange Commission’s website available on our website at http://www.aurelioresource.com or via the SEC website at www.sec.gov. We send proxy and information statements directly to our shareholders when matters are brought to the vote of our shareholders.

Risk Factors

Shares of our common stock are speculative, especially since we are in the exploration stage of our new business. We operate in a volatile sector of business that involves numerous risks and uncertainties. The risks and uncertainties described below are not the only ones we face. Other risks and uncertainties, including those that we do not currently consider material, may impair our business. If any of the risks discussed below actually occur, our business, financial condition, operating results or cash flows could be materially adversely affected. This could cause the trading price of our securities to decline, and you may lose all or part of your investment. Prospective investors should consider carefully the risk factors set out below.

Risks Related to our Business

Because of the unique difficulties and uncertainties inherent in mineral exploration ventures, we face a high risk of business failure.

Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, environmental permitting difficulties and delays and additional costs and expenses that may exceed current estimates. The expenditures to be made by us in the exploration of the mineral claim may not result in the discovery of mineable mineral deposits. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. If the results of our exploration do not reveal viable commercial mineralization, we may decide to abandon our claims. If this happens, our business will likely fail.

Because of the speculative nature of exploration of mineral properties, we may never discover a commercially exploitable quantity of minerals, our business may fail and investors may lose their entire investment.

We have been conducting and plan to conduct mineral exploration on our mineral properties. The search for valuable minerals as a business is extremely risky. We can provide investors with no assurance that additional exploration on our properties will establish that commercially exploitable reserves of minerals exist on our property. Additional potential problems that may prevent us from discovering any reserves of minerals on our property include, but are not limited to, unanticipated problems relating to exploration, environmental permitting difficulties and delays and additional costs and expenses that may exceed current estimates. If we are unable to establish the presence of commercially exploitable reserves of minerals on our property our ability to fund future exploration activities will be impeded, we will not be able to operate profitably and investors decline and investors may lose all of their investment in our company.

Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages as we conduct our business.

The search for valuable minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. At the present time we have no coverage to insure against these hazards. The payment of such liabilities may have a material adverse effect on our financial position.

The potential profitability of mineral ventures depends in part upon factors beyond the control of our company and even if we discover and exploit mineral deposits, we may never become commercially viable and we may be forced to cease operations.

The commercial feasibility of mineral properties is dependent upon many factors beyond our control, including the existence and size of mineral deposits in the properties we explore, the proximity and capacity of processing equipment, market fluctuations of prices, taxes, royalties, land tenure, allowable production and environmental regulation. These factors cannot be accurately predicted and any one or a combination of these factors may result in our company not receiving an adequate return on invested capital. These factors may have material and negative effects on our financial performance and our ability to continue operations.

Exploration and exploitation activities are subject to comprehensive regulation which may cause substantial delays or require capital outlays in excess of those anticipated causing an adverse effect on our company.

Exploration and exploitation activities are subject to federal, state and local laws, regulations and policies, including laws regulating the removal of natural resources from the ground and the discharge of materials into the environment. Exploration and exploitation activities are also subject to federal, state and local laws and regulations which seek to maintain health and safety standards by regulating the design and use of drilling methods and equipment.

6

Various permits from government bodies are required for drilling operations to be conducted, and no assurance can be given that such permits will be received. Environmental and other legal standards imposed by federal, state, or local authorities may be changed and any such changes may prevent us from conducting planned activities or increase our costs of doing so, which would have material adverse effects on our business. Moreover, compliance with such laws may cause substantial delays or require capital outlays in excess of those anticipated, thus causing an adverse effect on us. Additionally, we may be subject to liability for pollution or other environmental damages which we may not be able to or elect not to insure against due to prohibitive premium costs and other reasons. Any laws, regulations or policies of any government body or regulatory agency may be changed, applied or interpreted in a manner which will alter and negatively affect our ability to carry on our business.

As we face intense competition in the mineral exploration industry, we will have to compete with our competitors for financing and for qualified managerial and technical employees.

Our mineral properties are in Arizona and Mexico and our competition there includes large, established mining companies with substantial capabilities and with greater financial and technical resources than we have. As a result of this competition, we may have to compete for financing and be unable to acquire financing on terms we consider acceptable. We may also have to compete with the other mining companies in the recruitment and retention of qualified managerial and technical employees. If we are unable to successfully compete for financing or qualified employees, our exploration programs may be slowed down or suspended, which may cause us to cease operations as a company.

Government regulation may adversely affect our business and planned operations.

We believe our exploration projects currently comply with existing environmental and mining laws and regulations affecting its operations. Our mineral exploration and development activities are subject to various laws governing prospecting, development, taxes, labor standards and occupational health, mine safety, toxic substances, land use, water use, land claims of local people and other matters. We cannot assure you that new rules and regulations will not be enacted or that existing rules and regulations will not be applied in a manner which could limit or curtail further exploration or development.

Legislation has been proposed that could significantly affect the mining industry in the United States of America.

Members of the U.S. Congress have repeatedly introduced bills which would supplant or alter the provisions of the Mining Law of 1872. If enacted, such legislation could change the cost of holding unpatented mining claims and could significantly impact our ability to develop mineralized material on unpatented mining claims.

A portion of the present Hill Copper-Zinc Project’s land position is located on unpatented mining claims located on U.S. federal public lands. The rights to use such claims are granted under the Mining Law of 1872. Unpatented mining claims are unique property interests in the United States, and are generally considered to be subject to greater title risk than other real property interests because the validity of unpatented mining claims is often uncertain. This uncertainty arises, in part, out of the complex federal and state laws and regulations under the 1872 Mining Law and the interaction of the 1872 Mining Law and other federal and state laws, such as those enacted for the protection of the environment.

In recent years, the U.S. Congress has considered a number of proposed amendments to the 1872 Mining Law. If adopted, such legislation could, among other things:

| | • | | impose a royalty on the production of metals or minerals from unpatented mining claims; |

| | • | | reduce or prohibit the ability of a mining company to expand its operations; and, |

| | • | | require a material change in the method of exploiting the reserves located on unpatented mining claims. |

All of the foregoing could adversely affect the economic and financial viability of future mining operations at the Hill Copper-Zinc Project. Although it is impossible to predict at this point what any legislated royalties might be, enactment could adversely affect the potential for development of such federal unpatented mining claims.

Amendments to current laws, regulations and permits governing operations and activities of mining and exploration companies, or more stringent implementation thereof, could have a material adverse impact on our business and cause increases in exploration expenses, capital expenditures or production costs or reduction in levels of production at producing properties or require abandonment or delays in development of new mining properties.

Our operating costs could be adversely affected by inflationary pressures especially to labor, equipment and fuel costs.

The global economy is currently in a period of high commodity prices and as a result the mining industry is attempting to increase production at new and existing projects, while also seeking to discover, explore and develop new projects. This has caused significant upward price pressures in the costs of mineral exploration companies, especially in the areas of skilled labor and drilling equipment, both of which are in tight supply and whose costs are increasing. Continued upward price pressures in our exploration costs may have an adverse impact to our business.

7

We may be adversely affected by fluctuations in copper, zinc, silver and gold prices.

The value and price of our common shares, our financial results, and our exploration, development and mining, if any, activities may be significantly adversely affected by declines in the price of copper, zinc, silver and gold. Mineral prices fluctuate widely and are affected by numerous factors beyond our control such as interest rates, exchange rates, inflation or deflation, fluctuation in the value of the United States dollar and foreign currencies, global and regional supply and demand, and the political and economic conditions of mineral producing countries throughout the world.

The prices used in making resource estimates for mineral projects are disclosed, and generally use significantly lower metal prices than daily metals prices quoted in the news media. The percentage change in the price of a metal cannot be directly related to the estimated resource quantities, which are affected by a number of additional factors. For example, a 10 percent change in price may have little impact on the estimated resource quantities, or it may result in a significant change in the amount of resources.

Estimates of mineralized materials are subject to geologic uncertainty and inherent sample variability.

Although the estimated resources at our Hill Copper-Zinc Project have been delineated with appropriately spaced drilling, there is inherent variability between duplicate samples taken adjacent to each other and between sampling points that cannot be reasonably eliminated. There also may be unknown geologic details that have not been identified or correctly appreciated at the current level of delineation. This results in uncertainties that cannot be reasonably eliminated from the estimation process. Some of the resulting variances can have a positive effect and others can have a negative effect on mining and processing operations. Acceptance of these uncertainties is part of any mining operation.

Mineral resources and proven and probable reserves are estimates.

Although the mineralized material figures included in this document have been carefully prepared by independent engineers, these amounts are estimates only, and we cannot be certain that specific quantities of copper, zinc, silver, gold or other mineral will in fact be realized. Any material change in the quantity of mineralization, grade or stripping ratio, or mineral prices may affect the economic viability of our properties. In addition, we cannot be certain that metal recoveries in small-scale laboratory tests will be duplicated in larger scale tests under on-site conditions or during production. Until an un-mined deposit is actually mined and processed the quantity of mineral resources and reserves and grades must be considered as estimates only.

Risks Associated with our Company

We have a history of losses and have a deficit, which raises substantial doubt about our ability to continue as a going concern.

We have not generated any revenues or profit since our incorporation and we will continue to incur operating expenses without revenues until we are in commercial deployment. We currently are in the exploration stage and have not found any commercially viable mineral deposits on our properties. We estimate our average monthly operating expenses to be approximately $50,000, before meeting our commitments for ongoing property acquisition and option payments. We cannot provide assurances that we will be able to successfully explore our properties and develop our business. These circumstances raise substantial doubt about our ability to continue as a going concern as described in an explanatory paragraph to our independent auditors’ report on our audited financial statements, contained elsewhere in the Form 10K. If we are unable to continue as a going concern, investors will likely lose all of their investments in our company.

Our future is dependent upon our ability to obtain financing. If we do not obtain such financing, we may have to cease our exploration activities and investors could lose their entire investment.

There is no assurance that we will operate profitably or generate positive cash flow in the future. We will require additional financing in order to proceed beyond the first few months of our exploration program. We will also require additional financing for the fees we must pay to maintain our status in relation to the rights to our properties and to pay the fees and expenses necessary to become and operate as a public company. We will also need more funds if the costs of the exploration of our mineral claims are greater than we have anticipated. We will also require additional financing to sustain our business operations if we are not successful in earning revenues. Beyond our recently completed financings, we currently do not have any arrangements for further financing and we may not be able to obtain financing on commercially reasonable terms or terms that are acceptable to us when it is required. Our future is dependent upon our ability to obtain financing. If we do not obtain such financing, our business could fail and investors could lose their entire investment.

Because we may never earn revenues from our operations, our business may fail and then investors may lose all of their investment in our company.

We have no history of revenues from operations. We have never had significant operations and have no significant assets. We have yet to generate positive earnings and there can be no assurance that we will ever operate profitably. Our company has a limited operating history and is in the exploration stage. The success of our company is significantly dependent on the uncertain events of the discovery and exploitation of mineral reserves on our properties or selling the rights to exploit those mineral reserves. If our business plan is not successful and we are not able to operate profitably, then our stock may become worthless and investors may lose all of their investment in our company.

8

Prior to completion of the exploration and pre-feasibility and feasibility stages, we anticipate that we will incur increased operating expenses without realizing any revenues. We therefore expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from the exploration of our mineral claims in the future, we will not be able to earn profits or continue operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide no assurance that we will generate any revenues or ever achieve profitability. If we are unsuccessful in addressing these risks, our business will fail and investors may lose all of their investment in our company.

Risks Associated with our Common Stock

We do not intend to pay dividends on any investment in the shares of stock of our company.

We have never paid any cash dividends and currently do not intend to pay any dividends for the foreseeable future. To the extent that we require additional funding currently not provided for in our financing plan, our funding sources may prohibit the payment of a dividend. Because we do not intend to declare dividends, any gain on an investment in our company will need to come through an increase in the stock’s price. This may never happen and investors may lose all of their investment in our company.

Our stock is a penny stock. Trading of our stock may be restricted by the SEC’s penny stock regulations which may limit a stockholder’s ability to buy and sell our stock.

Our stock is a penny stock. The Securities and Exchange Commission (“SEC”) has adopted Rule 15g-9 which generally defines “penny stock” to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and “accredited investors”. The term “accredited investor” refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standard risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of our common stock.

The exercise of options, warrants, and conversion of our existing debentures and the future issuances of common stock will dilute current shareholders and may reduce the market price of our common stock.

As of December 31, 2008 we have a substantial amount of outstanding options and warrants, which, combined with other shares and the convertible debentures and warrants issued subsequent to year-end, if completely exercised, would dilute existing stockholders’ ownership by approximately 46%. While all of our outstanding warrants and options are exercisable at prices in excess of the current market price of our common stock, if our share price increases substantially and these securities are exercised, then shareholders may experience substantial dilution of book value per share of our common stock. The issuance of additional securities may also reduce the market price of our common stock. Based on the need for additional capital to fund further exploration of our properties, it is likely that we will issue additional securities to provide such capital, and that such additional issuances may involve a significant number of shares, some of which may be offered at a discount to the current market price.

The price of our common stock has a history of volatility, which may prevent shareholders from realizing a profit from their investment during particular time frames.

The market price for shares of our common stock may be highly volatile depending on news announcements or changes in general market conditions. In recent years, the stock market has experienced extreme price and volume fluctuations. From January 1, 2008 to December 31, 2008, our stock closed in a range from a high of $0.40 to a low of $0.011 per share. Such volatility may cause large swings in the value of a shareholders’ investment in us.

9

Substantially all of our current assets will be pledged to secure our indebtedness pursuant to the NewCo (AIEX Corporation) Loan Agreement that will be entered into during 2009.

The Company’s rights and interests in the Gavilanes property will be pledged to secure indebtedness under the NewCo Loan Agreement to be entered into by and among Telifonda (Cayman) Ltd, the Company, and AIEX Corporation, a wholly owned subsidiary of Aurelio Resource Corp.

Since these assets represent substantially all of our current assets, we likely will not have access to additional secured lending until this indebtedness is repaid, which may require us to raise additional funds through unsecured debt and equity offerings. Default under our debt obligations would entitle our lenders to foreclose on our assets. The inability to raise additional working capital or the foreclosure of our assets could have a material adverse effect on our financial condition and results of operations.

The terms of the NewCo (AIEX Corporation) non-recourse loan include a number of restrictive covenants which, if breached, could result in loss of our rights and interests in the Gavilanes gold project.

The NewCo Non-Recourse Loan Agreement contains a number of conditions and limitations on the ways in which we can operate our business, including limitations on our ability to raise capital, sell or acquire assets and pay dividends. The NewCo Loan Agreement also contains various covenants. These limitations and covenants may force us to pursue less than optimal business strategies or forego business arrangements which could have been financially advantageous to us or our shareholders. There can be no assurance that we will fulfill these covenants or, if we do not fulfill one or more of these covenants, that we will receive from our lender waivers of the necessity of fulfilling such covenants.

Our failure to comply with the covenants and restrictions contained in the NewCo Loan Agreement could lead to a default under the terms of these agreements. If a default occurs and we are unable to renegotiate the terms of the debt, the lenders could declare all amounts borrowed and all amounts due to them under the agreements due and payable. If we are unable to repay the debt, the lenders could foreclose on our assets that are subject to liens and sell our assets to satisfy the debt. As part of our loan agreements, the assets of our AIEX subsidiary in the United States are subject to a security interest and the assets of our subsidiaries in Mexico are subject to a floating lien. Foreclosure on these assets could have a material adverse effect on our results of operations and financial condition.

Glossary of Geologic and Mining Terms

“airborne geophysical surveys” – the search for mineral deposits by measuring the physical property of near-surface rocks through the use of an airplane or helicopter in order to detect unusual responses caused by the presence of mineralization. Electrical, magnetic, gravitational, seismic and radioactive properties are the ones most commonly measured;

“alteration” – decomposition of a rock by hydrothermal solutions or weathering;

“anomalous” – either a geophysical response or a rock, stream silt, or soil sample assay value that is greater than the average background value;

“argillization” – turning into clay;

“assay” – a measure of valuable mineral content;

“azurite” – a blue oxide copper mineral, Cu3(CO3)2(OH)2; 55% copper

“batholith” – a great irregular mass of coarse-grained igneous rock with an exposed surface of more than 100 square kilometers, which has either intruded the country rock or been derived from it through metamorphism;

“biotite” – a very common mineral of the mica group, occurring in black, dark-brown, or dark-green sheets and flakes; an important constituent of igneous and metamorphic rocks;

“breccia” – a coarse-grained rock, composed of rounded to angular rock fragments held together by a finer-grained matrix;

“chalcocite” – a sulfide mineral of copper (Cu2S) confined to the zone of secondary enrichment, 80% copper;

“chalcocite blanket” – a flat-lying, blanket-shaped deposit of secondary chalcocite moving downward and precipitating at the ancient water table;

“chalcopyrite” – a brassy-colored copper iron sulfide, CuFeS2, 33% copper;

“claim” – a portion of land held either by a prospector or mining company;

“concession” – something conceded by a government or a controlling authority, as a grant of land, a privilege, or a franchise;

“core drilling” – involves extracting a long cylinder of rock from the ground to determine amounts of metals at different depths. Pieces of the rock obtained, known as drill core, are analyzed for mineral content;

“Cretaceous” – noting or pertaining to a period of the Mesozoic Era, from 140 million to 65 million years ago, characterized by the greatest development and subsequent extinction of dinosaurs and the advent of flowering plants and modern insects;

10

“dacite” – a type of fine-grained extrusive rock;

“development drilling” – drilling to establish accurate estimates of mineral reserves;

“dike” – a long, narrow, cross-cutting mass of igneous rock intruded into a fissure in older rock;

“Dirección General de Minas” – Department of Mines, Mexico;

“drill indicated resources” – the size and quality of a potential ore body as suggested by widely spaced drill-holes; more work is required before resources can be classified as probable or proven reserves;

“Eocene” – the Eocene epoch is part of the Tertiary Period in the Cenozoic Era, and lasted from about 54.8 to 33.7 million years ago;

“extrusive” – noting or pertaining to a class of igneous rocks that has been forced out in a molten or plastic condition upon the surface of the earth;

“fault” – a break in the Earth’s crust caused by tectonic forces; a surface or zone of rock fracture along which there has been displacement; movement of rock on one side with respect to the other;

“felsic” – a term used to describe light-colored rocks, typically containing feldspar and silica;

“geophysics” – the study of physical properties of rocks and minerals;

“geochemistry” – the study of chemical properties of rocks;

“gossan” – a rust-colored deposit of mineral matter at the outcrop of a vein or orebody containing iron-bearing materials;

“granodiorite” – a coarse-grained igneous rock consisting primarily of quartz, plagioclase, and potassium feldspar, and also containing biotite, hornblende, or pyroxene. It is the coarse-grained equivalent of dacite;

“greenschist” – a metamorphic schist containing chlorite and epidote (which are green) and formed by low-temperature, low-pressure metamorphism;

“heap leaching” – recovery of metals in a surface pad; copper recovered by dilute sulfuric acid solution;

“hectares” – a metric unit of area equal to 100 acres (2.471 acres);

“hemimorphite” – a mineral chiefly associated with smithsonite, containing up to 54.2% zinc;

“hornblende” – a dark-green to black mineral of the amphibole group, calcium magnesium iron and hydroxyl aluminosilicate;

“hydrothermal” – any process involving high-temperature groundwaters, especially the alteration and emplacement of minerals and the formation of hot springs and geysers;

“hydrozincite” – is a white carbonate mineral consisting of Zn5(CO3)2(OH)6;

“igneous rock” – a rock formed by the cooling of molten rock either underground or at the surface of the earth;

“intrusive rock” – a hot, fluid igneous rock which penetrated other rocks, but cooled beneath the surface;

“kilometer” – a metric unit of length equal to 1,000 meters (0.62 mile);

“leachability” – to dissolve out soluble constituents from material by percolation;

“limestone” – a sedimentary rock composed of calcium carbonate (CaCO3);

“lode” – a mineral deposit in solid rock;

“mafic” – a dark-colored mineral rich in iron and magnesium, especially a pyroxene, amphibole, or olivine.

“magnetic survey” – involves searching for changes in the magnetic field over property areas. Magnetic anomalies may be a result of accumulations of certain magnetic minerals such as pyrrhotite, hematite and magnetite, which are often found alongside base metals such as copper, zinc and nickel, or precious metals such as gold and silver;

“malachite” – a green oxide copper mineral; Cu2CO3(OH)2; 58% copper;

“matrix” – the fine-grained portion of a rock in which coarser crystals or rock fragments are embedded;

“melaconite” – a mineral consisting of cupric oxide, CuO;

“Mesozoic” – noting or pertaining to an era occurring between 230 and 65 million years ago, characterized by the appearance of flowering plants and by the appearance and extinction of dinosaurs;

“meta-arkoses” – a later alteration of arkose (a usually pinkish or red sandstone consisting primarily of quartz and feldspar. Arkose usually forms as the result of the rapid disintegration of granite in areas of vigorous erosion. Its grains are usually angular and poorly sorted (mixed randomly in differing sizes));

“metamorphism” – the changes of mineralogy and texture imposed on a rock by pressure and temperature in the Earth’s interior;

“metasediment” – metamorphosed sedimentary rock;

11

“meter” – the fundamental unit of length in the metric system, equivalent to 39.37 U.S. inches;

“mica” – any of a group of chemically and physically related aluminum silicate minerals, common in igneous and metamorphic rocks, characteristically splitting into flexible sheets;

“mine waste” – overburden or non-ore waste rock from a mine pit or workings;

“Miocene” – noting or pertaining to an epoch of the Tertiary Period, occurring from 25 to 10 million years ago, when grazing mammals became widespread;

“open pit” or “open cut” – surface mining in which the ore is extracted from a pit or quarry;

“ore” – a mixture of minerals from which at least one metal can be extracted at a profit; a mineral which can be mined at a profit;

“orebody” – a continuous well-defined mass of material containing enough ore to make extraction economically feasible;

“oxide” – a compound in which oxygen is bonded to one or more electropositive atoms;

“Paleocene” – noting or pertaining to an epoch of the Tertiary Period, from 65 to 55 million years ago, and characterized by a proliferation of mammals;

“patent” – the ultimate stage of holding a mineral claim, after which no more assessment work is necessary because all the mineral rights have been earned;

“phyllites” – a green, gray, or red metamorphic rock, similar to slate but often having a wavy surface and a distinctive micaceous luster;

“porphyry” – an igneous rock of any composition that contains conspicuously large mineral crystals set in a finer-grained groundmass;

“potassium-argon or K-Ar dating” – a geochronological method used in many geoscience disciplines. It is based on measuring the products of the radioactive decay of potassium (K), which is a common element found in materials; the radioactive isotope40K decays to40Ar and40Ca with a half-life of 1.26x109 years;

“primary mineralization” – originally formed, prior to leaching and oxidation at the surface to form “secondary mineralization”

“pyrite” – an iron sulfide (FeS2);

“pyritization” – a rock impregnated with pyrite;

“quartzite” – (1) a very hard, clean, white metamorphic rock formed from a quartz arenite (consolidated sedimentary rocks of sand-sized fragments) sandstone; (2) a quartz arenite containing so much cement that it resembles (1);

“replacement” – the process where a mineral replaces another mineral volume for volume;

“reserve” – that part of a mineral resource that can be mined profitably;

“royalty” – a compensation or portion of the proceeds paid to the owner of a right, as a patent or oil or mineral right, for the use of it;

“schist”–a metamorphic rock characterized by strong foliation or schistosity;

“secondary enrichment” – enrichment of a vein or mineral deposit by minerals that have been taken into solution from one part of the vein or adjacent rocks and redeposited in another;

“sericitization” – a hydrothermal or metamorphic process involving the introduction of or replacement by sericite (a fine-grained variety of muscovite produced by the alteration of feldspar);

“shale” – a rock of fissile or laminated structure formed by the consolidation of clay or fine-grained sediments;

“silicification” – to become converted into, or impregnated with, silica;

“skarn” – a coarse-grained metamorphic rock formed by the contact metamorphism of carbonate rocks;

“smelter” – an industrial plant for smelting (to melt or fuse (ores) in order to separate the metallic constituents);

“smithsonite” – an oxidized zinc mineral; 52% zinc;

“sphalerite” – zinc sulfide (ZnS), 67% zinc;

“stake” – to mark the location or limits of, commonly with wooden stakes, to locate a mining claim;

“stockwork” – a metalliferous deposit characterized by the impregnation of the mass of rock with many small veins (veinlets), irregularly grouped;

“strike” – the direction or trend of a “mineralized” structural feature; the direction or trend taken by a structural surface, e.g. a bedding or fault plane, as it intersects the horizontal;

“sulphide” – refers to several types of chemical compounds containing sulfur in its lowest oxidation number of –2;

“supergene” – formed by descending waters, as a mineral or ore deposits;

“SX/EW recovery” – Solvent Extraction ElectroWinning; a relatively inexpensive method of copper recovery, cheaper than milling;

12

“tenorite” – a copper oxide mineral with the simple formula CuO, it occurs in the weathered or oxidized zone associated with deeper primary copper sulfide orebodies;

“turquoise” – a blue to green phosphate copper mineral, in the near-surface zone, prized as a gemstone;

“unpatented claim” – usual lode, placer or mill site claim located under the mining laws;

“vein” – a mineral filling of a fault or fracture in the host rock, typically in tabular or sheet-like form;

“volcanic” – resulting from a volcano (any opening through the crust that has allowed magma to reach the surface, including the deposits immediately surrounding this vent); and

“weathering” – near-surface alteration and oxidation of minerals and rocks by exposure to the atmosphere or ground water.

| ITEM 1B | UNRESOLVED STAFF COMMENTS |

Not applicable.

| ITEM 2 | DESCRIPTION OF OUR MINERAL PROPERTIES |

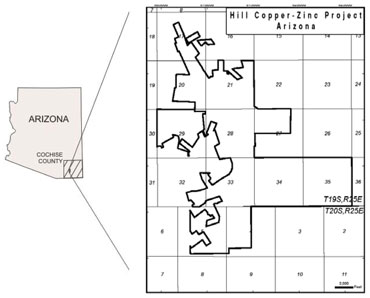

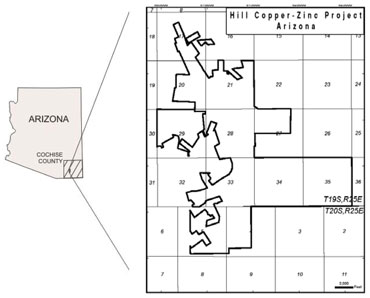

Hill Copper-Zinc Project, Arizona

Location, Access and Property Overview

The Hill Copper-Zinc Project is located on the eastern flank of the southern Dragoon Mountains, approximately 80 miles southeast of Tucson, Arizona. Access to the Hill Copper-Zinc Project from Tucson is via the Dragoon turnoff on I-10 freeway, 12 miles east of Benson, then east to Arizona Highway 191, then south through Sunsites Village and the nearby town of Pearce. The property is in the Turquoise Mountain Quadrangle, Courtland-Gleeson Mining District, Cochise County, Arizona. We are not aware of any particular environmental, political or regulatory problems that would adversely affect mineral exploration of the property.

The topography in the project area varies from flat to rolling hills with an average elevation of 4,600 feet above sea level. Vegetation in the area is sparse and is typical of a desert climate.

General Overview of our Arizona Mining Claims at the Hill Copper-Zinc Property

At December 31, 2008, we were the registered owner of a 100% interest in 36 MAN unpatented mining claims as well as the Gold Coin #55 unpatented mining claim, which are part of the 101 unpatented mining claims and 64 patented claims located on the Hill Copper-Zinc Project, as described in the table below. The unpatented claims are staked on federal lands administered by the U.S. Bureau of Land Management. In addition to the 13 claims acquired with the purchase of ARI, staked on two earlier occasions and all contiguous with one another, we also staked an additional 17 MAN unpatented mining claims during late 2006 which were recorded at the Bureau of Land Management (BLM) on January 24, 2007 and January 25, 2007. An additional four claims were staked and

13

recorded with the BLM on August 17, 2007. These claims are contiguous with the 13 initial MAN claims. Two additional small claims were staked and recorded in late 2008 to cover minor gaps. The mining claims are in good standing with all regulatory authorities, and the mining claims are properly registered at Cochise County in Bisbee, Arizona, and with the U.S. Bureau of Land Management in Phoenix, Arizona. The current annual maintenance fees on unpatented mining claims are $125 per claim due on or before August 31 of each year.

The claims staked or otherwise acquired, exploration permits and leases obtained, and other property acquisitions are listed chronologically:

| | | | | | | | | | | | | | |

Date | | Property Name | | Claims

Patented | | | Claims

Unpatented | | | Acres

Mineral | | | Acres

Surface | |

March 7, 2005 | | BLM filing date - MAN claims; quitclaim deed to Aurelio recorded January 19, 2007 | | | | | 6 | | | (see below | ) | | | |

November 8, 2005 | | BLM filing date - MAN claims; quitclaim deed to Aurelio recorded January 19, 2007 | | | | | 7 | | | (see below | ) | | | |

September 15, 2006 | | Hope Mining claims | | 30 | | | | | | 550 | | | 550 | |

January 24, 2007 | | BLM filing date - MAN claims | | | | | 9 | | | (see below | ) | | | |

January 25, 2007 | | BLM filing date - MAN claims | | | | | 8 | | | (see below | ) | | | |

April 15, 2007 | | Gold Coin – claims | | | | | 65 | (4) | | 1021 | | | | |

April 15, 2007 | | Gold Coin - 3 AZ state mineral exploration permits | | | | | | | | 251 | | | | |

August 6, 2007 | | Rae Family – claims | | 12.5 | (2) | | | | | 213 | | | 213 | |

| | Rae Family – 2 surface rights parcels | | | | | | | | | | | 744 | (4) |

| | Rae Family - surface & mineral rights (homestead patented) | | | | | | | | 292 | | | 292 | |

August 17, 2007 | | BLM filing date - MAN claims | | | | | 4 | | | (see below | ) | | | |

August 28, 2007 | | Bolsa received 3 AZ state mineral exploration permits, Sections 33, 34, 35, T19S, R25E | | | | | | | | 1320 | | | | |

September 24, 2007 | | Graham – 531 Courtland Town Site Lots (overlaps other surface rights) | | | | | | | | | | | | |

March 20, 2008 | | View Sites – purchase agreement – 20 patented claims | | 20 | | | | | | 360 | | | 360 | |

April 10, 2008, 2007 | | Newmont Mining – claims | | 1.5 | (2) | | | | | 24 | | | 24 | |

May 5, 2008 | | Location date for 2 MAN Claims 37 and 38 | | | | | 2 | | | 4 | | | | |

June 23, 2008 | | Hernandez - 2 Courtland Town Site Lots | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

TOTALS: | | Total patented claims | | 64 | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | Total unpatented claims | | | | | 101 | | | | | | | |

| | | | | | | | | | | | | | |

| | Total acres MAN Area unpatented 36 claims | | | | | | | | 388 | | | | |

| | | | | | | | | | | | | | |

| | Total acres mineral rights | | | | | | | | 4,417 | (1) | | | |

| | | | | | | | | | | | | | |

| | Total acres surface rights including all patented and surface rights | | | | | | | | | | | 2,183 | (1) |

| | | | | | | | | | | | | | |

| | Total acres mineral and surface | | | | | | | | | | | 5,161 | (3) |

| (1) | The total acreages are approximate due to the complexity of overlapping claims as well as incomplete surveys for Gold Coin, and MAN Claims. |

| (2) | The Rae Family and Newmont each hold 50% of one of the two claims. |

| (3) | Part of the surface rights overlap the MAN Claims (not controlled) |

| (4) | Bolsa acquired the Gold Coin #55 unpatented mining claims in April 2008 for $25,000 cash. |

Upon the completion of our acquisition of ARI in 2006, we had 100% rights to mineral exploration and development on 13 unpatented mining claims in Arizona (the MAN claims), and an option to earn a 100% interest in the mineral exploration and development of 3 mining claims/concessions covering approximately 1,000 hectares, in Durango, Mexico. Completing ARI’s purchase agreement of May 16, 2006, we also acquired 30 patented claims referred to as the Courtland claims in Cochise County, Arizona on September 18, 2006 from Hope Mining and Milling Company (“Hope MMC”) through our wholly-owned subsidiary, Bolsa. We also staked additional unpatented mining claims during late 2006 around the MAN and Courtland claims. We now refer to the Arizona property as the Hill Copper-Zinc Project.

During 2007, the Company added to its property interests and database for the Hill Copper-Zinc Project. These acquisitions included completion of an option agreement with Newmont Mining Corporation to purchase two of its patented mineral claims; an extensive exploration file of the Turquoise Mountain Mining District, Cochise County, Arizona, where the Hill Copper-Zinc Project is located including the logs and assay results of 274 holes, drilled by ten different companies between the 1950s to the mid-1990s; completion of a mineral lease and option agreement with three individual owners of the 65 Gold Coin mineral claims and three Arizona State exploration permits; and, acquired and took possession of 76,780 feet of drill core from 95 holes from prior drilling campaigns

14

around the Hill Copper-Zinc Project in the Turquoise Mining District. We also entered into a conditional agreement with the Rae family that gives us the right to purchase 13 patented mining claims (covering approximately 213 acres) located on the north of the MAN area. As part of the transaction, the Company has also acquired the right to acquire approximately 744 acres of surface rights covering the entire MAN deposit in an area to the west of the deposit, with an additional 292 acres of surface and mineral rights to the east of the deposit. These acquisitions were concluded through Bolsa. Bolsa entered into an option agreement to acquire surface rights, being town sites on part of the Courtland area from Kay B. Graham. The Company, through Bolsa, also staked an additional five unpatented BLM lode mining claims to the north and northeast of the MAN deposit, and also applied for three Arizona State mineral exploration permits covering an estimated 1,320 acres. An independent review of its in-house estimate of the mineralized material in the MAN area was completed in October 2007.

Also, during 2007, Aurelio drilled a total of 44 holes on the Arizona properties, totalling 21,489 feet, to obtain core and reverse circulation samples. The total amount spent in 2007 for drilling was approximately $1,023,000. Aurelio at the Hill Copper-Zinc Project now owns or has options to acquire a total of 45 patented claims, 119 unpatented claims. We have six Arizona State mineral exploration permits, and control approximately 5,041 acres of land in Arizona. We intend to explore our Arizona properties and hope to develop and exploit any mineral deposits we discover. Alternatively, we may in the future joint venture or sell an interest in or otherwise assign the rights to develop or exploit the properties.

During 2007, Aurelio also prepared seven drill pads and approximately three kilometers of road at the Gavilanes Gold Project in Mexico, at a cost of $50,045. We intend to explore our Mexican property as funds permit with a view to exploiting any mineral deposits we discover, or selling or otherwise assigning the rights to do so.

During 2008, the Company maintained its previous acquired property interests and added to its property interests and database for the Hill Copper-Zinc Project as follows:

| | • | | Gold assay results from 2007 drilling in the MAN Area indicated the presence of significant gold mineralization at the MAN Area. |

| | • | | Results from 2007 exploratory drilling between the MAN and South Courtland areas further extended the broad zone of zinc-silver mineralization running through the South Courtland area. |

| | • | | Aurelio received results from sequential leach test programs completed by two independent labs on mineralized material from the Company’s wholly-owned Hill Copper Leach Project. The results confirmed that secondary (chalcocite) copper mineralization at Hill is amenable to extraction of copper using industry-standard acid leach solution methods. |

During 2008 the Company, through Bolsa, acquired 20 patented mining claims (the “View Sites claims”) in the Turquoise Mining District of Cochise County, Arizona. The View Sites patented claims are located to the west and southwest of the MAN Area that is part of the Company’s wholly-owned Hill Copper-Zinc Project. These claims encompass 360 acres and incorporate projected extensions of copper-zinc-silver-gold sulfide mineralization as well as of the leachable oxide copper and chalcocite copper deposits overlying the MAN Area sulfide zone. Bolsa Resources will acquire the View Sites claims with staged payments totaling $950,000 over thirty months. Closing occurred on October 1, 2008 following completion of a detailed survey of the 20 patented mining claims. There is no production royalty payable on production from this transaction, nor were any fees or commissions paid in relation to the transaction.

Aurelio, through Bolsa, also closed on the mineral lease and option agreement with the Rae family (the “Rae Acquisition”) on April 17, 2008. The Rae Acquisition includes 12.5 patented mining claims on 213 acres, primarily located on the northern portion of the MAN Area, plus an additional 292 acres of surface and mineral rights located to the east of the MAN Area. As part of the transaction, the Company has also acquired approximately 744 acres of surface rights covering most of the MAN Area and includes 412 acres to the west. The acquisition incorporates projected extensions along strike of copper-zinc-silver-gold sulfide mineralization. There is no production royalty payable on production from this transaction, nor were any fees or commissions paid in relation to the transaction.

Aurelio, through Bolsa, also located two additional MAN Claims, Nos. 37 and 38. During the course of reviewing the MAN Claims, it was discovered that MAN Claim No. 30 was staked over a previously undetected patented mining claim, so the MAN Claim No. 30 Claim was deemed invalid and withdrawn.

Two Courtland Town Site Lots (Numbers 1 and 3, Block 23) were acquired from the Hernandez Trust in June 2008.

Mining and Exploration History of the Courtland-Gleeson (Turquoise) Mining District

Native Americans mined small amounts of turquoise, used as a medicine stone, from Turquoise Mountain on the extreme north end of the district, for an unknown number of years.

15

The first mining claims were staked on silver-lead deposits near Gleeson, on the south end of the district, in 1877. Exploration and development by the Calumet, Phelps Dodge and Great Western companies started a boom in the area in 1907, and copper production peaked in 1912. Mostly in the northern Courtland area, there was small-scale mining for shallow, oxidized high-value copper or lead-zinc replacement deposits in limestone, with by-product gold-silver. The larger underground mines closed by 1920, although small operators continued production until about 1932. There are at least 52 old mine workings in the Turquoise Mining District.

The district was explored prior to Aurelio’s consolidation of the land and commencement of the current exploration program with four large and seven small drilling programs since 1952, totalling 274 drill holes. In 1957, Minerals Exploration Company (MEXCO, a division of Union Oil Company) discovered the Star Hill replacement copper deposit in the MAN area with their first hole, based on an airborne magnetic geophysical anomaly. MEXCO then drilled 51 additional holes on an approximate 200-foot grid, but later abandoned the property.

Intense hydrothermal alteration, pyritization and fracturing in an area of approximately eleven square miles have long attracted the attention of several companies searching for a large porphyry copper deposit. In 1960 through 1967, Bear Creek Mining Company drilled 42 holes, totalling about 57,000 feet, in an area of approximately four square miles west of the old Courtland town site.

Beginning in 1986, Santa Fe Mining Company drilled 108 holes in three main areas: Maude Hill (1986) with 14 holes; an expansion of the MEXCO grid at Star Hill (1989 through 1990) with 52 holes, concentrating only on high-grade mineralization; and enlargement of the Courtland bulk-tonnage replacement copper deposit (1990) with 42 holes. Newmont Mining Company had previously drilled four bulk-tonnage discovery holes at Courtland in 1988.

Mineralization

The Hill Copper-Zinc Project contains two known types of mineralization: primary and secondary. Primary mineralization is at depth and secondary mineralization is closer to the surface.

(1) Primary mineralization (milling required, not amenable to heap leaching):

Massive pyrite plus chalcopyrite (copper) plus sphalerite (zinc) plus or minus magnetite/hematite (iron oxide), with some gold silver and lead, occurs in replacement deposits and skarn primarily within Abrigo limestone. This mineralization was the focus of historic underground mining operations. Lower grade, disseminated sulphide mineralization occurs in skarns and intrusive porphyries. Some primary mineralization is present in other sedimentary formations such as Bolsa Quartzite and Martin Limestone.

Hydrothermal alteration in the wall rock typically consists of intense stockwork and pervasive silicification, along with strong sericitization and argillization, to the extent that drill core is often unidentifiable.

(2) Secondary mineralization (amenable to heap leaching and SX/EW recovery):

Secondary mineralization occurs where near-surface primary mineralization has been oxidized and leached. Limestone areas contain copper oxide minerals (tenorite, malachite, azurite, chrysocolla, melaconite and neotocite) or zinc oxide minerals (such as hemimorphite, smithsonite and hydrozincite). This mineralization varies from iron-stained skarn and leached limestone to heavy gossanous material.

Underlying the oxide zone in some places, is an extensive ‘supergene enrichment blanket’, that contains chalcocite, a copper-rich secondary mineral. It occurs primarily in the MAN zone in the porphyritic intrusives.

All types of mineralization have been offset by numerous steep, closely spaced faults making lateral projection difficult in some cases.

The oxide mineralization is probably the most economically attractive in the Hill Copper-Zinc area because it is close to the surface, and might be mined with lower cost open-pit mining methods. The chalcocite blanket is very extensive and contains significant tonnages of potentially leachable copper mineralization. Together, these secondary types of mineralization make the Hill project an attractive exploration target.

In 2006 and 2007, Aurelio drilled 21,489 feet of core and reverse circulation drilling. This drilling has confirmed previous drilling results by Newmont, Santa Fe, Bear Creek, Great Gray and MEXCO. In 2007, follow-up drilling was begun to outline an oxide resource in the South Courtland zone.

Our 2006-2007 Drilling Program

Beginning in late 2005, ARI increased the potential for discovering bulk-tonnage mineral resources at Star Hill, now named the Hill Copper-Zinc Project, by re-evaluating the data from earlier drilling programs and by confirmatory drilling. Two principal zones were recognized, the Courtland Zone and the MAN Zone.

16

Phase 1 drilling started in the Fall of 2006. This work was confirmational in nature, attempting to verify the presence and grade of previously drilled mineralization by twinning Newmont and Santa Fe holes. Five holes were drilled on the Courtland zone, which was well-defined by previous drilling, and five more holes were drilled in the area between Courtland and MAN which had some scattered mineralized intervals.