- SHO Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Sunstone Hotel Investors (SHO) DEF 14ADefinitive proxy

Filed: 8 Apr 05, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Sunstone Hotel Investors, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Sunstone Hotel Investors, Inc.

903 Calle Amanecer, Suite 100

San Clemente, California 92673

Notice of 2005 Annual Meeting

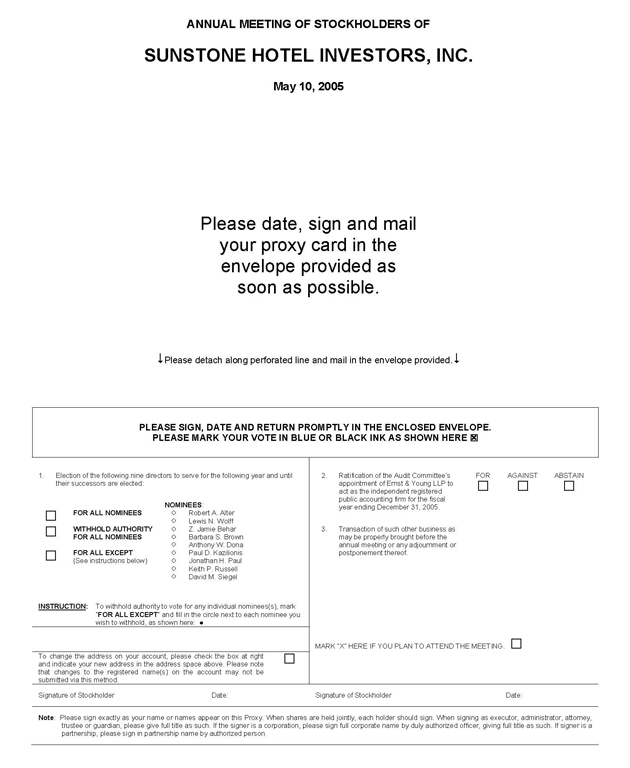

It is a pleasure to invite you to the 2005 annual meeting of stockholders of Sunstone Hotel Investors, Inc. (“Sunstone”), a Maryland corporation, to be held at the Embassy Suites Hotel, 600 North State Street, Chicago, Illinois on Tuesday, May 10, 2005 at 8:30 a.m. local time, for the following purposes:

*To elect nine directors to serve for the following year and until their successors are elected;

*To consider and vote upon ratification of the Audit Committee’s appointment of Ernst & Young LLP to act as the independent registered public accounting firm for fiscal year ending December 31, 2005; and

*To transact such other business as may properly come before the annual meeting, including any motion to adjourn to a later date to permit further solicitation of proxies, if necessary, or before any adjournment or postponement thereof.

Only stockholders of record of shares of Sunstone common stock at the close of business on April 1, 2005 are entitled to notice of and to vote at the 2005 annual meeting or any adjournment or postponement of the meeting.

Whether you own a few or many shares and whether you plan to attend in person, it is important that your shares be voted on matters that come before the meeting. You may be able to authorize a proxy to vote your shares by using a toll-free telephone number or the Internet. Instructions for using these convenient services are provided on the proxy card and in the attached proxy statement. If you prefer, you may still authorize a proxy to vote your shares by marking your votes on the proxy card, signing and dating it, and mailing it in the envelope provided. If you sign and return your proxy card without specifying your choices, it will be understood that you wish to have your shares voted in accordance with our board’s recommendations.

By Order of the Board of Directors

Jon D. Kline

Executive Vice President,

Chief Financial Officer and Secretary

April 8, 2005

Proxy Statement

| 1 | ||

| 1 | ||

| 5 | ||

| 5 | ||

| 5 | ||

| 8 | ||

| 8 | ||

| 8 | ||

| 9 | ||

| 9 | ||

| 9 | ||

| 9 | ||

| 10 | ||

Stockholder Communication with the Board and Non-Management Directors | 10 | |

| 11 | ||

| 11 | ||

| 11 | ||

| 11 | ||

| 12 | ||

| 13 | ||

| 13 | ||

| 14 | ||

| 16 | ||

| 16 | ||

| 17 | ||

| 17 | ||

| 19 | ||

| 20 | ||

| 21 | ||

| 21 | ||

Aggregated Option/SAR Exercises in Last Fiscal Year and Fiscal Year End Option Values | 21 | |

| 21 | ||

| 22 | ||

| 23 | ||

| 25 | ||

| 25 | ||

| 26 | ||

| 26 | ||

| 27 | ||

| 27 | ||

| 28 | ||

| 28 | ||

Share and Unit Ownership by Directors, Executive Officers and Five Percent Stockholders | 29 | |

| 30 | ||

| 31 | ||

| 31 | ||

| 31 | ||

| 32 |

Sunstone Hotel Investors, Inc.

903 Calle Amanecer, Suite 100

San Clemente, California 92673

Your vote is very important. For this reason, our Board of Directors is soliciting the enclosed proxy to allow your shares of common stock to be represented and voted, as you direct, by the proxy holders named in the enclosed proxy card at the 2005 annual meeting of stockholders of Sunstone Hotel Investors, Inc., a Maryland corporation, to be held on Tuesday, May 10, 2005, at 8:30 a.m. local time. “We,” “our”, “the Company” and “Sunstone” refer to Sunstone Hotel Investors, Inc. This proxy statement, the enclosed proxy card and our Annual Report on Form 10-K for the year ended December 31, 2004, are being mailed to stockholders beginning on or about April 8, 2005. Stockholders may obtain a copy of the exhibits to our Form 10-K for the year ended December 31, 2004 by writing to Sunstone Hotel Investors, Inc. at our principal executive office: 903 Calle Amanecer, Suite 100, San Clemente, California 92673-6212, Attention: Secretary. You may also view the exhibits to our Form 10-K in the Investor Relations section of our website at www.sunstonehotels.com.

Information About the Meeting and Voting

What am I voting on?

The Board of Directors is soliciting your vote:

*To elect nine directors to serve for the following year and until their successors are elected; and

*To ratify the Audit Committee’s appointment of Ernst & Young LLP to act as the independent registered public accounting firm for year ending December 31, 2005.

With respect to any other matter that properly comes before the meeting or any adjournment or postponement thereof, the representatives holding proxies will vote as recommended by the Board, or if no recommendation is given, in their own discretion.

Who is entitled to vote?

Stockholders of record as of the close of business on April 1, 2005 (record date) are entitled to vote on matters that properly come before the meeting. Shares of common stock can be voted only if the stockholder is present in person or is represented by proxy. At the close of business on the record date, there were 34,533,321 shares of common stock outstanding and entitled to vote.

How many votes do I have?

Each share of common stock has one vote.

1

How do I vote?

You can ensure that your shares are voted at the meeting by submitting your instructions by completing, signing, dating and returning the enclosed proxy form in the envelope provided.

If you own your shares through a bank or broker, you may be eligible to authorize a proxy to vote your shares electronically over the Internet or by telephone. A large number of banks and brokerage firms are participating in the ADP Investor Communication Services online program. This program provides eligible stockholders who receive a paper copy of the Annual Report and Proxy Statement the opportunity to authorize a proxy to vote via the Internet or by telephone. If your bank or brokerage firm is participating in ADP’s program, your voting form will provide instructions. The Internet and telephone proxy facilities will close at 11:59 p.m. E.S.T. on May 9, 2005. Stockholders who authorize a proxy to vote through the Internet or telephone should be aware that they may incur costs to access the Internet, such as usage charges from telephone companies or Internet service providers, and that these costs must be borne by the stockholder. Stockholders who authorize a proxy to vote by Internet or telephone need not return a proxy card by mail. If your voting form does not reference Internet or telephone information, please complete and return the paper Proxy in the self-addressed postage paid envelope provided.

If you attend the annual meeting in person, you may request a ballot when you arrive. If your shares are held in the name of your bank, broker or other nominee, prior to attending the meeting you need to request a legal proxy from your bank, broker or nominee as indicated on the back of the Voter Information form you received with your proxy material. The legal proxy must be presented to vote these shares in person at the annual meeting. If you have previously authorized a proxy, you may still vote in person at the annual meeting, which will serve as a revocation of your previous proxy.

Does Sunstone have a policy for confidential voting?

Sunstone has a confidential voting policy. All proxies and other materials, including telephone and Internet proxy authorization, are kept confidential and are not disclosed to third parties. Such voting documents are available for examination by the inspector of election and certain personnel associated with processing proxy cards and tabulating the vote. We plan to appoint one independent inspector of election, a representative of our transfer agent, American Stock Transfer and Trust, to review and confirm the tabulation of votes at the annual meeting.

What if I return my proxy but do not mark it to show how I am voting?

If your proxy card is signed and returned without specifying your choices, your shares will be voted as recommended by the Board of Directors.

What are the Board’s recommendations?

The Board recommends that you vote FOR each of the nominees for Director and FOR Proposal 2.

What vote is required to approve each proposal?

Election of Directors: There is no cumulative voting in the election of Directors. The nine Directors are elected by a plurality of votes cast at a meeting at which a quorum is present. Any shares not voted (whether by abstention, “broker non-vote” (i.e., shares held by a broker or nominee which are represented at the meeting, but with respect to which such broker or nominee is not instructed to vote on a particular proposal), or otherwise) have no impact on the vote.

Ratification of Appointment of Independent Registered Public Accounting Firm: This proposal requires the affirmative vote of a majority of the votes cast at a meeting at which a quorum is present. Any shares not voted (whether by abstention, broker non-vote, or otherwise) have no impact on the vote.

2

What if other items come up at the annual meeting and I am not there to vote?

We are not now aware of any matters to be presented at the annual meeting other than those described in this proxy statement. When you return a signed and dated proxy card or provide your voting instructions by telephone or the Internet, you give the proxy holders (the names of which are listed on your proxy card) the discretionary authority to vote on your behalf on any other matter that is properly brought before the annual meeting.

Can I change my vote?

You can change your vote by revoking your proxy at any time before it is exercised in one of four ways:

*Notify Sunstone’s Secretary (Jon D. Kline, c/o Sunstone Hotel Investors, Inc., 903 Calle Amanecer, Suite 100, San Clemente, California 92673-6212) in writing or by facsimile (at 949-369-3179) before the annual meeting that you are revoking your proxy;

*Submit another proxy with a later date;

*Submit your voting instructions again by telephone or the Internet; or

*Vote in person at the annual meeting.

What does it mean if I receive more than one proxy card?

Some of your shares are likely registered differently or are in more than one account. You should vote each of your accounts by telephone or the Internet or mail. If you mail proxy cards, please sign, date and return each proxy card to guarantee that all of your shares are voted.

If you hold your shares in registered form and wish to combine your stockholder accounts in the future, you should contact our transfer agent, American Stock Transfer and Trust, at 1-800-937-5449. Combining accounts reduces excess printing and mailing costs, resulting in savings for Sunstone that benefit you as a stockholder.

What if I receive only one set of proxy materials although there are multiple stockholders at my address?

If you and other residents at your mailing address own shares in street name, your broker or bank may have sent you a notice that your household will receive only one annual report and proxy statement for each company in which you hold shares through that broker or bank. This practice of sending only one copy of proxy materials is known as “householding.” If you did not respond that you did not want to participate in householding, you were deemed to have consented to the process. If the foregoing procedures apply to you, your broker has sent one copy of our annual report and proxy to your address. You may revoke your consent to householding at any time by contacting your broker or bank. The revocation of your consent to householding will be effective 30 days following its receipt. In any event, if you did not receive an individual copy of this proxy statement or our annual report, we will send a copy to you if you address your written request to Sunstone Hotel Investors, Inc., 903 Calle Amanecer, Suite 100, San Clemente, California 92673-6212, Attention: Secretary.

What constitutes a quorum?

The presence of the owners of at least a majority (greater than 50%) of the common shares entitled to vote at the annual meeting constitutes a quorum. Presence may be in person or by proxy. You will be considered part of the quorum if you return a signed and dated proxy card, if you authorize a proxy to vote by telephone or the Internet, or if you attend the annual meeting.

3

Abstentions and broker “non-votes” are counted as present and entitled to vote for purposes of determining a quorum. A broker “non-vote” occurs when a bank or broker holding shares for a beneficial stockholder does not vote on a particular proposal because the bank or broker does not have discretionary voting power with respect to the item and has not received voting instructions from the beneficial stockholder.

How do I access proxy materials on the Internet?

Stockholders can access our notice of annual meeting and proxy statement and annual report on the Internet on the Sunstone website at www.sunstonehotels.com (“Investor Relations” Section).

How do I submit a stockholder proposal for inclusion in the proxy statement for next year’s annual meeting?

Stockholder proposals may be submitted for inclusion in our 2006 annual meeting proxy statement after the 2005 annual meeting, but must be received no later than December 8, 2005. Proposals should be sent via registered, certified, or express mail to: Jon D. Kline, Executive Vice President, Chief Financial Officer and Secretary, 903 Calle Amanecer, Suite 100, San Clemente, California 92673-6212. See also “Stockholder Proposals for the 2006 Annual Meeting” later in this proxy statement.

What do I need to do to attend the annual meeting?

If you are a holder of record, you should indicate on your proxy card that you plan to attend the meeting by marking the box on the proxy card provided for that purpose.

For the safety and comfort of our stockholders, admission to the annual meeting will be restricted to:

*Stockholders of record as of the close of business on April 1, 2005 or their duly authorized proxies;

*Beneficial stockholders whose shares are held by a bank, broker or other nominee, and who present proof of beneficial ownership as of the close of business on April 1, 2005;

*Representatives of the press or other news media with proper credentials;

*Financial analysts with proper credentials; and

*Employees and representatives of Sunstone whose job responsibilities require their presence at the meeting.

Please note that space limitations may make it necessary to limit attendance. Admission to the meeting will be on a first-come, first-served basis. No more than two representatives of any corporate or institutional stockholder will be admitted to the meeting.

If you attend the meeting, you may be asked to present valid government-issued photo identification, such as a driver’s license or passport, before being admitted. Cameras, recording devices, and other electronic devices will not be permitted, and attendees may be subject to security inspections or other security precautions.

4

Election of Directors

The business and affairs of Sunstone are managed under the direction of our Board of Directors. Our Board has responsibility for establishing broad corporate policies and for the overall performance of Sunstone, rather than for day-to-day operating details. Our Board currently consists of 9 directors.

The proxy holders named on the proxy card intend to vote for the election of the nine nominees listed below. The Board has selected these nominees on the recommendation of the Nominating and Corporate Governance Committee. If you do not wish your shares to be voted for particular nominees, please identify the exceptions in the designated space provided on the proxy card or, if you are authorizing a proxy to vote by telephone or the Internet, follow the instructions provided when you access the telephone or internet proxy facilities. Directors will be elected by a plurality of the votes cast. Any shares not voted, whether by abstention, broker non-vote, or otherwise, will have no impact on the vote.

If at the time of the meeting one or more of the nominees have become unable to serve, shares represented by proxies will be voted for the remaining nominees and for any substitute nominee or nominees designated by the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee knows of no reason why any of the nominees will be unable to serve.

Directors elected at the annual meeting will hold office until the next annual meeting and until their successors have been elected and qualified. For each nominee there follows a brief listing of principal occupation for at least the past five years, other major affiliations, and age as of March 8, 2005.

Nominees for Election as Directors

Robert A. Alter | Age: 54 | Director |

Mr. Alter is our Chief Executive Officer. Until our formation, Mr. Alter served as Chief Executive Officer of one of our predecessor companies formed in 1985, which became a public company in August 1995. The public company, Sunstone Hotel Investors, Inc., commenced doing business in August 1995 upon its initial public offering. In November 1999, Mr. Alter and one of the Contributing Entities (as defined below) completed a management-led buyout to take the company private. He has been an owner of hotels since 1976 and is a past president of the Holiday Inn Franchise Association and a member of the Marriott Franchise board. Mr. Alter holds a B.S. degree in Hotel Administration from Cornell University.

Lewis N. Wolff | Age: 68 | Chairman |

Mr. Wolff currently serves as our Chairman. Mr. Wolff has been Chairman of Wolff Urban Management since 1980, which is a real estate acquisition, investment, development and management firm. Mr. Wolff is also a co-founder and, since 1994, has served as Chairman of Maritz, Wolff & Co., a privately held hotel investment group that has acquired, in cooperation with other persons, 18 luxury hotel properties. From 1999 to 2004, Mr. Wolff also served as Co-Chairman of Fairmont Hotels & Resorts, a hotel management company formed by Fairmont Hotel Management Company and Canadian Pacific Hotels & Resorts, Inc. Mr. Wolff also serves on the boards of Grill Concepts, Inc. and First Century Bank. Mr. Wolff holds a B.A. degree in Business Administration from the University of Wisconsin, Madison, and an M.B.A. degree from Washington University in St. Louis, Missouri.

5

Z. Jamie Behar | Age: 47 | Director |

Ms. Behar has been a Portfolio Manager with General Motors Investment Management Corporation (together with its predecessors, GMIMCo) since 1986. Ms. Behar manages GMIMCo clients’ real estate investment portfolios, a number of which have interests in funds managed by Westbrook Real Estate Partners, L.L.C. that own interests in the Contributing Entities; however, Ms. Behar does not have voting or investment control over such interests in the Contributing Entities. Ms. Behar serves on the boards of directors of Desarrolladora Homex, S.A. de C.V., a publicly-listed home development company located in Mexico, as well as Hospitality Europe BV, a private European hotel company, and FountainGlen Properties, LLC, a private senior housing company. Ms. Behar holds a B.S.E. degree from The Wharton School of the University of Pennsylvania and an M.B.A. degree from the Columbia University Graduate School of Business. Ms. Behar is a Chartered Financial Analyst.

Barbara S. Brown | Age: 47 | Director |

Ms. Brown has been a Senior Managing Director of Newlin Capital Partners, L.L.C., a real estate asset management company since February 2005. Newlin Capital Partners, L.L.C. has three separate fund-of-funds partnerships which invest in real estate, energy and timber. Prior to joining Newlin Capital Partners, L.L.C., Ms. Brown was a Senior Portfolio Manager of Allstate Investments, LLC from 1995 to 2005. From 1979 to 1995, Ms. Brown held various other positions at Allstate primarily relating to equity real estate investments. Ms. Brown holds a B.S. degree in Accountancy from the University of Illinois and an M.B.A. degree from DePaul University.

Anthony W. Dona | Age: 45 | Director |

Mr. Dona formed a real estate private equity business called Thackeray Partners in January 2005. Mr. Dona was the Chief Executive Officer of Crow Holdings, the holding company for the Trammell Crow family’s investments, until December 2004. He had been with Trammell Crow affiliated entities since 1985 and oversaw a diversified investment portfolio that includes real estate private equity funds, real estate assets, marketable securities and other investments and operating companies. Mr. Dona is a member of the boards of Crow Holdings and the American Red Cross Endowment Fund and other charitable and civic organizations. Mr. Dona holds a B.A. degree in Political Science and a B.B.A. degree in Business Administration from Southern Methodist University and an M.B.A. degree from Harvard University.

Paul D. Kazilionis | Age: 47 | Director |

Mr. Kazilionis has been a Managing Principal of Westbrook Real Estate Partners, L.L.C., a real estate investment management company, since 1994. Prior to co-founding Westbrook Real Estate Partners, L.L.C., Mr. Kazilionis spent 12 years at Morgan Stanley & Co. Incorporated, serving most recently as Managing Director and President of the General Partner of the Morgan Stanley Real Estate Fund, through which Morgan Stanley conducted its principal real estate investment activities. Mr. Kazilionis is a member of the Board of Overseers of Colby College and serves as a member of the Dartmouth College Real Estate Advisory Committee. Mr. Kazilionis holds an A.B. degree from Colby College and an M.B.A. degree from The Amos Tuck School of Business Administration at Dartmouth College.

Jonathan H. Paul | Age: 40 | Director |

Mr. Paul has been a Managing Principal of Westbrook Real Estate Partners, L.L.C. since 1994 and a Managing Principal of Rockpoint Group, L.L.C. since its formation in 2003. Prior to joining Westbrook, Mr. Paul spent six years at Morgan Stanley in the real estate and corporate finance areas, including three years with the Morgan Stanley Real Estate Fund. Mr. Paul holds an A.B. degree from Dartmouth College and an M.B.A. degree from The Amos Tuck School of Business Administration at Dartmouth College.

6

Keith P. Russell | Age: 59 | Director |

Mr. Russell is President of Russell Financial, Inc., a strategic and financial consulting firm serving businesses and high net worth individuals. Mr. Russell is retired as the Chairman of Mellon West and the Vice Chairman of Mellon Financial Corporation, in which capacities he served from May 1996 until March 2001. From September 1991 through April 1996, Mr. Russell served in various positions at Mellon, including Vice Chairman and Chief Risk Officer of Mellon Bank Corporation and Chairman of Mellon Bank Corporation’s Credit Policy Committee. From 1983 to 1991, Mr. Russell served as President and Chief Operating Officer, and a director, of Glenfed/Glendale Federal Bank. Mr. Russell also serves on the boards of Nationwide Health Properties, Inc. and Countrywide Financial Corporation. Mr. Russell holds a B.A. degree in Economics from the University of Washington and an M.A. degree in Economics from Northwestern University.

David M. Siegel | Age: 62 | Director |

Mr. Siegel has been the principal of DMS Financial Services, which provides financial consulting to the real estate industry, since 2000. Prior to forming DMS Financial, Mr. Siegel served as Senior Vice President and Chief Financial Officer of the Presley Companies from 1985 to 2000 and served on its board of directors. Before that time, Mr. Siegel was employed by the public accounting firm of Kenneth Leventhal & Company for 14 years, where he served as a Managing Partner of its Newport Beach, California office. Mr. Siegel holds a B.S. degree in Accounting and Business Administration from the University of California, Los Angeles.

The Board of Directors recommends a vote FOR each of the nominees.

7

Ratification of the Audit Committee’s Appointment of

Independent Registered Public Accounting Firm

The Audit Committee has selected and appointed the firm of Ernst & Young LLP to act as our independent registered public accounting firm for the year ending December 31, 2005. Ernst & Young LLP audited the financial statements for us and our predecessors for the years ended December 31, 2004, 2003 and 2002. Ratification of the appointment of Ernst & Young LLP requires a majority of the votes cast. Any shares not voted, whether by abstention, broker non-vote, or otherwise, have no impact on the vote.

The Board recommends that Sunstone stockholders vote FOR ratification of the appointment of Ernst & Young LLP.

Although stockholder ratification of the appointment of our independent auditor is not required by our bylaws or otherwise, we are submitting the selection of Ernst & Young LLP to our stockholders for ratification as a matter of good corporate governance practice. Even if the selection is ratified, the Audit Committee in its discretion may select a different independent registered public accounting firm at any time if it determines that such a change would be in the best interests of Sunstone and its stockholders. If our stockholders do not ratify the Audit Committee’s selection, the Audit Committee will take that fact into consideration, together with such other factors it deems relevant, in determining its next selection of our independent registered public accounting firm.

Representatives of Ernst & Young LLP are expected to be present at the annual meeting. These representatives will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Audit, Audit-Related, Tax and Other Fees

The following presents fees billed for audit services rendered by Ernst & Young LLP for the audit of our financial statements for the year ended December 31, 2004.

Audit Fees: $1,524,174 for 2004. These fees include $260,000 for the 2004 audit and $1,264,174 for services related to our initial public offering.

Audit-Related Fees: There were no audit-related fees for 2004.

Tax Fees: $185,012 for 2004. These fees relate to tax consulting and advisory services.

All Other Fees: There were no other fees for 2004.

Preapproval Policies and Procedures

Our Audit Committee has adopted a pre-approval policy requiring that the Audit Committee pre-approve all audit and permissible non-audit services to be performed by Ernst & Young LLP. Any proposed service that has received pre-approval but which will exceed pre-approved cost limits will require separate pre-approval by the Audit Committee. The Audit Committee has delegated to its Chairman the authority to grant the required approvals for approved services that do not exceed $75,000 for any one project, provided that the Chairman report the details of the exercise of any such delegated authority at the next meeting of the Audit Committee.

8

In light of the recent and ongoing developments, such as Sarbanes-Oxley Act of 2002 and related rule proposals by the New York Stock Exchange (“NYSE”) and the Securities and Exchange Commission (“SEC”), we provide the following discussion to bring you up to date with respect to our efforts to assure that Sunstone is governed by the highest standards. A copy of our Corporate Governance Guidelines is available in the Investor Relations section of our website at www.sunstonehotels.com. In addition, a printed copy of the Corporate Governance Guidelines will be provided without charge upon request to the Secretary, Sunstone Hotel Investors, Inc., 903 Calle Amanecer, Suite 100, San Clemente, CA 92673.

We established conflict of interest and other policies to serve the long-term interests of our stockholders and further align the interests of directors and management with our stockholders.

We adopted a policy that the approval of our Nominating and Corporate Governance Committee is required for any transaction involving us and:

| • | any of our directors, officers or employees, or any entity in which any of our directors, officers or employees is employed or has an interest of more than 5%; or |

| • | the Contributing Entities (Sunstone Hotel Investors, L.L.C., Sunstone/WB Hotel Investors IV, LLC, Sunstone/WB Manhattan Beach, LLC and WB Hotel Investors, LLC) or their affiliates. |

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics, which provides that directors, officers (including our Chief Executive Officer and all senior financial officers) and employees owe a duty to us to advance our business interests when the opportunity to do so arises. Among other things, our directors, officers and employees will be prohibited from taking (or directing to a third party) a business opportunity that is discovered through the use of corporate property, information or position, unless we have already been offered the opportunity and turned it down, in which case our Nominating and Corporate Governance Committee must in any event approve the director, officer or employee interest therein. More generally, our directors, officers and employees are prohibited from using corporate property, information or position for personal gain. The Code of Business Conduct and Ethics is posted in the Investor Relations section of our website at www.sunstonehotels.com. In addition, a copy of the Code of Business Conduct and Ethics will be provided without charge upon request to the Secretary, Sunstone Hotel Investors, Inc., 903 Calle Amanecer, Suite 100, San Clemente, CA 92673.

Independence of Directors and Committees

The Board has determined that a majority of the Board is independent as defined under the new NYSE rules. Directors who serve on the Compensation Committee and the Nominating and Corporate Governance Committee are also subject to these independence requirements. Directors who serve on the Audit Committee are subject to additional independence requirements.

To be considered independent under the new NYSE rules, the Board must determine that a director does not have a material relationship with Sunstone and/or its consolidated subsidiaries (either directly or as a partner, stockholder or officer of an organization that has a relationship with any of those entities).

9

The Board undertook a review of the independence of directors nominated for election at the upcoming annual meeting. During this review, the Board considered transactions and relationships during the prior year between each director or any member of his or her immediate family and Sunstone and its subsidiaries and affiliates, including those reported under “Certain Relationships And Related Transactions” below. The Board also examined transactions and relationships between Directors or their affiliates and members of the senior management or their affiliates. The purpose of this review was to determine whether any such relationships or transactions were inconsistent with a determination that the director is independent.

As a result of this review, the Board affirmatively determined that Messrs. Wolff, Dona, Russell and Siegel and Ms. Behar and Brown are independent of Sunstone and its management under the independence standards of the NYSE.

Director Attendance at Meetings

Each of our directors is expected to attend each annual meeting of stockholders. Although our Board recognizes that conflicts may occasionally prevent a director from attending a Board or stockholder meeting, the Board expects each director to make every possible effort to keep such absences to a minimum. The Board held 3 meetings in 2004. During that period, all directors attended at least 75% of the meetings of the Board and committees of the Board on which they served. We did not have an annual meeting of stockholders in 2004.

Stockholder Communication with the Board and Non-Management Directors

Stockholders may communicate any matters they wish to raise with the directors by writing to the Board of Directors, Sunstone Hotel Investors, Inc., 903 Calle Amanecer, Suite 100, San Clemente, California 92673-6212, Attn: Secretary. Stockholders should provide proof of share ownership with their correspondence. All communications from verified stockholders will be received and processed by the Secretary and then directed to the appropriate member(s) of the Board.

In addition, any interested party who wishes to communicate directly with our Non-Management Directors or the presiding Non-Management Director may contact our Chairman at the mailing address of the Company’s executive offices at 903 Calle Amanecer, Suite 100, San Clemente, California 92673-6212. All communications will be received and processed by the Secretary and then directed to the appropriate Non-Management Director(s).

10

Committees of the Board of Directors

Our Board of Directors has established a number of committees, including the Compensation Committee, the Audit Committee and the Nominating and Corporate Governance Committee, each of which is briefly described below. Each of our committees has a charter, current copies of which may be viewed in the Investor Relations section of our website at www.sunstonehotels.com. In addition, printed copies of our committee charters will be provided without charge upon request to the Secretary, Sunstone Hotel Investors, Inc., 903 Calle Amanecer, Suite 100, San Clemente, CA 92673.

The Compensation Committee determines compensation and benefits for all executive officers, oversees our equity compensation plans and assists in the establishment of policies applicable to employees generally.

The members of the Compensation Committee are independent directors as required by the listing standards and rules of the NYSE and are “nonemployee” directors within the meaning of Section 162(m) of the Internal Revenue Code and the applicable rules of the SEC. None of these directors, nor any of our executive officers, serves as a member of the governing body or compensation committee of any entity that has one or more executive officers serving as a member of our Board of Directors or Compensation Committee.

Our Compensation Committee is comprised of Anthony W. Dona and Lewis N. Wolff. Mr. Dona is the chair. The Compensation Committee held one meeting during 2004.

Our Board of Directors has adopted an Audit Committee charter, which defines the Audit Committee’s purposes to include overseeing:

| (1) | the integrity of our financial statements; |

| (2) | our compliance with legal and regulatory requirements; |

| (3) | the independent auditors’ qualifications and independence; |

| (4) | the performance of the independent auditors and our internal audit function; and |

| (5) | preparing an audit committee report as required by the SEC for inclusion in our annual proxy statement. |

All of the members of the Audit Committee are financially literate within the meaning of the listing standards and rules of the NYSE. At least one member is an audit committee financial expert as that term is defined by applicable rules of the SEC, and at least one member possesses accounting and financial management expertise within the meaning of the listing standards and rules of the NYSE. The Board has determined that each member of the Audit Committee is independent within the meaning of the rules of both the NYSE and the SEC.

11

Our Audit Committee is comprised of David M. Siegel, Anthony W. Dona and Keith P. Russell. Mr. Siegel is the chair. The Audit Committee held two meetings during 2004. A copy of the Audit Committee’s charter is attached to this Proxy Statement as Appendix A.

Nominating and Corporate Governance Committee

Although the Board of Directors is ultimately responsible for selecting its own nominees for election as directors and recommending them for election by the stockholders, the Board has delegated to the Nominating and Corporate Governance Committee the power, authority, duties and responsibilities to recommend to the Board nominees for election at the next annual meeting, or any special meeting of stockholders, and any person to be considered to fill a vacancy or a newly created directorship resulting from any increase in the authorized number of directors. The Nominating and Corporate Governance Committee is also responsible for nominating board committee members, reviewing our corporate governance guidelines, assisting with the annual evaluation of the Board and approving certain transactions involving a conflict of interest. The Board has determined that each of the members of the Nominating and Corporate Governance Committee is independent within the meaning of the listing standards of the NYSE.

In connection with its annual process for identifying directors to be recommended to the Board for nomination or renomination, the Nominating and Corporate Governance Committee seeks to determine whether the proposed candidate demonstrates an ability and willingness to:

*maintain the highest personal and professional ethics, integrity and values;

*represent the long-term interests of stockholders;

*exercise independence of thought, objective perspective and mature judgment;

*constructively challenge ideas and assumptions;

*understand the business operations and objectives of Sunstone and provide thoughtful and creative strategic guidance;

*contribute to the ongoing development and effective functioning of the Board;

*dedicate sufficient time, energy and attention to ensure the diligent and thoughtful performance of his or her duties; and

*demonstrate sincere commitment to the long-term success of Sunstone and the achievement of its objectives.

Additionally, in reviewing the qualifications of particular candidates, the Nominating and Corporate Governance Committee may choose to recommend individuals who can contribute an important, special or unique skill, expertise or perspective to the Board. The Nominating and Corporate Governance Committee also reviews the results of the evaluations provided by the directors with respect both to the Board and the individual directors and considers these results in light of the criteria for individual directors and objectives of the Board. Based on this process, the Nominating and Corporate Governance Committee is able to recommend, among other things, whether the existing Board contains the appropriate size, structure and composition, whether some or all of the incumbent directors should be recommended to the Board for re-nomination, and whether the Board should be enlarged to include additional directors.

If the Board determines to seek additional directors for nomination, the Nominating and Corporate Governance Committee will consider as potential director nominees, candidates recommended by various sources, including any member of the Board or senior management. The Nominating and

12

Corporate Governance Committee may also retain a third-party search firm to identify candidates. The Nominating and Corporate Governance Committee also considers recommendations for nominees timely submitted by stockholders under and in accordance with the provisions of Article II, Section 2.11 of our Bylaws for stockholder nominees. (See “Stockholder Proposals For The 2005 Annual Meeting.”). In addition to satisfying the timing, ownership and other requirements specified in Article II, Section 2.11 of the Bylaws, a stockholder’s notice must set forth as to each person whom the stockholder proposes to recommend that the committee nominate for election to the Board all information relating to such person that is required to be disclosed in solicitations of proxies for election of directors in an election contest, or is otherwise required, pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended (including such person’s written consent to being named in the proxy statement as a nominee and to serve as a director if elected). Properly communicated stockholder recommendations will be considered in the same manner as recommendations received from other sources.

Our Nominating and Corporate Governance Committee is comprised of Keith P. Russell, Z. Jamie Behar, and Lewis N. Wolff. Mr. Russell is the chair. The Nominating and Corporate Governance Committee held one meeting during 2004.

The table below summarizes membership information for each of the Board committees:

| Compensation | Audit | Nominating and Corporate Governance | ||||

Mr. Alter | ||||||

Mr. Wolff | X | X | ||||

Ms. Behar | X | |||||

Ms. Brown | ||||||

Mr. Dona | X* | X | ||||

Mr. Kazilionis | ||||||

Mr. Paul | ||||||

Mr. Russell | X | X* | ||||

Mr. Siegel | X* | |||||

| * | Chair |

Audit Committee Financial Expert

The Board has determined that Keith P. Russell and David M. Siegel are qualified as audit committee financial experts within the meaning of SEC regulations. In making this determination, the Board considered the following qualifications: (a) understanding of generally accepted accounting principles (“GAAP”); (b) ability to apply GAAP to accounting for estimates, accruals and reserves; (c) experience preparing, auditing, analyzing or evaluating financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the issues likely to be raised by our financial statements, or experience actively supervising persons engaged in these activities; (d) understanding of internal control over financial reporting; and (e) understanding of audit committee functions.

13

Meetings of Non-Management Directors

Ms. Behar and Brown and Messrs. Wolff, Dona, Kazilionis, Paul, Russell and Siegel are our non-management directors (the “Non-Management Directors”). Mr. Wolff has been selected to preside over executive sessions of the Non-Management Directors. The Non-Management Directors expect to meet regularly beginning in 2005.

14

Report of the Audit Committee of the Board of Directors

The purpose of the Audit Committee of Sunstone Hotel Investors, Inc. (“Sunstone”) is to assist the Board of Directors in its oversight of (i) the integrity of Sunstone’s financial statements, (ii) Sunstone’s compliance with legal and regulatory requirements, (iii) the independent auditors’ qualifications and independence, and (iv) the performance of the independent auditors; to retain Sunstone’s independent auditors and to prepare this report. As set forth in the Audit Committee charter, a copy of which is attached to the Proxy Statement for the 2005 Annual Meeting as Appendix A, management of Sunstone is responsible for the preparation, presentation and integrity of Sunstone’s financial statements, Sunstone’s accounting and financial reporting principles and internal controls and procedures are designed to assure compliance with accounting standards and applicable laws and regulations. The independent auditors are responsible for auditing Sunstone’s financial statements and expressing an opinion as to their conformity with generally accepted accounting principles.

In performance of its oversight function, the Audit Committee has considered and discussed the audited financial statements with management and the independent auditors. The Audit Committee has also discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 90, Communication with Audit Committees, as amended. In addition, the Audit Committee has discussed with the independent auditors the auditors’ independence from Sunstone and its management, including the matters in the written disclosures and letter required by Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees, a copy of which the Audit Committee has received.

The members of the Audit Committee are not full-time employees of Sunstone and are not performing the functions of auditors or accountants. As such, it is not the duty or responsibility of the Audit Committee or its members to conduct “field work” or other types of auditing or accounting reviews or procedures or to set auditor independence standards. Members of the Audit Committee necessarily rely on the information provided to them by management and the independent accountants. Accordingly, the Audit Committee’s considerations and discussions referred to above do not assure that the audit of the Company’s financial statements has been carried out in accordance with generally accepted accounting principles or that the Company’s auditors are in fact “independent.”

In reliance on the reviews and discussions referred to above, and subject to the limitations on the role and responsibilities of the Audit Committee referred to above and in the Audit Committee charter, the Audit Committee recommended to the Board the inclusion of the audited financial statements in Sunstone’s 2004 Annual Report on Form 10-K for filing with the Securities and Exchange Commission.

AUDIT COMMITTEE

David M. Siegel, Chair

Anthony W. Dona

Keith P. Russell

15

Each of our independent directors is entitled to receive an annual stock grant of shares having a value equal to $50,000 for serving on our Board of Directors, and an attendance fee paid in cash of $1,000 per meeting of our Board of Directors if the meeting is attended in person or $250 if the meeting is attended telephonically. Mr. Kazilionis and Mr. Paul have agreed to waive their director fees. Pursuant to an arrangement with Ms. Behar’s employer, all director fees for Ms. Behar (including the annual stock grant) are paid in cash to her employer.

In addition, each member of our audit committee is entitled to an attendance fee of $750 per meeting of the Audit Committee or $250 if the meeting is attended telephonically. Each member of our Compensation Committee and our Nominating and Corporate Governance Committee is entitled to an attendance fee of $500 if the meeting is attended in person or $250 if the meeting is attended telephonically.

The chair of our Audit Committee receives $5,000, the chair of our Compensation Committee receives $4,000 and the chair of our Nominating and Corporate Governance Committee receives $1,000, in each case, on an annual basis.

Directors are also entitled to reimbursement for expenses incurred in fulfilling their duties as our directors and receive complimentary hotel rooms at our hotels and resorts when on personal travel.

The following sets forth biographical information regarding our executive officers as of March 8, 2005 other than Mr. Alter whose biographical information is set forth above under “Proposal 1: Election of Directors”.

Jon D. Kline,38, is our Executive Vice President and Chief Financial Officer. From April 2003 to our formation, Mr. Kline served as the Executive Vice President and Chief Financial Officer of Sunstone Hotel Investors, L.L.C. Previously, Mr. Kline spent five years with Merrill Lynch & Co.’s Investment Banking Division, during which time he directed the firm’s Hospitality and Leisure practice. Before that time, he was a member of the Real Estate and Lodging Finance Group of Smith Barney’s Investment Banking Division as well as an attorney with Sullivan & Cromwell LLP. Mr. Kline holds a B.A. degree in Economics from Emory University and a J.D. degree from New York University School of Law.

Gary A. Stougaard, 50, is our Executive Vice President and Chief Investment Officer. From October 1997 to our formation, Mr. Stougaard was employed by Sunstone Hotel Investors, L.L.C. overseeing the company’s acquisition, development and hotel renovation and redevelopment activities. Since 1985 and prior to joining Sunstone, he served as a developer and asset manager of hotel properties and prior to that time he was a certified public accountant in private practice. Mr. Stougaard holds a B.A. degree in Accounting from Michigan State University.

16

The following table sets forth the compensation paid or accrued in the years ended December 31, 2003 and 2004, to our Chief Executive Officer and our two other most highly compensated executive officers (our “named executive officers”).

| Summary Compensation Table | |||||||||||||||

| Annual Compensation | Long-Term Compensation | ||||||||||||||

Name and Principal Position | Year(1) | Salary | Bonus | Restricted Stock Unit Awards(2) | All Other Compensation | ||||||||||

Robert A. Alter, Chairman and Chief Executive Officer | 2004 2003 | $ | 709,692 707,023 | $ | 365,000 — | $ | 3,578,947 — | $ | 364,987 285,757 | (3) (4) | |||||

Jon D. Kline Executive Vice President and Chief Financial Officer(5) | 2004 2003 | | 281,599 168,269 | | 294,000 175,960 | | 2,013,158 — | | 298,783 16,674 | (6) (7) | |||||

Gary Stougaard Executive Vice President and Chief Investment Officer | 2004 2003 | | 251,992 210,000 | | 263,500 105,000 | | 1,565,789 — | | 383,629 140,884 | (8) (9) | |||||

| (1) | All compensation paid prior to our initial public offering on October 26, 2004 was paid by our predecessor entities. Compensation amounts listed for 2004 represent the sum of compensation paid by us after October 26, 2004 and compensation paid by our predecessor entities before October 26, 2004. |

| (2) | Represent restricted stock units granted under the 2004 long-term incentive plan. Amounts shown reflect the market value of the awards on the date of grant. |

| (3) | Includes $285,672 of fees related to the sale of hotels, $70,002 of split dollar life insurance premiums, $2,025 of life insurance premiums and $7,288 of health insurance premiums paid by our predecessor entities. |

| (4) | Includes $247,035 of fees related to the sale of hotels, $32,146 of split dollar life insurance premiums and $6,576 of health insurance premiums paid by our predecessor entities. |

| (5) | Mr. Kline commenced employment on April 21, 2003. |

| (6) | Includes $85,702 of fees related to the sale of hotels, $100,000 in connection with our initial public offering and related transactions, $105,729 related to the forgiveness of a loan and $7,352 of health insurance premiums paid by our predecessor entities. |

| (7) | Includes $11,970 of fees related to the sale of hotels and $4,704 of health insurance premiums paid by our predecessor entities. |

| (8) | Includes $185,687 of fees related to the sale of hotels, $100,000 in connection with our initial public offering and related transactions, $46,860 related to economic interests in Sunstone Hotel Investors, L.L.C., $50,000 related to a special bonus and $1,082 of health insurance premiums paid by our predecessor entities. |

| (9) | Includes $100,000 of fees related to the acquisition of hotels in December 2002, $25,935 of fees related to the sale of hotels and $14,949 related to economic interests in Sunstone Hotel Investors, L.L.C paid by our predecessor entities. |

Each of Robert A. Alter, Jon D. Kline and Gary A. Stougaard have entered into an employment agreement with the Company. These agreements became effective on October 26, 2004.

Robert A. Alter.We have entered into an employment agreement with Mr. Alter that provides that Mr. Alter will serve as our Chief Executive Officer. The agreement has an initial term of three years and will be automatically extended for additional one-year periods, unless terminated by either party upon 90

17

days’ notice prior to the renewal date. A decision by us or Mr. Alter not to renew his employment agreement will not trigger any severance payments. The agreement provides for an annual base salary of $550,000 and an annual incentive bonus in a target amount of between 40% and 125% of his base salary. Mr. Alter received a bonus of $365,000 for 2004. Mr. Alter was granted 210,526 restricted stock units at the closing of our initial public offering, of which 25.0% vested immediately, 15.0% will vest on the second anniversary of the closing of our initial public offering, 20.0% will vest on each of the third, fourth and fifth anniversaries of the closing of our initial public offering so long as Mr. Alter remains employed by us. He is also entitled to receive all employee benefits and participate in all insurance programs generally available to similarly situated employees. In the event we terminate Mr. Alter without cause or he terminates his employment for good reason, Mr. Alter will receive all of the following amounts: (1) salary and accrued vacation through the date of termination; (2) bonus for any completed fiscal year elapsed prior to the date of termination; (3) a lump sum payment equal to one times Mr. Alter’s salary plus a bonus severance amount (which will be equal to the target annual bonus if the termination occurs in 2005 or the lesser of the target annual bonus for the year in which the termination occurs or the actual bonus earned in the prior calendar year, if the termination occurs during the remainder of the employment term); (4) 18 months of continued health insurance coverage for Mr. Alter and his dependents; and (5) all outstanding and then unvested equity awards due to vest in the succeeding 12 months will become fully vested and exercisable. If following a change in control, we terminate Mr. Alter’s employment without cause or Mr. Alter terminates his employment for good reason, then he will be entitled to the same amounts as specified above within 180 days after the effective date of the change in control, except that the severance amount will be calculated using a multiple of two rather than one.

Jon D. Kline.We entered into an employment agreement with Mr. Kline that provides that Mr. Kline will serve as our Executive Vice President and Chief Financial Officer. The agreement has an initial term of five years and will be automatically extended for additional one-year periods, unless terminated by either party upon 90 days’ notice prior to the renewal date. A decision by us or Mr. Kline not to renew his employment agreement will not trigger any severance payments. The agreement provides for an annual base salary of $375,000 and an annual incentive bonus in a target amount of between 40% and 125% of his base salary. Mr. Kline received a bonus of $294,000 for 2004. Mr. Kline was granted 118,421 restricted stock units at the closing of our initial public offering, of which 25.0% vested immediately, 15.0% will vest on the second anniversary of the closing of our initial public offering and 20.0% will vest on each of the third, fourth and fifth anniversaries of the closing of our initial public offering. He is also entitled to receive all employee benefits and participate in all insurance programs generally available to similarly situated employees. In the event we terminate Mr. Kline without cause or he terminates his employment for good reason, Mr. Kline will receive all of the following amounts: (1) salary and accrued vacation through the date of termination; (2) bonus for any completed fiscal year elapsed prior to the date of termination; (3) a lump sum payment equal to one times Mr. Kline’s salary plus a bonus severance amount (which will be equal to the target annual bonus if the termination occurs in 2005 or the lesser of the target annual bonus for the year in which the termination occurs or the actual bonus earned in the prior calendar year, if the termination occurs during the remainder of the employment term); (4) 18 months of continued health insurance coverage for Mr. Kline and his dependents; and (5) all outstanding and then unvested equity awards due to vest in the succeeding 12 months will become fully vested and exercisable. If following a change in control, we terminate Mr. Kline without cause or Mr. Kline terminates his employment for good reason, then he will be entitled to the same amounts as specified above within 180 days after the effective date of the change in control, except that the severance amount will be calculated using a multiple of two rather than one, and all outstanding and then unvested equity awards will become fully vested and exercisable. In addition, Mr. Kline received a cash bonus of $100,000 upon the closing of our initial public offering in October 2004.

Gary A. Stougaard.We entered into an employment agreement with Mr. Stougaard that provides that Mr. Stougaard will serve as our Executive Vice President and Chief Investment Officer. The agreement has an initial term of five years and will be automatically extended for additional one-year periods, unless terminated by either party upon 90 days’ notice prior to the renewal date. A decision by us or Mr. Stougaard not to renew his employment agreement will not trigger any severance payments. The agreement provides for an annual base salary of $350,000 and an annual incentive bonus in a target amount of between 40% and 125% of his base salary. Mr. Stougaard received a bonus of $263,500 for

18

2004. Mr. Stougaard was granted 92,105 restricted stock units at the closing of our initial public offering, of which 25.0% vested immediately, 15.0% will vest on the second anniversary of the closing of our initial public offering and 20.0% will vest on each of the third, fourth and fifth anniversaries of the closing of our initial public offering. He is also entitled to receive all employee benefits and participate in all insurance programs generally available to similarly situated employees. In the event we terminate Mr. Stougaard without cause or he terminates his employment for good reason, Mr. Stougaard will receive all of the following amounts: (1) salary and accrued vacation through the date of termination; (2) bonus for any completed fiscal year elapsed prior to the date of termination; (3) a lump sum payment equal to one times Mr. Stougaard’s salary plus a bonus severance amount (which will be equal to the target annual bonus if the termination occurs in 2005 or the lesser of the target annual bonus for the year in which the termination occurs or the actual bonus earned in the prior calendar year, if the termination occurs during the remainder of the employment term); (4) 18 months of continued health insurance coverage for Mr. Stougaard and his dependents; and (5) all outstanding and then unvested equity awards due to vest in the succeeding 12 months will become fully vested and exercisable. If following a change in control, we terminate Mr. Stougaard’s employment without cause or Mr. Stougaard terminates his employment for good reason, then he will be entitled to the same amounts as specified above within 180 days after the effective date of the change in control, except that the severance amount will be calculated using a multiple of two rather than one, and all outstanding and then unvested equity awards will become fully vested and exercisable. In addition, Mr. Stougaard received a cash bonus of $100,000 upon the closing of our initial public offering in October 2004.

Each of the above named executives has entered into a non-competition agreement with us that restricts him from directly or indirectly engaging in any business that is directly competitive with our business and/or having ownership interests in any business that is, directly or indirectly, competitive with our business during the term of his employment and for one year following his termination, with exceptions for existing investments and direct or indirect ownership of up to 3% of the outstanding equity interests of any public company. Each of the non-competition agreements also prevents the named executive from soliciting our employees for one year following the date of termination of his employment.

We adopted a long-term incentive plan that became effective in October 2004 upon completion of our initial public offering. The purpose of the plan is to attract and retain our directors, executive officers and employees. The 2004 long-term incentive plan is administered by our compensation committee or the Board of Directors, which has broad powers to interpret and implement the plan.

Types of Awards.The long-term incentive plan provides for grants of incentive stock options (within the meaning of Section 422 of the Code), nonqualified stock options, stock appreciation rights, dividend equivalent rights, restricted stock, restricted stock units and other stock-based awards such as performance shares.

Shares Subject to the 2004 Long-Term Incentive Plan; Other Limitations on Awards.The number of shares of common stock that may be issued under the plan may not exceed 2,100,000. A total of 539,474 restricted stock units were granted under the long-term incentive plan in October 2004 at the closing of our initial public offering. These shares may be authorized but unissued shares of our common stock or otherwise acquired for the purposes of the plan. If any award is forfeited or is otherwise terminated or canceled without the delivery of shares of our common stock, if shares of our common stock are surrendered or withheld from any award to satisfy a recipient’s income tax or other withholding obligations, or if shares of our common stock owned by a recipient are tendered to pay the exercise price of awards, then such shares will again become available under the long-term incentive plan. Additionally, on February 16, 2005, the following directors were each awarded 2,941 shares of restricted stock: Lewis N. Wolff, Barbara S. Brown, Anthony W. Dona, Keith P. Russell and David M. Siegel. These restricted stock awards are part of the directors’ annual restricted stock grant and will fully vest on the day of the Sunstone’s 2005 Annual Stockholders Meeting. The compensation committee will adjust the terms of any outstanding awards and the number of shares of our common stock issuable under the plan for any increase or decrease in the number of issued shares of our common stock resulting from a stock split, reverse stock split, stock dividend, spin-off, combination or reclassification of our common stock, or any other event that the compensation committee determines affects our capitalization.

19

Eligibility.Awards may be made to any director, officer or employee, including any prospective employee, and to any consultant or advisor selected by the compensation committee.

Stock Options and Stock Appreciation Rights.The compensation committee may grant incentive stock options and non-qualified stock options to purchase shares of our common stock from us (at the price set forth in the applicable award agreement), and stock appreciation rights in such amounts, and subject to such terms and conditions, as the compensation committee may determine. No grantee of an option or stock appreciation right will have any of the rights of a stockholder of us with respect to shares subject to their award until the issuance of the shares.

Restricted Stock.The compensation committee may grant restricted shares of common stock in amounts, and subject to terms and conditions, as the compensation committee may determine. The grantee will have the rights of a stockholder with respect to the restricted stock, subject to any restrictions and conditions as the compensation committee may include in the applicable award agreement.

Restricted Stock Units.The compensation committee may grant restricted stock units in amounts, and subject to terms and conditions, as the compensation committee may determine. Recipients of restricted stock units have only the rights of a general unsecured creditor of us and no rights as a stockholder of us until the common stock underlying the restricted stock units is delivered, which occurs within a period following vesting of the restricted stock units and is subject to tax withholding.

Other Equity-Based Awards.The compensation committee may grant other types of equity-based awards, including the grant of unrestricted shares, in amounts, and subject to terms and conditions, as the compensation committee may determine. These awards may involve the transfer of actual shares of our common stock, or the payment in cash or otherwise of amounts based on the value of shares of our common stock.

Change in Control. The compensation committee may provide in any award agreement for provisions relating to a change in control of us or any of our subsidiaries or affiliates, including, without limitation, the acceleration of the exercisability of, or the lapse of restrictions with respect to, the award.

Dividend Equivalent Rights.The compensation committee may in its discretion include in the award agreement a dividend equivalent right entitling the grantee to receive amounts equal to the dividends that would be paid, during the time such award is outstanding, on the shares of our common stock covered by such award as if such shares were then outstanding.

Nonassignability.Except to the extent otherwise provided in the applicable award agreement or approved by the compensation committee, no award or right granted to any person under the stock incentive plan will be assignable or transferable other than by will or by the laws of descent and distribution, and all awards and rights will be exercisable during the life of the grantee only by the grantee or the grantee’s legal representative.

Amendment and Termination.The Board of Directors may from time to time suspend, discontinue, revise or amend the 2004 long-term incentive plan.

Senior Management Incentive Plan

We adopted a senior management incentive plan that became effective in October 2004 upon the closing of our initial public offering. The plan is designed to attract, retain and motivate selected employees in order to promote our long term growth and profitability. Our compensation committee or the Board of Directors has sole discretion in implementing the plan. The amount of any bonus paid under the plan may, but need not, be based on objective performance goals and a targeted level or levels of

20

performance with respect to each goal as specified by the compensation committee or the Board of Directors. At the compensation committee’s discretion, bonuses shall be payable in cash and/or equity awards of equivalent value. Any equity-based awards shall be subject to such terms and conditions, including vesting requirements, as the compensation committee may determine. No rights under the plan may be assigned or transferred. The Board of Directors may from time to time modify, alter, amend, suspend, discontinue or terminate the senior management incentive plan. There is no limitation on the amount of bonus the Board of Directors or compensation committee can award to senior management. Any such bonus payments would increase our compensation expense and reduce our cash available for distribution.

Equity Compensation Plan Information

The following table summarizes information, as of December 31, 2004, with respect to compensation plans (including individual compensation arrangements) that are in effect under which shares of common stock are authorized for issuance:

Equity Compensation Plan Information

| Number of securities to be issued upon exercise of outstanding awards (a) | Weighted-average exercise price of outstanding awards (b) | Number of securities remaining available for future issuance under the Long-term Incentive Plan (excluding securities reflected in column a) (c) | ||||

Equity compensation plans approved by the Company’s stockholders: | ||||||

-2004 Long-term Incentive Plan | 539,474 | N/A | 1,560,526 |

Option/SAR Grants in Last Fiscal Year

There were no option or SAR grants in the last fiscal year.

Aggregated Option/SAR Exercises in Last Fiscal Year and Fiscal Year End Option Values

There were no option or SAR exercises in the last fiscal year.

Long-Term Incentive Plans-Awards in Last Fiscal Year

There were no long-term incentive plan awards in the last fiscal year. The restricted stock units granted under our 2004 Long-Term Incentive Plan do not qualify as long-term incentive plan awards for purposes of Item 402 of Regulation S-K.

21

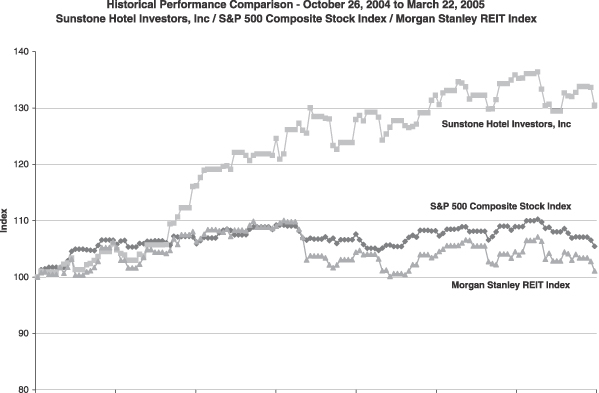

Historical Performance Comparison

The following graph compares our stockholder returns (assuming reinvestment of dividends) since October 26, 2004, with the S&P 500 Composite Stock Index and the Morgan Stanley REIT Index (“RMS”). The graph assumes an investment of $100 in each of Sunstone, the S&P 500 Index and the RMS on October 26, 2004. Equity REITs are defined as those companies that derive more than 75% of their income from equity investments in real estate assets. The RMS Index is a free float market capitalization weighted index that is comprised of equity REIT’s securities that belong to the Morgan Stanley Capital International, Inc. US Investable Market 2500 Index.

Compensation Committee Report to Stockholders

The Compensation Committee of the Board, composed of the undersigned independent directors, is responsible for establishing the terms of the compensation of Sunstone’s executive officers and the granting of awards under Sunstone’s Long-Term Incentive Plan.

The Compensation Committee seeks to attract, motivate and retain Sunstone’s executive officers, including the Chief Executive Officer, through competitive compensation arrangements that provide strong financial incentives for the executive officers to maximize shareholder value. The Compensation Committee reviews executive compensation annually to ensure that the arrangements remain competitive and reflect Sunstone’s performance. Sunstone’s executive officers have employment agreements that provide for a minimum base salary and other compensation arrangements. See “Employment Agreements” above for a summary of the terms of certain of these agreements. Future employment agreements with executive officers will be reviewed and approved by the Compensation Committee prior to their execution.

Compensation generally has three primary components: base salary, incentive bonus and long-term equity compensation.

Base Salaries

Base salaries for executive officers, including the Chief Executive Officer, are based on (i) the responsibilities of the position, (ii) the individual’s performance and perceived ability to influence Sunstone’s financial performance in the short and long-term and (iii) an evaluation of salaries for similar positions in companies of similar size, complexity and business as Sunstone.

Incentive Bonuses

Incentive bonuses are structured to further motivate executive officers, including the Chief Executive Officer, by establishing a relationship between the bonuses and the performance of Sunstone and the executive officer. Bonuses are typically determined based on (i) specific objective measures of Sunstone’s performance such as funds from operations and return on invested capital and (ii) subjective measures of performance such as positioning Sunstone for short and long-term growth through acquisitions and development.

Long-term Equity Compensation

The Compensation Committee believes that the interests of Sunstone’s shareholders and executive officers, including the Chief Executive Officer, will be aligned if executive officers are given the opportunity to own Sunstone’s stock through substantial restricted stock awards that are granted on a fixed share basis without adjusting the number of shares granted to offset changes in Sunstone’s stock price. The Compensation Committee bases these awards on the same criteria used to determine incentive bonuses. These awards are a significant part of executive officer compensation packages and will be granted annually.

Chief Executive Officer’s Compensation

Mr. Alter’s base salary for 2005 of $550,000 was established at the time of the initial public offering. The Compensation Committee believes that Mr. Alter’s base salary is consistent with the base salaries of other chief executive officers of companies of similar size and complexity.

23

Mr. Alter’s incentive bonus for 2004 was $365,000. He also received 210,526 restricted stock units in October 2004. The restricted stock unit award was made at the time of the initial public offering. Mr. Alter’s compensation in 2004 (excluding the restricted stock unit award) was $1,439,679. This compares to compensation in 2003 of $992,780. Mr. Alter’s 45.0% increase in compensation in 2004 reflects his and Sunstone’s performance in 2004, as well as his contribution to the initial public offering.

Policy Regarding Section 162(m)

Section 162(m) of the Internal Revenue Code of 1986, as amended, which was adopted in 1993, provides that, in general, publicly traded companies may not deduct, in any taxable year, compensation in excess of $1,000,000 paid to their chief executive officer and each of the next four most highly compensated executive officers as of the end of any fiscal year unless that compensation qualifies as “performance based,” as defined in Section 162(m). The Compensation Committee believes that it is in the best interests of Sunstone and its shareholders to comply with the limitations of Section 162(m) of the Code to the extent practicable and consistent with retaining, attracting and motivating Sunstone’s executive officers. Accordingly, to maintain flexibility in compensating executive officers in a manner designed to promote the goals of Sunstone and its shareholders, the Compensation Committee may from time to time approve awards which would vest upon the passage of time or other compensation which would not result in qualification of those awards as performance-based compensation. Consequently, the compensation paid to Sunstone’s Chief Executive Officer and its four other most highly compensated executive officers may not meet the requirements of Section 162(m) and may be subject to the $1,000,000 limitation when paid.

COMPENSATION COMMITTEE

Anthony W. Dona, Chair

Lewis N. Wolff

24

Certain Relationships and Related Transactions

Messrs. Alter, Kline and Stougaard directly or indirectly own interests in Sunstone Hotel Investors, L.L.C., WB Hotel Investors, LLC, Sunstone/WB Hotel Investors IV, LLC and Sunstone/WB Manhattan Beach, LLC (the “Contributing Entities”). As a result of holding these interests, these individuals will receive cash when the Contributing Entities sell shares of our common stock and distribute the proceeds to their investors.

Mr. Alter directly and indirectly owns 100% of Alter SHP LLC, which owns 0.66% of the outstanding Class B membership units, 57.9% of the outstanding Class C membership units and 50.1% of the outstanding Class D membership units of Sunstone Hotel Investors, L.L.C. Mr. Stougaard owns 3.1% of the outstanding Class C membership units, 3.0% of the outstanding Class D membership units and an economic interest equivalent to 0.04% of the outstanding Class B membership units in Sunstone Hotel Investors, L.L.C. Class B unit holders receive a first priority distribution equal to a specified return on initial capital contributions, then distributions equal to their initial contributions. It is not expected that the Class C and Class D membership units will receive any distributions. In addition, pursuant to Sunstone Hotel Investors, L.L.C.’s disposition fee incentive plan, Messrs. Alter, Kline and Stougaard received disposition fees in connection with the initial public offering of $285,672, $85,702 and $185,687, respectively, and are entitled to receive disposition fees upon a sale of the JW Marriott, Cherry Creek, Colorado and a sale of the properties described below under “—Other Properties.” Pursuant to the terms of his previous employment agreement, Mr. Kline has an economic interest in Sunstone Hotel Investors, L.L.C. which entitles him to receive 2.0% of any increase in value of Sunstone Hotel Investors, L.L.C. above a specified amount as of the disposition date for the entity.