Tilson Investment Trust

July __, 2013

Dear Shareholder:

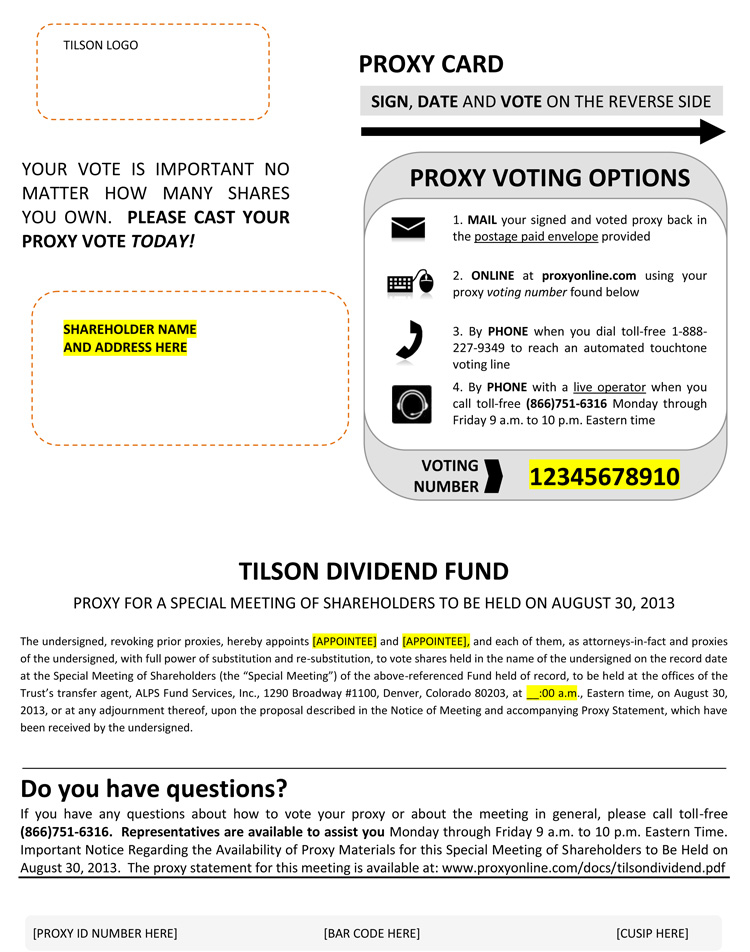

You are cordially invited to attend two Special Meetings of Shareholders of the Tilson Investment Trust (the “Trust”) on August 30, 2013, to be held at the offices of the Trust’s transfer agent, ALPS Fund Services, Inc., 1290 Broadway #1100, Denver, Colorado 80203 (each a “Meeting” and together the “Meetings”). The first Meeting will be held at 1:00 p.m., Mountain time, and the second Meeting second will be held at 1:30 p.m., Mountain time. Formal notice of the Meetings appears after this letter, followed by a joint proxy statement for both Meetings and two proxy cards. We hope that you can attend each of the Meetings in person; however, we urge you in any event to vote your shares by either completing and returning each of the two enclosed proxies in the envelopes provided, voting by telephone or voting through the Internet at your earliest convenience.

First Meeting is to Approve a New Investment Advisory Agreement. At the first meeting shareholders will be asked to vote on a proposal to approve a new investment advisory agreement between Centaur Capital Partners, L.P. (“Centaur”) and the Trust on behalf of the Tilson Dividend Fund (the “Fund”). Centaur currently serves as sub-advisor to the Fund. T2 Partners Management LP (“T2”), the investment advisor to the Fund, is contemplating changes in its ownership structure whereby one of the principals will acquire 100% ownership of T2 and intends to focus on the management of its privately offered funds. In anticipation of changes in its management focus, T2 has tentatively agreed to a transaction with Centaur, whereby: (i) T2 will assign its current investment advisory agreement with the Fund to Centaur, and (ii) Centaur will become the investment advisor to the Fund pursuant to a new investment advisory agreement between Centaur and the Trust, on behalf of the Fund (the “Transaction”). Under the Investment Company Act of 1940, the Transaction will, when effected, terminate the current investment advisory agreement between T2 and the Trust and will also require that the Trust obtain from shareholders of the Fund their approval of a new investment advisory agreement between the Trust and Centaur.

T2 and Centaur are excited about the Transaction for a number of reasons, including the fact that Centaur will continue to manage the Fund’s investment using the same investment objective and strategies. In addition, Malcolm “Zeke” Ashton, the Fund’s current portfolio manager, will remain the Fund’s portfolio manager for the Fund as he has done since the Fund’s inception. The Fund will not pay any additional management fees as a result of the Transaction.

The Trust’s Board of Trustees has approved the new investment advisory agreement and recommends that you vote “FOR” the new advisory agreement.

Second Meeting is to Approve Three Trustees. At the second meeting shareholders will be ask to vote on a proposal to elect three individuals to serve on the Trust’s Board of Trustees. Two nominees currently serve as Trustees and one nominee is a new candidate for election to the Trust’s Board of Trustees.

The Trust’s Board of Trustees recommends that you vote “FOR” the election of each of the nominees as Trustees of the Trust.

More information about each proposal is included in the enclosed Q&A and proxy statement.

Your vote is important regardless of the number of shares you own. In order to avoid follow-up solicitations and possible adjournments, please take a few minutes to read the proxy statement and cast your votes. It is important that you vote for the proposals at each of the two Meetings and that your votes be received no later than August 29, 2013.

Shareholders of record as of the close of business on June 28, 2013 will be entitled to vote. It is important that you vote even if your account was closed after June 28, 2013.

In addition to voting by mail, you may also vote by telephone or through the Internet as follows:

| | TO VOTE BY TELEPHONE: | | TO VOTE BY INTERNET: |

| 1) | Read the proxy statement and have the appropriate enclosed proxy card at hand | 1) | Read the proxy statement and have the appropriate enclosed proxy card at hand |

| 2) | Call the toll-free number that appears on the appropriate enclosed proxy card | 2) | Go to the website that appears on the appropriate enclosed proxy card |

| 3) | Enter the control number that appears on the appropriate enclosed proxy card and follow the simple instructions | 3) | Enter the control number that appears on the appropriate enclosed proxy card and follow the simple instructions |

The enclosed proxy cards are not duplicates. A separate proxy card is enclosed for each Meeting, and each relates to the matters being voting on at the Meeting. We encourage you to vote by telephone or through the Internet using the control number that appears on each enclosed proxy card. Use of telephone or Internet voting will reduce the time and costs associated with this proxy solicitation. Whichever method you choose, please read the enclosed proxy statement carefully before you vote.

We appreciate your participation and prompt response in this matter and thank you for your continued support. If you have any questions after considering the enclosed materials, please call toll free at 866-751-6316.

| | Sincerely, |

| | |

| | Whitney R. Tilson |

| | President, Tilson Investment Trust |

TILSON INVESTMENT TRUST

NOTICE OF FIRST SPECIAL MEETING OF SHAREHOLDERS

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD AT 1:00 P.M., MOUNTAIN TIME, ON AUGUST 30, 2013. THE PROXY STATEMENT TO SHAREHOLDERS IS

AVAILABLE AT WWW.PROXYONLINE.COM/DOCS/TILSONDIVIDEND.PDF

OR BY CALLING THE FUND AT 866-751-6316

To the Shareholders of the Tilson Dividend Fund:

NOTICE IS HEREBY GIVEN that a Special Meeting of Shareholders (the “Meeting”) of the Tilson Dividend Fund (the “Fund”), a series of the Tilson Investment Trust (the “Trust”), will be held at the offices of the Trust’s transfer agent, ALPS Fund Services, Inc., 1290 Broadway #1100, Denver, Colorado 80203, at 1:00 p.m., Mountain time, on August 30, 2013, as may be adjourned from time to time. The purpose of the Meeting is to consider and vote on the following proposal:

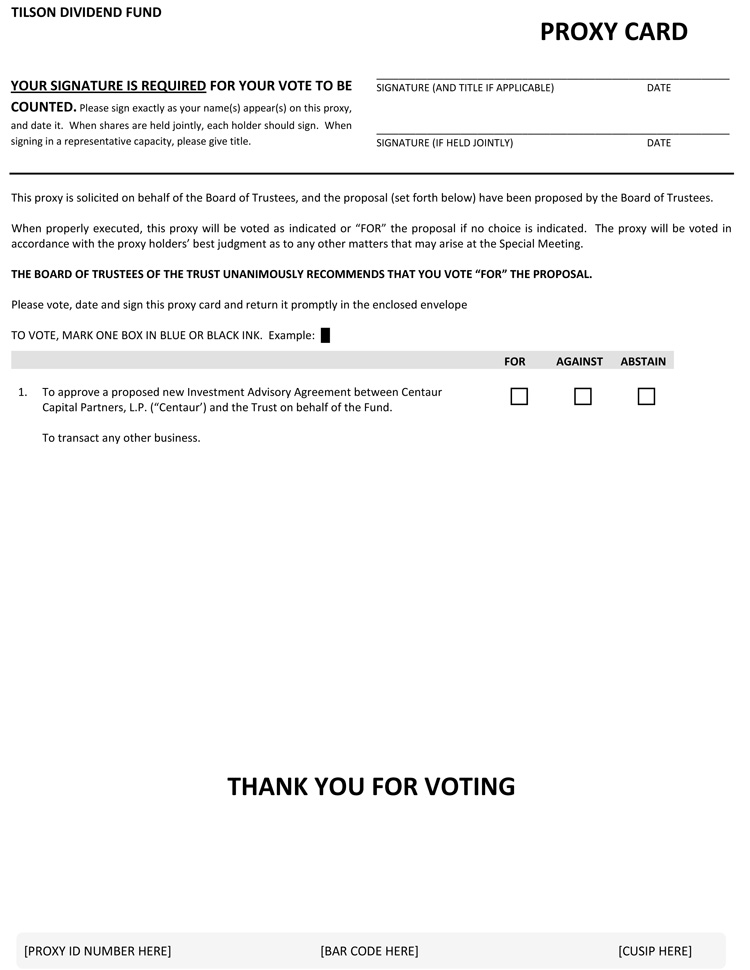

| | 1. | To approve a proposed new Investment Advisory Agreement with Centaur Capital Partners, L.P. |

Shareholders will also be asked to transact any other business as may properly come before the Meeting.

Shareholders of record as of the close of business on June 28, 2013 will be entitled to notice of and to vote at the Meeting or any adjournment thereof. A proxy statement and proxy card solicited by the Trust are included herewith.

The Board of Trustees of the trust unanimously recommends that you vote “FOR” the above proposal.

PLEASE VOTE BY TELEPHONE OR THROUGH THE INTERNET BY FOLLOWING THE INSTRUCTIONS ON YOUR PROXY CARD, THUS AVOIDING ADDITIONAL SOLICITATIONS AND UNNECESSARY EXPENSE AND DELAY. YOU MAY ALSO EXECUTE THE ENCLOSED PROXY AND RETURN IT PROMPTLY IN THE ENCLOSED ENVELOPE. NO POSTAGE IS REQUIRED IF MAILED IN THE UNITED STATES. THE PROXY IS REVOCABLE AND WILL NOT AFFECT YOUR RIGHT TO VOTE IN PERSON IF YOU ATTEND THE MEETING.

| | By order of the Board of Trustees, |

| | |

| | |

| | Rhonda A. Mills |

| | Secretary |

| | Tilson Investment Trust |

Dated: ________ __, 2013

TILSON INVESTMENT TRUST

NOTICE OF SECOND SPECIAL MEETING OF SHAREHOLDERS

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD AT 1:30 P.M., MOUNTAIN TIME, ON AUGUST 30, 2013. THE PROXY STATEMENT TO SHAREHOLDERS

IS AVAILABLE AT WWW.PROXYONLINE.COM/DOCS/TILSONDIVIDEND.PDF

OR BY CALLING THE FUND AT 866-751-6316

To the Shareholders of the Tilson Dividend Fund:

NOTICE IS HEREBY GIVEN that a Special Meeting of Shareholders (the “Meeting”) of the Tilson Dividend Fund (the “Fund”), a series of the Tilson Investment Trust (the “Trust”), will be held at the offices of the Trust’s transfer agent, ALPS Fund Services, Inc., 1290 Broadway #1100, Denver, Colorado 80203, at 1:30 p.m., Mountain time, on August 30, 2013, as may be adjourned from time to time. The purpose of the Meeting is to consider and vote on the following proposal:

| | 2. | To elect three individuals to serve on the Board of Trustees of the Trust. |

Shareholders will also be asked to transact any other business as may properly come before the Meeting.

Shareholders of record as of the close of business on June 28, 2013 will be entitled to notice of and to vote at the Meeting or any adjournment thereof. A proxy statement and proxy card solicited by the Trust are included herewith.

The Board of Trustees of the trust unanimously recommends that you vote “FOR” the above proposal.

PLEASE VOTE BY TELEPHONE OR THROUGH THE INTERNET BY FOLLOWING THE INSTRUCTIONS ON YOUR PROXY CARD, THUS AVOIDING ADDITIONAL SOLICITATIONS AND UNNECESSARY EXPENSE AND DELAY. YOU MAY ALSO EXECUTE THE ENCLOSED PROXY AND RETURN IT PROMPTLY IN THE ENCLOSED ENVELOPE. NO POSTAGE IS REQUIRED IF MAILED IN THE UNITED STATES. THE PROXY IS REVOCABLE AND WILL NOT AFFECT YOUR RIGHT TO VOTE IN PERSON IF YOU ATTEND THE MEETING.

| | By order of the Board of Trustees, |

| | |

| | |

| | Rhonda A. Mills |

| | Secretary |

| | Tilson Investment Trust |

Dated: ________ __, 2013

IMPORTANT INFORMATION TO HELP YOU UNDERSTAND THE PROPOSALS

You should carefully read the entire text of the enclosed joint proxy statement (“Proxy Statement”). We have provided you with a brief overview of the Proxy Statement using the questions and answers below. If you have any questions regarding the proposals please call your Investment Consultant or the Tilson Dividend Fund (the “Fund”) at 866-751-6316.

QUESTIONS AND ANSWERS

Q. Why am I receiving this package of materials?

A. The Fund, the sole series of the Tilson Investment Trust (the “Trust”), is conducting two special meetings of shareholders of the Trust (each a “Meeting”, and together the “Meetings”) scheduled to be held on August 30, 2013. The Board of Trustees of the Trust (the “Board of Trustees”) is soliciting your vote in connection with the Meetings. As a shareholder of record, you are invited to attend each Meeting, and are entitled to and requested to vote on the items of business described in the Proxy Statement. Your prompt response will help save the need for further solicitations for shareholder votes and possible adjournments.

Q: What am I being asked to vote on?

A: You are being asked to approve the following proposals (each a “Proposal” and together the “Proposals”):

At the First Meeting:

Proposal 1: To approve a proposed new Investment Advisory Agreement (the “New Advisory Agreement”) between Centaur Capital Partners, L.P. (“Centaur”) and the Trust on behalf of the Fund; and

At the Second Meeting:

Proposal 2: The election of three nominees to serve as members of the Board of Trustees.

Q. How does the Board of Trustees recommend that I vote with respect to each Proposal?

A. After careful consideration of the Proposals, the Board of Trustees, including all of the independent trustees, recommends that you vote FOR each of the Proposals.

Q: Why am I being asked to vote on the New Advisory Agreement?

A: T2 Partners Management LP (“T2”) currently serves as the investment advisor to the Fund and Centaur currently serves as the sub-advisor to the Fund. T2 is contemplating changes in its ownership whereby one of the principals will acquire 100% ownership of T2 and intends to focus its energy on the management of its privately offered funds. In anticipation of changes to its priorities, T2 has tentatively agreed to a transaction with Centaur, whereby: (i) T2 will assign its current investment advisory agreement with the Fund (the “Current Advisory Agreement”) to Centaur and (ii) Centaur will become the investment advisor to the Fund pursuant to a new investment advisory agreement (the “New Advisory Agreement”) between Centaur and the Trust, on behalf of the Fund (the “Transaction”). As part of the Transaction, it is anticipated that the current sub-advisory agreement between T2 and Centaur (the “Current Sub-Advisory Agreement”) will be terminated. On May 20, 2013, the Board of Trustees, after careful consideration, approved the Transaction.

The Board of Trustees, after careful consideration, has also approved the New Advisory Agreement to replace the Current Advisory Agreement if and when it terminates at the closing of the Transaction. However, under the Investment Company Act of 1940, as amended (the “1940 Act”), the New Advisory Agreement requires shareholder approval in order to become effective. Therefore, the Board is submitting the New Advisory Agreement to a vote of the shareholders of the Fund. As a shareholder in the Fund, you are entitled to vote on the approval of the New Advisory Agreement.

Q. Will the portfolio manager of the Fund Change?

A. No. It is anticipated that Malcolm “Zeke” Ashton, a principal at Centaur and the Fund’s current portfolio manager, will remain the portfolio manager to the Fund.

Q. Does the Board of Trustees recommend that shareholders vote to approve the New Advisory Agreement?

A. Yes, the Board of Trustees unanimously recommends that the shareholders of the Fund vote to approve the Fund’s New Advisory Agreement. The various factors the Board of Trustees considered in making this determination are described in the Proxy Statement.

Q: When would the New Advisory Agreement take effect?

A: If approved by shareholders of the Fund, the New Advisory Agreement would take effect if and when the Transaction is completed. Currently, it is expected that the closing of the Transaction will occur immediately after the approval of the New Advisory Agreement by the shareholders, subject to certain customary closing conditions.

Q: How will the Transaction affect shareholders of the Fund?

A: Centaur is the current sub-advisor to the Fund and will become the advisor to the Fund under the New Advisory Agreement. Centaur intends to manage the Fund in substantially the same manner as the Fund is currently being managed, except that Centaur will be the advisor to the Fund instead of sub-advisor as it currently is. There is no present intention to make any changes to the amount of fees charged to the Fund.

Q: How does the New Advisory Agreement differ from the Current Advisory Agreements?

A: The terms and conditions of the New Advisory Agreement are substantially identical to those of the Current Advisory Agreement, and differ only with respect to the parties thereto, the effective date and the termination date.

Q: Will the approval of the Fund’s New Advisory Agreement change the total fees payable under the Fund’s Current Advisory Agreement?

A: No. The total fees, including waivers and expense reimbursements, payable to the Fund’s investment advisor under the New Advisory Agreement will be the same as the fees paid under the Current Advisory Agreement. The Fund does not currently pay Centaur directly for its services as sub-advisor.

Q: Why am I being asked to elect Trustees?

A: Federal security laws generally require that a majority of the members of the Board of Trustees (the “Trustees”) be elected by shareholders. The current Trustees on the Board of Trustees are Jack E. Brinson, James H. Speed, Jr. and Whitney R. Tilson. Mr. Tilson has notified the Board of Trustees of his desire to step down from the Board of Trustees so he can focus on the management of T2. The Board of Trustees is proposing the following nominees for trustee positions: Mr. Brinson, Mr. Speed and Thomas G. Douglass. Although Mr. Brinson and Mr. Speed are current Trustees only Mr. Brinson has been previously elected by the shareholders. Electing the nominees for trustee positions at this Special Meeting will ensure that each of the Trustees has been elected by the shareholders.

Q. Does the Board of Trustees recommend that shareholders vote to elect the Trustees?

A. The Board of Trustees, after careful consideration, is asking the shareholders to vote on election of all three nominees in accordance with provisions of the Trust’s governing documents and applicable law. Information regarding the qualifications of each nominee is set forth in the discussion of Proposal 2 in the Proxy Statement.

Q: Who is eligible to vote?

A: Shareholders of record at the close of business on June 28, 2013 are entitled to be present and to vote at each Meeting. Each share of record of the Fund is entitled to one vote (and a proportionate fractional vote for each fractional share) on each matter presented at each Meeting.

Q: When and where will the shareholder meetings be held?

A: The first Meeting will be held at 1:00 p.m., Mountain Time, unless it is adjourned, and the second Meeting will be held at 1:30 p.m., Mountain Time, unless it is adjourned, at the offices of the Trust’s transfer agent, ALPS Fund Services, Inc., 1290 Broadway #1100, Denver, Colorado 80203 on August 30, 2013. Proposal 1 will be considered at the first Meeting, and Proposal 2 will be considered at the second Meeting.

Q: How do I ensure that my vote is accurately recorded?

A: You may attend each of the Meetings and vote in person or you may vote by telephone or Internet or complete and return the enclosed proxy cards. Proxy cards that are properly signed, dated and received prior to the Meetings will be voted as specified. If you specify a vote on any Proposal, your proxy will be voted as you indicate, and any Proposals for which no vote is specified will be voted FOR that Proposal. If you simply sign, date and return the proxy cards, but do not specify a vote on any of the Proposals, your shares will be voted FOR all Proposals.

Q: May I revoke my proxy?

A: You may revoke your proxy at any time prior to use by filing with the Secretary of the Trust an instrument revoking the proxy prior to the Meetings, by submitting a proxy bearing a later date, or by attending and voting at each of the Meetings.

Q: What will happen if there are not enough votes to have a Meeting?

A: It is important that shareholders vote by telephone or Internet or complete and return signed proxy cards promptly, but no later than August 29, 2013 to ensure there is a quorum for each of the Meetings. If we do not receive your proxy card(s) in a few weeks, you may be contacted by officers of the Trust or the Advisor or our proxy solicitor, AST Fund Solutions, who will remind you to vote your shares. If we have not received sufficient votes to have a quorum at a Meeting or have not received enough votes to approve the New Advisory Agreement, we may adjourn the Meetings to a later date so we can continue to seek more votes.

Q: What happens if Proposal 1 is not approved?

A: The closing of the Transaction is contingent upon a number of customary conditions, including approval by shareholders of the Fund of the New Advisory Agreement. If the closing conditions are not satisfied or waived, the Transaction will not close. If the Transaction does not close, then Proposal 1 will not take effect.

Q: Who will pay for the proxy solicitation?

A: T2 has agreed to pay for the proxy solicitation, legal and other costs associated with the solicitation of the Proposals. Neither the Fund nor its shareholders will bear any of these costs.

Q: Why have I have received two proxy cards?

A: The two enclosed proxy cards are NOT duplicates. A separate proxy card is enclosed for each Meeting, and each relates to a separate Proposal. You are being asked to vote separately for each Meeting and we have included a separate proxy card for each Meeting. The Board of Trustees is asking that you vote both proxy cards.

Q: Whom can I call for additional information about the Proxy Statement?

A: If you have any questions regarding the Proxy Statement or completing and returning your proxy cards, you can call us toll free in the U.S. at 866-751-6316.

TILSON INVESTMENT TRUST

SPECIAL MEETINGS OF SHAREHOLDERS

To Be Held on August 30, 2013

JOINT PROXY STATEMENT

This joint proxy statement (“Proxy Statement”) is furnished in connection with the solicitation by the Board of Trustees (the “Board” or “Board of Trustees”) of Tilson Investment Trust (the “Trust”) of proxies for use at the Special Meetings of Shareholders (each a “Meeting and together the “Meetings”) of the Tilson Dividend Fund (the “Fund”), the sole series of the Trust, or at any adjournment thereof, to be held at the offices of the Trust’s transfer agent, ALPS Fund Services, Inc., 1290 Broadway #1100, Denver, Colorado 80203. The first Meeting will be held at 1:00 p.m., Mountain Time, and the second Meeting will be held at 1:30 p.m., Mountain Time, each as may be adjourned from time to time. The principal address of the Trust is 152 West 57th Street, 46th Floor, New York, New York 10019. This proxy statement and form of proxy were first mailed to shareholders on or about July ___, 2013.

The first Meeting is being held for the purpose of considering and voting on the following proposal (“Proposal 1”):

| | 1. | To approve a proposed new Investment Advisory Agreement between Centaur Capital Partners, L.P. (“Centaur’) and the Trust on behalf of the Fund. |

The second Meeting is being held for the purpose of considering and voting on the following proposal (“Proposal 2”):

| | 2. | To elect three individuals to serve on the Board of Trustees of the Trust. |

Enclosed with this proxy statement is a separate proxy card for each Meeting. Please be certain to sign, date and return each proxy card. A proxy, if properly executed, duly returned and not revoked, will be voted in accordance with the specifications therein. A proxy that is properly executed but has no voting instructions with respect to a Proposal will be voted for that Proposal. A shareholder may revoke a proxy at any time prior to use by filing with the Secretary of the Trust an instrument revoking the proxy, by submitting a proxy bearing a later date, or by attending and voting at the Meeting.

The Trust has retained AST Fund Solutions, LLC (“AST”) to solicit proxies for the Meetings, which solicitation may be by mail, telephone, facsimile or otherwise. AST is responsible for printing proxy cards, mailing proxy material to shareholders, soliciting brokers, custodians, nominees and fiduciaries, tabulating the returned proxies and performing other proxy solicitation services. The anticipated cost of these services is approximately $11,000.00, and will be paid by T2 Partners Management, LP (“T2”).

In addition to solicitation by AST, proxies may be solicited by officers, employees and agents of the Trust without cost to the Trust, and such solicitation may be through the mail, by telephone, facsimile or otherwise. It is anticipated that banks, broker-dealers and other financial institutions will be requested to forward proxy materials to beneficial owners and to obtain approval for the execution of proxies. T2 has agreed to reimburse brokers, custodians, nominees and fiduciaries for the reasonable expenses incurred by them in connection with forwarding solicitation material to the beneficial owners of shares held of record by such persons.

FIRST MEETING

| PROPOSAL 1: | TO APPROVE A PROPOSED NEW ADVISORY AGREEMENT BETWEEN Centaur Capital Partners, L.P. AND THE TRUST ON BEHALF OF THE FUND |

Background. T2 is currently the investment advisor to the Fund. T2 is currently owned 50% by Whitney R. Tilson, a Trustee and President of the Trust, and 50% by Glenn H. Tongue, the Vice-President, Treasurer (Principal Financial Officer), and Chief Compliance Officer of the Trust. Centaur is currently the Fund’s sub-advisor. Centaur is controlled by Malcolm Ezekial “Zeke” Ashton, who is also the portfolio manager of the Fund.

T2 is contemplating changes to its ownership whereby Mr. Tilson will acquire 100% ownership of T2. In addition, T2 is contemplating changing it focus and energy to the management of its privately offered funds. In anticipation of T2 changing its focus and energy, T2 and Centaur have entered into an agreement under which T2 will assign its current investment advisory agreement with the Fund (the “Current Advisory Agreement’) to Centaur and Centaur will become the investment advisor to the Fund.

Terms of the Transaction. Under the terms of the proposed transaction between T2 and Centaur: (i) T2 will assign the Current Advisory Agreement to Centaur; and (ii) Centaur will become the investment advisor to the Fund pursuant to a new investment advisory agreement (the “New Advisory Agreement”) between Centaur and the Trust, on behalf of the Fund (the “Transaction”). It is also anticipated as part of the Transaction that the current sub-advisory agreement between T2 and Centaur (the “Current Sub-Advisory Agreement”) will be terminated;

As consideration for the assignment of the Current Advisory Agreement, Centaur will pay to T2 the following:

| | · | Cash consideration in an amount equal to (i) the aggregate assets under management of the Fund on the date of the closing of the Transaction divided by (ii) 120 (the “Cash Consideration”); provided that fifty percent (50%) of the Cash Consideration will be deferred (the “Deferred Portion”), and all or a part of the Deferred Portion will only become due upon a future assignment of the New Advisory Agreement by Centaur. It is currently expected that the total amount of the Cash Consideration will be approximately $500,000; and |

| | · | a 1% non-voting interest in Centaur will be issued to each of the two current principals of T2. |

On May 20, 2013, the Board of Trustees, after careful consideration, approved the Transaction. The Board of Trustees has also approved, upon the approval of Proposal 1, the Trust, at a later date, changing its name to the “Centaur Mutual Funds Trust” and the Fund changing its name to the “Centaur Total Return Fund”.

The consummation of the Transaction is subject to the satisfaction or waiver of various customary conditions, including, but not limited to, obtaining shareholder approval of the New Advisory Agreement for the Fund.

Current Advisory Agreement and Sub-Advisory Agreement. T2 currently provides investment advisory services to the Fund pursuant to the Current Advisory Agreement, dated February 17, 2005, as amended on June 21, 2012. Centaur currently provides sub-advisory services to the Fund pursuant to the Current Sub-Advisory Agreement, dated December 17, 2004, as amended on June 21, 2012. The Current Advisory Agreement and the Current Sub-Advisory Agreement were last submitted to and approved by shareholders of the Fund in February 2005, in connection with the Fund’s initial engagement of T2 and Centaur. The continuance of the Current Advisory Agreement and Current Sub-Advisory Agreement were last approved by the Board of Trustees, including a majority of the members of the Board of Trustees (individually, a “Trustee” and collectively, the “Trustees”) who are not interested persons, as defined under the Investment Company Act of 1940, as amended (the “1940 Act”), of the Trust (the “Independent Trustees”) on February 12, 2013 and December 4, 2012, respectively.

Under the Current Advisory Agreement, as full compensation for the investment advisory services provided to the Fund, T2 receives monthly compensation based on the Fund’s average daily net assets at the annual rate of 1.50%.

In addition, T2 and the Trust have entered into an expense limitation agreement (the “Current Expense Limitation Agreement”) under which T2 has agreed to reduce the amount of the investment advisory fees to be paid to T2 by the Fund for certain months and to assume other expenses of the Fund, if necessary, in an amount that limits “Total Annual Fund Operating Expenses” (exclusive of interest, taxes, brokerage fees and commissions, investment advisory fees paid to T2, extraordinary expenses, and payments, if any, under a Rule 12b-1 Plan) to not more than 0.45% of the average daily net assets of the Fund for the fiscal year ending March 31, 2013. The Trust or T2 may terminate the Current Expense Limitation Agreement at the end of the then-current term upon not less than 90-days’ notice to the Trust as set forth in the Current Expense Limitation Agreement.

For the fiscal year ended October 31, 2012, T2 earned fees in the amount of $1,076,414 and reimbursed expenses in the amount of $122,006 with respect to the Fund. For the fiscal year ended October 31, 2011, T2 earned fees in the amount of $1,094,457 and reimbursed expenses in the amount of $71,645 with respect to the Fund. For the fiscal year ended October 31, 2010 T2 earned fees in the amount of $233,395 and reimbursed expenses in the amount of $129,829 with respect to the Fund. There is no assurance that any fee waivers or expense reimbursement will continue in the future.

Under the Current Sub-Advisory Agreement, Centaur receives from T2 quarterly compensation based upon the Fund’s average daily net asset at the annualized rate of 0.75%, less certain of T2’s marketing and operating expenses, as agreed to between T2 and Centaur. Centaur has also agreed to allow T2 to withhold from Centaur’s compensation up to one-half of T2’s expenses under the Current Expense Limitation Agreement as it relates to the Fund. Under the Current Advisory Agreement and Current Sub-Advisory Agreement, the Fund does not pay a direct fee to Centaur.

Assignment and Termination of the Current Advisory Agreement. Under the 1940 Act, an investment advisory agreement will automatically terminate in the event of its assignment. Consummation of the Transaction will result in an “assignment” and termination of the Current Advisory Agreement; therefore, the Current Advisory Agreement will terminate upon the successful closing of the Transaction. The Current Expense Limitation Agreement will also be terminated upon the successful closing of the Transaction. In addition, it is expected that the Current Sub-Advisory Agreement will be terminated upon the successful closing of the Transaction.

New Advisory Agreement. If the New Advisory Agreement is approved by shareholders of the Fund, then it will become effective upon the consummation of the Transaction. It is expected that the closing of the Transaction will occur immediately after the approval of the New Advisory Agreement, provided the other customary conditions of closing are satisfied or waived.

The New Advisory Agreement with Centaur will contain substantially identical terms and conditions to those of the Current Advisory Agreement, and will differ only with respect to the parties, effective date and the termination date.

Under the New Advisory Agreement, Centaur will manage the investment and reinvestment of assets of the Fund, select the securities to be purchased, retained or sold by the Fund, and, upon making any purchase or sale decision, place orders for the execution of such portfolio transactions, all in accordance with the 1940 Act and any rules thereunder, the supervision and control of the Board of Trustees of the Trust, such specific instructions as the Board of Trustees may adopt and communicate to Centaur and the investment objectives, policies and restrictions of the Fund. Under the New Advisory Agreement, Centaur will receive the same fee that T2 currently receives from the Fund under the Current Advisory Agreement. A description of these fees and how they are calculated is set forth below.

Advisory Fee. Under the New Advisory Agreement, as full compensation for the investment advisory services provided to the Fund, Centaur will receive monthly compensation based on the Fund’s average daily net assets at the annual rate of 1.50%.

In addition, Centaur has agreed upon the approval of the New Advisory Agreement to enter into an expense limitation agreement with the Trust on behalf of the Fund (the “New Expense Limitation Agreement”) under which Centaur will agree to reduce the amount of the investment advisory fees to be paid to Centaur by the Fund and assume other expenses of the Fund for at least one year, if necessary, in an amount that limits “Total Annual Fund Operating Expenses” (exclusive of interest, taxes, brokerage fees and commissions, extraordinary expenses, and payments, if any, under a Rule 12b-1 Plan) to not more than 1.95% of the average daily net assets of the Fund for any fiscal year. Because the Current Expense Limitation Agreement does not include the current investment advisory fees of 1.50%, the 1.95% expense limitation in the New Expense Limitation Agreement is effectively the same as the 0.45% expense limitation in the Current Expense Limitation Agreement. Under the New Expense Limitation Agreement, the Trust or Centaur may terminate the Expense Limitation Agreement at the end of the then-current term upon not less than 90-days’ notice to the Trust as set forth in the Expense Limitation Agreement.

Additional Information Regarding New Advisory Agreement. The New Advisory Agreement provides that it will remain in force for an initial term of two years, and from year to year thereafter, subject to annual approval by (a) the Board of Trustees or (2) a vote of a majority (as defined in the 1940 Act) of the outstanding shares of the Fund. In either event, continuance of the New Advisory Agreement must also be approved by a majority of the Independent Trustees, by a vote cast in person at a meeting called for the purpose of voting on the continuance. The New Advisory Agreement may be terminated at any time, on 60 days’ written notice, without the payment of any penalty, by the Board of Trustees, by a vote of a majority of the outstanding voting shares of the Fund, or by Centaur. The New Advisory Agreement automatically terminates in the event of its “assignment” (as defined by the 1940 Act and the rules thereunder).

The New Advisory Agreement provides that Centaur shall not be liable for any error of judgment or for any loss suffered by the Trust or a Fund in connection with the matters to which the Agreement relates, except a loss resulting from a breach of fiduciary duty with respect to receipt of compensation for services or a loss resulting from willful misfeasance, bad faith or gross negligence on its part in the performance of, or from reckless disregard by it of its obligation and duties under the agreement.

In the event the Transaction is not consummated for any reason, it is contemplated that T2 will continue to serve as the investment advisor of the Fund and Centaur will continue to serve as the sub-advisor to the Fund, pursuant to the terms of the Current Advisory Agreement and Current Sub-Advisory Agreement, respectively. However, T2 has indicated its desire to focus its management energy on its privately offered funds and may at some point elect to terminate the Current Advisory Agreement. If such an event occurs, the Board of Trustees will have to determine what, if any, additional action should be taken with respect to the Fund.

The forms of the proposed New Advisory Agreement and New Expense Limitation Agreement are attached to this Proxy Statement as Exhibit A and Exhibit B, respectively. The descriptions of the New Advisory Agreement and New Expense Limitation Agreement set forth in this Proxy Statement are qualified in their entirety by reference to Exhibit A and Exhibit B, respectively.

Evaluation by the Board of Trustees

At meetings held on February 12, 2013 and May 20, 2013, T2 and Centaur presented to the Board of Trustees the proposed terms of the Transaction. For each of these meetings, the Board of Trustees requested and received such information from T2 and Centaur as the Trustees believed was reasonably necessary to understand the Transaction and the potential effects on the Trust and the Fund from the Transaction. The Board of Trustees discussed these matters with T2 and Centaur, including, without limitation, the potential benefits from the Transaction to the Fund and its shareholders, the Advisor and Centaur. As part of the discussion, Centaur stressed that under the New Advisory Agreement Centaur intends to manage the Fund in substantially the same manner and style as it currently manages the Fund as sub-advisor. Centaur also assured the Trustees that no changes were anticipated in Centaur’s portfolio management team and that Mr. Ashton intended to remain the Fund’s portfolio manager under the New Advisory Agreement.

On February 12, 2013, the Board of Trustees, and after consultation by the Independent Trustees with their independent counsel, the Board of Trustees, with the Independent Trustees voting separately, unanimously approved the New Advisory Agreement. In determining whether to approve the New Advisory Agreement, the Trustees considered, among other things: (1) the nature, extent and quality of the services to be provided by Centaur; (2) the investment performance of the Fund and Centaur, (3) the costs of the services to be provided and profits to be realized by Centaur from its relationship with the Fund; (4) the extent to which economies of scale would be realized as the Fund grows and whether management fee levels reflect these economies of scale for the benefit of the Fund’s investors; and (5) the likely effects of the Transaction on the Fund and its shareholders. Throughout this process, the Independent Trustees were advised and supported by independent counsel to the Independent Trustees.

| | (i) | The nature, extent, and quality of the services provided by Centaur. In this regard, the Trustees reviewed the services which have been provided to the Fund by Centaur, as the Fund’s sub-advisor, and which are expected to be provided by Centaur, as advisor, to the Fund including, without limitation, the quality of its investment advisory services since the Fund’s inception (including research and recommendations with respect to portfolio securities); its procedures for formulating investment recommendations and assuring compliance with the Fund’s investment objectives and limitations; its coordination of services for the Fund among the Fund’s service providers; and its efforts to promote the Fund, grow the Fund’s assets, and assist in the distribution of Fund shares. The Trustees noted that employees at Centaur have agreed to serve as the Fund’s principal executive officer, principal financial officer and president without additional compensation from the Fund. After reviewing the foregoing information and further information in the memorandum from Centaur (e.g., Centaur’s Form ADV and descriptions of Centaur’s business and compliance programs), the Board concluded that the nature, extent, and quality of the services to be provided by Centaur were satisfactory and adequate for the Fund. |

| | (ii) | The investment performance of the Fund and Centaur. In this regard, the Trustees compared the performance of the Fund with the performance of its benchmark index, comparable funds with similar objectives managed by other investment advisors, and comparable peer group indices (e.g., Bloomberg peer group averages). The Trustees also considered the consistency of Centaur’s management of the Fund with its investment objective and policies. After reviewing the short and long-term investment performance of the Fund, Centaur’s experience managing the Fund as sub-advisor and managing other advisory accounts, Centaur’s historical investment performance, and other factors, the Board concluded that the investment performance of the Fund and Centaur were satisfactory. |

| | (iii) | The costs of the services to be provided and profits to be realized by Centaur and its affiliates from the relationship with the Fund. In this regard, the Trustees considered Centaur’s staffing, personnel, and methods of operating; the education and experience of Centaur’s personnel; Centaur’s compliance policies and procedures; the financial condition of Centaur; the level of commitment to the Fund by Centaur and its principals; the asset level of the Fund; and the overall expenses of the Fund, including certain prior reimbursements made by Centaur as sub-advisor on behalf of the Fund and the nature and frequency of Centaur fee payments; and the differences in fees and services provided to Centaur’s other clients that may be similar to the Fund. The Trustees reviewed the financial statements for Centaur and discussed the financial stability and profitability of the firm. The Trustees considered the proposed Fund’s Expense Limitation Agreement with Centaur, including the nature and scope of the proposed cost allocation for such fees. The Trustees also considered potential benefits for Centaur in managing the Fund, including promotion of Centaur’s name, the ability for Centaur to place small accounts into the Fund, and the potential for Centaur to generate soft dollars from certain of the Fund’s trades that may benefit Centaur’s other clients as well. The Trustees also reviewed the fees to be paid to Centaur under the New Advisory Agreement. The Trustees then compared the fees and expenses of the Fund (including the management fee) to other funds comparable to the Fund in terms of the type of fund, the style of investment management, the size of the fund, and the nature of its investment strategy, among other factors. With respect to the Fund, the Trustees determined that, while the management fee and net expense ratio were higher than the comparable funds and the peer group average, the size of the Fund was much smaller than the peer group average. Following this comparison and upon further consideration and discussion of the foregoing, the Board concluded that the proposed fees to be paid to Centaur were fair and reasonable in relation to the nature and quality of the services to be provided by Centaur. |

| | (iv) | The extent to which economies of scale would be realized as the Fund grows and whether advisory fee levels reflect those economies of scale for the benefit of the Fund’s investors. In this regard, the Trustees considered that Fund’s proposed fee arrangement with Centaur involved both the management fee and the New Expense Limitation Agreement. The Trustees noted that, while the management fee remained the same at all asset levels, the Fund’s shareholders would experience benefits from the New Expense Limitation Agreement and would benefit from economies of scale under the Fund’s agreements with other service providers. Following further discussion of the Fund’s asset levels, expectations for growth, and fee levels, the Board determined that the Fund’s fee arrangement was fair and reasonable in relation to the nature and quality of the services to be provided by Centaur, as investment advisor, and that the New Expense Limitation Agreement provided potential savings for the benefit of the Fund’s investors. |

| | (v) | Centaur’s practices regarding brokerage and portfolio transactions. In this regard, the Trustees reviewed Centaur’s standards, and performance in utilizing those standards, for seeking best execution for the Fund’s portfolio transactions. The Trustees also considered the anticipated portfolio turnover rate for the Fund; the process by which evaluations are made of the overall reasonableness of commissions paid; the method and basis for selecting and evaluating the broker-dealers used; and any anticipated allocation of portfolio business to persons affiliated with Centaur. After further review and discussion, the Board determined that Centaur’s practices regarding brokerage and portfolio transactions were satisfactory. |

| | (vi) | Centaur’s practices regarding possible conflicts of interest. In this regard, the Trustees evaluated the potential for conflicts of interest and considered such matters as the experience and ability of the advisory personnel assigned to the Fund; the basis of decisions to buy or sell securities for the Fund and/or Centaur’s other accounts; the method for bunching of portfolio securities transactions; and the substance and administration of Centaur’s code of ethics. Following further consideration and discussion, the Board indicated that Centaur’s standards and practices relating to the identification and mitigation of possible conflicts of interests were satisfactory. |

The Trustees also determined that the scope, quality and nature of services to be provided by Centaur, and the fees to be paid to Centaur, under the New Advisory Agreement and New Expense Limitation Agreement will be substantially similar to the scope, quality and nature of services provided, and fees paid, under the Current Advisory Agreement and Current Expense Limitation Agreement. Following its consideration of all of the foregoing, the Board of Trustees unanimously approved the New Advisory Agreement and recommended approval of the New Advisory Agreement by shareholders of the Fund, the New Advisory Agreement to become effective if and when the Transaction closes. No single factor was considered in isolation or to be determinative to the decision of the Trustees to approve the New Advisory Agreement and recommend approval to the Fund’s shareholders. Rather, the Trustees concluded, in light of their weighing and balancing all factors, that approval of the New Advisory Agreement was in the best interests of the Fund and its shareholders.

On May 20, 2013, after considering the presentations by T2 and Centaur and reviewing other information received by the Board of Trustees, and after consultation by the Independent Trustees with their independent counsel, the Board of Trustees, with the Independent Trustees voting separately, unanimously approved the Transaction and the New Advisory Agreement and recommended approval of the New Advisory Agreement to the Fund's shareholders.

Additional Information Regarding Centaur

Centaur, with its principal place of business at Southlake Town Square, 1460 Main Street, Suite 234, Southlake, TX 76092, will serve as the investment advisor to the Fund under the New Advisory Agreement. Centaur was organized as a Delaware limited partnership, and is controlled by Mr. Ashton. Centaur and its affiliates have experience in managing investments for clients, including individuals, corporations, non-taxable entities, and other business and private accounts, since 2002. Centaur, together with its affiliates, has approximately $160 million in assets under management as of January 31, 2013. It is anticipated that Mr. Ashton will serve as President (Principal Executive Officer) of the Trust following the successful closing of the Transaction. Whitney R. Tilson, Managing Member of T2, currently owns 2% of Centaur.

The names and principal occupations of each principal executive officer, director and general partner of Centaur are listed below:

| Name | Principal Occupation/Title |

| Ashton Enterprises, LLC | General Partner |

| Malcolm “Zeke” Ashton | Managing Partner, Chief Compliance Officer |

The business address for each of the aforementioned officers, directors and general partners, is 1460 Main Street, Suite 234, Southlake, TX 76092. Other than the Fund, Centaur does not serve as advisor or sub-advisor to any other mutual funds.

The Board of Trustees recommends that shareholders of the Fund vote FOR the New Advisory Agreement.

SECOND MEETING

| PROPOSAL 2: | TO ELECT THREE TRUSTEES TO SERVE ON THE BOARD OF TRUSTEES |

Background. The Board of Trustees is currently comprised of three trustees (each a “Trustees” and collectively the “Trustees”): Jack E. Brinson, James H. Speed, Jr, and Whitney R. Tilson. Messrs. Brinson and Tilson were duly elected at the organizational meeting of the Trust and by the original shareholder of the Trust. Mr. Speed was elected by the Independent Trustee and the full Board at meeting of the Board of Trustees on March 31, 2009. Mr. Tilson has indicated a desire to step down from the Board in order to focus his attention on the management of T2 and its privately offered funds. The Trust’s Nominating Committee has recommended, with the approval of the Board of Trustees, that the following three individuals stand for election by shareholders of the Fund: Jack E. Brinson, James H. Speed, Jr. and Thomas G. Douglass (collectively the “Nominees”). Although Mr. Brinson has been previously elected, the shareholders of the Trust are being asked to vote on a proposal to elect all three Nominees. All nominees will, upon their election as Trustees by the Fund’s shareholders, serve as Independent Trustees, with Mr. Douglass replacing Mr. Tilson.

The Nominating Committee of the Board of Trustees (the “Nominating Committee”), which is comprised of the Independent Trustees of the Trust, is responsible for nominating, selecting and appointing Independent Trustees to stand for election at appropriate meetings of the shareholders of the Trust. Among the factors that the Nominating Committee generally considers are the candidate’s general understanding of the mutual fund industry; educational background; business and professional experience; interpersonal skills and ability to contribute to the ongoing functions of the Board; and any specific financial, technical or other expertise possessed by the candidate. While the Nominating Committee has not adopted a specific policy on diversity or a particular definition of diversity, when considering candidates, the Nominating Committee generally considers the manner in which each candidate’s experience, viewpoints and backgrounds are complementary to the existing Trustees’ attributes. Due to the Board’s historical small size and low rate of turnover, the Nominating Committee does not currently operate pursuant to a formal charter.

The Trust’s current Independent Trustees recommended Thomas G. Douglass to the Nominating Committee. On May 20, 2012, the Nominating Committee met to review pertinent information on the nomination of Mr. Douglass to the Board of Trustees. After considering Mr. Douglass’s background, experience, qualifications, attributes and skills, the Nominating Committee nominated and selected Mr. Douglass for election as a Trustee. The Nominating Committee also reviewed and considered the continuation of Messrs. Brinson and Speed as Trustees and nominated and selected them for election as Trustees. On May 20, 2012, the Board of Trustees approved the nomination of each of the Nominees be elected to serve as a Trustee of the Trust.

Section 16(a) of the 1940 Act provides that no person shall serve as a director of a registered investment company unless elected to that office by the holders of the outstanding voting securities of such company, at an annual or a special meeting duly called for that purpose; except that vacancies occurring between such meetings may be filled in any otherwise legal manner if immediately after filling any such vacancy at least two-thirds of the directors then holding office shall have been elected to such office by the holders of the outstanding voting securities of the company at such an annual or special meeting. As discussed above, Mr. Brinson has been previously elected by the shareholders of the Trust, but neither Mr. Speed nor Mr. Douglas have been previously elected by the shareholders. To ensure continued compliance with the forgoing requirement, shareholders are being asked at this Meeting to elect the three Nominees. The term of office of each Nominee will be until he dies, resigns, is declared bankrupt or incompetent by a court of appropriate jurisdiction, or is removed, or, if sooner, until the next meeting of shareholders called for the purpose of electing Trustees and until his successor is elected and qualified. Each Nominee has indicated a willingness to serve as a member of the Board of Trustees if elected. If any of the Nominees should not be available for election, the persons named as proxies (or their substitutes) may vote for other persons in their discretion. However, management has no reason to believe that any Nominee will be unavailable for election.

Background and other information regarding the Trustees , the Nominees and the Fund’s officers is set forth below.

The Board of Trustees Generally

The By-Laws of the Trust provide that the Board of Trustees shall consist of not fewer than the minimum number of Trustees permitted by applicable law nor more than fifteen Trustees, with the exact number being set from time to time by the Board. As noted above, the Board currently consists of three Trustees (Messrs. Brinson, Speed and Tilson).

The Board of Trustees oversees the management of the Trust and meets quarterly to review reports about the Trust’s operations, or more frequently if necessary. The Board of Trustees provides broad supervision over the affairs of the Trust. The Board of Trustees, in turn, elects the officers of the Trust to actively supervise the Fund’s day-to-day operations. Subject to the 1940 Act and applicable Delaware law, the Trustees may fill vacancies in or reduce the number of Board members, and may elect and remove officers and appoint and terminate agents, as they consider appropriate. The Trustees may appoint from their own number and establish (and terminate) one or more committees consisting of two or more Trustees who may exercise the powers and authority of the Board to the extent that the Trustees determine. The Trustees may, in general, delegate such authority as they consider desirable to any officer of the Trust, to any Committee of the Board or to any agent or employee of the Trust.

The Declaration of Trust for the Trust provides that the Trust will indemnify its Trustees and officers against liabilities and expenses incurred in connection with any claim, action, suit or proceeding in which they may be involved because of their offices with the Trust, except that no Trustee or officer shall be indemnified against any liability to the Trust or its shareholders to which such Trustee or officer would otherwise be subject by reason of willful misfeasance, bad faith, gross negligence or reckless disregard of the duties involved in the conduct of such Trustee or officer or if it is determined that the Trustee or officer has not acted in good faith in the reasonable belief that his action was in the best interest of the Trust.

Information Regarding the Nominees and Officers of the Trust. The Nominating Committee and the Board have considered each Nominee's experience, qualifications, attributes and skills in light of the Board’s function and the Trust’s business and structure, and has determined that each Nominee possesses experience, qualifications, attributes and skills that will enable the Nominee to be an effective member of the Board. Set forth in the table below is a summary of the specific experience, qualifications, attributes and/or skills for each Nominee. The Nominating Committee and the Board have determined that each of the Nominees’ careers and background, combined with their interpersonal skills and general understanding of financial and other matters, will enable the nominees to effectively participate in and contribute to the Board’s functions and oversight of the Trust. References to the qualifications, attributes and skills of Nominees are pursuant to requirements of the Securities and Exchange Commission, do not constitute holding out the Board or any Nominee as having any special expertise or experience, and shall not impose any greater responsibility on any such person or on the Board by reason thereof.

Independent Trustee Nominees |

| Mr. Brinson has experience in and knowledge of the financial industry as an individual investor and in his role as trustee on several other mutual fund boards. He also has previous business experience as an owner of an automobile dealer business. |

| Mr. Douglass has experience in and knowledge of the financial industry as an individual investor. He is also an attorney with experience in dealing with trusts and has knowledge of securities laws from previously serving as an arbitrator for the National Association of Securities Dealers, which is now part of the Financial Industry Regulatory Authority. |

| Mr. James H. Speed, Jr. has experience in and knowledge of the financial industry as an individual investor and in his role as a trustee on several other mutual fund boards. He also has business experience as President and CEO of an insurance company and as President of a company in the business of consulting and private investing. |

The following is a list of the Nominees and current Trustees, as well as the current and proposed executive officers of the Trust as of May 30, 2013. The business address of each Nominee, Trustee and executive officer is 1290 Broadway, Suite 1100, Denver, CO 80203. All Nominees are Independent Trustees; that is, no Nominee is considered an “interested person” of the Trust under the 1940 Act, because they are not employees or officers of, and have no financial interest in, the Trust’s affiliates or its service providers.

| Position(s) held with Trust | | | | Other Directorships Held by Director or Nominee |

|

Jack E. Brinson (age 80) | | Since | Retired since 2000; Previously, President, Brinson Investment Co. (personal investments) and President, Brinson Chevrolet, Inc. (auto dealership). | | Independent Trustee of DGHM Investment Trust for its two series, Gardner Lewis Investment Trust for its two series, Hillman Capital Management Investment Trust for its one series, Brown Capital Management Funds for its three series, and Starboard Investment Trust for its twenty-three series (all registered investment companies); previously, Independent Trustee of de Leon Funds Trust for its one series from 2000 to 2005, MurphyMorris Investment Trust for its one series from 2003 to 2006, New Providence Investment Trust for its one series from 1999 to 2011, and Piedmont Investment Trust for its one series from 2005 to 2006 (all registered investment companies). |

Thomas G. Douglass (age 57) | | | Principal, Douglass and Douglas, Attorneys | | |

James H. Speed, Jr. (age 59) | Trustee, Chairman and Nominee | Since | President and CEO of NC Mutual Life Insurance Company (insurance company) since May 2003; President of Speed Financial Group, Inc. (consulting/private investments) from March 2000 to April 2003. | | Independent Trustee of Hillman Capital Management Investment Trust for its one series, Brown Capital Management Funds for its three series, and Starboard Investment Trust for its twenty-three series (all registered investment companies); Member of Board of Directors of NC Mutual Life Insurance Company; Member of Board of Directors of M&F Bancorp; Member of Board of Directors of Investors Title Company; previously, Independent Trustee of New Providence Investment Trust for its one series from 2009 to 2010 (registered investment company). |

|

Whitney R. Tilson (age 46) | Trustee, President (Principal Executive Officer) *** | Since | Founder and Managing Partner, T2 Partners Management LP (formerly Tilson Capital Partners LLC) and various affiliated entities since 1998. | | |

| | * | Reflects number of Funds that would be overseen by Mr. Douglass if he is elected to the Board. |

| | ** | Mr. Tilson is considered to be an “Interested Person” of the Trust, as that term is defined in the 1940 Act, because he is a Managing Member of T2 Partners Management LP, the investment advisor of the Fund. |

| | *** | Mr. Tilson will resign as Trustee and President of the Trust upon successful closing of the Transaction. |

| Position(s) held with Trust | | | Number of Portfolios in Fund Complex Overseen by Trustee | Other Directorships Held by Director or Nominee |

Glenn H. Tongue (age 54)* | Vice-President, Treasurer (Principal Financial Officer), and Chief Compliance Officer | | Fund Manager, T2 Partners Management LP since 2004; previously, Investment Banker, UBS (investment banking firm) from 2002 to 2003; Executive, DLJ direct (on-line brokerage firm). | | |

| Malcolm “Zeke” Ashton (age 42)** | President (Principal Executive Officer) | | Mr. Ashton has been Managing Partner of Centaur since 2002. | | |

| Position(s) held with Trust | | | Number of Portfolios in Fund Complex Overseen by Trustee | Other Directorships Held by Director or Nominee |

| | Since | Vice President and Associate Counsel, ALPS since 2011; Managing Member, Mills Law, LLC, 2010 – 2011; Counsel, Old Mutual Capital, Inc. 2006 – 2009. | | |

| | | Senior Vice President and Director of Fund Administration, ALPS, 2004-Present | | |

| | * | Mr. Tongue will resign as Vice President, Treasurer (Principal Financial Officer) and Chief Compliance Officer of the Trust upon the successful closing of the Transaction. |

| | ** | Reflects Officer appointments to be effective upon successful completion of the Transaction. |

Board Leadership Structure, Risk Oversight and Committee Arrangements

The Trust’s Board currently includes two Independent Trustees (Mr. Brinson and Mr. Speed) and one Interested Trustee, Mr. Tilson, by virtue of his relationship with T2. The proposed addition of Mr. Douglass would bring the total number of Independent Trustees to three. Upon successful completion of the Transaction, Mr. Tilson will resign as Trustee.

With respect to the current leadership structure of the Board, Mr. Speed, an Independent Trustee, serves as Chair of the Board of Trustees and Mr. Tilson, an Interested Trustee, currently serves as the Trust’s Principal Executive Officer; however, following the successful closing of the Transaction, Mr. Tilson will resign from such position and it is anticipated that Mr. Ashton will be appointed as the Trust’s Principal Executive Officer.

The Board has established five standing committees: an Audit Committee, a Governance Committee, a Nominating Committee, a Proxy Voting Committee, and a Qualified Legal Compliance Committee. These standing committees are comprised entirely of the Independent Trustees. Information about these standing committees is set forth below. The Board has determined that the Board’s structure is appropriate given the characteristics, size, and operations of the Trust. The Board also believes that its leadership structure, including its committees, helps facilitate effective oversight of Trust management. The Board reviews its structure annually.

With respect to risk oversight, the Board considers risk management issues as part of its general oversight responsibilities throughout the year. The Board holds four regular board meetings each year during which the Board receives risk management reports and/or assessments from Trust management, the Fund’s advisor, sub-advisor, administrator, transfer agent and distributor, and receives an annual report from the Trust’s Chief Compliance Officer (“CCO”). The Audit Committee also meets with the Trust’s independent registered public accounting firm on an annual basis, to discuss among other things, the internal control structure of the Trust’s financial reporting function. When appropriate, the Board may hold special meeting or communicate directly with Trust management, the CCO, the Trust’s third party service providers, legal counsel or independent registered public accounting firm to address matters arising between regular board meeting or needing special attention. In addition, the Board has adopted policies and procedures for the Trust to help detect and prevent and, if necessary, correct violations of federal securities laws. The Board of Trustees held four regular quarterly meetings and one special meeting during the fiscal year ended October 31, 2012, and Mr. Tilson, Mr. Brinson and Mr. Speed attended all of those meetings.

The Board annually performs a self-assessment of its current members, which includes a review of the composition of the Board and its committees, including diversity of trustees’ age, experience and skills; trustees’ service on other boards; committee structure; size of the Board and ratio of interested to independent trustees; size of the committees and ratio of interested to independent trustees; process for identifying and recruiting new trustees; qualifications for Board membership and determination of trustee independence.

Trustee Standing Committees. The Board of Trustees has established the following standing committees:

Audit Committee: Each of the Independent Trustees currently serving on the Board is a member of the Audit Committee. It is anticipated that Mr. Douglass will also serve on the Audit Committee, if elected to the Board. The Audit Committee oversees the Fund’s accounting and financial reporting policies and practices, reviews the results of the annual audits of the Fund’s financial statements, and interacts with the Fund’s independent auditors on behalf of all the Trustees. The Audit Committee operates pursuant to an Audit Committee Charter and meets periodically as necessary. The Audit Committee met twice during the Fund’s last fiscal year.

Nominating Committee: Each of the Independent Trustees currently serving on the Board is a member of the Nominating Committee. It is anticipated that Mr. Douglass will also serve on the Nominating Committee, if elected to the Board. The Nominating Committee nominates, selects, and appoints independent trustees to fill vacancies on the Board of Trustees and to stand for election at meetings of the shareholders of the Trust. The nomination of Independent Trustees is in the sole and exclusive discretion of the Nominating Committee. The Nominating Committee meets only as necessary and did not meet during the Fund’s last fiscal year. The Nominating Committee will not consider nominees recommended by shareholders of the Trust. The Nominating Committee does not have a formal charter.

Proxy Voting Committee: Each of the Independent Trustees currently serving on the Board is a member of the Proxy Voting Committee. It is anticipated that Mr. Douglass will also serve on the Proxy Voting Committee, if elected to the Board. The Proxy Voting Committee will determine how the Fund should vote, if called upon by the Board, T2 or Centaur, when a matter with respect to which the Fund is entitled to vote presents a conflict between the interests of the Fund’s shareholders, on the one hand, and those of the Fund’s investment advisor, sub-advisor, principal underwriter, or an affiliated person of the Fund, its investment advisor, or principal underwriter, on the other hand. The Proxy Voting Committee will review the Trust’s Proxy Voting Policy and recommend any changes to the Board as it deems necessary or advisable. The Proxy Voting Committee will also decide if the Fund should participate in a class action settlement, if called upon by T2 or Centaur, in cases where a class action settlement with respect to which the Fund are eligible to participate presents a conflict between the interests of the Fund’s shareholders, on the one hand, and those of T2 or Centaur, on the other hand. The Proxy Voting Committee meets only as necessary and did not meet during the Fund’s last fiscal year.

Qualified Legal Compliance Committee: Each of the Independent Trustees currently serving on the Board is a member of the Qualified Legal Compliance Committee. It is anticipated that Mr. Douglass will also serve on the Qualified Legal Compliance Committee, if elected to the Board. The Qualified Legal Compliance Committee receives, investigates, and makes recommendations as to appropriate remedial action in connection with any report of evidence of a material violation of securities laws or breach of fiduciary duty or similar violation by the Trust, its officers, trustees, or agents. The Qualified Legal Compliance Committee meets only as necessary and did not meet during the Fund’s last fiscal year.

Governance Committee: Each of the Independent Trustees currently serving on the Board is a member of the Governance Committee. It is anticipated that Mr. Douglass will also serve on the Governance Committee, if elected to the Board. The Governance Committee assists the Board in adopting fund governance practices and reviewing the Trust’s fund governance standards. The Governance Committee operates pursuant to a Governance Committee Charter and meets periodically as necessary and did not meet during the Fund’s last fiscal year.

Beneficial Equity Ownership Information. The table below shows, for each current Trustee, the value of shares of the Fund beneficially owned, and the aggregate value of investments in shares of all funds in the Fund complex, as of June 28, 2013, and stated as one of the following ranges:

A = None; B = $1–$10,000; C = $10,001–$50,000; D = $50,001–$100,000; and E = over $100,000.

| Dollar Range of Shares of the Fund Owned by Trustee | Aggregate Dollar Range of Shares of All Funds Overseen by Trustee |

|

| | |

| | |

| | |

| |

|

| | |

Compensation. Officers of the Trust and the Trustees who are interested persons of the Trust, T2 or Centaur receive no salary from the Trust. Each Trustee who is not an “interested person” of the Trust receives a fee of $2,000 each year plus $500 per series of the Trust per meeting attended in person and $200 per series of the Trust per meeting attended by telephone. The Trust expects that half of the fees received by such Trustees will be invested in shares of the particular Fund on that Trustee’s (or Trustee designee’s) behalf on the date they are received. All Trustees and officers are reimbursed for any out-of-pocket expenses incurred in connection with attendance at meetings. The following table presents the compensation for each Trustee for the fiscal year ending October 31, 2012 :

| | Pension or Retirement Benefits Accrued As Part of Fund Expenses | Estimated Annual Benefits Upon Retirement | Total Compensation From the Fund and Fund Complex Paid to Trustees |

|

| | | | |

| | | | |

|

| | | | |

The Board of Trustees recommends that shareholders of the Fund vote FOR the election of the three Nominees to serve on the Board of Trustees.

OUTSTANDING SHARES AND VOTING REQUIREMENTS

Record Date. The Board of Trustees has fixed the close of business on June 28, 2013 (the “Record Date”) as the record date for the determination of shareholders of the Fund entitled to notice of and to vote at the Meeting or any adjournment thereof. The Fund offers a single classes of shares. As of the Record Date, there were 4,224,528.667 shares of beneficial interest of the Trust outstanding. All full shares of the Trust are entitled to one vote, with proportionate voting for fractional shares.

5% Shareholders. As of June 28, 2013, the Trustees and officers of the Trust, as a group, owned beneficially (i.e., had voting and/or investment power) less than 1% of the then outstanding shares of the Fund. On that same date, the shareholder(s) listed below owned of record more than 5% of the outstanding shares of the Fund. Except as provided below, no person is known by the Trust to be the beneficial owner of more than 5% of the outstanding shares of the Fund as of June 28, 2013.

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | |

Charles Schwab and Co. Inc. Attn: Mutual Funds 101 Montgomery Street San Francisco, CA 94104 | 753358.677 | 17.832964% |

TD Ameritrade | | |

Quorum. A quorum is the number of shares legally required to be at a meeting in order to conduct business. The presence, in person or by proxy, of more than 50% of the outstanding shares of the Trust is necessary to constitute a quorum for each of the Meetings. Proxies properly executed and marked with a negative vote or an abstention will be considered to be present at a Meeting for purposes of determining the existence of a quorum for the transaction of business. If a Meeting is called to order but a quorum is not present at the Meeting, the persons named as proxies may vote those proxies that have been received to adjourn the Meeting to a later date. If a quorum is present at a Meeting but sufficient votes to approve a Proposal described herein are not received, the persons named as proxies may propose one or more adjournments of the Meeting to permit further solicitation of proxies. Any such adjournment will require the affirmative vote of a majority of those shares represented at the Meeting in person or by proxy. The persons named as proxies will vote those proxies received that voted in favor of a Proposal in favor of such an adjournment and will vote those proxies received that voted against the Proposal against any such adjournment.

If a quorum (more than 50% of the outstanding shares of the Trust and of the Fund) is present at the first Meeting, the vote of a majority of the outstanding shares of the Fund is required for approval of the New Advisory Agreement with respect to the Fund (Proposal 1). If a quorum is present at the second Meeting, the vote of a plurality of the Trust’s shares represented at the Meeting is required for the election of Trustees (Proposal 2). The vote of a majority of the outstanding shares means the vote of the lesser of (1) 67% or more of the shares present or represented by proxy at the Meeting, if the holders of more than 50% of the outstanding shares are present or represented by proxy, or (2) more than 50% of the outstanding shares.

Abstentions and “broker non-voters” are counted for purposes of determining whether a quorum is present but do not represent votes cast with respect to a Proposal. “Broker non-votes” are shares held by a broker or nominee for which an executed proxy is received by the Trust, but are not voted as to one or more Proposals because instructions have not been received from the beneficial owners or persons entitled to vote and the broker or nominee does not have discretionary voting power. Notwithstanding the foregoing, “broker non-votes” will be excluded from the denominator of the calculation of the number of votes required to approve any Proposal to adjourn the Meeting. Accordingly, abstentions and “broker non-votes” will effectively be a vote against the Proposal, for which the required vote is a percentage of the outstanding voting shares and will have no effect on a vote for adjournment.

The Trustees of the Trust intend to vote all of their shares in favor of the Proposals described herein. On the Record Date, all Trustees and officers of the Trust as a group owned of record or beneficially less than 1% of the outstanding shares of the Fund.

ADDITIONAL INFORMATION ON THE OPERATION OF THE FUNDS

Information Regarding the Officers, Trustees and Proposed Trustees of the Trust

The following is a list of the current executive officers, Trustees and Proposed Trustees of the Fund, their current positions with the Fund, and their current positions with T2 or Centaur, if any:

| | | |

| | | |

| | | |

| Trustee, President of Trust | Managing Partner, Portfolio Manager | |

| Proposed Independent Trustee | | |

| Vice-President, Treasurer (Principal Financial Officer), and Chief Compliance Officer | Fund Manager, Portfolio Manager | |

| | | |

| | | |

Principal Underwriter. ALPS Distributors, Inc. (“ADI” or “Distributor”), 1290 Broadway, Suite 1100, Denver, CO 80203, acts as an underwriter and distributor of the Fund’s shares for the purpose of facilitating the registration of shares of the Fund under state securities laws and to assist in sales of Fund shares pursuant to the Distribution Agreement approved by the Trustees. In this regard, ADI has agreed, at its own expense, to qualify as a broker-dealer under all applicable federal or state laws in those states which the Fund shall from time to time identify to ADI as states in which it wishes to offer its shares for sale, in order that state registrations may be maintained for the Fund. Rhonda Mills is also a Vice President of ADI.

The Distributor is a broker-dealer registered with the SEC and a member in good standing of the Financial Industry Regulatory Authority, Inc. The Distribution Agreement may be terminated by either party upon 60 days’ prior written notice to the other party. ADI does not receive any compensation under the Distribution Agreement.

Fund Accountant and Administrator. The Trust has entered into an Administration, Bookkeeping and Pricing Services Agreement with ALPS Fund Services, Inc. (“ALPS” or “Administrator”), 1290 Broadway, Suite 1100, Denver, CO 80203.

The Administrator performs the following services for the Fund: (1) procures a custodian on behalf of the Trust, and coordinates with and monitors the services it provides to the Fund; (2) coordinates with and monitors any other third parties furnishing services to the Fund; (3) provides necessary office space, telephones, and other communications facilities and personnel competent to perform administrative and clerical functions for the Fund; (4) assists or supervises the maintenance by third parties of such books and records of the Fund as may be required by applicable federal or state law; (5) assists or supervises the preparation by third parties of all federal, state, and local tax returns and reports of the Fund required by applicable law; (6) prepares and, after approval by the Trust, files and arranges for the distribution of proxy materials and periodic reports to shareholders of the Fund as required by applicable law; (7) assists in the preparation of and, after approval by the Trust, arranges for the filing of such registration statements and other documents with the SEC and other federal and state regulatory authorities as may be required by applicable law; (8) reviews and submits to the officers of the Trust for their approval invoices or other requests for payment of Fund expenses and instructs the custodian to issue checks in payment thereof; and (9) takes such other action with respect to the Fund as may be necessary in the opinion of the Administrator to perform its duties under the agreement. The Administrator also provides certain accounting and pricing services for the Fund.