UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21606

Centaur Mutual Funds Trust

(Exact name of registrant as specified in charter)

470 Park Avenue South, 9th Floor

New York, NY 10016

(Address of principal executive offices) (Zip code)

Ultimus Fund Solutions, LLC

Attn: Zachary P. Richmond

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-513-587-3400

Date of fiscal year end: October 31

Date of reporting period: October 31, 2022

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| |

| |

| |

| |

| |

| |

| DCM/INNOVA HIGH EQUITY INCOME INNOVATION FUND |

| |

| |

| |

| |

| |

| |

| LEBENTHAL ULTRA SHORT TAX-FREE INCOME FUND |

| |

| |

| |

| |

| |

| |

| |

| |

| ANNUAL REPORT |

| |

| October 31, 2022 |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Centaur Mutual Funds Trust |

| Message from the Chief Executive Officer |

| October 31, 2022 (Unaudited) |

Dear Fellow Shareholder,

It’s better to be dependable than right.

I say this because looking back at my letter to you in last year’s Annual Report, we see that I was right about the shift from headlines dominated by COVID to ones dominated by Inflation and the Federal Reserve Board’s interest rate policy. While that proved to be the case for this past fiscal year, what should matter to us more is how well one can depend on our mutual funds to achieve their respective objectives for shareholders (of which I am one.)

In the case of our Lebenthal Ultra Short Tax-Free Income Fund (the “Lebenthal Fund”), the objective includes capital preservation. The past year included no shortage of threats to capital preservation in the bond markets, which saw declines across the board—even in the Fund’s Morningstar category of Short-Term Municipal—and yet the Lebenthal Fund preserved capital like a true fortress. The Lebenthal Fund’s NAV stability was second to none throughout the entire turbulent year. And the Lebenthal Fund produced attractive levels of tax-free income, true to its name. Personally, I will share with you that while I typically like to focus on the long-term power of equities for capital, this was a year I was reminded why I allocate a material part of my family’s capital to “boring”, low-growth cash. The Lebenthal Fund has served us all very, very well and when we needed most to depend on its stability—2022.

In the case of our DCM/INNOVA High Equity Income Innovation Fund (the “DCM/ INNOVA Fund”), it truly delivered its namesake high income from a smartly designed equity portfolio; dividend income (yield) which was five times that of its benchmark S&P 500® Total Return Index (the “S&P 500® Index”). Neither the DCM/INNOVA Fund nor the S&P 500® Index managed to escape the declines of 2022’s Bear Market. As investors, we have to always remind ourselves of the patience and fortitude required to realize the long-term effects of equities’ ability to provide above-average capital appreciation as an asset class. Not lost on us are the preceding three calendar years of returns for the S&P 500® Index, which are 28.71%, 18.40%, and 31.49% respectively. Suffice it to say, we often are taking one step backwards to go three steps forward in the equity markets.

Rather than attempt to predict what stories the markets focus on in 2023, just as I did last year (although I’m tempted to since I’m on a bit of a roll), I’ll share with you some things that are much more predictable; namely, the growth of our mutual fund lineup. Three years ago, we were offering just one mutual fund. It was called the Centaur Fund. We shaped that into a fund we thought folks would really enjoy if they were seeking attractive income from the dividends of equities. You know that Fund today as the DCM/ INNOVA High Equity Income Innovation Fund.

| Annual Report | October 31, 2022 | 1 |

| Centaur Mutual Funds Trust |

| Message from the Chief Executive Officer |

| October 31, 2022 (Unaudited) |

We also created a fund for one’s cash with my all-time favorite name for municipal bond management excellence—Lebenthal. The Lebenthal Ultra Short Tax-Free Income Fund is finally having its day in the sun. We’ve proven both during the COVID Shock of March 2020 and this year’s series of bazooka-sized Fed rate hikes just how well we can preserve capital and generate attractive, 100% tax-free income.

By the end of 2022, we are planning to announce our third mutual fund in this trust (the Centaur Mutual Funds Trust). The Copley Fund was created in 1974 and developed an admirable track record of conservative appreciation from the equities of utility companies and other low-volatility, dividend-paying equities. With the successful vote of Copley Fund shareholders, DCM Advisors, LLC becomes the Advisor to the Copley Fund and the third fund in the offering set for our shareholders. Many tax-savvy shareholders have shared their passion for the Copley Fund with me and I’m very excited by the prospects of what we can do for shareholders in 2023.

Just as shareholders have depended on our mutual funds delivering on their key objectives these past three years; just as seasoned investors have focused on the long-term strength of equity returns amidst volatile markets, you can depend on me to write more about the Copley Fund in our next report. For now, please enjoy the letters that follow from our portfolio managers and know that we thank you very much for your trust and confidence in our abilities to deliver quality, thoughtful, well-managed investment vehicles for your capital and mine.

Marc Rappaport

Chief Executive Officer

DCM Advisors

DCM/INNOVA High Equity Income Innovation Fund

Letter from the Portfolio Manager |

| October 31, 2022 (Unaudited) |

The DCM/INNOVA High Equity Income Innovation Fund’s (the “Fund’s”) fiscal year ended October 31, 2022, saw major selloffs in equity and bond markets driven by high inflation and a hawkish Federal Reserve (the “Fed”). Geopolitical considerations also affected markets adversely. While COVID faded into the background, the Russian invasion of Ukraine roiled commodity markets, and China’s strict approach to dealing with COVID exacerbated supply chain problems.

Equities’ steady fall over the course of the Fund’s fiscal year was punctuated by two sharp rallies. Despite the rallies, the S&P 500® Total Return Index (the “S&P 500 Index”) had total returns (including dividends) of -14.61%. Bonds tend to provide safety when equity markets sell off aggressively. Surprisingly, bonds experienced much worse returns than equities. The Bond market started the Fund’s fiscal year with the 10-year Government Bond yielding 1.55% and ended the Fund’s fiscal year at a yield of 4.05%. As an example of the pain of the Bond market, the iShares 20+ year Treasury Bond ETF was down greater than 33% over the course of the Fund’s fiscal year.

Inflation had started to perk up beyond the Fed’s 2% target in the second quarter of 2021. By December of 2021, inflation was running at a 7% annual headline rate, with the Fed’s preferred measure of inflation, the Personal Consumption Expenditures Price Index running at just over 5%. Initially, the Fed assumed that inflation would prove transitory, and was slow to act. When inflation appeared to be sticky even beyond the end of 2021, the Fed decided to raise rates starting in the middle of March 2022. It started with a 25 basis points raise in mid-March, followed by a 50 basis points increase in May of 2022. The following three raises, in June, July, and September, were 75 basis points each as headline inflation rose to as high as 9%.

Companies in the “old economy” sectors outperformed the broad market, while fast-growing, but money-losing companies underperformed. Only two of the 11 equity sectors, Energy and Consumer Staples, had positive total returns. The Russell 3000 Energy sector was up 57.4% as Russia’s war on Ukraine led to elevated energy prices. Defensive sectors such as Consumer Staples, which is defensive, was up 8.6%. Utilities were down 1.1% and the Health Care sector was down only 5.8%.

Higher interest rates adversely affected richly valued growth companies in sectors such as Technology, Consumer Discretionary and Communication Services. The Nasdaq Composite Index, which primarily includes growth companies, was down 28.5%. The other sector that was adversely affected by higher rates was Real Estate, with the Russell 3000 Real Estate Index down 21.2%.

| Annual Report | October 31, 2022 | 3 |

DCM/INNOVA High Equity Income Innovation Fund

Letter from the Portfolio Manager |

| October 31, 2022 (Unaudited) |

Increasing bond yields favor the value style of investing over the growth style. As a result, value style strongly outperformed the growth style with the Russell 1000 Value Index returning -7.0% compared with the -24.5% return of the Russell 1000 Growth Index. The DXY Dollar Index climbed 18.5% over the Fund’s fiscal year. This reflected the stronger economy in the U.S. compared with international economies, higher bond yields, and the fact that the Fed was raising rates more aggressively than other Central Banks. The strong dollar has been a headwind for equities, causing U.S. exports to become less competitive.

Equity markets rallied sharply from mid-June through mid-August, and then had another sharp leg down through mid-October. As a result, the Fund’s fiscal fourth quarter saw the S&P Index decline 5.9%. The S&P Index found some support at the 3,600 level and has been rallying from there. Over this period the Fund slightly lagged the S&P 500 Index with a return of -6.6%. Over the Fund’s fiscal year ended October 31, 2022, the Fund lagged the S&P 500 Index with returns of -23.57% compared with the Fund’s benchmark the S&P 500® Total Return Index returns of -14.61%.

Corporate earnings and revenues have held up better than what we expected from the increases in bond yields, the weaker GDP growth numbers in Q1 and Q2 of 2022, and increased volatility in equity and bond markets. At the beginning of the Fund’s fiscal year, in early November 2021 the Bloomberg forecast for earnings growth for the S&P 500 Index for 2022 was 7.4%. Towards the end of the Fund’s fiscal year ended October 31, 2022, the forecast for 2022 was up slightly at 8.4%. Revenue forecasts for calendar year 2022 were up from 8.1% in November 2021 to 11.3% in October 2022.

We have positioned the Fund to perform broadly in-line with the S&P Index over the long run but with a dividend yield that is three to four times as high as the S&P 500® Index dividend yield utilizing a proprietary process. During the fourth fiscal quarter, the Fund realized an annualized dividend yield of 4.76%, and a trailing 12-month yield of 10.16%. We believe the Fund is poised to provide S&P 500-like returns with a much higher dividend yield than this popular index going forward.

Vijay Chopra, PhD, CFA

Portfolio Manager

Lebenthal Ultra Short Tax-Free Income Fund

Letter from the Portfolio Manager |

| October 31, 2022 (Unaudited) |

In plain English, the past year has been a difficult one for the municipal market and fixed income markets overall. We have moved from the seemingly intractable low-rate environment to some of the highest rates seen in a decade, punctuated with outsized rate hikes from the Federal Reserve (the “Fed”). Municipal bonds overall returned a disappointing -11.98%, only to be eclipsed by treasuries -14.09% and U.S. Corporates -19.57%. Closer to home, the short end of the municipal market too fared poorly, returning a -2.19% return for the Bloomberg 1 Year Municipal Bond Index for the 1-year period ended October 31, 2022.

Trading and managing municipal bonds this year was a challenge, as there were periods of both volatility and “head-fakes” as investors tried to gauge the seriousness of the Fed’s response to inflation, and ultimately make a guess on what effect the series of large, constant rate-hikes would have on the economy going forward.

At the start of the fiscal year, we were coming out of the Pandemic, and we were evaluating the disparate potential of renewed shutdowns caused by Omicron and increasing inflation. These competing forces kept municipal rates largely unchanged and somewhat positive. But as the headline risk of Omicron faded going into calendar year 2022, the markets focused fully and entirely on the Fed’s fight against inflation.

The rest of this annual period has been marked by a recurring theme, and the volatility from that theme creating potential pitfalls for investors. In short, the Fed has tried to maintain an open and transparent dialogue - detailing exactly what they are looking to achieve, what they are focused on, and how they plan on getting there. The market’s response was to attempt to out-guess the Fed. And that attempt failed. This led to the repeat cycles of scrambling to buy bonds and pushing rates down – May and July 2022 – and capitulation – June, August and October – as inflation numbers remained high and the Fed committed to its series of large 75 basis points hikes in June, July, and September.

During this period, both Marc and I have been focused on two things: maintaining price stability and capturing the increasing yield provided by the Fed’s rate hikes. As fixed coupon bonds matured in the Lebenthal Ultra Short Tax-Free Income Fund (the “Fund”), we looked to increase the Variable Rate Demand Note allocation. This allocation increased from approximately 36% of holdings to 82%. That has provided the Fund a bulwark against price volatility caused by hikes and allowed the Fund to maintain its objective of capital preservation with de minimis NAV volatility. The remaining Fund assets were invested judiciously in very short maturity assets to capture incrementally increased yields without exposing the Fund to substantially increased duration. We sought to be consistent to this dual mandate especially during volatile periods, and not try to outsmart ourselves or fight the Fed.

| Annual Report | October 31, 2022 | 5 |

Lebenthal Ultra Short Tax-Free Income Fund

Letter from the Portfolio Manager |

| October 31, 2022 (Unaudited) |

We feel that the Fund has performed admirably over the course of the year. The Fund managed to provide stability with only a brief, 1–penny (one–tenth of one percent) move in its stable $10 NAV price. For the fiscal year ended October 31, 2022, the Fund has increased its 7-day tax-free yield from almost zero yield to over 2%. The Fund’s Class I Shares provided a positive return of 0.57% (to shareholders) whereas the Fund’s primary benchmark, the Bloomberg 1 Year Municipal Bond Index returned -2.19%.

Robert Morgan

Portfolio Manager

| Centaur Mutual Funds Trust |

| Important Disclosures |

| October 31, 2022 (Unaudited) |

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month end are available by calling 1-888-484-5766.

An investor should consider the investment objectives, risks, charges and expenses of the Funds carefully before investing. The Funds’ prospectus contains this and other important information. To obtain a copy of the Funds’ prospectus please visit the Funds’ website at http://www.dcmmutualfunds.com or call 1-888-484-5766 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Funds are distributed by Ultimus Fund Distributors, LLC.

The Letters from the Portfolio Managers seek to describe some of the investment advisor’s current opinions and views of the financial markets. Although the investment advisor believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed. The securities held by the Funds that are discussed in the Letters from the Portfolio Managers were held during the period covered by this annual report. They do not comprise the entire investment portfolio of the Funds, may be sold at any time and may no longer be held by the Funds. For a complete list of securities held by the Funds as of October 31, 2022, please see the Schedules of Investments sections of this annual report. The opinions of DCM Advisors, LLC with respect to those securities may change at any time.

Statements in the Letters from the Portfolio Managers that reflect projections or expectations for future financial or economic performance of the Funds and the market in general and statements of the Funds’ plans and objectives for future operations are forward-looking statements. No assurance can be given that actual results or events will not differ materially from those projected, estimated, assumed, or anticipated in any such forward-looking statements. Important factors that could result in such differences, in addition to factors noted with such forward-looking statements, include, without limitation, general economic conditions, such as inflation, recession, and interest rates. Past performance is not a guarantee of future results.

| Annual Report | October 31, 2022 | 7 |

DCM/INNOVA High Equity Income Innovation Fund

Performance Update |

| October 31, 2022 (Unaudited) |

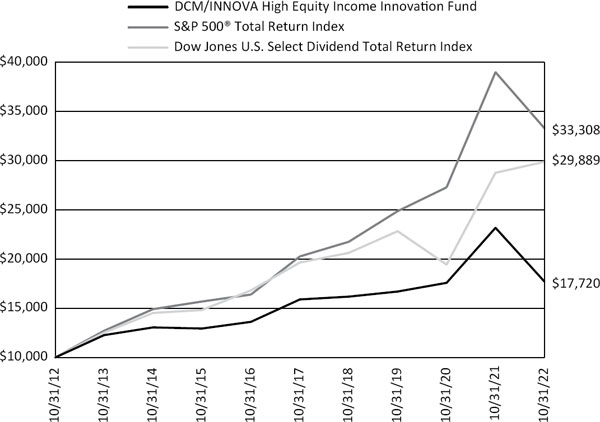

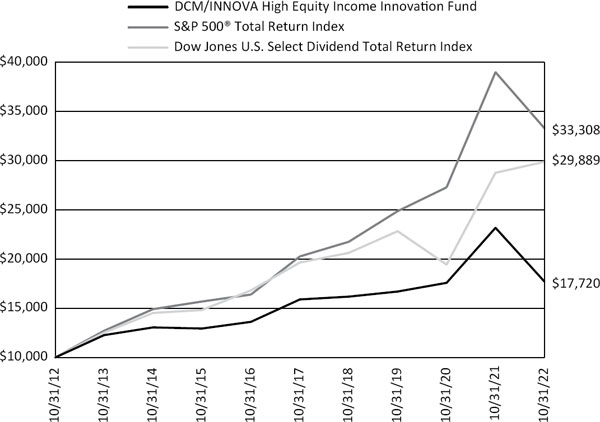

Growth of $10,000 Investment

For the period from October 31, 2012 to October 31, 2022:

This graph assumes an initial $10,000 investment made on October 31, 2012 and held through October 31, 2022. All dividends and distributions are reinvested, if any. This graph depicts the performance of the DCM/INNOVA High Equity Income Innovation Fund (the “DCM/INNOVA Fund”) versus the S&P 500® Total Return Index and the Dow Jones U.S. Select Dividend Total Return Index. It is important to note that the DCM/INNOVA Fund is a professionally managed mutual fund while the indices are not available for investment and are unmanaged. The comparison is shown for illustrative purposes only.

DCM/INNOVA High Equity Income Innovation Fund

Performance Update |

| October 31, 2022 (Unaudited) |

Average Annual Total Returns for the years ended October 31, 2022*

| | One | Five | Ten | Since |

| | Year | Year | Year | Inception(a) |

| DCM/INNOVA High Equity Income Innovation Fund | -23.57% | 2.19% | 5.89% | 7.09% |

| S&P 500® Total Return Index(b) | -14.61% | 10.44% | 12.79% | 9.10% |

| Dow Jones U.S. Select Dividend Total Return Index(c) | 3.87% | 8.75% | 11.57% | 8.22% |

| | | | | |

| | | | | Expense |

| | | | | Ratios(d) |

| Gross | | | | 2.39% |

| With Applicable Waivers | | | | 1.54% |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on the DCM/INNOVA High Equity Income Innovation Fund (the “DCM/INNOVA Fund”) distributions or the redemption of shares. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling (888) 484-5766.

| * | Return figures reflect any change in price per share and assume the reinvestment of all distributions. The DCM/INNOVA Fund’s returns reflect any fee reductions during the applicable period. If such fee reductions had not occurred, the quoted performances would have been lower. |

| (a) | The DCM/INNOVA Fund’s inception date – March 16, 2005 (Date of Initial Public Investment). |

| (b) | The S&P 500® Total Return Index is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the DCM/ INNOVA Fund’s portfolio. |

| (c) | The Dow Jones U.S. Select Dividend Total Return Index consists of 100 of the highest dividend-yielding securities (excluding Real Estate Investment Trusts (REITs)) in the Dow Jones U.S. Index, a broad-based index representative of the total market for the United States equity securities. Individuals cannot invest directly in an index; however, an individual can invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

| (d) | The expense ratios shown are from the DCM/INNOVA Fund’s prospectus dated February 28, 2022. Additional information pertaining to the expense ratios as of October 31, 2022 can be found in the financial highlights. |

An investor should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. The DCM/INNOVA Fund’s prospectus contains this and other important information. To obtain a copy of the Fund’s prospectus please visit our website at http://www.dcmmutualfunds.com or call (888) 484-5766 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest.

The DCM/INNOVA Fund is distributed by Ultimus Fund Distributors, LLC., Member FINRA/SIPC.

| Annual Report | October 31, 2022 | 9 |

Lebenthal Ultra Short Tax-Free Income Fund

Performance Update |

| October 31, 2022 (Unaudited) |

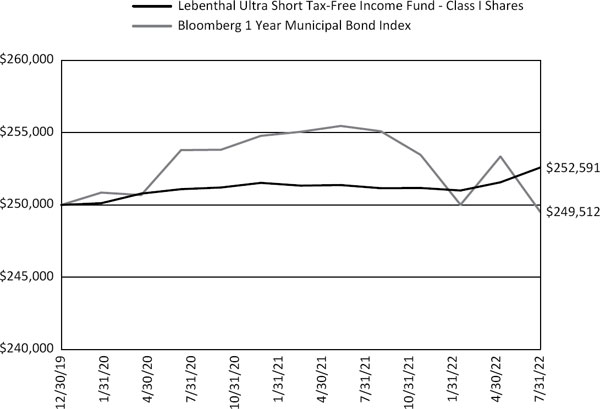

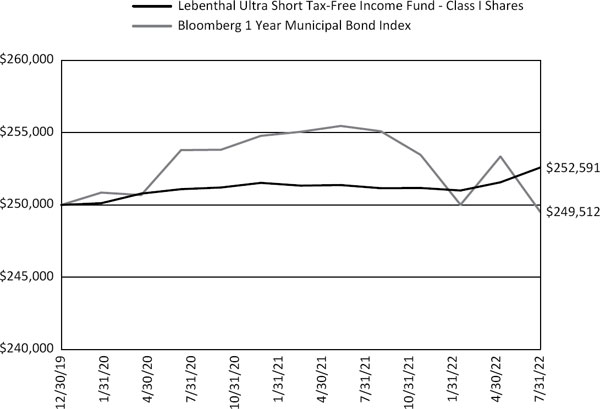

Growth of $250,000 Investment

For the period from December 30, 2019 (inception date) to October 31, 2022:

This graph assumes an initial $250,000 investment on December 30, 2019, the inception date of the Lebenthal Ultra Short Tax-Free Income Fund (the “Lebenthal Fund”) and held through October 31, 2022. All dividends and distributions are reinvested, if any. This graph depicts the performance of the Lebenthal Fund versus the Bloomberg 1 Year Municipal Bond Index. It is important to note that the Lebenthal Fund is a professionally managed mutual fund while the indices are not available for investment and are unmanaged. The comparison is shown for illustrative purposes only.

Lebenthal Ultra Short Tax-Free Income Fund

Performance Update |

| October 31, 2022 (Unaudited) |

Performance Returns for the periods ended October 31, 2022*

| | | Since |

| | One Year | Inception(a) |

| Lebenthal Ultra Short Tax-Free Income Fund - Class I Shares | 0.57% | 0.36% |

| Lebenthal Ultra Short Tax-Free Income Fund - Class A Shares (Without Load) | 0.30% | 0.12% |

| Lebenthal Ultra Short Tax-Free Income Fund - Class A Shares (With Load) | -0.20% | -0.05% |

| Bloomberg 1 Year Municipal Bond Index(b) | -2.19% | -0.07% |

| | | |

| | Expense Ratios(c) |

| | Class A Shares | Class I Shares |

| Gross | 3.35% | 3.10% |

| With Applicable Waivers | 0.74% | 0.49% |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on the Lebenthal Ultra Short Tax-Free Income Fund (the ” Lebenthal Fund”) distributions or the redemption of shares. Current performance may be lower or higher than the performance quoted. In the case of investments at or above $250,000, a contingent deferred sales charge (CDSC) of up to 0.25% may be charged on Class A shares redeemed within 12 months of purchase if you paid no sales charge on the original purchase and a finder’s fee was paid. Performance data current to the most recent month end may be obtained by calling (888) 484-5766.

| * | Return figures reflect any change in price per share and assume the reinvestment of all distributions. The Lebenthal Fund’s returns reflect any fee reductions during the applicable period. If such fee reductions had not occurred, the quoted performances would have been lower. |

| (a) | The Lebenthal Fund’s inception date – December 30, 2019 (Date of Initial Public Investment). |

| (b) | The Bloomberg 1 Year Municipal Bond Index is an unmanaged index of municipal bonds with a remaining maturity of one to two years. Individuals cannot invest directly in an index; however, an individual can invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

| (c) | The expense ratios shown are from the Lebenthal Fund’s prospectus dated February 28, 2022. Additional information pertaining to the expense ratios as of October 31, 2022 can be found in the financial highlights. |

An investor should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. The Fund’s prospectus contains this and other important information. To obtain a copy of the Fund’s prospectus please visit our website at http://www.dcmmutualfunds.com or call (888) 484-5766 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest.

The Lebenthal Fund is distributed by Ultimus Fund Distributors, LLC., Member FINRA/SIPC.

| Annual Report | October 31, 2022 | 11 |

| DCM/INNOVA High Equity Income Innovation Fund |

| Schedule of Investments |

| October 31, 2022 |

| | | Shares | | | Fair Value | |

| COMMON STOCKS — 93.06% | | | | | | | | |

| | | | | | | | | |

| Communications — 6.89% | | | | | | | | |

| Activision Blizzard, Inc. | | | 170 | | | $ | 12,376 | |

| Alphabet, Inc., Class C(a) | | | 1,528 | | | | 144,640 | |

| Alphabet, Inc., Class A(a) | | | 1,876 | | | | 177,300 | |

| AT&T, Inc. | | | 3,433 | | | | 62,584 | |

| Charter Communications, Inc., Class A (a) | | | 23 | | | | 8,455 | |

| Comcast Corp., Class A | | | 1,017 | | | | 32,280 | |

| DISH Network Corp., Class A(a) | | | 48 | | | | 716 | |

| Electronic Arts, Inc. | | | 48 | | | | 6,046 | |

| Expedia Group, Inc.(a) | | | 9 | | | | 841 | |

| Fox Corp., Class B | | | 81 | | | | 2,203 | |

| Fox Corp., Class A | | | 66 | | | | 1,905 | |

| Interpublic Group of Cos., Inc. | | | 114 | | | | 3,396 | |

| Lumen Technologies, Inc. | | | 124 | | | | 913 | |

| Match Group, Inc.(a) | | | 44 | | | | 1,901 | |

| Meta Platforms, Inc., Class A(a) | | | 736 | | | | 68,566 | |

| Netflix, Inc. (a) | | | 100 | | | | 29,188 | |

| News Corp., Class A | | | 69 | | | | 1,164 | |

| News Corp., Class B | | | 79 | | | | 1,353 | |

| Omnicom Group, Inc. | | | 41 | | | | 2,983 | |

| Take-Two Interactive Software, Inc. (a) | | | 46 | | | | 5,450 | |

| T-Mobile US, Inc.(a) | | | 141 | | | | 21,370 | |

| VeriSign, Inc.(a) | | | 22 | | | | 4,410 | |

| Verizon Communications, Inc. | | | 958 | | | | 35,800 | |

| ViacomCBS, Inc., Class B | | | 162 | | | | 2,968 | |

| Walt Disney Co. (The)(a) | | | 395 | | | | 42,084 | |

| Warner Bros. Discovery, Inc.(a) | | | 483 | | | | 6,279 | |

| | | | | | | | 677,171 | |

| Consumer Discretionary — 9.39% | | | | | | | | |

| Advance Auto Parts, Inc. | | | 5 | | | | 950 | |

| Amazon.com, Inc.(a) | | | 2,616 | | | | 267,984 | |

| Aptiv PLC(a) | | | 56 | | | | 5,100 | |

| AutoZone, Inc.(a) | | | 4 | | | | 10,132 | |

| Bath & Body Works, Inc. | | | 1 | | | | 33 | |

| Best Buy Co., Inc. | | | 52 | | | | 3,557 | |

| Booking Holdings, Inc.(a) | | | 11 | | | | 20,564 | |

| BorgWarner, Inc. | | | 143 | | | | 5,367 | |

| Caesars Entertainment, Inc.(a) | | | 119 | | | | 5,204 | |

| CarMax, Inc.(a) | | | 23 | | | | 1,449 | |

| Carnival Corp.(a) | | | 75 | | | | 680 | |

| See Notes to Financial Statements |

| 12 | www.dcmmutualfunds.com |

| DCM/INNOVA High Equity Income Innovation Fund |

| Schedule of Investments |

| October 31, 2022 |

| | | Shares | | | Fair Value | |

| COMMON STOCKS — 93.06% (CONTINUED) | | | | | | | | |

| | | | | | | | | |

| Consumer Discretionary — 9.39% (Continued) | | | | | | | | |

| Chipotle Mexican Grill, Inc.(a) | | | 6 | | | $ | 8,990 | |

| Copart, Inc.(a) | | | 80 | | | | 9,201 | |

| D.R. Horton, Inc. | | | 127 | | | | 9,763 | |

| Darden Restaurants, Inc. | | | 27 | | | | 3,865 | |

| Domino’s Pizza, Inc. | | | 12 | | | | 3,987 | |

| eBay, Inc. | | | 116 | | | | 4,621 | |

| Etsy, Inc.(a) | | | 32 | | | | 3,005 | |

| Ford Motor Co. | | | 816 | | | | 10,910 | |

| Fortune Brands Home & Security, Inc. | | | 21 | | | | 1,267 | |

| General Motors Co. | | | 345 | | | | 13,541 | |

| Genuine Parts Co. | | | 6 | | | | 1,067 | |

| Hasbro, Inc. | | | 21 | | | | 1,370 | |

| Hilton Worldwide Holdings, Inc. | | | 285 | | | | 38,548 | |

| Home Depot, Inc. (The) | | | 358 | | | | 106,016 | |

| Las Vegas Sands Corp.(a) | | | 96 | | | | 3,649 | |

| Lennar Corp., Class A | | | 63 | | | | 5,084 | |

| Live Nation Entertainment, Inc. (a) | | | 12 | | | | 955 | |

| LKQ Corp. | | | 23 | | | | 1,280 | |

| Lowe’s Cos, Inc. | | | 154 | | | | 30,022 | |

| Marriott International, Inc., Class A | | | 50 | | | | 8,006 | |

| Masco Corp. | | | 2 | | | | 93 | |

| McDonald’s Corp. | | | 157 | | | | 42,807 | |

| MGM Resorts International | | | 112 | | | | 3,984 | |

| Newell Brands, Inc. | | | 2 | | | | 28 | |

| NIKE, Inc., Class B | | | 294 | | | | 27,248 | |

| Norwegian Cruise Lines Holdings Ltd.(a) | | | 22 | | | | 372 | |

| NVR, Inc.(a) | | | 1 | | | | 4,238 | |

| O’Reilly Automotive, Inc. (a) | | | 13 | | | | 10,883 | |

| Penn National Gaming, Inc. (a) | | | 52 | | | | 1,721 | |

| Pool Corp. | | | 13 | | | | 3,955 | |

| PulteGroup, Inc. | | | 76 | | | | 3,039 | |

| PVH Corp. | | | 5 | | | | 257 | |

| Ralph Lauren Corp. | | | 2 | | | | 185 | |

| Ross Stores, Inc. | | | 61 | | | | 5,837 | |

| Royal Caribbean Cruises Ltd.(a) | | | 45 | | | | 2,402 | |

| Starbucks Corp. | | | 252 | | | | 21,821 | |

| Tapestry, Inc. | | | 44 | | | | 1,394 | |

| Tesla, Inc.(a) | | | 729 | | | | 165,877 | |

| TJX Cos., Inc. (The) | | | 239 | | | | 17,232 | |

| See Notes to Financial Statements |

| Annual Report | October 31, 2022 | 13 |

| DCM/INNOVA High Equity Income Innovation Fund |

| Schedule of Investments |

| October 31, 2022 |

| | | Shares | | | Fair Value | |

| COMMON STOCKS — 93.06% (CONTINUED) | | | | | | | | |

| | | | | | | | | |

| Consumer Discretionary — 9.39% (Continued) | | | | | | | | |

| Tractor Supply Co. | | | 33 | | | $ | 7,252 | |

| Ulta Beauty, Inc.(a) | | | 12 | | | | 5,032 | |

| VF Corp. | | | 72 | | | | 2,034 | |

| Whirlpool Corp. | | | 3 | | | | 414 | |

| Wynn Resorts Ltd.(a) | | | 31 | | | | 1,981 | |

| Yum! Brands, Inc. | | | 57 | | | | 6,740 | |

| | | | | | | | 922,993 | |

| Consumer Staples — 6.43% | | | | | | | | |

| Altria Group, Inc. | | | 364 | | | | 16,842 | |

| Archer-Daniels-Midland Co. | | | 116 | | | | 11,250 | |

| Brown-Forman Corp., Class B | | | 40 | | | | 2,720 | |

| Campbell Soup Co. | | | 42 | | | | 2,222 | |

| Church & Dwight Co., Inc. | | | 53 | | | | 3,929 | |

| Clorox Co. (The) | | | 23 | | | | 3,359 | |

| Coca-Cola Co. (The) | | | 869 | | | | 52,010 | |

| Colgate-Palmolive Co. | | | 199 | | | | 14,694 | |

| Conagra Brands, Inc. | | | 169 | | | | 6,202 | |

| Constellation Brands, Inc., Class A | | | 23 | | | | 5,683 | |

| Costco Wholesale Corp. | | | 147 | | | | 73,720 | |

| Dollar General Corp. | | | 62 | | | | 15,813 | |

| Dollar Tree, Inc.(a) | | | 45 | | | | 7,133 | |

| Estee Lauder Cos., Inc. (The), Class A | | | 53 | | | | 10,626 | |

| General Mills, Inc. | | | 864 | | | | 70,486 | |

| Hershey Co. (The) | | | 38 | | | | 9,073 | |

| Hormel Foods Corp. | | | 85 | | | | 3,948 | |

| J.M. Smucker Co. (The) | | | 17 | | | | 2,561 | |

| Kellogg Co. | | | 54 | | | | 4,148 | |

| Keurig Dr Pepper, Inc. | | | 256 | | | | 9,943 | |

| Kimberly-Clark Corp. | | | 78 | | | | 9,708 | |

| Kraft Heinz Co. (The) | | | 104 | | | | 4,001 | |

| Kroger Co. (The) | | | 145 | | | | 6,857 | |

| Lamb Weston Holdings, Inc. | | | 18 | | | | 1,552 | |

| McCormick & Co., Inc. | | | 50 | | | | 3,932 | |

| Molson Coors Brewing Co., Class B | | | 17 | | | | 857 | |

| Mondelez International, Inc., Class A | | | 288 | | | | 17,706 | |

| Monster Beverage Corp.(a) | | | 110 | | | | 10,309 | |

| PepsiCo, Inc. | | | 318 | | | | 57,742 | |

| Philip Morris International, Inc. | | | 363 | | | | 33,342 | |

| Procter & Gamble Co. (The) | | | 530 | | | | 71,375 | |

| See Notes to Financial Statements |

| 14 | www.dcmmutualfunds.com |

| DCM/INNOVA High Equity Income Innovation Fund |

| Schedule of Investments |

| October 31, 2022 |

| | | Shares | | | Fair Value | |

| COMMON STOCKS — 93.06% (CONTINUED) | | | | | | | | |

| | | | | | | | | |

| Consumer Staples — 6.43% (Continued) | | | | | | | | |

| Sysco Corp. | | | 102 | | | $ | 8,829 | |

| Target Corp. | | | 122 | | | | 20,039 | |

| Tyson Foods, Inc., Class A | | | 82 | | | | 5,605 | |

| Walgreens Boots Alliance, Inc. | | | 202 | | | | 7,373 | |

| Wal-Mart Stores, Inc. | | | 325 | | | | 46,257 | |

| | | | | | | | 631,846 | |

| Energy — 5.12% | | | | | | | | |

| APA Corp. | | | 22 | | | | 1,000 | |

| Baker Hughes Co. | | | 288 | | | | 7,966 | |

| Chevron Corp. | | | 441 | | | | 79,778 | |

| ConocoPhillips | | | 295 | | | | 37,197 | |

| Coterra Energy, Inc. | | | 219 | | | | 6,817 | |

| Devon Energy Corp. | | | 131 | | | | 10,133 | |

| Diamondback Energy, Inc. | | | 48 | | | | 7,541 | |

| Enphase Energy, Inc.(a) | | | 34 | | | | 10,438 | |

| EOG Resources, Inc. | | | 376 | | | | 51,332 | |

| Exxon Mobil Corp. | | | 924 | | | | 102,389 | |

| Halliburton Co. | | | 238 | | | | 8,668 | |

| Hess Corp. | | | 79 | | | | 11,145 | |

| Kinder Morgan, Inc. | | | 329 | | | | 5,961 | |

| Marathon Oil Corp. | | | 62 | | | | 1,888 | |

| Marathon Petroleum Corp. | | | 154 | | | | 17,497 | |

| Occidental Petroleum Corp. | | | 170 | | | | 12,342 | |

| ONEOK, Inc. | | | 157 | | | | 9,313 | |

| Phillips 66 | | | 108 | | | | 11,263 | |

| Pioneer Natural Resources Co. | | | 66 | | | | 16,923 | |

| Schlumberger Ltd. | | | 366 | | | | 19,043 | |

| SolarEdge Technologies, Inc.(a) | | | 16 | | | | 3,680 | |

| Valero Energy Corp. | | | 549 | | | | 68,928 | |

| Williams Cos., Inc. (The) | | | 80 | | | | 2,618 | |

| | | | | | | | 503,860 | |

| Financials — 10.02% | | | | | | | | |

| Aflac, Inc. | | | 54 | | | | 3,516 | |

| Allstate Corp. (The) | | | 56 | | | | 7,070 | |

| American Express Co. | | | 125 | | | | 18,556 | |

| American International Group, Inc. | | | 187 | | | | 10,659 | |

| Ameriprise Financial, Inc. | | | 22 | | | | 6,801 | |

| Aon PLC, Class A | | | 39 | | | | 10,978 | |

| Arthur J. Gallagher & Co. | | | 61 | | | | 11,412 | |

| See Notes to Financial Statements |

| Annual Report | October 31, 2022 | 15 |

| DCM/INNOVA High Equity Income Innovation Fund |

| Schedule of Investments |

| October 31, 2022 |

| | | Shares | | | Fair Value | |

| COMMON STOCKS — 93.06% (CONTINUED) | | | | | | | | |

| | | | | | | | | |

| Financials — 10.02% (Continued) | | | | | | | | |

| Assurant, Inc. | | | 7 | | | $ | 951 | |

| Bank of America Corp. | | | 2,210 | | | | 79,647 | |

| Bank of New York Mellon Corp. (The) | | | 191 | | | | 8,043 | |

| Berkshire Hathaway, Inc., Class B(a) | | | 398 | | | | 117,445 | |

| BlackRock, Inc. | | | 27 | | | | 17,439 | |

| Brown & Brown, Inc. | | | 68 | | | | 3,998 | |

| Capital One Financial Corp. | | | 92 | | | | 9,754 | |

| Cboe Global Markets, Inc. | | | 19 | | | | 2,366 | |

| Charles Schwab Corp. (The) | | | 356 | | | | 28,362 | |

| Chubb Ltd. | | | 95 | | | | 20,415 | |

| Cincinnati Financial Corp. | | | 70 | | | | 7,232 | |

| Citigroup, Inc. | | | 417 | | | | 19,124 | |

| Citizens Financial Group, Inc. | | | 104 | | | | 4,254 | |

| CME Group, Inc. | | | 81 | | | | 14,037 | |

| Comerica, Inc. | | | 6 | | | | 423 | |

| Discover Financial Services | | | 59 | | | | 6,163 | |

| Everest Re Group Ltd. | | | 26 | | | | 8,389 | |

| F.N.B. Corp. | | | 6,400 | | | | 92,479 | |

| Fifth Third Bancorp | | | 119 | | | | 4,247 | |

| First Republic Bank | | | 36 | | | | 4,324 | |

| Franklin Resources, Inc. | | | 93 | | | | 2,181 | |

| Globe Life, Inc. | | | 5 | | | | 578 | |

| Goldman Sachs Group, Inc. (The) | | | 77 | | | | 26,527 | |

| Hartford Financial Services Group, Inc. (The) | | | 15 | | | | 1,086 | |

| Huntington Bancshares, Inc. | | | 287 | | | | 4,357 | |

| Intercontinental Exchange, Inc. | | | 131 | | | | 12,520 | |

| Invesco Ltd. | | | 88 | | | | 1,348 | |

| JPMorgan Chase & Co. | | | 837 | | | | 105,361 | |

| KeyCorp | | | 156 | | | | 2,788 | |

| Lincoln National Corp. | | | 46 | | | | 2,478 | |

| Loews Corp. | | | 5 | | | | 285 | |

| M&T Bank Corp. | | | 30 | | | | 5,051 | |

| Marsh & McLennan Cos., Inc. | | | 119 | | | | 19,217 | |

| MetLife, Inc. | | | 148 | | | | 10,835 | |

| Morgan Stanley | | | 312 | | | | 25,637 | |

| Nasdaq, Inc. | | | 69 | | | | 4,295 | |

| Northern Trust Corp. | | | 44 | | | | 3,711 | |

| PNC Financial Services Group, Inc. (The) | | | 85 | | | | 13,756 | |

| Principal Financial Group, Inc. | | | 41 | | | | 3,613 | |

| See Notes to Financial Statements |

| 16 | www.dcmmutualfunds.com |

| DCM/INNOVA High Equity Income Innovation Fund |

| Schedule of Investments |

| October 31, 2022 |

| | | Shares | | | Fair Value | |

| COMMON STOCKS — 93.06% (CONTINUED) | | | | | | | | |

| | | | | | | | | |

| Financials — 10.02% (Continued) | | | | | | | | |

| Progressive Corp. (The) | | | 149 | | | $ | 19,132 | |

| Prudential Financial, Inc. | | | 735 | | | | 77,315 | |

| Raymond James Financial, Inc. | | | 63 | | | | 7,443 | |

| Regions Financial Corp. | | | 101 | | | | 2,217 | |

| Signature Bank | | | 13 | | | | 2,061 | |

| State Street Corp. | | | 76 | | | | 5,624 | |

| SVB Financial Group(a) | | | 54 | | | | 12,472 | |

| Synchrony Financial | | | 142 | | | | 5,050 | |

| T. Rowe Price Group, Inc. | | | 74 | | | | 7,856 | |

| Travelers Cos., Inc. (The) | | | 58 | | | | 10,699 | |

| Truist Financial Corp. | | | 364 | | | | 16,304 | |

| U.S. Bancorp | | | 316 | | | | 13,414 | |

| W.R. Berkley Corp. | | | 31 | | | | 2,306 | |

| Wells Fargo & Co. | | | 753 | | | | 34,630 | |

| Willis Towers Watson PLC | | | 22 | | | | 4,801 | |

| Zions Bancorporation | | | 3 | | | | 156 | |

| | | | | | | | 985,188 | |

| Health Care — 13.68% | | | | | | | | |

| Abbott Laboratories | | | 686 | | | | 67,873 | |

| AbbVie, Inc. | | | 410 | | | | 60,024 | |

| ABIOMED, Inc.(a) | | | 9 | | | | 2,269 | |

| Agilent Technologies, Inc. | | | 48 | | | | 6,641 | |

| Align Technology, Inc.(a) | | | 21 | | | | 4,080 | |

| AmerisourceBergen Corp. | | | 64 | | | | 10,062 | |

| Amgen, Inc. | | | 121 | | | | 32,712 | |

| Anthem, Inc. | | | 52 | | | | 28,432 | |

| Baxter International, Inc. | | | 113 | | | | 6,142 | |

| Becton, Dickinson and Co. | | | 58 | | | | 13,686 | |

| Biogen, Inc.(a) | | | 22 | | | | 6,236 | |

| Bio-Rad Laboratories, Inc., Class A(a) | | | 8 | | | | 2,814 | |

| Bio-Techne Corp. | | | 12 | | | | 3,555 | |

| Boston Scientific Corp.(a) | | | 281 | | | | 12,114 | |

| Bristol-Myers Squibb Co. | | | 529 | | | | 40,982 | |

| Cardinal Health, Inc. | | | 76 | | | | 5,768 | |

| Catalent, Inc.(a) | | | 39 | | | | 2,563 | |

| Centene Corp.(a) | | | 237 | | | | 20,176 | |

| Charles River Laboratories International, Inc. (a) | | | 10 | | | | 2,123 | |

| Cigna Corp. | | | 92 | | | | 29,722 | |

| Cooper Cos., Inc. (The) | | | 15 | | | | 4,101 | |

| See Notes to Financial Statements |

| Annual Report | October 31, 2022 | 17 |

| DCM/INNOVA High Equity Income Innovation Fund |

| Schedule of Investments |

| October 31, 2022 |

| | | Shares | | | Fair Value | |

| COMMON STOCKS — 93.06% (CONTINUED) | | | | | | | | |

| | | | | | | | | |

| Health Care — 13.68% (Continued) | | | | | | | | |

| CVS Health Corp. | | | 328 | | | $ | 31,062 | |

| Danaher Corp. | | | 241 | | | | 60,652 | |

| DaVita, Inc.(a) | | | 4 | | | | 292 | |

| DENTSPLY SIRONA, Inc. | | | 51 | | | | 1,572 | |

| DexCom, Inc.(a) | | | 108 | | | | 13,044 | |

| Edwards LifeSciences Corp.(a) | | | 140 | | | | 10,140 | |

| Eli Lilly & Co. | | | 284 | | | | 102,834 | |

| Embecta Corp. | | | 160 | | | | 4,947 | |

| Gilead Sciences, Inc. | | | 279 | | | | 21,890 | |

| HCA Healthcare, Inc. | | | 56 | | | | 12,178 | |

| Henry Schein, Inc.(a) | | | 5 | | | | 342 | |

| Hologic, Inc.(a) | | | 45 | | | | 3,051 | |

| Humana, Inc. | | | 27 | | | | 15,068 | |

| IDEXX Laboratories, Inc.(a) | | | 6 | | | | 2,158 | |

| Illumina, Inc.(a) | | | 31 | | | | 7,093 | |

| Incyte Corp.(a) | | | 86 | | | | 6,393 | |

| Intuitive Surgical, Inc.(a) | | | 80 | | | | 19,718 | |

| IQVIA Holdings, Inc.(a) | | | 33 | | | | 6,919 | |

| Johnson & Johnson | | | 602 | | | | 104,730 | |

| Laboratory Corp. of America Holdings | | | 21 | | | | 4,659 | |

| McKesson Corp. | | | 30 | | | | 11,681 | |

| Medtronic PLC | | | 284 | | | | 24,805 | |

| Merck & Co., Inc. | | | 572 | | | | 57,886 | |

| Mettler-Toledo International, Inc. (a) | | | 5 | | | | 6,325 | |

| Moderna, Inc.(a) | | | 85 | | | | 12,778 | |

| Molina Healthcare, Inc.(a) | | | 25 | | | | 8,972 | |

| Organon & Co. | | | 24 | | | | 628 | |

| PerkinElmer, Inc. | | | 21 | | | | 2,805 | |

| Pfizer, Inc. | | | 1,932 | | | | 89,935 | |

| Quest Diagnostics, Inc. | | | 27 | | | | 3,879 | |

| Regeneron Pharmaceuticals, Inc. (a) | | | 23 | | | | 17,221 | |

| ResMed, Inc. | | | 35 | | | | 7,829 | |

| STERIS PLC | | | 23 | | | | 3,969 | |

| Stryker Corp. | | | 71 | | | | 16,276 | |

| Teleflex, Inc. | | | 6 | | | | 1,287 | |

| Thermo Fisher Scientific, Inc. | | | 131 | | | | 67,330 | |

| UnitedHealth Group, Inc. | | | 301 | | | | 167,100 | |

| Universal Health Services, Inc., Class B | | | 13 | | | | 1,506 | |

| Vertex Pharmaceuticals, Inc.(a) | | | 66 | | | | 20,592 | |

| See Notes to Financial Statements |

| 18 | www.dcmmutualfunds.com |

| DCM/INNOVA High Equity Income Innovation Fund |

| Schedule of Investments |

| October 31, 2022 |

| | | Shares | | | Fair Value | |

| COMMON STOCKS — 93.06% (CONTINUED) | | | | | | | | |

| | | | | | | | | |

| Health Care — 13.68% (Continued) | | | | | | | | |

| Viatris, Inc. | | | 365 | | | $ | 3,697 | |

| Waters Corp.(a) | | | 15 | | | | 4,488 | |

| West Pharmaceutical Services, Inc. | | | 20 | | | | 4,602 | |

| Zimmer Biomet Holdings, Inc. | | | 13 | | | | 1,474 | |

| Zoetis, Inc., Class A | | | 113 | | | | 17,038 | |

| | | | | | | | 1,344,920 | |

| Industrials — 7.50% | | | | | | | | |

| 3M Co. | | | 165 | | | | 20,755 | |

| A.O. Smith Corp. | | | 19 | | | | 1,041 | |

| Alaska Air Group, Inc.(a) | | | 74 | | | | 3,290 | |

| Allegion PLC | | | 26 | | | | 2,724 | |

| American Airlines Group, Inc.(a) | | | 129 | | | | 1,829 | |

| AMETEK, Inc. | | | 66 | | | | 8,558 | |

| Amphenol Corp., Class A | | | 722 | | | | 54,748 | |

| Boeing Co. (The)(a) | | | 115 | | | | 16,389 | |

| Carrier Global Corp. | | | 204 | | | | 8,111 | |

| Caterpillar, Inc. | | | 118 | | | | 25,542 | |

| CH Robinson Worldwide, Inc. | | | 51 | | | | 4,984 | |

| Cintas Corp. | | | 18 | | | | 7,696 | |

| CSX Corp. | | | 313 | | | | 9,096 | |

| Cummins, Inc. | | | 46 | | | | 11,248 | |

| Deere & Co. | | | 53 | | | | 20,978 | |

| Delta Air Lines, Inc.(a) | | | 140 | | | | 4,750 | |

| Dover Corp. | | | 29 | | | | 3,790 | |

| Eaton Corp. PLC | | | 72 | | | | 10,805 | |

| Emerson Electric Co. | | | 159 | | | | 13,769 | |

| Expeditors International of Washington, Inc. | | | 82 | | | | 8,024 | |

| Fastenal Co. | | | 209 | | | | 10,101 | |

| FedEx Corp. | | | 55 | | | | 8,815 | |

| Fortive Corp. | | | 17 | | | | 1,086 | |

| Generac Holdings, Inc.(a) | | | 17 | | | | 1,970 | |

| General Dynamics Corp. | | | 63 | | | | 15,737 | |

| General Electric, Co. | | | 196 | | | | 15,251 | |

| Honeywell International, Inc. | | | 141 | | | | 28,768 | |

| Howmet Aerospace Inc. | | | 1 | | | | 36 | |

| Huntington Ingalls Industries, Inc. | | | 16 | | | | 4,113 | |

| IDEX Corp. | | | 21 | | | | 4,669 | |

| Illinois Tool Works, Inc. | | | 63 | | | | 13,452 | |

| Ingersoll Rand, Inc. | | | 152 | | | | 7,676 | |

| See Notes to Financial Statements |

| Annual Report | October 31, 2022 | 19 |

| DCM/INNOVA High Equity Income Innovation Fund |

| Schedule of Investments |

| October 31, 2022 |

| | | Shares | | | Fair Value | |

| COMMON STOCKS — 93.06% (CONTINUED) | | | | | | | | |

| | | | | | | | | |

| Industrials — 7.50% (Continued) | | | | | | | | |

| Jacobs Solutions, Inc. 47 $5,416 | | | | | | | | |

| JB Hunt Transport Services, Inc. | | | 30 | | | | 5,132 | |

| Johnson Controls International PLC | | | 103 | | | | 5,958 | |

| Keysight Technologies, Inc.(a) | | | 50 | | | | 8,708 | |

| L3 Harris Technologies, Inc. | | | 69 | | | | 17,006 | |

| Lockheed Martin Corp. | | | 47 | | | | 22,874 | |

| Nordson Corp. | | | 9 | | | | 2,025 | |

| Norfolk Southern Corp. | | | 34 | | | | 7,754 | |

| Northrop Grumman Corp. | | | 28 | | | | 15,372 | |

| Old Dominion Freight Line, Inc. | | | 19 | | | | 5,217 | |

| Otis Worldwide Corp. | | | 109 | | | | 7,700 | |

| PACCAR, Inc. | | | 99 | | | | 9,586 | |

| Parker-Hannifin Corp. | | | 35 | | | | 10,172 | |

| Pentair PLC | | | 1 | | | | 43 | |

| Quanta Services, Inc. | | | 35 | | | | 4,971 | |

| Raytheon Technologies Corp. | | | 341 | | | | 32,334 | |

| Republic Services, Inc. | | | 54 | | | | 7,161 | |

| Robert Half International, Inc. | | | 33 | | | | 2,523 | |

| Rockwell Automation, Inc. | | | 30 | | | | 7,659 | |

| Rollins, Inc. | | | 94 | | | | 3,956 | |

| Roper Technologies, Inc. | | | 23 | | | | 9,534 | |

| Snap-on, Inc. | | | 3 | | | | 666 | |

| Southwest Airlines Co.(a) | | | 150 | | | | 5,453 | |

| Stanley Black & Decker, Inc. | | | 22 | | | | 1,727 | |

| TE Connectivity Ltd. | | | 68 | | | | 8,312 | |

| Teledyne Technologies, Inc.(a) | | | 13 | | | | 5,174 | |

| Textron, Inc. | | | 23 | | | | 1,574 | |

| Trane Technologies PLC | | | 38 | | | | 6,066 | |

| Transdigm Group, Inc. | | | 11 | | | | 6,333 | |

| Trimble, Inc.(a) | | | 66 | | | | 3,971 | |

| Union Pacific Corp. | | | 256 | | | | 50,468 | |

| United Airlines Holdings, Inc.(a) | | | 101 | | | | 4,351 | |

| United Parcel Service, Inc., Class B | | | 180 | | | | 30,199 | |

| United Rentals, Inc.(a) | | | 17 | | | | 5,367 | |

| W.W. Grainger, Inc. | | | 12 | | | | 7,012 | |

| Wabtec Corp. | | | 66 | | | | 6,156 | |

| Waste Management, Inc. | | | 98 | | | | 15,520 | |

| Watsco, Inc. | | | 130 | | | | 35,225 | |

| Xylem, Inc. | | | 31 | | | | 3,175 | |

| | | | | | | | 737,651 | |

| See Notes to Financial Statements |

| 20 | www.dcmmutualfunds.com |

| DCM/INNOVA High Equity Income Innovation Fund |

| Schedule of Investments |

| October 31, 2022 |

| | | Shares | | | Fair Value | |

| COMMON STOCKS — 93.06% (CONTINUED) | | | | | | | | |

| | | | | | | | | |

| Materials — 2.66% | | | | | | | | |

| Air Products & Chemicals, Inc. | | | 60 | | | $ | 15,024 | |

| Albemarle Corp. | | | 23 | | | | 6,437 | |

| Amcor PLC | | | 822 | | | | 9,519 | |

| Avery Dennison Corp. | | | 35 | | | | 5,934 | |

| Ball Corp. | | | 73 | | | | 3,605 | |

| Celanese Corp. | | | 39 | | | | 3,749 | |

| CF Industries Holdings, Inc. | | | 32 | | | | 3,400 | |

| Corteva, Inc. | | | 74 | | | | 4,835 | |

| Dow, Inc. | | | 188 | | | | 8,787 | |

| DuPont de Nemours, Inc. | | | 1 | | | | 57 | |

| Eastman Chemical Co. | | | 22 | | | | 1,690 | |

| Ecolab, Inc. | | | 35 | | | | 5,497 | |

| FMC Corp. | | | 29 | | | | 3,448 | |

| Freeport-McMoRan, Inc. | | | 315 | | | | 9,982 | |

| International Flavors & Fragrances, Inc. | | | 96 | | | | 9,371 | |

| International Paper Co. | | | 35 | | | | 1,176 | |

| Linde PLC | | | 186 | | | | 55,307 | |

| LyondellBasell Industries N.V., Class A | | | 738 | | | | 56,420 | |

| Martin Marietta Materials, Inc. | | | 15 | | | | 5,040 | |

| Mosaic Co. (The) | | | 57 | | | | 3,064 | |

| Newmont Corp. | | | 196 | | | | 8,295 | |

| Nippon Steel Trading Corp. | | | 100 | | | | 3,443 | |

| Nucor Corp. | | | 74 | | | | 9,723 | |

| Packaging Corp. of America | | | 27 | | | | 3,246 | |

| PPG Industries, Inc. | | | 56 | | | | 6,394 | |

| Sealed Air Corp. | | | 28 | | | | 1,333 | |

| Sherwin-Williams Co. (The) | | | 54 | | | | 12,152 | |

| Shougang Fushan Resources Group Ltd. | | | 2,000 | | | | 543 | |

| Vulcan Materials Co. | | | 16 | | | | 2,619 | |

| WestRock Co. | | | 59 | | | | 2,010 | |

| | | | | | | | 262,100 | |

| Real Estate — 1.91% | | | | | | | | |

| Alexandria Real Estate Equities, Inc. | | | 58 | | | | 8,427 | |

| American Tower Corp. | | | 104 | | | | 21,548 | |

| AvalonBay Communities, Inc. | | | 29 | | | | 5,078 | |

| Boston Properties, Inc. | | | 29 | | | | 2,108 | |

| Camden Property Trust | | | 22 | | | | 2,542 | |

| CBRE Group, Inc., Class A(a) | | | 115 | | | | 8,158 | |

| Crown Castle International Corp. | | | 91 | | | | 12,127 | |

| See Notes to Financial Statements |

| Annual Report | October 31, 2022 | 21 |

| DCM/INNOVA High Equity Income Innovation Fund |

| Schedule of Investments |

| October 31, 2022 |

| | | Shares | | | Fair Value | |

| COMMON STOCKS — 93.06% (CONTINUED) | | | | | | | | |

| | | | | | | | | |

| Real Estate — 1.91% (Continued) | | | | | | | | |

| Digital Realty Trust, Inc. | | | 74 | | | $ | 7,419 | |

| Equinix, Inc. | | | 18 | | | | 10,196 | |

| Equity Residential | | | 73 | | | | 4,600 | |

| Essex Property Trust, Inc. | | | 12 | | | | 2,667 | |

| Extra Space Storage, Inc. | | | 30 | | | | 5,323 | |

| Federal Realty Investment Trust | | | 6 | | | | 594 | |

| Healthpeak Properties, Inc. | | | 129 | | | | 3,061 | |

| Host Hotels & Resorts, Inc. | | | 13 | | | | 245 | |

| Iron Mountain, Inc. | | | 64 | | | | 3,204 | |

| Kimco Realty Corp. | | | 125 | | | | 2,673 | |

| Mid-America Apartment Communities, Inc. | | | 17 | | | | 2,677 | |

| Prologis, Inc. | | | 204 | | | | 22,593 | |

| Public Storage | | | 20 | | | | 6,195 | |

| Realty Income Corp. | | | 218 | | | | 13,575 | |

| Regency Centers Corp. | | | 16 | | | | 968 | |

| SBA Communications Corp., Class A | | | 23 | | | | 6,208 | |

| Simon Property Group, Inc. | | | 72 | | | | 7,847 | |

| UDR, Inc. | | | 81 | | | | 3,221 | |

| Ventas, Inc. | | | 72 | | | | 2,817 | |

| VICI Properties, Inc. | | | 358 | | | | 11,463 | |

| Vornado Realty Trust | | | 25 | | | | 590 | |

| Welltower, Inc. | | | 112 | | | | 6,836 | |

| Weyerhaeuser Co. | | | 91 | | | | 2,815 | |

| | | | | | | | 187,775 | |

| Technology — 25.54% | | | | | | | | |

| Accenture PLC, Class A | | | 150 | | | | 42,585 | |

| Adobe, Inc.(a) | | | 162 | | | | 51,597 | |

| Advanced Micro Devices, Inc.(a) | | | 379 | | | | 22,763 | |

| Akamai Technologies, Inc.(a) | | | 36 | | | | 3,180 | |

| Analog Devices, Inc. | | | 109 | | | | 15,546 | |

| ANSYS, Inc.(a) | | | 18 | | | | 3,981 | |

| Apple, Inc. | | | 4,401 | | | | 674,849 | |

| Applied Materials, Inc. | | | 208 | | | | 18,364 | |

| Arista Networks, Inc.(a) | | | 51 | | | | 6,164 | |

| Autodesk, Inc.(a) | | | 52 | | | | 11,144 | |

| Automatic Data Processing, Inc. | | | 88 | | | | 21,270 | |

| Broadcom, Inc. | | | 138 | | | | 64,877 | |

| Broadridge Financial Solutions, Inc. | | | 35 | | | | 5,252 | |

| Cadence Design Systems, Inc.(a) | | | 62 | | | | 9,386 | |

| See Notes to Financial Statements |

| 22 | www.dcmmutualfunds.com |

| DCM/INNOVA High Equity Income Innovation Fund |

| Schedule of Investments |

| October 31, 2022 |

| | | Shares | | | Fair Value | |

| COMMON STOCKS — 93.06% (CONTINUED) | | | | | | | | |

| | | | | | | | | |

| Technology — 25.54% (Continued) | | | | | | | | |

| CDW Corp. | | | 26 | | | $ | 4,493 | |

| Ceridian HCM Holding, Inc.(a) | | | 9 | | | | 596 | |

| Cisco Systems, Inc. | | | 1,433 | | | | 65,101 | |

| Cognizant Technology Solutions Corp., Class A | | | 107 | | | | 6,661 | |

| Corning, Inc. | | | 181 | | | | 5,823 | |

| DXC Technology Co.(a) | | | 1 | | | | 29 | |

| EPAM Systems, Inc.(a) | | | 14 | | | | 4,900 | |

| Equifax, Inc. | | | 19 | | | | 3,221 | |

| F5, Inc.(a) | | | 6 | | | | 857 | |

| FactSet Research Systems, Inc. | | | 10 | | | | 4,255 | |

| Fidelity National Information Services, Inc. | | | 165 | | | | 13,693 | |

| Fiserv, Inc.(a) | | | 175 | | | | 17,980 | |

| FleetCor Technologies, Inc.(a) | | | 19 | | | | 3,536 | |

| Fortinet, Inc. (a) | | | 502 | | | | 28,694 | |

| Garmin Ltd. | | | 345 | | | | 30,374 | |

| Gartner, Inc.(a) | | | 22 | | | | 6,642 | |

| Global Payments, Inc. | | | 93 | | | | 10,626 | |

| Hewlett Packard Enterprise Co. | | | 256 | | | | 3,653 | |

| HP, Inc. | | | 217 | | | | 5,994 | |

| Intel Corp. | | | 921 | | | | 26,184 | |

| International Business Machines Corp. | | | 408 | | | | 56,422 | |

| Intuit, Inc. | | | 58 | | | | 24,795 | |

| Jack Henry & Associates, Inc. | | | 18 | | | | 3,583 | |

| Juniper Networks, Inc. | | | 3 | | | | 92 | |

| KLA Corp. | | | 33 | | | | 10,443 | |

| Lam Research Corp. | | | 30 | | | | 12,143 | |

| Leidos Holdings, Inc. | | | 17 | | | | 1,727 | |

| MarketAxess Holdings, Inc. | | | 9 | | | | 2,196 | |

| MasterCard, Inc., Class A | | | 256 | | | | 84,015 | |

| Microchip Technology, Inc. | | | 99 | | | | 6,112 | |

| Micron Technology, Inc. | | | 229 | | | | 12,389 | |

| Microsoft Corp. | | | 2,210 | | | | 513,007 | |

| Monolithic Power Systems, Inc. | | | 13 | | | | 4,413 | |

| Moody’s Corp. | | | 36 | | | | 9,535 | |

| Motorola Solutions, Inc. | | | 37 | | | | 9,239 | |

| MSCI, Inc. | | | 18 | | | | 8,439 | |

| NetApp, Inc. | | | 43 | | | | 2,979 | |

| NortonLifeLock, Inc. | | | 3 | | | | 68 | |

| NVIDIA Corp. | | | 826 | | | | 111,485 | |

| See Notes to Financial Statements |

| Annual Report | October 31, 2022 | 23 |

| DCM/INNOVA High Equity Income Innovation Fund |

| Schedule of Investments |

| October 31, 2022 |

| | | Shares | | | Fair Value | |

| COMMON STOCKS — 93.06% (CONTINUED) | | | | | | | | |

| | | | | | | | | |

| Technology — 25.54% (Continued) | | | | | | | | |

| NXP Semiconductors NV | | | 64 | | | $ | 9,349 | |

| ON Semiconductor Corp.(a) | | | 34 | | | | 2,089 | |

| Oracle Corp. | | | 331 | | | | 25,841 | |

| Paychex, Inc. | | | 60 | | | | 7,099 | |

| Paycom Software, Inc. (a) | | | 12 | | | | 4,152 | |

| PayPal Holdings, Inc.(a) | | | 266 | | | | 22,232 | |

| PTC, Inc.(a) | | | 27 | | | | 3,181 | |

| Qorvo, Inc.(a) | | | 29 | | | | 2,496 | |

| Qualcomm, Inc. | | | 258 | | | | 30,356 | |

| S&P Global, Inc. | | | 185 | | | | 59,431 | |

| Salesforce.com, Inc.(a) | | | 380 | | | | 61,784 | |

| Seagate Technology PLC | | | 42 | | | | 2,086 | |

| ServiceNow, Inc.(a) | | | 88 | | | | 37,025 | |

| Skyworks Solutions, Inc. | | | 44 | | | | 3,784 | |

| Synopsys, Inc.(a) | | | 33 | | | | 9,654 | |

| Teradyne, Inc. | | | 56 | | | | 4,556 | |

| Texas Instruments, Inc. | | | 208 | | | | 33,411 | |

| Tyler Technologies, Inc.(a) | | | 14 | | | | 4,527 | |

| Verisk Analytics, Inc. | | | 5 | | | | 914 | |

| Visa, Inc., Class A | | | 549 | | | | 113,732 | |

| Western Digital Corp.(a) | | | 50 | | | | 1,719 | |

| Zebra Technologies Corp., Class A(a) | | | 15 | | | | 4,248 | |

| | | | | | | | 2,511,018 | |

| Utilities — 3.92% | | | | | | | | |

| AES Corp. | | | 113 | | | | 2,956 | |

| Alliant Energy Corp. | | | 53 | | | | 2,765 | |

| Ameren Corp. | | | 67 | | | | 5,462 | |

| American Electric Power Co., Inc. | | | 118 | | | | 10,375 | |

| American Water Works Co., Inc. | | | 39 | | | | 5,669 | |

| Atmos Energy Corp. | | | 40 | | | | 4,262 | |

| CenterPoint Energy, Inc. | | | 129 | | | | 3,691 | |

| CMS Energy Corp. | | | 71 | | | | 4,051 | |

| Consolidated Edison, Inc. | | | 80 | | | | 7,037 | |

| Constellation Energy Corp. | | | 48 | | | | 4,538 | |

| Dominion Energy, Inc. | | | 178 | | | | 12,455 | |

| DTE Energy Co. | | | 1,016 | | | | 113,903 | |

| Duke Energy Corp. | | | 184 | | | | 17,144 | |

| Edison International | | | 114 | | | | 6,845 | |

| Entergy Corp. | | | 669 | | | | 71,676 | |

| See Notes to Financial Statements |

| 24 | www.dcmmutualfunds.com |

| DCM/INNOVA High Equity Income Innovation Fund |

| Schedule of Investments |

| October 31, 2022 |

| | | Shares | | | Fair Value | |

| COMMON STOCKS — 93.06% (CONTINUED) | | | | | | | | |

| | | | | | | | | |

| Utilities — 3.92% (Continued) | | | | | | | | |

| Evergy, Inc. | | | 99 | | | $ | 6,052 | |

| Eversource Energy | | | 88 | | | | 6,713 | |

| Exelon Corp. | | | 116 | | | | 4,476 | |

| FirstEnergy Corp. | | | 142 | | | | 5,355 | |

| NextEra Energy, Inc. | | | 419 | | | | 32,472 | |

| Nisource, Inc. | | | 73 | | | | 1,875 | |

| NRG Energy, Inc. | | | 168 | | | | 7,459 | |

| Pinnacle West Capital Corp. | | | 62 | | | | 4,167 | |

| PPL Corp. | | | 50 | | | | 1,325 | |

| Public Service Enterprise Group, Inc. | | | 46 | | | | 2,579 | |

| Sempra Energy | | | 67 | | | | 10,113 | |

| Southern Co. (The) | | | 224 | | | | 14,668 | |

| WEC Energy Group, Inc. | | | 74 | | | | 6,758 | |

| Xcel Energy, Inc. | | | 125 | | | | 8,139 | |

| | | | | | | | 384,980 | |

| Total Common Stocks (Cost $9,690,025) | | | | | | | 9,149,502 | |

| | | | | | | | | |

| EXCHANGE-TRADED FUNDS — 5.13% | | | | | | | | |

| | | | | | | | | |

| iShares S&P 500 Growth ETF | | | 4,357 | | | | 263,207 | |

| SPDR S&P 500 ETF Trust | | | 625 | | | | 241,381 | |

| | | | | | | | | |

| Total Exchange-Traded Funds (Cost $540,317) | | | | | | | 504,588 | |

| | | | | | | | | |

| MONEY MARKET FUNDS — 0.32% | | | | | | | | |

| | | | | | | | | |

| First American Treasury Obligations Fund, Class X, 3.67%(b) | | | 31,801 | | | | 31,801 | |

| | | | | | | | | |

| Total Money Market Funds (Cost $31,801) | | | | | | | 31,801 | |

| | | | | | | | | |

| Total Investments — 98.51% (Cost $10,262,143) | | | | | | | 9,685,891 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 1.49% | | | | | | | 146,206 | |

| | | | | | | | | |

| NET ASSETS — 100.00% | | | | | | $ | 9,832,097 | |

| (a) | Non-income producing security. |

| (b) | Rate disclosed is the seven day effective yield as of October 31, 2022. |

ETF - Exchange-Traded Fund

SPDR - Standard & Poor’s Depositary Receipt

| See Notes to Financial Statements |

| Annual Report | October 31, 2022 | 25 |

| DCM/INNOVA High Equity Income Innovation Fund |

| Schedule of Investments |

| October 31, 2022 |

| Summary of Investments | | % of Net Assets | | | Fair Value | |

| Common Stocks | | | | | | | | |

| Communications | | | 6.89 | % | | $ | 677,171 | |

| Consumer Discretionary | | | 9.39 | % | | | 922,993 | |

| Consumer Staples | | | 6.43 | % | | | 631,846 | |

| Energy | | | 5.12 | % | | | 503,860 | |

| Financials | | | 10.02 | % | | | 985,188 | |

| Health Care | | | 13.68 | % | | | 1,344,920 | |

| Industrials | | | 7.50 | % | | | 737,651 | |

| Materials | | | 2.66 | % | | | 262,100 | |

| Real Estate | | | 1.91 | % | | | 187,775 | |

| Technology | | | 25.54 | % | | | 2,511,018 | |

| Utilities | | | 3.92 | % | | | 384,980 | |

| Exchange-Traded Funds | | | 5.13 | % | | | 504,588 | |

| Money Market Funds | | | 0.32 | % | | | 31,801 | |

| Other Assets in Excess of Liabilities | | | 1.49 | % | | | 146,206 | |

| Total | | | 100.00 | % | | $ | 9,832,097 | |

| See Notes to Financial Statements |

| 26 | www.dcmmutualfunds.com |

| Lebenthal Ultra Short Tax-Free Income Fund |

| Schedule of Investments |

| October 31, 2022 |

| | | Principal | | | | |

| | | Amount | | | Fair Value | |

| MUNICIPAL BONDS — 95.32% | | | | | | | | |

| Colorado — 0.06% | | | | | | | | |

| City & County of Denver, CO Airport System Revenue Bonds, Series 2012 B, 5.00%, 11/15/2022 | | $ | 5,000 | | | $ | 5,003 | |

| | | | | | | | | |

| Connecticut — 0.06% | | | | | | | | |

| University of Connecticut General Obligation Bonds, Series 2019 A, 5.00%, 11/1/2022 | | | 5,000 | | | | 5,000 | |

| | | | | | | | | |

| District of Columbia — 6.37% | | | | | | | | |

| District of Columbia Carnegie Endowment for International Peace Revenue Bonds, Series 2006, 2.23%, 11/1/2045(a) | | | 300,000 | | | | 300,000 | |

| District of Columbia Water & Sewer Authority Public Utilities Revenue Bonds, Series 2014 B-2, 2.26%, 10/1/2050(a) | | | 250,000 | | | | 250,000 | |

| | | | | | | | 550,000 | |

| Florida — 3.48% | | | | | | | | |

| JEA Water & Sewer System Revenue Bonds, Series 2008 B, 2.30%, 10/1/2041(a) | | | 300,000 | | | | 300,000 | |

| | | | | | | | | |

| Illinois — 8.11% | | | | | | | | |

| Chicago Midway International Airport Second Lien Revenue Bonds, Series 2004 D, 2.23%, 1/1/2035(a) | | | 300,000 | | | | 300,000 | |

| Illinois Educational Facilities Authority Revenue Bonds, Series 2003 B, 2.23%, 7/1/2033(a) | | | 400,000 | | | | 400,000 | |

| | | | | | | | 700,000 | |

| Maryland — 3.42% | | | | | | | | |

| Washington Suburban Sanitary District General Obligation Multi-Modal Bond Anticipation Notes, Series 2016 B-4, 2.25%, 6/1/2023(a) | | | 200,000 | | | | 200,000 | |

| Washington Suburban Sanitary District General Obligation Multi-Modal Bond Anticipation Notes, Series 2015 B-3, 2.25%, 6/1/2023(a) | | | 95,000 | | | | 95,000 | |

| | | | | | | | 295,000 | |

| See Notes to Financial Statements | |

| Annual Report | October 31, 2022 | 27 |

| Lebenthal Ultra Short Tax-Free Income Fund |

| Schedule of Investments |

| October 31, 2022 |

| | | Principal | | | | |

| | | Amount | | | Fair Value | |

| MUNICIPAL BONDS — 95.32% (CONTINUED) | | | | | | | | |

| Massachusetts — 11.01% | | | | | | | | |

| Massachusetts State Health & Educational Facilities Authority Revenue Bonds, Series 2001 J-2, 2.12%, 7/1/2031(a) | | $ | 300,000 | | | $ | 300,000 | |

| Massachusetts State Housing Finance Agency Housing Revenue Bonds, Series 2018 200, 2.24%, 12/1/2048(a) | | | 350,000 | | | | 350,000 | |

| Massachusetts Water Resources Authority Revenue Bonds, Series 2008 E, 2.25%, 8/1/2037(a) | | | 300,000 | | | | 300,000 | |

| | | | | | | | 950,000 | |

| Nevada — 0.93% | | | | | | | | |

| County of Washoe, NV General Obligation Bonds, Series 2021, 5.00%, 12/1/2022 | | | 80,000 | | | | 80,119 | |

| | | | | | | | | |

| New York — 27.70% | | | | | | | | |

| Battery Park City Authority Junior Revenue Bonds, Series 2019 D-1, 2.22%, 11/1/2038(a) | | | 300,000 | | | | 300,000 | |

| Metropolitan Transportation Authority NY Revenue Bonds, Series 2016 C-1, 5.00%, 11/15/2022 | | | 200,000 | | | | 200,118 | |

| New York City Industrial Development Agency Variable Rate Demand Liberty Revenue Bonds, Series 2007, 2.04%, 10/1/2042(a) | | | 500,000 | | | | 500,000 | |

| New York City Municipal Water Finance Authority Water & Sewer System Revenue Bonds, Series 2019 BB, 2.20%, 6/15/2051(a) | | | 400,000 | | | | 400,000 | |

| New York City Trust for Cultural Resources Revenue Bonds, Series 2009 A, 2.22%, 7/1/2032(a) | | | 250,000 | | | | 250,000 | |

| New York City Trust for Cultural Resources Revenue Bonds, Series 2006 A-2, 2.12%, 10/1/2036(a) | | | 200,000 | | | | 200,000 | |

| New York State Energy Research & Development Authority Facilities Revenue Bonds, Series 2005 A-3, 2.24%, 5/1/2039(a) | | | 300,000 | | | | 300,000 | |

| Village of Harrison, Westchester County, NY Public Improvement Bonds, Series 2013, 4.00%, 12/1/2030 | | | 240,000 | | | | 240,165 | |

| | | | | | | | 2,390,283 | |

| Ohio — 10.72% | | | | | | | | |

| Ohio State General Obligation Infrastructure Improvement Bonds, Series 2004 A, 2.24%, 2/1/2023(a) | | | 225,000 | | | | 225,000 | |

| Ohio State University (The) Revenue Bonds, Series 2014 B-2, 2.22%, 12/1/2039(a) | | | 300,000 | | | | 300,000 | |

| See Notes to Financial Statements | |

| 28 | www.dcmmutualfunds.com |

| Lebenthal Ultra Short Tax-Free Income Fund |

| Schedule of Investments |

| October 31, 2022 |

| | | Principal | | | | |

| | | Amount | | | Fair Value | |

| MUNICIPAL BONDS — 95.32% (CONTINUED) | | | | | | | | |

| Ohio — 10.72% (Continued) | | | | | | | | |

| Ohio Water Development Authority Water Pollution Control Loan Fund Revenue Bonds, Series 2016 A, 2.20%, 12/1/2036(a) | | $ | 400,000 | | | $ | 400,000 | |

| | | | | | | | 925,000 | |

| South Carolina — 4.63% | | | | | | | | |

| City of Columbia, SC Waterworks & Sewer System Revenue Bonds, Series 2009, 2.24%, 2/1/2038(a) | | | 400,000 | | | | 400,000 | |

| | | | | | | | | |

| Texas — 11.30% | | | | | | | | |

| Dallas Fort Worth International Airport Joint Revenue Improvement Bonds, Series 2013 B, 5.00%, 11/1/2027 | | | 400,000 | | | | 400,001 | |

| Dallas Fort Worth International Airport Joint Revenue Improvement Bonds, Series 2013 B, 5.00%, 11/1/2038 | | | 325,000 | | | | 325,000 | |

| State of Texas Veterans Bonds, Series 2016, 2.23%, 12/1/2046(a) | | | 250,000 | | | | 250,000 | |

| | | | | | | | 975,001 | |

| Virginia — 7.53% | | | | | | | | |

| Fairfax County, VA Economic Development Authority Revenue Bonds, Series 2003 A, 2.12%, 12/1/2033(a) | | | 300,000 | | | | 300,000 | |

| Fairfax County, VA Economic Development Authority Revenue Bonds, Series 2007, 2.30%, 6/1/2037(a) | | | 350,000 | | | | 350,000 | |

| | | | | | | | 650,000 | |

| | | | | | | | | |

| Total Municipal Bonds (Cost $8,225,825) | | | | | | | 8,225,406 | |

| See Notes to Financial Statements | |

| Annual Report | October 31, 2022 | 29 |

| Lebenthal Ultra Short Tax-Free Income Fund |

| Schedule of Investments |

| October 31, 2022 |

| | | Shares | | | Fair Value | |

| MONEY MARKET FUNDS — 3.86% | | | | | | | | |

| Federated Institutional Tax-Free Cash Trust, Premier Shares, 2.02%(b) | | | 333,328 | | | $ | 333,328 | |

| | | | | | | | | |

| Total Money Market Funds (Cost $333,328) | | | | | | | 333,328 | |

| | | | | | | | | |

| Total Investments — 99.18% (Cost $8,559,153) | | | | | | | 8,558,734 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 0.82% | | | | | | | 70,629 | |

| | | | | | | | | |

| NET ASSETS — 100.00% | | | | | | $ | 8,629,363 | |

| (a) | Certain variable rate securities are not based on a published reference rate spread but are determined by the issuer or agent and are based on current market conditions. These securities, therefore, do not indicate a reference rate and spread. |

| (b) | Rate disclosed is the seven day effective yield as of October 31, 2022. |

| See Notes to Financial Statements | |

| 30 | www.dcmmutualfunds.com |

| Lebenthal Ultra Short Tax-Free Income Fund |

| Schedule of Investments |

| October 31, 2022 |

| Summary of Investments | | % of Net Assets | | | Fair Value | |

| Municipal Bonds | | | | | | | | |

| Colorado | | | 0.06 | % | | $ | 5,003 | |

| Connecticut | | | 0.06 | % | | | 5,000 | |

| District of Columbia | | | 6.37 | % | | | 550,000 | |

| Florida | | | 3.48 | % | | | 300,000 | |

| Illinois | | | 8.11 | % | | | 700,000 | |

| Maryland | | | 3.42 | % | | | 295,000 | |

| Massachusetts | | | 11.01 | % | | | 950,000 | |

| Nevada | | | 0.93 | % | | | 80,119 | |

| New York | | | 27.70 | % | | | 2,390,283 | |

| Ohio | | | 10.72 | % | | | 925,000 | |

| South Carolina | | | 4.63 | % | | | 400,000 | |

| Texas | | | 11.30 | % | | | 975,001 | |

| Virginia | | | 7.53 | % | | | 650,000 | |

| Money Market Funds | | | 3.86 | % | | | 333,328 | |

| Other Assets in Excess of Liabilities | | | 0.82 | % | | | 70,629 | |

| Total | | | 100.00 | % | | $ | 8,629,363 | |

| See Notes to Financial Statements | |

| Annual Report | October 31, 2022 | 31 |

| Centaur Mutual Funds Trust |

| Statements of Assets and Liabilities |

| October 31, 2022 |

| | | DCM/INNOVA | | | Lebenthal | |

| | | High Equity | | | Ultra Short | |

| | | Income Innovation | | | Tax-Free Income | |

| | | Fund | | | Fund | |

| Assets | | | | | | | | |

| Investments in securities, at fair value (cost $10,262,143 and $8,559,153) | | $ | 9,685,891 | | | $ | 8,558,734 | |

| Foreign currencies, at value (cost $1,943 and $–) | | | 1,891 | | | | — | |

| Receivable from Advisor | | | 54,718 | | | | 33,289 | |

| Dividends and interest receivable | | | 7,040 | | | | 42,384 | |

| Tax reclaims receivable | | | 113,778 | | | | — | |

| Prepaid expenses | | | 11,454 | | | | 29,876 | |

| Total Assets | | | 9,874,772 | | | | 8,664,283 | |

| | | | | | | | | |

| Liabilities | | | | | | | | |

| Payable for fund shares redeemed | | | 3,626 | | | | — | |

| Payable for distributions to shareholders | | | — | | | | 176 | |

| Accrued 12b-1 fees – Class A Shares | | | — | | | | 3 | |

| Payable to Administrator | | | 7,321 | | | | 7,578 | |

| Other accrued expenses | | | 31,728 | | | | 27,163 | |

| Total Liabilities | | | 42,675 | | | | 34,920 | |

| Net Assets | | $ | 9,832,097 | | | $ | 8,629,363 | |

| | | | | | | | | |

| Net Assets consist of: | | | | | | | | |

| Paid-in capital | | | 17,675,840 | | | | 8,629,706 | |

| Accumulated deficit | | | (7,843,743 | ) | | | (343 | ) |

| Net Assets | | $ | 9,832,097 | | | $ | 8,629,363 | |

| See Notes to Financial Statements | |

| 32 | www.dcmmutualfunds.com |

| Centaur Mutual Funds Trust |

| Statements of Assets and Liabilities |

| October 31, 2022 |

| | | DCM/INNOVA | | | Lebenthal | |

| | | High Equity | | | Ultra Short | |

| | | Income Innovation | | | Tax-Free Income | |

| | | Fund | | | Fund | |

| Class I Shares: | | | | | | | | |

| Net Assets | | | | | | $ | 8,614,315 | |

| Shares outstanding (unlimited number of shares authorized, no par value) | | | | | | | 861,458 | |

| Net asset value, offering and redemption price per share | | | | | | $ | 10.00 | |

| | | | | | | | | |

| Class A Shares: | | | | | | | | |

| Net Assets: | | | | | | $ | 15,048 | |

| Shares outstanding (unlimited number of shares authorized, no par value) | | | | | | | 1,503 | |

| Net asset value, redemption price per share (a) | | | | | | $ | 10.01 | |

| Offering price per share (100%/(100%-0.50% (maximum sales charge)) of net asset value adjusted to the nearest cent) | | | | | | $ | 10.06 | |

| | | | | | | | | |

| Net Assets | | $ | 9,832,097 | | | | | |

| Shares outstanding (unlimited number of shares authorized, no par value) | | | 995,404 | | | | | |

| Net asset value, offering and redemption price per share | | $ | 9.88 | | | | | |

| (a) | In the case of investments at or above $250,000, a contingent deferred sales charge of up to 0.25% may be charged on shares redeemed within 12 months of purchase if no sales charge on the original purchase and a finder’s fee was paid. |

| See Notes to Financial Statements | |

| Annual Report | October 31, 2022 | 33 |

| Centaur Mutual Funds Trust |

| Statements of Operations |

| For the year ended October 31, 2022 |

| | | DCM/INNOVA | | | Lebenthal | |

| | | High Equity | | | Ultra Short | |

| | | Income Innovation | | | Tax-Free Income | |

| | | Fund | | | Fund | |

| Investment Income | | | | | | | | |

| Dividend income (net of foreign taxes withheld of $321,954 and $–) | | $ | 2,886,590 | | | $ | 1,741 | |

| Interest income | | | — | | | | 70,906 | |

| Total investment income | | | 2,886,590 | | | | 72,647 | |

| | | | | | | | | |

| Expenses | | | | | | | | |

| Advisor | | | 207,249 | | | | 40,340 | |

| Custodian | | | 65,814 | | | | 5,224 | |

| Administration | | | 45,629 | | | | 41,500 | |

| Legal | | | 35,615 | | | | 38,599 | |

| Fund accounting | | | 32,701 | | | | 36,469 | |

| Registration | | | 27,952 | | | | 36,703 | |

| Insurance | | | 17,268 | | | | 7,138 | |

| Audit and tax | | | 17,000 | | | | 16,400 | |

| Transfer agent | | | 15,000 | | | | 12,000 | |

| Report printing | | | 9,666 | | | | 8,585 | |

| Pricing | | | 8,534 | | | | 14,595 | |

| Trustee | | | 6,000 | | | | 6,000 | |

| 12b-1 fees – Class A Shares | | | — | | | | 487 | |

| Miscellaneous | | | 33,111 | | | | 21,059 | |

| Total expenses | | | 521,539 | | | | 285,099 | |

| Fees contractually waived and expenses reimbursed by Advisor | | | (107,460 | ) | | | (237,549 | ) |

| Fees voluntarily waived and expenses reimbursed by Advisor | | | — | | | | (26,308 | ) |

| Net operating expenses | | | 414,079 | | | | 21,242 | |

| Net investment income | | | 2,472,511 | | | | 51,405 | |

| | | | | | | | | |

| Net Realized and Change in Unrealized Loss on Investments | | | | | | | | |

| Net realized loss on: | | | | | | | | |

| Investment securities | | | (7,245,605 | ) | | | — | |

| Foreign currency transactions | | | (178,878 | ) | | | — | |

| Change in unrealized depreciation on: | | | | | | | | |

| Investment securities | | | (2,847,353 | ) | | | (3,033 | ) |

| Foreign currency translations | | | (11,837 | ) | | | — | |

| Net realized and unrealized gain (loss) on investment securities and foreign currency transactions | | | (10,283,673 | ) | | | (3,033 | ) |

| Net increase (decrease) in net assets resulting from operations | | $ | (7,811,162 | ) | | $ | 48,372 | |

| See Notes to Financial Statements | |

| 34 | www.dcmmutualfunds.com |

| DCM/INNOVA High Equity Income Innovation Fund |

| Statements of Changes in Net Assets |

| | | For the | | | For the | |

| | | Year Ended | | | Year Ended | |

| | | October 31, 2022 | | | October 31, 2021 | |

| Increase (Decrease) in Net Assets due to: | | | | | | | | |