UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant [X] Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| [X] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [ ] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12 |

CENTAUR MUTUAL FUNDS TRUST

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required. |

| | | |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | | |

| | (5) | Total fee paid: |

| | | |

| | | |

| [ ] | Fee paid previously with preliminary materials. |

| | | |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by the registration statement number, or the Form or Schedule and the date of its filing. |

| | | |

| | (1) | Amount Previously Paid: |

| | | |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | | |

| | (3) | Filing Party: |

| | | |

| | | |

| | (4) | Date Filed: |

| | | |

Proxy Statement

December [●], 2023

Important Voting Information Inside

DCM/INNOVA High Equity Income Innovation Fund (TILDX)

Please vote immediately!

You can vote through the internet, by telephone, or

by mail. Details on voting can be found on

your proxy card.

Centaur Mutual Funds Trust

33 Whitehall Street, 11th Floor

New York NY 10004

SPECIAL MEETING OF SHAREHOLDERS

Important Voting Information Inside!

TABLE OF CONTENTS

| Letter from the Chairman and DCM Advisors, LLC | 1 |

| Notice of Special Meeting of Shareholders | 3 |

| Important Information to Help You Understand the Proposal | 4 |

| Proxy Statement | 8 |

| Proposal 1: To approve a sub-advisory agreement to be entered into by and between DCM Advisors, LLC, USCA Asset Management LLC and Centaur Mutual Funds Trust, on behalf of the DCM/INNOVA High Equity Income Innovation Fund | 10 |

| Proposal 2: To transact any other business that may properly come before the Special Meeting or any adjournment or postponement thereof in the discretion of the proxies or their substitutes | 15 |

| Additional Information Regarding Shareholders And Voting Requirements | 16 |

| Additional Information Regarding the Operation of the Fund | 17 |

| Other Matters | 19 |

| Appendix A: Form of the proposed investment sub-advisory agreement to be entered into by and between DCM Advisors, LLC, USCA Asset Management LLC and Centaur Mutual Funds Trust, on behalf of the DCM/INNOVA High Equity Income Innovation Fund | A-1 |

Centaur Mutual Funds Trust

December 22, 2023

Dear Shareholder:

We are pleased to invite you to a Special Meeting of Shareholders (the “Special Meeting”) of DCM/INNOVA High Equity Income Innovation Fund (the “Fund”), a series of Centaur Mutual Funds Trust (the “Trust”). The Special Meeting will be held at 1 p.m., Eastern time, January 29, 2024 at the offices of the Fund’s transfer agent, Ultimus Fund Solutions, LLC, 225 Pictoria Drive, Suite 450, Cincinnati, OH 45246. At the Special Meeting, shareholders will be asked to vote on a proposal to approve an investment sub-advisory agreement on behalf of the Fund and to transact any other business that may properly come before the Special Meeting.

Shareholders of the Fund are being asked to appoint a new sub-adviser to the Fund by approving a new investment sub-advisory agreement among DCM Advisors, LLC (“DCM” or the “Adviser”), USCA Asset Management LLC (“USCA” or the “Sub-Adviser”) and the Trust, on behalf of the Fund (the “Sub-Advisory Agreement”). Recently, the Ziegler FAMCO Hedged Equity Fund (the “Acquired Fund”) was reorganized into the Fund (the “Reorganization”). The Reorganization closed on November 3, 2023. Prior to the Reorganization, USCA served as the sub-adviser to the Acquired Fund. The Adviser recommended the retention of USCA as sub-adviser to the Fund because the Adviser believes that USCA will enhance the Fund’s ability to pursue its investment objective going forward and after the Reorganization. Because the Adviser will pay USCA out of its management fee, there will be no increase in management fees paid by the Fund as a result of the appointment of USCA as the sub-adviser of the Fund. The Adviser will continue to serve as the Fund investment adviser and will oversee the services of the Sub-Adviser.

The close of business on November 20, 2023 has been fixed as the record date for the determination of shareholders entitled to receive notice of and to vote at the Special Meeting.

This Proxy Statement contains information about the proposal and the materials to use when voting by mail, telephone, or through the Internet. The enclosed Q&A is provided to assist you in understanding the proposal. The proposal is described in greater detail in the Proxy Statement.

After careful consideration, the Board of Trustees of the Trust has unanimously approved the Sub-Advisory Agreement and unanimously recommends that you vote “FOR” the approval of the Sub-Advisory Agreement for the Fund.

Your vote is important regardless of the number of shares you own. In order to avoid the added cost of follow-up solicitations and possible adjournments or postponements, please take a few minutes to read the Proxy Statement and cast your vote. It is important that your vote be received no later than 11:59 p.m., Eastern time, on January 28, 2024.

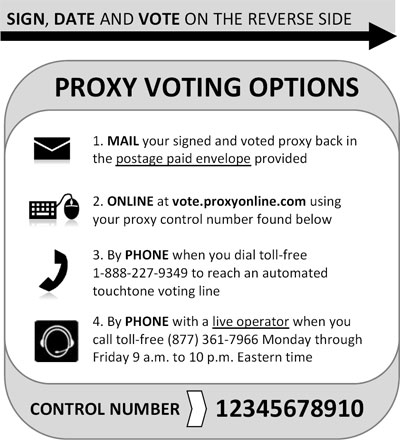

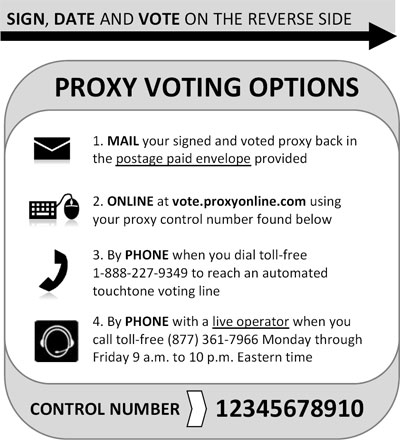

You may cast your vote by signing, dating and mailing the enclosed proxy card in the postage prepaid return envelope provided. In addition to voting by mail you may also vote either by telephone or through the internet as follows:

| | TO VOTE BY TELEPHONE: | | | TO VOTE BY INTERNET: |

| 1) | Read the Proxy Statement and have the enclosed proxy card at hand | | 1) | Read the Proxy Statement and have the enclosed proxy card at hand |

| 2) | Call the toll-free number that appears on the enclosed proxy card and follow the simple instructions | | 2) | Go to the website that appears on the enclosed proxy card and follow the simple instructions |

Although you may vote in person at the Special Meeting, you are encouraged to vote by telephone or through the internet using the control number that appears on the enclosed proxy card. Use of telephone or internet voting will reduce the time and costs associated with this proxy solicitation. Whichever method you choose, please read the enclosed Proxy Statement carefully before you vote.

If you have any questions regarding the proposal or need assistance in completing your proxy card, please contact us, toll-free at (800) 814-9324.

Thank you for your time in considering this important proposal and for your continuing investment and support of DCM/INNOVA High Equity Income Innovation Fund.

| James H. Speed, Jr. |

| Chairman, Centaur Mutual Funds Trust |

| Glenn Grossman |

| CEO, DCM Advisors, LLC |

DCM/INNOVA High Equity Income Innovation Fund

a series of Centaur Mutual Funds Trust

33 Whitehall Street, 11th Floor

New York, NY 10004

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETING OF SHAREHOLDERS TO BE HELD AT 1:00 P.M., EASTERN TIME, JANUARY 29, 2024. THE PROXY STATEMENT TO SHAREHOLDERS IS AVAILABLE AT www.https://vote.proxyonline.com/centaur/docs/proxy2024.pdf OR BY CALLING EQ Fund Solutions TOLL FREE AT (800) 814-9324.

To the Shareholders of DCM/INNOVA High Equity Income Innovation Fund:

NOTICE IS HEREBY GIVEN that a Special Meeting of Shareholders (the “Special Meeting”) of DCM/INNOVA High Equity Income Innovation Fund (the “Fund”), a series of the Centaur Mutual Funds Trust (the “Trust”), will be held at the offices of the Fund’s transfer agent, Ultimus Fund Solutions, LLC, 225 Pictoria Drive, Suite 450, Cincinnati, OH 45246 at 1:00 p.m. Eastern time, January 29, 2024. The purpose of the Special Meeting is to consider and vote on the following matters:

| 1. | To approve a sub-advisory agreement (the “Sub-Advisory Agreement”) to be entered into by and between DCM Advisors, LLC (“DCM” or the “Adviser”), USCA Asset Management LLC (“USCA” or the “Sub-Adviser”) and the Trust, on behalf of the Fund. |

| 2. | To transact any other business that may properly come before the Special Meeting or any adjournment or postponement thereof in the discretion of the proxies or their substitutes. |

It is not anticipated that any matter other than the approval of the Sub-Advisory Agreement will be brought before the Special Meeting. Shareholders of record of the Fund as of the close of business on November 20, 2023, will be entitled to notice of and to vote at the Special Meeting or any adjournment or postponement thereof. A Proxy Statement and proxy card solicited by the Trust are included herewith. If you need directions to the Special Meeting, please call (800) 814-9324, the Fund’s proxy solicitor, at the number stated above.

The Board of Trustees of the Trust has approved the Sub-Advisory Agreement and recommends that you vote “FOR” the Sub-Advisory Agreement.

YOUR VOTE IS IMPORTANT. PLEASE VOTE BY TELEPHONE OR THROUGH THE INTERNET BY FOLLOWING THE INSTRUCTIONS ON YOUR PROXY CARD, THUS AVOIDING UNNECESSARY EXPENSE AND DELAY. YOU MAY ALSO EXECUTE THE ENCLOSED PROXY AND RETURN IT PROMPTLY IN THE ENCLOSED ENVELOPE. NO POSTAGE IS REQUIRED IF MAILED IN THE UNITED STATES. THE PROXY IS REVOCABLE AND WILL NOT AFFECT YOUR RIGHT TO VOTE IN PERSON IF YOU ATTEND THE SPECIAL MEETING.

By Order of the Board of Trustees,

Paul F. Leone

Secretary, Centaur Mutual Funds Trust

IMPORTANT INFORMATION to Help You Understand the Proposal

While we encourage you to read the full text of the enclosed Proxy Statement, for your convenience, we have provided a brief overview of the matters affecting DCM/INNOVA High Equity Income Innovation Fund (the “Fund”), a series of Centaur Mutual Funds Trust (the “Trust”), that require a shareholder vote.

| Q. | Why am I receiving this proxy statement? |

| A. | You are receiving the enclosed Proxy Statement as a shareholder of the Fund, in connection with a special meeting of shareholders of the Fund (the “Special Meeting”) scheduled to be held at 1:00 p.m., Eastern time, January 29, 2024. All holders of Fund shares as of the close of business on November 20, 2023 (the “Record Date”), are entitled to attend and vote at the Special Meeting. |

| Q. | What am I being asked to vote on? |

| A. | At the Special Meeting, you will be asked to vote on the proposal to approve the Sub-Advisory Agreement among DCM Advisors, LLC (“DCM” or the “Adviser”), USCA Asset Management LLC (“USCA” or the “Sub-Adviser”) and the Trust, on behalf of the Fund; and any other business as may properly come before the Special Meeting or any adjournment(s) or postponement(s) thereof. If approved by shareholders of the Fund, the Sub-Advisory Agreement will become effective following the Special Meeting and will remain in effect for an initial two-year period. A copy of the Sub-Advisory Agreement is included in this Proxy Statement as Appendix A. |

| A. | USCA is an SEC-registered investment advisory firm and a wholly-owned subsidiary of U.S. Capital Advisors LLC. (“U.S. Capital Advisors”) which was founded in 2003. As of June 30, 2023, U.S. Capital Advisors. had assets under management of approximately $7.5 billion. |

On November 3, 2023, the Ziegler FAMCO Hedged Equity Fund, a series of Trust for Advised Portfolios (the “Acquired Fund”) was reorganized into the Fund (the “Reorganization”). USCA served as the adviser to the Acquired Fund’s predecessor fund from its inception in November 2016 until such predecessor fund was reorganized into the Acquired Fund in 2020 and after such reorganization, USCA served as the sub-adviser to the Acquired Fund until the closing of the Reorganization. Prior to the Reorganization two of the Acquired Fund’s portfolio managers, Davis Rushing and Kelly Rushing, employees of USCA had served as portfolio managers of the Acquired Fund since its predecessor fund’s inception in November 2016. It is anticipated that if the Sub-Advisory Agreement is approved, Davis Rushing and Kelly Rushing will serve as the portfolio managers to the Fund.

| Q. | Why is the Sub-Advisory Agreement being voted on? |

| A. | Under the 1940 Act, a fund’s shareholders must approve any new investment advisory agreement for the fund. The Board has considered and approved the calling of a special meeting of shareholders and solicitation of proxies for shareholders of the Fund to consider and vote on approval of the Sub-Advisory Agreement. |

| Q. | Why is DCM proposing to appoint USCA to serve as sub-adviser to the Fund? |

| A. | DCM has been responsible for the day-to-day management of the Fund’s portfolio since DCM was appointed as investment adviser for the Fund in 2019. At a special meeting of the Board of Trustees of the Trust (the “Board”) held on May 30, 2023 (the “May 2023 Board Meeting”), based on the recommendation of DCM, the Board, including all of the trustees (the “Trustees”) who are not “interested persons” of the Fund as that term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”) (the “Independent Trustees”) unanimously approved the Reorganization which closed on November 3, 2023. |

| As a result of the discussions and considerations by DCM leading up to its decision to recommend the Reorganization to the Board, including USCA’s long history managing the assets of the Acquired Fund (and its predecessor fund), DCM determined that USCA would enhance the Fund’s ability to pursue its investment objective going forward and after the Reorganization and recommended to the Board that USCA be appointed as sub-adviser to the Fund after the closing of the Reorganization. Based upon such recommendation, at the May 2023 Board Meeting, the Board considered and approved the Sub-Advisory Agreement, subject to and contingent upon the closing of the Reorganization and the approval of the Sub-Advisory Agreement by the post-Reorganization shareholders of the Fund. In accordance with the requirements of the 1940 Act, the Board now seeks shareholder approval of the Sub-Advisory Agreement at the Special Meeting. |

| Q. | Does the Board of Trustees recommend that shareholders vote to approve the Sub-Advisory Agreement? |

| A. | Yes, the Board unanimously recommends that the shareholders of the Fund vote to approve the Sub-Advisory Agreement. The various factors the Board considered in making this determination are described in the Proxy Statement. |

| Q. | When would the Sub-Advisory Agreement take effect? |

| A. | If approved by the Fund’s shareholders, it is expected that the Sub-Advisory Agreement would take effect immediately. |

| Q. | Will the approval of the Sub-Advisory Agreement increase the fees payable by the Fund? |

| A. | No. DCM will pay USCA’s sub-advisory fee out of DCM’s advisory fee, and there will be no increase in the aggregate advisory fees payable by the Fund, including the advisory fees payable to DCM, as a result of USCA’s appointment as the sub-adviser to the Fund. |

| Q. | Will the approval of the Sub-Advisory Agreement change the current portfolio management of the Fund? |

| A. | The Fund is currently managed by Dr. Vijay Chopra, who is an employee of the Adviser. Upon approval of the Sub-Advisory Agreement by the Fund’s shareholders, it is anticipated that Dr. Chopra will no longer manage the Fund and, instead, Davis Rushing and Kelly Rushing will serve as portfolio managers of the Fund and will be responsible for the day-to-day management of the Fund’s portfolio. The Adviser will continue to provide the Fund with services under its investment advisory agreement that have not been delegated by the Adviser to USCA pursuant to the Sub-Advisory Agreement, including investment oversight, administrative, operational, risk management, and compliance services. |

| Q. | Who is eligible to vote? |

| A. | Shareholders of record of the Fund at the close of business on November 20, 2023 are entitled to be present and to vote at the Special Meeting. Each shareholder is entitled to one vote for each dollar (and a proportionate fractional vote for each fractional dollar) of the net asset value of each share (including fractional shares) held by such shareholder on the Record Date. |

| A. | You can vote in one of the following four ways: |

| 1. | Complete, sign, date and promptly return the enclosed proxy card in the enclosed postage prepaid envelope; |

| 2. | Call the toll-free telephone number found on the enclosed proxy card; |

| 3. | Go to the website found on the enclosed proxy card and enter the control number that appears on the proxy card; or |

| 4. | Attend the Special Meeting and vote in person. |

Proxy cards that are properly signed, dated and received prior to the Special Meeting will be voted as specified. If you specify a vote on the proposal to approve the Sub-Advisory Agreement (the “Proposal”), your proxy will be voted as you indicate. If you simply sign, date and return the proxy card, but do not specify a vote on the Proposal, your shares will be voted FOR the Proposal.

| A. | You may revoke your proxy at any time prior to use by filing with the Secretary of the Trust an instrument revoking the proxy prior to the Special Meeting, by submitting a proxy bearing a later date, or by attending and voting at the Special Meeting. |

| Q. | What will happen if there are not enough votes to have the Special Meeting? |

| A. | It is important that shareholders vote by telephone or internet or complete and return signed proxy cards promptly, but no later than 11:59 p.m., Eastern time, January 28, 2024, to ensure there is a quorum for the Special Meeting. You may be contacted by officers of the Trust, DCM or USCA, or by EQ Fund Solutions, the Fund’s proxy solicitor, who will assist you in voting your shares. If the Fund has not received sufficient votes to have a quorum at the Special Meeting or has not received enough votes to approve the Sub-Advisory Agreement, then the Special Meeting may be adjourned or postponed to a later date so we can continue to seek more votes. |

| Q. | What happens if the Proposal is not approved? |

| A. | If the Proposal is not approved, then the Sub-Advisory Agreement will not take effect and the Adviser will continue to be responsible for the day-to-day management of the Fund’s portfolio. The Board may consider additional actions as it deems to be in the best interests of the Fund, including, among other things, potentially re-soliciting shareholder approval of the Sub-Advisory Agreement. |

| Q. | Who will pay for the proxy solicitation? |

| A. | DCM has agreed to assume all costs, fees and expenses incurred by the Fund in connection with the Special Meeting and proxy statement, including legal and accounting fees and costs associated with the solicitation of proxies with respect to the Proposal (including the fees of EQ Fund Solutions as proxy solicitor). The Fund will not bear any of these costs. |

| Q. | Whom should I call for additional information about the Proxy Statement? |

| A. | If you have any questions regarding the Proxy Statement or completing and returning your proxy card, you can call EQ Fund Solutions, the Fund’s proxy solicitor, toll free at (800) 814-9324. |

DCM/INNOVA High Equity Income Innovation Fund

a series of Centaur Mutual Funds Trust

33 Whitehall Street, 11th Floor

New York, NY 10004

SPECIAL MEETING OF SHAREHOLDERS

To Be Held January 29, 2024

PROXY STATEMENT

This Proxy Statement is furnished in connection with the solicitation by the Board of Trustees (the “Board” or “Board of Trustees”) of Centaur Mutual Funds Trust, a Delaware statutory trust (the “Trust”) of proxies for use at the Special Meeting of Shareholders (the “Special Meeting”) of the DCM/INNOVA High Equity Income Innovation Fund (the “Fund”), a series of the Trust, to be held at the offices of the Fund’s transfer agent, Ultimus Fund Solutions, LLC, 225 Pictoria Drive, Suite 450, Cincinnati OH 45246, at 1:00 p.m., Eastern time, January 29, 2024, or at any adjournment or postponement thereof. The principal address of the Trust is 33 Whitehall Street, 11th Floor New York, NY 10004. This Proxy Statement and form of proxy is first being mailed on or about December 22, 2023, to all shareholders entitled to vote at the Special Meeting.

The Special Meeting is being held for the following purposes:

| 1. | To approve a sub-advisory agreement (the “Sub-Advisory Agreement”) to be entered into by and between DCM Advisors, LLC (“DCM” or the “Adviser”), USCA Asset Management LLC (“USCA” or the “Sub-Adviser”) and the Trust, on behalf of the Fund; and |

| 2. | To transact any other business that may properly come before the Special Meeting or any adjournment or postponement thereof in the discretion of the proxies or their substitutes. |

Shareholders of record of the Fund as of the close of business on November 20, 2023, are entitled to notice of and to vote at the Special Meeting or any adjournment or postponement thereof.

A proxy, if properly executed, duly returned and not revoked, will be voted in accordance with the specifications therein. A proxy that is properly executed but has no voting instructions with respect to a Proposal will be voted for that Proposal. A shareholder may revoke a proxy at any time prior to use by filing with the Secretary of the Trust an instrument revoking the proxy, by submitting a proxy bearing a later date or by attending and voting at the Special Meeting.

The Trust has retained EQ Fund Solutions to solicit proxies for the Special Meeting. EQ Fund Solutions is responsible for printing proxy cards, mailing proxy material to shareholders, soliciting brokers, custodians, nominees, fiduciaries and shareholders, tabulating the returned proxies and performing other proxy

solicitation services. The anticipated cost of these services is approximately $10,000 and will be paid by DCM.

In addition to solicitation through the mail, proxies may be solicited by officers, employees and agents of the Trust, DCM or USCA without cost to the Fund, or by EQ Fund Solutions. Such solicitation may be by telephone or otherwise. It is anticipated that banks, broker-dealers and other financial institutions will be requested to forward proxy materials to beneficial owners and to obtain approval for the execution of proxies. DCM will reimburse brokers, custodians, nominees and fiduciaries for the reasonable expenses incurred by them in connection with forwarding solicitation material to the beneficial owners of shares held of record by such persons.

PROPOSAL 1

TO APPROVE A SUB-ADVISORY AGREEMENT TO BE ENTERED INTO BY AND BETWEEN DCM ADVISORS, LLC, USCA ASSET MANAGEMENT LLC, AND THE CENTAUR MUTUAL FUNDS TRUST, ON BEHALF OF DCM/INNOVA HIGH EQUITY INCOME INNOVATION FUND.

The Board has called the Special Meeting to ask shareholders of the Fund to consider and vote on the proposed Sub-Advisory Agreement among DCM, USCA and the Trust, on behalf of the Fund. The Fund currently operates as a separate series of the Trust. DCM currently serves as investment adviser to the Fund pursuant to an investment advisory agreement. The Board considered and approved the Sub-Advisory Agreement at a special meeting held on May 30, 2023 (the “May 2023 Board Meeting”), subject to the closing of the Reorganization (defined below) and the approval of the Fund’s shareholders.

At the May 2023 Board Meeting, based on the recommendation of DCM, the Board, including all the Independent Trustees, also unanimously approved a transaction whereby the Ziegler FAMCO Hedged Equity Fund, a series of Trust for Advised Portfolios (the “Acquired Fund”) would be reorganized into the Fund (the “Reorganization”). The Reorganization closed on November 3, 2023. USCA served as the adviser to the Acquired Fund’s predecessor fund from such predecessor fund’s inception in November 2016 until it was reorganized into the Acquired Fund in 2020 and after such reorganization, USCA served as the sub-adviser to the Acquired Fund until the closing of the Reorganization on November 3, 2023. Prior to the Reorganization, Davis Rushing and Kelly Rushing, employees of USCA, had served as portfolio managers of the Acquired Fund since its predecessor fund’s inception in November 2016.

As a result of the discussions and considerations by DCM leading up its decision to recommend the Reorganization to the Board, including USCA’s long history managing the assets of the Acquired Fund (and its predecessor fund), DCM determined that USCA would enhance the Fund’s ability to pursue its investment objective going forward and after the Reorganization and recommended to the Board that USCA be appointed as sub-adviser to the Fund after the closing of the Reorganization.

The Fund is currently managed by Dr. Vijay Chopra, who is an employee of DCM. If the Fund’s shareholders approve the Sub-Advisory Agreement, it is anticipated that Dr. Chopra will no longer manage the Fund and, instead, Davis Rushing and Kelly Rushing, each of whom is an employee of USCA, will serve as portfolio managers of the Fund and will be responsible for the day-to-day management of the Fund’s portfolio. The investment objective, strategies and policies of the Fund are not expected to change in connection with the approval of the Sub-Advisory Agreement. DCM will continue to serve as the Fund’s investment adviser and provide the Fund with all services provided for under its investment advisory agreement it has not delegated to USCA, including investment oversight, administrative, operational, risk management, and compliance services.

Board Considerations

The Board, which consists solely of Independent Trustees, believes that the terms of the Sub-Advisory Agreement are fair and not unreasonable and that the implementation of the Sub-Advisory Agreement is in the best interests of shareholders of the Fund.

In determining to approve the Sub-Advisory Agreement, the Board considered and discussed responses to a due diligence questionnaire that had been provided to USCA with respect to certain matters relevant to the consideration of the approval of the Sub-Advisory Agreement under Section 15 of the 1940 Act. At the May 2023 Board Meeting, the Board, including all of the Independent Trustees, met with a representative of USCA and asked additional questions regarding the services to be provided to the Fund pursuant to the proposed Sub-Advisory Agreement. The Board also discussed with DCM the anticipated sub-advisory relationship with DCM and oversight and services that DCM would continue to provide as investment adviser to the Fund. The Board was satisfied with the answers they received to their questions posed at the May 2023 Board Meeting. Thereafter, the Board considered and approved the Sub-Advisory Agreement in substantially the form attached hereto as Appendix A, subject to the closing of the Reorganization and the Sub-Advisory Agreement’s approval by the post-Reorganization shareholders of the Fund.

As described above, the Board requested and received detailed information from USCA. The information requested and received by the Board included, among other information, the following:

| · | The organization and financial condition of USCA; |

| · | The personnel and services to be provided to the Fund; |

| · | USCA’s investment advice process and past performance; |

| · | USCA’s trading practices (including its practices regarding best execution, soft dollars, allocation of portfolio transactions among clients, and directed brokerage); |

| · | The proposed sub-advisory fee, other benefits USCA expects to receive from its relationship with the Fund, and anticipated profitability from its relationship with the Fund; |

| · | Any anticipated revenue sharing arrangements with brokers, dealers, or other financial intermediaries; |

| · | USCA’s compliance program; and |

| · | Information about any current legal matters or regulatory examinations. |

Throughout their deliberations, the Independent Trustees were assisted by counsel, who provided the Board with a memorandum regarding its responsibilities with respect to the approval of the Sub-Advisory Agreement.

After reviewing and considering such information and materials as they deemed necessary, the Board of Trustees, including all the Independent Trustees, unanimously approved the Sub-Advisory Agreement and recommended approval of the Sub-Advisory Agreement to the Fund’s shareholders.

In determining whether to approve the Sub-Advisory Agreement, the Trustees considered the best interests of the Fund and its shareholders. The Board considered, among other things: (1) the nature, extent and quality of the services to be provided by the sub-adviser; (2) the investment management capabilities and experience of the sub-adviser; (3) the costs of the services to be provided and profits to be realized by the sub-adviser and its affiliates from the relationship with the Fund; (4) the extent to which the Fund and its investors would benefit from economies of scale; (5) the sub-adviser’s practices regarding brokerage and portfolio transactions; and (6) possible conflicts of interest.

Matters considered by Board, including all the Independent Trustees, in connection with its approval of the Sub-Advisory Agreement included, among other things, the following:

The nature, extent, and quality of the services to be provided by the sub-adviser. In this regard, the Board considered the responsibilities USCA, as sub-adviser, would have under the Sub-Advisory Agreement for the Fund. The Board also considered the proposed services that USCA would provide to the Fund including, without limitation, USCA’s plans and procedures for making investment decisions. In addition, the Board considered the education and experience of the key personnel at USCA; its compliance program, policies, and procedures; its trading policies, its financial condition and the level of commitment to the Fund. After reviewing the foregoing and further information provided in the Board Materials (e.g., descriptions of USCA’s business and Form ADV), the Board concluded that the quality, extent, and nature of the services to be provided by USCA to the Fund were satisfactory.

The investment management capabilities and experience of the sub-adviser. In this regard, the Board considered the investment management experience of USCA and its principals. The Board considered its discussion with USCA regarding USCA’s experience and plans for implementing the Fund’s investment strategies. In particular, the Board considered the information from USCA regarding its experience serving as sub-adviser to the Acquired Fund and the Acquired Fund’s historical performance. After consideration of these and other factors, the Board determined that USCA has the requisite knowledge and experience to serve as investment sub-adviser for the Fund.

The costs of the services to be provided and profits to be realized by the sub-adviser and its affiliates from the relationship with the Fund. In this regard, the Board considered that USCA’s compensation for managing the Fund would be solely the responsibility of DCM, and that the Fund would not be responsible for paying USCA. The Board also considered the advisory fees charged by USCA to its other clients and the potential benefits for USCA in managing the Fund, including

promotion of USCA’s name and the ability to place smaller client accounts into the Fund. The Board considered the financial information USCA had provided and based upon that provided, the Board determined that it was reasonable to conclude that USCA’s profitability with respect to the Fund would not be excessive and that the sub-advisory fee to be received by USCA out of the management fee for the Fund from DCM was reasonable in light of the nature and quality of services to be provided to the Fund by USCA.

The extent to which the Fund and its investors would benefit from economies of scale. In this regard, the Board considered economies of scale in connection with the Fund and the extent to which the benefits of any such economies of scale may be shared with the Fund and its shareholders. The Board recognized that economies of scale are difficult to identify and quantify and are rarely identifiable on a fund-by-fund basis. The Board considered DCM’s proposed reduction in the expense limitation agreement for the Fund and noted that while the proposed sub-advisory fee was flat and would stay the same as asset levels increased, the shareholders of the Fund did not directly pay the sub-advisory fee. The Board also noted it will have the opportunity to periodically re-examine whether the Fund has achieved economies of scale, as well as appropriateness of the sub-advisory fee payable to USCA. Based upon this evaluation, the Board concluded the proposed sub-advisory fee for the Fund was reasonable in light of the information that was provided to the Board with respect to economies of scale.

Brokerage and portfolio transactions. The Board considered USCA’s policies and procedures as they relate to seeking best execution for its clients. The Board also considered the anticipated method and basis for selecting and evaluating broker-dealers used to complete the Fund’s portfolio transactions; any anticipated allocation of portfolio business to persons affiliated with USCA; and the extent to which the Fund’s trades may be allocated to soft-dollar arrangements. After further review and discussion, the Board determined that USCA’s practices regarding brokerage and portfolio transactions were satisfactory.

Possible conflicts of interest. In evaluating the possibility for conflicts of interest, the Board considered such matters as the experience and abilities of the advisory personnel to be assigned to the Fund and USCA’s process for allocating trades among the Fund and other clients with similar types of investment objectives and strategies. Following further consideration and discussion, the Board determined that USCA’s standards and practices relating to the identification and mitigation of potential conflicts of interests for the Fund were satisfactory.

After further discussion of the factors noted above and in reliance of the information provided by DCM, USCA and management of the Trust and taking into account the totality of all factors discussed and information presented, the Board indicated its desire to approve the Sub-Advisory Agreement. It was noted that in the Trustees’ deliberations regarding the approval of the Sub-Advisory Agreement, the Trustees did not identify any particular information or factor that was all-important or controlling, and that each individual Trustee may have attributed different weights to the various factors listed above.

Description of the Proposed Sub-Advisory Agreement

The Sub-Advisory Agreement, the form of which is attached to this Proxy Statement as Appendix A, calls for USCA to provide day-to-day portfolio management services to the Fund, in substantially the same way as are currently being provided to the Fund by DCM. No changes to the investment objective, the principal investment strategies or the principal risks of the Fund are expected to occur as a result of or in connection with the implementation of the Sub-Advisory Agreement. As investment adviser, DCM would be responsible for overseeing USCA and its services. For a more complete understanding of the Sub-Advisory Agreement, you should read the form of Sub-Advisory Agreement contained in Appendix A. The descriptions of the Sub-Advisory Agreement in this Proxy Statement are qualified in their entirety by reference to Appendix A.

Services. Under the Sub-Advisory Agreement, USCA will, subject to the oversight of the Board and DCM, provide an investment program for the Fund’s assets, including investment research and management with respect to securities and other investments, including cash and cash equivalents, and will determine from time to time what securities and other investments will be purchased, retained or sold. USCA will provide the services under the Sub-Advisory Agreement in accordance with the Fund’s investment objective, policies and restrictions as stated in the Fund’s registration statement.

Fees. The total investment advisory fee that the Fund pays to DCM will not change as a result of the Sub-Advisory Agreement. Under the Sub-Advisory Agreement, DCM will pay a sub-advisory fee to USCA at the annualized rate of 0.25% of the average daily net assets of the Fund. DCM and USCA believe the sub-advisory fee proposed to be charged by USCA is fair and reasonable in light of the sub-advisory services proposed to be provided to the Fund.

Effective Date. The Sub-Advisory Agreement shall take effect with respect to the Fund following its approval by shareholders of the Fund.

Term. If the Sub-Advisory Agreement is approved by shareholders of the Fund, it is expected to become effective with respect to the Fund immediately upon the final adjournment of the Meeting. Unless sooner terminated as provided in the Sub-Advisory Agreement, the Sub-Advisory Agreement shall continue in effect for an initial term of two years, and from year to year thereafter, subject to annual approval by: (1) the Board, or (2) a vote of a majority of the outstanding voting securities of the Fund as prescribed under the 1940 Act. In either event, continuance of the Sub-Advisory Agreement must also be approved by a majority of the Independent Trustees, by a vote cast in person at a meeting called for the purpose of voting on the continuance.

Termination. The Sub-Advisory Agreement may be terminated at any time, (i) upon termination of the investment advisory agreement between DCM and the Trust, on behalf of the Fund, by either party thereto (accompanied by simultaneous notice to USCA), (ii) by the Fund at any time upon written notice to USCA that the Board or the shareholders by vote of a majority of the outstanding voting securities of the Fund, as provided by the 1940 Act, have terminated this Agreement, (iii) upon at least sixty days’ written notice to USCA by DCM, and (iv) by USCA upon ninety days’ written notice to DCM and the Trust. The Sub-Advisory Agreement automatically terminates in the event of its assignment, as defined by the 1940 Act and the rules thereunder.

Information About USCA

USCA and its managing partners are located at 4444 Westheimer Road, Suite G500, Houston, Texas 77027. USCA’s managing partners are Patrick Mendenhall (CEO) and David King. Managing USCA is Mr. Mendenhall and Mr. King’s primary occupation. USCA is an SEC-registered investment advisory firm and a wholly-owned subsidiary of U.S. Capital Advisors, LLC (“U.S. Capital Advisors”) which was founded in 2003 and is located at 4444 Westheimer Road, Suite G500, Houston, Texas 77027 . U.S. Capital Advisors is substantially owned by its employees. As of June 30, 2023, U.S. Capital Advisors had assets under management of approximately $7.5 billion. USCA does not currently serve as the investment adviser for any other fund having a similar investment objective to the Fund.

Davis Rushing has been a registered representative of USCA since 2016 and has served as a Managing Director of the USCA’s parent, U.S. Capital Advisors since 2015. In addition to his role as a registered representative of USCA, Mr. Rushing is also a registered representative of U.S. Capital Advisor’s, affiliates, U.S. Capital Wealth Advisors, LLC, an SEC registered investment adviser, USCA Securities LLC, an SEC registered broker-dealer. In these capacities, Mr. Rushing provides investment advice on a discretionary and non-discretionary basis to clients, which advice includes covered call strategies similar to those employed by Fund. Prior to joining USCA, Mr. Rushing worked in financial services for nine years, most recently as a Vice President - Wealth Management and Portfolio Manager at UBS, from 2011 to 2015, where he employed a strategy similar to that of the Fund.

Kelly Rushing has been a registered representative of USCA since 2016 and has served as a Managing Director of USCA’s parent, U.S. Capital Advisors since 2015. In addition to his role as a registered representative of USCA, Mr. Rushing is also a registered representative of U.S. Capital Advisors’ affiliates, U.S. Capital Wealth Advisors, LLC, an SEC registered investment adviser, USCA Securities LLC, an SEC registered broker-dealer. In these capacities, Mr. Rushing provides investment advice on a discretionary and non-discretionary basis to clients, which advice includes covered call strategies similar to those employed by the Fund. Prior to joining USCA, from 2006 to 2015, Mr. Rushing served as a portfolio manager in UBS’ “Portfolio Management Program,” where he employed a strategy similar to that of the Fund. Mr. Rushing’s experience with the strategy dates back to his days at the University of Texas where he authored a paper on the subject as part of his graduate work and began managing his first account (his own) utilizing the strategy in 1999.

Shareholder Approval

To become effective with respect to the Fund, the vote of a “majority of the outstanding voting securities” (as defined in the 1940 Act) of the Fund is required for approval of the Sub-Advisory Agreement. The vote of a majority of the outstanding shares of the Fund means the vote of the lesser of: (1) 67% or more of the shares of the Fund present or represented by proxy at the Special Meeting, if the holders of more than 50% of the outstanding shares of the Fund are present or represented by proxy, or (2) more than 50% of the outstanding shares of the Fund. For purposes of determining the approval of the Sub-Advisory Agreement, abstentions will have the same effect as shares voted against the Proposal.

THE BOARD, INCLUDING ALL OF THE INDEPENDENT TRUSTEES, UNANIMOUSLY RECOMMENDS THAT THE SHAREHOLDERS OF THE FUND VOTE FOR THE APPROVAL OF THE SUB-ADVISORY AGREEMENT.

PROPOSAL 2

To transact any other business that may properly come before the Special Meeting or any adjournment or postponement thereof in the discretion of the proxies or their substitutes.

The proxy holders have no present intention of bringing any other matter before the Special Meeting other than those specifically referred to above or matters in connection with or for the purpose of effecting the same. Neither the proxy holders nor the Board of Trustees are aware of any matters which may be presented by others. If any other business shall properly come before the Special Meeting, the proxy holders intend to vote thereon in accordance with their best judgment.

ADDITIONAL INFORMATION REGARDING SHAREHOLDERS AND VOTING REQUIREMENTS

Record Date. The Board has fixed the close of business on November 20, 2023 (the “Record Date”), as the record date for the determination of shareholders of the Fund entitled to notice of and to vote at the Special Meeting or any adjournment or postponement thereof.

Outstanding Shares. As of the Record Date, there were 2,446,304.0710 shares of beneficial interest of the Fund outstanding and entitled to vote. All shareholders of the Fund will vote together as a single class. All full shares of the Trust are entitled to one vote, with proportionate voting for fractional shares.

Required Vote. The approval of the Proposal requires the affirmative vote of a “majority of the outstanding voting securities” (as defined in the 1940 Act) of the Fund, which means the lesser of (1) the holders of 67% or more of the Shares of the Fund present at the Special Meeting if the holders of more than 50% of the outstanding shares of the Fund are present or represented by proxy or (2) more than 50% of the outstanding shares of the Fund.

Quorum. A quorum is the number of shares legally required to be at a meeting in order to conduct business. The presence, in person or by proxy, of more than 50% of the outstanding shares of the Fund is necessary to constitute a quorum at the Special Meeting. Proxies properly executed and marked with a negative vote or an abstention will be considered to be present at the Special Meeting for purposes of determining the existence of a quorum for the transaction of business. If the Special Meeting is called to order but a quorum is not present at the Special Meeting, the persons named as proxies may vote those proxies that have been received to adjourn the Special Meeting to a later date. If a quorum is present at the Special Meeting but sufficient votes to approve the Proposal are not received, the persons named as proxies may propose one or more adjournments of the Special Meeting to permit further solicitation of proxies. Any such adjournment will require the affirmative vote of a majority of those shares represented at the Special Meeting in person or by proxy. The persons named as proxies will vote those proxies received that voted in favor of the Proposal in favor of such an adjournment and will vote those proxies received that voted against the Proposal against any such adjournment.

Abstentions are counted for purposes of determining whether a quorum is present but do not represent votes cast with respect to the Proposal. Accordingly, abstentions will effectively be a vote against a proposal, for which the required vote is a percentage of the outstanding voting shares and will have no effect on a vote for adjournment.

Principal Holders of the Fund’s Shares. As of the Record Date, the persons listed in the table below are deemed to be control persons or principal owners of the Fund, as defined in the 1940 Act. Control persons own of record or beneficially 25% or more of a fund’s outstanding securities and are presumed to control the fund for purposes of voting on matters submitted to a vote of shareholders. Principal holders own of record or beneficially 5% or more of a fund’s outstanding voting securities.

| Shareholder Name and Address | Number of Shares Owned | Percentage of Shares Owned |

National Financial Services LLC 499 WASHINGTON BLVD JERSEY CITY, NJ 07310 | 1,767,816.0210 | 72.26% |

CHARLES SCHWAB & CO INC. SPECIAL CUSTODY A/C FBO CUSTOMERS ATTN MUTUAL FUNDS 101 MONTGOMERY ST SAN FRANCISCO, CA 94104-4151 | 158,600.8600 | 6.48% |

Morgan Stanley Smith Barney LLC FBO a customer of MSSB 784-034301-000 1 New York Plaza New York, NY 10004 | 126,343.1480 | 5.16% |

As of the Record Date, the Trustees and Officers, as a group, owned less than 1% of the outstanding shares of the Fund.

ADDITIONAL INFORMATION REGARDING THE OPERATION OF THE FUND

Investment Adviser

DCM Advisors, LLC

DCM Advisors, LLC is the investment adviser for the Fund. DCM is located at 33 Whitehall Street, 11th Floor, New York, NY 10004. DCM, organized as a Delaware limited liability company, is controlled by Dinosaur Group Holdings, LLC. DCM and its affiliates have experience in managing investments for clients, including individuals, corporations, non-taxable entities, and other business and private accounts, since October 2002. As of June 30, 2023, DCM had assets under management of approximately $325.75 million. DCM has served as investment adviser to the Fund since 2018. Subject to the authority of the Board, DCM provides guidance and policy direction in connection with its daily management of the Fund’s assets. DCM is also responsible for the selection of broker-dealers for executing portfolio transactions, subject to the brokerage policies established by the trustees of the Trust. A discussion regarding the basis for the Board’s approval of DCM’s investment advisory agreement is available in the Fund’s semi-annual report to shareholders for the fiscal period ended April 30, 2023. If the Sub-Advisory Agreement is approved by shareholders of the Fund, DCM will continue to provide the Fund with services under its investment advisory agreement that have not been delegated by DCM to USCA pursuant to the Sub-Advisory Agreement, including investment oversight, administrative, operational, risk management, and compliance services.

Portfolio Managers

The Fund is currently managed by Dr. Vijay Chopra, who is primarily responsible for the day-to-day management of the Fund’s portfolio.

Dr. Vijay Chopra has served as a portfolio manager of the Fund since December 24, 2021, and served as its sole portfolio manager from November 16, 2018 to December 23, 2021, and since November 14, 2013. Dr. Chopra is Head of Quantitative Strategies at DCM where he has worked since September 1, 2017. Prior to joining DCM, Dr. Chopra managed equity strategies at Lebenthal Asset Management, Roosevelt Investments, Mesirow Financial and Bear Stearns Asset Management. He received a degree in electrical engineering from the Indian Institute of Technology. He also received his MBA and PhD in Finance from Vanderbilt University. He has over 25 years’ experience in the investment advisory business.

Principal Underwriter

Ultimus Fund Distributors, LLC (the “Distributor”), whose principal address is 225 Pictoria Drive, Suite 450, Cincinnati, OH 45246, is the distributor (also known as principal underwriter) of the shares of the Fund. The Distributor is a registered broker-dealer and is a member of FINRA.

Under a Distribution Agreement with the Trust, the Distributor acts as the agent of the Trust in connection with the continuous offering of shares of each series of the Trust, including the Fund. The Distributor continually distributes shares of the Fund on a best efforts basis. The Distributor has no obligation to sell any specific quantity of Fund shares. The Distributor and its officers have no role in determining the investment policies or which securities are to be purchased or sold by the Trust. The Distributor is paid a fee of $8,000 per year by the Fund or its investment adviser for certain distribution-related services.

The Distributor may enter into agreements with selected broker-dealers, banks or other financial intermediaries for distribution of shares of the Fund. With respect to certain financial intermediaries and related fund “supermarket” platform arrangements, the Fund and/or DCM, rather than the Distributor, typically enter into such agreements. These financial intermediaries may charge a fee for their services and may receive shareholder service or other fees from parties other than the Distributor. These financial intermediaries may otherwise act as processing agents and are responsible for promptly transmitting purchase, redemption and other requests to the Fund.

Administration, Fund Accounting, Transfer Agency and Other Services

Ultimus Fund Solutions, LLC (the “Administrator”), whose principal address is 225 Pictoria Drive, Suite 450, Cincinnati, OH 45246, perform administration, fund accounting, and transfer agent services to the Fund pursuant to a Master Services Agreement (the “Administration Agreement”).

Pursuant to the Administration Agreement the Fund pays the Administrator a bundled fee for administration, fund accounting and transfer agency services. The Fund also pays the Administrator certain surcharges and shareholder account fees. The fee is accrued daily by the Fund and are paid monthly based on the average net assets, transactions and positions for the prior month, subject to a minimum fee per month.

Annual and Semiannual Reports

The Fund will furnish, without charge, a copy of its most recent annual report and most recent semi-annual report succeeding such annual report, if any, upon request. To request the annual or semi-annual report, please call us toll free at 1-888-484-5766 or write to Fund at DCM Advisors Funds, c/o Transfer Agency, P.O. Box 46707, Cincinnati, OH 45246-0707. The Fund’s annual and semi-annual reports are also available, without charge, on the Fund’s website at http:// www.dcmadvisors.com.

OTHER MATTERS

Shareholder Proposals

As a Delaware statutory trust, the Trust does not intend to, and is not required to hold annual meetings of shareholders, except under certain limited circumstances. The Board of Trustees does

not believe a formal process for shareholders to send communications to the Board of Trustees is appropriate due to the infrequency of shareholder communications to the Board of Trustees. The Trust has not received any shareholder proposals to be considered for presentation at the Special Meeting. Under the proxy rules of the SEC, shareholder proposals may, under certain conditions, be included in the Trust’s proxy statement and proxy for a particular meeting. Under these rules, proposals submitted for inclusion in the Trust’s proxy materials must be received by the Trust within a reasonable time before the solicitation is made. The fact that the Trust receives a shareholder proposal in a timely manner does not insure its inclusion in its proxy materials, because there are other requirements in the proxy rules relating to such inclusion. Annual meetings of shareholders of the Fund are not required as long as there is no particular requirement under the Investment Company Act of 1940, as amended, which must be met by convening such a shareholder meeting. Any shareholder proposal should be sent to Paul Leone, Secretary, Centaur Mutual Funds Trust at 225 Pictoria Drive, Suite 450, Cincinnati, OH 45246.

Board Meetings During the Most Recent Fiscal Year

The Board held six meetings during the Fund’s most recent fiscal year ended October 31, 2023.

Shareholder Communications with Trustees

Shareholders who wish to communicate with the Board or individual Trustees should write to the Board or the particular Trustee, care of the Fund, at the offices of the Trust as set forth below. All communications will be forwarded directly to the Board or the individual Trustee.

Shareholders also have an opportunity to communicate with the Board at shareholder meetings. The Trust does not have a policy requiring Trustees to attend shareholder meetings.

Proxy Delivery

The Trust may only send one Proxy Statement to shareholders who share the same address unless the Trust has received different instructions from one or more of the shareholders. The Fund will deliver promptly to a shareholder, upon oral or written request, a separate copy of the Proxy Statement to a shared address to which a single copy of the Proxy Statement was delivered. By calling or writing the Fund, a shareholder may request separate copies of future proxy statements, or if the shareholder is receiving multiple copies of the proxy statement now, may request a single copy in the future. To request a paper or email copy of the Proxy Statement or annual report at no charge, or to make any of the aforementioned requests, call us toll free at 1-888-484-5766 or write to the Fund at DCM Advisors Funds, c/o Transfer Agency, P.O. Box 46707, Cincinnati, OH 45246-0707 or go to http:// www.dcmadvisors.com.

By Order of the Board of Trustees,

Paul F. Leone

Secretary, Centaur Mutual Funds Trust

Date: December 22, 2023

YOUR VOTE IS IMPORTANT NO MATTER HOW MANY SHARES YOU OWN. PLEASE CAST YOUR PROXY VOTE TODAY!

PROXY CARD

DCM/INNOVA High Equity Income Innovation Fund (TILDX)

PROXY FOR A SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON JANUARY 29, 2024

The undersigned, revoking prior proxies, hereby appoints Glenn Grossman, Andrew Greenstein, and Matthew Millter, and each of them, as attorneys-in-fact and proxies of the undersigned, granted in connection with the voting of the shares subject hereto with full power of substitution, to vote shares held in the name of the undersigned on the record date at the Special Meeting of Shareholders of the above-named Fund (the “Fund”) to be held at the offices of the Fund’s transfer agent, Ultimus Fund Solutions, LLC, 225 Pictoria Drive, Suite 450, Cincinnati, OH 45246 on January 29, 2024, at 1:00 p.m. Eastern Time, or at any adjournment thereof, upon the Proposal described in the Notice of Meeting and accompanying Proxy Statement, which have been received by the undersigned.

Do you have questions?If you have any questions about how to vote your proxy or about the meeting in general, please call toll-free (877) 361-7966. Representatives are available to assist you Monday through Friday 9 a.m. to 10 p.m. Eastern Time.

Important Notice Regarding the Availability of Proxy Materials for this Special Meeting of Shareholders to Be Held on January 29, 2024. The proxy statement for this meeting is available at:

https://vote.proxyonline.com/centaur/docs/proxy2024.pdf.

| [PROXY ID NUMBER HERE] | [BAR CODE HERE] | [CUSIP HERE] |

| |

| |

| DCM/INNOVA High Equity Income Innovation Fund (TILDX) |

| |

| YOUR SIGNATURE IS REQUIRED FOR YOUR VOTE TO BE COUNTED. The signer(s) acknowledges receipt with this Proxy Statement of the Board of Trustees. Your signature(s) on this should be exactly as your name(s) appear on this Proxy (reverse side). If the shares are held jointly, each holder should sign this Proxy. Attorneys-in-fact, executors, administrators, trustees or guardians should indicate the full title and capacity in which they are signing. |

| PROXY CARD |

| | |

| | |

| | |

| | |

| SIGNATURE (AND TITLE IF APPLICABLE) | DATE |

| | |

| | |

| | |

| SIGNATURE (IF HELD JOINTLY) | DATE |

| | |

This proxy is solicited on behalf of the Fund’s Board of Trustees, and the Proposal has been unanimously approved by the Board of Trustees and recommended for approval by shareholders. When properly executed, this proxy will be voted as indicated or “FOR” the proposal if no choice is indicated. The proxy will be voted in accordance with the proxy holders’ best judgment as to any other matters that may arise at the Special Meeting.

THE BOARD OF TRUSTEES OF THE FUND UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE PROPOSAL.

| TO VOTE, MARK CIRCLES BELOW IN BLUE OR BLACK INK AS FOLLOWS. Example: | ● |

| | FOR | AGAINST | ABSTAIN |

| 1. | To approve a sub-advisory agreement (the “Sub-Advisory Agreement”) to be entered into by and between DCM Advisors, LLC (“DCM” or the “Adviser”), USCA Asset Management LLC (“USCA” or the “Sub-Adviser”) and the Trust, on behalf of the Fund. | ○ | ○ | ○ |

| | | | | |

| 2. | To transact any other business that may properly come before the Special Meeting or any adjournment or postponement thereof in the discretion of the proxies or their substitutes. | | | |

THANK YOU FOR VOTING

| [PROXY ID NUMBER HERE] | [BAR CODE HERE] | [CUSIP HERE] |

APPENDIX A

FORM OF INVESTMENT SUB-ADVISORY AGREEMENT

INVESTMENT SUB-ADVISORY AGREEMENT

THIS INVESTMENT SUB-ADVISORY AGREEMENT (the “Agreement”) made this [●] day of [●], 2023 by and among DCM ADVISORS, LLC (hereinafter referred to as the “Investment Adviser”), USCA ASSET MANAGEMENT, LLC (hereinafter referred to as the “Subadviser”) and Centaur Mutual Funds Trust (the “Trust”), on behalf of the DCM/INNOVA High Equity Income Innovation Fund (the “Fund”), which Agreement may be executed in any number of counterparts, each of which shall be deemed to be an original, but all of which together shall constitute but one instrument.

WHEREAS, the Investment Adviser has been retained by the Trust, a registered management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”), to provide investment advisory services to the Fund;

WHEREAS, the Investment Adviser wishes to enter into a contract with the Subadviser to provide research, analysis, advice and recommendations with respect to the purchase and sale of securities and other investments, and make investment commitments with respect to the Fund’s assets (“Allocated Assets”), subject to oversight by the Trust’s Board of Trustees (the “Board”) and the supervision of the Investment Adviser.

NOW THEREFORE, in consideration of the mutual agreements herein contained, and intending to be bound, the parties agree as follows:

1. In accordance with the Investment Advisory Agreement between the Trust and the Investment Adviser (“Investment Advisory Agreement”) with respect to the Fund, the Investment Adviser hereby appoints the Subadviser to act as subadviser with respect to the Allocated Assets for the period and on the terms set forth in this Agreement. The Subadviser accepts such appointment and agrees to render the services set forth herein, for the compensation provided herein.

2. For all of the services rendered with respect to the Fund as herein provided, the Investment Adviser shall pay to the Subadviser a fee (for the payment of which the Fund shall have no obligation or liability), equal to an annualized rate of 0.25% of the average daily net assets of the Fund. The fee shall be calculated as of the last business day of each month based upon the average daily net assets of the Fund determined in the manner described in the Fund’s Prospectus and/or Statement of Additional Information, and shall be paid to the Subadviser by the Investment Adviser within twenty (20) days thereafter. In the case of termination of this Agreement during any calendar month, the fee accrued to, but excluding, the date of termination shall be paid promptly following such termination.

3. This Agreement shall become effective as of the date and year upon which the Fund’s shareholders approve this Agreement.

4. Unless sooner terminated as hereinafter provided, this Agreement shall continue in effect for a period of two years from its effective date and shall continue from year to year thereafter provided such continuance is approved at least annually by the Board or by a vote of the majority of the outstanding voting securities of the Fund as prescribed by the 1940 Act and provided further that such continuance is approved at least annually by a vote of a majority of the Trust’s Board, who are not parties to such Agreement or interested persons of such a party, cast in person at a meeting called for the purpose of voting on such approval. This Agreement will terminate without the payment of any penalty by the Fund (i) upon termination of the Investment Advisory Agreement by either party thereto (accompanied by simultaneous notice to the Subadviser), (ii) by the Fund at any time upon written notice to the Subadviser that the Board or the shareholders by vote of a majority of the outstanding voting securities of the Fund, as provided by the 1940 Act, have terminated this Agreement, or (iii) upon at least sixty days’ written notice to the Subadviser by the Investment Adviser. This Agreement may also be terminated by the Subadviser without penalty paid by the Fund upon ninety days’ written notice to the Investment Adviser and the Trust. This Agreement shall terminate automatically in the event of its assignment or, upon notice thereof to the Subadviser, the assignment of the Investment Advisory Agreement (in each case as the term “assignment” is defined in Section 2(a)(4) of the 1940 Act, subject to such exemptions as may be granted by the Securities and Exchange Commission (“SEC”) by any rule, regulation, order or interpretive guidance).

5. Subject to the oversight of the Board and the Investment Adviser, the Subadviser will provide an investment program for the Allocated Assets, including investment research and management with respect to securities and other investments, including cash and cash equivalents, and will determine from time to time what securities and other investments will be purchased, retained or sold. The Subadviser will provide the services under this Agreement in accordance with the Fund’s investment objective, policies and restrictions as stated in the Fund’s registration statement, as provided to the Subadviser by the Investment Adviser. The Subadviser further agrees that, in all matters relating to the performance of this Agreement, it:

(a) shall act in conformity with the Trust’s Declaration of Trust, By-Laws and currently effective registration statements under the 1940 Act and the Securities Act of 1933 (the “1933 Act”) and any amendments or supplements thereto (the “Registration Statements”) and with the written policies, procedures and guidelines of the Fund, and written instructions and directions of the Board (provided such policies, procedures, guidelines, instructions and directions are timely delivered to the Subadviser as described below and are not inconsistent with the Subadviser’s duties under this Agreement) and shall comply with the requirements of the 1940 Act and the Investment Advisers Act of 1940, as amended (the “Advisers Act”) and the rules thereunder, and all other applicable federal and state laws and regulations. The Investment Adviser agrees to provide Subadviser with copies of the Trust’s Declaration of Trust, By-Laws, Registration Statements, written policies, procedures and guidelines, and written instructions and directions of the Board, and any amendments or supplements to any of them at, or, if practicable, before the time such materials, instructions or directives become effective;

(b) will maintain at all times during the term of this Agreement, in full force and effect, insurance, including without limitation errors and omissions insurance, with reputable

insurance carriers, in such amounts, covering such risks and liabilities, and with such deductibles and self-insurance as are consistent with customary industry practice;

(c) will pay expenses incurred by it in connection with its activities under this Agreement other than the cost of securities and other investments (including brokerage commissions and other transaction changes, if any) purchased for the Fund;

(d) will transmit buy and sell transactions, in a mutually agreeable format, pursuant to its investment determinations for the Allocated Assets to the Investment Adviser for execution through the Investment Adviser’s trading personnel;

(e) will review the daily valuation of investments comprising the Allocated Assets of the Fund as obtained on a daily basis by the Fund or its agents and sent to the Subadviser, and will promptly notify the Trust and the Investment Adviser if the Subadviser believes that any such valuations may not properly reflect the market value of any investments owned by the Fund, provided, however, that the Subadviser is not required by this subparagraph to obtain valuations of any such investments from brokers or dealers or otherwise, or to otherwise independently verify valuations of any such securities;

(f) will attend regular business and investment-related meetings with the Board and the Investment Adviser if requested to do so by the Trust and/or the Investment Adviser, and at its expense, shall supply the Board, the officers of the Trust, and the Investment Adviser with all information and reports reasonably required by them and reasonably available to the Subadviser relating to the services provided by the Subadviser hereunder;

(g) will furnish to the Investment Adviser and the Board such periodic and special reports as they may reasonably request with respect to the Fund, and provide in advance to the Investment Adviser all of such reports to the Board for examination and review within a reasonable time prior to the Trust’s Board meetings;

(h) will pay expenses incurred by the Trust for any matters related to any transaction or event that is deemed to result in a change of control of the Subadviser or otherwise result in the assignment of the Agreement under the 1940 Act.

6. The Investment Adviser or its affiliates may, from time to time, engage other subadvisers to advise other series of the Trust (or portions thereof) or other registered investment companies (or series or portions thereof) that may be deemed to be under common control (each a “Sub-Advised Fund”). The Subadviser agrees that it will not consult with any other subadviser engaged by the Investment Adviser or its affiliates with respect to transactions in securities or other assets concerning the Fund or another Sub-Advised Fund, except to the extent permitted by the rules under the 1940 Act that permit certain transactions with a subadviser or its affiliates.

7. Subadviser agrees with respect to the services provided to the Fund that:

(a) it will promptly communicate to the Investment Adviser such information relating to Fund transactions as the Investment Adviser, officers of the Trust, or Board may reasonably request and as communicated to the Subadviser;

(b) it will promptly notify the Investment Adviser and the Trust in writing about: (i) any financial condition that is likely to impair the Subadviser’s ability to fulfill its commitment under this Agreement; (ii) any contemplated change in control or management of the Subadviser; (iii) any change in the Subadviser’s personnel materially involved in the management of the Allocated Assets; (iv) any failure by the Subadviser to remain registered as an investment adviser under the Advisers Act or under the laws of any jurisdiction in which the Subadviser is required to be registered; (v) the Subadviser being served or receiving notice of any action, suit, proceeding, inquiry or investigation, at law or in equity, before or by any court, public board or body, or government or regulatory agency in any way relating to the Fund or potentially affecting the Subadviser’s services under this Agreement; and (v) any violation by the Subadviser of the federal securities laws;

(c) it will comply with Rule 206(4)-7 under the Advisers Act and provide an annual certification to the Investment Adviser and the Trust stating that the Subadviser has implemented a compliance program that is reasonably designed to prevent violations of the federal securities laws and will provide the Investment Adviser and the Trust access to information regarding the Subadviser’s compliance program and assistance with the Trust’s compliance with Rule 38a-1 under the 1940 Act;

(d) it will provide access to personnel, records, communications, systems, and all other relevant material as may be requested by the Investment Adviser or the Trust periodically, including but not limited to remote and on-site testing, due diligence reviews, and periodic compliance-related reports and certifications;

(e) it will treat confidentially and as proprietary information of the Trust all records and other information relative to the Fund and its prior, present or potential shareholders (“Confidential Information”), will comply at all times with all applicable laws and regulations relating to the confidentiality of “nonpublic personal information” including the Gramm-Leach-Bliley Act or other federal or state privacy laws and the regulations promulgated thereunder, and will not use such Confidential Information for any purpose other than the performance of its responsibilities and duties hereunder (except after prior notification to and approval in writing by the Trust, which approval may not be withheld where Subadviser is advised by counsel that the Subadviser may be exposed to civil or criminal contempt or other proceedings for failure to comply, when requested to divulge such information by duly constituted authorities, or when so requested by the Trust).

8. Each of the Investment Adviser and the Subadviser represents and warrants to the other that the execution, delivery and performance of this Agreement is within its powers and have been duly authorized by all necessary actions of its directors or members, and no action by, or in respect of, or filing with, any governmental body, agency or official is required on the part of such party for execution, delivery and performance of this Agreement, and the execution, delivery and performance by such party of this Agreement do not contravene or constitute a violation of, or a material default under, (i) any provision of applicable law, rule or regulation, (ii) such party’s governing instruments, or (iii) any agreement, judgment, injunction, order, decree or other instrument binding upon such party.

9. In compliance with the requirements of Rule 31a-3 under the 1940 Act, Subadviser acknowledges that all records which it maintains for the Trust are the property of the Trust and agrees to surrender promptly to the Trust any of such records upon the Trust’s request, provided that Subadviser may retain copies thereof at its own expense. Subadviser further agrees to preserve for the periods prescribed by Rule 31a-2 under the 1940 Act the records required to be maintained by Rule 31a-1 under the 1940 Act relating to transactions recommended by Subadviser for the Fund.

10. It is expressly understood and agreed that the services to be rendered by the Subadviser to the Investment Adviser under the provisions of this Agreement are not to be deemed to be exclusive, and the Subadviser shall be free to provide similar or different services to others so long as its ability to provide the services provided for in this Agreement shall not be materially impaired thereby. In addition, but without limiting any separate agreement between the Subadviser and the Investment Adviser to the contrary, nothing in this Agreement shall limit or restrict the right of any director, officer, or employee of the Subadviser who may also be a Trustee, officer, or employee of the Trust, to engage in any other business or to devote his or her time and attention in part to the management or other aspects of any other business, whether of a similar nature or a dissimilar nature.

11. The Investment Adviser agrees that it will furnish currently to the Subadviser all information with reference to the Fund and the Trust that is reasonably necessary to permit the Subadviser to carry out its responsibilities under this Agreement, and the parties agree that they will from time to time consult and make appropriate arrangements as to specific information that is required under this paragraph and the frequency and manner with which it shall be supplied. Without limiting the generality of the foregoing, Investment Adviser will furnish to Subadviser procedures consistent with the Trust’s contract with the Fund’s custodian from time to time (the “Custodian”), and reasonably satisfactory to Subadviser, for consummation of portfolio transactions for the Fund by payment to or delivery by the Custodian of all cash and/or securities or other investments due to or from the Fund, and Subadviser shall not have possession or custody thereof or any responsibility or liability with respect to such custody. Upon giving proper instructions to the Custodian, Subadviser shall have no responsibility or liability with respect to custodial arrangements or the acts, omissions or other conduct of the Custodian.

12. Unless otherwise agreed by the parties in writing, the Investment Adviser, and not the Subadviser, shall be solely responsible for:

(a) (i) voting or directing the voting of proxies solicited by or with respect to the issuers of securities held by the Fund, (ii) maintaining records of such voting as may be required by applicable law or regulation, and (iii) coordinating all filings with service providers on Form N-PX or similar forms related to such voting as may be required by applicable law or regulation;

(b) making all filings required under Section 13 of the Securities Exchange Act of 1934, as amended, and rules promulgated thereunder, to the extent such filings relate to the Fund;

(c) maintaining books and records with respect to investment transactions for

the Allocated Assets of the Fund;

Each of the parties hereto acknowledge and agree that neither the Subadviser nor Investment Adviser shall advise or act for the Fund in any legal proceeding or class action involving the Fund or issuers of securities held by the Fund.

13. The Subadviser shall comply with all applicable laws and regulations in the discharge of its duties under this Agreement; shall comply with the investment policies, guidelines and restrictions of the Fund (provided Subadviser receives timely notice of such policies, guidelines and restrictions as described in Section 5 above); shall act at all times in the best interests of the Fund; and shall discharge its duties with the care, skill, prudence and diligence under the circumstances then prevailing that a prudent person acting in a like capacity and familiar with such matters would use in the conduct of a similar enterprise. The Subadviser shall be liable to the Fund for any loss (including brokerage charges) incurred by the Fund as a result of any investment made by the Subadviser in violation of this Section 13 hereof.

Except as provided in the foregoing paragraph, the Subadviser and its directors, officers, stockholders, employees and agents shall not be liable for any error of judgment or mistake of law or for any loss suffered by the Investment Adviser or the Trust in connection with any matters to which this Agreement relates or for any other act or omission in the performance by the Subadviser of its duties under this Agreement except for any liability that is due to Subadviser’s willful misfeasance, bad faith, or gross negligence in the performance of its duties or by reckless disregard of its obligations or duties under this Agreement.