Review of Third Quarter FY 15 Results February 5, 2015 Exhibit 99.2

T h i r d Q u a r t e r F Y 1 5 R e s u l t s 2 This presentation contains certain “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, such as statements about the Company’s product introductions, geographic expansion, investments in brand building, debt reduction, integration of the Insight acquisition, product mix, consumption growth and market position of the Company’s brands, M&A market activity, cost efficiencies, and the Company’s future financial performance. Words such as “continue,” “will,” “expect,” “target,” “project,” “anticipate,” “likely,” “estimate,” “may,” “should,” “could,” “would,” and similar expressions identify forward-looking statements. Such forward-looking statements represent the Company’s expectations and beliefs and involve a number of known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from those expressed or implied by such forward- looking statements. These factors include, among others, the failure to successfully integrate or capture cost savings from the Insight or Hydralyte businesses or future acquisitions, the failure to successfully commercialize new products, the severity of the cold and flu season, the inability of third party suppliers to meet demand, competitive pressures, the effectiveness of the Company’s brand building investments, fluctuating foreign exchange rates, and other risks set forth in Part I, Item 1A. Risk Factors in the Company’s Annual Report on Form 10-K for the year ended March 31, 2014 and in Part II, Item 1A. Risk Factors in the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2014. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. Except to the extent required by applicable law, the Company undertakes no obligation to update any forward-looking statement contained in this presentation, whether as a result of new information, future events, or otherwise. Safe Harbor Disclosure

T h i r d Q u a r t e r F Y 1 5 R e s u l t s 3 Agenda for Today’s Discussion Third Quarter FY 15 Review I. Performance Highlights II. Financial Overview III. FY 15 Outlook and the Road Ahead

T h i r d Q u a r t e r F Y 1 5 R e s u l t s 4

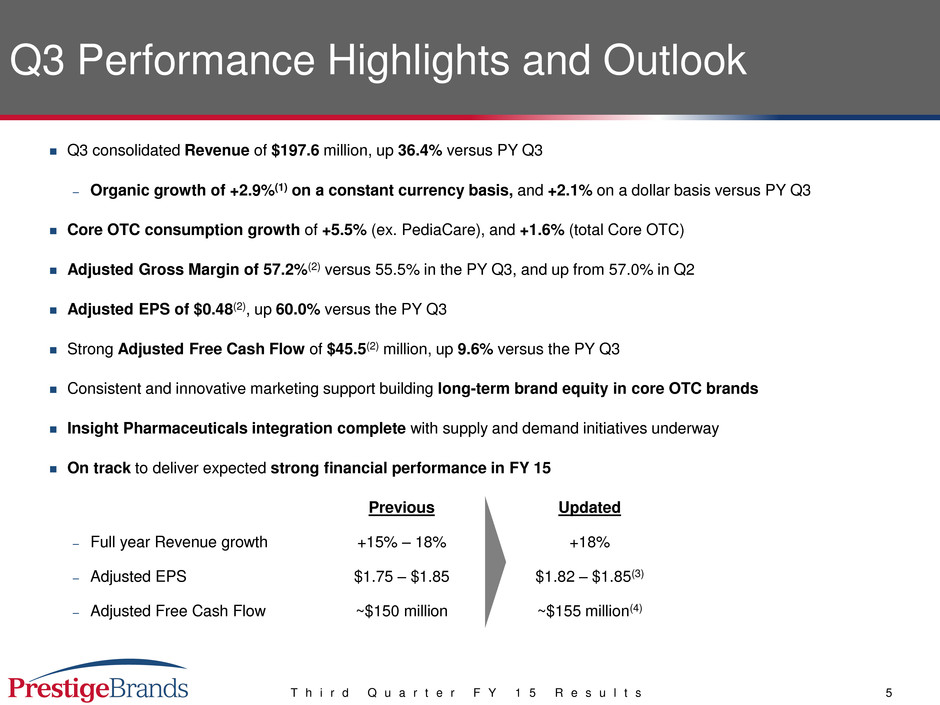

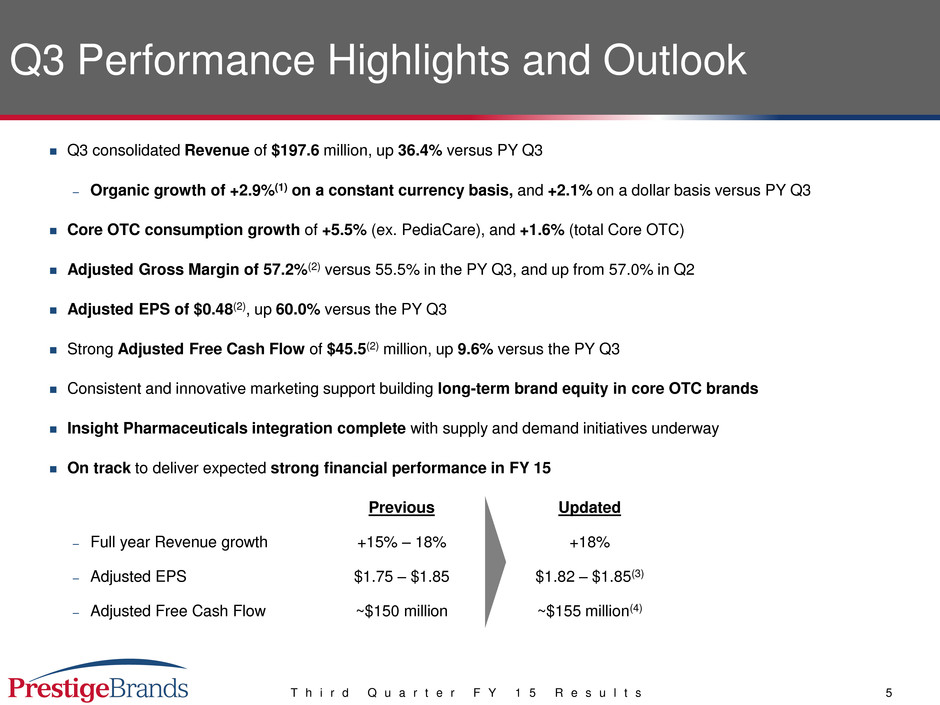

T h i r d Q u a r t e r F Y 1 5 R e s u l t s 5 Q3 Performance Highlights and Outlook Q3 consolidated Revenue of $197.6 million, up 36.4% versus PY Q3 – Organic growth of +2.9%(1) on a constant currency basis, and +2.1% on a dollar basis versus PY Q3 Core OTC consumption growth of +5.5% (ex. PediaCare), and +1.6% (total Core OTC) Adjusted Gross Margin of 57.2%(2) versus 55.5% in the PY Q3, and up from 57.0% in Q2 Adjusted EPS of $0.48(2), up 60.0% versus the PY Q3 Strong Adjusted Free Cash Flow of $45.5(2) million, up 9.6% versus the PY Q3 Consistent and innovative marketing support building long-term brand equity in core OTC brands Insight Pharmaceuticals integration complete with supply and demand initiatives underway On track to deliver expected strong financial performance in FY 15 Previous Updated – Full year Revenue growth +15% – 18% +18% – Adjusted EPS $1.75 – $1.85 $1.82 – $1.85(3) – Adjusted Free Cash Flow ~$150 million ~$155 million(4)

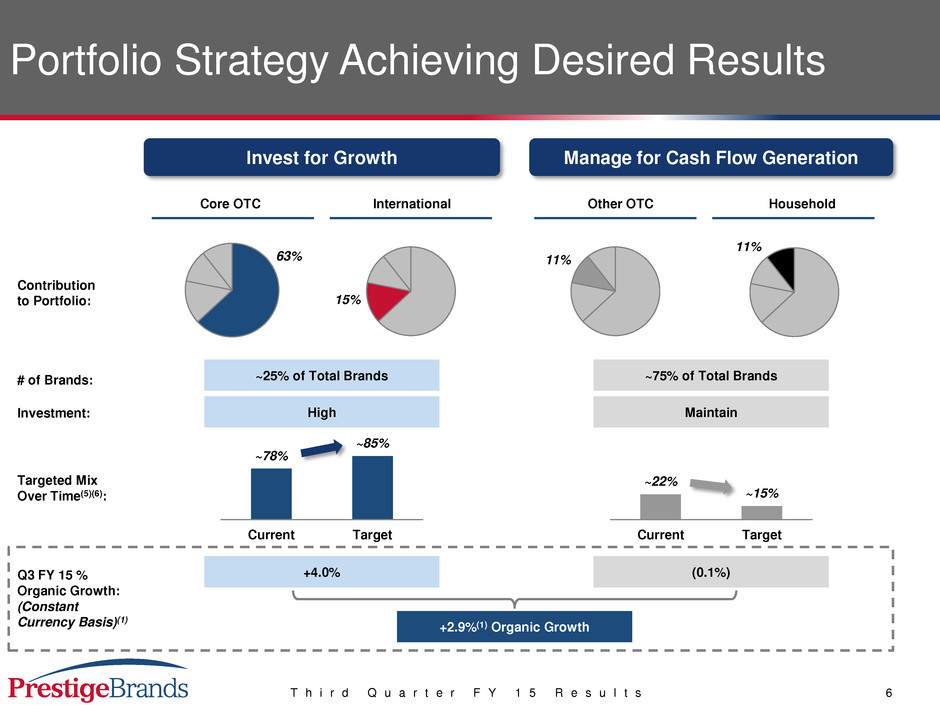

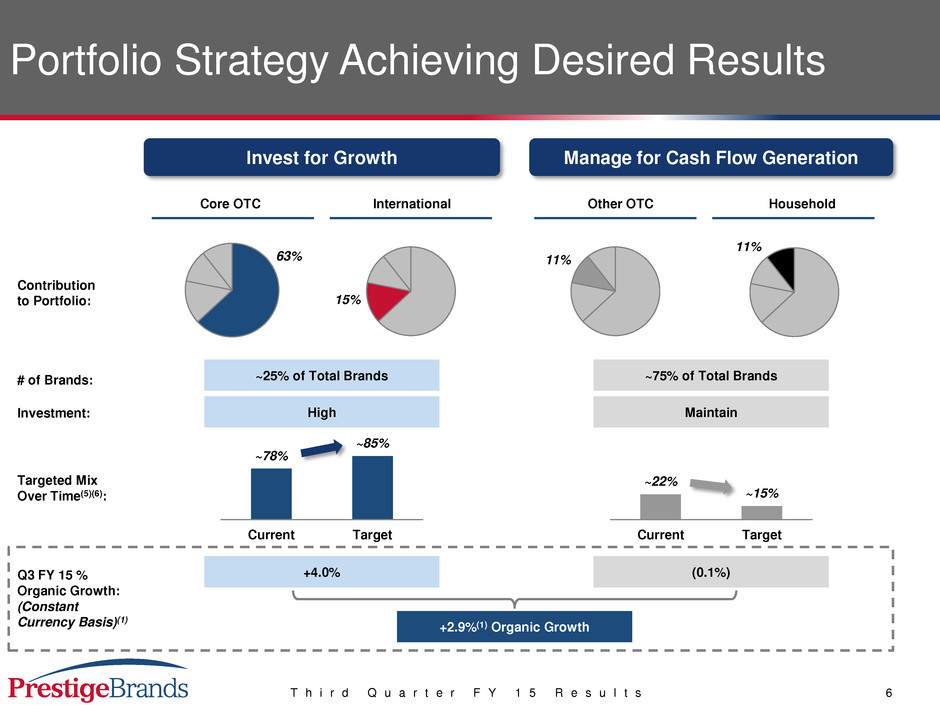

T h i r d Q u a r t e r F Y 1 5 R e s u l t s 6 Core OTC International Other OTC Household Contribution to Portfolio: # of Brands: Investment: Targeted Mix Over Time(5)(6): Q3 FY 15 % Organic Growth: (Constant Currency Basis)(1) Invest for Growth Manage for Cash Flow Generation 11% 11% ~25% of Total Brands ~75% of Total Brands 63% 15% Portfolio Strategy Achieving Desired Results +4.0% (0.1%) +2.9%(1) Organic Growth High Maintain ~78% ~85% Current Target ~22% ~15% Current Target

T h i r d Q u a r t e r F Y 1 5 R e s u l t s 7 Core OTC Consumption Growth Has Accelerated, Contributing to Sustained Sales Momentum Consumption Growth Organic Sales Growth (1.8%) 1.0% 1.6% 0.8% 3.9% 5.5% Q1 Q2 Q3 (5.0%) (4.2%) 2.8% (2.4%) 0.0% 8.3% Q1 Q2 Q3 FY 15 Core OTC, excludes Insight Pharmaceuticals. Source: IRI multi-outlet retail dollar sales growth for relevant period. Data reflects retail dollar sales percentage growth versus prior period. FY 15 +0.1% Y/Y % ∆: +0.2% (0.2%) (0.4%) +0.7% Excluding PediaCare

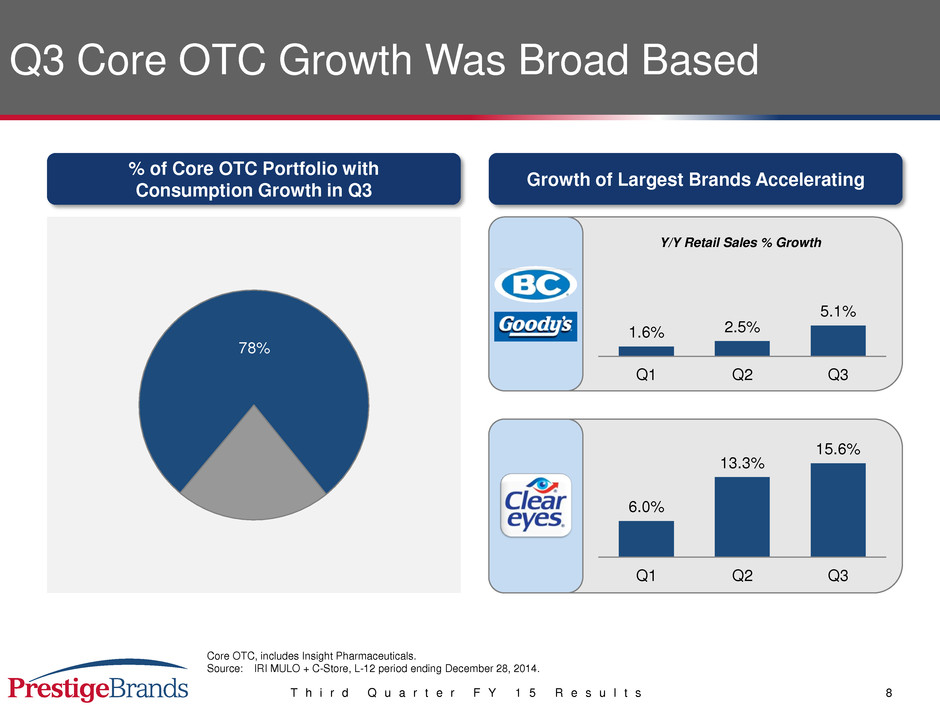

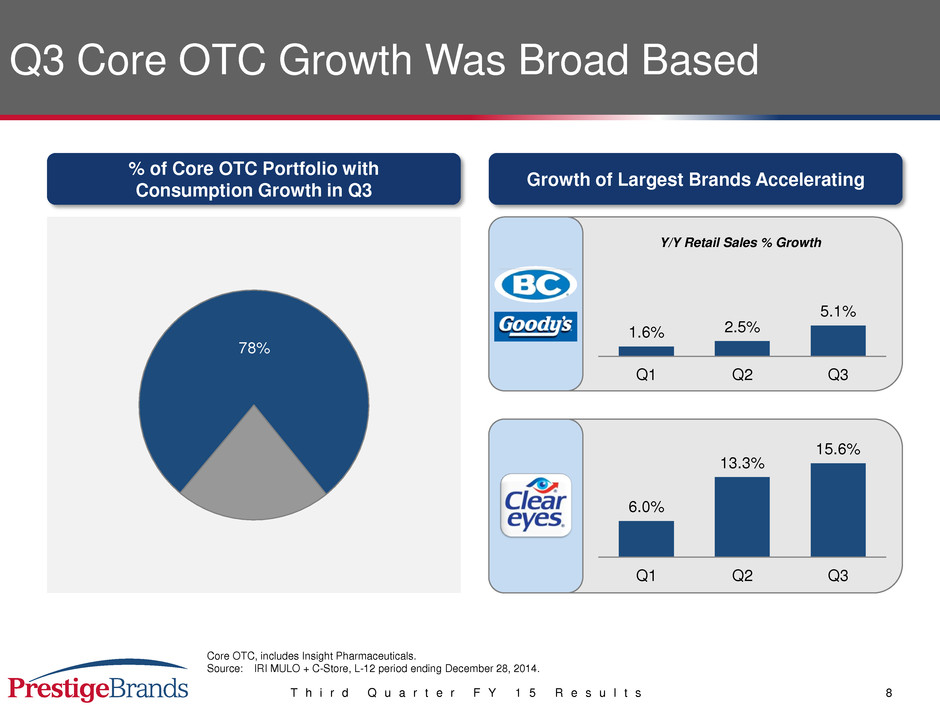

T h i r d Q u a r t e r F Y 1 5 R e s u l t s 8 Q3 Core OTC Growth Was Broad Based % of Core OTC Portfolio with Consumption Growth in Q3 10 5 Core Brands Growing Declining Accelerating Core Growth is Broad Based 78% Growing Brands* Proportion of Core Retail Sales 6.0% 13.3% 15.6% Q1 Q2 Q3 0.4% 3.6% 4.5% Q1 Q2 Q3 Growth of Largest Brands Accelerating 1.6% 2.5% 5.1% Q1 Q2 Q3 15 Y/Y Retail Sales % Growth Core OTC, includes Insight Pharmaceuticals. Source: IRI MULO + C-Store, L-12 period ending December 28, 2014. % of Core OTC Retail Sales Represented by Growing Brands

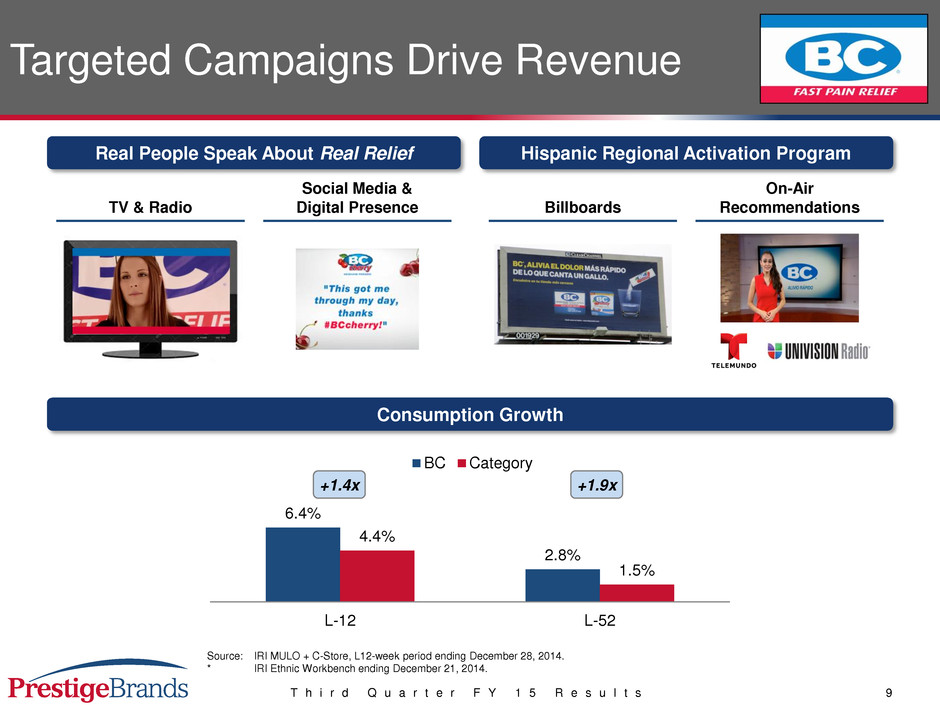

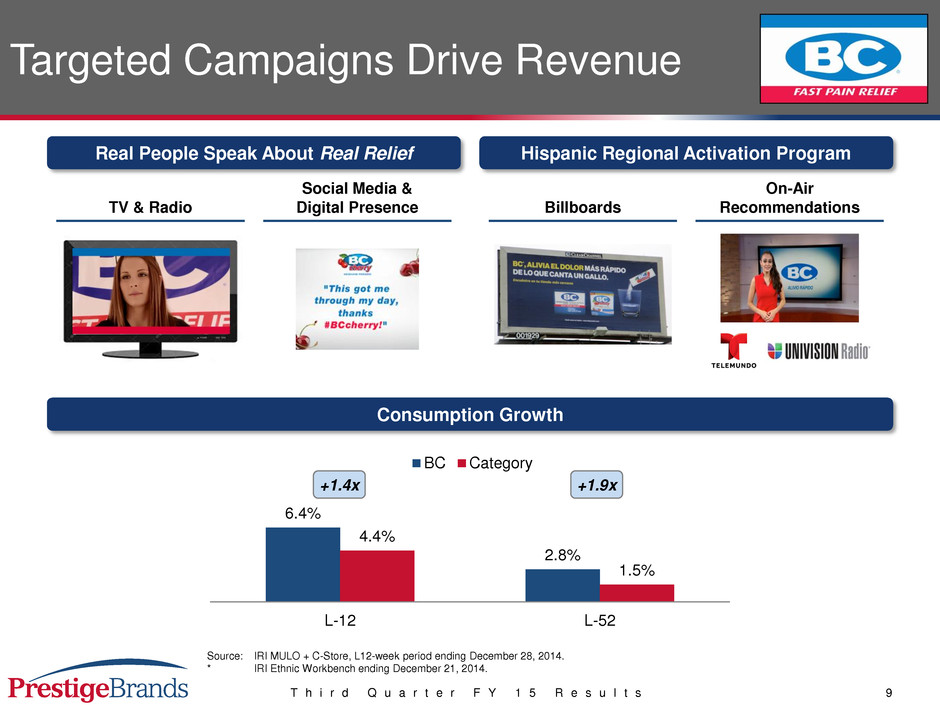

T h i r d Q u a r t e r F Y 1 5 R e s u l t s 9 TV & Radio Social Media & Digital Presence Targeted Campaigns Drive Revenue 6.4% 2.8% 4.4% 1.5% L-12 L-52 BC Category Real People Speak About Real Relief Hispanic Regional Activation Program Billboards On-Air Recommendations Consumption Growth Results +12% L-4 Consumption in the region +12% in the L-4 weeks* BC Cherry up +34.7% in C-Stores from increased distribution On-the-Go placement at front- end retail drives impulse sales in all channels Source: IRI MULO + C-Store, L12-week period ending December 28, 2014. * IRI Ethnic Workbench ending December 21, 2014. +1.9x +1.4x

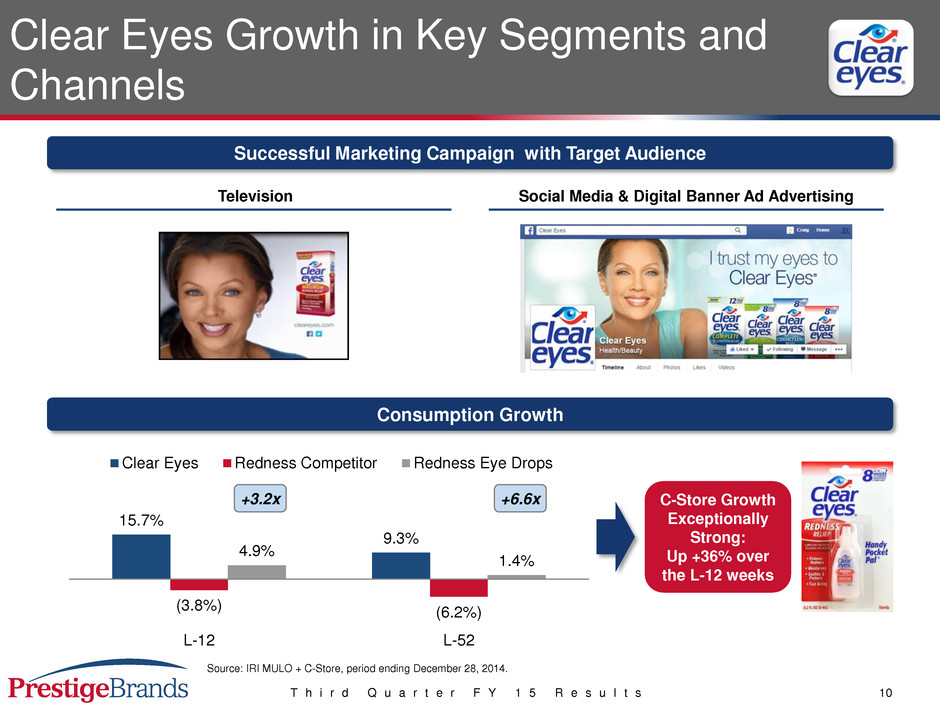

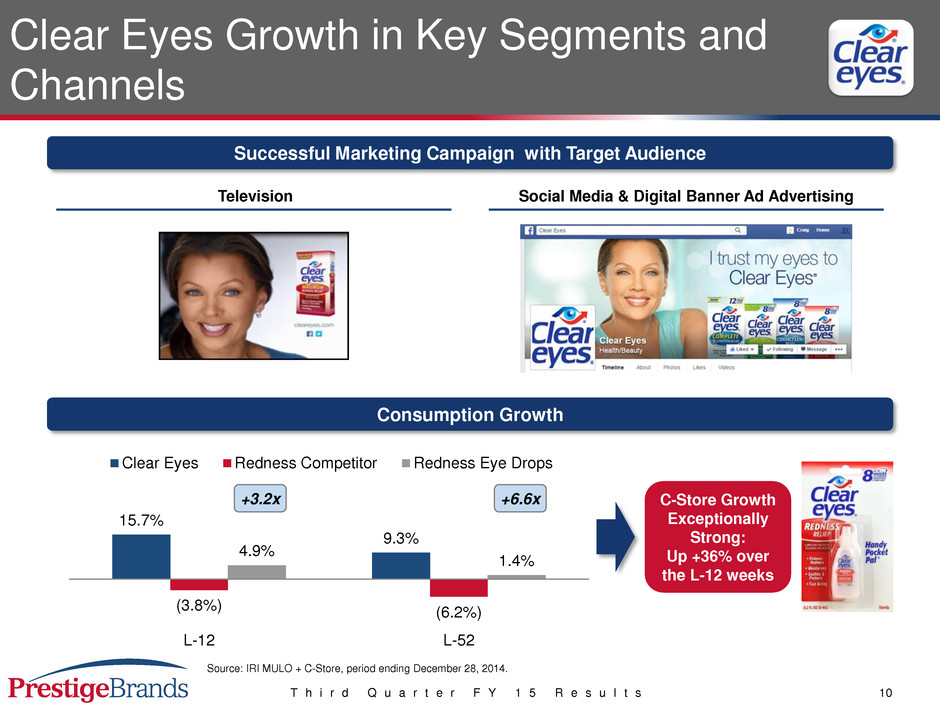

T h i r d Q u a r t e r F Y 1 5 R e s u l t s 10 Clear Eyes Growth in Key Segments and Channels Successful Marketing Campaign with Target Audience Robust Marketing Campaign & Distribution Gains Drive Clear Eyes To #1 in Redness Relief With Revenues to +$100 Million at Retail Consumption Growth 15.7% 9.3% (3.8%) (6.2%) 4.9% 1.4% L-12 L-52 Clear Eyes Redness Competitor Redness Eye Drops Television Social Media & Digital Banner Ad Advertising Source: IRI MULO + C-Store, period ending December 28, 2014. +6.6x +3.2x C-Store Growth Exceptionally Strong: Up +36% over the L-12 weeks

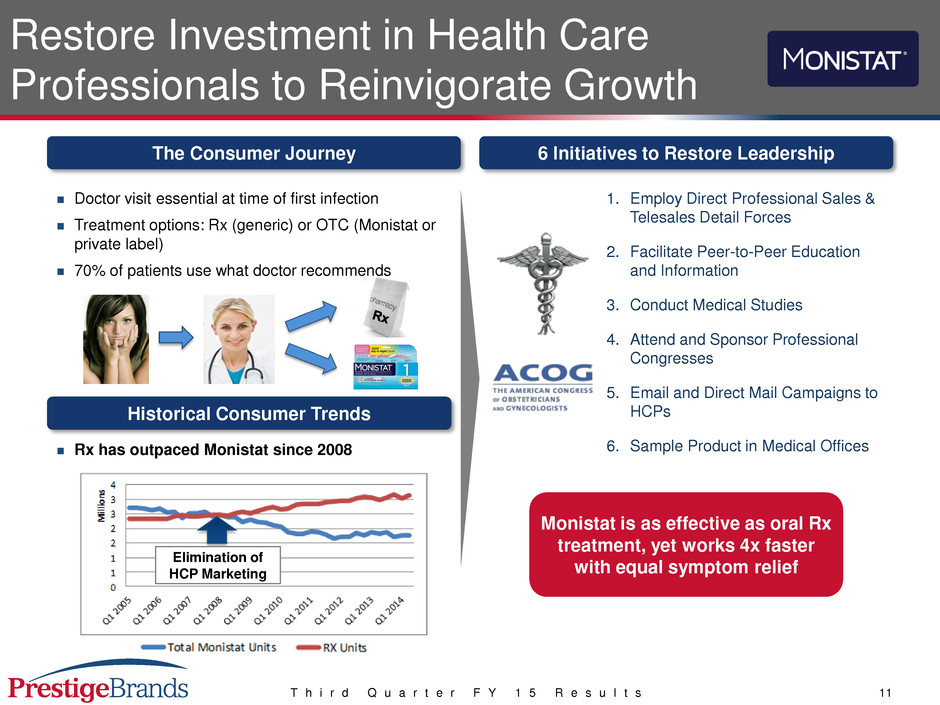

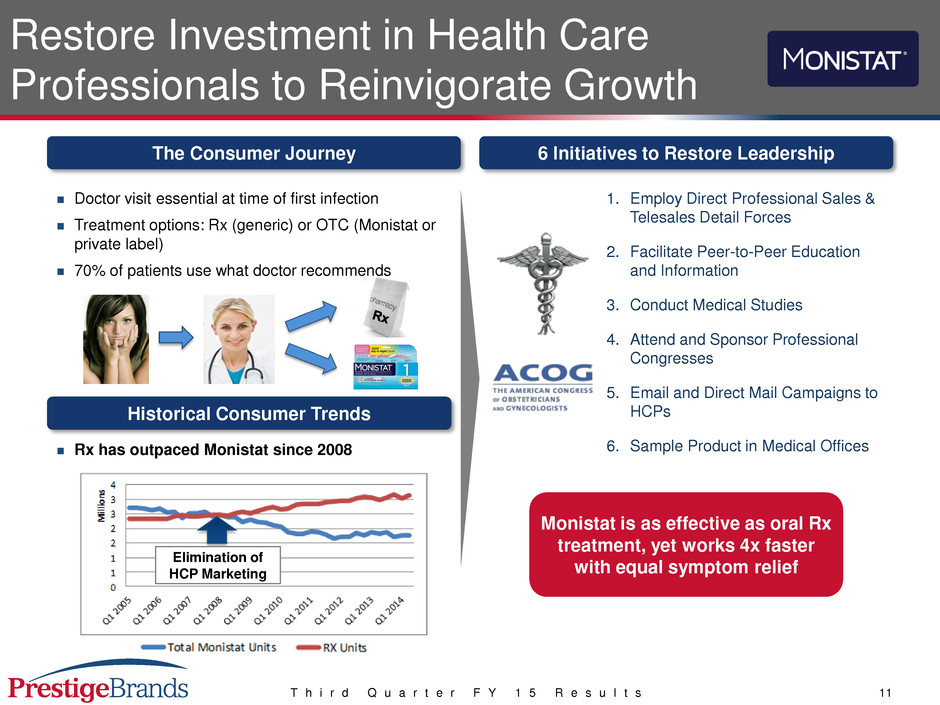

T h i r d Q u a r t e r F Y 1 5 R e s u l t s 11 Source: IRI MULO + C-Store, L12-week period ending December 28, 2014. Restore Investment in Health Care Professionals to Reinvigorate Growth The Consumer Journey 6 Initiatives to Restore Leadership Historical Consumer Trends Doctor visit essential at time of first infection Treatment options: Rx (generic) or OTC (Monistat or private label) 70% of patients use what doctor recommends Elimination of HCP Marketing Rx has outpaced Monistat since 2008 1. Employ Direct Professional Sales & Telesales Detail Forces 2. Facilitate Peer-to-Peer Education and Information 3. Conduct Medical Studies 4. Attend and Sponsor Professional Congresses 5. Email and Direct Mail Campaigns to HCPs 6. Sample Product in Medical Offices Monistat is as effective as oral Rx treatment, yet works 4x faster with equal symptom relief

T h i r d Q u a r t e r F Y 1 5 R e s u l t s 12 International Scale Contributing to Growth Profile Australasia Initiatives Underway Hydralyte New Product Development Strong pipeline of innovation − Supported by HCP sampling, PR and digital campaigns − Continued success of driving consumption occasions advertising campaigns Continued successful innovation Continued UK Innovation New Murine product launch in UK and Ireland − HA Preservative-Free launch − EU launch opportunity Geographic expansion into New Zealand with Care Pharma introductions

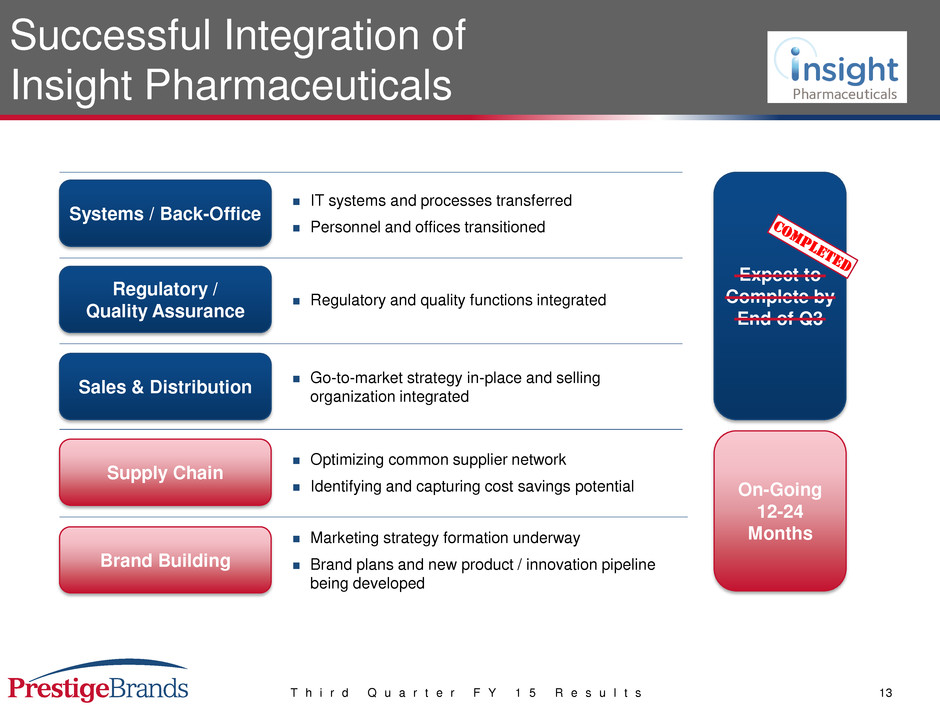

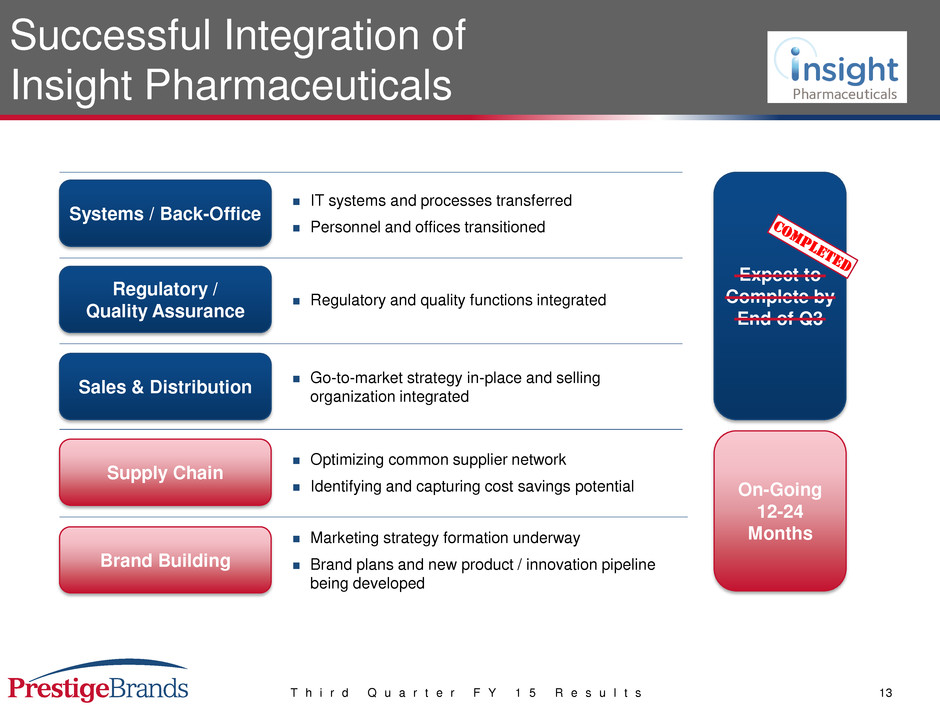

T h i r d Q u a r t e r F Y 1 5 R e s u l t s 13 Successful Integration of Insight Pharmaceuticals Regulatory / Quality Assurance Systems / Back-Office Supply Chain Sales & Distribution IT systems and processes transferred Personnel and offices transitioned Brand Building Expect to Complete by End of Q3 On-Going 12-24 Months Regulatory and quality functions integrated Go-to-market strategy in-place and selling organization integrated Optimizing common supplier network Identifying and capturing cost savings potential Marketing strategy formation underway Brand plans and new product / innovation pipeline being developed

T h i r d Q u a r t e r F Y 1 5 R e s u l t s 14

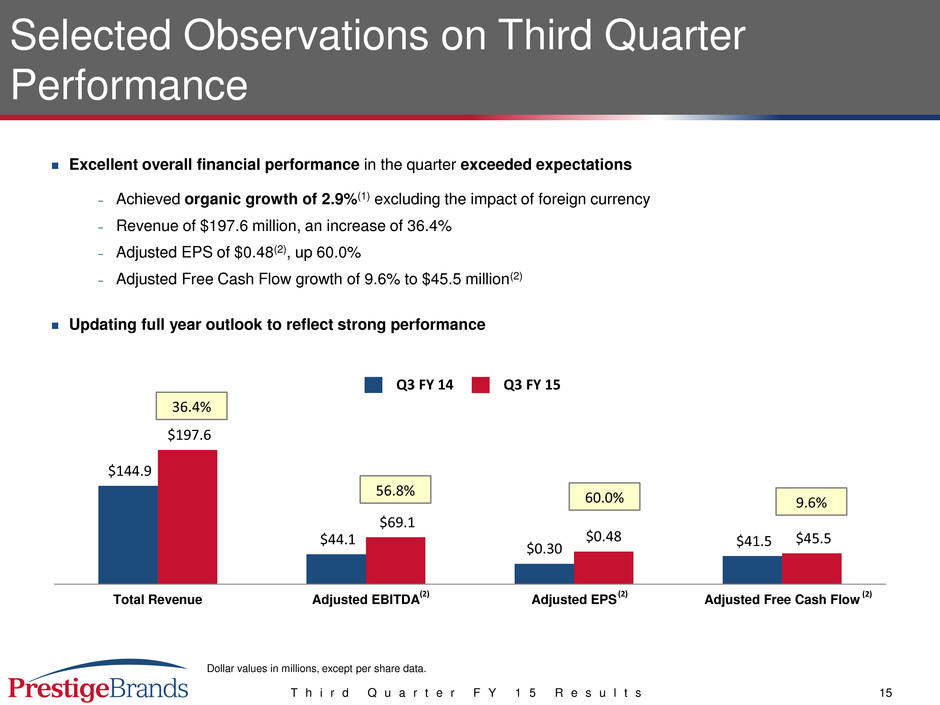

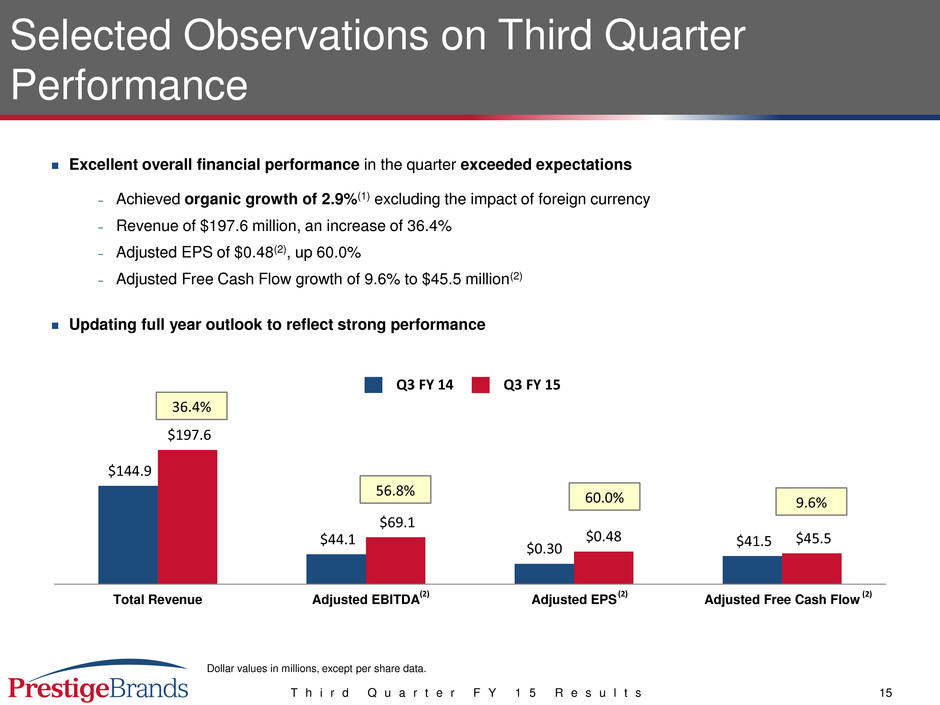

T h i r d Q u a r t e r F Y 1 5 R e s u l t s 15 Selected Observations on Third Quarter Performance Excellent overall financial performance in the quarter exceeded expectations − Achieved organic growth of 2.9%(1) excluding the impact of foreign currency − Revenue of $197.6 million, an increase of 36.4% − Adjusted EPS of $0.48(2), up 60.0% − Adjusted Free Cash Flow growth of 9.6% to $45.5 million(2) Updating full year outlook to reflect strong performance $144.9 $44.1 $41.5 $197.6 $69.1 $45.5 Total Revenue Adjusted EBITDA Adjusted EPS Adjusted Free Cash Flow Q3 FY 15 Q3 FY 14 36.4% 56.8% 60.0% 9.6% $0.30 $0.48 (2) (2) (2) Dollar values in millions, except per share data.

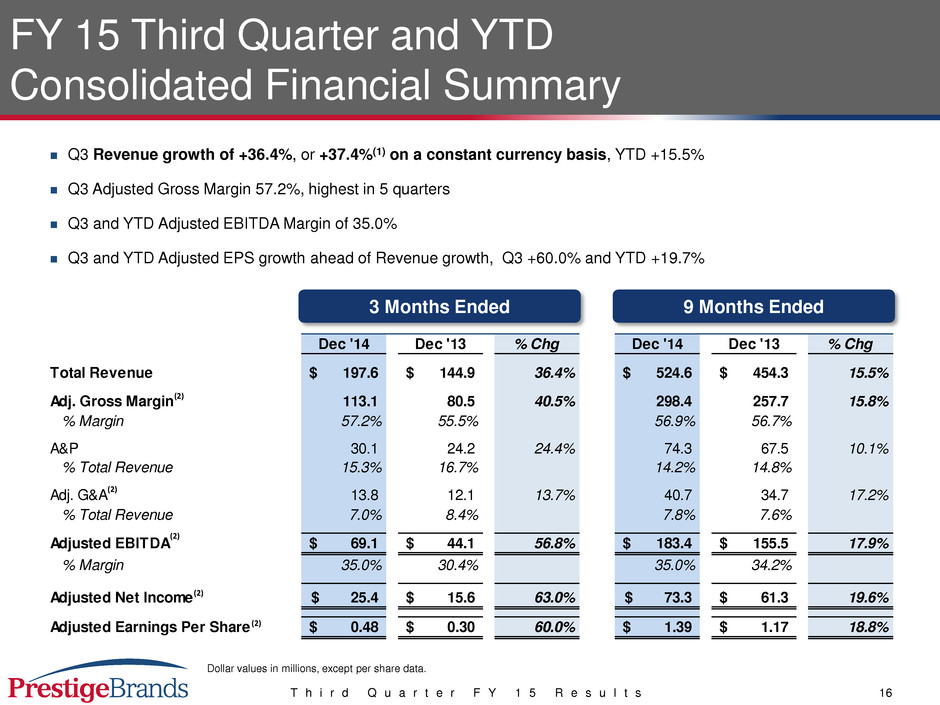

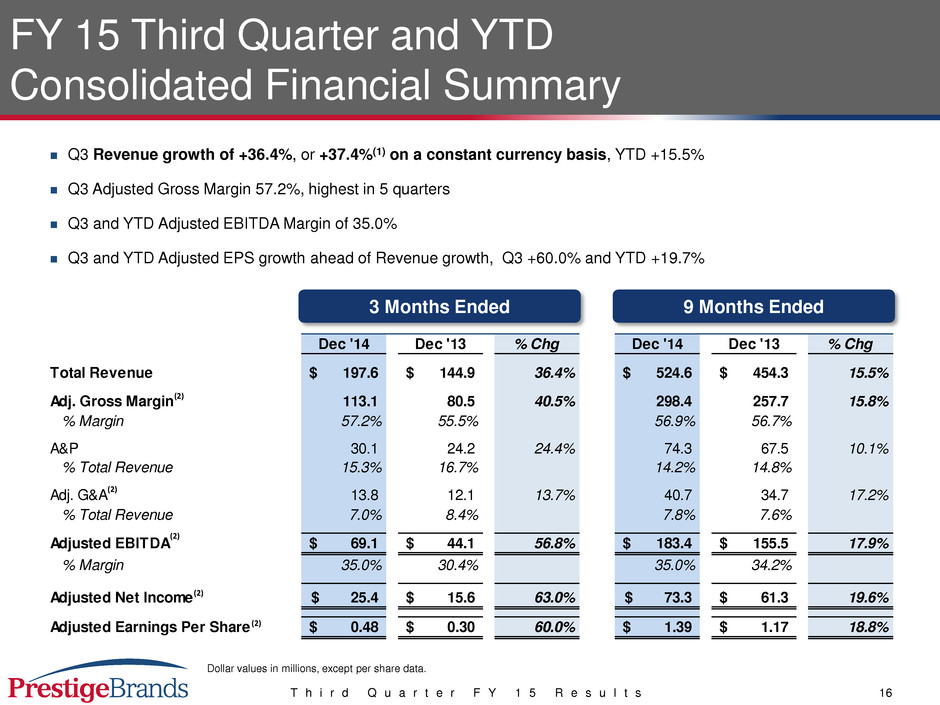

T h i r d Q u a r t e r F Y 1 5 R e s u l t s 16 Dec '14 Dec '13 % Chg Dec '14 Dec '13 % Chg Total Revenue 197.6$ 144.9$ 36.4% 524.6$ 454.3$ 15.5% Adj. Gross Margin 113.1 80.5 40.5% 298.4 257.7 15.8% % Margin 57.2% 55.5% 56.9% 56.7% A&P 30.1 24.2 24.4% 74.3 67.5 10.1% % Total Revenue 15.3% 16.7% 14.2% 14.8% Adj. G&A 13.8 12.1 13.7% 40.7 34.7 17.2% % Total Revenue 7.0% 8.4% 7.8% 7.6% Adjusted EBITDA 69.1$ 44.1$ 56.8% 183.4$ 155.5$ 17.9% % Margin 35.0% 30.4% 35.0% 34.2% Adjusted Net Income 25.4$ 15.6$ 63.0% 73.3$ 61.3$ 19.6% Adjusted Earnings Per Share 0.48$ 0.30$ 60.0% 1.39$ 1.17$ 18.8% FY 15 Third Quarter and YTD Consolidated Financial Summary Q3 Revenue growth of +36.4%, or +37.4%(1) on a constant currency basis, YTD +15.5% Q3 Adjusted Gross Margin 57.2%, highest in 5 quarters Q3 and YTD Adjusted EBITDA Margin of 35.0% Q3 and YTD Adjusted EPS growth ahead of Revenue growth, Q3 +60.0% and YTD +19.7% 3 Months Ended 9 Months Ended (2) (2) (2) (2) (2) Dollar values in millions, except per share data.

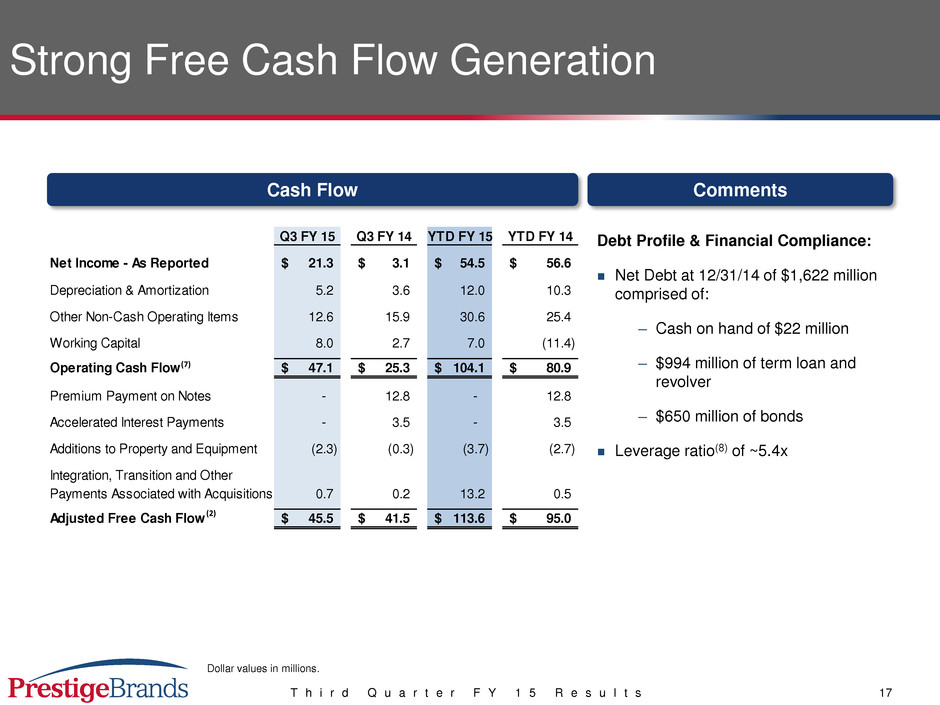

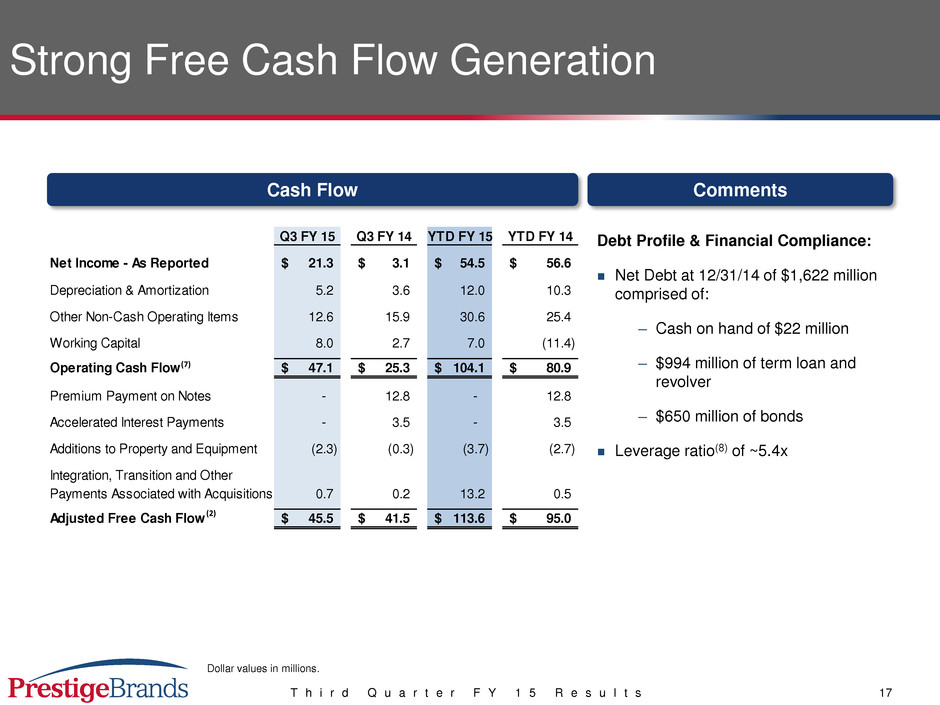

T h i r d Q u a r t e r F Y 1 5 R e s u l t s 17 Q3 FY 15 Q3 FY 14 YTD FY 15 YTD FY 14 Net Income - As Reported 21.3$ 3.1$ 54.5$ 56.6$ Depreciation & Amortization 5.2 3.6 12.0 10.3 Other Non-Cash Operating Items 12.6 15.9 30.6 25.4 Working Capital 8.0 2.7 7.0 (11.4) Operating Cash Flow 47.1$ 25.3$ 104.1$ 80.9$ Premium Payment on Notes - 12.8 - 12.8 Accelerated Interest Payments - 3.5 - 3.5 Additions to Property and Equipment (2.3) (0.3) (3.7) (2.7) Integration, Transition and Other Payments Associated with Acquisitions 0.7 0.2 13.2 0.5 Adjusted Free Cash Flow 45.5$ 41.5$ 113.6$ 95.0$ Debt Profile & Financial Compliance: Net Debt at 12/31/14 of $1,622 million comprised of: – Cash on hand of $22 million – $994 million of term loan and revolver – $650 million of bonds Leverage ratio(8) of ~5.4x Strong Free Cash Flow Generation Cash Flow Comments (7) (2) Dollar values in millions.

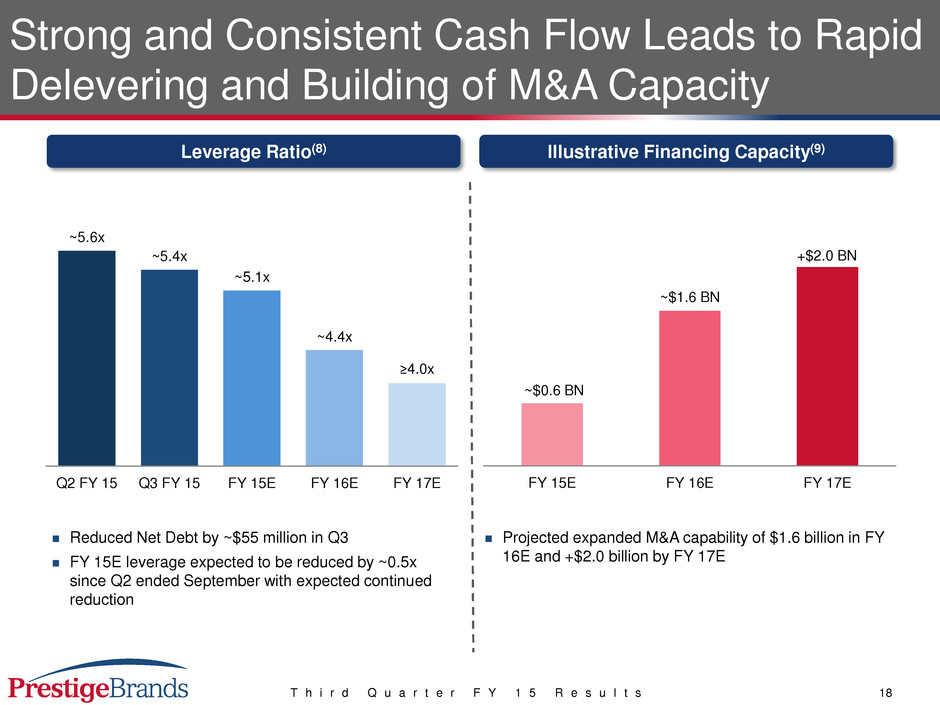

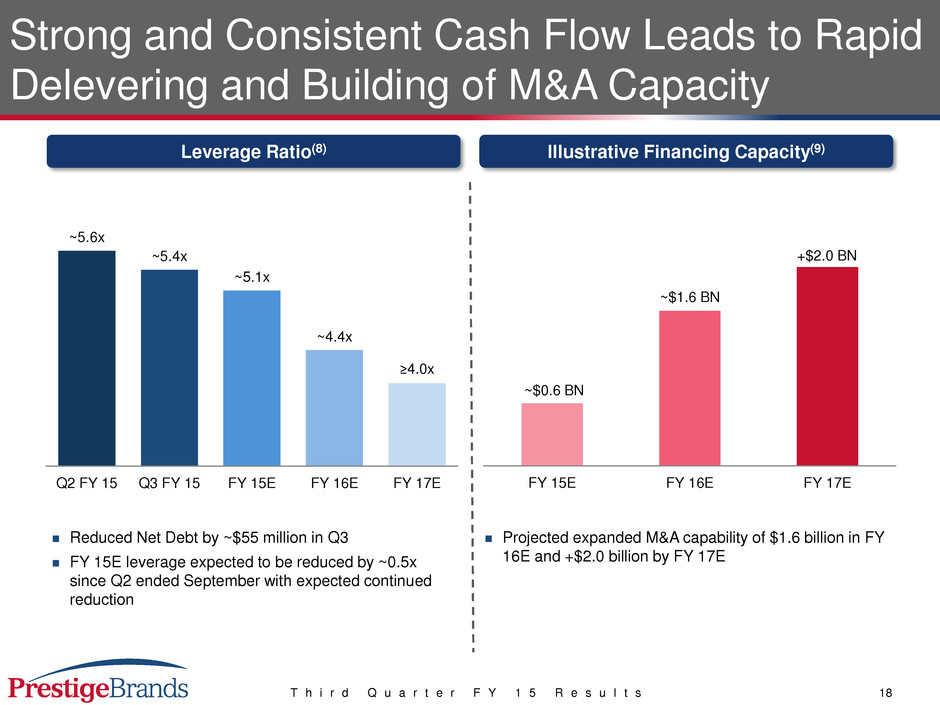

T h i r d Q u a r t e r F Y 1 5 R e s u l t s 18 Strong and Consistent Cash Flow Leads to Rapid Delevering and Building of M&A Capacity Leverage Ratio(8) FY 15E FY 16E FY 17E ~$1.6 BN +$2.0 BN ~$0.6 BN Illustrative Financing Capacity(9) ~5.6x ~5.4x ~5.1x ~4.4x ≥4.0x Q2 FY 15 Q3 FY 15 FY 15E FY 16E FY 17E Reduced Net Debt by ~$55 million in Q3 FY 15E leverage expected to be reduced by ~0.5x since Q2 ended September with expected continued reduction Projected expanded M&A capability of $1.6 billion in FY 16E and +$2.0 billion by FY 17E

T h i r d Q u a r t e r F Y 1 5 R e s u l t s 19

T h i r d Q u a r t e r F Y 1 5 R e s u l t s 20 Stay the Strategic Course to Continue to Create Shareholder Value Insight Integration FY 15 Full Year Outlook M&A Strategy Brand Building Continue investment and focus on Core OTC and International to drive consumption growth Deliver new product innovations on a consistent basis (five planned in Q4 in both domestic/international) Assess appropriate Pediatric strategies moving forward post cough/cold season in relation to total portfolio Innovate and evolve marketing vehicles across key brands, recognizing retail environment Stabilize portfolio over initial 12 months Commence investment in Monistat Optimize supply chain and capture cost savings over 12-24 months Remain aggressive and disciplined Appropriately capitalize on industry consolidation and announcements Explore creative deal structures and partnerships Strong Revenue growth (+18%) in challenging retail environment — Organic growth in Q3 and expected in Q4 — Solid cough/cold season — Work to do on Insight Portfolio — Retailer inventory pressure continues — Currency headwinds in Q4 and beyond Adjusted EPS growth of 19% to 21% at $1.82 to $1.85 expected for full year Excellent estimated Adjusted Free Cash Flow of ~$155 million continues to drive long-term strategy

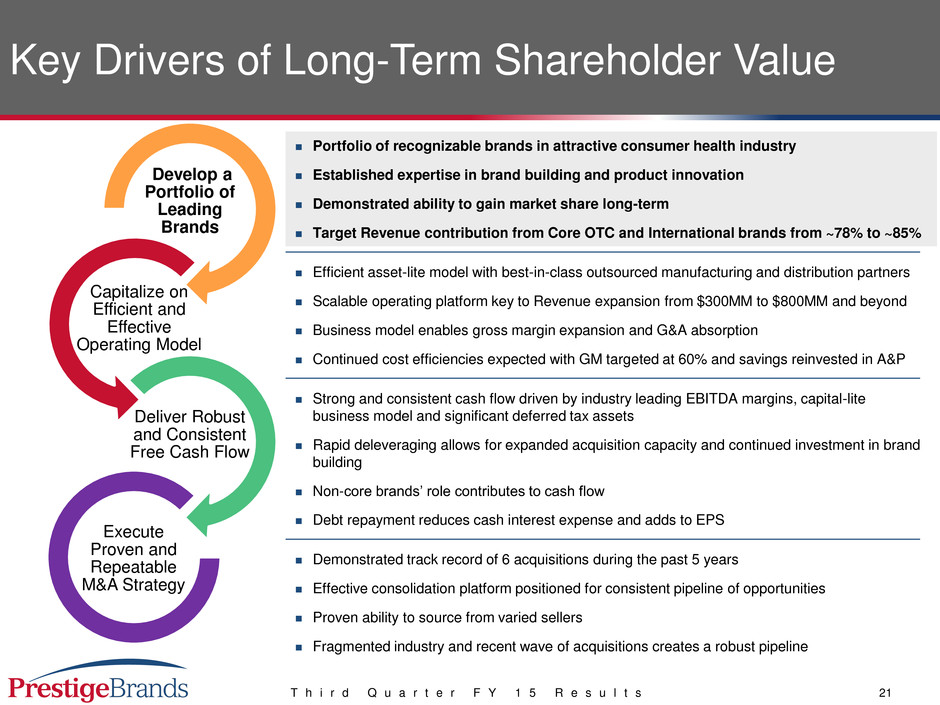

T h i r d Q u a r t e r F Y 1 5 R e s u l t s 21 Key Drivers of Long-Term Shareholder Value Develop a Portfolio of Leading Brands Capitalize on Efficient and Effective Operating Model Deliver Robust and Consistent Free Cash Flow Execute Proven and Repeatable M&A Strategy Portfolio of recognizable brands in attractive consumer health industry Established expertise in brand building and product innovation Demonstrated ability to gain market share long-term Target Revenue contribution from Core OTC and International brands from ~78% to ~85% Demonstrated track record of 6 acquisitions during the past 5 years Effective consolidation platform positioned for consistent pipeline of opportunities Proven ability to source from varied sellers Fragmented industry and recent wave of acquisitions creates a robust pipeline Strong and consistent cash flow driven by industry leading EBITDA margins, capital-lite business model and significant deferred tax assets Rapid deleveraging allows for expanded acquisition capacity and continued investment in brand building Non-core brands’ role contributes to cash flow Debt repayment reduces cash interest expense and adds to EPS Efficient asset-lite model with best-in-class outsourced manufacturing and distribution partners Scalable operating platform key to Revenue expansion from $300MM to $800MM and beyond Business model enables gross margin expansion and G&A absorption Continued cost efficiencies expected with GM targeted at 60% and savings reinvested in A&P

T h i r d Q u a r t e r F Y 1 5 R e s u l t s 22 Q&A

T h i r d Q u a r t e r F Y 1 5 R e s u l t s 23 Appendix (1) Revenue Growth on a constant currency basis is a Non-GAAP financial measure and is reconciled to its most closely related GAAP financial measure in our earnings release in the “About Non-GAAP Financial Measures” section. (2) Adjusted Gross Margin, Adjusted G&A, Adjusted Net Income, Adjusted EPS and Adjusted Free Cash Flow are non-GAAP financial measures and are reconciled to their most closely related GAAP financial measures in our earnings release in the “About Non-GAAP Financial Measures” section. (3) Adjusted EPS for FY15 is a projected Non-GAAP financial measure, is reconciled to projected GAAP EPS in our earnings release in the “About Non-GAAP Financial Measures” section for Q3 FY 15 and is calculated based on projected GAAP EPS of $1.35 to $1.38 plus $0.47 of projected acquisition related items totaling $1.82 to $1.85. (4) Adjusted Free Cash Flow for FY15 is a projected Non-GAAP financial measure, is reconciled to projected GAAP Net Cash Provided by Operating Activities in our earnings release in the “About Non-GAAP Financial Measures” section and is calculated based on projected Net Cash Provided by Operating Activities of $146 million, plus projected integration costs of $15 million less projected capital expenditures of $6 million. (5) Pro forma Net Sales is projected for FY 15 as if Insight and Hydralyte were acquired on April 1, 2014. (6) Based on Company's organic long-term plan. Source: Company data. (7) Operating cash flow is equal to GAAP net cash provided by operating activities. (8) Leverage ratio reflects net debt / covenant defined EBITDA. (9) Assumes max leverage of 5.75x and average EBITDA acquisition multiple consistent with previous acquisitions.